Garanti BBVA offers access to Forex, Futures, Options, and Equities markets. The minimum deposit for Forex trading is TRY 50,000.

The broker supports various data terminals, including Matriks and Ideal.

Garanti BBVA; An Introduction to the Company and Its Regulatory Status

Garanti BBVA (formerly known as Garanti Bank) is Turkey's second-largest private bank, owned (86%) by the Spanish bank Banco Bilbao Vizcaya Argentaria (BBVA).

The bank provides brokerage services through Garanti BBVA Securities.

Garanti BBVA Securities was titled the "Best Investment Bank" for five consecutive years from2007 to 2011. Key features of the broker:

- Minimum Deposit: TRY 50,000

- Maximum Leverage: Up to 1:10

- Chairman: Süleyman Sözen

- CEO: Recep Baştuğ

The Forex broker operates under the regulatory oversight of the Capital Markets Board of Turkey (CMB), ensuring compliance with national and international financial regulations.

Garanti BBVA has been publicly listed on the Borsa Istanbul since 1990, offering a high level of corporate accountability.

As a licensed member of the BIST stock exchange, Garanti BBVA submits quarterly and annual reports, and it holds client funds in segregated accounts to safeguard traders' capital.

The table below summarizes the company's details:

Entity Parameters/Branches | Garanti Yatırım Menkul Kıymetler A.Ş. |

Regulation | CMB |

Regulation Tier | 2 |

Country | Turkey |

Investor Protection Fund / Compensation Scheme | Investor Compensation Center |

Segregated Funds | Yes |

Negative Balance Protection | Not Specified |

Maximum Leverage | 1:10 |

Client Eligibility | Global |

Garanti BBVA Table of Key Features

Here’s a detailed list of the broker’s key features:

Broker | Garanti BBVA |

Account Types | Real, Demo |

Regulating Authorities | CMB |

Based Currencies | TRY |

Minimum Deposit | TRY 50,000 |

Deposit Methods | Bank Transfers, Western Union, FAST Money Transfers, Credit/Debit Cards |

Withdrawal Methods | Bank Transfers, Western Union, FAST Money Transfers, Credit/Debit Cards |

Minimum Order | 0.01 lots |

Maximum Leverage | 1:10 |

Investment Options | Real Shares, Asset Management |

Trading Platforms & Apps | Garanti BBVA Mobile, I-Trader, eTrader, FX Trader |

Markets | Equities, VIOP, Stock, Futures, Warrants, Forex |

Spread | Variable based on the instrument |

Commission | Variable based on the instrument |

Orders Execution | Market |

Margin Call / Stop Out | N/A |

Trading Features | Mobile Trading, Real Shares |

Affiliate Program | N/A |

Bonus & Promotions | No |

Islamic Account | Yes |

PAMM Account | No |

Customer Support Ways | Call Center, Physical Branches, Technical Remote Support, Ticket |

Customer Support Hours | 09:15 / 23:15 (GMT+3) |

Garanti BBVA Broker Account Types

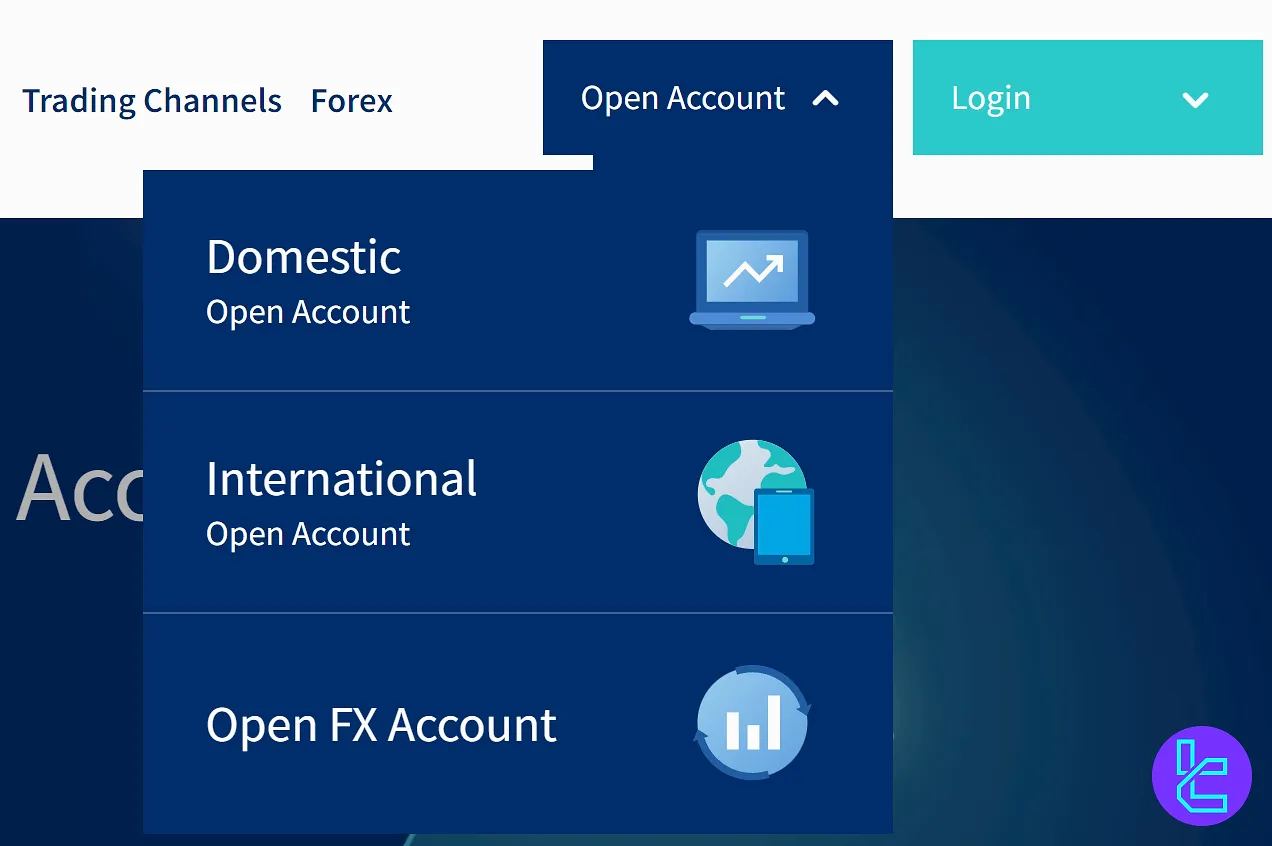

Garanti BBVA Securities offers three account types: Domestic (Istanbul Borsa), International (Stocks and Equities), and FX. Here’s a brief look into Garanti BBVA FX account features:

- Minimum Initial Margin: TRY 50,000

- Requirement: Demo trading for at least 6 days and executing 50 trades

- Forex pairs

Garanti BBVA Benefits and Drawbacks

Garanti BBVA Securities has received multiple awards, including "Best Investment Bank" in 2011 by the Global Finance and World Finance Banking Awards and the "Best Investment Bank" award from Euromoney in 2012.

However, to have a balanced view, we must weigh the broker’s advantages against its disadvantages.

Pros | Cons |

Reduced fees for high-volume traders | Limited FX assets |

Strong regulatory framework | Complex product offerings |

Multiple physical branches in Turkey | Demo trading requirement before getting a real account |

Real share trading | No live chat feature |

Garanti BBVA Account Opening and KYC

In this Garanti BBVA review, we must mention that you must be over 18 and trade for a minimum of 6 days on a demo account to open a real account with the broker.

#1 Visit the Broker's Website

Visit the Garanti BBVA official website, then look for the "Open account" button. Afterwards, choose your account type.

#2 Fill Out the Form

Fill out the demo account registration form with the details required by the brokerage.

#3 Pass the Demo Trading Phase

For signing up with this broker, you must execute a minimum of 50 trades in at least 6 consecutive days of trading to become eligible for a Real account.

#4 Verify Your Identity

Provide identity documentation, including a driving license and identity card, and upload the residency proof (utility bill or bank statement) to pass the KYC and get access to all features and services with no limitations.

Garanti BBVA Broker Trading Platforms

The company offers four trading platforms for various devices, including mobile and PC.

- Garanti BBVA eTrader Android (for Equities)

- Garanti BBVA eTrader iOS (for Equities)

- Garanti FX Trader Android

- Garanti FX Trader iOS

- Garanti BBVA Mobile Android

- Garanti BBVA Mobile iOS

- Garanti BBVA I-Trader (Web-based for equities)

Trading Costs

The broker offers two commission models for domestic stocks: fixed and volume-based. The commissions vary based on the trading market:

- Volume-based commission for domestic stock: from 0.199% to 0.09%

- Fixed commission for domestic stock: 0.1950%

- Annual equity account maintenance fee: TRY 500

- Futures (VIOP): 0.084%

- Data monitoring packages: from TRY 0 to TRY 950

- International stock: 0.3%

- International markets standard commission: $6.8 per lot

Swap Rates

Investors who trade international stocks should note the carrying cost on open positions. This expense is calculated as:

Non-Trading Fees

Equity accounts on Borsa Istanbul (BIST) are subject to a periodic account maintenance fee of 250 TL every six months, totaling 500 TL annually.

This charge is deducted from stock sales settlement amounts. Exemptions may apply depending on trading activity within the preceding year, and approved accounts can remain exempt for the following two billing cycles.

Beyond account upkeep, investors also face costs related to data monitoring services on platforms such as Garanti BBVA e-Trader. Pricing varies by package:

- Equity Level 1+ access is 450 TL, while deeper market insights such as Level 2 and Level 2+ data are priced at 720 TL and 950 TL respectively;

- Broker ID data for equities or futures is available from 250 TL (end-of-day) up to 400 TL (real-time);

- Specialized VIOP (Futures & Options) data feeds mirror these tiers, ranging from 450 TL to 950 TL;

- Additional analytics, like settlement distribution reports, cost 120 TL.

Garanti BBVA Broker Payment Options

Garanti BBVA offers various payment options for depositing and withdrawing funds, including:

- Bank Transfers

- Western Union

- FAST Money Transfers

- Credit/Debit Cards

Garanti BBVA Investment Plans and Copy Trading?

The broker provides access to real stocks for investing and not just CFDs! It also features various investment funds and asset management services.

- Investment Funds: Various funds catering to different investor profiles and goals

- Stocks: Easy access to stock trading through Garanti BBVA Mobile and Internet Banking

Garanti BBVA Broker Trading Markets

Garanti BBVA Securities provides access to various assets, from the Forex market to Futures trading and Options.

The table below consists of the available instruments:

Category | Type of Instruments | Number of Symbols | Competitor Average |

Forex | FX trading via Garanti BBVA FX Trader platform | Over 40 currency pairs | 50–70 currency pairs |

Stocks | Domestic and international stocks listed on Borsa İstanbul (BIST) and major global exchanges | Around 2000+ listed shares | 800–1200 |

Indices | CFDs or structured products on global indices | Around 10–15 indices | 10–20 indices |

Commodities | Trading in precious metals (gold, silver) and energy products (oil, gas) | Around 10 instruments | 10–20 instruments |

Derivatives | Futures and options trading on the Turkish Derivatives Exchange (VIOP) | Over 100 derivative contracts | 80–120 |

Garanti BBVA Promotional Offerings

While the broker itself doesn’t offer promotional programs, its mother company provides various promotions, including:

- Interest-free loan up to TRY 75,000

- Up to TRY 15,000 for those who receive retirement pensions from the bank

- Seasonal rewards

Garanti BBVA Support Channels

The broker has founded 30 branches throughout Turkey. It provides support from 9:15 to 23:15 (GMT+3) through various channels, including:

- Phone: 4440630

- Ticket: Through the “Contact Us” page

- Technical Remote Support: TeamViewer

Garanti BBVA Restricted Countries

The company abides by the Financial Action Task Force (FATF) and doesn’t offer services in countries sanctioned by the authority, including:

- Iran

- North Korea

- Myanmar

- Algeria

- Angola

- Bulgaria

- Cameroon

- Croatia

- Haiti

- Kenya

- Laos

- Lebanon

- Mali

- Monaco

- Nepal

- Nigeria

- South Sudan

- Syria

- Venezuela

- Yemen

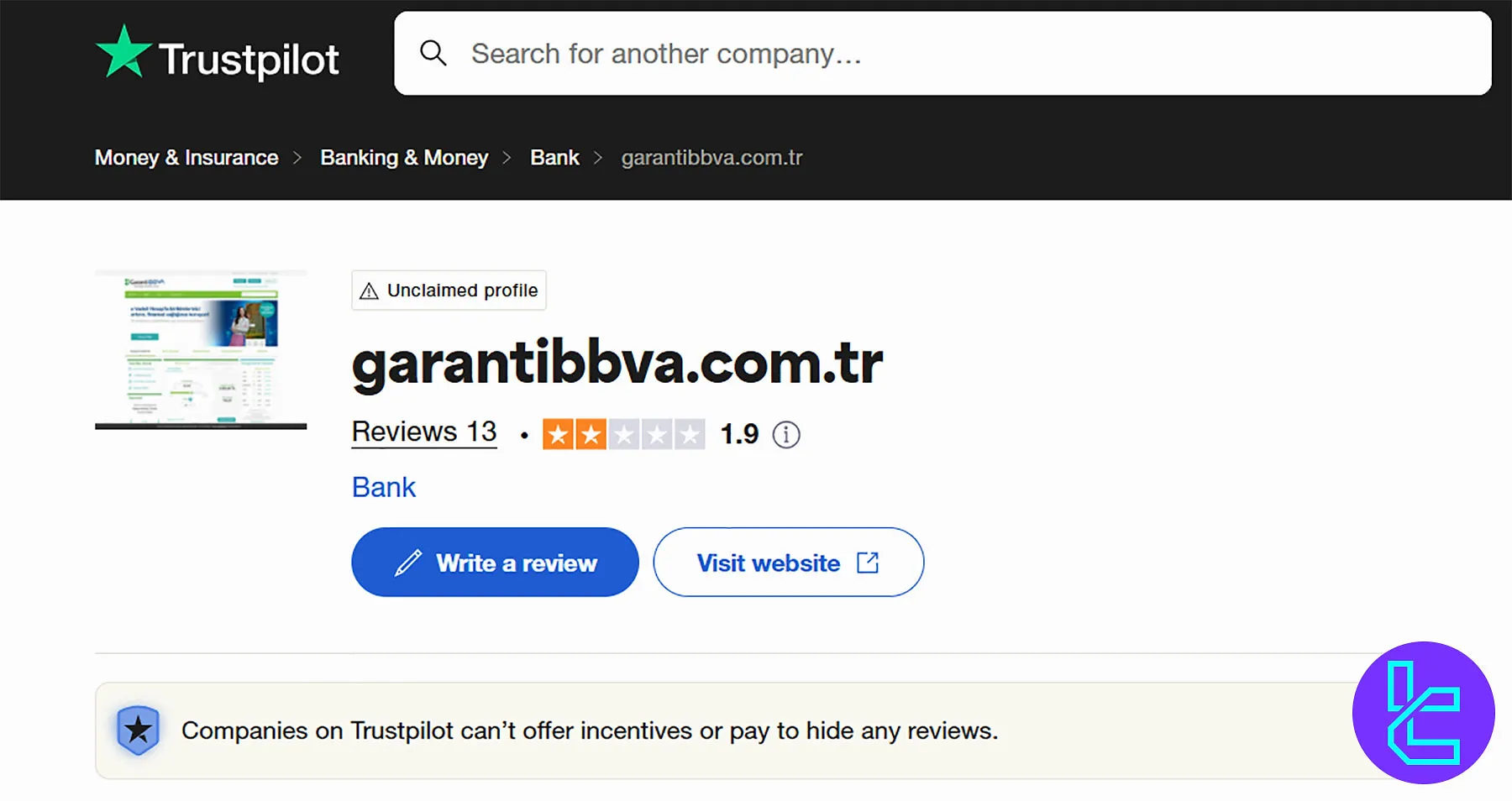

Client Satisfaction

Garanti BBVA reviews on platforms like Trustpilot paint a mixed picture. There are 13 comments; 92% are negative (1-star and 2-star), and only 8% are positive (4-star).

The Garanti BBVA Trustpilot profile has a poor score of 1.9 out of 5.

Educational Resources

The Garanti BBVA website features a research section offering various resources and reports, including:

- Daily Bulletin: Weekly agenda and daily market reports

- Company and Sector Reports: Financial analysis, company reports, strategy reports, and model portfolio updates

- Macro Economic Reports

Compare Garanti BBVA with Other Brokers

Here's a table outlining the key differences between Garanti BBVA and some of its competitors:

Parameter | Garanti BBVA Broker | |||

Regulation | CMB | None | FCA, FSCA, CySEC, SCB | Cent, Zero, Pro, Premium |

Minimum Spread | Varies | 0.1 Pips | 0.0 Pips | 0.0 Pips |

Commission | Varies | None | From Zero | From Zero |

Minimum Deposit | 50,000 TRY | $10 | $100 | From $0 |

Maximum Leverage | 1:10 | 1:3000 | 1:500 | 1:2000 |

Trading Platforms | Garanti BBVA Mobile, I-Trader, eTrader, FX Trader | MT4, MT5 | MT4, MT5, cTrader, Web Trader, Mobile App | MT4, MT5, Mobile App |

Account Types | Real, Demo | Standard, Premium, VIP, CIP | Standard, Pro, Raw+, Elite | Cent, Zero, Pro, Premium |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | N/A | 50+ | 270+ | 1,000+ |

| Trade Execution | Market | Market, Instant | Market, Instant | Market, Buy Stop, Stop Loss, Limit, Take Profit |

Conclusion and Final Words

Garanti BBVA Securities provides real FX accounts with a requirement of 6 days demo trading and executing 50 demo trades.

It supports Western Union and FAST Money Transfers payment methods. The company has a low score of 1.9/5 on Trustpilot.