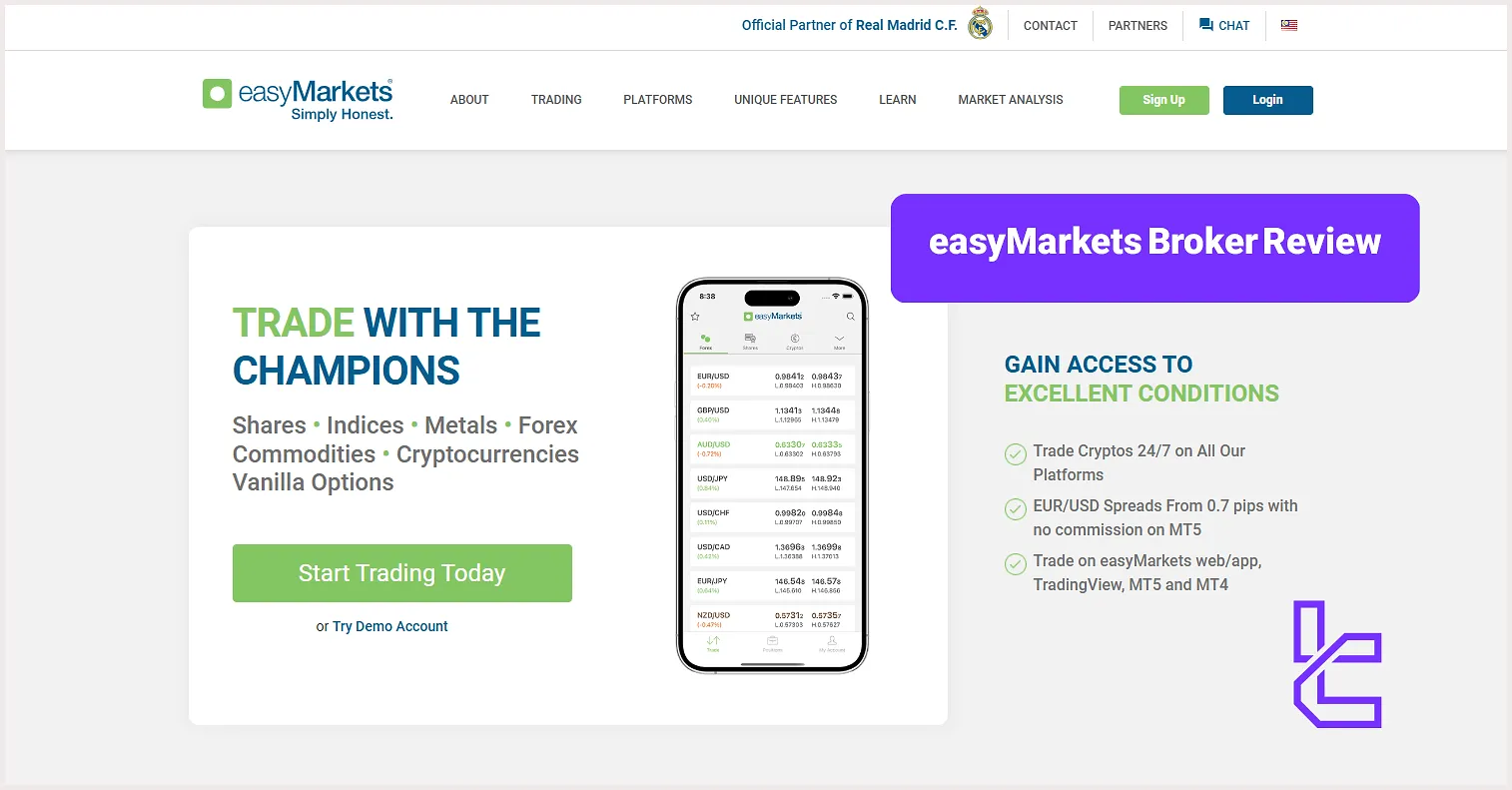

easyMarkets won the “Best Forex/CFD Broker” award in TradingView awards 2023 and the “Leading Broker of the Year” prize at the Forex Expo Dubai 2024. The broker provides commission-free trading for a minimum deposit of $25.

easyMarkets offers maximum leverage of 1:2000 for traders seeking amplified exposure. Also, it operates under regulators including ASIC, CySEC, FSCA, FSA Seychelles and FSC BVI.

easyMarkets (Is the Company Regulated?)

Easy Markets is a Cyprus-based brokerage company led by CEO Nikos Antoniades. The Forex broker was founded in 2021, and since then, it has acquired multiple licenses from top-tier regulatory bodies, including:

Entity Parameter / Branches | Easy Forex Trading Ltd (Cyprus) | Easy Markets Pty Ltd (Australia) | EF Worldwide Ltd (Seychelles) | EF Worldwide Ltd (BVI) | EF Worldwide (PTY) Ltd (South Africa) |

Regulation | CySEC | ASIC | FSA Seychelles | FSC BVI | FSCA South Africa |

Regulation Tier | 1 | 1 | 4 | 3 | 2 |

Country | Cyprus | Australia | Seychelles | British Virgin Islands | South Africa |

Investor Protection / Compensation Scheme | ICF –€20,000 | None | None | None | None |

Segregated Funds | Yes | Yes | Yes | Yes | Yes |

Negative Balance Protection | Yes | Yes | Yes | Yes | Yes |

Maximum Leverage | 1:30 | 1:30 | 1:2000 | 1:2000 | 1:2000 |

Client Eligibility | EU / EEA (except Espain) | Australia (retail) | International (except restricted) | International (except restricted) | South Africa |

easyMarkets Broker Specifications

The company offers a comprehensive suite of trading services and features designed to cater to novice and experienced traders. Here's a table summarizing the key specifications of Easy Markets.

Broker | easyMarkets |

Account Types | easyMarkets Web/App and TradingView, MT4, MT5 |

Regulating Authorities | CySEC, ASIC, FSA, FSC, FSCA |

Based Currencies | USD, GBP, EUR, CAD, CZK, JPY, NZD, AUD, PLN, TRY, CNY, HKD, SGD, CHF, MXN, NOK, SEK, ZAR |

Minimum Deposit | $25 |

Deposit Methods | VISA, MasterCard, Maestro, Bank Wire, Skrill, Neteller, Fast Bank Transfers |

Withdrawal Methods | VISA, MasterCard, Maestro, Bank Wire, Skrill, Neteller, Fast Bank Transfers |

Minimum Order | 0.01 lots |

Maximum Leverage | 1:2000 |

Investment Options | None |

Trading Platforms & Apps | MT4, MT5, TradingView, Proprietary platform |

Markets | Forex, Indices, Metals, Commodities, Crypto, Stocks |

Spread | Fixed, Variable |

Commission | None |

Orders Execution | Market |

Margin Call / Stop Out | 70% / 30% (EU residents only) |

Trading Features | Mobile Trading, Market Analysis, Futures, Options, dealCancellation, Freeze Rate, Free Guaranteed Stop Loss |

Affiliate Program | Yes |

Bonus & Promotions | Referral, First Deposit, Sign Up |

Islamic Account | Yes |

PAMM Account | No |

Customer Support Ways | Email, Live Chat, Phone, Facebook Messenger, Viber, WhatsApp |

Customer Support Hours | 24/5 |

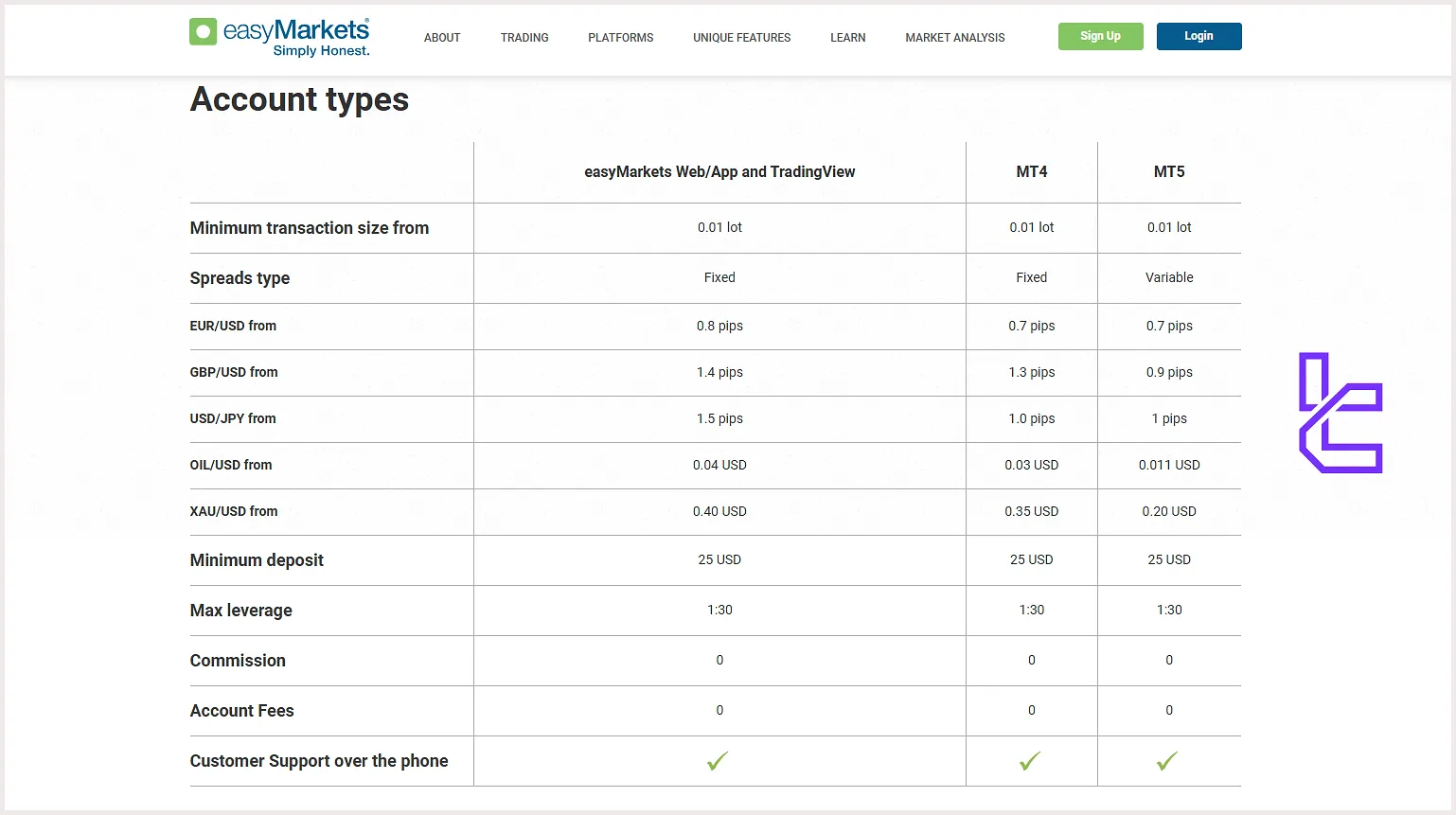

easyMarkets Account Types

Easy Markets previously only offered Fixed Spread accounts. However, as of 2022, by utilizing the robust MetaTrader 5 trading features, it also offers Variable Spread accounts.

easyMarkets offers Islamic accounts with a position-holding period of two weeks

easyMarkets offers Islamic accounts with a position-holding period of two weeks

Comparison between easyMarkets account types:

Features | easyMarkets Web/App and TradingView | MT4 | MT5 |

Min Order Size | 0.01 lots | 0.01 lots | 0.01 lots |

Base Currency | USD, GBP, EUR, CAD, CZK, JPY, NZD, AUD, PLN, TRY, CNY, HKD, SGD, CHF, MXN, NOK, SEK, ZAR | ||

Commission | $0 | $0 | $0 |

Spreads Type | Fixed | Fixed | Variable |

Max Leverage | 1:400 | 1:400 | 1:200 |

Phone Support | Yes | Yes | Yes |

Guaranteed Stop Loss | Yes | No | No |

Min Deposit | $25 | $25 | $25 |

The company also offers professional accounts with leverage up to 1:500 under certain conditions, including a €500,000 portfolio and work experience in the financial sector.

easyMarkets Pros & Cons

When considering Easy Markets as your broker, weighing its advantages and potential drawbacks is essential to make an informed decision.

Pros | Cons |

Regulated by multiple top-tier authorities | Limited range of tradable assets |

Trading Safety Features (No Slippage and Guaranteed Stop Loss) | No cryptocurrency deposits or withdrawals |

Fixed and variable spreads | Lack of 24/7 support |

No commissions or hidden fees | Geo-restrictions |

Multiple trading platforms (Proprietary, MT4, MT5, TradingView) | - |

Long-standing reputation (since 2001) | - |

The strong regulatory framework and commission-free trading make the Forex broker a proper platform for your trading journey.

How to Open an Account and Verify It on easyMarkets Broker?

The easyMarkets Registration is fast, secure, and aligned with regulatory compliance standards. To ensure uninterrupted trading, completing identity verification within 15 days is mandatory.

#1 Access the easyMarkets Signup Page

Go to easyMarkets' official website and click “Sign Up.”

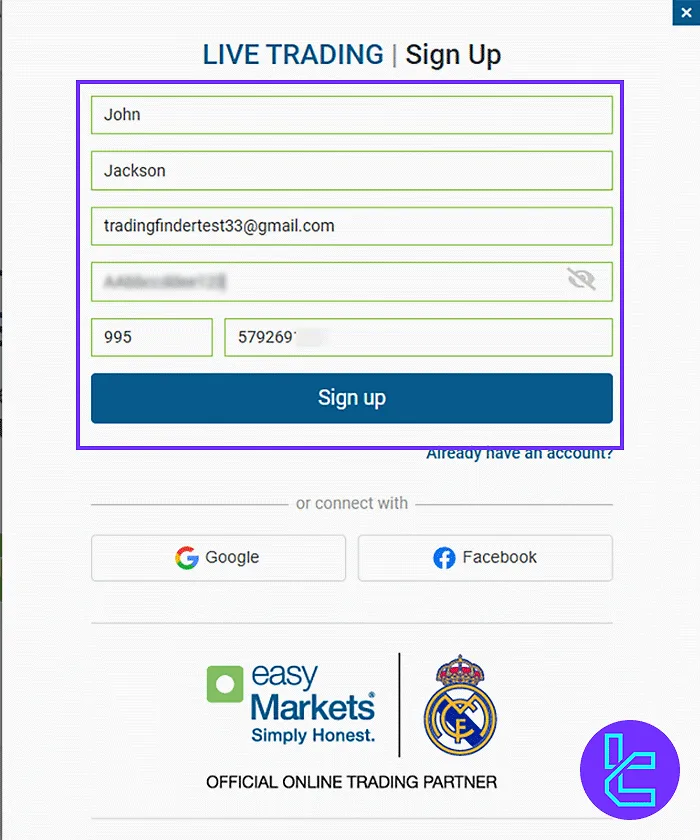

#2 Fill in the easyMarkets Signup Form

Register using the online form or link your Google or Facebook account for quick access.

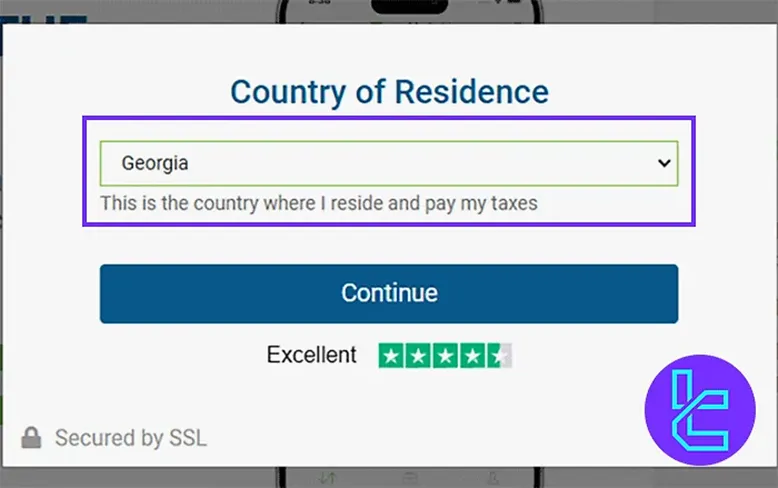

#3 Choose Your Country and Move Forward with Easy Markets

- Select your country of residence from the dropdown menu;

- Then click Continue to advance to the following step.

Upload a passport or driving license for ID verification, plus a recent utility bill or bank statement as proof of residence.

#4 easyMarkets Verification

By accessing the verification page from the profile section, upload the required documents, such as your passport and bank statement.

It is worth mentioning that you must complete the KYC procedure within 15 days of the account opening date. Otherwise, your trades will be closed, and your account will be suspended.

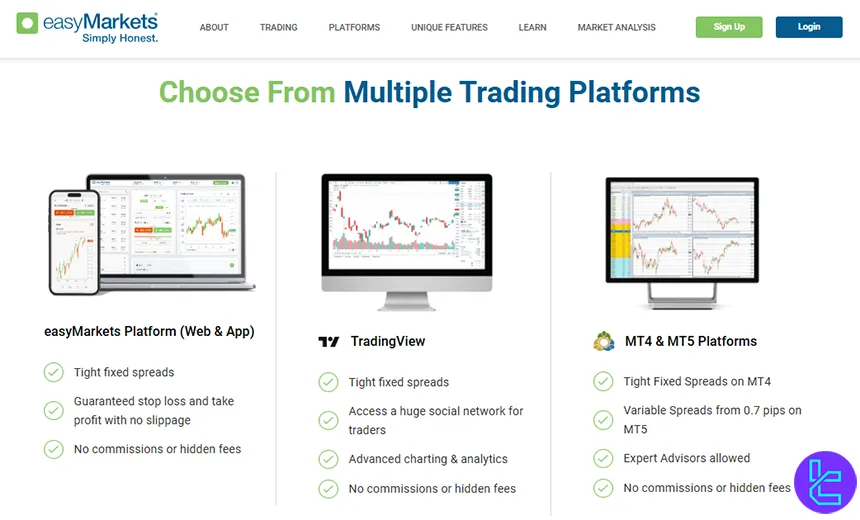

easyMarkets Trading Platforms

The company offers diverse trading platforms to cater to different trader preferences and styles. Here's an overview of the available platforms on Easy Markets.

easyMarkets Proprietary Platform

TradingView

- TradingView Android

- TradingView iOS

- Desktop

- Web

MetaTrader 4 (MT4)

- MT4 Android

- MT4 iOS

- Desktop

- web

MetaTrader 5 (MT5)

- MT5 Android

- MT5 iOS

- Desktop

- web

easyMarkets distinguishes itself with two exclusive trading tools available only on its proprietary platform. The dealCancellation feature gives traders the option to cancel losing trades within 1, 3, or 6 hours after execution, effectively acting like short-term trade insurance.

Meanwhile, Freeze Rate lets users momentarily pause the market rate to secure a more favorable price, helping avoid volatility and execution delays. These tools are not available on MT4.

To access additional analytical tools and oscillators, you can check TradingFinder's comprehensive list of MT5, MT4, and TradingView indicators.

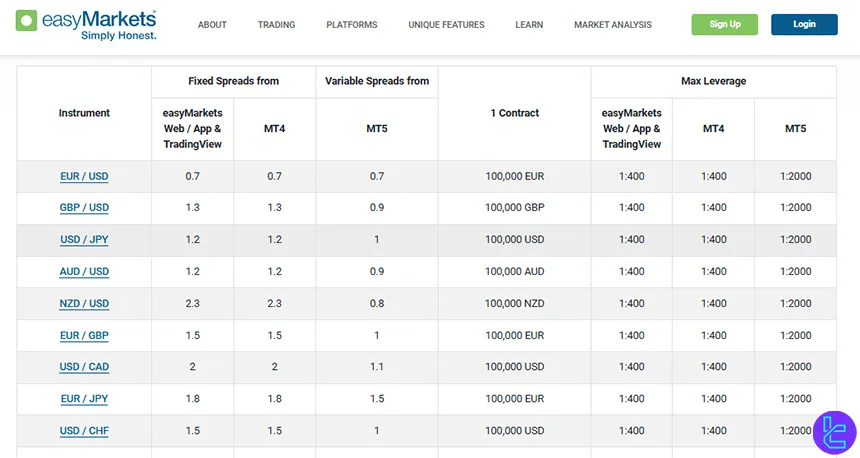

easyMarkets Broker Fees Explained

Easy Markets has a transparent fee structure consisting mainly of spreads. The no-commission approach is attractive and makes understanding the fee structure simpler. In the table below, we gather spread data on some of the most popular instruments.

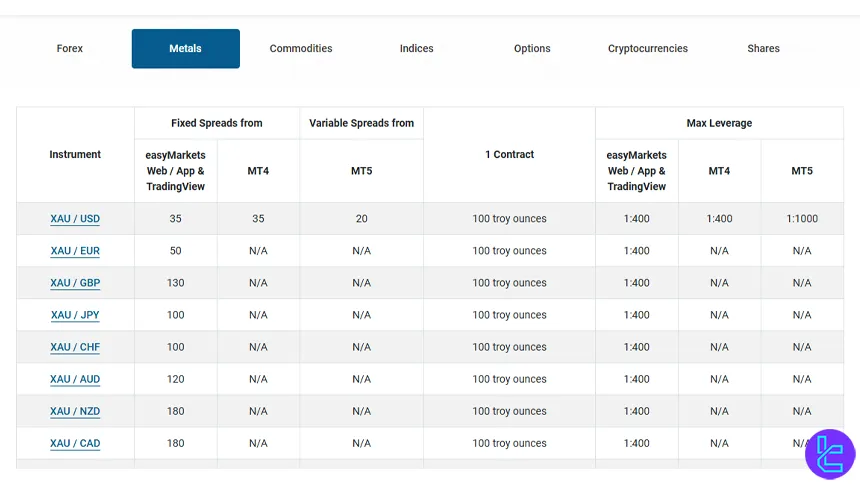

Trading Asset | Fixed Spreads From (Pips) | Variable Spreads From (Pips) |

EUR/USD | 0.7 | 0.7 |

GBP/USD | 1.3 | 0.9 |

XAU/USD | 35.0 | 20.0 |

OIL/USD | 3.0 | 1.1 |

NDQ/USD | 5.0 | 5.0 |

BTC/USD | 85.0 | 75.0 |

AMZ/USD | 0.25 | 0.2 |

These spreads demonstrate easyMarkets’ commitment to competitive pricing across major forex, commodities, indices, cryptocurrencies, and shares.

Swap Fee at easyMarkets

Overnight financing (swap) with easyMarkets applies when you hold a trade open beyond the day; they charge or pay a “rolling fee” (interest) depending on the instrument and direction.

Here are some key official points about swap at easyMarkets:

- Rolling fees are charged on MT4/MT5 at 00:00 GMT (weekdays) with triple‑size collection on Wednesdays;

- On their proprietary platform, the rollover (renewal) happens at 22:00 GMT nightly;

- If easyMarkets cannot collect rollover fees on proprietary accounts, they may close “least profitable” positions after 24 hours;

- For clients who choose a swap-free / Islamic account, rollover fees are not charged or credited.

Non-Trading Fees at easyMarkets

easyMarkets does not clearly charge typical non-trading fees such as inactivity or account maintenance in its publicly available cost disclosures.

Their fee policy is very simple with most non-trade costs either absent or not transparently detailed on their main website.

Below are the key observations drawing on their official information:

- Deposit and withdrawal: According to their deposit/withdrawal page, there is no processing fee for deposits or withdrawals on many methods;

- easyMarkets deposit/withdrawal page also mentions a 10% withdrawal fee for a withdrawal ≥ USD 500 if the withdrawal does not meet a minimum trading volume threshold.

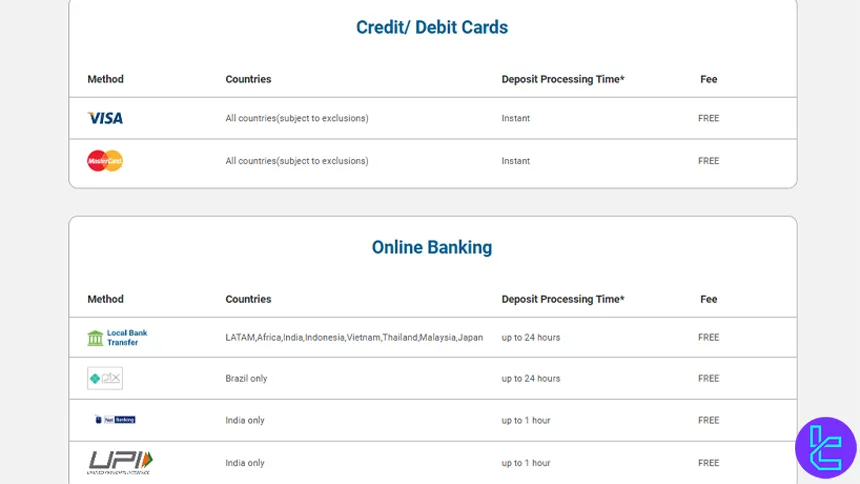

Easy Markets Payment Options

We must explore the available deposit and withdrawal methods in this easyMarkets review. the broker provides a variety of options to facilitate convenient funding and withdrawals for traders worldwide.

- VISA

- MasterCard

- Maestro

- Local Bank transfer

- Bank Wire

- Neteller

Deposit Methods at easyMarkets

easyMarkets allows funding through multiple non-chargeable methods across card, bank, eWallet, and cryptocurrency, making it flexible for different types of traders.

According to their deposit/withdrawal page, there are no fees from the broker for deposits, regardless of method.

Here are the main deposit options and their details:

Deposit Method | Currency | Minimum Amount | Deposit Fee | Funding Time |

Credit / Debit Card | Multiple (base currencies) | 25 | Free | Instant |

Online Banking (local) | Local currencies (varies) | 25 | Free | Up to 24 hours |

eWallet (e.g. Neteller, Skrill) | Multiple | 25 | Free | Instant for most |

Bank Wire Transfer | Base currency / major currencies | 25 | Free | 1 working day |

Cryptocurrency (e.g. BTC, USDT, ETH, LTC) | Crypto | 25 | Free | Up to ~3 hours (depending on coin) |

Withdrawal Methods at easyMarkets

easyMarkets uses the same payment methods for both deposits and withdrawals, which makes the funding process straightforward for traders.

Withdrawal requests are reviewed and processed by the Back Office within 48 hours, and funds are normally returned to the original method used for depositing.

Here are the key points:

- Credit/debit card and eWallet withdrawals have no minimum withdrawal amount;

- Bank transfer withdrawals require a minimum of USD 50;

- Funds are returned to the same method used for deposits, unless the withdrawn amount exceeds total deposits;

- Verification is required before withdrawing, including proof of identity and proof of address.

Does easyMarkets Offer Copy Trading or Investment Plans?

The broker does not offer copy trading or specific investment plans as of the latest information available. Instead, the company provides innovative trading tools and features to empower traders in making informed decisions.

easyMarkets Broker Financial Markets

easyMarkets provides a diverse range of instruments, including forex, shares, indices, commodities, metals, cryptocurrencies and options. Each asset class comes with specific leverage limits and a competitive number of tradable symbols:

Category | Type of Instruments | Number of Symbols | Competitor Average | Max. Leverage |

Forex | Major, minor & exotic currency pairs | 60+ | 70–80 | 1:2000 |

Shares | Global shares (US, EU, etc.) | 65 | 50–100 | 1:40 |

Indices | Global cash & futures indices | 26 | 8–12 | 1:400 |

Commodities | Agricultural & energy commodities | 12 | 8–15 | 1:400 |

Metals | Precious & industrial metals | 19 | 5–10 | 1:1000 |

Crypto (BTC, ETH, XRP, LTC, etc.) | 19 | 6–12 | 1:400 | |

Options | Vanilla options on FX, metals, crypto | 25+ | 20–40 | N/A |

easyMarkets offers a total of over 200 instruments, allowing traders of all styles and preferences to trade freely and with full flexibility.

easyMarkets Broker Bonus Offerings

Easy Markets provides several promotional offerings and incentives to attract and retain traders, with a focus on their referral program.

- Affiliate: Earn commissions as CPA and lot rebates;

- Welcome Gift: A gift that is available exclusively for clients who have verified their phone numbers;

- First Deposit Bonus: Receive up to $2,000 extra funds on your first account funding.

Note that not all traders are eligible for the welcome gift and first deposit bonus promotions. You must contact your dedicated account manager to check your eligibility.

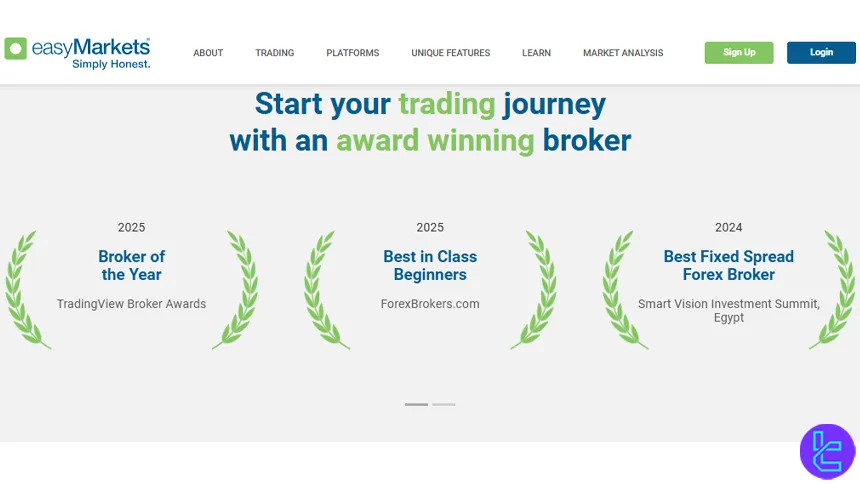

easyMarkets Awards

easyMarkets has established a strong reputation in the trading industry through excellence and innovation. easyMarkets awards reflect the broker’s commitment to transparent trading conditions, tight fixed spreads, and a client-focused experience.

They showcase achievements shared with clients, team members, and partners alike.

Here are some of the most important awards easyMarkets has won:

- Broker of the Year — TradingView Broker Awards (2025)

- Best in Class – Beginners —com (2025)

- Best Fixed Spread Forex Broker — Smart Vision Investment Summit, Egypt (2024)

- Leading Broker of the Year — Forex Expo Dubai (2024)

- Best Regulated Broker — Smart Vision Summit, South Africa (2024)

- Best Forex Broker — TradingView Broker Awards (2024)

How to Reach easyMarkets Support?

easyMarkets offers multilingual and 24/5 support to cater to its global clientele. In order to provide traders with quick responses, the broker has implemented a wide range of support channels, including:

support@easymarkets.com | |

Phone Call | +357 25 828 899 |

Fax | +357 25 817 183 |

+357 99 875 998 | |

Viber | +357 99 875 998 |

Facebook Messenger | Find easyMarkets and start chatting |

Live Chat | Available on the official website |

easyMarkets Geo-Restrictions

While the broker strives to serve a global clientele, certain geo-restrictions apply due to regulatory requirements and local laws. Red Flag countries on Easy Markets:

- United States of America

- Israel

- British Columbia (Canada)

- Manitoba (Canada)

- Quebec (Canada)

- Ontario (Canada)

- Afghanistan

- Belarus

- Congo

- Cuba

- Democratic Republic of the Congo

- Iran

- Iraq

- Kosovo

- Libya

- Mozambique

- North Korea

- Russian Federation

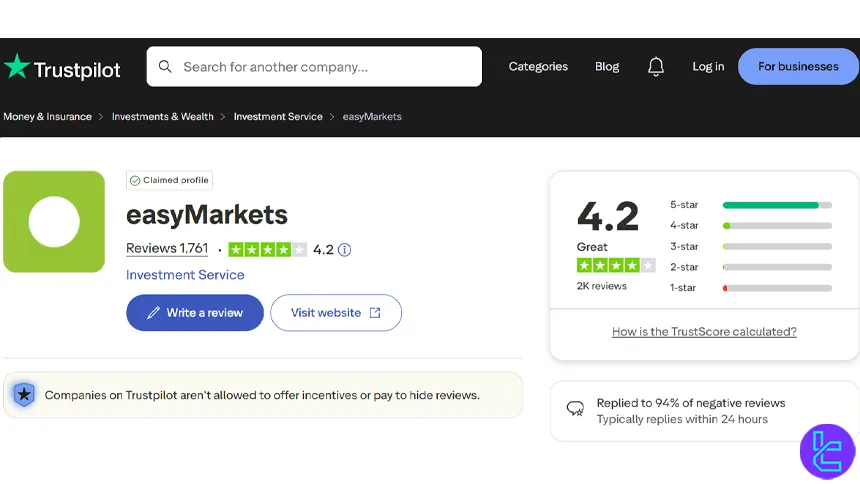

easyMarkets User Satisfaction

Trust score is one of the main factors when evaluating a broker, and it plays a crucial part in any easyMarkets review. the company has garnered positive feedback across various reputable review platforms.

4.5 out of 5.0 based on 1,666 ratings | |

Forex Peace Army | 3.0 out of 5.0 based on 166 comments |

TradingView | 4.7 out of 5.0 based on 2,100 reviews |

easyMarkets has achieved a high TrustPilot rating of 4.5 out of 5.0, reflecting strong user satisfaction and positive client feedback.

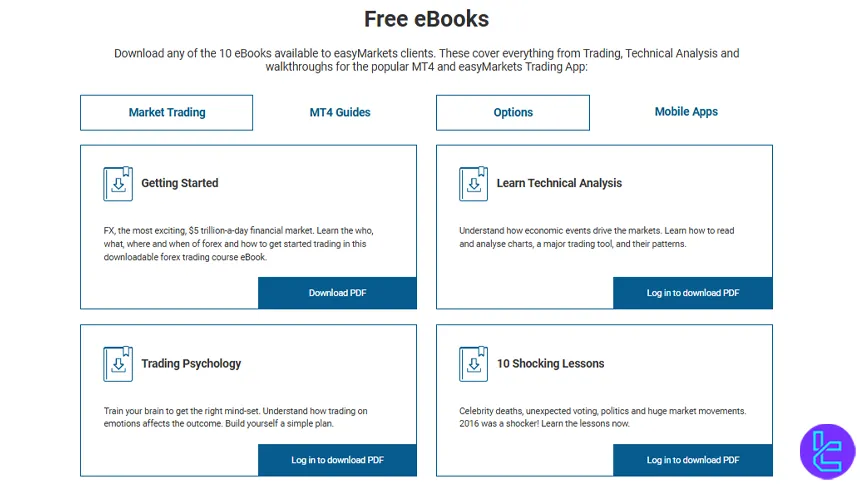

Does easyMarkets Broker Provide Educational Content?

Easy Markets understands the importance of trader education and offers a comprehensive "Learn" section on their website. This treasure trove of educational resources caters to traders of all experience levels, from novices to seasoned professionals.

- Video tutorials covering platform features and trading strategies

- In-depth e Books on various trading topics

- Daily market analysis and economic calendar

- Economic Indicator glossary

- Glossary of trading terms for quick reference

- Demo account to practice trading risk-free

Check TradingFinder's Forex education section for additional learning materials.

easyMarkets in Comparison with Others

To choose the best broker, here is a quick comparison between easyMarkets and competitors; easyMarkets Comparison:

Parameter | easyMarkets Broker | |||

Regulation | CySEC, ASIC, FSA, FSC, FSCA | FSA, CySEC, FCA, FSCA, CBCS, FSC, CMA | FCA, FSCA, CySEC, SCB | FSA, CySEC, ASIC |

Minimum Spread | 0.7 Pips | 0.0 Pips | Varies based on Account | 0.0 Pips |

Commission | None | From $0.2 to USD 3.5 | Varies based on Account | Average $1.5 |

Minimum Deposit | $25 | $10 | $100 | $200 |

Maximum Leverage | 1:2000 | Unlimited (Subject to account) | 1:500 | 1:500 |

Trading Platforms | MT4, MT5, TradingView, Proprietary platform | Exness Trade (mobile), Exness Terminal (web), MT4, MT5 | MT4, MT5, cTrader, Web Trader, Mobile App | MT4, MT5, cTrader, cTrader Web, IC Markets Mobile |

Account Types | easyMarkets Web/App and TradingView, MT4, MT5 | Standard, Standard Cent, Pro, Raw Spread, Zero | Standard, Pro, Raw+, Elite | Standard, Raw Spread, Islamic |

Islamic Account | Yes | Yes | Yes | Yes |

Currency Pairs | 95+ | Over 100 | 200 | 861 |

Number of Tradable Assets | 275+ | 500+ | Not specified | Not specified |

Trade Execution | Market, Pending, and Options | Market Execution, Instant Execution | Market Execution, Instant Execution | Market |

Conclusion and Final Words

easyMarkets provides CFDs, Futures, and Options trading across 6 asset classes, including Forex and Crypto, with leverage options of up to 1:2000 (1:500 for professionals.) easyMarkets broker supports MT4/5 and TradingView platforms, andSkrill / Neteller payments.