Bourse Direct is an AMF-regulated broker that provides access to 7 asset classes, including UCITS, CFDs, Futures, and Options. The broker offers tax-free investment of up to €150,000 on European Companies Securities.

Bourse Direct Broker Company Information & Regulation

Bourse Direct, founded in 1996, is a French broker with licenses from ACPR, AMF, and ORIAS. The company is listed on the Euronext Paris stock exchange.

Key features of Bourse Direct:

- Regulated by the Financial Markets Authority (AMF)

- Registered with ORIAS, the register of insurance, banking, and finance intermediaries

- Approved and regulated by the Prudential Control and Resolution Authority (ACPR)

- Over 340K customer accounts (as of September 2024)

- 4M orders executed (as of September 2024)

Up-to-date and precise information from Bourse Direct, such as Maximum Leverage, Client Eligibility and Regulation Tier, is provided below in the table:

Entity Parameters/Branches | Bourse Direct |

Regulation | AMF, ACPR |

Regulation Tier | Tier-1 |

Country | France |

Investor Protection Fund/Compensation Scheme | FGDR (€70,000) |

Segregated Funds | Yes |

Negative Balance Protection | No |

Maximum Leverage | 1:5 |

Client Eligibility | All countries except restricted (e.g., Iran, Syria) |

Bourse Direct Broker Summary of Specifics

Let's take a quick look at what makes Bourse Direct stand out in the crowded world of online Forex Brokers.

Broker | Bourse Direct |

Account Types | Securities, PEA / PEA-PME, PEA Youth, Corporate, CFD |

Regulating Authorities | ACPR, AMF, Orias |

Based Currencies | EUR |

Minimum Deposit | None |

Deposit Methods | Credit/Debit Cards, Bank Transfer |

Withdrawal Methods | Credit/Debit Cards, Bank Transfer |

Minimum Order | 0.01 lots |

Maximum Leverage | 1:5 |

Investment Options | Stocks, Securities, Life Insurance, Real State, Invest in Cinema, Real Economy |

Trading Platforms & Apps | TradeBox, Proprietary Mobile App |

Markets | Forex, Stocks, Warrants, Trackers, UCITS, Options, CFDs |

Spread | Variable based on the instrument |

Commission | Variable based on the account type and instruments |

Orders Execution | NDD |

Margin Call / Stop Out | N/A |

Trading Features | Investment Plans, Mobile Trading, Futures, Options, Analysis, Market News |

Affiliate Program | Yes |

Bonus & Promotions | Affiliate, Welcome bonus, Trading Offers |

Islamic Account | No |

PAMM Account | No |

Customer Support Ways | Phone, Ticket, Live Chat, Mail |

Customer Support Hours | Monday – Friday: 9 am – 8 pm Saturday: 11 am – 3 pm |

Bourse Direct Broker Account Types

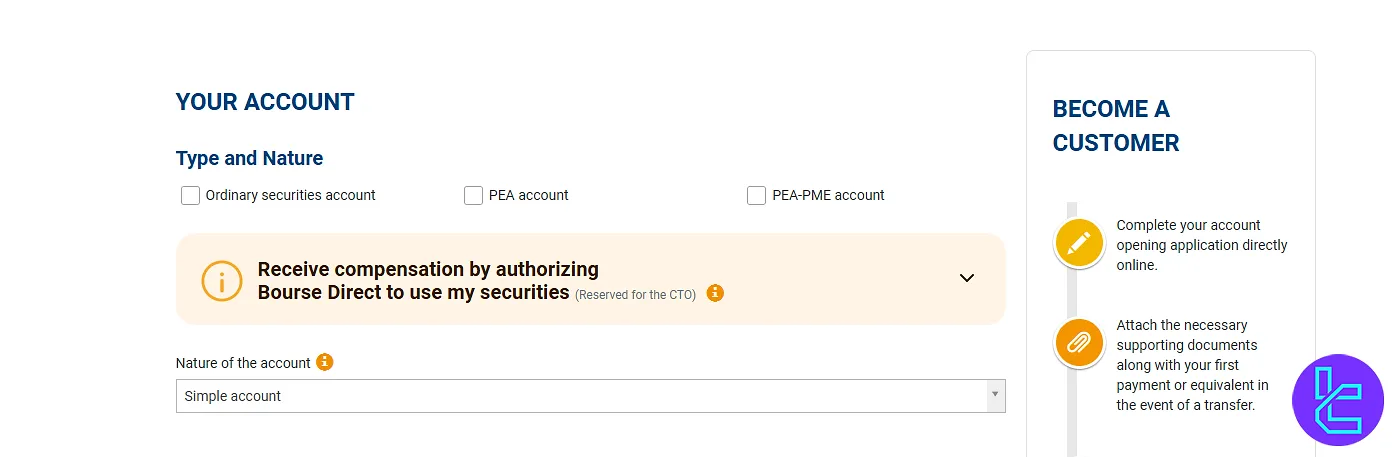

This Forex Broker offers 4 account types focusing on stock investment. It also has a CFD trading account to invest with leverage on Indices, Forex, and many more. Bourse Direct account types and their features:

Securities

This account allows you to trade a variety of securities across French, European, and international markets, providing flexibility and coverage for investors.

- Securities on French, European, and international stock exchanges

- No minimum deposit

- 100% coverage of account transfer fees up to €200

- Leverage of up to 1:5 with the Deferred Settlement Service

PEA / PEA-PME

The PEA and PEA-PME accounts are designed to provide tax advantages while investing in European companies, including SMEs and ETIs.

- No taxes included

- Purchase of securities of European companies up to €150,000

- Small and medium-sized enterprises (SMEs) and intermediate-sized enterprises (ETIs) securities via the PEA-PME plan with a payment ceiling of €225,000

- One account limitation per taxpayer

- Exclusive to French tax residents

PEA Youth

The PEA Youth account is tailored for young investors aged 18–25, offering favorable tax conditions while remaining part of their parents’ tax household.

- Designed for Young individuals between the ages of 18 and 25 who are still part of their parents' tax household

- Advantageous tax conditions

- Same conditions as the classic PEA with a payment ceiling of €20,000

Corporate

Corporate accounts give legal entities access to securities trading with flexible funding and the same benefits as standard securities accounts.

- A regular securities account designed for legal entities

- No minimum deposit

- Leverage of up to 5 with the SRD

- Cash available at any time

- Same rates as the ordinary Securities account

CFD

The CFD account allows leveraged trading across Forex, Indices, Stocks, and Commodities using advanced platforms and charting tools.

- Forex, Indices, Stocks, and Commodities with leverage

- TradeBox platform, available on desktop and mobile

- Free access to ProRealTime charts

- EURUSD spreads from 0.6 points

- A demo account with €30,000 in trading funds

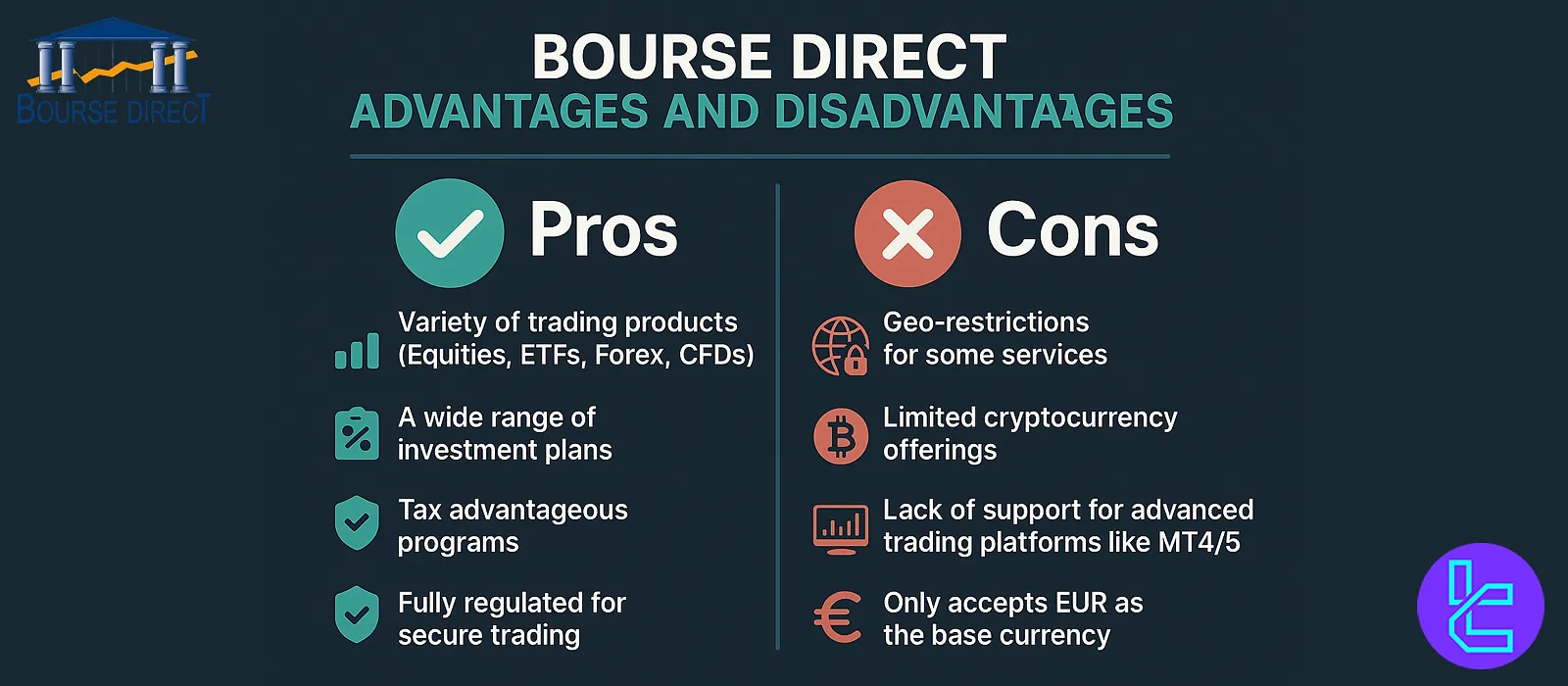

Bourse Direct Advantages and Disadvantages

We must discuss the upsides and downsides in this Bourse Direct review to give you a balanced look into the broker’s offerings.

Pros | Cons |

Variety of trading products (Equities, ETFs, Forex, CFDs) | Geo-restrictions for some services |

A wide range of investment plans | Limited cryptocurrency offerings |

Tax advantageous programs | Lack of support for advanced trading platforms like MT4/5 |

Fully regulated for secure trading | Only accepts EUR as the base currency |

These points indicate that, despite some drawbacks, Bourse Direct can be a viable choice.

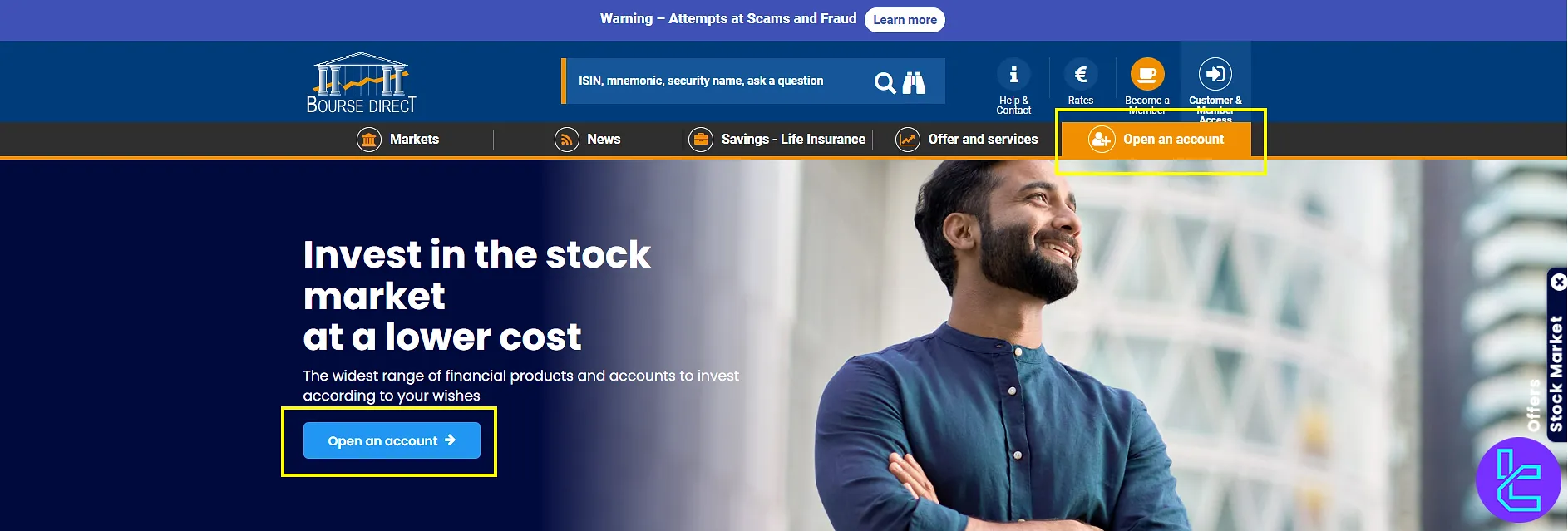

Bourse Direct Sign Up & Verification Guide

Getting started with the broker is a straightforward process, followed by a comprehensive Know Your Customer (KYC) procedure to comply with regulatory requirements. Bourse Direct registration and verification:

#1 Access the Broker's Website

Visit the official website of the Bourse Direct broker and click on the "Open an Account" button.

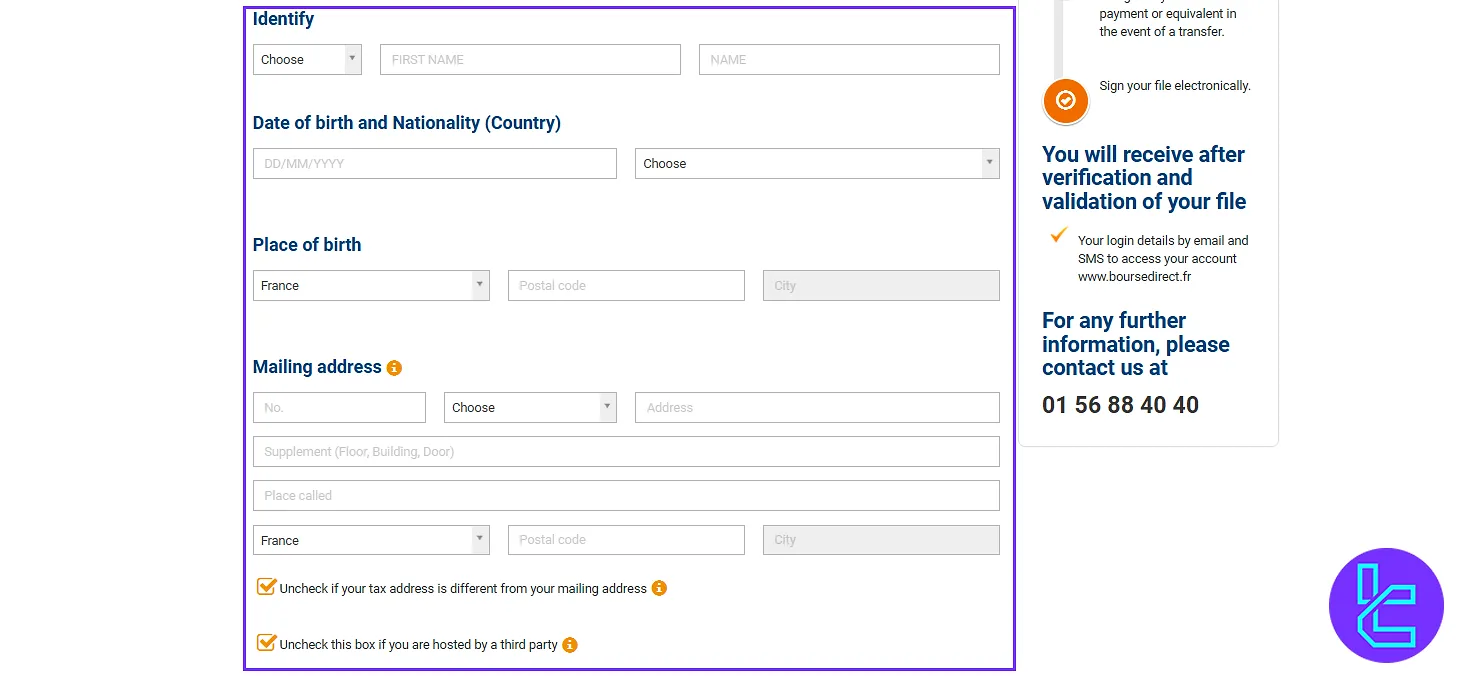

#2 Personal Information & Address

In this step, you need to complete your personal details such as your full name, gender, and place of birth. Then, carefully enter your postal address.

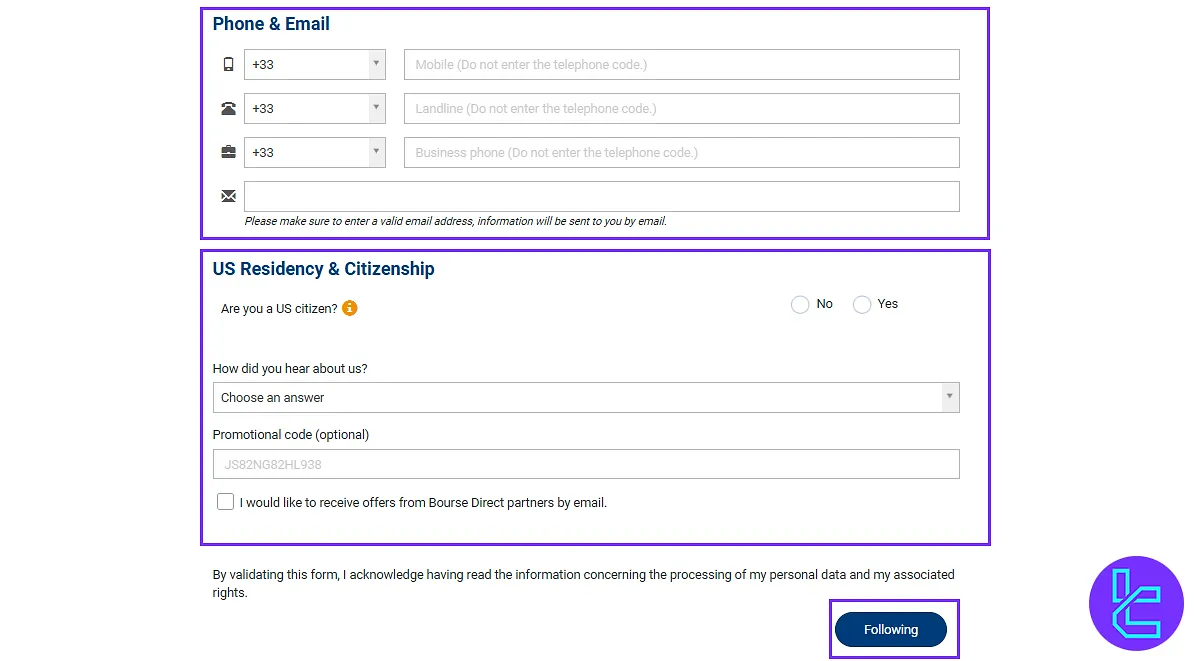

#3 Contact Information

Next, continue with the previous form by providing your mobile or landline phone number and your email address. After answering a few general questions, click the “Following” button to proceed to the next step.

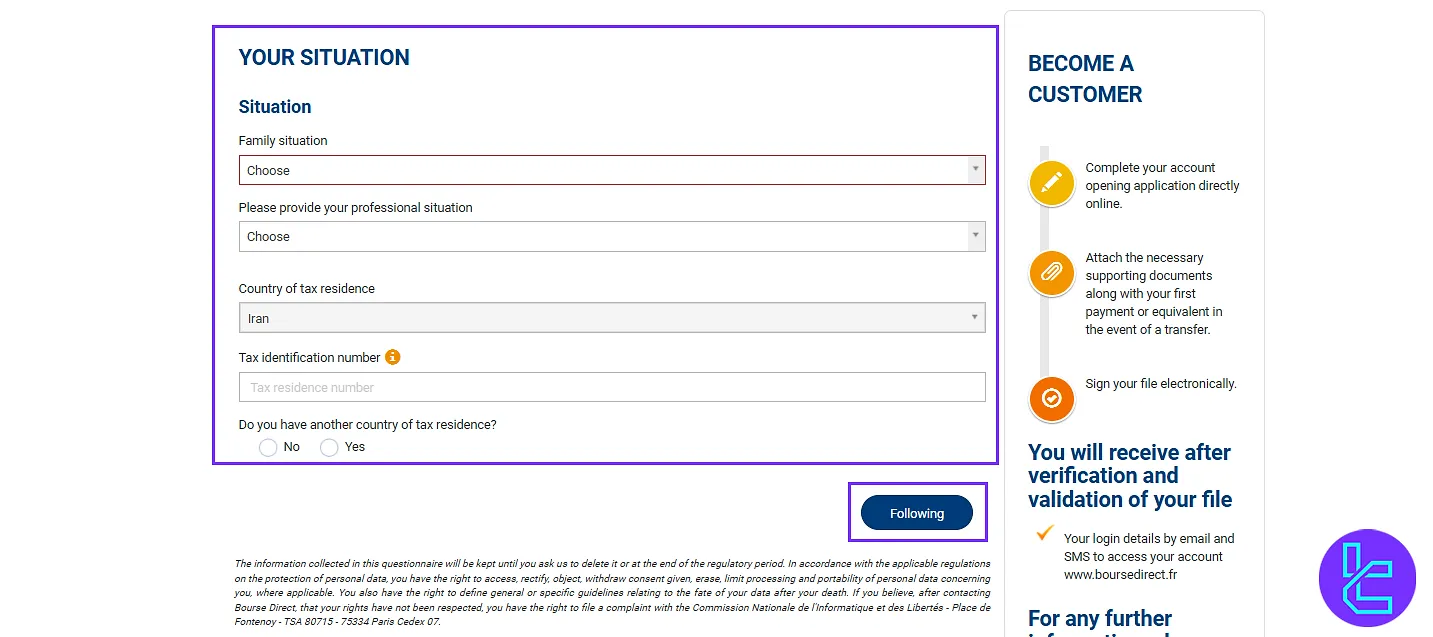

#4 Your Situation

In this stage, you are required to enter information about Your Situation, such as your marital status. Then click “Following” again to move to the next step.

#5 Account Type Selection

Here, you need to select the type of account you wish to operate.

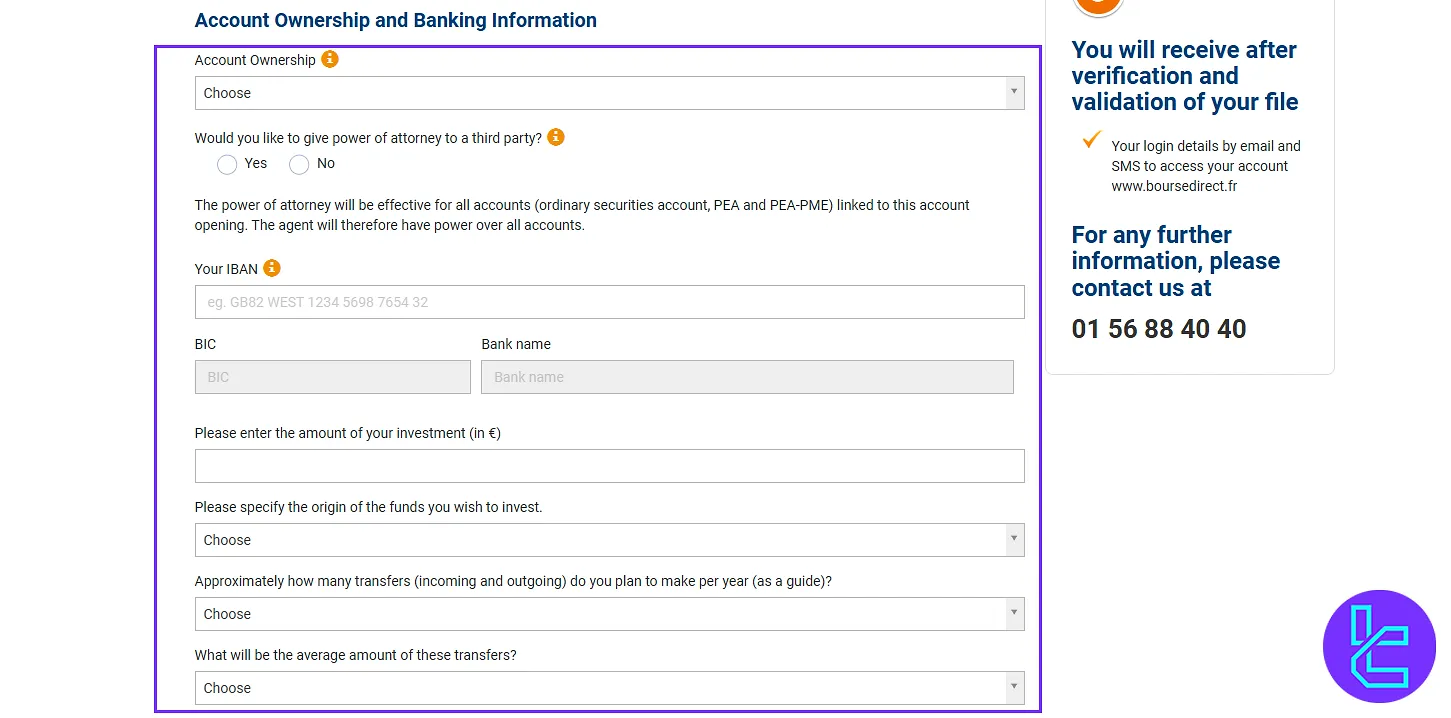

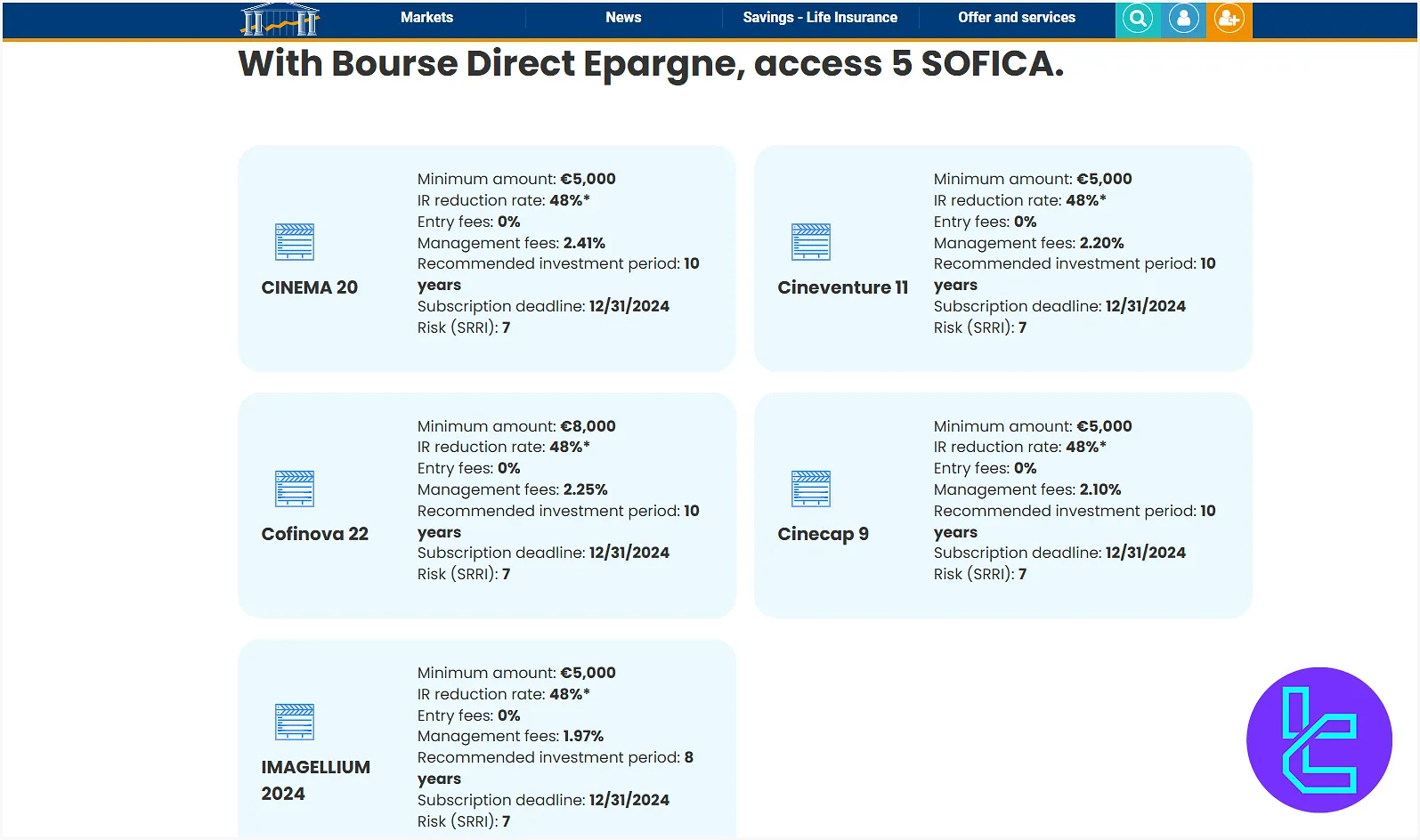

#6 Account Ownership & Banking Information

Next, complete the section on Account Ownership and Banking Information based on the questions provided, including default and optional answers.

#7 Income & Asset Information

In the final step, after entering information about your income and assets, click the “Following” button to create your account.

#8 Verify Your Trading Account

Provide proof of identity (ID card, passport, resident card, or French driving license), proof of address (utility bill), and proof of payment method (bank identity statement for the same account used for making the initial deposit).

Bourse Direct Broker Trading Platforms

Bourse Direct offers TradeBox and a proprietary mobile app as its main trading solutions.

While the Bourse Direct app allows you to manage your Stock, ETFs, and Warrants portfolio, TradeBox enables you to trade Options, Futures, CFDs, and Stocks.

Bourse Direct Trading App

TradeBox

- TradeBox iOS

- Web

Bourse Direct Spreads and Commissions

The fee structure is the next topic in this Bourse Direct review. The company takes a simple approach to fees and commissions.

It charges no custody, subscription, or maintenance fees. Key points about the Bourse Direct fee structure:

Securities, PEA, PEA-PME, and PEA Youth

The following table shows the fees applied by Bourse Direct for different order sizes in Securities, PEA, PEA-PME, and PEA Youth accounts.

Order Size | Actions – ETFs – Stock market products |

Up to €500 | €0.99 |

€500 - €1,000 | €1.90 |

€1,000 – €2,000 | €2.90 |

€2,000 – €4,400 | €3.80 |

Over €4,400 | 0.09% |

CFD

There are 3 commission plans for the TradeBox CFD account. The costs differ based on the trading volume.

- Flat Rate Package: From €5 to €9.60 per executed order less than €100,000 for a period of six months

- Decreasing Pack: From €3 to €12 per executed order less than €100,000 for a duration of 1 year

- ProRealTime: From €3 to €13 per executed order less than €100,000 for a duration of 1 year

Note that for executed orders of €100,000 or more, a brokerage rate of 0.09% will be applied to the total order value. Bourse Direct also charges spreads on CFD contracts, which differ based on the trading asset.

Instrument | Spreads From (Points) |

Indices | 0.4 |

Metals | 0.3 |

Forex | 0.6 |

Swap Fee at Bourse Direct

Swap fees apply when you hold a position overnight under Bourse Direct’s SRD / deferred settlement service.

The daily financing fee (CRD) is 0.023 % per position per day, and if the position is carried into the next month a “report” fee of 0.24 % (minimum €11.90) is charged.

- The CRD fee is waived for intraday round-trip trades (i.e. you open and close within the same day);

- Not all securities are eligible for SRD / rollover service;

- Bourse Direct does not offer swap-free or Islamic accounts.

Non-Trading Fees at Bourse Direct

Bourse Direct advertises zero fees for custody, account maintenance and inactivity. Their published tariff schedule lists various administrative and non-trading charges such as:

- Conversion to nominative registration: €18

- Handling of non-dematerialized securities: €150 per operation

- Change of tariff: €120

- Succession / estate file processing: €350 per account

- Seizure / third-party notice (avis à tiers détenteur): up to €75 (10 %)

- Debit / negative balance interest: 7.5 %

- Administrative/research fees: minimum €18 or quote

Bourse Direct Deposit & Withdrawal

The company offers limited options for funding accounts and withdrawals, with Bank Wire and Credit/Debit Cards being the only available options. There are two transfer methods:

- Express: The deposit processing time is less than 1 hour;

- Standard: The duration will be 24 to 48 hours.

Deposit Methods at Bourse Direct

Bourse Direct offers limited but reliable funding options. Deposits are mainly handled through bank transfers (standard or express), and you may also transfer securities from another broker or bank.

Other common methods like cards or e-wallets or cryptocurrency’s transfer are not supported at this broker.

For more details, see the table below:

Deposit Method | Currency | Minimum Amount | Deposit Fee | Funding Time |

Bank Transfer (Standard) | EUR | N/A | €0 | 24–48 hours |

Bank Transfer (Express) | EUR | N/A | €0 | < 1 hour (during business hours) |

Securities Transfer | EUR (securities) | Depends on account/type | No Bourse Direct fee (origin broker may charge) | ~2–3 weeks |

Withdrawal Methods at Bourse Direct

Withdrawals at Bourse Direct are processed exclusively through bank transfers to an account in the client’s name. Other withdrawal options such as cards or e-wallets are not supported.

Fees apply for outgoing transfers to French bank accounts, and international transfers may incur additional costs depending on the receiving bank.

For detailed conditions, see the table below:

Withdrawal Method | Currency | Minimum Amount | Withdrawal Fee | Processing Time |

Bank Transfer (to French bank) | EUR | N/A | €6 fixed fee | 2–3 business days |

Bank Transfer (to non-French bank) | EUR | N/A | €6 + possible extra bank fees | 3–5 business days |

Bourse Direct Broker Investment Plans

While the company has no copy trading or social trading features, it offers a full suite of investment plans, from equities to real estate investment.

- Retirement (PER): Invest and reduce your taxes by up to 45%

- Real Estate (SCPI): Buy “paper-bricks” from a few hundred euros with no property management

- Real Economy: Invest in private equity funds and buy shares of unlisted companies (SMEs and SMIs)

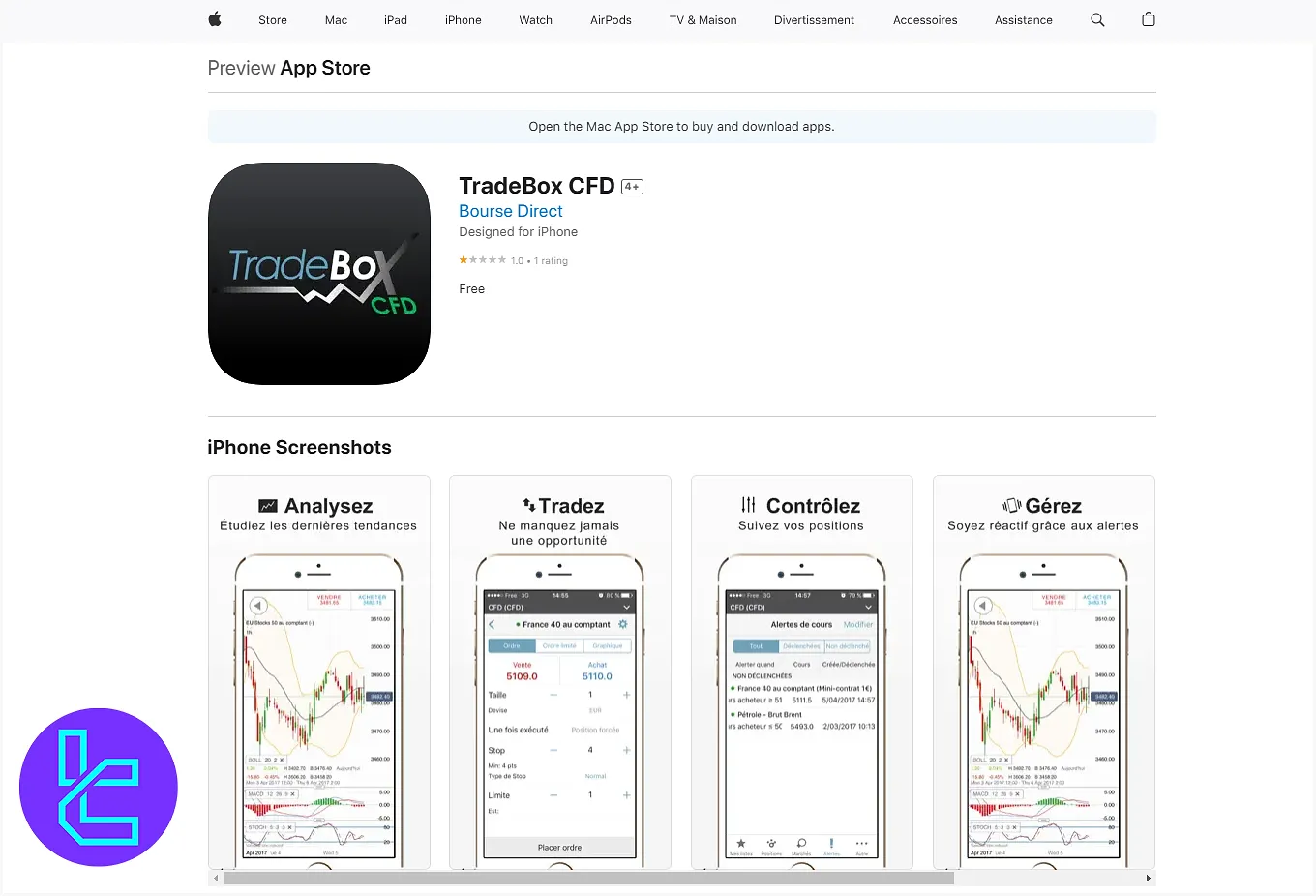

- French Cinema (SOFICA): Support French culture and enjoy a tax reduction of up to 48%

Bourse Direct Tradable Markets & Symbols Overview

The company provides access to a wide array of financial instruments, from Trackers/ETFs to CFDs.

Category | Type of Instruments | Number of Symbols | Competitor Average | Max. Leverage |

CFDs | Forex, Indices, Shares, Commodities | ~1,000+ | 2,000–3,000 | N/A |

Trackers | ETFs incl. crypto exposure | 4,300+ | 2,000–5,000 | 1:5 |

UCITs | Managed funds / portfolios | 6,000+ | 3,000–6,000 | 1:1 |

Warrants | Call / Put on assets | ~2,100 | 700–2,000 | 1:5 |

Turbos | Knock-out / leverage products | ~2,200 | 800–2,500 | N/A |

Certificates | OTC structured products | ~1,300+ | 600–2,000 | N/A |

Options | On indices & stocks | 1,000+ | 1,500–3,000 | 1:5 |

With this information, you will be able to make precise and targeted investments in one or several of the instruments and products offered by Bourse Direct.

Bourse Direct Bonuses

Promotion may be the most attractive topic in this Bourse Direct review. The broker offers various promotional programs, from welcome gifts to affiliates.

- Welcome Bonus: Promo codes for a €200 discount in brokerage fees on French markets (code: FRANCE200) and US markets (code: US200)

- Trading Offers: Zero or reduced brokerage fees on certain products, including Morgan Stanley Warrants, Amundi ETF, and BNP Paribas Asset Management

- Affiliate: 20 free orders for the godfather and a €200 fee discount for the godson

Bourse Direct Awards

Bourse Direct provides innovative investment solutions and high-quality financial services to its clients.

The broker has been recognized with awards in areas such as life insurance, ETFs, and online multi-support contracts.

Some of the recent awards received by Bourse Direct include:

- Oscar Gestion de Fortune Best Profiled Management Dynamic Profile 2025

- Label of Excellence awarded by Les Dossiers de l'Epargne 2025

- Best ETF Contract 3rd consecutive year Victory of Gold – The Individual 2024

- Best Multi-Support Internet Contract Bronze Victory The Individual 2024

Bourse Direct Broker Support

The company prides itself on providing comprehensive customer support via online chat, email, and phone calls, Monday to Friday from 8:00 a.m. to 8:00 p.m. and Saturday from 10:00 a.m. to 3:00 p.m.

See the table below for a full overview of contact options:

Phone | +33172785871 |

Live Chat | Available on the official website |

Ticket | Via the “Contact” form |

Bourse Direct, 374 rue Saint-Honoré, 75001 Paris |

Bourse Direct Broker Restricted Countries

As a French broker, Bourse Direct primarily serves the French market and European Union residents. However, its website does not provide specific information about restricted countries.

It's always best to check directly with the support team or consult their terms of service for the most up-to-date information on geographical restrictions.

While there is no specific data, Bourse Direct probably doesn’t provide services in the following countries.

- Iran

- North Korea

- Syria

- Gaza

- Yemen

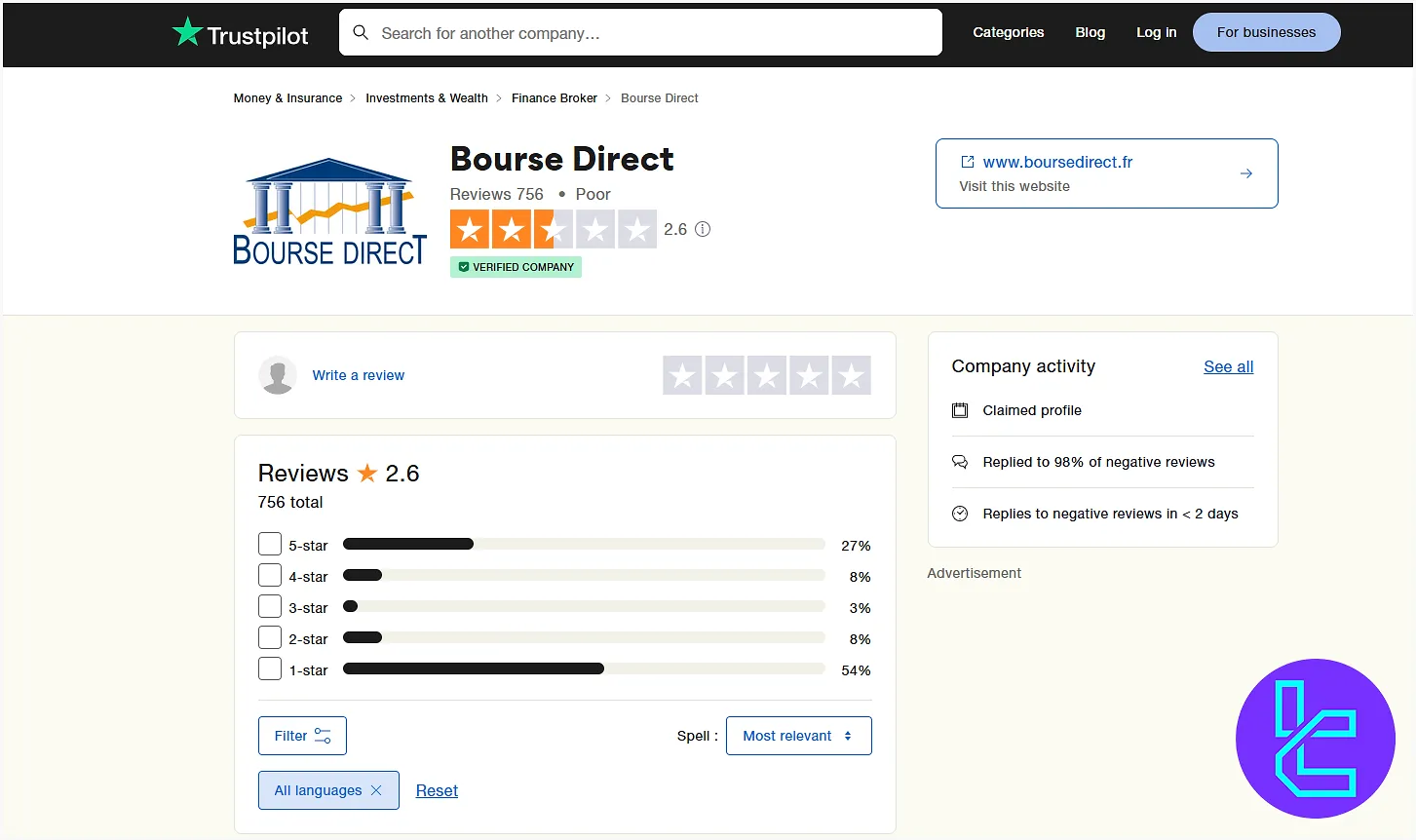

Trust Scores & Reviews

User Satisfaction is the most important topic in this Bourse Direct review. The Bourse Direct Trustpilot profile has a poor rating of 2.6 out of 5 (based on 755 comments).

More than 50% of users have rated Bourse Direct as a 1-star broker.

Bourse Direct Education

The broker empowers traders with a full suite of educational offerings, from webinars & training to personalized coaching. Bourse Direct educational materials:

- Free training: webinars and online trading tutorials

- Personalized coaching: A 2-day program hosted by Christian Sanson

- Getting started: Articles about the starting process, product introductions, platform applications, and account types

- Trading strategies: Various investing and trading strategies

Bourse Direct Comparison Table

To fully understand the benefits and drawbacks of trading with Bourse Direct in comparison with other brokers, check the table below.

Parameters | Bourse Direct Broker | |||

Regulation | ACPR, AMF, Orias | No | FSA, CySEC, FCA, FSCA, CBCS, FSC, CMA | ASIC, FSC, DFSA, CySEC |

Minimum Spread | From 0.6 Pips | From 0.1 Pips | From 0.0 Pips | From 0.6 Pips |

Commission | From $0 | $0 | From $0.2 to USD 3.5 | $0 (except on Shares account) |

Minimum Deposit | $0 | $1 | $10 | $5 |

Maximum Leverage | 1:5 | 1:3000 | Unlimited | 1:1000 |

Trading Platforms | TradeBox, Proprietary Mobile App | MetaTrader 4, MetaTrader 5 | Exness Trade (mobile), Exness Terminal (web), MT4, MT5 | MT4, MT5, Mobile App |

Account Types | Securities, PEA / PEA-PME, PEA Youth, Corporate, CFD | Standard, Premium, VIP, CIP | Standard, Standard Cent, Pro, Raw Spread, Zero | Micro, Standard, Ultra Low, Shares |

Islamic Account | No | Yes | Yes | Yes |

Number of Tradable Assets | N/A | 45 | 200+ | 1400+ |

Trade Execution | NDD | Market, Instant | Market, Instant | Market, Instant |

Conclusion

Bourse Direct broker provides a full range of trading and investing products from Forex and CFDs to Warrants and ETFs with a maximum leverage of 1:5 via the TradeBox platform.

Bourse Direct has been listed on Euronext Paris stock exchange, and offers 5 SOFICA products for investing in French Cinema. The company has a 2.6 score on TrustPilot.