Deniz Yatırım provides a minimum deposit of 1,500 USD for its Forex account, while the Investment account focuses on stock trading and other products available on the Istanbul Stock Exchange. It operates without affiliate programs, bonuses, Islamic accounts, or PAMM accounts.

The broker Deniz Yatırım operates under the supervision of the reputable Turkish regulator CMBT (SPK Turkey), and its clients are protected up to EUR 30,000 through the Investor Protection Fund. The broker also allows its clients to trade with a maximum leverage of 1:10.

Company Information & Regulation Status

Deniz Yatırım, founded in 1998 and headquartered in Istanbul, Turkey, is a multi-asset trading platform that has established itself as a significant player in the financial markets.

The company facilitates trading in Stocks, Forex, Futures, Options, and various other financial instruments on the Istanbul Stock Exchange (ISE) and Turkish Derivatives Exchange (TurkDEX). Key points about Deniz Yatırım:

- Provides a mobile app for iOS and Android: DenizTrader PRO;

- Founder and CEO: Fatima Yuksel.

While Deniz Yatırım is a well-established and fully regulated investment firm under the Capital Markets Board of Turkey (SPK), it is not supervised by major international financial regulators.

Traders seeking brokers licensed by authorities such as the FCA, CySEC, or ASIC may find this lack of international oversight an important consideration.

Entity / Branch | Deniz Yatırım |

Regulation | CMBT (SPK Turkey) |

Regulation Tier | 2 |

Country | Turkey |

Investor Protection Fund / Compensation Scheme | YTM – up to 30,000 EUR |

Segregated Funds | No |

Negative Balance Protection | No |

Maximum Leverage | 1:10 |

Client Eligibility | Turkish residents |

Summary of Specifics

Unfortunately, due to limited information about Deniz Yatırım's broker services, a comprehensive summary of their specifics cannot be provided. However, based on available information, we can highlight some key aspects of their forex brokerage offering:

Broker | Deniz Yatırım |

Account Types | Forex, Investment account |

Regulating Authorities | CMBT (SPK Turkey) |

Based Currencies | TRY |

Minimum Deposit | 50,000 TRY |

Deposit/Withdrawal Methods | Bank Transfer |

Minimum Order | 0.01 |

Maximum Leverage | 1:10 |

Investment Options | YES |

Trading Platforms & Apps | MT5 |

Markets | CFDs on stocks, futures, options, currency pairs, precious metals, indices, Commodities |

Spread | 0,2 to 0,4 pips |

Commission | $1 |

Orders Execution | Market |

Margin Call/Stop Out | N/A |

Trading Features | Mobile Trading, Stock Trading |

Affiliate Program | No |

Bonus & Promotions | No |

Islamic Account | N/A |

PAMM Account | No |

Customer Support Ways | Email, Phone, Live Chat, Contact Form |

Customer Support Hours | 24/5 |

It's important for potential clients to conduct thorough research and possibly contact Deniz Yatırım directly for the most up-to-date and accurate information about their services and trading conditions.

Types of Accounts

As with other forex brokers, Deniz Yatırım offers two primary account types for traders:

Account | Focus | Platforms | Minimum account opening amount |

Forex | currency pairs, commodities, and CFDs | MetaTrader 5 | 1,500 USD |

Investment | stock trading and other investment products, Istanbul Stock Exchange | N/A | N/A |

Deniz Yatırım's account offerings cater to both forex traders and traditional investors, providing a range of options to suit different trading and investment styles.

Advantages and Disadvantages

When considering Deniz Yatırım as a forex broker, it's important to weigh its advantages and disadvantages:

Advantages | Disadvantages |

Established presence in the Turkish financial market | Lack of international regulation may concern some traders |

Access to MetaTrader 5, a popular and feature-rich trading platform | The high minimum deposit requirement (50,000 TRY) may be prohibitive for some |

Wide range of trading instruments, including forex, CFDs, and stocks | Limited information available about specific trading conditions |

Competitive spreads (reported to be between 0.2-0.4 pips) | May not offer as wide a range of educational resources |

Integration with DenizBank services for easy fund transfers | - |

Traders should carefully consider these factors, especially the limited Forex education, in light of their own trading needs and risk tolerance.

Signing Up & Verification Process

To open a Forex account with DenizFX, you must provide your personal details, including your contact details.

#1 Access and Initiate Deniz Yatırım Signup

Visit the official Deniz Yatırım website and click the “SIGN IN” button. From the login page, select “Sign Up” to begin creating a new account.

#2 Fill Out the Deniz Yatırım Registration Form

Enter your full name, email address, and phone number in the form fields. Next, create a strong, unique password to protect your account. Once done, check your inbox and confirm your email address through the link provided.

#3 Verify Your Identity on Deniz Yatırım

Navigate to the verification section within your user dashboard. Follow the on-screen instructions and upload the required identity documents as prompted. Completing this step activates your account for full trading access.

Deniz Yatırım’s Trading Platforms

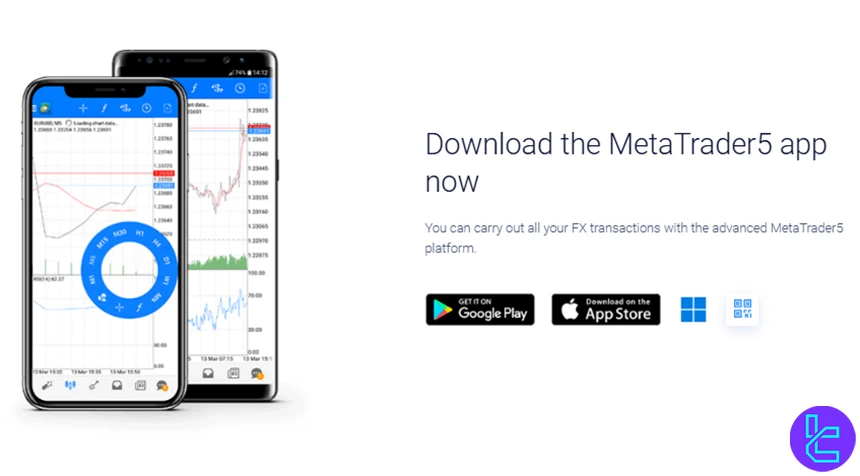

It appears that the broker has upgraded to MT5, which is the more advanced version of the popular MetaTrader series. Key features of the MT5 platform include:

- Advanced Charting: Multiple timeframes and over 80 built-in MT5 indicators;

- Automated Trading: Supports Expert Advisors (EAs) for algorithmic trading;

- Market Depth: View the full order book for better price analysis;

- Economic Calendar: Integrated calendar for tracking important economic events.

The widespread adoption of MetaTrader 5 in the forex industry ensures a wealth of resources and community support for users of the platform.

Spreads and Commission Structure

Deniz Yatırım offers competitive pricing for forex trading:

- Spreads: Ranged from 0.2 to 0.4 pips on major currency pairs;

- Commission: $1 per lot traded.

This pricing structure is quite competitive in the forex market, especially for a broker based in Turkey. The combination of tight spreads and a low per-lot commission can result in reduced trading costs for active traders.

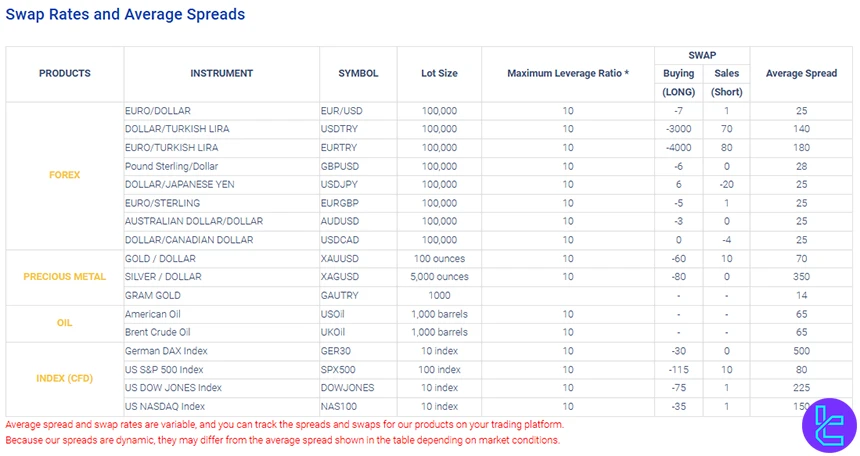

Swap Fee at Deniz Yatırım

Deniz Yatırım applies clearly defined overnight swap charges across its instruments, with rates varying per lot and per direction. For example, on EUR/USD, holding a long position overnight results in a –7 USD swap, while a short position earns +1 USD per lot.

These values change depending on market rates and are updated directly by the broker’s liquidity providers.

With these mechanics in mind, here are the key details:

- A 3-day swap is applied mid-week depending on the instrument group, significantly affecting positions in pairs like USDTRY and EURTRY;

- Swap is charged per lot in the quote currency and on USDJPY, for example, long positions earn +6 while short positions are charged –20 per lot;

- Exotic FX pairs such as USDTRY (–3000 / +70) and EURTRY (–4000 / +80) carry substantially higher swap rates due to Turkey’s interest-rate environment;

- There is no clear or officially stated swap-free / Islamic account option;

- Deniz Yatırım may adjust swap values at any time, reflecting changes in underlying bank funding costs.

Non-Trading Fees at Deniz Yatırım

DenizFX provides limited information on non-trading fees, and their official documentation does not mention any inactivity fee for dormant accounts.

The main costs disclosed relate primarily to withdrawal transactions and are clearly stated in their fee schedule.

These official details highlight what clients should expect regarding additional charges beyond trading:

- USD withdrawal fee: Withdrawals in USD are subject to a fee charged to the investor;

- No fee for local DenizBank account: Withdrawals in supported currencies to a DenizBank account are free of charge.

Deposit & Withdrawal Methods

Deniz Yatırım's deposit and withdrawal processes are primarily conducted through bank transfers, which is common for Turkish brokers. Important Notes:

- Only bank transfers are mentioned as a funding method, which may limit options for international clients;

- The high minimum deposit requirement of 50,000 TRY may be a barrier for some traders;

- Always verify the most current deposit and withdrawal procedures directly with Deniz Yatırım.

Deposit Methods at Deniz Yatırım

Available information on the broker’s deposit methods is limited, and the official resources do not provide a full breakdown of supported funding channels. However, certain operational sections indicate how clients are expected to fund their accounts.

Key Points:

- The Expenses section specifies that deposits can be made via “bank transfer”;

- The broker enforces a minimum deposit of 50,000 TRY, which is considerably higher than typical requirements among international brokers.

Withdrawal Methods at Deniz Yatırım

The situation regarding withdrawals does not differ much from deposits, as publicly available information remains limited and lacks a full breakdown of supported methods. Still, certain details provide insight into how withdrawal requests are handled.

Key Points:

- Withdrawal channels are not clearly listed, but operational notes imply processing is done primarily through “bank transfers”;

- For USD withdrawals, the fee is charged to the investor; however, no fee applies if the requested funds are already held by DenizBank;

- No minimum withdrawal amount is specified in the accessible documents.

Copy Trading & Investment Options

Deniz Yatırım offers copy trading options for investors looking to replicate the trades of successful traders. However, it's important to note that they do not offer PAMM (Percentage Allocation Management Module) accounts.

However, it's crucial to remember that copy trading still carries risks, and past performance doesn't guarantee results in the future. Traders should carefully select which traders to follow and monitor their performance regularly.

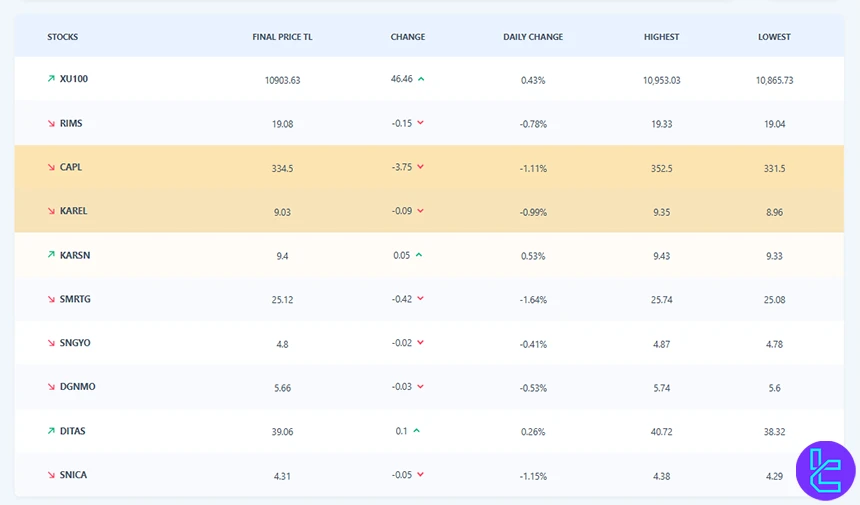

Tradable Markets & Symbols Overview

Deniz Yatırım, through its DenizFX platform, provides access to various financial instruments, including Forex, stocks, commodities, indices, options and futures.

VİOP, the Turkish Derivatives Market, allows clients to trade futures and options on equities, indices, currencies, and commodities with leverage, offering both speculative and hedging opportunities.

This table summarizes available markets at Deniz Yatırım:

Category | Type of Instruments | Number of Symbols | Competitor Average | Max. Leverage |

Forex | Major, minor and exotic pairs | 40+ | 40–100 | 1:10 |

Stocks / Equities | Individual stocks | 590+ | 300–5000 | N/A |

Commodity | Gold, Silver, Oil CFDs | 5+ | 5–20 | 1:10 |

Stock Indices / CFDs | Major indices CFDs, Turkish stock indices | N/A | 10–30 | 1:10 |

Options / Derivatives | Options contracts | N/A | 50–200 | N/A |

Futures | Various futures contracts | N/A | 500–1000 | N/A |

Bonuses and Promotion Offerings

As of the latest available information, Deniz Yatırım does not offer any specific bonuses or promotions for its forex trading services. This is not uncommon for established brokers, especially those focusing on providing competitive trading conditions rather than promotional offers.

Traders should base their choice of broker on factors such as trading conditions, platform quality, customer support, and overall reliability rather than promotional offers.

Deniz Yatırım Awards

Deniz Yatırım has not publicly received any industry awards. Official documents, including framework agreements and strategy reports, make no mention of recognitions or prizes, indicating the broker currently has no verifiable awards listed in its public disclosures.

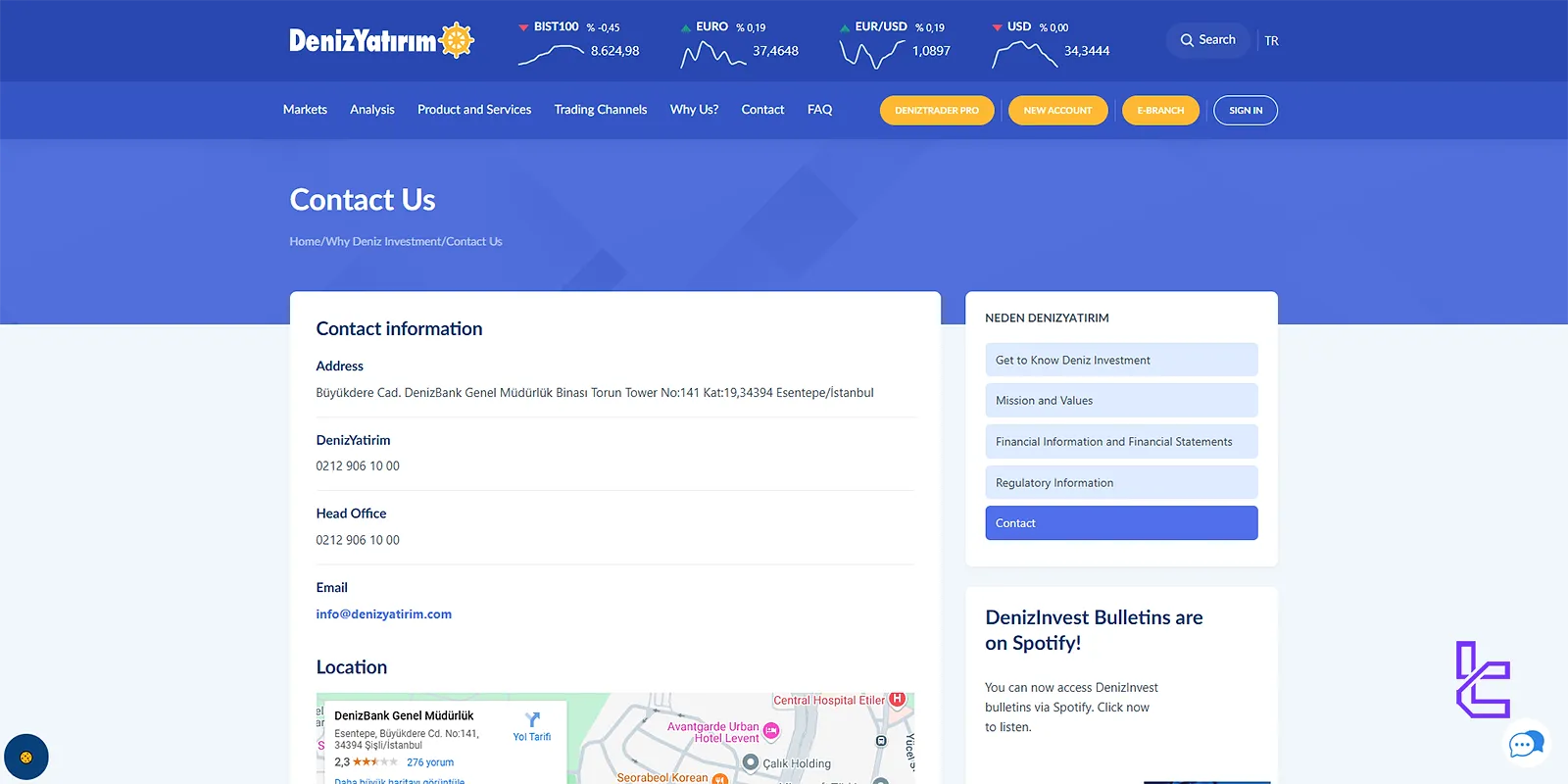

Support Team and Hours

Deniz Yatırım provides multiple channels for customer support, ensuring that traders can reach out for assistance through their preferred method:

- Email Support: info@denizyatirim.com

- Phone Support: 0212 906 10 00

- Contact Form

- Live Chat

Support Hours:

- Trading hours support (typically 24/5 for forex);

- General support during Turkish business hours.

While Deniz Yatırım offers multiple support channels, the quality and responsiveness of their customer service should be verified by potential clients. It's also important to note that as a primarily Turkish-focused broker, language support for international clients may be limited.

List of Restricted Countries

Unfortunately, specific information about Deniz Yatırım's list of restricted countries is not readily available. This lack of information is not uncommon for brokers primarily focused on serving the domestic market of their home country. Key points to consider:

- Deniz Yatırım is primarily focused on serving Turkish clients, which may limit their international reach;

- As a Turkish broker, it may face restrictions in offering services to clients in certain countries due to regulatory requirements;

- The availability of services to international clients may be limited or subject to specific conditions;

- Potential clients from outside Turkey should directly contact Deniz Yatırım to confirm if they can open an account.

Trust Scores & Reviews

While specific trust scores and reviews for Deniz Yatırım's brokerage services are not available, not even on Trustpilot, we can provide some context about the company's standing in the Turkish financial market:

- Established Presence: Founded in 1996, Deniz Yatırım has a long-standing presence in the Turkish financial sector;

- Part of DenizBank Group: As a subsidiary of DenizBank, it benefits from the backing of a major Turkish bank;

- Wide Client Base: Deniz Yatırım serves a diverse range of corporate and individual clients across Turkey.

Trust Considerations:

- Regulation: While respected in Turkey, the lack of international regulation may concern some traders;

- Transparency: The availability of public reviews and trust scores is limited;

- Track Record: Long history in Turkish markets, but international reputation may be less established.

Educational Resources on the Website

Educational resources for Deniz Yatırım Broker are currently not available. While the broker provides a wide range of trading instruments and integration with DenizBank services, it may not offer the same depth of educational materials as some international brokers.

This could be a limitation for beginner traders who rely on structured learning resources to develop their skills.

Deniz Yatırım Broker in Comparison with Others

Here is a detailed comparison of Deniz Yatırım features and those of other Forex brokers; Deniz Yatırım Comparison:

Parameters | Deniz Yatırım Broker | ||||

Regulation | CMBT (SPK Turkey) | ASIC, VFSC | FSC | FSA, FSC, Misa, FinaCom | No |

Minimum Spread | 0.2 Pips | 0.0 Pips | 0.0 Pips | 0.0 Pips | 0.1 Pips |

Commission | $1 | $0 | $0 | $0 | $0 |

Minimum Deposit | 50,000 TRY | $0 | $200 | $100 | $1 |

Maximum Leverage | 1:10 | 1:500 | 1:3000 | 1:3000 | 1:3000 |

Trading Platforms | MT5 | MetaTrader 4, MetaTrader 5, TradingView, cTrader | MetaTrader 4, MetaTrader 5, FXTM Trader App | MetaTrade 4, MetaTrade 5, Mobile App | MetaTrader 4, MetaTrader 5 |

Account Types | Forex, Investment account | Zero, Classic | ADVANTAGE, STOCKS, ADVANTAGE, ADVANTAGE PLUS | Standard, ECN, Fixed, Crypto | Standard, Premium, VIP, CIP |

Islamic Account | No | Yes | Yes | Yes | Yes |

Number of Tradable Assets | not specified | 250+ | 1000+ | 700+ | 45 |

Trade Execution | Not Specified | Market, Limit, Stop, Trailing Stop, Take Profit | Market | Market, Instant | Market, Instant |

Conclusion and Final Words

Deniz Yatırım offers a commission of $1 per lot traded and a minimum order size of 0.01. The platform operates with market execution of orders.

Customer support is available 24/7, and support methods include email, phone, live chat, and a contact form. Additionally, it offers copy trading services but does not support PAMM accounts.