Capital.com offers access to 3200+ trading instruments with leverage options of up to 1:30 through MT4 and TradingView platforms. It accepts PayPal and Giropay payments with no transaction commissions.

Capital.com operates under reputable regulations such as ASIC, FCA, and CySEC. It provides secure and high-quality services to most countries around the world.

Capital.com Forex Broker Company Information & Regulation Status

Capital.com has quickly established itself as a prominent player in the online trading industry.

Founded in 2016, this technology-driven company has built a solid reputation for providing a user-friendly experience, high-quality client support, and value for money.

Here's what you need to know about Capital.com's company information and regulatory status:

- Headquarters: com has offices across the UK, Europe, and Australia, serving clients in over 180 countries;

- Global reach: The platform boasts over 650,000 traders worldwide;

- Customer support: A dedicated team of over 50 client support staff is available 24/7 in 10+ languages.

Capital.com is regulated by several reputable financial authorities, including:

- Cyprus Securities and Exchange Commission (CySEC), License Number 319/17

- European Union Markets in Financial Instruments Directive (MiFID) Compliance

- FCA

- ASIC

- FSA

- SCB

Entity Parameter/ Branches | Capital.com SV Investments Ltd (Cyprus/EU) | Capital.com (UK) Ltd | Capital.com Australia Pty Ltd | Capital.com MENA Securities Trading L.L.C. (UAE) | Capital.com Online Investments Ltd (Bahamas) |

Regulation | CySEC | FCA | ASIC | SCA | SCB |

Regulation Tier | Tier-1 | Tier-1 | Tier-1 | Tier-2 | Tier-3 |

Country | Cyprus | UK | Australia | UAE | Bahamas |

Investor Protection | ICF €20k + Insurance | FSCS £85k | None | None | None / Insurance up to $1M |

Segregated Funds | Yes | Yes | Yes | Yes | Yes |

Negative Balance Protection | Yes | Yes | Yes | Yes | Yes |

Maximum Leverage | 1:30 | 1:30 | 1:30 | 1:300 | 1:300 |

Client Eligibility | Residents of the EEA | UK residents | Australian residents | Clients from GCC and Middle Eastern regions approved by the SCA | International clients outside EU, UK, and Australia |

Capital.com offers leverage of up to 1:300 only to “professional clients” on selected markets. Retail clients are subject to lower leverage limits in line with regional regulations.

This regulatory structure ensures that clients' funds are protected and any issues are resolved fairly, adding an extra layer of security for traders using the Forex broker.

Capital.com Broker Summary of Specifics

To give you a quick overview of what Capital.com offers, here's a summary table of its key features:

Broker | Capital.com |

Account Types | Professional, Demo, Retail |

Regulating Authorities | CySEC, FCA, ASIC, FSA, SCB, MiFID |

Based Currencies | EUR, USD, GBP, PLN |

Minimum Deposit | $20 or equivalent |

Deposit/Withdrawal Methods | Trustly, Giropay, PayPal, AstropayTEF, iDeal, 2c2p, Sofort, Multibanko, Credit and debit card payment systems, Przelewy24, Bank transfer. |

Minimum Order | 0.01 |

Maximum Leverage | 1:300 |

Investment Options | No |

Trading Platforms & Apps | MT4,Web Trader, Mobile App, TradingView |

Markets | Share, Forex, Indices, Commodities, Cryptocurrencies, ESG |

Spread | Varies |

Commission | Zero |

Orders Execution | market |

Margin Call/Stop Out | 100%/50% |

Trading Features | Economic Calendar |

Affiliate Program | YES |

Bonus & Promotions | No |

Islamic Account | No |

PAMM Account | No |

Customer Support Ways | Online Chat, Ticket |

Customer Support Hours | 24/7 |

Capital.com's offerings cater to a wide range of traders, from beginners looking to learn the ropes to experienced investors seeking advanced tools and competitive pricing.

Capital.com Forex Broker Account Types

Capital.com provides three distinct account types, designed to accommodate traders at every experience level:

- Demo Account: Ideal for beginners or those testing new strategies, this simulated environment replicates live market conditions without financial risk;

- Retail Account: This default live account gives access to all 3,800+ CFDs across asset classes and supports advanced features like knock-out products and 1X (unleveraged) trading;

- Professional Account: Tailored for eligible high-volume traders, this account unlocks increased leverage, volume-based rebates, VIP services, and other premium benefits.

Traders can open an account with just $10 (debit card, Apple Pay) or $20 for most other methods. Bank transfers may require a higher threshold depending on the region.

This tiered account system ensures flexibility while maintaining regulatory compliance and transparency

Capital.com Forex Broker Advantages and Disadvantages

To help you make an informed decision, let's look at the pros and cons of trading with Capital.com:

Advantages | Disadvantages |

User-friendly platform | Lack of support for MetaTrader 5 |

Wide range of tradable assets | Reliance only on CFDs |

Strong educational resources | Lack of an easy process for opening an account |

Competitive pricing | - |

Capital.com's innovative technology and focus on education make it an excellent choice for beginners and intermediate traders.

However, advanced traders might have limitations regarding platform options and advanced research tools.

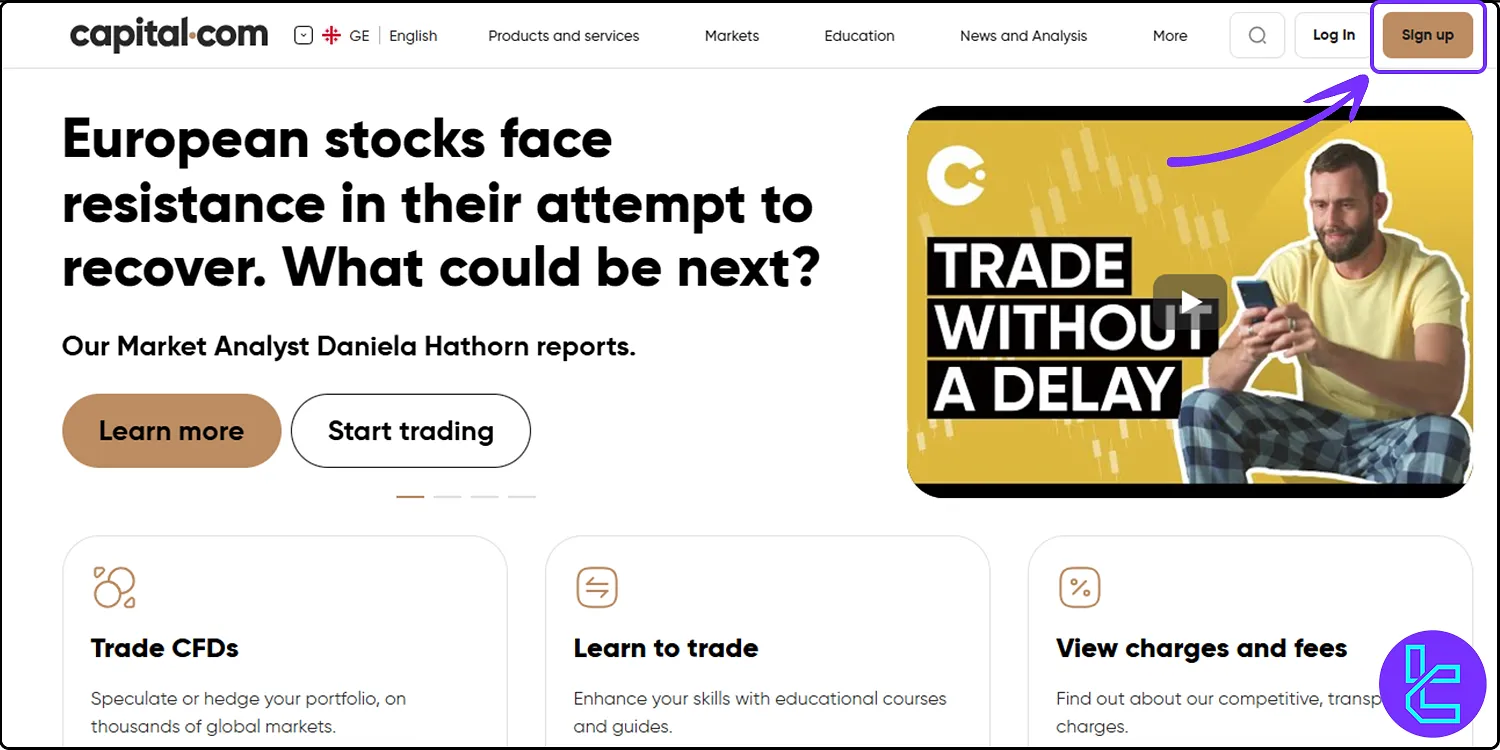

Capital.com Broker Signing Up & Verification: Complete Guide

Opening a new trading account with Capital.com broker is easy and only requires completing 5 steps. Capital.com registration and verification:

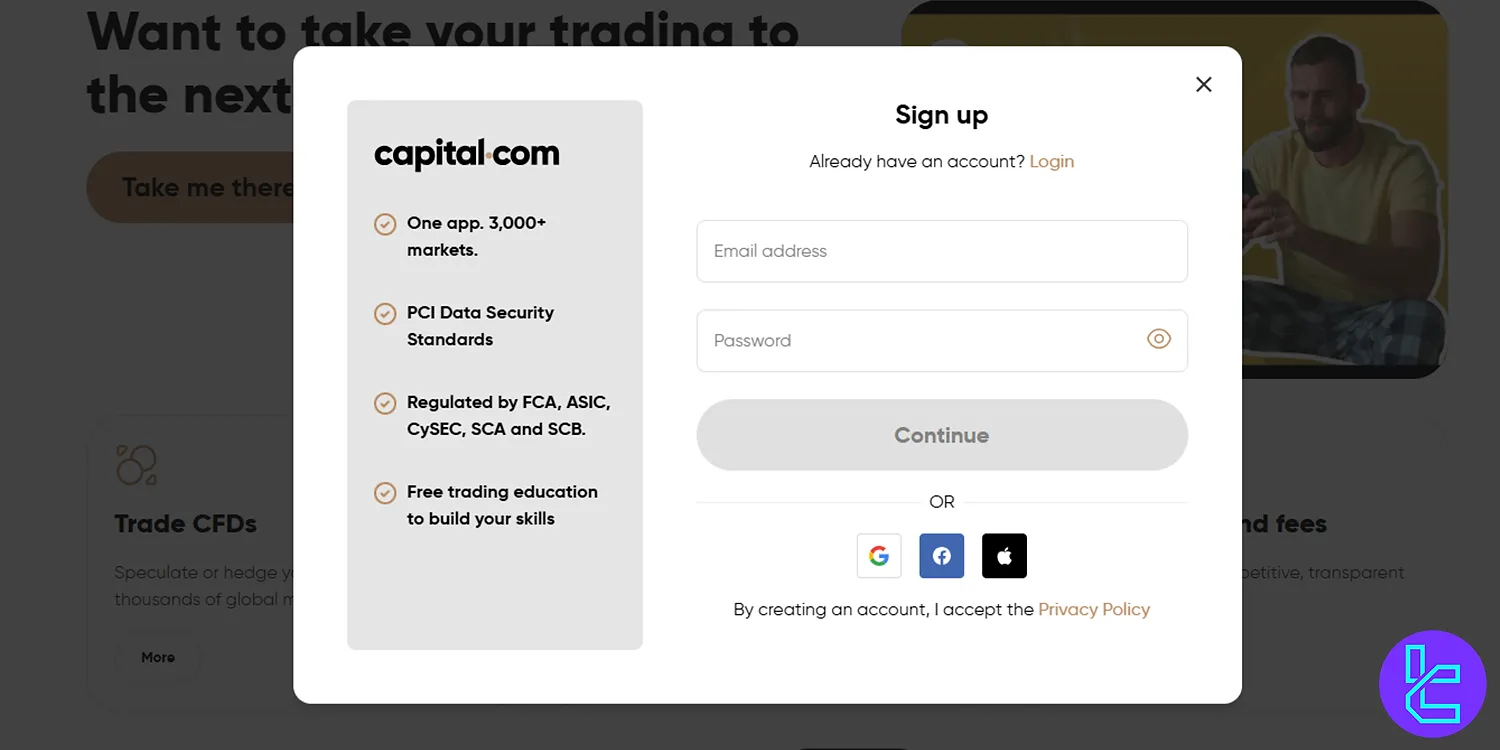

#1 Initiate the Registration

Select the "Sign-Up" option on the Capital.com website and proceed to create your trading profile.

#2 Create Login Credentials

Provide a valid email and a strong password that includes upper/lowercase letters, numbers, and special characters. Press “Continue”.

#3 Enter Personal Details

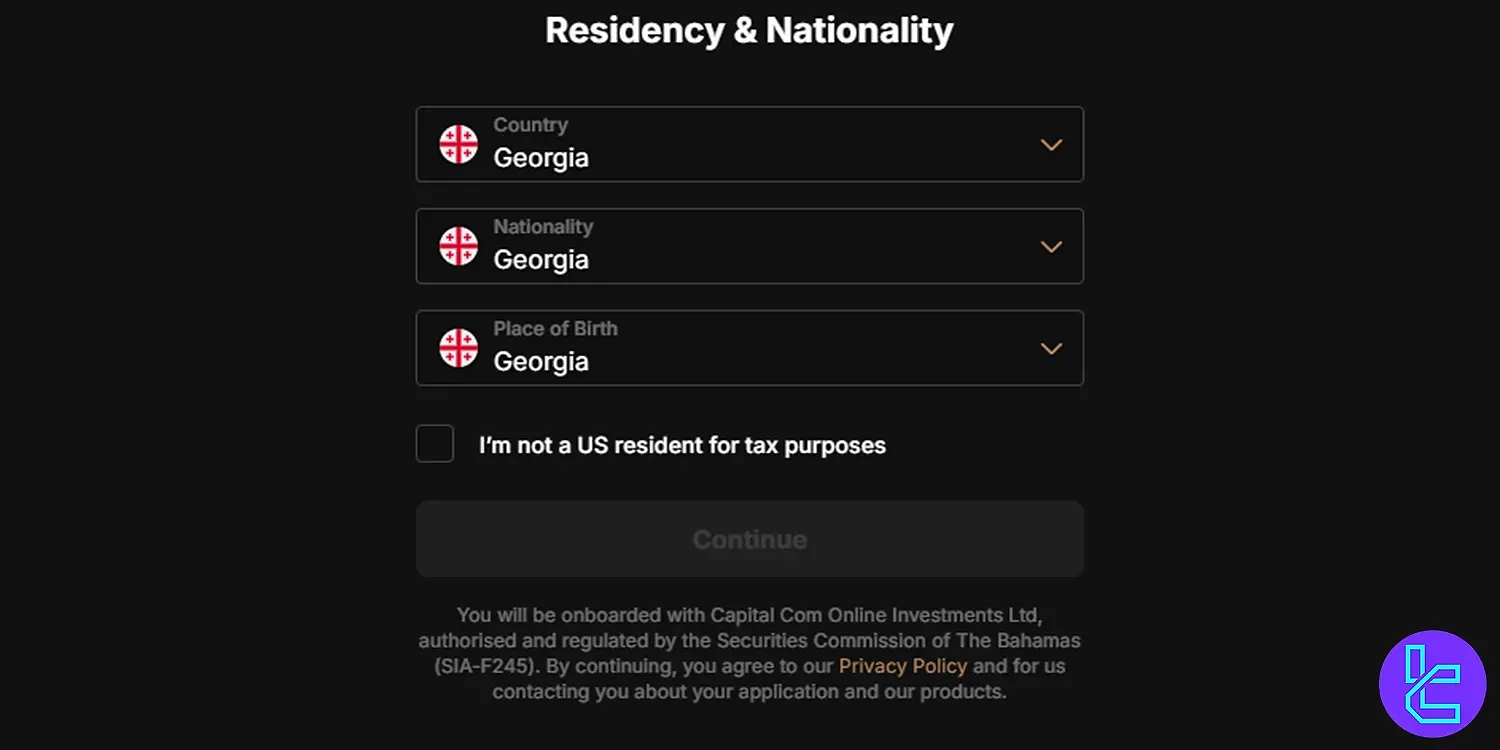

Select your country of residence and confirm that you are not a US citizen.

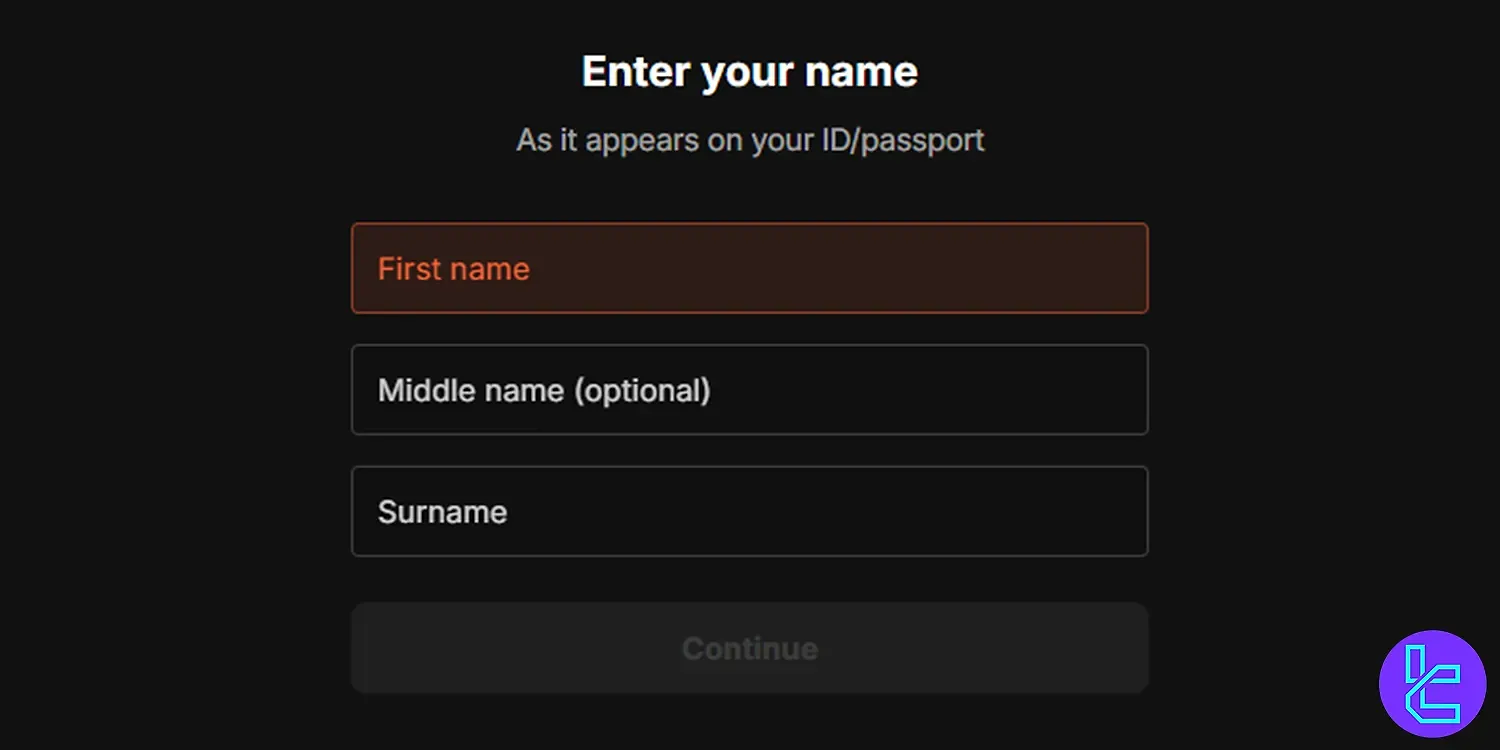

Provide your first name, middle name (if applicable), and surname exactly as shown on your official ID.

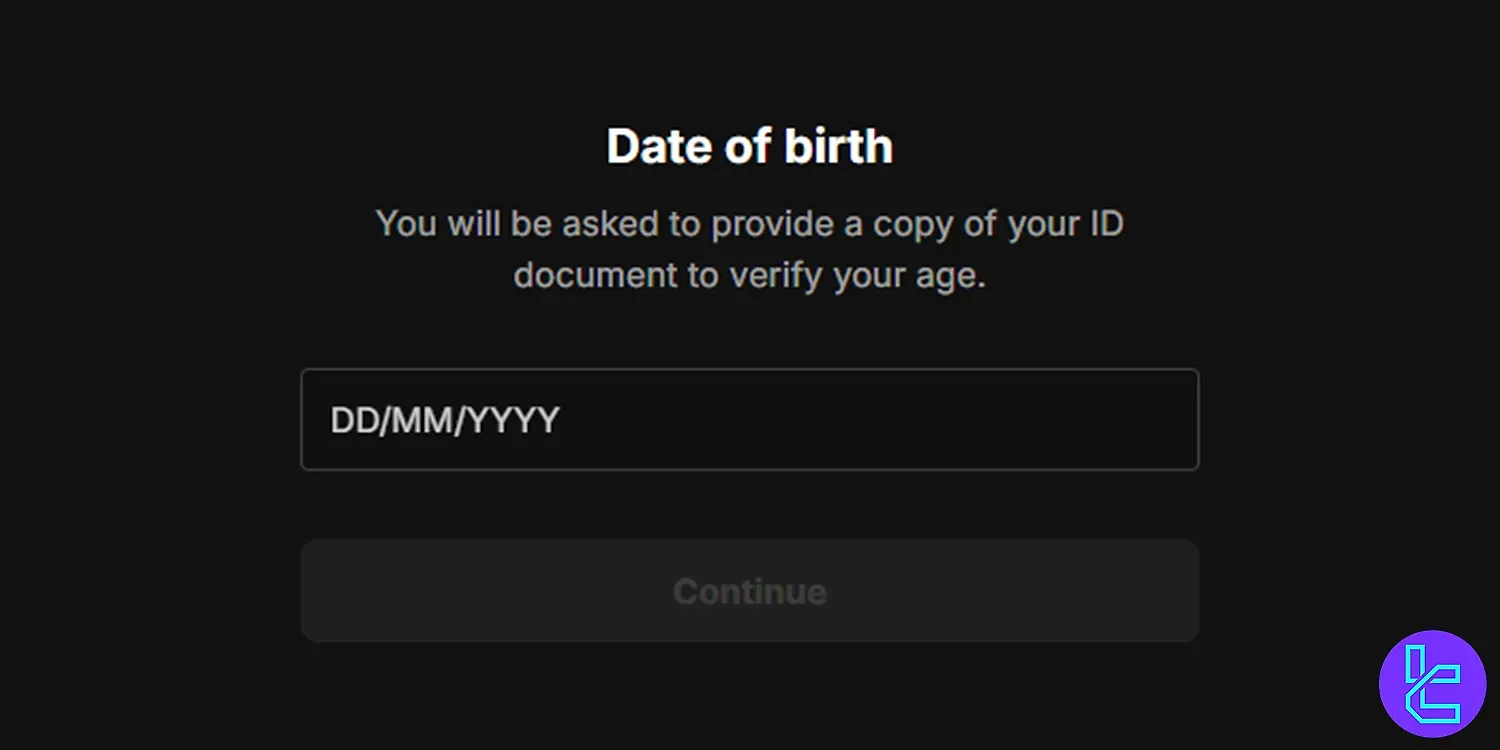

Enter your date of birth and proceed.

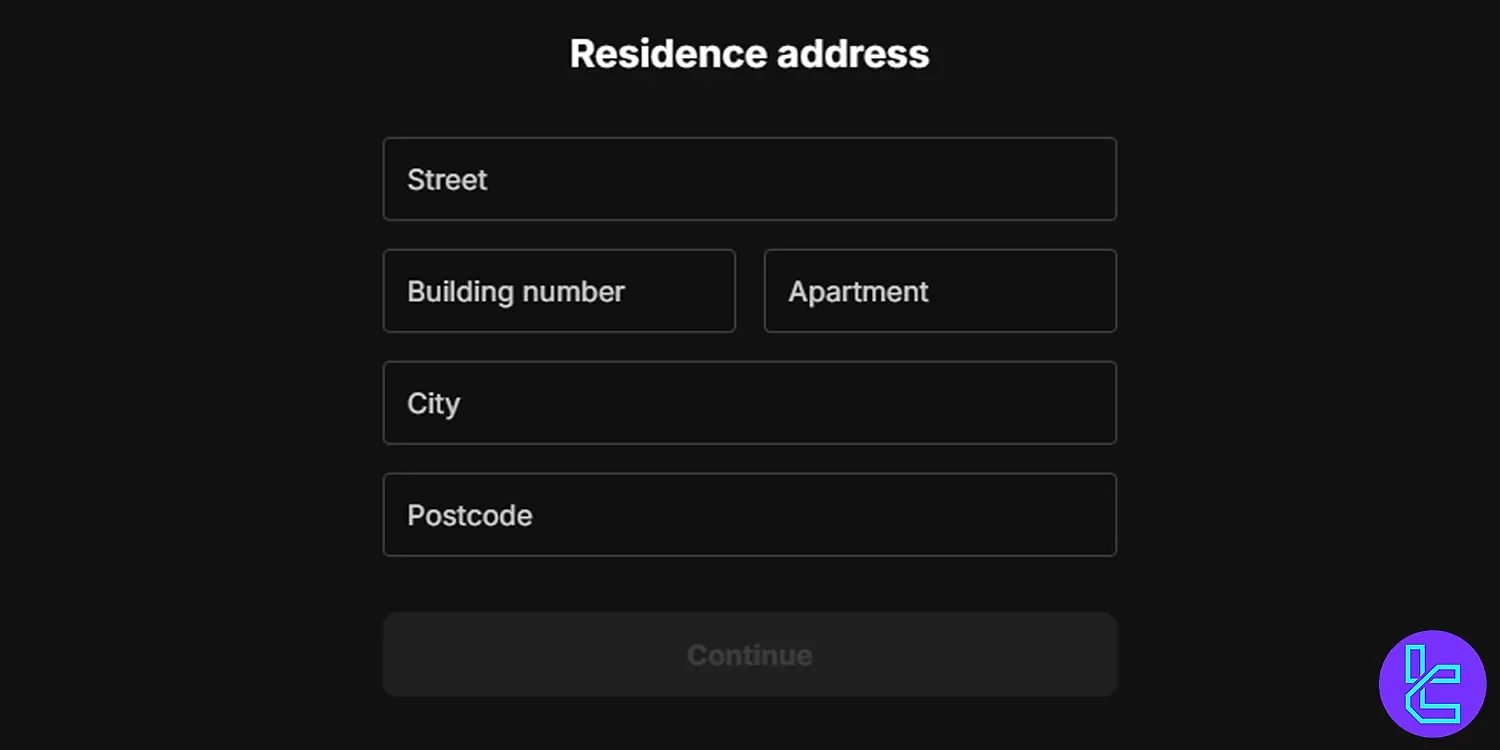

Input your residential address to complete the personal information section.

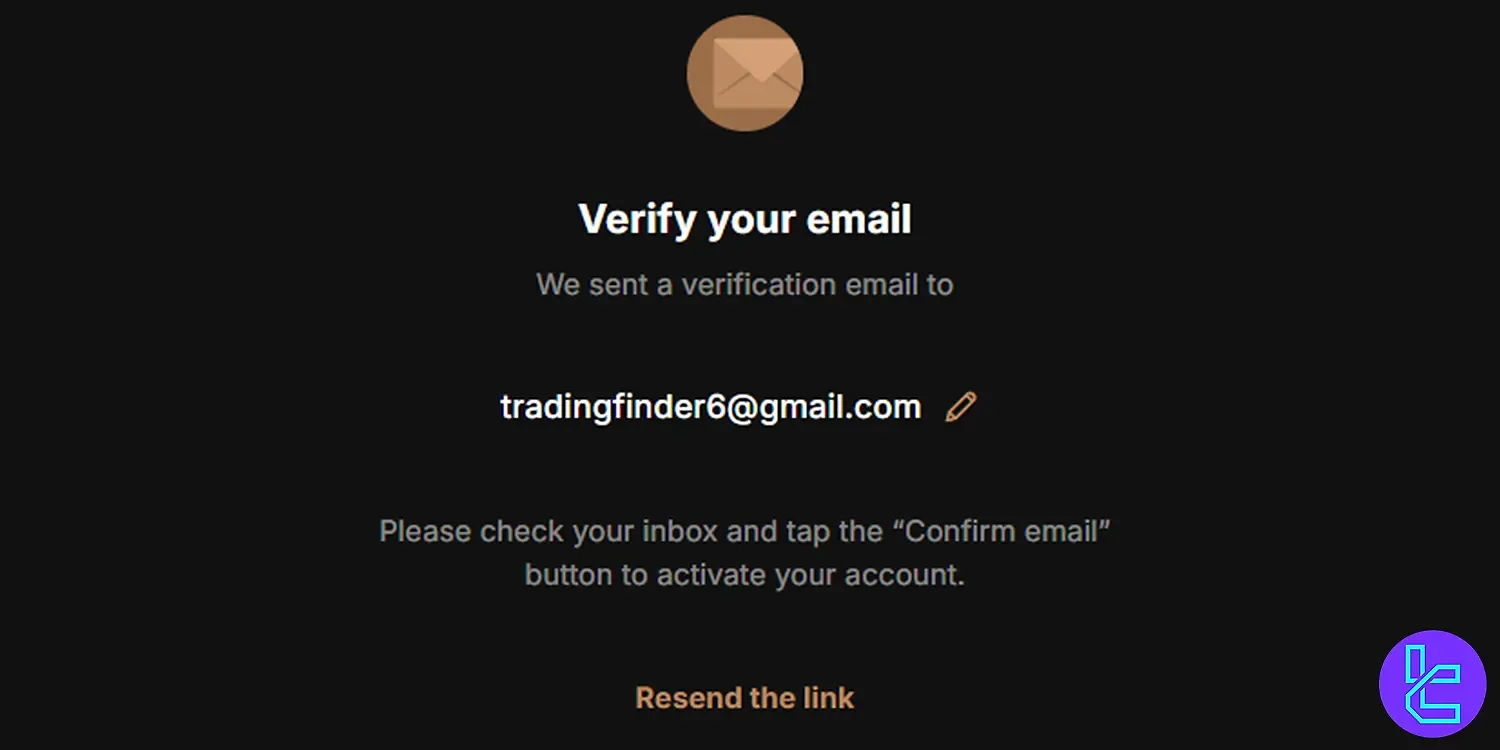

#4 Verify Your Email

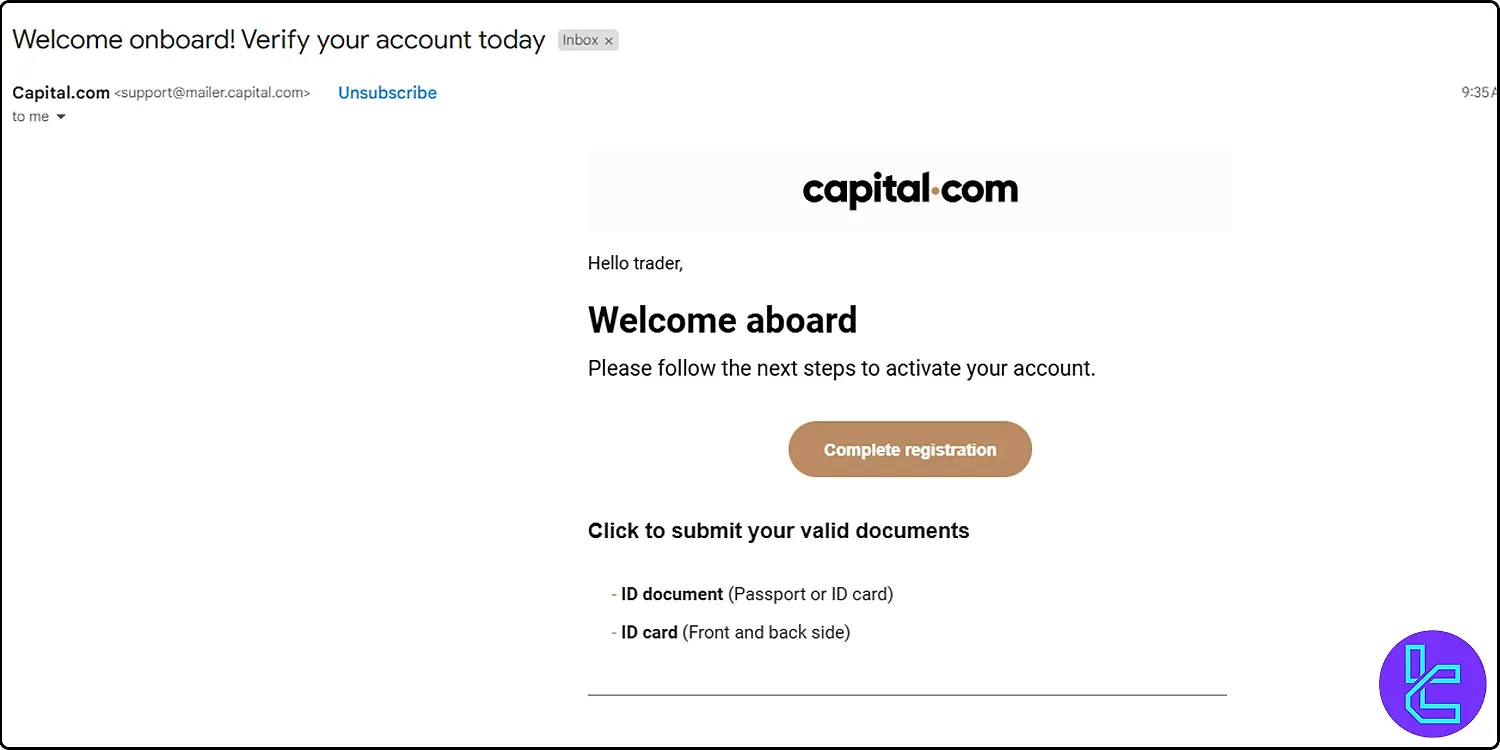

Check your inbox for the verification email sent by Capital.com.

Click “Complete Registration” to continue.

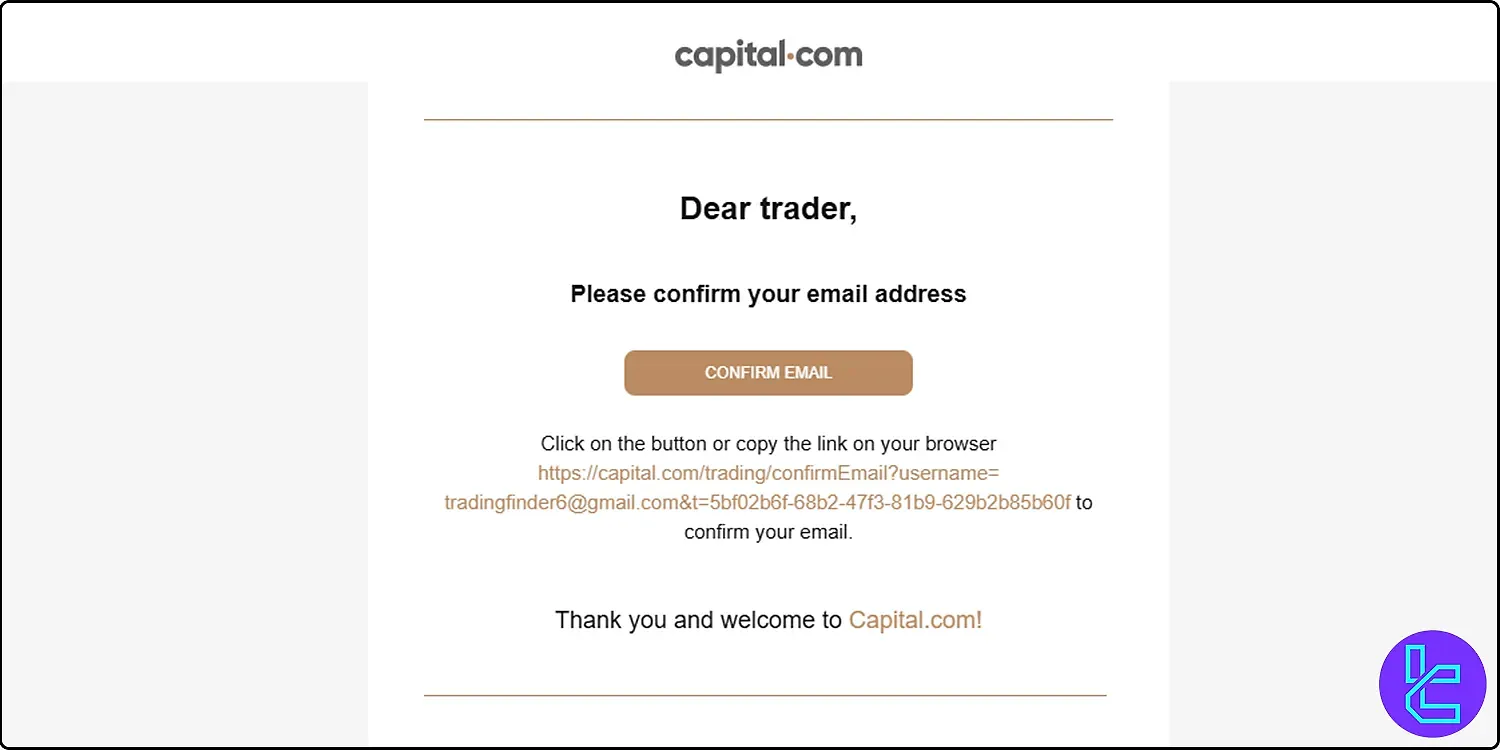

After the platform reloads, review the broker’s terms and conditions and click “Confirm”. Open the second email from Capital.com and click “Confirm Email” to finalize verification.

#5 Complete Account Verification

To trade with the Capital.com broker, traders must upload proof of address (utility bill and bank statement) and proof of identity (ID card, passport, driver's license) documents.

For a detailed guide on the Capital.com verification process, refer to the YouTube video below.

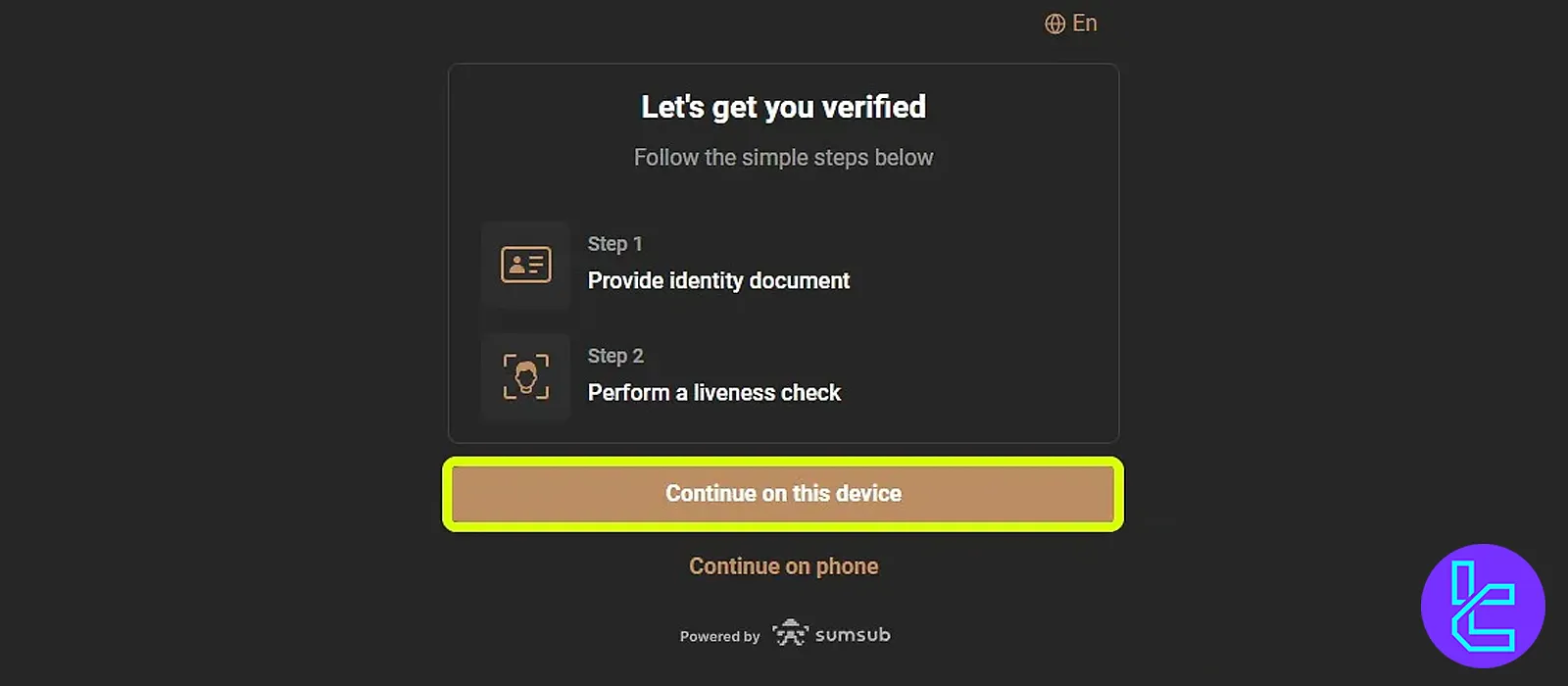

Step 1: Access User Identification

Navigate to your dashboard and select “Verify your account” in the profile section. Then, click “Continue on this device” to start the verification process.

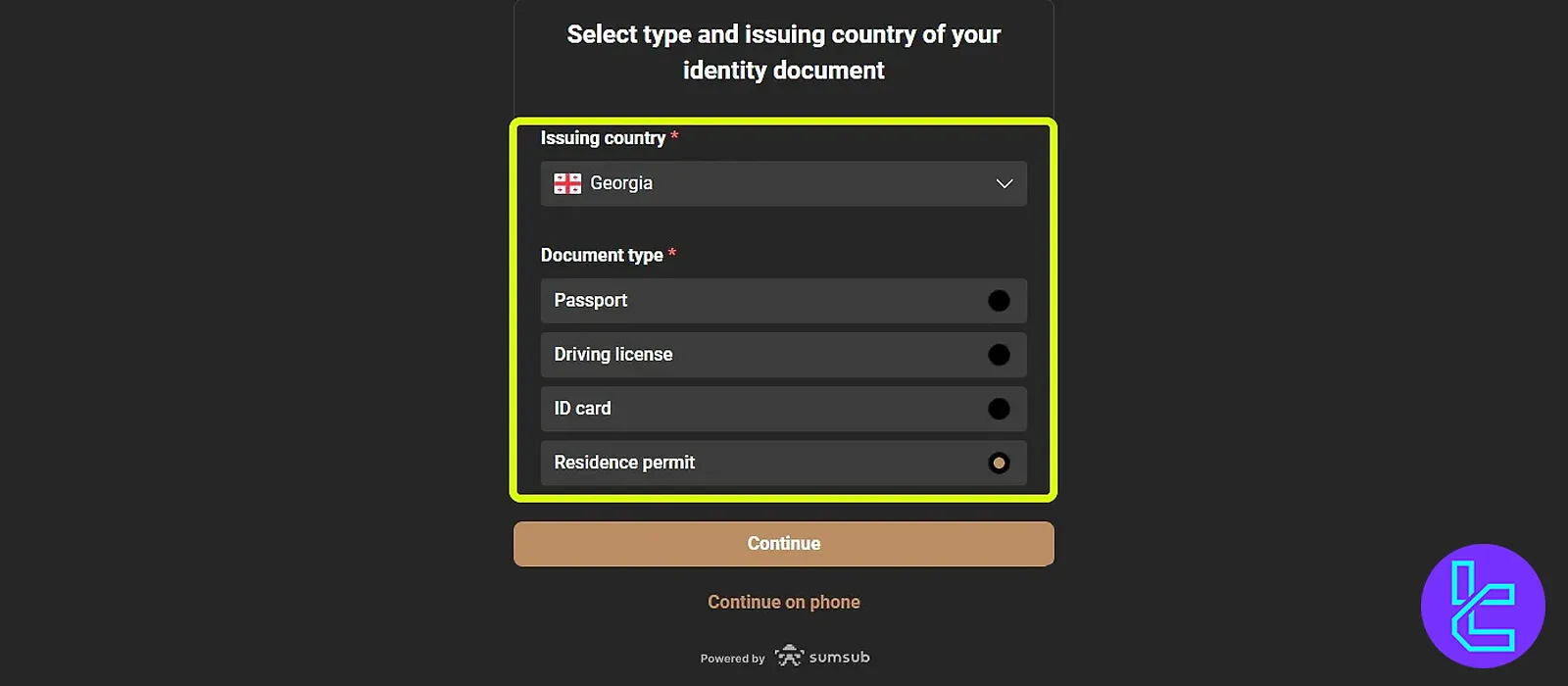

Step 2: Select Document and Issuing Country

Choose the country that issued your identification and the document type. Also, accepted documents include:

- Passport

- driver’s license

- ID card

- residence permit

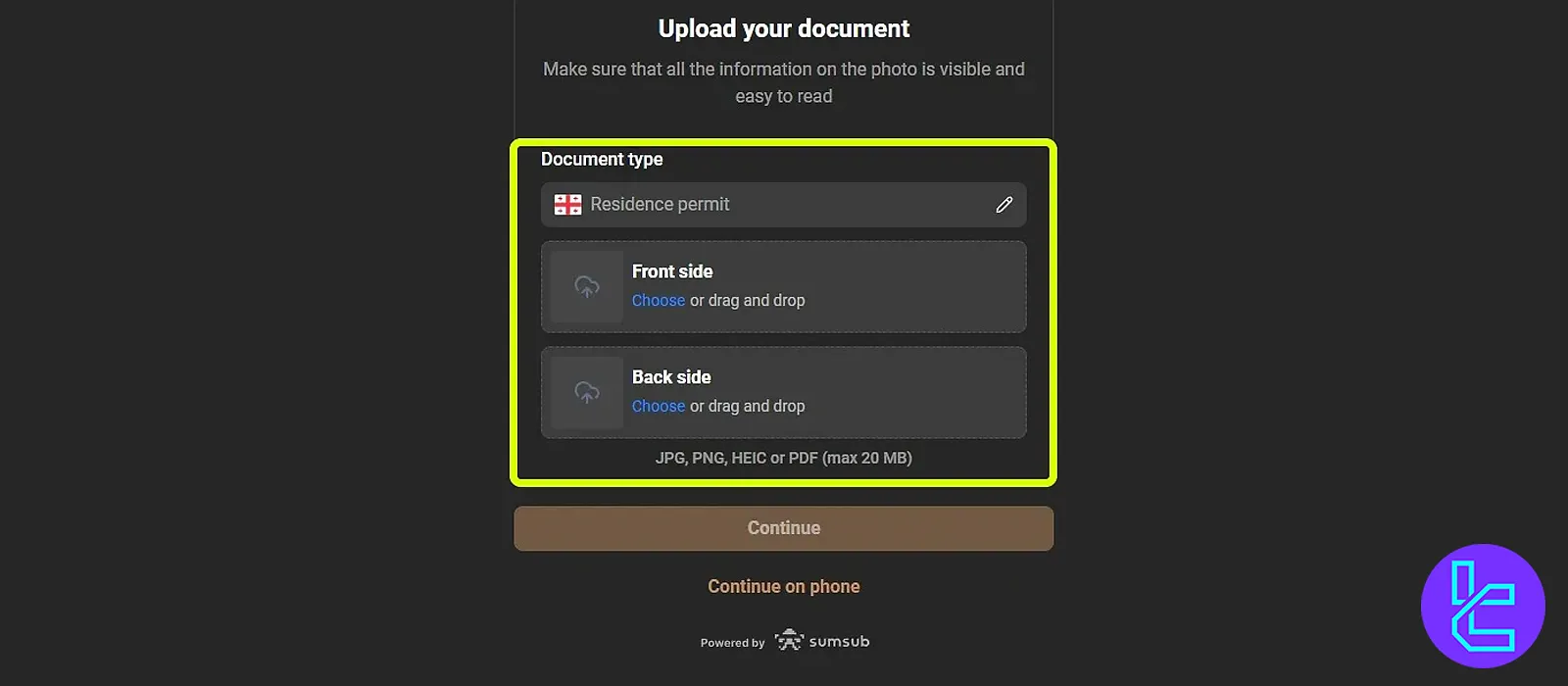

Step 3: Upload Document Images

Upload clear front and back images of the selected document. Supported formats are JPEG, PNG, PDF (maximum 20 MB). Then, click “Continue” after uploading.

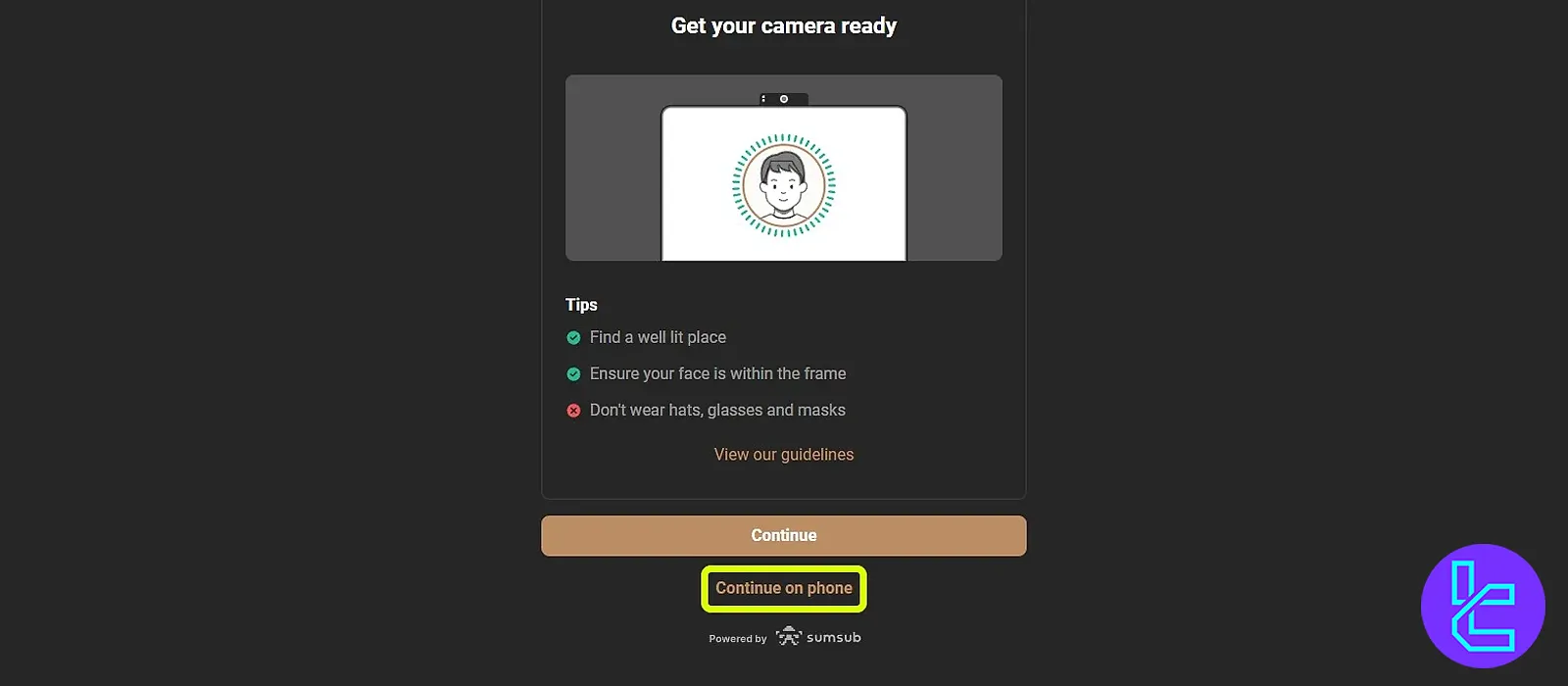

Step 4: Complete Liveness Check

Perform a 3D facial scan using a mobile device with a quality camera. Then, select “Continue on Phone”, scan the QR code and follow on-screen instructions.

Ensure proper lighting, keep your face fully in the frame and remain steady during the scan.

Step 5: Confirmation

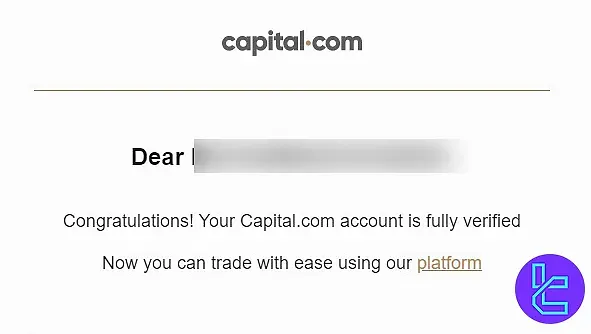

Within minutes, you will receive a verification confirmation on the platform. Check your email for an additional confirmation message from Capital.com.

Once completed, your Capital.com account will be fully verified and ready for trading.

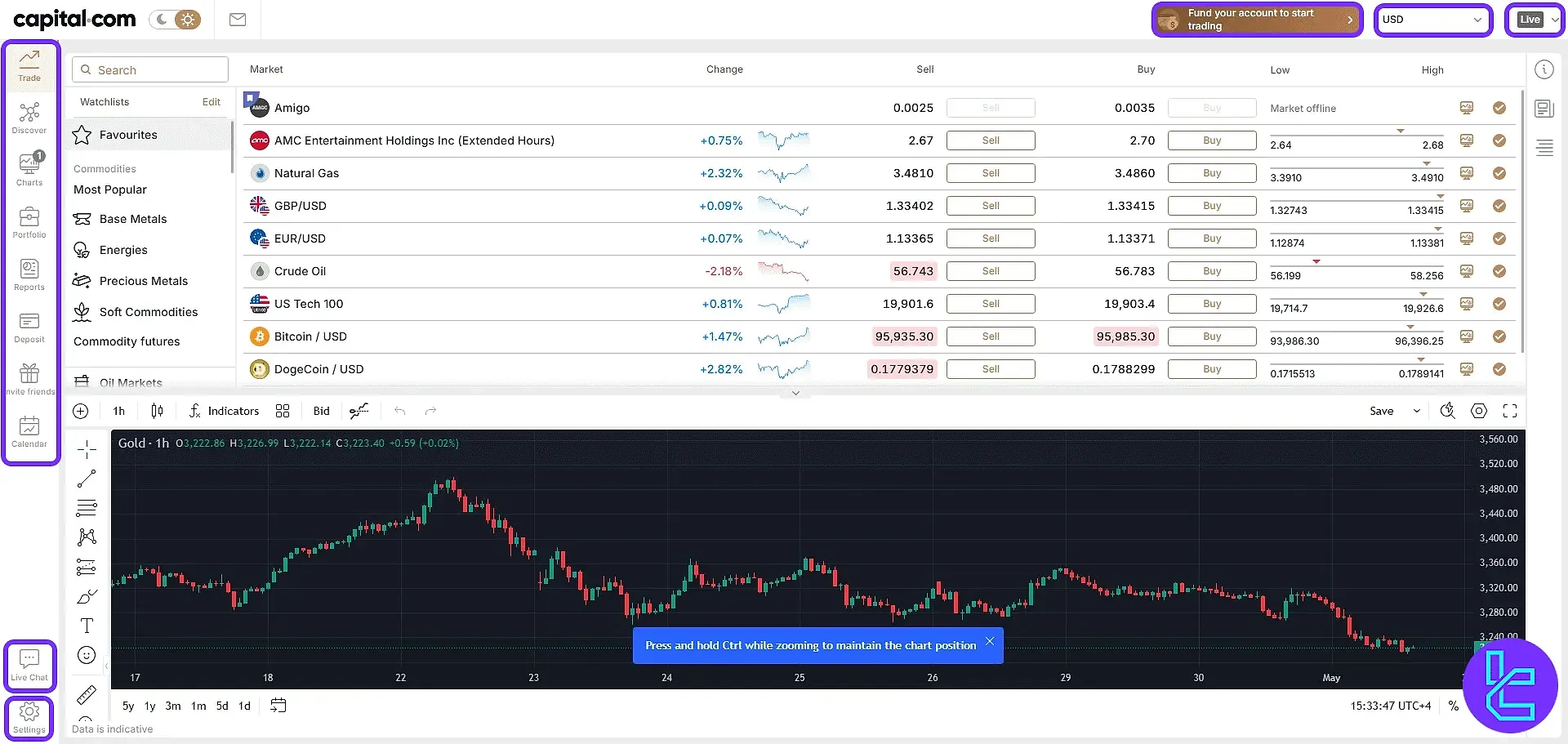

Capital.com Dashboard Overview

The Capital.com dashboard serves as a comprehensive control center for traders, integrating account management, market analysis, trading tools, deposits, reports, and customer support across 11 main sections.

Accessing the Dashboard

Upon completing registration, users gain access to the trading cabin, enabling efficient management of accounts, monitoring positions, and executing trades. The main sections include:

- Dashboard Interface

- Trade

- Discover

- Charts

- Portfolio

- Reports

- Deposit

- Invite Friends

- Calendar

- Live Chat

- Settings

Main Interface

The dashboard’s left sidebar provides rapid access to all tools, while the bottom-left corner features “Live Chat” and “Settings”.

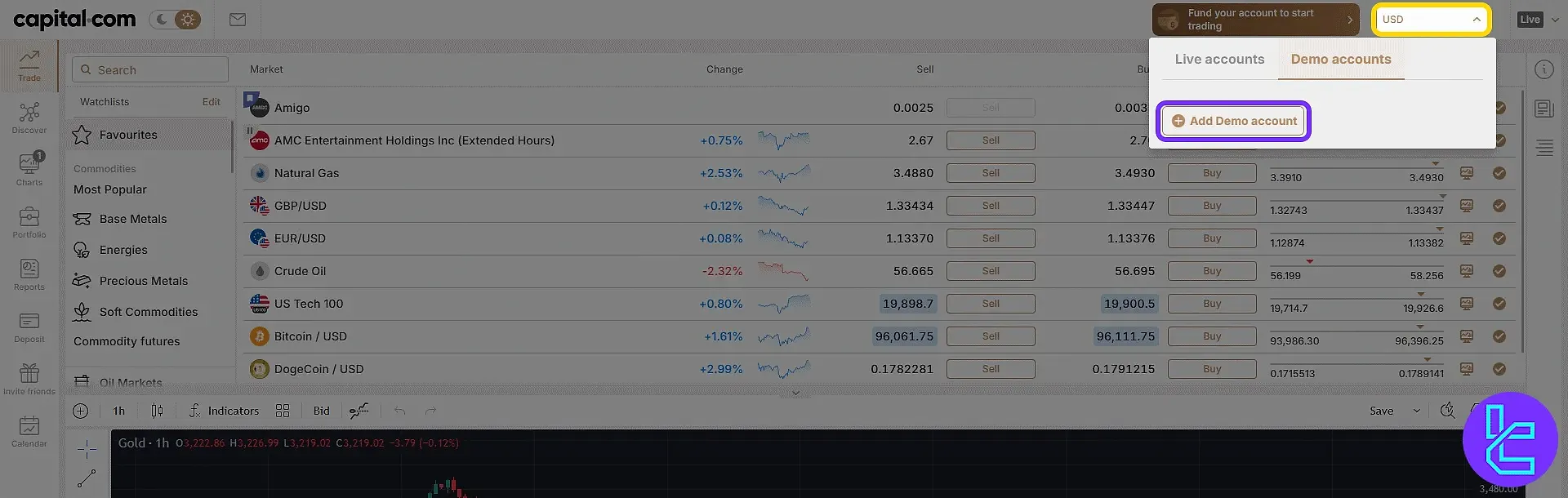

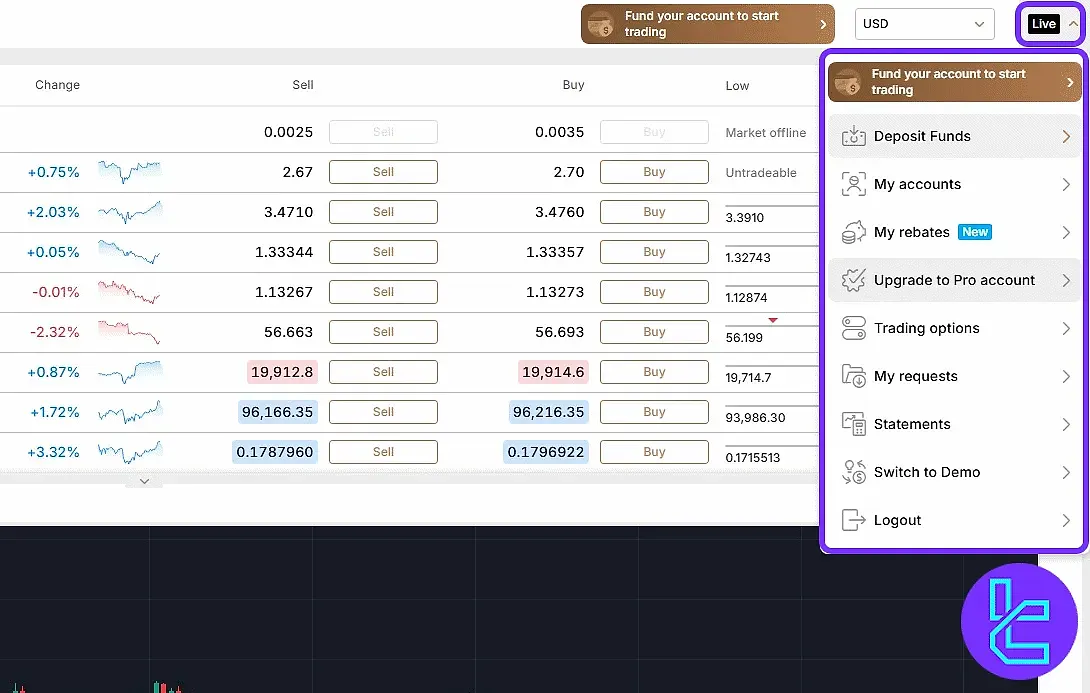

The top-right area shows wallet balance, a quick access menu, and a “Fund your account” shortcut.

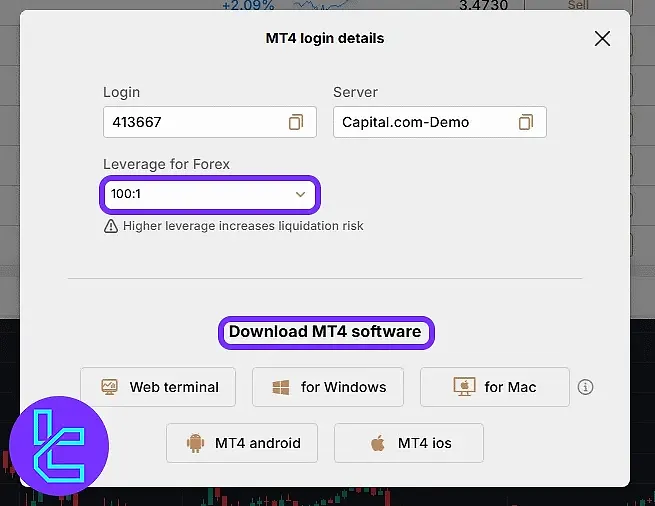

Users can toggle between live and demo accounts, or create a new demo account instantly. After selecting account type and base currency, details are generated automatically.

Leverage settings can be modified, and trading software such as MetaTrader 4 is available for download.

The Live menu provides direct options for:

- Deposit Funds: Add money via multiple payment methods;

- My Accounts: Manage live and demo accounts;

- My Rebates: Check bonus offers and rebates;

- Upgrade to Pro Account: Access higher leverage, up to 1:300;

- Trading Options: Configure interface features;

- My Requests: Submit and track support tickets;

- Statements: View transaction history and trading reports;

- Switch to Demo: Practice without financial risk;

- Logout: Exit the platform.

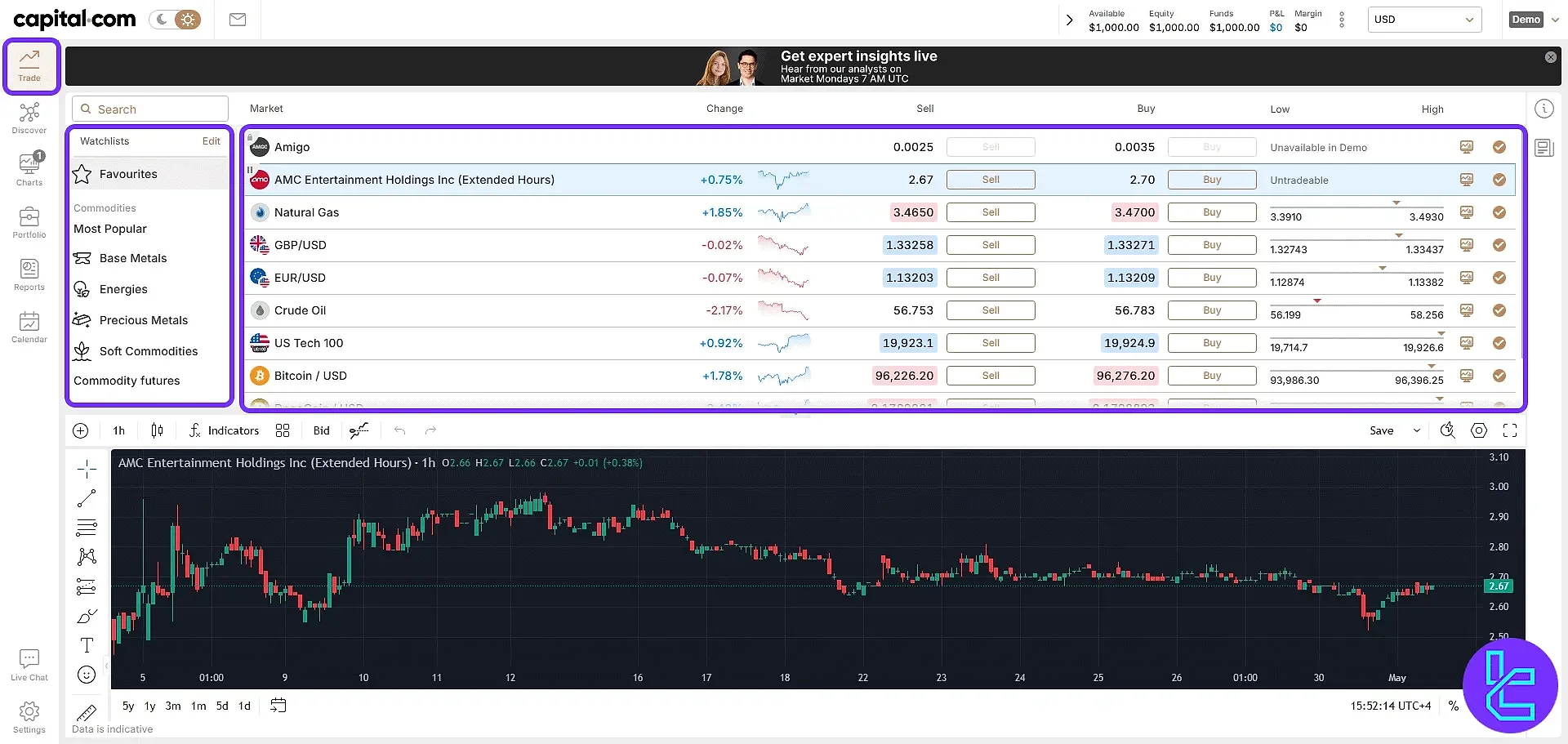

Trade Section

The Trade tab offers a fully customizable watchlist with real-time Buy and Sell options.

Users can view price changes, performance snapshots, and a candlestick chart with advanced drawing tools for technical analysis.

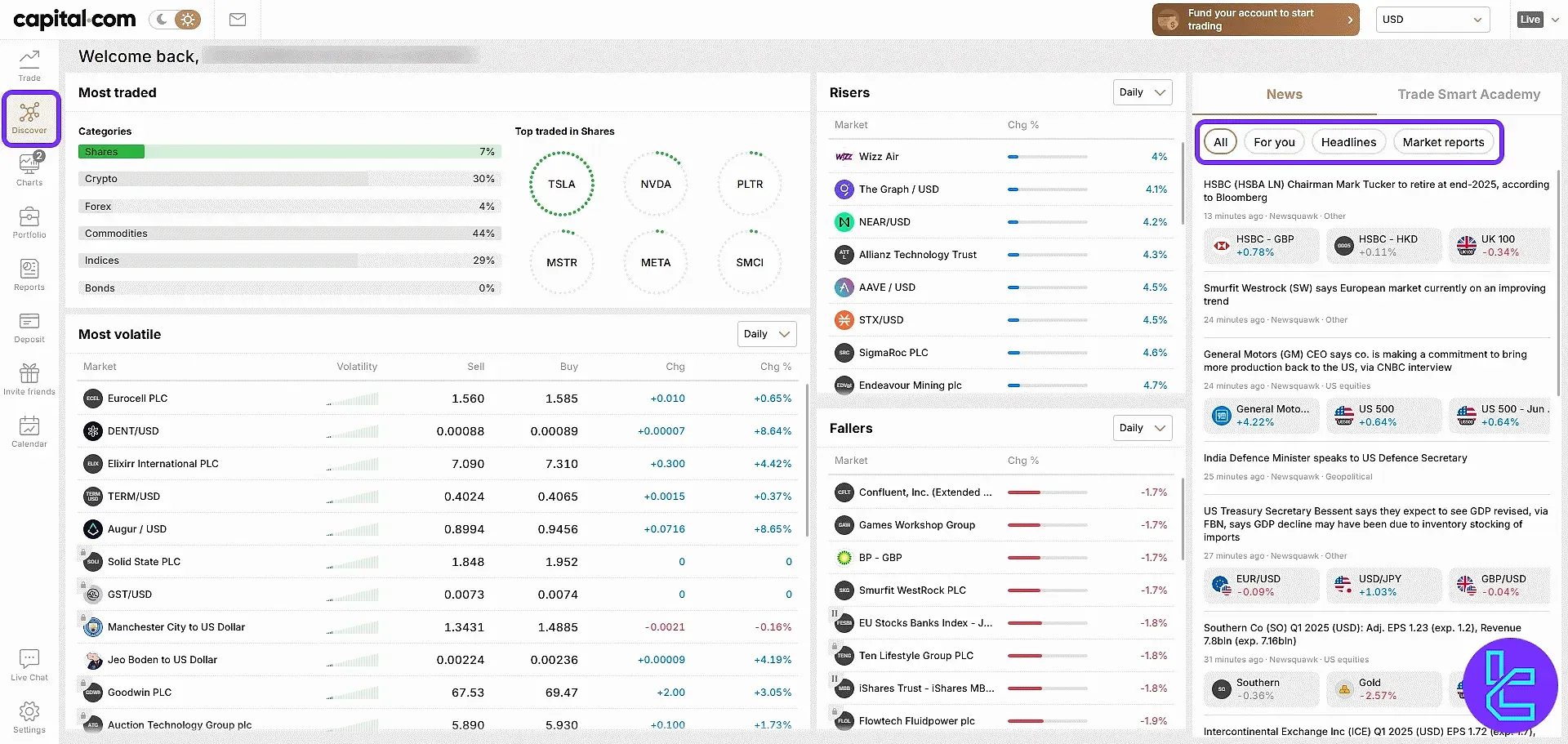

Discover Section

In Discover, markets are sorted by volatility and trading volume. Traders can track top gainers and losers, and access a filtered financial news feed with categories like All, For You, Headlines, and Market Reports.

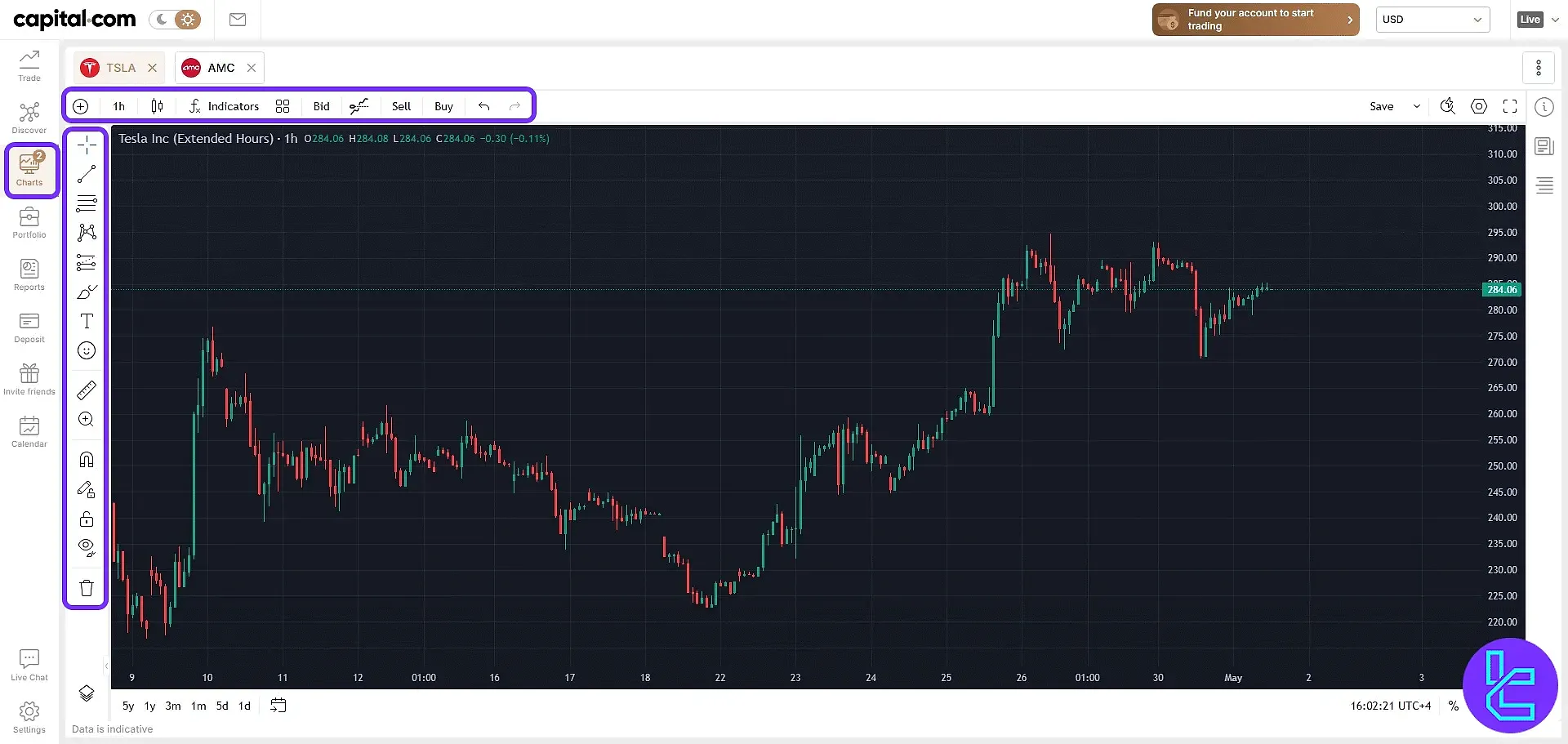

Charts

The Charts area allows full use of overlays, technical indicators, and adjustable timeframes. Orders can be executed directly from charts.

You can also utilize the wide range of TradingView indicators from TradingFinder to enhance technical analysis.

Portfolio

The Portfolio tab displays:

- Trades active positions

- Orders pending and executed trades

Reports

The Reports section provides a clear record of:

- Transactions deposits and withdrawals

- Activity logs platform usage and login events

Filters by type, status, and date range allow precise tracking.

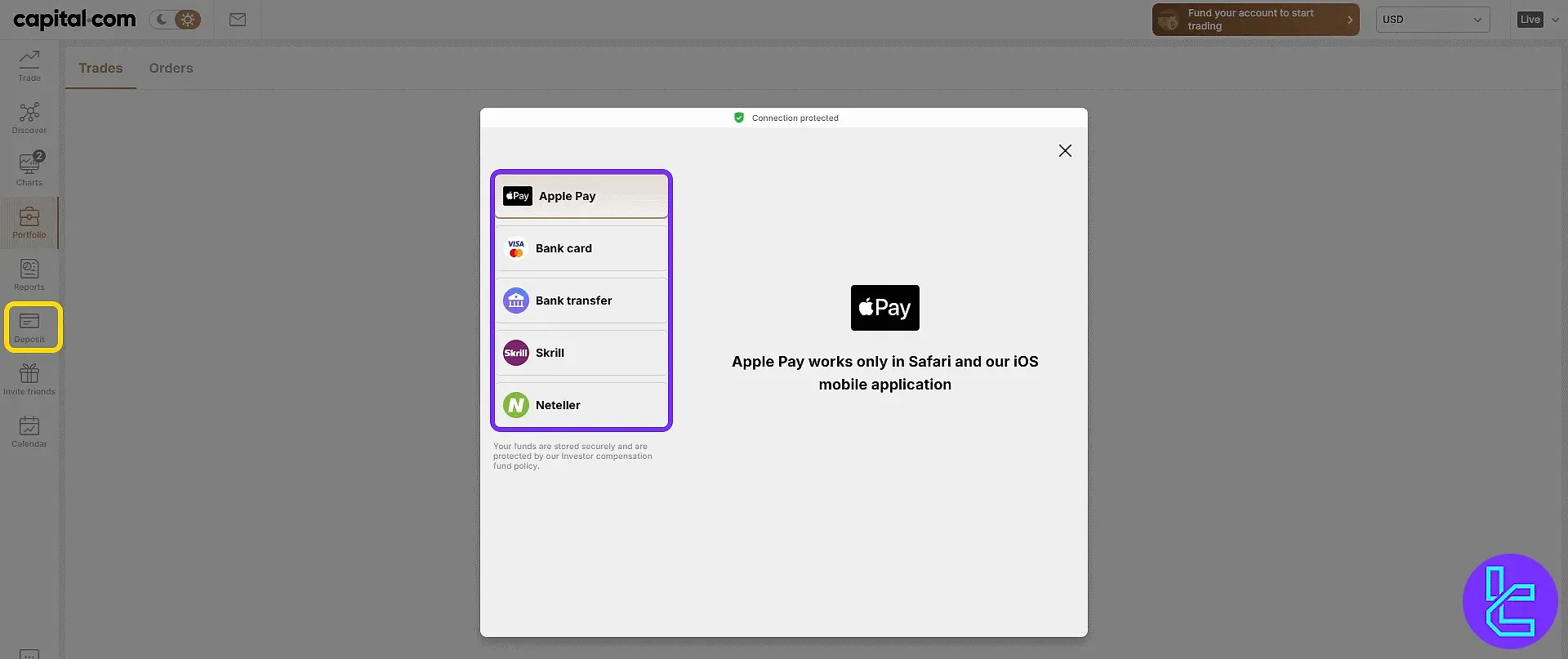

Deposit

Capital.com supports multiple secure payment methods, including:

- Apple Pay

- Bank Card

- Bank Transfer

- Skrill

- Neteller

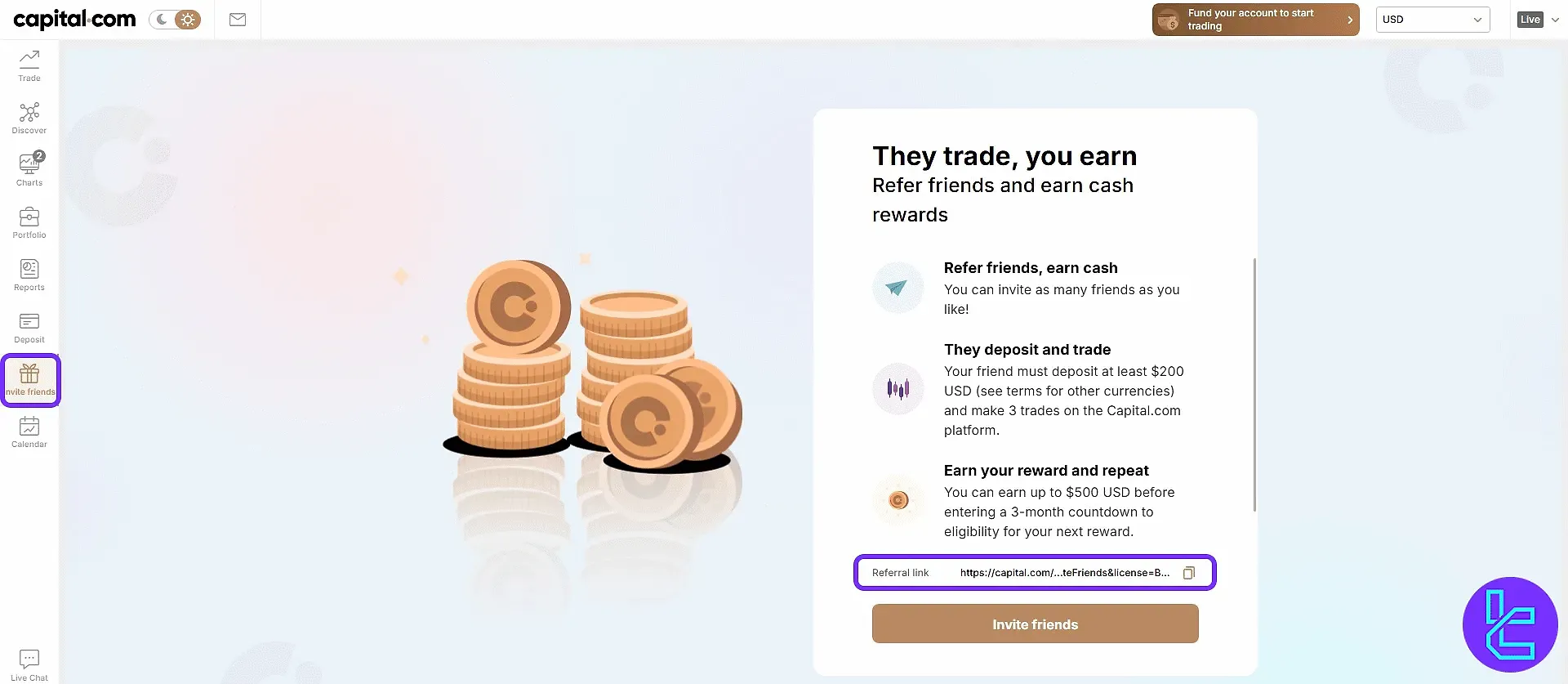

Invite Friends

The referral system provides a unique link for sharing. Rewards activate when a referred user deposits at least $200 and completes three trades.

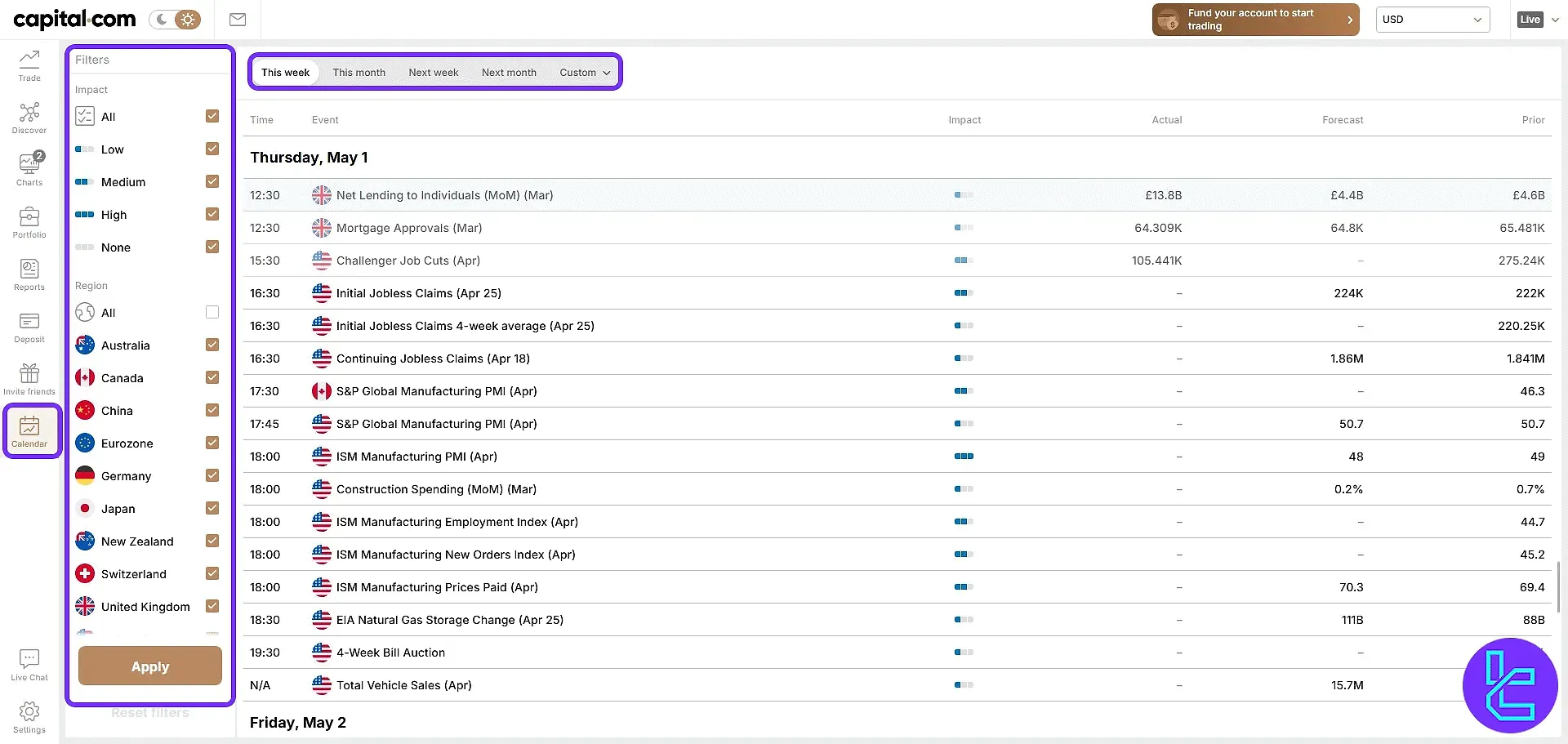

Calendar

The Calendar tab lists economic events, sortable by region and impact. Filters include This Week, Next Week, Next Month, and custom date ranges.

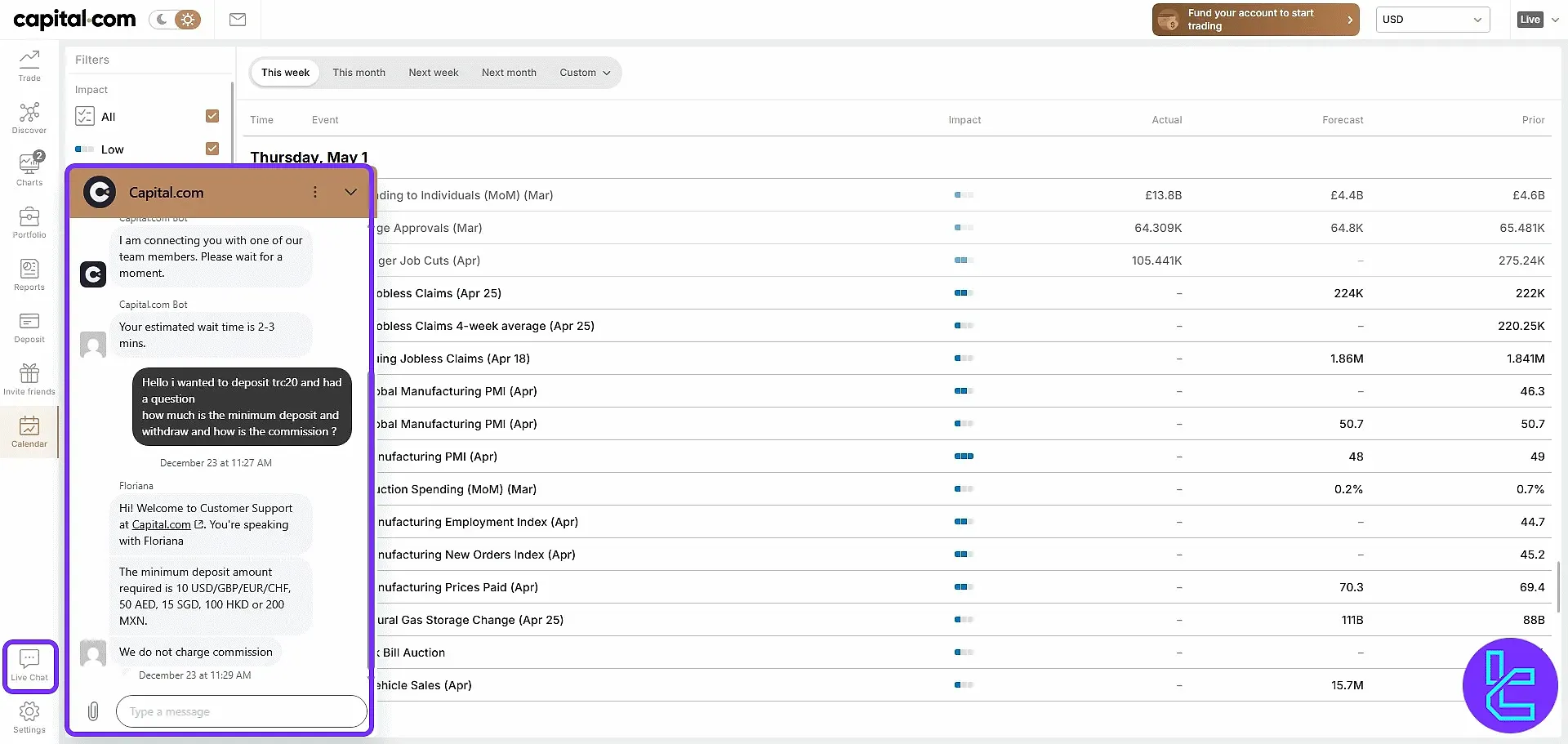

Live Chat

Accessible from the bottom-left corner, Live Chat connects users to support agents or automated bots for immediate assistance.

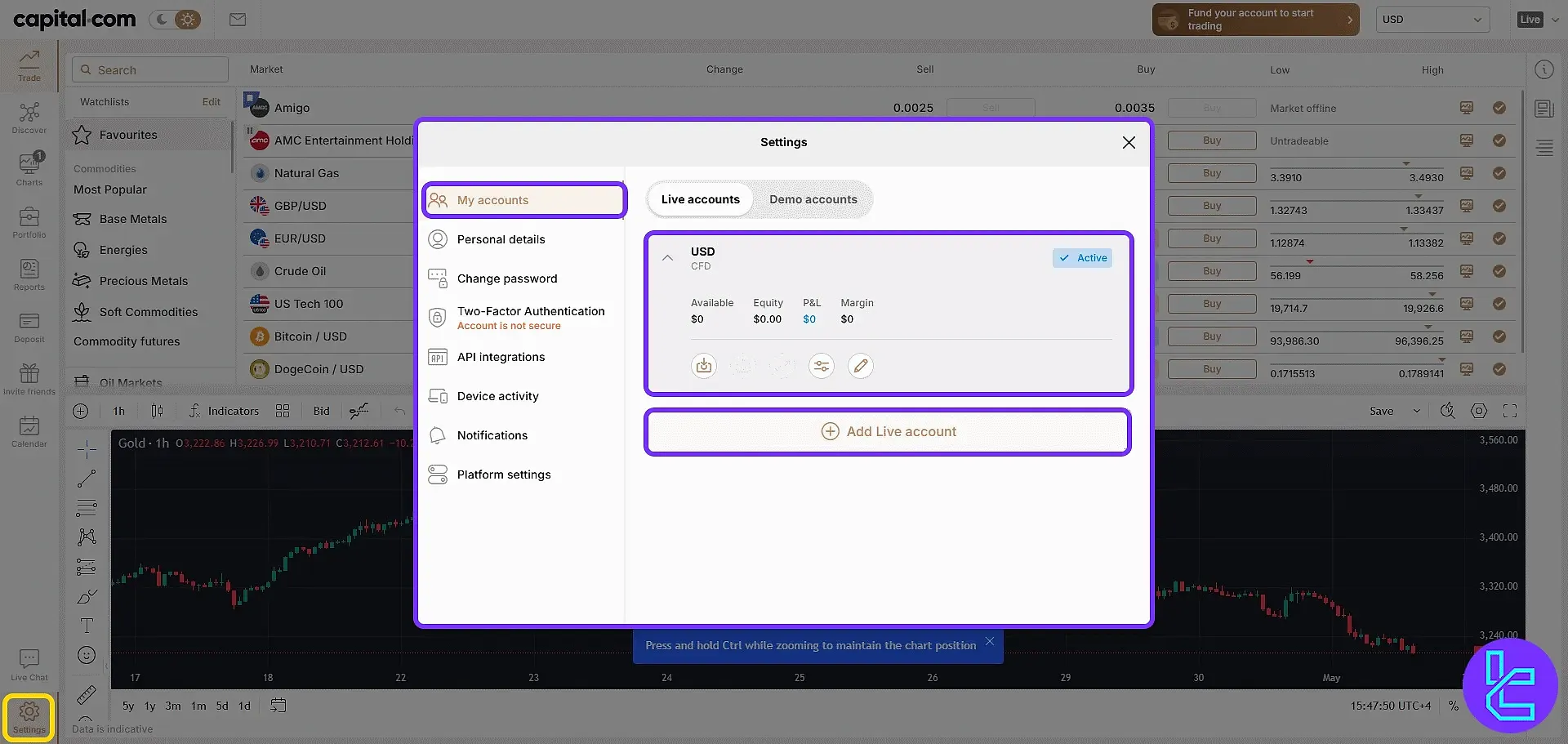

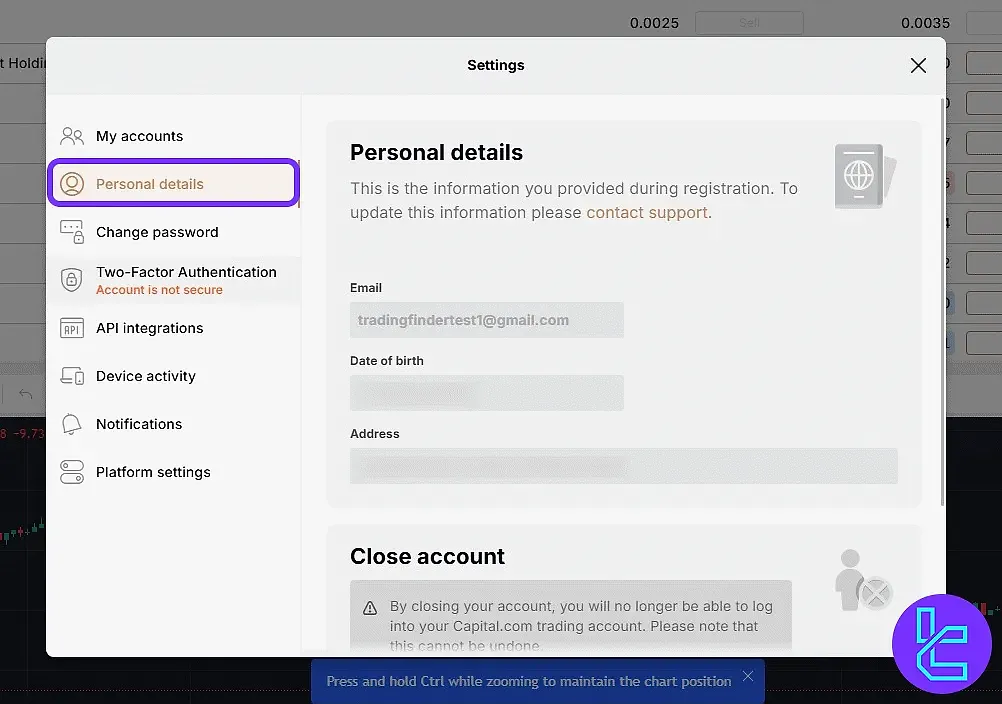

Settings

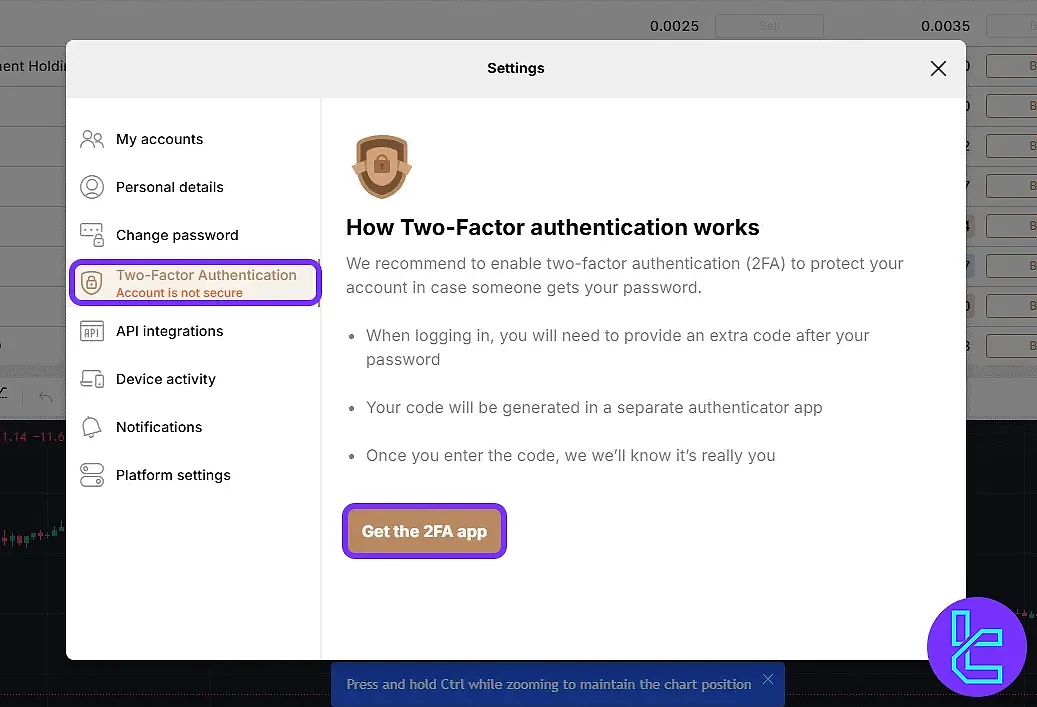

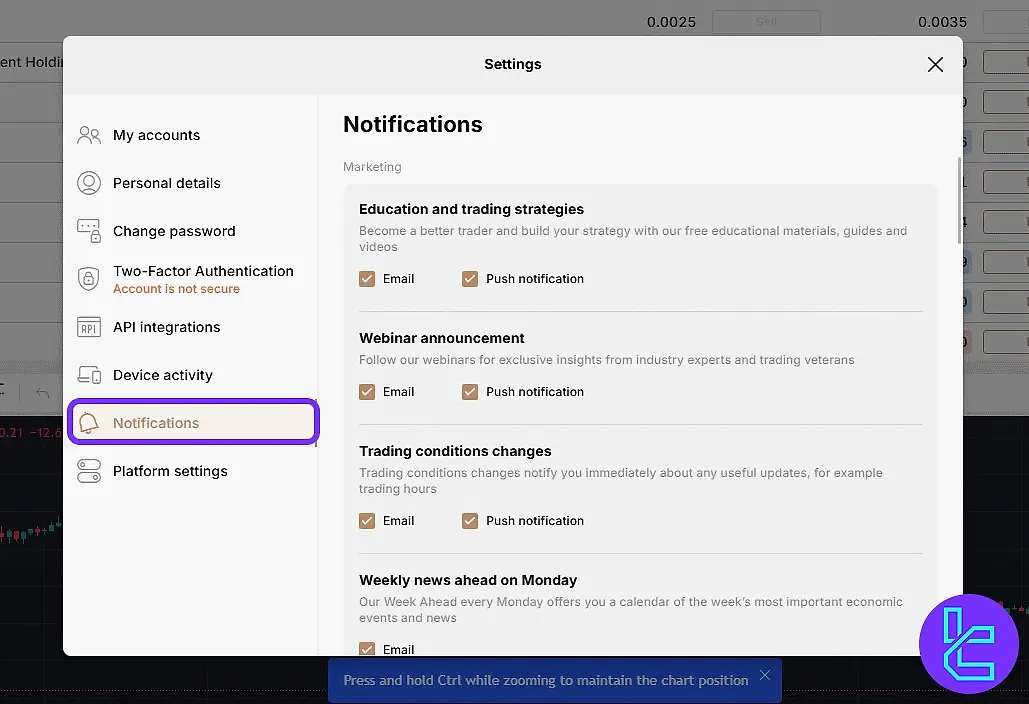

The Settings section centralizes account management and platform configuration:

- My Accounts: view and switch between live/demo accounts; monitor margin, equity, and P&L;

- Personal Details: update registration information for smooth verification;

- Change Password: securely modify login credentials;

- Two-Factor Authentication (2FA): enhance security with time-based codes;

- API Integrations: connect with third-party apps for algorithmic trading;

- Device Activity: review recent logins and revoke unauthorized sessions;

- Notifications: customize alerts for trades, updates, and promotions;

- Platform Settings: adjust language, time zone, and interface preferences.

Capital.com Forex Broker Trading Platforms

Capital.com delivers a flexible trading experience through a trio of robust platforms designed for both beginners and experienced traders:

- Proprietary Web Platform: An intuitive, browser-based platform with powerful charting, built-in technical tools, and real-time market data;

- Mobile Apps (iOS & Android): The Capital.com mobile app mirrors the full functionality of the web platform, supporting on-the-go trading with advanced charts, technical indicators, price alerts, and smart notifications;

- MetaTrader 4 and MetaTrader 5 Integration: The broker supports both MT4 and MT5, enabling traders to utilize algorithmic strategies, Expert Advisors (EAs), and customizable templates within a familiar, global-standard environment.

Additionally, Capital.com features full TradingView integration, providing access to 100+ technical indicators, drawing tools, and community-driven insights.

Capital.com Forex Broker Spreads and Commissions

Capital.com operates with a highly transparent, commission-free pricing model that appeals to both beginners and cost-conscious traders:

- 0% Commissions: All trades across Capital.com’s asset classes are free from trading commissions. The broker earns revenue solely through tight, variable spreads

- Competitive Spreads: With an average spread of just 0.67 pips on EUR/USD, Capital.com positions itself below the industry average in cost

- Swap-Free on 1:1 Leverage: Traders using no leverage on CFD stocks and cryptocurrency enjoy zero overnight fees

Other Fees:

- Inactivity fees apply after 12 months of no account usage ($10 for SCB-regulated clients, €10 under CySEC)

- Currency conversion and overnight fees, depending on the asset and jurisdiction

- Guaranteed stop-loss orders (GSLOs) only incur a charge if activated

With no deposit or withdrawal fees and full pricing transparency, Capital.com’s fee structure is designed to keep total trading costs low and predictable.

Swap Fee at Capital.com

Capital.com applies swap, also known as overnight funding, to leveraged positions held beyond market close. The standard annual rate is 4%, calculated daily based on a 360- or 365-day year, depending on the currency.

For USD-denominated instruments, this translates to approximately 0.01111% per day.

Holding a long CFD Contract on an index like the US Tech 100 can result in an overnight cost of around 0.02374%, reflecting the SOFR benchmark plus the platform fee.

Important Considerations:

- Applies to leveraged trades; 1:1 leveraged CFDs on stocks and cryptocurrencies may incur 0% overnight fees, subject to regional rules;

- Daily charges are calculated as benchmark interest rates (e.g., SOFR, SONIA) plus or minus the platform’s daily fee;

- Current swap rates are visible in real time on the Capital.com platform and may adjust with market conditions;

- A swap-free (Islamic) account is available for residents of Bahrain, Qatar, Kuwait, UAE, Egypt, Algeria and several other Muslim-majority countries.

Non-Trading Fees at Capital.com

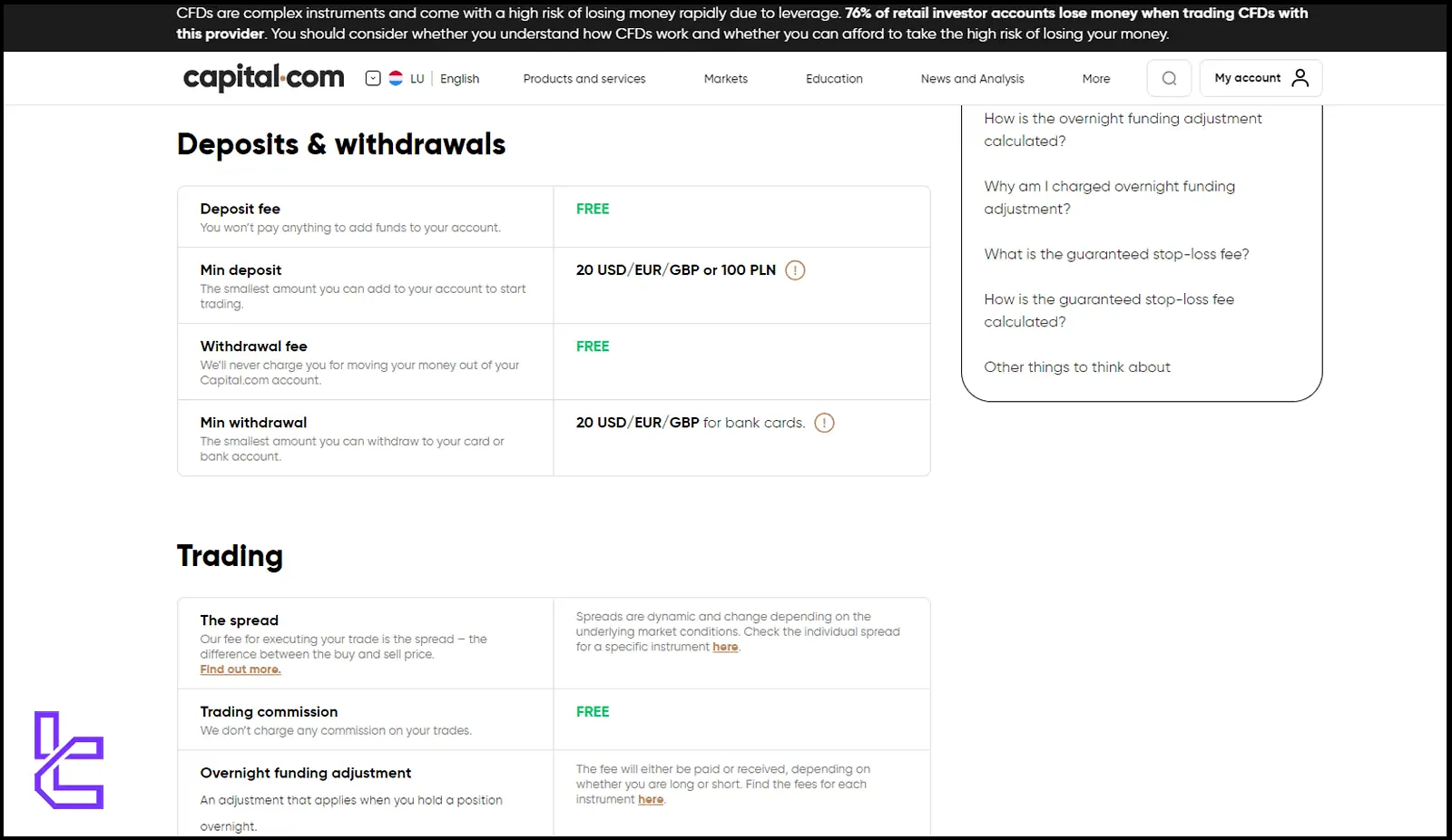

Capital.com maintains a transparent fee structure, ensuring no hidden charges for its clients. Below is a summary of the key non-trading fees associated with the platform:

- Currency Conversion: 0.7% per transaction (0.5% for professional clients) when trading or converting different currencies;

- Inactivity Fee: €10/month after 12 months without trading; only charged if funds available;

- Guaranteed Stop-Loss Order (GSLO) Fee: Paid only if the GSLO is triggered; varies by market and position size;

- Dynamic Currency Conversion (DCC): Applies when depositing/withdrawing in a currency different from your bank; depends on provider.

Capital.com Broker Deposit & Withdrawal

Capital.com provides various options for funding your account and withdrawing your profits:

- Credit and debit card payment systems

- PayPal

- Bank transfer

- iDeal

- Trustly

- Sofort

- Giropay

- Przelewy24

- AstropayTEF

- Multibanko

- 2c2p

Capital.com's efficient deposit and withdrawal system ensures traders can easily manage their funds with minimal delays. For detailed inforamtion about payment methods, we suggest checking the Capital.com dashboard.

Deposit Methods at Capital.com

Capital.com offers multiple deposit options including cards, bank transfers, e-wallets and local methods, each with varying minimums and processing times.

The available methods generally cover most users’ needs, though wire transfers may require a higher minimum.

Below is a summary table with key details:

Deposit Method | Currency | Minimum Amount | Deposit Fee | Funding Time |

Card (Visa / Mastercard / Maestro) | EUR / USD / GBP | 20 | Free | Instant or near instant |

Bank Transfer / Wire | EUR / USD / GBP | 50 | Free | 1–5 business days |

Apple Pay / Google Pay | EUR / USD / GBP | 20 | Free | Instant or near instant |

E-wallets (PayPal, Skrill, Neteller, Trustly, etc.) | EUR / USD / GBP | 20 | Free | Instant or up to 1 business day |

Local methods (e.g. iDEAL, Przelewy24, SPEI) | Local currency | Depends on method / country | Free | Generally fast / hours to 1 business day |

Withdrawal Methods at Capital.com

At Capital.com, you can withdraw funds via the same or similar methods to your deposit bank cards, bank transfers, e-wallets, etc.

All withdrawal requests are processed internally within 24 hours (most in about 5 minutes), though receiving the money may take a few business days depending on the method and country.

There are minimum withdrawal amounts per method; if your balance is below that, you’ll need to withdraw the full amount.

Below is a summary table with key details:

Withdrawal Method | Currency | Minimum Amount | Withdrawal Fee | Funding Time |

Bank Card (Credit/Debit) | USD / EUR / GBP | ~20 | Free | 1–5 business days |

Bank Transfer / Wire | USD / EUR / GBP | ~50 | Free | 1–5 business days |

Apple Pay / Google Pay | USD / EUR / GBP | ~20 | Free | 1–2 business days |

E-wallets (PayPal, Skrill, Neteller, etc.) | USD / EUR / GBP | ~10–20 | Free | Within 24h–2 business days |

Crypto Withdrawals | Major cryptos | ~50 USD equivalent | Free | Within 24h (plus blockchain time) |

Copy Trading & Investment Options Offered on Capital.com Broker

Capital.com does not offer direct copy trading features or traditional investment options like owning underlying assets.

Instead, the broker specializes in CFD trading, allowing traders to speculate on price movements across various markets without owning the assets themselves.

This focus on CFD trading is supported by competitive spreads, making it attractive for traders who prefer low-cost trading.

Needless to say, Capital.com's AI-powered insights and personalized news feed can help traders make better decisions based on market trends and expert analysis.

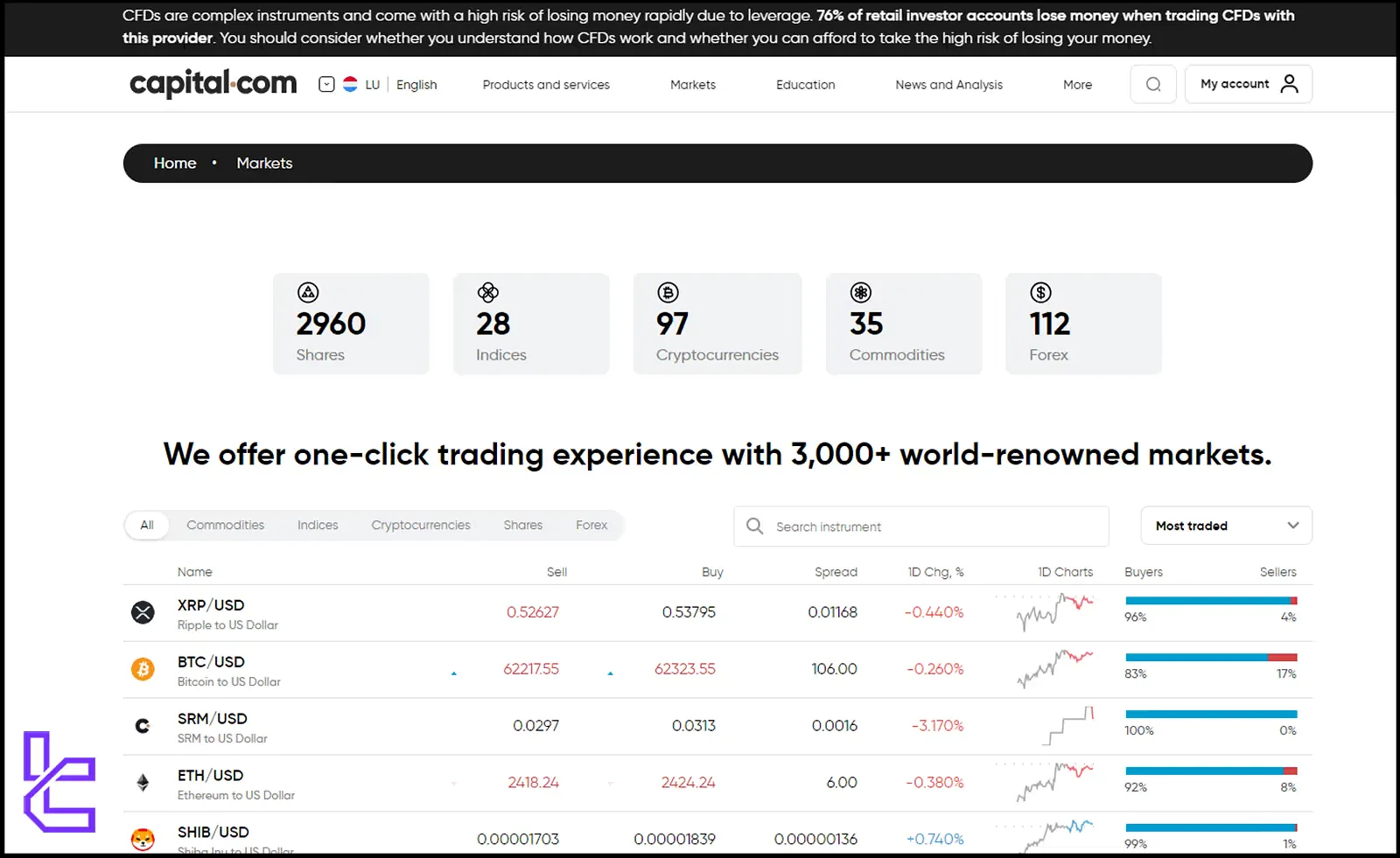

Capital.com Forex Broker Tradable Markets & Symbols Overview

Capital.com offers a diverse range of tradable markets and symbols:

Category | Type of Instruments | Number of Symbols | Competitor Average | Max. Leverage |

Major, minor, exotic FX CFDs | 100+ | ~70–90 | 1:30 | |

Indices | Global stock indices CFDs | 20+ | ~15–20 | 1:20 |

Commodities | Metals, energies, softs | 20–30 | ~15–25 | 1:10 |

Shares | Company stock CFDs | 2,500+ | ~1,500–2,000 | 1:5 |

Cryptocurrencies | Crypto CFDs | 285+ | ~100–200 | 1:2 |

This wide selection allows traders to explore various markets and find opportunities that align with their trading strategies and risk tolerance.

Capital.com Forex Broker Bonuses and Promotions

Capital.com generally focuses on providing a straightforward trading experience and, as such, does not currently offer any bonuses or promotions.

This lack of promotional incentives may be a strategic decision aimed at maintaining transparency and simplicity in their fee structures. Some traders might find the other brokers best for offerings below:

- Deposit Bonus

- No-deposit bonus

- CashBack

While some brokers use bonuses to attract new clients or incentivize trading activity, Capital.com opts to concentrate on delivering competitive trading conditions and a robust platform.

Traders should carefully evaluate their needs and preferences, as the absence of bonuses may appeal to those who prioritize straightforward pricing over promotional offers.

Capital.com Awards

Over the years, Capital.com has won multiple awards in areas such as user experience, education, and trading platform quality.

These awards have primarily been granted by reputable international organizations and industry sources.

Here are some of Capital.com’s notable awards:

- Best in Class: Beginners 2024

- Best in Class: Crypto Trading 2024

- Best in Class: Ease of Use 2024

- Best in Class: Education 2024

- Best in Class: Commissions & Fees 2024

- Top 5 Trading Platforms Globally 2022

Capital.com Broker Support Team

Capital.com provides reliable support channels to assist traders effectively, primarily through the options below:

- Email: support@capital.com;

- Phone: +33 187654090;

- Online chat;

- Ticket system.

The online chat feature allows for immediate interaction, enabling users to resolve queries quickly and efficiently.

For more complex issues that may require detailed explanations, the ticket system is available, allowing traders to submit inquiries and receive responses from the support team in a timely manner.

Capital.com Broker List of Restricted Countries

While Capital.com serves clients in over 180 countries, some restrictions exist due to regulatory requirements and company policies. Some of the restricted countries includes:

- USA

- Canada

- Japan

- Turkey

- Belgium

- Pakistan

- Iraq

- Iran

- DPRK

- Syria

- Somalia

These restrictions are in place to ensure compliance with international regulations and to protect both the company and its clients from potential legal issues.

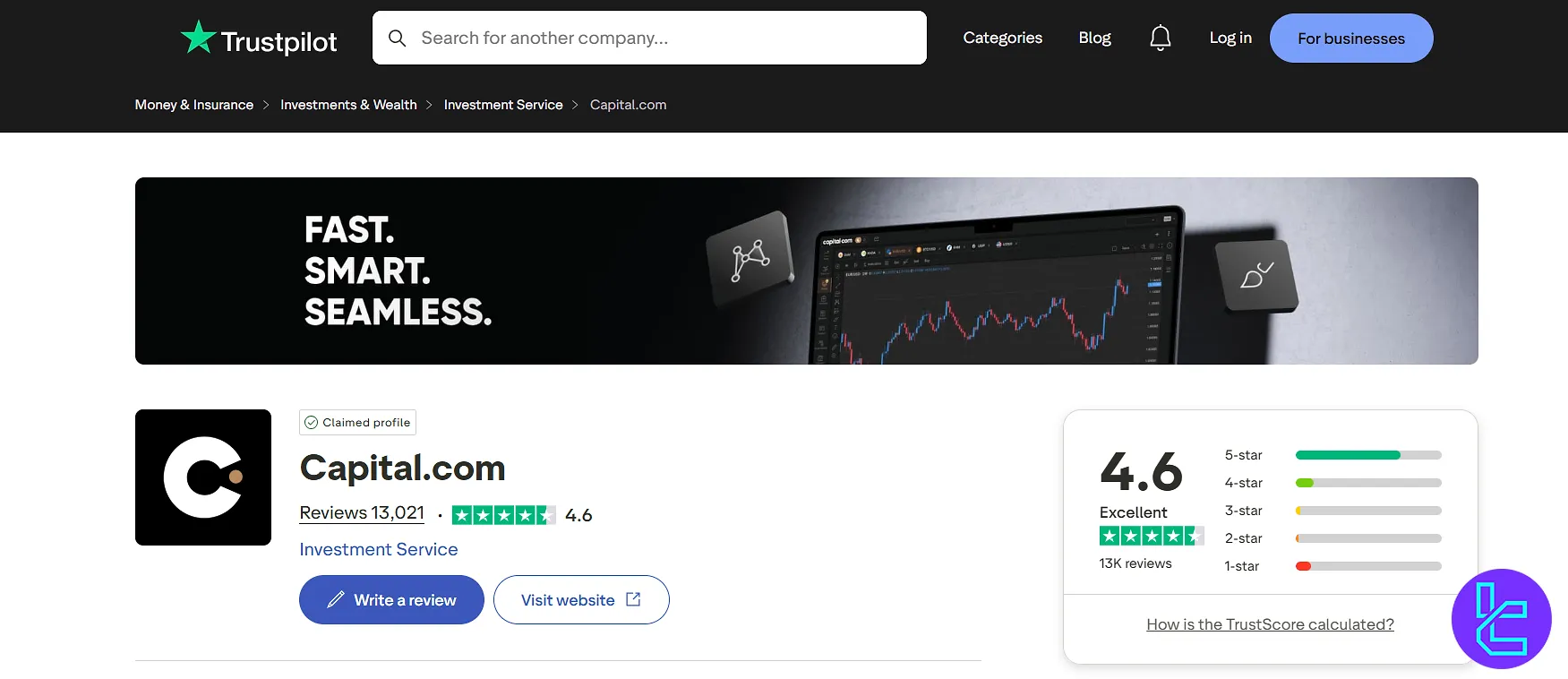

Capital.com Broker Trust Scores & Reviews

Trust and reputation are crucial factors when choosing a forex broker. Capital.com has received generally positive reviews and trust scores from Trustpilot:

- Score: 4.6/5 (Excellent)

- Praised for: user-friendly platform, responsive customer support, and efficiency

While the Capital.com TrustPilot score reflects positively on Capital.com, traders should conduct their own research and consider their individual needs when choosing a broker.

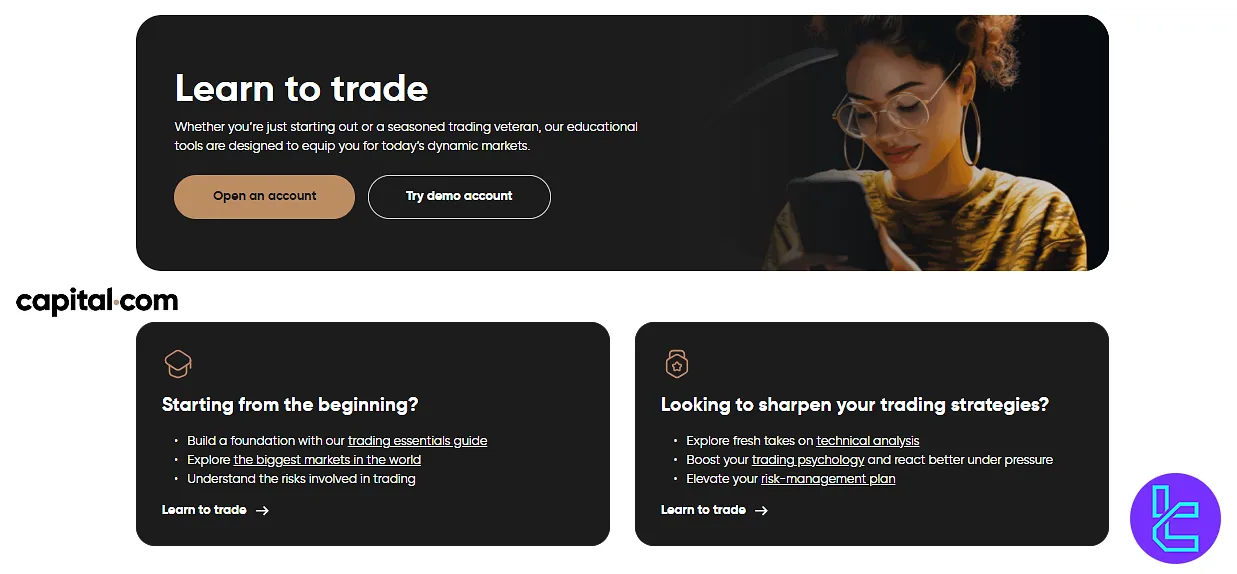

Education on Capital.com Broker

Capital.com places a strong emphasis on trader education, offering a comprehensive suite of learning resources:

Category | Resources |

Market Guides | Shares Trading Commodities Trading Forex Trading Cryptocurrency Trading Indices Trading ETF Trading |

Learning Hub | The Basics of Trading Trading Courses CFD Trading Guide Glossary of Trading Terms Investmate App Toolbox for Traders |

Trading Strategies Guide | Day Trading Trend Trading Position Trading Swing Trading Margin Trading Trading Psychology Guide Power Pattern |

The educational content is designed for traders at all levels, from complete beginners to seasoned professionals looking to refine their skills.

To access these sources, go to the Education bar on the main page of the website.

Capital.com in Comparison with Other Forex Brokers

Let's compare the most important aspects of trading with Capital.com in comparison with other Forex brokers.

Parameters | Capital.com Broker | |||

Regulation | CySEC, FCA, ASIC, FSA, SCB, MiFID | FSA, FSC, Misa, FinaCom | FSA, FCA, CySEC, LFSA, FSCA | VFSC, CySEC, FSA, FSCA |

Minimum Spread | From 0.67 Pips | From 0.0 pips | From 0.0 Pips | From 0.0 Pips |

Commission | $0 | From $0.0 | From $0.0 | From $0.0 |

Minimum Deposit | $20 or equivalent | $100 | $100 | $5 |

Maximum Leverage | 1:300 | 1:3000 | 1:1000 | 1:5000 |

Trading Platforms | MT4,Web Trader, Mobile App, TradingView | MetaTrade 4, MetaTrade 5, Mobile App | Metatrader 4, Metatrader 5, Metatrader Web, Mobile App | MT4, MT5 |

Account Types | Professional, Demo, Retail | Standard, ECN, Fixed, Crypto, Demo | Classic, Raw | Standard+, ECN Zero, Mini Optimus, Pro |

Islamic Account | No | Yes | Yes | Yes |

Number of Tradable Assets | 3200+ | 550+ | 620+ | N/A |

Trade Execution | Market | Instant, Market | Market | Market |

Conclusion and final words

Capital.com provides CFD trading across 6 asset classes, including Forex and ESG. It has an excellent TrustPilot score of 4.3. Clients from United States and Canada are not accepted.