Eurotrader is a regulated Forex and CFD broker based in Cyprus that offers trading services through 2 main account types, including Standard and Raw, for over 800 tradable instruments with spreads as low as 0.0 pips.

This broker provides 3 deposit and withdraw methods with a low processing time of just 1 day.

This broker operates under reputable regulations such as CySEC in Cyprus and FCA in the UK which allows this broker to offer trading services to residents of EEA and Great Britain.

Eurotrader Broker Regulation and Company Information

Eurotrader is a relatively new player in the CFD brokerage scene, but it's quickly establishing itself as a force to be reckoned with.

Founded by a team with over 40 years of combined industry experience, Eurotrader aims to redefine the trading experience.

Eurotrader is regulated by the Cyprus Securities and Exchange Commission (CySEC) [license number 279/15], ensuring a high level of investor protection and adherence to strict financial standards.

This broker claims that it has regulation from other financial authorities, including FSC, FSA, and FSCA. Eurotrader headquarters are in London, and have an office in Limassol, Cyprus.

Entity Parameters / Branches | Asset Capital / Eurotrade Capital Ltd | Eurotrade Investments RGB Ltd | Eurotrade SA (Pty) Ltd | Eurotrade International Ltd |

Regulation | FCA | CySEC | FSCA | FSC |

Regulation Tier | 1 | 1 | 2 | N/A |

Country | United Kingdom | Cyprus | South Africa | Mauritius |

Investor Protection Fund/Compensation Scheme | Yes (FSCS up to £85k) | Yes (ICF up to €20k) | No | No |

Segregated Funds | Yes | Yes | Yes | Yes |

Negative Balance Protection | Yes | Yes | Yes | Yes |

Maximum Leverage | 1:30 | 1:30 | 1:1000 | 1:1000 |

Client Eligibility | UK | EU/EEA | South Africa | Global except prohibited (e.g. USA, Japan) |

Eurotrader Specifications

Let’s provide a detailed table to give you an overall view of what Eurotrader offers as a Forex Broker:

Broker | Eurotrader |

Account Types | Standard, Raw spread |

Regulating Authorities | FSC, FSA, FSCA, CySEC |

Based Currencies | $USD, £GBP, €EUR |

Minimum Deposit | $50 |

Deposit Methods | Visa/MasterCard, Bank wired, Skrill |

Withdrawal Methods | Visa/MasterCard, Bank wired, Skrill |

Minimum Order | 0.01 Lot |

Maximum Leverage | 1:30 |

Investment Options | Copy trading, signal trading |

Trading Platforms & Apps | MT4, MT5 |

Markets | Forex, indices, commodities, shares, crypto |

Spread | Floating from 0.0 pips |

Commission | From $7 |

Orders Execution | Market |

Margin Call/Stop Out | No |

Trading Features | Demo account, Forex calculator, economic calendar, Forex VPS |

Affiliate Program | Yes |

Bonus & Promotions | Deposit bonus, cashback bonus |

Islamic Account | Yes |

PAMM Account | No |

Customer Support Ways | Email, live chat, phone |

Customer Support Hours | 24/5 |

Restricted Countries | Iran, Canada, North Korea, USA, and more |

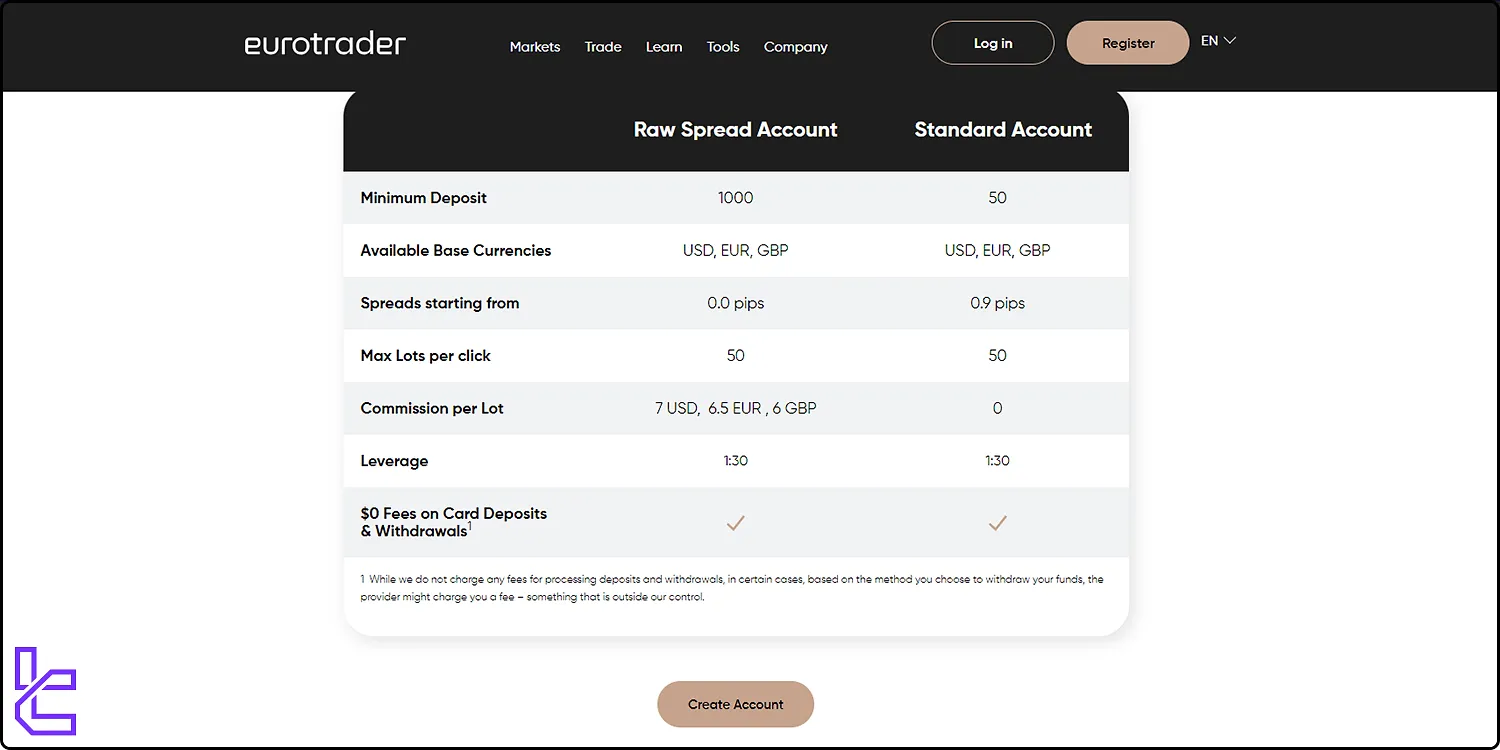

What Account Types Does Eurotrader Offer?

Eurotrader offers 2 account types to suit different trading styles and preferences:

Account types | Standard | Raw |

Minimum deposit | $50 | $1000 |

Minimum trading volume | 0.01 Lot | 0.01 Lot |

Maximum Leverage | 1:1000 | 1:1000 |

Spreads | Floating from 0.9 pips | Floating from 0.0 pips |

Commission | $0 | 7 USD, 6.5 EUR, 6 GBP |

An Islamic account is available too. EuroTrader's simple account structure helps traders choose the account type that best aligns with their trading experience and preferences.

Eurotrader also offers a demo account with a variety of features:

- Risk-free practice environment

- Replicates live trading conditions

- Ideal for testing strategies and getting familiar with the platform

Eurotrader Broker Pros and Cons

Let’s have a balanced look at Eurotrader's benefits and drawbacks:

Advantages | Disadvantages |

Regulated by CySEC, FSA, FSC, and FSCA | Relatively new broker, still building reputation |

Over 800 tradable instruments | $1000 minimum deposit for the Raw account |

Competitive spreads from 0.0 pips | - |

Access to popular MT4 and MT5 platforms | - |

Eurotrader Sign-Up and Verification Process

Eurotrader Registration is a detailed yet streamlined process that takes around 10 minutes.

From personal data to financial background, each step ensures compliance and tailored account setup.

#1 Begin Eurotrader Registration

Visit the official Eurotrader website and click “Register” to access the sign-up form.

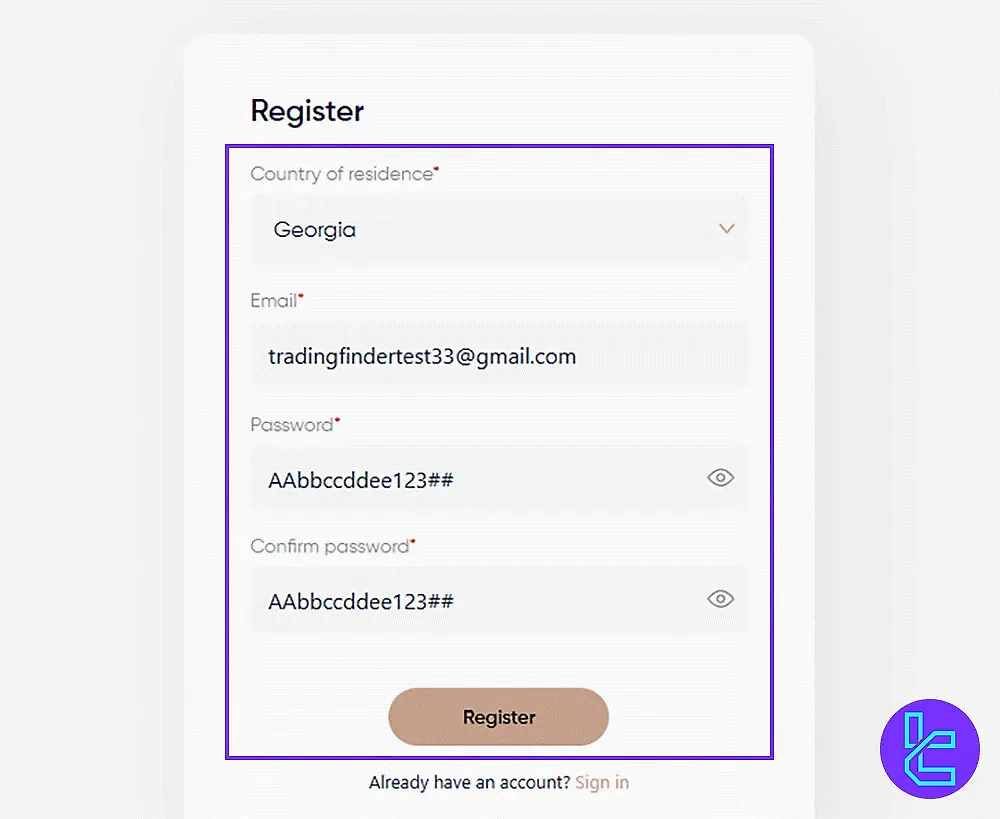

#2 Create Eurotrader Login Credentials

Fill in the registration form with the following information:

- Country

- Email address

- Password

- Confirm password

Once all required fields are completed, click “Register”.

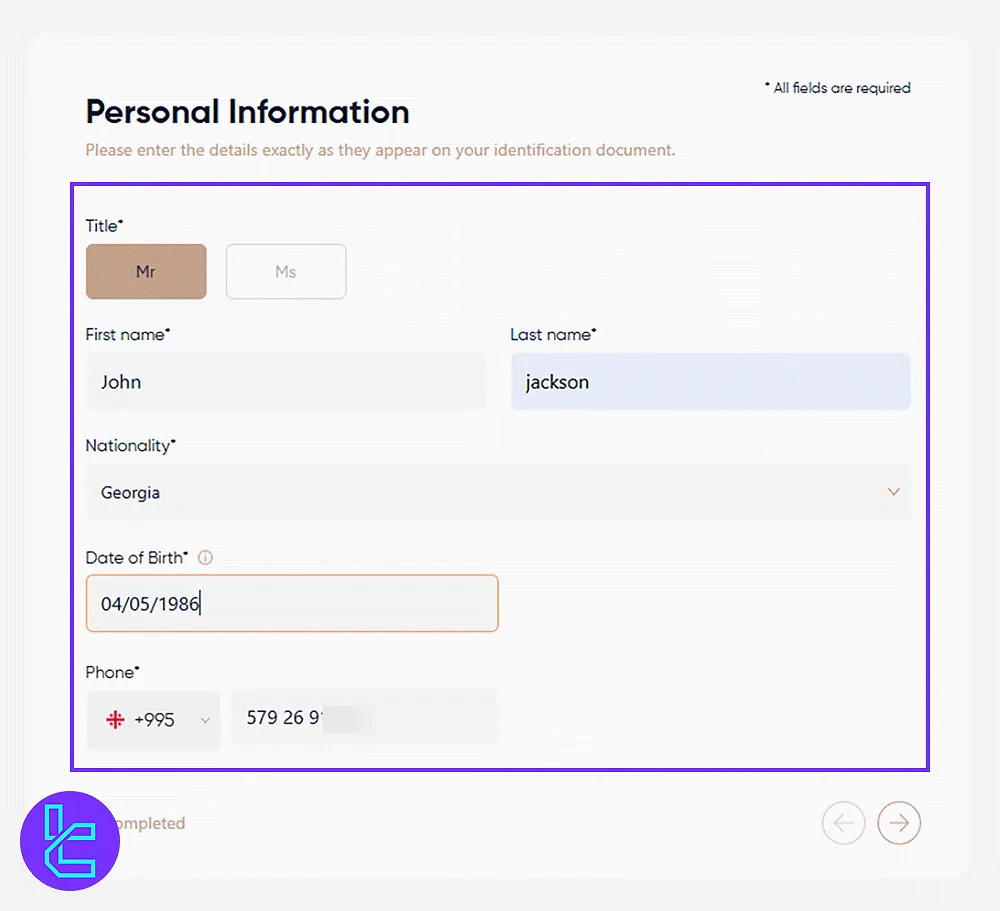

#3 Provide Personal Information on Eurotrader

On the following page, click “Continue” and provide your personal information:

- Title (Mr., Mrs., etc.)

- First name

- Last name

- Nationality

- Date of birth

- Mobile phone number

After completing these fields, click “Next” to move forward.

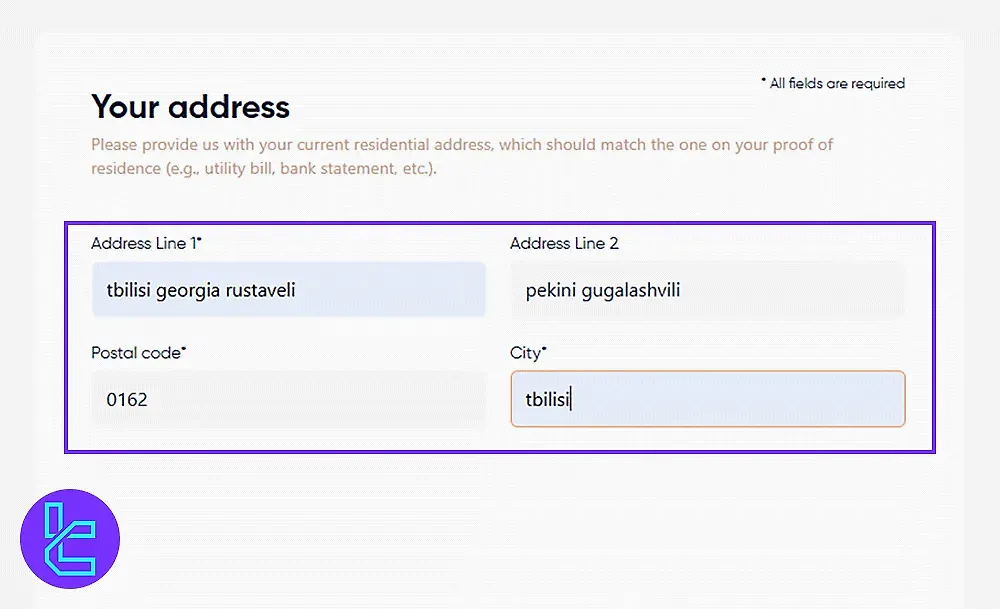

#4 Add Address Details in Eurotrader

Fill in your full residential address, including postal code.

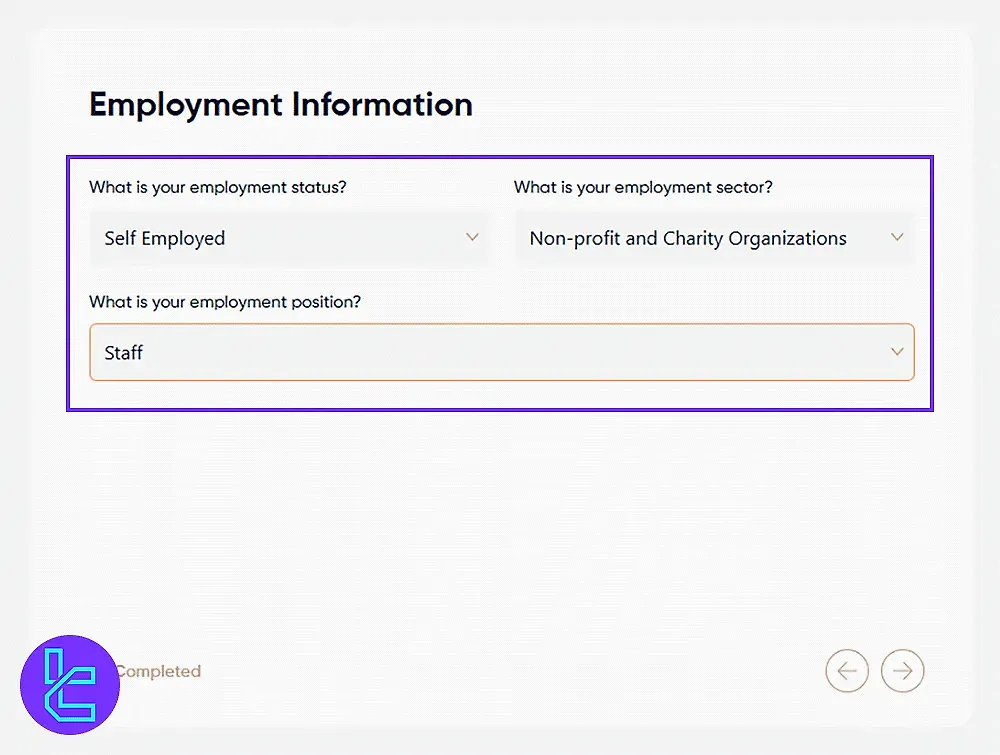

#5 Enter Employment & Financial Background in Eurotrader

On this page, complete the following steps and click “Next” after each entry:

- Indicate your U.S. citizenship status (choose No if it does not apply)

- Specify your employment details, including status, job type, and position

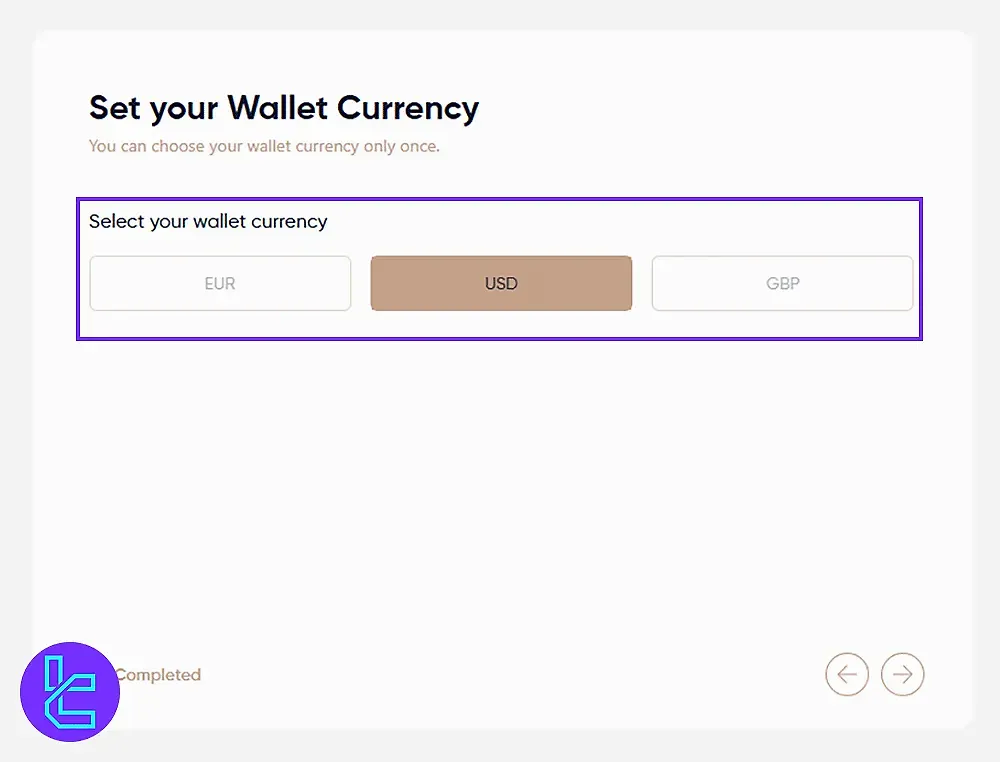

#6 Set Eurotrader Account Preferences

Choose youraccount currency (USD, GBP, EUR), accept the terms, and submit the form.

#7 Verify Your Email on Eurotrader

Open your inbox, find the Eurotrader verification email, and click the “Verify My Email” link to activate your account.

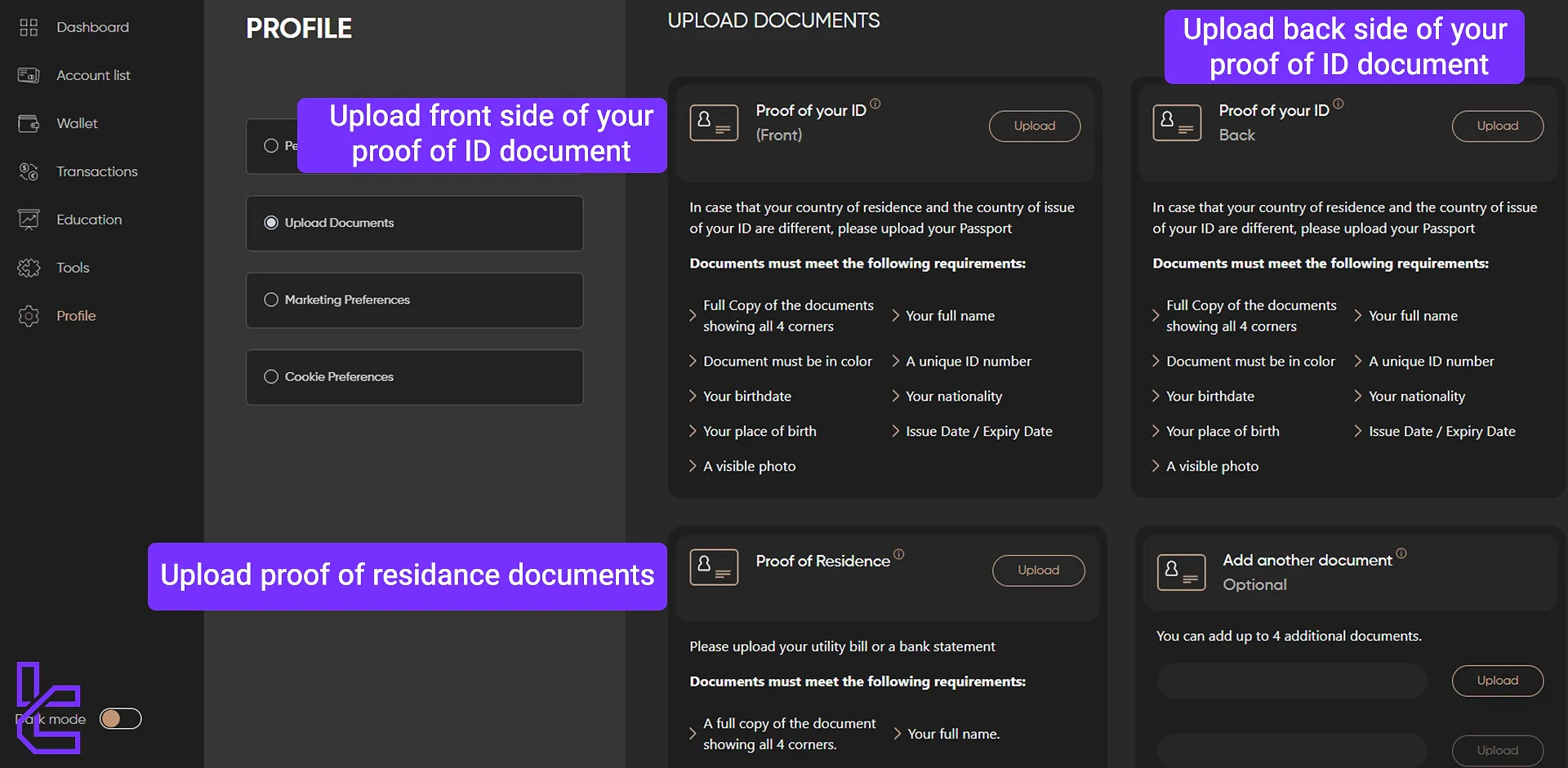

#8 Eurotrader Verification

To unlock full functionality, including deposits and trading access, you must complete identity verification using a passport, ID, or driver’s license, along with proof of address.

Eurotrader Broker Trading Platforms Overview

Eurotrader provides traders with access to the industry-leading MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, known for their robust features and user-friendly interfaces. Here's what you can expect:

MetaTrader 4 (MT4):

- Ideal for forex trading

- Advanced charting tools

- Expert Advisors (EAs) for automated trading

- Available on desktop, web, and mobile devices

Links:

MetaTrader 5 (MT5):

- Multi-asset trading platform

- Enhanced analytical tools

- More timeframes and pending order types

- Improved strategy tester

Links:

Eurotrader ensures that traders have access to these powerful platforms, allowing for a seamless trading experience across various devices.

You can access the MT4 indicators by visiting the related page on the website.

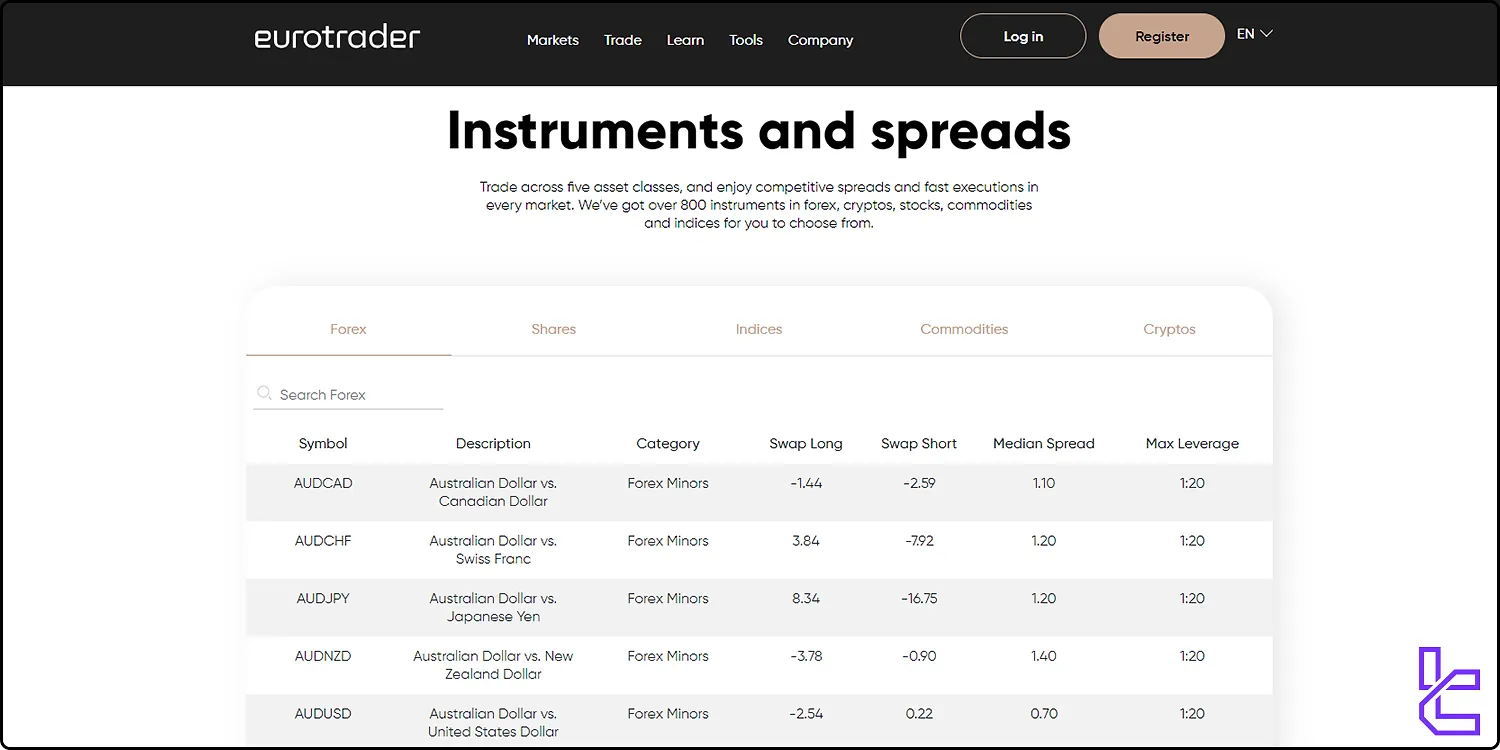

Eurotrader Broker Spreads and Commissions

Eurotrader offers competitive pricing structures across its account types:

Account types | Spread | Commission |

Standard | From 0.9 Pips | No commission |

Raw | From 0.0 Pips | $7 per lot per side |

The Swap-Free account delivers typical spreads between 1.1 and 1.3 pips, also without commissions.

Swap Fee at Eurotrader

Swap (overnight financing) charges at Eurotrader are applied when a position is held past the daily cutoff time, and the exact amount depends on the instrument, long vs short direction, and number of nights.

Their published “Costs & Charges” and “Cost and Charges (EU)” documents provide precise swap rates and illustrate how swaps are calculated.

Below are key points to know about their swap policy:

- Swap is posted at 23:59 server time daily and may be tripled on certain days to cover weekend accruals;

- For Forex, the formula used is: Lot size × swap rate × number of nights (for example, 1 lot × –58 = –6.58 USD);

- Swap-free or Islamic accounts waive interest swap fees, but instead charge an administration fee per lot nightly;

- A daily financing (swap) cost is illustrated as $0.70 for one day holding of a position.

Non-Trading Fees at Eurotrader

Eurotrader clearly outlines several non-trading fees in its official documentation, including withdrawal charges under specific conditions and inactivity fees applied to dormant accounts.

These costs are separate from spreads, commissions, or overnight swap rates, and can influence a trader’s net profitability.

Below are the key official non-trading fees disclosed by the broker:

- A 2% withdrawal fee applies when clients request funds before executing any trades on their account;

- The broker generally does not charge fees for deposits or withdrawals, as most transaction costs are covered by Eurotrader itself;

- For small card withdrawals equal to or below €20 (or equivalent), a fixed fee of €10 may be applied;

- Accounts with no trading activity for six consecutive months are subject to a $25 (or equivalent) monthly inactivity fee;

- When the account balance is below $25, the inactivity fee equals the remaining amount, effectively closing the account.

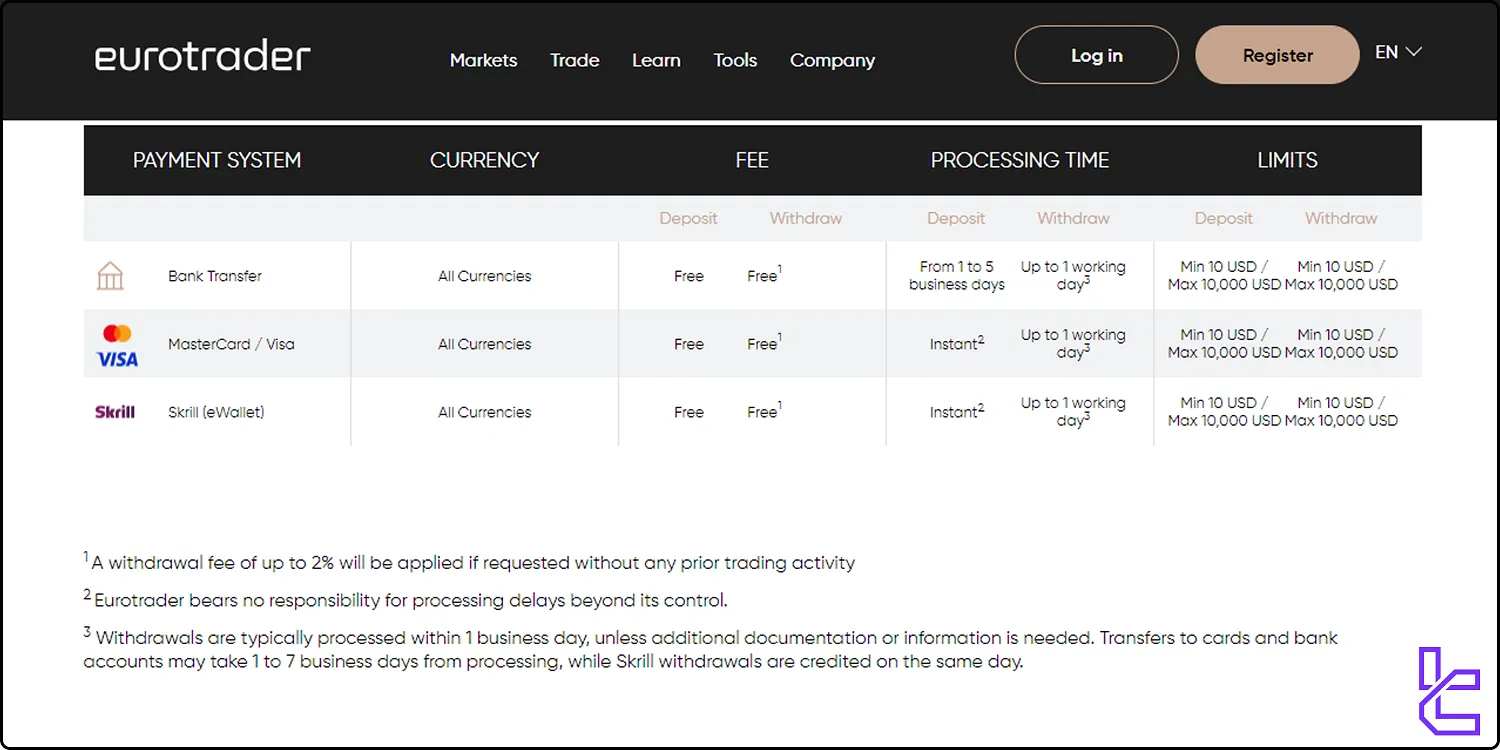

Eurotrader Broker Deposit & Withdrawal Review

Eurotrader offers a variety of convenient payment methods for deposits and withdrawals:

- Bank transfer

- Credit/debit cards

- Skrill

Key points about Eurotrader deposit/withdrawals:

- Minimum Deposit: $10 USD

- Maximum Deposit: $10,000 USD

- Processing Times: instant transfers for credit card and skrill deposits and 1 to 5 days for bank transfers

- Fees: Eurotrader does not charge fees for deposits or withdrawals, except for a potential 2% fee on withdrawals without prior trading activity

Deposit Methods at Eurotrader

Eurotrader offers multiple deposit methods, each with its own minimum, processing speed, and fee structure as officially disclosed in their “Withdrawals & Deposits” section.

Their system supports funding in all platform-currencies and emphasizes “fee-free” deposits (i.e. Eurotrader claims not to charge deposit fees).

Below is a table summarizing the core deposit options:

Deposit Method | Currency | Minimum Amount | Deposit Fee | Funding Time |

Bank Transfer | All Currencies | 10 USD | Free | 1 to 5 business days |

MasterCard / Visa | All Currencies | 10 USD | Free | Instant |

Skrill (eWallet) | All Currencies | 10 USD | Free | Instant |

Cryptocurrency | All Currencies | 20 USD | Free | Instant |

Withdrawal Methods at Eurotrader

Eurotrader supports several withdrawal options designed to offer flexibility and quick fund access for traders.

All standard methods are generally processed without internal fees, though specific conditions, such as withdrawals without prior trading activity may trigger additional costs.

Withdrawals are processed typically within 1 working day (although card or bank transfers may take 1–7 business days).

Below is a summary of the main withdrawal methods:

Withdrawal Method | Currency | Minimum Amount | Withdrawal Fee | Processing Time |

Bank Transfer | All Currencies | 10 USD | Free | Up to 1 working day + 1–7 business days external |

Visa / MasterCard | All Currencies | 10 USD | Free | Up to 1 working day |

Skrill (eWallet) | All Currencies | 10 USD | Free | Up to 1 working day |

Cryptocurrency | All Currencies | 20 USD | Free | Up to 1 working day |

Copy Trading & Investment Options Offered on Eurotrader Broker

Eurotrader offers a robust copy trading feature, allowing traders to replicate the strategies of successful traders:

- Copy Trading App: Easily follow and copy top-performing traders

- Diverse Strategies: Choose from a range of trading styles and risk profiles

- Performance Metrics: Detailed statistics to help you select the best traders to copy

- Customizable Settings: Adjust copy ratios and risk management parameters

- Real-Time Sync: Trades are copied instantly for optimal performance

Unfortunately, we couldn’t download and use the Eurotrader copy trading app so we only included the topics the broker promises to deliver.

Eurotrader also offers signal trading services through their partnership with Trading Central.

Traders can receive notification alerts on their web, mobile, or desktop about profitable trades in different markets.

Eurotrader Broker Tradable Markets & Instruments

Eurotrader offers a diverse range of trading instruments across multiple asset classes, providing traders with extensive opportunities to engage in various markets.

The broker supports over 800 instruments, encompassing forex pairs, commodities, indices, stocks, and cryptocurrencies.

Below is a table summarizing the trading instruments and markets offered by Eurotrader:

Category | Type of Instruments | Number of Symbols | Competitor Average¹ | Max. Leverage |

Forex | Majors, minors & exotics (currency pairs) | 60+ | 100–200 | 1:1000 |

Commodities | Spot metals, energy (gold, oil, silver) | 6 | 30–100 | 1:500 |

Indices | Global stock indices CFDs (e.g., S&P, DAX) | 11 | 20–50 | 1:500 |

Stocks | Single-share CFDs from global exchanges | 670 | 1000+ | 1:25 |

Cryptocurrencies | Major & alt coin CFDs | 40+ | 20–100 | 1:20 |

Bonds and ETFs are currently not supported. Traders benefit from multi-asset exposure via MetaTrader 4 and MetaTrader 5 platforms.

Bonuses and Promotions in Eurotrader broker

Now it’s time to go through bonuses and promotions in our Eurotrader review. Eurotrader offers several attractive promotions to both new and existing clients:

- 111% Deposit Bonus: Boost your trading capital with this generous offer on deposits between $50 to $20k;

- $50 No Deposit Bonus: Get started with a risk-free bonus to explore the platform;

- Affiliate Program: Earn commissions by referring new clients to Eurotrader.

It's important to read and understand these conditions before participating in any bonus program.

Eurotrader Broker Support Channels and Operating Hours

Eurotrader provides comprehensive customer support through various channels:

- Live Chat: Available 24/5 for quick queries and assistance

- Phone Support: +35725262826

- Email Support: Support@eurotrader.com

The multi-channel support system ensures that traders can get help when they need it, enhancing the overall trading experience.

The support is active 24/5 and offers assistance in English, Spanish, Italian, German, and more.

Eurotrader Restricted Countries

While Eurotrader aims to serve clients worldwide, regulatory restrictions prevent them from accepting clients from certain jurisdictions, including:

- United States

- Canada

- Cuba

- Iran

- North Korea

- Venezuela

- Yemen

- Sudan

Eurotrader Trust Scores and User Reviews

User reviews are a great source to gain valuable insights regarding a broker’s quality of services. Eurotrader Trustpilot score is 3.2 stars out of 5 from over 170 reviews.

While the broker has received mixed reviews, many clients appreciate their transparent approach and responsive customer service.

Does Eurotrader Offer Education Resources?

Eurotrader offers a comprehensive education hub to support traders at all levels:

- Education Hub: Structured curriculum covering trading basics to advanced strategies

- Blog: Regular updates on market trends and trading tips

- Platform Tutorials: Step-by-step guides for MT4 and MT5

- Ebooks: In-depth resources on various trading topics

- Video Courses: Visual learning materials for different trading aspects

These educational resources demonstrate Eurotrader's commitment to empowering traders with knowledge and skills for successful trading.

Comparing Eurotrader with Other Brokers

Let's compare the Eurotrader's features with those of other brokers; Eurotrader Comparison:

Parameters | Eurotrader Broker | |||

Regulation | FSC, FSA, FSCA, CySEC | FSA, CySEC, ASIC | CySEC, DFSA, FCA, FSCA, FSA | No |

Minimum Spread | Floating from 0.0 pips | 0.0 Pips | 0.0 Pips | 0.1 Pips |

Commission | $7 | Average $1.5 | From Zero | $0 |

Minimum Deposit | $50 | $200 | From $0 | $1 |

Maximum Leverage | 1:1000 | 1:500 | 1:2000 | 1:3000 |

Trading Platforms | MT4, MT5 | Metatrader 4, Metatrader 5, cTrader, cTrader Web, IC Markets Mobile | MT4, MT5, Mobile App | MetaTrader 4, MetaTrader 5 |

Account Types | Standard, Raw spread | Standard, Raw Spread, Islamic | Cent, Zero, Pro, Premium | Standard, Premium, VIP, CIP |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | 800+ | 2,250+ | 1,000+ | 45 |

Trade Execution | Market, Limit, Stop, and Pending | Market | Market, Buy Stop, Stop Loss, Limit, Take Profit | Market, Instant |

TF Expert Suggestion

EuroTrader aims to provide a top-tier trading experience with low spreads on the Standard (from 0.9 pips) and Raw (from 0.0 pips) accounts, with a maximum leverage of 1:30.

However, it isn’t quite successful in doing so since it only has 3.2 out of 5 stars on the Trustpilot website from over 170 reviews.

Many traders mentioned the high minimum deposit ($1,000) and commission ($7) of the Raw account as major drawbacks.