Forex, CFD, and spread betting trading are available in the CAPITAL INDEX broker with a minimum deposit of $100. The FCA United Kingdom licenses the broker and enables traders to use a maximum leverage of 1:200.

At Capital Index there are no hidden commissions apart from the disclosed spreads and swap/financing fees; however, stock and equity symbols are subject to a separate commission.

CAPITAL INDEX Company Information & Regulation

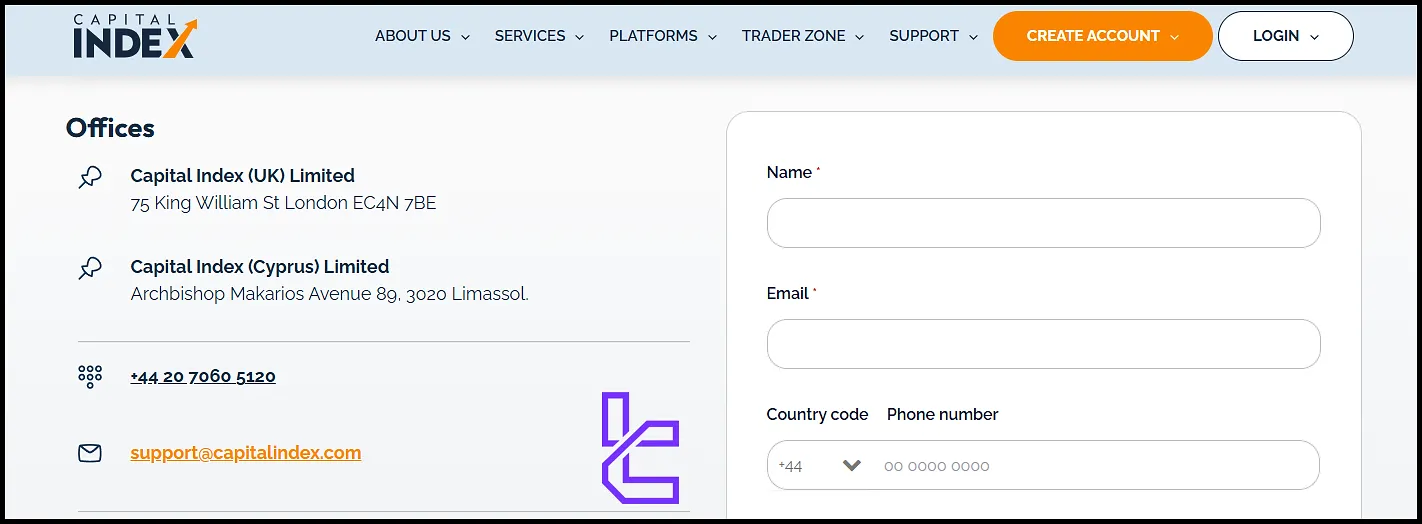

CAPITAL INDEX (UK) LIMITED, founded in 2014, is a private limited company registered in England and Wales.

With its headquarters at 75 King William Street, London, EC4N 7BE, the company has established itself as a significant player in the financial intermediation sector. CAPITAL INDEX Information:

- Company number: 09532185

- Company status: Active

- Nature of business: Financial intermediation not elsewhere classified

Entity Parameters / Branches | Capital Index (UK) Ltd | Capital Index (Global) Ltd |

Regulation | FCA | SCB |

Regulation Tier | Tier 1 | Mid / Lower |

Country | United Kingdom | Bahamas |

Investor Protection Fund / Compensation Scheme | FSCS (up to £85,000) | None |

Segregated Funds | Yes | Yes |

Negative Balance Protection | Yes (Retail) | Yes |

Maximum Leverage | 1:30 | 1:200 |

Client Eligibility | Only UK citizens | All countries except restricted (e.g. USA, Iran) |

CAPITAL INDEX is regulated by the UK's Financial Conduct Authority (FCA), one of the most respected financial regulators globally.

This regulation ensures that the broker adheres to strict financial standards, providing a layer of security for traders.

Additionally, the company is regulated by the Securities Commission of The Bahamas (SCB), which further extends its global reach and enhances regulatory compliance.

Specifications

CAPITAL INDEX forex broker stands out in the crowded forex market with its robust offering of trading instruments and user-friendly platforms. Here's a quick overview of what sets this broker apart:

Broker | CAPITAL INDEX |

Account Types | ADVANCED, PRO, Classic |

Regulating Authorities | FCA Britain, SCB Bahamas |

Based Currencies | GBP/EUR/USD |

Minimum Deposit | $100 |

Deposit/Withdrawal Methods | Bank Transfer and Credit/Debit Cards |

Minimum Order | 0.01 |

Maximum Leverage | 1:200 |

Investment Options | None |

Trading Platforms & Apps | MT4, MarketBook |

Markets | Forex, CFD, Spread Betting |

Spread | From 1.0 Pips |

Commission | 0.02/unit/trade (min £10 (UK)/€10 (EU)/$15 (US) per trade) |

Orders Execution | Market |

Margin Call/Stop Out | No Information Provided |

Trading Features | 24/5 Support, Demo Trading, 1:200 Maximum Leverage |

Affiliate Program | Yes |

Bonus & Promotions | No |

Islamic Account | Yes |

PAMM Account | No |

Customer Support Ways | Indoor Meeting, Phone Call, Email, Live Chat |

Customer Support Hours | 24/5 |

What Accounts Does CAPITAL INDEX Offer?

Capital Index offers three distinct live account types, each designed to match varying levels of trader experience and strategy preference:

- Classic Account: No minimum deposit is required. This entry-level account features fixed spreads and zero commission. It does not support VPS or phone trading but does allow spread betting. Maximum leverage is capped at 1:100;

- Advanced Account: Requires a $100 minimum deposit and offers variable spreads with no commissions (except for stock and equity symbols). Traders can access VPS and phone dealing services. This account supports spread betting and provides leverage up to 1:200;

- Pro Account: Designed for professionals, this account requires a $500 deposit. It features variable spreads and charges a commission of $3.50 per FX lot. Neither VPS nor spread betting is supported. Leverage remains at 1:200.

All accounts are MT4-compatible and come with access to free webinars, seminars, and Islamic (swap-free) account options. A demo account is also available for risk-free testing.

What Are the Advantages and Disadvantages?

The answer to this question helps you to have a better outlook from this broker; CAPITAL INDEX Pros and Cons:

Advantages | Disadvantages |

Regulated By FCA And SCB | No Cent Accounts for Beginners |

User-Friendly MT4 And Proprietary Platforms | Low Range of Trading Instruments |

Competitive Spreads (From 1.0 Pip) | No Passive Income Options |

No Hidden Commissions | Relatively High Minimum Deposit for Pro Account |

Suitable Educational Resources | - |

Sign Up & Verification: Comprehensive Guide

Opening a new trading account with Capital Index is easy. Capital Index registration:

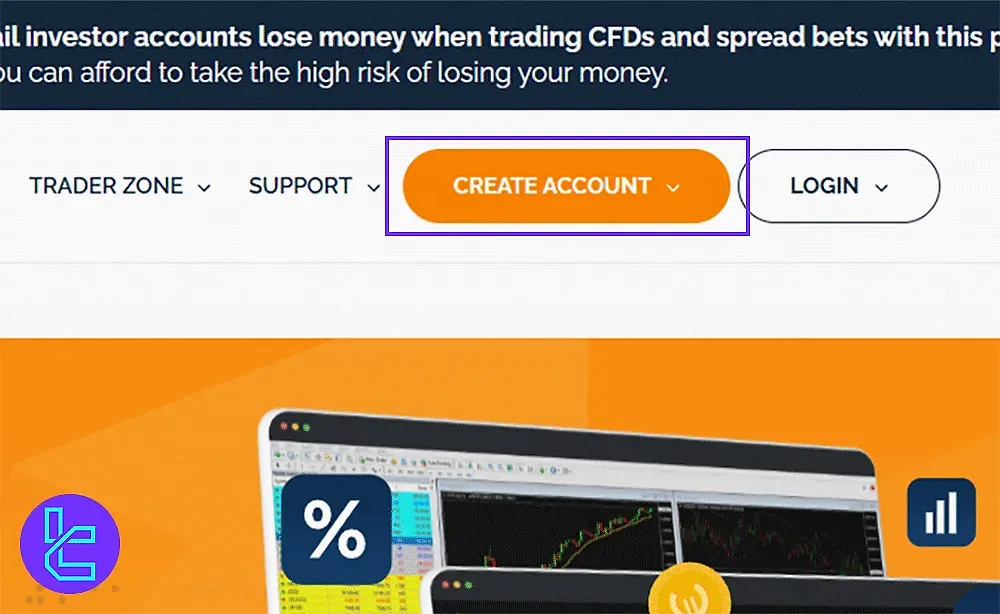

#1 Access the Registration Page

Visit Capital Index’s homepage and select “Create Account” to start your registration process.

#2 Complete the Account Form

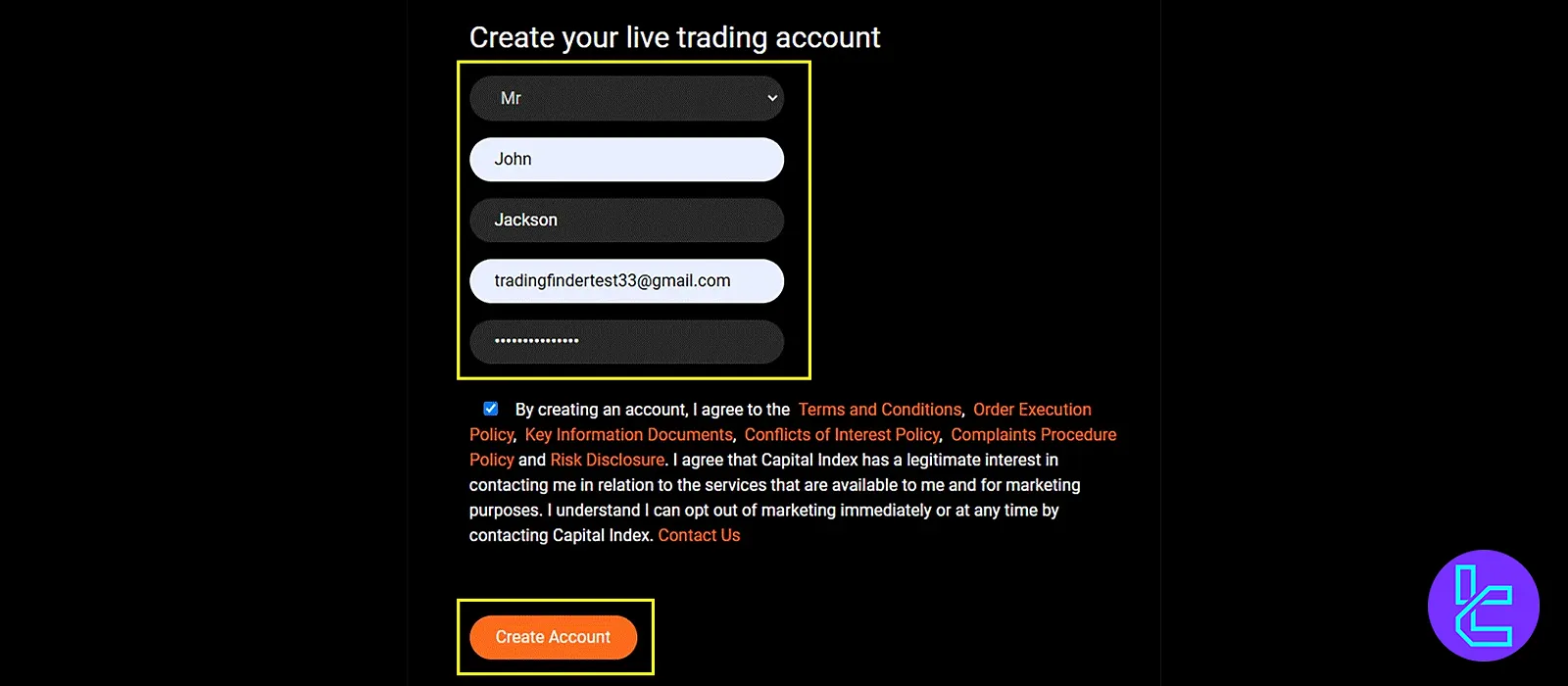

To begin your registration, enter the following basic information:

- Title

- First name

- Last name

- Email address

- Secure password (include uppercase, lowercase, numbers, and symbols)

Now accept the terms and conditions to proceed.

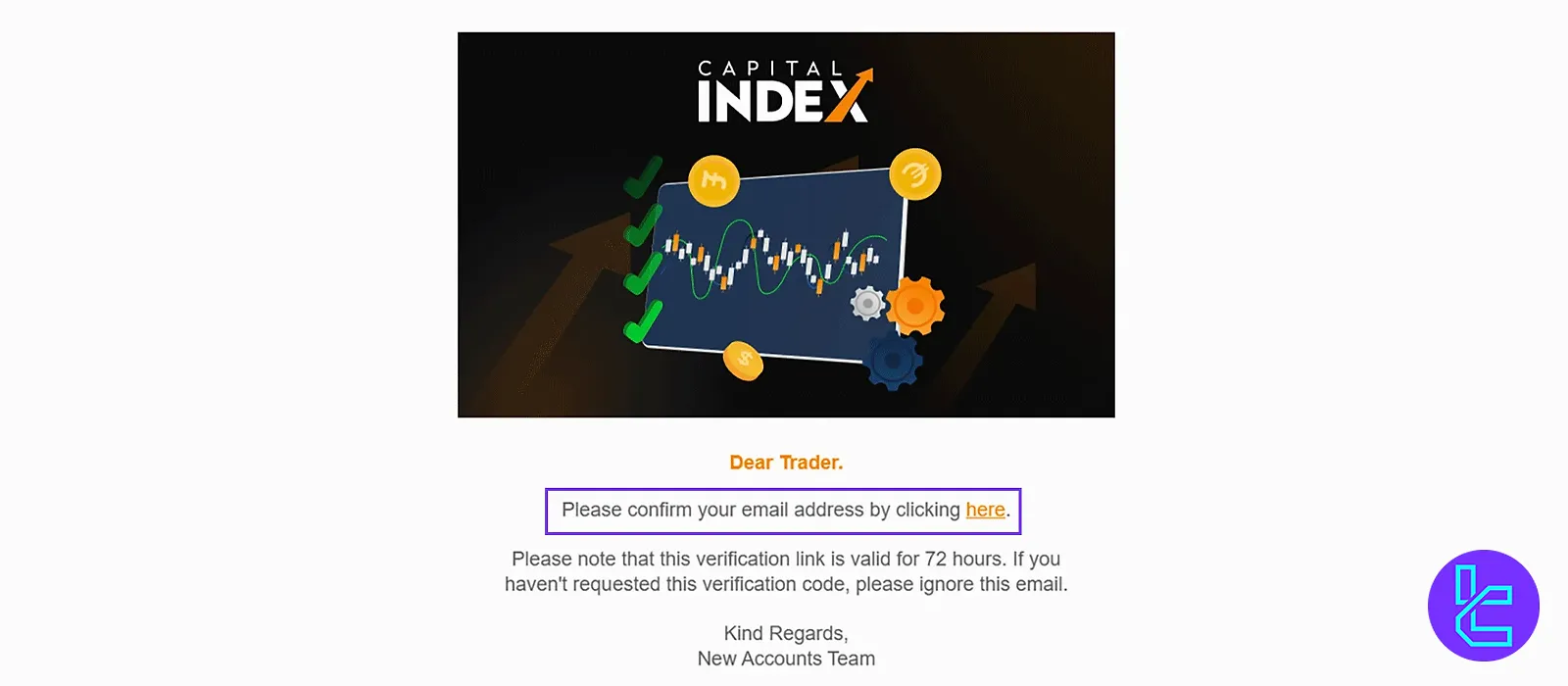

#3 Verify Your Email

Check your inbox for Capital Index’s verification email and click the confirmation link to validate your email address.

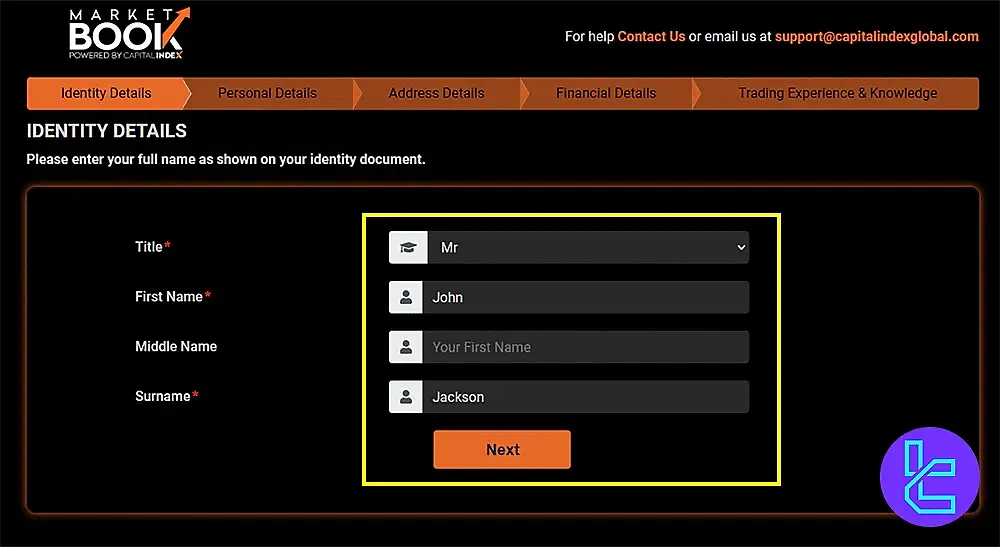

#4 Provide Identity Information

To complete this section, provide the following identity details:

- Gender

- First name

- Middle name

- Last name

Then proceed to the next section.

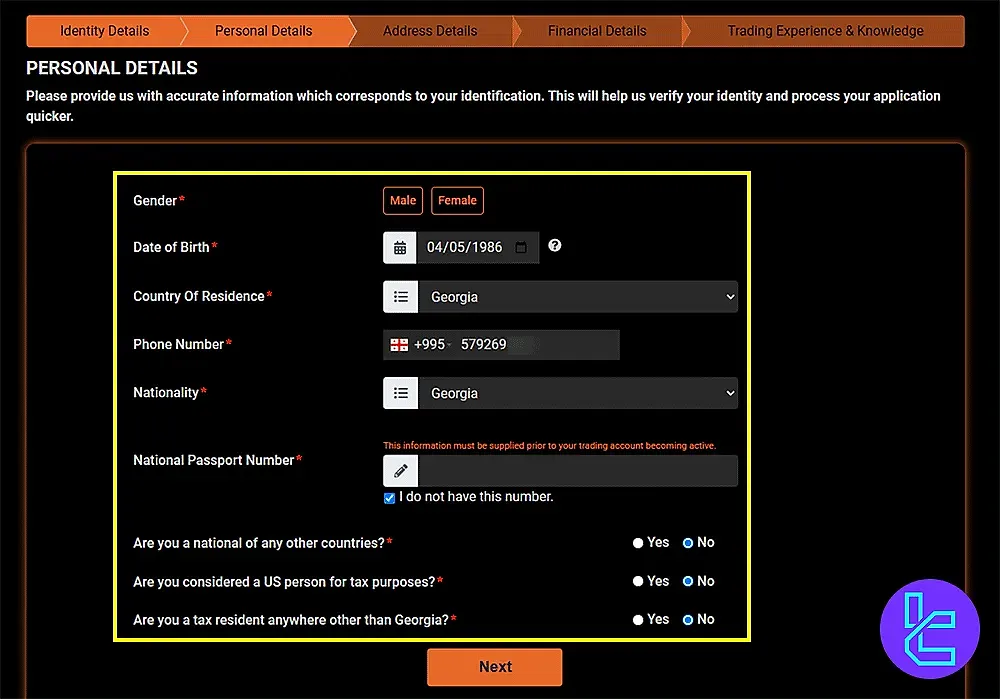

#5 Enter Personal Details

To verify your identity, please provide the following details:

- Date of birth

- Country of residence

- Phone number

- Nationality

Passport number Indicate if you hold additional nationalities or reside in another country for tax purposes.

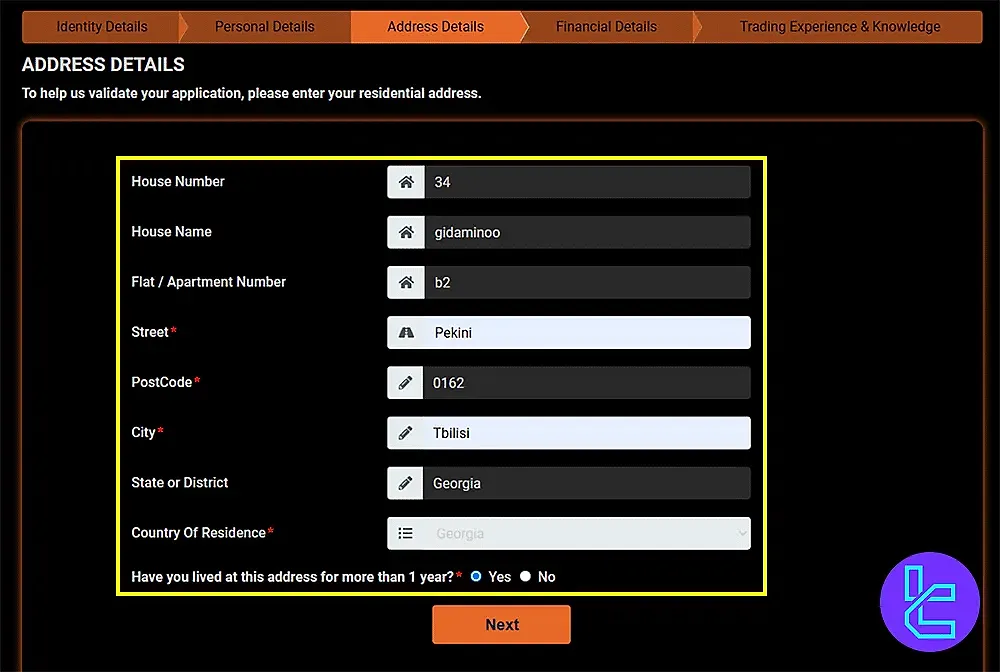

#6 Add Address Information

Submit your full address, city, postcode, and indicate if you have lived there for over one year before moving forward.

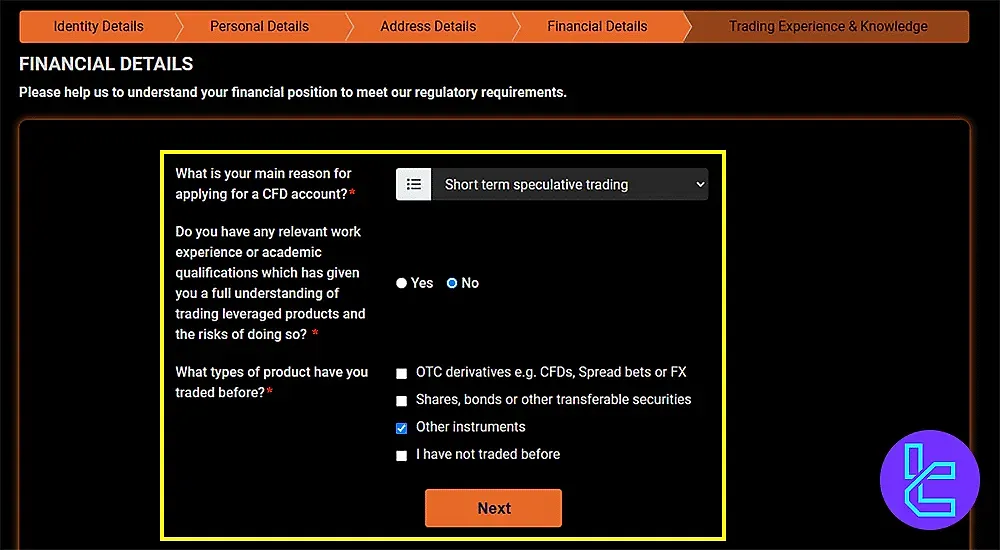

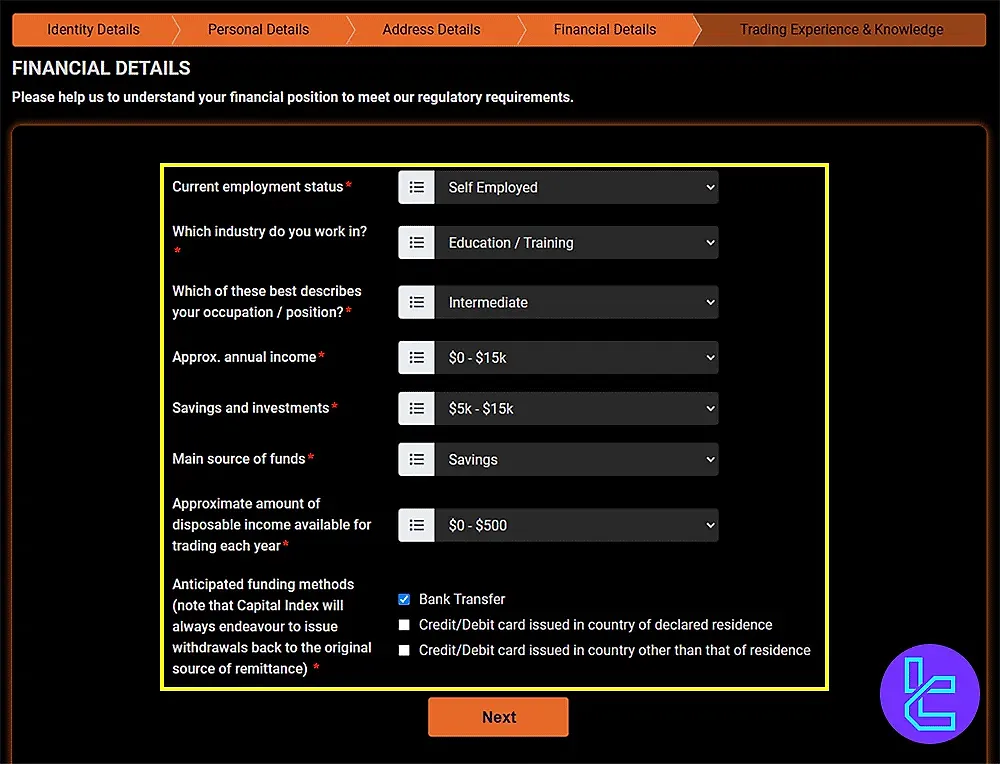

#7 Provide Financial Details

Specify your trading experience, objectives and the trading product you were using, and click “Next”;

Fill in the financial position form and click “Next”.

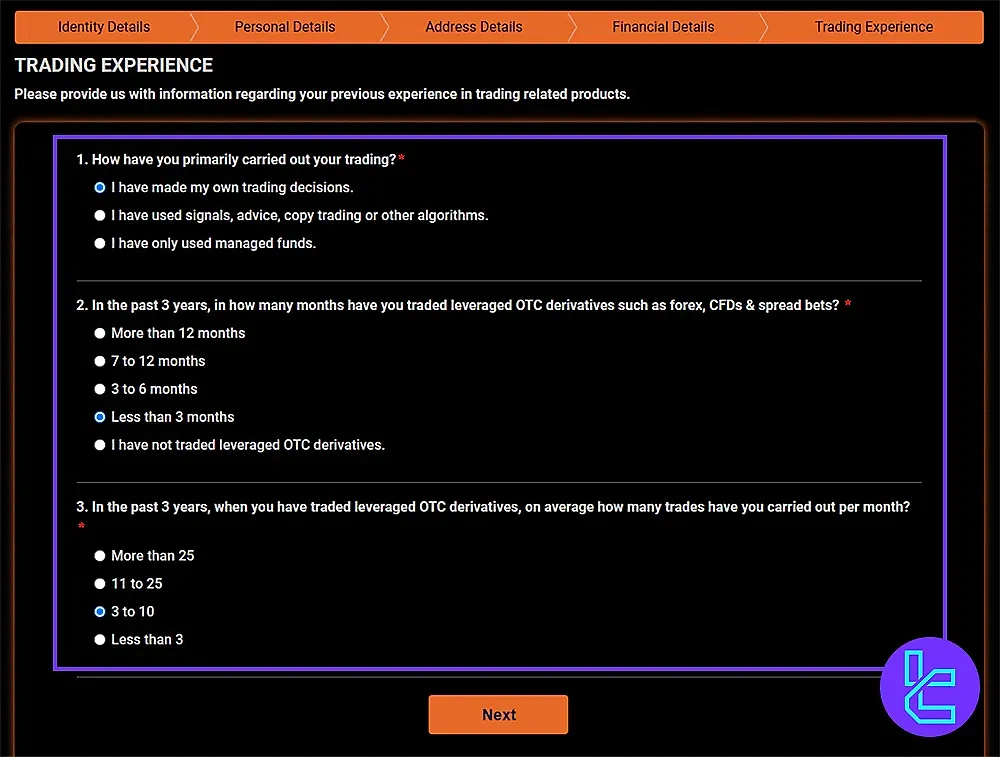

#8 Detail Your Trading Experience

Answer questions about your experience with various trading products to help Capital Index assess your background.

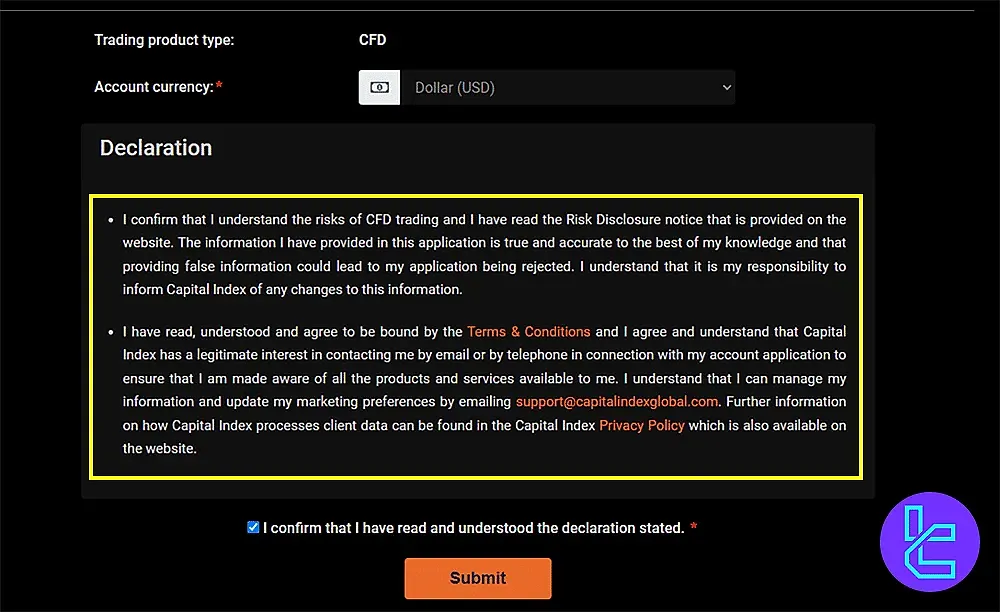

#9 Confirm the Declaration Statement

Review the required declaration, check the confirmation box, and submit your registration to complete the account setup.

#10 Identity Verification

To complete identity verification with the Capital Index broker, traders must submit their KYC documents (such as an ID card, driver's license, or passport) through the broker's dashboard.

What Are CAPITAL INDEX Trading Platforms?

CAPITAL INDEX offers two robust trading platforms, including MetaTrader 4, to suit different trader preferences; CAPITAL INDEX Global TradingPlatforms:

MetaTrader 4 (MT4)

- Trading-standard platform with advanced charting tools;

- Customizable interface and indicators;

- Supports Expert Advisors (EAs) for automated trading;

- Available on desktop, web, and mobile devices.

MarketBOOK

- Proprietary CAPITAL INDEX platform designed for both novice and experienced traders;

- Real-time market data and analytics;

- Customizable indicators and alerts;

- Advanced risk management features;

- Automated trading capabilities.

How Much Are CAPITAL INDEX Broker Spreads and Commissions?

Capital Index follows a transparent pricing model, with trading costs structured by account type:

- Advanced Account: Features spreads starting from 1.4 pips. No commission is charged per trade;

- Pro Account: Spreads begin at 1.0 pips, also with zero trading commission;

- Black Account: Offers spreads from as low as 0.4 pips and applies a trading commission of $4 per trade.

In addition to spreads, overnight positions incur swap charges. While deposits are free, withdrawal fees may apply, particularly when using instant wire transfer services.

Importantly, there are no hidden charges, and the broker's total average trading commission was benchmarked at $9.30 per trade, placing it in the higher-cost tier relative to competitors.

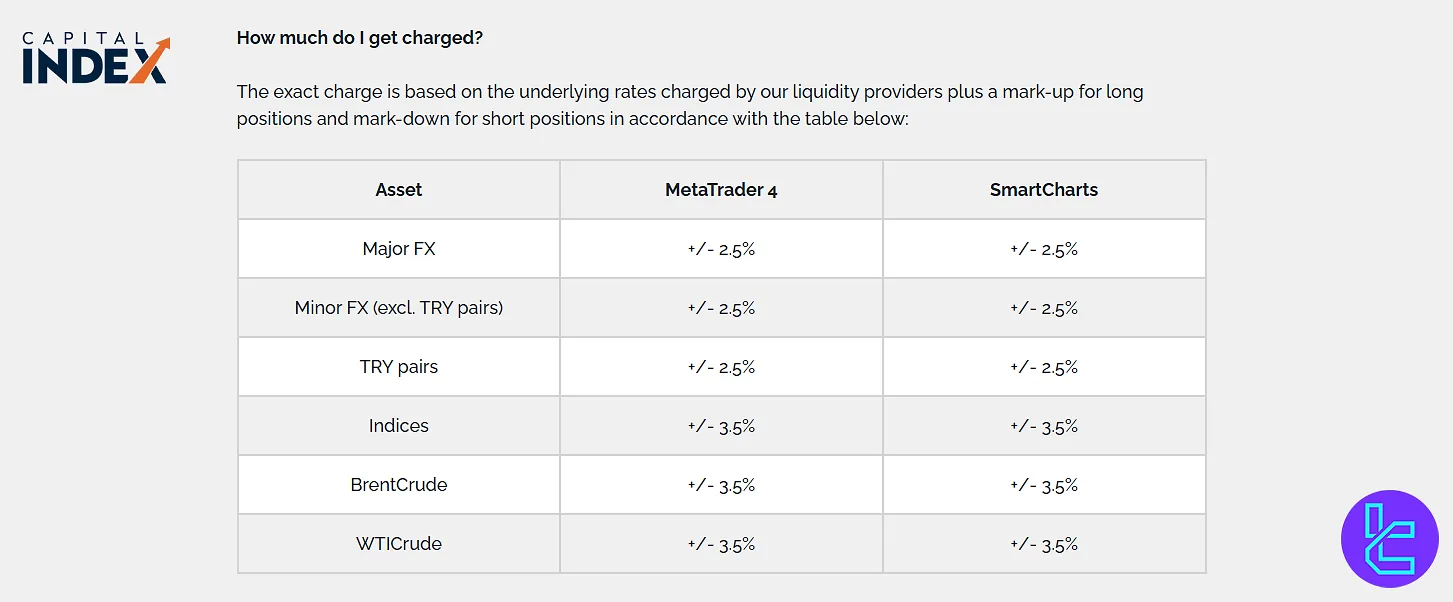

Swap Fee at Capital Index

Overnight financing fees are charged at Capital Index and apply whenever positions remain open past the daily cut-off (22:00 UK time / 00:00 server time).

For currency pairs, an additional mark-up of 2.5% is applied to the swap rate on MetaTrader 4, SmartCharts, and MarketBOOK.

Contracts on indices, precious metals, and crude oil carry a 3.5% mark-up added to the swap fees across the same platforms.

Key considerations:

- Triple swaps are applied mid-week (Wednesday) for Forex and Metals, and on Friday for indices and oil;

- Rates include an adjustment on top of interbank benchmarks;

- While typically negative, financing can occasionally be positive under certain market conditions;

- Traders are advised to consult the instrument-specific swap schedule before holding overnight.

- Capital Index also provides swap-free (Islamic) accounts, designed to comply with Shariah principles by removing overnight interest charges.

Non-Trading Fees at Capital Index

Capital Index does not prominently disclose a large set of non-trading fees on its main pages.

In general, the broker claims to avoid many hidden charges, but some non-trading costs may apply depending on account activity, withdrawal methods or service usage.

Key notes & caveats:

- Capital Index states there is no deposit fee for funding accounts via standard payment methods;

- Capital Index charges a monthly inactivity fee of GBP 15 / USD 15 / EUR 15 after six months of no trading activity;

- Withdrawal fees may apply in certain cases (e.g. instant wire transfers or selected payment systems), though not for standard withdrawal methods;

- The broker indicates that it charges no hidden commissions beyond the stated spreads or swap/financing costs, except for stock and equity symbols, which include a commission.

What Are the Deposit & Withdrawal Methods of CAPITAL INDEX?

In this part of the CAPITAL INDEX reviews, we checked its payment methods and discovered that there are only 2 available options! CAPITAL INDEX Payment Methods:

- Bank Transfer

- Credit/Debit Cards (Visa, Mastercard)

Key Points of Withdrawing or Depositing in This Broker:

- No fees for deposits or standard withdrawals

- Same-day bank transfers incur a small charge

- Client funds are fully segregated from company assets

- Covered by the UK's Financial Services Compensation Scheme (up to £50,000 protection for retail clients)

- Third-party payments are not allowed

- The minimum funding to open an account is $100 units.

Deposit Methods at Capital Index

Capital Index supports common funding routes such as bank transfers and debit/credit cards, which generally suffice for most traders’ needs.

Nevertheless, depending on where you are, your preferred method or speed may vary.

Below is a table summarizing the available deposit methods and their key terms:

Deposit Method | Currency | Minimum Amount | Deposit Fee | Funding Time |

Bank Transfer | EUR / USD / GBP | 100 (base currency units) | Free | Usually same day (or several days for international) |

Debit Card / Credit Card (Visa / Mastercard) | EUR / USD / GBP | 100 | Free | Instant / near instant |

Withdrawal Methods at Capital Index

Capital Index facilitates withdrawals through standard channels such as bank transfers and credit/debit cards, which typically meet most clients’ needs.

That said, processing times and specific rules (e.g. third-party restrictions) may affect speed or availability.

The full breakdown of withdrawal options is shown in the table below:

Withdrawal Method | Currency | Minimum Amount | Withdrawal Fee | Processing Time |

Bank Transfer | EUR / USD / GBP | 100 (base currency units) | Usually Free (expedited transfers may incur ~15 units fee) | Local: 24 h, International: up to 5 days |

Credit Card / Debit Card (Visa / Mastercard) | EUR / USD / GBP | 10 | Free | Up to 3 days |

Copy Trading & Investment Options Offered by CAPITAL INDEX

Unfortunately, CAPITAL INDEX does not currently offer copy trading or social trading features. This could be a drawback for traders who prefer to follow and replicate the strategies of successful traders.

Additionally, there are no specific investment options or managed account services available through the platform.

What Assets Are Tradable on CAPITAL INDEX?

Unlike many other brokers such as AvaTrade or Alpari, you can’t trade 5 or 6 markets in CAPITAL INDEX! The broker’s focus is on providing the chance to trade forex market, CFDs and spread betting. CAPITAL INDEX Instruments:

Category | Type of Instruments | Number of Symbols | Competitor Average | Max. Leverage |

Forex | Currency Pairs | 60+ | 50–70 | 1:200 |

Indices | Stock Indices | 10+ | 10–15 | 1:100 |

Commodities | Metals & Energy | 5+ | 5–10 | 1:200 |

Shares | Equities (UK, US, EU) | 100+ | 100–200 | 1:50 |

This wide selection allows traders to diversify their portfolios and take advantage of opportunities across different asset classes.

However, it's crucial to remember that CFDs and spread betting are complex instruments that come with a high risk of losing money rapidly due to leverage.

Does CAPITAL INDEX Provide Bonuses?

At the time of writing, CAPITAL INDEX does not offer any bonuses or promotional offers.

This approach aligns with stricter regulatory requirements in some jurisdictions, which have limited or banned trading bonuses.

Customer Support

CAPITAL INDEX customer support is available 24/5 and closed on weekends and holidays. You can contact them through multiple channels:

- Phone: Available 24/5 for urgent inquiries

- Email: For less time-sensitive questions

- Live Chat: Instant support during business hours

- In-Person Meetings: Available by appointment at their London office

The support team is staffed by experienced professionals who can assist with technical issues, account queries, and general trading advice.

However, it's worth noting that 24/7 support is not available, which could be an issue for traders operating in different time zones.

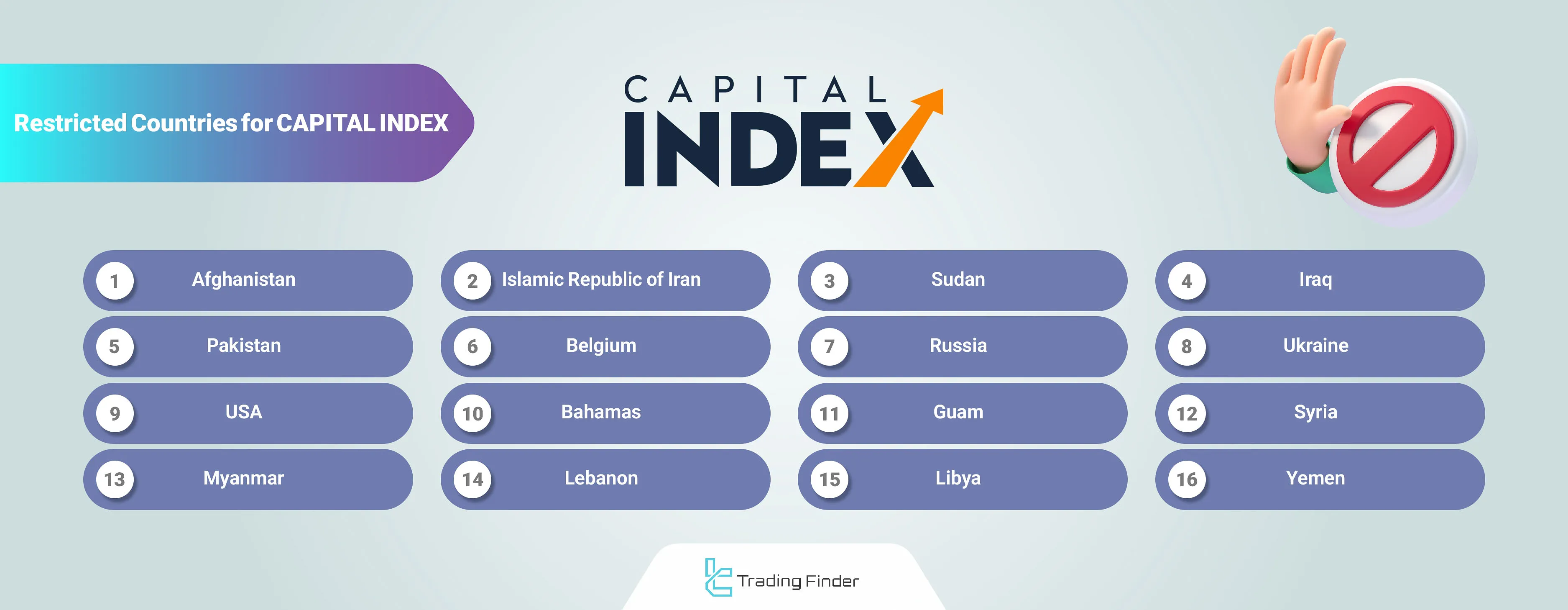

What Countries Are Banned from Using CAPITAL INDEX?

While CAPITAL INDEX serves a global clientele, there are certain countries from which they cannot accept clients due to regulatory restrictions. CAPITAL INDEX Global Restricted Countries:

- Asia: Afghanistan, Iran, Iraq, Korea (the Democratic People's Republic of), Lebanon, Maldives, Myanmar, Pakistan, Syrian Arab Republic, Yemen

- Europe: Belgium, Bosnia and Herzegovina, Russian Federation, Ukraine

- Africa: Burundi, Central African Republic, Congo (the Democratic Republic of the), Côte d'Ivoire, Eritrea, Guinea, Guinea-Bissau, Liberia, Libya, Mali, Somalia, South Sudan, Sudan, Zimbabwe

- North America: Bahamas, Nicaragua, United States, Virgin Islands (U.S.)

- South America: Venezuela

- Oceania: American Samoa, Guam, Niue

Prospective clients should check with CAPITAL INDEX directly or refer to the terms and conditions on their website for the most up-to-date information on country restrictions.

CAPITAL INDEX Trust Scores & Reviews

As we went through CAPITAL INDEX reviews, discovered that it has received mixed reviews from traders in Capital Index Trustpilot and Forex Peace Army, reflecting both positive experiences and areas for improvement:

- Trustpilot: 3.1/5 based on 25+ reviews;

- ForexPeaceArmy: 2.1/5 out of just 4 reviews.

While some traders have reported positive experiences with CAPITAL INDEX's customer service and trading platforms, others have expressed concerns about withdrawal difficulties and aggressive sales tactics.

As with any broker, it's essential to conduct thorough research and consider multiple sources of information before opening an account.

Educational Resources of CAPITAL INDEX

Capital Index offers a modest but helpful range of educational and research tools aimed primarily at beginner and intermediate traders. Resources include:

- Forex trading guides and textual tutorials explaining the basics of market operation, order types, and trading strategies

- Live seminars and on-demand webinars, freely accessible to all account types

- A weekly market commentary highlighting key upcoming economic events, central bank meetings, and macroeconomic trends

- An up-to-date economic calendar to assist with event-driven trading

- A comprehensive glossary defining essential financial and trading terms

- An extensive FAQ section that revisits many of the glossary topics in more practical terms

While the offering supports foundational knowledge and market awareness, the absence of advanced strategy content, video series, or interactive tools may leave experienced traders seeking more robust educational material.

Capital Index Vs Other Brokers

The table below helps you understand the key differences between Capital Index and other Forex brokers.

Parameters | Capital Index Broker | |||

Regulation | FCA Britain, SCB Bahamas | FCA, FSCA, CySEC, SCB | FSA, CySEC, FCA, FSCA, CBCS, FSC, CMA | No |

Minimum Spread | From 1.0 Pips | From 0.0 Pips | From 0.0 Pips | From 0.1 Pips |

Commission | 0.02/unit/trade (min £10 (UK)/€10 (EU)/$15 (US) per trade) | From $0 | From $0.2 to USD 3.5 | $0 |

Minimum Deposit | $100 | $100 | $10 | $1 |

Maximum Leverage | 1:200 | 1:500 | Unlimited | 1:3000 |

Trading Platforms | MT4, MarketBook | MT4, MT5, cTrader, Web Trader, Mobile App | Exness Trade (mobile), Exness Terminal (web), MT4, MT5 | MetaTrader 4, MetaTrader 5 |

Account Types | ADVANCED, PRO, Classic | Standard, Pro, Raw+, Elite | Standard, Standard Cent, Pro, Raw Spread, Zero | Standard, Premium, VIP, CIP |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | N/A | 2100+ | 200+ | 45 |

Trade Execution | Market | Market, Pending | Market, Instant | Market, Instant |

TradingFinder Expert Conclusion and final words

Capital Index offers 2 account types [ADVANCED, PRO] with a commission of 0.02 units per trade. Spreads start from 1.0 pips, no bonuses, and a lack of copy trading are some of the cons of the CAPITAL INDEX broker.