Forex.ee offers two types of ECN accounts, enabling traders to access four different asset classes, from Forex to Crypto, with a minimum deposit of $15 and leverage options of up to 1:500.

Forex.ee broker supports and Crypto transactions for deposits and withdrawal. It offers a unique trading pair, Tether Gold (XAUt) and a total of 3 asset classes on TickTrader Android/iOS/Windows/Web versions.

Forex.ee; Company Information and Regulation

ForexEE originated in Estonia in 1998. It’s a brand name of NTS Systems LLC, which was later registered in the UK on 4 May 2004. However, the company registration license in England expired on 12 October 2021. Note that currently, the broker is not regulated by any major financial authority. Key features of Forex.ee:

- Leverage up to 1:500

- Spreads from 0.0 pips

- No requotes or interventions

- True ECN

Forex.ee operates under an unregulated structure, which allows for flexible trading conditions but offers no investor protection.

Since 2013, the broker has adopted both STP and ECN execution models, enabling traders to connect directly to liquidity providers for optimal pricing and fast order execution.

Over the years, it has evolved into a technology-driven platform with a focus on minimal spreads and fast order routing.

While the broker underwent major updates in 2014 and expanded into crypto trading by 2015, Forex.ee still positions itself as a low-cost, high-speed solution for traders who prefer ECN transparency and flexibility over regulatory safeguards.

Forex.ee Specific Details

Here is a brief summary of company information about Forex.ee:

Entity Parameters / Branches | Forex.ee |

Regulation | Not regulated |

Regulation Tier | N/A |

Country | Estonia |

Investor Protection Fund / Compensation Scheme | No |

Segregated Funds | No |

Negative Balance Protection | Yes |

Maximum Leverage | 1:500 |

Client Eligibility | Worldwide |

ForexEE boasts complete transparency and no conflict of interest with the clients. Let’s look at what the Forex broker has to offer.

Broker | Forex.ee |

Account Types | ECN NET, ECN GROSS |

Regulating Authorities | None |

Based Currencies | USD, EUR |

Minimum Deposit | $15 |

Deposit Methods | Crypto |

Withdrawal Methods | Crypto |

Minimum Order | 0.01 lots |

Maximum Leverage | 1:500 |

Investment Options | None |

Trading Platforms & Apps | TickTrader |

Markets | Forex, Metals, Crypto |

Spread | From 0.0 pips |

Commission | 3.5 units of base currency per lot |

Orders Execution | Market |

Margin Call / Stop Out | 100% / 50% |

Trading Features | Economic Calendar, Mobile Trading |

Affiliate Program | Yes |

Bonus & Promotions | Partnership program, Deposit bonus, Free signals, Special commission |

Islamic Account | Yes |

PAMM Account | No |

Customer Support Ways | Email, Phone, Live Chat |

Customer Support Hours | Monday – Friday 7 AM to 4 PM GMT |

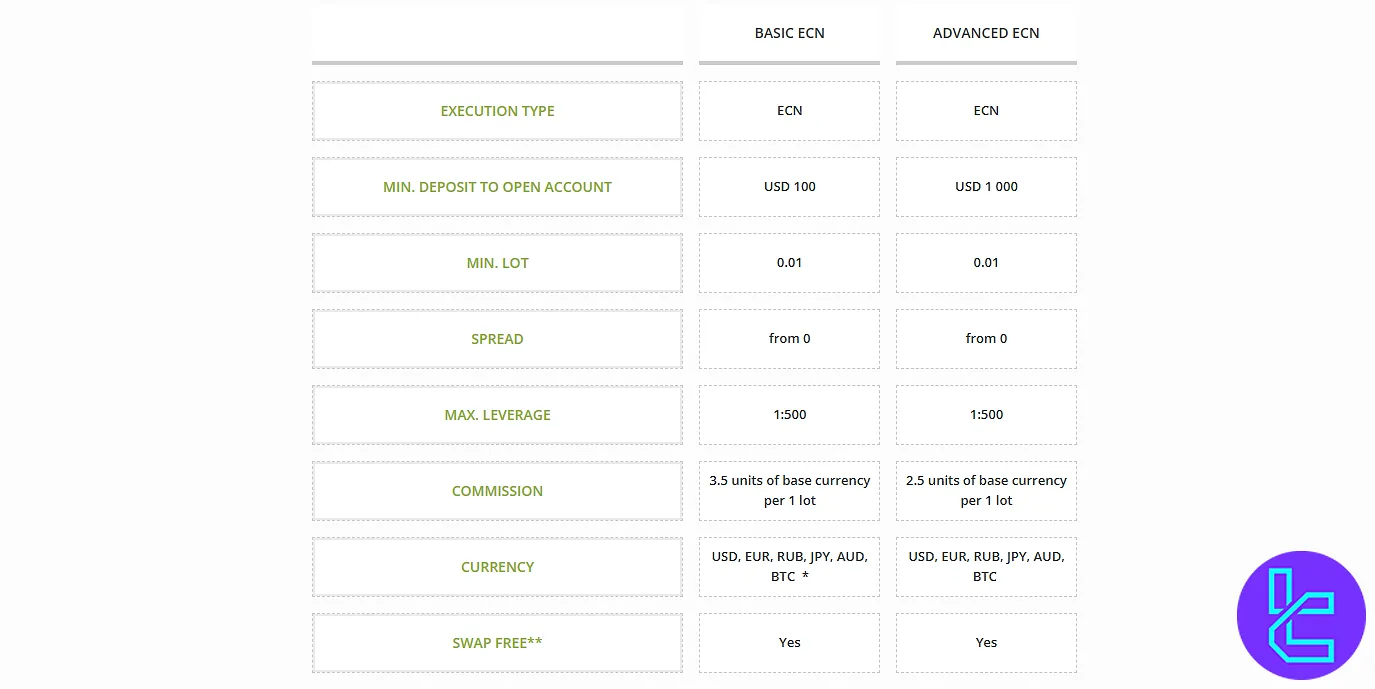

Forex.ee Broker Account Offerings

Forex EE prides itself on being a true ECN (Electronic Communication Network) broker, directly connecting to the interbank forex market.

While the broker’s website indicates that there are two account types, Basic and Advanced, when you log in to the client portal and attempt to create a live account, you’ll see that the available types are different. They’re named NET and GROSS.

While the two accounts are basically the same, they differ in regard to order types and the number of positions on the same instrument. Key features of Forex.ee ECN account:

Base Currency | USD, EUR |

Min Deposit | $15 |

Max Leverage | 1:500 |

Min Order Size | 0.01 lots |

Margin Call | 100% |

Stop Out | 50% |

Spreads | Floating from 0.0 pips |

Commission | 3.5 units of base currency per lot |

Swap Free | Available |

Additionally, traders can open demo and swap-free (Islamic) accounts. All ECN accounts support micro-lot trading (0.01 lots) and allow for leverage options up to 1:500, depending on balance and asset class.

Forex.ee Broker Pros and Cons

When considering Forex EE as your potential broker, weighing both the advantages and disadvantages is essential.

Let’s take a brief look at the broker’s advantages and disadvantages:

Pros | Cons |

True ECN execution with deep liquidity | Conflicting information on the broker’s website |

No restrictions on trading styles (scalping, EAs allowed) | Limited tradable assets |

Mobile trading support | Not regulated by any major financial authority |

Offers Islamic and demo accounts | Lack of transparency regarding company structure |

Forex.ee Account Opening and Verification

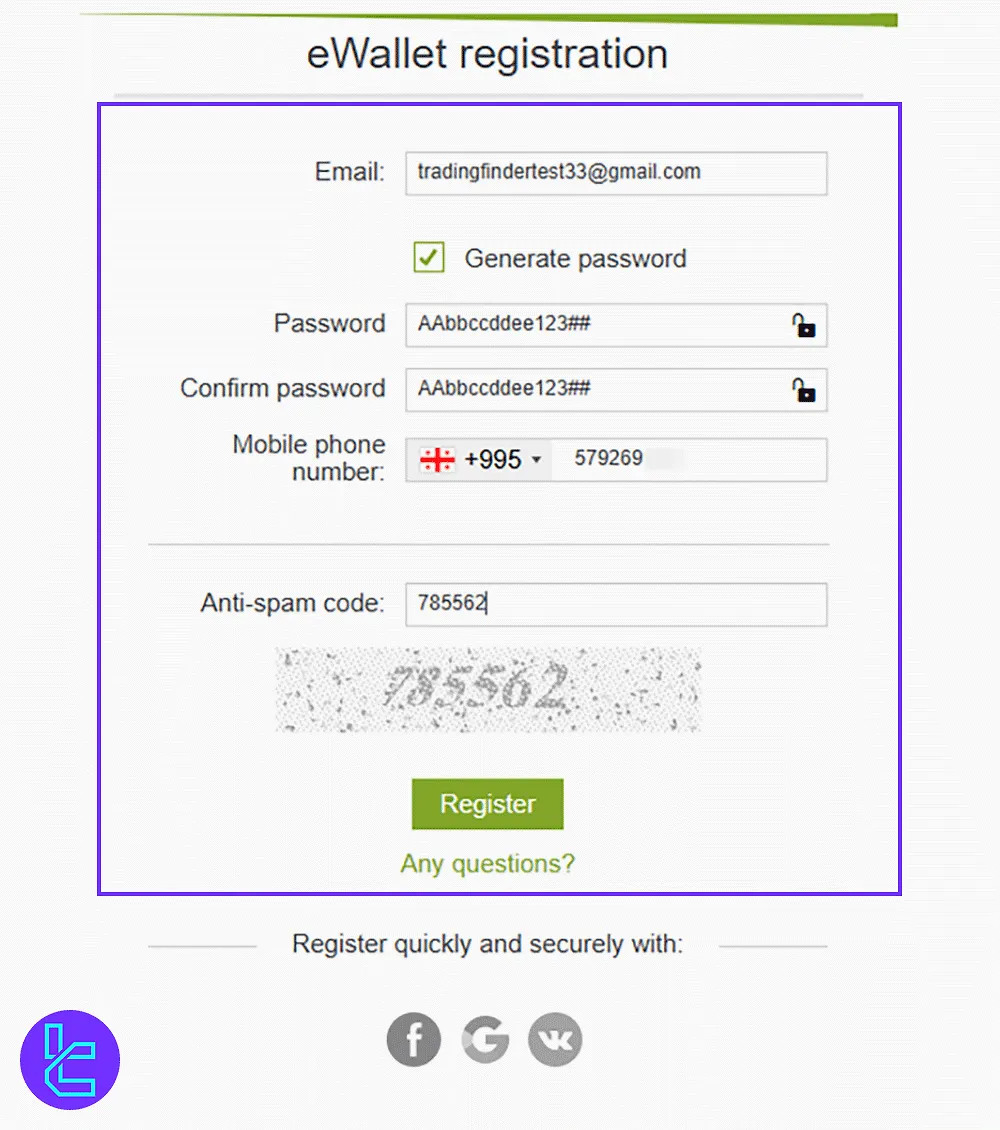

The Forex.ee registration process is designed for speed and simplicity, letting traders open a live or demo account using just an email, mobile number, and a secure password. Social sign-up via Google, Facebook, or VK is also supported.

#1 Go to the Account Opening Page

Visit the official Forex.ee website and click on “Open Live” from the homepage to access the registration form.

#2 Enter Your Basic Information

Complete the sign-up form by submitting:

- A valid email address

- A password (10–120 characters, or auto-generated)

- Your mobile number

- The displayed anti-spam code

Click “Register” and securely store your login credentials and eWallet number displayed on-screen.

#3 Complete the KYC Process

Once your “eWallet” is registered, log in to the client portal, click "Add Account", choose one of the available options, and create a live account. Provide supporting documents, including:

- Proof of ID (Passport or Driving license)

- Proof of Address (Utility bill or Bank statement)

- A selfie with your ID card

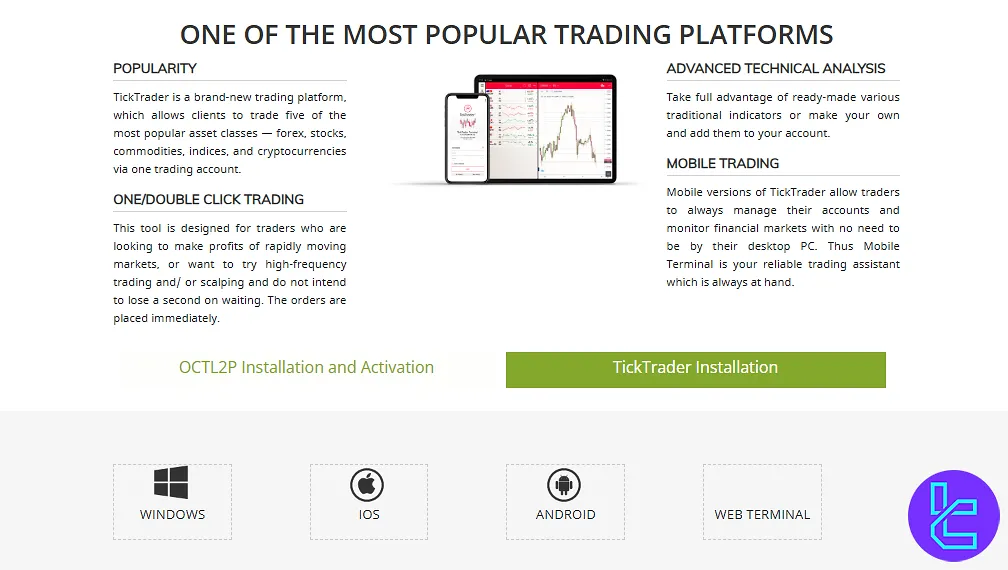

Forex EE Broker Trading Platforms?

We must discuss the platform offerings in this Forex.ee review. The broker utilizes TickTrader as its main trading solution, offering market access across various devices, including:

- TickTrader Android

- TickTrader iOS

- Desktop

- Web

Although advanced integrations like TradingView or proprietary APIs are not available, the platform selection meets the core needs of algorithmic and discretionary traders alike.

Forex.ee Fees Explained

The company boasts its competitive trading conditions by offering ECN commissions and spreads from 0.0 pips. As we mentioned before, the commission is 3.5 units per lot.

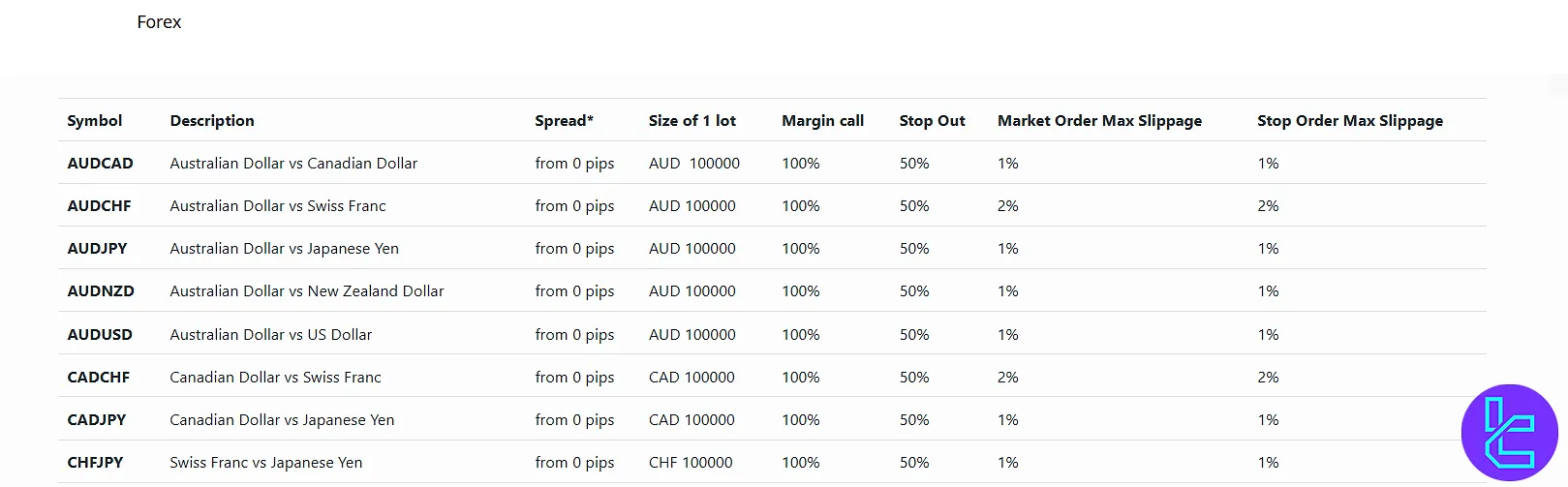

After exploring trading assets on Forex.ee broker’s web terminal, we can say that the company’s spreads are higher than average. We’ll gather the spread data for some of the most popular financial instruments in the table below.

Markets | Spreads (pips) |

EURUSD | 69 |

GBPUSD | 23 |

USDJPY | 122 |

BTCEUR | 7320 |

LTCUSD | 8 |

ETHUSD | 317 |

Gold | 205 |

The company also charges a maintenance fee of up to $10 for inactive accounts, and the reactivation costs $50.

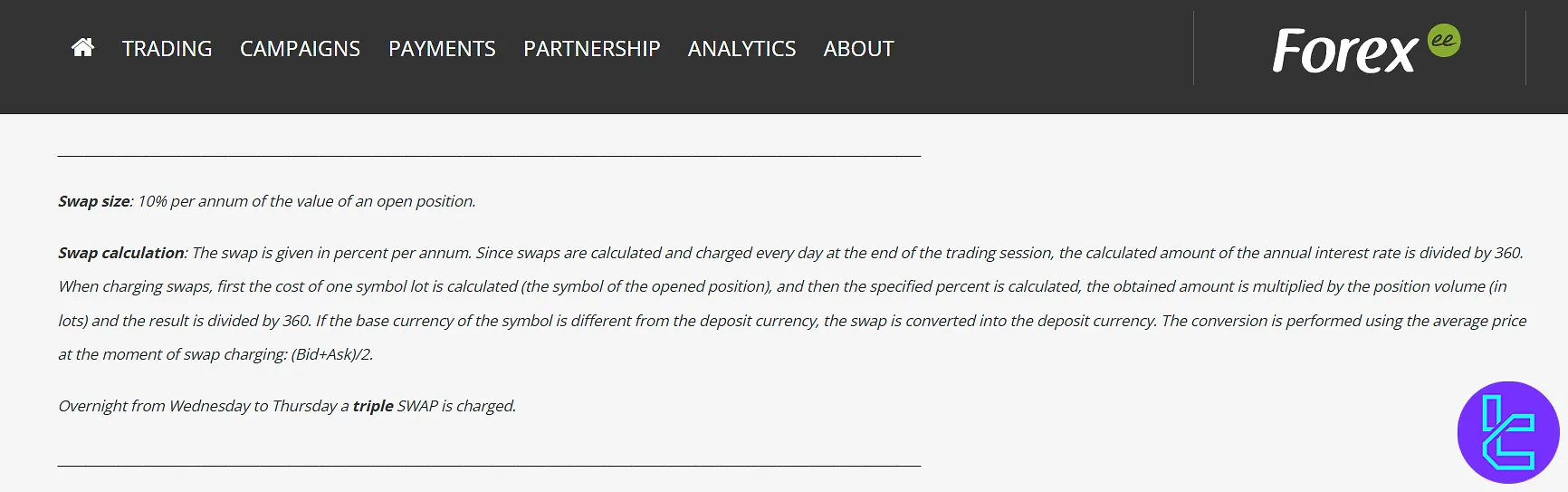

Swap Fee at Forex.ee

Swap is set at 10% per annum of the open position’s value at Forex.ee broker. Also, Positions held overnight from Wednesday to Thursday incur a triple swap charge.

The daily amount of swap charges is calculated by dividing the annual percent by 360, then multiplied by the number of lots and the lot value.

Here are the key details:

- If the base currency of the traded symbol differs from your deposit currency, the swap is converted using the average of Bid and Ask at the moment of charging;

- If you hold a swap-free / Islamic account, no swap fee is added;

- Both Basic ECN and Advanced ECN included a swap-free option.

Non-Trading Fees at Forex.ee

Forex.ee enforces a defined framework for non-trading costs to maintain account efficiency. Dormant accounts incur a USD 10 monthly fee after three months of inactivity, and reactivation costs USD 50 once trading resumes.

These measures help control system overhead while encouraging clients to stay active.

To better understand, consider the following points:

- Deposit processing is free of charge from the broker’s side;

- Most withdrawal requests are processed without broker fees, but external payment systems may deduct up to 2–3% depending on the method;

- Internal transfers between Forex.ee accounts are free and typically instant.

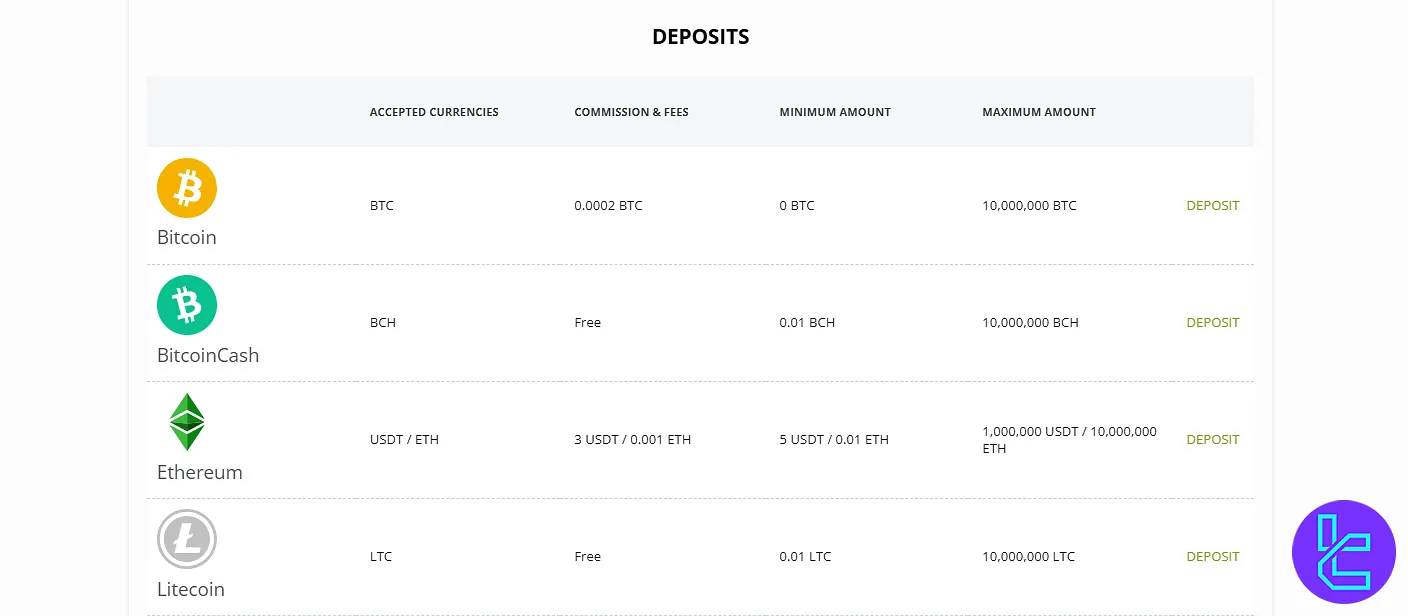

Forex.ee Broker Payment Options

Forex EE offers only one main payment method, Cryptocurrency, to cater to traders from different regions.

Method | Deposit Fee | Deposit Limitations | Withdrawal Fee | Withdrawal Limitations |

Bitcoin | 0.0002 BTC | 0 – 10,000,000 BTC | 0.0003 BTC | 0.002 – 10,000,000 BTC |

BitcoinCash | Free | 0.01 – 10,000,000 BCH | 0.0001 BCH | 0.01 – 10,000,000 BCH |

Ethereum (USDT, ETH) | 3 USDT | 5 – 1,000,000 USDT | 10 USDT | 30 – 10,000,000 USDT |

Litecoin | Free | 0.01 – 10,000,000 LTC | 0.0005 LTC | 0.1 – 10,000,000 LTC |

Deposits are generally processed instantly for crypto; bank wires may take up to 7 business days. The broker does not charge deposit or withdrawal fees, and the minimum deposit amount starts from $1, depending on the selected account.

The minimum withdrawal starts from $1, and funds are returned via the original deposit method when possible. Crypto wallets are fully supported, and traders receive unique wallet addresses for each deposit.

Deposit Methods at Forex.ee

Forex.ee provides multiple cryptocurrency deposit options, each with clearly defined minimum and maximum amounts, as well as precise commission rates.

Bitcoin, Bitcoin Cash, Ethereum, Litecoin, and USDT are all supported, giving traders flexibility to fund their accounts in popular digital currencies.

Here’s an overview of the main deposit methods from the official English page:

Deposit Method | Currency | Minimum Amount | Deposit Fee |

Bitcoin | BTC | 0 BTC | 0.0002 BTC |

Bitcoin Cash | BCH | 0.01 BCH | Free |

Ethereum | ETH / USDT | 0.01 ETH / 5 USDT | 0.001 ETH / 3 USDT |

Litecoin | LTC | 0.01 LTC | Free |

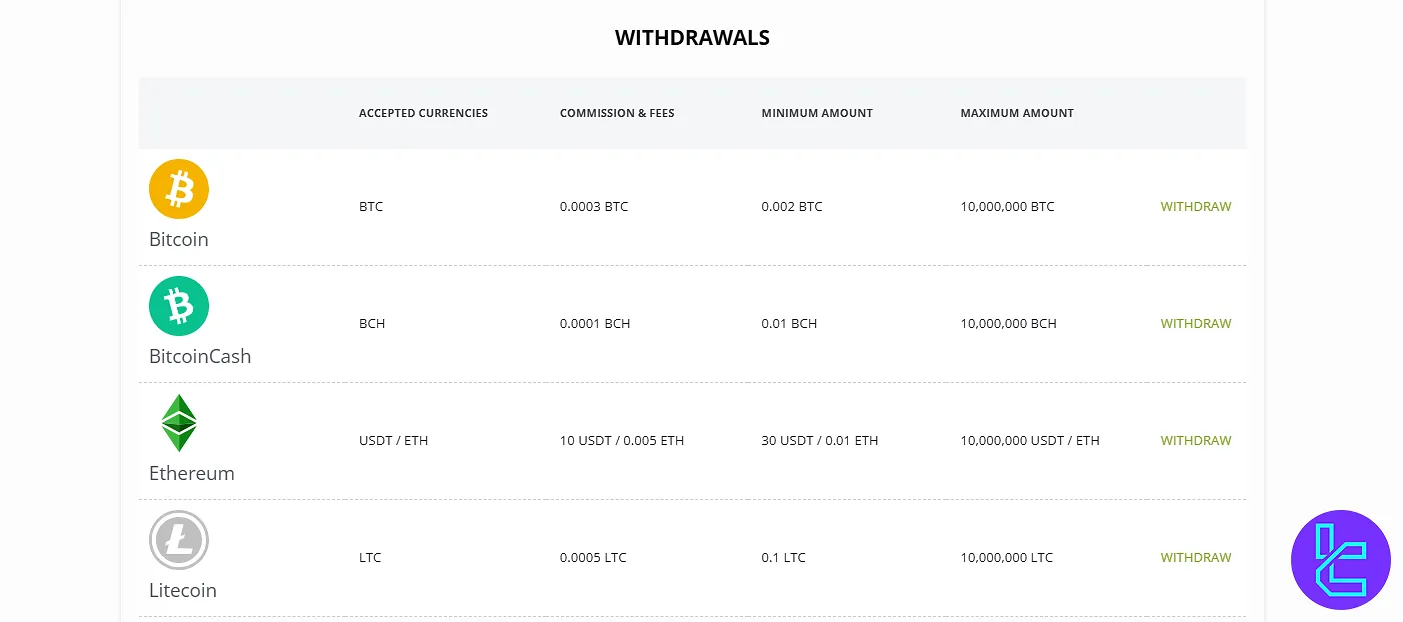

Withdrawal Methods at Forex.ee

Forex.ee supports withdrawals in major cryptocurrencies with clearly defined minimum and maximum amounts, as well as precise withdrawal fees.

Bitcoin, Bitcoin Cash, Ethereum, Litecoin, and USDT are all accepted, allowing traders to access their funds efficiently.

Here’s the official breakdown based on Forex.ee:

Withdrawal Method | Currency | Minimum Amount | Withdrawal Fee |

Bitcoin | BTC | 0.002 BTC | 0.0003 BTC |

Bitcoin Cash | BCH | 0.01 BCH | 0.0001 BCH |

Ethereum | ETH / USDT | 0.01 ETH / 30 USDT | 0.005 ETH / 10 USDT |

Litecoin | LTC | 0.1 LTC | 0.0005 LTC |

Investment Plans and Copy Trading on Forex.ee

As of the latest information available, Forex EE does not offer specific investment plans or copy trading features. It’s a letdown for potential clients who lack the necessary experience to trade on their own.

Forex EE Financial Instruments

The next topic of this Forex.ee review is about available tradable assets on the broker. The company’s market offerings are limited to the Forex market, metals, and crypto assets.

Category | Type of Instruments | Number of Symbols | Competitor Average | Max. Leverage |

Forex | Currency Pairs | 50+ | 40–60 | 1:500 |

BTC, BCH, ETH, LTC, USDT | 40+ | 5–10 | N/A | |

Metals (CFDs) | Gold, Silver | 2 | 2–5 | N/A |

The broker does not support ETFs, bonds, or futures. All assets are offered as CFDs. Leverage is available up to 1:500 for forex and metals, while crypto CFDs are capped at 1:3.

While the range is narrower than top-tier brokers, it covers the most commonly traded instruments and is suitable for short-term trading strategies.

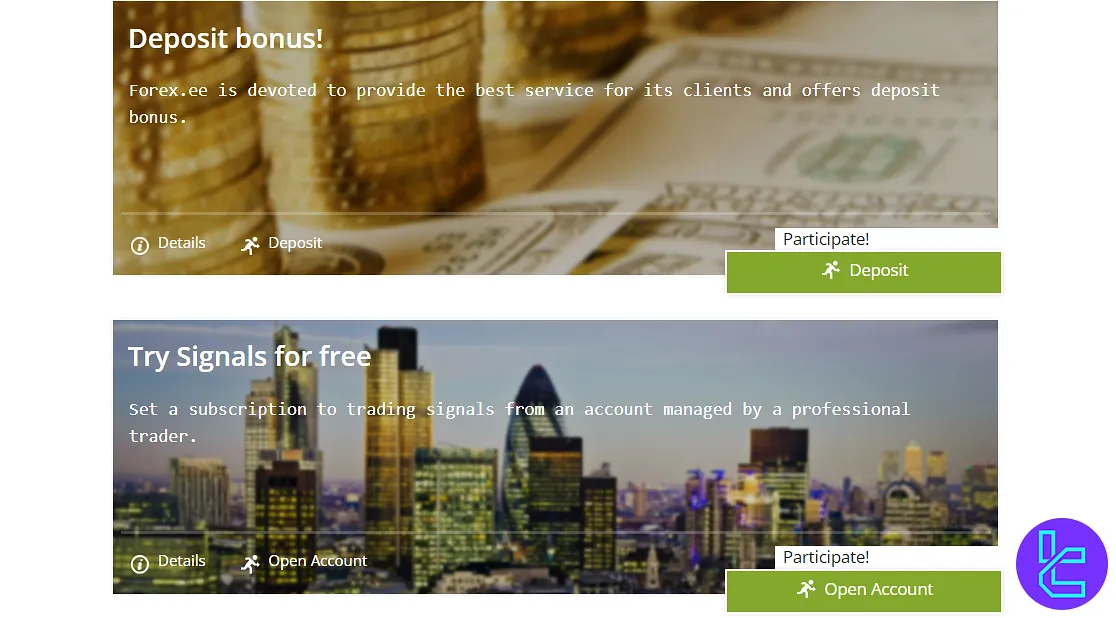

Forex EE Promotional Plans

Forex.ee offers several bonus plans and a comprehensive IB program to attract and retain traders.

- Deposit Bonus: $15 extra funds on deposits of above $15

- Free Signals: Coverage for the cost of MQL Signal Service

- Special Commission: Reduced commission of $1 for up to 8 weeks

- IB: A multi-level commission-based structure for referring new clients

Forex.ee Broker Customer Support

Forex EE provides support Monday – Friday from 7 AM to 4 PM GMT through various channels, including:

support@forex.ee | |

Phone | +442035198249 |

Live Chat | Accessible through the client portal |

While the broker ensures timely responses during working hours, no weekend assistance is available, which may be a limitation for some global clients.

ForexEE Prohibited Countries

Forex.ee, like many online brokers, has restrictions on which countries it can provide services. These limitations are mainly due to the regulatory status of the broker. Forex.ee red flag countries:

- United States of America

- Canada

- Belgium

- North Korea

- Iran

- Yemen

- Gaza

- Israel

- Austria

- Congo

- Central African Republic

- France

- American Samoa

Forex.ee Broker User Satisfaction

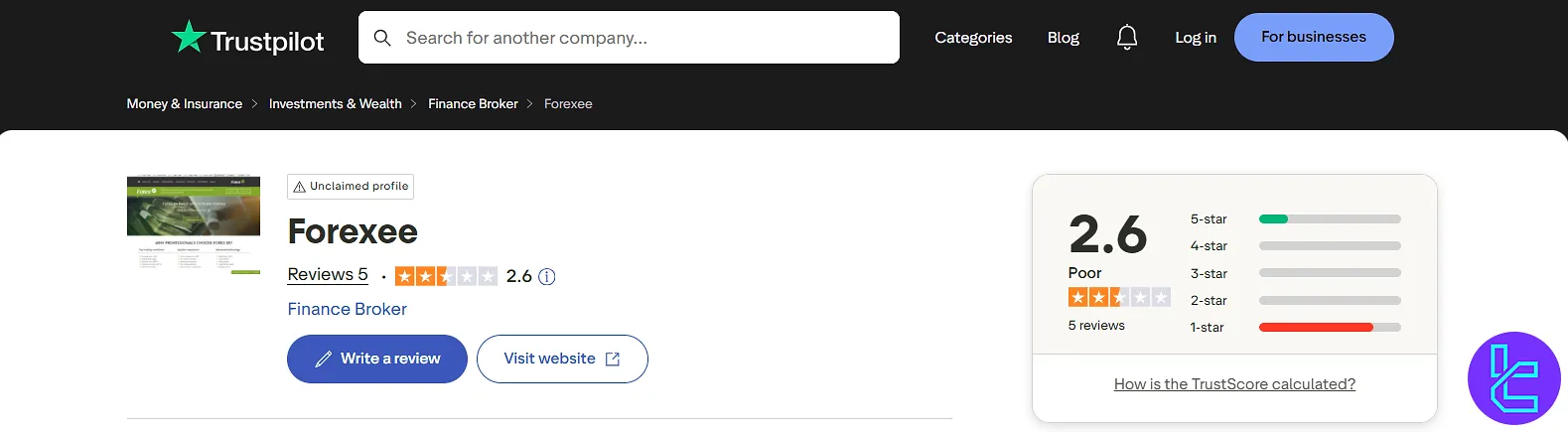

Trust Score may be the most important topic of this Forex.ee review. Despite the long track record, the broker doesn’t have all that many user reviews on reputable websites.

The Forex EE TrustPilot profile has only one comment rating the company as a 5-star broker, resulting in a score of 2.6 out of 5.

Forex.ee Broker Educational Resources

Many brokers empower traders by offering comprehensive and thorough educational materials through various methods, such as webinars, e-books, and articles.

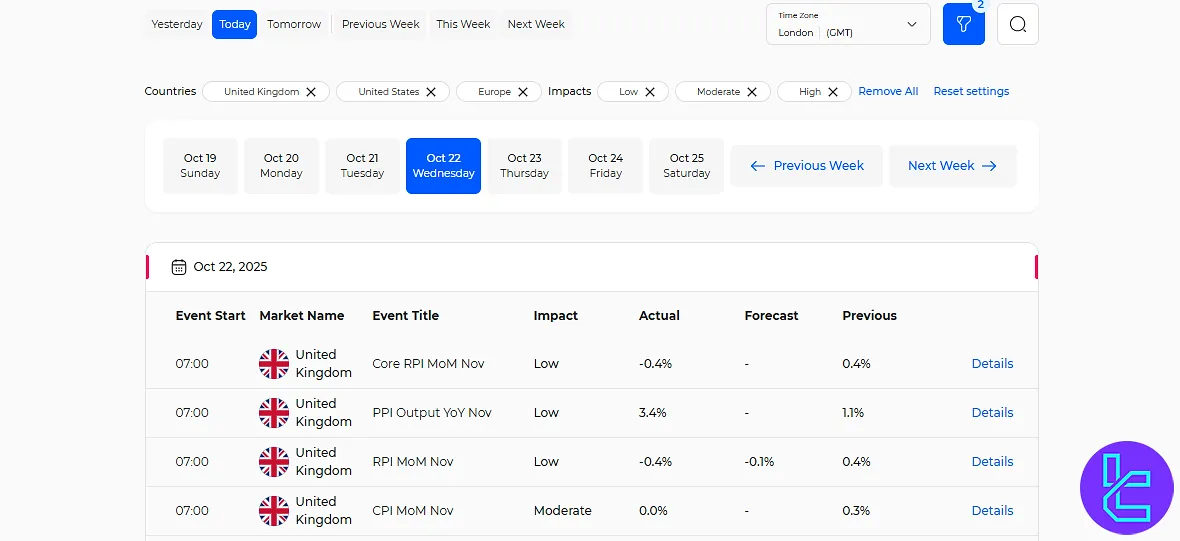

While Forex EE doesn’t take this aspect seriously and provides no dedicated resources to educate traders, it does offer an economic calendar.

Check TradingFinder's Forex education and crypto tutorials sections for additional resources.

Forex.ee Comparison Table

The table below provides a comprehensive comparison of Forex.ee offerings and those of other brokers:

Parameter | Forex.ee Broker | IC Markets Broker | XM Broker | LiteForex Broker |

Regulation | None | FSA, CySEC, ASIC | ASIC, FSC, DFSA, CySEC | CySEC |

Minimum Spread | From 0.0 Pips | From 0.0 Pips | From 0.6 Pips | From 0.0 Pips |

Commission | 3.5 units of base currency per lot | From $3 | $0 (except on Shares account) | From $0.0 |

Minimum Deposit | $15 | $200 | $5 | $50 |

Maximum Leverage | 1:500 | 1:500 | 1:1000 | 1:30 |

Trading Platforms | TickTrader | Metatrader 4, Metatrader 5, cTrader, cTrader Web, IC Markets Mobile | MT4, MT5, Mobile App | MetaTrader 4, MetaTrader 5, Mobile Proprietary App |

Account Types | ECN NET, ECN GROSS | Standard, Raw Spread, Islamic | Micro, Standard, Ultra Low, Shares | Classic, ECN, Demo |

Islamic Account | Yes | Yes | Yes | No |

Number of Tradable Assets | N/A | 2,250+ | 1400+ | N/A |

Trade Execution | Market | Market | Market, Instant | Market |

Conclusion and Final Words

Forex.ee is a True ECN broker with a trust score of 2.6 on TrustPilot. It offers various promotions like a $15 deposit bonus and reduced commissions (down to $1). You can deposit and withdraw via 5 cryptocurrencies, including BTC, BCH, ETH, LTC, and USDT.

We also discussed some of the broker's weaknesses in this Forex.ee review, including the lack of licensing from reputable regulatory bodies and the limited support, which is available Monday to Friday from 7 AM to 4 PM GMT.

Note that the services are not available for US citizens or residents. You should consider all of the mentioned factores before opening a real account on Forex.ee broker.