GMI Markets is a Forex and CFD broker with over 1 million traders in 30 countries. This broker is registered and regulated in Mauritius Financial Services Commission (FSC).

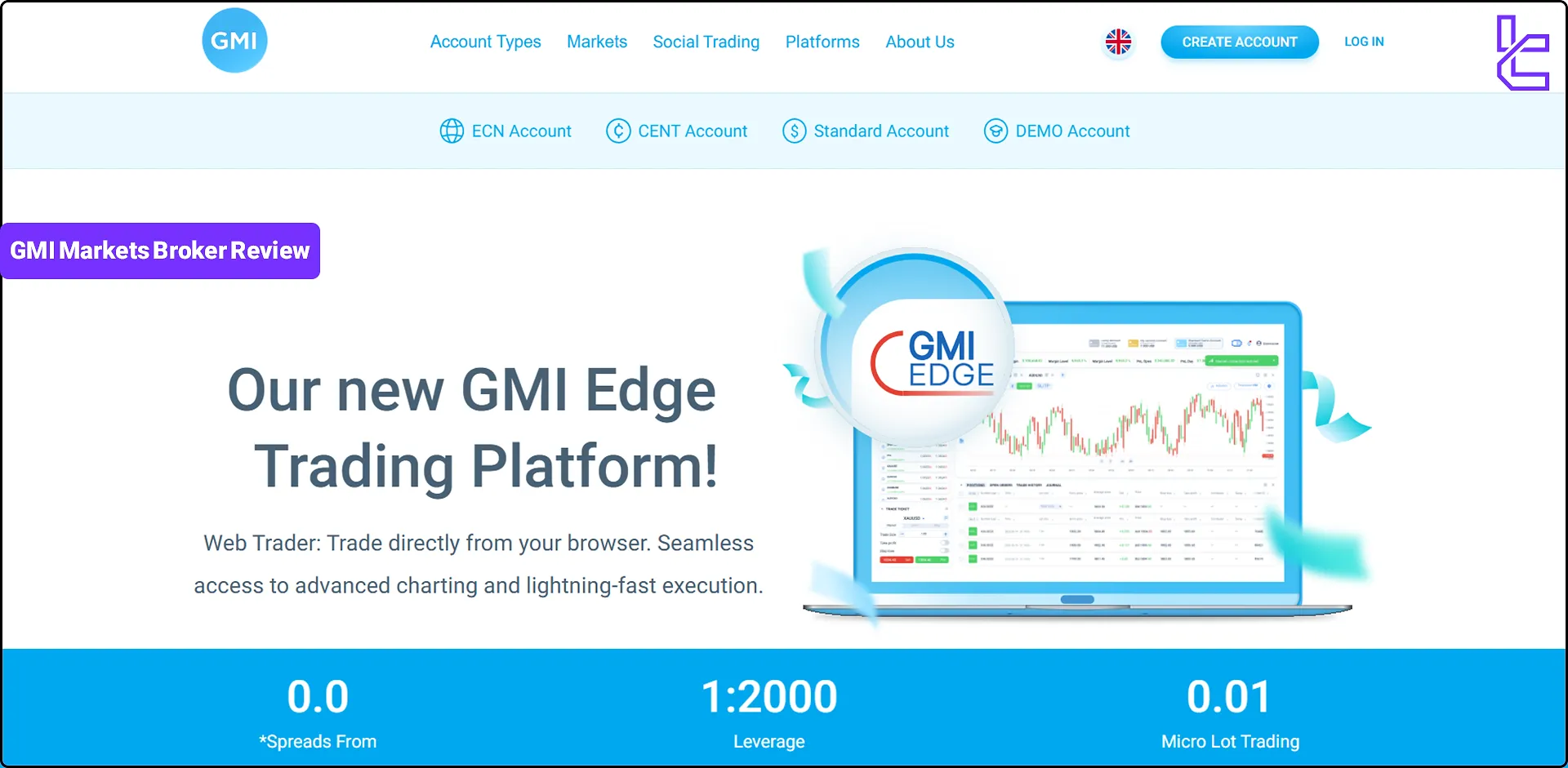

This broker provides 3 trading platforms, including MetaTrader 4, MetaTrader 5, and GMI Edge, for trades to buy and sell over 70 instruments in 3 different markets.

Company Information & Regulation GMI Markets

GMI Markets, formerly known as GMI, has been a player in the forex market and CFD brokerage space for over 14 years. The company has multiple branches registered in different parts of the world.

GMI Markets is regulated by the Financial Services Commission (FSC) in these regions, which provides a level of oversight and ensures compliance with relevant financial regulations. However, it's worth noting that these jurisdictions are not considered top-tier regulatory environments.

The table below is a summary of the broker's company details:

Entity Parameters/Branches | Global Market Index Limited |

Regulation | FSC |

Regulation Tier | 3 |

Country | Mauritius |

Investor Protection Fund / Compensation Scheme | N/A |

Segregated Funds | No |

Negative Balance Protection | Yes |

Maximum Leverage | 1:2000 |

Client Eligibility | Global |

GMI Markets Broker Specifications

Let's check what GMI Markets has to offer and if its offerings are at the level of top Forex brokers:

Broker | GMI Markets |

Account Types | Standard, Standard bonus, Cent, ECN |

Regulating Authorities | FSC |

Based Currencies | USD |

Minimum Deposit | $15 |

Deposit Methods | Bank transfer, Skrill, Neteller, Fasapay, UnionPay, Dragonpay, USDT |

Withdrawal Methods | Bank transfer, Skrill, Neteller, Fasapay, UnionPay, Dragonpay, USDT |

Minimum Order | 0.01 Lot |

Maximum Leverage | 1:2000 |

Investment Options | EAs, MAM, Social trading |

Trading Platforms & Apps | MT4, MT5, GMI Edge |

Markets | Forex, indices, commodities |

Spread | Floating from 0.0 pips |

Commission | From $4 |

Orders Execution | Market |

Margin Call/Stop Out | 60%/30% |

Trading Features | Demo account |

Affiliate Program | Yes |

Bonus & Promotions | 30% Welcome bonus |

Islamic Account | Yes |

PAMM Account | No |

Customer Support Ways | Email, live chat |

Customer Support Hours | 24/5 |

Restricted Countries | Iran, Syria, North Korea, USA, Canada and more |

Markets Broker Account Types Overview

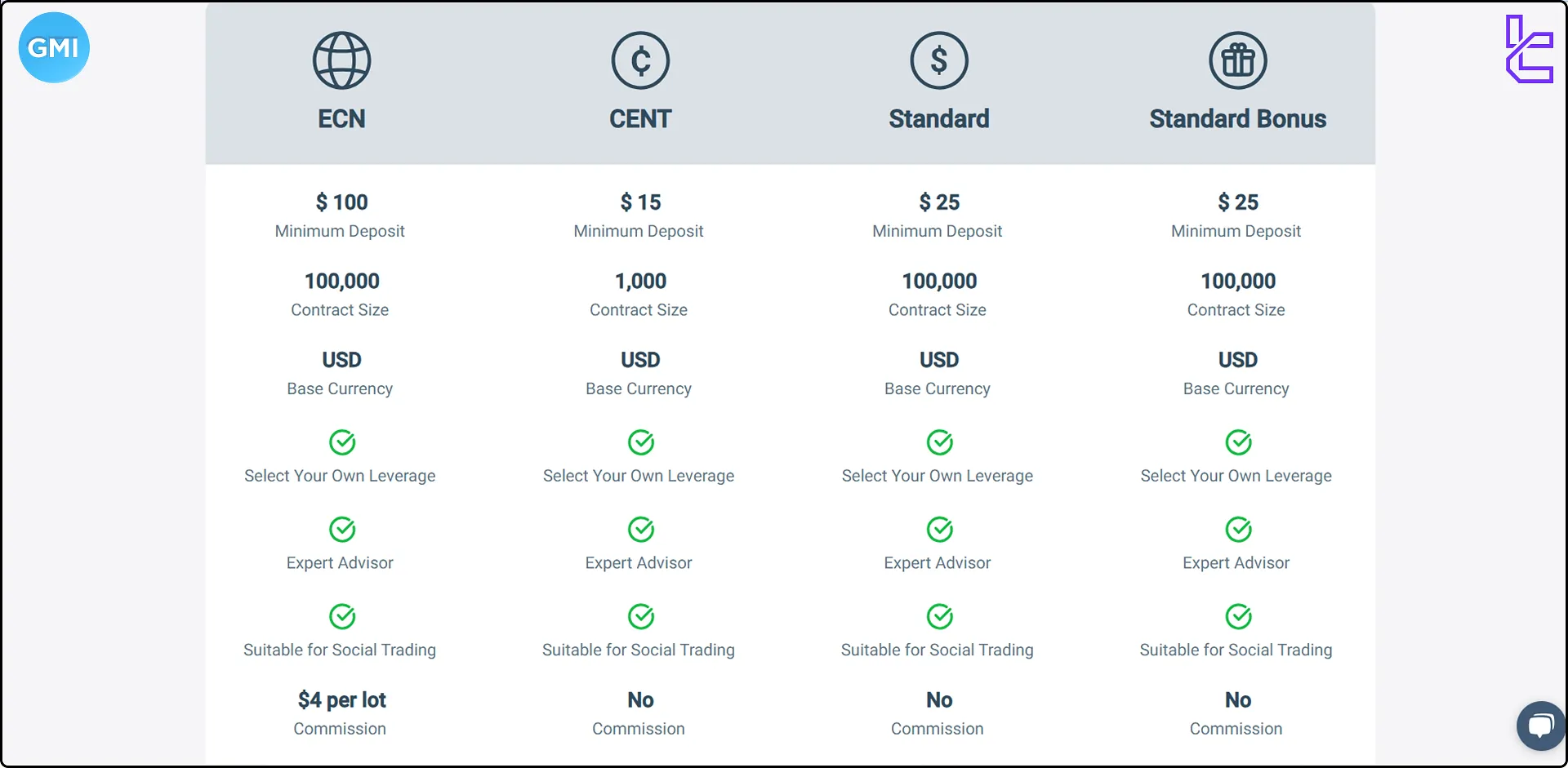

Let’s give you an overview of the account types and their features in our GMI Markets review:

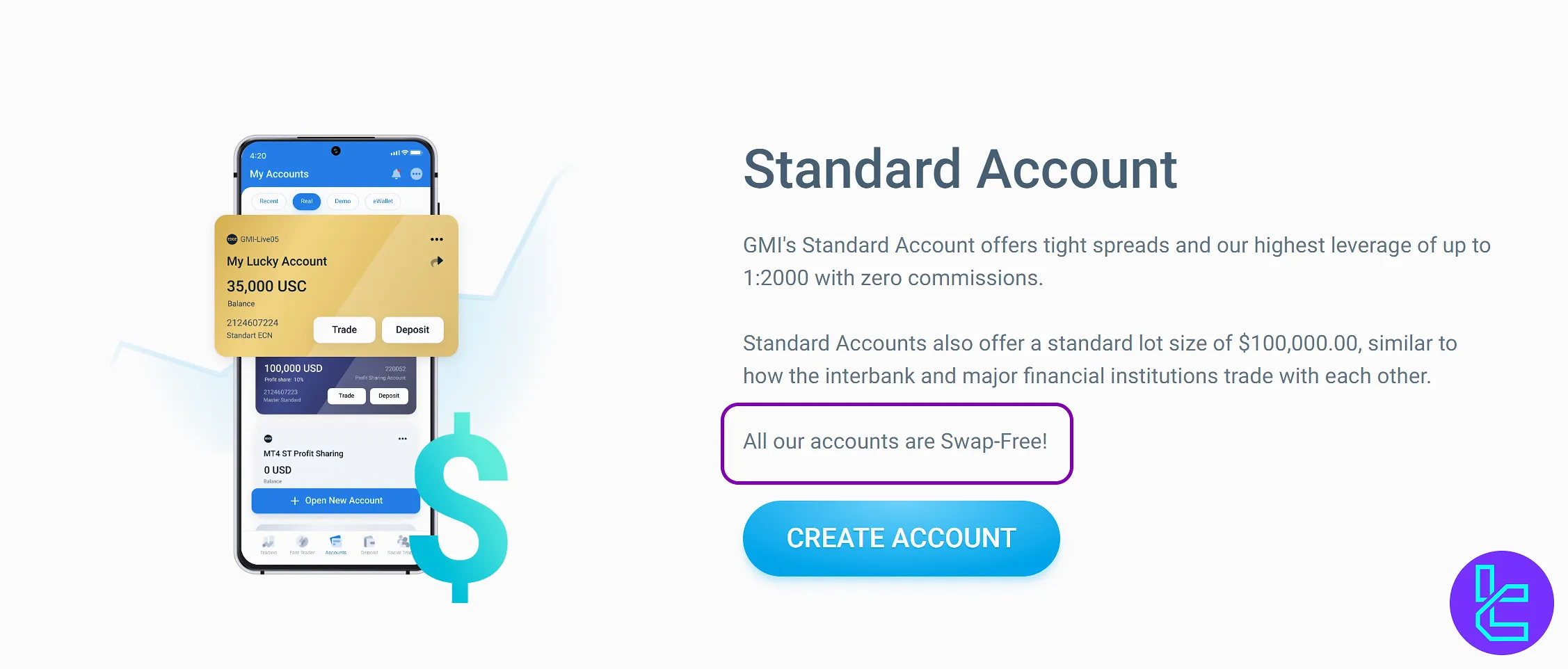

Account types | Standard | Standard Bonus | ECN | Cent |

Minimum deposit | 25$ | 25$ | 100$ | $15 |

Base Currency | USD | USD | USD | USD |

1:2000 | 1:2000 | 1:500 | 1:100 | |

Commission | $4 per lot | No commission | No commission | No commission |

Instruments | Forex, commodities, indices | Forex, commodities, indices | Forex, commodities, indices | Forex, commodities, indices |

It’s worth mentioning that all account types have a swap-free option enabled by default for Muslim traders who shouldn’t pay interest based on Sharia law.

GMI Markets has a demo account for beginner trader who want to learn Forex trading without risking capital.

GMI Markets Pros and Cons

Let's weigh the pros and cons of trading with GMI Markets:

Advantages | Disadvantages |

Up to 1:2000 leverage | No top-tier regulation |

Multiple account types | Limited assets and instruments compared to other brokers |

Social trading and MAM accounts | Negative user reviews |

30% welcome bonus | - |

GMI Markets Account Opening and Verification Guide

GMI Markets registration is relatively straightforward and takes just a few minutes.

#1 Begin on the Official Website

Navigate to the official GMI Markets website and initiate your registration by selecting the "Create Account" option. This directs you to the secure account creation form.

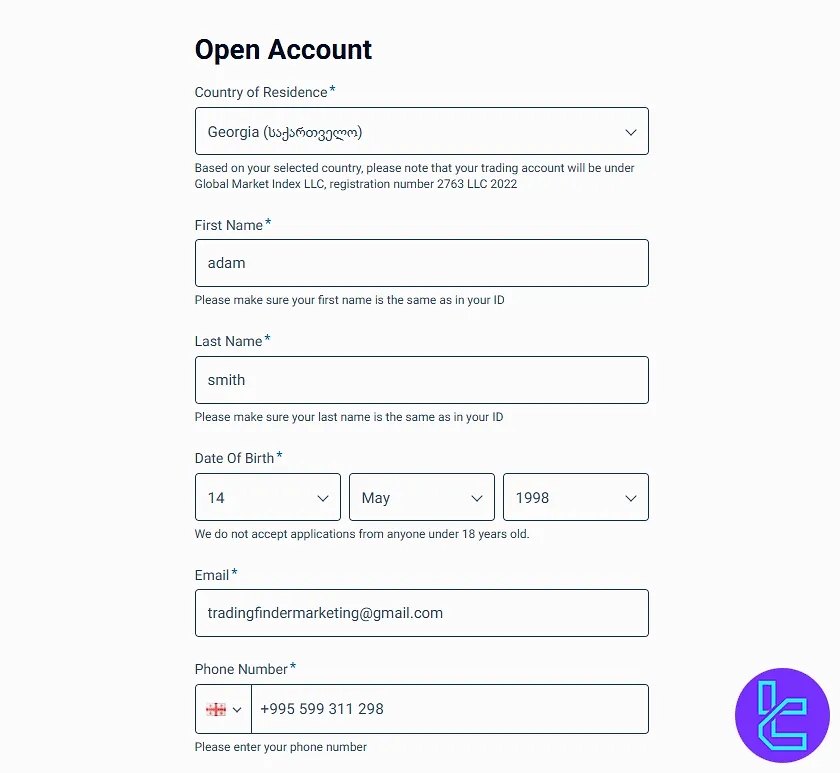

#2 Fill in Personal Details and Set a Password

Provide essential information, including:

- Country of residence

- Full name

- Date of birth

- Email address

- Phone number

Afterwards, choose a password withat least 8 characters. After agreeing to the terms, click "Continue" to activate your account.

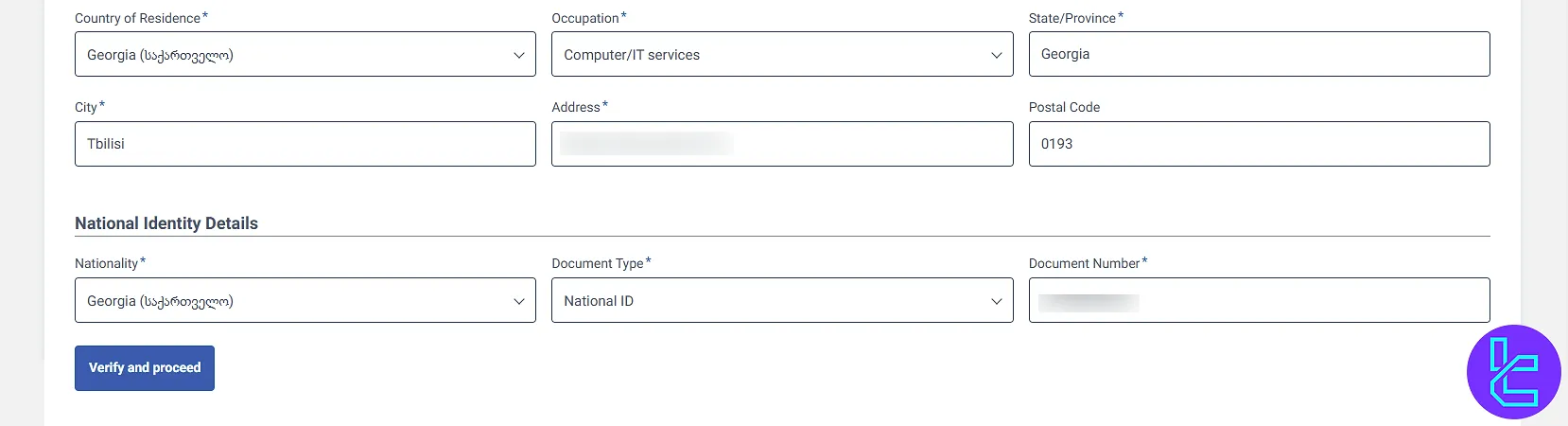

#3 Complete Personal Details for Verification

For GMI Markets verification, log in to your GMI Markets profile and enter your the required details such as address and nationality.

Select your preferred language, country of residence, and occupation before proceeding.

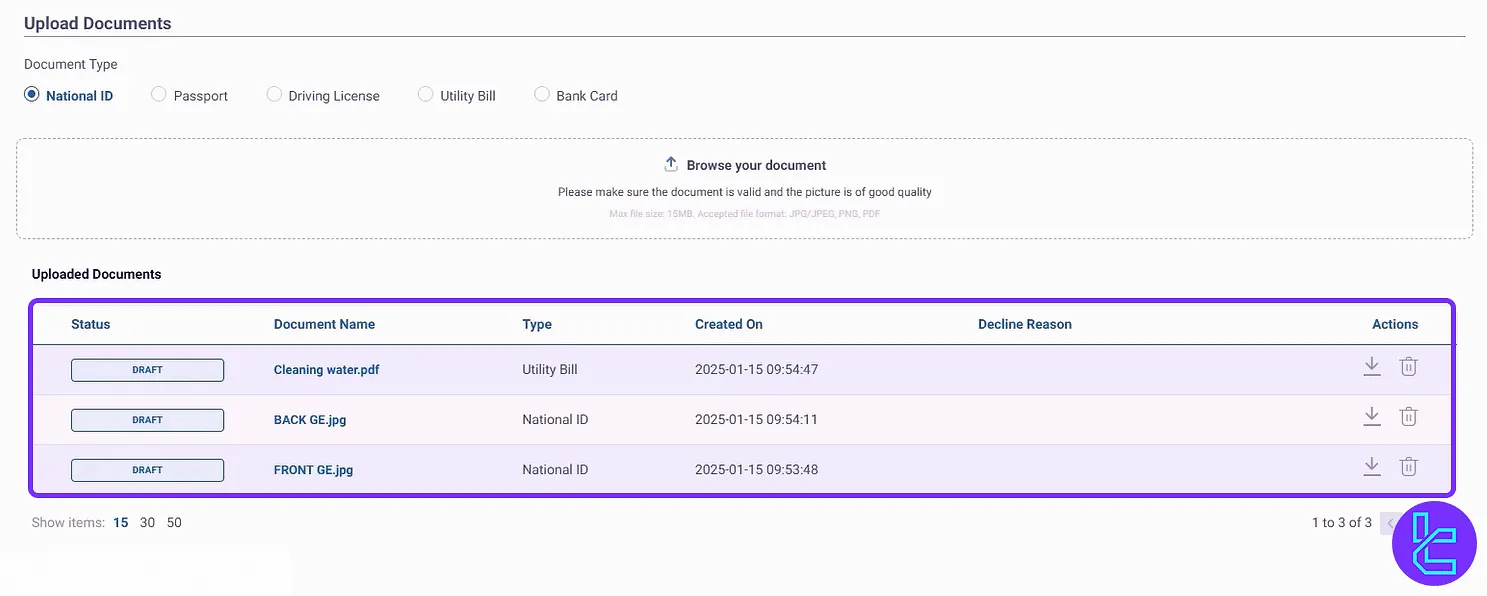

#4 Upload Documents & Get Approved

Choose your ID type, upload clear front and back images, and submit recent proof of address (issued within 3-6 months).

Once verified, you can monitor approval status directly in your profile and start funding your account.

Trading Platforms and Applications in GMI Markets

GMI Markets offers a range of trading platforms to cater to different trader preferences:

GMI Edge

GMI Edge is the proprietary mobile trading platform used by the GMI Markets broker. Key features of this platform include:

- Seamless access to trading accounts

- Supports trading in Forex, gold, silver, indices,

- Easy deposit, withdrawal, and fund management

- Social trading capabilities

Links:

MetaTrader 4 (MT4)

GMI offers the Industry-standard trading platform, MetaTrade 4. Key points about this platform:

- Advanced charting

- Supports expert advisors and custom indicators

- A variety of time frames and technical analysis tools

Links:

- MT4 Android

- MT4 iOS

- Windows

- Mac

MetaTrader 5 (MT5)

GMI market allows trader to open MT5 trading account and use this modern trading platform to buy and sell various instruments. key features of MT5 trading platform:

- Next-generation trading platform

- Enhanced analytical capabilities

- Supports a wider range of asset classes

Links:

- MT5 Android

- MT5 iOS

- Windows

- Mac

GMI Markets Broker Spreads and Commissions

GMI Markets has low Forex and CFD trading spreads. Here’s the average trading spread on different instruments:

- Forex: From 0.2 pips

- Commodities: 0.5 pips

- Indices: 1.5 pips

All GMI Markets accounts are commission free except the ECN account which has $4 per lot commission.

Swap Fees

GMI Markets offers accounts that are typically swap-free, allowing positions to remain open overnight or through weekends without incurring swap fees.

This feature can benefit Islamic traders or anyone seeking to avoid such costs. Traders should confirm the swap-free status of their chosen account or instrument within the trading platform, as terms may differ across instruments.

Non-Trading Costs

The list below demonstrates the other fees involving with GMI broker:

- No inactivity fee

- No deposit or withdrawal commission on most solutions

- Average currency conversion fees

GMI Markets Deposit & Withdrawal Methods

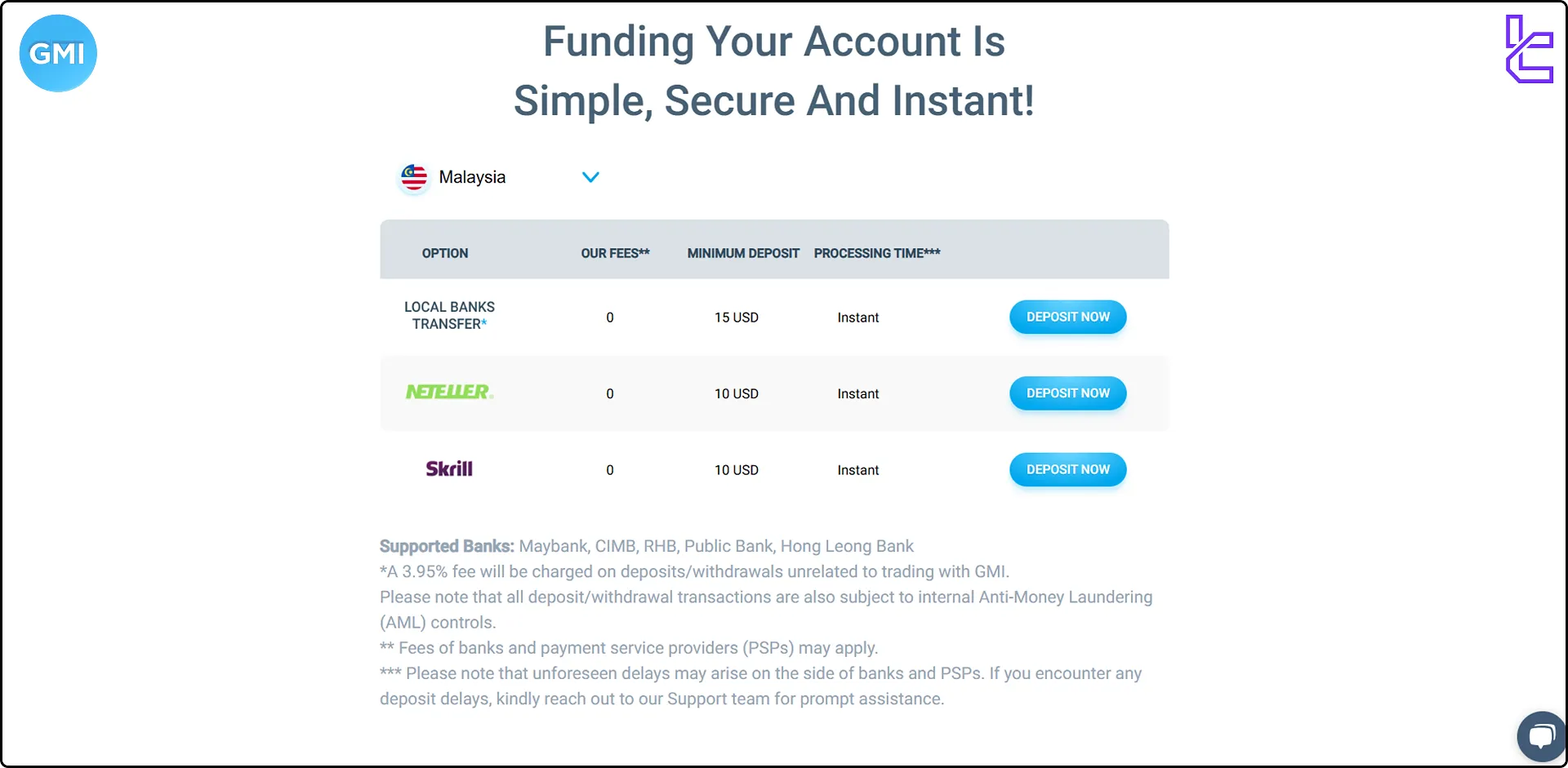

GMI Markets supports various deposit and withdrawal options that might vary depending on the client's region.

Deposit Solutions

The available payment systems for making deposits on the mentioned broker are listed below:

Payment Methods | Minimum deposit | Processing time |

Bank Transfer | $15 | Instant |

Netteler | $10 | Instant |

Skrill | $10 | Instant |

Fasapay | $10 | Instant |

Dragonpay | $50 | Instant |

USDT | $200 | Instant |

UnionPay | $200 | Instant |

Traders should remember that not all payment methods are available worldwide, and there are restrictions. It's crucial for traders to thoroughly research and understand the deposit and withdrawal processes before committing funds to a GMI Markets account.

Withdrawal Options

There are no differences between the available methods for funding and withdrawal in GMI Markets:

Withdrawal Choices | Broker's Fees | Processing time |

Bank Transfer | None | 8:00-18:00 Daily |

Netteler | 4% | Instant |

Skrill | 4% | Instant |

Fasapay | None | Instant |

Dragonpay | None | Instant |

USDT | 1.5% | Within 1 Day for Less Than $5K |

UnionPay | None | Within 1 Day for Less Than $5K |

GMI Markets Copy Trading & Investment Options Overview

GMI Markets offers social copy trading, allowing investors to automatically replicate the trades of successful traders. This feature is particularly beneficial for:

- Beginner traders looking to leverage experienced traders' strategies

- Traders seeking to diversify their portfolios

- Those who want to save time on market analysis and trade execution

The broker also provides a Multi-Account Manager (MAM) solution for money managers, enabling them to trade multiple client accounts simultaneously and automate performance fee billing.

Traders can also use MT4 and MT5 Expert Advisors (EAs) to perform passive income strategies on these trading platforms

GMI Markets Broker Available Markets & Symbols

GMI Markets offers a range of trading instruments, including:

Category | Type of Instruments | Number of Symbols | Competitor Average |

Forex | CFDs on major & minor currency pairs | 5 Currency Pairs | 50–70 currency pairs |

Commodities | CFDs on precious metals & energy products | 7 Instruments (Gold, Silver, UK Oil, etc.) | 10–20 instruments |

Indices | CFDs on global stock indices | 8 Indices (FTSE 100, Nasdaq, etc.) | 10–20 indices |

The broker claims to offer over 70 instruments but there is no information about other tradable instruments in this broker.

GMI Markets Bonuses and Promotions

GMI Markets offers a 30% welcome bonus for new traders on forex, gold, energies, and indices. To claim the bonus, new traders need to:

- Register an account

- Deposit funds

- Get the bonus

Besides the 30% welcome bonus traders can become GMI Markets’ introducing broker and receive commissions based on their referees.

GMI Markets Support channels

GMI Markets offers 2 support channels for traders to reach out for help:

- Email: cs.global@gmimarkets.com

- Live chat: available on the website

The broker claims to offer 24/5 customer support, but the effectiveness and responsiveness of their support team are unclear based on the available information.

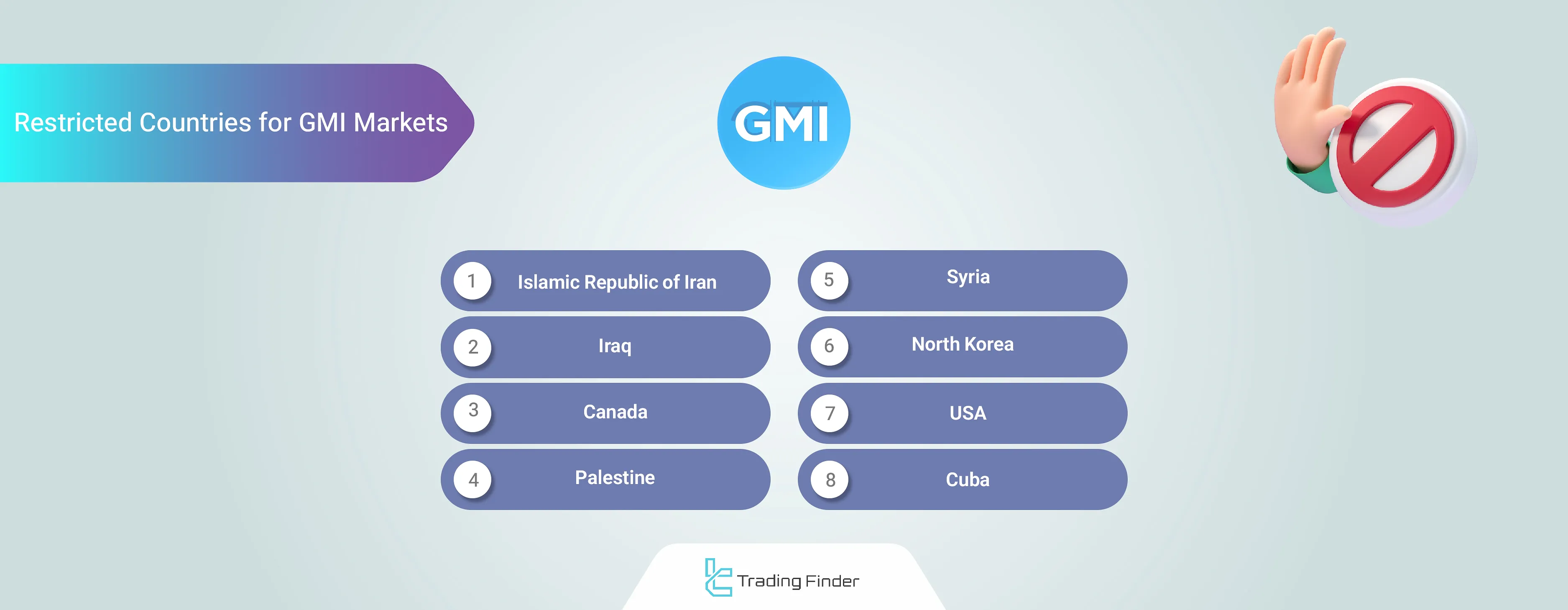

GMI Markets Broker Restricted Countries

GMI Markets doesn’t provide information about the restricted countries on its platform. However, based on its current regulatory status, GMI doesn’t provide services to traders from countries listed below:

- Iran

- Iraq

- North Korea

- USA

- Canada

- Cuba

- Syria

- Palestine

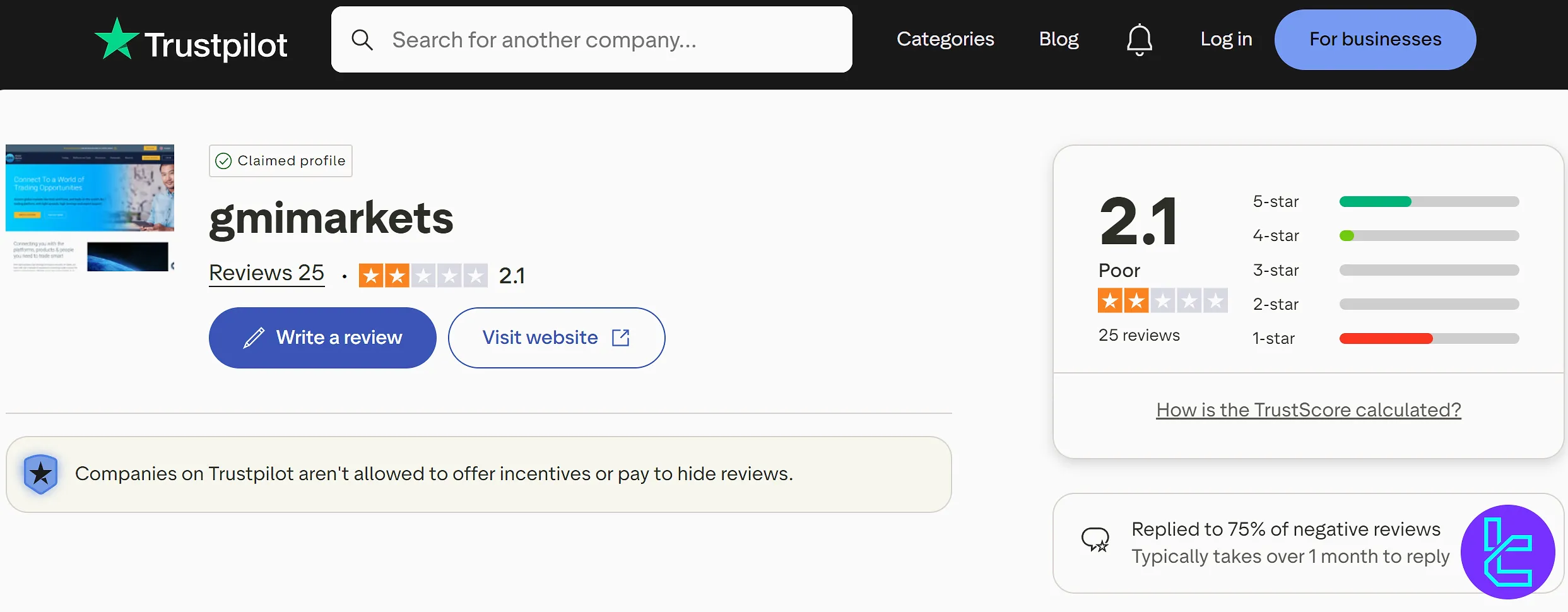

GMI Markets Broker Trust Score

While GMI Markets has been operating since 2009, the company hasn’t received positive feedback from traders community.

The GMI Markets Trustpilot page has a 2.1 out of 5 stars rating based on only 25 reviews. Potential traders should exercise caution and conduct thorough research before opening an account with GMI Markets.

GMI Markets Broker Education

Unlike some of its competitors, GMI Markets does not offer extensive educational resources on its website. This lack of comprehensive learning materials is a significant drawback, especially for novice traders looking to develop their skills and knowledge.

The absence of these resources at GMI Markets may push some traders, particularly beginners, to seek out brokers such as IG or AvaTrade that has more comprehensive educational offerings.

You can also use TradingFinder's Forex education section to expand your knowledge of the market and its trading conditions.

How Does GMI Markets Fare Compared to Top Brokers?

Here, we will compare this brokerage to some of the main competitors based on important parameters:

Parameter | GMI Markets Broker | |||

Regulation | FSC | FSA, CySEC, ASIC | FCA, FSCA, CySEC, SCB | Standard, Standard Cent, pro, Raw Spread, Zero |

Minimum Spread | 0 Pips | 0.0 Pips | 0.0 Pips | 0.0 Pips |

Commission | From $4 | Average $1.5 | From Zero | From $0.2 |

Minimum Deposit | $15 | $200 | $100 | $10 |

Maximum Leverage | 1:2000 | 1:500 | 1:500 | Unlimited |

Trading Platforms | MT4, MT5, GMI Edge | Metatrader 4, Metatrader 5, cTrader, cTrader Web, IC Markets Mobile | MT4, MT5, cTrader, Web Trader, Mobile App | Exness Trade (mobile), Exness Terminal (web), MT4, MT5 |

Account Types | Standard, Standard bonus, Cent, ECN | Standard, Raw Spread, Islamic | Standard, Pro, Raw+, Elite | Standard, Standard Cent, pro, Raw Spread, Zero |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | 70+ | 2,250+ | 270+ | 230+ |

| Trade Execution | Market | Market | Market, Instant | Market, Instant |

TF Expert Suggestion

GMI Markets' low spreads from 0.0 pips, 1:12000 leverage, and $15 minimum deposit are the main benefits of trading with this broker.

On the other hand, the lack of top-tier regulation by authorities such as ASIC, CFTC, and CySEC, combined with the low Trustpilot score (2.1/5), might raise concerns about this broker.