Darwinex is a brokerage company and asset management firm that provides access to 1500+ financial instruments and multiple investment plans, including DarwinIA (seed allocation program) and Darwins (top strategies as investment products).

Darwinex provides traders with regulated access to global markets under FCA، FSA and CNMV supervision. Also, the broker provides a maximum leverage of 1:200.

Darwinex; Company Information and Regulatory Status

Darwinex is a regulated broker founded in March 2012, holding licenses from reputable regulatory bodies, including the UK FCA and Spain CNMV. The company offers 1,500+ financial instruments to trade and invest. Key features of Darwinex:

- Regulated by FCA, CNMV, and the Seychelles FSA

- More than 70 employees

- $15B monthly trading volume from 80+ countries

- A wide range of financial markets, including Forex, CFDs, Futures, Stocks, Indices, and ETFs

- Providing seed capital for top strategies through the DarwinIA service

- Darwinex Zero program with no risk and a monthly subscription fee for asset managers

- Integration with Interactive Brokers (IBKR), the largest brokerage company in the United States

Client funds are safeguarded through strict regulatory mechanisms and are held in major European banks. Investors are protected under compensation schemes - up to £85,000 in the UK and up to €100,000 in Spain - depending on the regulatory entity chosen.

Here are what you need to know about Darwinex broker:

Entity Parameters / Branches | Tradeslide Global Ltd. | Tradeslide Trading Tech Ltd | Sapiens Markets EU S.V. |

Regulation | FSA (Seychelles) | FCA | CNMV |

Regulation Tier | 4 | 1 | 1 |

Country | Seychelles | UK | Spain |

Investor Protection Fund / Compensation Scheme | None | FSCS £85,000 | FOGAIN €100,000 |

Segregated Funds | Yes | Yes | Yes |

Negative Balance Protection | Yes | Yes | Yes |

Maximum Leverage | 1:200 | 1:200 | 1:200 |

Client Eligibility | Worldwide (except restricted) | UK Residents | European Union |

Darwinex Table of Specifics

Darwinex's unique selling point is its ability to transform traders' strategies into investable assets called DARWINs, allowing successful traders to attract investor capital and earn performance fees.

Broker | Darwinex |

Account Types | Live, Professional, Darwin IBKR, Classic IBKR |

Regulating Authorities | FCA, CNMV, FSA |

Based Currencies | EUR, USD, GBP |

Minimum Deposit | $500 |

Deposit Methods | Credit/Debit Cards, Bank Transfer |

Withdrawal Methods | Credit/Debit Cards, Bank Transfer |

Minimum Order | 0.01 lots |

Maximum Leverage | 1:200 |

Investment Options | Investment Portfolio |

Trading Platforms & Apps | MT4, MT5, WebTrader, TradingView, NinjaTrader, TWS, MultiCharts, DARWIN API, FIX, ZORRO IB Bridge, IB Gateway |

Markets | CFDs (Forex, Indices, Commodities, ETFs, Stocks), Stocks, ETFs, Futures, Options |

Spread | Variable based on the instrument |

Commission | Variable based on the account type and instrument |

Orders Execution | Market |

Margin Call / Stop Out | 100% / 50% |

Trading Features | Mobile Trading, Investment Services, Stocks Trading, ALGO Trading, EAs |

Affiliate Program | Yes |

Bonus & Promotions | Referral |

Islamic Account | No |

PAMM Account | No |

Customer Support Ways | Email, Chat Bot, Phone, Ticket |

Customer Support Hours | Monday to Thursday, 8:00 AM to 7:00 PM UTC Friday, 8:00 AM to 5:00 PM UTC |

Darwinex Account Type Offerings

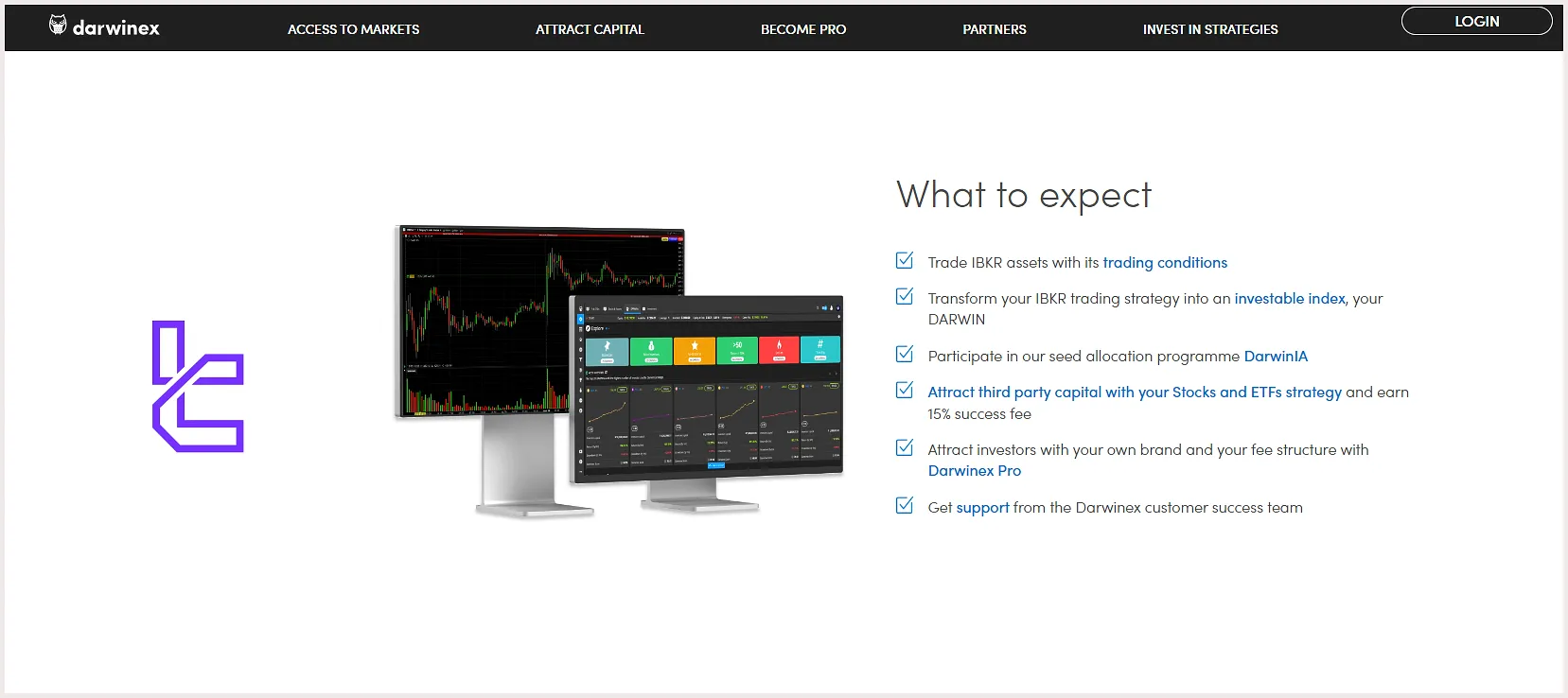

As one of the Forex Brokers and asset management firms, Darwinex has a wide range of account types catering to both traders and investors. Integration with IBKR in 2021 has made way for IBKR accounts.

Live

- Standard account for individual traders

- Access to all trading instruments

- Minimum deposit of $500

- Available in various base currencies, including USD, EUR, and GBP

- Leverage up to 1:30

- Spreads from 0.0 pips

Professional

- For experienced traders who want to attract capital with their own brand leveraging the Darwinex Pro platform

- Higher leverage available (up to 1:200)

- Less regulatory protection

- A one-time set-up fee of $10,000

- Subject to AuM-based fee and Value Added Tax (VAT)

DARWIN IBKR

- Turning strategies into DARWINs (investable assets)

- Two subtypes: Stocks (800 US stocks and ETFs) and Futures (60 futures contracts on the CME, CBOE, EUREX, and ICE exchanges)

- Access to seed allocation program (DarwinIA)

- Third-party capital

Classic IBKR

- For traders who don't plan to manage investor capital

- Direct access to Interactive Brokers' platform

- 150 global markets and diverse financial instruments, including Stocks, Options, Futures, Currencies, Bonds, Funds, and more

- Possibility of moving track records to the Darwin IBKR account

Darwinex also provides a demo account (MT4/MT5) with a customizable virtual balance. However, unused demo accounts are automatically closed after 20 days. The broker does not offer cent accounts or Islamic (swap-free) account options.

Darwinex Broker Pros & Cons

Darwinex stands out for its innovative DARWIN system and low trading costs, but the high minimum deposit and limited global availability may deter some traders.

Upsides | Downsides |

Well-regulated (FCA, CNMV, FSA) | Geo-Restrictions |

Low spreads from 0.0 pips | Relatively high minimum deposit ($500) |

Investment portfolios | No swap-free Islamic accounts |

Advanced asset managing programs like DarwinIA and Darwin Zero | Complex platform Interface for beginners |

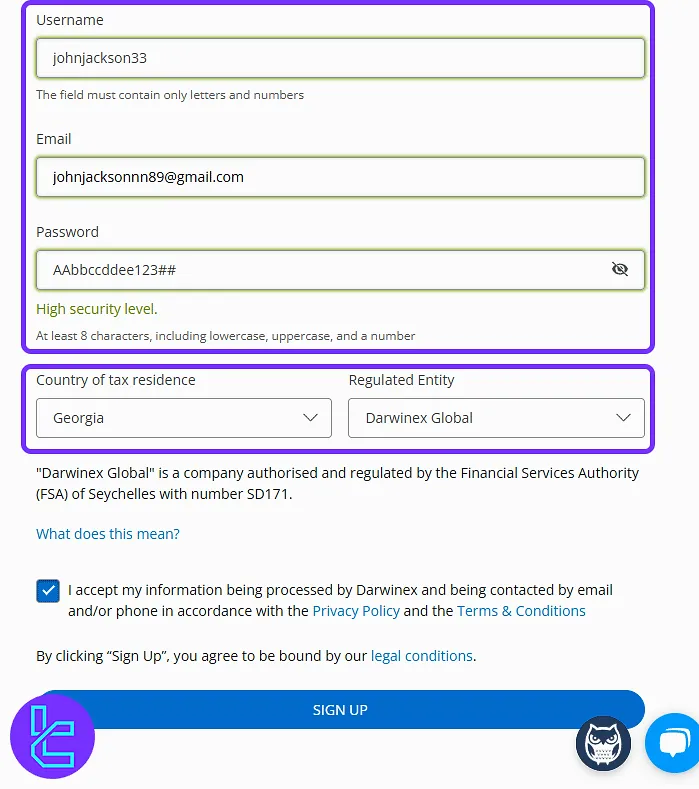

Darwinex Registration and KYC Verification

Creating a trading account with Darwinex Global is simple and quick. Through the Darwinex registration process, you can start trading in under 10 minutes and gain access to a wide range of diversified markets, including Forex, stocks, crypto, futures, and more.

#1 Launch the Darwinex Registration Page

Use TradingFinder to securely navigate to Darwinex, then create a username, set a password, and enter your email and tax residency. Choose Darwinex Global as your entity and accept the terms.

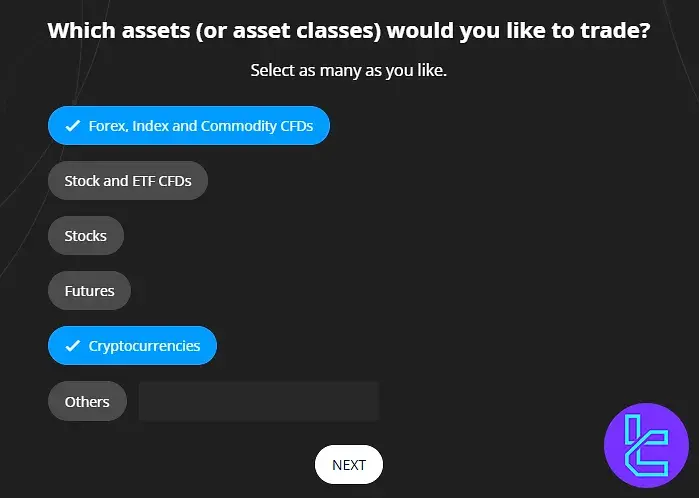

#2 Choose Your Market Focus on Darwinex

Select from available assets - Forex, cryptocurrencies, commodities, or indices - or specify a custom market.

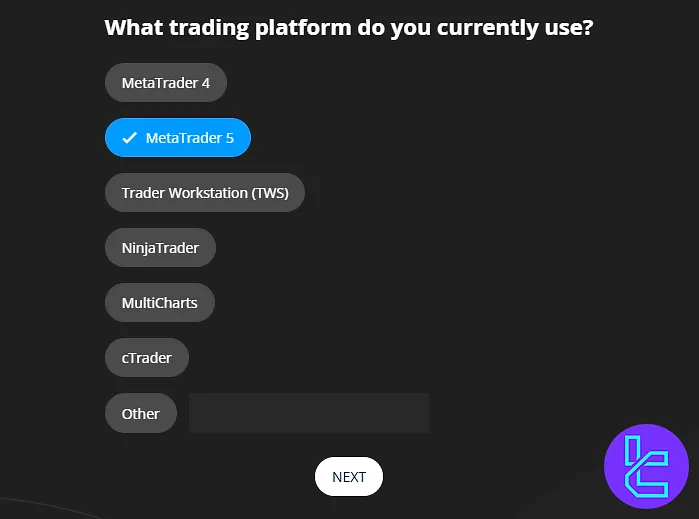

#3 Pick a Trading Platform in Darwinex

Select your preferred terminal: MT4, MT5, TWS, cTrader, etc.

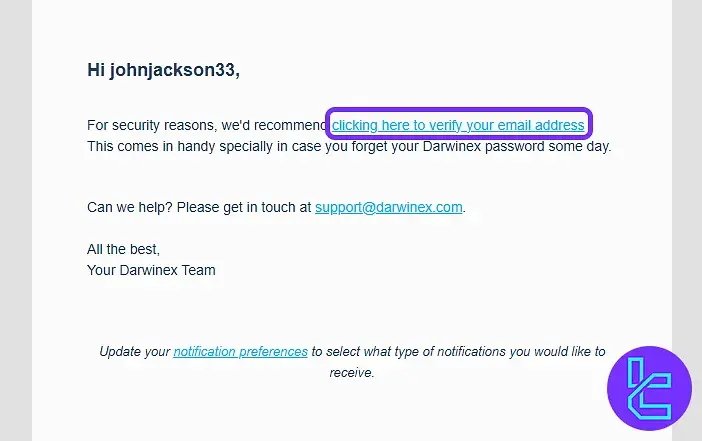

#4 Confirm Email on Darwinex

Check your inbox for the verification link to finalize your registration and unlock the trading dashboard.

Darwinex Verification

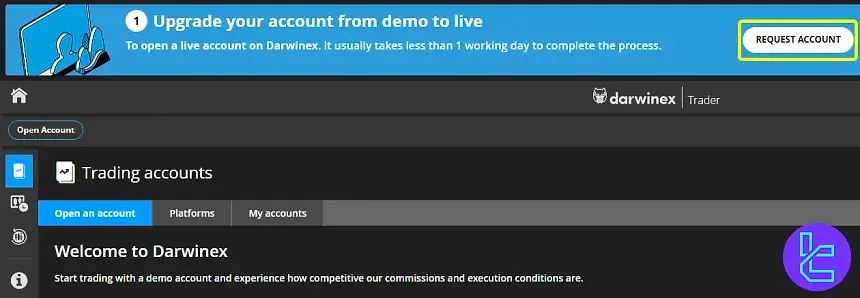

After completing your Darwinex sign-up, the verification workflow inside the Darwinex dashboard involves several short steps to activate the trading account.

Darwinex verification overview:

- Choose “Request an Account” in the Darwinex dashboard;

- Enter Personal Information;

- Submit Financial Details;

- Upload Required Documents.

Identity approval is compulsory and can typically be finished in under five minutes.

#1 Choose “Request an Account” in the Darwinex dashboard

Access your Darwinex dashboard and move to the section where new accounts are created.

Select “Request an Account”, pick the account category you intend to open, and continue to the next step.

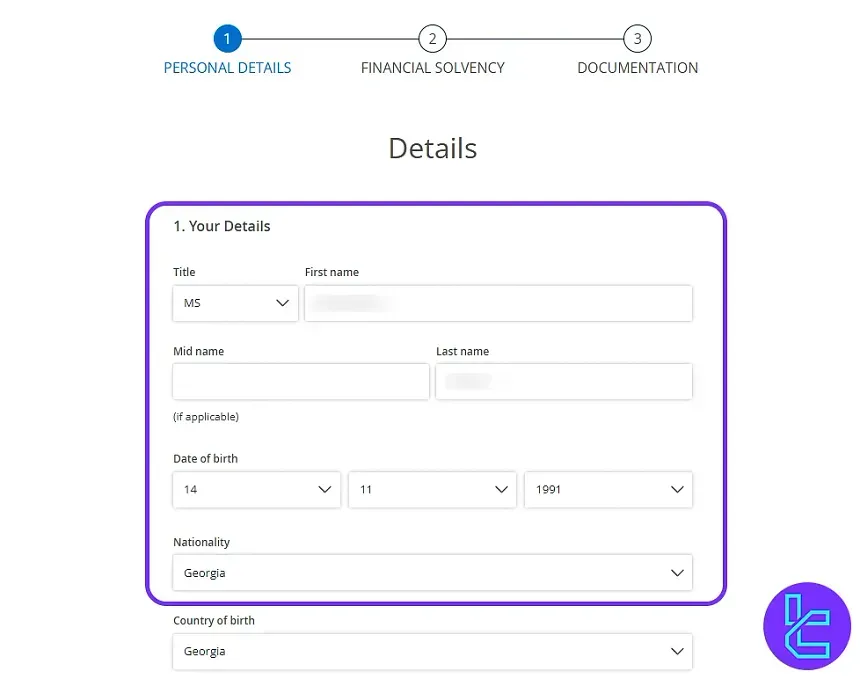

#2 Entering Personal Information

Provide your full legal name, add any middle name if relevant, and choose the correct title. Also, enter essential details such as your date of birth, nationality, country of birth, and mobile number.

Finally, add your residential address and complete the requested tax-related information.

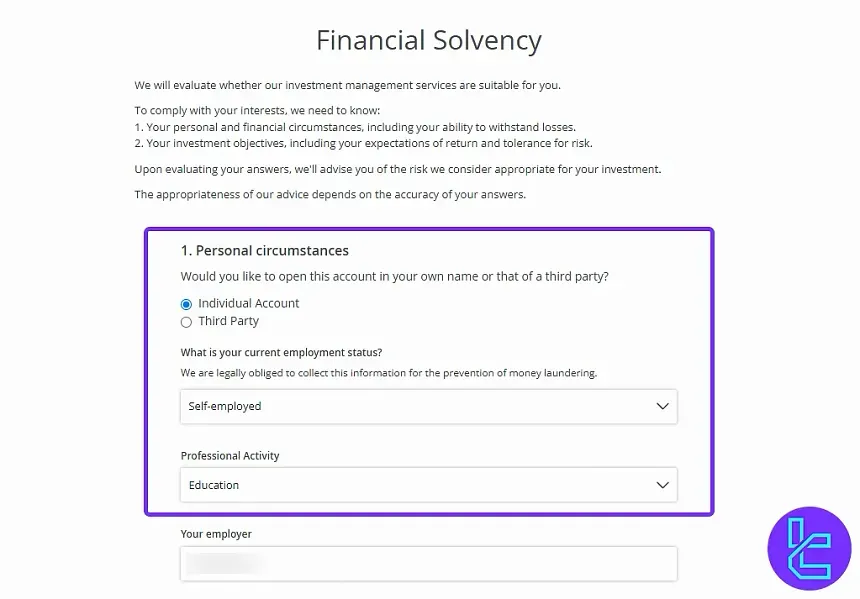

#3 Submitting Financial Details

Within the KYC stage, Darwinex requires basic financial and employment information. You need to specify your employment situation and field of work, as well as indicate your financial background and income range.

If necessary, declare whether you fall under the politically exposed person (PEP) category before moving forward.

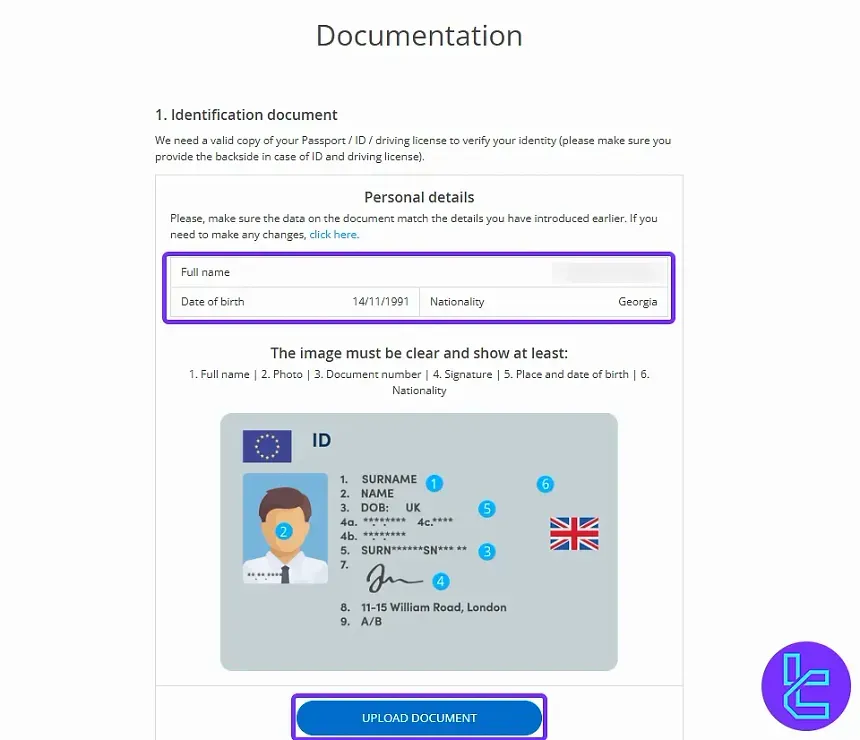

#4 Uploading Required Documents

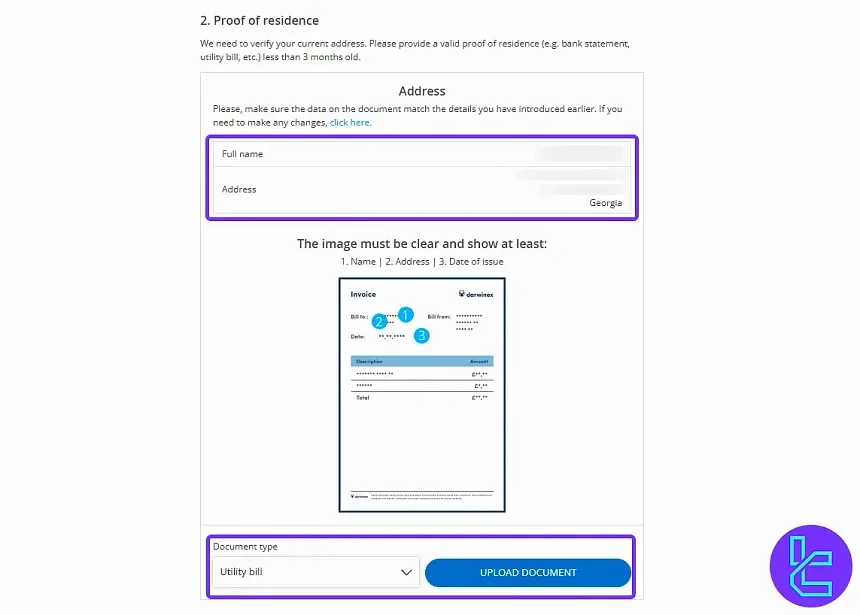

To complete Darwinex verification, upload both identity and address documentation. Select “Upload Document”, choose your country, and pick the ID type you will use.

Verification can be done through mobile capture, a system camera or by uploading files directly.

Next, provide proof of residence, such as a utility bill or recent bank statement.

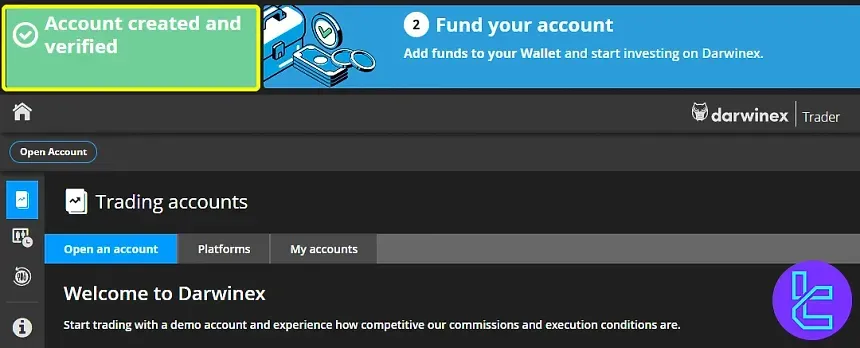

Once everything is submitted, the account status will switch to “Under Review” until approved. Typically, within one business day, your Darwinex account becomes fully operational.

Darwinex Broker Trading Platforms

The company offers a diverse range of trading platforms to cater to different trader preferences. Note that trading platforms for Darwinex Live accounts differ from those for IBKR accounts.

Live and Professional

- MetaTrader 4 (MT4)

- MetaTrader 5 (MT5)

- DARWIN API

IBKR Accounts

- TradingView

- Web Trader

- Trader workstation (TWS)

- NinjaTrader

- MultiCharts

- ZORRO IB Bridge

- IB Gateway

Darwinex Trading and Non-Trading Costs

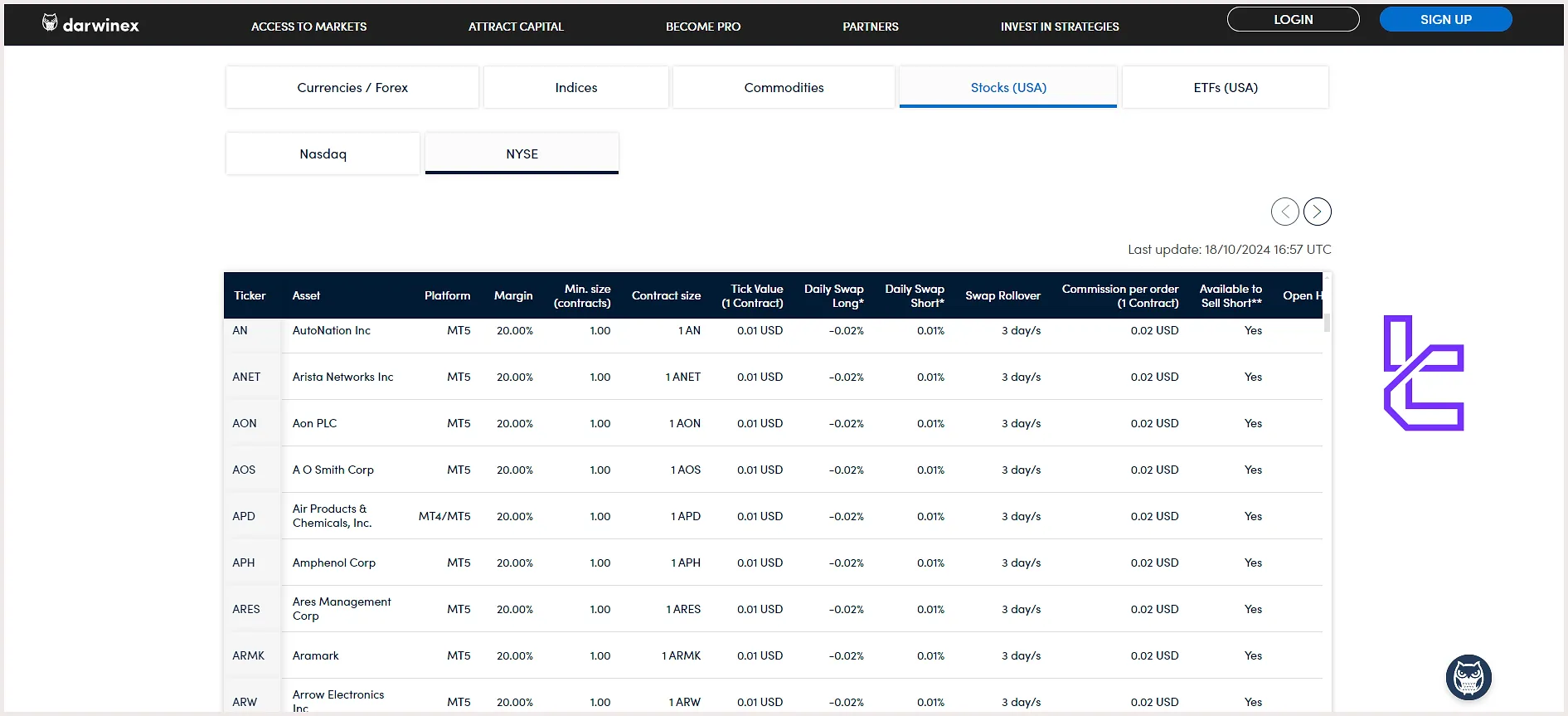

The broker’s trading costs vary based on the account type and instrument. While the live account comes with spreads from 0.0 pips and low commissions, the IBKR accounts follow the Interactive Broker’s fixed pricing conditions.

Live

Asset Class | Commission (per order) |

Forex / Currencies | 2.5 units of the base currency |

Indices | Average 2.75 units of the base currency |

Commodities | 0.0025% Order value |

Stocks (USA) | $0.02 |

ETFs (USA) | $0.02 |

Darwinex IBKR

Asset Class | Commission |

Stocks | $0.005 per share |

ETFs | $0.005 per share |

Options | $0.650 per contract |

Futures | $0.850 per contract |

Spreads are floating and vary by market conditions, but remain among the tightest in the industry:

- EUR/USD: as low as 0.1 pips (min), averaging 0.3 pips

- GBP/USD: as low as 0.1 pips (min), averaging 0.4 pips

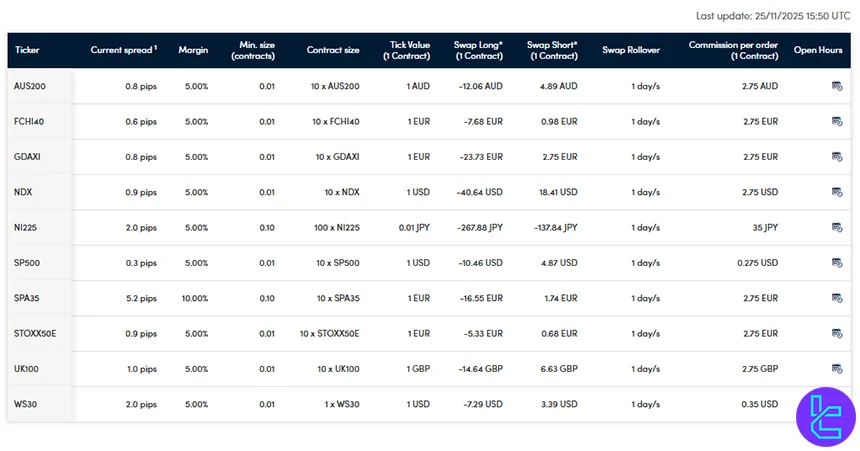

Swap Fees at Darwinex

At Darwinex, swap (roll-over) costs are settled daily at 17:00 New York time, and triple the normal rate on Wednesdays to cover the weekend. For example, a 1-lot EUR/USD long position incurs about –9.70 USD, while the short side for that same contract is roughly +3.30 USD.

These swaps reflect the interest-rate differential between currencies plus liquidity-provider markups.

Here are the most important facts about Darwinex swaps:

- Indicative rates: Swap values come from liquidity providers and Darwinex may adjust them if their internal cost differs;

- Asymmetry: Long and short swap rates can differ due to markups applied by liquidity providers;

- Daily variation: Swap values are updated every day and may change without prior notice;

- Example: For a 1-lot AUD/USD position, Darwinex might charge –40 USD on long and –0.90 USD on short;

- Islamic account: Darwinex does not offer swap-free (Islamic) accounts.

Non-Trading Fees at Darwinex

Darwinex does not charge any platform subscription or account maintenance fees for its trading clients.

Non-trading costs are limited mostly to deposit/withdrawal commissions and performance-oriented fees.

Here are the key non-trading cost points:

- Deposits: A 5 EUR/GBP/USD commission applies to bank transfers below 500 EUR/GBP/USD; additional bank charges may apply for USD deposits below 2,000 USD;

- Withdrawals: Costs are passed to clients; there is no fixed penalty, but banks may charge fees depending on the method;

- DARWIN Management Fee: For DARWIN investors, there is a 1.2% annual management fee on invested equity, charged daily;

- DARWIN Performance Fee: A 20% performance fee (with high-water mark) applies on net profits for investor capital;

- Inactive DARWIN Periods: No management fees are charged during periods of inactivity in a DARWIN (defined as 4+ weeks without market exposure).

Darwinex Payment Options

The next topic in this Darwinex review is deposit/withdrawal. The broker offers several options for funding and withdrawal transactions, including:

Conditions | Credit/Debit Cards | Bank Transfer |

Currencies | USD, EUR, GBP | USD, EUR, GBP |

Withdrawal Limitations | 200 – 20,000 | Unlimited |

Deposit Limitations | 500 – 20,000 | 500 – No Maximum |

Withdrawal Commission | 1% | 15 |

Deposit Commission | No commission | Bank fee |

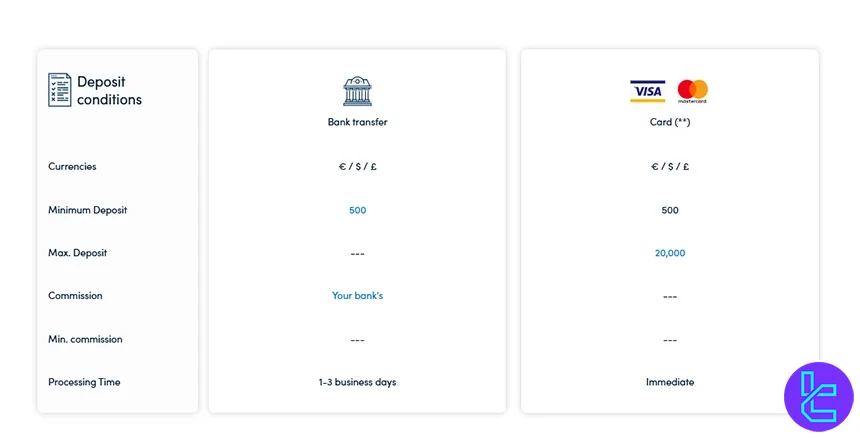

Deposit Methods at Darwinex

Darwinex allows clients to fund their accounts using bank transfers and credit/debit cards (Visa & Mastercard). Each method comes with clear minimum amounts, applicable fees, and expected processing times.

Bank transfers are ideal for larger deposits, while card payments offer instant funding. The broker covers most costs, making it efficient and transparent for traders.

Below is a detailed breakdown of the available deposit methods:

Deposit Method | Currency | Minimum Amount | Deposit Fee | Funding Time |

Bank Transfer | EUR / USD / GBP | 500 (first deposit) / 100 (subsequent, except wire) | 5 EUR/USD/GBP commission for transfers below 500; additional bank charges for USD wires under 2,000 | 1–3 business days |

Credit / Debit Card (Visa, MasterCard) | EUR / USD / GBP | 500 | 0 | Immediate |

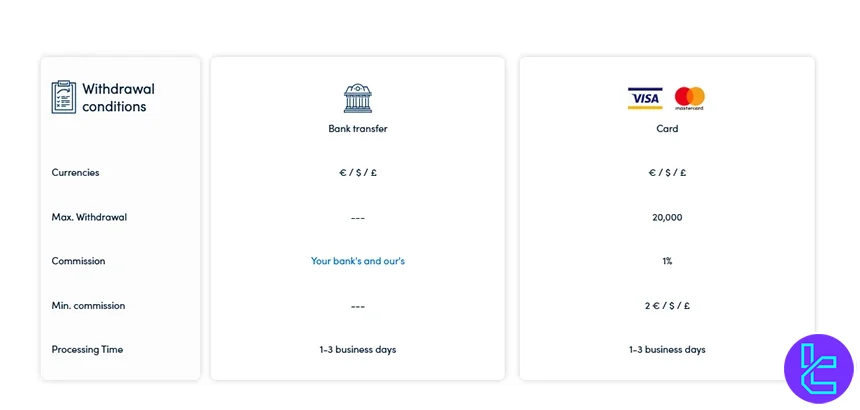

Withdrawal Methods at Darwinex

Darwinex offers the same methods for withdrawals as for deposits, namely bank transfers and credit/debit cards for certain entities.

Before the first bank‑wire withdrawal, they require verification of the destination bank account.

Here are the key withdrawal details:

Withdrawal Method | Currency | Minimum Amount | Withdrawal Fee | Processing Time |

Bank Transfer | EUR / USD / GBP | 10 | 250 (non-DARWIN accounts) 500 (DARWIN accounts) | 1–3 business days |

Credit / Debit Card (Visa, MasterCard) | EUR / USD / GBP | Up to 100% of deposited amount | 1% (minimum 2€/$/£) | 1–3 business days |

Darwinex Broker Investment Plans and Copy Trading

While the company doesn’t offer a dedicated copy trading service, it provides robust money management and investment services. however, the investment plan is not available globally, and only residents of the UK and EU can use this feature.

You can invest in Darwins (Top Trading Strategies) and receive profits. Note that you should pay a 20% performance fee, 5% for the broker, and 15% for the strategy provider. Key features of Darwins Investment:

- Certified and standardized for fair competition;

- Investors can access uncorrelated trading strategies;

- A curated selection of best-performing DARWINs;

- Investors can build diversified portfolios;

- Exclusive and dedicated Risk Engine.

Darwinex Trading Assets

Darwinex’s core offering focuses on CFDs across multiple markets, including Forex, Indices, Commodities and Cryptocurrencies.

By integrating with Interactive Brokers (IBKR), additional tradable assets such as Futures, Options, and US Stocks are also available, expanding the range for investors.

See the full list of instruments and details below:

Category | Type of Instruments | Number of Symbols | Competitor Average | Max. Leverage |

Forex CFDs | Currency pairs | 42 | ~50 | 1:200 |

Index CFDs | Global indices (S&P500, DAX, IBEX, etc.) | 10 | ~12–15 | 1:20 |

CFDs on Commodities | Gold, Silver, Oil, Gas | 4 | ~5–8 | 1:33 |

US Stocks | Single-stock CFDs (Darwinex) & IBKR Stocks | ~800 | ~500–1200 | 1:5 |

ETFs | US ETFs (CFDs & IBKR ETFs) | ~100 | ~80–150 | N/A |

Cryptocurrency CFDs | BTC, ETH, XRP, BNB, ADA, DOGE, SOL | 7 | ~5–10 | 1:1 |

Futures | IBKR Futures (tradable via Interactive Brokers DARWIN account) | 50+ | ~50–150 | N/A |

The platform provides competitive leverage where applicable, giving both retail and professional traders flexibility and access to global markets.

Does Darwinex Offer Bonus or Promotional Programs?

The company does not offer traditional bonuses or promotional programs such as sign-up or deposit bonuses. This approach aligns with the regulatory guidelines set by the UK's Financial Conduct Authority (FCA), which discourages brokers from offering such incentives.

However, we must mention in this Darwinex review that if you’re a regulated financial advisor, the broker has an affiliate program for you. In order to submit a request and receive a unique referral code, contact “info@darwinex.com”.

Darwinex Broker Awards

Darwinex does not list any formal broker awards on its official website. While the platform highlights trader incentive programs like DarwinIA and performance-based recognitions, there is no specific mention of industry or external awards granted to the broker itself.

Darwinex Broker Customer Support

The company provides customer support from Monday to Thursday, 8:00 AM to 7:00 PM UTC, and Friday, 8:00 AM to 5:00 PM UTC, through various channels, including:

info@darwinex.com | |

Phone Call | +44 330 808 0575 |

Chat Bot | Available on the website 24/7 |

Ticket | Submit a request on the “Contact Us” page |

Restricted Countries on Darwinex

As an FCA/CNMV-regulated broker, the company operates under certain restrictions regarding the countries it can serve. Red flag countries on Darwinex:

- Afghanistan

- American Samoa

- Bahrain

- Barbados

- Belarus

- Benin

- Bolivia

- Bosnia and Herzegovina

- Iran

- United States

Darwinex Trust Scores

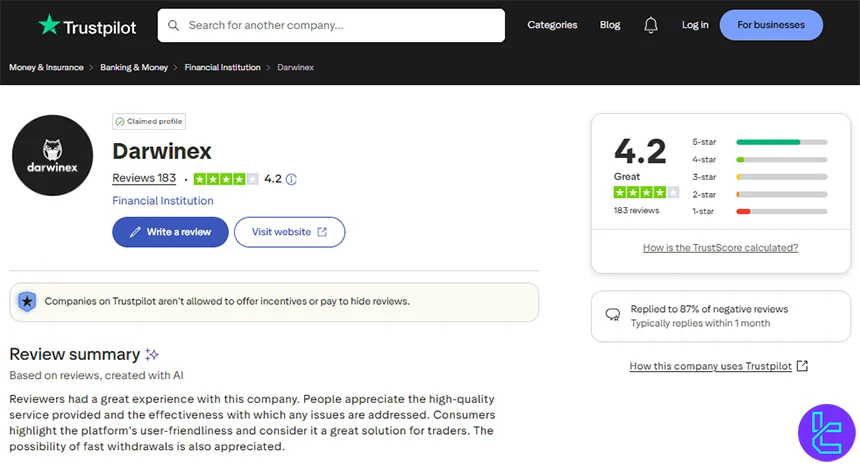

User satisfaction is one of the most important factors to consider before choosing a broker. Darwinex, with its strong regulatory status and ratings, is a good choice for traders and investors.

Some trust scores were given to Darwinex which you can see here:

4.2 out of 5.0 based on 183 reviews | |

Forex Peace Army | 4.0 out of 5.0 based on 46 ratings |

Reviews.io | 3.4 out of 5.0 based on 19 reviews |

Darwinex Educational Content

The company’s educational materials are presented mainly through its YouTube channel, covering a diverse range of topics, including:

- Introduction to the platform and tools

- Trading tips

- Risk management techniques

- Indicators

- Tutorial on ALGO Trading

- MQL coding techniques

Darwinex shares its educational material mainly on YouTube, covering platform basics, trading tips, risk management, indicators, ALGO trading and MQL coding.

Darwinex in Comparison with Others

Choosing the best broker is a must; Darwinex Comparison:

Parameter | Darwinex Broker | |||

Regulation | FCA, CNMV, FSA | FSA, CySEC, FCA, FSCA, CBCS, FSC, CMA | FCA, FSCA, CySEC, SCB | FSA, CySEC, ASIC |

Minimum Spread | Variable | 0.0 Pips | Varies based on Account | 0.0 Pips |

Commission | Variable | From $0.2 to USD 3.5 | Varies based on Account | Average $1.5 |

Minimum Deposit | $500 | $10 | $100 | $200 |

Maximum Leverage | 1:200 | Unlimited (Subject to account) | 1:500 | 1:500 |

Trading Platforms | MT4, MT5, WebTrader, TradingView, NinjaTrader, TWS, MultiCharts, DARWIN API, FIX, ZORRO IB Bridge, IB Gateway | Exness Trade (mobile), Exness Terminal (web), MT4, MT5 | MT4, MT5, cTrader, Web Trader, Mobile App | MT4, MT5, cTrader, cTrader Web, IC Markets Mobile |

Account Types | Live, Professional, Darwin IBKR, Classic IBKR | Standard, Standard Cent, Pro, Raw Spread, Zero | Standard, Pro, Raw+, Elite | Standard, Raw Spread, Islamic |

Islamic Account | No | Yes | Yes | Yes |

Currency Pairs | 42 | Over 100 | 200 | 861 |

Number of Tradable Assets | over 1,500 | 500+ | Not specified | Not specified |

Conclusion and Final Words

Darwinex provides access to 60 Futures products across multiple exchanges, including CME, CBOE, EUREX, and ICE, by integrating with Interactive Brokers (IBKR). Stock trading with a $0.005 commission is available with a minimum deposit of $500.