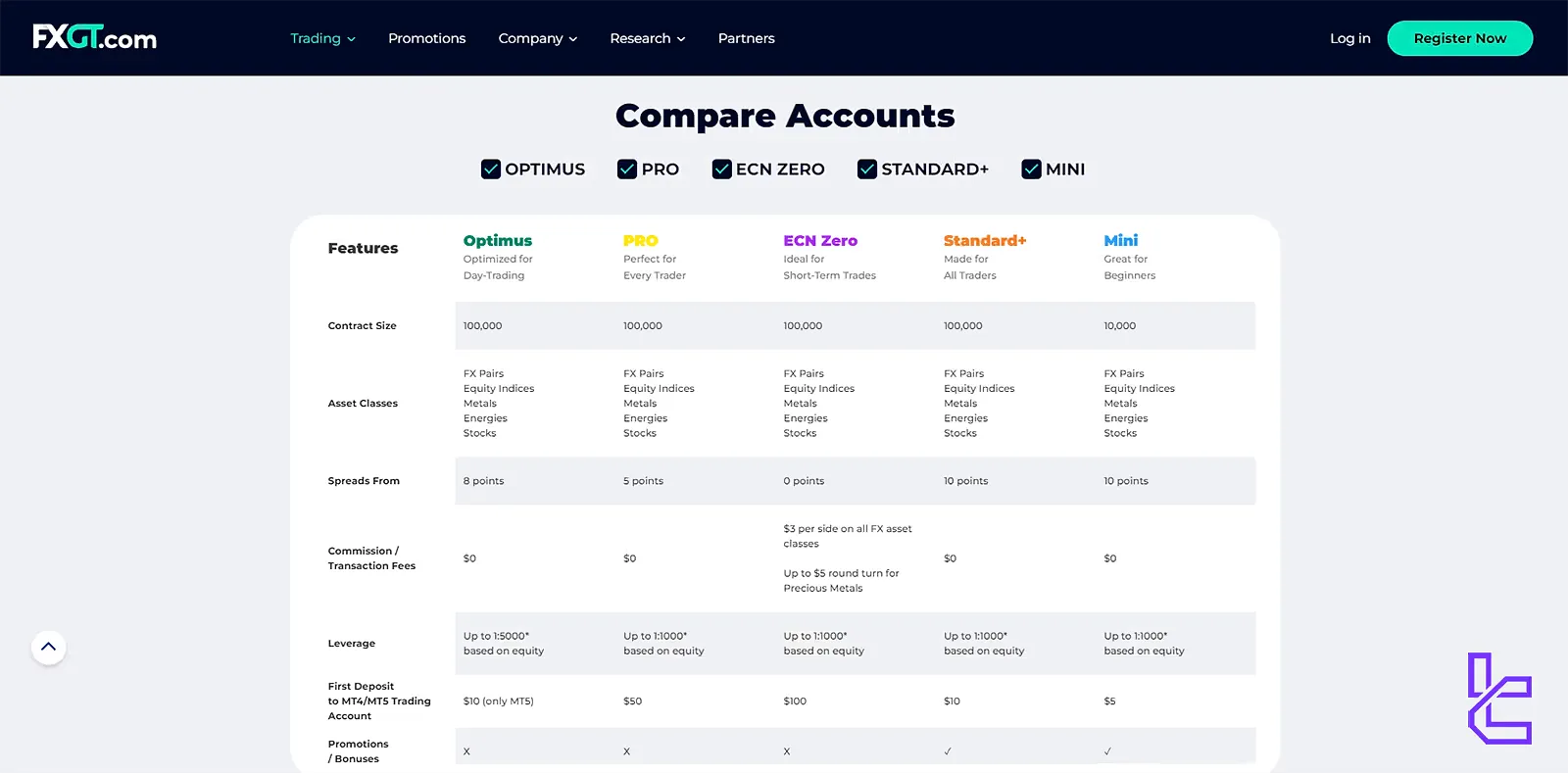

FXGT's multiple account types (Optimus, Pro, Standard+, ECN Zero, Mini) allow traders to select the option that best suits their trading style and experience level.

The broker offers spreads from 0, with its ECN Zero account providing commission as low as $3 per side for FX pairs and up to $5 for metals.

The broker supports MT4 and MT5 platforms, offering flexibility and a user-friendly experience.

FXGT Company Information & Regulation Status

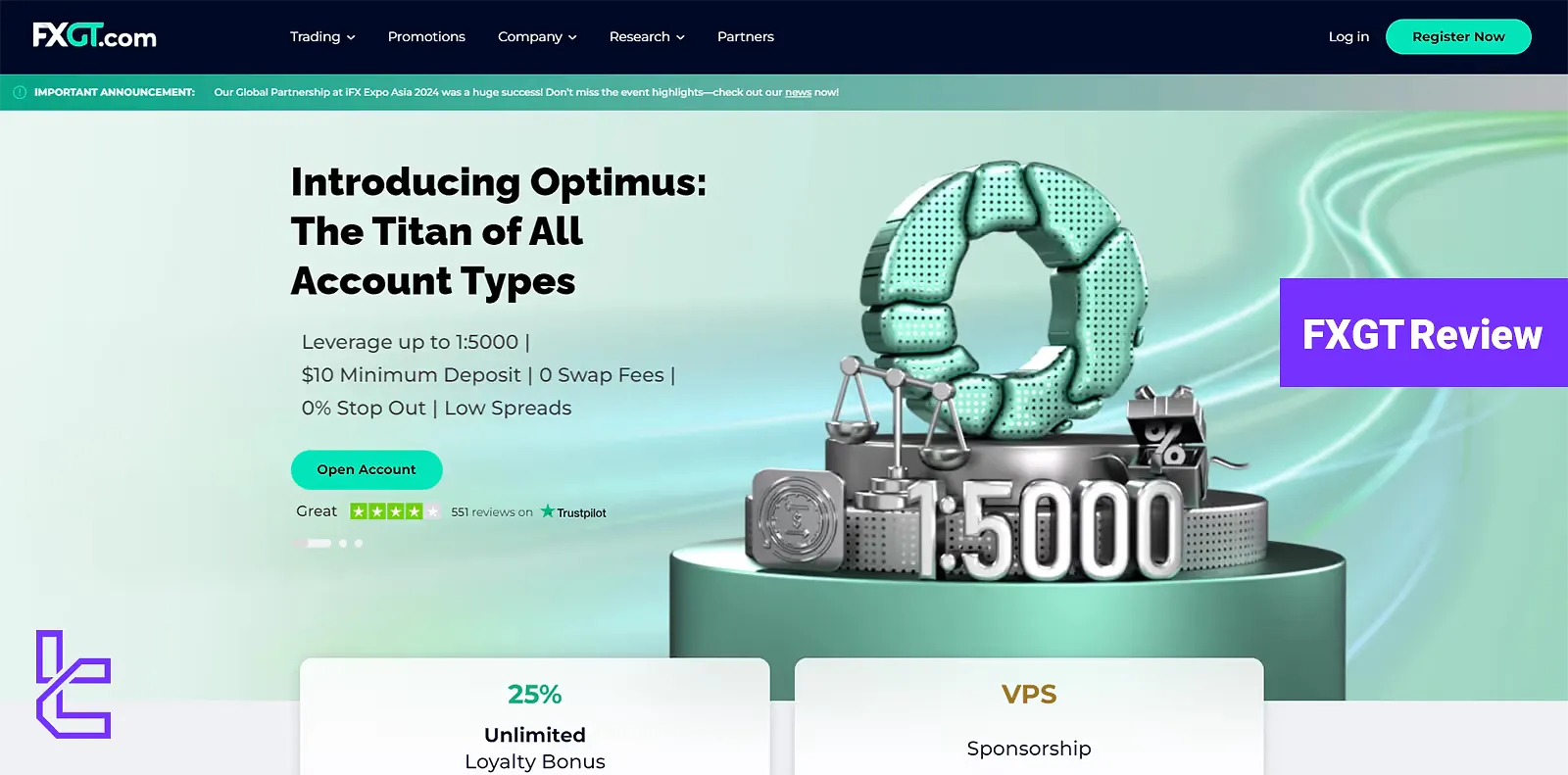

Since its launch in 2019, FXGT.com has quickly established itself as a formidable contender in the online trading space. The company's mission is clear: to provide traders with a seamless and secure trading environment backed by cutting-edge technology and competitive trading conditions. Here is why you might be interested in trading with the broker:

- Leverage up to 1:5000

- $10 minimum deposit

- 0% Stop Out

One of FXGT's strongest selling points is its robust regulatory framework. The broker is licensed and overseen by several reputable financial authorities, including:

- Financial Services Authority (FSA) of Seychelles

- Financial Sector Conduct Authority (FSCA) of South Africa

- Vanuatu Financial Services Commission (VFSC)

- Cyprus Securities and Exchange Commission (CySEC) - for institutional clients only

This multi-jurisdictional approach to regulation demonstrates FXGT's commitment to maintaining high standards of operational integrity and client fund protection.

Here's a summary table for different entities and branches of FXGT:

Entity Parameters/Branches | GT Investment Services Ltd | GT Global Markets Ltd | GT IO Markets (Pty) Ltd | GT Global Ltd |

Regulation | CySEC | VFSC | FSCA | FSA |

Regulation Tier | 1 | 4 | 2 | 4 |

Country | Cyprus | Vanuatu | South Africa | Seychelles |

Investor Protection Fund / Compensation Scheme | ICF (up to €20,000) | None | None | None |

Segregated Funds | Yes | Yes | Yes | Yes |

Negative Balance Protection | Yes | Yes | Yes | Yes |

Maximum Leverage | 1:500 (Pro) | 1:5000 | 1:200 | 1:5000 |

Client Eligibility | Institutional Clients Only | Global (Ex. restricted) | South African Residents | Global (Offshore) |

FXGT Broker Summary of Specifics

To give you a clear picture of what the Forex broker offers, here's a concise summary of its key features and specifications:

Broker | FXGT |

Account Types | Standard+, ECN Zero, Mini Optimus, Pro |

Regulating Authorities | VFSC, CySEC, FSA, FSCA |

Based Currencies | ADA, XRP, EUR, USD, BTC, ETH, USDT |

Minimum Deposit | $5 |

Deposit Methods | VISA, Mastercard, Bitwallet, Sticpay, Instant Local Bank Transfers / QR, Neteller, Apple Pay, Google Pay |

Withdrawal Methods | VISA, Mastercard, Bitwallet, Sticpay, Neteller, Apply Pay, Google Pay |

Minimum Order | 0.01 |

Maximum Leverage | 1:5000 |

Investment Options | No |

Trading Platforms & Apps | MT4,MT5 |

Markets | Equity Indices, Stocks, Forex, Precious Metals, Energies |

Spread | From 0 |

Commission | From 0 |

Orders Execution | Market |

Margin Call/Stop Out | 50%/20% |

Trading Features | Copy Trading, Economic Calendar |

Affiliate Program | YES |

Bonus & Promotions | YES |

Islamic Account | YES |

PAMM Account | NO |

Customer Support Ways | Email, Ticket, Live Chat |

Customer Support Hours | 24/7 |

FXGT Types of Trading Accounts

The broker offers a range of account types to cater to different trading styles and experience levels.

Here's a breakdown of the four main account types available:

Account Type | Minimum Deposit | Leverage up to | Minimum Trade Size | Ideal For |

Mini | $5 | 1:1000 | 0.01 | Beginners and those trading with smaller capital |

Standard+ | $10 | 1:1000 | 0.01 | Intermediate traders looking for tighter spreads |

PRO | $50 | 1:1000 | 0.01 | Experienced traders seeking low spreads without commissions |

ECN Zero | $100 | 1:1000 | 0.01 | Professional traders and scalpers looking for the tightest spreads |

Optimus | $10 | 1:5000 | 0.01 | Day-Trading |

All account types share some common features:

- Access toMT4/MT5 platforms

- Negative balance protection

- Multiple payment options, including cryptocurrencies

- Swap-free Islamic accounts are available upon request

The variety of account types ensures traders can choose an option that aligns with their trading goals, capital, and risk tolerance.

FXGT Forex Broker Advantages and Disadvantages

As with any broker, FXGT comes with its strengths and weaknesses. Let's examine the advantages and disadvantages to help you make an informed decision:

Advantages | Disadvantages |

Low minimum deposit ($5) | Limited number of tradeable symbols (around 150) |

High leverage options up to 1:1000 | Lack of advanced educational videos |

Multiple regulatory licenses | No trading signals offered |

Access to popular MT4/MT5 platforms | Does not accept US clients |

Competitive spreads, especially on ECN accounts | Relatively new broker (established in 2019) |

Despite the limitations, FXGT's overall offering presents a compelling option for many traders, especially those seeking a regulated broker with competitive trading conditions and a low entry barrier.

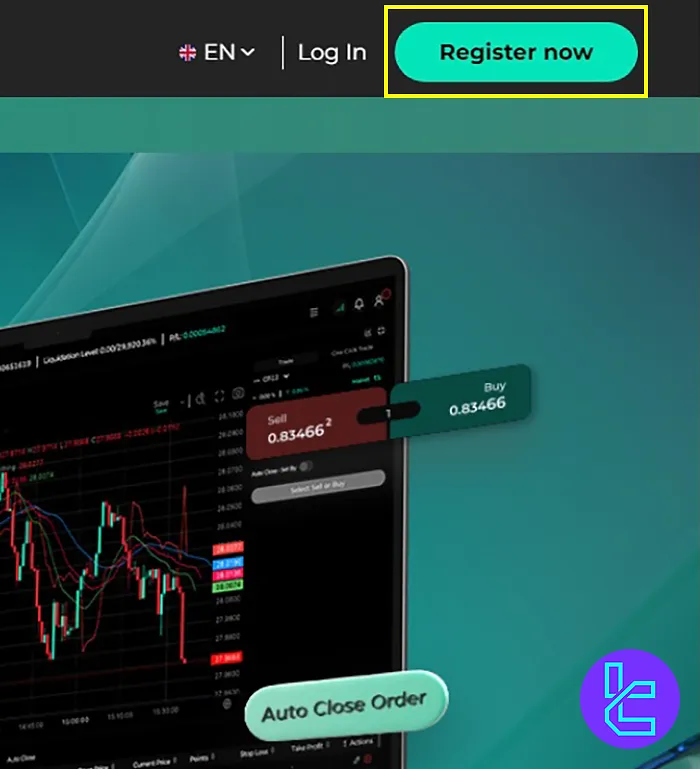

FXGT Broker Signing Up

Creating a new account with the FXGT broker is easy, even for beginners. FXGT registration:

#1 Navigate to the FXGT Signup Page

Go to the official FXGT website through your preferred broker review source, then click on “Register Now”.

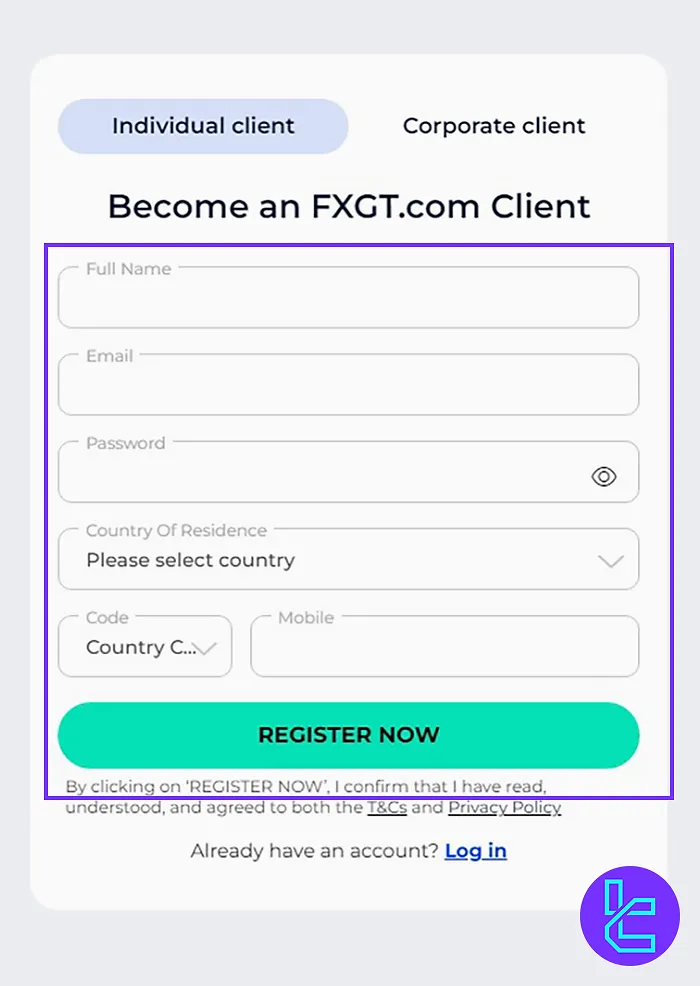

#2 Complete the Registration Form

Fill out the Individual Client Form by entering your full name, email, password, mobile phone, and country. Then click Register.

#3 Verify Your Email Address

Check your inbox and click on the verification link provided. After confirming, continue to the login page.

#4 Log In and Accept Terms

Enter your login credentials, agree to the platform’s terms, and proceed to access your FXGT dashboard.

Do I need to complete my KYC to start trading with FXGT?

Yes, KYC is required. However, you can open a live trading account and deposit up to $2,000 (or equivalent) without fully completing the KYC process. To start trading and make withdrawals, you must complete your KYC verification.

To verify your account with the FXGT broker, you must first provide the following information:

- Nationality

- Middle name (mandatory if applicable)

- Tax ID (if applicable)

- Country Code and Contact Number

- First name

- Date of Birth

- Gender

- Last name

Traders must also upload these documents:

- Proof of identity: Passport, ID card, or driver's license

- Proof of address: utility bill, bank statement, or residence permit

FXGT Trading Platforms and Apps

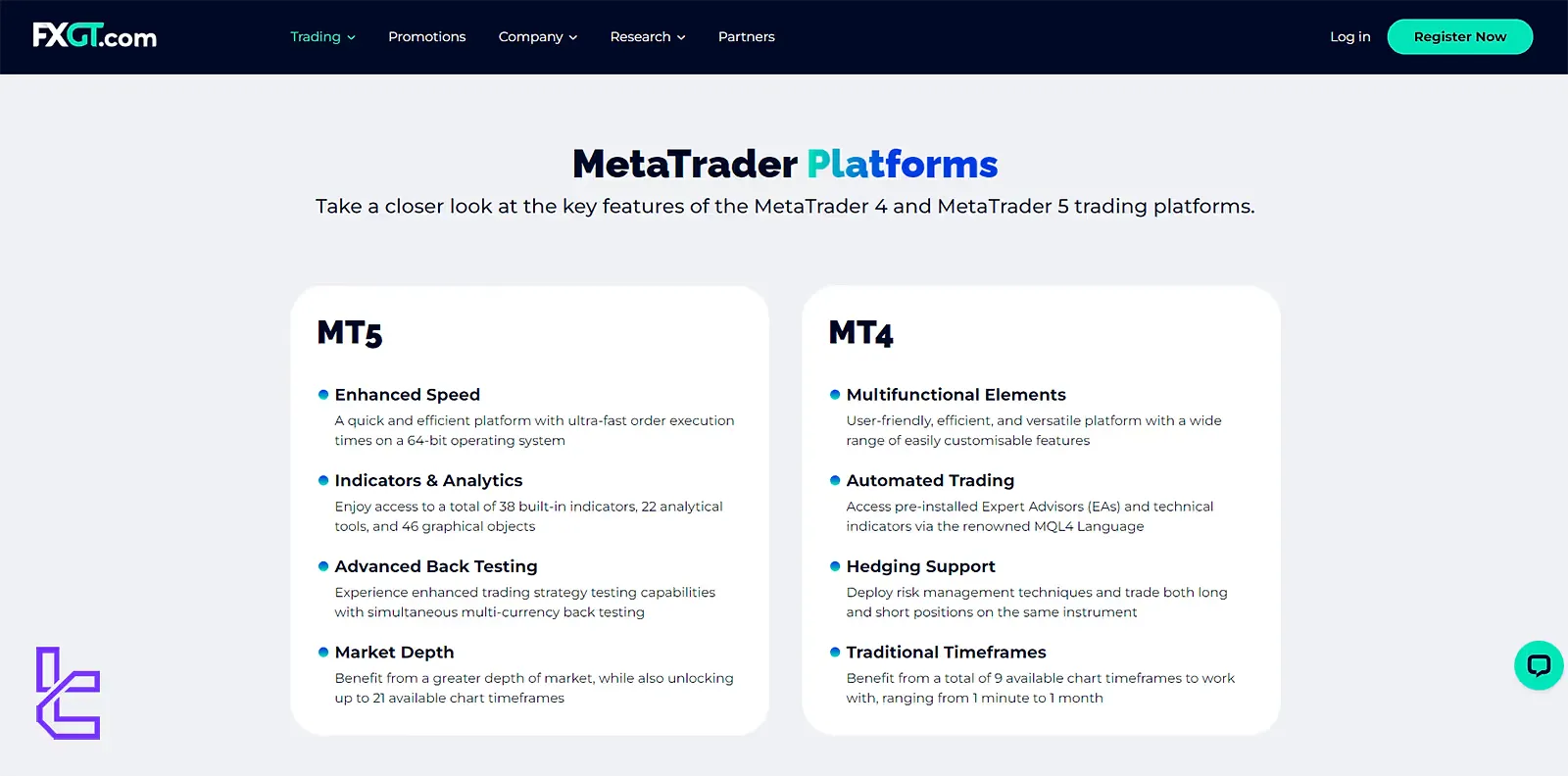

FXGT, as one of the forex brokers, provides traders access to the industry's most popular and powerful trading platforms:

MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Both platforms offer a wide range of features and tools to enhance your trading experience. Key features of FXGT's trading platforms:

- One-click trading for fast execution

- Real-time quotes and market news

- Customizable interface and workspace

- Save multiple chart templates

- Algorithmic trading and copy trading options

- Demo accounts are available for practice

FXGT ensures its platforms are optimized for fast and reliable execution, with servers located strategically to minimize latency. The broker also provides regular updates and maintenance to keep the platforms running smoothly. You can download MT4 & MT5 from the provided links below:

- MT4

- MT5

Check TradingFinder's list of MT4 indicators and MT5 indicators to access additional analytical tools.

FXGT Forex Broker Spreads and Commissions

FXGT offers competitive pricing structures across various account types, striking a balance between low spreads and reasonable commissions. Here's a breakdown of the spreads and commissions you can expect:

Account Type | Spreads From | Commission |

Mini | 10 points | $0 |

Standard+ | 10 points | $0 |

PRO | 5 points | $0 |

ECN Zero | 0 points | $3 per side on FX, |

Optimus | 8 points | $0 |

It's important to note that spreads can vary depending on market conditions and the specific instrument being traded. Major currency pairs typically have the tightest spreads, while exotic pairs and other instruments may have wider spreads.

If you're looking for a way to reduce your trading costs with the FXGT broker, we recommend checking the FXGT rebate article.

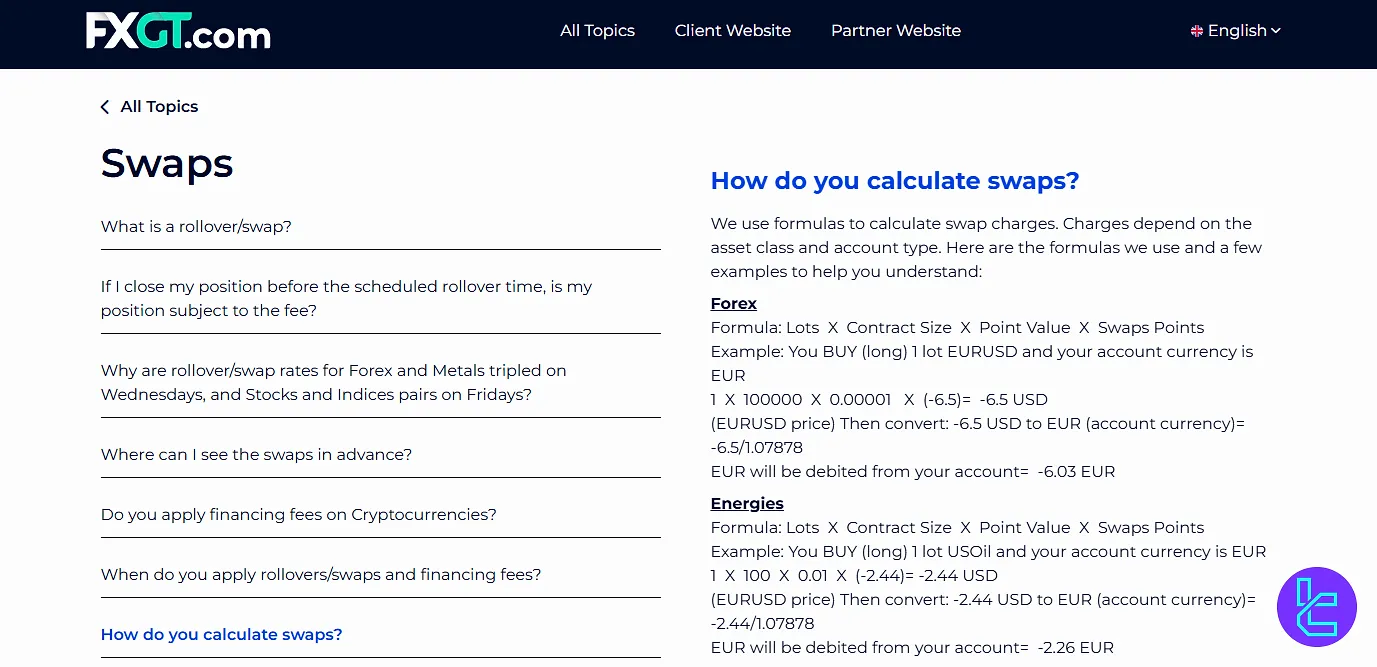

Swap Fees

FXGT charges overnight fees on positions held open past the daily cut-off time. These rates vary by instrument and can be positive or negative.

Swap fees are determined by asset type, position size, and account currency. Each category follows a specific formula, and conversions are applied based on current exchange rates.

Below is a structured overview of calculation methods and examples. Note that Swap rates may fluctuate daily based on liquidity providers and market conditions. No advance notice is guaranteed.

Always verify the latest rates before holding positions overnight.

Forex

- Formula: Lots × Contract Size × Point Value × Swap Points

- Example: Buying 1 lot EURUSD with account currency in EUR

1 × 100,000 × 0.00001 × (–6.5) = –6.5 USD

Converted to EUR: –6.5 ÷ 1.07878 = –6.03 EUR

Energies

- Formula: Lots × Contract Size × Point Value × Swap Points

- Example: Buying 1 lot USOil with EUR account

1 × 100 × 0.01 × (–2.44) = –2.44 USD

Converted to EUR: –2.44 ÷ 1.07878 = –2.26 EUR

Equity Indices

- Formula: Lots × Contract Size × Swap Rate × (Symbol Price ÷ 360)

- Example: Buying 1 lot US30 at 33,000 with an EUR account

1 × 1 × (–5%) × (33,000 ÷ 360) = –4.58 USD

Converted to EUR: –4.58 ÷ 1.07878 = –4.25 EUR

Precious Metals

- Formula: Lots × Contract Size × Point Value × Swap Points

- Example: Buying 1 lot XAGUSD with an EUR account

1 × 5,000 × 0.001 × (–1.98) = –9.9 USD

Converted to EUR: –9.9 ÷ 1.07878 = –9.18 EUR

Stocks

- Formula: Lots × Contract Size × Swap Rate × (Symbol Price ÷ 360)

- Example: Buying 1 lot #AAPL at 165.69 with EUR account

1 × 100 × (–5.1%) × (165.69 ÷ 360) = –2.35 USD

Converted to EUR: –2.35 ÷ 1.07878 = –2.18 EUR

Cryptocurrencies

Crypto Max Account:

- Formula: Lots × Contract Size × (Swap Charge ÷ 100)

- Example: Buying 1 lot BTCUSD

1 × 1 × (–0.023 ÷ 100) = –0.00023 BTC

Converted at BTCEUR 25,000: –0.00023 × 25,000 = –5.75 EUR

Standard Trading Account:

- Formula: Swap Points × Contract Size × Point Value × Lots

- Example: Buying 1 lot BTCUSD

(–1447) × 1 × 0.01 × 1 = –14.47 USD

Mini Trading Account:

- Formula: Swap Points × Contract Size × Point Value × Lots

- Example: Buying 1 lot ETHUSDm

(–106) × 1 × 0.01 × 1 = –1.06 USD

DeFi Tokens

- Formula: Lots × Contract Size × Swap Points

- Example: Buying 10 lots of LNKUSD

10 × 1 × (–0.020%) = –0.002 LNK

Converted at 7.39: –0.002 × 7.39 = –0.15 USD

NFTs

- Formula: Lots × Contract Size × Swap Points

- Example: Buying 100 lots THTUSD

100 × 1 × (–0.022%) = –0.022 THT

Converted at 1.398: –0.022 × 1.398 = –0.03 USD

Non-Trading Commissions

FXGT applies certain non-trading charges that users should be aware of. A monthly inactivity fee of $10 is triggered if an account remains unused for 90 consecutive days.

While deposits and withdrawals are generally free of charge from the broker’s side, currency conversion costs may still occur depending on the third-party payment provider used.

These conversion-related expenses are not imposed directly by FXGT but may apply during cross-currency transactions.

FXGT Broker Deposit & Withdrawal Methods

FXGT offers a variety of deposit and withdrawal methods to cater to traders from different regions. Here's an overview of the process:

Deposit Methods | Withdrawal Methods |

VISA | VISA |

Mastercard | Mastercard |

Bitwallet | Bitwallet |

Sticpay | Sticpay |

Instant Local Bank Transfers / QR | Neteller |

Neteller | - |

Apple Pay | - |

Google Pay | - |

FXGT broker does not impose any fees for deposits or withdrawals made on its platform. However, it's important to note that third-party fees, such as those from banks or payment providers, may still apply.

These additional charges are beyond the broker's control and can vary depending on the specific payment method used.

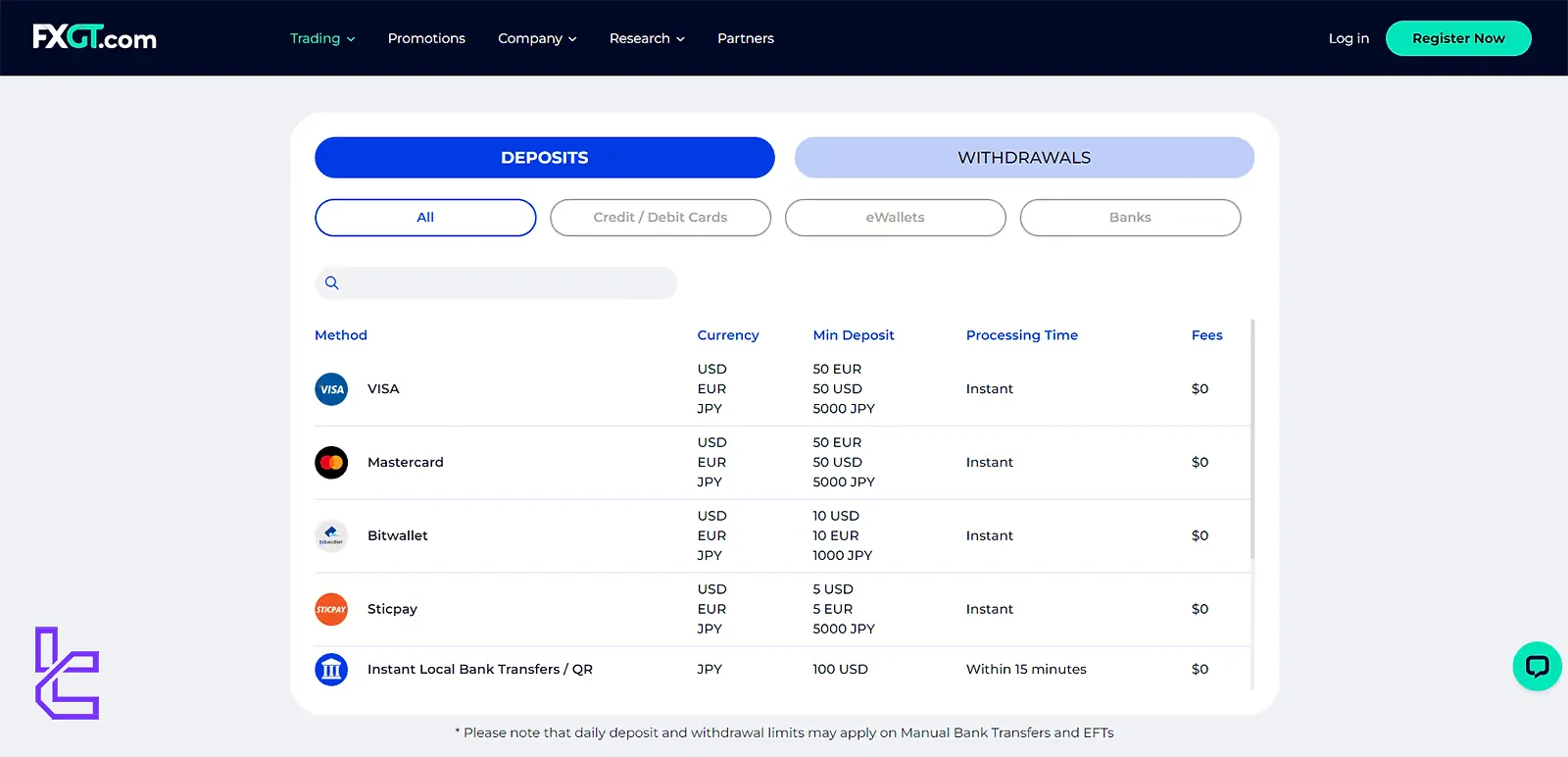

Broker Deposit Options

The payment systems offered by the brokerage process clients' deposits within 15 minutes tops. The table below provides complete information:

Deposit Methods | Base Currencies | Min. Deposit |

VISA | USD | 50 USD 50 EUR 5000 JPY |

Mastercard | USD | 50 USD 50 EUR 5000 JPY |

Bitwallet | USD | 10 USD 10 EUR 1000 JPY |

Sticpay | USD | 5 USD 5 EUR 5000 JPY |

Instant Local Bank Transfers / QR | JPY | 100 USD |

Neteller | USD | 5 USD |

Apple Pay | USD | 50 USD |

Google Pay | USD | 50 USD |

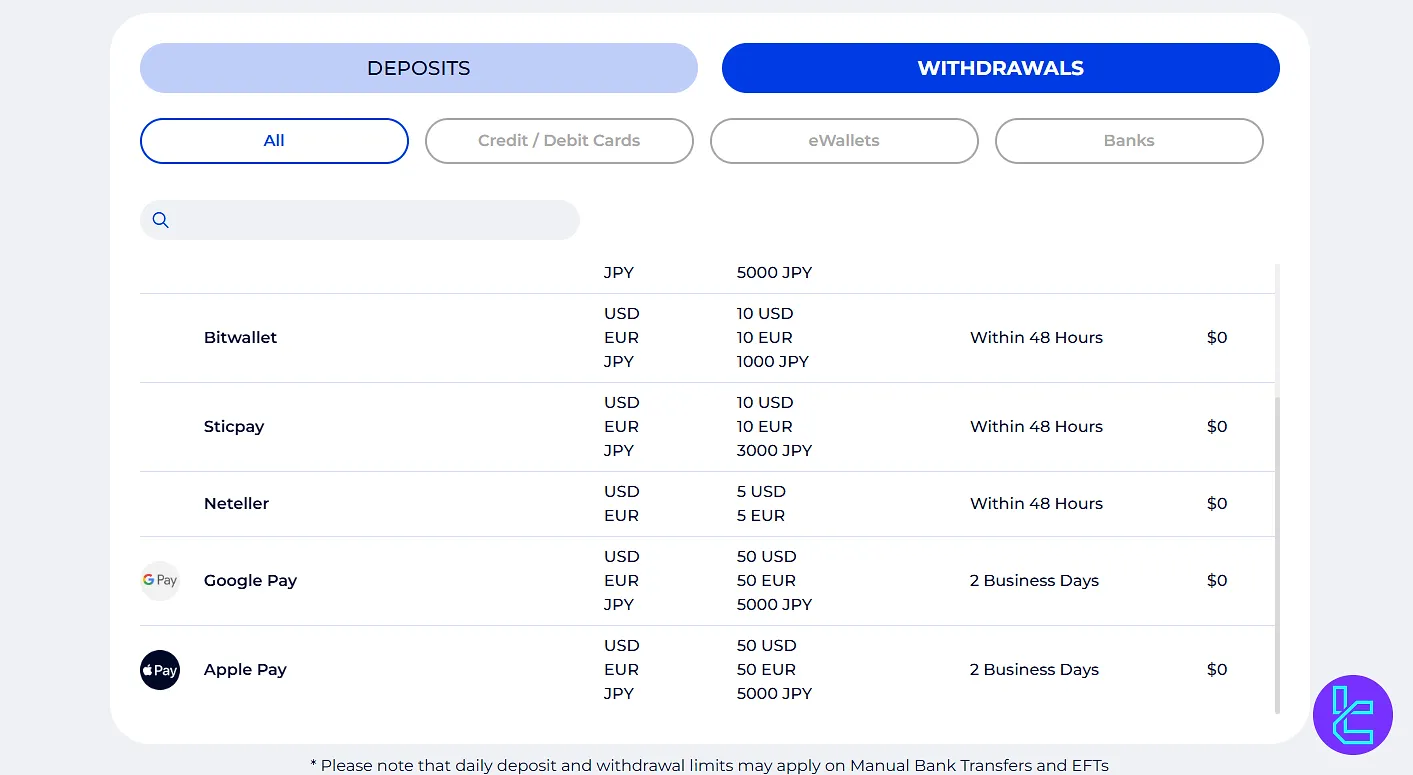

Withdrawal Methods

The minimum withdrawal requirement across all options is 5 USD/EUR. Look at the table below for additional details:

Withdrawal Methods | Base Currency | Processing Time |

VISA | USD | 2 Business Days |

Mastercard | USD | 2 Business Days |

Bitwallet | USD | Within 48 Hours |

Sticpay | USD | Within 48 Hours |

Neteller | USD | Within 48 Hours |

Apple Pay | USD | 2 Business Days |

Google Pay | USD | 2 Business Days |

FXGT Copy Trading & Investment Offerings

The broker offers copy trading functionality through its integration with the MetaTrader platforms, allowing traders to automatically replicate the trades of successful investors. Copy Trading on FXGT:

- Available through both MT4 and MT5 platforms

- Access to a diverse pool of strategy providers

- Real-time copying of trades with customizable risk settings

- Ability to monitor and analyze the performance of strategy providers

FXGT does not offer traditional investment options such as managed or PAMM accounts. The broker emphasizes flexible leverage, competitive spreads, and advanced trading tools, catering to traders who prefer more control over their trading strategies rather than relying on managed investments.

FXGT Forex Broker Tradable Markets & Symbols Overview

FXGT provides access to a diverse mix of over 185 tradable assets across both traditional and next-generation markets. Look at the table below for an overview of its offerings in detail:

Category | Type of Instruments | Number of Symbols | Competitor Average | Max. Leverage |

Majors, minors, exotics (Standard, ECN accounts) | 40+ Forex pairs | 50–70 currency pairs | 1:5000 for Major and Minor Pairs 1:500 for Exotic Pairs | |

Precious Metals | CFDs on metals (Gold, Silver) | 2 instruments | 2–5 instruments | 1:2000 |

Energies | CFDs on energy products (Crude Oil, Natural Gas) | 2 instruments | 2–5 instruments | 1:100 |

Equity Indices | CFDs on major global indices (e.g., US30, NAS100, GER40, JP225) | 4 indices | 10–20 indices | 1:100 |

Stocks | CFDs on popular global equities (e.g., AAPL, AMZN, BABA) | Wide range of global stocks | 800–1200 stocks | 1:50 |

Cryptocurrencies & Synthetic | CFDs on crypto coins & baskets (e.g., BTC, ETH, UNI, GTi12 Index) | Multiple coins + synthetic products | 10–30 symbols | Not Specified |

DeFi Tokens & NFTs | Available only on ECN accounts, includes DeFi projects & NFT-related assets | Limited offering | N/A | Not Specified |

While it doesn’t offer bonds, ETFs, or traditional investment vehicles like PAMM accounts, FXGT compensates with high-leverage access, raw spread trading, and the inclusion of DeFi/NFT assets, rarely seen among mainstream brokers. This multi-asset coverage caters to traders seeking both speculative opportunities and diversified exposure.

FXGT Forex Broker Bonuses and Promotions

The broker provides enticing bonuses and promotions aimed at enriching traders' experiences and offering extra capital for their trading activities:

- 25% Unlimited Loyalty Bonus: Earn a 25% bonus on every deposit, with the limit resetting after reaching $10,000

- VPS Sponsorship Program: Utilize high-speed servers for seamless trading and reduced order execution delays

- Ongoing Rewards: Benefit from continuous incentives through the Loyalty Bonus, specifically tailored for Mini and Standard+ accounts

These offerings are designed to encourage trading engagement and equip traders with additional resources to effectively execute their strategies.

FXGT Awards

The brokerage has not received many awards from reputable and famous icons in the industry. However, based on the available data, FXGT had been awarded three times at the 2024 Awards for Brokers with Outstanding Assessment by BrokersView:

- Best Global Trading Conditions

- Best Global CFD Broker

- Best Global IB/Affiliate Program

FXGT Broker Support Team

FXGT boasts a dedicated 24/7 multilingual support team committed to assisting clients and partners with their inquiries and concerns.

This team is readily accessible through various channels, ensuring that traders receive prompt and efficient support whenever they need it.

Whether you have questions about account opening, onboarding, or any other issues, FXGT's support team is equipped to help.

- Live Chat: Engage with the support team for immediate assistance

- Email Support: for detailed inquiries

- Ticket system: Send a message through the online form for a prompt response

Here are the email addresses to contact the support team:

- Clients: support@fxgt.com

- Partners: partners@fxgt.com

FXGT Broker List of Restricted Countries

The broker maintains a list of restricted countries where its services may not be available due to regulatory compliance and legal considerations:

- United States of America

- Canada

- European countries

- Iran

- North Korea

- Belize

FXGT Broker Trust Scores & User Reviews

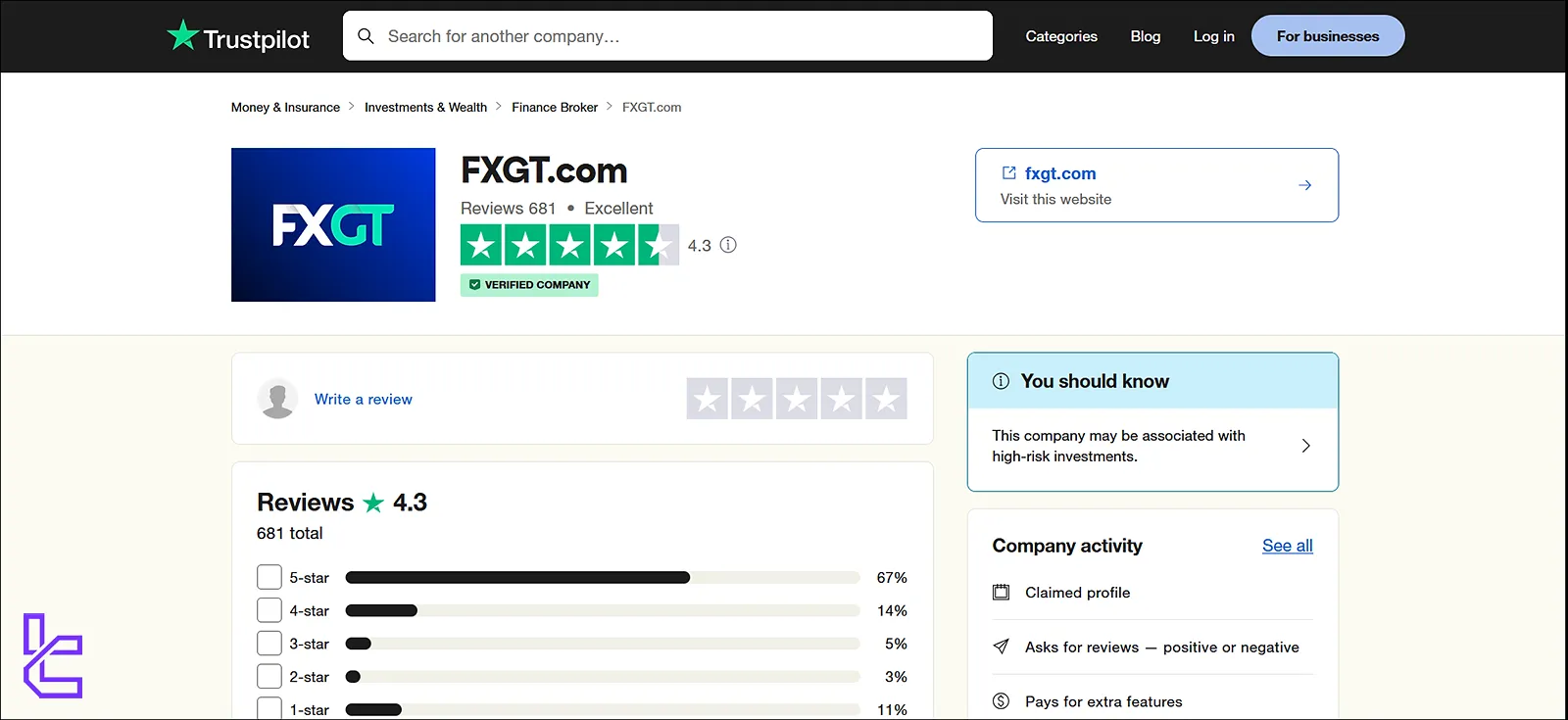

The broker has attracted considerable attention within the trading community, and its trust scores reflect its reputation among users and regulatory authorities. Trader reviews can offer valuable insights into the broker's reliability, customer service, and overall trading experience.

- Trustpilot Rating: FXGT has garnered mixed reviews on platforms such as the FXGT Trustpilot page (4.3 out of 5), showcasing experiences from both satisfied and dissatisfied traders;

- User Feedback: Reviews frequently highlight the platform’s intuitive interface and responsive customer support, influencing potential traders’ decisions.

Education on FXGT Broker

The FXGT Broker Blog is the website's sole educational resource, providing traders with a wealth of information to enhance their financial knowledge and skills.

It covers a diverse range of topics, making it a valuable resource for both novice and experienced traders.

The blog features market analysis to keep traders informed about current trends and price movements, as well as company news that provides insights into FXGT's operations and offerings. Blog Topics:

- Market Analysis

- Company News

- Forex Trading education

- General Trading

- Trading Strategy

- Stocks Trading

- Cryptocurrency

- CFD Trading

FXGT in Comparison with Other Brokers

Comparing FXGT with other brokers helps you understand the advantages and disadvantages of trading with this broker instead of other competitors.

Parameters | FXGT Broker | |||

Regulation | VFSC, CySEC, FSA, FSCA | FSA, CySEC, ASIC | No | FSA, CySEC, FCA, FSCA, CBCS, FSC, CMA |

Minimum Spread | From 0.0 Pips | From 0.0 Pips | From 0.1 Pips | From 0.0 Pips |

Commission | $0 | From $3 | $0 | From $0.2 to USD 3.5 |

Minimum Deposit | $5 | $200 | $1 | $10 |

Maximum Leverage | 1:5000 | 1:500 | 1:3000 | Unlimited |

Trading Platforms | MT4,MT5 | Metatrader 4, Metatrader 5, cTrader, cTrader Web, IC Markets Mobile | MetaTrader 4, MetaTrader 5 | Exness Trade (mobile), Exness Terminal (web), MT4, MT5 |

Account Types | Standard+, ECN Zero, Mini Optimus, Pro | Standard, Raw Spread, Islamic | Standard, Premium, VIP, CIP | Standard, Standard Cent, Pro, Raw Spread, Zero |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | 2,800+ | 2,250+ | 45 | 200+ |

Trade Execution | Market | Market | Market, Instant | Market, Instant |

Conclusion and final words

In conclusion, FXGT provides high-leverage options up to 1:5000 and access to copy trading. It ensures segregated accounts and negative balance protection for peace of mind.

FXGT’s trust score is 4.3 out of 5 on Trustpilot, reflecting positive user experiences. With 24/7 multilingual support, FXGT is a considered choice for traders of all levels.