ForexTB is a CySEC-regulated broker with 4 account types [Basic, Gold, Platinum, VIP], differentiating in terms of spreads and number of free withdrawals; Basic allows only 1 free withdrawal request, while VIP doesn’t set any limitations in this regard.

ForexTB Broker Company Information & Regulation

This Cypriot Forex broker, under the legal name Forex TB Limited, was founded in 2012. Key Facts About the Company and Regulation:

- Regulatory Body: Cyprus Securities and Exchange Commission (CySEC)

- License Number: 272/15

- Headquarters: Lemesou Avenue 138, 2nd Floor, Office 108, 2015 Strovolos, Nicosia, Cyprus

The broker adheres to the European Union's MiFID II framework, ensuring investor protection, transparent operations, and regulatory compliance across the European Economic Area (EEA).

ForexTB Key Specifications

Here's a quick snapshot of what this brokerage brings to the table:

Broker | ForexTB |

Account Types | Basic, Gold, Platinum, VIP |

Regulating Authority | CySEC |

Based Currencies | USD, EUR |

Minimum Deposit | €250 |

Deposit Methods | Skrill, Neteller, PayU, Sofort, Euteller, GiroPay, iDeal, etc.), Credit/Debit Cards (MasterCard, VISA) |

Withdrawal Methods | Skrill, Neteller, PayU, Sofort, Euteller, GiroPay, iDeal, etc.), Credit/Debit Cards (MasterCard, VISA) |

Minimum Order | 0.01 |

Maximum Leverage | 1:400 (1:30 for Retail) |

Investment Options | Copy Trading via MT4 |

Trading Platforms & Apps | MetaTrader 4, Proprietary |

Markets | Forex, Stocks, Metals, Commodities, Indices, Crypto |

Spread | Floating |

Commission | No Trading Commissions |

Orders Execution | Instant, Market |

Margin Call / Stop Out | N/A |

Trading Features | Economic Calendar |

Affiliate Program | None |

Bonus & Promotions | None |

Islamic Account | N/A |

PAMM Account | None |

Customer Support Ways | Email, Phone, Live Chat |

Customer Support Hours | 24/5 |

Account Types Details

ForexTB offers four distinct account types with differences in terms of spreads and commissions. The table below mentions each account with its minimum required deposit and free withdrawals:

Account Type | Min. Deposit | Free Withdrawals |

Basic | €250 | 1 |

Gold | €25,000 | 1 per Month |

Platinum | €100,000 | 3 per Month |

VIP | €250,000 | Unlimited |

In addition to the mentioned items, a demo account is also provided with 100,000 units of virtual currency that is accessible without verification.

Per our investigations, the maximum available leverage for Retail accounts is 1:30; it goes up to 1:400 for Professional clients.

Notable Benefits and Drawbacks

Like any broker, ForexTB has its strengths and weaknesses. Let's break them down:

Benefits | Drawbacks |

CySEC Regulation | High Minimum Deposit for All Accounts |

300+ Instruments | Limited to EEA Countries |

Wide Range of Payment Options | - |

ForexTB Account Opening and Verification

Opening an account with the discussed brokerage won’t require too much effort. The following 3 sections will guide you through the process.

#1 Head to the Site

Navigate to the official website and click on the "Sign Up" option to access the registration form.

#2 Complete the Form

Provide your details, including name, email, and phone number, each in its respective field on the form.

Next, verify your phone number by entering the verification code you received. Now, you have an account on the broker’s website.

#3 Verify Your Identity

To verify your identity, you must answer the questionnaire and provide the required documents.

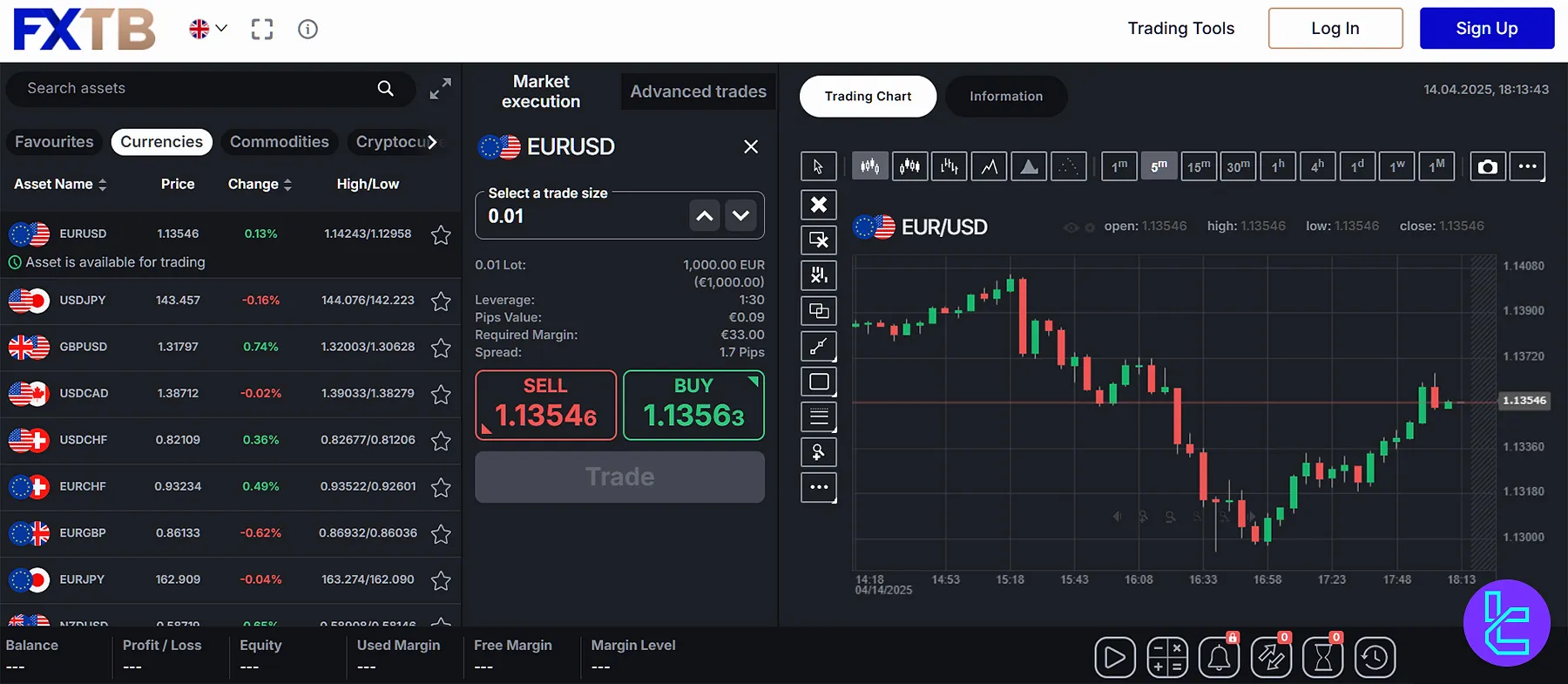

Trading Platforms and Terminals

ForexTB provides two trading platforms. One of them is MetaTrader 4, which is widely recognized as the industry standard, offering access to essential trading tools and features. Download/Access Links:

Also, the brokerage offers a proprietary web trading terminal called ForexTB WebTrader, with all necessary options and a more modern-looking interface compared to MT4.

ForexTB Fees and Commissions

This broker operates on a spread-based pricing model, meaning they make their money through the difference between the buy and sell price of an asset. Floating Spreads Based on Accounts:

Account Type | EUR/USD Min. Spread (Pips) | GBP/USD Min. Spread (Pips) |

Basic | 3.0 | 3.4 |

Gold | 2.7 | 3.1 |

Platinum | 2.1 | 2.5 |

VIP | 1.6 | 2.0 |

Based on the available data, there is no deposit fee, but inactivity and withdrawal (under certain conditions) commissions are charged in unannounced amounts by the broker.

What Payment Options Are Available?

ForexTB offers a long list of payment methods to cater to different preferences:

- Bank Transfers: Several options available

- E-Payment Systems: Skrill, Neteller, PayU, Sofort, Euteller, GiroPay, iDeal, etc.

- Credit/Debit Cards: MasterCard & VISA

The website states that these choices “may vary depending on the client’s region”.

Any Copy Trading & Other Investment Methods?

ForexTB offers copy trading functionality through the MT4 platform, allowing traders to:

- Follow and copy successful traders

- Diversify their portfolio easily

- Learn from experienced traders' strategies

ForexTB Broker Tradable Instruments

This company has a list of over 300 tradable instruments across 5 asset classes:

- Forex Market: Major, minor, and exotic currency pairs

- Stocks: CFDs on global company shares

- Commodities: Metals, energies, and agricultural products

- Indices: Stock index symbols

- Cryptocurrencies: Bitcoin, Ethereum, and other popular digital assets

Available Bonuses and Promotions

As per our examinations, ForexTB does not offer any bonuses or promotions. This is in line with stricter regulatory requirements aimed at protecting traders from potentially misleading offers.

ForexTB Broker Support Contact Channels and Working Hours

This company has 3 usual common contact options for its customer service department:

- Email: info@forextb.com

- Phone: +357 2 222 2353

- Live Chat: Available via the website

The brokerage has set a 24/5 schedule for its support agents. There have been some unsatisfactory comments on review sources on the customer service provided by the broker.

Geographical Restrictions: Is ForexTB Available for Everyone?

This broker has clearly stated on its official website that “Forex TB Limited offers services within the European Economic Area (excluding Belgium) and Switzerland”. Therefore, clients from other regions are not accepted by this company.

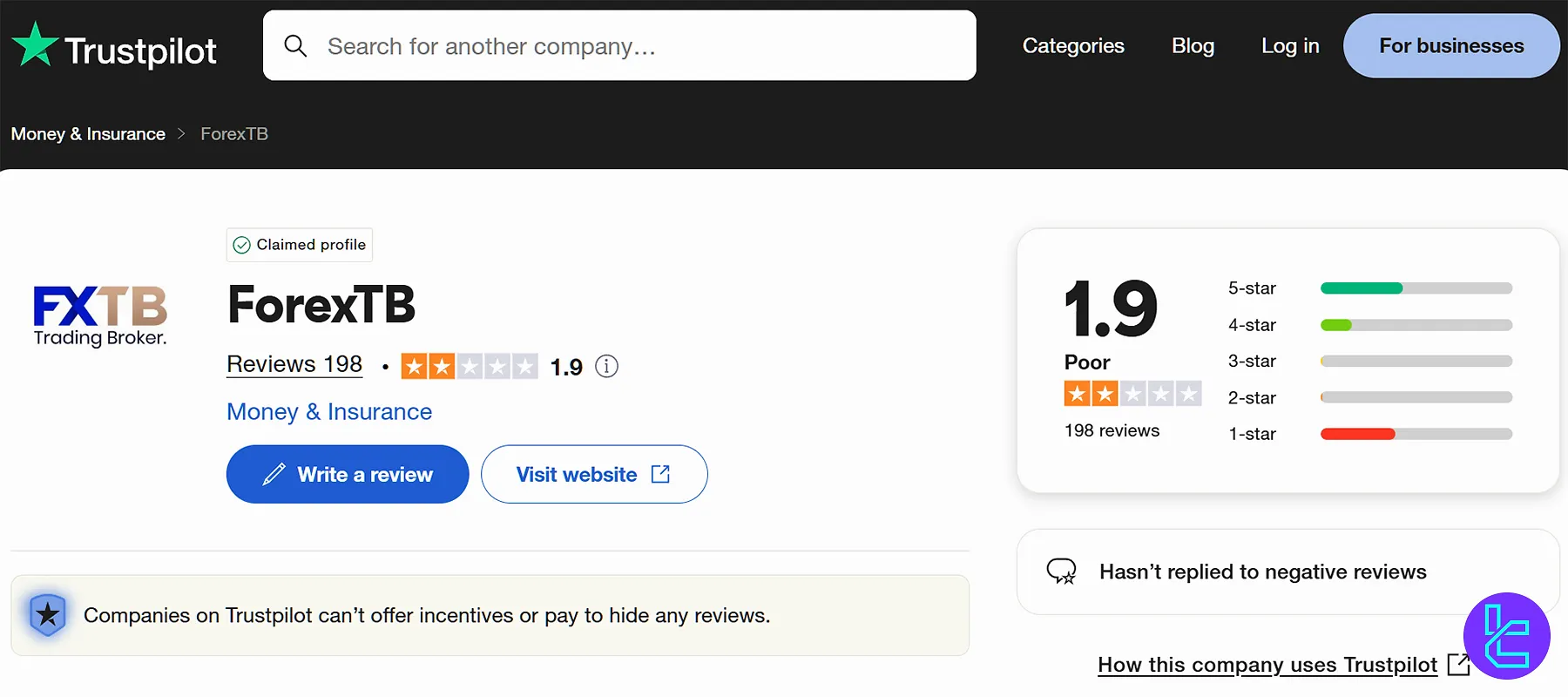

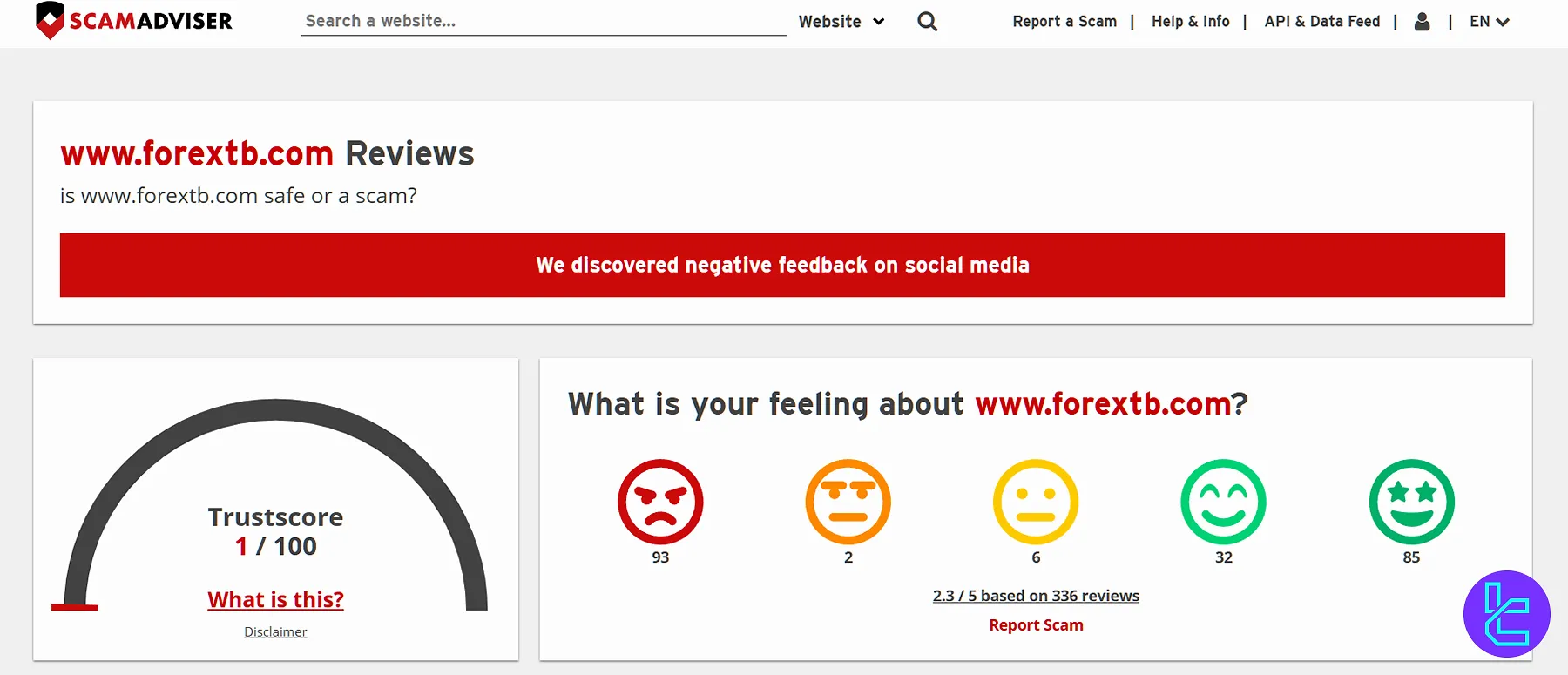

Trust Scores & Reviews

ForexTB's page on Trustpilot and other reliable sources show a generally negative reputation among traders:

- Trustpilot: 1.9/5 based on 190+ reviews

- REVIEWS.io: 1.6/5 with 20+ user ratings

- ScamAdviser: 1/100 Trustscore, 1.4/5 average user scores

Approximately 45% of the reviews on Trustpilot are 5-star, while almost 40% are 1-star. Additionally, the review platform has noted that the company hasn't responded to negative reviews.

How Deep are the Education Resources in ForexTB?

This broker offers a decent range of educational resources:

- Webinars on various trading topics

- E-books covering trading strategies, capital management, psychology, etc

- Glossary consisting of technical terms sorted in alphabetical order

- Economic calendar for tracking market-moving events

- Articles on leverage, margin, technical/fundamental analysis, and CFD trading tips

ForexTB in Comparison with Other Brokerages

This brokerage is compared to some of the top brokers in the industry in the table below:

Parameter | ForexTB Broker | |||

Regulation | CySEC | FSA, CySEC, FCA, FSCA, CBCS, FSC, CMA | FCA, FSCA, CySEC, SCB | FSA, FCA, CySEC, LFSA, FSCA |

Minimum Spread | 1.6 pips | From 0.0 pips | 0.0 Pips | 0.0 Pips |

Commission | None | From $0.2 | From $0 | From $0 |

Minimum Deposit | €250 | $10 | $100 | $100 |

Maximum Leverage | 1:400 (1:30 for Retail) | Unlimited | 1:500 | 1:1000 |

Trading Platforms | MetaTrader 4, Proprietary | Exness Trade (mobile), Exness Terminal (web), MT4, MT5 | MT4, MT5, cTrader, Web Trader, Mobile App | Metatrader 4, Metatrader 5, Metatrader Web, Mobile App |

Account Types | Basic, Gold, Platinum, VIP | Standard, Standard Cent, pro, Raw Spread, Zero | Standard, Pro, Raw+, Elite | Classic, Raw |

Islamic Account | N/A | Yes | Yes | Yes |

Number of Tradable Assets | 300+ | 200+ | 2100+ | 600+ |

| Trade Execution | Instant, Market | Market, Instant | Market, Pending | Market |

Conclusion and Final Words

ForexTB does not charge any trading commissions, but there are floating spreads. EUR/USD has a minimum spread of 2.7 pips on Gold accounts; it is lower at 1.6 pips in VIP account type.

More than 190 users have given an average review score of 1.9/5 to ForexTB broker on “Trustpilot”.