CapitalXtend is regulated by the Financial Services Commission (FSC) of Mauritius and offers leverage up to 1:5000. This forex broker provides access to Forex, cryptocurrencies, commodities, indices, and precious metals across global markets.

The broker supports MetaTrader 4 and MetaTrader 5 platforms, with spreads starting from 0.0 pips and low commissions. CapitalXtend offers Standard, ECN, Pro ECN, and Platinum trading accounts.

General Information and Regulation of CapitalXtend

CapitalXtend operates under the legal entity of CapitalXtend (Mauritius) LLC, which was established in 2005 and provides online trading services to global clients.

The broker is regulated by the Financial Services Commission (FSC) of Mauritius as an Investment Dealer, allowing it to offer leveraged CFD trading across multiple asset classes.

Basic details about the broker:

- Registered Address: Level 2, Suite 201, The Catalyst, 40 Silicon Avenue, Cybercity, 72201, Ebene, Republic of Mauritius

- License Type: Investment Dealer (FX & CFD services)

- Contact Phone Numbers: +357 25056441 / +230 52970933

In addition to its regulatory license, CapitalXtend applies several risk-mitigation and client-protection measures. The broker offers negative balance protection, ensuring traders cannot lose more than their deposited funds, and keeps client capital in segregated accounts, separate from company operating funds.

Moreover, CapitalXtend is a member of the Financial Commission (FC), an independent dispute resolution organization that provides an extra layer of trader protection through a compensation mechanism.

Further regulatory and entity-related details are summarized in the table below:

Entity Parameters / Branches | CapitalXtend (Mauritius) LLC | CapitalXtend LLC |

Regulation | FSC | SVG |

Regulation Tier | 3 | 3 |

Country | Mauritius | Saint Vincent and the Grenadines |

Investor Protection Fund / Compensation Scheme | FC (up to EUR 20,000), Fund insurance of up to $1M | N/A |

Segregated Funds | Yes | Yes |

Negative Balance Protection | Yes | Yes |

Maximum Leverage | 1:5000 | 1:5000 |

Client Eligibility | International (excluding USA, Canada, Japan and Saint Vincent and the Grenadines) | Global |

CapitalXtend Broker Specifications

CapitalXtend offers a diversified set of trading conditions and accounts. The broker supports industry-standard platforms (MT4/MT5) with competitive spreads, multiple account tiers, and both live and demo trading options to match different strategies.

Below is a comprehensive overview of its specifications:

Broker | CapitalXtend |

Account Types | Standard, ECN, Pro-ECN, Platinum (plus Demo) |

Regulating Authorities | FSC, SVG |

Based Currencies | USD |

Minimum Deposit | $12 |

Deposit Methods | Cryptos, Visa/Master Cards, Bank Transfer, Local Transfer, Online Banking |

Withdrawal Methods | Cryptos, Visa/Master Cards, Bank Transfer, Local Transfer, Online Banking |

Minimum Order | 0.01 lots |

Maximum Leverage | 1:5000 |

Investment Options | Copy Trading, Affiliate/IB |

Trading Platforms & Apps | MetaTrader 4 & MetaTrader 5 |

Markets | Forex, spot metals, spot energies, CFD indices, cryptocurrencies |

Spread | From 0.0 pips |

Commission | From $0 |

Orders Execution | Market |

Margin Call / Stop Out | 80%/10% on most accounts; 100%/50% on Platinum |

Trading Features | Swap-free options, pending orders/limit/stop allowed, Hedging, Demo account |

Affiliate Program | Yes |

Bonus & Promotions | Yes |

Islamic Account | Yes |

PAMM Account | No |

Customer Support Ways | Email, live chat, phone, contact form, physical office |

Customer Support Hours | 24/7 |

Restricted Countries | USA, Canada, Japan, Saint Vincent & Grenadines |

Account Types at CapitalXtend

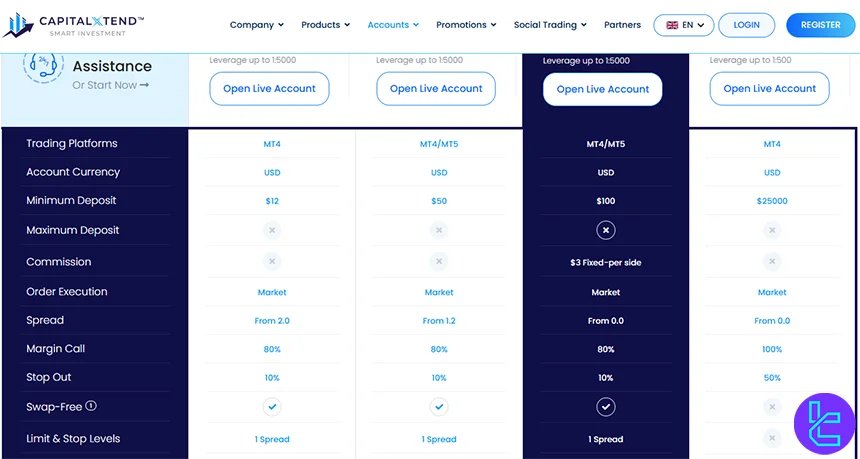

CapitalXtend provides four live account types, including Standard, ECN, Pro‑ECN, and Platinum. Each account differs in minimum deposit, leverage, spreads, commissions, and platform support, catering to beginners, active traders, and high‑volume investors.

The accounts offer swap‑free / Islamic options and multi-asset trading including Forex, commodities, indices, metals, and cryptocurrencies. Pro‑ECN features tight spreads with fixed commissions, while Platinum suits institutional or high‑volume trading strategies.

Here is CapitalXtend account comparison table:

Feature / Account | Standard | ECN | Pro-ECN | Platinum |

Minimum Deposit | $12 | $50 | $100 | $25,000 |

Maximum Leverage | Up to 1:5000 | Up to 1:5000 | Up to 1:5000 | Up to 1:500 |

Trading Platforms | MT4 | MT4/MT5 | MT4/MT5 | MT4 |

Spread From | From 2.0 pips | From 1.2 pips | From 0.0 pips | From 0.0 pips |

Commission | None | None | $3 per side | None |

Order Execution | Market | Market | Market | Market |

Margin Call | 80% | 80% | 80% | 100% |

Stop Out | 10% | 10% | 10% | 50% |

CapitalXtend Strengths & Weaknesses

CapitalXtend is a Mauritius‑regulated broker offering multiple account types, MT4/MT5 platform support, and access to various assets. From the other hand, it is not entirely free from limitations.

For a clear overview of the broker’s advantages and limitations, please refer to the table below.

Pros | Cons |

Negative balance protection | No tier-1 regulated |

High leverage up to 1:5000 | No ETFs |

Supports MT4 & MT5 platforms on desktop, web, and mobile | - |

Swap-free / Islamic option | - |

Copy trading and social trading available | - |

Registration and Verification at CapitalXtend

To deposit funds and start trading with CapitalXtend, you must first complete the registration process. CapitalXtend registration is straightforward and can be completed within a few minutes. After registration, you need to upload your documents to complete the KYC verification.

Below is a step‑by‑step guide to registering with CapitalXtend:

#1 Start from Homepage

First, visit the CapitalXtend website and click on the “Register” button located at the top right corner to be redirected to the registration page.

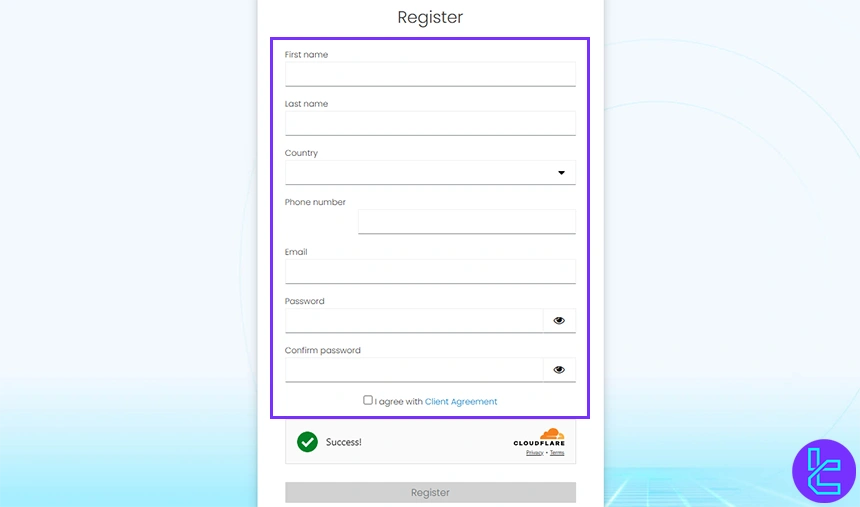

#2 Fill Out the Registration Form

In this step, you will see a registration form containing the following fields:

- First Name

- Last Name

- Country

- Phone Number

- Password

Enter your information, read the terms and conditions, check the confirmation box, and then click the “Register” button to proceed.

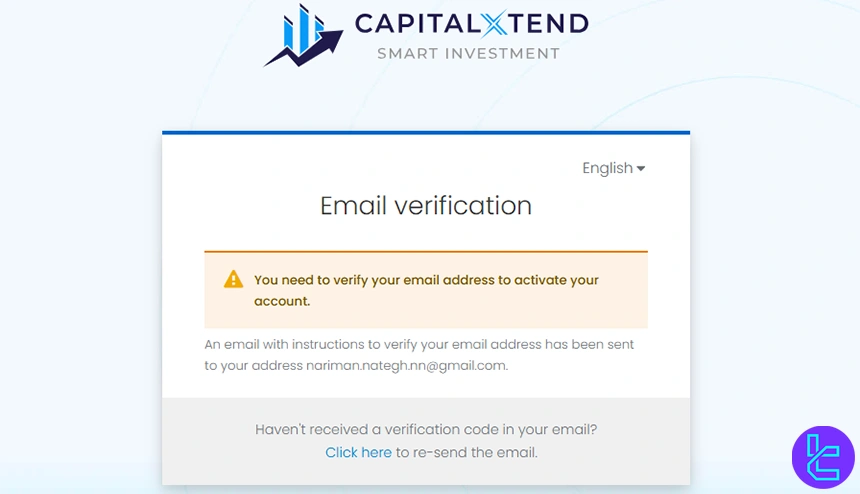

#3 Email Verification

An activation email will be sent to the email address you provided during registration. Open your inbox, locate the email from CapitalXtend, and click on the link to activate your account.

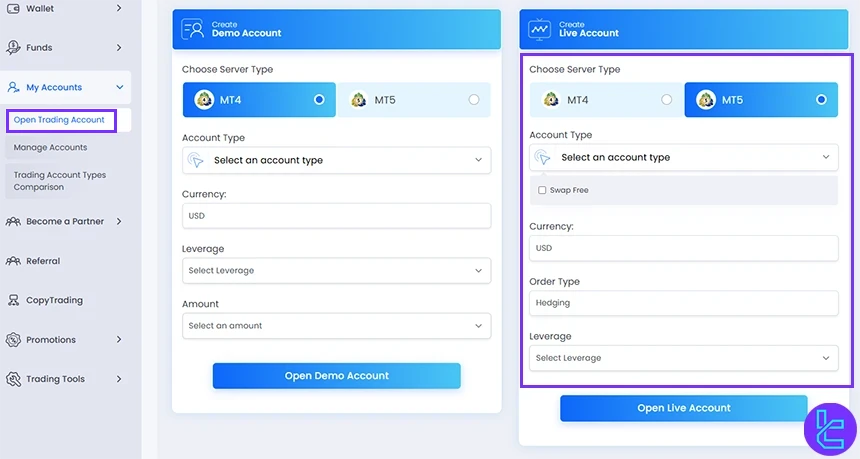

#4 Open your Trading Account

From your user dashboard, click on “Open Trading Account”. Then, select your desired settings for your live account, which include:

- Trading Platform (MT4/MT5)

- Account Type

- Base Currency

- Order Type

- Leverage

Finally, click on “Open Live Account” to create your trading account.

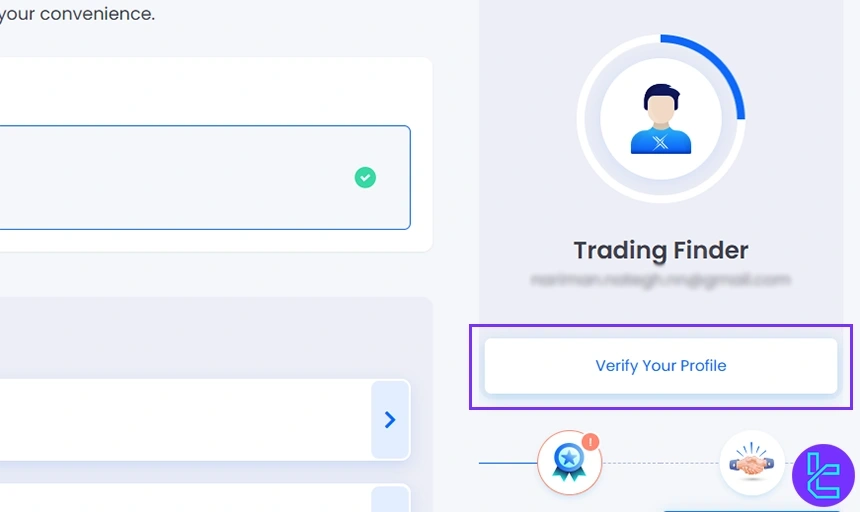

#5 Verify your Profile

Finally, to access all features and enable withdrawals, you must verify your profile. Click on “Verify Your Profile” and upload the required documents, such as:

- Identity Documents (Passport, ID card)

- Bank Documents

- Proof of Residence

This completes the KYC verification process.

CapitalXtend Trading Platforms Overview

CapitalXtend provides traders access to the widely‑used MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. These platforms serve different trading styles, from classic Forex and CFD execution to more advanced multi‑asset analysis and automated trading.

Both platforms support market execution, analytical tools, multiple indicators, and real‑time quotes for a complete trading experience.

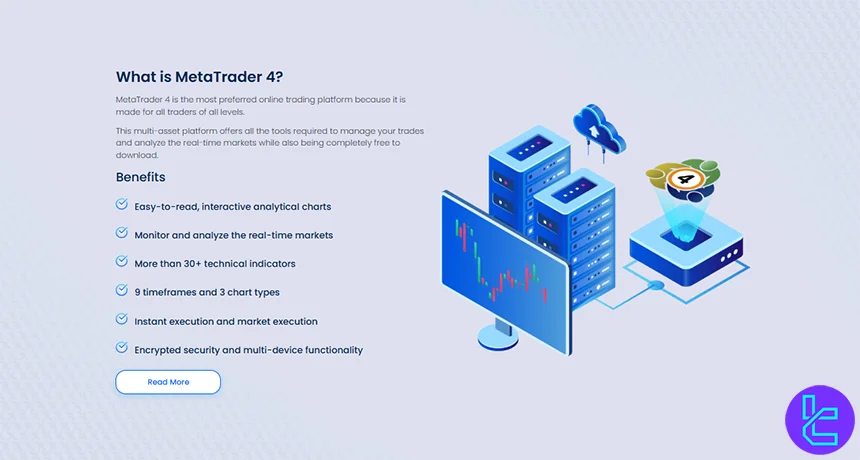

MetaTrader 4 (MT4)

MetaTrader 4 is a classic and dependable trading platform offered by CapitalXtend, ideal for Forex and CFD traders of all experience levels, combining intuitive charting with analytical features.

MT4 is available on:

- Desktop (Windows/Mac)

- Mobile (iOS & Android)

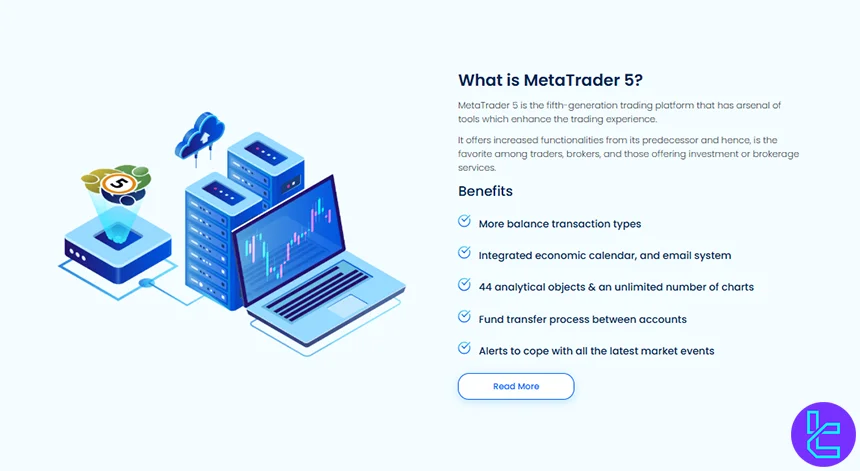

MetaTrader 5 (MT5)

MetaTrader 5 enhances the MT4 experience with expanded capabilities, supporting multi‑asset trading, deeper market analysis, and additional trading tools. It is suited for traders seeking more complex strategies and broader instrument access.

MT5 is available on:

- Desktop (Windows/Mac)

- Mobile (iOS & Android)

Spreads, Commissions and Account Fees Overview

At CapitalXtend, the cost of trading is primarily driven by spreads and, for certain account types, commissions. Spreads are varied by account tier and market conditions, with tighter spreads generally offered on higher‑tier ECN and Pro‑ECN accounts.

Competitive spreads help reduce the cost of opening and closing positions, especially for frequent traders and strategies like scalping or high‑volume execution.

Below is an overview of spread ranges and commission associated with the live accounts at CapitalXtend:

Account Type | Spreads (Indicative Starting Levels) | Commission |

Standard | From ~2.0 pips | $0 |

ECN | From ~1.2 pips | $0 |

Pro‑ECN | From ~0.0 pips | $3 per side |

Platinum | From ~0.0 pips | $0 |

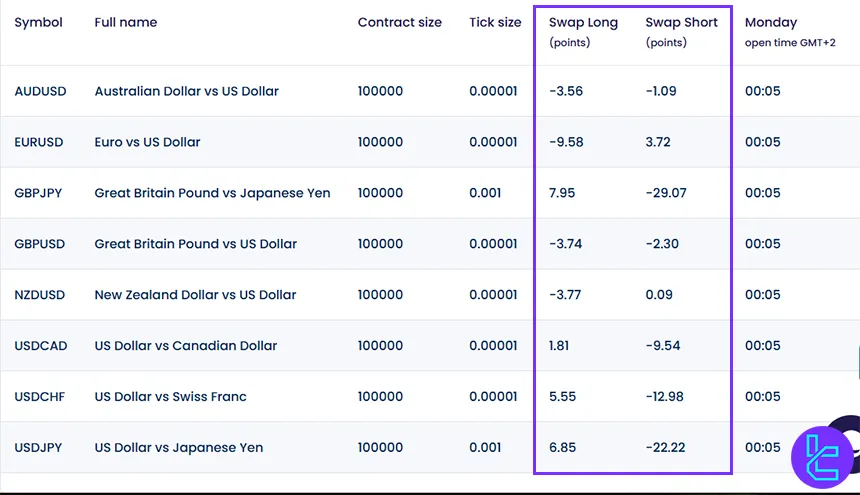

Swap Fee at CapitalXtend

CapitalXtend applies overnight swap fees on positions held past the trading day rollover. For example, a 1 lot EUR/USD long position incurs a long swap of -9.58 and a short swap of 3.72 points.

Swap rates are listed per instrument, providing transparency for overnight costs and supporting Islamic accounts.

Here are key points from the official swap policy:

- 1 lot XAU/USD long position has a swap of -59.52 points;

- Rates may increase on certain weekdays, e.g., rollover fees can triple on Wednesdays/Thursdays;

- Swap values can change without notice, so always check the latest contract specifications;

- Swap‑free (Islamic) accounts allow trading without overnight swaps.

Non-Trading Fees at CapitalXtend

CapitalXtend maintains a transparent approach to non-trading fees, covering deposits, withdrawals, and account handling. Deposits are free, while withdrawals may involve fixed or network-based fees depending on the method and currency.

The broker ensures clear disclosure of all non-trading charges to help clients plan effectively.

Key non-trading fee points:

- Withdrawals may incur fees on certain methods. for example, Visa withdrawals charge $2.5 per transaction;

- According to the official client agreement, inactive accounts for six consecutive months may incur a handling fee of $5 per month at the broker’s discretion;

- External charges from banks or payment processors may apply during transfers.

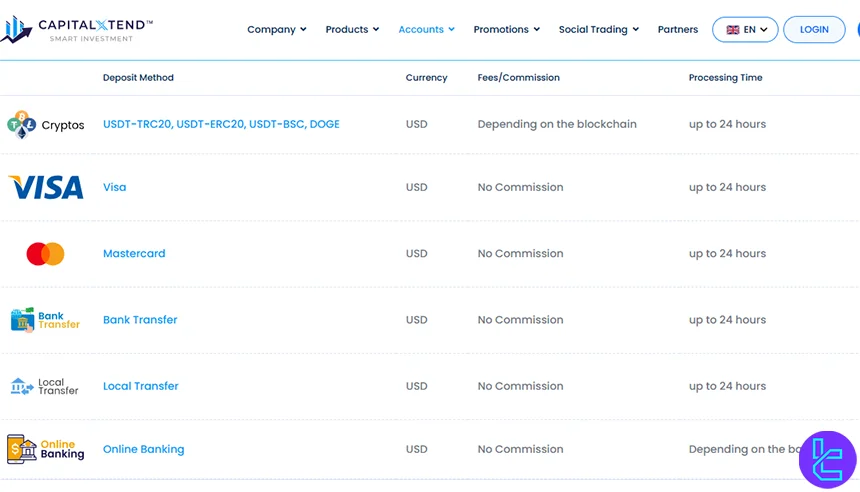

CapitalXtend Broker Deposit & Withdrawal Methods

CapitalXtend provides a variety of funding and withdrawal solutions covering cards, bank transfers, and cryptocurrencies. The base currency for most deposit and withdrawal methods is USD.

Supported payment methods include:

- Visa & Mastercard

- Bank Wire Transfer

- Local Transfer

- Online Banking

- Cryptocurrencies (USDT-TRC20, USDT-ERC20, USDT-BSC, DOGE)

Deposit Methods at CapitalXtend

Clients can fund their trading accounts using fiat or cryptocurrency, with most deposits credited instantly. Blockchain-based deposits may vary slightly due to network processing times.

The table below summarizes the official deposit conditions:

Deposit Method | Currency | Minimum Amount | Deposit Fee | Processing Time |

Crypto (TRC20, ERC20, BSC, DOGE) | USD | $12 | Depending on blockchain | Up to 24 hours |

Visa | USD | $12 | No Commission | Up to 24 hours |

Mastercard | USD | $12 | No Commission | Up to 24 hours |

Bank Transfer | USD | $12 | No Commission | Up to 24 hours |

Local Transfer | USD | $12 | No Commission | Up to 24 hours |

Online Banking | USD | $12 | No Commission | Depends on the bank |

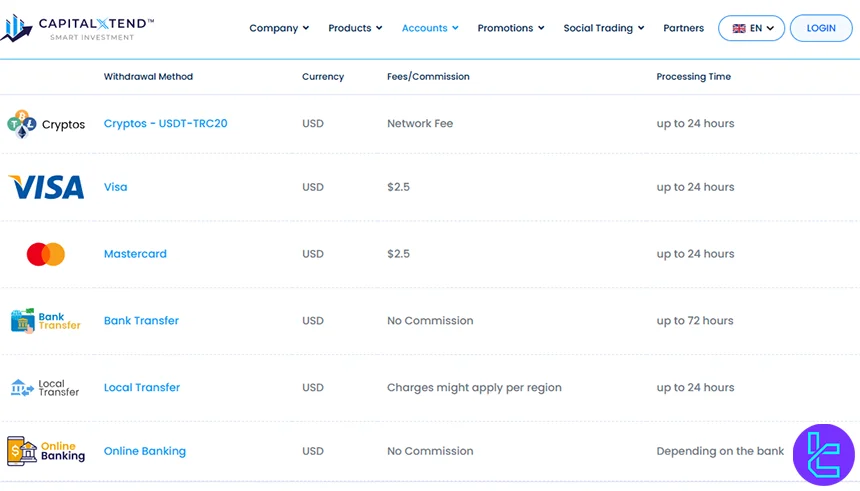

Withdrawal Methods at CapitalXtend

Withdrawal options mirror deposits. Some methods may incur fees depending on the channel, while others remain free. Processing times vary with method and currency, ensuring transparency and efficiency.

The table below summarizes the official withdrawal conditions:

Withdrawal Method | Currency | Minimum Amount | Withdrawal Fee | Processing Time |

Crypto (TRC20, ERC20, BSC, DOGE) | USD | $10 | Depending on blockchain | Up to 24 hours |

Visa | USD | $10 | $2.5 | Up to 24 hours |

Mastercard | USD | $10 | $2.5 | Up to 24 hours |

Bank Transfer | USD | $10 | No Commission | Up to 72 hours |

Local Transfer | USD | $10 | Charges may apply per region | Up to 24 hours |

Online Banking | USD | $10 | No Commission | Depends on the bank |

Copy Trade and Other Investment Options of CapitalXtend

CapitalXtend offers multiple investment-oriented solutions designed for traders and partners seeking alternative ways to participate in the financial markets. These options include copy trading for passive investors, as well as partnership models such as Affiliate and Introducing Broker (IB) programs for revenue generation.

Copy Trading

CapitalXtend’s Copy Trading platform enables users to automatically replicate the trades of professional traders in real time. Investors can select traders from a public leaderboard, define investment amounts, and subscribe to master accounts without executing trades manually.

Key features and benefits of CapitalXtend Copy Trading include:

- Ability to copy multiple master traders simultaneously

- Full control to close or manage copied trades at any time

- Flexible subscription and unsubscription without restrictions

- Real-time monitoring of copied trades and performance

- Access to multiple instruments such as forex, commodities, and stocks

- Minimum trade size aligned with contract specifications, typically from 0.01 lots

Affiliate Program

The CapitalXtend Affiliate Program allows partners to earn commissions by referring new clients to the platform. Earnings are generated when referred clients become active traders, using flexible commission models defined by the broker.

Key features and benefits of the Affiliate Program include:

- Flexible commission structures based on CPA and revenue sharing

- Fast and transparent payout system

- No upfront investment required

- Access to marketing tools designed to improve conversion rates

- Dedicated account manager support

- 24/7 multilingual customer assistance

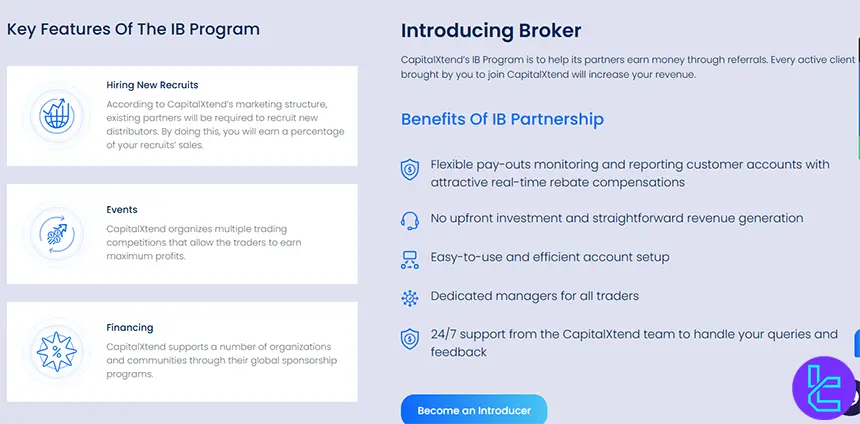

Introducing Broker (IB) Program

CapitalXtend’s Introducing Broker (IB) Program is designed for partners who manage client relationships and generate ongoing income through trading rebates. Revenue is linked directly to the trading activity of referred clients.

Key features and benefits of the IB Program include:

- Real-time monitoring and reporting of referred client accounts

- Flexible payout structures with rebate-based compensation

- Simple account setup with no initial capital requirement

- Dedicated managers assigned to partners

- Continuous operational and technical support from CapitalXtend

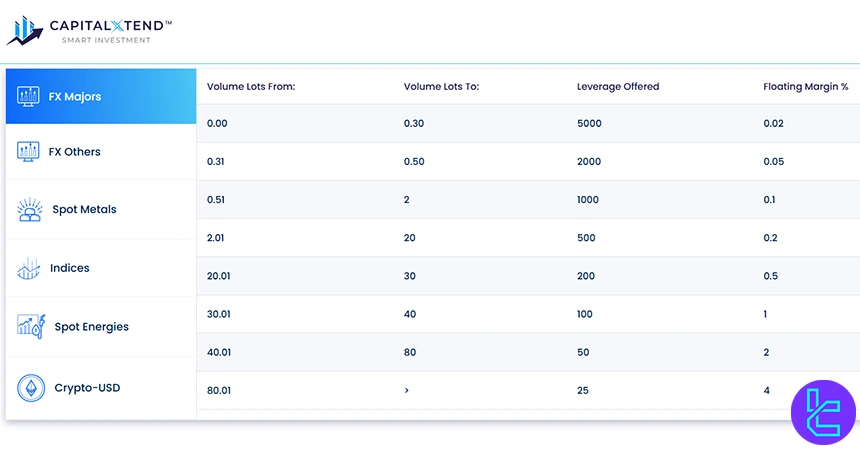

Tradable Markets and Financial Instruments at CapitalXtend

CapitalXtend provides traders access to a diverse range of financial instruments. Broker’s products and asset classes cover forex market currency pairs, CFD indices, spot metals, spot energies, and cryptocurrencies.

Below is an overview of the tradable markets and key instrument categories offered by CapitalXtend:

Category | Type of instruments | Number of symbols | Competitor average | Max. leverage |

Forex | Major, minor, and exotic currency pairs | 68 | 45-80 | 1:5000 |

CFD Indices | Global stock indices | 12 | 10-25 | 1:1000 |

Spot Metals | Precious metals (e.g., gold, silver) | 7 | 4-8 | 1:5000 |

Spot Energies | Energy products (e.g., oil, gas) | 3 | 3-6 | 1:2000 |

Crypto CFDs (BTC, ETH, LTC, SOL, etc.) | 8 | 10-20 | 1:500 |

Bonuses and Promotions at CapitalXtend

CapitalXtend offers time-limited promotional programs designed to enhance trading capacity and reward active clients. These promotions mainly focus on deposit-based bonuses and volume-driven cashback incentives, allowing traders to increase margin availability or earn withdrawable rewards based on trading activity.

30% Deposit Bonus at CapitalXtend

The 30% Deposit Bonus is a temporary promotion that provides extra trading credit when funding an eligible trading account. The bonus is intended to increase available margin and support higher trading exposure, subject to specific terms and conditions.

Key features and conditions:

- 30% bonus credit applied to the trading account balance

- Bonus amount capped at $300 per client

- Minimum deposit requirement of $100

- Bonus is credited instantly after successful opt-in and deposit

- Maximum payout generated from bonus profits is limited to $300

This bonus must be activated through the Promotions section in the client dashboard before funding the account.

Cashback Reward Program at CapitalXtend

CapitalXtend’s Cashback Reward program allows traders to earn withdrawable cash rebates based on trading volume. The program is structured into multiple levels, with higher rebates unlocked as trading activity increases.

Key features and conditions:

- Cashback rebates of up to $3 per traded lot

- Maximum withdrawable cashback of up to $5,000

- Weekly cashback payments credited to the client’s e-wallet

- Multiple reward levels with increasing rebate rates

- Real-time tracking of pending and credited rebates via the dashboard

The Cashback Reward remains active as long as the trader stays enrolled and continues trading.

CapitalXtend Broker Awards

CapitalXtend has been recognized with several industry awards highlighting its trading services, reliability, and innovation across the market. CapitalXtend awards reflect independent recognition for its execution quality, ECN/STP trading infrastructure, and trust among traders and partners.

Below is a list of awards CapitalXtend has received:

- Most Trusted Broker 2021 - FXDailyInfo

- Best Standard & ECN Broker 2021 - FXDailyInfo

- Best ECN Broker PAN Asia 2021 - World Economic Magazine GlobeNewswire

- Most Innovative ECN Broker Asia 2021 - Global Business Review Magazine CapitalXtend

- Best CFD Broker Asia 2022 - World Economic Magazine

CapitalXtend Customer Support

CapitalXtend provides clients with comprehensive support through official channels, including email, live chat, and phone, physical office, and contact form. These services cover general inquiries, account assistance, and trading-related support, ensuring timely responses via the broker’s official website.

The available customer support channels are summarized below:

Support Channel | Details |

support@capitalxtend.com, complaints@capitalxtend.com, documents@capitalxtend.com | |

Phone | +357 25056441 |

Physical Office | Suite 201 The Catalyst 40 Silicon Avenue Cybercity, 72201 Ebene, Republic of Mauritius |

Live Chat | Available via the official CapitalXtend website |

Contact Form | Available via the “Contact Us” page in official CapitalXtend website |

CapitalXtend Banned Countries

CapitalXtend operates globally but imposes restrictions on certain jurisdictions to comply with regulatory requirements and internal compliance policies. Clients from restricted countries are not eligible to open accounts or use the broker’s trading services.

The officially restricted countries include:

- Canada

- United States

- Japan

- Saint Vincent and the Grenadines

CapitalXtend on Review Websites

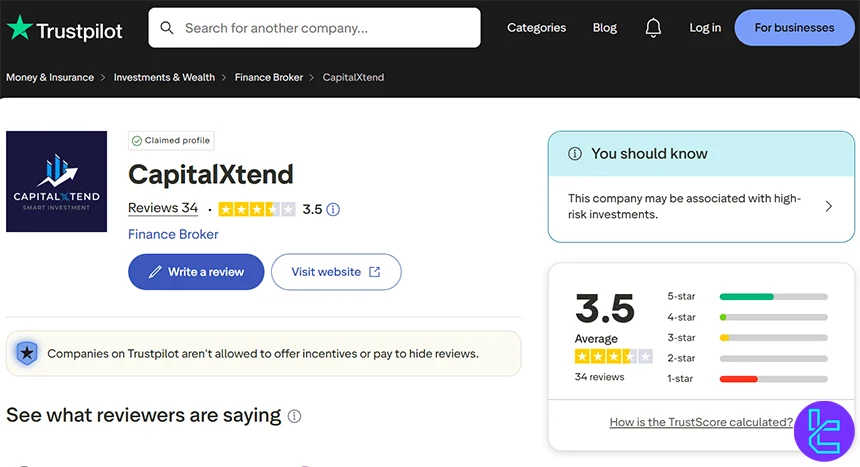

CapitalXtend’s reputation across online broker review platforms shows a mix of positive and negative feedbacks. On Trustpilot, CapitalXtend has a TrustScore of 3.5 out of 5 based on 34 reviews. This score is around or slightly below the average for mid-tier brokers.

Below are key review scores from major broker review platforms:

Below is a table summarizing CapitalXtend’s scores from several review platforms:

Review Website | Score |

3.5/5 | |

1.6/5 |

CapitalXtend Educational Resources

CapitalXtend provides a structured “Forex Academy” directly on its official website, offering a broad range of educational articles. Topics range from understanding basic market structures to detailed guides on trading specific instruments such as forex pairs, commodities, indices, and cryptocurrencies.

These educational resources are regularly updated in line with the latest changes in the financial markets. In addition, they are provided free of charge to all users of the Capita Extend broker.

CapitalXtend in Comparison with Other Brokers

Here is a comparative overview of CapitalXtend alongside several well-established brokers operating in the global financial markets:

Parameter | CapitalXtend | |||

Regulation | FSC, SVG | CIMA, CySEC, ASIC, FSC | ASIC, FSCA, VFSC, FCA, CIMA | FCA, ASIC, CySEC, MAS, EFSA, DFSA, AFSC, FMA |

Minimum Spread | From 0.0 pips | From 0.4 pips | 0.0 pips | From 0.5 pips |

Commission | From $0 | $0 | From $0 | $0 |

Minimum Deposit | $12 | $20 | $20 | $100 |

Maximum Leverage | 1:5000 | 1:200 | 1:1000 | 1:30 |

Trading Platforms | MT4, MT5 | Proprietary platform | MT4, MT5, ProTrader, TradingView, proprietary application | Proprietary Platform |

Account Types | Standard, ECN, Pro-ECN, Platinum (plus Demo) | Live, Demo | Standard STP, Standard Cent, Raw ECN, Pro ECN, Swap Free | Retail, Professional |

Islamic Account | Yes | No | Yes | No |

Number of Tradable Assets | 100+ | 400+ | 1000+ | 2800+ |

Trade Execution | Market | Market | Market | Market |

Final Words

CapitalXtend operates under FSC Mauritius regulation and offers maximum leverage of up to 1:5000. The broker provides access to forex, energies, indices, metals, and cryptocurrencies, across multiple global financial markets.

The broker relies on the MT4 and MT5 trading platform and supports various deposit and withdrawal methods, including cards, bank transfers, online banking, and cryptocurrencies. CapitalXtend has also received several industry awards.