IFC Markets verification is an essential 3-step process that ensures your account is fully authenticated before accessing the broker’s financial services.

You will need to confirm your date of birth, submit identity and address documents, and review your profile KYC status.

IFC Markets Authentication Process

After finalizing the IFC Markets registration process, to activate full access to the IFC Markets broker services, you should complete the KYC procedure by uploading the necessary documents.

IFC Markets verification overview:

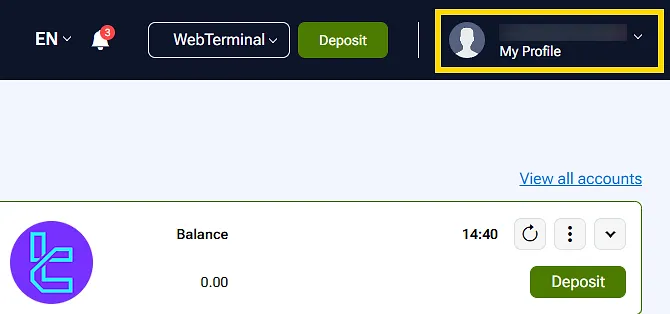

- Access the identity confirmation panel via "My Profile";

- Complete the form and upload the required documents;

- Track your KYC status from the "My Profile".

#1 Accessing the KYC Section

Traders can start this procedure by following the steps below:

- log into your account and clicking on the "My Profile" tab;

- Select the "Profile Authentication".

#2 Submitting Documents and Information

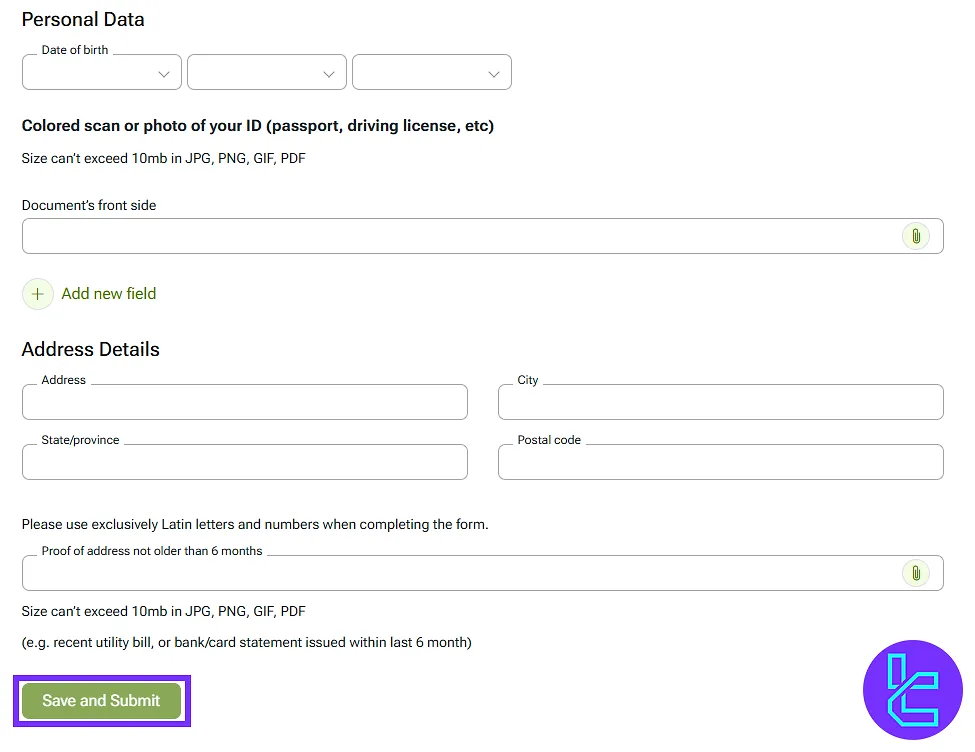

Enter your date of birth. Then, upload your identity document such as:

- Passport

- ID card

- Driver's license

If needed, click on "Add New Field" to submit additional files.

Scroll down to the address section, fill in full residential details (city, area, postal code), and upload one of the following documents dated within the last six months:

- Utility bill

- Bank statement

Click on the "Save and Submit" button to complete this stage.

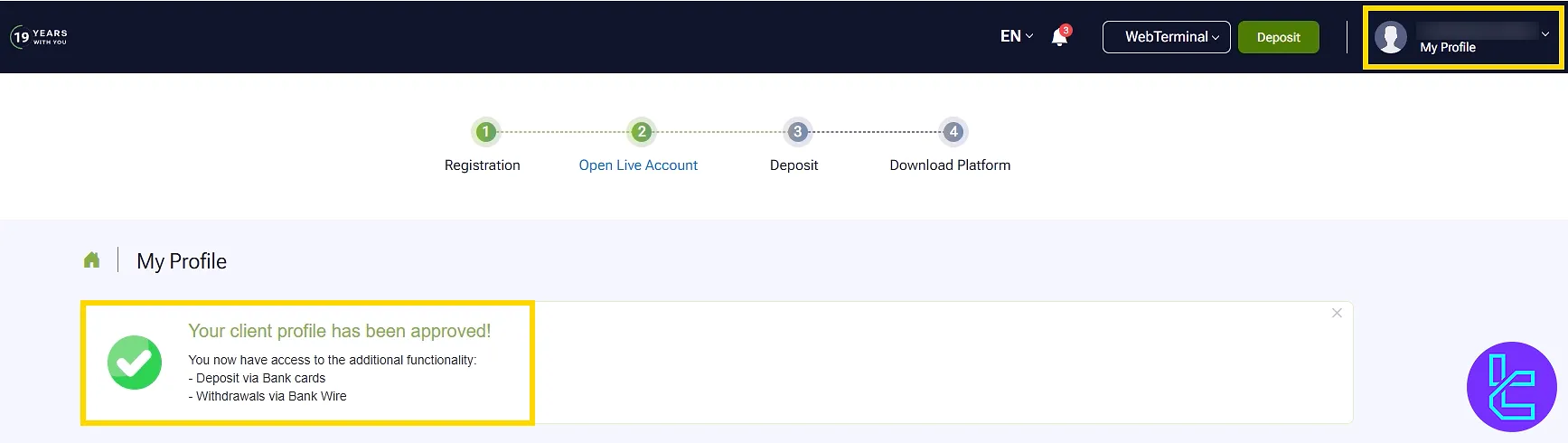

#3 Reviewing Documents Status

Go back to the "My Profile" section to track the status of your request. Once approved, the profile will display a confirmation message.

TF Expert Suggestion

IFC Markets verification and document upload takes about 8 minutes to complete while the document review process will take a few hours.

Required documents include a valid photo of ID and an address confirmation document (no older than 6 months).

Once verified, users gain access to all IFC Markets deposit and withdrawal options on the platform.

For complete instructions on using the available methods, visit the IFC Markets tutorial page.