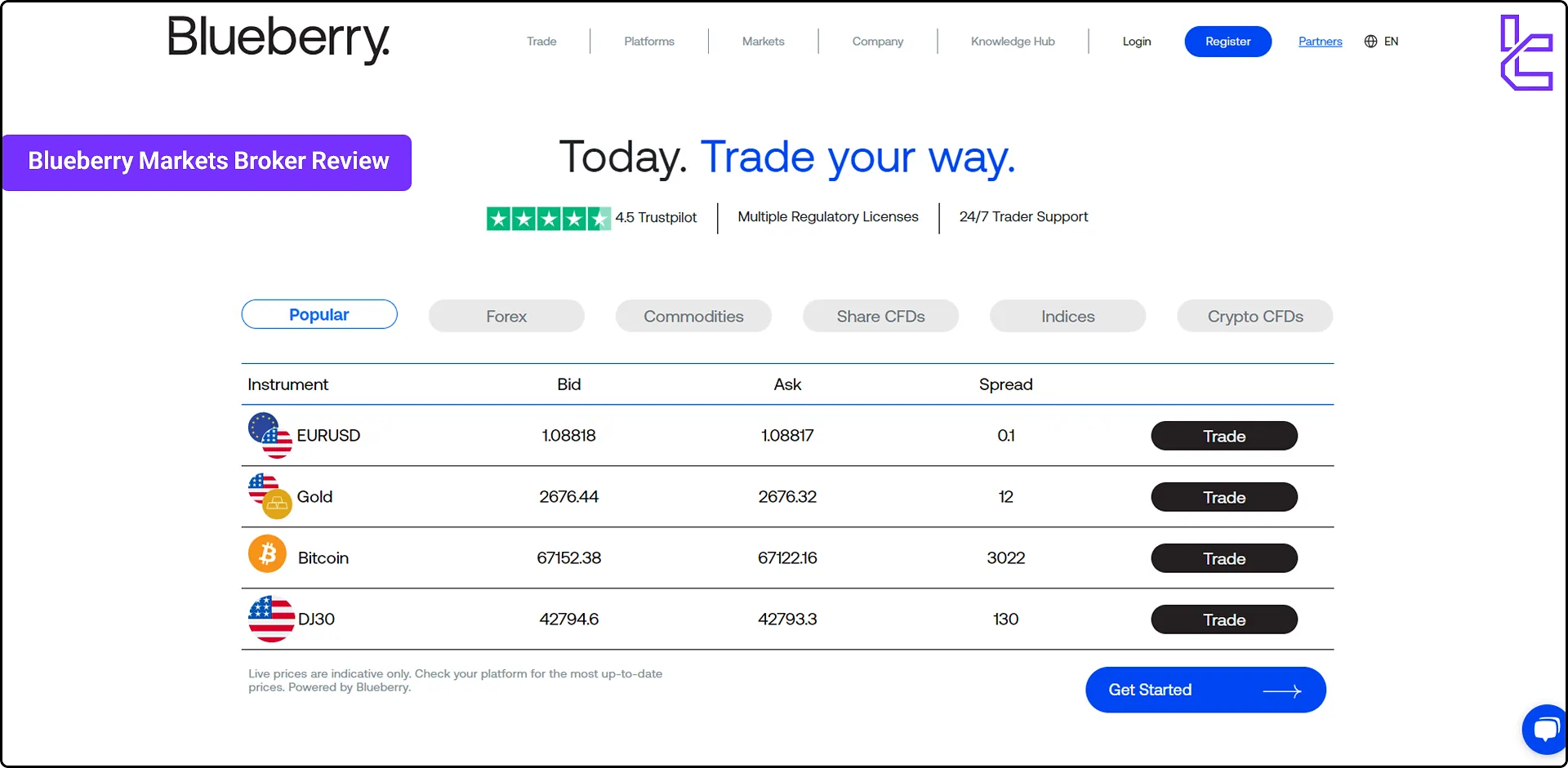

Blueberry Markets is a reliable Forex and CFD broker founded in 2016. This Australian broker provides trading and investing services for over 300 instruments with up to 1:500 maximum leverage.

Blueberry Markets offers Standard and Direct accounts with a minimum deposit of just $100. Traders can use these accounts to trade on multiple trading platforms, including MetaTrader 4, MetaTrader 5, cTrader, TradingView, and Bluberry X.

Company Information & Regulation of Blueberry Markets

Blueberry Markets Group Pty Ltd is an Australian-based forex and CFD broker that has garnered attention for its commitment to transparency and customer satisfaction. The company operates under two key regulatory bodies:

- Australian Securities and Investments Commission (ASIC): Blueberry Markets Pty Ltd is regulated by ASIC (no. 535887), ensuring strict compliance with Australian financial regulations;

- Vanuatu Financial Services Commission (VFSC): Blueberry Markets Group Ltd is also regulated by the VFSC (no. 700697), providing an additional layer of regulatory oversight.

These dual regulations underscore Blueberry Markets' commitment to maintaining high standards of financial integrity and client fund protection.

Key regulation, protections, and eligibility of Blueberry Markets:

Parameter / Branches / Entity | Blueberry Markets (Mauritius) Ltd | Blueberry Markets (V) Ltd |

Regulation | Financial Services Commission (Mauritius), Global Business Licence GB24203929 | Vanuatu Financial Services Commission (VFSC), Company no. 700697 |

Regulation Tier | Tier-3 | Tier-3 |

Country / Jurisdiction | Mauritius | Vanuatu |

Investor Protection Fund | No | No |

Segregated Funds | Yes | Yes |

Negative Balance Protection | Yes | Yes |

Maximum Leverage | Up to 1:500 | Up to 1:500 |

Client Eligibility | Global | Global |

Blueberry Markets Broker Summary of Specifications

Here's a quick overview of what Blueberry Markets offers:

Broker | Blueberry Markets |

Account Types | Standard, Direct |

Regulating Authorities | ASIC, VFSC |

Based Currencies | USD, EUR, GBP, AUD, NZD, SGD, CAD |

Minimum Deposit | $100 |

Deposit Methods | Visa/MasterCard, Bank wired |

Withdrawal Methods | Visa/MasterCard, Bank wired |

Minimum Order | 0.01 Lot |

Maximum Leverage | 1:500 |

Investment Options | Copy trading |

Trading Platforms & Apps | MT4, MT5, Webtrader |

Markets | Forex, indices, commodities, crypto, shares, metals |

Spread | Floating from 0.0 pips |

Commission | $7 |

Orders Execution | Market |

Margin Call/Stop Out | 100%/500% |

Trading Features | Demo account, Forex VPS |

Affiliate Program | Yes |

Bonus & Promotions | No |

Islamic Account | No |

PAMM Account | No |

Customer Support Ways | Email, live chat, phone |

Customer Support Hours | 24/7 |

Restricted Countries | Iran, Syria, North Korea, USA, Sudan, Yemen and more |

Blueberry Markets Accounts

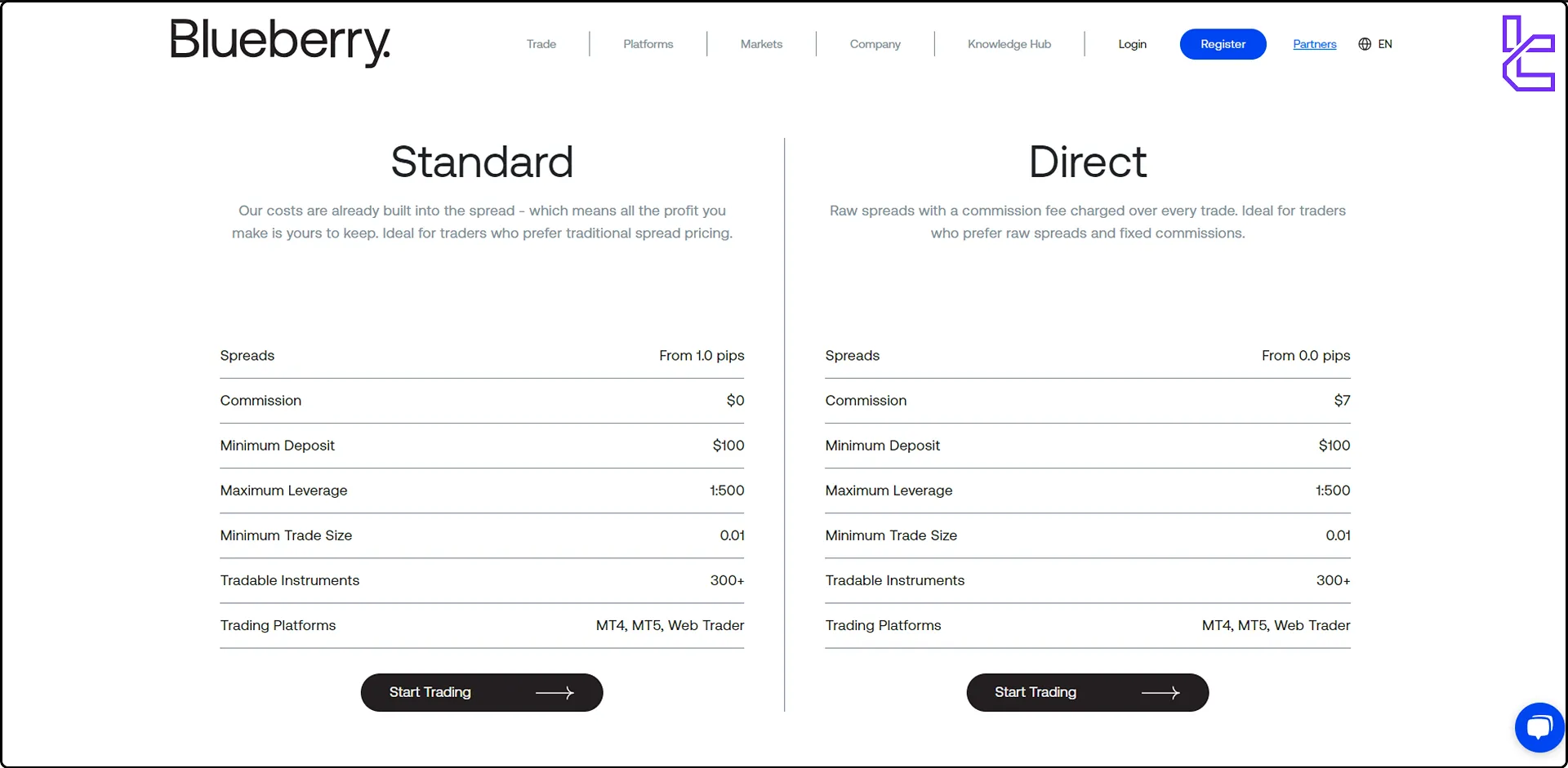

Blueberry Markets offers 2 main account types to cater to different trading styles and preferences:

Account types | Standard | Direct |

Minimum deposit | $100 | $100 |

Minimum trading volume | 0.01 Lot | 0.01 Lot |

Maximum Leverage | 1:500 | 1:500 |

Spreads | Floating from 1.0 pips | Floating from 0.0 pips |

Commission | No commission | 7$ |

Trading platform | MT4, MT5, Web Trader | MT4, MT5, Web Trader |

This simple approach makes choosing an account type easy for traders of all levels.

Blueberry Markets also offers Premium and Premium+ accounts to support traders with high trading capital and monthly trade volume of over 100 lots.

This broker has a Demo Account for beginner traders to learn Forex trading. Key features of Blueberry Markets demo trading account:

- Risk-free practice with $100,000 virtual funds

- Access to all features of live trading

- Perfect for testing strategies and getting familiar with the platform

Blueberry Markets Benefits and Drawbacks

Let's weigh the pros and cons of trading with Blueberry Markets:

Advantages | Disadvantages |

ASIC and VFSC regulated | Not available to US citizens |

Competitive spreads | High minimum deposit compared to other brokers |

Multiple base currencies | - |

Advanced copy trading services | - |

Blueberry Markets Broker Account Opening and Verification Guide

Creating a new trading account with Bluberry Markets is easy and accessible even for beginners. Blubberry Markets registration:

#1 Access the Registration Portal

Visit the official Blueberry Markets website and select either the “Register” or “Open an Account” button to start.

#2 Enter Contact Information

Provide your email address, mobile number, and create a strong password (up to 25 characters with mixed case, numbers, and symbols).

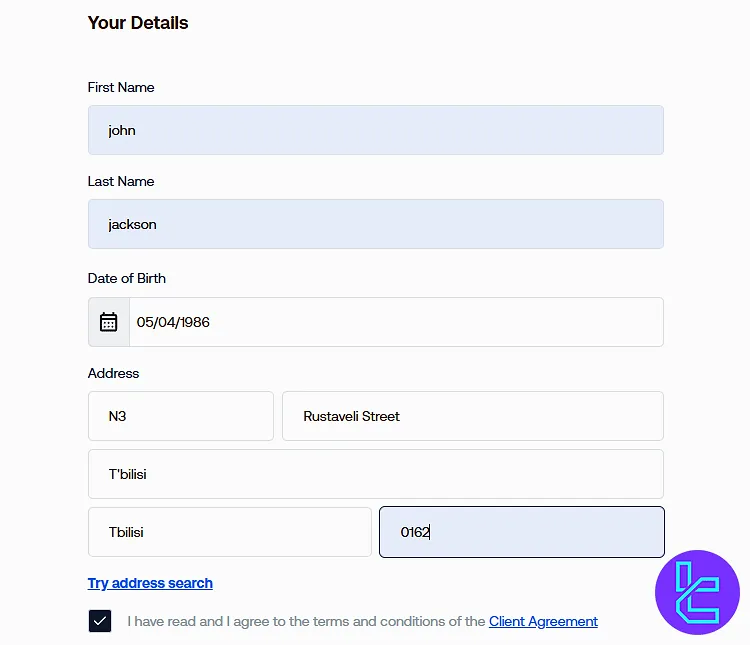

#3 Submit Identity Details

Select your country of residence, input yourfull name, date of birth, address, and postal code. Accept the terms to proceed.

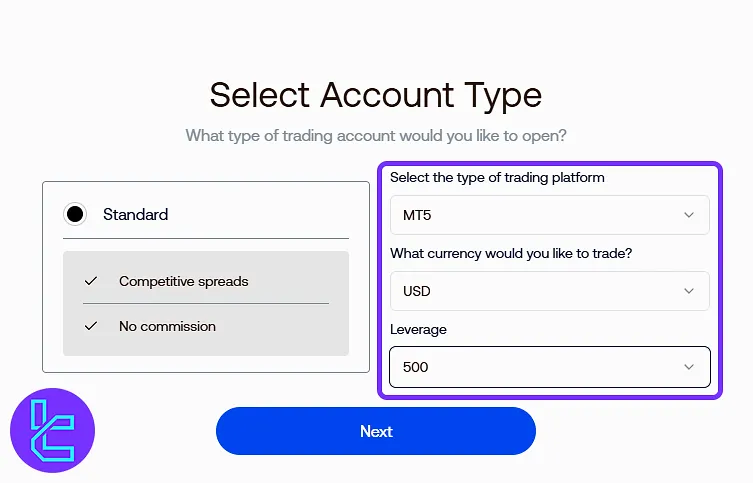

#4 Select Account Type

Choose between a Standard or RAW account, ensuring the account type is set to real trading.

#5 Customize Trading Preferences

Finalize your setup by selecting your preferred platform, account currency, and desired leverage level.

Blueberry Markets KYC

To increase your account security and comply with anti-money laundering laws (AML), traders must complete the Bluberry Markets verification process. Required documents include:

- Proof of identity: Passport, ID card, or Driver's license

- Proof of address: Utility bill or bank statement

Blueberry Markets Trading Platforms and Apps

Blueberry Markets offers industry-standard trading platforms:

MetaTrader 4 (MT4):

- User-friendly interface

- Advanced charting tools

- Expert Advisors (EAs) for automated trading

- Available on desktop, web, and mobile

MetaTrader 5 (MT5):

- Enhanced version of MT4

- More timeframes and analytical tools

- Supports trading in stocks and futures

- Available on desktop, web, and mobile

WebTrader:

- Browser-based trading

- No download required

- Access your account from any device

These platforms offer a range of features suitable for both novice and experienced traders, including customizable charts, one-click trading, and advanced order types.

Blueberry Markets Trading Fees (Spreads and Commissions)

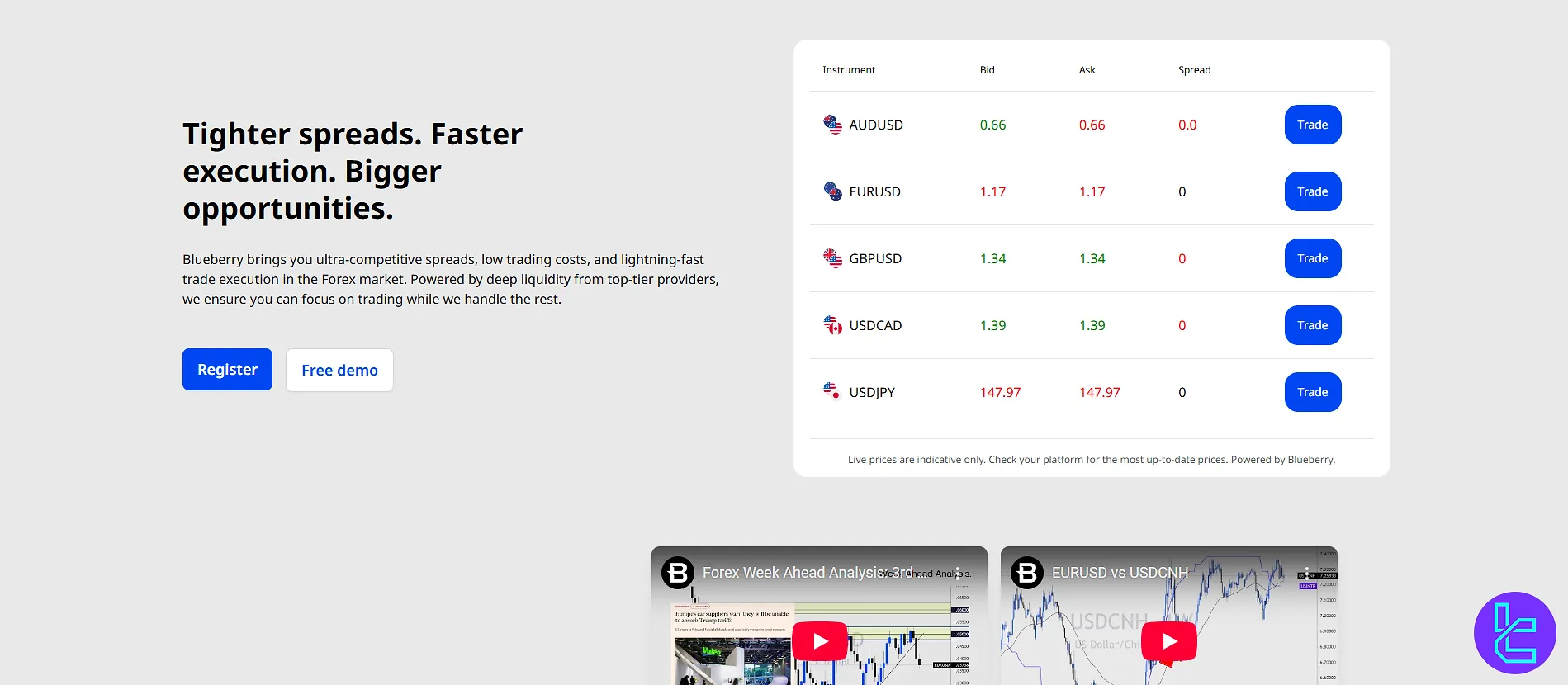

Blueberry Markets offers competitive pricing across its account types:

- Standard Account: Spreads from 1.0 pips with no commission

- Direct Account: Raw spreads from 0.0 pips with a $7 round turn commission per lot

Blueberry markets other fees:

- No deposit and withdrawal fees

- No inactivity fee

Blueberry Markets Swap Fees

Overnight financing “swaps” applies to positions held past the daily rollover; the amount is credited or debited based on the interest-rate differential of the instruments traded.

Swap-free (Islamic) accounts waive overnight interest; administrative charges apply to cover financing/operational costs. Rollover is applied after 5:00 p.m. ET for positions held overnight.

- Swap Long: Credit or charge depending on instrument and rates;

- Swap Short: Credit or charge depending on instrument and rates.

Blueberry Markets Non-Trading Fees

Funding/withdrawal methods include bank transfers, cards, and supported e-wallets. Most deposits reflect instantly; withdrawals are processed within 24 hours on business days.

Accounts with 90+ days of inactivity and a zero or negative balance may be closed.

Deposit & Withdrawal Methods in Blueberry Markets

Blueberry Markets provides various funding and payout methods:

- Credit/Debit cards

- Bank transfers (domestic and international)

- E-wallets: Skrill, Neteller, FasaPay

- Localized systems: POLi, UnionPay (for Asia-Pacific users)

- Crypto payments via Banxa or other regional facilitators

Deposits are typically credited within the same business day, while withdrawals are processed within 24 hours. Notably, Blueberry does not charge any internal fees for funding or withdrawals; however, intermediary banking or e-wallet providers may impose separate charges.

The platform enforces a minimum deposit of $100, with no minimum required for most withdrawals.

These conditions make Blueberry especially attractive to traders seeking both flexibility and fast transaction speeds.

The lack of variety in the payment options is a negative aspect of working with this broker.

Deposit Options

Funding methods listed on the Blueberry include bank wire, cards, crypto (two rails: “Pay with Crypto” and “Crypto Funding Multichannel”), JetonWallet, Skrill/Neteller, plus region-specific local options (IDR, PHP, GHS, KES, MYR, SGD, THB, VND). Min/max amounts and fee notes (e.g., MDR/interchange/network fees) are specified per method.

Official deposit methods, accepted currencies, and minimums from Blueberry Markets:

Option | Processing Time | Min. Deposit |

Bank Wire Transfer | 1-7 Business Days | $50 |

Credit/Debit Funding | 30 minutes to 1 hour | $50 |

Crypto USDT.TRC20 Funding | 30 minutes to 1 hour | $100 |

Crypto BTC Funding | 30 minutes to 1 hour | $100 |

Crypto LTC Funding | 30 minutes to 1 hour | $100 |

Crypto Funding Multichannel | 30 minutes to 1 hour | $100 |

Jeton Wallet | 30 minutes to 1 hour | $50 |

Local Funding GHS | 30 minutes to 1 hour | $50 |

Local Funding KES | 30 minutes to 1 hour | $20 |

Local IDR Funding | 30 minutes to 1 hour | $50 |

Local INR Bank & UPI Funding | 30 minutes to 1 hour | $50 |

Local INR UPI Funding | 30 minutes to 1 hour | $50 |

Local MYR Funding | 30 minutes to 1 hour | $20 |

Local MYR Online Wire | 30 minutes to 1 hour | $50 |

Local PHP Funding | 30 minutes to 1 hour | $50 |

Local E-Wallet & Bank PHP | 30 minutes to 1 hour | $50 |

Local SGD Funding | 30 minutes to 1 hour | $5 |

Local THB Funding | 30 minutes to 1 hour | $20 |

Local VND Funding | 30 minutes to 1 hour | $50 |

Skrill | 30 minutes to 1 hour | $50 |

Neteller | 30 minutes to 1 hour | $50 |

Withdrawal Solutions

The Blueberry Markets specifies processing within 24–48 business hours for most requests, with certain methods eligible for instant processing (credit timing then depends on the provider).

Method-specific details include card refunds back to the original card and bank wires that typically incur ~USD $25 intermediary bank fees and take 3–7 business days to reach the recipient after processing.

Official withdrawal methods, processing windows, and fees from Blueberry Markets:

Withdrawal Solution | Processing Time | Withdrawal Fee |

Bank Wire | Processed 24–48 business hours; then 3–7 business days to reach bank | ~USD $25 intermediary bank fee (client responsibility) |

Credit/Debit Card (refunds) | Processed 24–48 business hours; should appear instantly on card after processing | Not stated |

Crypto | Instant-eligible; network congestion may affect arrival time | Not stated |

Skrill | Instant-eligible; provider-dependent crediting | Not stated |

Neteller | Instant-eligible; provider-dependent crediting | Not stated |

Local (Indonesia / Vietnam / Malaysia) | Instant-eligible; provider-dependent crediting | Not stated |

Investment Options Offered by Blueberry Markets Broker

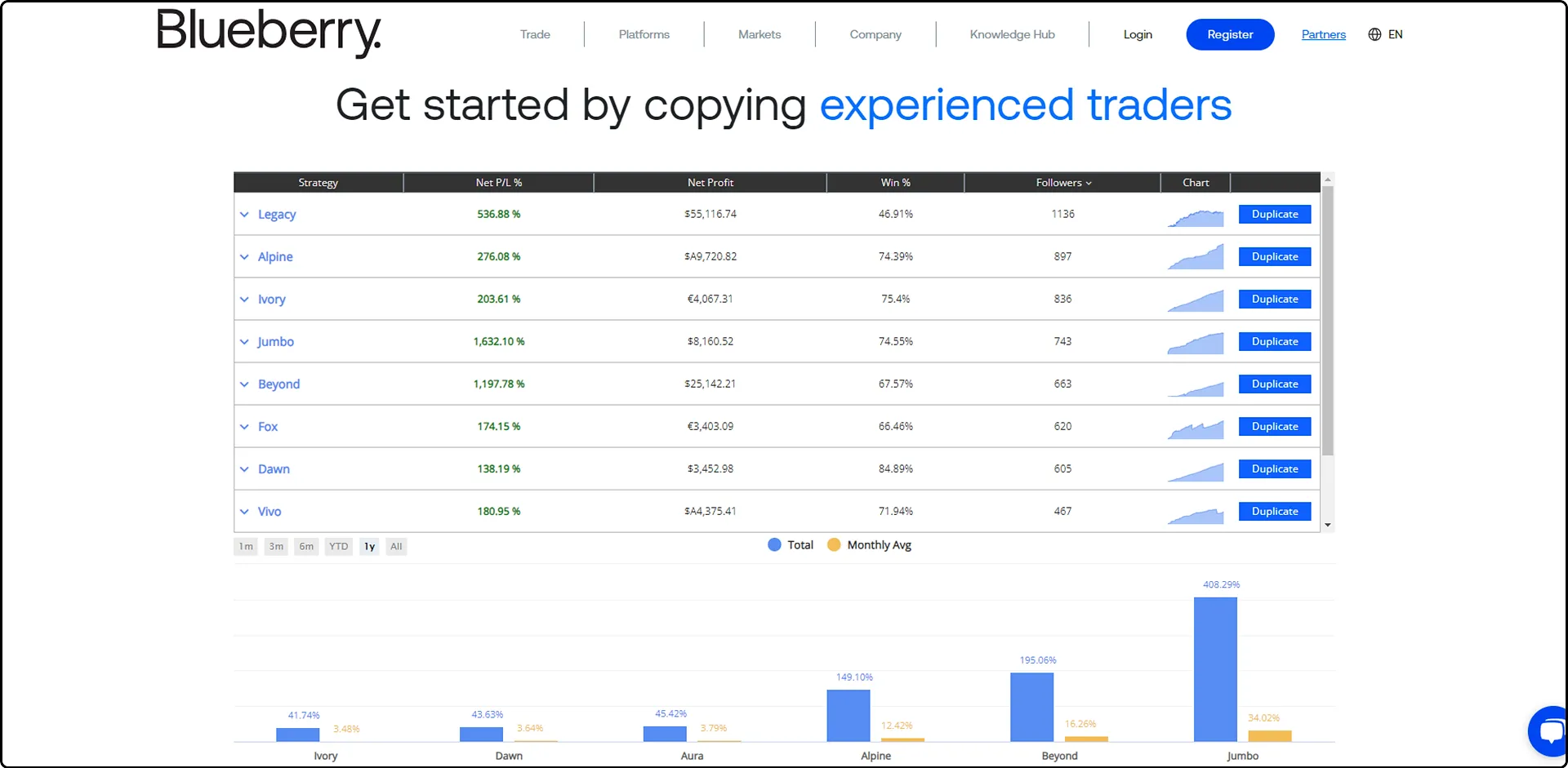

Blueberry Markets offers copy trading options to help traders benefit from others' expertise. Duplitrade is an automated trading platform that allows you to copy the trades of experienced traders.

This feature can be particularly beneficial for novice traders or those looking to diversify their trading strategies.

Blueberry Markets Broker Markets & Symbols

Blueberry Markets provides access to over 300 trading instruments across various asset classes:

Category | Type of Instruments | Number of Symbols | Competitor Average | Max. Leverage |

Forex | Major, Minor & Exotic Currency Pairs | 5+ | 50–70 | Up to 1:500 |

Shares | CFDs on Popular International Stocks | 100+ | 800–1200 | Up to 1:5 |

Commodities | CFDs on Metals & Energies | 4+ | 10–20 | Not stated |

Indices | CFDs on Global Indices (AU200, US SP500, UK100, etc.) | 7+ | 10–20 | Not stated |

Cryptocurrencies | CFDs on Major Coins (e.g., BTC, ETH) | 5+ | 20–40 | Not stated |

This diverse range of assets allows traders to trade on the assets that they can analyze best and diversify their portfolios and take advantage of opportunities across different markets.

Bonuses and Promotional programs in Blueberry Markets Broker

While Blueberry Markets doesn't offer traditional deposit bonuses due to regulatory restrictions, they provide a refer-a-friend Program to reward traders for introducing new traders.

Traders can earn up to $1000 by referring 5 friends to Blueberry Markets.

Blueberry Markets Awards

As of now, Blueberry Markets has not received any official industry awards or recognitions. While the broker maintains a presence in the trading community, there are no verified records of achievements or honors from financial organizations or review platforms.

Its reputation mainly relies on client feedback and market performance rather than formal accolades.

Blueberry Markets Restricted Countries List

While Blueberry Markets accepts clients from many countries, there are some countries and regions banned from using this broker:

- USA

- North Korea

- Sudan

- South Sudan

- Yemen

- Mali

- Libya

- Lebanon

- Iraq

- Iran

- Guam

- Guinea-Bissau

- US Virgin Islands

- Vanuatu

- Congo

- Canada

- American Samoa

- Central African Republic

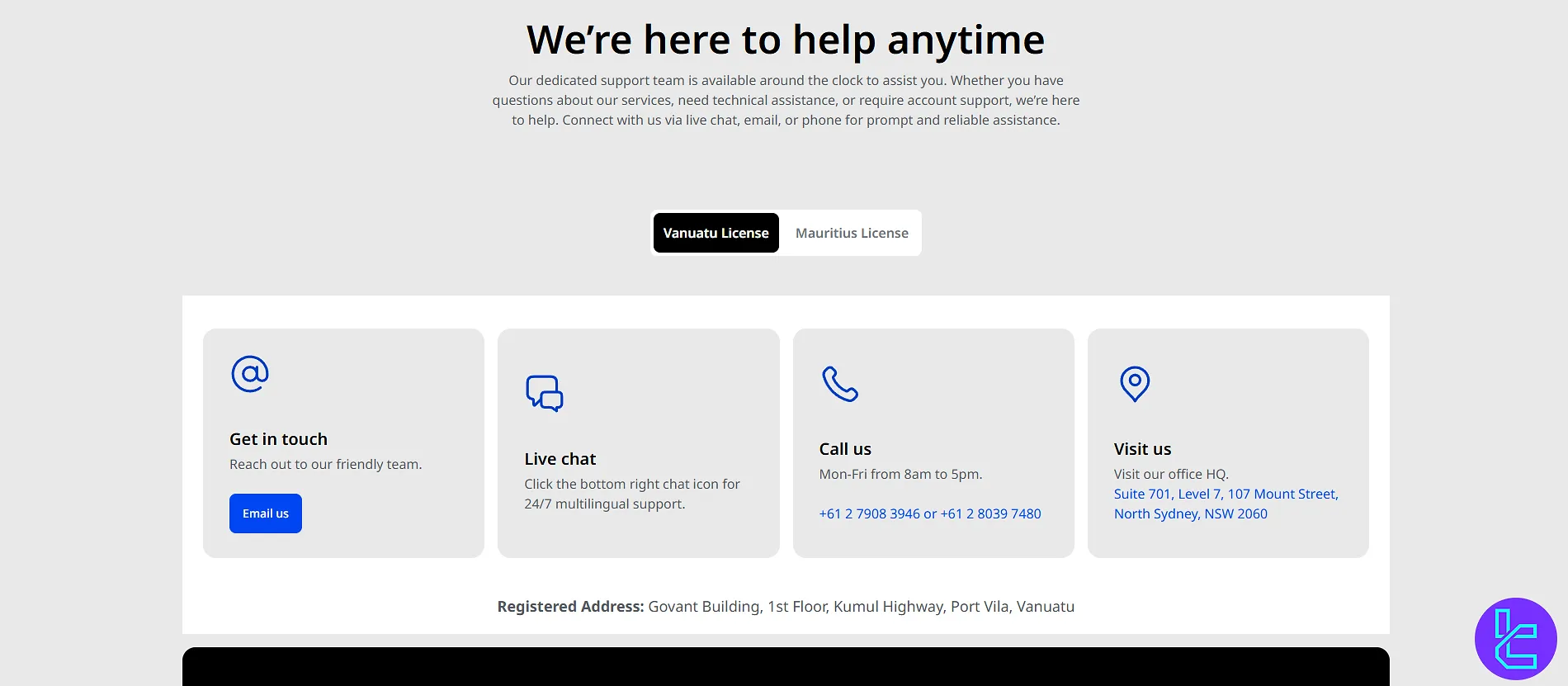

Blueberry Markets Support Channels

Blueberry Markets prides itself on providing responsive customer support:

- Live Chat: Available 24/5

- Email: customer-care@blueberrymarkets.com

- Phone: +61279083946 or +61280397480 (Australia)

The support team is known for its quick response times and helpful attitude. They can assist with technical issues, account queries, and general trading questions.

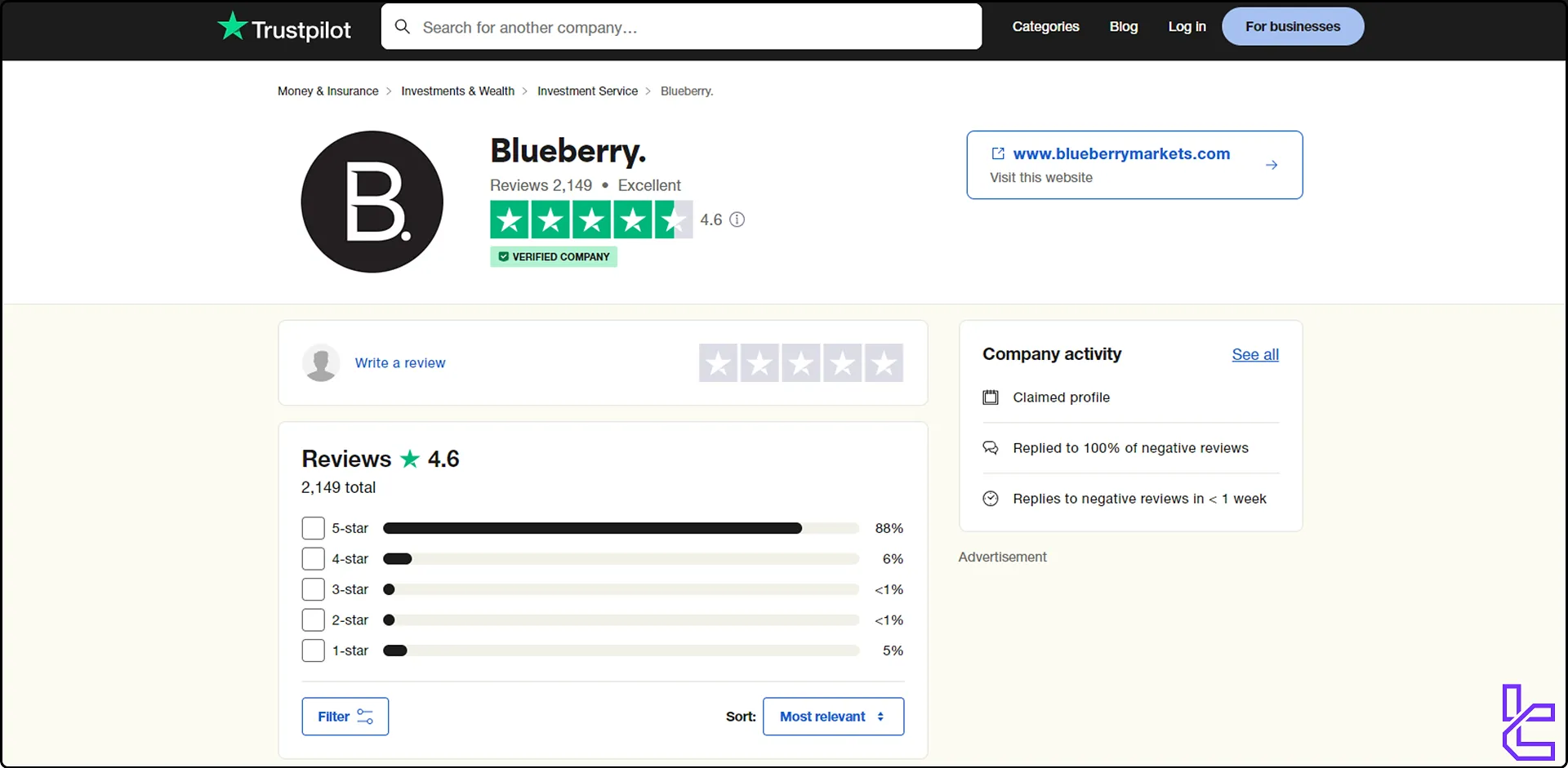

Blueberry Markets Broker Trust Scores & User Reviews

Blueberry Markets has garnered positive reviews from traders on the Blueberry Trustpilot page. This broker has 4.6 out of 5 stars on this website with over 88%, 5-star review.

These high trust scores reflect the broker's commitment to customer satisfaction and reliable service.

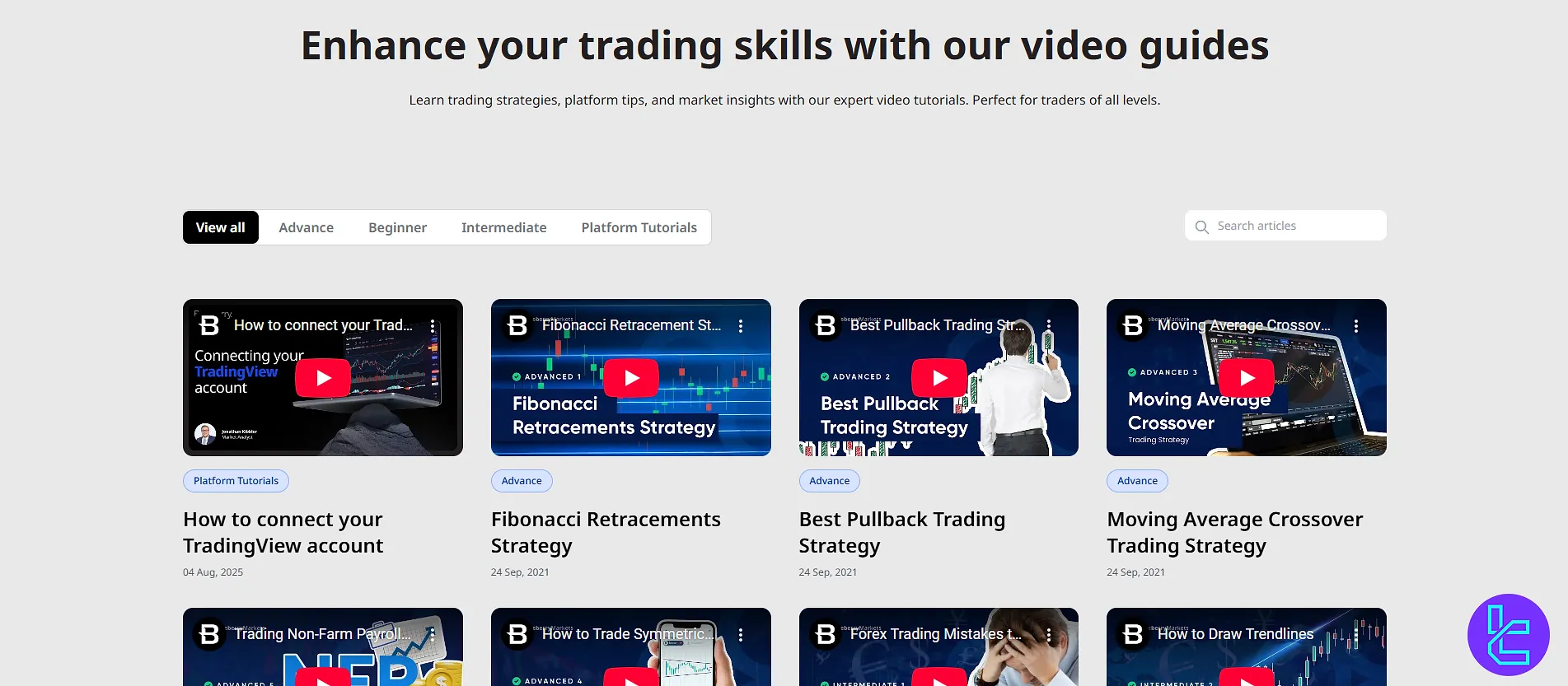

Blueberry Markets Education Materials Overview

Blueberry Markets offers a range of educational resources to help traders improve their skills:

- Academy: Articles and guides on trading topics

- Webinars: Regular online sessions with trading experts

- Video tutorials: Step-by-step guides on platform usage

- Market Analysis: Up-to-date market predictions based on Fundamental and technical analysis

These resources cater to traders of all levels, from beginners to advanced.

Comparing Blueberry Markets with Other Brokers

The table below helps traders compare the pros and cons of trading with Blueberry Markets against other brokers.

Parameters | Blueberry Markets Broker | |||

Regulation | ASIC, VFSC | FSA, CySEC, ASIC | CySEC, DFSA, FCA, FSCA, FSA | No |

Minimum Spread | Floating from 0.0 pips | 0.0 Pips | 0.0 Pips | 0.1 Pips |

Commission | $7 | Average $1.5 | From Zero | $0 |

Minimum Deposit | $100 | $200 | From $0 | $1 |

Maximum Leverage | 1:500 | 1:500 | 1:2000 | 1:3000 |

Trading Platforms | MetaTrader 4, MetaTrader 5, WebTrader | Metatrader 4, Metatrader 5, cTrader, cTrader Web, IC Markets Mobile | MT4, MT5, Mobile App | MetaTrader 4, MetaTrader 5 |

Account Types | Standard, Direct | Standard, Raw Spread, Islamic | Cent, Zero, Pro, Premium | Standard, Premium, VIP, CIP |

Islamic Account | No | Yes | Yes | Yes |

Number of Tradable Assets | 300+ | 2,250+ | 1,000+ | 45 |

Trade Execution | Market | Market | Market, Buy Stop, Stop Loss, Limit, Take Profit | Market, Instant |

TF Expert Suggestion

Blueberry Markets, with over 7 years of experience, stands out as a solid choice for traders seeking a regulated broker under the supervision of the ASIC and VFSC authorities.

Its strengths lie in its variety of trading platforms (MT4 and MT5) and advanced copy trading services with Duplitrader. However, traders must do their own due diligence before joining this broker and depositing funds into the platform.