FinPros offers commission-free trading (except on the RAW+ account) and tight spreads from 0.1 pips, with no deposit or withdrawal fees. It supports Crypto, STICPAY, and help2pay for instant deposits with a minimum requirement of $10.

Recognized globally, FinPros has earned awards from IFINEXPO, Wiki Finance Expo, and the Forex Traders Summit for innovation, institutional services, and execution reliability. The broker offers Islamic (swap-free) trading only through the ClassiQ account.

FinPros Broker; Company Background and Regulation

Founded in 2021, FinPros operates under the global structure of FinPros Group with multi jurisdiction oversight from the Cyprus Securities and Exchange Commission and the Seychelles Financial Services Authority.

The Forex broker delivers regulated market access, segregated client funds, and licensed operations across more than 10 global financial hubs.

- Regulated as a Securities Dealer in Seychelles under FSA License SD087

- Merchant operations managed by Finquotes Management LTD in Limassol

- Domain ownership registered under FQ Holdings LTD in the Isle of Man

- Founded in 2021 by industry veterans with decades of experience

- Compliance-first infrastructure supporting retail, professional, and institutional clients

- Multiple global awards from IFINEXPO, Wiki Finance Expo, and Forex Traders Summit

FinPros structures its entire brokerage ecosystem around regulatory transparency, legal accountability, and institutional-grade protection. This framework allows the company to operate as a globally distributed broker while maintaining strict control over client fund security and operational compliance.

FinPros Financial Ltd | Finquotes Management | Entity Parameters/Branches |

FSA | CySEC | Regulation |

3 | 1 | Regulation Tier |

Seychelles | Cyprus | Country |

No | Yes | Investor Protection Fund/Compensation Scheme |

Yes | Yes | Segregated Funds |

Yes | Yes | Negative Balance Protection |

1:1000 | 1:30 | Maximum Leverage |

Global | EU | Client Eligibility |

FinPros Table of Specifications

FinPros provides a feature-rich trading environment with multi-tier accounts, strong oversight under CySEC and FSA, and access to 400+ markets across Forex and more. Designed for beginners and professionals alike, the broker delivers high-leverage trading, modern platforms, and flexible funding options.

Broker | FinPros |

Account Types | Cent, ClassiQ, Pro, Raw+, Social |

Regulating Authorities | CySEC, FSA |

Based Currencies | USD, EUR, GBP, CAD, JPY, USC |

Minimum Deposit | $10 |

Deposit Methods | Bank Cards, Crypto Wallets, STICPAY, help2pay, Bank Transfer, Interac, IBAN Transfer |

Withdrawal Methods | Bank Cards, Crypto Wallets, STICPAY, help2pay, Bank Transfer, Interac, IBAN Transfer |

Minimum Order | 0.01 micro lots |

Maximum Leverage | 1:1000 |

Investment Options | Social account |

Trading Platforms & Apps | MT5, WebTrader |

Markets | Forex, Metals, Energies, Indices, Shares, Crypto |

Spread | From 0.1 pips |

Commission | Variable based on the account type |

Orders Execution | Market, Instant |

Margin Call / Stop Out | 100% / 30% |

Trading Features | Commission-free trading, Social Trading, Cent Account, Economic Calendar, NDD Execution |

Affiliate Program | Yes |

Bonus & Promotions | No |

Islamic Account | Yes |

PAMM Account | No |

Customer Support Ways | Email, Ticket, Live chat |

Customer Support Hours | 24/5 |

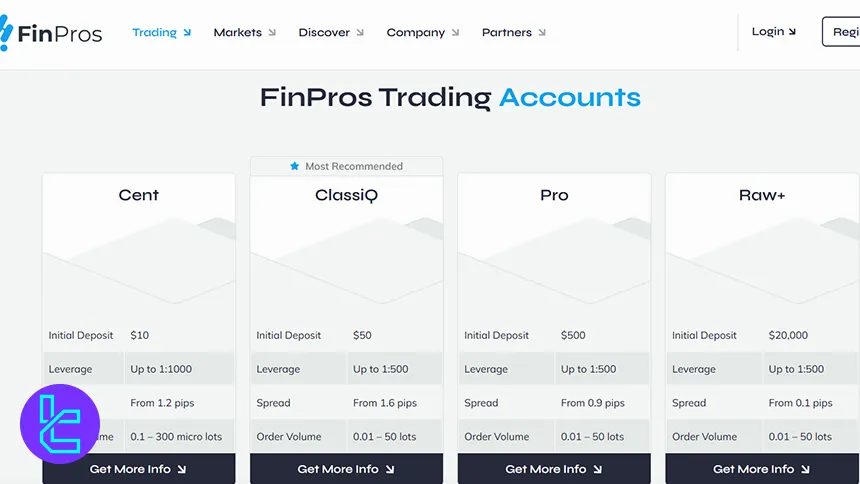

FinPros Broker Trading Accounts

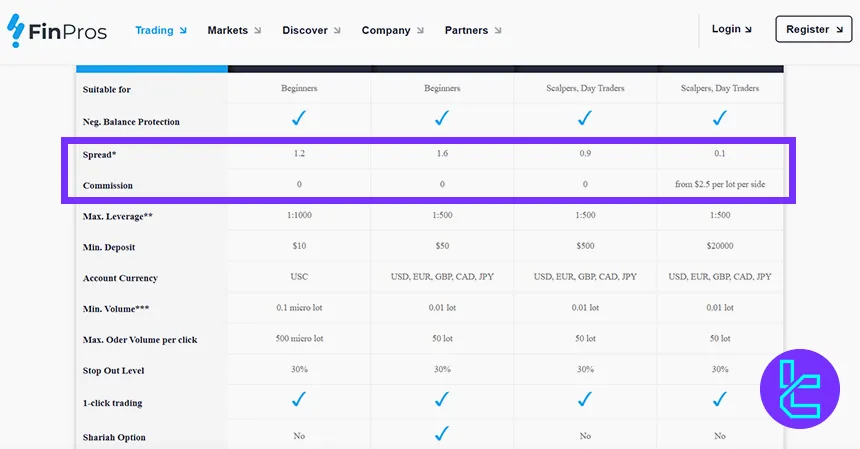

Operated under FinPros Group and powered by MetaTrader 5, FinPros offers four core trading accounts starting from just $10 and scaling to institutional level trading. Leverage reaches up to 1:1000 with access to over 400 global instruments.

Feature | Cent | ClassiQ | Pro | Raw+ |

Minimum Deposit | $10 | $50 | $500 | $20,000 |

Leverage | Up to 1:1000 (Dynamic) | Up to 1:500 | Up to 1:500 | Up to 1:500 |

Spread From | 1.2 pips | 1.6 pips | 0.9 pips | 0.1 pips |

Commission | None | None | None | From $2.5 per lot per side |

Order Volume | 0.01 to 500 micro lots | 0.01 to 50 lots | 0.01 to 50 lots | 0.01 to 50 lots |

Account Currency | USC | USD, EUR, GBP, CAD, JPY | USD, EUR, GBP, CAD, JPY | USD, EUR, GBP, CAD, JPY |

Swap Free | Not Available | Available | Not Available | Not Available |

Stop Out | 30% | 30% | 30% | 30% |

FinPros structures its account ecosystem to support every trading profile, from micro lot beginners to high volume institutional traders. Each account is built on a regulated infrastructure with negative balance protection and fast execution.

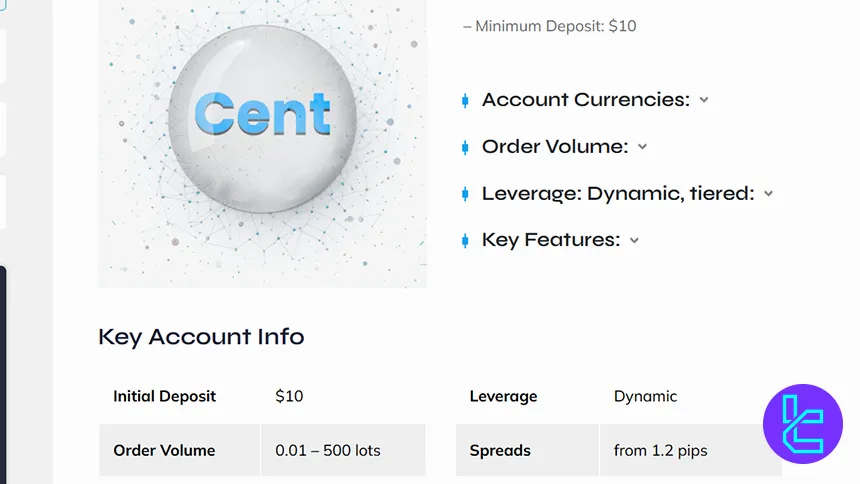

FinPros Cent Account

The Cent Account is engineered for beginners who want live market exposure with minimal risk. With a $10 minimum deposit and dynamic leverage up to 1:1000, traders operate in cent-denominated balance units while accessing over 400 real market instruments.

Minimum Deposit | $10 |

Account Currency | USC |

Order Volume | 0.01 to 500 micro lots |

Leverage | Dynamic up to 1:1000 |

Spread | From 1.2 pips |

Commission | None |

Stop Out | 30% |

Swap Free | Not Available |

Platform | MetaTrader 5 |

Balance Protection | Yes |

History Storage | 3 months |

The Cent Account allows traders to test real execution, manage leverage dynamically, and build consistency with limited capital exposure.

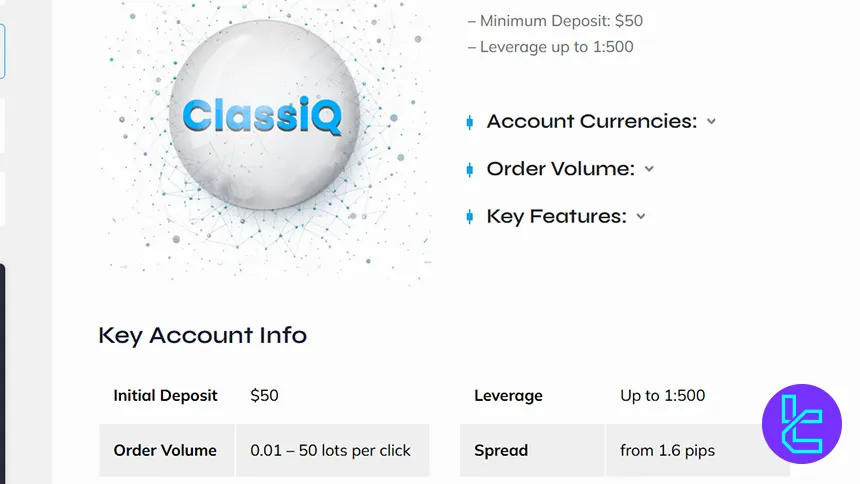

FinPros Broker ClassiQ Account

The ClassiQ Account is the most balanced option at FinPros, combining affordability with professional level conditions. It requires only a 50 USD deposit and offers leverage up to 1:500 with zero commission trading across more than 400 instruments.

Minimum Deposit | $50 |

Account Currencies | USD, EUR, GBP, CAD, JPY |

Order Volume | 0.01 to 50 lots |

Leverage | Up to 1:500 |

Spread | From 1.6 pips |

Commission | None |

Stop Out | 30% |

Swap Free | Available |

Platform | MetaTrader 5 |

Balance Protection | Yes |

History Storage | 3 months |

The ClassiQ Account fits both developing traders and consistent market participants seeking commission-free pricing with regulated execution.

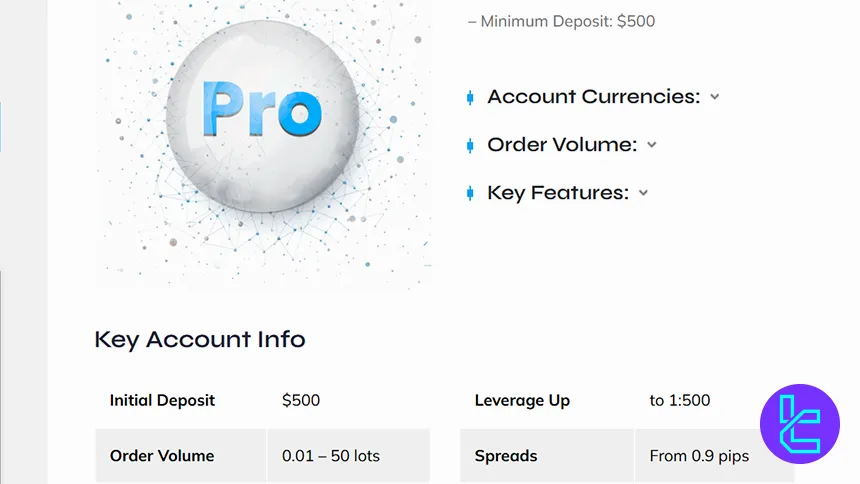

FinPros Pro Account

The Pro Account is tailored for high-activity traders who require tighter spreads and faster execution. With a minimum deposit of 500 USD, traders gain access to spreads from 0.9 pips and NDD execution across 400+ markets.

Minimum Deposit | $500 |

Account Currencies | USD, EUR, GBP, CAD, JPY |

Order Volume | 0.01 to 50 lots |

Leverage | Up to 1:500 |

Spread | From 0.9 pips |

Commission | None |

Stop Out | 30% |

Swap Free | Not Available |

Platform | MetaTrader 5, Web Trader |

Balance Protection | Yes |

History Storage | 3 months |

The Pro Account is designed for precision trading, low-latency execution, and consistent high-frequency trading strategies.

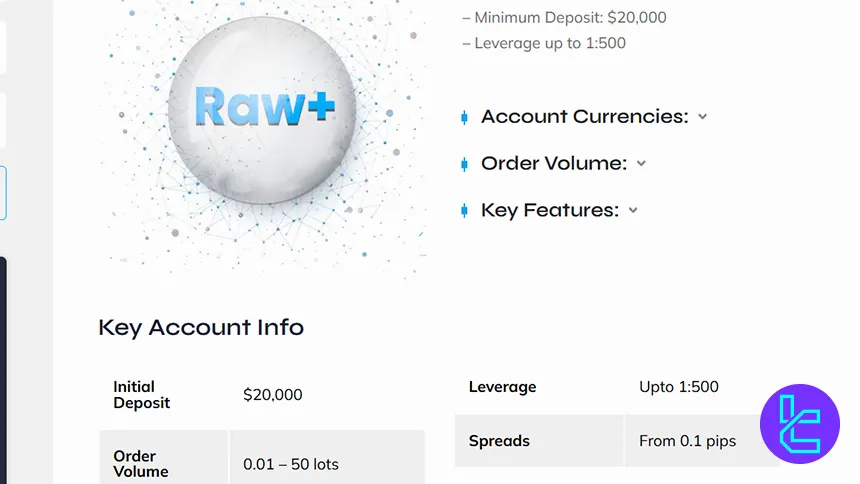

FinPros Raw+ Account

The Raw+ Account delivers institutional-grade trading with ultra tight spreads starting from 0.1 pips and transparent commissions. With a 20,000 USD minimum deposit, it is built for advanced traders who demand deep liquidity and high execution efficiency.

Minimum Deposit | $20,000 |

Account Currencies | USD, EUR, GBP, CAD, JPY |

Order Volume | 0.01 to 50 lots |

Leverage | Up to 1:500 |

Spread | From 0.1 pips |

Commission | From $2.5 per lot per side |

Stop Out | 30% |

Swap Free | Not Available |

Platform | MetaTrader 5 |

Balance Protection | Yes |

History Storage | 6 months |

The Raw+ Account is optimized for scalpers, algorithmic traders, and professionals seeking maximum market depth and minimal trading costs.

FinPros Broker Social Account

The Social Account enables copy trading functionality, allowing users to mirror the strategies of experienced traders automatically. It is suitable for beginners and investors seeking passive market exposure without managing trades manually.

FinPros Demo Account

The Demo Account by FinPros provides a full risk-free trading environment with real market pricing on MetaTrader 5. It allows traders to test strategies, explore tools, and practice order execution without financial exposure.

FinPros Islamic Account

The Islamic Account is designed for traders who require swap-free trading under Shariah-compliant conditions. It removes overnight interest charges while maintaining the same pricing structure, execution speed, and trading access available on standard live accounts.

FinPros provides Islamic trading only through the ClassicQ account with a $50 minimum deposit and leverage options up to 1:500.

FinPros Advantages and Disadvantages

We must mention in this FinPros review that the broker operates with regulatory oversight from CySEC and the Seychelles FSA. It combines mobile-first trading technology, segregated funds, and access to 400+ instruments across forex, stocks, indices, crypto, and CFDs.

Pros | Cons |

Regulated under CySEC and Seychelles FSA | No publicly disclosed ownership structure |

Segregated client funds for higher security | Limited historical transparency |

Low entry with a Cent account from $10 | High $20,000 deposit for the Raw+ account |

Leverage up to 1:1000 on Cent accounts | The Islamic option unavailable on Pro and Raw+ |

MetaTrader 5 and mobile trading supported | No educational materials |

FinPros balances strong regulatory coverage, modern trading infrastructure, and beginner-friendly access with a few transparency and account accessibility limitations. This profile places the broker between retail accessibility and professional-grade execution.

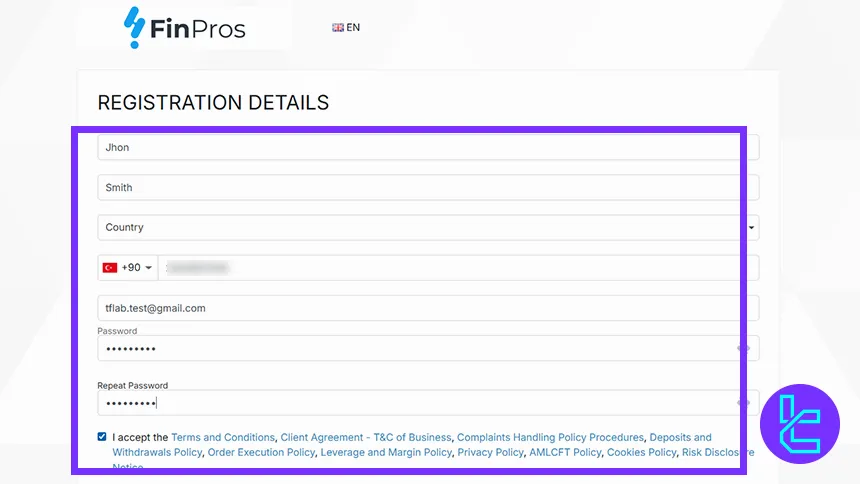

FinPros Registration and KYC

Opening an account with FinPros involves a fast digital registration and a secure identity verification process powered by Sumsub. The system follows global AML and KYC compliance standards while allowing users to access trading features within minutes.

#1 Access the Sign Up Page

The first step of the FinPros registration begins by entering the official sign-up interface. This page connects users directly to the secure onboarding system, where all personal and trading profiles are created under encrypted protection.

- Visit the official FinPros website;

- Click the “Register” button;

- Redirect to the secure registration page;

- Choose preferred language interface;

- Begin the account creation process.

#2 Fill Out the Registration Form

After accessing the sign-up page, users must complete the FinPros registration form by entering personal information, contact details, and login credentials. This data is required for account activation and future identity verification. Required Information:

- First and last name

- Country of residence

- Phone number with international code

- Email address

- Password and password confirmation

- Acceptance of terms, policies, and legal agreements

After submitting the form, the trading profile is instantly created, allowing users to proceed to KYC verification and unlock deposit, withdrawal, and full platform access.

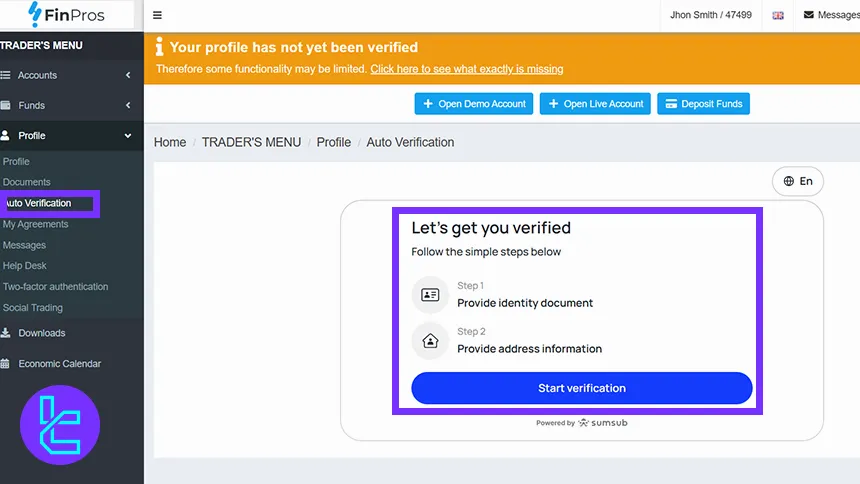

#3 Complete KYC Verification

After creating the trading profile, identity verification becomes mandatory to unlock full account functionality at FinPros. The process is securely handled through Sumsub, ensuring global AML compliance, data encryption, and fast automated approval.

- Open the Auto Verification section from the trader dashboard;

- Select the issuing country of the identity document;

- Choose a document type such as ID card, passport, or driving license;

- Upload a clear image of the identity document;

- Submit proof of address when requested;

- Complete live facial verification if required.

Once the documents are submitted, the automated system reviews the data in real time. After approval, all trading features, including deposits, withdrawals, and live account access, become fully available without restrictions.

FinPros Broker Trading Platform

In this FinPros review, we must mention that the broker delivers multi-asset trading through professional-grade platforms built for speed, automation, and mobile access. Traders can operate on MetaTrader 5 for manual and algorithmic trading or use FinPros Social for regulated copy trading with real-time performance control.

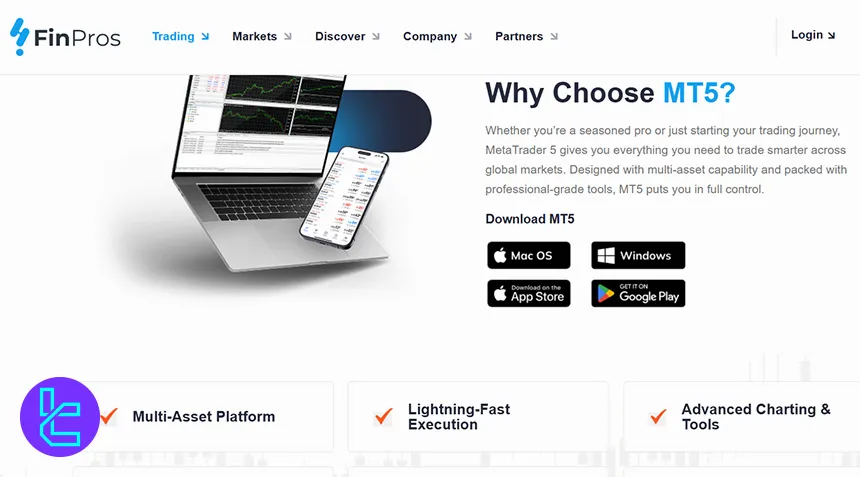

FinPros MetaTrader 5 (MT5)

MetaTrader 5 at FinPros is a multi-asset trading platform engineered for fast execution, advanced analytics, and automated strategies across global markets. It supports forex, stocks, indices, commodities, and crypto CFD contracts from a single trading terminal.

- Multi-asset trading for forex, stocks, indices, metals, and energies

- Ultra-low latency execution optimized for high-speed order routing

- Over 80 built-in MT5 indicators and 21 timeframes

- Integrated real time economic calendar

- Advanced order management with trailing stops and pending orders

- Full support for Expert Advisors and algorithmic trading via MQL5

- Available on Desktop (Windows, Mac, Linux), Mobile (iOS, Android), and Web Trader

MT5 offers a complete trading environment for discretionary traders, scalping, and algorithmic system builders who demand institutional-level execution and full analytical depth. Mobile download links:

FinPros Social Trading Platform

The FinPros Social platform enables traders to copy strategies from global top-performing traders directly through a regulated mobile trading environment. It is designed for beginners, time-limited traders, and investors seeking passive exposure through copy trading.

- Access to hundreds of verified strategy providers worldwide

- Copy trading across currencies, metals, indices, and energies

- Real-time performance statistics and full trade history

- Custom risk management with Warning Level, Soft-stop, and Hard-stop

- Full control over open, pending, and closed copied positions

- Mobile based execution with instant copy activation

The FinPros Social trading service operates in partnership with London & Eastern LLP and is delivered through Pelican Exchange Limited as an Appointed Representative regulated by the Financial Conduct Authority (FCA). FinPros remains regulated by the Seychelles FSA as a Securities Dealer under License SD087. Download links:

FinPros Commissions, Spreads, and Non-Trading Costs

FinPros broker offers a transparent pricing model across all account types, featuring zero-commission trading on Cent, ClassiQ, and Pro accounts, while Raw+ provides institutional spreads with a low per-lot fee. This structure supports both beginner and professional traders through predictable cost conditions.

Account Type | Commission |

Cent | None |

ClassiQ | None |

Pro | None |

Raw+ | From $2.5 per lot per side |

FinPros provides competitive spreads designed for different trading styles. While Cent and ClassiQ accounts use traditional spread-only pricing, Pro reduces spreads significantly, and Raw+ delivers ultra-tight institutional spreads for high-volume execution.

Account Type | Spreads From |

Cent | 1.2 pips |

ClassiQ | 1.6 pips |

Pro | 0.9 pips |

Raw+ | 0.1 pips |

The pricing model balances accessibility and precision, allowing traders to choose between low-spread or zero-commission setups based on strategy and risk tolerance.

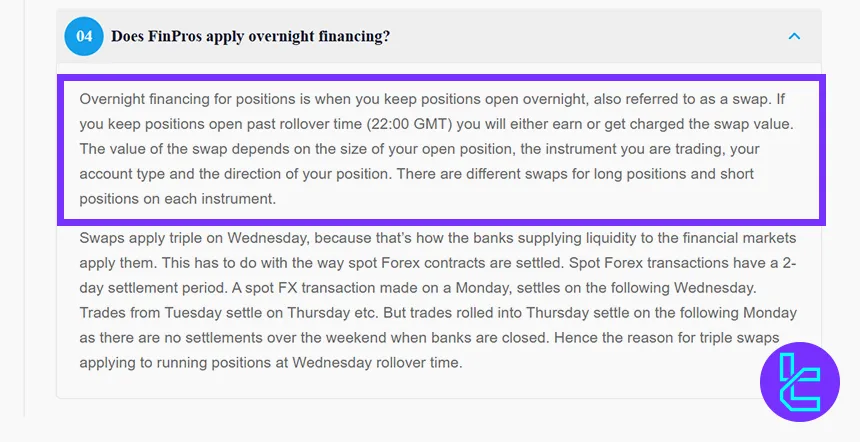

Swap Rates at FinPros

FinPros applies overnight financing, also known as swaps, when positions remain open past the daily rollover (22:00 GMT). Swap values vary depending on position size, instrument type, direction (long or short), and account category.

- Long and short positions carry different swap values;

- Swaps apply at rollover time daily at 22:00 GMT;

- Triple swaps occur on Wednesday due to weekend settlement schedules;

- FX swaps reflect the two-day settlement cycle of spot transactions;

- Swap costs or earnings depend on market interest rate differentials.

Non-Trading Costs at FinPros

FinPros maintains a low-fee environment with no charges for deposits, withdrawals, or internal transfers. The primary non-trading cost is the inactivity (dormant account) fee applied after 90 days without trading activity.

Fee Type | Details |

Deposit Fee | None |

Withdrawal Fee | None |

Currency Conversion Fee | None |

Inactivity Fee | $20 / €22 / £15 per month after 90 inactive days |

Dormant Archive | Account is archived once the balance reaches zero |

The broker keeps overall non-trading fees minimal, ensuring traders retain more capital while maintaining compliance with operational and administrative standards.

FinPros Broker Deposit and Withdrawal

FinPros supports instant and low-cost funding through multiple local and global payment solutions. Traders benefit from zero fees, support for fiat and cryptocurrency, and processing times ranging from instant to 3–5 business days, depending on the method.

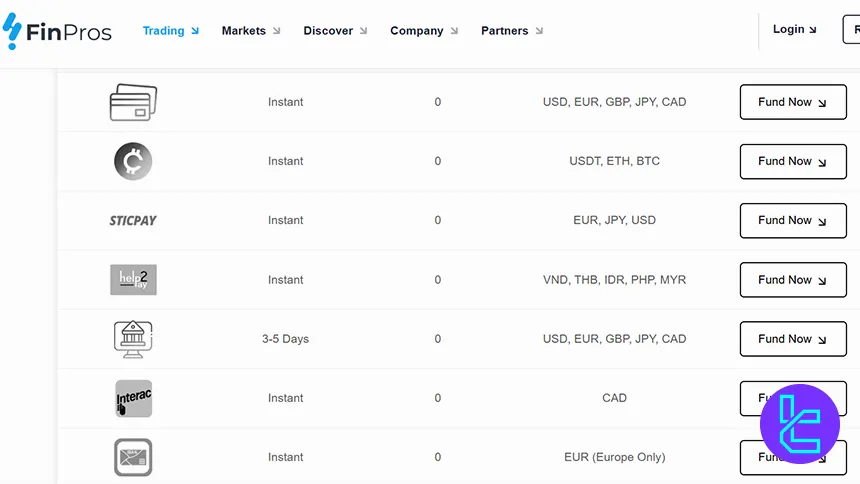

FinPros Deposit Methods

The broker enables fast account funding through cards, crypto, e-wallets, and local bank solutions. Most deposit methods process instantly with 0 commission, allowing traders to activate their accounts without delays.

Method | Processing Time | Fee | Supported Currencies |

Bank Cards | Instant | 0 | USD, EUR, GBP, JPY, CAD |

Crypto Wallets | Instant | 0 | USDT, BTC, ETH |

STICPAY | Instant | 0 | USD, EUR, JPY |

help2pay | Instant | 0 | VND, THB, IDR, PHP, MYR |

Bank Transfer | 3–5 Days | 0 | USD, EUR, GBP, JPY, CAD |

Interac | Instant | 0 | CAD |

IBAN Transfer | Instant | 0 | EUR (Europe only) |

FinPros structures its deposit system to serve both international and regional traders with instant processing, multi-currency support, and no internal transaction charges.

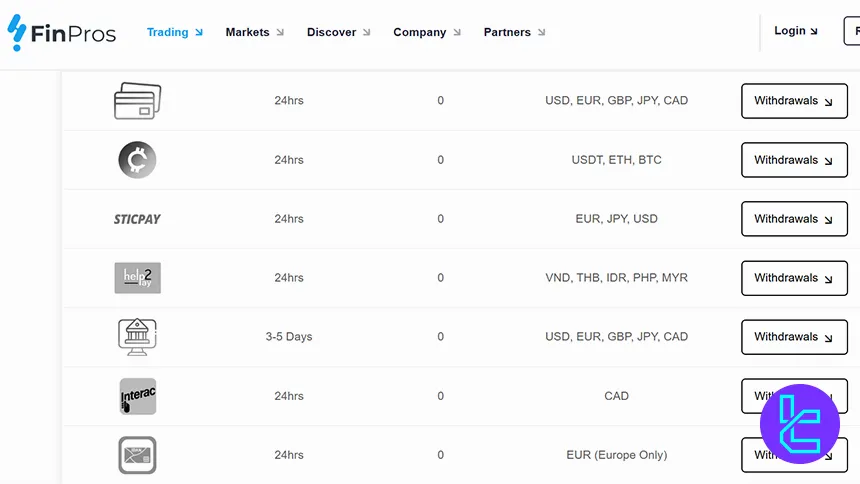

FinPros Withdrawal Methods

The broker processes withdrawals through the same secure payment channels as deposits. Most methods are completed within 24 hours, while bank transfers may take 3–5 business days, all with zero withdrawal commissions from the broker side.

Method | Processing Time | Fee | Supported Currencies |

Bank Cards | Up to 24 Hours | 0 | USD, EUR, GBP, JPY, CAD |

Crypto Wallets | Up to 24 Hours | 0 | USDT, BTC, ETH |

STICPAY | Up to 24 Hours | 0 | USD, EUR, JPY |

help2pay | Up to 24 Hours | 0 | VND, THB, IDR, PHP, MYR |

Bank Transfer | 3–5 Days | 0 | USD, EUR, GBP, JPY, CAD |

Interac | Up to 24 Hours | 0 | CAD |

IBAN Transfer | Up to 24 Hours | 0 | EUR (Europe only) |

FinPros applies a clean withdrawal policy with no hidden charges, direct access from the trading dashboard, and standardized processing timelines across both fiat and crypto payout systems.

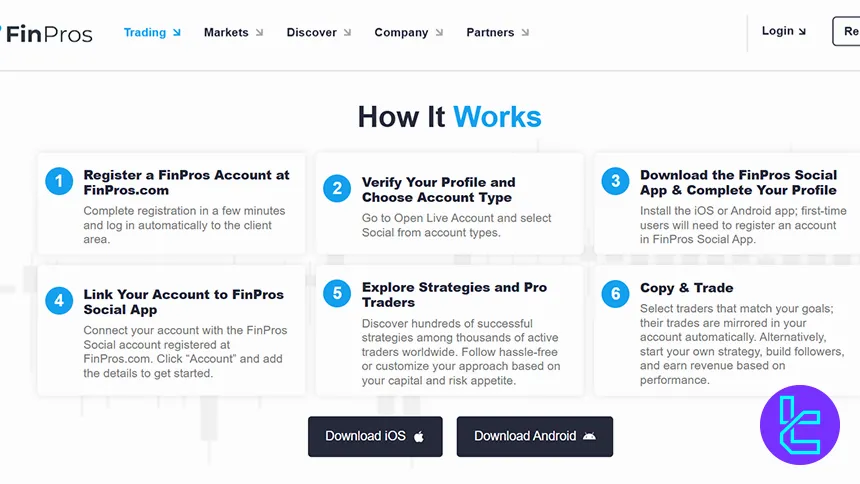

FinPros Social Trading

The social trading service enables real-time copy trading through a regulated mobile platform available on iOS and Android. Traders can follow hundreds of strategies, mirror professional positions instantly, and manage risk dynamically without manual chart analysis.

- Real-time copy trading from global professional traders

- Beginner-friendly system with no technical analysis required

- Access to conservative, balanced, and high-growth strategies

- Full capital control with pause, switch, and stop options

- Mobile trading through iOS and Android applications

- Performance statistics and trading history for every strategy provider

- Strategy creation for traders who want to build followers and earn performance-based revenue

- Regulated infrastructure with secure fund protection

FinPros Social Trading combines automation, transparency, and flexibility in a mobile copy trading ecosystem. It allows investors to participate in global markets with direct exposure to professional trading decisions and full control over capital allocation.

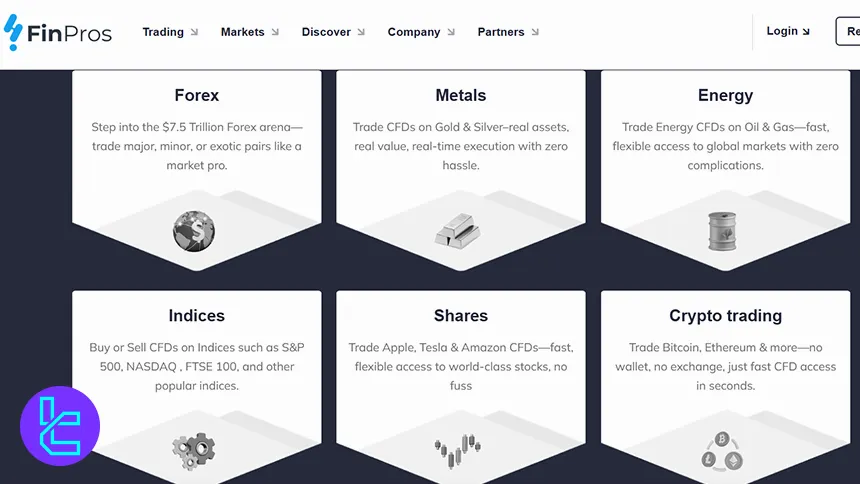

FinPros Broker Trading Markets

We must mention in this FinPros review that the broker offers access to 400+ global CFD instruments across major asset classes, from the Forex market to Stocks, allowing traders to operate in multi-market conditions from a single MT5 or mobile platform.

With deep liquidity, fast execution, and diversified exposures, FinPros supports both short-term trading and long-term strategies.

Category | Type of Instruments | Number of Symbols | Competitor Average | Maximum Leverage |

Forex | CFDs | 60+ pairs | 50–70 pairs | 1:1000 |

Metals | CFDs | 6 symbols (Gold, Silver, Platinum, Palladium, etc.) | 2–5 symbols | 1:500 |

Energies | CFDs | 5 symbols (Brent, WTI, Natural Gas, etc.) | 2–4 symbols | 1:500 |

Indices | CFDs | 20 symbols (US, EU, Asia indices) | 10–20 indices | 1:500 |

Shares | CFDs | 280+ stocks (US + EU majors) | 150–300 stocks | 1:100 |

Crypto | CFDs | 40+ assets | 10–20 assets | 1:50 |

FinPros delivers a broad, multi-asset environment designed for traders seeking diversification, speed, and modern market accessibility across global financial products.

FinPros Broker Promotions

While FinPros does not provide traditional bonuses or trading promotions, it offers revenue-driven partnership programs designed for affiliates, influencers, and introducing brokers. These programs allow users to earn commissions, rebates, and CPA rewards by referring traders to the platform.

- Introducing Broker (IB) Program: Offers rebates based on client trading volume, with scalable payouts that increase as more clients are referred;

- Affiliate Program: Provides competitive CPA rewards for each funded account introduced through your marketing channels;

- Access to exclusive marketing materials, localized promotional assets, and tracking tools for improved conversions;

- Programs can be customized through dedicated Partner Account Managers, ensuring flexible terms matched to long-term business goals;

- Additional tailored partnership schemes are available for educators, communities, and institutional partners seeking deeper collaboration.

FinPros focuses on long-term, growth-oriented partnerships instead of short-term bonuses, offering a sustainable earning model for affiliates and IBs across global markets.

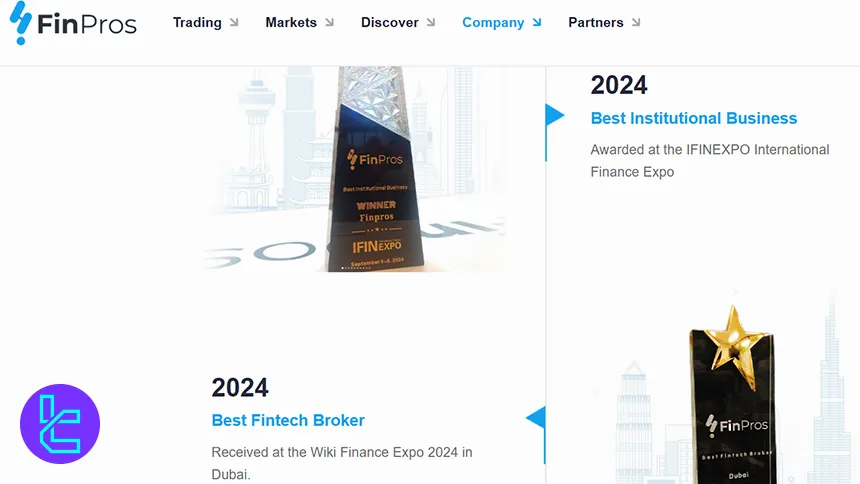

FinPros Broker Awards

Since its launch in 2021, FinPros has earned multiple international awards for execution quality, institutional services, and fintech innovation. These recognitions were presented at leading global finance events across Dubai and Macau between 2024 and 2025.

- 2024 – Best Institutional Business: At the IFINEXPO International Finance Expo, recognizing FinPros' performance in institutional-grade brokerage services;

- 2024 – Best Fintech Broker: At the Wiki Finance Expo in Dubai for innovation in trading technology and client infrastructure;

- 2025 – Most Reliable Execution Platform: Awarded at the Forex Traders Summit in Dubai, highlighting execution speed and stability;

- 2025 – Most Innovative Service Broker: Presented by the Organizing Committee of the International Wealth Management and Financial Investment Forum in Macau.

These awards confirm FinPro's position as a technology-driven, institution-ready broker with a strong global presence and a continued focus on execution quality, innovation, and client-centric infrastructure.

FinPros Customer Support

FinPros delivers 24/5 multilingual customer support for traders and partners worldwide. With operational teams positioned across major financial hubs and a central office in Mahé, clients receive fast, professional assistance for trading, technical, and account-related needs.

- Email: supportpros@finpros.com

- Address: CT House, Office 4A, Providence, Mahe, Seychelles

- Ticket: Through the “Contact Us” form

- Live chat: Available on the website

FinPros maintains a client-first support structure focused on speed, accuracy, and accessibility, ensuring traders receive reliable assistance throughout every stage of their trading journey.

FinPros Restricted Countries

FinPros operates under strict international compliance standards and does not provide services in jurisdictions where regulation or legal restrictions prohibit online trading access. The broker maintains a clearly defined list of restricted regions to ensure regulatory integrity and client protection.

- Afghanistan

- Botswana

- Central African Republic

- Chad

- Cuba

- Democratic People’s Republic of Korea (North Korea)

- Democratic Republic of the Congo

- Equatorial Guinea

- Eritrea

- Guinea

- Guinea-Bissau

- Guyana

- Iran

- Laos

- Libya

- Myanmar (Burma)

- Palestine

- Republic of Belarus

- Republic of South Sudan

- Republic of the Sudan (North Sudan)

- Russian Federation

- Somalia

- Tajikistan

- Trinidad and Tobago

- Turkmenistan

- United States of America and its Dependent Territories

- Uzbekistan

- Vanuatu

- Yemen

- Zimbabwe

The company continually reviews its jurisdictional restrictions to remain aligned with global regulatory requirements and ensure its services are offered only where legally permitted.

FinPros Trust Scores

The FinPros Trustpilot profile holds a 4.1/5 TrustScore based on 22 verified reviews, positioning it as a “Great” investment service provider. The score reflects consistently positive feedback on execution, withdrawals, and customer support across global trading communities.

- TrustScore: 1 out of 5, rated “Great”

- Total Reviews: 22 verified client experiences

- Rating Breakdown: 82% 5-star, 18% 1-star

- Common Praise: fast withdrawals, tight spreads, responsive support, and stable MT5 performance

- Negative Mentions: isolated feedback regarding account-manager communication and delayed responses

FinPros’ Trustpilot performance showcases overall client satisfaction, particularly in execution quality and customer service, while also highlighting areas for continued improvement through open and transparent review management.

FinPros Educational Content

While FinPros offers strong trading infrastructure and competitive account conditions, the broker provides no educational materials, creating a noticeable gap for beginners seeking structured learning resources such as tutorials, webinars, or market guides.

Traders can use TradingFinder’s Forex education and Crypto tutorial sections for comprehensive learning materials.

FinPros Comparison Table

FinPros competes with major global brokers by offering high leverage, low spreads, and accessible minimum deposits. When compared with HFM, FxPro, and FXGlory, FinPros stands out with its 1:1000 leverage and multi-tier account structure tailored for different trader profiles.

Parameter | FinPros Broker | |||

Regulation | CySEC, FSA | CySEC, DFSA, FCA, FSCA, FSA | FCA, FSCA, CySEC, SCB | No |

Min Spread | From 0.1 pips | From 0.0 Pips | From 0.0 Pips | From 0.1 Pips |

Commission | From $0 | From $0 | From $0 | $0 |

Min Deposit | $10 | From $0 | $100 | $1 |

Max Leverage | 1:1000 | 1:2000 | 1:500 | 1:3000 |

Trading Platforms | MT5, WebTrader | MT4, MT5, Mobile App | MT4, MT5, cTrader, Web Trader, Mobile App | MetaTrader 4, MetaTrader 5 |

Account Types | Cent, ClassiQ, Pro, Raw+, Social | Cent, Zero, Pro, Premium | Standard, Pro, Raw+, Elite | Standard, Premium, VIP, CIP |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Instruments | 400+ | 1,000+ | 2100+ | 45 |

Trade Execution | Market, Instant | Market, Buy Stop, Stop Loss, Limit, Take Profit | Market, Pending | Market, Instant |

Conclusion and Expert Suggestions

FinPros’ infrastructure supports micro-lot trading from 0.01 lots, stop-out protection at 30%, and spreads starting from 0.1 pips on Raw+. Its Social Trading platform connects users to hundreds of verified strategy providers, while 24/5 multilingual support enhances user experience across global regions.

FinPros broker maintains structured account security with automatic KYC verification through Sumsub. Client history is stored for 3 to 6 months, depending on the account type, and all live accounts operate with 100% margin-call protection to reduce liquidation risk.