During our latest checkup on the broker's website, we realized that IMS Markets is not operational at the moment. The official website reads "We're working hard behind the scenes. Check back soon!", and it has been like that for a while now. This page might indicate an end to the business, but nothing is official, at least, yet.

IMS Markets offers access to over 60 trading instruments for a minimum deposit of $50.

It supports the MT5 platform through 3 different account types, including Classic (minimum deposit: $50), Gold (minimum deposit: $500), and Premium (minimum deposit: $1,000).

IMS Markets: Broker Information and Regulation

Initial Merit Secure Ltd operates the IMS Markets broker. It is licensed and regulated by the Cyprus Securities and Exchange Commission (CySEC), with license number 229/14.

The broker has founded the IMS Initiative, which supports various charity foundations, including Dr. Yota Dimitrious’s Dancing Queen (Children Mental Health Care). Key features of IMS Markets:

- Leverage options of up to 1:30

- Multilingual localized support

- Member of the Investor Compensation Fund

- Less than 50 employees

- Executive Directors: Stavri Antoniou and Marios Zantis

The Forex broker is also registered with these authorities:

- Italy CONSOB

- France REGAFI

- Spain CNMV

- UK FCA

- Greece HCMC

- Austria FMA

- Sweden FI

- Norway FSAN

- Germany BaFin

- Czech CNB

- Hungary MNB

- Malta MFSA

- Romania CNVMR

- Slovenia ATVP

- Netherlands AFM

- And more

IMS Markets Specific Features

The broker offers negative balance protection, 24/5 support, and many more features, including:

Broker | IMS Markets |

Account Types | Classic, Gold, Premium |

Regulating Authorities | CySEC, FCA, CNMV, BaFin, and many more |

Based Currencies | USD, EUR, GBP |

Minimum Deposit | $50 |

Deposit Methods | Bank Transfer, VISA, MasterCard, Skrill, Neteller |

Withdrawal Methods | Bank Transfer, VISA, MasterCard, Skrill, Neteller |

Minimum Order | 0.01 lots |

Maximum Leverage | 1:30 |

Investment Options | None |

Trading Platforms & Apps | MT5 |

Markets | Forex, Indices, Commodities |

Spread | Variable based on the account type |

Commission | Variable based on the account type |

Orders Execution | Market |

Margin Call / Stop Out | N/A / 50% |

Trading Features | Mobile Trading, CFDs |

Affiliate Program | Yes |

Bonus & Promotions | No |

Islamic Account | N/A |

PAMM Account | No |

Customer Support Ways | Email, Ticket, Call Center |

Customer Support Hours | 24/5 |

IMS Markets Broker Trading Accounts

The company offers three account types with different fee structures and minimum deposits.

Features | Classic | Gold | Premium |

Base Currency | USD, EUR, GBP | USD, EUR, GBP | USD, EUR, GBP |

Min Deposit | 50 | 500 | 1,000 |

Max Leverage | 1:30 | 1:30 | 1:30 |

Stop Out Level | 50% | 50% | 50% |

Min Order Size | 0.01 lots | 0.01 lots | 0.01 lots |

Account Manager | Yes | Yes | Yes |

IMS Markets Upsides and Downsides

The broker offers a strong regulatory framework and free demo account trading. However, the limited asset offering is a letdown in this IMS Markets review.

Pros | Cons |

CySEC-regulated | Low leverage options (1:30) |

Multilingual 24/5 support | Limited educational resources |

Low entry barrier ($50) | No support for copy trading |

Micro lot trading | Limited trading platforms (only MT5) |

IMS Markets also offers a professional account with higher leverage options to traders who have two of the following criteria:

- 10 transactions of significant volume over the previous four quarters

- Portfolio value of €500,000

- Financial sector experience for at least one year

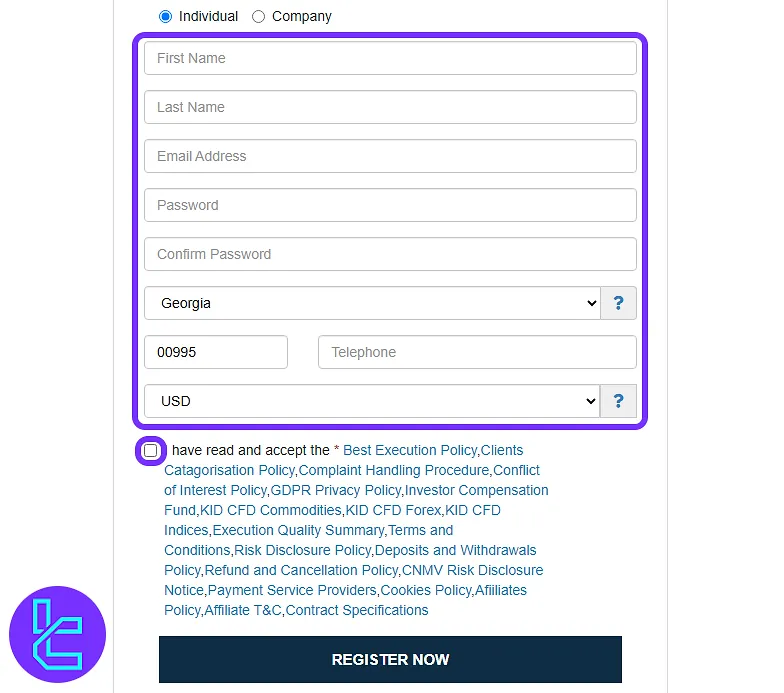

IMS Markets Registration and Verification

The broker offers an insurance scheme of up to €20,000 per client. It requires clients to provide identification documents, or else it blocks their accounts. IMS Markets registration is explained in separate sections in this part of the article.

#1 Start from the Official Website

Go to the IMS Markets homepage and select “Log In” from the top menu.

On the redirected page, click “Register Now” to begin your onboarding journey.

#2 Submit Account Information

Complete the registration form by entering these details:

- Full name

- Email address

- Password

- Residence country

- Phone number

- Account base currency

Agree to the terms and proceed with the account creation.

#3 Confirm Email & Access the Platform

Check your inbox for a verification message. Clicking the confirmation link instantly activates your profile and logs you into the IMS Markets trading dashboard.

#4 Go Through the KYC Procedure

- Upload proof of ID (passport or national ID) and proof of residence (utility bill or bank statement);

- After document approval, navigate to the “Trading Accounts” in the member area and click “Create a Live Account”.

IMS Markets Broker Platforms and Apps

The company offers the world-renowned and advanced MetaTrader 5 platform to its clients. You can download the PC version from the IMS Markets client portal. MT5 mobile download links:

TradingFinder has developed an advanced range of MT5 indicators that you can use for free.

IMS Markets Trading Costs

In this IMS Markets review, we must mention that the broker offers spreads from 0.5 pips and commissions from $4. However, the amounts vary based on the account type.

Account Type | Average Spread (pips) | Commission (per round lot) |

Classic | 2.0 | $4 |

Gold | 0.5 | $8 |

Premium | 0.5 | $5 |

Non-trading fees are minimal:

- No deposit or withdrawal fees

- No monthly inactivity fees

The broker does not charge fees for funding transactions through a bank. However, the bank may charge additional rates.

IMS Markets Deposits and Withdrawals

The company processes payments in EUR, USD, and GBP through various methods, including:

Payment Method | Min Deposit | Min Withdrawal |

Bank Transfer | 50 | No minimum |

VISA / MasterCard | 50 | No minimum |

Skrill | 50 | No minimum |

Neteller | 50 | No minimum |

While the processing time for all transactions is up to 24 hours, bank transfers are processed in 2-5 business days (Monday - Friday).

Does IMS Markets Offer Copy Trading or Investment Plans?

While IMS Markets doesn't have built-in copy trading or investment plans, it offers access to the MT5 platform, which you can use to utilize 3rd party copy trading solutions, and an affiliate program for passive income.

Trading Instruments

IMS Markets broker has listed over 60 trading instruments across three asset classes, including the Forex market and Indices.

- Forex: Major, minor, and exotic pairs

- Indices: Global stock indices

- Commodities: Precious metals (e.g., gold and silver) and energies (e.g., oil and natural gas)

IMS Markets Promotional Offerings

The broker is registered with 23 regulatory authorities across Europe. While this provides peace of mind for traders, it prohibits the broker from offering incentives, promotions, and bonuses.

Customer Support

In this IMS Markets review, we must mention that the broker boasts 24/5 multilingual localized support via various channels, including:

- Email: info@imsmarkets.com

- Phone Number: +35725754323

- Address: 3 Pythagora Street, Pythagoras Court, 4th Floor, Limassol 3027, Cyprus

- Ticket: Through the “Contact Us” page

IMS Markets Broker Restricted Countries

The company requires clients to be above 18 and do not reside in Japan, USA, Canada, Turkey, and FATF blacklisted countries. Here’s a complete list of restricted countries on IMS Markets:

- USA

- Japan

- Canada

- Turkey

- Iran

- Myanmar

- North Korea

- Algeria

- Angola

- Bulgaria

- Burkina Faso

- Cameron

- Croatia

- Democratic Republic of the Congo

- Haiti

- Kenya

- Laos

- Lebanon

- Mali

- Monaco

- Mozambique

- Namibia

- Nepal

- Nigeria

- South Africa

- South Sudan

- Syria

- Tanzania

- Venezuela

- Vietnam

- Yemen

Trust Scores

There are very few IMS Markets reviews on reputable platforms. While the company has a profile on Trustpilot, no users have left a comment about it. ForexPeaceArmy hasn’t even listed the broker on its website.

IMS Markets Educational Offerings

The broker offers limited educational resources through its blog covering various topics, including:

- Introduction to top Forex indicators

- Trading psychology

- Forex trading terminology

- Top economic events

- Trading strategies

You can also access additional educational resources through TradingFinder’s Forex education section.

Comparison Between IMS and Other Brokers

This section compares the discussed broker with some of the other companies in the industry:

Parameter | IMS Broker | HFM Broker | FxPro Broker | FXGlory Broker |

Regulation | CySEC, FCA, CNMV, BaFin, and many more | CySEC, DFSA, FCA, FSCA, FSA | FCA, FSCA, CySEC, SCB | No |

Minimum Spread | Variable Based on the Account Type | From 0.0 Pips | From 0.0 Pips | From 0.1 Pips |

Commission | Variable Based on the Account Type | From $0 | From $0 | $0 |

Minimum Deposit | $50 | From $0 | $100 | $1 |

Maximum Leverage | 1:30 | 1:2000 | 1:500 | 1:3000 |

Trading Platforms | MetaTrader 5 | MT4, MT5, Mobile App | MT4, MT5, cTrader, Web Trader, Mobile App | MetaTrader 4, MetaTrader 5 |

Account Types | Classic, Gold, Premium | Cent, Zero, Pro, Premium | Standard, Pro, Raw+, Elite | Standard, Premium, VIP, CIP |

Islamic Account | N/A | Yes | Yes | Yes |

Number of Tradable Assets | 60+ | 1,000+ | 2100+ | 45 |

Trade Execution | Market | Market, Buy Stop, Stop Loss, Limit, Take Profit | Market, Pending | Market, Instant |

Conclusion and Final Words

IMS Markets offers three asset classes, including Forex and Indices, with leverage options of up to 1:30.

The broker accepts Skrill and Neteller payment methods. It provides micro lot trading and an insurance scheme of up to €20,000 per client.