Founded in 2017, CDOMarkets has positioned itself as a multi-asset broker {Over 700+} catering to traders in Europe, Asia, and the Middle East.

Regulated by the Cyprus Securities and Exchange Commission (CySEC), the company provides access to Forex pairs, precious metals, global indices, and energy commodities through the popular MetaTrader 4 and MetaTrader 5 platforms.

CDOMarkets Information & Regulation

CDOMarkets is an international forex broker established in 2017, headquartered in Limassol, Cyprus, and regulated by the Cyprus Securities and Exchange Commission (CySEC).

This regulatory oversight ensures that client funds are protected under MiFID II guidelines and held in segregated accounts with tier-one banks.

In this part of our CDOMarkets broker review, we explore the company’s compliance, security measures, and operating standards. The facts below examines the credibility of CDOMarkets:

- Licensed and supervised by the CySEC under license number 278/15;

- Operates in line with MiFID II regulations for European financial markets;

- Ensures client funds are kept in segregated accounts with top-tier banks;

- Offers investor compensation through the Investor Compensation Fund (ICF).

Also, table below is an overview of CDOMarkets branches and their entity parameters:

Entity Parameters/Branches | CDOMarkets Ltd (VFSC) | CDOMarkets Pty Ltd (ASIC) | CDOMarkets International Ltd |

Regulation | VFSC | ASIC | Unregulated Offshore Entity |

Regulation Tier | 3 | 1 | 4 |

Country | Vanuatu, Port Vila | Australia, Sydney | Saint Vincent & Grenadines |

Investor Protection Fund | N/A | N/A | N/A |

Segregated Funds | Yes | Yes | No |

Negative Balance Protection | Yes | Yes | Limited |

Compensation Scheme | No | No | No |

Maximum Leverage | 1:500 | 1:30 | 1:1000 |

Client Eligibility | International Clients (Excl. restricted countries) | Only Australian Residents | High-risk jurisdictions (no major restrictions) |

Summary of Specifications

CDOMarkets Capital Ltd (FCA, United Kingdom), CDOMarkets Pty Ltd (ASIC, Australia), CDOMarkets Markets Ltd (CySEC, Cyprus), and CDOMarkets Global Ltd (FSC, Mauritius) operate under separate regulatory frameworks; Each with unique leverage limits, investor protections, and client eligibility while providing access to MT4 and MT5 platforms.

The details below highlight minimum deposits, spreads, platforms, and account features designed to support both retail and professional clients:

Broker | CDOMarkets |

Account Types | Standard, ECN, Islamic, Professional |

Regulating Authority | CySEC (License No. 278/15) |

Base Currencies | USD, EUR, GBP, AUD |

Minimum Deposit | $100 |

Deposit Methods | Visa/MasterCard, Skrill, Neteller, Bank Wire, Crypto |

Withdrawal Methods | Visa/MasterCard, Skrill, Neteller, Bank Wire, Crypto |

Minimum Order | 0.01 lots |

Maximum Leverage | 1:400 for professional clients, 1:30 for retail |

Investment Options | Copy Trading, Managed Accounts |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, Mobile Apps |

Markets | Forex, Metals, Energies, Indices, Shares CFDs |

Spread | From 0.3 pips |

Commission | $7 per standard lot (ECN accounts) |

Orders Execution | STP/ECN |

Margin Call/Stop Out | 80% / 50% |

Trading Features | Demo accounts, VPS hosting, Economic Calendar |

Affiliate Program | Yes |

Bonus & Promotions | Seasonal trading bonuses |

Islamic Account | Yes |

PAMM/MAM Account | Yes |

Customer Support Ways | Live chat, phone, email, ticket system |

Customer Support Hours | 24/5 |

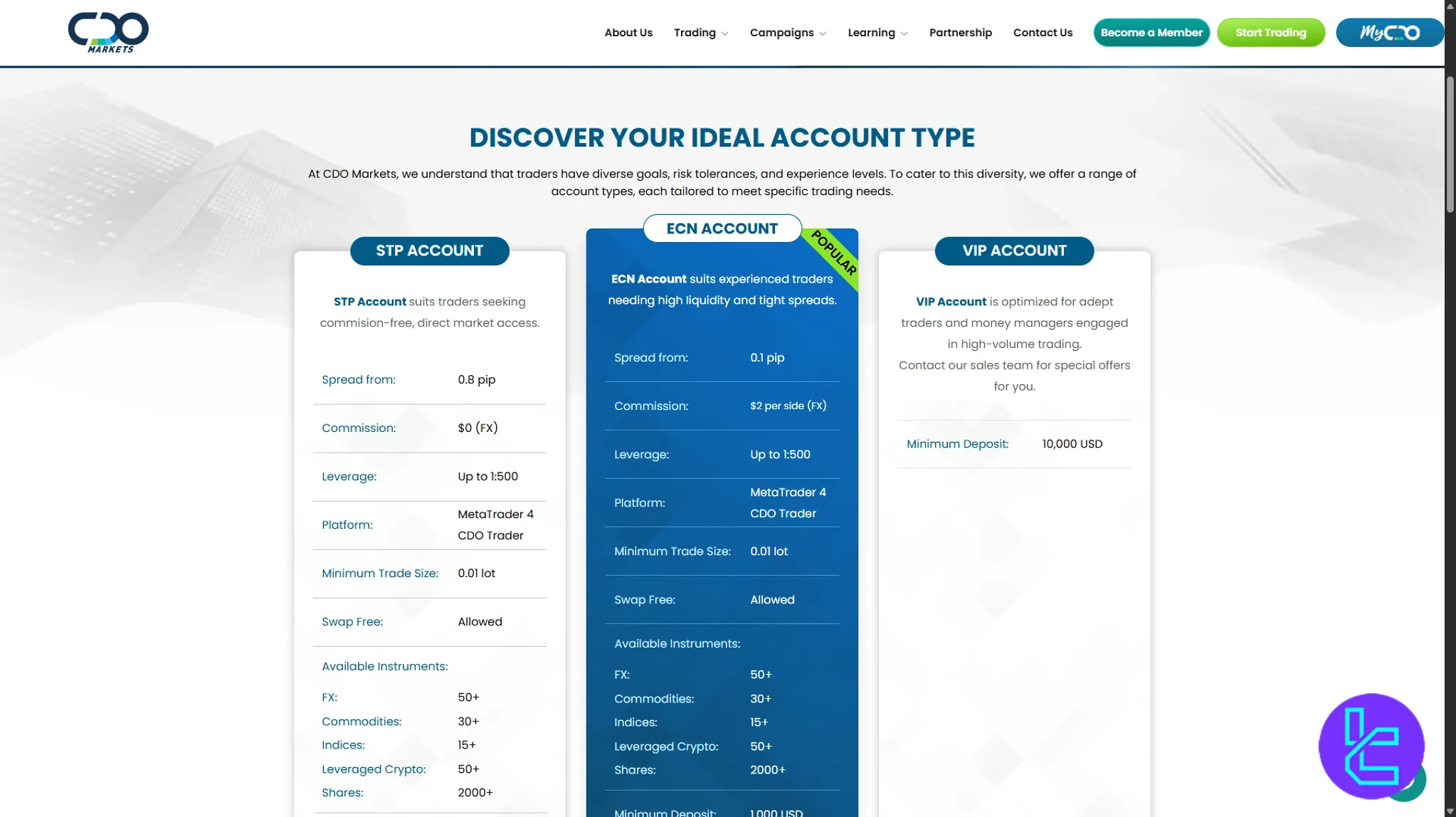

What are CDOMarkets Account Types?

CDOMarkets provides three distinct account types tailored to various trading preferences: the STP Account, ECN Account, and VIP Account.

The STP Account is ideal for traders seeking commission-free access with competitive spreads starting from 0.8 pips and leverage up to 1:500.

The ECN Account caters to those desiring tighter spreads from 0.1 pips and a commission of $4 per lot, with leverage up to 1:100.

For high-volume traders or professionals, the VIP Account offers personalized services; specific details are provided upon request.

All accounts are swap-free, accommodating traders who prefer islamic account.

Feature | STP Account | ECN Account | VIP Account |

Minimum Deposit | $100 | $1,000 | $10,000 |

Leverage | Up to 1:500 | Up to 1:100 | Up to 1:200 |

Spreads | From 0.8 pips | From 0.1 pips | Custom |

Commission | None | $4 per lot | Custom |

Swap-Free | Yes | Yes | Yes |

Ideal For | Retail traders | Active traders | Professional traders |

CDOMarkets Pros and Cons

When analyzing CDOMarkets, traders will find both appealing features and certain limitations worth noting.

The broker provides access to Islamic accounts, supports VPS hosting for algorithmic trading, and integrates with copy trading solutions that attract newer investors.

On the downside, advanced traders may be discouraged by the absence of multi-language weekend support and relatively modest research resources compared to competitors.

The table below highlights the main pros and cons of trading with CDOMarkets in a quick glance:

Pros | Cons |

Swap-free Islamic accounts available | No weekend customer support |

VPS hosting for expert advisors (EAs) | Limited proprietary research tools |

Integrated copy trading solutions | Fewer educational webinars than peers |

Supports PAMM/MAM account management | Loyalty rewards and bonuses not always offered |

Wide choice of payment methods including crypto funding | Withdrawal processing can take longer at times |

CDOMarkets Sign Up: Complete Tutorial for Traders

CDOMarkets sign up is a short, site-driven process that uses the homepage entry points Start Trading, OPEN LIVE or OPEN DEMO and the Become a Member form to create your profile.

The flow links registration to the Live Application Form, account-type selection (STP, ECN, VIP), and MY CDO LOGIN so you can fund via fasapay, crypto, credit card or SWIFT and launch trading on MetaTrader 4 or CDO Trader. The process can be completed in 4 steps.

#1 Choose How to Start on the Homepage

Begin at the CDOMarkets homepage and select the exact entry that matches your intent. Each entry opens the site flow that pre-fills context-aware prompts and shows the linked pages (Become a Member or Open Live Account).

This ensures you follow the platform’s exact labels and land on the correct form for either demo account or live application.

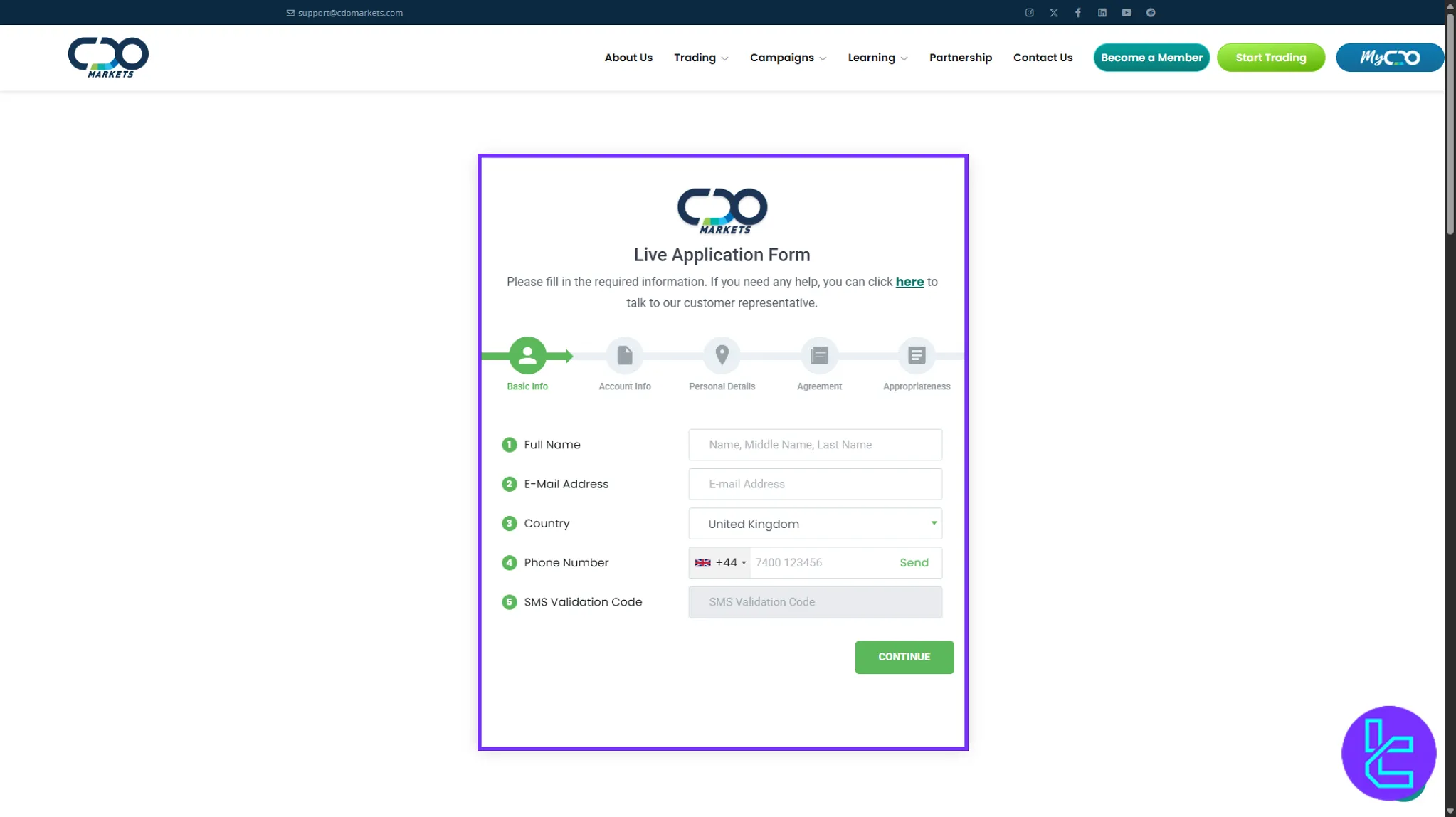

#2 Complete the Become a Member Form

Fill the Become a Member form with accurate personal details to create your site profile and receive SMS validation:

- Enter full name exactly as on your ID;

- Provide e-mail address and phone number and click send to receive the sms validation code;

- Input the SMS code and click Register to activate the member account.

After registration you can access the My CDO area to continue with a live application.

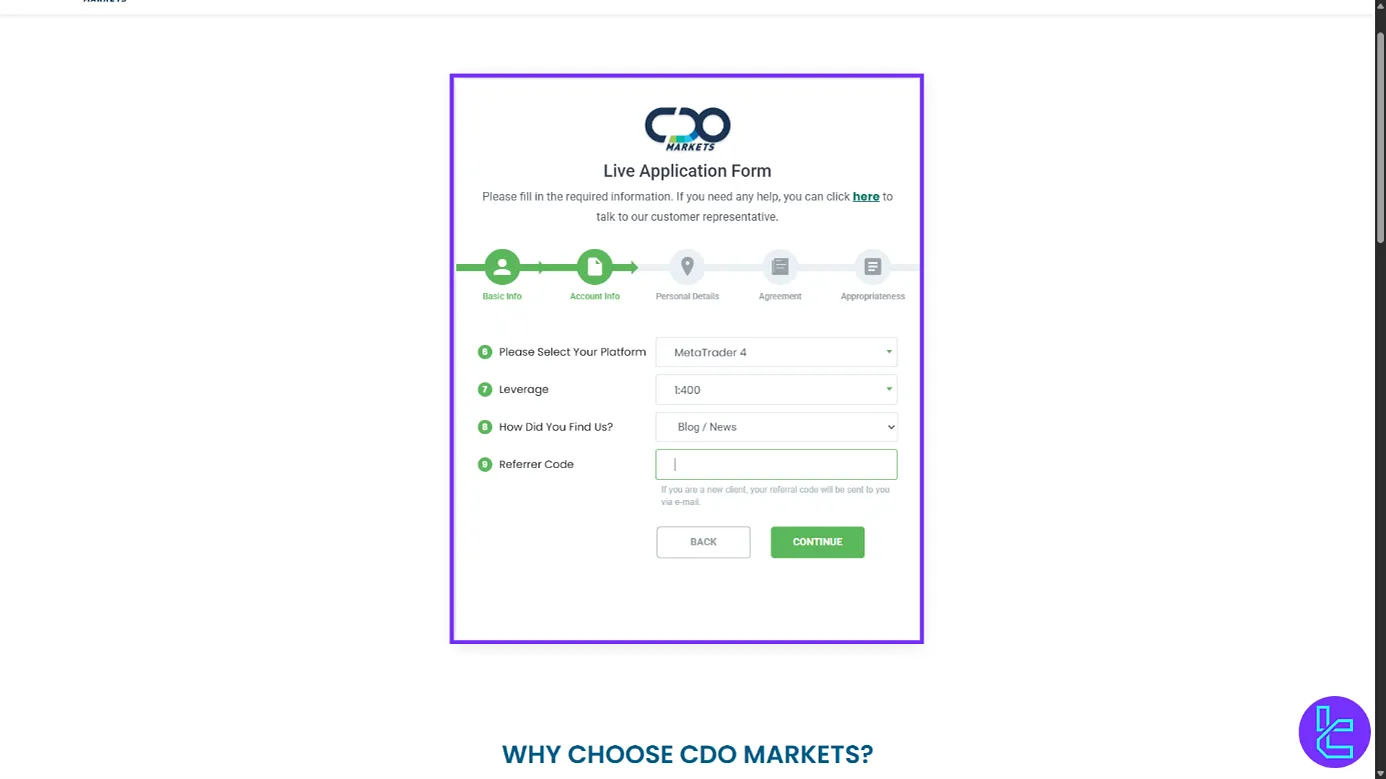

#3 Complete the Live Application and Choose Account Type

If you selected “OPEN LIVE”, complete the live application form shown on the site and review the account tiers before submitting:

- Select the account type displayed on CDOMarkets such as STP ACCOUNT, ECN ACCOUNT, or VIP ACCOUNT according to the listed minimum deposits and features;

- Specify your base currency and platform preference, for example MetaTrader 4 or CDO Trader, as required on the live application;

- Submit any requested trading experience details and confirm the application to proceed.

#4 Fund Your Account, Verify and Start Trading

Use “MY CDO LOGIN” to enter your portal, open the Deposit page, and choose a funding method from the site’s options such as fasapay, crypto, credit card or SWIFT.

Then, upload any verification documents if prompted by the portal to satisfy site KYC requirements and speed up activation.

After successful funding and verification you will see your account status change to ready and can launch trades on the selected platform.

CDOMarkets Bonuses & Discounts

When it comes to promotions, CDOMarkets offers seasonal bonuses designed to enhance trader capital and provide incentives for active participation.

These include deposit matchbonuses during specific campaigns, referral rewards for introducing new clients, and loyalty discounts on trading commissions for high-volume accounts.

In this CDOMarkets broker review, we note that while these offers add value, they are usually subject to eligibility criteriaunder MiFID II regulations.

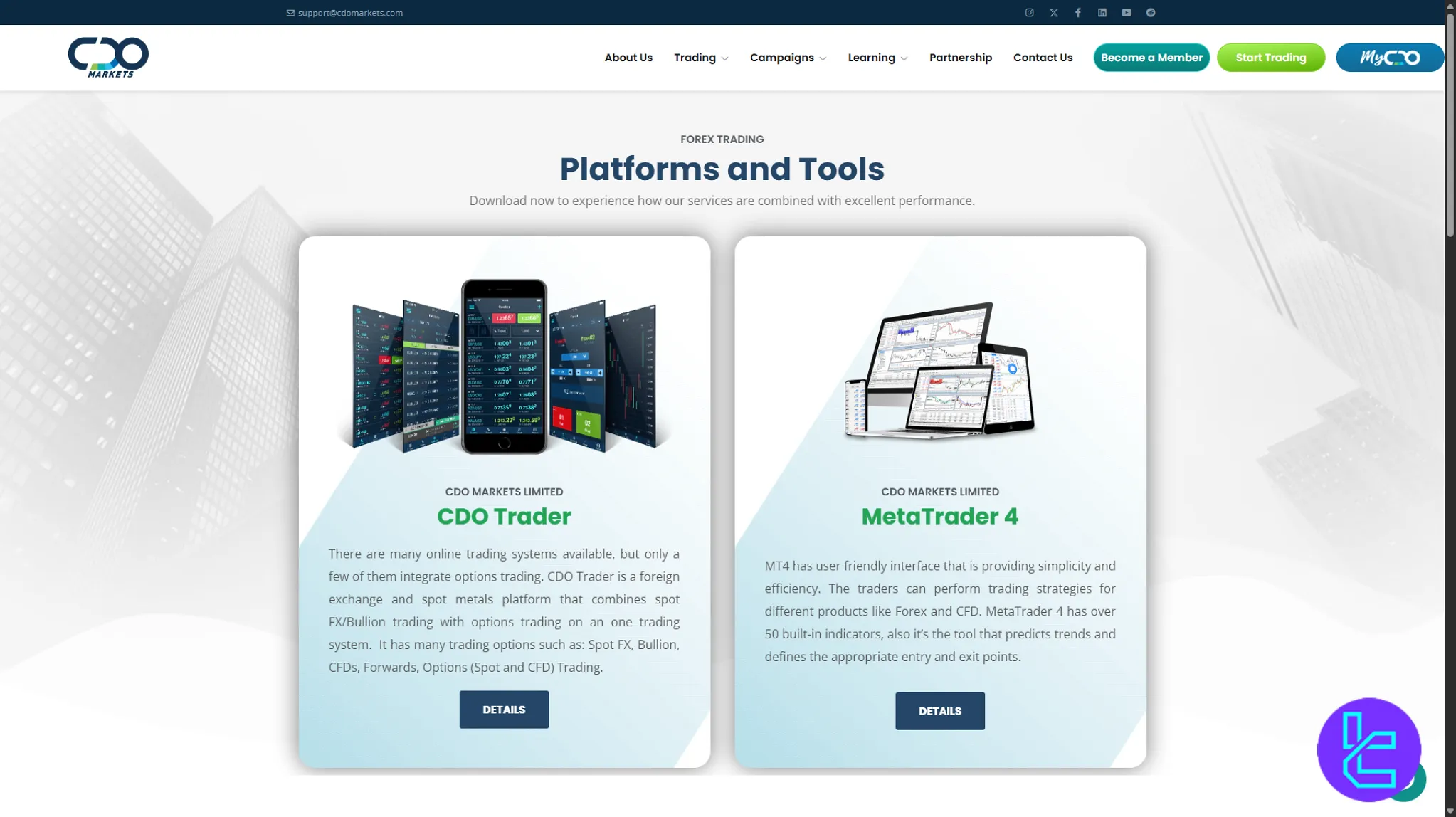

What Platforms are Available on CDOMarkets?

Traders using CDOMarkets gain access to multiple advanced platforms that cater to different strategies and experience levels.

Beyond the popular MetaTrader 5 (MT5) with its multi-asset capabilities and depth of market (DOM) tools, the broker also supports ThinkTrader, known for its intuitive mobile interface and more than 80 built-in indicators.

Additionally, integration with TradingView allows clients to leverage advanced charting, backtesting, and social trading features directly from a web-based environment.

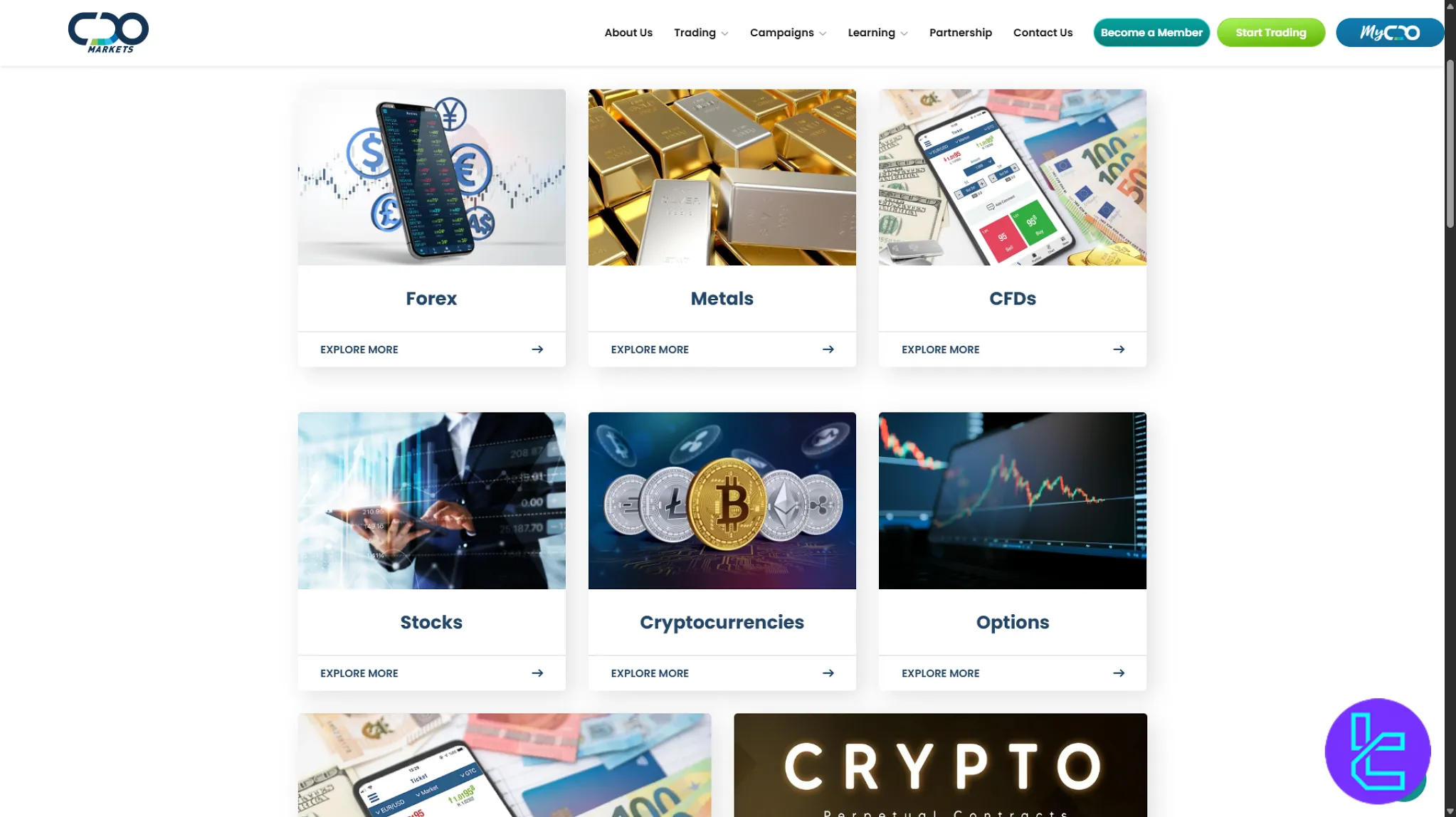

What Instruments and Assets are Tradable on CDOMarkets?

CDOMarkets provides traders with a broad spectrum of instruments spanning global markets.

Clients can diversify portfolios across Forex currency pairs, precious metals, energy commodities, global indices, and even cryptocurrency CFDs.

This wide coverage allows both short-term scalping and long-term investors to access asset classes with different levels of volatility and leverage.

CDOMarkets tradable instruments:

- Forex currency pairs

- Precious metals like gold and silver

- Energies including crude oil and natural gas

- Global equity indices

- Major cryptocurrencies such as Bitcoin and Ethereum

The table below provides a detailed breakdown of tradable asset classes on CDOMarkets, including categories, instrument types, symbol counts, competitor averages, and maximum leverage:

Category | Type of Instruments | Number of Symbols | Competitor Average | Max. Leverage |

Forex | Major, Minor & Exotic pairs | 50+ Currency Pairs | 50–70 Currency Pairs | 1:400 |

Shares | CFDs on Global Companies (e.g., Apple, Tesla) | 700+ Global Stocks | 800–1200 | 1:20 |

Commodities | CFDs on Metals & Energies | ~15 Instruments | 10–20 Instruments | 1:100 |

Indices | CFDs on Global Benchmarks (US30, DE40, UK100) | ~14 Indices | 10–20 Indices | 1:200 |

Crypto | CFDs on BTC, ETH, LTC, XRP | 20+ Cryptocurrencies | 15–25 | 1:10 |

CDOMarkets Forex Broker Spreads and Commissions Overview

CDOMarkets applies spreads starting from 0.3 pips, commission rates linked to trading volume, and tier-based pricing for retail and professional accounts.

Spreads vary depending on account type, trading volume, and market conditions, with ECN accounts typically offering tighter spreads compared to Standard accounts.

The broker also implements an Inactivity Rule, where dormant accounts may incur small fees after prolonged inactivity.

Refunds on overnight swaps and partial trade reversals are subject to terms outlined in the client agreement, providing added clarity for risk-conscious investors.

- Spreads from 0.3 pips on major currency pairs;

- Commission on ECN accounts charged per 100,000 units traded;

- No hidden fees for deposits or withdrawals;

- Inactivity fee applies after 12 months without trading;

- Refunds for overnight swaps available under certain conditions.

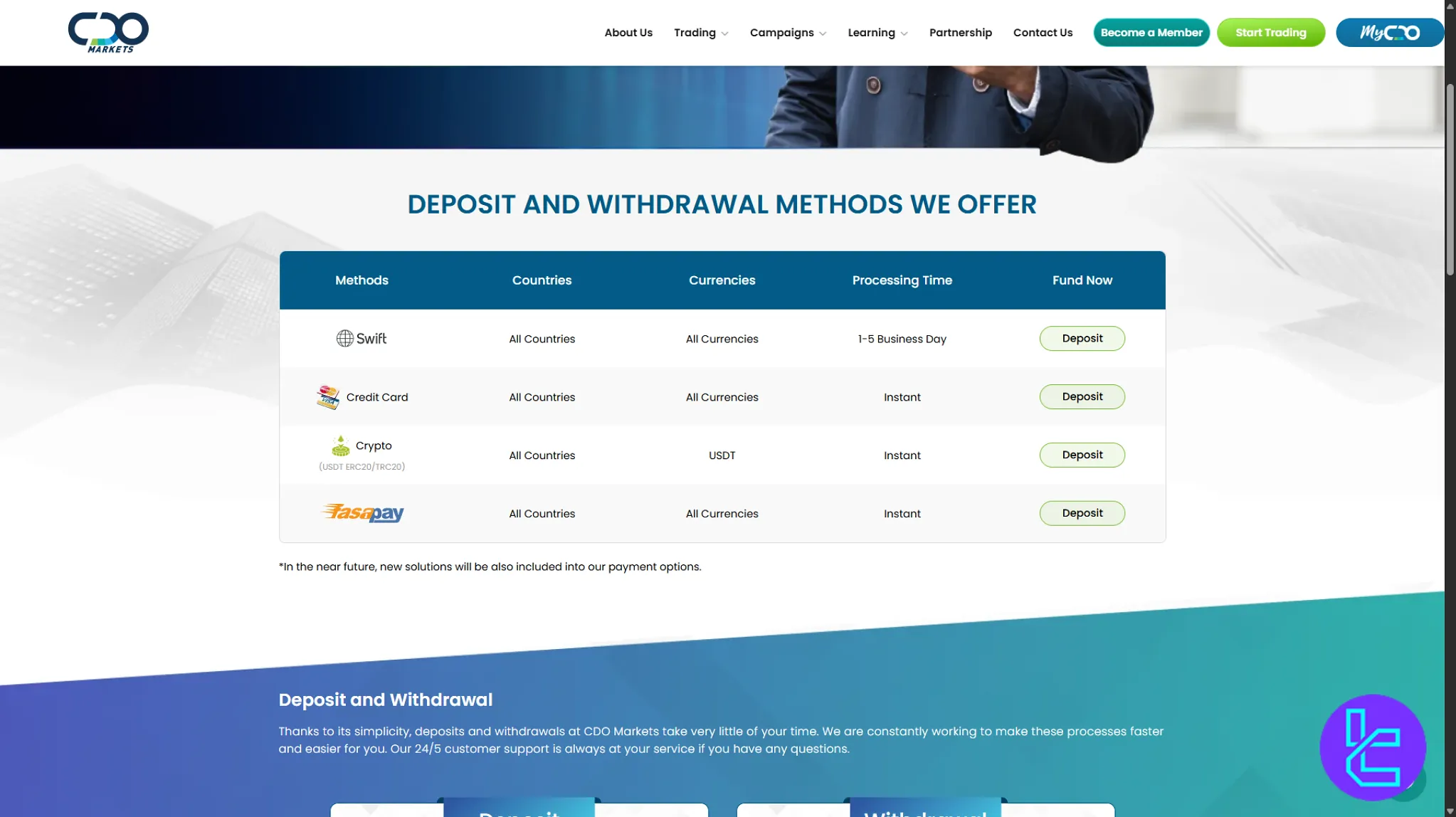

What Deposit & Withdrawal Methods are on CDOMarkets?

CDOMarkets offers a diverse range of deposit and withdrawal methods to cater to its global clientele.

Traders can fund their accounts using traditional options like bank wire transfers and credit cards, as well as modern solutions such as USDT ERC-20 and TRC-20, Perfect Money, and FasaPay.

These methods ensure flexibility and convenience for users across different regions. Withdrawals are processed efficiently, with options available through the same channels, maintaining a seamless experience for traders.

Deposit Options

CDO Markets provides multiple deposit methods to accommodate various preferences and regions. Whether you're using traditional banking services or digital payment systems, there's an option suited for you.

Option | Accepted Currencies | Min. Deposit |

Bank Wire | USD, EUR, GBP, SGD, AED, PLN | $300 |

Visa/MasterCard | USD, EUR, GBP, PLN | $50 |

Neteller | USD, EUR, GBP, BRL | $50 |

Skrill | USD, EUR, GBP, PLN | $50 |

USDT (ERC-20/TRC-20) | USDT | $50 |

Perfect Money | USD, EUR, BRL | $50 |

FasaPay | USD, EUR, IDR | $50 |

Available Withdrawal Solutions

When it comes to withdrawing funds, CDO Markets ensures that traders have access to a variety of methods, making the process straightforward and efficient.

Withdrawal Solution | Processing Time | Withdrawal Fee |

Bank Wire | 1–3 Business Days | No Fees |

Visa/MasterCard | 1–5 Business Days | No Fees |

Neteller | Same Business Day | No Fees |

Skrill | Same Business Day | No Fees |

USDT (ERC-20/TRC-20) | Same Business Day | No Fees |

Perfect Money | Same Business Day | No Fees |

FasaPay | Same Business Day | No Fees |

Copy Trading & Investment Options

CDO Markets currently does not offer a copy trading feature, which means traders cannot automatically replicate the trades of other investors.

CDOMarkets Educational Resources

CDOMarkets provides a variety of educational resources designed to help both novice and experienced traders improve their skills.

The broker maintains a comprehensive blog covering market analysis, trading strategies, and platform tutorials. Additionally, the FAQ section addresses common questions about account setup, funding, and order execution.

CDOMarkets provides educational resources including blogs, FAQs, webinars, video tutorials, and downloadable eBooks to support traders at every level.

- Blog with market insights and trading strategy guides

- FAQ section for quick troubleshooting

- Webinars and live trading sessions

- Video tutorials for MetaTrader platforms

- Downloadable trading guides and eBooks

What Countries are Restricted from CDO Markets Services?

CDOMarkets has specific policies regarding the countries from which it accepts clients.

The firm does not offer trading services to residents or citizens of certain jurisdictions due to regulatory constraints and compliance requirements.

This restriction is primarily due to CDO Markets' regulatory status with the Vanuatu Financial Services Commission (VFSC), which does not permit operations in the U.S.

Individuals from other countries should consult CDO Markets' official website or contact their customer support to confirm the availability of services in their respective regions.

Trust Scores & Reviews

CDOMarkets has received positive evaluations across multiple review platforms, reflecting its reputation among traders.

On CDOMarkets Trustpilot, the broker holds a score of 4.5/5, with clients praising its responsive support and straightforward funding process.

While some reviews note areas for improvement, such as expanded educational content, the overall feedback reinforces confidence in its services.

Awards

As of now, CDO Markets has not received any industry-specific awards or formal recognitions.

While the firm offers a range of trading services, including forex market, commodities, indices, and cryptocurrencies, there is no publicly available information indicating that CDO Markets has been honored with awards such as the Global Recognition Award.

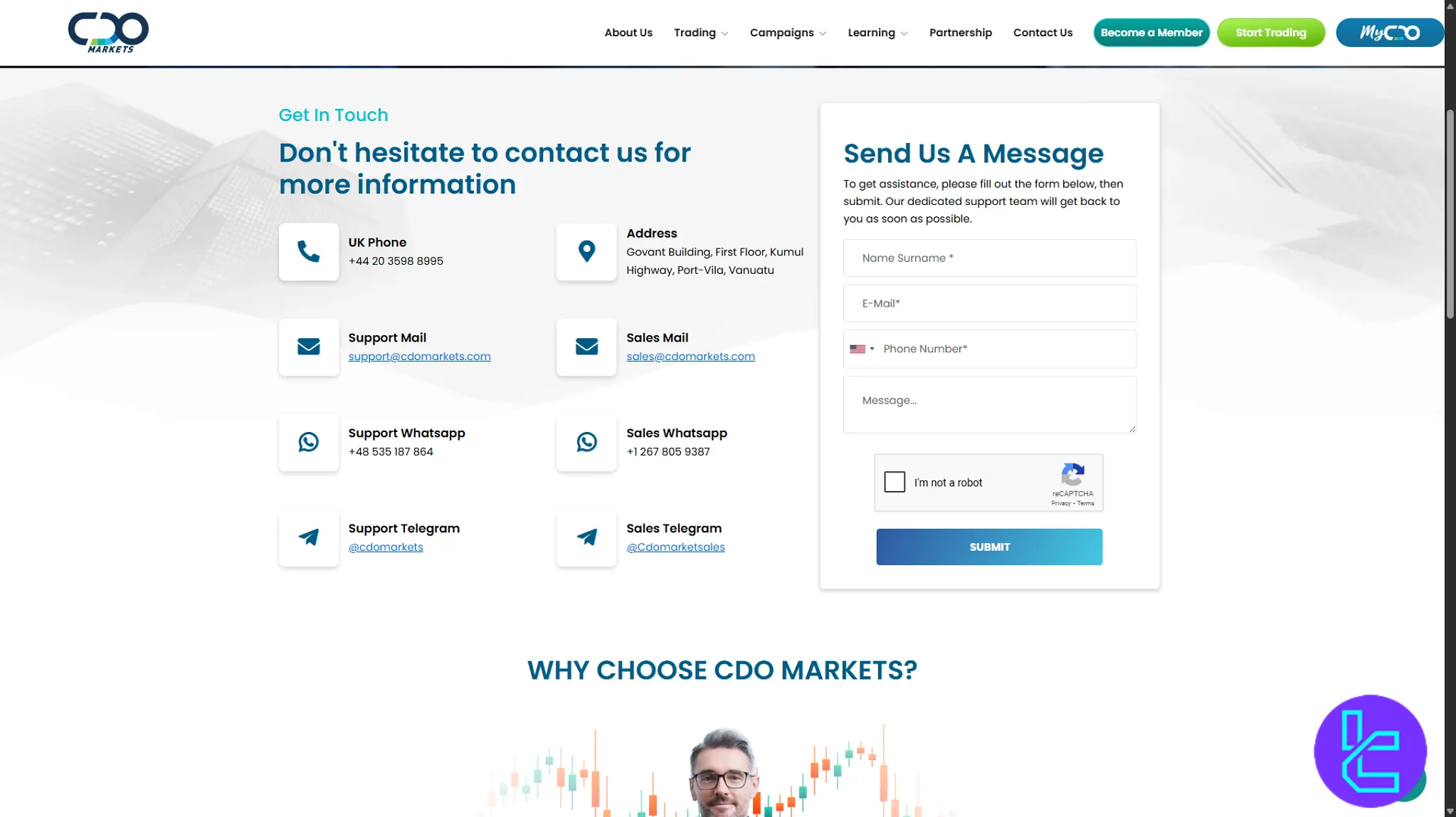

Customer Services

CDOMarkets offers a variety of customer support channels designed to assist traders efficiently. Clients can reach the support team via live chat for instant responses, or use email and ticketing systems for more detailed inquiries.

Additionally, the broker maintains a Discord community, where traders can engage with peers, discuss strategies, and get real-time updates.

- Live chat for instant support

- Email and ticket system for detailed inquiries

- Phone support for urgent matters

- Discord community for peer interaction

- Social media updates and announcements

CDOMarkets in Comparison with Other Brokers

When evaluating CDOMarkets against other brokers such as XM Broker and Exness, several key metrics stand out.

These include spreads, commissions, account types, leverage, and available trading platforms.

Let's compare the CDOMarkets features with those of other brokers; CDOMarkets Comparison:

Feature | CDO Markets | |||

Regulation | VFSC, ASIC | VFSC, ASIC, CySEC, FCA, FSCA, FSA (offshore) | CySEC, FCA, FSCA, FSA (offshore), FSC, CMA | FSA, CySEC, ASIC |

Minimum Spread | From 0.3 pips | From 0.1 pips (Ultra Low account) | From 0.0 pips (Raw Spread account) | From 0.0 Pips |

Commission | From $18 per 100k units | From $15 per 100k units (Ultra Low account) | From $2.25 per side (Raw Spread account) | From $3 |

Minimum Deposit | $100 | $5 (Micro, Standard, Ultra Low accounts), $10,000 (Shares account) | $10 (Standard account), $500 (Pro, Zero, Raw Spread accounts) | $200 |

Maximum Leverage | 1:400 | 1:1000 (Ultra Low account), 1:500 (Standard account) | 1:Unlimited (based on region and instrument) | 1:500 |

Trading Platforms | MT4, MT5, ThinkTrader, TradingView | MT4, MT5, XM WebTrader | MT4, MT5, Exness Trade app, Exness Terminal | Metatrader 4, Metatrader 5, cTrader, cTrader Web, IC Markets Mobile |

Account Types | Standard, ECN, Islamic | Micro, Standard, Ultra Low, Shares, Islamic | Standard, Pro, Zero, Raw Spread, Islamic | Standard, Raw Spread, Islamic |

Islamic Account | Yes | Yes (available on Micro, Standard, Ultra Low, and Shares accounts) | Yes (available on Standard and Extended Swap-free accounts) | Yes |

Number of Tradable Assets | 200+ | 1,000+ | Over 100 instruments (forex, metals, cryptos, energies, stocks, indices) | 2,250+ |

Trade Execution | ECN/STP/Market Maker | Market execution with no re-quotes or rejections | Market execution with no re-quotes or rejections | Market |

Conclusion and Final Words

CDOMarkets stands out with its regulated status under ASIC and VFSC, alongside a diverse range of 700+ tradable assets.

Traders can access markets through MT4, MT5, ThinkTrader, and TradingView, with flexible account models like the Lightning and Nexus Challenges.

The broker’s cashback and bonus offerings provide added incentives, while multiple funding methods, including bank transfer and crypto payments, ensure accessibility.