Deriv offers complex derivative products, including Options and Multipliers on 5 asset classes (e.g., Forex, Stocks, and Cryptocurrencies) with floating spreads from 0.24 pips and no commissions. The FSA-regulated broker offers its affiliates a monthly income of up to $34,000.

Deriv Company Information

Deriv, formerly known as Binary.com, is a member of the Regent Markets Group, established in 1999. With its rebranding in 2020, the company has expanded its offerings to leveraged trading and CFD instruments.

The broker processes more than $46M in withdrawals per month and has a monthly volume of $650B. While it’s not licensed by any top-tier regulatory bodies, Deriv is regulated by multiple entities, including:

- Malta Financial Services Authority (MFSA) – License 70156

- Labuan Financial Services Authority (FSA) – License MB/18/0024

- Vanuatu Financial Services Commission (VFSC) – License 14556

- British Virgin Islands Financial Services Commission (BVI) License SIBA/L/18/1114

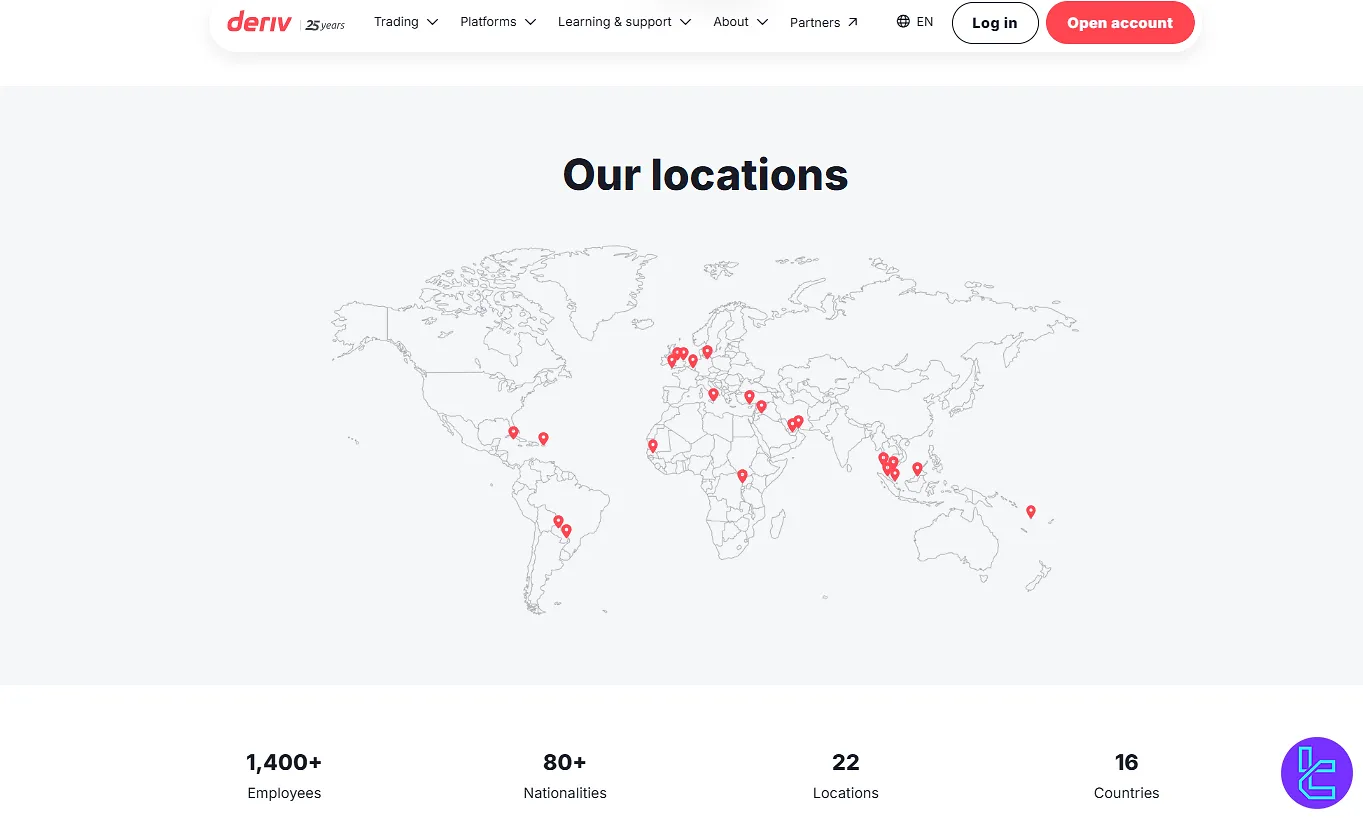

The company was founded by CEO Jean-Yves Sireau to provide a better trading experience than traditional brokers, focusing on innovation and accessibility. Key features of Deriv.com:

- Regulated by multiple financial authorities worldwide

- Over 2.5 million registered users across 16 countries

- More than 1,300 employees representing over 70 nationalities

- 187M+ monthly trades

- 20 global locations, including Berlin, Paris, Cyprus, Hong Kong, Singapore, and Dubai

It's important to note that the products offered by Deriv carry significant risks. 70.78% of retail investor accounts lose money when trading CFDs with this provider.

Before analyzing trading conditions, it is essential to understand the legal framework and regulatory oversight of Deriv. The following table outlines the broker’s different entities, their regulation tiers, country of registration, and investor compensation schemes. It also highlights key aspects such as negative balance protection, segregated funds, and maximum leverage offered by each branch:

Entity Parameters/Branches | Deriv Investments (Europe) Ltd | Deriv (BVI) Ltd |

| Deriv (V) Ltd |

Regulation | MFSA | FSC BVI | FSA | VFSC |

Regulation Tier | 1 | 3 | 3 | 3 |

Country | Birkirkara, Malta | British Virgin Islands |

| Port Vila, Vanuatu |

Investor Protection Fund/ Compensation Scheme | Up to EUR 20,000 under ICF | Up to €20,000 under Financial Commission | Up to EUR 20,000 under The Financial Commission | Up to EUR 20,000 under The Financial Commission |

Segregated Funds | Yes | Yes | Yes | Yes |

Negative Balance Protection | Yes | Yes | Yes | Yes |

Maximum Leverage | 1:30 | 1:2000 | 1:100 | 1:1000 |

Client Eligibility | Malta | Global | Global | Global |

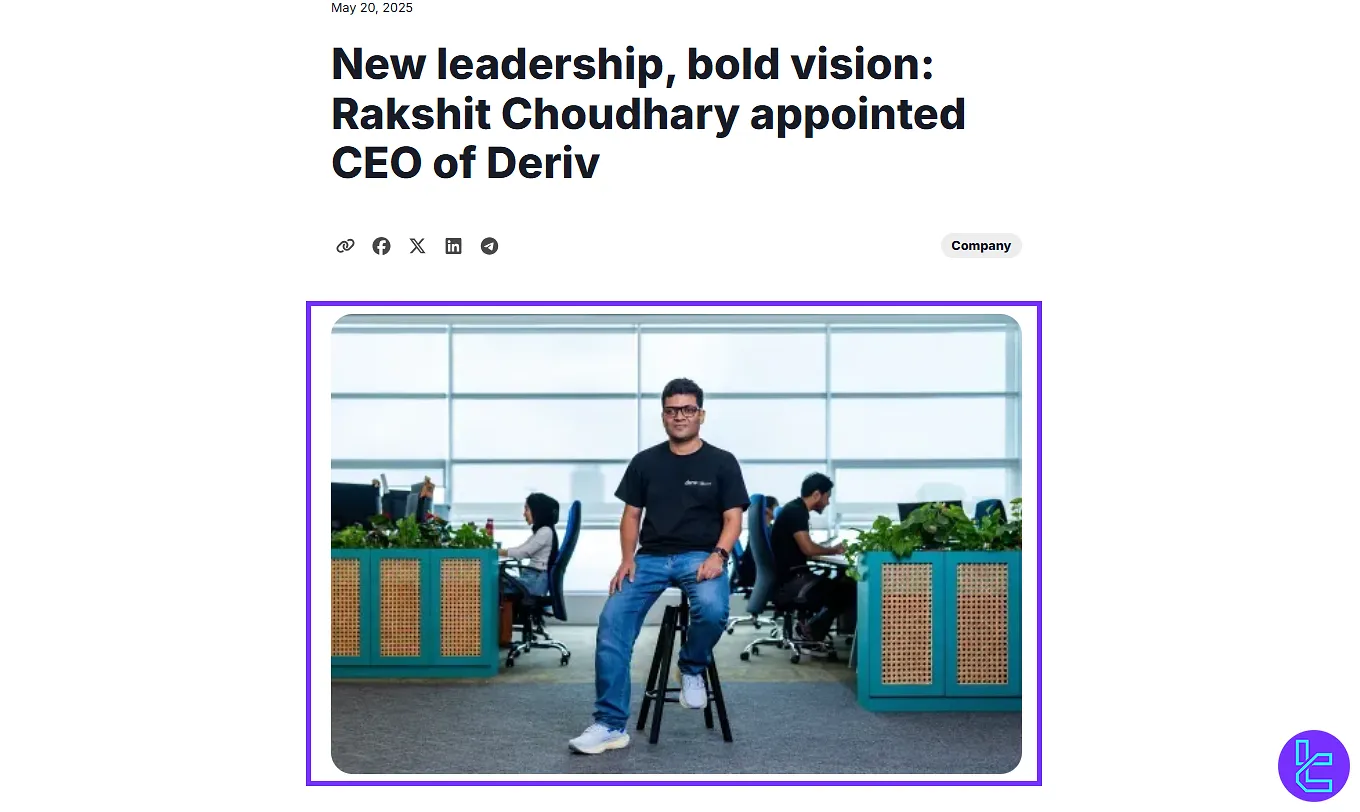

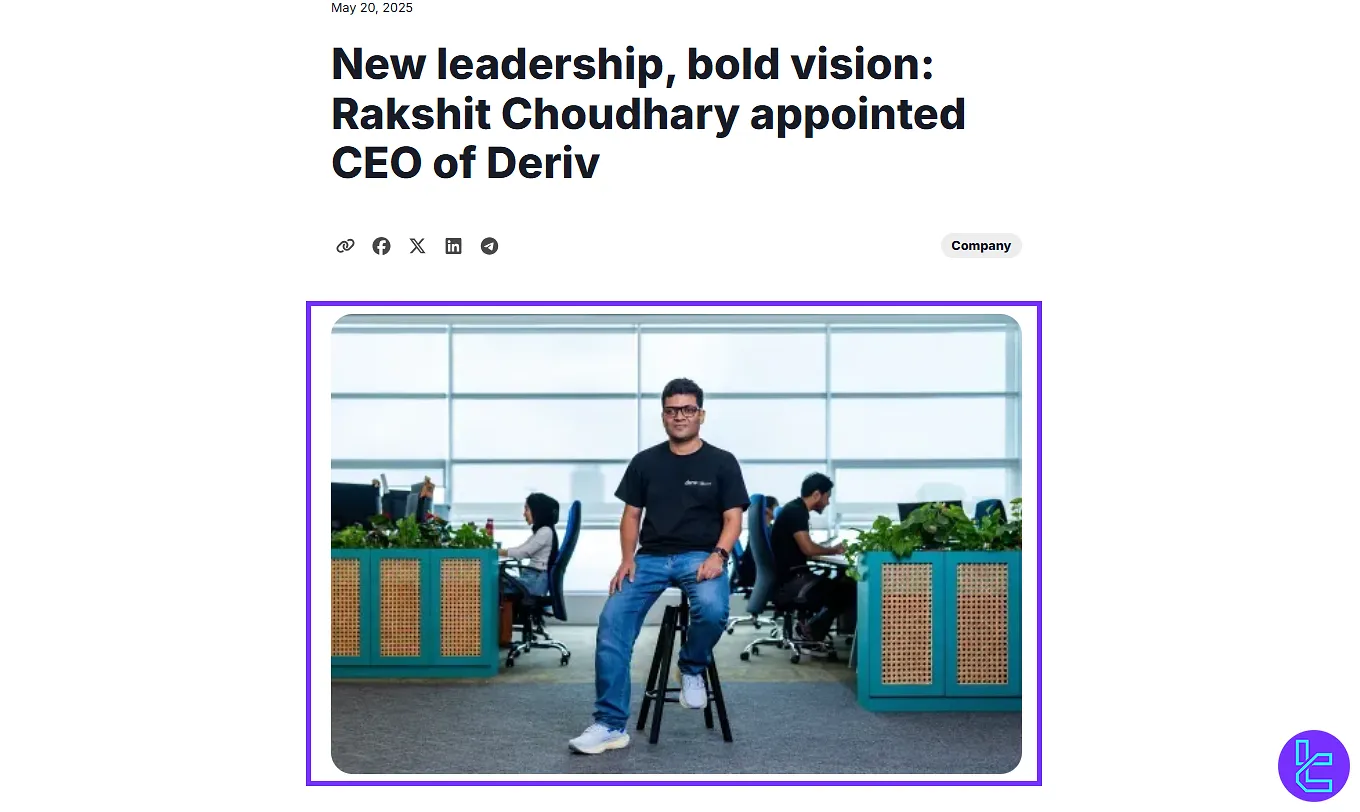

CEO of Deriv Broker

Deriv has announced a significant leadership change with Rakshit Choudhary stepping into the role of Chief Executive Officer.

A 16-year veteran of the company, Choudhary has progressed from intern to COO, then co-CEO, and now takes the helm to lead Deriv’s next phase of innovation.

His track record includes scaling the client base to over three million worldwide, introducing cutting-edge trading products, and driving the company’s mission to make trading simple, fair, and accessible.

This transition comes as Deriv accelerates its AI-firststrategy, backed by major investments in infrastructure, technology, and talent.

Founder Jean-Yves Sireau, who will remain majority shareholder, shifts his focus to strategic guidance and his new venture, n1.healthcare.To learn more about his career journey and professional background, visit Rakshit Choudhary’s LinkedIn profile.

Specifics of Deriv Broker

More than ten payment methods, 24/7 support, and a wide range of trading instruments are some of the features that make the broker stand out. Key specifications of Deriv.com:

Broker | Deriv |

Account Types | Standard, Financial, Swap-Free |

Regulating Authorities | MFSA, FSA, VFSC, BVI |

Based Currencies | USD, EUR, GBP, USDT, BTC, ETH, LTC, USDC |

Minimum Deposit | $5 |

Deposit Methods | Credit/Debit Cards, Online Banking, Mobile Payments, E-Wallets, Crypto, Voucher, Deriv P2P |

Withdrawal Methods | Credit/Debit Cards, Online Banking, Mobile Payments, E-Wallets, Crypto, Voucher, Deriv P2P |

Minimum Order | 0.01 lot |

Maximum Leverage | 1:1000 |

Investment Options | Copy Trading |

Trading Platforms & Apps | MT5, cTrader, Deriv X |

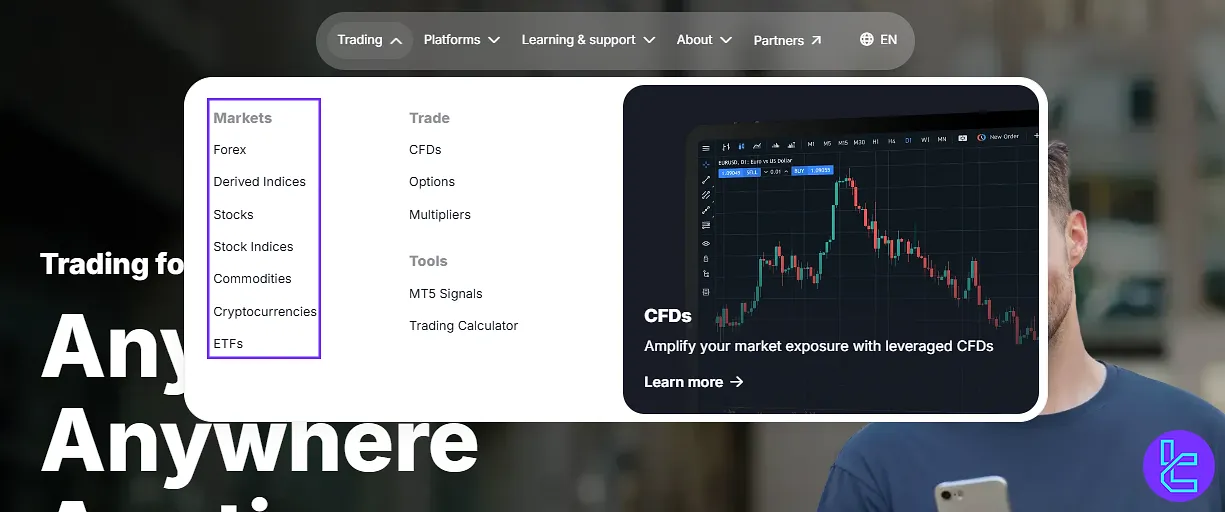

Markets | Forex, Stocks, Indices, Commodities, Cryptocurrencies, ETFs |

Spread | Floating from 0.24 pips |

Commission | $0.0 |

Orders Execution | Market |

Margin Call / Stop Out | 100% / 50% |

Trading Features | Blog, Copy Trading, MT5 Signals |

Affiliate Program | Yes |

Bonus & Promotions | Referral |

Islamic Account | Yes |

PAMM Account | No |

Customer Support Ways | Email, Live Chat, WhatsApp |

Customer Support Hours | 24/7 |

Account Types

Deriv offers two main account types for different trading preferences and experience levels:Deriv Trader and Deriv MT5. The first one is designed to provide Options trading on financial markets.

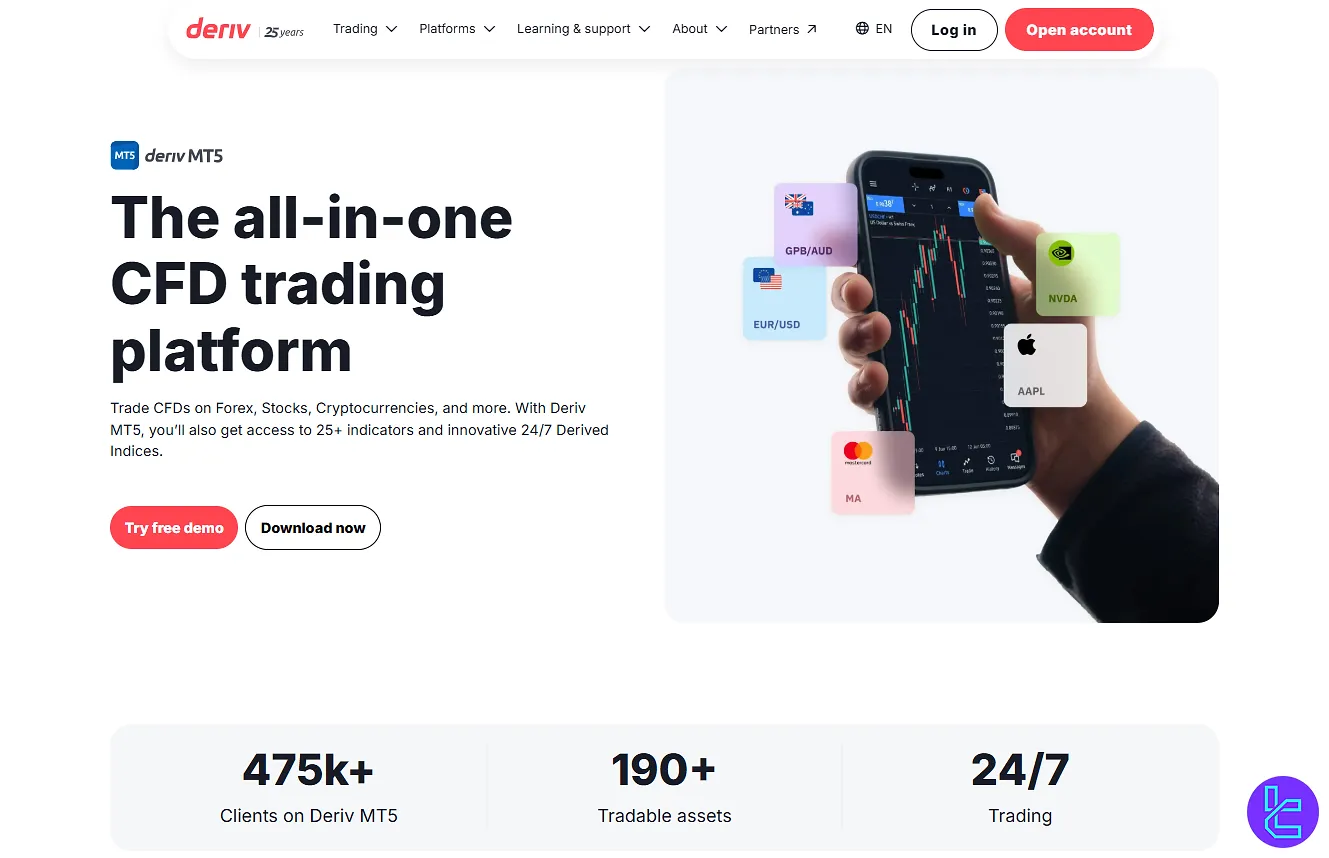

The MT5 account is exclusively for trading CFDs on Forex, Indices, Stocks, and Cryptocurrencies; Key features of Deriv MT5 Account:

Features | Standard | Financial | Swap-Free |

Min Deposit | $5.0 | $5.0 | $5.0 |

Leverage | 1:1000 | 1:1000 | 1:1000 |

Assets | 210+ | 170+ | 40+ |

Margin Call | 100% | 100% | 100% |

Stop Out | 50% | 50% | 50% |

Base Currency | USD, EUR, GBP, USDT, BTC, ETH, LTC, USDC | ||

There is also a free Demo account for beginners who might prefer practicing platform before depositing any money.

Deriv Pros & Cons

The broker provides secure segregation of client funds and uses SSL encryption to protect customer data, ensuring a safe trading environment. To help you make an informed decision, let's break down the main advantages and potential drawbacks of trading with Deriv.

Pros | Cons |

Wide range of tradable assets | Limited support options |

Leverage up to 1:1000 | Complex user interface |

Regulated by multiple financial authorities | No PAMM or MAM accounts |

24/7 multilingual customer support | - |

Registration and KYC on Deriv

The Deriv Registration requires only an email address. You can also sign up withGoogle, Facebook, or Apple accounts. You’ll select your account currency (USD, BTC, ETH, etc.), enter personal data, and complete email verification - all within 10 minutes.

#1 Begin at the Deriv Official Website

Click “Try Free Demo” on Deriv’s homepage and submit your email address to start.

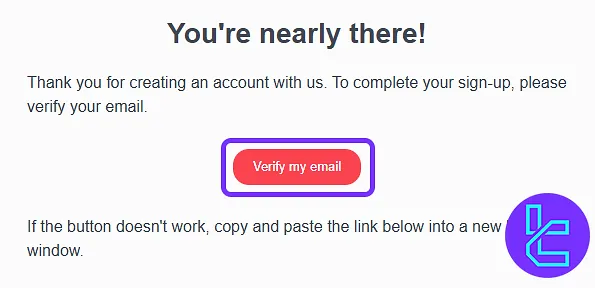

#2 Confirm Your Email on Deriv

Check your inbox and click “Verify my email” to activate the signup flow.

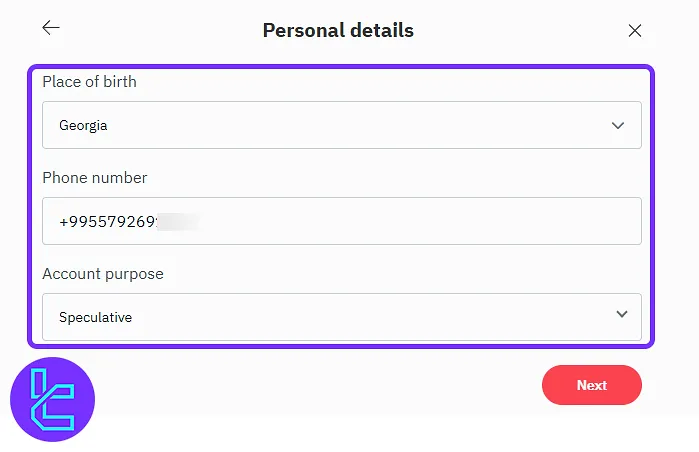

#3 Set Up Your Deriv Account

Choose your residence, create a secure password, and select your trading currency. Then enter your name, birth details, contact number, employment status, tax information, and account purpose.

#4 Add Address Details & Accept Deriv Terms

Provide your city, postal code, and region, then agree to the platform's terms to complete the setup.

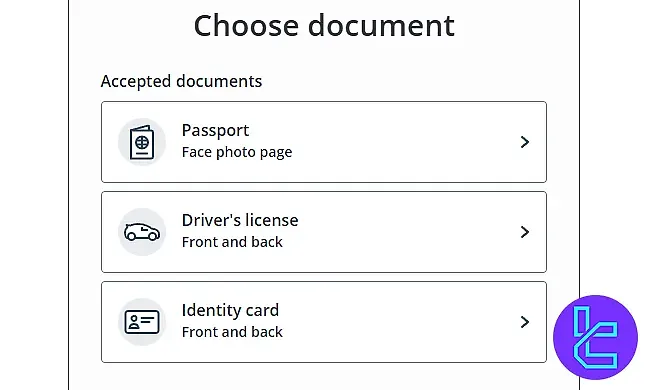

#5 Deriv Verification

After successfully creating an account, you can make deposit and withdrawal transactions up to $10,000 before Deriv Verification. However, let’s play it safe. Upload the KYC documents in the “Verification” menu from “Account Settings” in your dashboard. Deriv KYC documents:

- Proof of Identity: Passport or driver’s license

- Proof of Address: Utility bill or bank statement

Available Trading Platforms on Deriv

Deriv offers 2 primary trading platforms, each designed to cater to different trading preferences and styles. WhileDeriv Trader is designed for options trading, the designated platform for CFD trading is the robust MetaTrader 5. Deriv MT5download links:

- Windows

- macOS

- MetaTrader 5 Android

- MetaTrader 5 iOS

- Linux

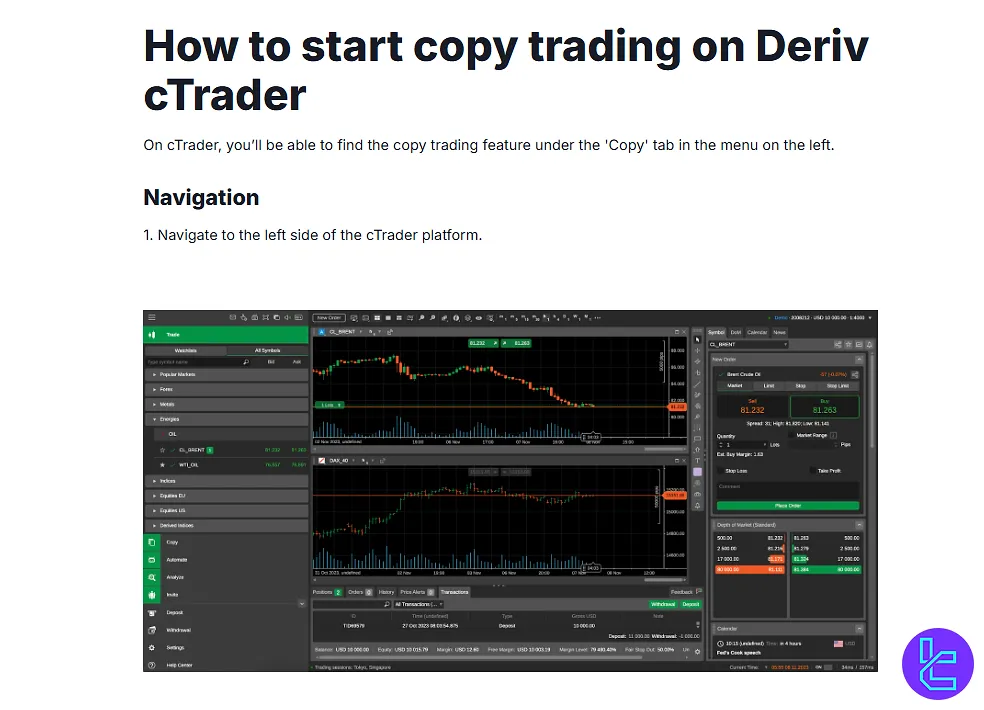

Deriv also offers copy trading services on 150+ financial assets with zero commissions through cTrader. DerivTrader download link:

- Windows

- macOS

- cTrader Android

- cTrader iOS

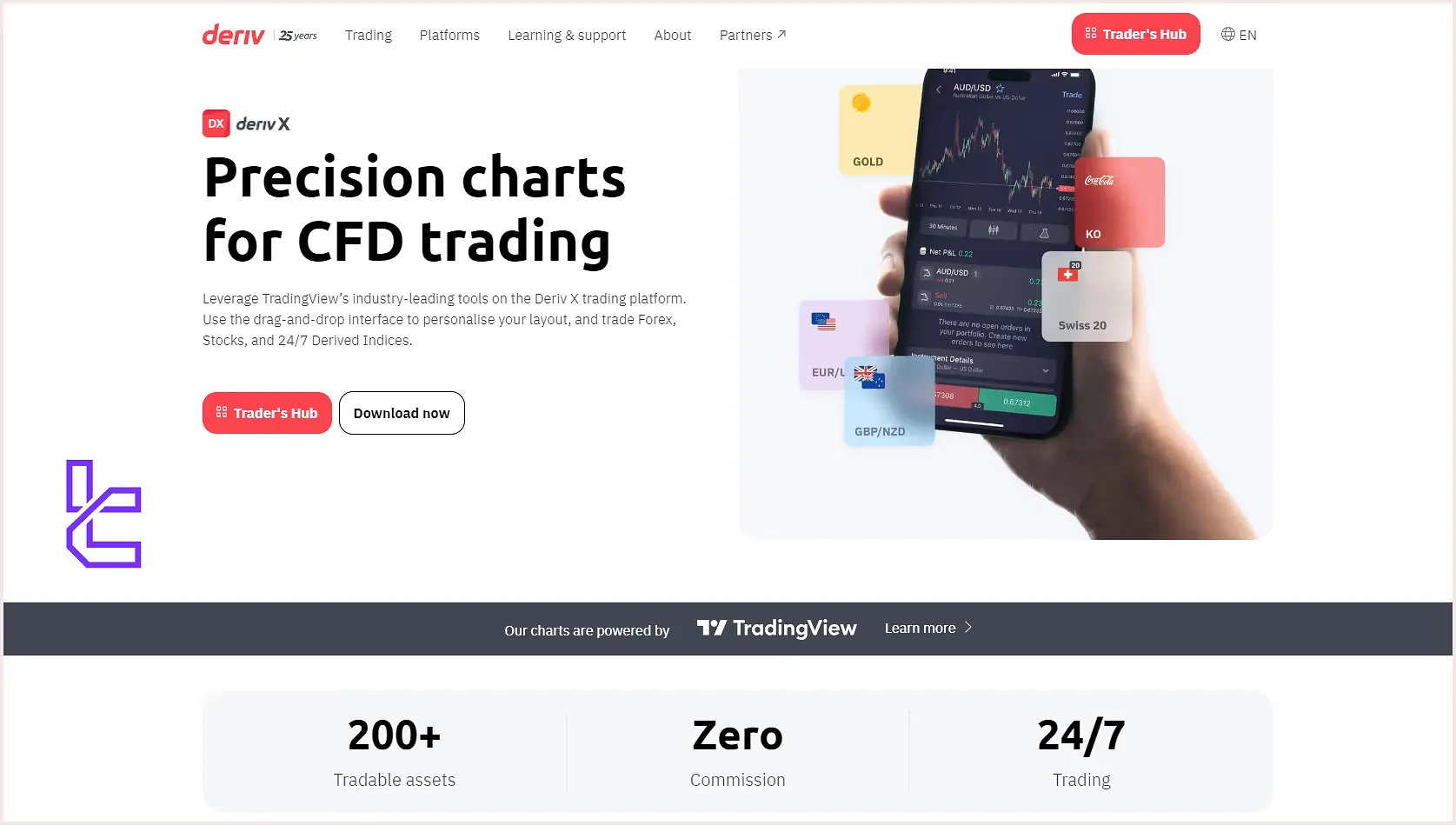

The broker also offers integrity with the cutting-edge trading platform, TradingView, through its Deriv X platform. Use it to trade Forex, Stocks, and Indices. Deriv X download links:

Trading Costs (Commission and Spread)

One of Deriv's standout features is its zero-commission trading accounts, which can potentially lead to significant cost savings for traders. The broker only charges spreads from 0.0 pips on CFD trading. Deriv broker’s spreads on various markets:

Asset Class | Spreads from (pips) | Max Leverage |

Forex | 0.3 | 1:1000 |

Derived Indices | 0.24 | 1:4000 |

Stocks | 0.6 | 1:50 |

Stock Indices | 0.6 | 1:100 |

ETFs | 1.0 | 1:5 |

Commodities | 0.6 | 1:500 |

Cryptocurrencies | 0.8 | 1:100 |

Here are the detailed spreads across different assets:

- EUR/USD: From 0.5 to 0.8 pips

- GBP/USD: From 0.5 to 0.8 pips

- Gold: From $0.29

- Bitcoin: Around $30

Swap Fees

On MetaTrader 5 Swap-Free accounts, overnight positions are subject to administration fees.

The timing of these charges depends on the asset type: for Derived indices, fees begin after the fifth day of holding a position, while for financial instruments, there is a 15-day grace period before any charges apply.

Once the grace period ends, a fixed daily fee — calculated in USD per lot — is applied.

The exact rate varies by trading instrument, and the formula used is:

Administration Fee (USD) × Trade Volume (lots)

Each instrument has its own fee schedule, and traders can review the specific costs for their preferred markets or explore fee policies for other account types by referring to the platform’s detailed documentation.

Non-trading Fees

An inactivity charge applies to accounts with no trading or transaction activity for a period exceeding 12 months. This dormant account fee is assessed every six months and can be as high as 25 USD, EUR, or GBP (or the equivalent in other currencies).

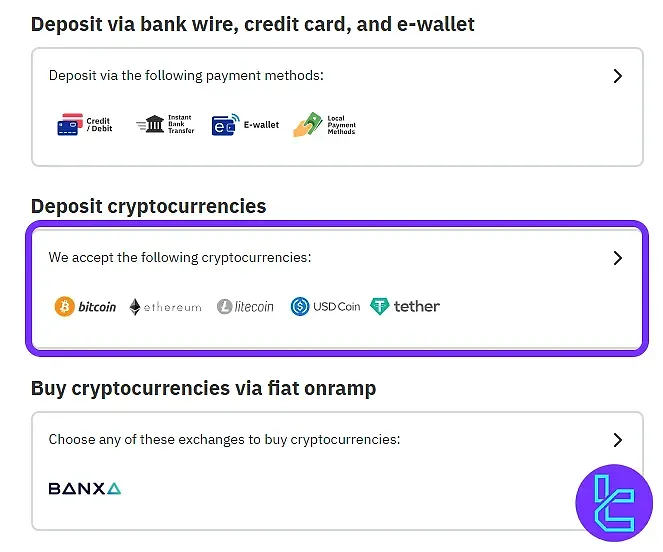

Available Payment Methods

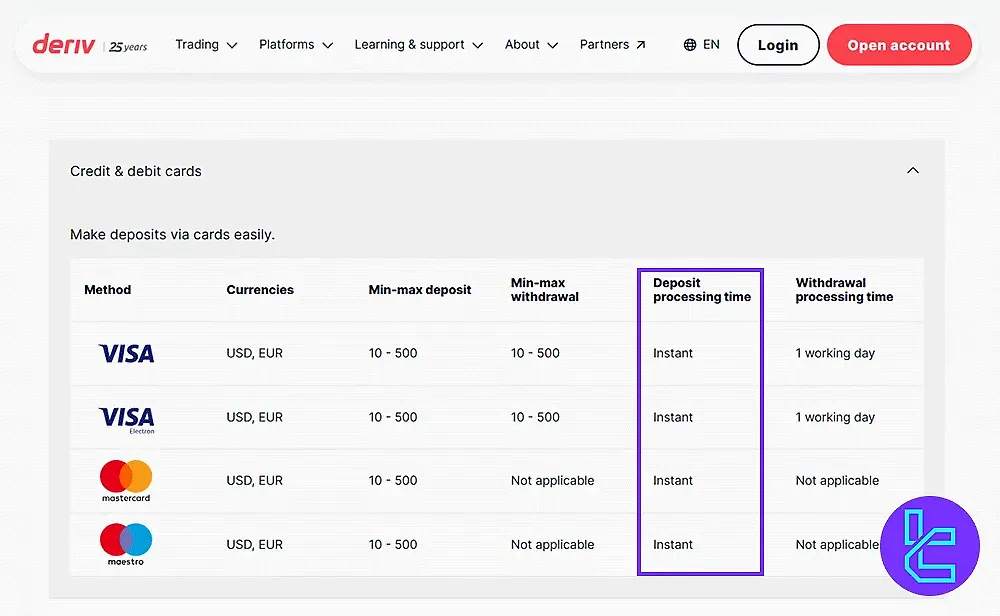

It’s time to explore payment options in this Deriv review. The broker offers a variety of methods to cater to its global client base. Deposit/Withdrawal methods on Deriv.com:

Methods | Gateway | Min/Max Deposit | Min/Max Withdrawal | Currencies |

Credit/Debit Cards | VISA, MasterCard, Maestro, Diners Club, Discover | 10 / 5,000 | 10 / 10,000 | USD, EUR, AUD |

Online Banking | Bank Wire, Pix, Help2Pay, ZingPay, Ozow, UPI | 5 / 5,000 | 10 / 10,000 | USD, EUR, AUD |

Mobile Payments | MTN, Airtel, Equitel, Vodafone, M-Pesa | 5 / 1,000 | 5 / 1,000 | USD |

E-Wallets | Volet, AirTM, Jeton, Neteller, Perfect Money, Skrill | 5 / 10,000 | 5 / 10,000 | USD, EUR, AUD |

Crypto | Bitcoin, Ethereum, Litecoin, Tether, USD Coin | Unlimited | Unlimited | BTC, USDT, ETH, LTC, USDC |

Voucher | OXXO, SPEI, 1Voucher, VeitQR, Jeton Cash | 5 / 5,000 | 5 / 1,000 | USD, EUR, AUD |

Deriv P2P | Deriv P2P | Up to 10,000 | Up to 10,000 | USD |

Deriv maintains a minimum deposit starting at just $5, though this may vary depending on the payment method or currency. For example:

- E-wallets and cards: $5

- Crypto: No enforced minimum

- P2P: $500

Deposit

Deriv supports fast, fee-free deposits through credit/debit cards and e-wallets, with limits ranging from $10 to $500. Card payments are processed instantly, while e-wallet funding is completed within one working day.

Available Deposit Methods:

- Credit/Debit Cards: Visa, Visa Electron, MasterCard, Maestro

- E-wallets: Skrill, Neteller, Jetonbank

Supported Currencies:

- Cards – USD, EUR

- E-wallets – USD, EUR (Jetonbank: EUR only)

Deposit Summary Table:

Method | Processing Time | Min–Max Amount | Currencies | Fees |

Visa / Visa Electron | Instant | $10–$500 | USD, EUR | None |

MasterCard / Maestro | Instant | $10–$500 | USD, EUR | None |

Skrill | 1 day | $10–$500 | USD, EUR | None |

Neteller | 1 day | $10–$500 | USD, EUR | None |

Jetonbank | 1 day | $10–$500 | EUR | None |

Deriv TRC20 Deposit

The Deriv TRC20 deposit option allows funding with Tether (USDT) on the TRC-20 network, starting from $50. To deposit, log in to your Deriv account, click “Deposit Now”, choose Cryptocurrency, and select Tether (TRC-20).

A unique wallet address will be generated—transfer your USDT to this address using your crypto wallet. Blockchain confirmation usually takes around five minutes.

Once processed, the amount will appear in your account balance. Transactions can be verified via the Statement section. Each wallet address is single-use, so a new one must be generated for every deposit.

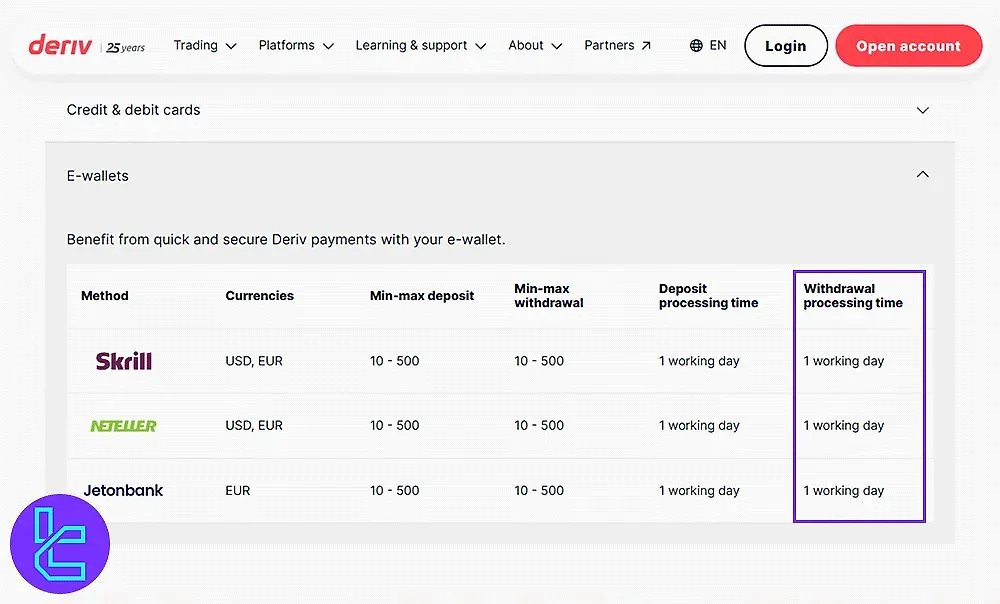

Withdrawal

Withdrawals on Deriv are completed within 1 working day, with no service charges applied. Payments can be made via cards and e-wallets, with limits between $10 and $500 per transaction.

Available Withdrawal Methods:

- Cards: Visa, Visa Electron (MasterCard and Maestro are not supported for withdrawals)

- E-wallets: Skrill, Neteller, Jetonbank

Supported Currencies:

- Cards – USD, EUR

- E-wallets – USD, EUR (Jetonbank: EUR only)

Withdrawal Summary Table:

Method | Processing Time | Min–Max Amount | Currencies | Fees |

Visa / Visa Electron | 1 day | $10–$500 | USD, EUR | None |

Skrill | 1 day | $10–$500 | USD, EUR | None |

Neteller | 1 day | $10–$500 | USD, EUR | None |

Jetonbank | 1 day | $10–$500 | EUR | None |

Copy Trading and Growth Plans

The broker offers copy trading functionality through its Deriv cTrader platform, allowing less experienced traders to benefit from the expertise of successful traders. Key features of Deriv copy trading service:

- Automatically replicate trades of experienced Strategy Providers;

- Access global financial markets, including Forex, ETFs, stocks, indices, and Derived Indices;

- 24/7 trading is available on some instruments;

- Covers 150+ tradable assets.

Deriv Broker Financial Markets

The next step in this Deriv review is exploring available markets and financial instruments on the broker.

The table below reviews the instruments available on the Deriv broker:

Category | Types of Instruments | Number of Symbols | Competitor Average |

Forex | Major, Minor, Exotic, and Micro Currency Pairs (via MT5) | Approx. 70+ Pairs | 68–180 Pairs (e.g., OANDA ~68 Pairs; Saxo ~180 Pairs) |

S tocks | Stock CFDs (e.g., TSLA, AMZN, AAPL, etc.) | ~58+ Instruments | Typically, Hundreds of Underlying CFDs on FX Brokers |

Indices | Standard and Derived Indices (Synthetic, 24/7 Tradable) | Multiple Global Indices , Exact Count Unspecified | Varies Widely; Mid-Tier Brokers often Offer ~30–50 Index CFDs |

Commodities | Gold, Silver, Oil, Natural Gas, Sugar, etc. | Available (Symbol Counts not Public) | Usually ~20–40 Commodity CFDs at Competitors |

Cryptocurrencies | Crypto CFDs (e.g., Bitcoin, Ethereum, Altcoins) | ~30+ Instruments | 10–15 on Average; Top Providers like Eightcap offer 95+ |

ETFs | ETF CFDs (via MT5) | Available (Symbol Counts Unspecified) | Often ~50–200 Depending on Broker’s Scope |

Does Deriv Offer Bonus and Promotion Plans?

While the broker doesn't offer traditional bonuses or promotions for traders, they do have an attractive affiliate program.

- Up to $34,000 income per month

- Commissions for qualified referrals who deposit on Deriv platforms

- Available in over 190 countries

- Over $47 million in payouts to affiliates since inception

- Marketing materials

- 24/7 customer support for affiliates

Deriv Award for Affiliate Program

Deriv, has received the ‘Best Partner Programme’ award at the inaugural FX Trust Score Awards.

This recognition comes after other recent accolades, including ‘Broker of the Year’ (Global) and ‘Most Trusted Broker’ (Africa) from the Finance Magnates Awards , as well as ‘Best Customer Support’ from the Global Forex Awards .

Customer Support

Another key aspect of the Deriv review is customer support. The broker prioritizes customers by providing several contact channels.

However, a lack of phone support can be a letdown for potential clients.

complaints@deriv.com | |

Live Chat | Message |

Deriv Broker Geo-restrictions

The list of restricted countries is one of the most important topics in this Deriv review. Before creating an account and depositing funds, you should ask if the broker provides services in your region. Restricted countries on Deriv broker:

- USA

- Canada

- Israel

- Malaysia

- Belarus

- Caribbean

- Cayman Islands

- Hong Kong

- Jersey

- Iran

Trust Scores

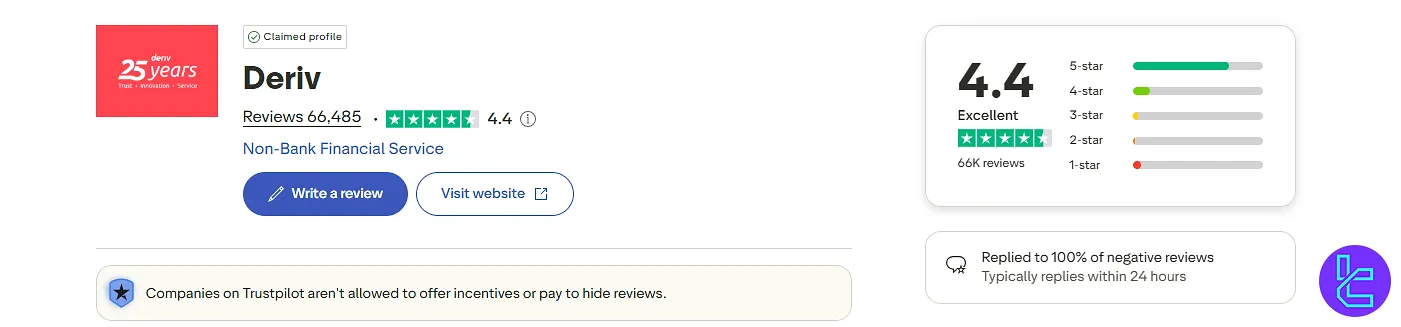

The company has established itself as a reputable broker in the online trading industry.

With a score of 4.4 on TrustPilot, it’s safe to say that the majority of clients are happy with the company. Deriv trust scores:

4.4 out of 5 based on 52,758 reviews | |

Reviews.io | 3.4 out of 5 based on 7 reviews |

Does Deriv Broker Provide Educational Materials?

The last topic that we discuss in this Deriv review is the educational material provided by the broker. The company offers some educational resources, though they may be limited compared to other brokers.

- Blog with articles on basic trading concepts and strategies

- A community to share ideas, knowledge, and many more

Deriv in Comparison with Others

Let's compare the key features of Deriv with some other brokers;Deriv Comparison:

Parameters | Deriv Broker | |||

Regulation | MFSA, FSA, VFSC, BVI | ASIC, VFSC | FSC | FSA, FSC, Misa, FinaCom |

Minimum Spread | 0.24 pips | 0.0 Pips | 0.0 Pips | 0.0 Pips |

Commission | $0 | $0 | $0 | $0 |

Minimum Deposit | $5 | $0 | $200 | $100 |

Maximum Leverage | 1:1000 | 1:500 | 1:3000 | 1:3000 |

Trading Platforms | MT5, cTrader, Deriv X | MetaTrader 4, MetaTrader 5, TradingView, cTrader | MetaTrader 4, MetaTrader 5, FXTM Trader App | MetaTrade 4, MetaTrade 5, Mobile App |

Account Types | Demo, Standard, Financial, Swap-Free | Zero, Classic | ADVANTAGE, STOCKS, ADVANTAGE, ADVANTAGE PLUS | Standard, ECN, Fixed, Crypto |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | 200+ | 250+ | 1000+ | 700+ |

Trade Execution | Market | Market, Limit, Stop, Trailing Stop, Take Profit | Market | Market, Instant |

Conclusion and Final Words

Deriv provides CFDs, Futures, and Options trading with a low entry barrier of $5. It also offers some assets like crypto and customized Indices (Derived Indices) for 24/7 trading.

Deriv broker has a leverage options of up to 1:1000, and provides commission-free trading. Derive reviews on TrustPilot has gained the company a great score of 4.4.