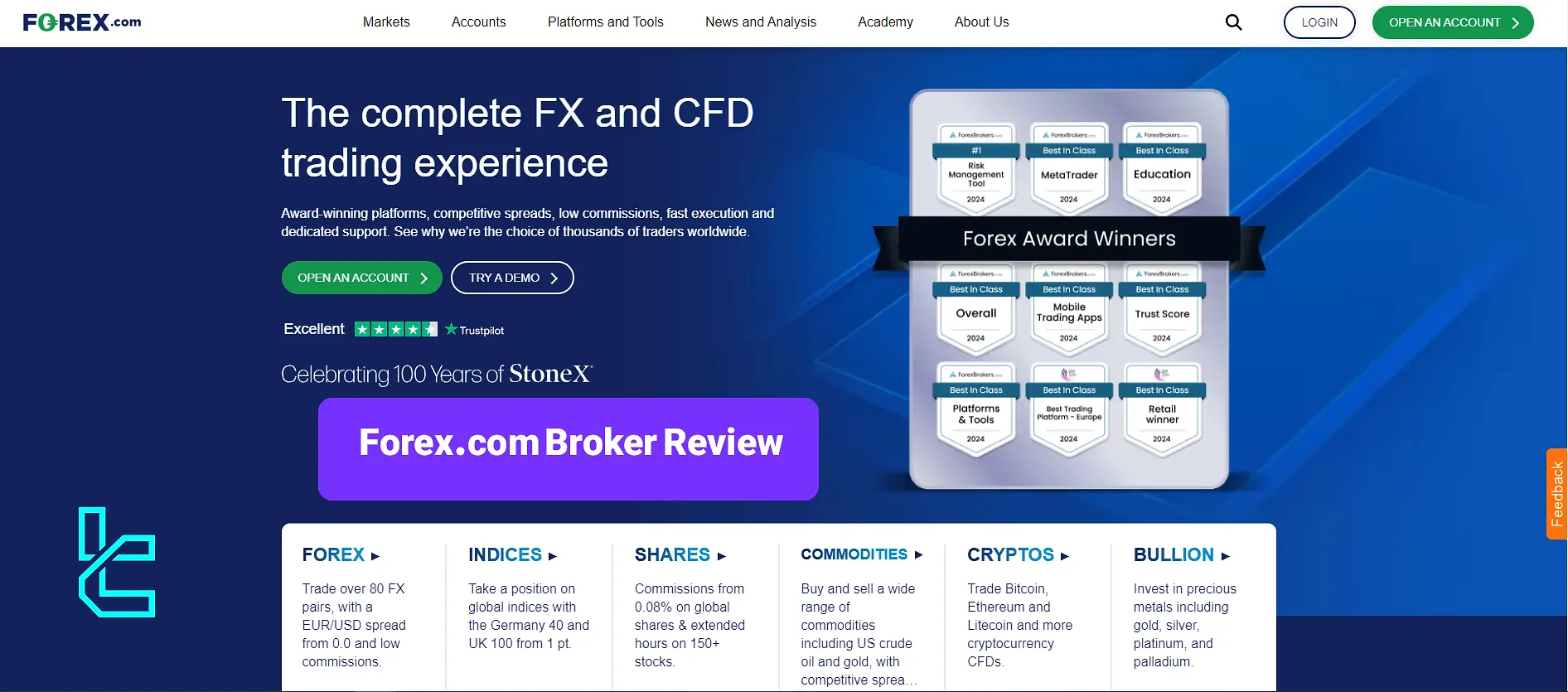

Forex.com has won the “Most Competitive Broker” prize from “Global Forex Awards 2023”. The broker offers VIP members up to 4.5% APY interest on their free margin, and a 5% cashback up to $10,000 for all clients.

An international brokerage company with 800+ employees and over 1200 partners

An international brokerage company with 800+ employees and over 1200 partners

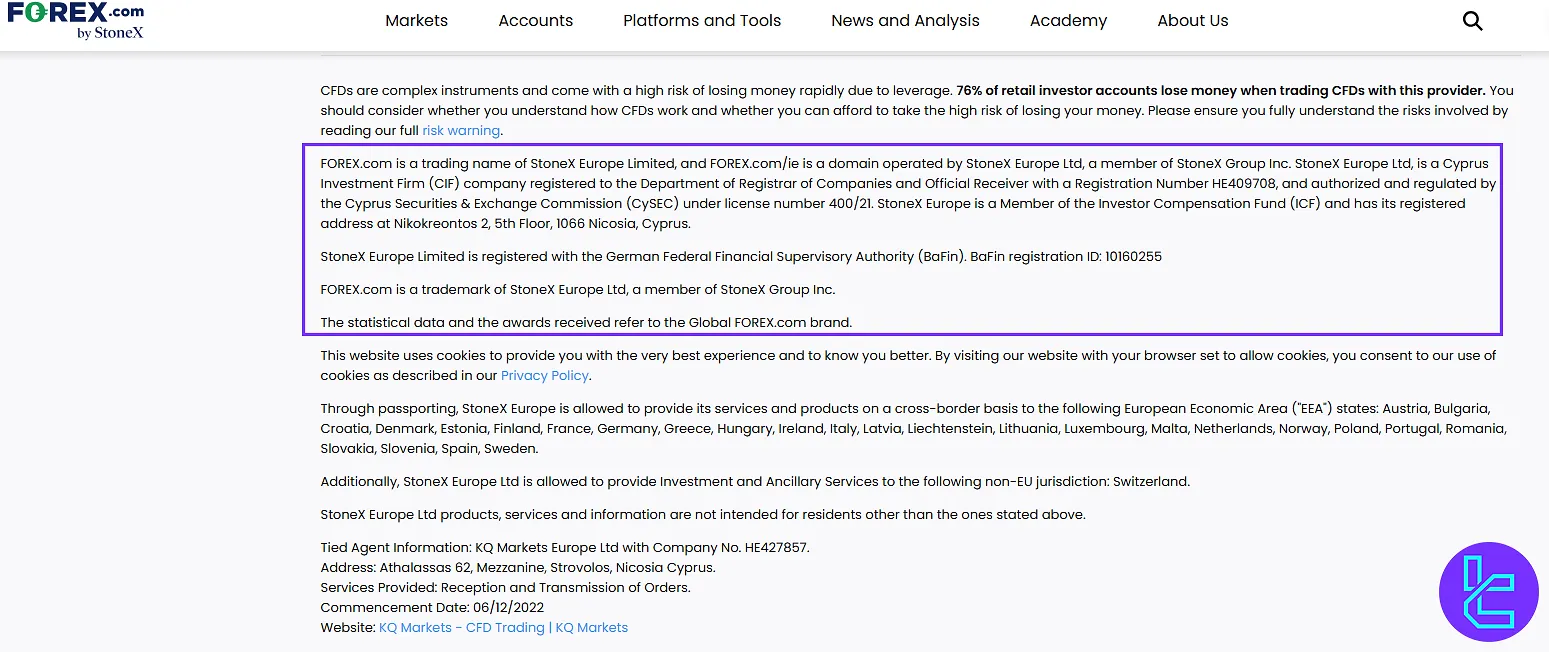

Forex.com (Company Information and Regulation)

Forex.com was launched in 2001 in New Jersey, and in 2009, it expanded to UK and Japan. StoneX Group Inc. acquired the award-winning company in 2020 and shortly after launched the broker in Europe.

The Forex broker benefits from the mother company’s financial strength. StoneX Group published an annual report in 2022 indicating that it has $19.68B in total assets and $277M in annual income before tax. Key Features of Forex.com:

- Regulated by multiple top-tier authorities, including:

- Commodity Futures Trading Commission (CFTC) and Securities and Exchange Commission (SEC) in the United States

- Financial Conduct Authority (FCA) in the United Kingdom

- Australian Securities and Investments Commission (ASIC) in Australia

- Monetary Authority of Singapore (MAS) in Singapore

- Canadian Investment Regulatory Organization (CIRO) in Canada

- Financial Services Agency (FSA) in Japan

- Cyprus Securities & Exchange Commission (CySEC) in Cyprus

- Over 1,000,000 customers

- The Most Competitive Broker in “Global Forex Awards 2023”

- 1000+ financial instruments

- Average trade speed of 0.02 seconds

This multi-jurisdictional regulation ensures that Forex.com operates with transparency and accountability, providing traders with peace of mind when it comes to the safety of their investments. Clients are assigned to different legal entities based on their geographic location.

While Tier-1 regulated entities like FCA, ASIC, and CySEC provide strong protections (e.g., FSCS or ICF compensation schemes, segregated funds, and negative balance protection), the Cayman Islands entity (GGMI) offers higher leverage and operational flexibility but does not offer an investor compensation scheme.

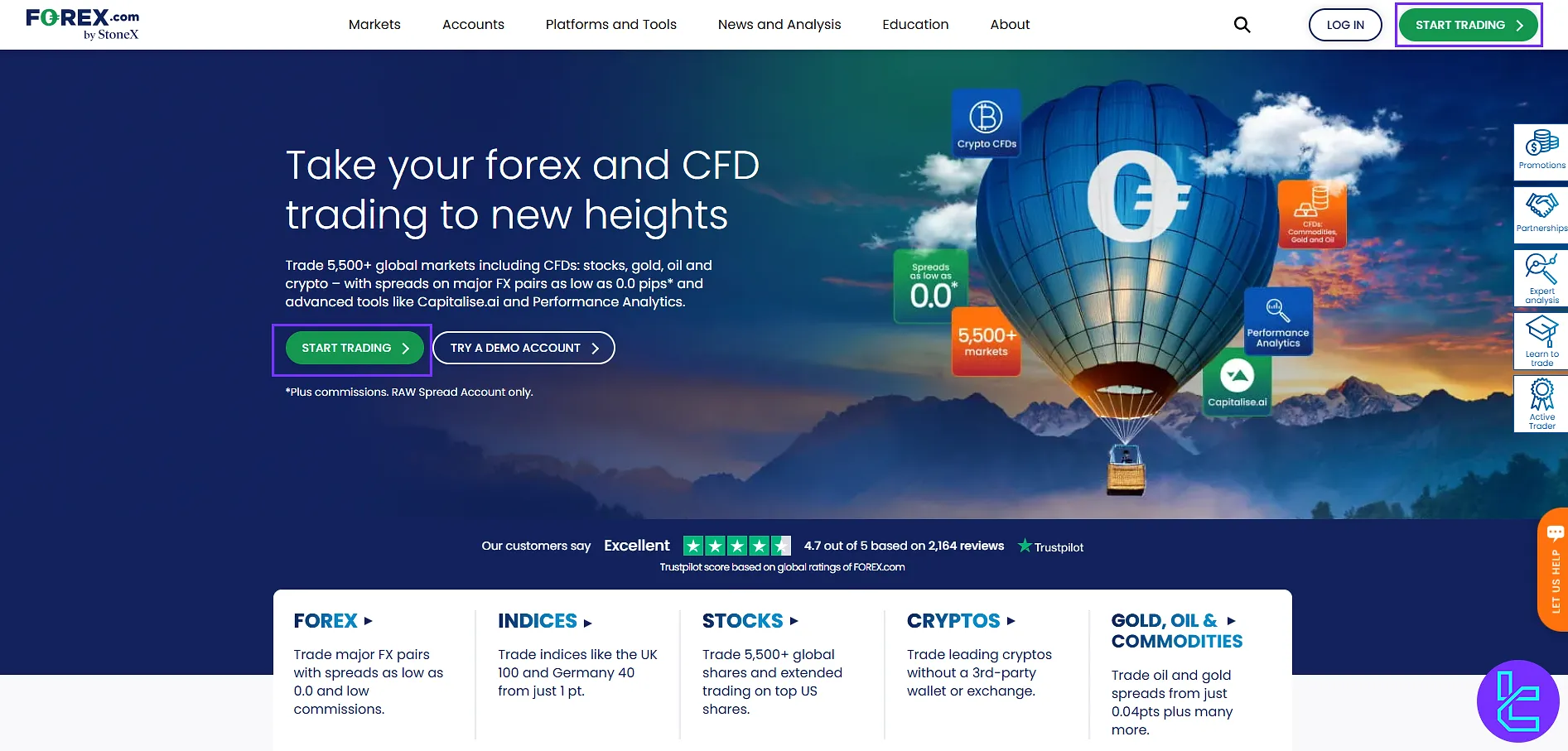

The broker offers a wide range of financial instruments, including Forex, stocks, indices, commodities, gold, cryptocurrencies, and bullion.

With support for multiple trading platforms, including MetaTrader 5 and a proprietary web trader, Forex.com caters to both beginners and experienced traders.

Its commitment to client fund protection, security, and global transparency has made it one of the most recognized names in the forex industry.

To better understand the regulatory status and conditions of each entity, the table below provides full details:

GAIN Global Markets Inc | StoneX Financial (HK) Ltd | StoneX Securities Co. Ltd | StoneX Financial Pte. Ltd. | FOREX.com Canada Ltd. | GAIN Capital Group LLC | StoneX Financial Pty Ltd. | StoneX Europe Ltd | StoneX Financial Ltd. | Entity Parameters/Branches |

CIMA | SFC | JFSA | MAS | IIROC | NFA | ASIC | CySEC | FCA | Regulation |

3 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | Regulation Tier |

| Hong Kong | Tokyo, Japan | Singapore | Canada | United States | Sydney, Australia | Limassol, Cyprus |

| Country |

No | No | No | No | Yes | Yes | No | Up to €20,000 under ICF | Up to £85,000 under FSCS | Investor Protection Fund/ Compensation Scheme |

Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Segregated Funds |

No | No | yes | Yes | No | No | Yes | Yes | Yes | Negative Balance Protection |

1:400 | 1:20 |

|

| 1:33 | 1:50 |

|

|

| Maximum Leverage |

Cayman Islands | Only Hong Kong | Only Japan | Only Singapore | Only Canada | United States | Only Australia | Only EU/EEA Residents | Only United Kingdom | Client Eligibility |

FOREX.com Leadership and Ownership

FOREX.com operates as a wholly-owned subsidiary of StoneX Group Inc., a global financial services network. The brand was originally launched under GAIN Capital, led by founder and long-time CEO Glenn Stevens, before its acquisition by StoneX. Today, FOREX.com is integrated into the wider StoneX structure, with the group’s CEO overseeing the brand at the parent-company level.

Specifics of Forex.com broker

The broker stands out in the crowded forex broker market due to its comprehensive offerings and user-friendly approach. Here's a breakdown of what makes Forex.com unique.

Broker | Forex.com |

Account Types | Standard, Raw Spread, MetaTrader |

Regulating Authorities | CFTC, SEC, FCA, ASIC, MAS, CIRO, FSA, CySEC |

Based Currencies | USD, EUR, GBP |

Minimum Deposit | $100 |

Deposit Methods | Local Transfer, Credit/Debit Cards, Wire Transfer, Neteller, Skrill |

Withdrawal Methods | Credit/Debit Cards, Wire Transfer |

Minimum Order | 1,000 units |

Maximum Leverage | 1:50 |

Investment Options | EAs |

Trading Platforms & Apps | MT5, TradingView, Proprietary Platform |

Markets | Forex, Indices, Shares CFD, Commodities, Cryptocurrencies, Thematic Indices |

Spread | Variable based on the instruments |

Commission | $0.0 (except for Shares) |

Orders Execution | Market, Limit, Stop-Loss, Trailing Stops, Trigger |

Margin Call / Stop Out | N/A |

Trading Features | Academy, EAs, Performance Analytical, Economic Calendar |

Affiliate Program | Yes |

Bonus & Promotions | Referral |

Islamic Account | Yes |

PAMM Account | No |

Customer Support Ways | Email, Live Chat, Phone, Ticket |

Customer Support Hours | 24/5 |

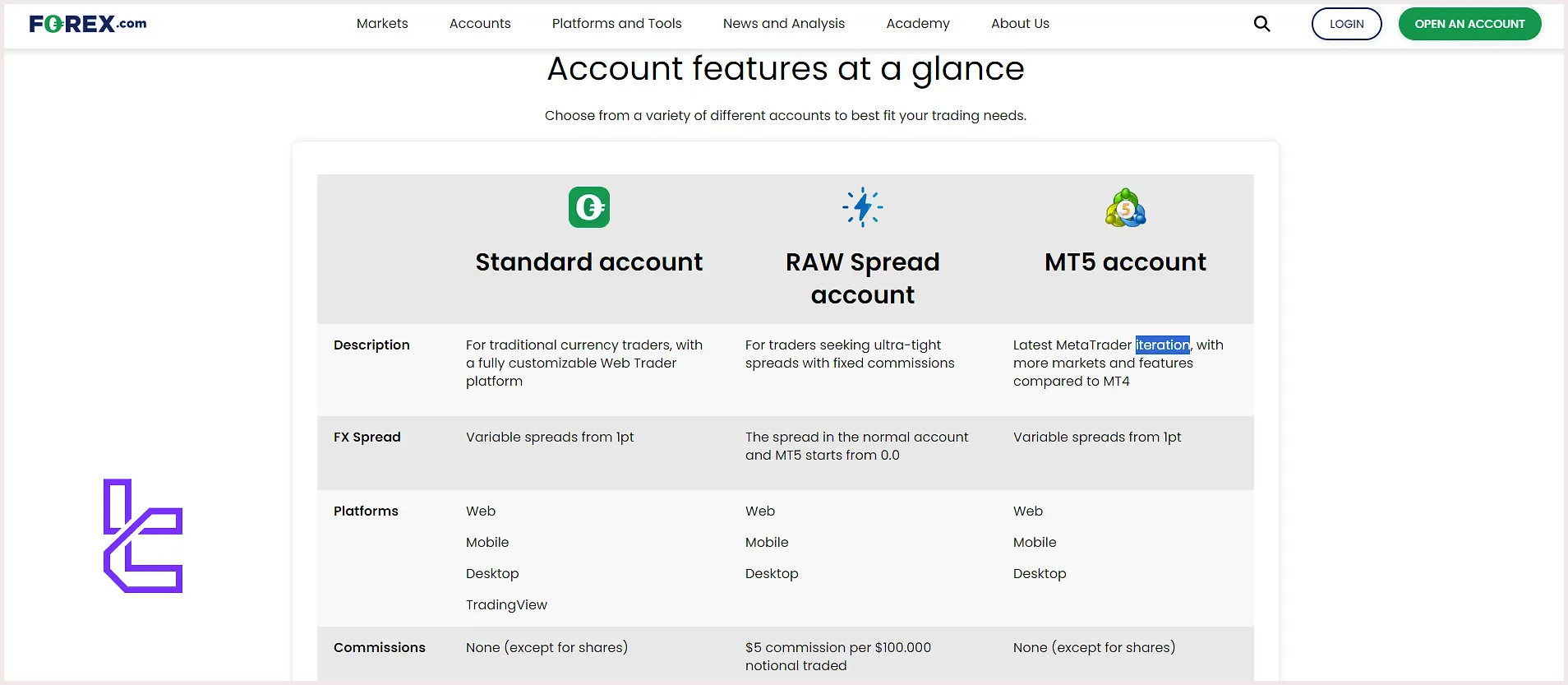

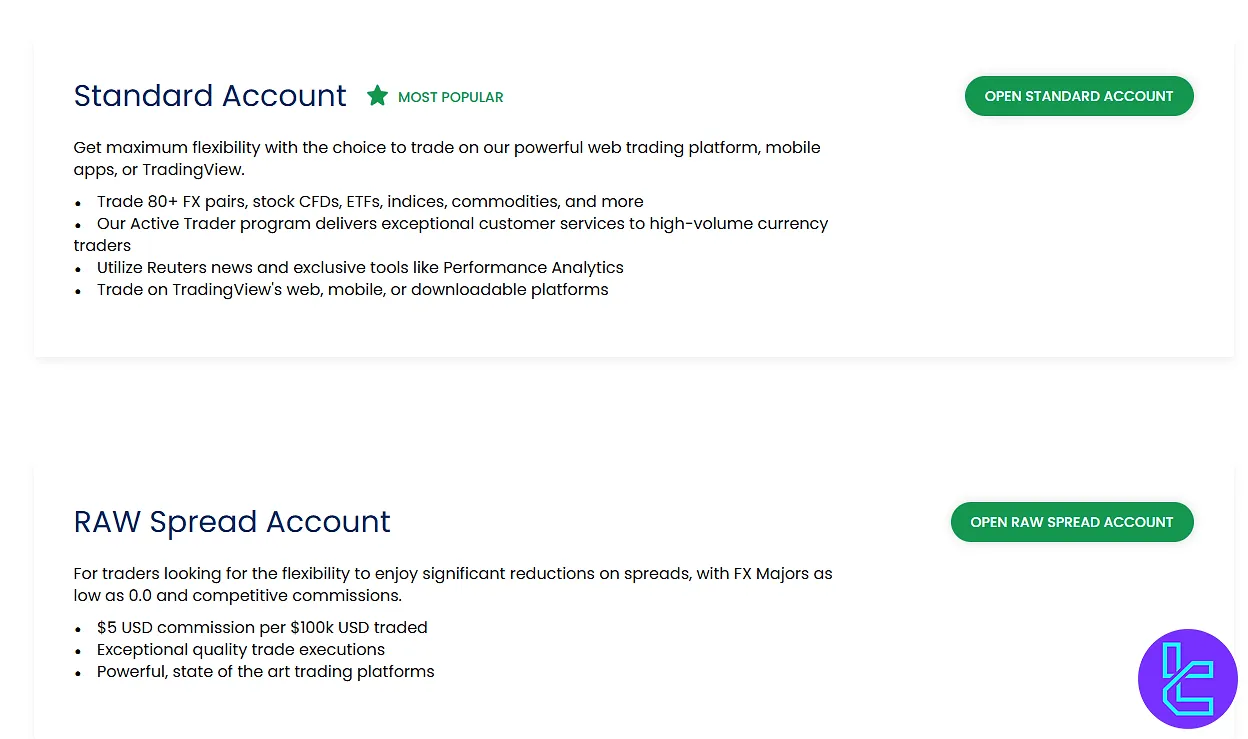

Forex.com Broker Account Types

The broker offers several account types to suit different trading styles and experience levels.

- Standard: A traditional account with spreads as low as 1.0pt and TradingView accessibility

- Raw Spread: Ultra-tight spreads from 0.0pts on major currency pairs, ideal for high-volume traders seeking tighter spreads. Eligible for a six-tier Active Trader rebate program (up to $9/million traded)

- MetaTrader: Access the latest MT5 version with floating spreads from 1.0pt

These accounts also come with technical analysis, market insights, an integrated economic calendar, research, and account management.

The minimum deposit is $100 for all account types, but Forex.com recommends $1,000 to enable proper risk management. Demo accounts are available for up to 90 days with $50,000 in virtual funds.

Forex.com Pros and Cons

Let's take a balanced look at the advantages and disadvantages of trading with Forex.com.

Pros | Cons |

A wide range of tradable instruments | Higher spreads compared to some low-cost brokers |

High-quality trading platforms | Geo-Restrictions |

Excellent market research and educational content | Inactivity fees |

Strong regulatory oversight | - |

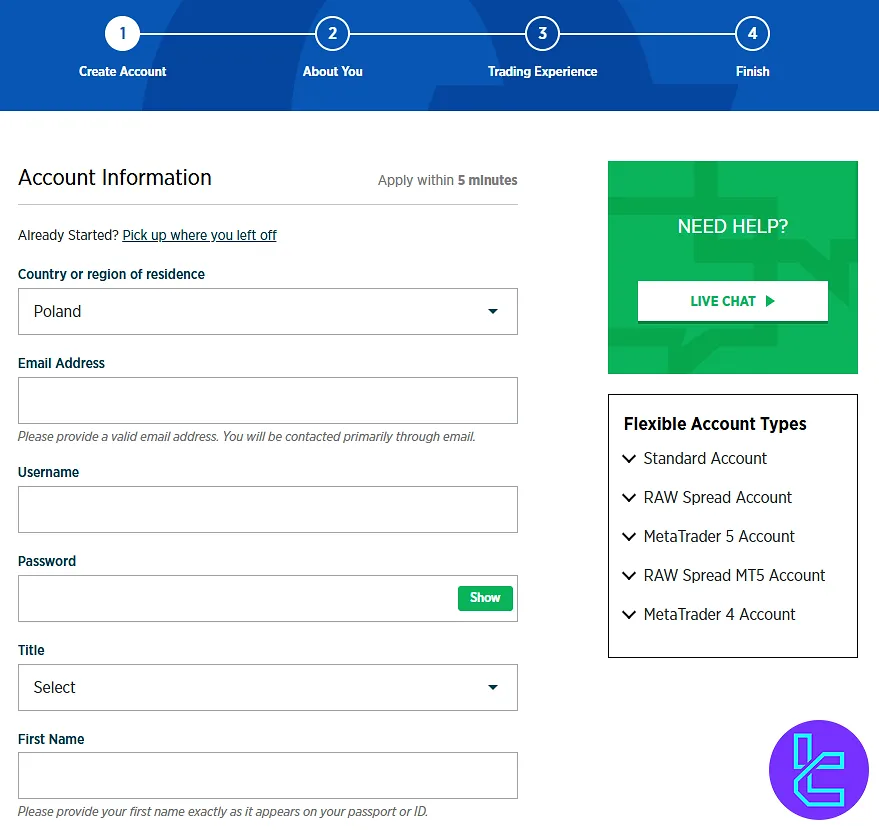

Registration and KYC on Forex.com Broker

Setting up an account with Forex.com is quick and secure, with a regulatory-compliant onboarding process that includes full KYC verification. Traders gain access to a wide range of forex pairs, CFDs, and commodities, all through trusted platforms like MetaTrader 4 and Forex.com Web Trader.

#1 Access the Registration Portal

Go to the official Forex.com website and click on “Open an Account” to begin the sign-up process.

#2 Select an Account Type

Choose the appropriate account type based on your trading needs, such as Standard, Commission, or DMA accounts, each offering different spreads, execution models, and minimum deposits.

#3 Enter Personal and Financial Details

Complete all required forms, including:

- Account Information (email, country, login credentials)

- About You (personal identification, employment)

- Trading Experience (knowledge level, past trading activity)

#4 Submit KYC Documents

Upload two key documents:

- A valid government-issued ID (passport or driver’s license)

- A recent proof of address (utility bill or bank statement)

After a successful review, your account will be verified and ready for funding and live trading under the Forex.com infrastructure.

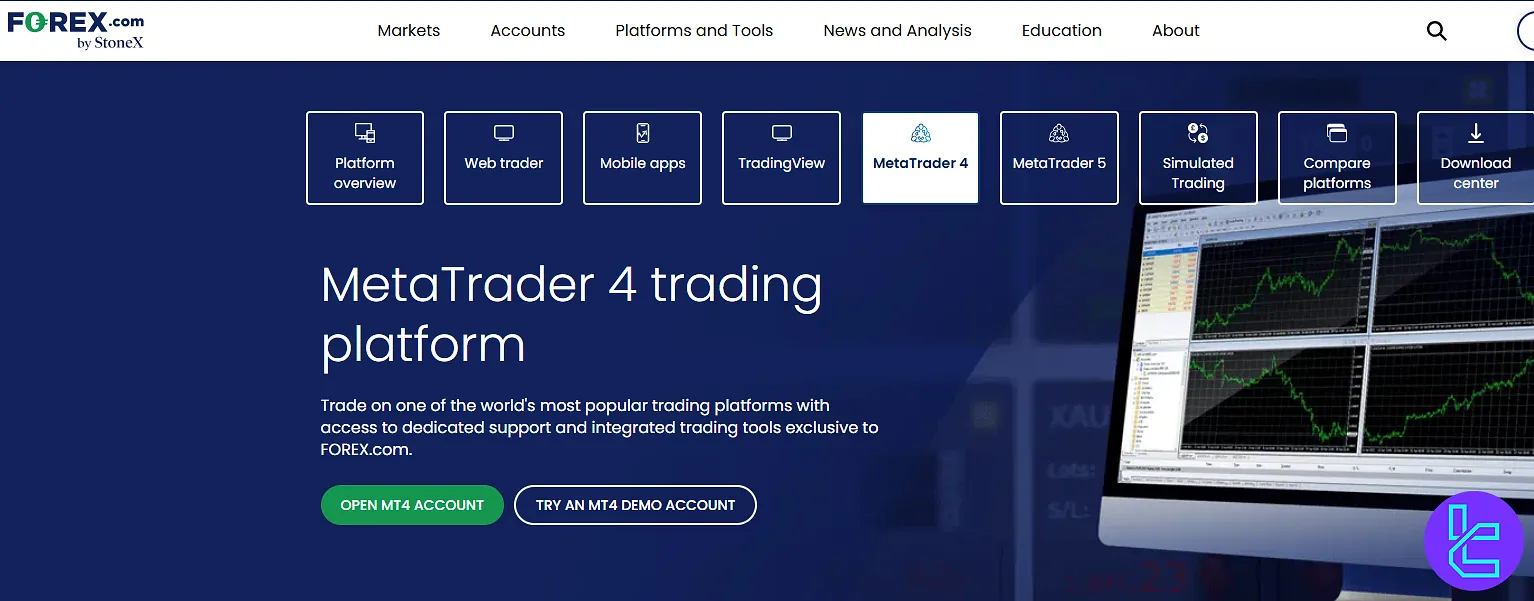

Forex.com Trading Platform Offerings

Forex.com provides a variety of trading platforms, from MetaTrader 4 to a proprietary platform, to cater to different trader preferences and needs.

Forex.com Proprietary Platform

Integration with TradingView, 80 Indicators, 11 chart types, and 14 time frames, available on the following systems:

Forex.com MetaTrader 5

Integration with Reuters news, 9 EAs, 2100 technical indicators, available on the following systems:

- Windows

- Web

- MT5 Android

- MT5 iOS

Forex.com TradingView

Create a TV login, connect your Forex.com account to it, enjoy exclusive trading tools, and join the community of 50M users.

Forex.com Fee Structure

The next stage in the Forex.com review is the fee structure. Understanding it is crucial for managing your trading costs effectively. Here's an overview of Forex.com fees on the most important markets and instruments.

Markets | Spread | Commission |

EUR/USD | From 0.7pts | None |

Germany 40 | From 1.0pt | None |

UK 100 | From 1.0pt | None |

Spot Oil | From 0.0pts | None |

Gold | 0.15 Cents | None |

Shares | N/A | 0.1% |

Note that the Raw Spread account has a fixed $5 commission per $100,000 traded on FX. The broker applies an inactivity fee of $15/month after 12 months of no trading activity.

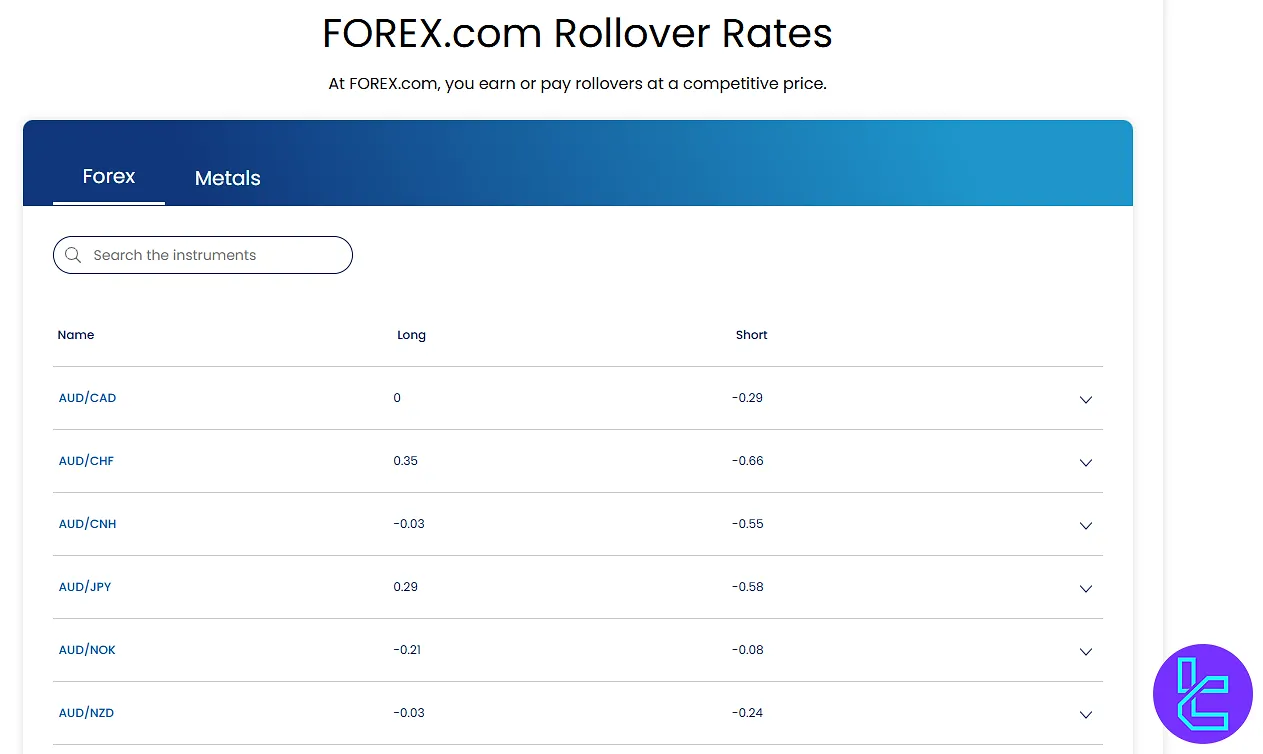

Forex.com Swap Fees

At FOREX.com, rollover is the interest adjustment applied when positions are held past 5:00 PM ET.

Traders may earn or pay depending on the interest rate differential between the two currencies.

Indicative examples (per 10K position):

- AUD/CHF: Long: +0.35 - Short: -0.66

- AUD/JPY: Long: +0.29 - Short: -0.58

- AUD/USD: Long: -0.23 - Short: -0.05

Rollovers are charged once daily, with Wednesdays covering three days to account for weekends. Rates may vary at month-end, holidays, or during market shifts.

Unlike some brokers that apply continuous charges, FOREX.com processes rollover once daily, keeping costs more transparent.

Forex.com Inactivity Fees

Accounts without trading activity or open positions for 12 months or longer are subject to a monthly inactivity charge of €15 or the equivalent in local currency.

Activity is defined strictly as executing trades or maintaining positions; simply placing pending orders does not qualify.

Fee Structure (per currency):

Currency | Inactivity Fee |

GBP | £12 |

USD | 15 |

EUR | 15 |

CHF | 15 |

SGD | 15 |

AUD | 15 |

CAD | 20 |

NZD | 25 |

JPY | 1500 |

HKD | 100 |

PLN | 50 |

HUF | 4500 |

For retail clients inactive 3+ years and professional clients inactive 1+ year, account details and trading experience must be reassessed. In these cases, completing an account reactivation form is required before trading access is restored.

Available Payment Methods on Forex.com Broker

The company offers a variety of payment methods to accommodate traders from different regions. Forex.com funding options:

Method | Min Amount | Max Amount | Currencies | Processing Time |

Local Transfer | $100 | $10,000 | USD, ARS, MYR, THB, VND, IDR, PHP, BRL, COP, CRC, CLP, MXN, PEN | 0 - 30mins |

Credit/Debit Cards | $100 | $10,000 | USD, EUR, GBP | Immediate |

Wire Transfer | None | None | USD, EUR, GBP | Up to 1-2 business days |

Neteller or Skrill | $100 | $10,000 | USD, EUR, GBP | Immediate |

While the broker offers various methods for depositing funds, these options are limited when it comes to withdrawals:

Method | Min Amount | Max Amount | Currencies | Processing Time |

Credit/Debit Cards | $100 | $50K | USD, EUR, CAD, JPY, CHF, AUD, GBP | Up to 24 hours |

Wire Transfer | $100 | Unlimited | USD, EUR, CAD, JPY, CHF, AUD, GBP | Up to 48 hours |

Forex.com Deposit

Clients can fund their accounts through credit or debit card, wire transfer, local online transfer, or e-wallets such as Neteller and Skrill.

Deposits are managed via the MyAccount portal. Checks, Western Union, and PayPal are not accepted.

Deposit Parameters:

Method | Minimum / Maximum | Accepted Currencies | Processing Time | Fees |

Local Online Transfers | $100 – $10,000 | USD, ARS, MYR, THB, VND, IDR, PHP, BRL, COP, CRC, CLP, MXN, PEN | 0–30 min | None |

Credit/Debit Cards | $100 – $10,000 | USD, EUR, GBP (Visa) | Immediate | None |

Wire Transfer | No Minimum/Maximum | USD, EUR, GBP | 1–2 Business Days | None |

Neteller / Skrill | $100 – $10,000 | USD, EUR, GBP | Immediate | None |

*Banks may apply their own service fees.

Key Notes

- The minimum initial deposit is $100 (or equivalent);

- Multiple cards can be used for funding, but withdrawals return to original funding sources;

- Currency conversions apply when funding in a different base currency;

- The maximum initial deposit limit can vary by country.

FOREX.com complies with CIMA regulation (Cayman Islands), which requires full segregation of client funds. Daily reconciliations ensure all assets remain properly separated. In case of default, segregated clients hold creditor priority.

Additionally, the broker maintains capital reserves above regulatory requirements and reviews counterparty risk under an internal risk committee.

Forex.com Withdrawal

Clients can request withdrawals directly through the MyAccount portal. The minimum withdrawal is 100 in the account’s base currency, or the remaining balance if it is below this amount.

Funds must be returned to the original deposit source. If multiple methods were used, withdrawals follow this order:

- Credit/Debit Card

- Neteller or Skrill

- Wire Transfer

Any additional profits or balances exceeding deposit amounts are typically returned via bank or wire transfer. If using a new bank account, a recent bank statement must be uploaded as proof of ownership.

Withdrawal Methods:

Method | Processing Time | Maximum Withdrawal | Fees |

Credit/Debit Card | Up to 24 hours | $50,000 or up to the original deposit amount | None |

Wire Transfer | Up to 48 hours | Unlimited (after card refunds are completed) | Bank fees may apply on receipt |

Note that withdrawing funds reduces available margin. If margin levels fall below requirements, open positions may be liquidated .

Internal account-to-account transfers require contacting client services.

Responsibility rests with the trader to maintain sufficient margin before submitting a withdrawal request.

Does Forex.com Offer Copy Trading and Growth Plans?

The broker does not offer a dedicated copy trading service or structured growth plans as of the latest information available. Forex.com focuses primarily on providing tools and resources for self-directed trading.

Forex.com Broker Markets and Instruments

Forex.com offers access to over 5,500 tradable instruments, making it a strong multi-asset brokerage.

The assets available on FOREX.com are presented in the table below:

Category | Types of Instruments | Number of Symbols | Competitor Average |

Forex | Spot currency pairs | 80+ | 55–100 |

Indices | CFD trading on major global indices (e.g., S&P 500, DAX, FTSE 100) | 15+ | 6–10 |

Shared CFD | Not separately defined; overlaps with equities/indices/commodities CFDs | — | Typically included with indices/equities |

Commodities | Commodity CFDs (metals, energies, softs) | Broad range (exact not specified) | 20+ |

Cryptocurrencies | Crypto CFDs (Bitcoin, Ethereum, Litecoin, Ripple, BTC Cash) | 5 | 4–10 |

Thematic Indices | Theme-Based Basket CFD Indices | Not Specified | Rare Among Brokers |

Does Forex.com Offer Bonus and Promotional Programs?

The broker’s bonus and promotion offerings vary based on the client’s region. The US branch currently offers 4.5% interest on average daily available margin and 5% cashback up to $10,000.

However, the Europe branch doesn’t offer any specific promotional programs, except for a referral program which enables you to receive a minimum commission of $300 for each referred account that makes at least a deposit of $300. Note that the commission plan has a leveraged structure with the following specifics.

First Deposit | Commission |

$300 - $499 | $300 |

$500 - $799 | $500 |

$800 - $1,199 | $800 |

$1200 | $1,000 |

You can use TradingFinder's Rebate Calculator to get an estimate of your cashback earnings.

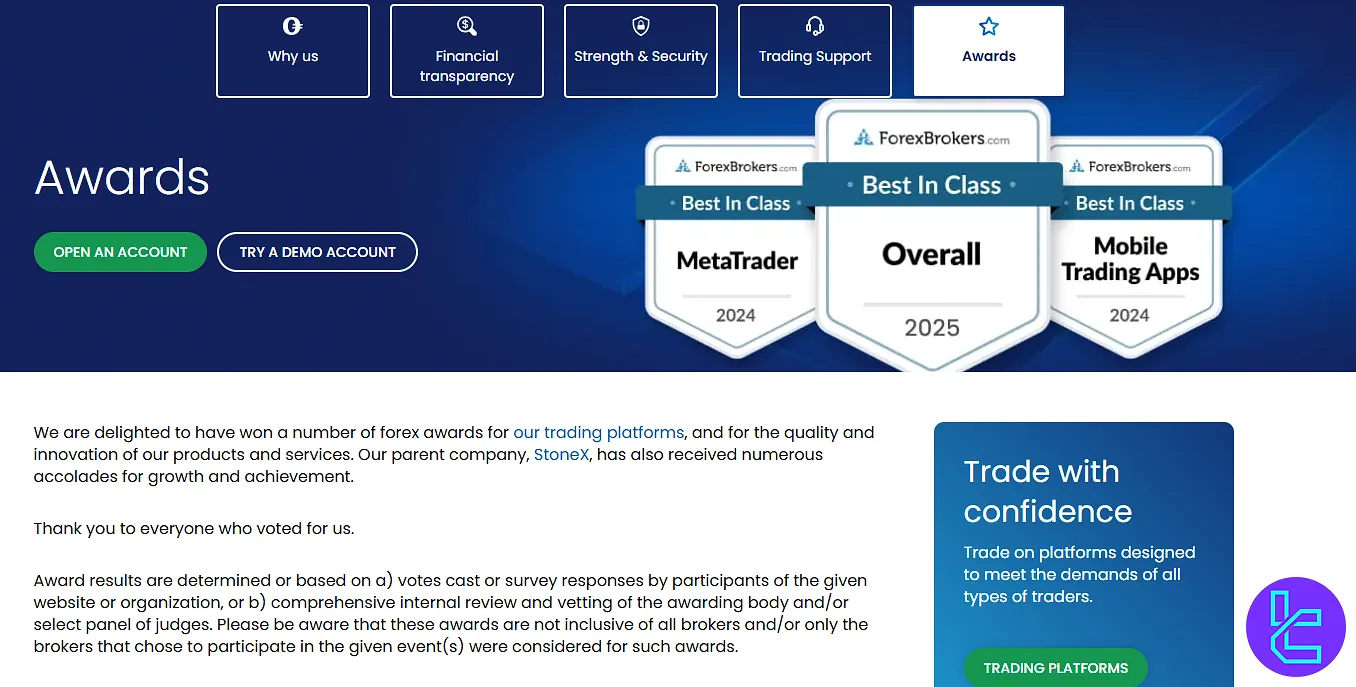

Forex.com Awards

FOREX.com and its parent company StoneX Group Inc. have been acknowledged by industry organizations for platform innovation, product quality, and service standards.

Awards are typically based on public voting, independent surveys, or evaluations by dedicated judging panels. Participation is limited to brokers reviewed or entered into each event, meaning results do not represent the entire market.

Awards & Industry Recognition

Year | Awarding Body | Category / Recognition |

2025 | Forexbrokers.com Annual Review | Best in Class |

2024 | Forexbrokers.com Annual Review | Best in Class – Mobile App, MetaTrader, Trust Score, Risk Management Tool, Professional Trading, Performance & Tools |

2024 | Dubai Forex Expo | Best HNW Service |

2024 | Rankia Awards | Best Broker for CFDs |

2023 | Global Forex Awards | Most Competitive Broker |

2023 | Forexbrokers.com Annual Review | Best in Class – Mobile Trading Apps, Investments Offering, Performance Analytics |

2022 | Dubai Forex Expo | Best HNW Service |

2022 | Rankia Awards | Best CFD Broker |

2021 | Dubai Forex Expo | Best HNW Service |

2021 | InvestinGoal Best Broker Awards | Best Broker in North America |

2021 | ADVFN International Financial Awards | Best Forex Platform |

2021 | Online Personal Wealth Awards | Best Education |

2020 | Benzinga Global Fintech Awards | Best Brokerage (Forex) |

2020 | Investment Trends | Mobile Platform/App (UK Leverage Trading Report) |

2020 | Online Personal Wealth Awards | Best CFD FX Provider, Best Trading Analysis Provider |

2020 | London Trader Show | Best Forex Trading Platform, Best Forex Provider of the Year |

2019 | Shares Awards | Best Forex Service Provider |

2019 | Online Personal Wealth Awards | Best Education |

2019 | Forexbrokers.com Annual Review | Best in Class – Active Trading, Mobile Trading, Commissions & Fees, Education, Investments Offering, Trust Score, Research |

2018 | Forexbrokers.com Annual Review | Best in Class – Active Trading, Mobile Trading, Commissions & Fees, Education, Platforms & Tools, Research |

2018 | UK Forex Awards | Best Forex Fundamental Analysis Provider |

For more information, you can visit the FOREX.com Awards page.

Forex.com Broker Customer Support

We must discuss customer support in the Forex.com review. The broker prides itself on providing comprehensive customer support to its clients through various channels.

Ticket | On the “Contact US” page |

Live Chat | Through the official website |

Phone | +357 220 900 62 |

support.en@forex.com |

Service is available 24/5, and support agents are trained to handle technical, compliance, and platform-related inquiries.

Forex.com Geo-Restrictions

While the company is a global broker, it does have certain geo-restrictions due to regulatory requirements.List of restricted countries on Forex.com:

- Iran

- Israel

- Lebanon

- Libya

- North Korea

- Sudan

Forex.com Trust Scores

One of the most important topics in this Forex.com review is user satisfaction. The broker has earned high trust scores from various review platforms and industry experts.

4.7 out of 5 based on 1,607 reviews | |

Forex Peace Army | 2 out of 5 based on 303 reviews |

Investopedia | 4.5 out of 5 |

Is There Any Educational Content on Forex.com?

The broker offers a wealth of educational content for traders of all levels on its Academy section. These materials are divided into two main categories: Education and Tutorials.

- Education: Courses, Lessons, Self-Assessment, and Glossary

- Tutorials: On various subjects, such as MetaTrader, Mobile Apps, Web Trader, and How to Trade CFDs

You can also check TradingFinder's Forex education section for additional resources.

Forex.com Comparison Table

Let's compare Forex.com offerings with other popular brokers:

Parameter | Forex.com Broker | Alpari Broker | FXGT Broker | Pepperstone Broker |

Regulation | CFTC, SEC, FCA, ASIC, MAS, CIRO, FSA, CySEC | MISA | VFSC, CySEC, FSA, FSCA | ASIC, SCB, FCA, DFSA, CMA, BaFin, CySEC |

Minimum Spread | From 0.0 pts | From 0.0 Pips | From 0.0 Pips | From 0.0 pips |

Commission | From $0.0 | From $0.0 | From $0.0 | From $0.0 |

Minimum Deposit | $100 | $50 | $5 | $1 |

Maximum Leverage | 1:50 | 1:3000 | 1:5000 | 1:500 |

Trading Platforms | MT5, TradingView, Proprietary Platform | MetaTrade 4, MetaTrade 5, Mobile App, Web Trader | MT4, MT5 | Proprietary Platform, cTrader, Trading View, MetaTrader 4&5 |

Account Types | Standard, Raw Spread, MetaTrader | Standard, ECN, Pro ECN, Demo | Standard+, ECN Zero, Mini Optimus, Pro | Standard, Razor |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | 5,500+ | 120+ | N/A | 1200+ |

Trade Execution | Market, Instant | Market | Market | Instant |

Conclusion and Final Words

Forex.com provides access to80+ FX pairs, Crypto, and 4 other asset classes with Raw spreads from 0.0 points. The company supports Neteller, Skrill, and Credit Card payments. While Stock trading has a commission of 0.1%, trading other instruments is commission-free. Forex.com broker has a TrustPilot score of 4.7.