eToro, an Israeli broker, provides 3 investment options [CopyTrader, Smart Portfolios, and Crypto Staking].

It offers 4 account types (Personal, Professional, Corporate, and Islamic), with several payment methods, including PayPal, Skrill, and Trustly.

Drawbacks include a lack of MT4/MT5 support and no phone calls for customer services.

eToro Company Information & Regulation

eToro was founded in January 2007 by 3 entrepreneurs: David Ring, Ronen Assia, and Yoni Assia, and operates under the legal name eToro Ltd.

The company is headquartered at Tel Aviv, Israel.

Regulating Bodies:

- Financial Conduct Authority (FCA) in the United Kingdom

- Cyprus Securities and Exchange Commission (CySEC)

- Malta Financial Services Authority (MFSA)

- Financial Services Regulatory Authority (FSRA) in Abu Dhabi

- Australian Securities and Investments Commission (ASIC)

- Financial Services Authority Seychelles (FSA)

- Gibraltar Financial Services Commission

With the regulatory details outlined above, below is a table summarizing eToro’s company information and branch locations.

Entity Parameters / Branches | eToro (UK) Ltd | eToro (Europe) Ltd | eToro AUS Capital Ltd | eToro X Ltd (Gibraltar) | eToro USA Securities Inc. | eToro (Seychelles) Ltd | eToro (ME) Limited (ADGM) |

Regulation | FCA | CySEC | ASIC | GFSC (DLT provider) | SEC / FINRA | FSA Seychelles | ADGM FSRA |

Regulation Tier | 1 | 2 | 1 | 2 | 1 | 3 | 2 |

Country | United Kingdom | Cyprus (EU) | Australia | Gibraltar | United States | Seychelles | Abu Dhabi (UAE) |

Investor protection fund / compensation | Up to GBP 85,000 under FSCS | Up to EUR 20,000 under ICF | No | No | Up to $500,000 under SIPC | No | No |

Segregated Funds | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

Negative Balance Protection | Yes | Yes | Yes | No | No | No | Yes |

Maximum Leverage (highest offered) | 1:30 | 1:30 | 1:30 | N/A | 1:1 | 1:400 | 1:30 |

Client eligibility | Residents of the UK | EU/EEA residents | Australian residents | Clients in regions permitted for crypto services under GFSC | US residents only | Global | Residents of UAE |

Key Features and Specifications

In this section, we will provide a table of important features for a general image of the Forex broker. Here's a quick snapshot of eToro's key specifics:

Broker | eToro |

Account Types | Personal, Professional, Corporate, Islamic |

Regulating Authorities | FCA, CySEC, MFSA, FSRA, ASIC, FSA, Gibraltar FSC |

Based Currencies | USD, EUR, GBP |

Minimum Deposit | $10 |

Deposit Methods | eToro Money, Credit/Debit Card, Bank Transfer, PayPal, Neteller, Skrill, Online Banking (Trustly), iDEAL, Sofort, Przelewy24 |

Withdrawal Methods | eToro Money, Credit/Debit Card, Bank Transfer, PayPal, Neteller, Skrill, Online Banking (Trustly), iDEAL, Sofort, Przelewy24 |

Minimum Order | $1 for Copy Trading $10 for Stocks |

Maximum Leverage | 1:400 |

Investment Options | CopyTrader, Crypto Staking, Smart Portfolios |

Trading Platforms & Apps | Proprietary App |

Markets | Stocks, ETFs, Commodities, Currencies, Indices, Crypto |

Spread | Varies |

Commission | Varies in Different Parts |

Orders Execution | Not Specified |

Margin Call/Stop Out | Not Specified |

Trading Features | Demo Account, Crypto Staking, Smart Portfolios |

Affiliate Program | Yes |

Bonus & Promotions | No |

Islamic Account | Yes |

PAMM Account | No |

Customer Support Ways | Email, Ticket, Live Chat |

Customer Support Hours | 24/5 |

Trading Accounts in eToro

The mentioned broker offers 4 main account types. Here's an overview:

- Personal Account: Ideal for individual retail traders with a minimum deposit of $10

- Professional Account: For experienced traders meeting specific criteria

- Corporate Account: Designed for businesses and institutions

- Islamic Account: Swap-free account adhering to Islamic finance principles

The Personal Account is the most common, providing access to all of eToro's social trading features. Professional Accounts offer higher leverage but with reduced regulatory protections.

Also, a demo account is provided containing $100,000 of virtual funds for trading in a 100% risk-free environment.

Notable Pros and Cons

Every broker includes some drawbacks beside of its strengths and benefits. In this section, we will review the advantages and disadvantages of eToro:

Pros | Cons |

Proprietary Platform | No MT4/MT5 Support |

Innovative Social Trading Features | No Phone Call Option for Customer Service |

A Very Wide Range of Instruments | - |

Regulated in Multiple Jurisdictions | - |

Guide on Getting Started: Signing Up and Verification

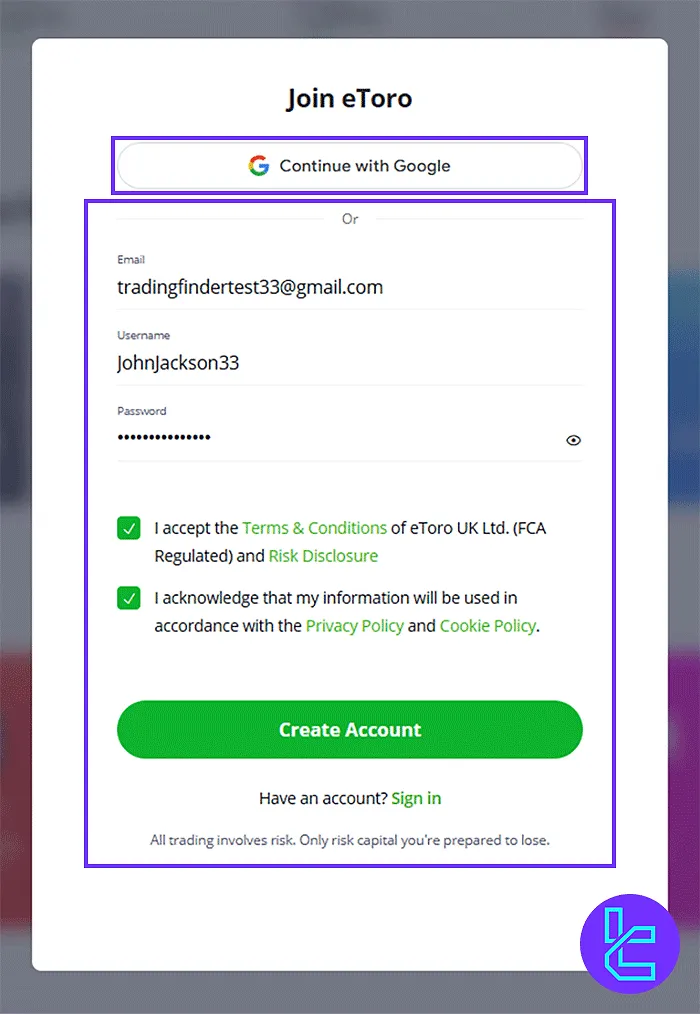

The eToro (UK Ltd) Registration is simple, secure, and takes under 5 minutes. You can register using your Google account or manually with an email address and custom login credentials.

#1 Visit the eToro Sign-Up Page

Go to the eToro homepage and click “Join eToro” to begin the registration.

#2 Enter Basic Information on eToro

Fill in the form with your email, username, and a strong password. Accept the terms and click “Create Account.”

#3 Choose Your Country in eToro

Select your country of residence and click “Continue” to finalize the account setup.

#4 eToro Verification

Once registered, you’ll need to verify your identity by submitting a government-issued ID and proof of address to unlock full trading features.

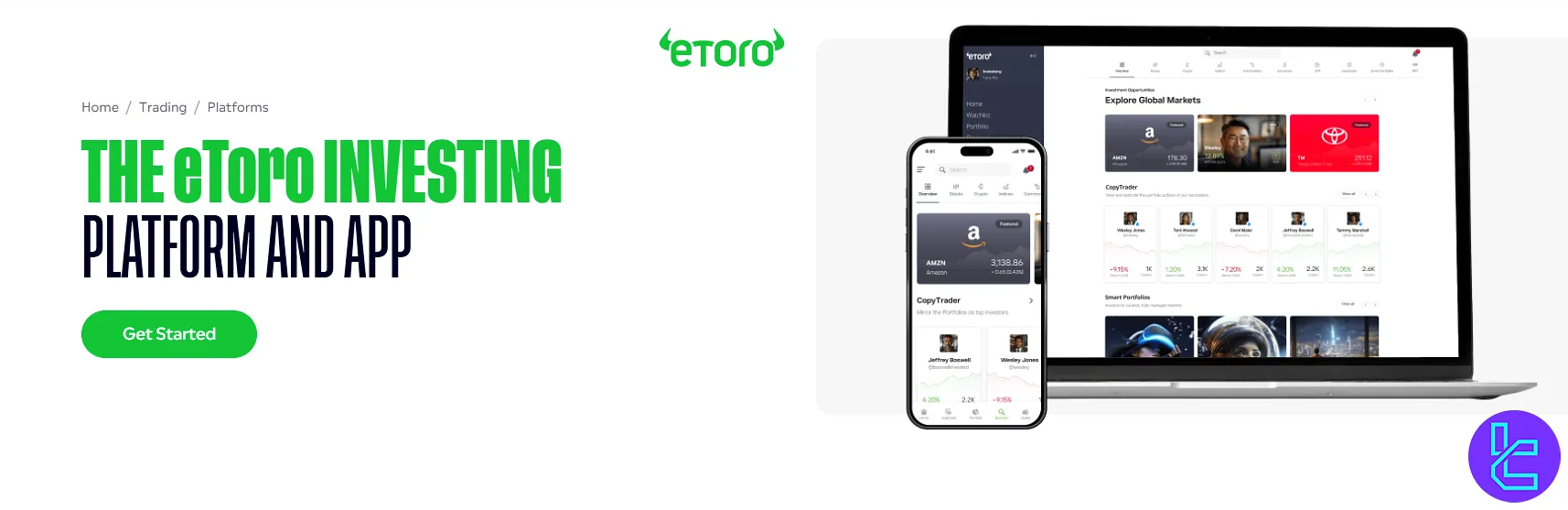

Does eToro Have A Proprietary Platform?

The broker's proprietary trading platform is the only option for clients to enter financial markets.

Traders can monitor and execute their trades across all available instruments and markets (including currencies, stocks, and cryptocurrencies) directly through this platform.

The terminal provides several trading tools, features, and services, including:

- Easy-to-use interface

- One-click trading for helping with habits

- Stop loss and take profit levels

- two-step and biometric verification

- ProCharts tool for comparing charts from different financial instruments

The platform is accessible via these operating systems and facilities:

Fees and Costs for Trading/Non-Trading Activities

eToro has a specific structure for trading commissions and spreads for the broker. We will investigate it in the next sections.

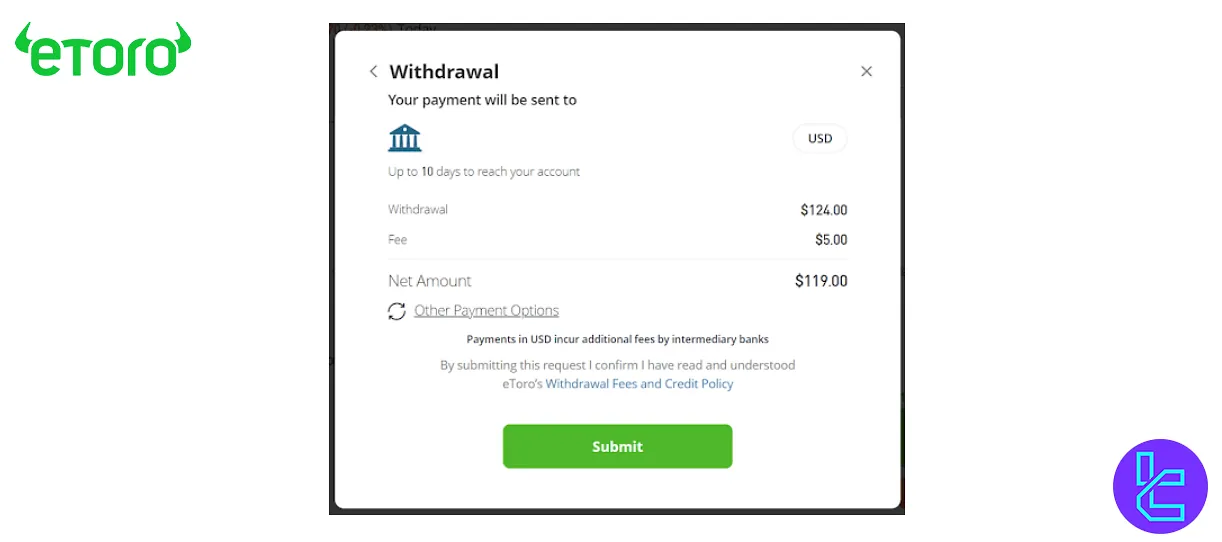

Withdrawals

No fee is charged for withdrawals from GBP accounts or EUR accounts to an external account. However, there is a fixed $5 cost for making withdrawals from a USD account.

Trading

The commission for trading varies based on the region and asset. Here's a quick rundown:

- Stocks: Depending on the country and the stock exchange, starting from $0, typically around $1 or $2

- ETFs: none

- Crypto: 1% buy/sell fee

- CFDs: Relatively high; for stock CFDs, a 0.15% spread per side

- Margin Rate: ~8.3% annually for USD-denominated accounts

Other Costs

There is a monthly $10 inactivity fee for accounts with no activity in the previous 12 months. Also, a conversion fee is charged based on the location, payment method, and club level.

Swap Fee at eToro

An overnight fee (swap) at eToro is charged when you hold a CFD position open past market close.

The size of that fee depends on the asset, position size, and whether you are long or short; it's clearly shown before opening the trade.

Below are some key points to keep in mind regarding eToro’s swap/overnight cost structure:

- Overnight (rollover) fees are applied nightly at 21:00 GMT (22:00 during DST) for open CFD trades;

- Weekend fees are triple the normal overnight rate and charged once during the week (Wednesdays for most FX/commodities; Fridays for stocks, indices, ETFs);

- For non-leveraged stock / ETF long positions, eToro typically does not charge overnight fees (since they're executed as actual equities, not CFDs);

- All crypto CFD positions (including non-leveraged ones) incur daily overnight fees;

- eToro updates overnight fees based on global market/interest conditions, and changes may apply to already open positions;

- eToro offers Islamic, swap-free accounts designed to comply with Sharia principles, ensuring that no interest or overnight fees are charged on trading positions.

Non-Trading Fees at eToro

eToro applies only a few non-trading fees, designed to cover account maintenance and withdrawal handling rather than trading activity itself.

While deposits remain free, some charges may apply depending on the user’s actions and level of activity.

Key non-trading costs to note include:

- $5 withdrawal fee for transactions from USD accounts;

- Currency conversion surcharges (≈ 0.5%) apply when funding or withdrawing in non-USD currencies;

- No deposit fees, though external banks or payment gateways may impose their own charges;

- $10 monthly inactivity fee after 12 months of no login or trading;

- The inactivity charge continues until the account balance reaches zero or activity resumes;

- Third-party costs (such as conversion or processing fees) are not controlled by eToro.

eToro Brokerage Funding and Withdrawal Methods

The brokerage offers a variety of funding options and deposit methods for its clients. Note that not all these options are available worldwide:

- eToro Money

- Credit/Debit Card

- Bank Transfer

- PayPal

- Neteller

- Skrill

- Online Banking (Trustly)

- iDEAL

- Sofort

- Przelewy24

How Do You Deposit Money with eToro?

Depositing funds into your eToro account is generally straightforward and supports multiple funding channels, each with its own minimums and processing times.

The platform does not charge explicit deposit fees, though currency conversion and third-party costs may apply.

Below is a snapshot of common deposit options and their characteristics:

Deposit Method | Currency | Minimum Amount | Deposit Fee | Funding Time |

eToro Money | GBP, EUR | N/A | None | Instant |

Credit / Debit Card | Multi-currency (regional availability) | $50 | None | Instant |

PayPal | USD, GBP, EUR, AUD | $50 | None | Instant |

Neteller | USD, GBP, EUR | $50 | None | Instant |

Skrill | USD, GBP, EUR | $50 | None | Instant |

iDEAL | EUR | $50 | None | Instant |

Bank Transfer | USD, GBP, EUR, AUD, AED, CHF, DKK, NOK, PLN, SEK, HUF, RON, CZK | $500 (U.S.) / $50 (others) | None | 4–7 business days |

Online Banking – Trustly | EUR, GBP, SEK, NOK | $50 | None | Instant |

Przelewy 24 | PLN | $50 | None | Instant |

How Do You Withdraw Money from eToro?

eToro enables withdrawals via multiple channels, each with its own conditions, processing times, and associated fees.

To request a withdrawal, your account must be verified and your available balance must exceed the withdrawal amount.

Because some funds must return via their original deposit route, eToro may split a withdrawal across multiple methods.

Here’s how those withdrawal options compare, side by side:

Withdrawal Method | Currency | Minimum Amount | Withdrawal Fee | Funding Time |

eToro Money | GBP, EUR | $30 | $5 | Instant |

Credit / Debit Card | Multi-currency (regional availability) | $30 | $5 | Up to 10 business days |

Bank Transfer | USD, EUR, GBP, AUD and others | $30 | $5 | Up to 10 business days |

Pay Pal | USD, GBP, EUR, AUD | $30 | $5 | Up to 2 business days |

Neteller | USD, GBP, EUR | $30 | $5 | Up to 2 business days |

Skrill | USD, GBP, EUR | $30 | $5 | Up to 2 business days |

Trustly | EUR, GBP, SEK, NOK | $30 | $5 | Up to 2 business days |

iDEAL | EUR | $30 | $5 | Up to 2 business days |

Copy Trading and Investment Services

The broker dedicates a part of its resources to offering investment options like copy trading. We will mention these methods in the list below:

- CopyTrader: Automatically copy the trades of successful investors, free of charge;

- Smart Portfolios: Thematic long-term investment portfolios with unique strategies, curated by eToro's analysts;

- Staking: Hold and lock your crypto balance to earn a monthly/yearly yield, available for Ethereum [ETH], Solana [SOL], Cardano [ADA], and Tron [TRX].

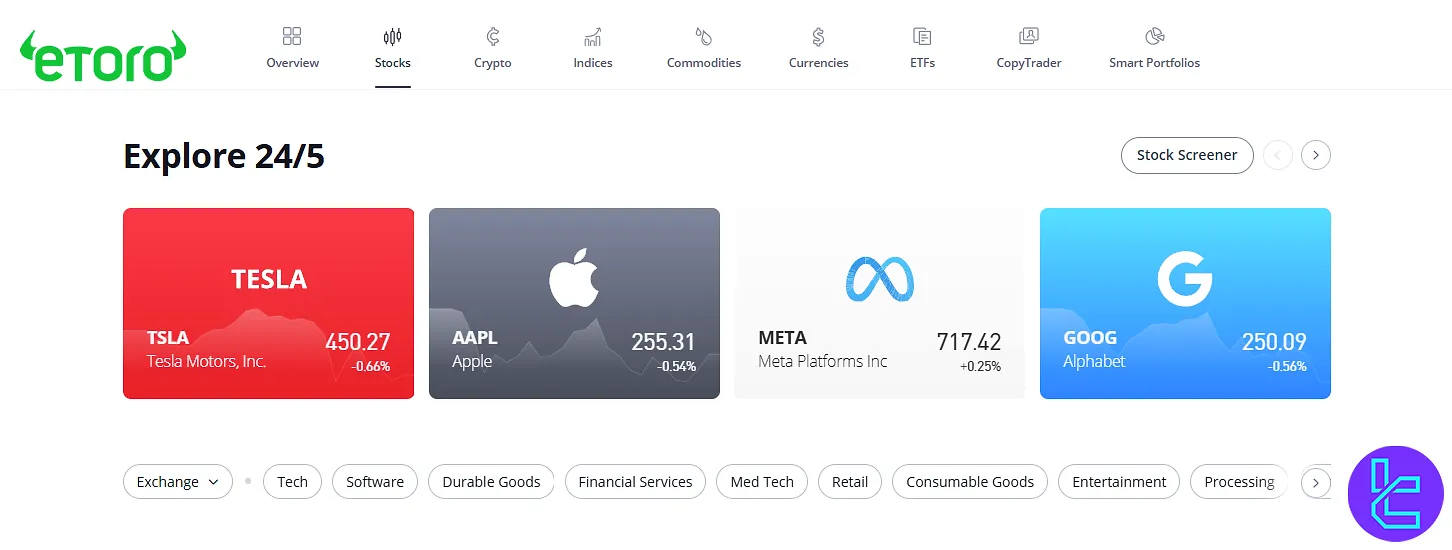

Which Markets and Symbols Are Tradable on eToro?

This brokerage provides access to +6,000 tradable assets across 6 different markets. We will take a look at the number of symbols in each market here:

Category | Type of Instruments | Number of Symbols / Assets | Competitor Average | Maximum Leverage |

Forex / Currencies | Major, minor, and exotic FX pairs (CFDs) | 62 | 60–80 | Retail: 1:30 / Pro: 1:400 |

Indices | Major global index CFDs | 31 | 10–30 | Retail: 1:20 / Pro: 1:100 |

Commodities | Metals, energies, and agricultural CFDs | 46 | 20–100 | Retail: 1:20 / Pro: 1:100 |

Stocks / Equities | Global company shares via CFD | 6000+ | 3000–10000 | Retail: 1:5 / Pro: 1:10 |

Cryptocurrencies | Spot and CFD crypto assets | 120+ | 50–150 | Retail: 1:2 / Pro: 1:5 |

ETFs / Funds | Non-leveraged Exchange Traded Funds | 735 | 500–1000 | Retail: 1:1 / Pro: 1:10 |

The maximum leverage for retail clients on eToro is 1:30, which applies to trading currencies.

On the other hand, if a trader qualifies as a professional client, they can access leverage of up to 1:400.

CFDs are available across most of these markets except in jurisdictions like the U.S., where only real crypto trading is supported via eToro USA LLC.

Bonuses, Promotions, and Incentive Offers

Based on our investigations, currently. eToro offers only a deposit bonus to its clients; you can receive $50 to your account balance for buying $500 worth of crypto assets.

We will update this article if any changes regarding these promotions happen with the broker.

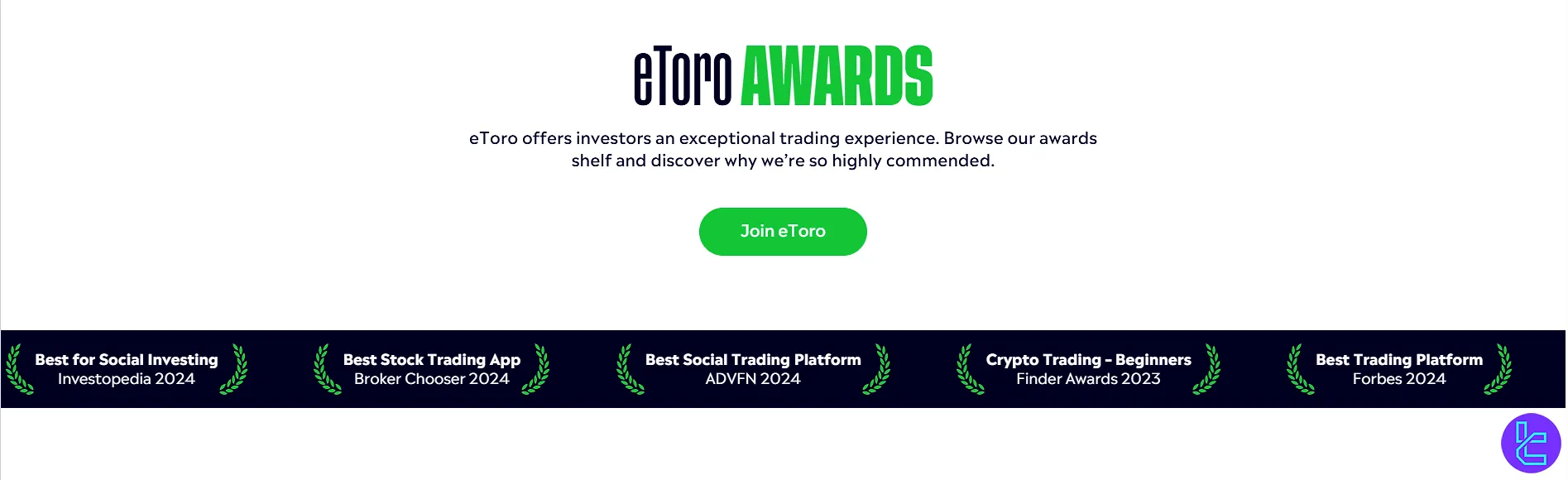

eToro Broker Awards

eToro has earned multiple industry recognitions, and its eToro Awards highlight the broker’s excellence in trading technology, social investing, and user experience.

For traders evaluating the broker’s credibility, these honors provide clear evidence of its standing in the global market.

The following are some of the most notable awards eToro has received:

- Forbes Advisor Best Trading Platform (2024)

- Investopedia Best for Social Investing (2024)

- ADVFN / Broker Chooser Best Social Trading Platform

- Forex Brokers.com Ease of Use / Social Copy Trading

- Good Money Guide Best Cryptocurrency Platform (2024)

- SourceForge Best Copy Trading Platform (2025)

How and When to Contact the Support Department

Customer service is usually provided via phone calls and messages. eToro follows the same rule, offering these contact channels:

- Ticket System: On the website

- Email Support: support@etoro.com

- Live Chat: Only available for registered users

Based on our examinations of reliable sources, support is available 24/5.

Restricted Countries and Regions

The broker's services are restricted to clients from many countries due to regulatory requirements and corporate decisions.

New users from these countries are not eligible to work with the brokerage:

- Syria

- Japan

- Turkmenistan

- Turkey

- Cuba

- Iran

- Iraq

- North Korea

- Pakistan

- Yemen

- Zimbabwe

- Virgin Islands

- Libya

- Liberia

- And more

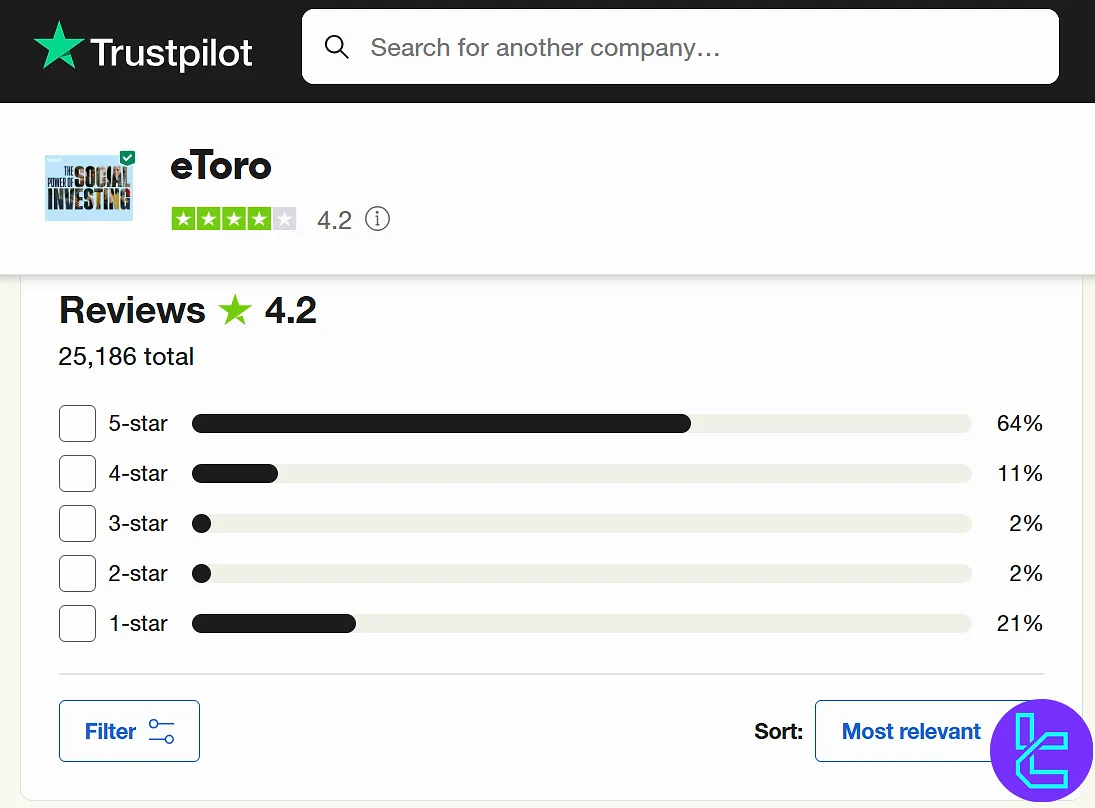

Trust Scores on Reliable Websites

According to the numbers shown on relevant websites, such as Trustpilot, REVIEWS.io, and ForexPeaceArmy, eToro's user reviews are generally positive:

- eToro Trustpilot: 4.2/5 (25,000+ reviews) with +60% of 5-star ratings

- reviews io: 2.6/5, only 11 user scores

- ForexPeaceArmy: 1.7/5 (220+ ratings)

While opinions vary, most users praise the broker's user-friendly platform and social trading features. Criticisms often focus on withdrawal times and customer support responsiveness.

Education Material Offering

eToro offers a variety of educational resources to help traders understand financial markets and the broker’s platform.

Topics include trading strategies, market analysis, and risk management.

Users can also access webinars, video tutorials, and interactive tools, allowing them to learn at their own pace and enhance their trading skills.

These resources include:

- Trading

- Investments

- Cryptocurrencies

- Getting started on the broker

- Technical analysis

- Working with charts

- And more

eToro UK in Comparison with Others

Here is a quick overview of eToro features compared to other well-known brokers; eToro Comparison:

Parameters | eToro UK Broker | TMGM Broker | FBS Broker | Alpari Broker |

Regulation | FCA, CySEC, MFSA, FSRA, ASIC, FSA, Gibraltar FSC | ASIC, VFSC, FSC, FMA | FSC, CySEC | MISA |

Minimum Spread | 0.0 Pips | 0.0 Pips | 0.0 Pips | 0.0 Pips |

Commission | From $0 | $3.5 in EDGE, $0.0 in CLASSIC | From $0 | From 0 on Trading (depending on the account type and payment method) |

Minimum Deposit | $10 | $100 | $5 | $50 |

Maximum Leverage | 1:400 | 1:1000 | 1:3000 | 1:3000 |

Trading Platforms | Proprietary App | MetaTrader 4, MetaTrader 5, IRESS, TMGM Mobile App | MetaTrader 4, MetaTrader 5, Mobile App | MetaTrader 4, MetaTrader 5, WebTrader |

Account Types | Personal, Professional, Corporate, Islamic | EDGE, CLASSIC | Standard | Standard, ECN, Pro ECN, Demo |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | 7,000+ | 12000+ | 550+ | 750+ |

Trade Execution | Market, Limit, Stop Loss, and Take Profit | Market Execution, Limit Order, ECN | Market | Market |

Conclusion and Final Words

eToro, as a financial broker, offers a $50 bonus for users who purchase $500 worth of cryptocurrencies. The platform charges a 1% fee for buying or selling crypto assets.

Additionally, a $10 monthly inactivity fee applies to accounts with no activity for 12 months. eToro boasts a Trustpilot rating of 4.2/5 based on over 25,000 reviews.