GCM Forex provides online trading services on Options, Futures, Turkish/International Stocks, and CFDs.

Authorized by the Capital Markets Board, GCM Forex broker has won multiple awards, including the "Best Investment Company 2019” by the International Business Magazine Awards.

GCM Forex; Company and Regulation [Capital Markets Board]

GCM Yatırım Menkul Değerler A.Ş., a prominent financial intermediary in Turkey, was established in 2012.

The company has been licensed by the Turkey Capital Markets Board (CMB) as a “WIDELY AUTHORIZED INTERMEDIARY FIRM” with license No. G-039 (398) since 2016.

Entity Parameters / Branches | GCM Investment Securities Inc. |

Regulation | CMB (SPK) |

Regulation Tier | 2 |

Country | Turkey |

Investor Protection Fund | Yes (TL 160,000) |

Segregated Funds | Yes |

Negative Balance Protection | Yes |

Maximum Leverage | 1:10 |

Client Eligibility | Turkey |

Client funds are held in segregated accounts with Tier-2 banks, enhancing security and ensuring that operational and customer balances remain separate.

In addition, the broker requires full identity verification (KYC) before withdrawals are processed, reinforcing its commitment to regulatory compliance.

Key features of GCM Investment Securities Inc:

- Leverage options of up to 1:10

- Phone trading

- No-commission Forex trading

- Flexibility in trading strategies like Scalping and Hedging

GCM Forex Specifications

GCM Yatırım offers a range of features and benefits, making it an attractive option for traders of all levels. Here's a table summarizing the key specifications of the Forex broker:

Broker | GCM Forex |

Account Types | Forex, Options, Futures, Stock |

Regulating Authorities | CMB |

Based Currencies | US, EUR, TRY |

Minimum Deposit | 50,000 TL |

Deposit Methods | Wire Transfer, EFT |

Withdrawal Methods | Wire Transfer |

Minimum Order | 0.01 lots |

Maximum Leverage | 1:10 |

Investment Options | Investment Model Portfolios |

Trading Platforms & Apps | MT4, MT5, GCM Traders, GCM Stock Exchange Traders, Matrix Trader, Option Traders |

Markets | Forex, CFDs, Options, Stocks, Futures |

Spread | Variable based on the account type |

Commission | No commission for Forex pairs |

Orders Execution | Market |

Margin Call / Stop Out | Margin Call 50% |

Trading Features | Stock Investment, Turkish Stocks, Affiliate |

Affiliate Program | Yes |

Bonus & Promotions | Partnership |

Islamic Account | Yes |

PAMM Account | Yes |

Customer Support Ways | Call Back Request, Email, Mail, Tel, Fax, Live Chat |

Customer Support Hours | 24/5 |

GCM Forex Account Types

GCM Forex broker offers four main account types for various contracts, such as CFDs, Options, and Futures, to cater to various trading preferences.

Forex

GCMForex Forex accounts provide traders with access to a wide range of trading instruments under competitive conditions. They allow trading with flexibility and low entry requirements.

Key features:

- Access to over 170 investment instruments

- No commissions

- Leverage options of up to 1:10

- Two types of Conditions: ECN and Standard

- Minimum deposit requirement of 50,000 TL

- Collateral margin requirements equal to Net Position

Options

GCMForex option accounts enable traders to use leverage and benefit from 24/5 market opportunities. They offer multiple asset classes for diversified strategies.

Key features:

- Option contracts with leverage

- 24/5 trading advantages

- Currency, commodity, equity, and index options

- GCM Trader platform

Futures

GCMForex futures accounts give traders flexible leverage and hedging possibilities. They can also practice using demo accounts without financial risk.

Key features:

- Free demo account with 100,000 TL in virtual money

- Hedging positions with flexible leverage

- MetaTrader 5 support

Stock

GCMForex stock accounts provide access to the Istanbul Stock Exchange and model investment portfolios. Traders can invest in Turkish market indexes.

Key features:

- Access to Istanbul Stock Exchange (BIST)

- Investment Model Portfolios

- Turkish market indexes

GCM Forex Broker Pros and Cons

Like any broker, GCM Forex has its strengths and weaknesses.

Here's a balanced overview of the pros and cons of trading with the Turkish broker.

Advantages | Disadvantages |

Various markets and instruments | Lack of licensing from tier-1 regulatory bodies |

Comprehensive educational resources | Limited deposit and withdrawal options |

Research and analysis center | Higher spreads compared to some competitors |

Advanced trading platforms | No TradingView support |

GCM Forex Sign Up and KYC Verification

The sign-up process for GCM Forex is designed to be straightforward while adhering to regulatory requirements.

You need to open a free trial account first in order to be able to open a live account.

#1 Go to the Company's Website

Visit the broker’s official website by searching the brand or entering the URL in a browser's address bar. Find and click on "Open New Account” on the home page.

#2 Complete the Form

Choose your preferred market from these options:

- Forex Market

- Options (Opsiyon)

- Futures (Viop)

- Stocks (Borsa)

Then, fill out the sign-up form. Afterwards, click on “Open Live Account” in your client area and complete another form with the required data.

#3 Finalization and Verification

For the final stage of account opening and verification, provide these documents:

- Signed account opening agreement

- Photocopy of the ID card

- Residence permit

GCM Forex Platforms and Apps

We must discuss the trading platforms in this GCM Forex review. The company offers various trading solutions for each of its markets.

MetaTrader 4 (MT4)

Exclusive to Forex trading and available on various devices, including:

- Desktop

- MT4 Android

- MT4 iOS

TradingFinder has developed a complete list of advanced MT4 indicators that you can use for free.

GCM Trader

Usable for trading Forex and Options with the broker, available on mobile devices, including:

This platform offers smooth and reliable access to Forex and options trading, giving users full control over their trades anytime, anywhere.

GCM Stock Trader

Exclusive to trading Turkish and international stocks with GCM Forex, available in the following versions:

It provides an intuitive environment for investing in Turkish and global stocks with real-time prices and advanced order features.

Matrix Trader

Matrix Mobile IQ and Matrix Data Terminal for catching up to the latest news and trading stocks:

- Web Terminal

- Matrix Trader Android

- Matrix Trader iOS

This solution delivers powerful tools and live market updates, helping traders stay informed and execute stock trades efficiently.

GCM MT5

Available for Options and Futures trading, accessible across various operating systems, including:

- Desktop

- WebTrader

- GCM MT5 Android

- GCM MT5 iOS

You can find various advanced and free MT5 indicators on TradingFinder.com.

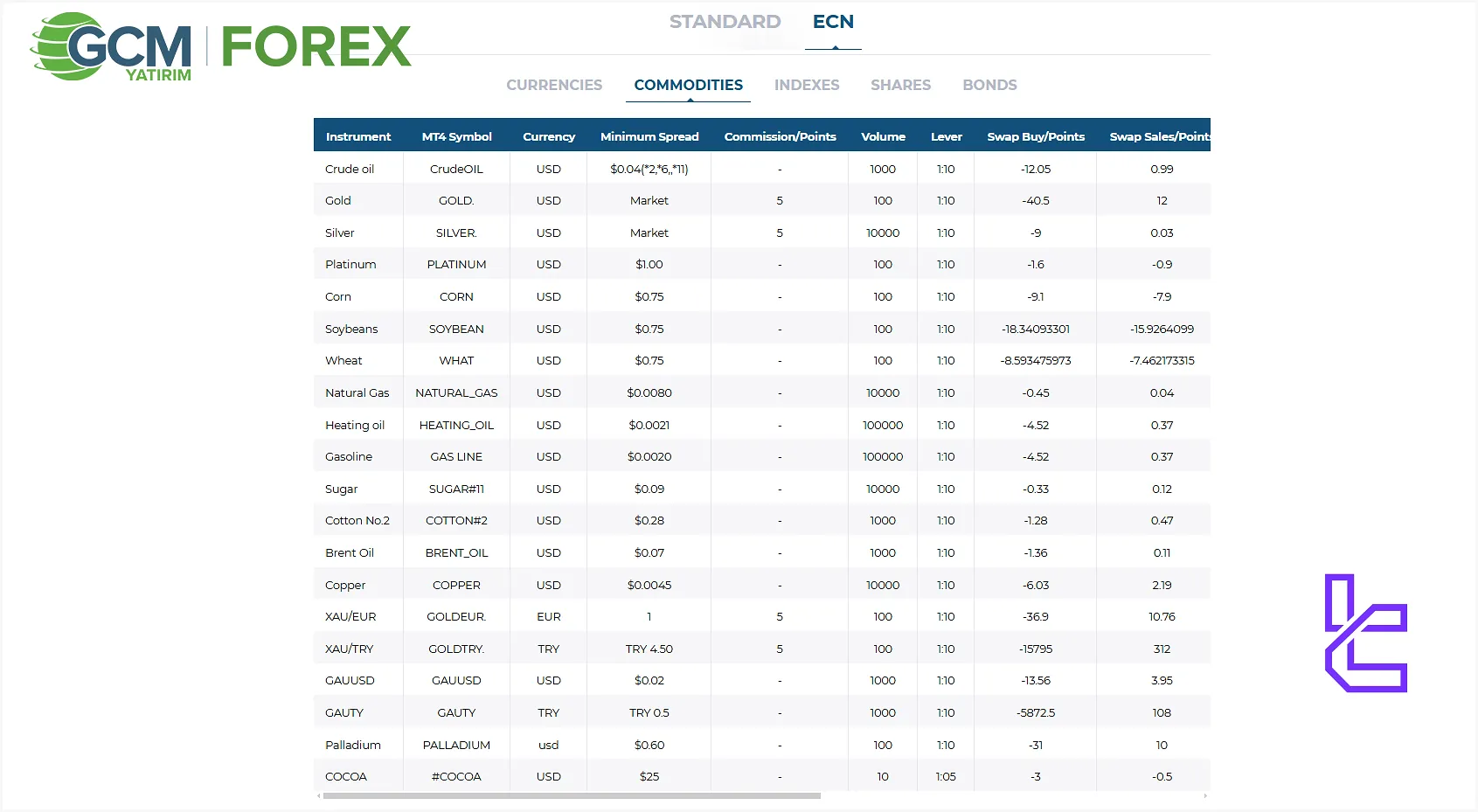

GCM Forex Fees Explained

Forex trading on GCM Yatırım comes with no commissions, and the only charges are spreads and swaps.

However, the company doesn’t provide any specific details about trading commissions on other instruments.

The company offers two spread types for Forex trading, including Standard and ECN.

While Standard spreads are variable, we’ve gathered some of the ECN spreads for Forex in the table below.

Instrument | ECN Spreads (Pips) |

EURUSD | 1.7 |

USDCHF | 1.6 |

USDTRY | 2 |

GBPUSD | 1.6 |

EURTRY | 2 |

USDJPY | 1.6 |

GBPTRY | 2 |

In terms of non-trading costs, GCM Forex does not charge inactivity or deposit fees. However, withdrawal fees may apply, ranging from 0% to 0.5% depending on the method used.

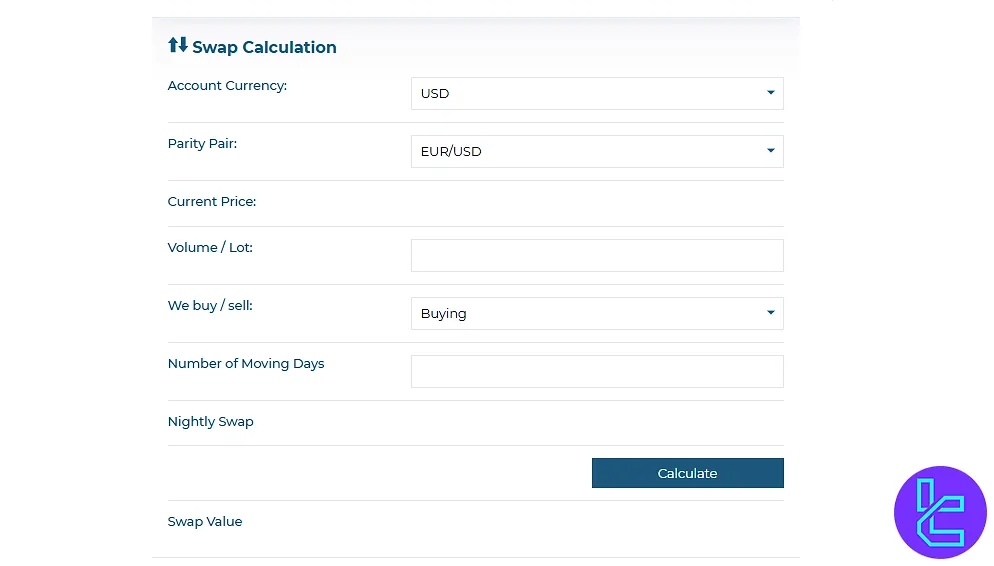

Swap Fee at GCM Forex

GCM Yatırım applies swap rates for positions held overnight, which can be either positive or negative.

These rates are influenced by market conditions and the interest rate differential between the currencies involved.

Here are the key details:

- Swap rates are subject to change and may vary daily based on market conditions;

- No swap charges on weekends; positions held over the weekend are not subject to swap fees;

- GCM Yatırım reserves the right to change swap rates at its discretion, depending on market conditions;

- An Islamic / islamic account option is available.

Non-Trading Fees at GCM Forex

GCM Forex applies specific non-trading fees that traders must consider to manage overall costs efficiently. These fees are detailed in the broker’s official policies and depend on account activity and currency.

Here are the key details and rules related to these fees:

Key Points:

- Dormant Account Fee: Accounts with no leveraged trading or open positions for three months incur a monthly fee;

- Fee Amounts: 350 TL for Turkish Lira accounts, 10 USD for US Dollar accounts, and 10 EUR for Euro accounts;

- Withdrawal Fees: Bank transfer withdrawals may be subject to fees, depending on the bank's policies.

GCM Forex Payment Methods

This topic of GCM Forex review is dedicated to deposits and withdrawals.

The broker only supports two models of bank payments, including:

- Electronic Funds Transfer (EFT)

- Bank Wires

Note that EFT is only acceptable from banks that GCM has agreements with, such as Akbank, Finansbank, Halk Bank, and Kuveyt Türk.

Deposit Methods at GCM Forex

GCM Forex provides secure, bank-based deposit solutions tailored for local and international clients. Deposits can be made in Turkish Lira (TRY), US Dollar (USD), or Euro (EUR) through domestic bank transfers or EFT systems.

The broker does not charge deposit fees, and transactions are typically processed on the same business day.

Below is a summary of the official deposit methods and their key details:

Deposit Method | Currency | Minimum Amount | Deposit Fee | Funding Time |

Bank Transfer (Havale) | TL, USD, EUR | TL 50,000 or equivalent | None | Same day |

EFT (Electronic Funds Transfer) | TL, USD, EUR | TL 50,000 or equivalent | None | Same business day |

Withdrawal Methods at GCM Forex

GCM Forex offers the same secure methods for withdrawals as for deposits, ensuring a smooth and transparent process for clients.

Funds can be withdrawn in Turkish Lira (TRY), US Dollars (USD), or Euros (EUR) through direct bank transfers or electronic funds transfer (EFT).

The broker does not charge withdrawal fees, though clients may be responsible for any charges applied by their bank.

Below is a summary of the available withdrawal methods:

Withdrawal Method | Currency | Minimum Amount | Withdrawal Fee | Funding Time |

Bank Transfer (Havale) | TRY, USD, EUR | TL 1, USD 1, EUR 1 | None | Same business day |

EFT (Electronic Funds Transfer) | TRY, USD, EUR | TL 1, USD 1, EUR 1 | None | Same business day |

GCM Forex Copy Trading and Investment Plans

While the company doesn’t provide direct copy trading features, its research department has prepared seven Model Portfolios with thorough analytical data that traders can use to make informed investment decisions, including:

- ŞİŞE CAM

- AKBANK

- THYAO

- TUPRS

- TURKCELL

- TÜRKİYE SİGORTA

- BUCIM

GCM Forex Financial Markets

GCM Forex provides access to a wide range of financial markets, from Forex and CFDs to Futures and Options.

The complete information is presented in the table below:

Category | Type of Instruments | Number of Symbols | Competitor Average* | Max. Leverage |

Currency pairs (major & minor) | 51 pairs | ~60 – 150 pairs | 1:10 | |

Commodities | Gold, silver, crude oil, and other CFDs | 20 commodities | ~30 – 50 commodities | 1:10 |

Indices | Major global indices (via CFDs) | 14 indices | ~15 – 30 indices | 1:10 |

Stocks (CFDs) | International and Turkish equities | 320+ stocks | ~300 – 500 stocks | 1:10 |

Bonds & Bills | Fixed-income instruments (CFDs) | 3 instruments | ~5 – 10 bonds | 1:10 |

V İ OP / Futures & Options | Borsa İstanbul derivatives (futures & options on equities, indices, commodities) | Various (≈ 50 contracts) | varies significantly | N/A |

GCM Forex stands out for its balanced selection of over 500 instruments, giving traders exposure to both global and Turkish markets.

GCM Forex Broker Promotions

The company doesn’t offer any traditional promotions like deposit bonuses or welcome gifts.

However, it has a comprehensive partnership program with various types, including:

- Up to $20 commission for each referred client

- Introducing Broker (IB)

- PAMM accounts for strategy providers to manage their client funds

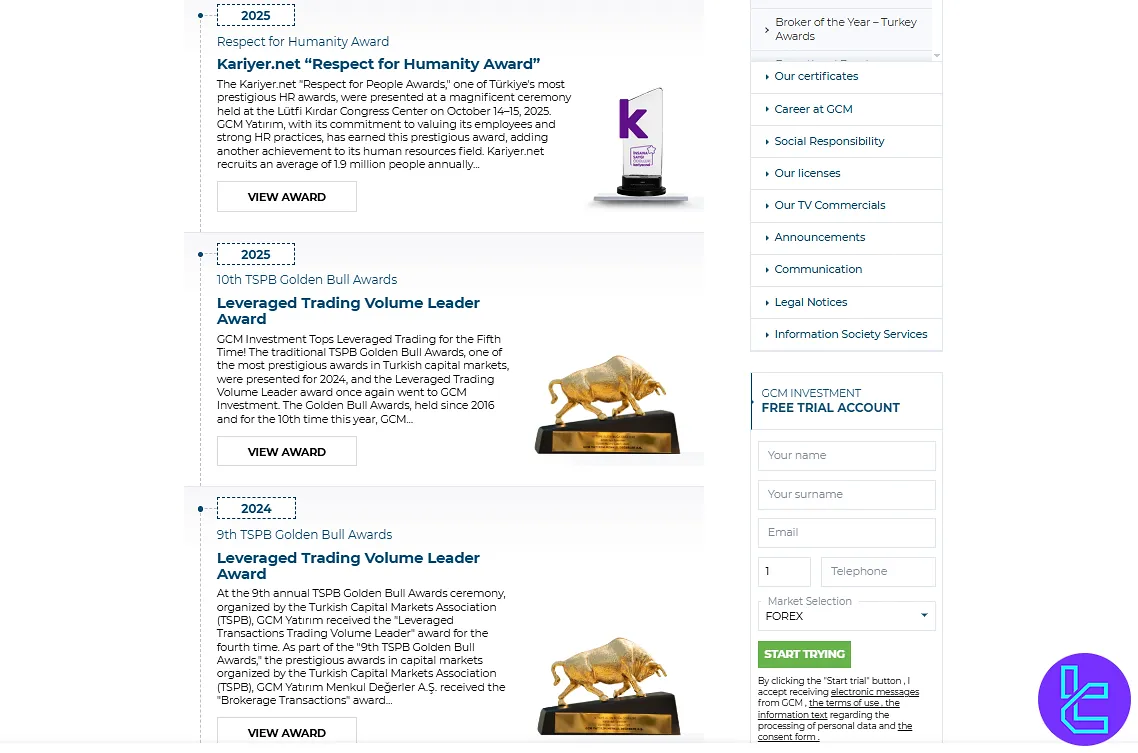

GCM Forex Awards

GCM Forex has earned multiple prestigious awards that highlight its commitment to quality, reliability, and innovation in the financial services industry.

GCM forex awards demonstrate its leadership in providing secure trading platforms, diverse financial instruments, and superior client support.

Here are some of the key awards and recognitions:

- Respect for Humanity Award 2025

- Leveraged Trading Volume Leader Award 2025

- Leveraged Trading Volume Leader Award 2024

- Most Trusted FX Broker (World Finance Awards) 2023

- Broker of the Year Turkey 2023

- Best Investment Broker Turkey 2022

- Best Investment Institution 2019

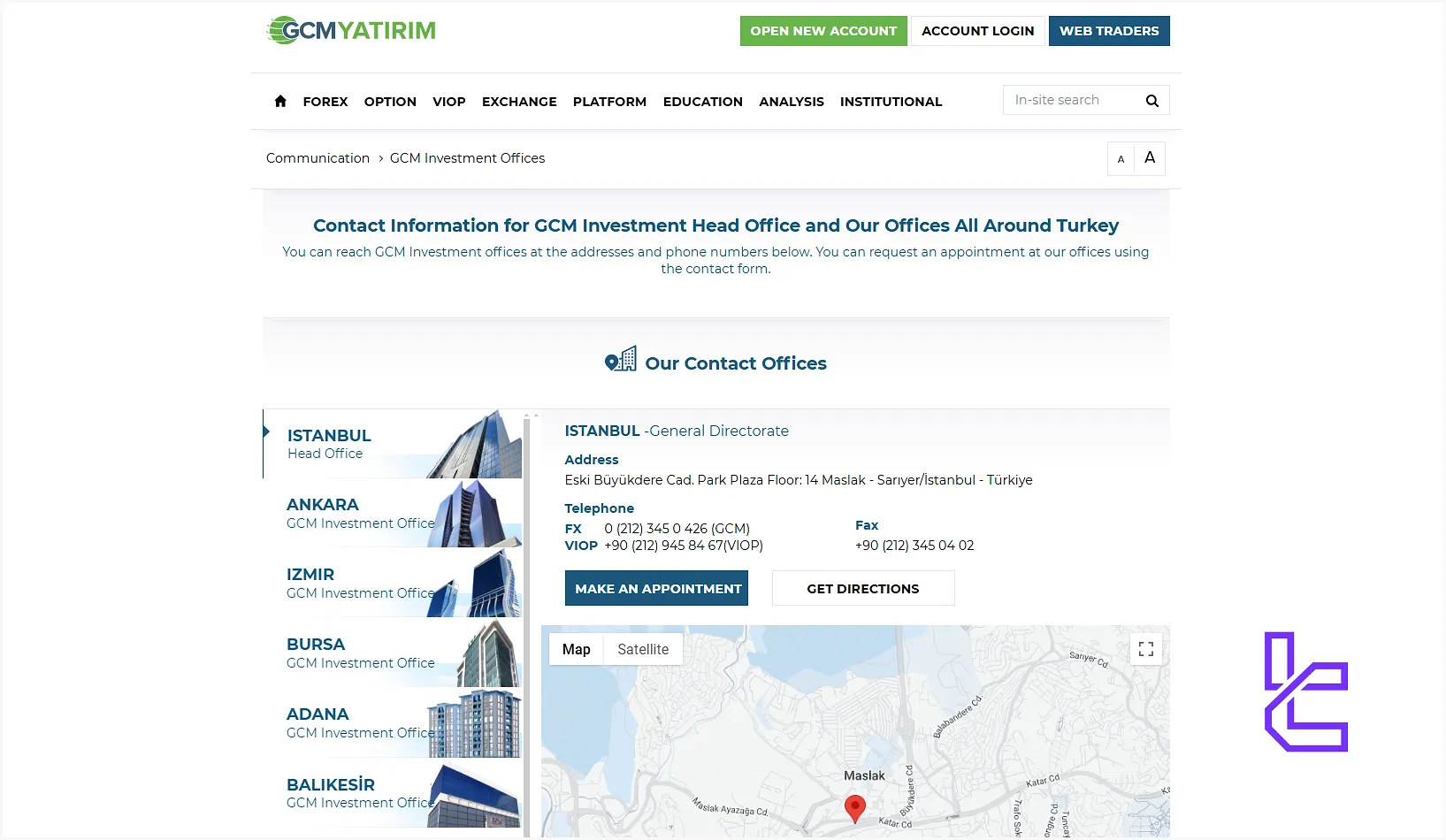

GCM Forex Customer Support

GCM Yatırım offers 24/5 support through various channels, including:

bilgi@gcmyatirim.com.tr | |

Tel | Forex 0 (212) 345 0 426 Futures +90 (212) 945 84 67 |

Fax | +90 (212) 345 04 02 |

Eski Büyükdere Street, Park Plaza, Floor 14, Maslak, Sarıyer/Istanbul, Turkey | |

Live Chat | Available on the “Our Contact Offices” page |

Call Back Request | Submit a request via the “Contact Form” |

GCM Forex Geo-Restrictions

While the broker doesn’t restrict certain areas, it indicates that use of the trading services is conditional to the client’s country's local laws. Users can only trade with GCM Forex if their country doesn’t prohibit such activities.

GCM Forex User Satisfaction

Trust score is one of the most important topics in this GCM Forex review. There are not many reviews online regarding the Turkish broker.

Reputable review websites like TrustPilot and Forex Peace Army haven’t listed the GCM Yatırım.

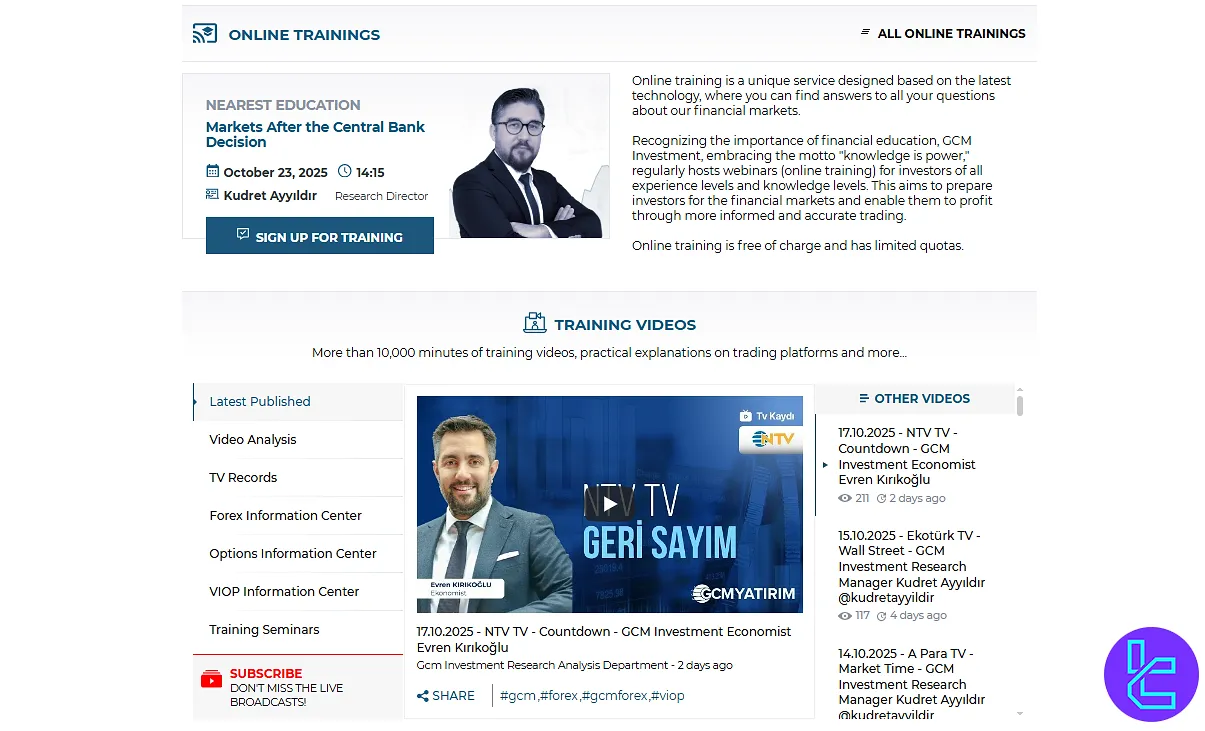

GCM Forex Educational Materials

GCM Forex broker takes trader’s education seriously and offers a wide range of educational resources, including:

- Training Videos: Tutorials on the trading platforms;

- Educational Activities: Seminars, live broadcasts, and their recordings;

- Documents: Articles on Forex, Futures, Options, Stocks, Technical Analysis, and Fundamental Analysis.

These materials are designed to help both beginner and advanced traders improve their market knowledge, develop strategies, and make informed trading decisions.

Comparison of GCM Forex With Other Forex Brokers

In this part of the review, the reviewed brokerage is compared to some of its best competitors:

Parameter | GCM Forex Broker | |||

Regulation | CMB | None | FCA, FSCA, CySEC, SCB | Cent, Zero, Pro, Premium |

Minimum Spread | Varies | 0.1 Pips | 0.0 Pips | 0.0 Pips |

Commission | No commission for Forex pairs | None | From Zero | From Zero |

Minimum Deposit | 50,000 TRY | $10 | $100 | From $0 |

Maximum Leverage | 1:10 | 1:3000 | 1:500 | 1:2000 |

Trading Platforms | MT4, MT5, GCM Traders, GCM Stock Exchange Traders, Matrix Trader, Option Traders | MT4, MT5 | MT4, MT5, cTrader, Web Trader, Mobile App | MT4, MT5, Mobile App |

Account Types | Forex, Options, Futures, Stock | Standard, Premium, VIP, CIP | Standard, Pro, Raw+, Elite | Cent, Zero, Pro, Premium |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | 370+ | 50+ | 270+ | 1,000+ |

| Trade Execution | Market | Market, Instant | Market, Instant | Market, Buy Stop, Stop Loss, Limit, Take Profit |

Conclusion and Final Words

GCM Forex provides trading services on 5 asset classes, from CFDs to Options, through 5 different platforms, including MT4, MT5, GCM Trader, GCM Stock Trader, and Matrix Trader.

GCM Forex broker offers Forex trading with no commissions and two types of spreads: ECN and Standard. There are not many GCM Forex reviews online, so we can’t really talk about user satisfaction.

However, considering the wide range of educational resources and investment plans with comprehensive data analytics (e.g., Model Portfolios), registering on GCM Yatırım could be a good choice for Turkish Stock market investors.