Exness is a global forex broker established in 2008 by Petr Valov and Igor Lychagov. The team behind this brokerage includes over 2,100 people from almost 100 countries. Valov serves as the chief executive officer of EXNESS Group, the company behind the broker.

Exness broker charges commissions starting from $0.2 up to $3.5 for trading. The spreads vary from zero to 0.8 pips.

Exness Forex Broker - Everything To Know & Regulation

Exness is a well-established and reputable forex broker that has been operating since 2008, with trading volumes surpassing $4 trillion per month. This broker is regulated by some of the most reputable financial authorities, such as:

Exness B.V | Exness (VG) Ltd. | Exness (SC) Ltd. | Exness (KE) Limited | Exness ZA (Pty) Ltd. | Exness (UK) Ltd. | Exness (Cy) Ltd. | Entity Parameters/Branches |

CBSC | FSC BVI | FSA | CMA | FSCA | FCA | CySec | Regulation |

3 | 3 | 3 | 2 | 2 | 1 | 1 | Regulation Tier |

Curaçao and Sint Maarten | British Virgin Islands | Seychelles | Kenya | South Africa | London, United Kingdom | Cyprus, Limassol | Country |

Up to €20,000 under Financial Commission | Up to €20,000 under Financial Commission | Up to €20,000 under Financial Commission | Up to €20,000 under Financial Commission | Up to €20,000 under Financial Commission | Up to £85,000 under FSCS | Up to €20,000 under ICF | Investor Protection Fund/Compensation Scheme |

Yes | Yes | Yes | Yes | Yes | Yes | Yes | Segregated Funds |

Yes | Yes | Yes | Yes | Yes | Yes | Yes | Negative Balance Protection |

1:2000 | 1:2000 | 1:2000 | 1:400 | 1:2000 | 1:2000 | 1:2000 | Maximum Leverage |

Global | Global | Global | Only Kenya | Only South Africa | Only United Kingdom | Only EU/EEA Residents | Client Eligibility |

Specifications

The broker positions itself as a leading global retail forex market maker, providing professional liquidity solutions to its clients. Here are some key specifications of the Exness forex broker:

Broker | Exness |

Account Types | Standard, Standard Cent, pro, Raw Spread, Zero |

Regulating Authorities | FSA, CySEC, FCA, FSCA, CBCS, FSC, CMA |

Based Currencies | EUR, USD, GBP, CAD, AUD, and CHF |

Minimum Deposit | $10 |

Deposit Methods | Neteller, Skrill, Perfect Money, Sticpay, Bank cards |

Withdrawal Methods | Neteller, Skrill, Perfect Money, Sticpay, Bank cards |

Minimum Order | 0.01 lot |

Maximum Leverage | Unlimited (Subject to account) |

Investment Options | Copy trading, algorithmic trading |

Trading Platforms & Apps | Exness Trade (mobile), Exness Terminal (web), MT4, MT5 |

Markets | Forex, indices, crypto, commodities, stock |

Spread | From 0.0 to 0.8 pips |

Commission | From $0.2 to USD 3.5 |

Orders Execution | Market Execution, Instant Execution |

Margin Call/Stop Out | Margin Call from 30% to 60% Stop Out 0% |

Trading Features | Negative Balance Protection, Exness VPS, Slippage rule |

Affiliate Program | Yes |

Bonus & Promotions | No |

Islamic Account | yes |

PAMM Account | no |

Customer Support Ways | Help Center, live chat, email, phone call |

Customer Support Hours | 24/7 |

Account Types

Exness offers several account types so that traders with different preferences can find the answer to their needs there. Account types include:

- Standard: designed for beginners and intermediate traders who prefer simplicity

- Standard Cent: perfect for beginners or those who prefer to trade with smaller amounts

- Pro: tailored for experienced and professional traders, offering flexibility for any trading style

- Zero: offers zero spreads during 95% of the day, making it ideal for high-frequency traders and scalpers

- Raw Spread: more suited to experienced traders who look for ultra-low, stable spreads

At the table below, we have an overview of each account's specifics:

Account type | Standard | Standard Cent | Pro | Zero | Raw Spread |

Spreads | From 0.2 pips | From 0.3 pips | From 0.1 pip | From 0.0 pips | From 0.0 pips |

Commissions | None | None | none | From $0.05/lot | From $0.00/lot to USD 3.5/lot |

Minimum deposit | $10 | $10 | $200 | $200 | $200 |

Leverage | Unlimited (Subject to conditions) | Unlimited (Subject to conditions) | Unlimited | Unlimited | Unlimited |

Margin Call | 60% | 60% | 30% | 30% | 30% |

Advantages and Disadvantages

When we are choosing among a list of suitable brokers, considering the pros and cons of each one is really important. Let's examine the positive and negative points of trading with Exness:

Advantages | Disadvantages |

Wide range of trading instruments | Limited educational resources for beginner traders |

Competitive spreads and commissions | Not all trading instruments are available on all account types |

Fast execution speeds and reliable trading platforms | Restricted in some countries |

Multi-regulated by reputable financial authorities | - |

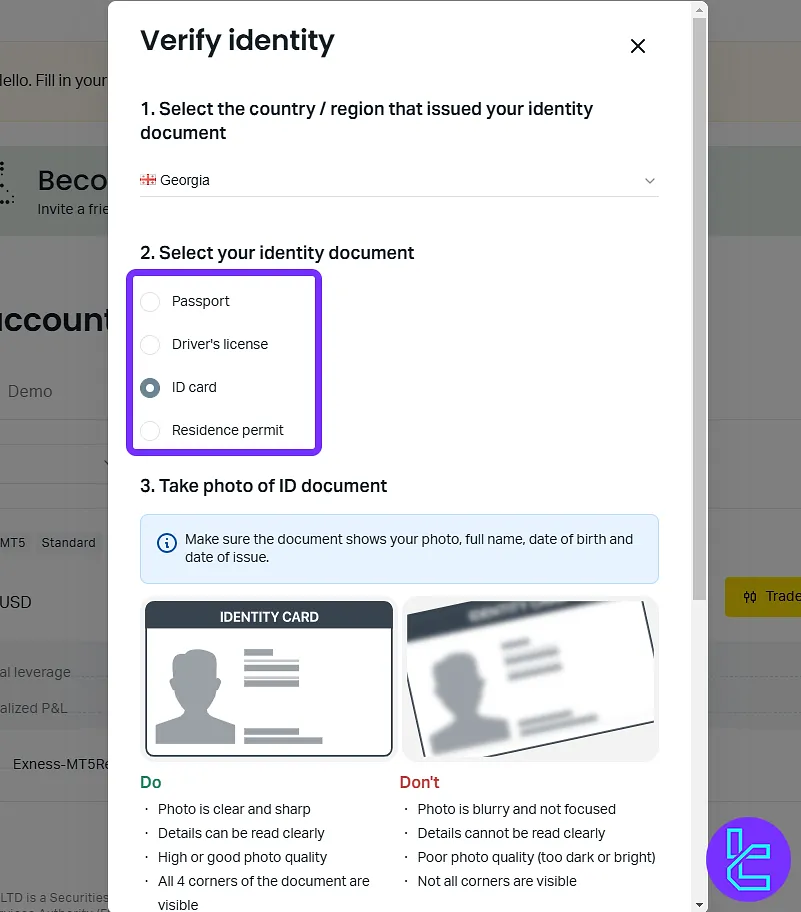

Registration and Verification

Signing up with Exness takes less than 5 minutes and gives you access to either a real or demo account, depending on your trading goals. The process is smooth and designed for both beginners and experienced traders. Exness registration:

#1 Visit the Exness Official Website

Go to Exness.com (or via TradingFinder) and click “Register” to begin.

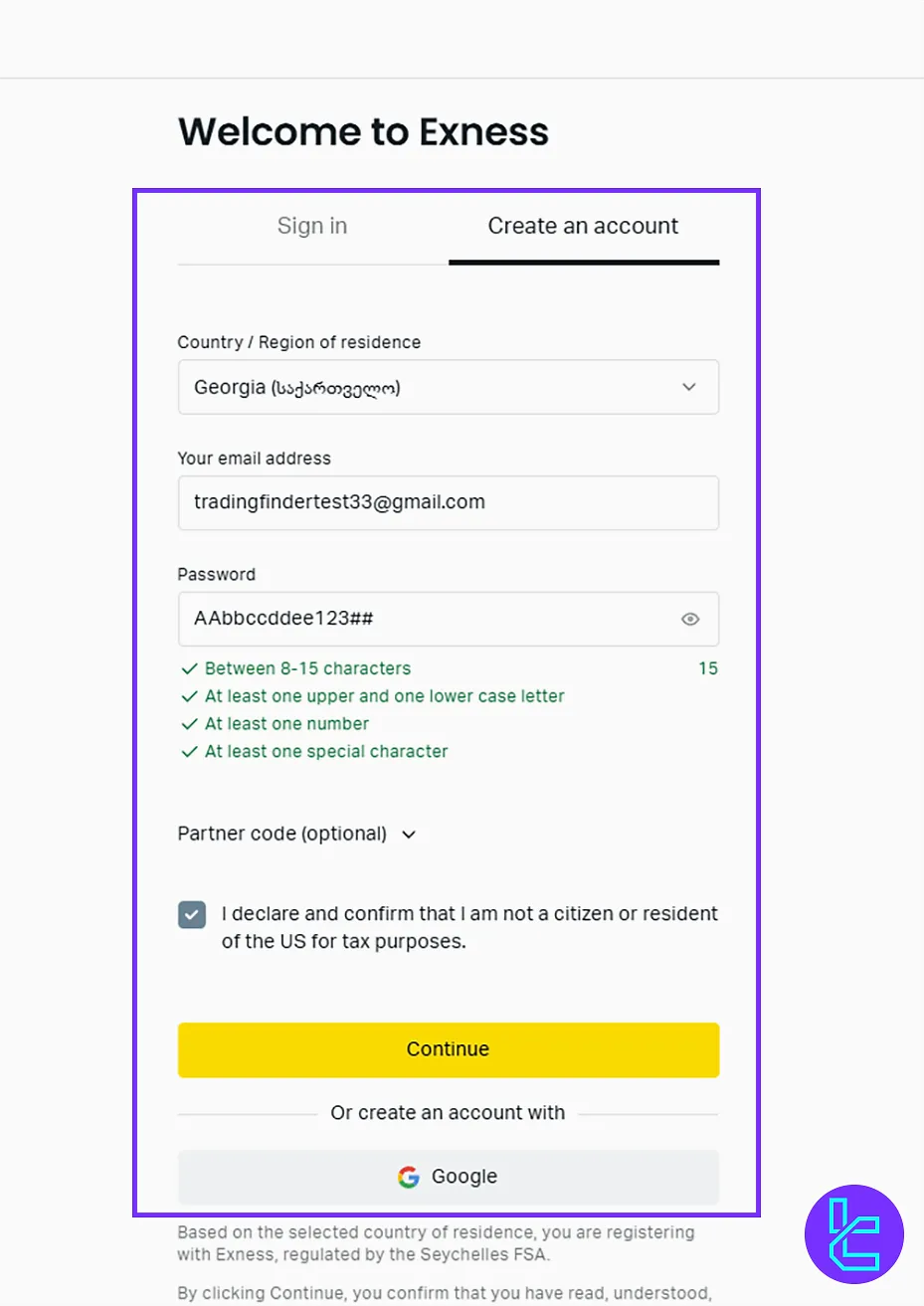

#2 Enter Your Registration Details

Select your country of residence, provide a valid email address, and create a secure password. Confirm you're not a U.S. citizen, and proceed.

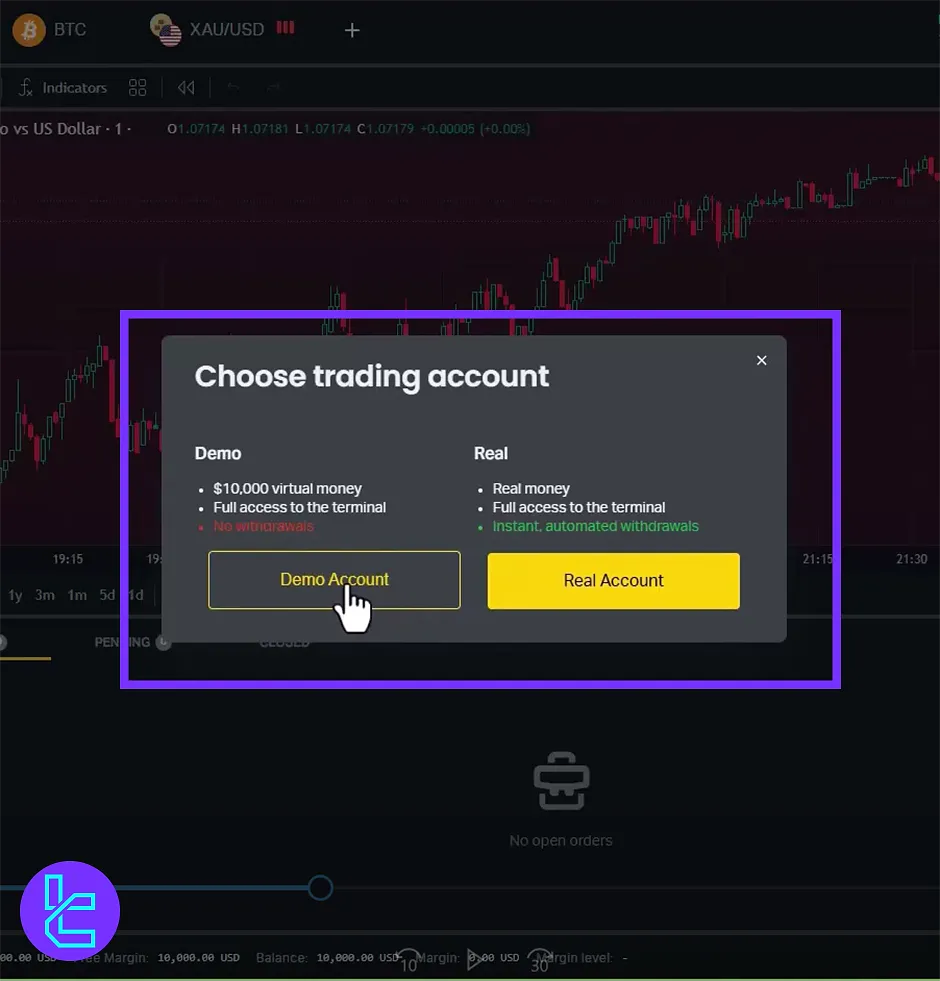

#3 Choose Exness Account Type

Pick between a Real or Demo account. You’ll then be redirected to the user dashboard (cabin).

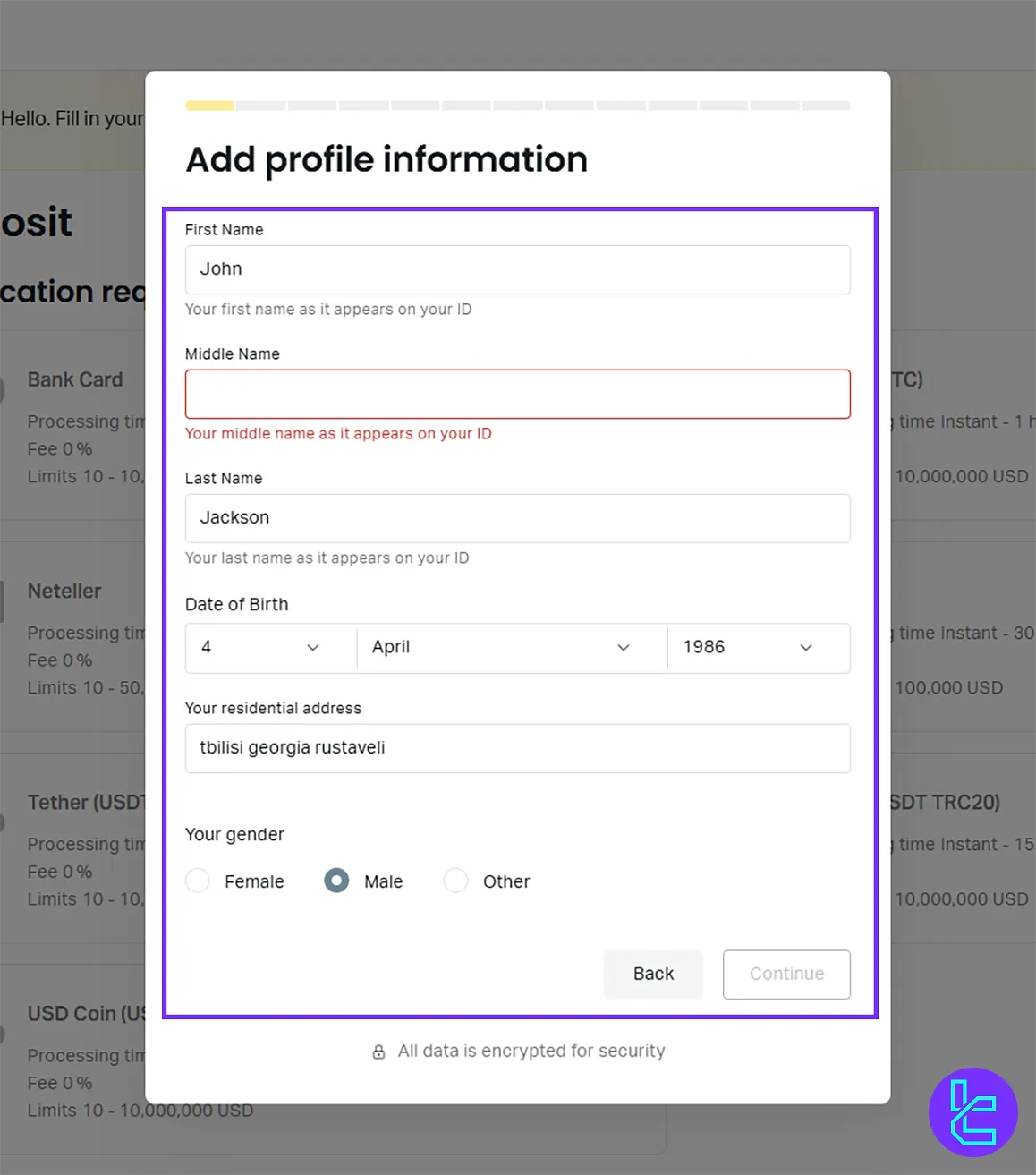

#4 Complete Your Profile on Exness

Fill in your name, date of birth, address, and gender. Submit your answers to the platform’s compliance questions to finalize setup.

#5 Verify Your Account on Exness

To activate full trading capabilities and unlock withdrawals, every Exness verification is mandatory.

This procedure involves seven streamlined stages, starting from basic contact validation to uploading an official Proof of Identity (POI) document, such as a passport, national ID, driver’s license, or residence permit.

Once the profile setup is initiated through the Exness dashboard, users confirm their email and phone number, submit personal and financial background details, and finally upload identity documents with clearly visible corners and legible information.

Most accounts are verified in under 10 minutes, with document reviews typically completed within 3 to 7 minutes. This verification is mandatory to enable withdrawals, and users can track their verification status directly from the dashboard.

Applications and Trading Platforms

Exness offers a variety of trading platforms to suit different trader preferences. You can choose one based on your needs.

- MetaTrader 4 (MT4): A popular platform known for its user-friendly interface and extensive technical analysis tools

- MetaTrader 5 (MT5): An advanced version of "MT4" with additional features and asset classes

- MultiTerminal: A trading platform on windows, suitable for managing multiple trading accounts

- WebTerminal: A web-based platform that requires no installation for trading instruments on Exness

- Exness Trade: Available for both iOS and Android devices, allowing traders to manage their accounts on the go

- Social Trading App: Allows clients to copy strategies from signal providers, with key metrics like drawdown, ROI, and a Trading Reliability Indicator

Commissions and Spreads

Exness offers competitive trading costs across its various account types. In the next parts, we will discuss this topic in these 2 categories:

- Commissions and fees

- Spreads

Commissions and Fees

Commission structures vary depending on the account type. Here, we will take a brief look at the commission for every account type:

Type | Amount |

Standard/Cent | None |

Pro | None |

Raw Spread | $0 to $3.5 |

Zero | From $0.05 per lot |

Exness does not charge any deposit, withdrawal, or inactivity fees. The only non-trading fee is a currency conversion fee when applicable.

Spreads

Just like commissions, spreads vary across account types in the mentioned broker. Spread the table for accounts:

Type | Amount |

Standard | From 0.2 pips |

Standard Cent | From 0.3 pips |

Pro | From 0.1 pips |

Raw Spread | From 0.0 pips |

Zero | From 0.0 pips |

Swap Fees

Exness offers swap-free conditions on a wide range of trading instruments, including major currency pairs, cryptocurrencies, indices, and gold. This means that overnight charges typically applied to extended positions are waived for these assets. However, eligibility and terms may vary depending on specific account settings and trading conditions.

Non-Trading Fees

Exness maintains a minimal non-trading fee structure, with no charges applied for account maintenance, inactivity, or fund deposits. Clients can also withdraw funds via cards, bank transfers, or e-wallets without incurring additional fees. These conditions contribute to a cost-efficient environment for managing funds outside of trading activity.

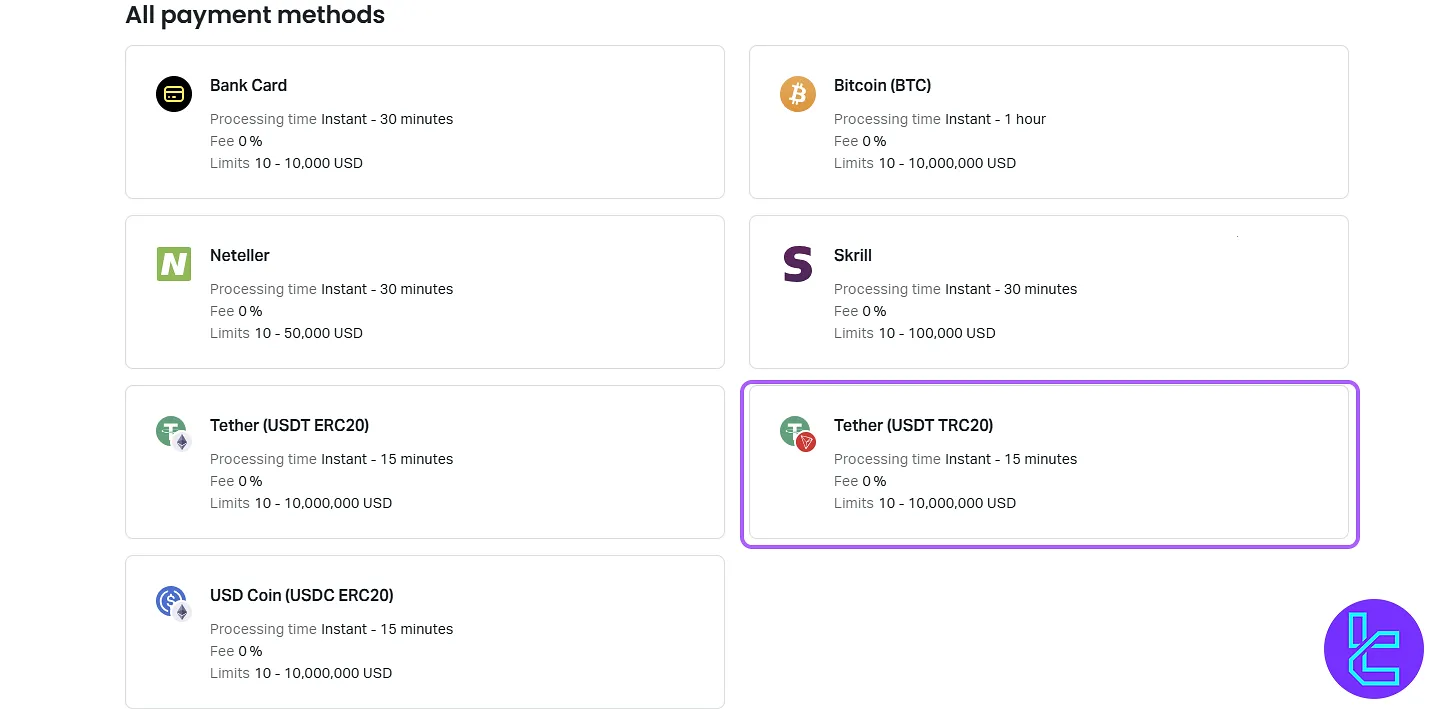

Deposit and Withdrawal Methods

Exness supports a wide variety of payment methods, allowing traders to transfer funds in and out of their accounts via the method that best suits them.

Clients can move funds through cryptocurrencies like USDT (ERC20/TRC20), BTC, and USDC, use e-wallets such as Neteller, Skrill, and SticPay, or opt for bank cards and Binance Pay. Internal transfers are also available between Exness accounts. Exness deposit and withdrawal Methods:

Exness Deposit

All deposits are fee-free, and most are processed instantly or within 30 minutes. Crypto channels like USDT TRC20/USDC often reflect within 15 minutes. Minimum deposits start at $10, while crypto methods allow up to $10 million per transaction, supporting high-volume traders.

Method | Minimum Deposit | Maximum Deposit | Processing Time |

Bank Card | $10 | $10,000 | Instant–30 minutes |

USDT (TRC20) | $10 | $10 Million | Instant–15 minutes |

USDT (ERC20) | $10 | $10 Million | Instant–15 minutes |

Skrill/Neteller | $10 | $100,000 | Instant–30 minutes |

Exness USDT TRC20 Deposit

To deposit USDT via TRC20 into your Exness trading account, log into your Exness Dashboard, choose the desired trading account, and click on “Deposit.” From the available methods, select Tether (TRC20) and confirm the account details to proceed.

A unique, one-time wallet address or QR code will be generated; copy it, and transfer your USDT from a licensed exchange or supported wallet. Each transaction requires a new wallet address, and the monthly deposit cap for this method is $30,000. Deposits typically complete within 15 minutes, offering a fast and efficient funding option for Exness users.

If you need visual guidance for this process, suggest checking the Exness USDT TRC20 deposit guide or watching the YouTube video below.

Exness Withdrawal

Payouts on Exness are equally swift, with crypto withdrawals like BTC and USDT processing in under 60 minutes, and most other methods within 1 day. No commission is charged on any withdrawal.

Method | Minimum Withdrawal | Maximum Withdrawal | Processing Time |

Bitcoin | $200 | $10 Million | Instant-1 Hour |

SticPay | $1 | $10,000 | Instant-1 Day |

Internal Transfer | $1 | $1 Million | Instant-1 Day |

USDT (ERC20) | $100 | $10 Million | Instant-15 Minutes |

Copy Trade and Investment Options

Exness offers a Social Trading service, allowing investors to copy the strategies of experienced traders. Here's a brief guide on how to start using Social Trading on this broker:

- Download the Exness Social Trading app;

- Create an account and deposit funds into your "Investment Wallet;"

- Browse available strategies, reviewing details like return, risk score, and commission rate;

- Select a strategy to copy and invest your desired amount;

- Trades are automatically copied from the strategy provider's account to yours.

Investors pay a commission fee to strategy providers based on a percentage of profits. This service provides an excellent opportunity for novice traders to learn from experienced professionals.

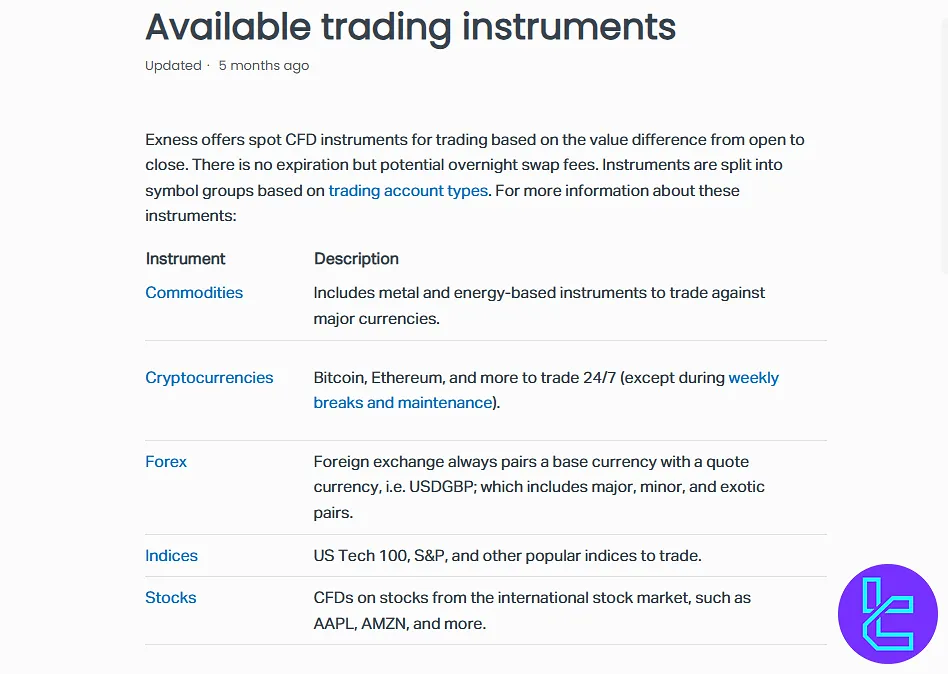

Which Markets and Symbols are Available for Trading?

On Exness, you can trade over 200 tradeable symbols and instruments across various markets:

Category | Type of Instruments | Number of Symbols | Competitor Average | Maximum Leverage |

Standard, Micro, Zero, Pro accounts (major, minor & exotic currency pairs) | 96 currency pairs | 50–70 currency pairs | 1:Unlimited (if eligible) | |

Stocks | CFDs on shares (via MT4/MT5) | Over 90 stock CFDs | 800–1,200 global stocks | 1:Unlimited (if eligble) |

Commodities | CFDs on commodities (metals & energies) | 18 commodity instruments | 10–20 instruments | 1:Unlimited (if eligble) |

Indices | CFDs on global indices | 10–12 major indices | 10–20 indices | 1:Unlimited (if eligble) |

CFDs on crypto assets | 9–10 cryptocurrency CFDs | Varies (often 5–15) | 1:Unlimited (if eligble) |

This variety of assets allows traders to invest and trade in various markets.

Bonus and Promotions

Exness does not offer traditional sign-up bonuses or deposit bonuses. However, they do provide:

- Referral bonus up to 50% of the broker's revenue through the Introducing Broker (IB) program

- Affiliate Program offering up to $1,850 for each referred client

- Occasional rewards based on specific campaign conditions

This approach aligns with Exness's commitment to transparency and fairness in trading conditions.

Exness Awards

Exness earned notable recognition across multiple financial summits for its performance in multi-asset trading and technological innovation. The broker was named Best Multi-Asset Trading Broker at the Africa Financial Technology Summit in Casablanca, and received the Best Broker in LATAM title during the iFX EXPO LATAM.

At the Smart Vision Summit Oman 2025, Exness was awarded for having the Most Trusted Multi-Assets Broker as well as the Best Copy Trading Program. It also secured the Most Innovative Broker accolade at Money Expo Abu Dhabi 2025. These acknowledgments reflect Exness's active role in expanding its offerings across regions and asset classes, while strengthening its reputation in both innovation and service quality.

How is Support and Customer Services in Exness?

Exness provides comprehensive customer support in different languages and through different methods. Here are some of its significant features:

- 24/7 customer support through live chat, email, and phone

- Multi-lingual support team

- Dedicated account managers for Pro account holders

- Extensive FAQ section and help center

- Positive reviews about the customer services

In What Countries is Exness Restricted?

While Exness is a global broker, it is restricted in certain jurisdictions due to regulatory requirements, or the broker itself does not offer service to the residents of those countries. Before trying to open an account on this paltform's website, you should check if your country is in the list here:

- Greece

- Hungary

- France

- Iran

- Iraq

- Syria

- Yemen

- New Zealand

- Canada

- Australia

- Vanuatu

- Israel

- Russia

Leverage and Margin: Numbers and Conditions

Exness offers competitive leverage options. If you are using MT4 or MT5 for trading on the broker, under specific conditions, you can have unlimited leverage for your account. Unlimited leverage conditions:

- Your trading account balance (equity) needs to be under 1,000 USD;

- You'll need to close at least 10 real trades (excluding pending orders) across all your accounts in your Personal Area (PA). Each trade must be for a minimum of 5 lots (or 500 cent lots)

If you trade on a "Standard" or "Standard Cent" account, the margin call will be 60%. On the other hand, it is 30%.

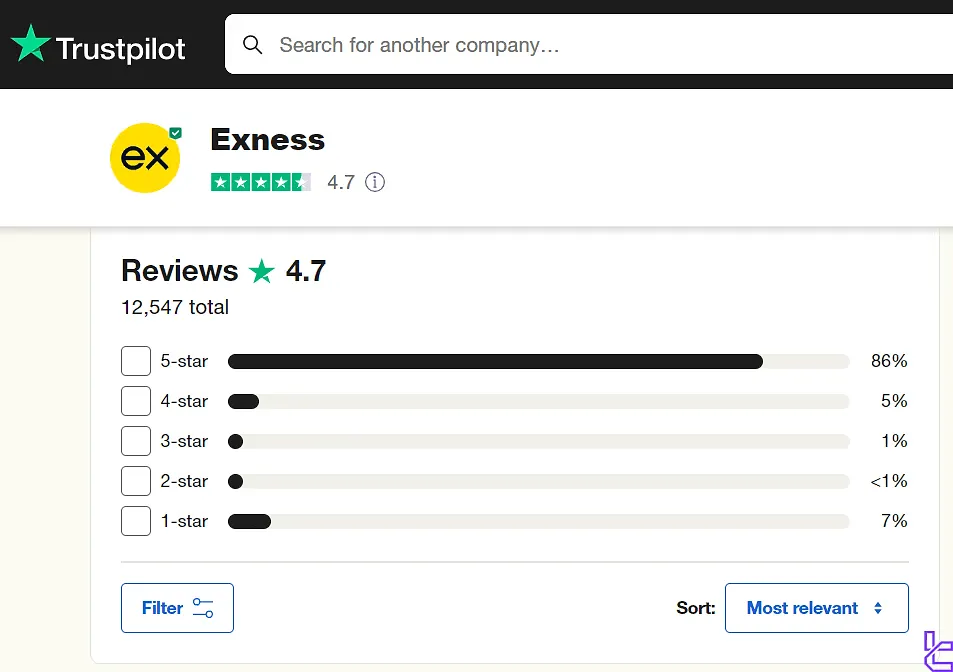

How do the Trust Scores Look on Reliable Websites?

Exness has received excellent trust scores from 2 of the top review websites:

- Trustpilot: 4.8 out of 5

Exness has received decent reviews from Trustpilot users.

Exness has received decent reviews from Trustpilot users.

- Exness Reviews.io: 2.5 out of 5

People have pointed out the fast support, vast range of tools and transparency as some of the significant strengths of this broker.

Overall, the broker has been successful in attracting users' positive reviews.

Education Content and Tools

Exness provides educational resources for traders:

- Blog with educational articles and posts

- Youtube tutorials and guides

- Market analysis and daily news updates

- Economic calendar

- Demo accounts for practice trading

While this broker offers these resources, some reviews suggest that the educational content could be expanded to compete with top-tier brokers in the industry.

Exness in Comparison with Other Brokers

To choose the best broker, here is a quick comparison between Exness and its rivals: Exness Comparison:

Parameter | Exness Broker | |||

Regulation | FSA, CySEC, FCA, FSCA, CBCS, FSC, CMA | No | FCA, FSCA, CySEC, SCB | FSA, CySEC, ASIC |

Minimum Spread | 0.0 Pips | 0.1 Pips | Varies based on Account | 0.0 Pips |

Commission | From $0.2 to USD 3.5 | $0 | Varies based on Account | Average $1.5 |

Minimum Deposit | $10 | $1 | $100 | $200 |

Maximum Leverage | Unlimited (Subject to account) | 1:3000 | 1:500 | 1:500 |

Trading Platforms | Exness Trade (mobile), Exness Terminal (web), MT4, MT5 | MetaTrader 4, MetaTrader 5 | MT4, MT5, cTrader, Web Trader, Mobile App | MT4, MT5, cTrader, cTrader Web, IC Markets Mobile |

Account Types | Standard, Standard Cent, Pro, Raw Spread, Zero | Standard, Premium, VIP, CIP | Standard, Pro, Raw+, Elite | Standard, Raw Spread, Islamic |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | 200+ | 45 | Not specified | Not specified |

Trade Execution | Market Execution, Instant Execution | Market, Instant | Market Execution, Instant Execution | Market |

TF Expert Suggestions

Currently, Exness is serving over 700,000 users, trading a monthly volume of over 4 trillion USD. This broker has obtained 8 licenses from trusted authorities [FSA, CySEC, FCA, FSCA, CBCS, FSC, CMA].

Also, the company maintains offices in 7 countries such as the UK, Cyprus, Kenya, Curaçao, Seychelles, British Virgin Islands, and South Africa.