The FP Markets verification process is a 3-step mandatory procedure, essential for accessing trading features and ensuring account security.

This process includes identity and address verification, using either desktop or mobile. After completing the KYC process, traders can open positions with leverage of up to 1:500 and low spreads from 0.0 pips.

How to Complete the FP Markets Verification Process

After completing FP Markets registration, follow these steps to unlock deposits and withdrawals in your client cabinet.

FP Markets broker verification process overview:

- Accessing the KYC section from the dashboard;

- Upload valid identity documents for proof of identity (POI);

- Provide a valid address document for proof of address (POA).

Ensure you have the following documents before starting the KYC process.

Verification Requirement | Yes/No |

Full Name | No |

Country of Residence | No |

Date of Birth Entry | No |

Phone Number Entry | No |

Residential Address Details | No |

Phone Number Verification | No |

Document Issuing Country | Yes |

ID Card (for POI) | Yes |

Driver’s License (for POI) | Yes |

Passport (for POI) | Yes |

Residence Permit (for POI or POA) | Yes |

Utility Bill (for POA) | Yes |

Bank Statement (for POA) | Yes |

2-Factor Authentication | No |

Biometric Face Scan | No |

Financial Status Questionnaire | No |

Trading Knowledge Questionnaire | No |

Restricted Countries | Yes |

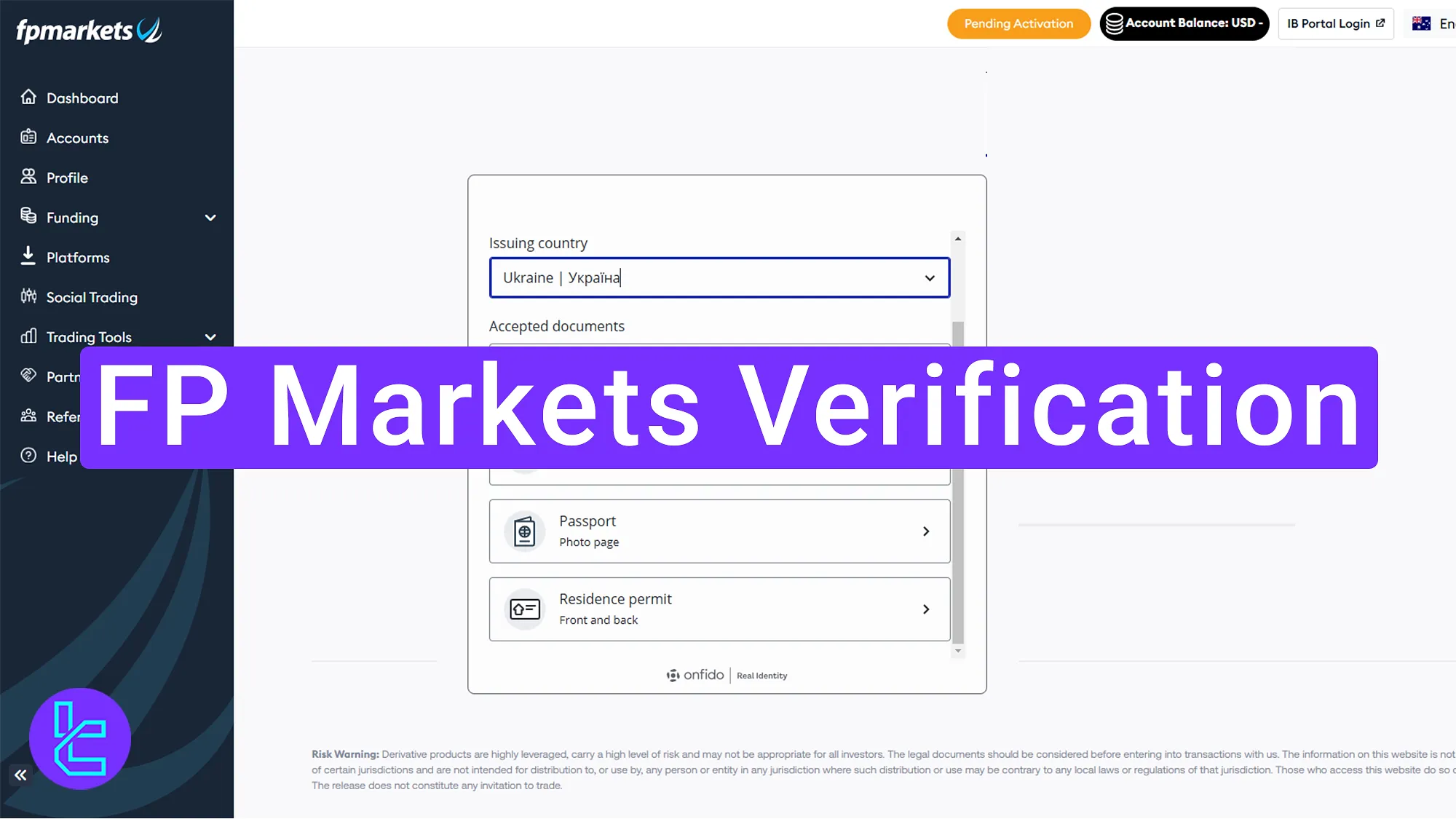

#1 Accessing the KYC Section from the Dashboard

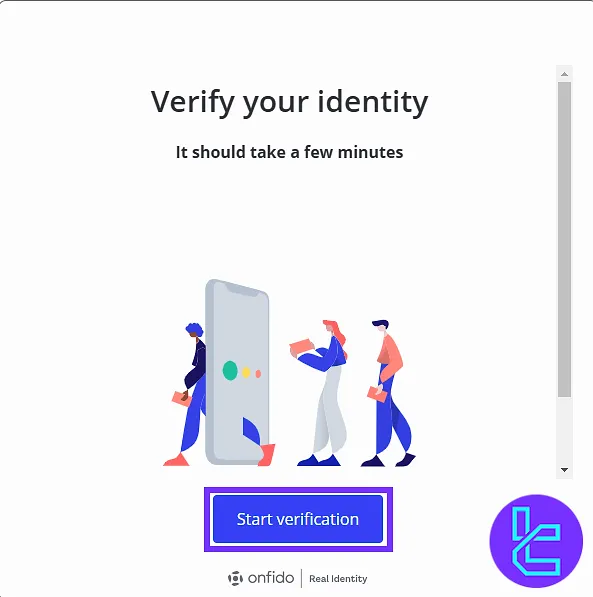

Log in to the FP Markets account dashboard. Click on "Start Verification" to begin the process.

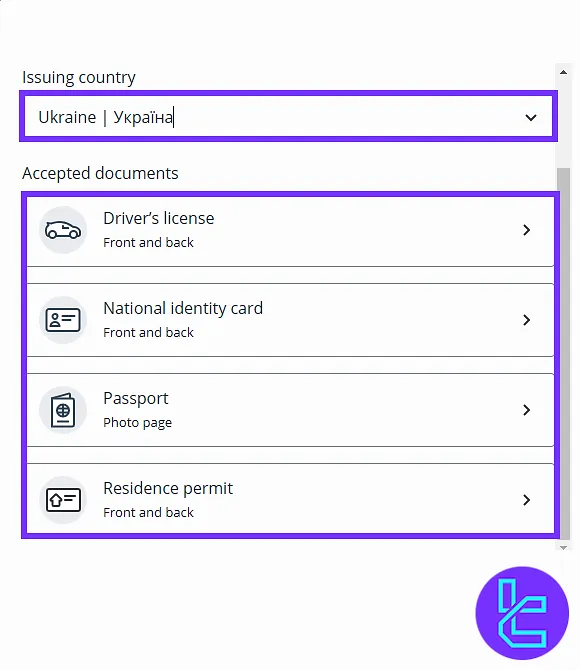

#2 Uploading Proof of Identity (POI)

Select your country of residence and the preferred ID document type, such as:

- National ID card

- residence permit

- passport

- driver’s license

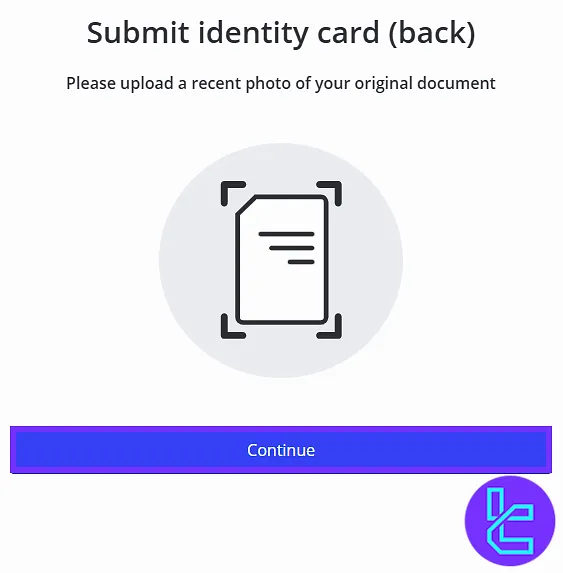

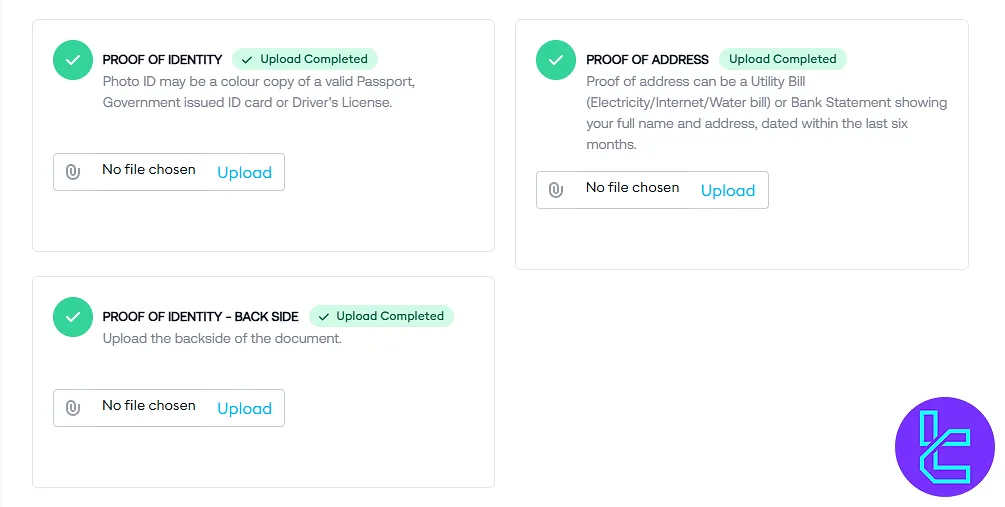

Upload clear photos of the front and back of the chosen identity document.

#3 Uploading Proof of Address (POA)

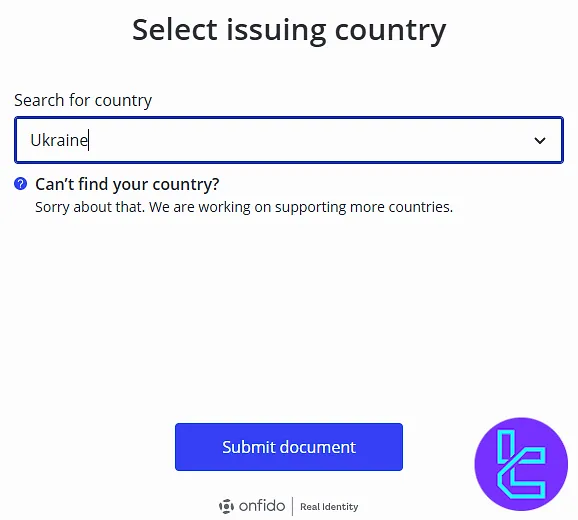

After identity authentication, proceed with uploading proof of address documentation. Select the country of issuance for the address document.

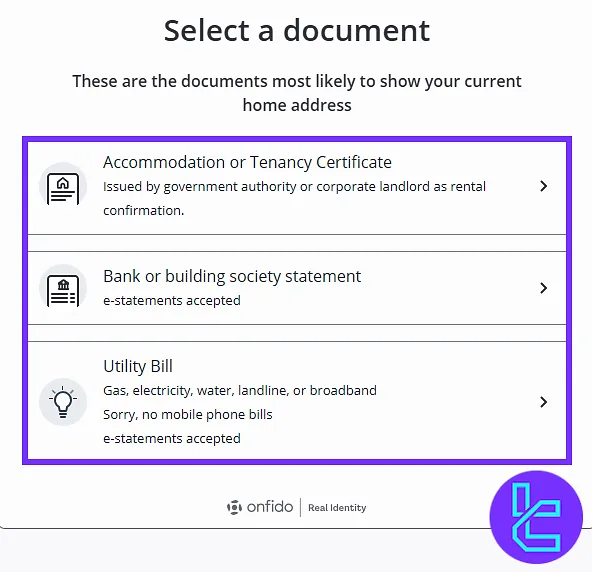

Choose the type of document, such as a recent utility bill, tenancy certificate, and bank statement. Ensure the document includes the account holder’s name, address, and issuance date.

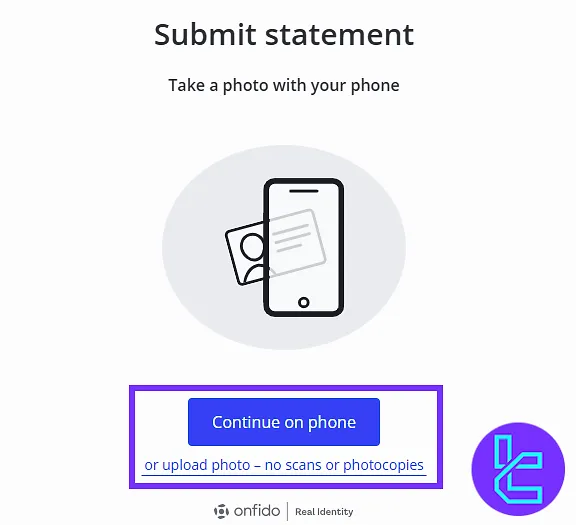

Upload the document via desktop or mobile, ensuring clarity and validity.

After submission, the verification status can be tracked from the account dashboard.

FP Markets KYC vs Other Brokers

The table below helps traders understand the differences in the KYC process of FP Markets and those of 3 other brokers.

Verification Requirement | FP Markets Broker | |||

Full Name | No | Yes | Yes | Yes |

Country of Residence | No | Yes | Yes | Yes |

Date of Birth Entry | No | Yes | Yes | Yes |

Phone Number Entry | No | Yes | No | No |

Residential Address Details | No | Yes | Yes | Yes |

Phone Number Verification | No | No | No | No |

Document Issuing Country | Yes | Yes | Yes | No |

ID Card (for POI) | Yes | Yes | Yes | Yes |

Driver’s License (for POI) | Yes | Yes | Yes | Yes |

Passport (for POI) | Yes | Yes | Yes | Yes |

Residence Permit (for POI or POA) | Yes | Yes | Yes | Yes |

Utility Bill (for POA) | Yes | Yes | Yes | Yes |

Bank Statement (for POA) | Yes | Yes | Yes | Yes |

2-Factor Authentication | No | No | No | No |

Biometric Face Scan | No | No | Yes | No |

Financial Status Questionnaire | No | Yes | No | Yes |

Trading Knowledge Questionnaire | No | Yes | Yes | Yes |

Restricted Countries | Yes | Yes | Yes | Yes |

TF Expert Suggestion

The FP Markets verification process is quick and takes 5 to 10 minutes to submit documents, with approval in 1 to 2 business days. Both proof of identity (POI) and proof of address (POA) are required.

Once verified, explore different FP Markets Deposit and Withdrawal Methods on the FP Markets tutorial page for a seamless trading experience.