Regulated by VFSC and ASIC, seven markets (forex, e.g.) are available to trade in Fusion Markets. It also offers $0 commission with a minimum deposit of $0. "Phil Horner" is the founder of this broker.

Fusion Markets Company Overview and Regulation

Fusion Markets is registered in Vanuatu (Company Number 40256) under the trading name “Gleneagle Securities Pty Limited”. The broker operates under the watchful eye of the Vanuatu Financial Services Commission (VFSC) and the Australian Securities and Investment Commission (ASIC).

This multi-jurisdictional compliance structure ensures operational transparency and client fund protection. The broker also benefits from institutional backing by Glen Eagle Securities, an Australian firm managing over $400M in client funds.

To further ease its clients’ minds, the company deposits all of its users’ funds in segregated accounts with two top-tier banks, HSBC and National Australia Bank (NAB). Key points about Fusion Markets:

- Phil Horner is the Founder and CEO of the company

- No minimum account size

- US Share trading with $0.0 commission

- Winner of multiple awards as the “Lowest Spread Forex Broker”

Entity Parameters/Branches | Gleneagle Securities Pty Limited | FMGP Trading Group Pty Ltd |

Regulation | VFSC | ASIC |

Regulation Tier | 3 | 1 |

Country | Vanuatu | Australia |

Investor Protection Fund / Compensation Scheme | No | No |

Segregated Funds | Yes | Yes |

Negative Balance Protection | No | Yes |

Maximum Leverage | 1:500 | 1:30 |

Client Eligibility | International Clients with Select Restrictions | International Clients with Select Restrictions |

Fusion Markets Broker Specifications

The company claims that it has 36% lower costs than competitors. Let's take a closer look at what the Forex broker brings to the table.

Broker | Fusion Markets |

Account Types | Zero, Classic, Swap-Free |

Regulating Authorities | ASIC, VFSC |

Based Currencies | USD, EUR, GBP, AUD, JPY, SGD, THB, CAD |

Minimum Deposit | $0 |

Deposit Methods | VISA, MasterCard, PayPal, Perfect Money, PayID, Bank Wire, Crypto, Skrill, Neteller, etc. |

Withdrawal Methods | PayPal, Perfect Money, Bank Wire, Crypto, Skrill, Neteller, etc. |

Minimum Order | 0.01 lots |

Maximum Leverage | 1:500 |

Investment Options | Copy Trading, MAM |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, TradingView, cTrader |

Markets | Forex, Indices, Share CFDs, Commodities, Metals, Energy |

Spread | Classic (from 0.9 pips) Zero (from 0.0 pips) |

Commission | Classic $0.0 Zero $4.5 |

Orders Execution | Market, Limit, Stop, Trailing Stop, Take Profit |

Margin Call / Stop Out | 90% / 20% |

Trading Features | Copy Trading, MAM Accounts, VPS, Calculators, Economic Calendar |

Affiliate Program | Yes |

Bonus & Promotions | Referral |

Islamic Account | Yes |

PAMM Account | Yes |

Customer Support Ways | Email, Live Chat, Phone, Ticket |

Customer Support Hours | 24/7 |

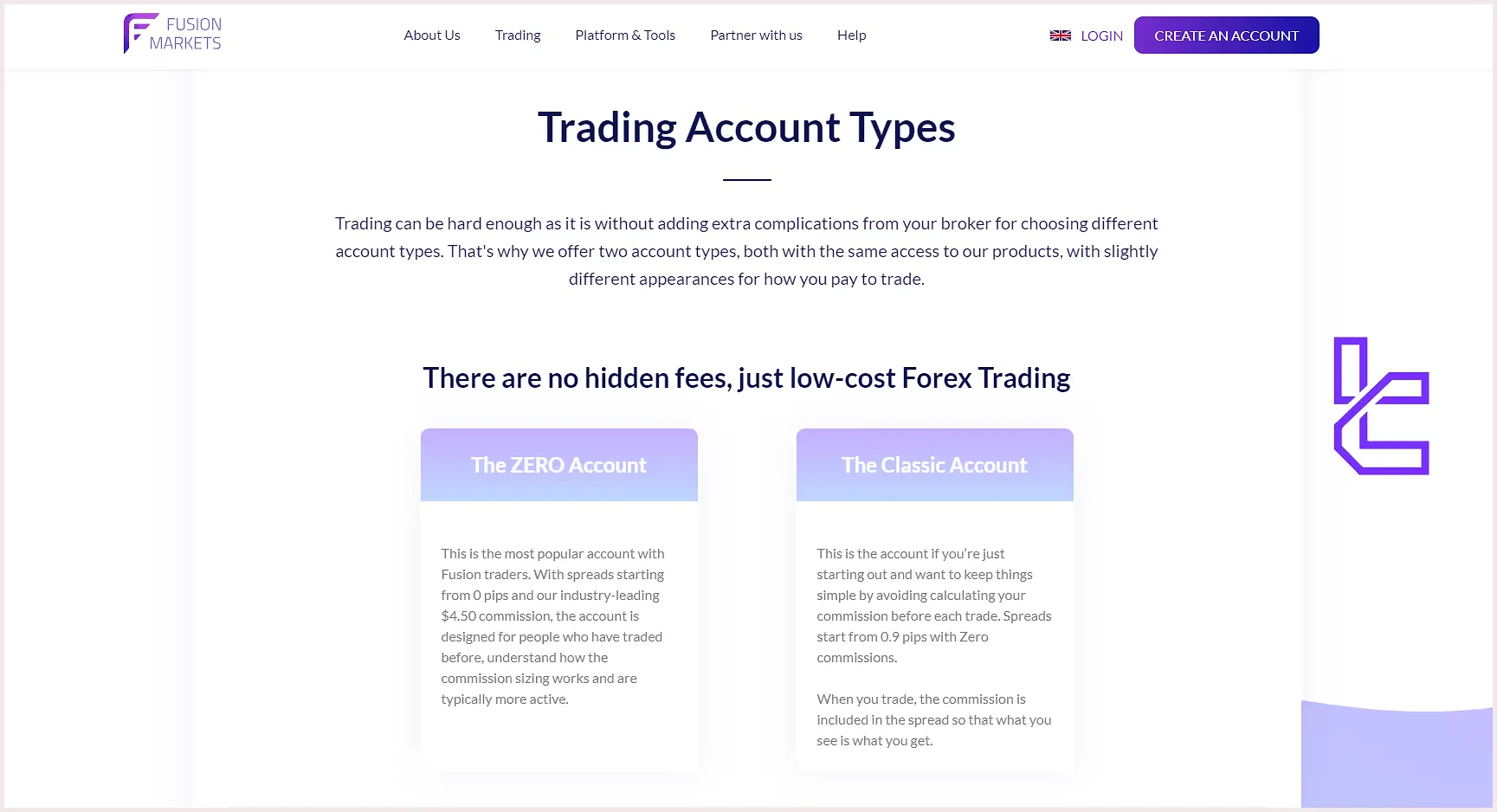

Fusion Markets Account Types

Fusion Markets forex brokeroffers a variety of account types to cater to different trading styles and preferences.

- Zero: Perfect for traders who want raw spreads with spreads starting from 0.0 pips and a fixed commission of $2.25 per side

- Classic: Suitable for those who prefer an all-inclusive experience with spreads from 0.9 pips and $0 commission

Additional options include:

- Demo accounts: For platform testing and trading strategy development

- Islamic (Swap-Free) accounts: Compliant with Shariah law

There is no minimum deposit requirement for either account.

Why Fusion Markets? (Pros & Cons)

No-commission trading, 250+ instruments, and fast execution speed are some of the advantages you’ll get by trading with Fusion Markets. But surely there are downsides, too.

Pros | Cons |

Ultra-low trading costs | Limited range of educational resources |

No minimum Deposit | No proprietary trading platform |

Zero deposit fees | Relatively new broker (launched in 2019) |

Regulated by VFSC and ASIC | Limited financial instruments |

Copy trading capabilities through Fusion+ | Lack of investor protection fund |

Sponsored VPS program | - |

A full package of trading platforms (MT4, MT5, cTrader, TradingView) | - |

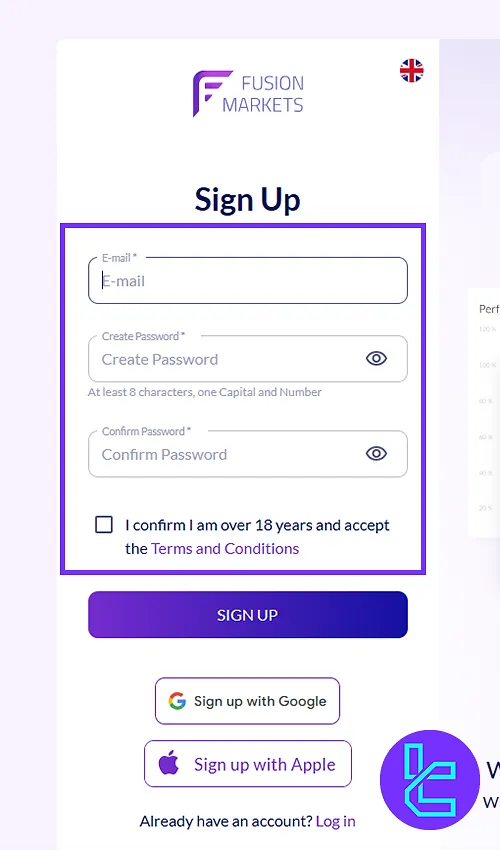

Account Opening and KYC Verification on Fusion Markets

The Fusion Markets registration takes less than 2 minutes and can be done using your email or by linking your Google or Apple ID.

The process is streamlined for fast access, with no immediate document upload required. After registration, users can begin exploring the trading interface and prepare for identity verification.

#1 Visit Fusion Markets Website

Go to the Fusion Markets website and click on “Create an Account” to reach the application form.

#2 Enter Email and Create a Secure Password

Type in your email address and set a secure password that includes uppercase and lowercase letters, numbers, and special characters. Confirm the password to proceed.

#3 Accept Terms and Finalize Registration

Tick the checkbox confirming you're over 18 and accept the broker’s terms and conditions. Click “Sign Up” to complete the registration.

After signing up, you’ll be offered a platform tour or can skip directly to your Fusion Markets dashboard.

#4 Complete the KYC Process

Navigate to the Fusion Markets verification menu, provide personal information, and upload supporting documents, including:

- Proof of ID: Passport or Driving license

- Additional Document: Utility bill, Bank statement, or ID card

Available Trading Platforms on Fusion Markets

The broker offers a variety of trading solutions, including MetaTrader 4, cTrader, TradingView, and MetaTrader 5, to cater to different preferences and styles. Fusion Markets trading platforms:

MetaTrader 4 (MT4)

MetaTrader 5 (MT5)

TradingView

cTrader

All platforms are available across desktop, web, and mobile. Fusion Markets boasts ultra-fast execution (~0.02ms) and offers VPS hosting to ensure uninterrupted trading sessions.

Commission and Spread on Fusion Markets Broker

The next subject in this Fusion Markets review is the fee structure. One of the broker’s key selling points is its ultra-low trading costs.

Account Type | Spread | Commission |

Zero | From 0.0 pips | $4.5 per lot |

Classic | From 0.9 pips | $0.0 |

Swap Free | From 1.4 pips | $0.0 |

The broker charges no fees on deposits and withdrawals and has no other hidden costs or markups.

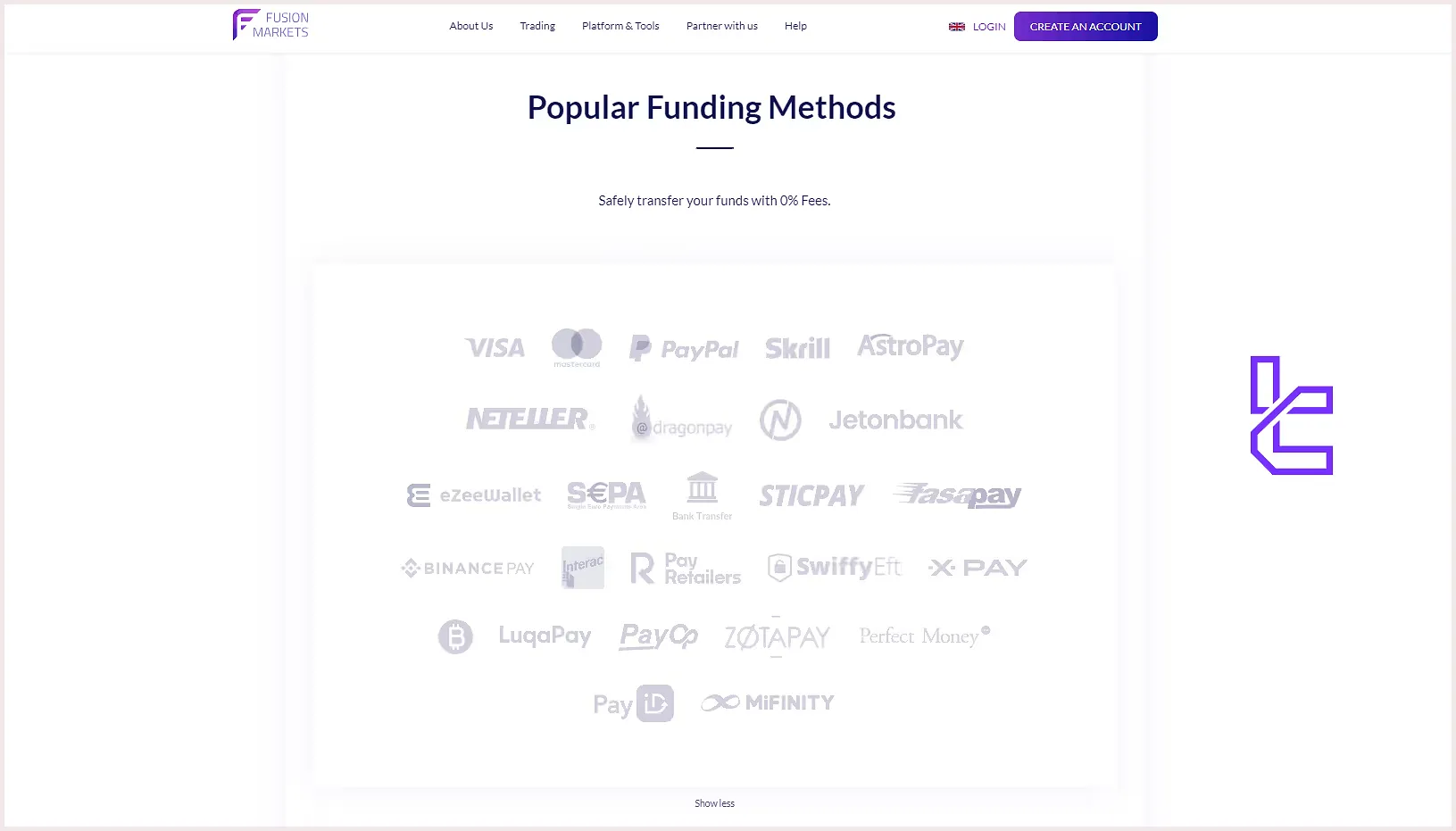

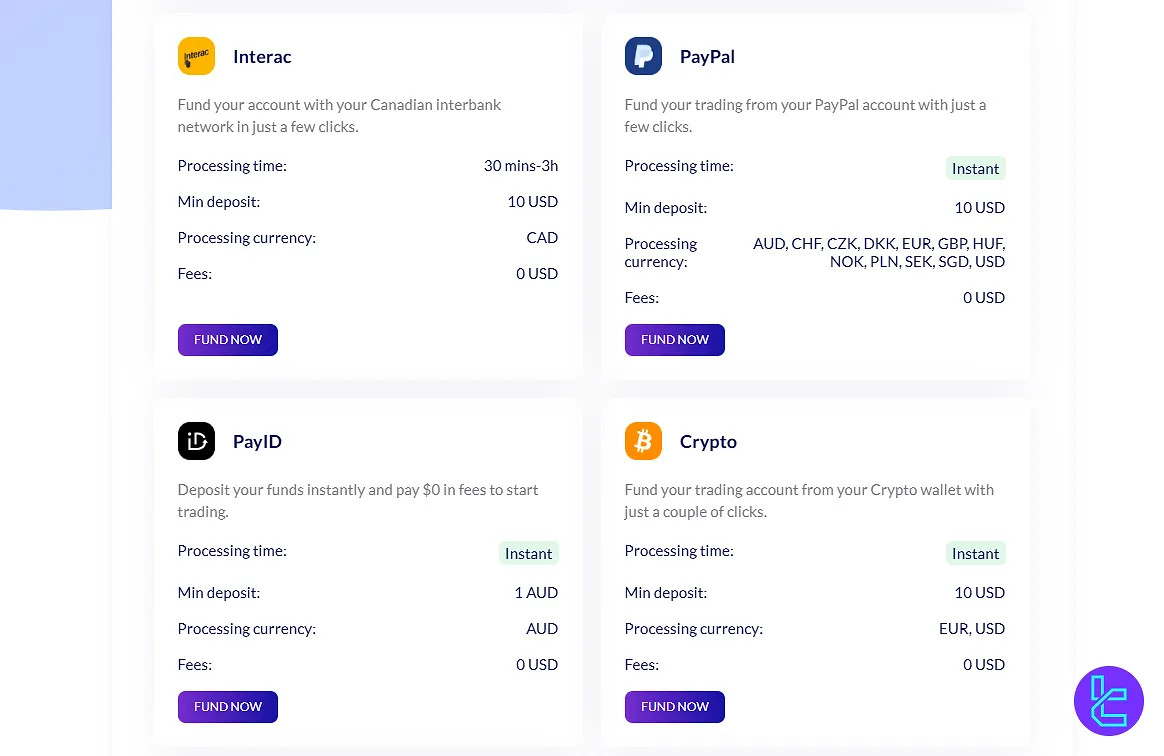

Fusion Markets Broker Deposit/Withdrawal Methods

The company offers a wide range of deposit and withdrawal options to cater to its global client base.

Deposit Methods

The brokerage enables over 30 options for making deposits for its clients. Some of the provided solutions are included in this table:

| Method | Processing Currency | Min. Deposit |

| Bank Wire | AUD, CAD, EUR, GBP, SGD, JPY, THB, USD | 10 USD |

| VISA/MasterCard | AUD, CAD, EUR, GBP, SGD, USD | 10 USD |

| Interac | CAD | 10 USD |

| PayPal | AUD, CHF, CZK, DKK, EUR, GBP, HUF, NOK, PLN, SEK, SGD, USD | 10 USD |

| PayID | AUD | 1 AUD |

| Crypto | EUR, USD | 10 USD |

| BinancePay | EUR, USD | 20 USD |

| Skrill | USD, AUD, GBP, EUR, SGD, JPY | 10 USD |

| Neteller | USD, AUD, GBP, EUR, SGD, JPY | 10 USD |

This broker charges no fees for depositing funds.

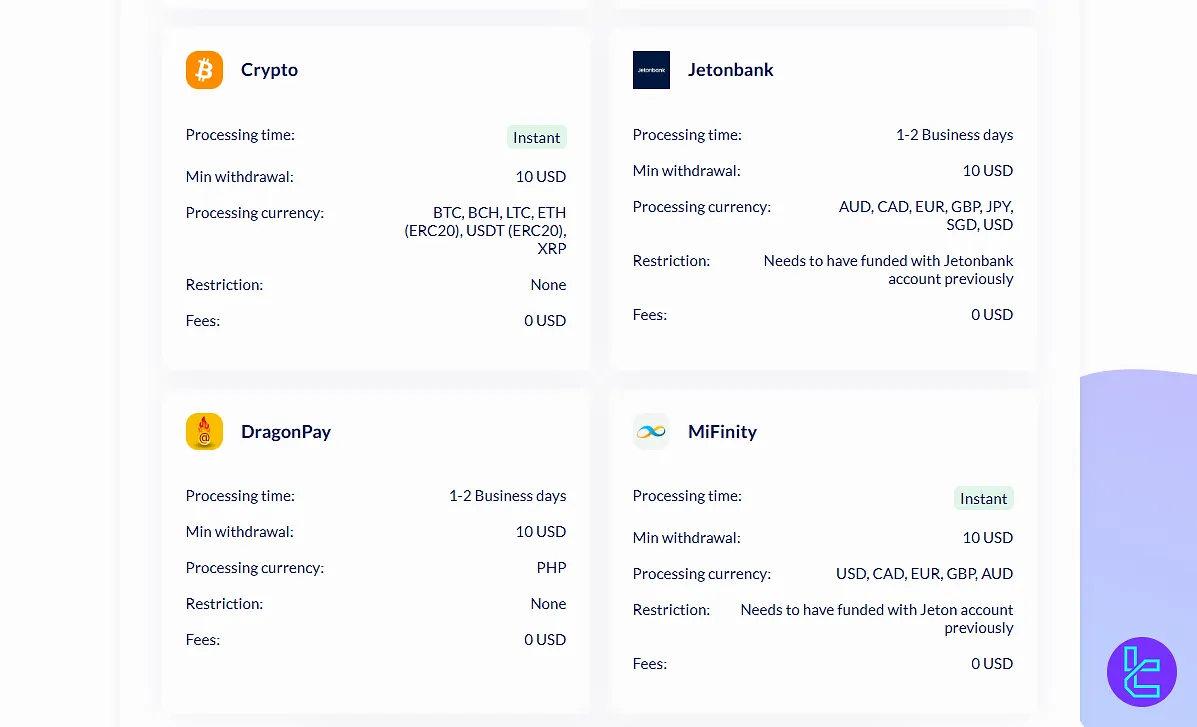

Withdrawal Options

The options for withdrawing funds from Fusion Markets overlap with the ones for deposits:

| Method | Processing Time | Min. Withdrawal |

| Local Bank Transfer | 1-2 Business Days | $10 |

| Bank Wire | 3-5 Business Days | #35 |

| Interac | 1-2 Business Days | $10 |

| PayPal | Instant | $10 |

| Skrill | Instant | $10 |

| Neteller | Instant | $10 |

| Crypto | Instant | $10 |

| Jetonbank | 1-2 Business Days | $10 |

| DragonPay | 1-2 Business Days | $10 |

Fusion Markets does not charge clients any commission for withdrawals, either.

Does Fusion Markets Offer Copy Trading and Growth Plans?

The brokerage company offers several options for copy trading and managed accounts, from Fusion+ to MAM/PAMM accounts.

- Fusion+: Free platform exclusively designed for money managers who trade at least 2.5 lotsof FX/Metals per month (otherwise, there is a monthly $10 fee)

- DupliTrade: Partner service for copy trading with the ability to automatically copy strategies of selected experienced traders

- Multi Account Manager (MAM): MetaFX platform for professional money managers with flexible order types, order sizes, and trading styles, with a cost of 0.1pips per trade

Fusion Markets Broker Financial Instruments

The company offers a diverse range of trading instruments (250+ markets) to cater to various trading preferences. Here's a table of details:

Category | Type of Instruments | Number of Symbols | Competitor Average | Max. Leverage |

Forex | Major, minor, and exotic currency pairs | 55 Currency Pairs | 50–70 currency pairs | Not Specified |

Precious Metals | CFDs on Gold, Silver, Platinum, Aluminum, Copper, Nickel, and Lead | 7+ Metals | 5–10 metals | 1:500 |

Indices | CFDs on major global indices (e.g., S&P 500, FTSE 100) | Around 14 indices | 10–20 indices | Not Specified |

Cryptocurrencies | CFDs on Bitcoin, Ethereum, and 11 other major cryptocurrencies | 13 Cryptocurrencies | 10–20 cryptocurrencies | 1:2 (Retail) 1:10 (Pro) |

US Share CFDs | Commission-free leveraged trading on US equities (e.g., Apple, Amazon, Microsoft) | 1000+ US Stocks | 800–1200 | 1:20 |

Energy & Soft Commodities | CFDs on Brent, Natural Gas, US Oil, Raw Sugar, Soybeans, etc. | Around 15 Instruments | 10–20 instruments | 1:500 |

Fusion Markets Bonus Plans

In this Fusion Markets review, we must mention the promotional programs. The broker doesn’t offer traditional promotions, such as welcome bonuses, due to regulatory compliance. However, it offers several attractive features and partnership programs, including:

- VPS (Virtual Private Server): Free VPS hosting for qualifying traders ensures stable and fast trading execution

- Affiliate: Earn one-off fees or CPA (cost-per-acquisition) for referring new clients with access to an affiliate portal with statistics and tracking

- Introducing Broker (IB): Designed for forex trading businesses, education companies, and trading websites to earn commissions on referred clients

- Refer a Friend: Simple sign-up process with rewards for both referrer and friend

Fusion Markets Awards

Fusion Markets has built a strong reputation for cost-efficiency, earning consistent industry recognition. From 2020 to 2025, the broker was awarded “Lowest Spread Forex Broker” and “Best MetaTrader Broker” by Brokerchooser, while Compare Forex Brokers named it “Lowest Commissions Forex Broker” over the same period.

These Fusion Markets awards reflect its commitment to competitive pricing across key platforms like MetaTrader 4 and MetaTrader 5. Beyond trading, its parent brand, Fusion Worldwide, secured the “International Branded Distributor” title at the EE Awards 2024, emphasizing broader excellence in global distribution.

How to Reach Fusion Markets Broker Customer Support

Fusion Markets prides itself on providing responsive and helpful customer support 24/7 through various channels, including:

help@fusionmarkets.com | |

Phone | +61 3 8376 2706 |

Address | Govant Building, BP 1276 Port Vila, Vanuatu |

Ticket | On the “Contact Us” page |

Live Chat | Available on the official website |

Restricted Countries on Fusion Markets

Due to regulatory restrictions, Fusion Markets cannot accept clients from certain countries. As of the latest update, these restricted countries include:

- Afghanistan

- Congo

- Iran

- Iraq

- Japan

- Myanmar

- New Zealand

- North Korea

- Ontario (Canada)

- Palestine

- Russia

- Spain

- Somalia

- Sudan

- Syria

- Ukraine

- Yemen

- United States and its territories

Fusion Markets on Review Websites (Trust Scores)

One of the most important topics in this Fusin Markets review is user satisfaction. The broker has garnered generally positive reviews across various review platforms.

4.6 out of 5 based on 1,778 comments | |

Forex Peace Army | 4.7 out of 5 based on 262 reviews |

Fusion Markets Educational Materials

The broker provides educational resources primarily through its blog. The content covers various topics, including:

- Market analysis and trading insights

- Platform tutorials and guides

- Trading strategy articles

- Economic calendar and market news updates

You can also use TradingFinder's Forex education section for additional learning materials.

Fusion Markets vs Other Brokers

The table below provides a comprehensive comparison between Fusion Markets and other brokers:

Parameter | Fusion Markets Broker | AMarkets Broker | FXTM Broker | TMGM Broker |

Regulation | ASIC, VFSC | FSA, FSC, Misa, FinaCom | FSC | ASIC, VFSC, FSC, FMA |

Minimum Spread | From 0.0 Pips | From 0.0 pips | From 0.0 pips | From 0.0 Pips |

Commission | From $0.0 | From $0.0 | Variable | From $0.0 |

Minimum Deposit | $0 | $100 | $200 | $100 |

Maximum Leverage | 1:500 | 1:3000 | 1:3000 | 1:1000 |

Trading Platforms | MetaTrader 4, MetaTrader 5, TradingView, cTrader | MetaTrade 4, MetaTrade 5, Mobile App | MT4, MT5, FXTM Trader App | MT4, MT5, IRESS, TMGM Mobile App |

Account Types | Zero, Classic, Swap-Free | Standard, ECN, Fixed, Crypto, Demo | Advantage, Stocks Advantage, Advantage Plus | EDGE, CLASSIC |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | 250+ | 550+ | 1000+ | 12000+ |

Trade Execution | Market, Instant | Instant, Market | Market, Instant | Market, Instant |

Conclusion and Final Words

Fusion Markets offers trading tools such as copy trading, PAMM/MAM accounts, and an economic calendar. In all of its three account types [Zero, Classic, Swap-Free], Fusion Markets offers 1:500 maximum leverage. On the contrary, educational resources offered by Fusion Markets are limited.

Need more guidance on using this broker? Read the TradingFinder Fusion Markets tutorial.