FxGrow verification is a mandatory 3-step process required to activate all trading features.

The process includes completing identity, financial, and trading history details, and submitting identification and proof of residence documents to the official website of this Forex broker.

Key Steps in FxGrow Verification

After FxGrow registration, you must verify your account in the FxGrow broker to unlock all trading features. FxGrow verification overview:

- Completing Identity, Financial, and Trading History Details;

- Submitting Identification and Proof of Address Documents;

- Tracking the KYC Status.

Traders must provide the following documents to finalize the KYC process.

Verification Requirement | Yes/No |

Full Name | No |

Country of Residence | No |

Date of Birth Entry | No |

Phone Number Entry | No |

Residential Address Details | No |

Phone Number Verification | No |

Document Issuing Country | Yes |

ID Card (for POI) | Yes |

Driver’s License (for POI) | Yes |

Passport (for POI) | Yes |

Residence Permit (for POI or POA) | Yes |

Utility Bill (for POA) | Yes |

Bank Statement (for POA) | Yes |

2-Factor Authentication | No |

Biometric Face Scan | No |

Financial Status Questionnaire | No |

Trading Knowledge Questionnaire | No |

Restricted Countries | Yes |

#1 Complete Identity, Financial, and Trading History Details

Log in to the FxGrow dashboard, where the 3 sections for identity, financial, and trading history information are displayed.

By selecting any of the options, you can answer the related questions and proceed through these steps.

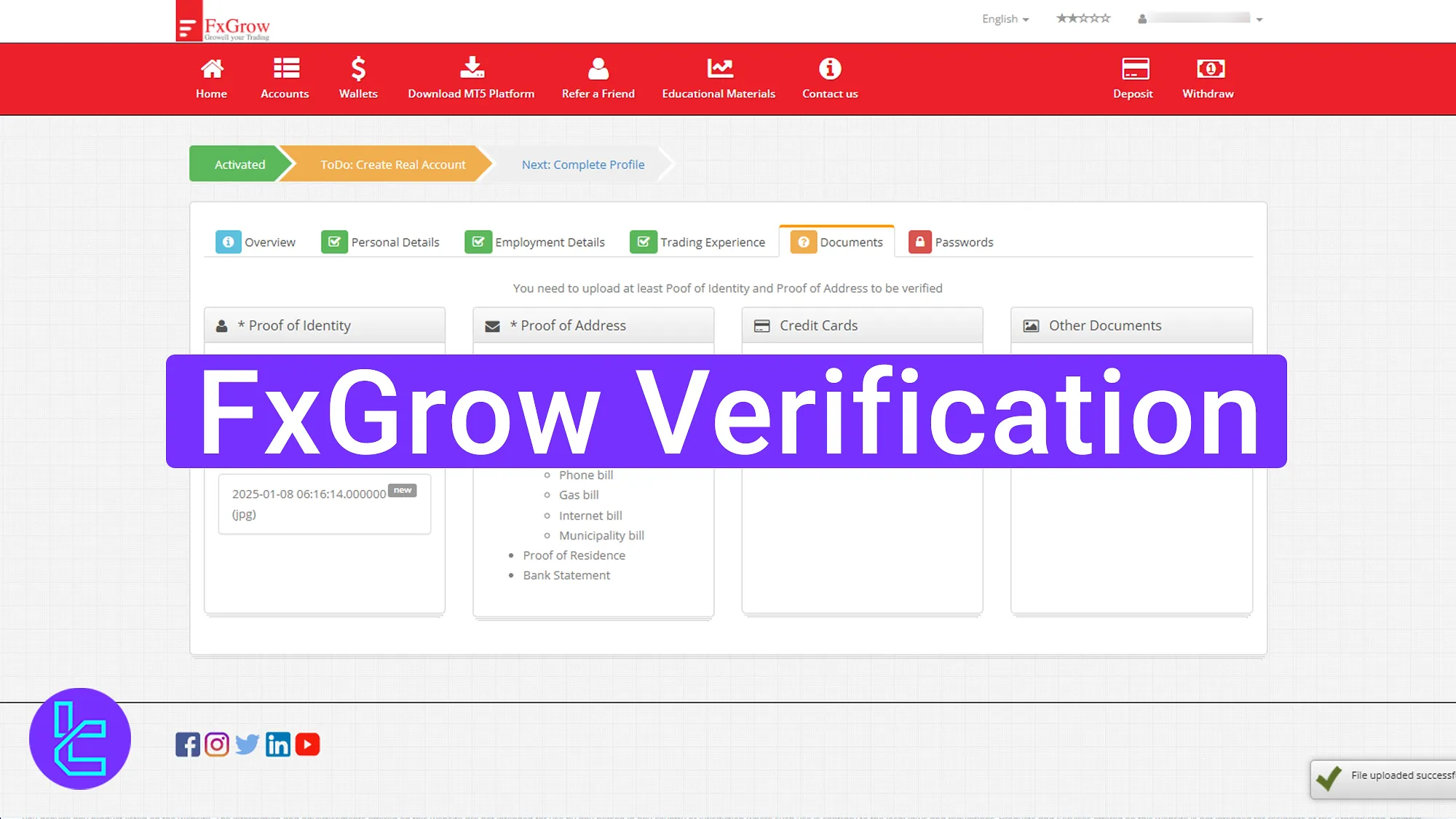

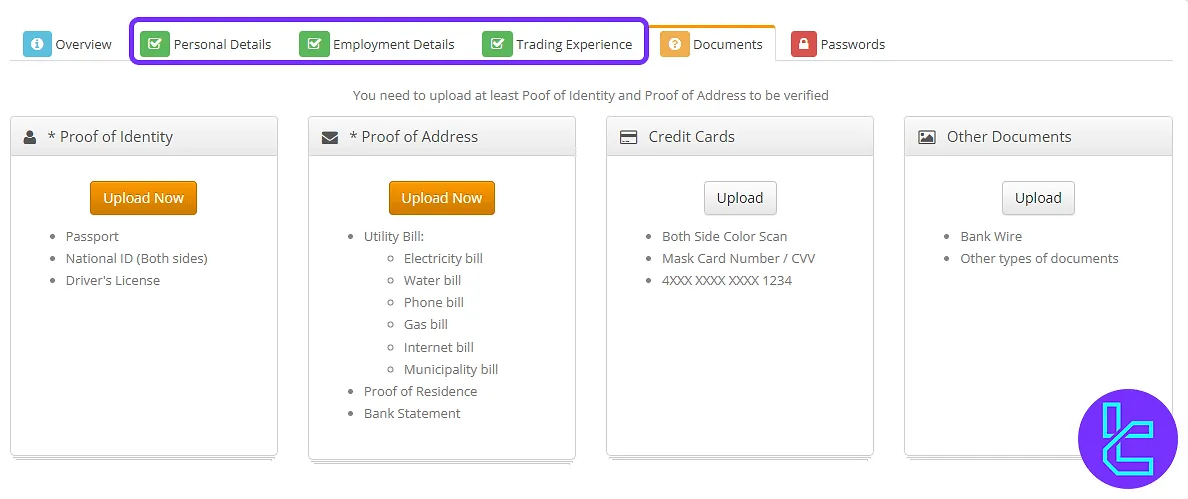

#2 Submitting Identification and Proof of Address Documents

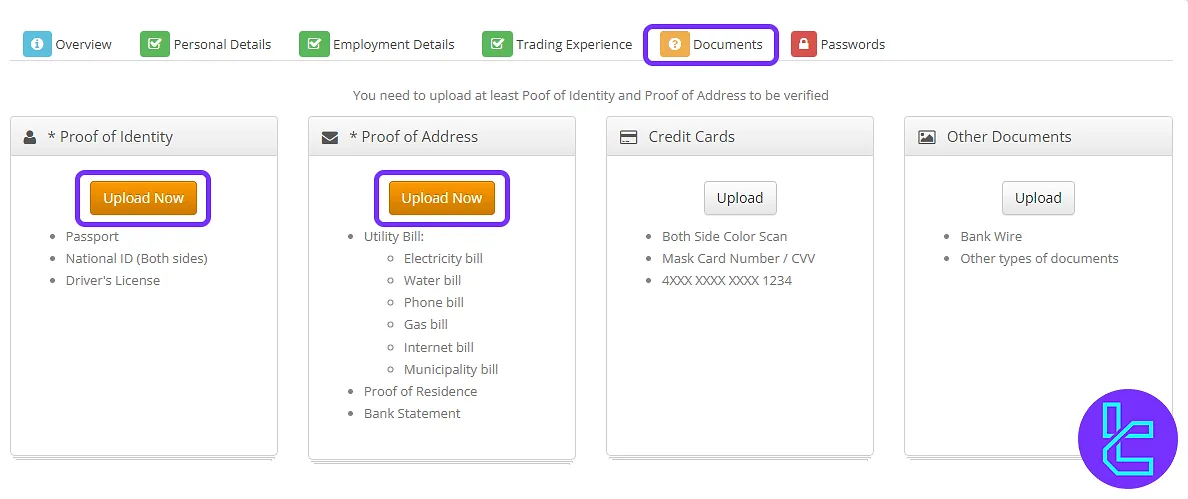

Navigate to the "Documents" section and click "Upload New" to submit Proof of ID (passport, National ID, driver's license) and proof of residence documents.

Traders can use, a bank statement, utility bill, or official residence document dated within the last 3 months to verify their residential address.

Once the documents are submitted, click "Request Verification", and the documents will be sent for review.

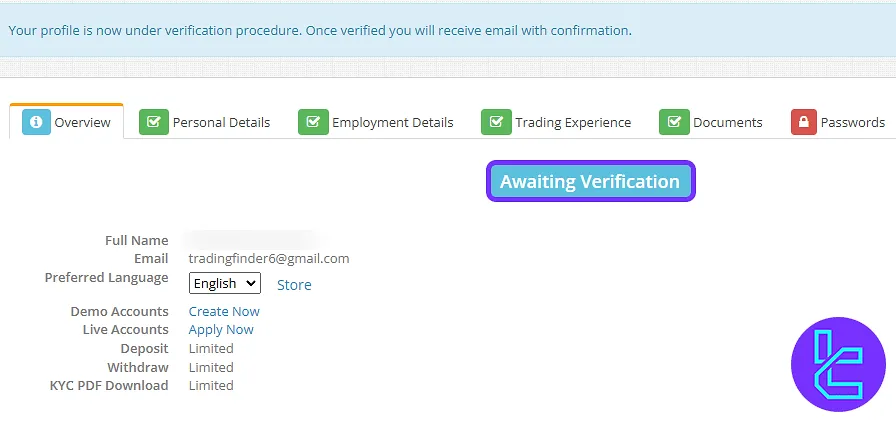

#3 Tracking the KYC Status

To check the KYC status, go to the "Profile" section in the FxGrow dashboard and click on "Profile" again to view the results.

FXGrow KYC Comparison Table

The table below provides a detailed comparison of the account authentication requirements in FXGrow and 3 other reputable brokers.

Verification Requirement | ||||

Full Name | No | Yes | No | Yes |

Country of Residence | No | Yes | No | Yes |

Date of Birth Entry | No | No | No | No |

Phone Number Entry | No | No | No | No |

Residential Address Details | No | No | Yes | Yes |

Phone Number Verification | No | No | No | No |

Document Issuing Country | Yes | Yes | Yes | Yes |

ID Card (for POI) | Yes | Yes | Yes | Yes |

Driver’s License (for POI) | Yes | Yes | Yes | Yes |

Passport (for POI) | Yes | Yes | Yes | Yes |

Residence Permit (for POI or POA) | Yes | Yes | Yes | Yes |

Utility Bill (for POA) | Yes | Yes | Yes | Yes |

Bank Statement (for POA) | Yes | Yes | Yes | No |

2-Factor Authentication | No | No | No | No |

Biometric Face Scan | No | No | No | No |

Financial Status Questionnaire | No | No | No | No |

Trading Knowledge Questionnaire | No | No | Yes | No |

Restricted Countries | Yes | Yes | Yes | Yes |

TF Expert Suggestion

FxGrow verification includes Proof of Identity (POI) and Proof of Address (POA) submission and can be completed in just 5 minutes. The verification status can be checked in the "Profile"section of the FxGrow dashboard.

With a verified account, users gain access to FxGrow deposit and withdrawal options, enabling them to manage funds and start trading. Detailed guidance is available on the FxGrow tutorial page.