Capex broker offers 2100+ tradable symbols in 8 different markets through its Essential, Original, and Signature account types.

These accounts have a $100 minimum deposit threshold, up to 1:300 leverage, and are available on TradingView, MT5, WebTrader, and the mobile app.

This broker also supports various deposit and withdrawal methods such as bank cards, Neteller, Skrill, and bank wire transfers.

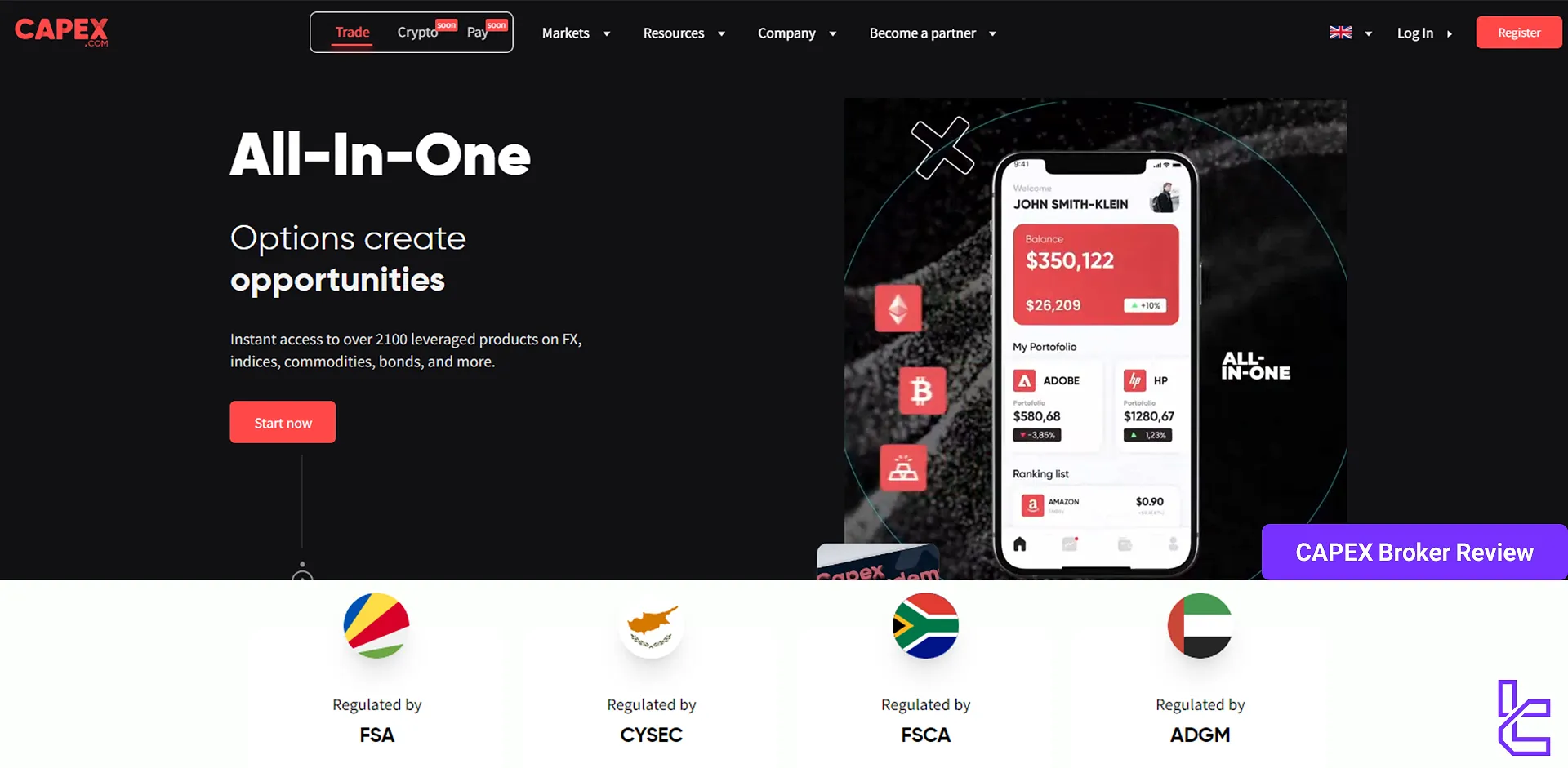

Company Information & Regulations of CAPEX Broker

CAPEX.com is a well-established, multi-licensed global Forex broker that offers access to thousands of leveraged products across various asset classes.

The broker is regulated, which provides licensing from reputable financial authorities, including:

- Financial Services Authority (FSA)

- Cyprus Securities and Exchange Commission (CySEC) {license number 292/16}

- Financial Sector Conduct Authority (FSCA)

- Abu Dhabi Global Markets - Financial Services Regulatory Authority (ADGM) [license number 190005]

However, note that the CAPEX website operates solely under the regulatory oversight of FSA Seychelles:

Parameter | (Seychelles) |

Regulation | FSA Seychelles (SD020) |

Regulation Tier | Tier 3 |

Country | Seychelles |

Investor Protection | No |

Segregated Funds | Yes |

Negative Balance Protection | Yes |

Maximum Leverage | 1:300 |

Client Eligibility | All countries except restricted (e.g., USA, Canada) |

These regulatory bodies ensure that CAPEX.com adheres to strict financial standards and practices, providing traders with a secure and transparent trading environment.

CAPEX Broker Summary of Specifications

To give you a general idea of what CAPEX has to offer, let’s review its features:

Broker | CAPEX |

Account Types | Essential, Original, Signature |

Regulating Authorities | FSA, FSCA, CySEC, ADGM |

Based Currencies | USD, CZK, DKK, EUR, GBP, HUF, PLN, RON, SEK, ZAR |

Minimum Deposit | $100 |

Deposit Methods | Visa/MasterCard, Bank wired, Neteller, Skrill |

Withdrawal Methods | Visa/MasterCard, Paypal, Bank wired, Neteller, Skrill |

Minimum Order | 0.01 Lot |

Maximum Leverage | 1:300 |

Investment Options | No |

Trading Platforms & Apps | MT5, WebTrader, mobile app |

Markets | Forex, indices, commodities, ETFs, Bonds, crypto, shares |

Spread | Floating from 0.01 pips |

Commission | No |

Orders Execution | Market execution and instant execution |

Margin Call/Stop Out | 50% |

Trading Features | Demo account, economic calendar |

Affiliate Program | Yes |

Bonus & Promotions | First deposit bonus, additional deposit bonus |

Islamic Account | Yes |

PAMM Account | No |

Customer Support Ways | Email, live chat, phone |

Customer Support Hours | 24/5 |

Restricted Countries | USA, Spain, Japan, and Canada |

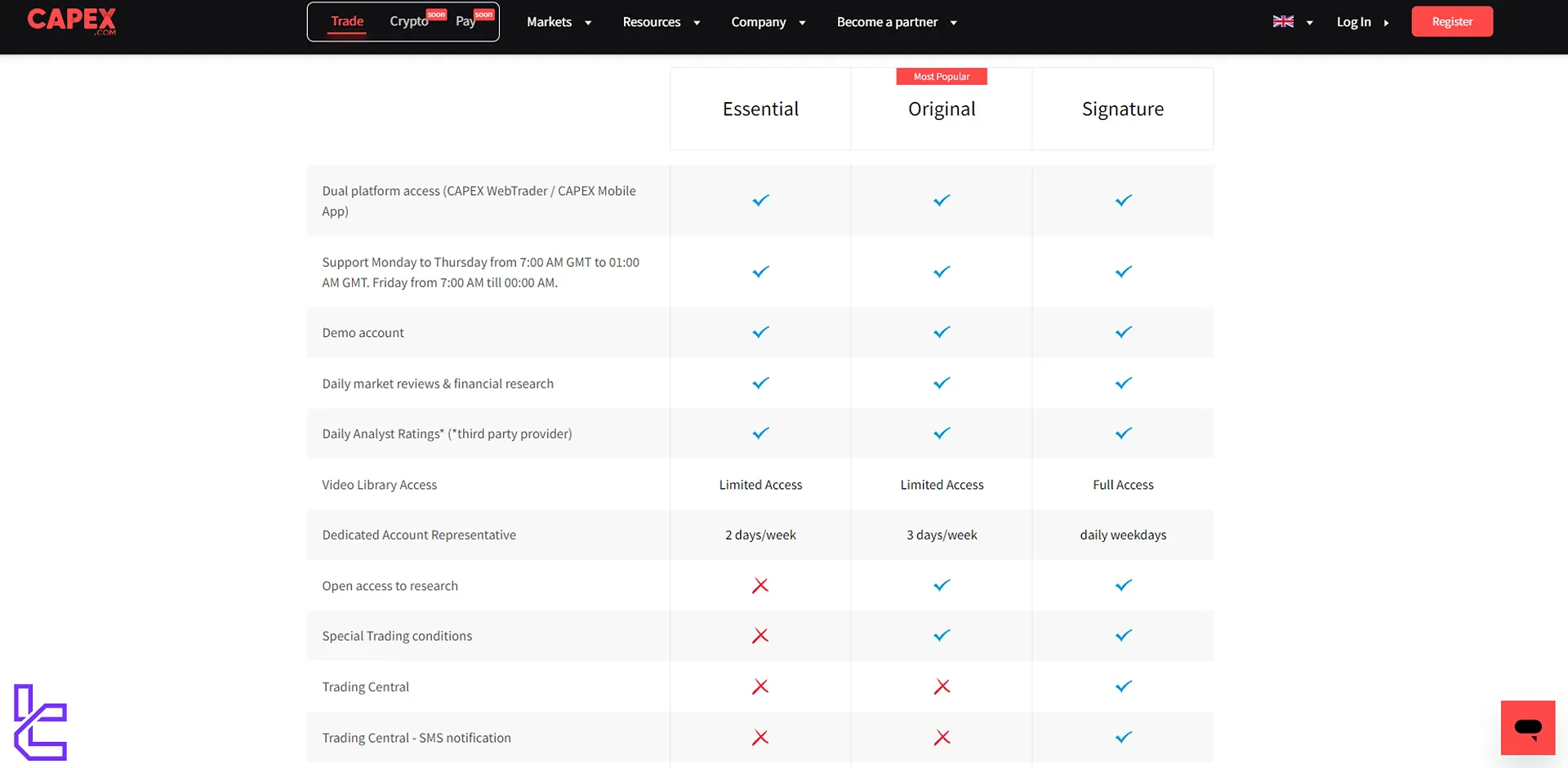

CAPEX Broker Accounts Overview

CAPEX.com offers three distinct trading account types to cater to the diverse needs of traders:

Essential Account

- Minimum deposit: $100

- Basic features: Dual platform access

- Limited video library access

- Dedicated account representative available 2 days per week

Original Account

- Minimum deposit: $5,000

- 3-day per week dedicated account representative

- Additional trading conditions and open access to research

Signature Account

- Minimum deposit: $25,000

- Full video library access

- Daily weekday meetings with a dedicated representative

- Access to Trading Central

- 1-on-1 meetings with an account representative

Regardless of the account type, all CAPEX clients benefit from:

- Access to a demo account for practice

- Ability to trade major markets through CAPEX web and mobile platforms

CAPEX Broker Advantages and Disadvantages

Just like any other broker, CAPEX has various benefits and drawbacks. Let’s review some of the essential pros and cons of this broker:

Advantages | Disadvantages |

Multi-regulated broker | High minimum deposit |

Wide range of tradable instruments | Not available to US traders |

Various deposit and withdrawal methods | - |

Wide variety of bonuses | - |

CAPEX Account Registration

Opening an account with Capex is straightforward and takes just two main steps. This guide outlines the process for new traders, ensuring a smooth registration experience.

#1 Access the Official Capex Platform

To start, visit the official Capex website using a trusted browser. Locate the “Register” button prominently displayed on the homepage and click to proceed. This action directs you to the account creation section.

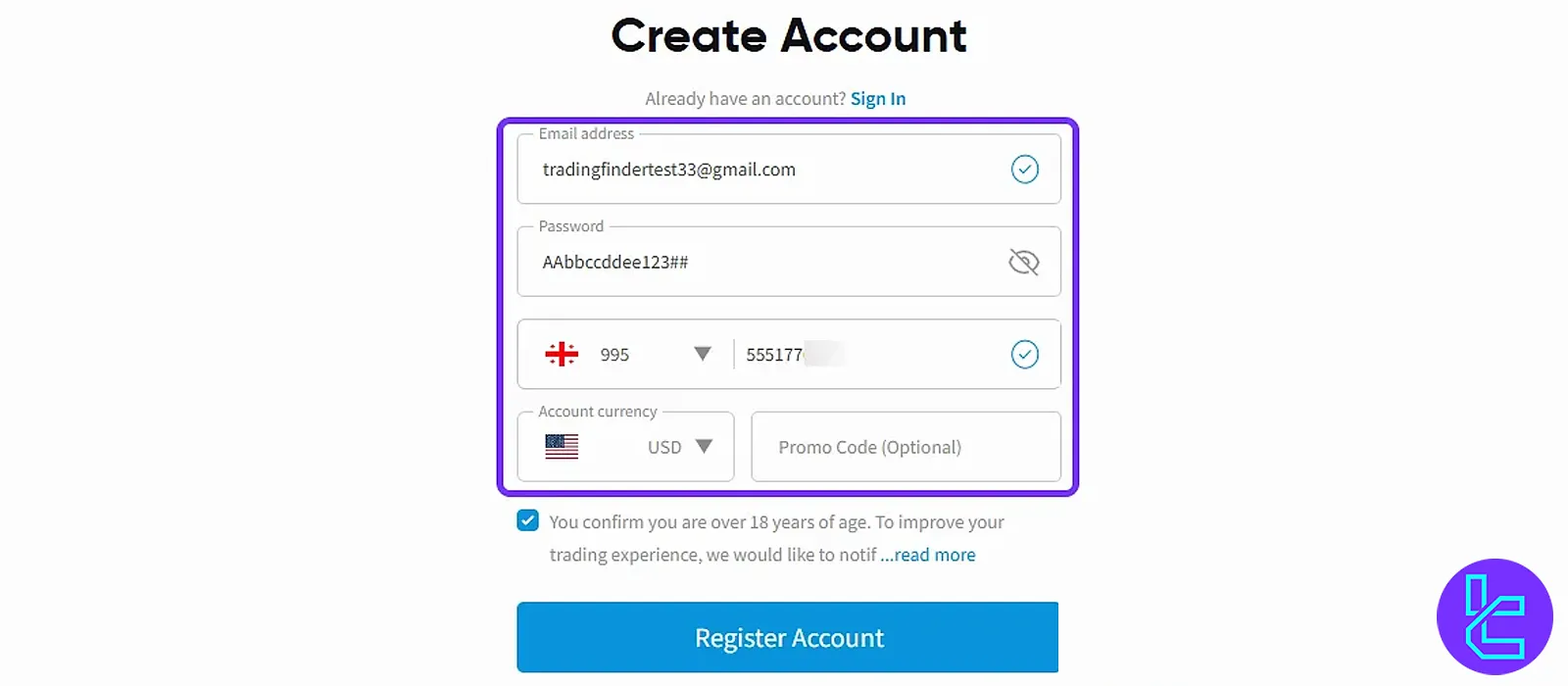

#2 Complete the Registration Form

To complete your registration, follow these steps:

- Enter your email address and create a strong password. use a mix of uppercase and lowercase letters, numbers, and symbols for better security;

- Provide your mobile number, choose your preferred base currency, and (optionally) enter a promo code;

- Review and accept the terms and conditions: then click “Register” to complete the process.

After completing these steps, your Capex account is successfully created. You can now click “Go to Platform” to access the trading interface and begin trading.

CAPEX Sign Up & Verification Guide

Unfortunately, CAPEX doesn’t currently accept new clients but offers trading with their partner company. We will update this article if CAPEX starts accepting new registrations.

CAPEX Broker Trading Platforms

CAPEX.com offers two main trading platforms to accommodate both manual and automated traders:

- CAPEX WebTrader: A proprietary platform with a clean UI, ideal for discretionary trading. It comes pre-loaded with advanced features like Trading Central analytics, Daily Analyst Ratings, Insider Hot Stocks, Bloggers' Opinions, Hedge Fund Activity, and News Sentiment indicators

- MetaTrader 5 (MT5): A globally recognized platform supporting algorithmic trading, expert advisors (EAs), and custom indicators. Copy trading is also integrated within MT5

CAPEX Broker Trading Fees (Spreads and Commissions)

CAPEX Broker offers competitive pricing:

- Spreads: Variable, starting from 0.01 pips on major forex pairs

- Commission: No commission

Key points:

- Leverage up to 1:300 for retail clients

- No fees for deposit or withdrawal fees

- $30 inactivity fee after 3 months

- Transparent fee structure with no hidden costs

This straightforward pricing structure allows traders to calculate their trading costs before entering it.

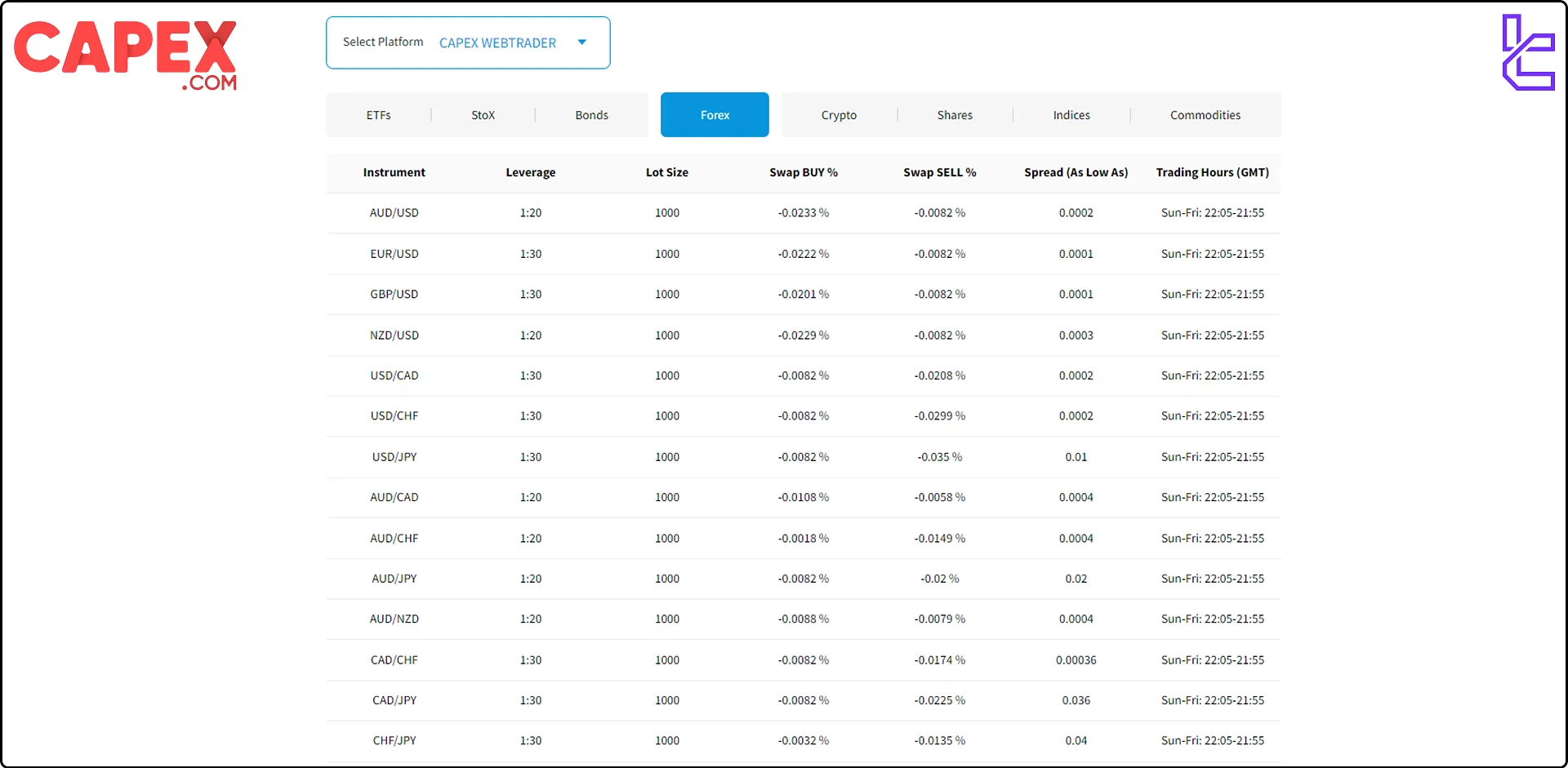

Swap Fee at CAPEX

At CAPEX, swap fees are charged when a position stays open past 21:00 GMT (summer) or 22:00 GMT (winter). The exact amount depends on the instrument, trade size, and position direction.

These fees are recalculated daily and shown transparently within the trading platform.

- Triple swap charged on specific weekdays (e.g., Wednesday for forex);

- Additional 0.5% conversion fee if trade currency differs from account currency;

- Swap-Free (Islamic) account is available for clients who request, exempt from overnight fees.

Non-Trading Fees at CAPEX

At CAPEX, non-trading fees are limited, with the most notable being the inactivity fee and the conversion fee.

These charges only apply in specific scenarios, such as long periods of no trading or operating in a different account currency.

- Inactivity fee: $15 (or equivalent) per month after 12 months of no account activity;

- Conversion fee: 0.5% applied to swaps, P/L, and margin in non-account currencies;

- No fees on deposits or withdrawals (third-party charges may apply);

- No direct trading commission, costs are built into spreads.

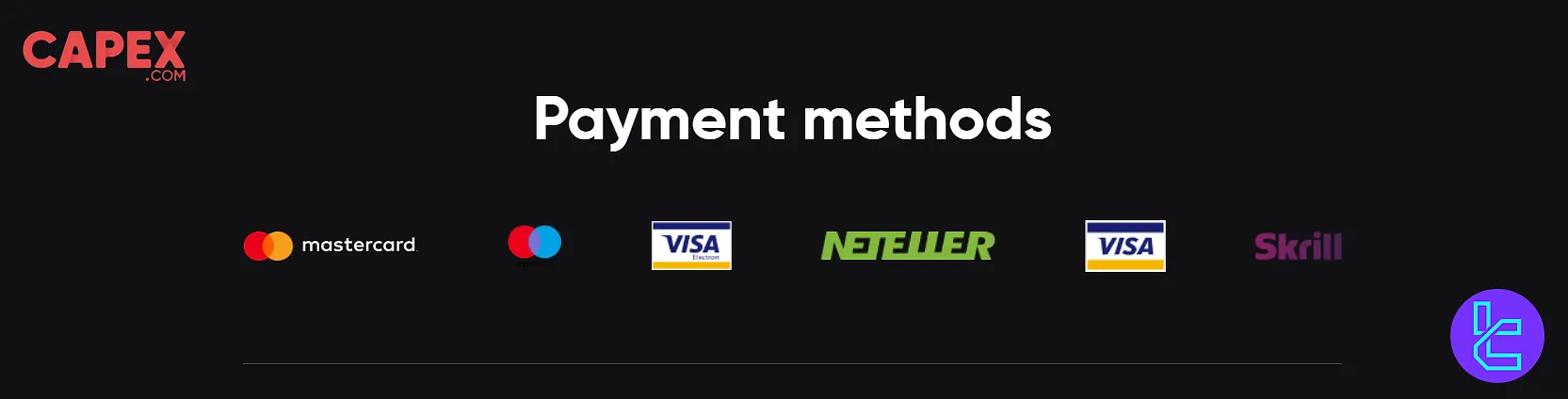

CAPEX Deposit & Withdrawal Options

CAPEX.com offers a range of payment methods for deposits and withdrawals:

- Credit/debit cards

- Bank wire transfer

- E-wallets (Skrill, Neteller)

Important notes:

- No deposit or withdrawal fees are charged by CAPEX

- Currency conversion fees may apply for non-account currency transactions

- Withdrawals are typically processed within 1-3 business days

- Minimum deposit in CAPEX broker is $100

CAPEX Deposit Methods

CAPEX offers a variety of deposit methods to make funding your trading account simple and accessible.

Depending on your region and preferences, you can choose from several options, including cards, bank transfers, and e-wallets.

Each method comes with its own conditions in terms of fees, processing time, and minimum amounts.

For more details, refer to the table below:

Deposit Method | Currency | Minimum Amount | Deposit Fee | Funding Time |

Credit/Debit Card | USD, EUR, GBP | $100 (or equivalent) | 0% | Instant |

Bank Transfer | USD, EUR, GBP | $250 (or equivalent) | Bank fees may apply | 1–3 business days |

E-Wallets (Skrill, Neteller) | USD, EUR | $100 (or equivalent) | 0% | Instant |

CAPEX Withdrawal Methods

CAPEX provides multiple withdrawal methods to ensure traders can access their funds securely and efficiently.

The available options generally match the method you used for depositing, and conditions may vary depending on the method and region.

check the table below for full details:

Withdrawal Method | Currency | Minimum Amount | Withdrawal Fee | Processing Time |

Credit/Debit Card | USD, EUR, GBP | $50 (or equivalent) | 0% | 3–5 business days |

Bank Transfer | USD, EUR, GBP | $100 (or equivalent) | Bank fees may apply | 3–5 business days |

E-Wallets (Skrill, Neteller) | USD, EUR | $50 (or equivalent) | 0% | 24 hours |

CAPEX Copy Trading

Currently, CAPEX.com does not offer copy trading or social trading features. This a major downside for novice traders who want to use the expertise of professionals.

CAPEX.com mainly focuses on providing a comprehensive set of tools and resources to help traders do profitable trading.

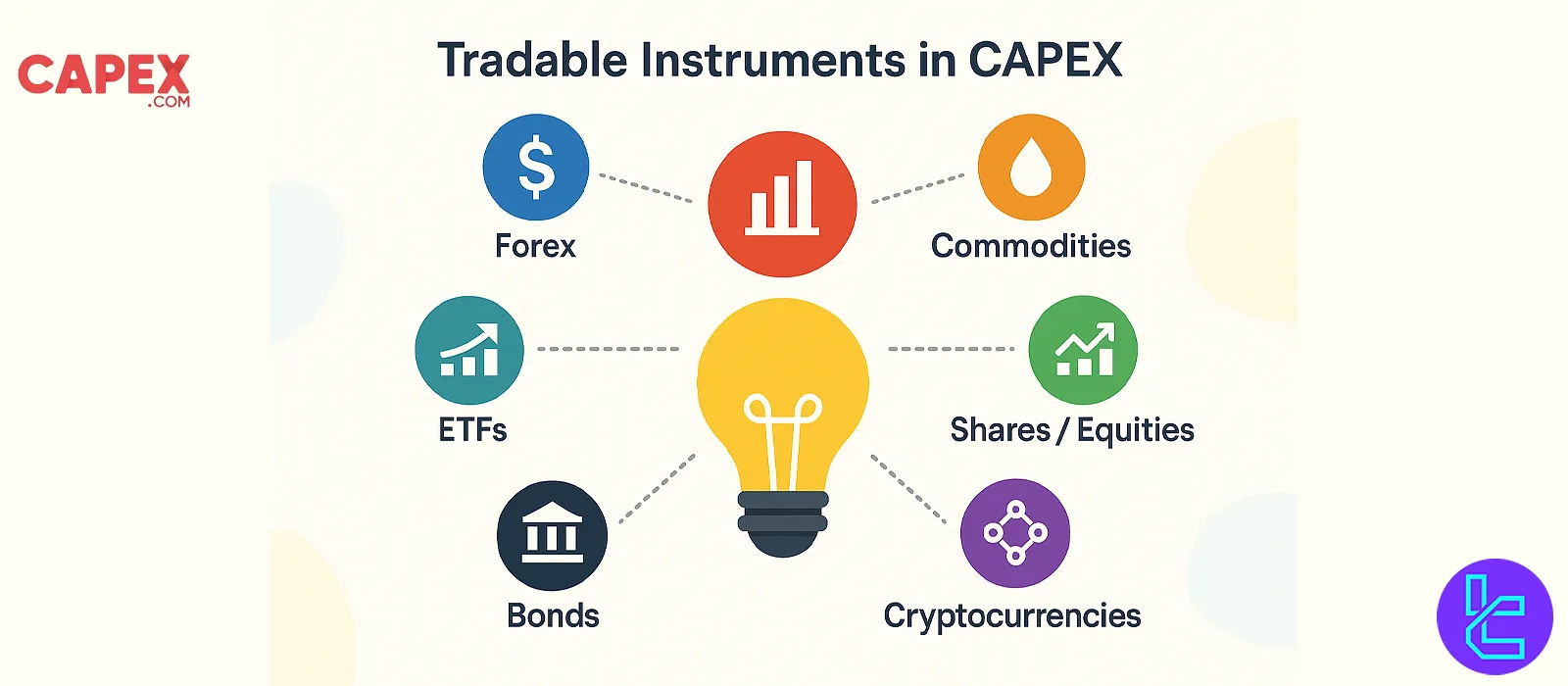

Tradable Instruments in CAPEX

CAPEX.com offers over 2100 tradable markets and instruments:

Category | Type of Instruments | Number of Symbols (CAPEX) | Competitor Average* | Max. Leverage (CAPEX) |

Forex | Major, minor & exotic FX pairs | 55+ | ~50–70 pairs | Up to 1:300 |

Indices | Global indices CFDs | 15+ | ~20–30 | Up to 1:200 |

Commodities | Metals, energy, agricultural CFDs | 18 | ~15–25 | Up to 1:200 |

Shares / Equities | Stock CFDs from global markets | 2,000+ | ~1,000–3,000 (depending on broker) | 1:10 |

ETFs | Exchange-Traded Funds CFDs | 80+ | ~20–100+ | Up to 1:100 |

Cryptocurrencies | Crypto CFDs (Bitcoin, Ethereum, etc.) | 20+ | ~10–20 (some >50) | Not explicitly listed by CAPEX |

Bonds | Government & corporate bond CFDs | 4 | Very limited (few brokers offer) | Up to 1:100 |

Given the wide range of instruments offered by CAPEX, you will have no difficulty selecting markets and instruments that align with your trading style and capital.

CAPEX Broker Bonuses and Promotions

CAPEX offers several bonuses and promotions to attract and reward traders:

- First Deposit Bonus: Traders can receive up to 40% bonus on the initial deposit (since the broker doesn’t allow new sign-ups, this bonus is basically deactivated)

- Additional Deposit Bonus: Up to 40% deposit bonus on all payments

- Refer a Friend Program: Traders can earn exclusive bonuses when friends open and fund accounts

Terms and conditions apply to all bonuses and promotions. It's important to read and understand these terms before participating in any promotional offers.

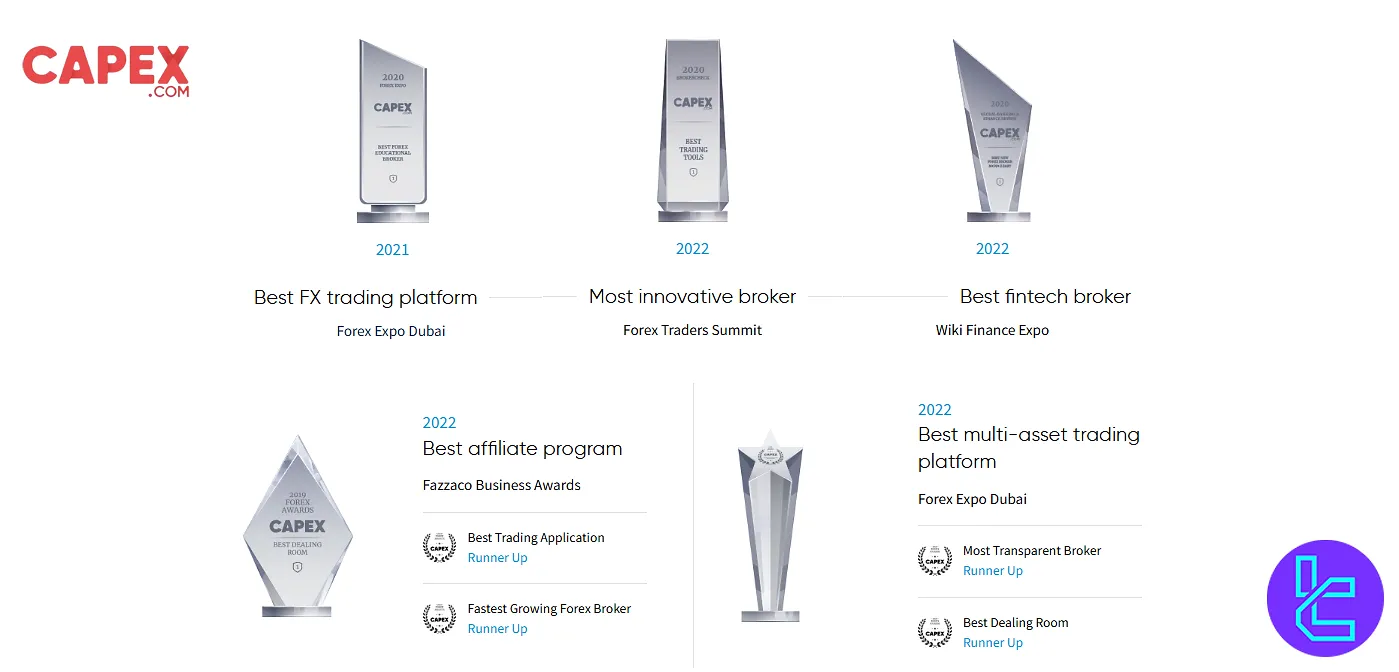

CAPEX Awards

CAPEX is globally recognized for its influence in shaping the future of trading. The broker highlights its performance, which distinguishes it from competitors.

Over the years, the broker has received multiple CAPEX Awards from reputable financial industry authorities.

A detailed list of its awards is available for review:

- 2021: Best FX Trading Platform – Forex Expo Dubai

- 2022: Most Innovative Broker – Forex Traders Summit

- 2022: Best Fintech Broker – Wiki Finance Expo

- 2022: Best Affiliate Program – Fazzaco Business Awards

- 2022: Best Trading Application – Runner Up

- 2022: Fastest Growing Forex Broker – Runner Up

- 2022: Best Multi-Asset Trading Platform – Forex Expo Dubai

- 2022: Most Transparent Broker – Runner Up

- 2022: Best Dealing Room – Runner Up

CAPEX Customer Support

It’s time to go through the quality and channels of customer support in ourCAPEX Review. This broker provides comprehensive customer support through various channels:

- Email: support.sc@capex.com

- Live chat: Available on the website

- Phone: +5078388497 (main support), +5078388626 (brokerage department)

- Help Center: Available on the website

Support is available 24/5, with multilingual assistance to cater to a global client base.

CAPEX Restricted Countries and Regions

CAPEX.com maintains a list of restricted countries where it does not offer its services due to regulatory, legal, or compliance reasons. This list is subject to change and currently includes:

- United States

- Canada

- Japan

- Spain

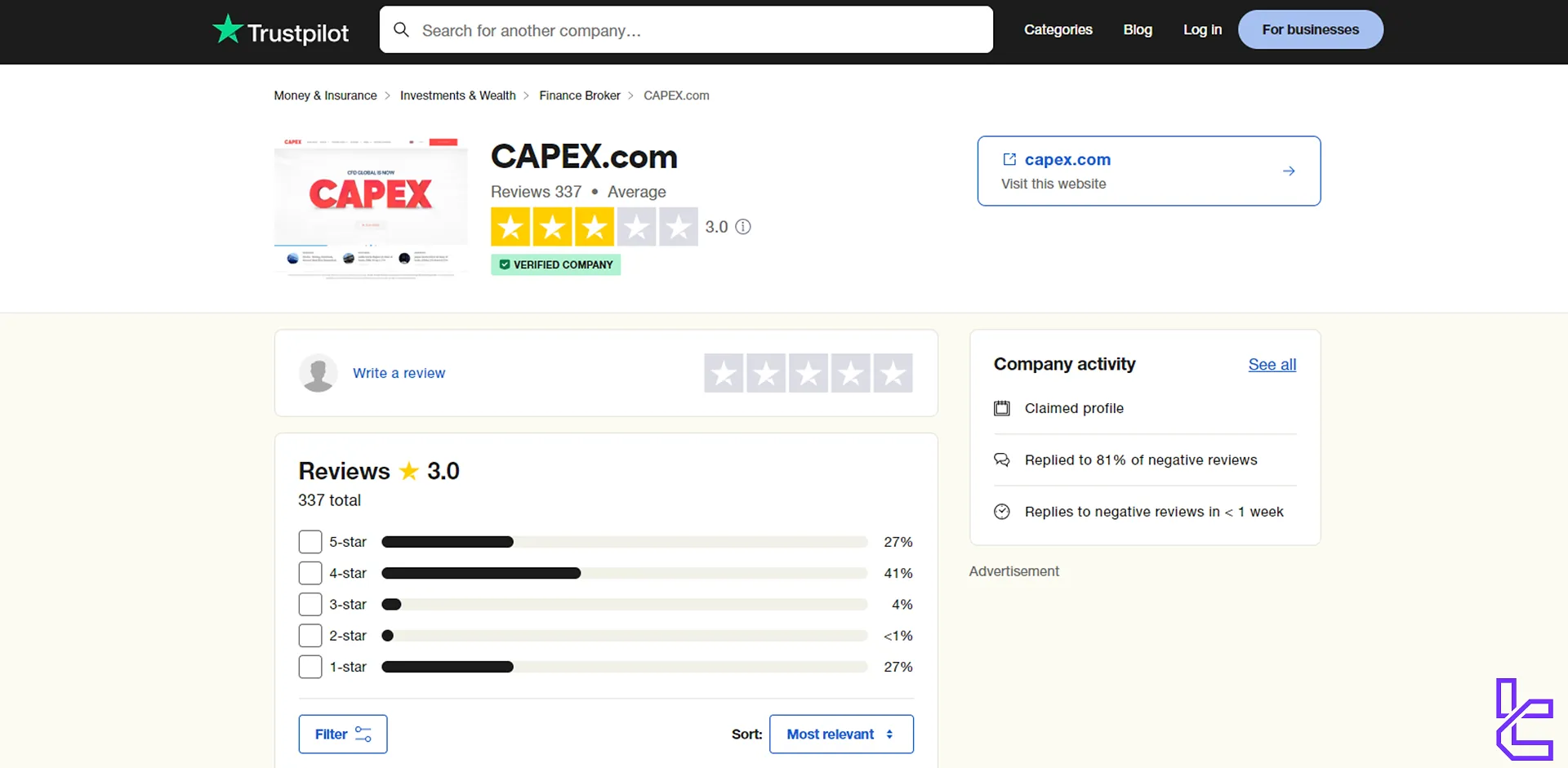

CAPEX Broker User Reviews and Trustscore

CAPEX has received mixed reviews on Capex Trustpilot, with an overall rating of 3.0 out of 5 stars.

It's important to note that individual experiences may vary, and potential traders should consider multiple sources of information when evaluating a broker.

The educational resources cater to both beginner and advanced traders, focusing on practical, step-by-step guides to trading and investing. Topics covered include risk management, money management, and developing the right trading mindset.

CAPEX Broker Educational Resources

CAPEX.com offers a robust educational program through its CAPEX Academy:

Free online courses covering:

- Basics of Trading

- Investing Basics

- Trading Strategies

- Cryptocurrency & Blockchain Basics

- Best of Crypto

- Crypto Strategies

- Regular webinars led by experienced market analysts

- Real-time market analysis and insights

- Q&A sessions with industry experts

The educational resources cater to both beginner and advanced traders, focusing on practical, step-by-step guides to trading and investing.

Topics covered include risk management, money management, and developing the right trading mindset.

Capex in Comparison with Other Brokers

Check the table below to get a better understanding of the pros and cons in the Capex broker.

Parameters | Capex Broker | |||

Regulation | FSA, FSCA, CySEC, ADGM | ASIC, SCB, FCA, DFSA, CMA, BaFin, CySEC | FSCA, FSRA | ASIC, CySEC, FSC, FSCA, FSA |

Minimum Spread | From 0.01 pips | From 0.0 pips | From 0.0 pips | From 0.0 pips |

Commission | No | From $0.0 | From $0.0 | $3 |

Minimum Deposit | $100 | $1 | $50 | $50 |

Maximum Leverage | 1:300 | 1:500 | 1:1000 | 1:500 |

Trading Platforms | MT5, WebTrader, mobile app | Proprietary Platform, cTrader, Trading View, MetaTrader 4&5 | MT4, MT5, Pro Trader, App Trader | MT4, MT5, cTrader |

Account Types | Essential, Original, Signature | Standard, Razor | Direct, Prime, Ultra | Standard, RAW |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | 2100+ | 1200+ | 1000+ | 1000+ |

Trade Execution | Market, Instant | Instant | Market | Instant |

TF Expert Suggestion

Capex strives to outweigh the $30 inactivity fee and no bonus offerings by providing quality trading conditions with floating spreads from 0.01 pips and $0 trading commissions.

Traders must remember that the broker doesn’t accept new users at the moment.