City Index, founded by Chris Chris Hales and Jonathan Sparke, is a Forex and CFD broker operating under StoneX. This broker offers various instruments in 13,500+ markets, allowing its over 1 million user base to trade and diversify their portfolios.

City Index also offers a no-commission trading experience, and trading spreads starting from 0.5 points on the MT4 account.

City Index General Company Information & Regulation

City Index is not just another run-of-the-mill online trading platform. It's a powerhouse in the world of financial markets, providing access to a diverse range of instruments, including Forex, CFDs, and spread betting.

But what sets City Index Forex broker apart is its solid regulatory framework and development team background. Let’s review key information about City Index broker:

- Founders: Chris Hales and Jonathan Sparke

- Founding Location: London

- Founding date: September 1983

- Parent Organization: StoneX Group

Over the years, City Index has gathered licenses from top-tier financial authorities, including:

- UK Financial Conduct Authority (FCA) (registration number 446717)

- Monetary Authority of Singapore (MAS)

- Australian Securities and Investments Commission (ASIC)

Entity Parameter \ Branches | StoneX Financial Ltd (City Index UK) | StoneX Financial Pte Ltd (City Index Singapore) | INTL FCStone Pty Ltd (City Index Australia) |

Regulation | FCA | MAS | ASIC |

Regulation Tier | Tier-1 | Tier-1 | Tier-1 |

Country | United Kingdom | Singapore | Australia |

Investor Protection / Compensation | FSCS £85,000 | None | None |

Segregated Funds | Yes | Yes | Yes |

Negative Balance Protection | Yes (retail) | Yes (retail) | Yes (retail) |

Maximum Leverage | 1:1000 | 1:1000 | 1:1000 |

Client Eligibility | All countries except restricted (USA, Canada) | All countries except restricted (USA, Canada) | All countries except restricted (USA, Canada) |

City Index Broker Summary of Specifications:

To familiarize you with City Index broker, let’s review key information about this broker:

Broker | City Index |

Account Types | Standard, MT4 account |

Regulating Authorities | FCA, ASIC, MAS |

Based Currencies | $USD, £GBP, €EUR |

Minimum Deposit | $150 |

Deposit Methods | Visa/MasterCard, Paypal, Bank wired |

Withdrawal Methods | Visa/MasterCard, Paypal, Bank wired |

Minimum Order | 0.01 Lot |

Maximum Leverage | 1:1000 |

Investment Options | No |

Trading Platforms & Apps | MT4, proprietary platform |

Markets | Forex, indices, commodities, shares, bonds, crypto, interest rates, futures, metals, |

Spread | Floating from 0.5 points |

Commission | $0 |

Orders Execution | Market |

Margin Call/Stop Out | From 5% |

Trading Features | Demo account, economic calendar |

Affiliate Program | Yes |

Bonus & Promotions | Deposit bonus, cash rebate |

Islamic Account | No |

PAMM Account | No |

Customer Support Ways | Email, live chat, phone |

Customer Support Hours | 24 hours from 10 am Sunday to 5 pm Friday |

Restricted Countries | USA, Canada, Belgium, Japan, Hong Kong, Brazil |

City Index Broker Account Types Review

City Index offers a range of account types designed for both individual and institutional clients:

- The Standard Account grants access to City Index’s proprietary platforms, offering variable spreads starting from 0.8 points. This account type is commission-free for most instruments, though standard fees apply to stock CFDs;

- The MT4 Account caters to traders who prefer MetaTrader 4. Spreads begin as low as 0.5 points, and the platform supports automated trading with Expert Advisors (EAs). As with the Standard account, stock trades may incur additional fees;

- The Professional Account is geared toward experienced traders who qualify based on trading activity, financial portfolio size, or industry background. It offers access to higher leverage and additional tools but forfeits certain retail protections such as negative balance safeguards;

- The Corporate Account is a tailored solution for institutional traders, offering multi-user access, advanced reporting, and direct support from dedicated account managers.

For those testing the waters, a 12-week demo account with £10,000 in virtual funds is available.

Although City Index’s global minimum deposit is listed at $0, some regions may require up to $150. Clients can fund accounts via bank wire or debit/credit cards, though PayPal was discontinued in 2024.

Each account type has its own set of features and requirements, so it's crucial to choose the one that best suits your trading goals and experience level.

It’s also worth mentioning that City Index offers a demo account but not a swap-free Islamic account.

Advantages and Disadvantages of City Index Broker

Let's break down the pros and cons of trading with City Index:

Advantages | Disadvantages |

Strong regulatory oversight | inactivity fees on dormant accounts |

Wide range of trading instruments (over 13500) | High stock trading fees |

Competitive spreads | Web Trader has an old design and outdated design |

Comprehensive educational resources |

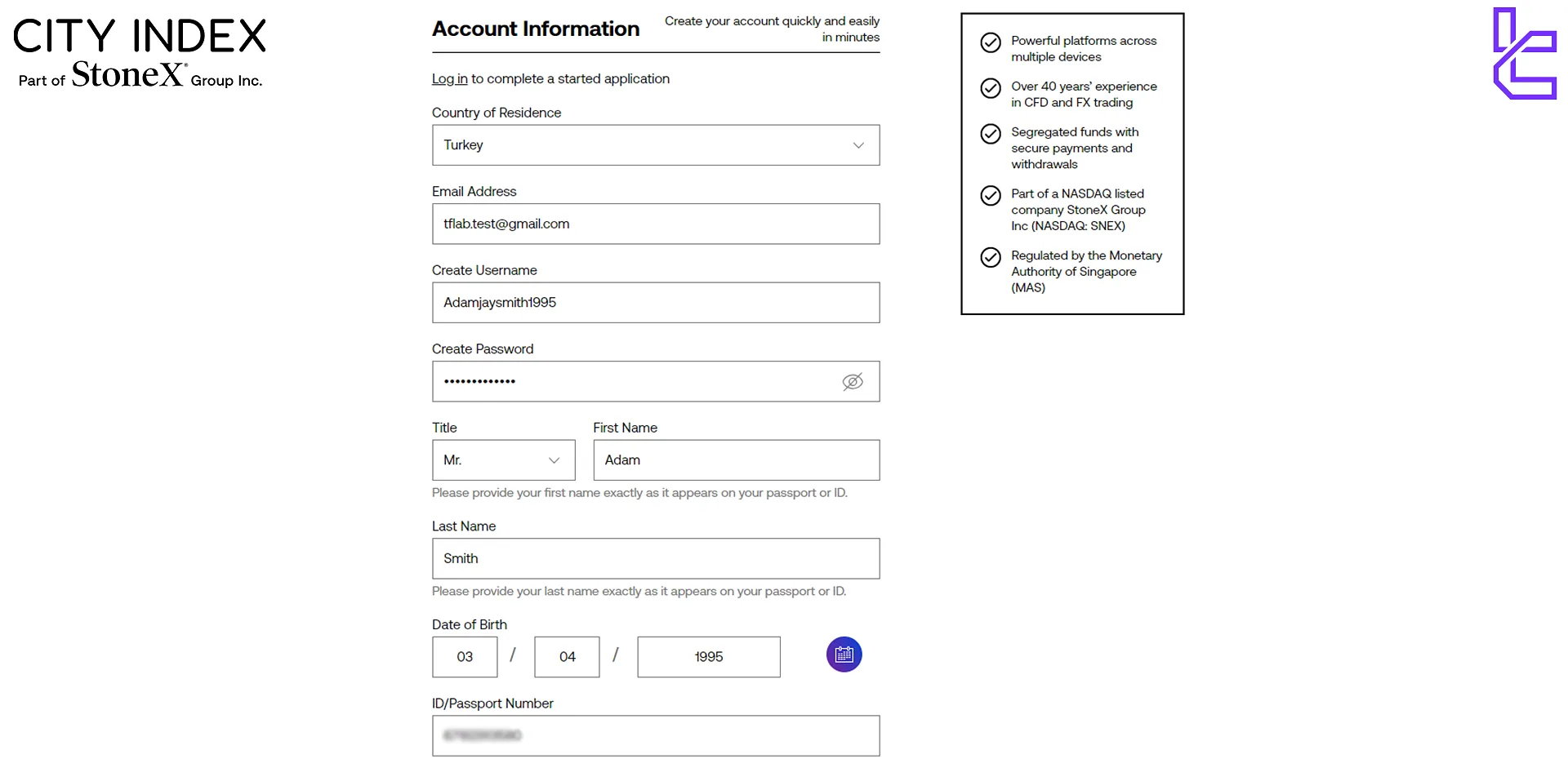

City Index Account Opening & Verification

Getting started with the City Index is simple. Here's a step-by-step guide to help you through the process:

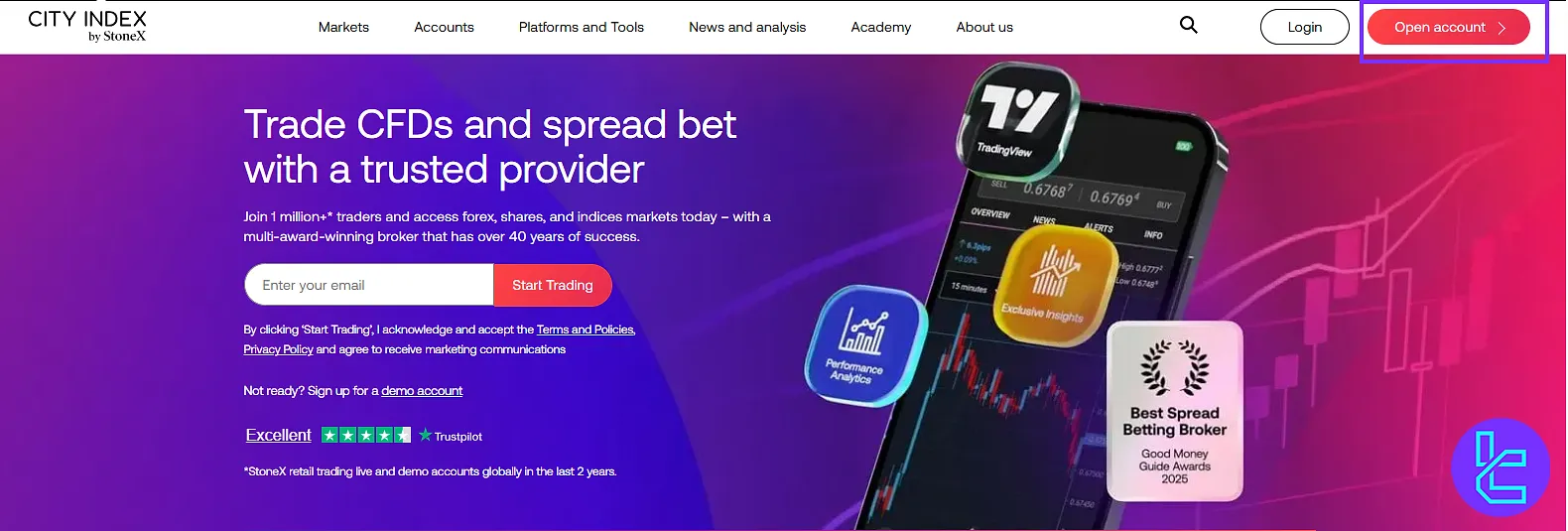

#1 Visit the City Index Website

Start by accessing the official website of the City Index broker. Then, click on the "Open an Account" button.

#2 Complete the Account Opening Form

Enter your personal information in the registration form including:

- Full Name

- Country of residence

- Email address

- Date of birth

- Passport/ID number

#3 Provide Residential Information

Now, you must submit your residential address details along with your tax information.

#4 Verify Your Account

This step requires traders to verify their account by providing a valid government-issued ID (passport, driver's license) and proof of address (utility bill, bank statement).

City Index Broker Trading Platforms

City Index knows the importance of trading platforms in the overall trading experience. That's why they offer a variety of options to suit different preferences.

MetaTrader 4 (MT4)

The gold standard in Forex trading platforms, MetaTrader 4 offers:

- Advanced charting tools

- Automated trading with Expert Advisors

- Customizable interface

- Extensive market analysis features

Mobile App

Trade on the go with City Index's powerful mobile application. Key features of this app:

- Available for iOS and Android devices

- Real-time price quotes

- Full trading functionality

- Account management features

Links:

Web Trader

City Index's proprietary web-based platform is a hit among traders who prefer not to download software:

- Intuitive interface

- Advanced charting tools

- One-click trading

- Customizable workspace

TradingView

City Index also offers seamless integration with TradingView. Main features of this trading platform:

- Over 100+ built-in indicators

- A variety of drawing tools and chart types

- Powerful strategy tester

Each platform has its strengths, so it's worth exploring them to find the one that best fits your trading style and needs.

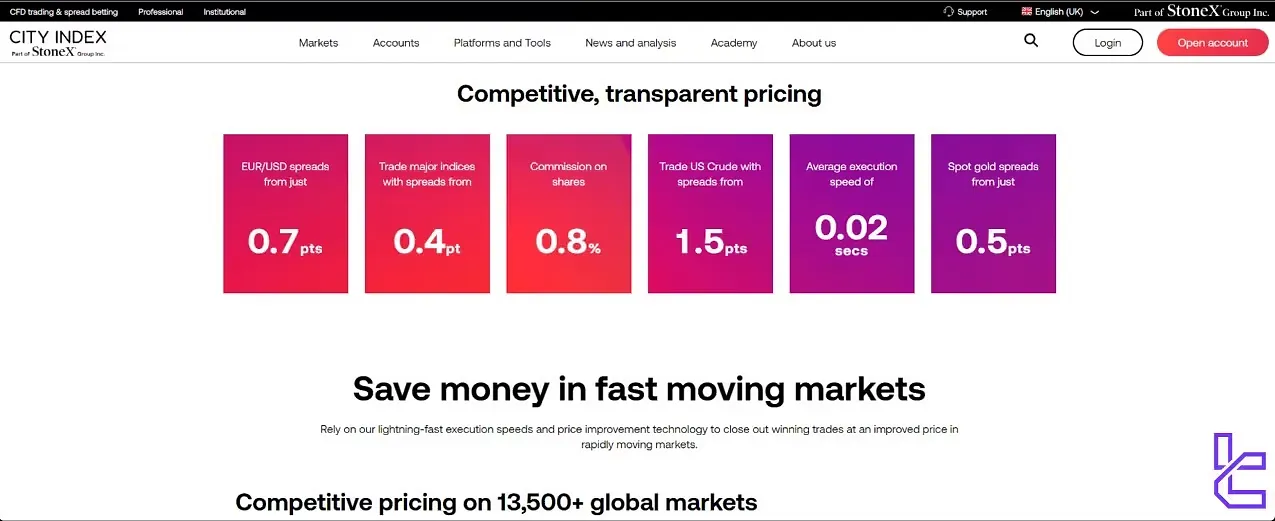

City Index Spreads and Commissions Review

When it comes to costs, City Index offers competitive rates:

Account types | Spread | Commission |

Standard | From 0.8 Points | No commission |

MT4 account | From 0.5 Points | No commission (except for shares trading) |

It's important to note that while City Index's spreads are generally competitive, they may not always be the lowest in the market.

Non-trading fees are reasonable:

- No fees for deposits or withdrawals

- A monthly inactivity fee of $12 applies after a prolonged period of account dormancy

Other trading fees:

- Inactivity fee: £12 per month

- Deposit and withdrawal fee: $0

- Currency conversion fee: 0.5%

Swap Fee at City Index

City Index does apply swap fees (overnight financing charges) on positions held open overnight. For long CFD positions, the charge is typically the benchmark rate plus 2.5% annually, while for short positions it is usually the benchmark rate minus 2.5%.

For example, holding a £22,020 position on the UK 100 with a SONIA rate of 0.25% would generate a financing rate of 2.75%, resulting in an overnight charge of around £1.65.

Key Points about Swap Fees at City Index:

- Swap fees apply only to markets without a fixed expiry date (e.g., CFDs without futures contracts);

- Financing is usually applied daily, including weekends, around 22:00 London time;

- City Index does not currently offer swap-free (Islamic) accounts, meaning all clients are subject to overnight financing unless trading expiry-based instruments;

- In some cases, even short positions may incur a charge when benchmark rates are very low.

Non-Trading Fees at City Index

City Index does apply non-trading fees, most notably an inactivity charge. If your account has no trading activity for 12 consecutive months, a fee of £12 (or currency equivalent) per month will be deducted.

Key Points about Non-Trading Fees at City Index:

- The fee continues monthly until trading resumes or the account balance is zero;

- City Index doesn’t charge for standard orders, but guaranteed stop-loss orders have a fee;

- No deposit or withdrawal fees from City Index, but banks/payment providers may charge their own fees.

Deposit & Withdrawal in City Index Broker

City Index offers various deposit and withdrawal methods:

- Bank wire transfer

- Credit/Debit cards (Visa, Mastercard)

- PayPal

Key Points:

- Minimum deposit is $150

- Minimum deposit for Credit/Debit cards is $250

- City Index uses advanced encryption to ensure the security of your transactions

- Withdrawals could take up to 3 days

Here's how quick guide to withdrawal funds from City Index broker:

- Login to your account;

- Choose funding section and click on "withdrawal;"

- Choose the payment method you used to deposit funds;

- Enter the withdrawal amount and complete the process.

Deposit Methods at City Index

City Index offers a variety of deposit methods, including debit/credit cards, bank transfers, and e-wallets. Minimum deposit amounts and processing times vary based on the payment method and your account's base currency.

Additional information is provided in the table below:

Deposit Method | Currency | Minimum Amount | Deposit Fee | Processing Time |

Debit/Credit Card | GBP, USD, EUR, PLN, CHF (and other base currencies) | £100 / $100 / €100 | Free | Instant |

Bank Transfer | GBP, USD, EUR, PLN, CHF (and other base currencies) | None | Free | 1-2 days |

Withdrawal Methods at City Index

City Index supports withdrawals via debit/credit cards and bank transfers, typically using the same method you used for funding.

They do not charge withdrawal fees in most cases, though processing times vary by method and region.

Additional information is provided in the table below:

Withdrawal Method | Currency | Minimum Amount | Withdrawal Fee | Processing Time |

Debit / Credit Card | GBP, USD, EUR, PLN, CHF | £100 (or equivalent) | Free | 3–5 working days |

Bank Transfer (Wire) | GBP, USD, EUR, PLN, CHF | £100 (or equivalent) | Free | 1–2 working days |

Pay Pal | GBP, USD, EUR, PLN, CHF (and other base currencies) | £100 / $100 / €100 | Free | Instant |

Investment Options Offered by City Index Broker

Unfortunately, City Index does not currently offer a copy trading or social trading feature. This might be disappointing for traders who prefer to follow and automatically copy the trades of successful investors.

While the lack of copy trading might be a drawback for some, City Index compensates with its comprehensive educational resources and market analysis tools, which can help traders develop their own successful strategies.

City Index Tradable Markets and Symbols

City Index provides access to a broad and diversified portfolio of over 13,500 tradable markets via CFDs and spread betting (depending on region). The offering spans:

Category | Type of Instruments | Number of Symbols / Markets | Competitor Average |

Major, minor, exotic currency pairs | 84+ pairs | 80–100 | |

Shares | Global equities | 4,700+ | 3,000–5,000 |

Indices | Global indices | 40+ | 30–50 |

Stock Index Futures | Futures on UK 100, Germany 40, US indices | 5+ | 5–10 |

Commodities | Oil, gold, silver (spot & futures) | 20+ | 20–30 |

Sector Indices | Thematic / sector indices | 14 sectors | 10–20 |

Bonds | Govt bonds (US T‑Note, UK Gilt, Euro Bund) | N/A | 10–20 |

Interest Rates | Short-term rate products | N/A | 5–10 |

Options | Options on indices (UK 100, SP 500, Germany 40) | 40+ markets | 30–50 |

Bitcoin, Ethereum, Litecoin, Ripple | 4 major crypto CFDs | 5–10 |

City Index does not currently support fractional shares or direct market access (DMA), but its product diversity makes it suitable for both directional and hedging strategies across asset classes.

City Index Broker Bonus Programs

City Index takes an excellent approach when it comes to bonuses and promotions. They offer various bonuses for new and old traders. City Index bonuses include:

- Welcome Bonus: Receive up to $ 2,000 for signing up and trading with City Index;

- Affiliate Program: City Index offers competitive commissions for individuals or entities who refer new clients to the platform;

- Cash rebate: Monthly cash rebates for forex, shares, and indices trading.

City Index Broker Awards

City Index has received multiple industry awards recognizing its excellence in CFD trading, spread betting, and trading platforms. These awards highlight the broker’s achievements and reputation in the financial services sector.

The accolades listed below represent some of the most recent and notable recognitions.

Here is a selection of City Index awards:

- Best CFD Trading & Spread Bet Provider Europe Global Business and Finance Magazine, 2025

- Best Spread Bet Broker Good Money Guide Awards, 2025

- Best CFD Provider ADVFN International Financial Awards, 2024

- Best CFD Provider Online Money Awards, 2024

- Best Trading App Good Money Guide Awards, 2024

City Index Broker Customer Support

City Index prides itself on providing responsive and knowledgeable customer support through various channels:

- Live Chat: Available 24/5, offering quick responses to urgent queries

- Phone Support: 0203 194 1801

- Email Support: support.uk@cityindex.com

The support team is multilingual and available from 10 am Sunday to 5pm Friday, catering to the global client base of City Index.

City Index Broker Restricted Countries and Regions

While City Index serves global clients, there are some restrictions based on regulatory requirements and company policy. City Index restricted countries:

- USA

- Brazil

- Belgium

- Hong Kong

- Japan

- Canada

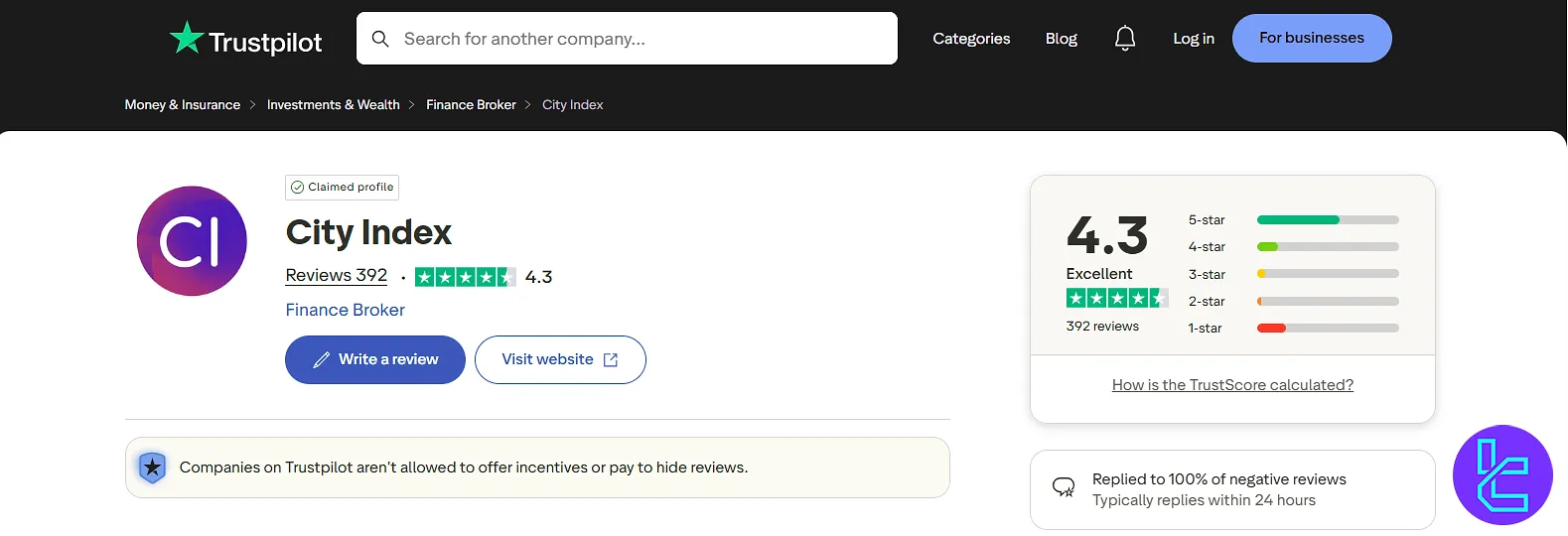

City Index Reviews and Trust Score

City Index has garnered strong trust scores and positive reviews across various platforms. This broker received a 4.3 trust score from over 300 reviews on the City Index Trustpilot page.

The general consensus among reviewers is that City Index is a reliable and well-regulated broker with competitive offerings.

City Index Broker Education

City Index stands out with its comprehensive educational resources:

- Trading Academy: In-depth courses covering basics to advanced trading strategies (+ a $40 exclusive bonus);

- Webinars and seminars: Regular sessions hosted by market experts;

- Market Analysis: Daily insights and commentary on market trends;

- Trading Guides: Detailed explanations of various trading concepts;

- Glossary: Comprehensive definitions of key trading terms, helping traders understand essential concepts and improve their market knowledge.

These resources cater to traders of all levels, from beginners looking to learn the ropes to experienced traders aiming to refine their strategies.

City Index in Comparison with Other Brokers

The table below helps traders decide whether Cty Index is the right broker for them.

Parameters | City Index Broker | |||

Regulation | FCA, ASIC, MAS | FSA, CySEC, ASIC | CySEC, DFSA, FCA, FSCA, FSA | FCA, FSCA, CySEC, SCB |

Minimum Spread | from 0.5 points | From 0.0 Pips | From 0.0 Pips | From 0.0 Pips |

Commission | $0 | From $3 | From $0 | From $0 |

Minimum Deposit | $150 | $200 | From $0 | $100 |

Maximum Leverage | 1:1000 | 1:500 | 1:2000 | 1:500 |

Trading Platforms | MT4, proprietary platform | Metatrader 4, Metatrader 5, cTrader, cTrader Web, IC Markets Mobile | MT4, MT5, Mobile App | MT4, MT5, cTrader, Web Trader, Mobile App |

Account Types | Standard, MT4 account | Standard, Raw Spread, Islamic | Cent, Zero, Pro, Premium | Standard, Pro, Raw+, Elite |

Islamic Account | No | Yes | Yes | Yes |

Number of Tradable Assets | $13500 | 2,250+ | 1,000+ | 2100+ |

Trade Execution | Market | Market | Market, Buy Stop, Stop Loss, Limit, Take Profit | Market, Pending |

TF Expert Suggestion

City Index broker aims to provide top-tier trading services by offering no commission deposit/withdrawals, high maximum leverage of 1:1000, and low spreads on Standard (floating from 0.8 points) and MT4 (floating from 0.5 points) accounts.

However, the high minimum deposit of $150 and the £12 per month inactivity fee are major drawbacks that traders must consider about this broker.