Forex Club offers various account types, such as MT4, MT5, and Libertex, each with a minimum order size of 0.01 lot.

The broker allows deposits via several methods, including Neteller, Skrill, Master Card, Visa Card, and Bitcoin, which provides traders with flexibility.

Forex Club Company Information & Regulation Status

ForexClub is a group of financial companies based in St. Vincent and the Grenadines, operating in the retail foreign exchange and CFD trading market since 1997. Key pointsabout the company:

- Established presence: ForexClub has a long-standing reputation, particularly in the CIS region;

- Regulatory challenges: The company has recently faced various regulatory and compliance issues;

- Regulatory status: The company no longer holds a license in Russia after its license was revoked in 2018;

- Offshore registration: Forex Club's offshore registration raises concerns about its regulatory oversight and reliability.

With an international footprint spanning over 120 countries and more than 3 million registered users, the company has established notable operational hubs, including one in New York City.

Forex Club is regulated in several jurisdictions, including oversight by the National Bank of the Republic of Belarus under license number 192580558, which supports its legitimacy. In the United States, the broker was previously regulated under the CFTC and had a compliance history with the NFA.

However, it is worth noting that in 2012, Forex Club faced a $300,000 fine from the NFA for regulatory violations. Despite this, the broker continues to operate with regulatory credentials in key regions, although users should verify the active status of licenses based on their country of residence.

Here are summary details about broker:

Entity Parameters / Branches | Forex Club International LLC | Libertex International Co. LLC | Indication Investments Ltd | Forex Club (Belarus) |

Regulation | SVG | SVG | CySEC (CIF 164/12) | NBRB (Belarus) |

Regulation Tier | N/A | N/A | 1 | 2 |

Country | St. Vincent & Grenadines | St. Vincent & Grenadines | Cyprus | Belarus |

Investor protection / Compensation | Financial Commission (up to €20,000) | Financial Commission (up to €20,000) | ICF (up to €20,000) | Yes |

Segregated Funds | No | No | Yes | Yes |

Negative Balance Protection | Yes | Yes | Yes | Yes |

Maximum Leverage | 1:1000 | 1:1000 | 1:30 | 1:100 |

Client Eligibility | Global (excluding restricted) | Global (excluding restricted) | EEA & Switzerland | Belarus residents |

While Forex Club was once considered a leading retail forex broker, its current status has declined due to regulatory challenges and mixed user experiences.

Forex Club Broker Summary of Specifics

The forex broker operates in the over-the-counter (OTC) markets, offering a decentralized platform for trading various financial instruments. Key features:

Broker | Forex Club |

Account Types | Libertex, MT5, MT4, Demo |

Regulating Authorities | Offshore regulations |

Based Currencies | USD, EUR |

Minimum Deposit | $10 |

Deposit/ Withdrawal Methods | Neteller (USD), Skrill (USD), Master Card, Visa Card, Bitcoin |

Minimum Order | 0.01 |

Maximum Leverage | 1:1000 |

Investment Options | No |

Trading Platforms & Apps | Libertex, MT4, MT5, Mobile App |

Markets | Forex, Stocks, Indices, Commodities, Cryptocurrencies |

Spread | From 0.0 |

Commission | 0.03% (Libertex) |

Orders Execution | Market, Instant |

Margin Call/Stop Out | 50%/20% |

Trading Features | Copy Trading |

Affiliate Program | YES |

Bonus & Promotions | YES |

Islamic Account | N/A |

PAMM Account | No |

Customer Support Ways | Email, Live Chat, Ticket |

Customer Support Hours | 24/7 |

While Forex Club offers flexibility and access to a wide range of investment opportunities, it's important to note that OTC markets come with significant risks. These include higher volatility, less transparency, and increased susceptibility to fraud.

ForexClub Types of Accounts

Forex Club, also known as Libertex, supports three main account types, denominated in USD and EUR.

The minimum deposit for either is set at $10, making the broker relatively accessible. Each account allows for a minimum trade size of 0.01 lots and features a 20% liquidation margin.

Account | Min. Deposit | Leverage Up to | Minimum Order (Lot) |

MT4 | $10 | 1:1000 | 0.01 |

MT5 | $10 | 1:1000 | 0.01 |

Libertex | $10 | 1:1000 | 0.01 |

Forex Club's versatile account offerings cater to both beginner and experienced traders, providing a range of options for various trading strategies and preferences.

Forex Club’s Advantages and Disadvantages

Here's a balanced overview of Forex Club's pros and cons:

Advantages | Disadvantages |

Long-standing experience | Lack of top-tier regulatory oversight |

Multiple trading platforms | Limited base currencies |

Wide range of trading instruments | Mixed recent user reviews |

While Forex Club offers some attractive features, the need for solid regulations and recent user complaints are significant concerns traders should consider carefully before opening an account.

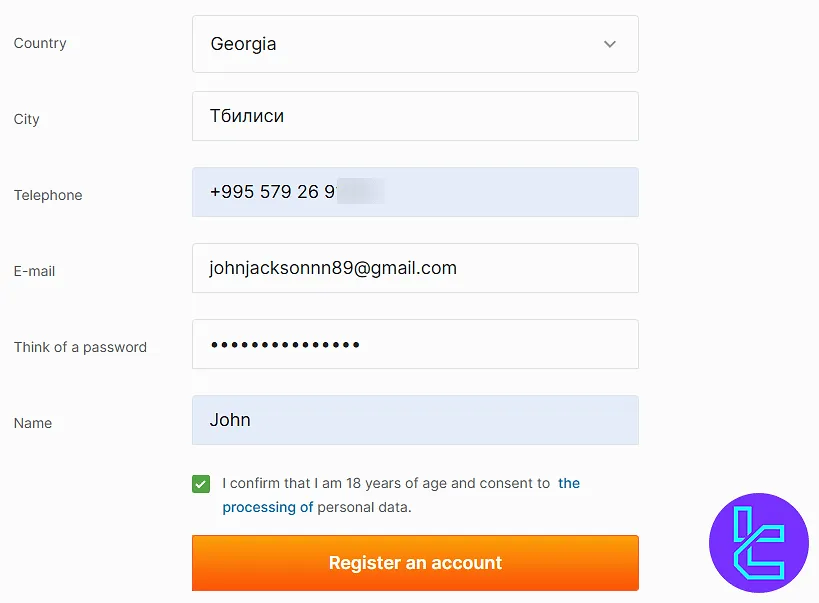

Forex Club Signing Up & Verification Guide

The Forex Club registration is a quick 4-step process that grants access to features likeup to 1:1000 leverage, spreads from zero, and a minimum deposit of just $10.

Whether you're trying a demo account or starting with real capital, the process is designed to onboard you within minutes.

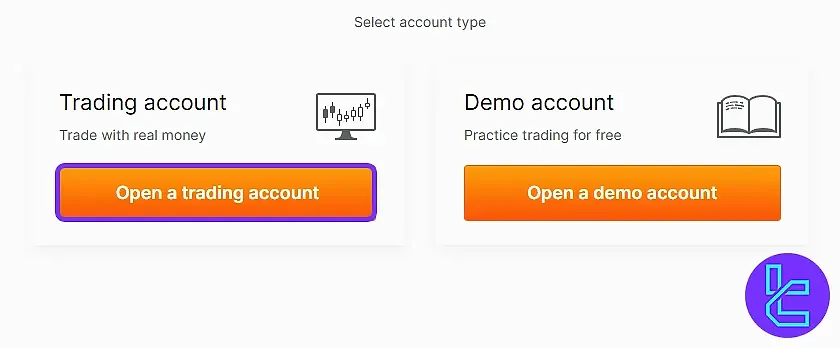

#1 Begin Registration

Visit the official Forex Club website and click the “Start Trading” button to initiate account creation.

#2 Choose Account Type

Select between a demo account for practice or a real account for live trading with actual funds.

#3 Fill Out Personal Details

Provide your personal information, including:

- Country

- City

- Phone number

- Password

Accept the terms to continue.

#4 Confirm Your Email

Check your inbox for a message from Forex Club and click the email confirmation link to activate your account.

#5 Complete the KYC Procedure

Provide additional information and supporting documents, including:

- Proof of ID: Passport or Driving license

- Proof of Address: Utility bill or Bank statement

Trading Platforms

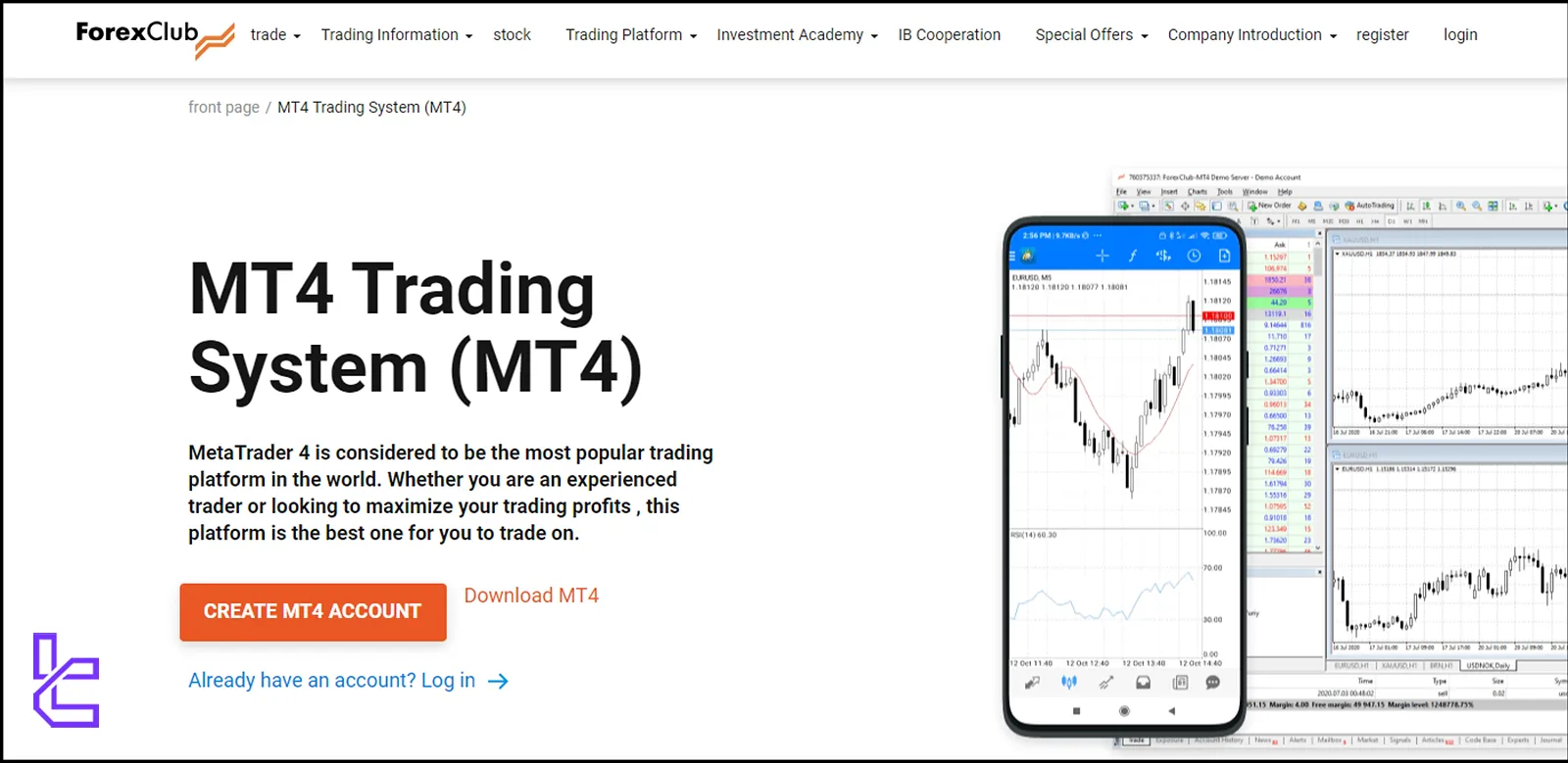

ForexClub offers a variety of popular trading platforms to suit different trader preferences:

- MetaTrader 4 (MT4)

- MetaTrader 5 (MT5)

- Libertex (proprietary platform)

- Mobile app

Forex Club's diverse platform offerings cater to traders from all levels, providing tools and features for various trading styles.

MT4 is recommended for beginners due to its ease of use, while MT5 offers deeper analytical capabilities for more advanced traders. The availability of both platforms enhances flexibility for all user levels.

TradingFinder has developed a wide range of MT4 and MT5 indicators that you can use for free.

ForexClub Spreads and Commission Structure

ForexClub offers competitive pricing through its various platforms:

- Spreads: Starting from 0.0 pips

- Commissions: From0.03% (on the Libertex platform)

Traders should carefully review the fee structure for their chosen instruments and platform, as rates may vary depending on the asset type and trading conditions.

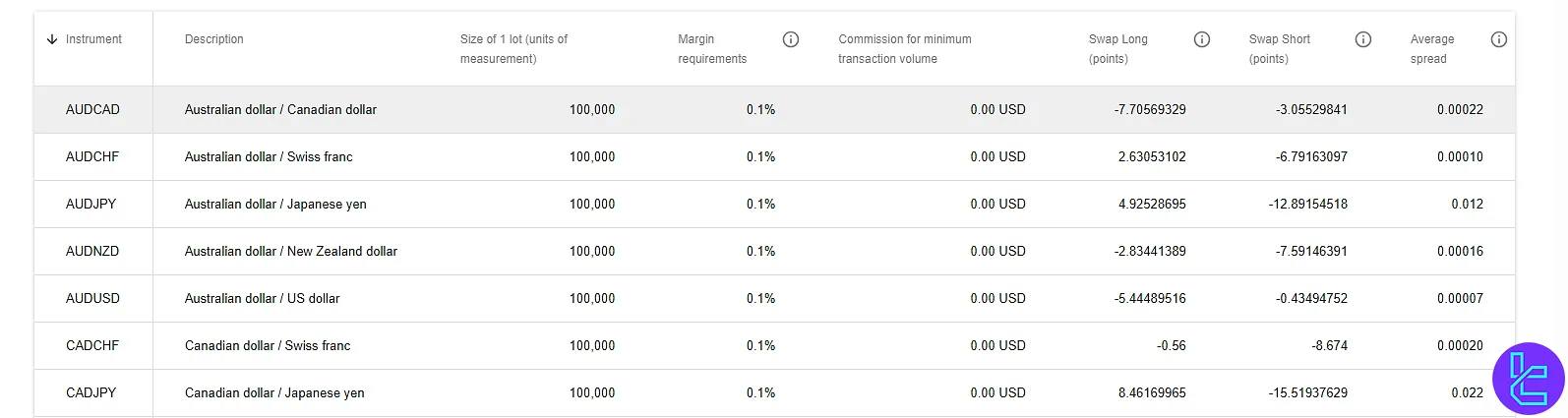

Swap Fee at Forex Club

Forex Club charges a swap fee when a position is rolled over to the next trading day, and that fee is either added or subtracted depending on whether you hold a buy or sell position.

Their official MetaFX Agreement specifies that swap is calculated at 21:00 GMT and that a triple rollover (triple swap) is applied at specific days for different instruments.

Below are a few key points drawn from their official sources:

- The “Instrument Specifications” section contains the complete list of swap rates (buy/sell) for all trading instruments;

- For EUR/USD, the swap is approximately –25 points (buy) and +0.95 points (sell) under standard conditions;

- For GBP/USD, the swap is approximately –80 points (buy) and +0.40 points (sell) based on current instrument data.

Non-Trading Fees at Forex Club

Forex Club outlines limited non-trading fees in its official client agreements and legal documentation.

While the broker’s primary costs remain trading-related (spreads, swaps, and commissions), certain administrative and inactivity charges are also defined contractually. Exact monetary values, however, are not published on the public website.

Below are the key points officially disclosed:

- The MetaFX Client Agreement allows the company to charge a service fee if no trading activity occurs within a period set by the broker;

- The same document states that inactive or dormant accounts may incur a maintenance fee;

- The company reserves the right to apply administrative charges for account servicing or processing actions.

Deposit & Withdrawal Methods

Forex Club, just like the other forex brokers, offers several methods for account funding and withdrawals:

- Neteller (USD)

- Skrill (USD)

- Master Card

- Visa Card

The minimum deposit is set at $100. While deposit processing is typically smooth, user feedback highlights recurring withdrawal delays, a key concern for clients who prioritize operational efficiency and timely fund access.

Always double-check deposit details before confirming any transactions.

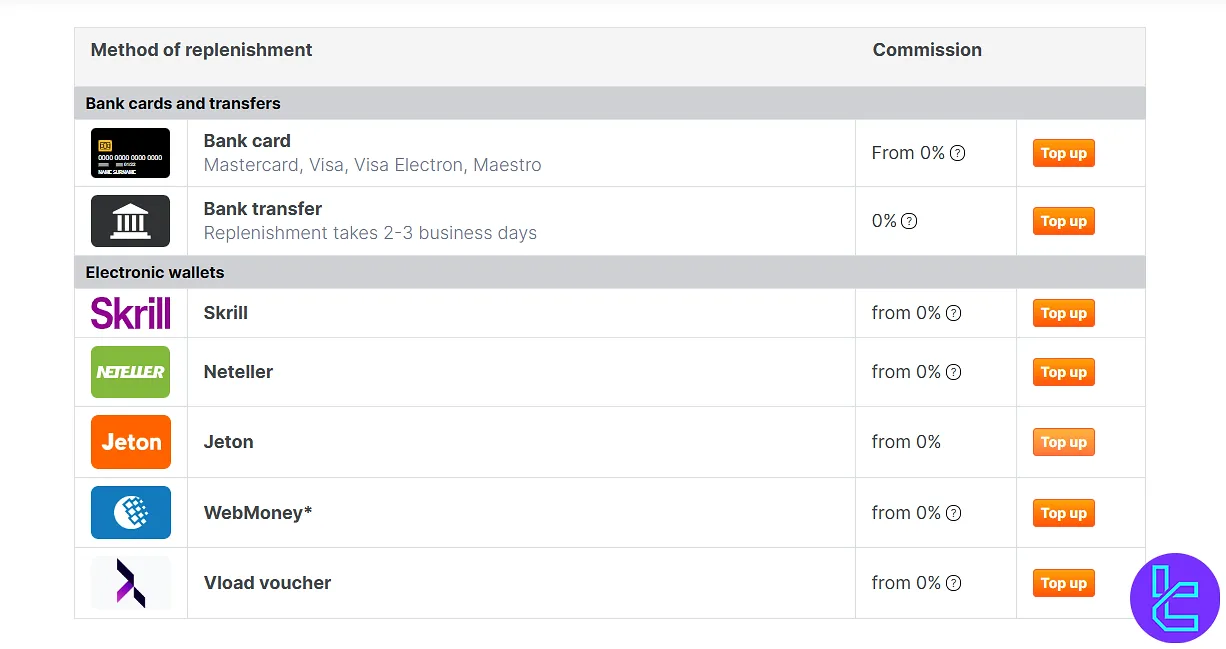

Deposit Methods at Forex Club

Forex Club offers a wide range of deposit methods for clients, including bank cards, bank transfers, and electronic wallets, with the notable feature that the broker compensates 100% of payment system commissions with bonus funds.

All deposits are processed instantly, except for bank transfers which typically take 2–3 business days. Special promotions, such as a 100% bonus on the first deposit, further enhance the value for new clients.

Here is a summary of the official deposit methods and conditions:

Deposit Method | Currency | Minimum Amount | Deposit Fee | Funding Time |

Bank Card (Visa, Mastercard, Visa Electron, Maestro) | USD, EUR, RUB, others | Not specified | From 0% | Instant |

Bank Transfer | USD, EUR, RUB, others | Not specified | 0% (Forex Club compensates $30 for payments ≥ $1,000) | 2–3 business days |

Skrill | USD, EUR, RUB, others | Not specified | From 0% | Instant |

Neteller | USD, EUR, RUB, others | Not specified | From 0% | Instant |

Jeton | USD, EUR, RUB, others | Not specified | From 0% | Instant |

Web Money | USD, EUR, RUB, others | Not specified | From 0% | Instant |

Vload Voucher | USD, EUR, RUB, others | Not specified | From 0% | Instant |

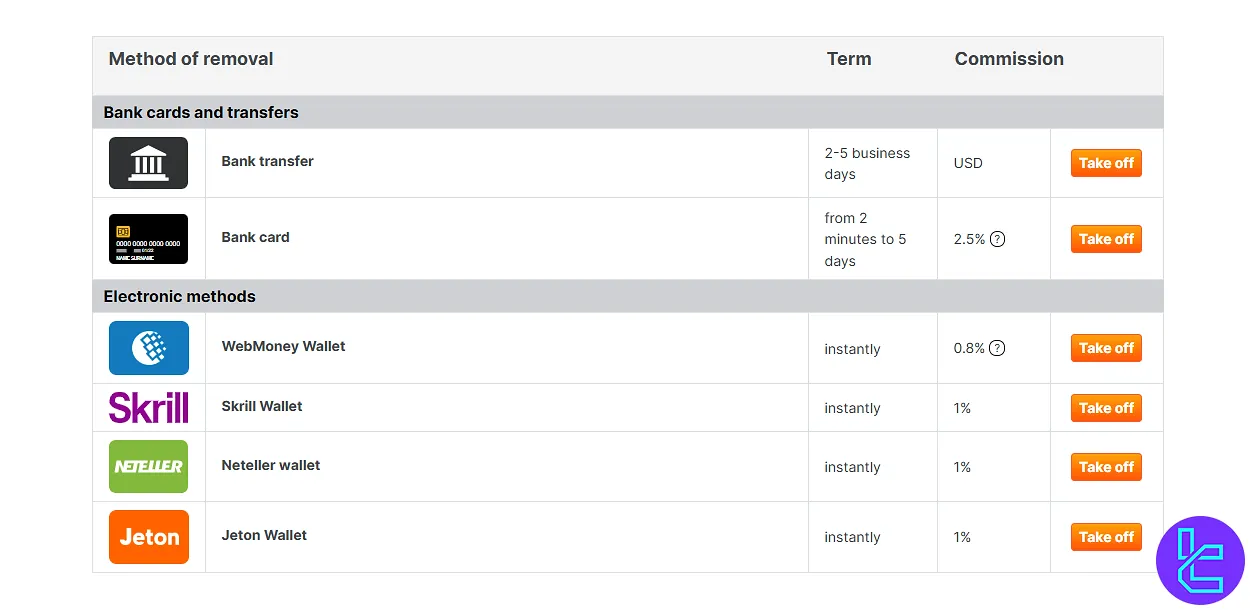

Withdrawal Methods at Forex Club

Forex Club provides clients with multiple withdrawal methods to ensure fast and secure access to their funds. Withdrawals can be made via bank cards, bank transfers, and electronic wallets, with processing times ranging from instant to several business days depending on the method.

Official conditions also specify that third-party withdrawals are prohibited, and fees vary according to the selected method and payment provider.

Below is an overview of the official withdrawal methods and their conditions:

Withdrawal Method | Currency | Minimum Amount | Withdrawal Fee | Funding Time |

Bank Card | USD, EUR, RUB, others | Not specified | 2.5% | From 2 minutes up to 5 business days |

Bank Transfer | USD, EUR, RUB, others | Not specified | 0% (provider fees may apply) | 2–5 business days |

WebMoney Wallet | USD, EUR, RUB, others | Not specified | 0.8% | Instant |

Skrill Wallet | USD, EUR, RUB, others | Not specified | 1% | Instant |

Neteller Wallet | USD, EUR, RUB, others | Not specified | 1% | Instant |

Jeton Wallet | USD, EUR, RUB, others | Not specified | 1% | Instant |

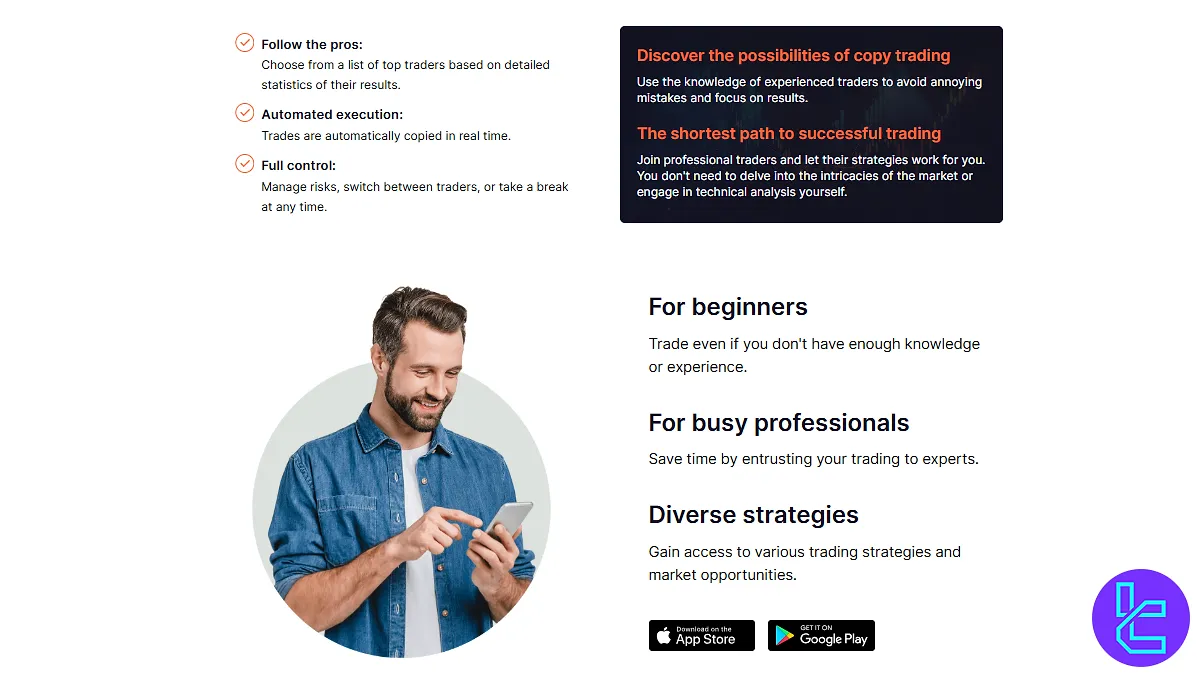

Copy Trading & Investment Options Offered by ForexClub

Forex Club offers copy trading functionality, allowing investors to automatically replicate experienced traders' trades. This feature provides several benefits:

- Novice traders can benefit from the knowledge of seasoned professionals;

- Eliminates the need to develop and execute complex trading strategies;

- Ability to copy multiple traders across various markets and instruments.

While copy trading can be an attractive option for some investors, it's important to remember that past performance doesn't guarantee future results, and all trading carries inherent risks.

Tradable Markets & Symbols Overview

Forex Club provides access to a range of markets, including the forex market, commodities (energies and precious metals), and indices. However, it does not currently support shares, ETFs, bonds, or mutual funds.

Here are all tradable instruments and markets:

Category | Type of Instruments | Number of Symbols | Competitor Average | Max. Leverage |

CFDs on digital currencies | 35+ | 25–50 | N/A | |

Indices | CFDs on global indices | 20+ | 20–40 | 1:1000 |

Oil and Gas | CFDs on oil and gas commodities | 8 | 10–25 | 1:400 |

Metals | CFDs on precious and industrial metals | 6 | 15–30 | 1:500 |

Stocks | CFDs on global stocks | 100+ | 100–200 | N/A |

Forex | Currency pairs (major, minor, exotic) | 70+ | 50–100 | 1:1000 |

Agriculture | CFDs on agricultural commodities | 10+ | 10–20 | N/A |

ETFs | CFDs on exchange-traded funds | 8 | 30–100 | N/A |

Bonus Offerings and Promotions

ForexClub offers an attractive100% Welcome Bonus for new clients. The broker also offers an IB Program with significant advantages. Here are the benefits:

- Higher Rebates & Flexible Cycles

- Multiple Regulatory Choices

- Advanced Agent Portal

- Multi-Level Agent Support

- Comprehensive Business Support

- Technical Analysis Tools

While these offers can be appealing, traders should carefully review the associated terms and consider how they align with their trading goals and risk tolerance.

You can use TradingFinder's Rebate Calculator to get an estimate of your cashback earnings.

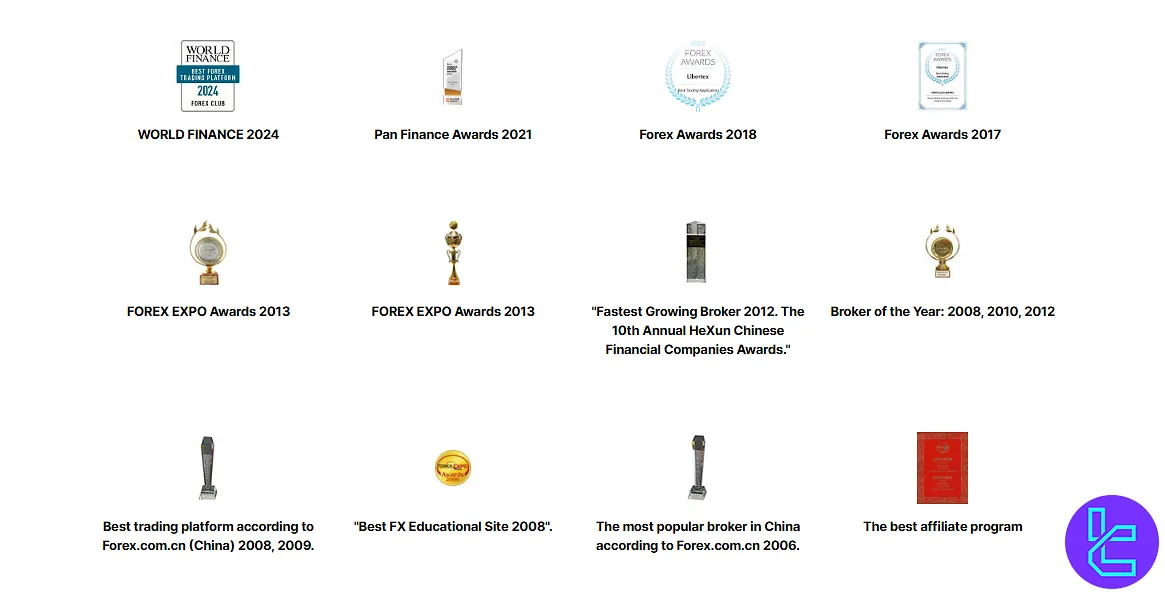

Forex Club Awards

Forex Club has been recognized with numerous prestigious awards, highlighting its commitment to excellence in the financial services industry.

These accolades reflect the company's dedication to providing top-tier trading platforms, innovative solutions, and exceptional customer service.

Here are some of the most notable Forex Club awards:

- WORLD FINANCE 2024

- Pan Finance Awards 2021

- Forex Awards 2018

- Forex Awards 2017

- FOREX EXPO Awards 2013

- Fastest Growing Broker of 2012

- Broker of the Year: 2008, 2010, 2012

Forex Club Support Team

Forex Club provides customer support through various channels:

- Email: china@help.fxclub.org

- Ticket system

- Live Chat

Support is typically available in multiple languages to cater to Forex Club's international client base. However, the quality and responsiveness of support may vary based on recent user reviews.

Forex Club Broker List of Restricted Countries

ForexClub does not provide clear information regarding its list of restricted countries directly on its website. But since the offshores brokers are not allowed to provide any services to certain countries, we can name some of them in the following:

- USA

- Canada

- Australia

- UK

Trust Scores & Reviews

ForexClub has faced regulatory challenges and received mixed reviews in recent years, so trust scores and reviews should be approached with caution.

While the broker has a long history in the industry, recent developments have raised concerns about its reliability and trustworthiness. Traders are advised to:

- Research current regulatory status;

- Read recent user reviews from multiple sources;

- Consider the potential risks associated with offshore brokers;

- Compare Forex Club's offerings with those of more strictly regulated brokers.

Unfortunately, based on our recent research about the broker, Forex Club appears to have no reviews on the Trustpilot website. Remember that trust scores and reviews can provide valuable insights, but they should be just one factor in your decision-making process when choosing a forex broker.

Education on Forex Club

ForexClub broker has dedicated an educational section to its website (Investment Academy), but there is no content available there yet. It’s expected of them to publish rich content with the following:

- Comprehensive courses

- Trading webinars

- Market analysis

- Video tutorials

- E-books and articles

These educational materials can be valuable for traders looking to enhance their skills and knowledge.

You can check TradingFinder's Forex education section for additional resources.

Forex Club vs Other Brokers

Let's compare Forex Club's offerings with other popular brokers:

Parameter | Forex Club Broker | Moneta Markets Broker | OctaFX Broker | FP Markets |

Regulation | Offshore regulations | FSCA, FSRA | FSCA, MISA | ASIC, CySEC, FSC, FSCA, FSA |

Minimum Spread | From 0.0 Pips | From 0.0 pips | From 0.0 pips | From 0.0 pips |

Commission | 0.03% | From $0.0 | From $0 | $3 |

Minimum Deposit | $10 | $50 | $25 | $50 |

Maximum Leverage | 1:1000 | 1:1000 | 1:1000 | 1:500 |

Trading Platforms | Libertex, MT4, MT5, Mobile App | MT4, MT5, Pro Trader, App Trader | MT4, MT5, OctaTrader, Octa Copy | MT4, MT5, cTrader |

Account Types | Libertex, MT5, MT4, Demo | Direct, Prime, Ultra | MT4, MT5, OctaTrader | Standard, RAW |

Islamic Account | N/A | Yes | Yes | Yes |

Number of Tradable Assets | N/A | 1000+ | 277 | 1000+ |

Trade Execution | Market, Instant | Market | Market | Instant |

Conclusion and final words

Forex Club’s commission structure is competitive, starting at 0.03% on Libertex. The broker provides a maximum leverage of 1:1000 for its accounts.

However, concerns must be considered about its mixed user reviews, lack of top-tier regulatory oversight, and restricted countries (such as the USA, Canada, Australia, and the UK).