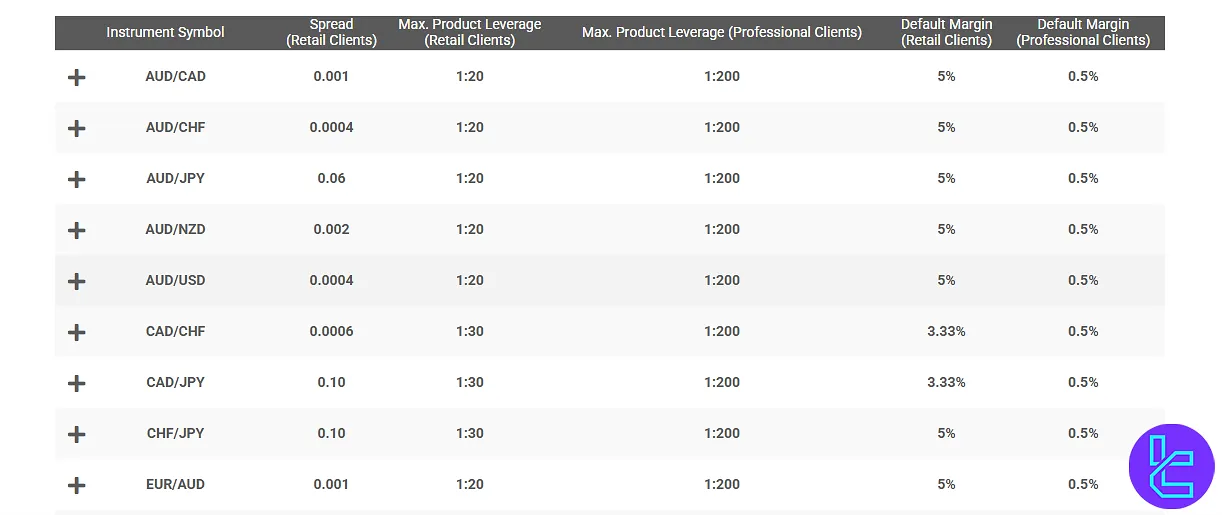

Finansero offers 2 trading accounts [Retail, Professional] with Rollover fees starting from 0.015% on currency pairs.Retail clients are allowed to trade with a maximum leverage of 1:30, while professional clients can trade with a maximum leverage of 1:200.

The broker's tradable instruments, with spreads from 0.6 pips on EUR/USD, are provided via the XCITE trading platform.

Finansero Review: account types, commissions, spreads, and everything else

Finansero Review: account types, commissions, spreads, and everything else

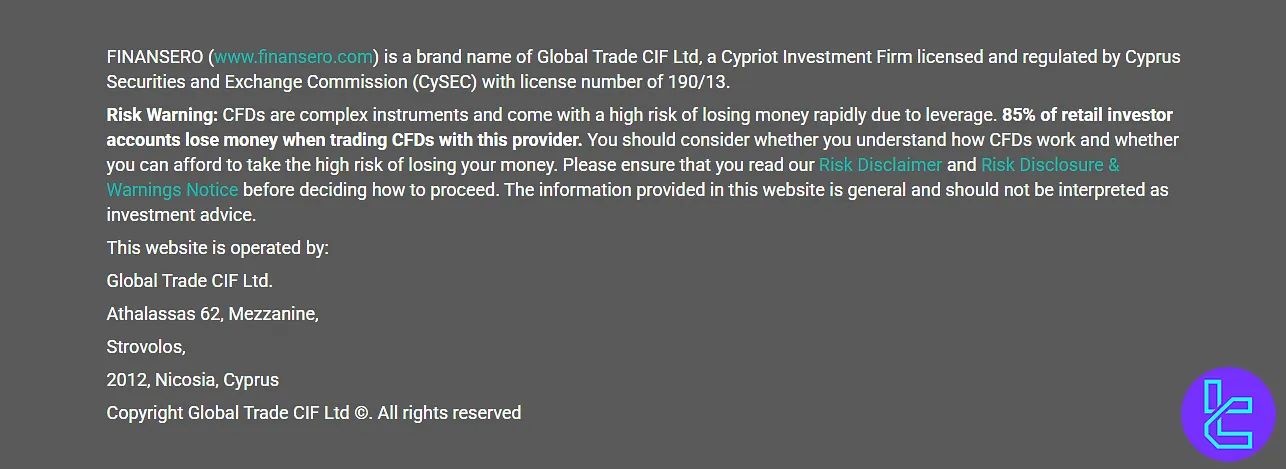

Finansero Company Information & Regulation

The broker operates under the umbrella of Global Trade CIF Ltd., a Cypriot company. Related Details and Specifics:

- Regulator: Cyprus Securities and Exchange Commission (CySEC) under license number 190/13

- License Number: 190/13

- Registered Address: Athalassas 62, Mezzanine, Strovolos, 2012, Nicosia, Cyprus

- Year Established: 2013

The broker enables CFD trading across more than 300 financial instruments, covering a diverse range of asset classes like forex, stocks, indices, commodities, cryptocurrencies, ETFs, and synthetic derivatives.

Operating under an STP execution model, Finansero emphasizes transparency and regulatory compliance, offering services in line with MiFID II and GDPR. The broker supports both retail and professional clients, with leverage up to 1:30 and 1:200, respectively.

Read a summary of the company information about Finansero in the table below:

Entity / Parameters | Global Trade CIF Ltd |

Regulation | CySEC (License 190/13) |

Regulation Tier | 1 |

Country | Cyprus |

Investor Protection Fund / Compensation Scheme | €20,000 (Investor Compensation Fund – ICF) |

Segregated Funds | Yes |

Negative Balance Protection | Yes |

Maximum Leverage | 1:200 |

Client Eligibility | EEA / EU clients only |

An investor compensation scheme offers protection up to €20,000. Finansero maintains a clean regulatory record, reinforcing its credibility as a safe and compliant broker for European clients.

Finansero Summary Of Key Specifics

Every Forex broker operates based on a structure of parameters and features. We will go through that of Finansero in the table below:

Broker | Finansero |

Account Types | Retail, Professional |

Regulating Authority | CySEC |

Based Currencies | EUR |

Minimum Deposit | $200 |

Deposit Methods | Credit/Debit Card, E-wallets, Bank Transfers |

Withdrawal Methods | Credit/Debit Card, E-wallets, Bank Transfers |

Minimum Order | 0.01 |

Maximum Leverage | 1:200 |

Investment Options | None |

Trading Platforms & Apps | XCITE |

Markets | Forex, Commodities, ETFs, Indices, Shares, Synthetic Derivatives, Crypto |

Spread | From 0.6 Pips on EUR/USD |

Commission | $0 |

Orders Execution | Market |

Margin Call / Stop Out | 100% / 50% |

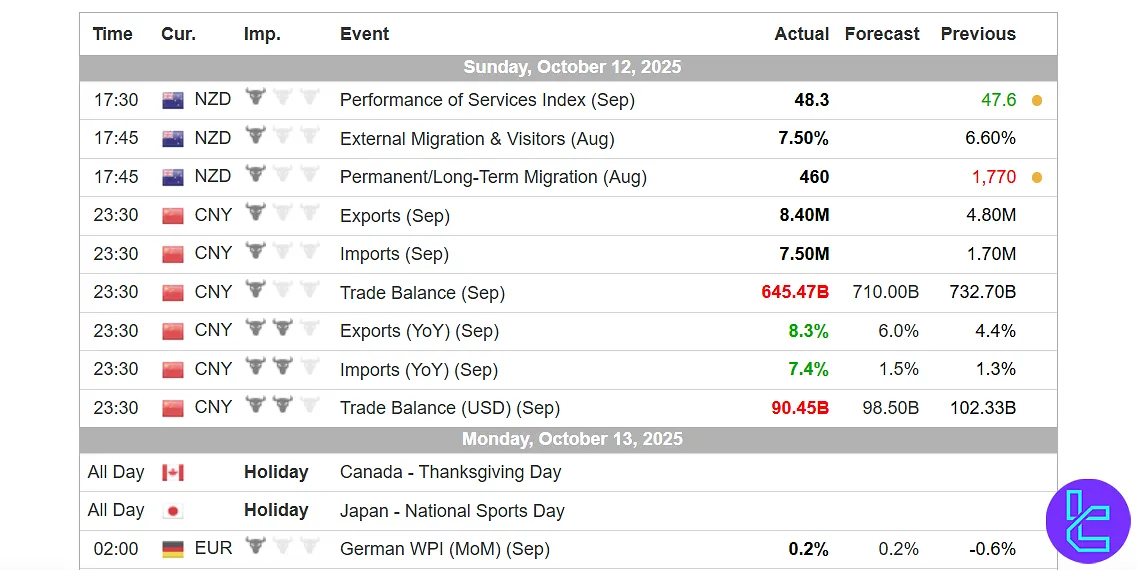

Trading Features | Economic Calendar, Glossary |

Affiliate Program | None |

Bonus & Promotions | None |

Islamic Account | None |

PAMM Account | None |

Customer Support Ways | Live Chat, Ticket, Email, Phone Call |

Customer Support Hours | 24/5 |

What Pros and Cons Should You Know About?

There are no brokerages that operate flawlessly. Let's mention the notable benefits and drawbacks of trading with Finansero:

Pros | Cons |

CySEC Regulation | High Minimum Deposit |

Autochartist Integration | No MT4/MT5 Platform Support |

Negative Balance Protection | - |

Available Trading Accounts

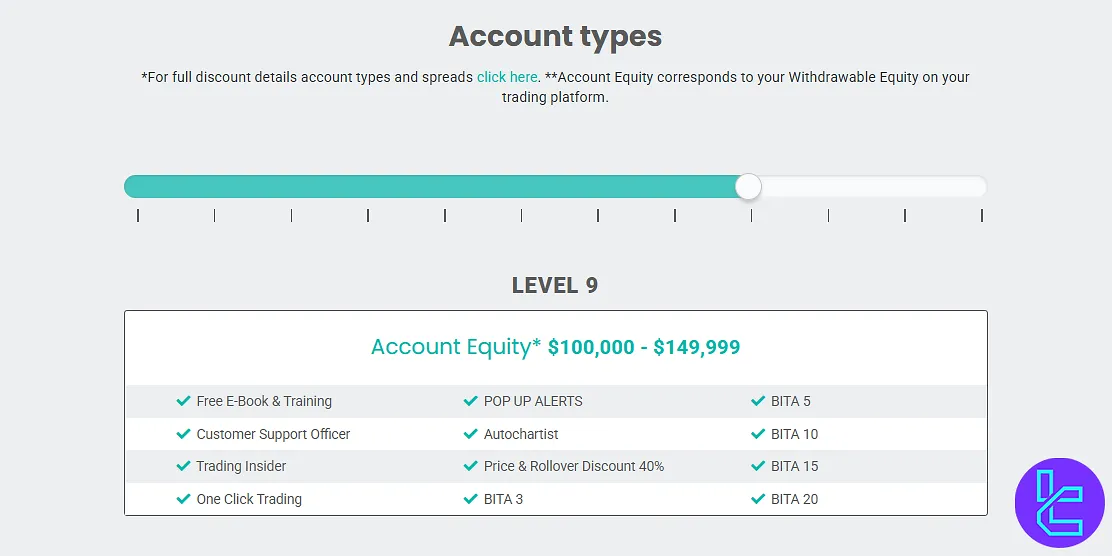

Finansero offers two main account types [Retail, Professional] with few differences to its clients. However, the former follows a tier system made up of 9 levels.

The higher the level, the lower the Rollover and prices will be. Account Details:

Account Type | Retail | Professional |

Min. Deposit | $200 | N/A |

Max. Leverage | 1:30 | 1:200 |

Swap-Free Account | None | |

The nine account levels start from $200 and extend beyond $100,000, unlocking tools and cost advantages at each stage.

From Level 3 upwards, advanced tools like Autochartist and BITA metrics for technical analysis become available. Traders in the highest tier benefit from up to 40% reductions on spreads and rollover fees.

For upgrading to a professional account, you will need to make a request after meeting the relevant criteria.

There is no demo account available as we have seen in other brokers. However, the first 5 trades on the retail account are "educational"; no profits or losses are effective. Currently, there is no provision for Islamic (swap-free) accounts.

Account Opening and Verification Process: Helpful Guide

Opening an account on Finansero is fast and user-friendly. Users can sign up using traditional input fields or link their Google or Facebook accounts.

After the initial step, full access requires completing a detailed onboarding flow that includes personal details, residency info, trading experience, and identity verification all accessible within the user dashboard.

#1 Start the Registration

Go to the Finansero website and click “Register”. Provide the following information:

- Full name

- Phone number

- Password

Click on the designated button on the website to register with Finansero

Click on the designated button on the website to register with Finansero

#2 Complete Profile Information

Once the basic account is created, log in to your dashboard and provide the following:

- Personal information and residency address

- Answers to a trading experience questionnaire

- ID documents for identity verification

Offered Platforms for Trading With Finansero Broker

The XCITE platform employed by the broker is the only option you have for working with it. Key Features:

- +300 various trading tools

- Essential functions such as the stop loss and the take profit

- Autochartist integration for technical analysis

- Access to an economic calendar

Here are the download links for installing the application on Android and iOS devices:

Integrated tools like Autochartist and Trading Insider enrich the trading experience with real-time analytics and social trading functionalities.

However, algorithmic and automated traders may find the absence of MT4/MT5 and cTrader platforms limiting. XCITE stands out for its simplicity, making it suitable for both novice and experienced traders seeking a streamlined environment.

Spreads and Commissions for Trading and Non-Trading Activities

Finansero operates on a spread-based model, meaning it charges no trading commissions. The spread varies depending on the trading pair; here are two popular examples:

- EUR/USD: Starting from 0.6 pips

- GBP/USD: Starting from 1.2 pips

These spreads reflect the typical cost of trading major currency pairs on Finansero and can fluctuate slightly depending on market conditions.

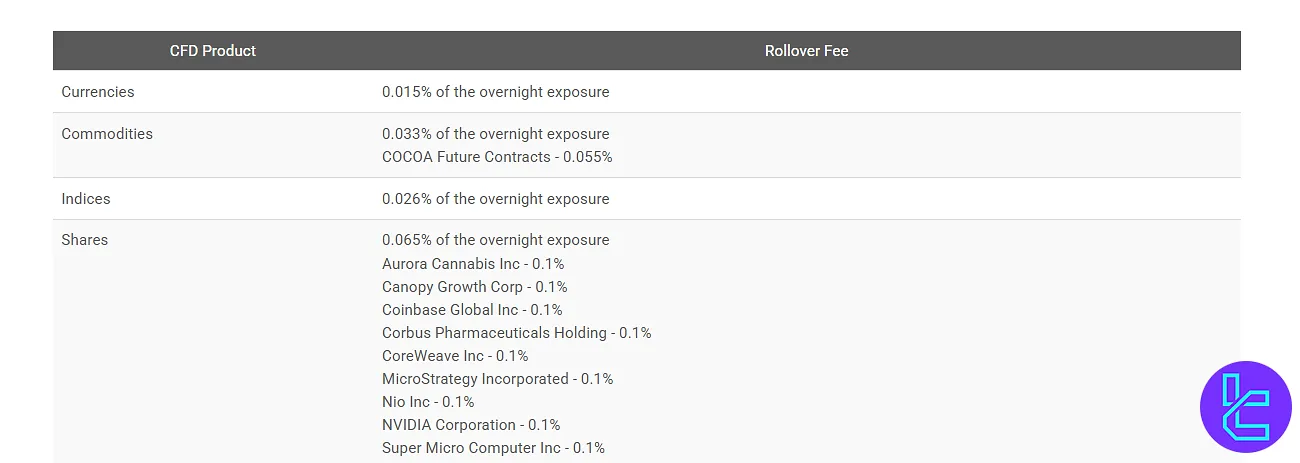

Swap Fee at Finansero

If a position remains open overnight at Finansero, a rollover fee is automatically applied to the account. This fee, also known as the swap charge, is deducted at 00:00 GMT.

According to its official cost structure, these fees differ across Forex, commodities, and cryptocurrencies, reflecting the specific risk and liquidity conditions of each market.

Below are the most important facts about Finansero’s swap fee policy:

- Forex positions incur an overnight rollover fee of 0.015% of the total exposure;

- Commodity instruments are charged a slightly higher overnight fee of 0.033%;

- Cryptocurrency assets have a 0.50% overnight financing fee applied to both Retail and Professional clients;

- For indices, an overnight swap fee of 0.026% of the position’s exposure is applied;

- Finansero does not offer swap-free /Islamic accounts.

Non-Trading Fees at Finansero

Finansero clearly outlines its non-trading fees, focusing on costs that apply outside of active trading such as currency conversion and potential account inactivity.

These charges can impact overall profitability, especially for long-term or multi-currency traders.

Here are the main non-trading fees to consider:

- Currency Conversion Fee: 0.7% applied to the trade’s realised profit or loss when the instrument’s currency differs from the account base currency;

- Deposit and Withdrawal Fees: No internal fees listed, though third-party payment processors may impose their own costs.

Funding/Withdrawal Methods

Finansero offers a variety of payment methods, including a total of 10+ options, to its clients. Here is a list mentioning them:

- Credit/Debit Cards: VISA, MasterCard, Maestro, etc.

- E-wallets: Skrill, Neteller, Apple Pay, Google Pay, iDEAL, and so on

- Bank Transfers: Various methods

The minimum deposit is €200, and the broker does not impose any deposit or withdrawal fees.

Withdrawals are processed within 24 hours, though actual clearance may depend on the external payment provider. To comply with AML regulations, withdrawals must be directed to the original deposit source.

The streamlined process via the XCITE platform ensures a smooth user experience during fund transfers.

How to Deposit Funds with Finansero

Below is a summary table of the current official deposit methods:

Deposit Method | Currency | Minimum Amount | Deposit Fee | Funding Time |

Credit/Debit Card | EUR (or equivalent) | €200 | No internal fee | Instant |

E-Wallets (via PSPs) | EUR (or equivalent) | €200 | No internal fee | Instant |

Bank Wire Transfer | EUR (or equivalent) | €200 | No internal fee | Up to 5 business days |

How to Withdraw Funds from Finansero

Finansero supports withdrawals via the same channels used for deposits, ensuring refund paths are consistent and aligned with anti-money laundering policies.

Below is a table summarizing key withdrawal method details:

Withdrawal Method | Currency | Withdrawal Fee | Funding Time |

Credit / Debit Card | Account base (e.g. EUR) | No commission | Processed in 24h, then depends on card issuer |

E-Wallets (e.g. Skrill, Neteller) | Account base | No commission | Processed in 24h, then depends on provider |

Bank Wire Transfer | Account base | No commission | Processed in 24h, then depends on banks |

Are There Any Copy Trading or Other Investment Options on Finansero?

Unfortunately at the time of reviewing this forex broker, it does not currently offer copy trading features.

However, this is not necessarily a notable drawback since an investment option is an additional feature; not a main service in a financial brokerage.

Trading Instruments and Markets

Finansero offers a diverse range of tradable instruments, featuring more than 300 symbols. Available Asset Categories:

Category | Type of Instruments | Number of Symbols | Competitor Average |

Forex CFDs | Major, minor, and exotic currency pairs | 50 | 60–80 |

Commodities CFDs | Metals, energies, and agricultural goods | 21 | 20–40 |

Indices CFDs | Global and regional stock indices | 20 | 20–30 |

Shares / Stocks CFDs | Global company shares | 220+ | 800–1200 |

ETF CFDs | Exchange-traded funds | 16 | 200–300 |

Synthetic Derivatives | Engineered indices and synthetic assets | 18 | 5–15 |

Cryptocurrency CFDs | Major crypto assets (BTC, ETH, etc.) | 12 | 30–50 |

This well-balanced asset lineup supports a variety of trading strategies, from macro trend-following to sector-specific speculation. However, expansion in the ETF and crypto categories would further improve the broker’s diversification capabilities.

Bonuses and Promotions Offered by Finansero

Unfortunately, based on the available data, there are no bonuses or promotional offers of any kind provided by the brokerage.

This could be due to its regulatory status; most brokers regulated by the CySEC follow the same rule of thumb.

Support Service Channels and Working Hours

Finansero provides 4 typical ways to get in touch with its support team:

- Email: customer.service@finansero.com

- Phone: +357 22 000 787

- Live Chat: Available on the website and via the Finansero WhatsApp account

- Support Ticket: Through the "Contact Us" section of the website

Based on the investigations by our team, the customer service in this company is offered 24/5.

Which Countries Are Restricted from Finansero's Services?

As mentioned earlier, this broker is regulated by the CySEC; meaning it accepts clients from many regions across the globe, but prohibits select countries. Other than that, the restriction could be because of the local regulations. Here is a list of some banned regions:

- United States

- North Korea

- Iran

- Afghanistan

- Pakistan

- Syria

- Iraq

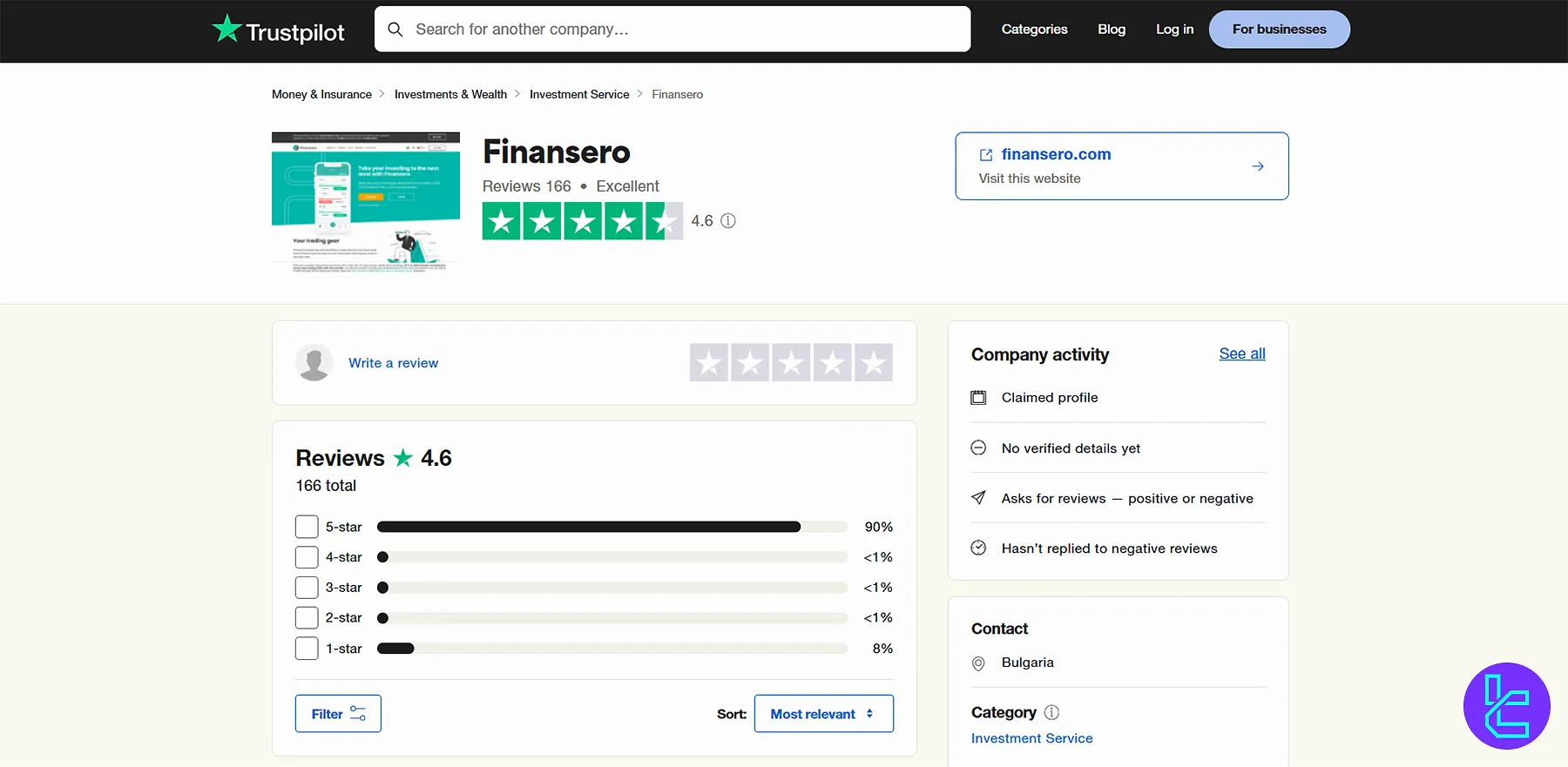

Trust Scores and User Reviews on Relevant Platforms

Finansero has received generally positive reviews and ratings from users and reliable sources such as "Trustpilot" and "ScamAdviser".

We will provide a summary of these scores in this section:

- Finansero Trustpilot: 4.6/5 with over 160 reviews

- ScamAdviser: Trustscore 60/100 and user reviews 4.4/5 (based on +130 ratings)

What Kind of Educational Resources Are Provided?

Finansero's educational offerings are somewhat limited compared to other brokers. They provide:

- Basic trading guides

- Short glossary consisting of a few terms

- Economic calendar

- Market news

However, they lack comprehensive video tutorials, webinars, or courses that some competitors offer.

You can check TradingFinder's Forex education section for additional resources.

Finansero Comparison Table

Let's check Finansero's standing in the forex trading world in comparison with other brokerage companies:

Parameter | Finansero Broker | AMarkets Broker | FXTM Broker | Fusion Markets Broker |

Regulation | CySEC | FSA, FSC, Misa, FinaCom | FSC | ASIC, VFSC |

Minimum Spread | From 0.6 Pips | From 0.0 pips | From 0.0 pips | From 0.0 pips |

Commission | $0 | From $0.0 | Variable | From $0.0 |

Minimum Deposit | $200 | $100 | $200 | $0 |

Maximum Leverage | 1:200 | 1:3000 | 1:3000 | 1:500 |

Trading Platforms | XCITE | MetaTrade 4, MetaTrade 5, Mobile App | MT4, MT5, FXTM Trader App | MetaTrader 4, MetaTrader 5, TradingView, cTrader |

Account Types | Retail, Professional | Standard, ECN, Fixed, Crypto, Demo | Advantage, Stocks Advantage, Advantage Plus | Zero, Classic, Swap-Free |

Islamic Account | No | Yes | Yes | Yes |

Number of Tradable Assets | 300+ | 550+ | 1000+ | 250+ |

Trade Execution | Market | Instant, Market | Market, Instant | Market, Instant |

Conclusion and Final Words

Finansero provides leverage up to 1:30 for its retail clients and 1:200 for professional accounts.

The company has received an average rating of 4.6/5 based on +160 user reviews on "Trustpilot". The score is 4.4/5 with over 130 comments on the ScamAdviser website.