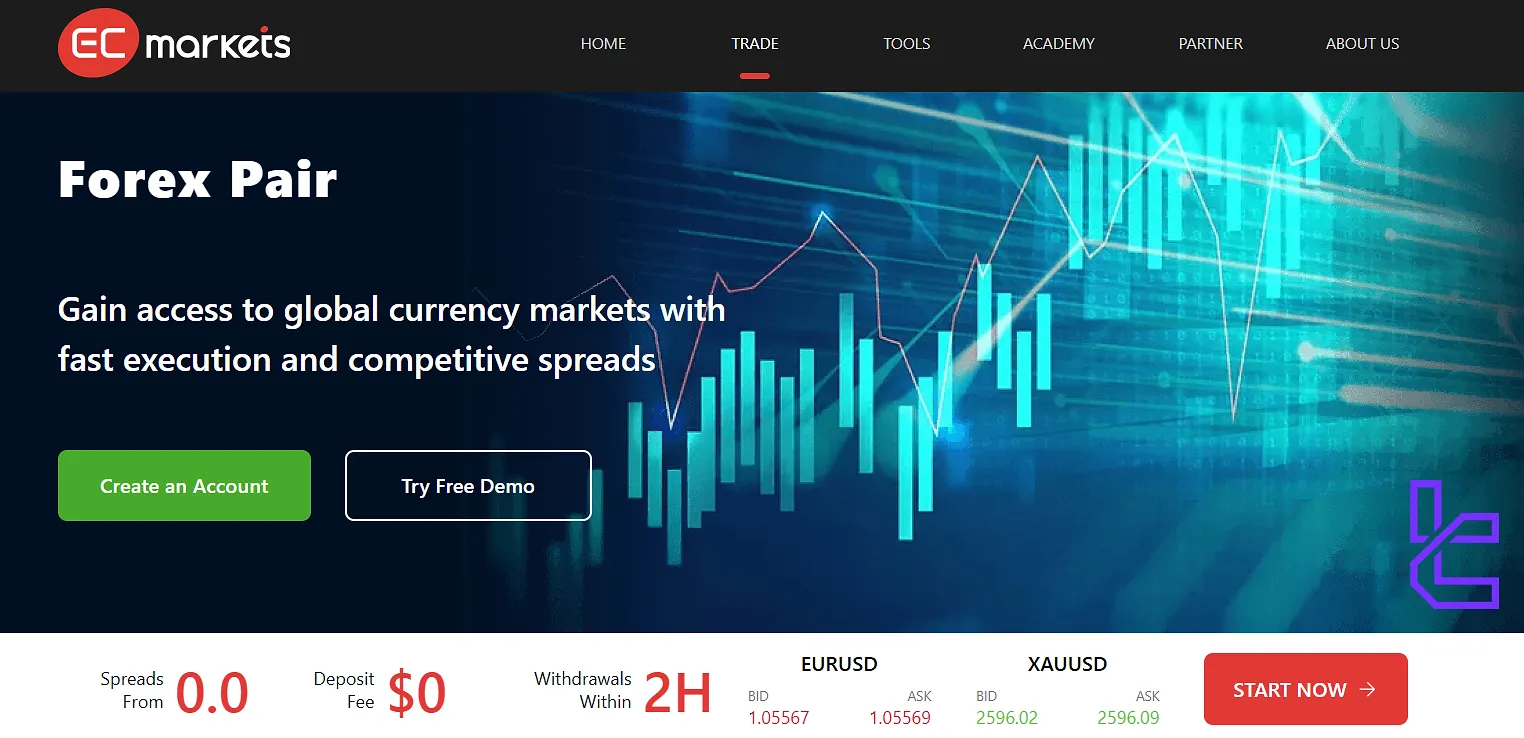

EC Markets is a London-based brokerageoffering more than 100 assets to trade. In addition, EC Markets broker is licensed by 6 regulators [FCA UK, ASIC Australia e.g].

EC Markets offers 1:1000 leverage in its 3 account types [STD, ECN, Pro] with 0.01 lot minimum order.

EC Markets Forex Broker Company Information & Regulation

EC Markets, one of the Forex Brokers, has established itself as a reputable player in the forex and CFD trading industry over the past 12 years. EC Markets boasts an impressive list of regulatory approvals, which adds credibility to its operations:

Entity Parameters / Branches | EC Markets Limited (FSC Mauritius) | EC Markets Group Ltd (FCA UK) | EC Markets Securities & Financial Promotion LLC (SCA UAE) | EC Markets Financial Limited (FSCA South Africa) | EC Markets Financial Limited (ASIC Australia) | EC Markets Financial Limited (FMA New Zealand) | EC Markets Limited (FSA Seychelles) |

Regulation | FSC Mauritius | FCA UK | SCA UAE | FSCA | ASIC | FMA NZ | FSA Seychelles |

Regulation Tier | 3 | 1 | 1 | 2 | 1 | 1 | 4 |

Country | Mauritius | United Kingdom | UAE | South Africa | Australia | New Zealand | Seychelles |

Investor Protection Fund / Compensation Scheme | No | FSCS –£85,000 | No | No | No | No | No |

Segregated Funds | Yes | Yes | No | Yes | Yes | Yes | Yes |

Negative Balance Protection | Yes | Yes | N/A | Yes | Yes | Yes | Yes |

Maximum Leverage | 1:1000 | 1:30 | N/A | 1:1000 | N/A | N/A | 1:1000 |

Client Eligibility | Global (except restricted) | UK residents | UAE residents | South Africa residents | Australia residents | New Zealand residents | Global (except restricted) |

This multi-jurisdictional regulation ensures that EC Markets adheres to strict financial standards and provides a secure trading environment for its clients across the globe.

Summary of Specifics

EC Markets offers a comprehensive suite of trading services and features designed to cater to the diverse needs of traders. Here's a quick overview of what the broker brings to the table:

Broker | EC Markets |

Account Types | STD, ECN, Pro |

Regulating Authorities | FSA, FCA, FSC, ASIC, FMA, FSCA |

Based Currencies | USD |

Minimum Deposit | $10 |

Deposit/Withdrawal Methods | Union Pay, OTC 365, SWIFT, VN Pay, POLi |

Minimum Order | 0.01 Lot |

Maximum Leverage | Forex: 1:1000 Metal: 1:1000 Crude Oil: 1:200 |

Investment Options | None |

Trading Platforms & Apps | MT4, MT5, Mobile App |

Markets | Forex, Metal, Oil, Indices, Cryptocurrency |

Spread | From 0.0 Pips in ECN Account, From 1.0 Pips in STD Account |

Commission | $3 in ECN Account, $0 in STD Account |

Orders Execution | Market |

Margin Call/Stop Out | 100%/50% |

Trading Features | 1:1000 Maximum Leverage, Demo Trading, $0 Commission, 0.0 Pips Spread, 24/5 Support |

Affiliate Program | Yes |

Bonus & Promotions | No |

Islamic Account | Yes |

PAMM Account | No |

Customer Support Ways | Email, Phone Call, Ticket, Live Chat |

Customer Support Hours | 24/5 |

What Are EC Markets Account Types?

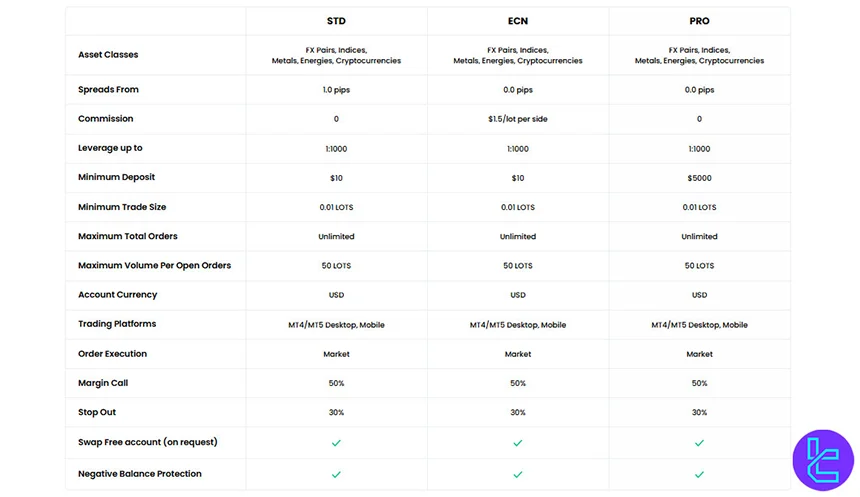

EC Markets offers 3 main account types to cater to different trading styles and preferences; EC Markets Broker Accounts:

Specifics | STD | ECN | Pro |

Spread | From 1.0 Pips | From 0.0 Pips | From 0.0 Pips |

Commission | $0 | $3 Per Trade | $0 |

Maximum Leverage | Forex: 1:1000 Metal: 1:1000 Crude Oil: 1:200 | Forex: 1:1000 Metal: 1:1000 Crude Oil: 1:200 | 1:500 |

Minimum Position Size | 0.01 Lot | 0.01 Lot | 0.01 Lot |

Maximum Position Size | Unlimited | Unlimited | Unlimited |

Margin Call | 100% | 100% | 100% |

Stop Out | 50% | 50% | 50% |

EC Markets provides three tailored account types STD, ECN, and Pro designed to suit varying trading strategies, offering competitive spreads, flexible leverage, and transparent commission structures for both retail and professional traders.

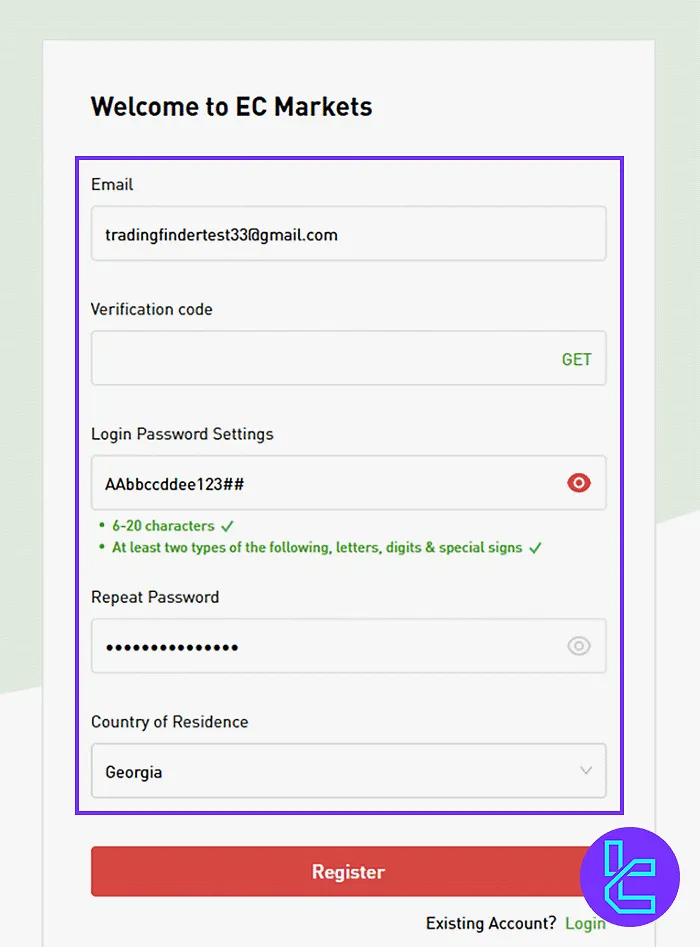

EC Markets Broker Signing Up & Verification: Easy Registration Guide

The EC Markets Registration is hassle-free and typically takes under 5 minutes. With support for STD, ECN, and Pro accounts, traders can quickly begin the onboarding process and access global markets.

#1 Start EC Markets Registration

Visit the official EC Markets website and click “Start Trading.”

#2 Fill Out the EC Markets Form

Enter your email address, set a secure password, and select your country of residence.

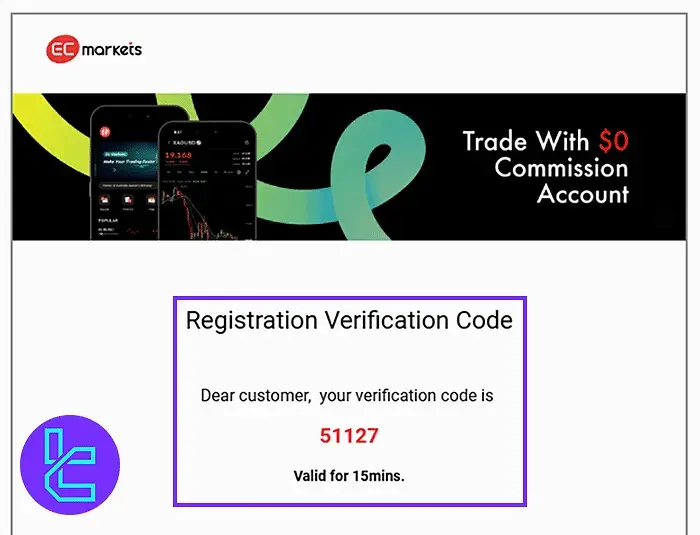

#3 Verify Your Email with a Code from EC Markets

Press the GET button, then look in your email inbox for a code and input it into the specified field. Note that the code remains valid for just 15 minutes.

#4 Upload Verification Documents in EC Markets

Submit a government-issued ID and proof of address (e.g., utility bill or bank statement). Your application is typically reviewed and approved within 24 - 48 hours. Once verified, fund your account and start trading on EC Markets with full access to all features.

EC Markets employs strict Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures to ensure the security and integrity of its trading environment.

Advantages and Disadvantages

While EC Markets offers numerous benefits, it's essential to consider both the pros and cons before choosing this broker:

Advantages | Disadvantages |

Multi-Regulated by Reputable Financial Authorities | Limited Information on Exact Minimum Deposit Requirements |

Competitive Spreads Starting From 0.0 Pips | No Social Trading or Copy Trading Features |

High Leverage Options Up to 1:1000 | Lack Of Clarity on Exact Commission Structures for ECN Accounts |

Wide Range of Tradable Instruments | Lack of Bonuses |

User-Friendly Mobile Trading App | - |

Fast Withdrawals Within 2 Hours | - |

No Deposit Fees | - |

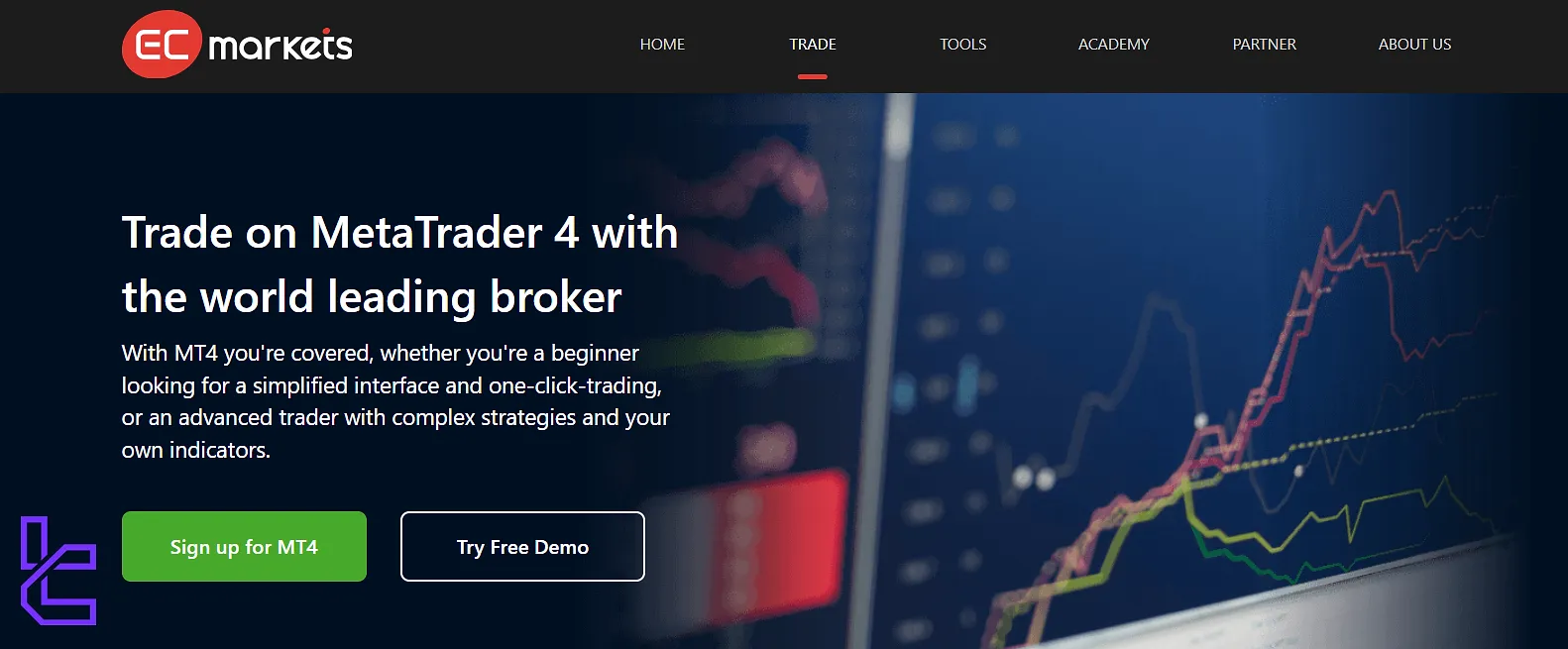

Trading Platforms

EC Markets offers two of the most popular trading platforms in the industry, MetaTrader 4 and MetaTrader 5, besides its proprietary mobile platform:

MetaTrader 4 (MT4)

- User-friendly interface suitable for beginners and advanced traders

- One-click trading and advanced charting tools

- Customizable indicators and expert advisors

- Available for desktop, web, and mobile devices

MetaTrader 5 (MT5)

- Multi-asset trading platform supporting a wider range of instruments

- Advanced technical analysis tools and economic calendar

- Supports algorithmic trading and custom indicators

- Available for desktop, web, and mobile devices

Mobile App

- Real-time market data

- Fast execution speed

- User-friendly interface

Spreads and Commissions

In EC Markets review we discoved that they offer competitive pricing structures across their account types; EC Markets Broker Fees:

Fees | STD | ECN |

Spread | From 1.0 Pips | From 0.0 Pips |

Commission | $0 | $3 Per Trade |

Swap Fee at EC Markets

EC Markets applies overnight rollover (swap) fees based on the interest-rate differential between currencies, and these rates are applied at 00:00 (GMT+2) daily.

In practice, these swap rates are competitive according to EC Markets, and if you hold a position from Wednesday to Thursday, you’re charged a triple rollover due to weekend interest being settled.

Here are some important details about EC Markets’ swap policy:

- Because EC Markets uses a 3-day rollover on Wednesdays, positions held across that night incur three days’ worth of interest;

- Swap rates are subject to change at EC Markets’ discretion;

- You can request a swap-free / Islamic account for STD, ECN and PRO account types.

Non-Trading Fees at EC Markets

EC Markets does not charge deposit fees or withdrawal fees, making fund movements surprisingly cheap. Their policy explicitly states there is no inactivity fee, even for dormant accounts older than 24 months.

These zero‑fee features align with EC Markets’ commitment to transparent and low‑cost trading.

regarding non-trading fees:

- Deposits made via the POLi method incur a 4% commission;

- The broker does not charge any withdrawal fees, however, banks or other service providers may apply transfer fees.

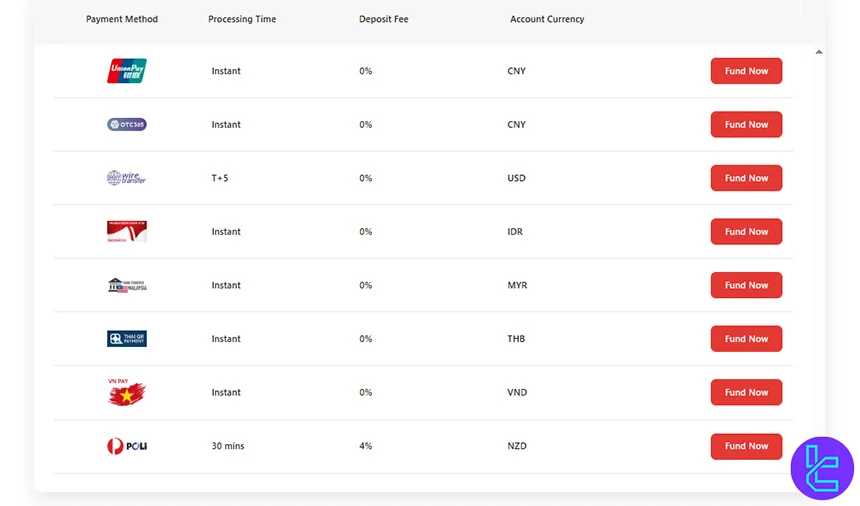

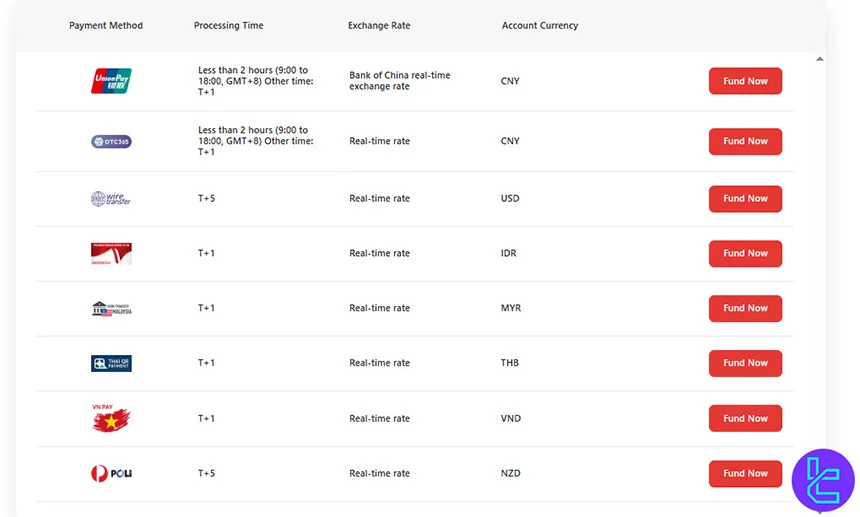

What Deposit & Withdrawal Methods Are Available at EC Markets?

EC Markets supports a variety of payment methods to facilitate easy deposits and withdrawals:

- Union Pay

- OTC 365

- SWIFT

- VN Pay

- POLi

The broker prides itself on offering zero deposit fees and fast withdrawals, with most requests processed within 2 hours. This efficient payment system ensures that traders can quickly access their funds when needed.

Deposit Methods at EC Markets

EC Markets provides a diverse range of deposit channels tailored for different regions, allowing clients to fund their trading accounts quickly and with minimal cost.

All supported methods come with a 0% deposit fee except POLi, which charges a 4% processing fee. The minimum deposit requirement is 10 USD, and for methods using local currencies, the equivalent value of 10 USD is applied.

Below is a structured overview of the supported funding methods:

Deposit Method | Currency | Minimum Amount | Deposit Fee | Funding Time |

Union Pay | CNY | Equivalent to 10 USD | 0% | Instant |

OTC 365 | CNY | Equivalent to 10 USD | 0% | Instant |

Wire Transfer | USD | 10 USD | 0% | T+5 |

Indonesia Bank | IDR | Equivalent to 10 USD | 0% | Instant |

Bank Transfer Malaysia | MYR | Equivalent to 10 USD | 0% | Instant |

Thai QR Payment | THB | Equivalent to 10 USD | 0% | Instant |

VN Pay | VND | Equivalent to 10 USD | 0% | Instant |

PO Li | NZD | Equivalent to 10 USD | 4% | 30 minutes |

Withdrawal Methods at EC Markets

EC Markets offers the same convenient funding methods for withdrawals that it does for deposits, with processing times measured in hours or business days depending on the method.

The broker claims “withdrawals credited within 2 H”, showing a commitment to quick cash-outs. Detailed conditions, including currency conversion rates and timing, are clearly stated for each withdrawal option.

Below is a structured overview of the supported Withdrawal methods:

Withdrawal Method | Currency | Minimum Amount | Withdrawal Fee | Funding Time |

Union Pay | CNY | N/A | Bank of China rate | Less than 2 hours (9:00-18:00 GMT+8), otherwise T+1 |

OTC 365 | CNY | N/A | Real-time rate | Less than 2 hours (9:00-18:00 GMT+8), otherwise T+1 |

Wire Transfer | USD | N/A | Real-time rate | T+5 business days |

Indonesia Bank | IDR | N/A | Real-time rate | T+1 |

Bank Transfer Malaysia | MYR | N/A | Real-time rate | T+1 |

Thai QR Payment | THB | N/A | Real-time rate | T+1 |

VN Pay | VND | N/A | Real-time rate | T+1 |

PO Li | NZD | N/A | Real-time rate | T+5 business days |

Does EC Markets Offers Copy Trade to Its Traders?

Unfortunately, EC Markets does not currently offer copy trading or social trading features. The broker focuses primarily on providing a robust trading environment for self-directed traders.

What Markets Can I Trade in EC Markets?

EC Markets offers a diverse range of trading instruments across multiple markets, catering to both beginner and professional traders. With over 100 symbols available, the broker provides highly competitive leverage, especially for forex and precious metals.

Here are all you need to know:

Category | Type of Instruments | Number of Symbols | Competitor Average | Max. Leverage |

Currency pairs (majors, minors, exotics) | 45+ | ~60–70 | 1:1000 | |

Precious Metals | Gold, Silver CFD | 2 | ~3–6 | 1:1000 |

Energy | Crude Oil (Brent, WTI) | 2 | ~3–5 | 1:200 |

Indices | Global equity index CFDs | 15+ | ~20–40 | 1:100 |

Crypto CFDs (BTC, ETH, ADA, XRP, SOL) | 7 | ~10–15 | 1:200 |

This wide selection ensures traders can diversify their portfolios while taking advantage of flexible leverage options.

Bonuses and Promotions

As of the time of writing, EC Markets does not offer any specific bonuses or promotions. The broker focuses on providing competitive trading conditions and reliable services rather than attracting clients through promotional offers.

This approach aligns with regulatory guidelines in many jurisdictions that discourage or prohibit forex trading bonuses.

EC Markets Broker Awards

EC Markets has consistently demonstrated excellence in trading services and client support, earning recognition across multiple global events.

These achievements highlight the broker’s commitment to quality, trust and value in the financial industry.

Here are some of their awards:

- Most Trusted Broker Latam 2025 – UF Awards

- Best IB Affiliate Programme 2025 – UF Awards

- Best Value Broker Global 2024 – UF Awards

- Best Customer Service 2024 – Forex Expo

Customer Support

EC Markets provides 24/5 (Closed on weekends) comprehensive customer support through multiple channels:

- Email: Good for non-urgent inquiries

- Phone: Direct line for urgent inquiries

- Ticket System: For detailed queries and account-specific issues

- Live Chat: Quick responses for general questions

The broker's customer support team is known for its professionalism and quick response times, ensuring that traders can get assistance whenever they need it.

EC Markets Restricted Countries

Due to regulatory restrictions, there are certain countries where EC Markets cannot offer its services.

The exact list of restricted countries may change over time but as of now, it includes:

- United States

- Canada

- Japan

- North Korea

- Iran

- Cuba

- Iraq

- Syria

- Yemen

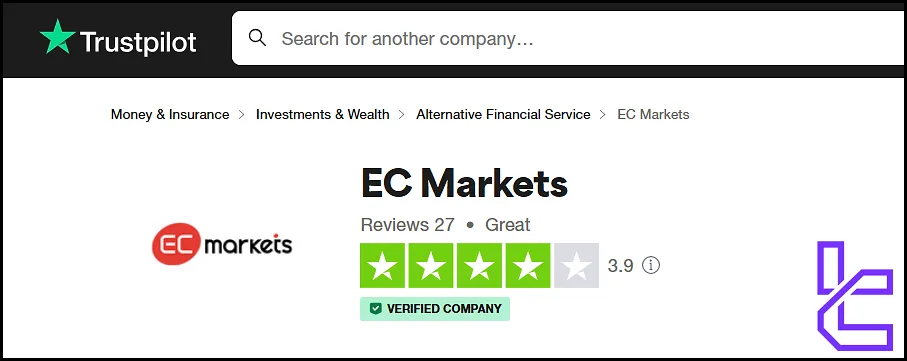

Trust Scores

EC Markets has garnered a respectable reputation in the online trading community. On Trustpilot, the broker maintains a rating of3.9 out of 5 stars based on 25+ reviews. This score indicates a generally positive sentiment among users, with many praising the broker in the EC Markets Trustpilot:

- Efficient customer support

- Fast withdrawal processing

- User-friendly trading platforms

- Competitive trading conditions

However, as with any financial service provider, there are also some negative reviews. It's essential for potential clients to conduct their own research and due diligence before opening an account.

EC Markets Educational Resources

In this part of the EC Markets review, we will go through the educational resources of the broker. EC Markets demonstrates a commitment to trader education through its comprehensive resources:

- Forex Academy: In-depth courses covering various aspects of trading;

- Forex Glossary: Extensive list of trading terms and concepts.

These educational tools cater to traders of all levels, from beginners looking to learn the basics to experienced traders seeking to refine their strategies.

EC Markets Compared to Other Brokers

To determine whether EC Markets is the right broker for you, take a look at the table below; EC Markets Comparison:

Parameters | EC Markets Broker | AvaTrade Broker | Tickmill Broker | FxGrow Broker |

Regulation | FSA, FCA, FSC, ASIC, FMA, FSCA | ASIC, CySEC, CBI, FSA, FSCA, MiFID, ADGM, PFSA, ISA | FSA, FCA, CySEC, LFSA, FSCA | CySec, MiFID, CNMV, MNB, FINANSTILSYNET, ACPR, KNF, BaFin, FI, HCMC |

Minimum Spread | 0.0 Pips | Depending on the Asset | 0.0 Pips | 0.00001 pips |

Commission | From $0 | No Commission on Deposits/Withdrawals Inactivity Fees Overnight Fees | $0 | $8 for FX |

Minimum Deposit | $10 | $100 | $100 | $100 |

Maximum Leverage | 1:1000 | 1:400 | 1:1000 | 1:300 |

Trading Platforms | MT4, MT5, Mobile App | MetaTrader 4, MetaTrader 5, Mobile App, WebTrader | MetaTrader 4, MetaTrader 5, Mobile App, WebTrader | MetaTrader 5 |

Account Types | STD, ECN, Pro | Retail, Professional, Islamic, Demo | Classic, Raw | ECN, ECN Plus, ECN VIP, Demo |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | 100+ | 1250+ | 600+ | 160+ |

Trade Execution | Market | Instant | Market | Market |

TradingFinder Expert Conclusion and Final Words

$10 Minimum deposit, $0 commission, and spreads from 0.0 pips are just some of the features of EC Markets. It also offers 1:500 maximum leverage in all of its trading platforms [MT4, MT5, Mobile App].

On the contrary, no social trading, no copy trading, and no bonuses are offered by EC Markets.