FXlift offers 300+ trading instruments with a minimum deposit of $200. It provides commission-free trading on Futures and Stock CFDs. The broker supports the MT4 platform, offering spreads from 0.0 pips.

FXlift; An Introduction to the Broker and Its Regulatory Status

FXlift is operated by Notesco Int Limited, registered in Anguilla with registration number A000001800.

The Forex broker provides institutional and retail services with leverage options of up to 1:1000 across six asset classes. However, we must mention in this FXlift review that the company is not regulated by any financial authority. Key features of FXlift:

- Spreads from 0.0 pips

- Free demo trading

- Market Execution with No Re-quotes

- CFDs on Stocks and Futures

The table below summarizes the company's details and information:

Entity Parameters/Branches | Notesco Int Limited |

Regulation | Not Regulated |

Regulation Tier | N/A |

Country | Anguilla |

Investor Protection Fund / Compensation Scheme | None |

Segregated Funds | Yes |

Negative Balance Protection | None |

Maximum Leverage | 1:1000 |

Client Eligibility | Global |

FXlift CEO: Any Information?

According to our team's investigations and research, the brokerage's director is not publicly available, and no information about his/her identity exists.

FXlift Broker Table of Specifications

To provide a clearer picture of FXlift's offerings, here's a table summarizing key specifications:

Broker | FXlift |

Account Types | Standard, Gold, STP/ECN No Commission |

Regulating Authorities | Not Regulated |

Based Currencies | Variable based on the account type |

Minimum Deposit | $200 |

Deposit Methods | Paysafe, Bank Transfer, Credit/Debit Cards, Neteller, Skrill, Bitwallet, Perfect Money, Union Pay, PIX, Crypto |

Withdrawal Methods | Paysafe, Bank Transfer, Credit/Debit Cards, Neteller, Skrill, Bitwallet, Perfect Money, Union Pay, PIX, Crypto |

Minimum Order | 0.01 lots |

Maximum Leverage | 1:1000 |

Investment Options | None |

Trading Platforms & Apps | MT4 |

Markets | Forex, Futures, Shares, Spot Metals, Spot Indices, Spot Commodities |

Spread | From 0.0 pips |

Commission | $0 |

Orders Execution | Market |

Margin Call / Stop Out | N/A / 20% |

Trading Features | Mobile Trading, CFDs, Futures Contracts, Deposit Bonus, Economic Calendar |

Affiliate Program | Yes |

Bonus & Promotions | 100% Mega Bonus, 40% Supercharge Bonus, 20% Welcome Bonus |

Islamic Account | Yes |

PAMM Account | Yes |

Customer Support Ways | Email, Ticket |

Customer Support Hours | Monday to Friday 24/5 |

FXlift Account Types

The company offers three main account types, each targeting different trader profiles:

Features | Standard | Gold | STP/ECN No Commission |

Base Currency | USD, EUR, JPY, CZK, NGN | USD | - |

Max Leverage | 1:1000 | 1:1000 | 1:200 |

Min Lot Size | 0.01 | 0.01 | 0.01 |

Personal Support | Yes | Yes | Yes |

Average Spread (pips) | 2.1 | 1.7 | 1.8 |

Commission | $0 | $0 | $0 |

All account types allowmicro-lot trading from 0.01 and offer access to the full suite of CFDs via the MetaTrader 4 platform. A demo account mimicking Standard account conditions is also available for risk-free practice.

Advantages and Disadvantages

While the broker’s wide range of trading instruments and its support for Futures contracts seem appealing, its lack of a regulatory license is a serious drawback.

Pros | Cons |

A wide range of tradable assets (300+) | Lack of licensing by financial authorities |

Competitive spreads (from 0.0 pip) | No support for MT5 or TradingView |

High leverage options (up to 1:1000) | Limited educational resources |

MetaTrader 4 support | Lack of transparency about the company’s background and managing team |

The broker provides live currency rates through the MT4 platform and a comprehensive IB program for passive income.

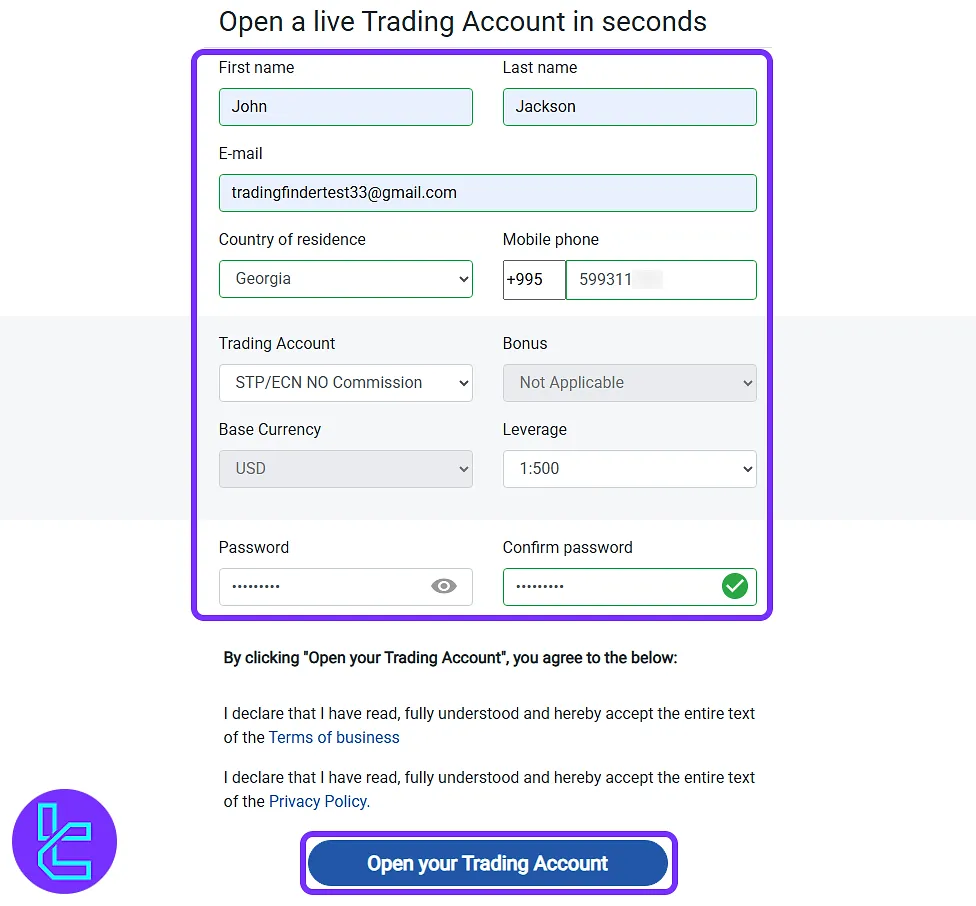

FXlift Account Opening and KYC

This broker enables traders to register and access their live dashboard in just 3 steps. The FXlift registration process requires your personal info, account preferences like ECN or STP, base currency, and desired leverage (up to 1:1000).

No documents are required during sign-up, and users can begin exploring their trading panel instantly.

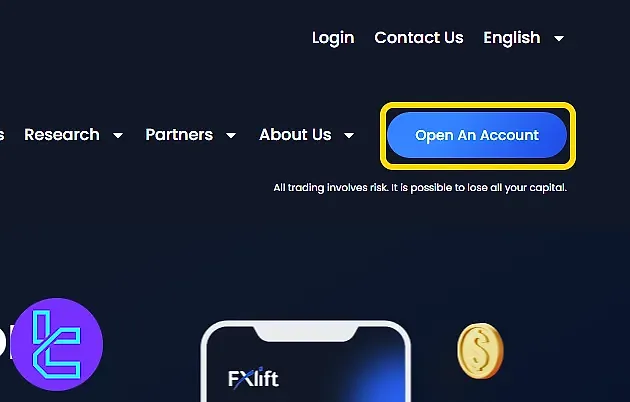

#1 Visit the FXlift Registration Page

Click Open an Account on the FXlift homepage to begin the account setup.

#2 Fill Out the Sign-Up Form

Submit your personal information:

- Name

- Phone number

- Residency

Adjust your trading account's settings, including:

- Account type

- Currency

- Leverage options

- Password

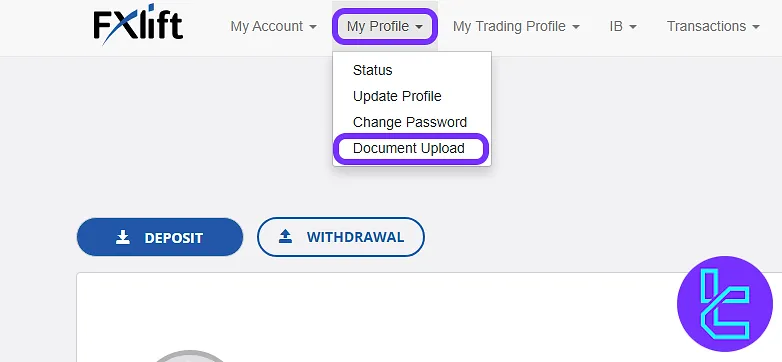

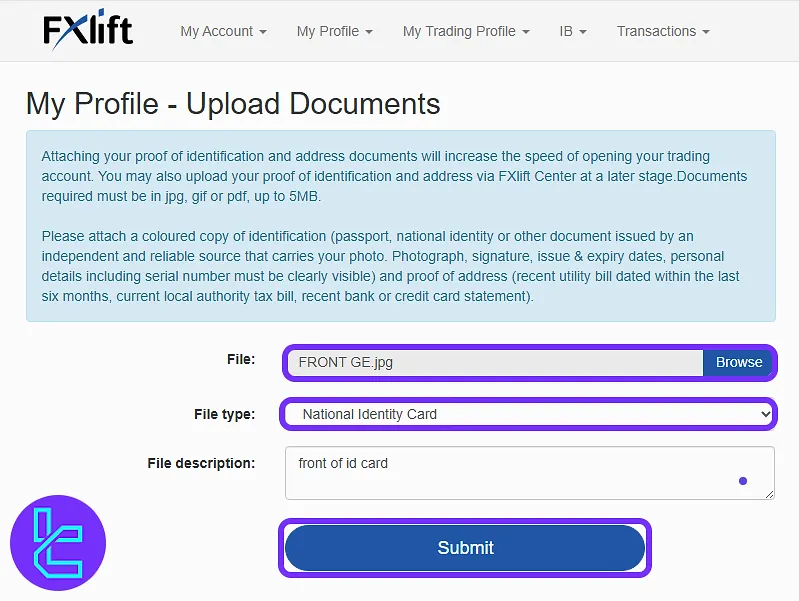

#3 Access the Document Upload Section

Log in to the dashboard, open "My Profile", and select "Document Upload" to start the FXlift verification process.

The beginning phase of FXlift verification

The beginning phase of FXlift verification

#4 Upload POI and POA

Submit proof of identity and proof of address documents based on these choices:

- POI Options: National ID, Passport, Driver’s License (front and back required)

- POA Options: Bank statement, electricity bill, or water bill dated within the last 6 months

Files must be under 5 MB and must clearly display name, photo, and address before submission.

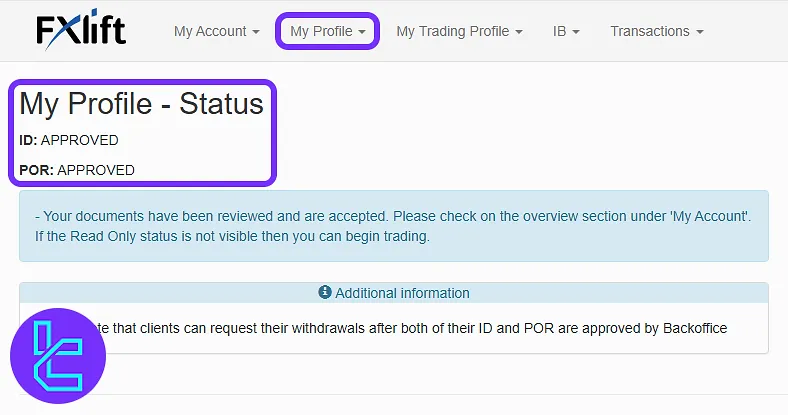

#5 Check Verification Status

Return to "My Profile" and open "Document Upload" to review your progress. When both documents are validated, the status will show "APPROVED".

FXlift Broker Trading Platforms

Supporting the well-known and reliable MetaTrader 4 platform is another upside in this FXlift review. The broker supports mobiles and other devices through this product.

- MT4 Android

- MT4 iOS

- Desktop

- Web-based

Despite its proven reliability, the absence of MT5 or integration with platforms like TradingView may limit appeal for traders seeking modern interfaces or more advanced analytics.

FXlift Fees Explained

The broker charges no commissions on either of its account types and offers competitive spreads from 0.0 pips. The table below provides the average spreads for popular trading pairs:

Trading Pair | Standard Spreads (Pips) | Gold Spreads (Pips) | STP/ECN Spreads (Pips) |

EURUSD | 1.4 | 1 | 0.8 |

EURGBP | 1.3 | 1.1 | 0.9 |

XAGUSD | 0.05 | 0.05 | 0.05 |

XAUUSD | 0.5 | 0.5 | 0.5 |

AUDUSD | 1.6 | 1.2 | 1 |

USDJPY | 1.4 | 1.1 | 0.9 |

USDCAD | 1.5 | 1.3 | 1.1 |

The tighter spreads in higher-tier accounts are especially favorable for USD-based trading pairs. This transparent structure supports traders looking for straightforward cost predictability, especially those engaged in short-term or high-frequency trading strategies.

The broker charges no deposit, withdrawal, or inactivity fees.

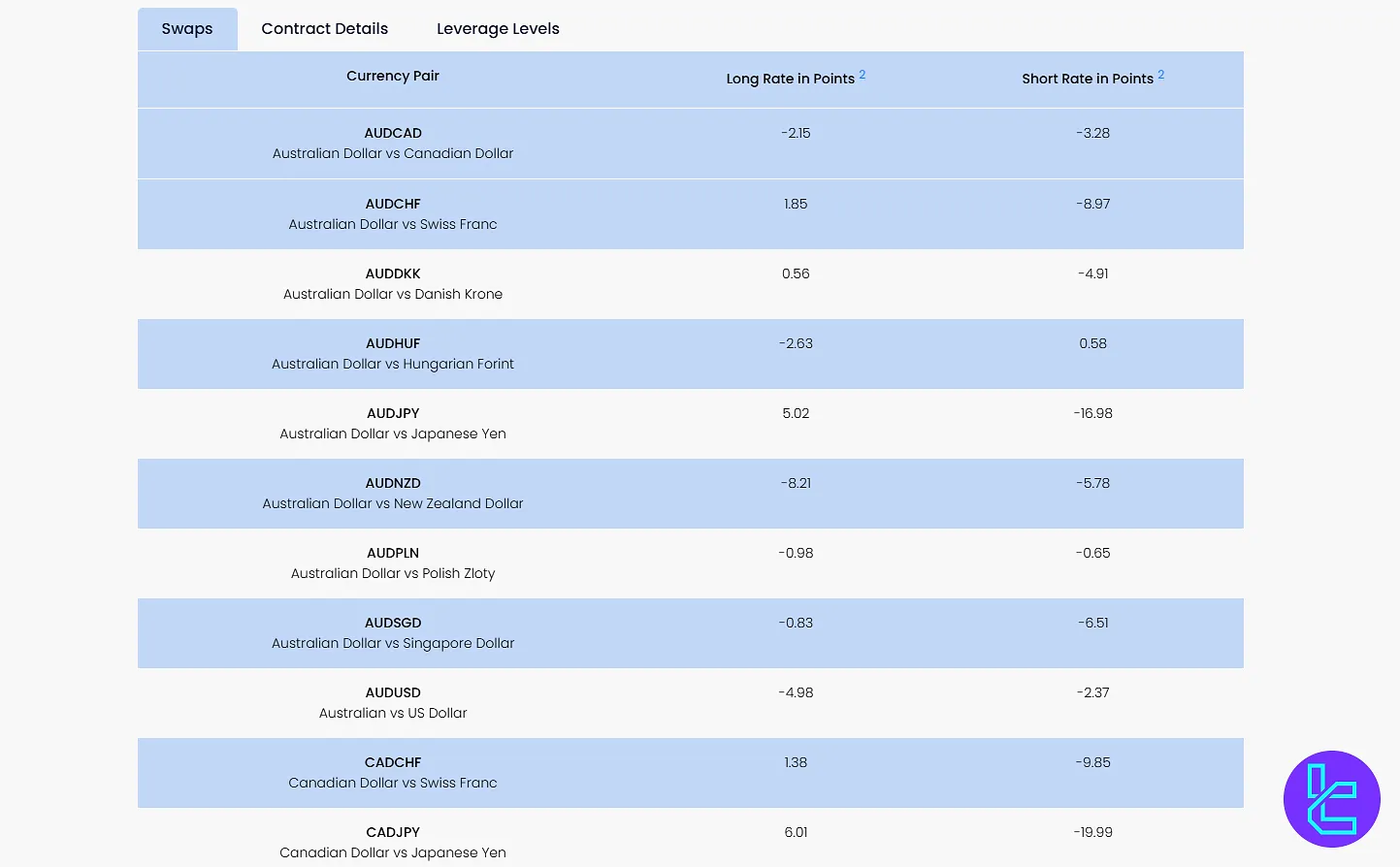

Swap Fees

Swap rates are influenced by the prevailing interest rate environment and the cost of holding a position overnight, and they are automatically converted to the trading account’s base currency.

The calculation is performed daily at 23:59 server time, and execution may require several minutes. STP swap values are derived from liquidity provider quotes with an added markup, which means they fluctuate frequently in line with market conditions.

Swaps are applied once between Friday and Monday, while positions held overnight from Wednesday to Thursday are charged three times. The broker may adjust swap rates for specific clients if suspicious trading behavior is identified.

FXlift Payment Methods

The broker offers commission-free deposits and withdrawals via various methods, including:

- Paysafe

- Bank Transfer

- Credit/Debit Cards

- Neteller

- Skrill

- Bitwallet

- Perfect Money

- Union Pay

- PIX

- Cryptocurrency

You can withdraw the initial deposit only through the method used in the first place for deposit; all profit withdrawals are processed via bank transfers.

Copy Trading and Investment Plans on FXlift

While the broker doesn’t offer a dedicated copy trading service, it features a Personal Multi-Account Manager (PMAM) platform with the following features:

- Real-time monitoring

- One-click order entry

- Unlimited accounts

- Activity reports

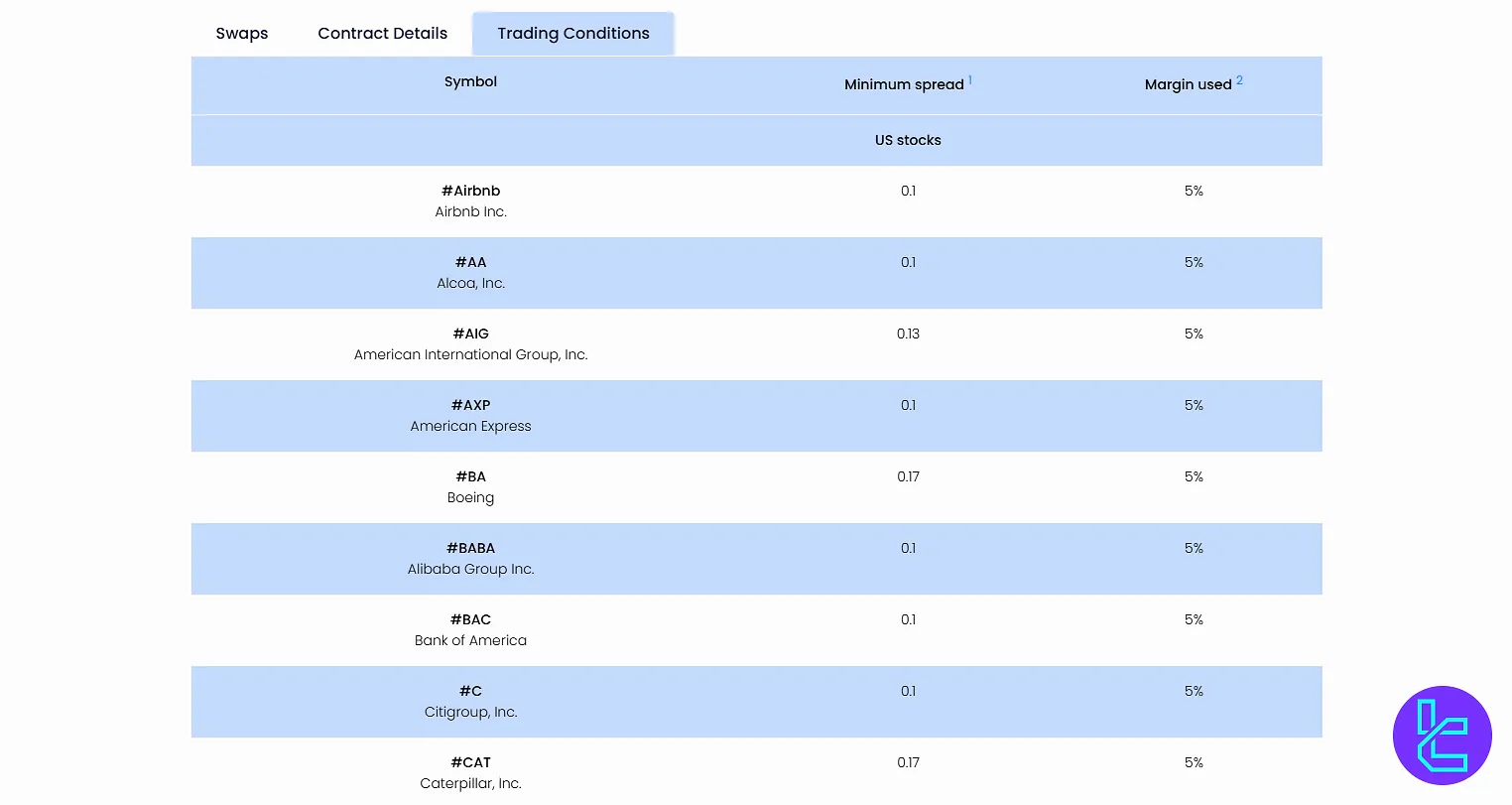

FXlift Broker Trading Products

The company offers 300+ tradable instruments across 6 asset classes, including the Forex market and Futures CFDs. FXlift Markets:

Category | Type of Instruments | Number of Symbols | Competitor Average |

Forex | Major, minor, and exotic currency pairs | Around 50–60 currency pairs | 50–70 currency pairs |

Futures | CFDs on futures contracts (US500, UK100, USDIndex, BRENT) | 4–6 major futures contracts | 5–10 contracts |

Shares | CFDs on global stocks (Amazon, Boeing, Barclays, etc.) | Over 800–1000 global stocks | 800–1200 |

Spot Metals | Gold (XAU) and Silver (XAG) | 2 metals | 2–5 metals |

Spot Indices | CFDs on major global indices (AUS200, HK50, JP225, etc.) | Around 10–15 indices | 10–20 indices |

Spot Commodities | Oil (WTI), natural gas, and agricultural products | 5–8 commodities | 5–10 instruments |

Though crypto CFDs and ETFs are absent, the wide range of traditional asset classes supports diverse trading strategies. Additionally, PAMM/managed account features allow portfolio exposure through professional trading structures.

FXlift Bonus and Promotions

We must mention in this FXlift review that the broker offers deposit bonuses on Standard and Gold accounts.

- 100% Mega Bonus

- 40% Supercharge Bonus

- 20% Welcome Bonus

Note that the bonuses are not available on the STP/ECN No Commission account.

FXlift Support Channels

The broker claims to offer 24/5 customer support through email and a ticket system from Monday to Friday. However, live chat is not offered, which may delay issue resolution.

- Email: support@fxlift.com

- Ticket: Through the client dashboard

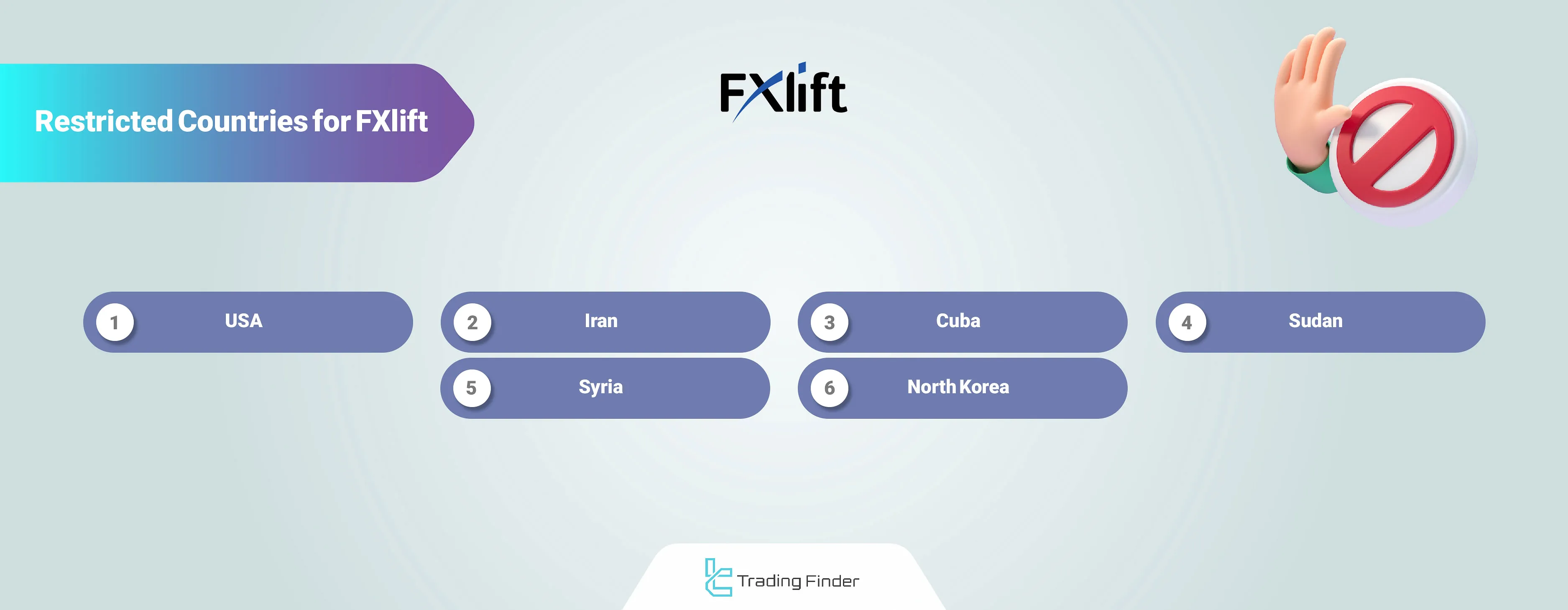

FXlift Broker Geo-Restrictions

While the company strives to serve a global clientele, it doesn’t offer services in certain jurisdictions, including:

- USA

- Iran

- Cuba

- Sudan

- Syria

- North Korea

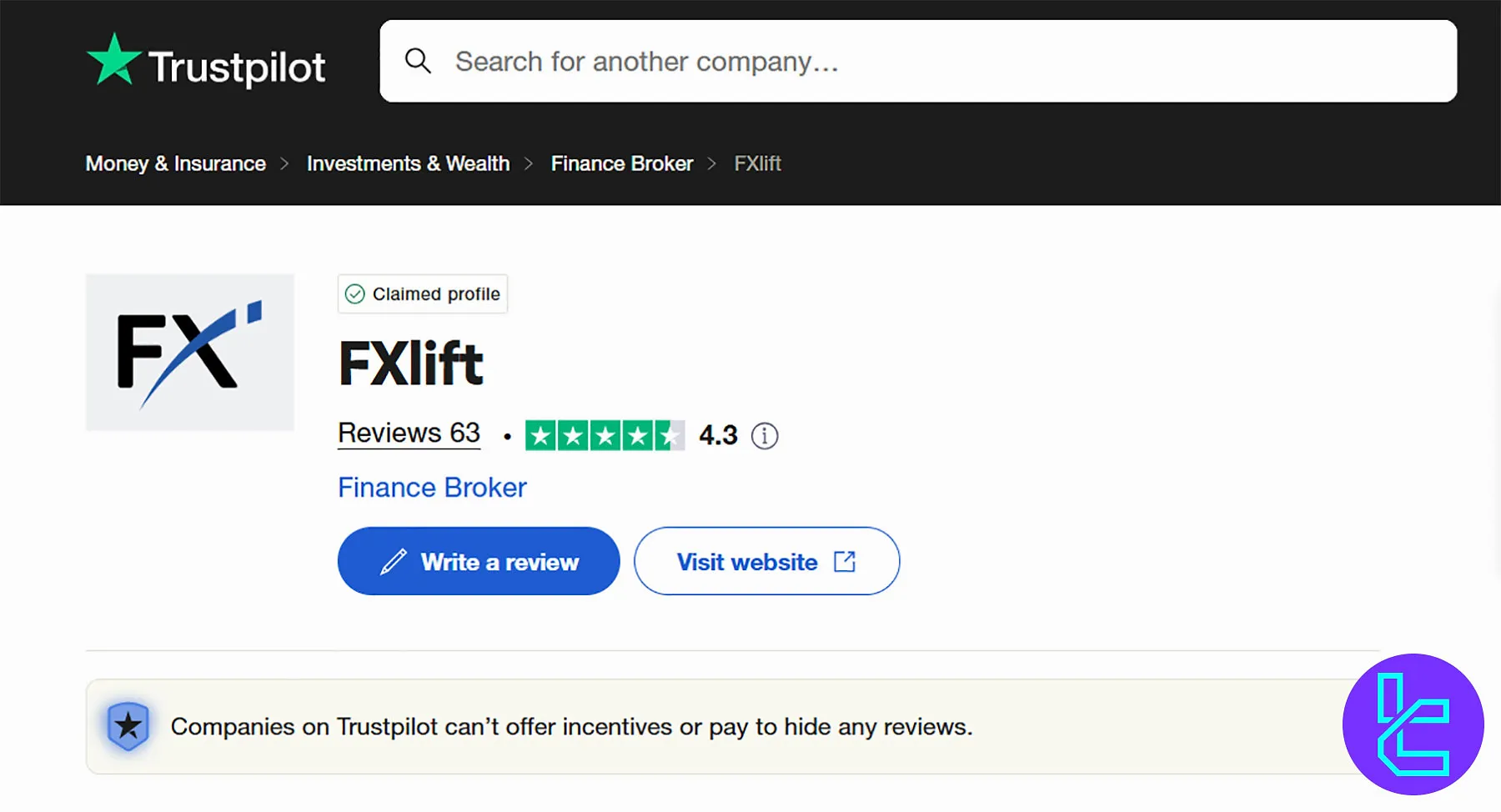

FXlift User Experience

While ForexPeaceArmy claims that the broker is a scam, there are 63 FXlift reviews on Trustpilot, most of which are positive. While 92% of the comments are 4-star and 5-star, only 5% of ratings on the FXlift Trustpilot profile are negative, resulting in an excellent score of 4.3 out of 5.

Educational Resources

While the broker doesn’t offer vast learning materials, its website features an economic calendar and a section for live economic news.

- Economic News: Regular updates on market-moving events

- Economic Calendar: Upcoming economic releases and their potential impact

You can check TradingFinder’s Forex education section for additional learning materials.

FXlift Comparison Table

The table below provides a comprehensive comparison between FXlift and other platforms:

Parameter | FXlift Broker | IC Markets Broker | XM Broker | LiteForex Broker |

Regulation | None | FSA, CySEC, ASIC | ASIC, FSC, DFSA, CySEC | CySEC |

Minimum Spread | From 0.0 Pips | From 0.0 Pips | From 0.6 Pips | From 0.0 Pips |

Commission | $0.0 | From $3 | $0 (except on Shares account) | From $0.0 |

Minimum Deposit | $200 | $200 | $5 | $50 |

Maximum Leverage | 1:1000 | 1:500 | 1:1000 | 1:30 |

Trading Platforms | MetaTrader 4 | Metatrader 4, Metatrader 5, cTrader, cTrader Web, IC Markets Mobile | MT4, MT5, Mobile App | MetaTrader 4, MetaTrader 5, Mobile Proprietary App |

Account Types | Standard, Gold, STP/ECN No Commission | Standard, Raw Spread, Islamic | Micro, Standard, Ultra Low, Shares | Classic, ECN, Demo |

Islamic Account | Yes | Yes | Yes | No |

Number of Tradable Assets | 300+ | 2,250+ | 1400+ | N/A |

Trade Execution | Market | Market | Market, Instant | Market |

Conclusion and Final Words

FXlift provides access to 6 asset classes, including Forex and Commodities. The broker supports Neteller, Skrill, and Crypto payments with no commissions. It has a score of 4.3 out of 5 on Trustpilot. The company doesn’t accept US clients.