HFM EU is the European branch of HF Markets broker, which provides services to residents of the EEA and some other countries, such as the United Kingdom, Dubai, South Africa, and Kenya.

HFM EU Company Information and Regulation

HF Markets (Europe) Ltd is a Cypriot Investment Firm (CIF) under number HE 277582. The Cyprus Securities and Exchange Commission (CySEC) regulates the broker under license number 183/12.

HF Markets operates in multiple jurisdictions through a group of companies and has acquired licenses from several regulatory bodies, including the FCA, DFSA, FSCA, FSA, and CMA. Key features of HFM EU:

- Spreads from 0.0 pips

- Leverage options of up to 1:30

- 500+ trading instruments

- Founded in 2010

- licensed by CySEC since 2012

The specifications of the HFM EU broker are as follows:

Entity Parameters/Branches | HFM EU |

Regulation | CySEC |

Regulation Tier | 1 |

Country | Cyprus, Limassol |

Investor Protection Fund | Up to €20,000 Under ICF |

Segregated Funds | Yes |

Negative Balance Protection | Yes |

Maximum Leverage | 1:30 |

Client Eligibility | Only EU/EEA Residents |

HFM EU Key Features

The Forex Broker offers a comprehensive suite of features for novice and experienced traders. Here's a table summarizing the key specifications of HF Markets Europe:

Broker | HF Markets Europe |

Account Types | Zero, Premium, Premium Pro |

Regulating Authorities | CySEC |

Based Currencies | USD, EUR |

Minimum Deposit | $0 |

Deposit Methods | Wire Transfer, Visa, MasterCard, Neteller, Skrill |

Withdrawal Methods | Wire Transfer, Visa, MasterCard, Neteller, Skrill |

Minimum Order | 0.01 lots |

Maximum Leverage | 1:30 (1:400 for professionals) |

Investment Options | None |

Trading Platforms & Apps | MT4, MT5, HFM platform |

Markets | Forex, Metals, Energies, Stocks, Indices, Commodities, Bonds, ETFs |

Spread | Variable based on the account type |

Commission | Variable based on the account type and instrument |

Orders Execution | Market |

Margin Call / Stop Out | Variable based on the account type |

Trading Features | Swap-free accounts, Autochartist, Trading calculators, Online trading courses |

Affiliate Program | Yes |

Bonus & Promotions | Referral |

Islamic Account | Yes |

PAMM Account | No |

Customer Support Ways | Email, Tel, Live Chat |

Customer Support Hours | 24/7 |

Account Offerings

Formerly known as HotForex, the broker offers three main account types: Zero, Premium, and Premium Pro (specially designed for professionals).

Features | Zero | Premium | Premium Pro |

Base Currency | USD, EUR | USD, EUR | USD, EUR |

Min Order Size | 0.01 lots | 0.01 lots | 0.01 lots |

Max Leverage | 1:30 | 1:30 | 1:400 for professionals |

Margin Call | 80% | 80% | 50% |

Stop Out | 50% | 50% | 20% |

Swap-Free Option | Yes | Yes | No |

Min Deposit | $0 | $0 | $5,000 for professionals |

Advantages and Disadvantages

To provide a balanced view, here's a table outlining the advantages and disadvantages of trading with HF Markets EU.

Pros | Cons |

Robust regulation by CySEC | The higher minimum deposit for the Premium Pro account ($5,000) |

Multiple trading platforms (MT4, MT5, HFM App) | Lack of Crypto CFDs |

Segregated accounts for client funds | Limited leverage options for retail traders (1:30) |

Premium account from $0 | No copy trading services |

HF Markets allows clients to use Hedging and Scalping strategies and provides them with 16 trading tools, including free VPS, Autochartist, and an economic calendar.

Account Opening and KYC on HFM EU Broker

The company has implemented a thorough Know Your Customer (KYC) procedure in accordance with CySEC and MiFID requirements. The following are the steps to open a live account on HF Markets Europe.

#1 Navigating to the Website

In the beginning, visit the broker’s official site. At the home page, click on the “Register” button.

#2 Complete the Form

After choosing the "Register" option, follow this guide:

- Fill out the registration form with the required details;

- Enter the OTC sent to your email;

- Fill in the profile information.

Then, your account will be set up with the brokerage.

#3 Account Authorization

Provide proof of identity (passport, national ID, or driving license) and proof of address (bank statement or utility bill) to verify your identity and access all features.

Available Trading Platforms

The European branch of HF Markets offers a selection of popular trading platforms, from MetaTrader to a proprietary mobile application.

MetaTrader 4 (MT4)

- MT4 Android

- MT4 iOS

- Desktop

MetaTrader 5 (MT5)

- MT5 Android

- MT5 iOS

- Desktop

HFM Application

TradingFinder has developed various MT4 indicators and MT5 indicators that you can use for free.

HFM EU Fees Explained

The broker has implemented a floating spread structure across its different accounts, while it doesn’t provide specific details about trading commissions.

Account Type | Spreads From (Pips) | Commissions for Forex |

Zero | 0.0 | Yes |

Premium | 1.4 | $0.0 |

Premium Pro | 1 | $0.0 |

The table below offers the typical spreads for the most popular currency pairs in this HFM EU review.

Forex Pairs | Typical Spreads (Pips) | ||

Zero | Premium | Premium Pro | |

EURUSD | 0.0 | 1.3 | 1.2 |

EURCAD | 0.9 | 2.6 | 2.3 |

EURGBP | 0.1 | 1.6 | 1.7 |

GBPUSD | 0.0 | 2.0 | 1.9 |

USDJPY | 0.4 | 2.4 | 2.1 |

USDCHF | 0.3 | 2.3 | 2.1 |

GBPJPY | 0.3 | 3.5 | 3.6 |

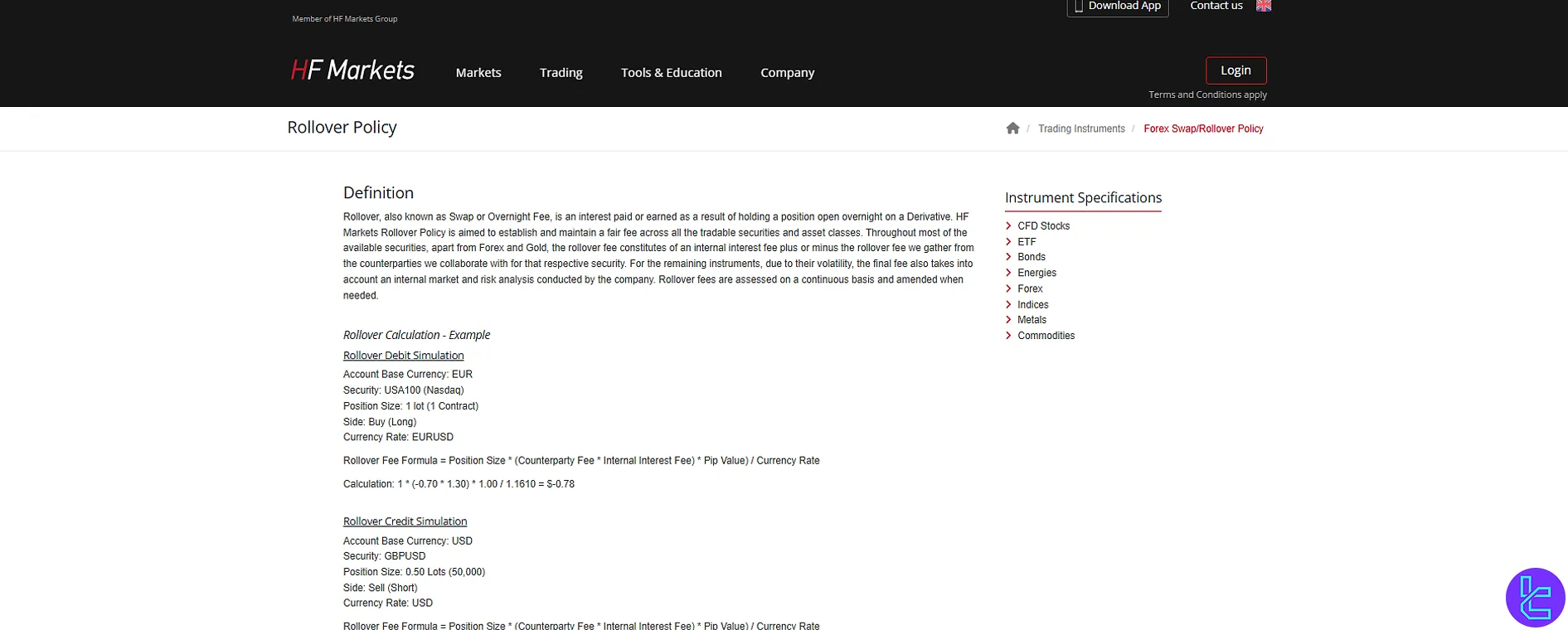

Swap Fees

To ensure consistency and transparency across different asset classes in HFM EU, the Markets Rollover Policy applies a dynamic fee structure tailored to each tradable security.

For most instruments—excluding Forex and Gold—the rollover charge typically reflects a combination of the platform’s internal interest rate and the fees associated with counterparties providing liquidity.

When it comes to more volatile assets, the rollover cost further incorporates the outcome of internal assessments on market behavior and risk exposure. These fees are reviewed regularly and adjusted in line with prevailing market conditions.

Rollover Charge (Debit) – Long Position on Index

The following example demonstrates how the rollover fee is calculated at HF Markets.

- Account Currency: EUR

- Instrument: USA100 (Nasdaq CFD)

- Trade Size: 1 Lot (1 Contract)

- Position Type: Buy (Long)

- EUR/USD Rate: 1.1610

Formula:

Calculation:

1 × (−0.70 × 1.30) × 1.00 ÷ 1.1610 = −$0.78

Rollover Credit – Short Position on Currency Pair

Rollover adjustments on Index CFDs may be affected by corporate actions such as dividend payments, mergers, or stock restructures. Since equity indices are composed of multiple stocks, swap values for these instruments can change frequently to reflect such events.

- Account Currency: USD

- Instrument: GBP/USD

- Trade Size: 0.50 Lots (50,000 units)

- Position Type: Sell (Short)

- Currency Rate: 1

Formula:

Calculation:

0.50 × (0.45 × 0.70) × 10.00 ÷ 1 = $1.57

Payment Methods

HFM EU offers a variety of payment methods to facilitate easy deposits and withdrawals. Additionally, the broker processes transactions 24/7 and charges no additional fees. HFM EU Deposit/Withdrawal Methods:

Method | Minimum Funding | Minimum Withdrawal |

Wire Transfer | $250 | $100 |

Visa / MasterCard | $50 | $5 |

Neteller | $50 | $5 |

Skrill | $50 | $5 |

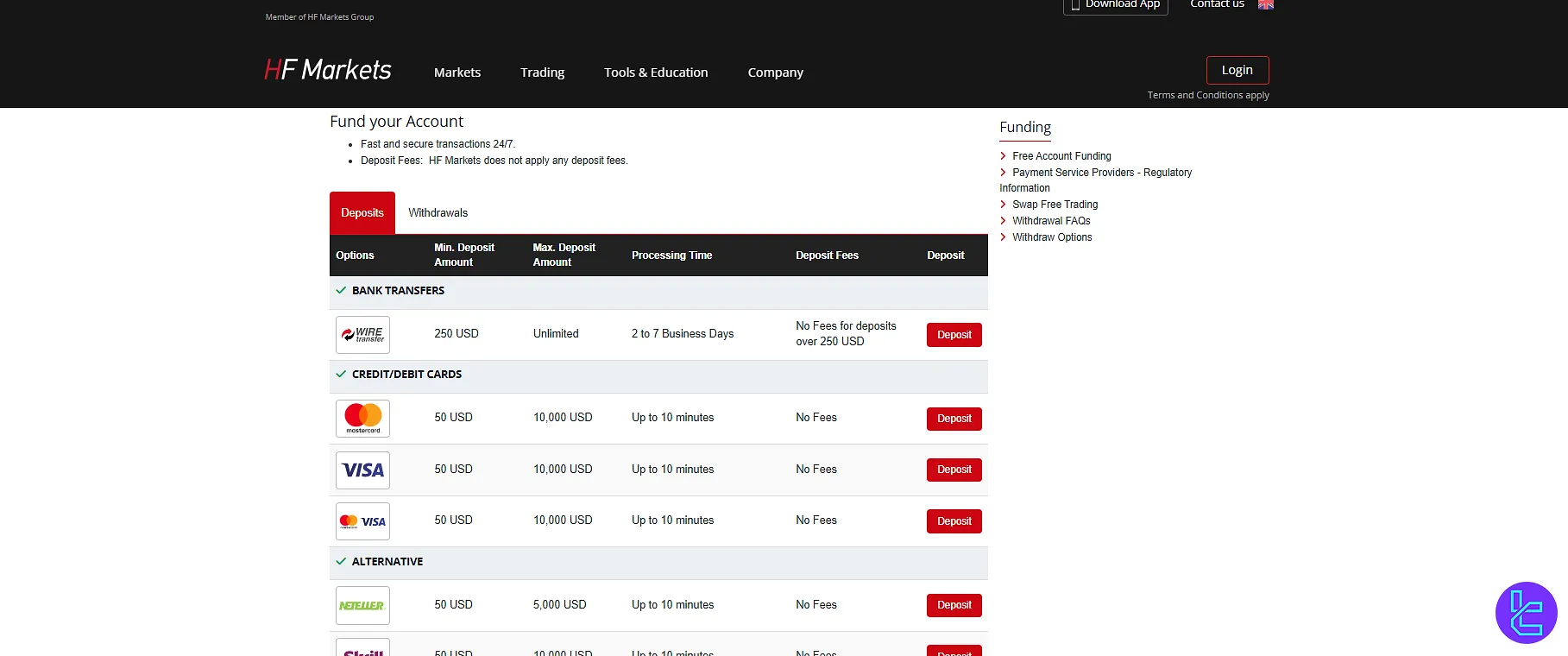

Deposit

The minimum deposit amount at HFM EU is $50, which can be made using alternative payment methods or credit cards. However, for bank wire transfers, the minimum deposit required is $250.

Deposit methods table:

Option | Minimum | Maximum | Processing Time | Fee |

Wire Transfer | 250 USD | Unlimited | 2 to 7 Business Days | No Fees for Deposits Over 250 USD |

MasterCard | 50 USD | 10,000 USD | Up to 10 Minutes | No Fees |

VISA | 50 USD | 10,000 USD | Up to 10 Minutes | No Fees |

NETELLER | 50 USD | 5,000 USD | Up to 10 Minutes | No Fees |

Skrill | 50 USD | 10,000 USD | Up to 10 Minutes | No Fees |

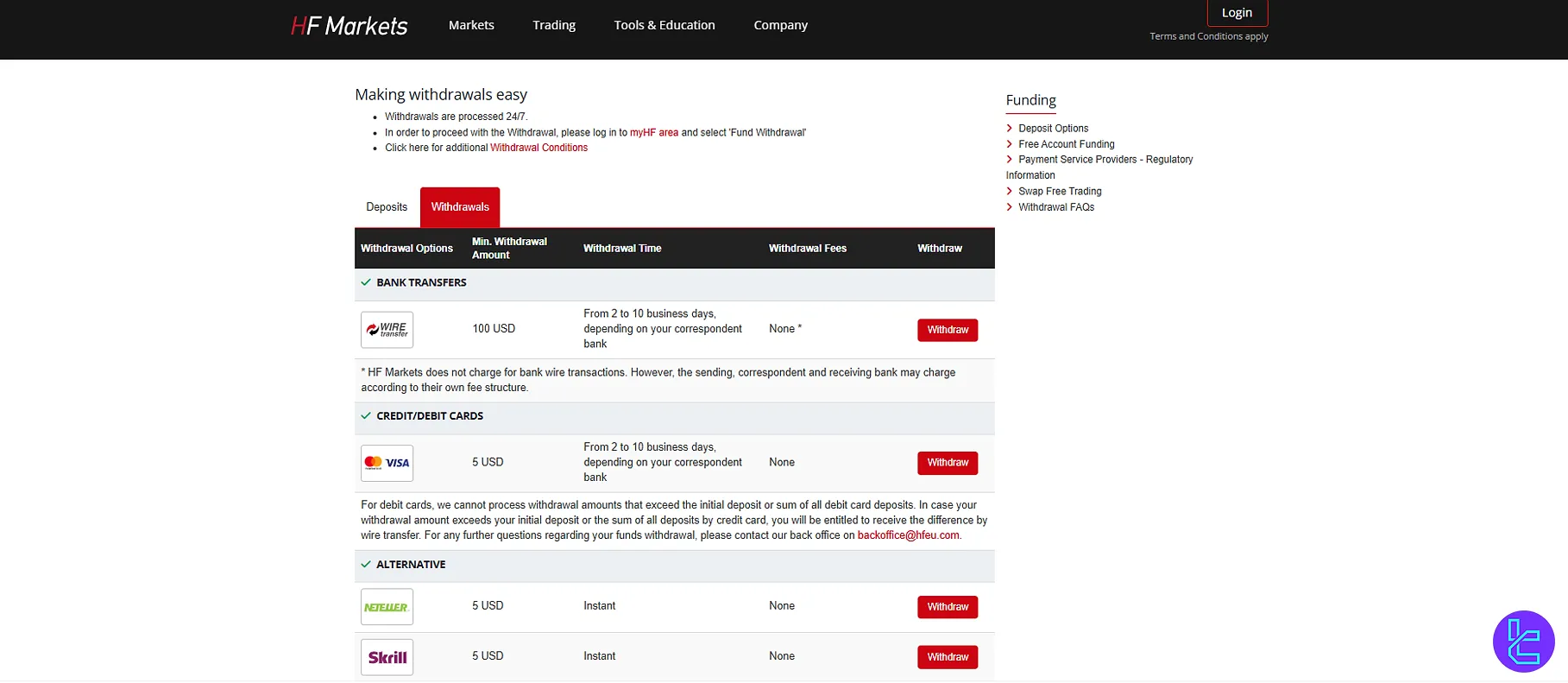

Withdrawal

Withdrawals from HFM EU are processed 24/7 without interruption, and market closures do not affect the withdrawal process.

To submit a withdrawal request, you must log in to your myHF area and select the "Fund Withdrawal" section.

Withdrawal methods table:

Options | Minimum | Maximum | Fees |

Wire Transfer | 100 USD | From 2 to 10 business days, depending on your correspondent bank | None |

VISA | 5 USD |

| None |

NETEELER | 5 USD | Instant | None |

Skrill | 5 USD | Instant | None |

Does HFM EU Broker Offer any Growth or Investment Plans?

While HF Markets primarily focuses on self-directed trading, it offers 16 trading tools that can support traders throughout their journey and help them make more profitable decisions, including:

- Autochartist Market Scanner

- Calculators

- VPS Hosting

- Economic Calendar

- Sentiment Trader

- Session Map

- Alarm Manager

However, the company offers no wealth management, copy trading, or investment services.

HFM Europe Trading Assets

The wide range of asset classes is one of the strength points in this HFM EU review. The broker provides access to 500+ trading instruments across 8 asset types, including:

Category | Types of Instruments | Number of Symbols | Competitor Average | Max Leverage (Retail Clients) |

Forex | Major & Minor Currency Pairs | 60+ Currency Pairs | 50–70 Currency Pairs | Up to 1:30 (Retail), 1:100 (Experienced), 1:400 (Professional) |

Metals | Gold, Silver, Platinum, Palladium | 4 Major Metals | 10–20 Instruments | Up to 1:20 for Gold (1:100 for Experienced/Pro), 1:10 for others |

Energies | CFDs on Crude Oil, Natural Gas, etc. | Multiple CFD Instruments | N/A | Up to 1:10 |

Stocks | Global Stock CFDs | 100+ Symbols | 800–1200 | Up to 1:5 |

Indices | Major Global Indices (e.g., S&P 500, DAX) | Around 11 Indices | 10–20 Indices | Up to 1:20 |

Commodities | Cocoa, Coffee, Sugar, Copper, etc. | Around 5 Soft Commodities | 10–20 Instruments | Up to 1:10 |

Bonds | Government Bonds (e.g., EU, US, UK) | 3 Bond Instruments | N/A | Up to 1:5 |

ETFs | Exchange-Traded Funds | 15+ ETFs | N/A | Up to 1:5 (Same as Stocks) |

HFM EU Affiliate

While the broker offers no traditional promotions like welcome gifts and deposit bonuses, it has a comprehensive affiliate program with the following details:

- CPAs of up to $650 per referred client

- Monthly payouts

- Minimum withdrawable commission: $300

- Unlimited passive income

- Two CPA schemes, including Standard and Exclusive (more than 20 clients)

HFM EU Broker Support Channels

The company prides itself on providing comprehensive 24/5 customer support through various channels, from a FAQ section to live chat.

support@hfeu.com | |

Tel | +357-244 001 65 |

Live Chat | Non-responsive |

HF Markets Europe is registered and headquartered at Spyrou Kyprianou 50, Irida 3 Tower 10th Floor, Larnaca 6057, Cyprus.

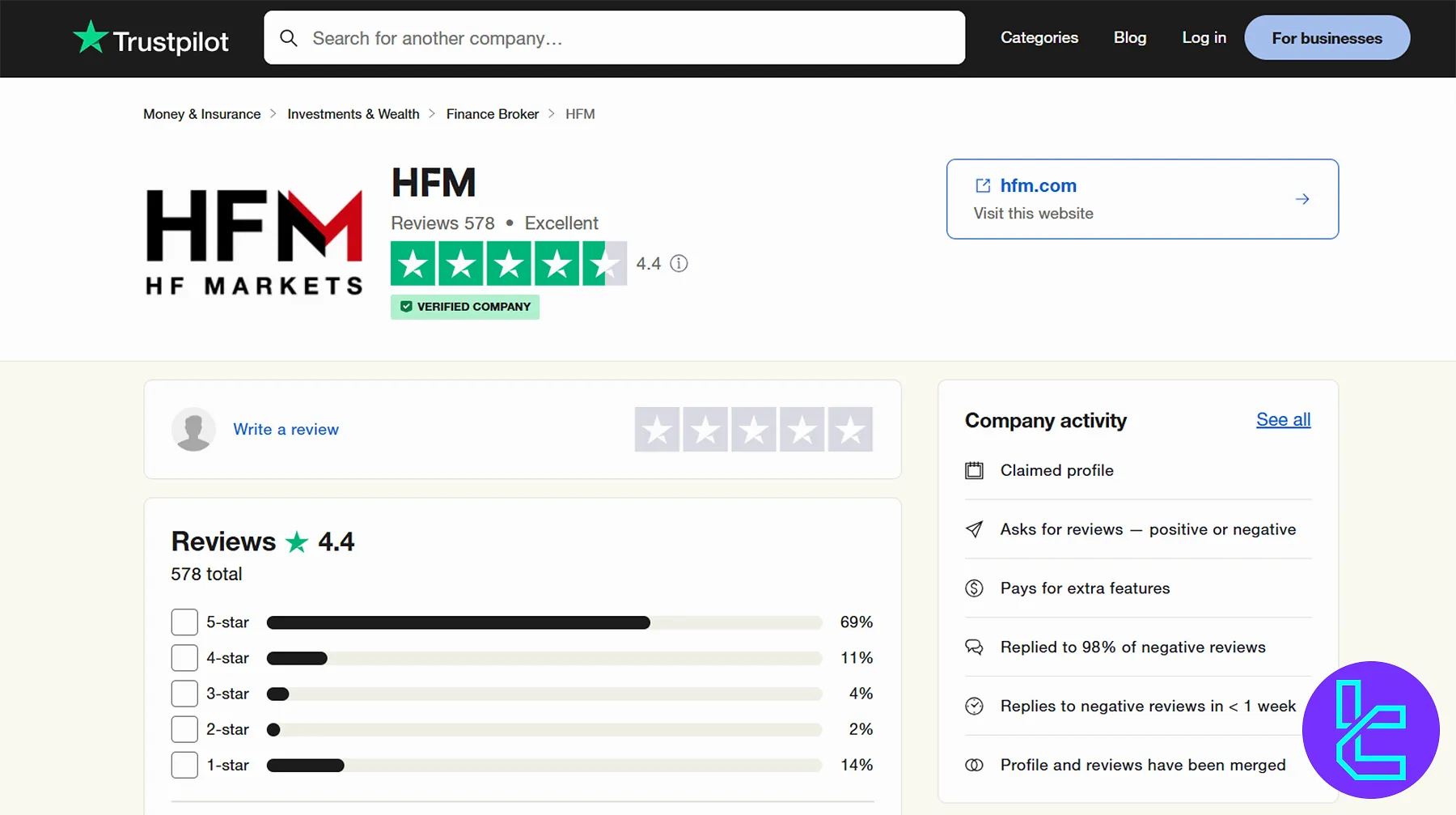

HFM EU Reviews

HFM EU offers services mainly to EEA residents (excluding Belgium). While the branch itself has no separate profiles on review websites, its mother company, HF Markets Group, has been featured on various platforms, including:

4.4/5 based on 578 ratings | |

ForexPeaceArmy | 3.73/5 based on 560 reviews |

Almost 80% of HFM reviews on Trustpilot are positive (4-star and 5-star).

HFM EU Education

In addition to a full suite of trading tools and market analysis, the broker offers two primary educational resources, including:

- Trading Courses: Tutorial videos on platforms, tools, strategies, markets, Futures, and CFDs

- Webinars: Online monthly events covering various trading strategies

HFM EU Compared to Major Brokers

Here's a comparison between HFM EU and other popular brokers:

Parameter | HFM EU Broker | |||

Regulation | CySEC | None | ASIC, FSC, DFSA, CySEC | ASIC, CySEC, CBI, FSA, FSCA, MiFID, ADGM, PFSA, ISA |

Minimum Spread | 0.0 Pips | 0.1 Pips | From 0.6 Pips | Depending on the Asset |

Commission | From Zero | None | From Zero | Zero |

Minimum Deposit | $0 | $10 | $5 | $100 |

Maximum Leverage | 1:30 (1:400 for professionals) | 1:3000 | 1:1000 | 1:400 |

Trading Platforms | MT4, MT5, HFM platform | MT4, MT5 | MT4, MT5, Mobile App | MetaTrader 4, MetaTrader 5, Mobile App, WebTrader |

Account Types | Zero, Premium, Premium Pro | Standard, Premium, VIP, CIP | Micro, Standard, Ultra Low, Shares | Retail, Professional, Islamic, Demo |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | 500+ | 50+ | 1,400+ | 1,250+ |

| Trade Execution | Market | Market, Instant | Market, Instant | Instant |

Conclusion and Final Words

HFM EU provides access to 8 asset classes, including 50+ Forex pairs and 12 ETFs. It accepts Neteller and Skrill deposits with a minimum required amount of $50.

The HFM EU broker is a part of HF Markets Group, regulated by entities like FCA, DFSA, and FSA, with a Trustpilot score of 4.4.