CWG Markets requires a minimum deposit of $10 with 3 accepted base currencies [GBP, EUR, USD] in 4 account types [Instant, Standard, Advanced, Institutional].

The maximum leverage is 1:2000 for all accounts except Institutional, which only provides leverage up to 1:100.

CWG Markets Company Information & Regulation

CWG Markets is a British broker founded on April 2, 1996. The broker's website is operated by CWG Group of companies. Regulating Authorities:

- VFSC (Vanuatu Financial Services Commission)

- FCA UK (Financial Conduct Authority)

- FSCA (Financial Sector Conduct Authority, South Africa)

Moreover, the brokerage is a member of the London Stock Exchange (LSE), adding to its reputation.

Here are important details about broker’s branches:

Entity Parameters / Branches | CWG Markets(VU) | CWG MARKETS LTD | CWG MARKETS SA (PTY) LTD |

Regulation | VFSC (Reg. 41694) | FCA (FRN 785129) | FSCA (FSP 54031) |

Regulation Tier | N/A | 1 | 2 |

Country | Vanuatu | UK | South Africa |

Investor Protection Fund | No | FSCS £85k | No |

Segregated Funds | Yes | Yes | Yes |

Negative Balance Protection | Yes | Yes | Yes |

Maximum Leverage | 1:2000 | 1:30 | 1:2000 |

Client Eligibility | Global (except restricted) | UK / EEA | South Africa |

CWG Markets Broker Key Parameters and Specifics

Here's a table covering what CWG Markets offers as a Forex broker:

Broker | CWG Markets |

Account Types | Instant, Standard, Advanced, Institutional |

Regulating Authority | VFSC, FCA UK, FSCA |

Based Currencies | GBP, EUR, USD |

Minimum Deposit | $10 |

Deposit Methods | Skrill, Neteller, Sticpay, UnionPay, Bank transfer, help2pay, 5pay, 77pay, ecom |

Withdrawal Methods | Skrill, Neteller, Sticpay, UnionPay, Bank transfer, help2pay, 5pay, 77pay, ecom |

Minimum Order | 0.01 |

Maximum Leverage | 1:2000 |

Investment Options | Copy Trading, PAMM |

Trading Platforms & Apps | MT4, MT5 |

Markets | Forex, Stocks, Metals, Energies, Indices, Commodity Futures |

Spread | From 0.0 Pips |

Commission | From $0 |

Orders Execution | Market |

Margin Call / Stop Out | 100% / 50% |

Trading Features | Economic Calendar |

Affiliate Program | Yes |

Bonus & Promotions | Daily Profits, Trading Rewards, 100% Deposit Bonus |

Islamic Account | Yes |

PAMM Account | Yes |

Customer Support Ways | Email, Ticket, Live chat, Phone |

Customer Support Hours | 24/7 |

Account Types Details and Comparison

CWG Markets offers 4 main account types, which differ in terms of minimum deposit, leverage,costs, etc. Live Accounts Properties:

Account Type | Instant | Standard | Advanced | Institutional |

Min. Deposit | $10 | $50 | $200 | $30,000 |

Base Currencies | GBP, EUR, USD | |||

Max. Leverage | 1:2000 | 1:100 | ||

Stop Out Level | 50% | |||

Margin Call Level | 100% | |||

All accounts have a swap-free (Islamic) option for all traders. Also, a demo account is provided for practicing strategies and trading skills.

To activate the Islamic Account, contact your official customer service or your account manager.

Important Pros and Cons

The table below consists of advantages and disadvantages in using CWG Markets services:

Pros | Cons |

Access to More Than 500 Tradable Instruments | No Crypto Trading |

Multiple Account Types | - |

Copy Trading and PAMM Features | - |

Regulated by FCA UK, A Top Tier Authority | - |

CWG Markets Registration and Verification

The CWG Markets Registration is a fast, 3-minute process designed for easy access to global Forex trading. You’ll need basic contact details to unlock the platform’s features and initiate your first trades.

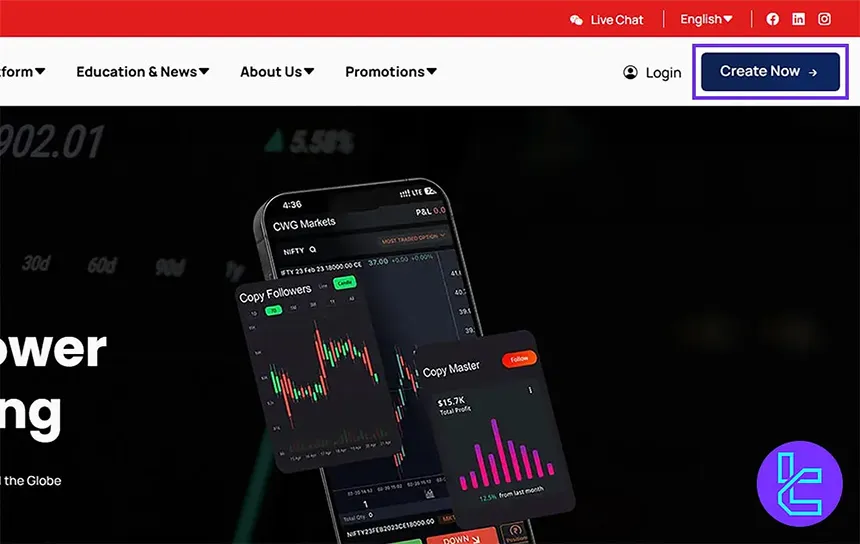

#1 Reach the CWG Markets Sign-Up Page

From the homepage, click “Create Now” or scroll to select “Open an Account.”

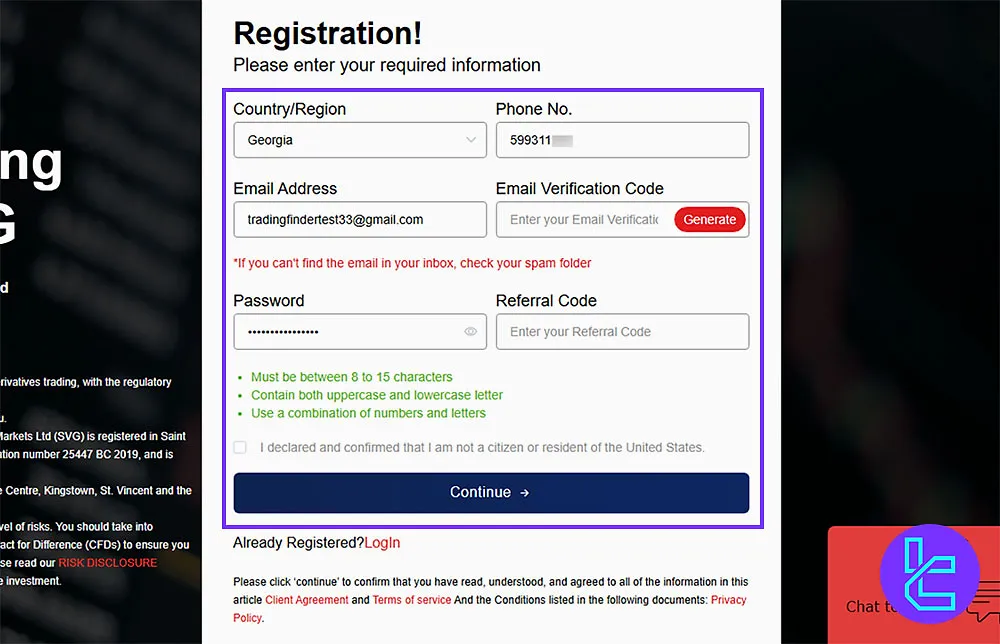

#2 Submit Basic Details in the CWG Markets Form

Fill in your country of residence, mobile number, and email address, then click Generate to receive your verification email.

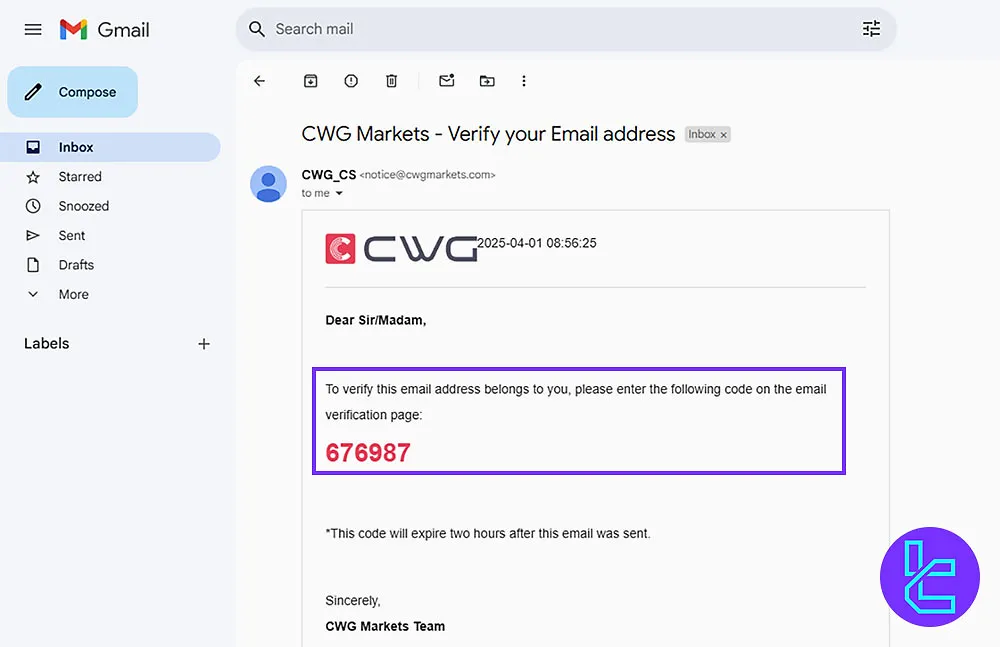

#3 Email Confirmation & Password Setup in CWG Markets

Check your inbox for a code, enter it on the platform, and create a secure password. Accept the terms and click Continue to finish.

#4 CWG Markets Verification

The CWG Markets verification framework designed to confirm client identity, assess financial background, and validate trading experience. After completing registration and passing the KYC review, users gain full access to the broker’s trading services, platforms, and available instruments.

CWG verification steps:

- Log in and enter the KYC menu

- Submit personal information

- Provide financial details and trading history

- Upload identity documentation

- Upload proof of address

- Receive verification approval via email

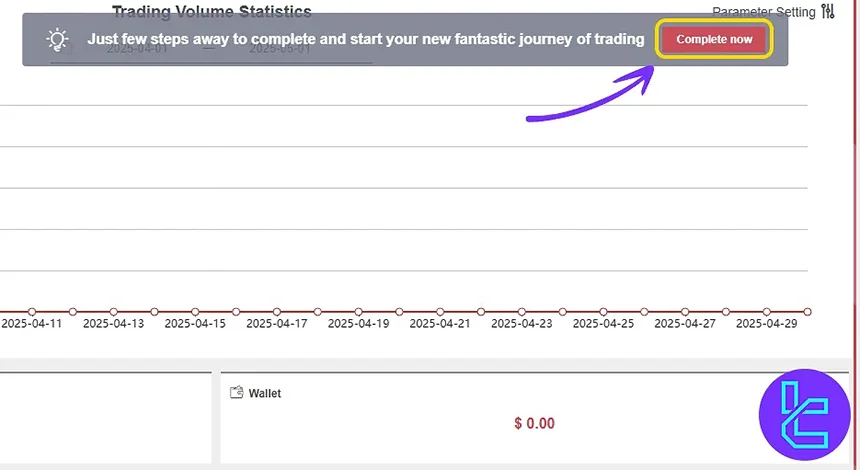

#1 Login and Start CWG Markets Verification

Sign in to your CWG Markets dashboard and select the “Complete Now” option displayed at the top to begin the approval workflow.

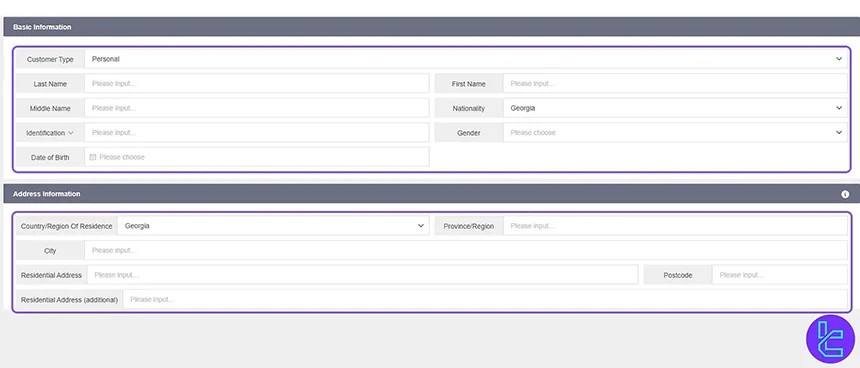

#2 Select Account Type and Add Personal & Address Details

Choose whether the account will operate as Individual or Corporate. Then complete the required personal information:

- First name

- Last name

- Optional middle name

- Nationality

- ID card number

- Gender

- Date of birth

Provide your full residential address by entering:

- Country

- City

- Complete street address

- Postal code

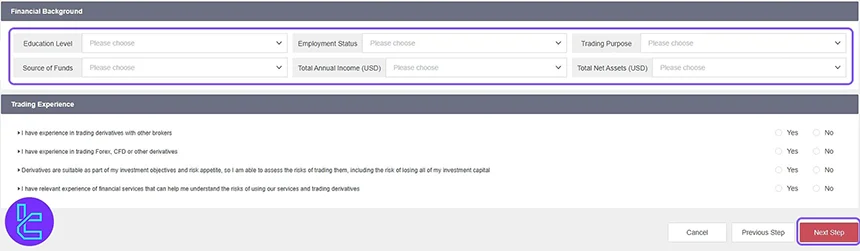

#3 Fill Out Financial Information

Provide your employment and income data and respond to the questionnaire regarding your prior trading experience.

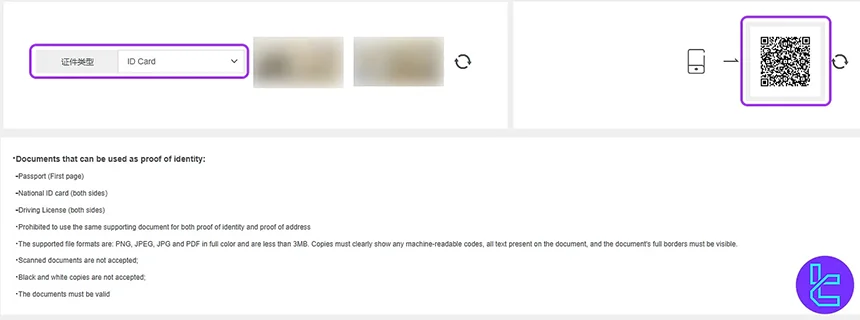

#4 Upload Identity Document

Pick a document from these categories:

- Passport

- ID card

- Driver’s license

Then, upload clear front and back images. A QR code is also available for continuing the upload process via mobile to speed up KYC completion.

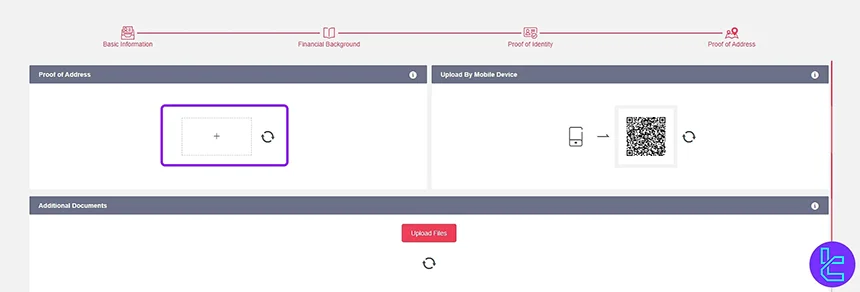

#5 Upload Proof of Address

Submit an acceptable POA, such as a recent bank statement or utility bill (issued within the last three months). Additional supporting documents may be uploaded. Select “Submit” once finished.

#6 Await Confirmation Email

After the review is completed, CWG Markets will send an email confirming successful account verification.

Trading Platforms and Terminals

CWG provides a popular selection with offering access to MetaTrader 4 and MetaTrader 5 platforms. These terminals enable access to analytics tools, indicators, order types, options, and more. Download Links for Mobile Devices:

Spreads and Commissions in CWG Markets

This broker has provided enough data for spreads and trading fees in its account types:

Account Type | Instant | Standard | Advanced | Institutional |

Spreads From | 2.2 Pips | 1.5 Pips | 0.0 Pips | |

Commission Per Lot | $0 | $6 | $3 | |

There are no other costs such as deposit, or withdrawal fees associated with CWG, which is a positive fact about this broker.

Swap Fees at CWG Markets

CWG Markets charges overnight swap (interest) according to its instrument-specific rates, and these are clearly defined in its Swaps section.

Swap is calculated daily, and for positions carried over a Wednesday, the charge is tripled. For traders using a Islamic account, all overnight interest is eliminated under the same trading conditions.

Here are the key official points to know about swap fees at CWG Markets:

- Swap is an overnight interest charge, and varies per instrument and direction (long vs short);

- Islamic accounts incur no swap fees while maintaining identical spreads and execution as regular accounts;

- For certain assets (e.g., some energy CFDs), CWG explicitly states “no Interest or Swap Fees” for long-term positions.

Non-Trading Fees at CWG Markets

CWG Markets applies a monthly inactivity fee of €/US$/GBP/CHF 20 if there’s no trading or funding for three consecutive months, provided there are sufficient funds.

If the account remains inactive for two years or more, CWG reserves the right to close it. There is no fee for deposits or withdrawals (except under special circumstances).

These are the key non-trading cost considerations:

- International Bank Transfer: withdrawals ≥ USD 500 have all bank fees covered by CWG Markets, while withdrawals < USD 500 incur a USD 25 bank fee;

- Currency conversion risk: clients bear any losses when CWG auto-converts currencies.

CWG Markets Broker Payment Methods

CWG Markets offers a wide range of over 10 payment options for deposits and withdrawals:

- E-wallets: Skrill, Neteller, Sticpay

- Credit/Debit Cards: Visa, MasterCard, UnionPay

- Local payment systems: help2pay, 5pay, 77pay

- Bank Transfer

- ecom

with these wide range of methods, deposit and withdrawal is so easy, fast and secure.

Deposit Methods at CWG Markets

CWG Markets offers a wide variety of deposit methods to accommodate global traders, including e-wallets, bank transfers, and regional payment systems.

All deposits are free of commission from CWG, though some intermediary banks may charge fees for international transfers. Most deposits are processed instantly or within a short window, with first-time deposits sometimes subject to manual review.

Here is a summary of the official deposit methods and details:

Deposit Method | Currency | Minimum Amount | Deposit Fee | Funding Time |

Skrill | USD/EUR | 10 USD (or equivalent) | Free | Within 30 min |

Neteller | USD/EUR | 10 USD (or equivalent) | Free | Within 30 min |

Sticpay | GBP/USD/EUR | 10 USD (or equivalent) | Free | Within 30 min |

China UnionPay | CNY | 10 USD (or equivalent) | Free | Within 30 min |

Bank Transfer | GBP/USD/EUR | 10 USD (or equivalent) | Free | Within 72 hours |

Help2Pay | THB/VND | 10 USD (or equivalent) | Free | Within 1 hour |

Spay Solution | THB/VND | 10 USD (or equivalent) | Free | Within 24 hours |

Spay Solution | USDT‑ERC20/USDT‑TRC20 | 10 USD (or equivalent) | Free | Within 1 hour |

77Pay | VND | 10 USD (or equivalent) | Free | Within 1 hour |

Kora | NGN/ZAR/KES/GHS/USD | 10 USD (or equivalent) | Free | Within 1 hour |

Pay Retailers | Supported for all South American countries | 10 USD (or equivalent) | Free | Within 1 hour |

Asia Banks | VND | 10 USD (or equivalent) | Free | Within 1 hour |

ECOM | VND | 10 USD (or equivalent) | Free | Within 1 hour |

Withdrawal Methods at CWG Markets

CWG Markets provides a wide range of withdrawal methods, matching its deposit options, to ensure clients can access their funds quickly and securely. Withdrawals are free of commission from CWG, but processing times may vary depending on the method and currency.

While most methods are processed within 1 hour, some regional or cryptocurrency options can take up to 48–72 hours to arrive in the client’s account.

Here is a summary of the official withdrawal methods:

Withdrawal Method | Currency | Minimum Amount | Withdrawal Fee | Funding Time |

Skrill | USD/EUR | N/A | Free | Instant |

Neteller | USD/EUR | N/A | Free | Instant |

Sticpay | GBP/USD/EUR | N/A | Free | Instant |

China UnionPay | CNY | N/A | Free | 1–72 hours |

Bank Transfer | GBP/USD/EUR | N/A | Free | 1–72 hours |

Help2Pay | THB/VND | N/A | Free | 1–48 hours |

Spay Solution | THB/VND | N/A | Free | 1–24 hours |

Spay Solution | USDT‑ERC20/USDT‑TRC20 | N/A | Free | 1–48 hours |

77Pay | VND | N/A | Free | 1–48 hours |

Kora | NGN/ZAR/KES/GHS/USD | N/A | Free | 1–48 hours |

Pay Retailers | Supported for all South American countries | N/A | Free | 1–48 hours |

Asia Banks | VND | N/A | Free | 1–48 hours |

ECOM | VND | N/A | Free | 1–48 hours |

Copy Trading Platforms and Investment Features

CWG Markets provides 2 investment options for traders:

- Copy Trading: Follow and copy trading signals and strategies provided by 500+ traders

- PAMM: Invest in accounts managed by money managers or seasoned traders

Trading Symbols and Available Markets in CWG Markets Broker

CWG Markets offers a very broad trading universe spanning multiple categories from forex to stocks, commodities and more, with more than 500+ symbols available.

Its product mix is designed to support both speculative and hedging strategies across global markets. Leverage varies significantly by asset class, with maximums up to 1:2000 on some instruments.

Below is a summary table:

Category | Type of Instruments | Number of Symbols | Competitor Average | Max. Leverage |

Currency pairs (major, minor) | ~50+ | ~60–70 | up to 1:2000 | |

Stock CFDs | Equities (NASDAQ, NYSE, HK) | 300+ | ~200–400 | N/A |

Precious Metals | Gold, Silver, etc. | 3+ | ~20–40 | 1:500 |

Energy | Crude oil, Natural Gas (spot) | 5+ | ~5–10 | 1:100 |

Indices | Global equity indices | N/A | ~20–40 | 1:100 |

Commodity Futures | Futures contracts via CFDs | N/A | ~10–40 | 1:50 |

Crypto CFDs | Cryptocurrencies like BTC, ETH, BNB, XRP | 40+ | ~20–50 | 1:100 |

CWG Markets continuously updates its instrument offerings to provide traders with diverse opportunities across global financial markets.

Bonuses and Promotional Offers in CWG

The broker offers 3 bonuses for promotional and marketing purposes:

- 100% Deposit Bonus: Up to $2,000 per trading account with a maximum of $10,000

- Daily Profit: Earn additional profits based on balance, not available for certain special accounts

- Trading Rewards: Unlimited cash rewards based on trading lots, only for standard accounts

CWG Markets Awards

The CWG Markets awards are due to its continuous growth since inception, driven by a strong focus on customer service, education-based support, segregated funding, and brand awareness. All of these factors have been widely acknowledged and favored by traders.

CWG Markets’ numerous awards certify its global leadership, with all honors granted to the CWG Group.

Some of these achievements are in the awards listed below:

- Best Mobile Trading Platform – 2025 by Trade Expo

- Excellence in Customer Satisfaction – 2025 by Trade Expo

- Top 100 Trusted Financial Institution – 2025 by Smart Vision

- Best Forex Education Platform – 2025 by Smart Vision

- Best Online Trading Service Provider UK – 2025 by Global Business & Finance Magazine

Support Contact Channels and Opening Hours

CWG Markets provides a set of 4 typical methods for contacting support agents:

- Email: service@cwgmarkets.com

- Support Ticket: Available through the website

- Phone: Global hotline at +44 2037699268 and +60 1800819380

- Live Chat: Accessible via the site

Based on the "Contact Us" page of the website, the support team is available 24/7.

CWG Markets List of Restricted Countries

This brokerage does not accept clients from all regions in the world; on its website, CWG has mentioned that "it does not provide services to residents of certain countries", such as:

- Iran

- United States

- Israel

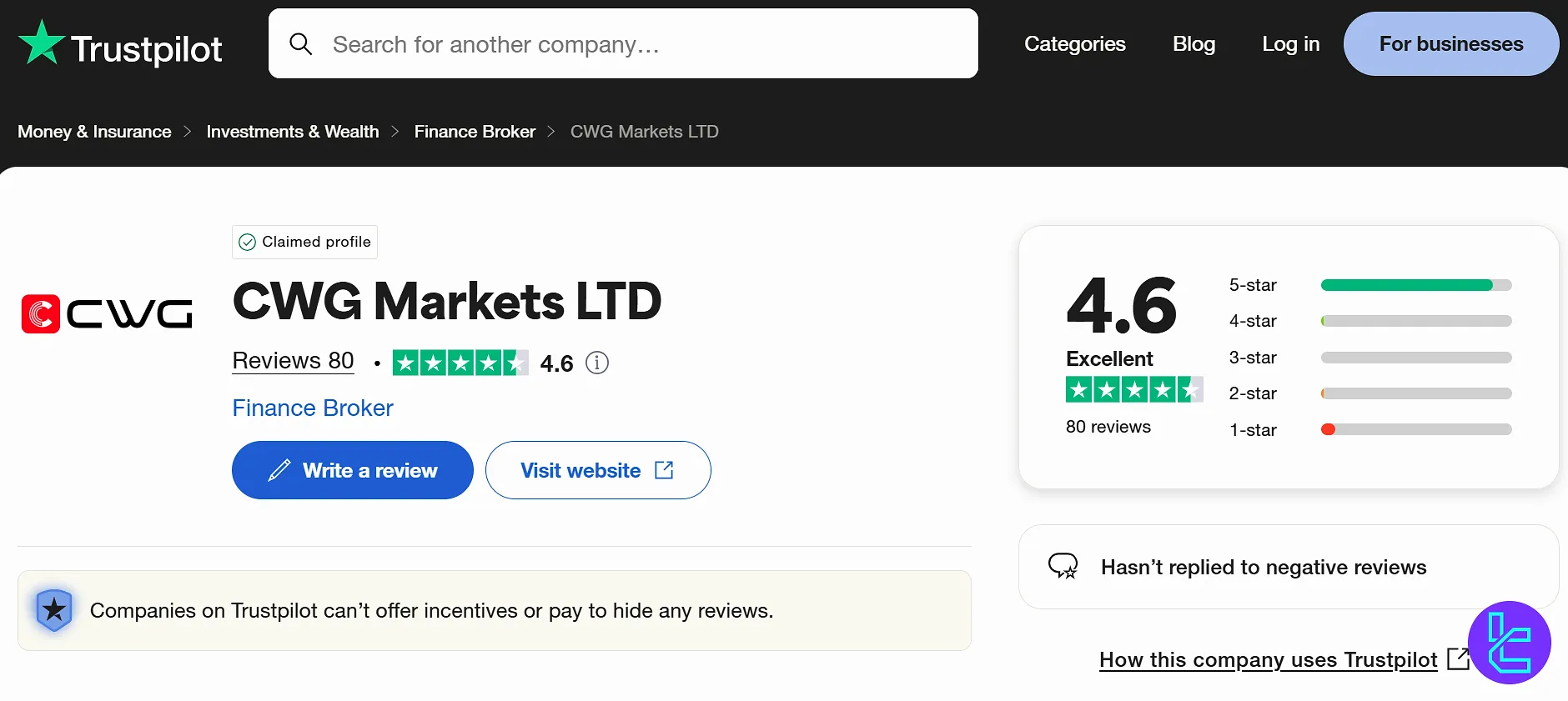

Trust Ratings and Reviews

CWG Markets Trustpilot score and other ratings show a positive level of opinions across various platforms:

- Trustpilot: 4.6/5 based on 80 reviews

- ScamAdviser: 46/100 Trustscore

- ForexPeaceArmy: 3.1 out of 5 with 5+ user ratings

Education Content on CWG

This broker offers a decent level of educational resources on the official website:

- Beginner guides on forex and CFD trading

- Intermediate and advanced articles

- Economic calendar and company news

- Webinars and video tutorials

- Glossary of technical words, terms, etc.

Traders are able to get help from these learning materials and improve their trading knowledge and strategies.

CWG Markets in Comparison with Others

To choose the best broker, here is a brief comparison between CWG Market and its rivals; CWG Markets Comparison:

Parameter | CWG Markets Broker | |||

Regulation | VFSC, FCA UK, FSCA | FSA, CySEC, FCA, FSCA, CBCS, FSC, CMA | FCA, FSCA, CySEC, SCB | FSA, CySEC, ASIC |

Minimum Spread | 0.0 Pips | 0.0 Pips | Varies based on Account | 0.0 Pips |

Commission | From $0 | From $0.2 to USD 3.5 | Varies based on Account | Average $1.5 |

Minimum Deposit | $10 | $10 | $100 | $200 |

Maximum Leverage | 1:2000 | Unlimited (Subject to account) | 1:500 | 1:500 |

Trading Platforms | MT4, MT5 | Exness Trade (mobile), Exness Terminal (web), MT4, MT5 | MT4, MT5, cTrader, Web Trader, Mobile App | MT4, MT5, cTrader, cTrader Web, IC Markets Mobile |

Account Types | Instant, Standard, Advanced, Institutional | Standard, Standard Cent, Pro, Raw Spread, Zero | Standard, Pro, Raw+, Elite | Standard, Raw Spread, Islamic |

Islamic Account | Yes | Yes | Yes | Yes |

Currency Pairs | 61 | Over 100 | 200 | 861 |

Number of Tradable Assets | Not specified | 500+ | Not specified | Not specified |

Trade Execution | Instant execution | Market Execution, Instant Execution | Market Execution, Instant Execution | Market |

Conclusion and Final Words

CWG Markets provides support services on a 24/7 basis via 4 channels [live chat, email, phone call, ticket].

This company has received a 4.6/5 user score on "Trustpilot", with 80 reviews. On the other hand, "ScamAdviser" has given a 46/100 TrustScore to this broker.