Deriv verification is a 4-step process required to activate all trading features. The process includes identity verification and proof of address.

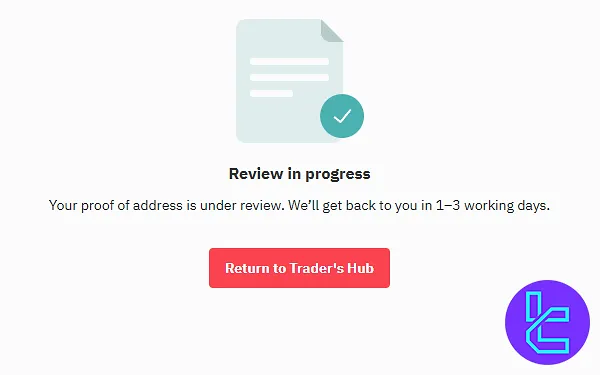

The procedure takes around 5 minutes, but document review may take 1 to 3 business days. After verifying your account in Deriv, you can trade in 7 different markets, including Forex, commodities, indices, ETFs, stocks, and metals.

A Step-by-Step Guide for Deriv KYC

After Deriv registration, you can verify your DerivForex Broker account through a 4-step process and gain full access to all its features.

Deriv broker verification’s key steps:

- Accessing the “Verification” Section;

- Providing Proof of Identity Documents;

- Submitting Proof of Address;

- Tracking the KYC Status.

Having the documents listed below is necessary to complete Deriv KYC.

Verification Requirement | Yes/No |

Full Name | No |

Country of Residence | Yes |

Date of Birth Entry | No |

Phone Number Entry | No |

Residential Address Details | Yes |

Phone Number Verification | No |

Document Issuing Country | Yes |

ID Card (for POI) | Yes |

Driver’s License (for POI) | Yes |

Passport (for POI) | Yes |

Residence Permit (for POI or POA) | Yes |

Utility Bill (for POA) | Yes |

Bank Statement (for POA) | Yes |

2-Factor Authentication | No |

Biometric Face Scan | Yes |

Financial Status Questionnaire | No |

Trading Knowledge Questionnaire | No |

Restricted Countries | Yes |

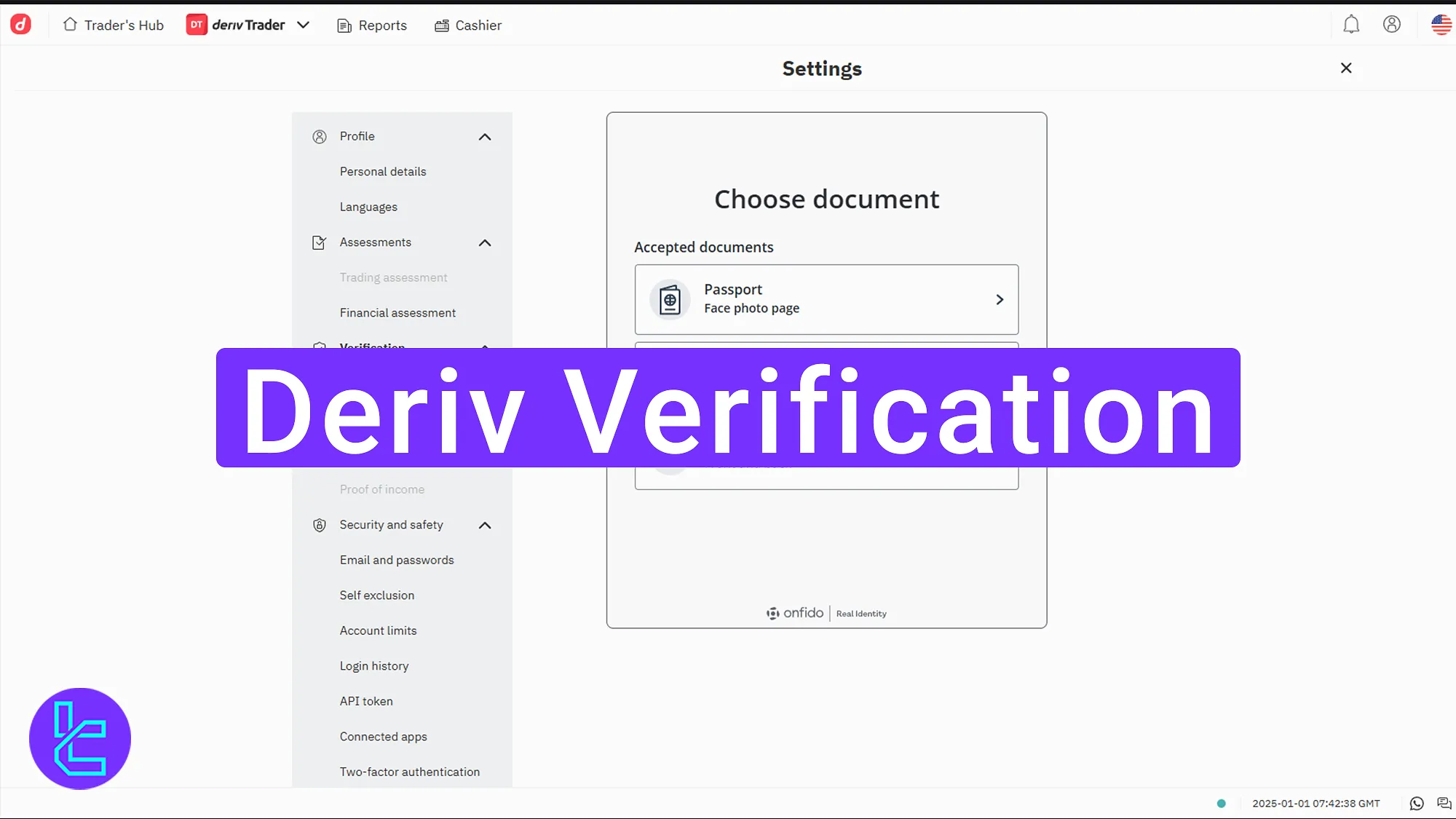

#1 Accessing the “Verification” Section

Log in to the Deriv dashboard, click on the "avatar icon", and navigate to the "Profile" section.

#2 Providing Proof of Identity Documents

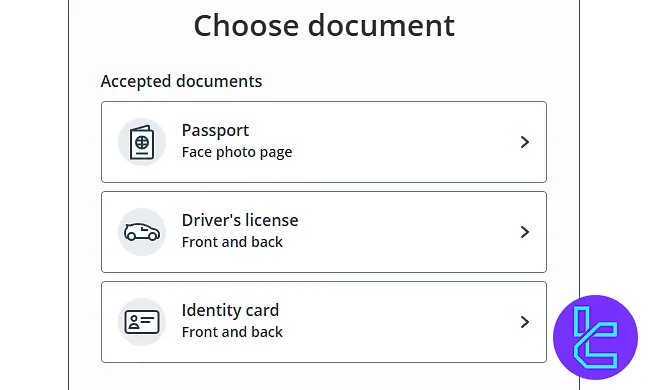

Go to the "Verification" section, select "Proof of Identity", and choose a country.

Select a valid ID document, such as a passport, national ID card, or driver's license.

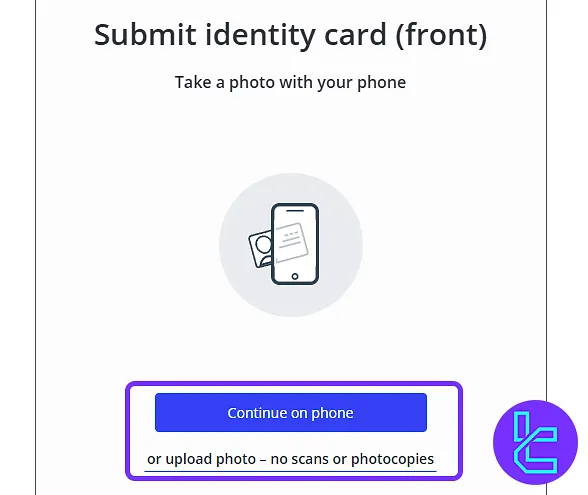

Upload the front and back of the ID using either a mobile phone camera or by uploading a scanned file.

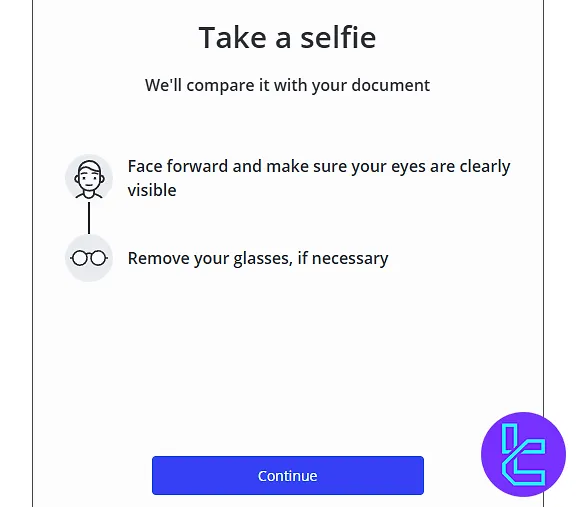

Take a selfie to allow the broker to match it with your ID documents.

#3 Submitting Proof of Address

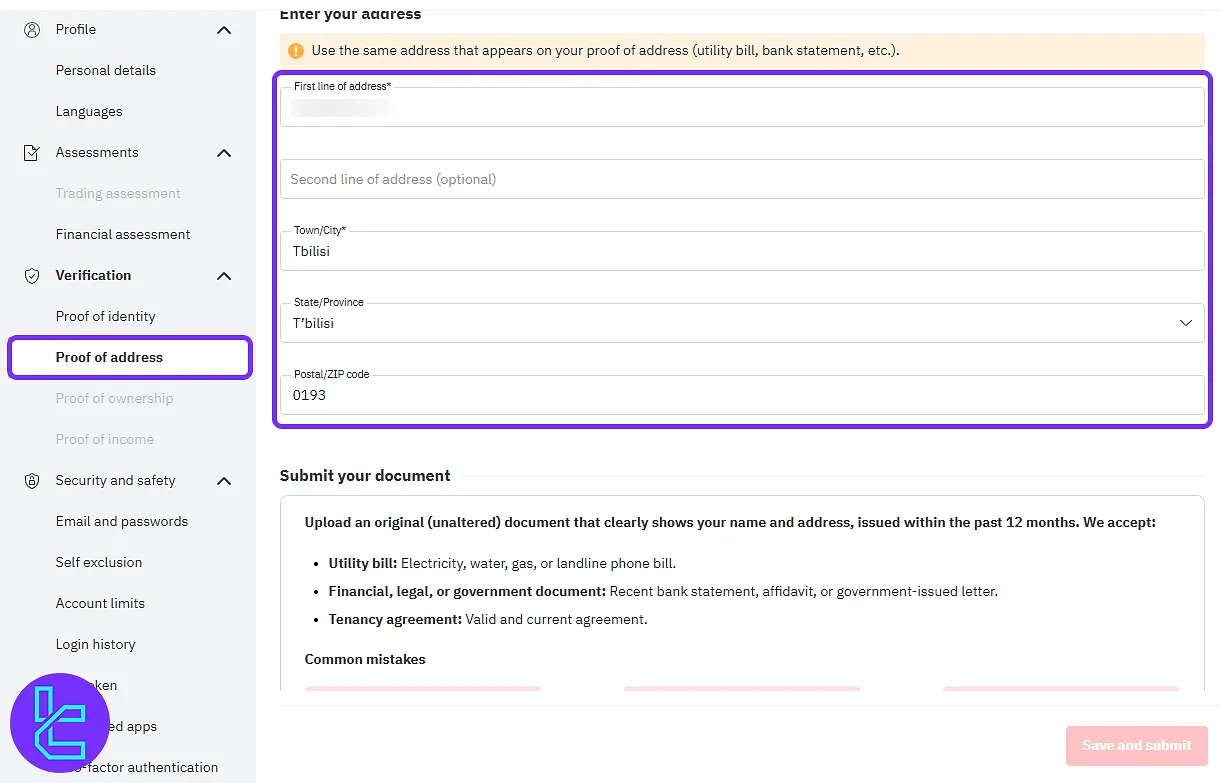

Click on "Proof of Address", enter your full address (street name, city, state) and postal code, and proceed to document upload.

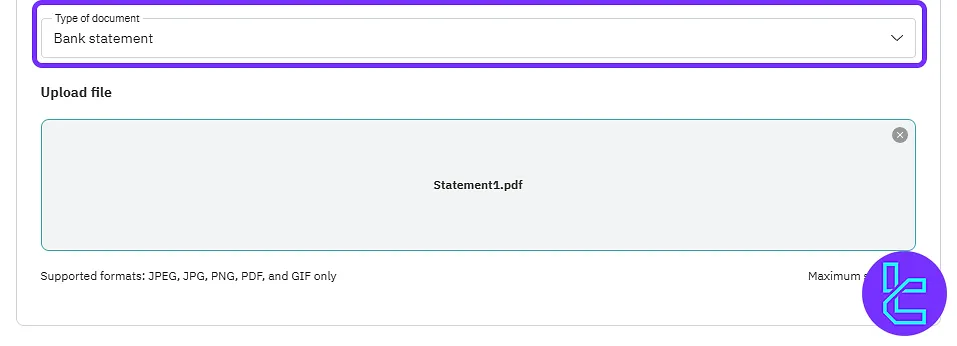

Select an accepted proof of address document, such as a bank statement, utility bill, or tenancy agreement then upload it to the broker. Click on "save and submit" button to proceed.

#4 Tracking the KYC Status

To check the KYC status, go to the "Verification" section under the "Profile" menu.

Here is a comparison of the KYC requirements in Deriv and 3 Other Forex brokers.

Verification Requirement | Deriv Broker | |||

Full Name | No | Yes | Yes | No |

Country of Residence | Yes | No | Yes | Yes |

Date of Birth Entry | No | Yes | Yes | No |

Phone Number Entry | No | No | No | No |

Residential Address Details | Yes | Yes | Yes | Yes |

Phone Number Verification | No | Yes | No | No |

Document Issuing Country | Yes | Yes | Yes | No |

ID Card (for POI) | Yes | Yes | Yes | Yes |

Driver’s License (for POI) | Yes | Yes | Yes | Yes |

Passport (for POI) | Yes | Yes | Yes | Yes |

Residence Permit (for POI or POA) | Yes | Yes | Yes | No |

Utility Bill (for POA) | Yes | No | Yes | Yes |

Bank Statement (for POA) | Yes | No | Yes | Yes |

2-Factor Authentication | No | No | No | No |

Biometric Face Scan | Yes | No | Yes | No |

Financial Status Questionnaire | No | Yes | No | Yes |

Trading Knowledge Questionnaire | No | Yes | Yes | No |

Restricted Countries | Yes | Yes | Yes | Yes |

TF Expert Suggestion

Deriv verification and document review take between 1 to 3 days to complete. Traders can upload a passport, National ID, driver’s license for proof of identity, and a bank statement, a utility bill, or a tenancy agreement for proof of address.

After completing the KYC process, visit the Deriv tutorial page to learn more about Deriv's deposit and withdrawal methods to fund your account and start trading.