Interactive Brokers is a financial broker with over 2,900,000 client accounts in more than 150 markets. The company accepts 2 payment methods [bank transfers, checks] in 6 account types [Individual, Joint, Trust, Retirement, Institutional, Non-Professional Advisor].

Over 100 forex currency pairs and more than 90 global stock exchanges are available for trading on the brokerage.

Company Information & Regulation

Interactive Brokers, headquartered in Greenwich, Connecticut, USA, has grown from humble beginnings to become a name in the brokerage industry.

Founded by Thomas Peterffy in 1977, the company initially operated under the name T.P. & Co. before rebranding to Timber Hill Inc. in 1982.

Today, Interactive Brokers boasts operations in 34 countries, dealing in 27 currencies, and serving over 2.6 million institutional and individual brokerage customers.

In terms of regulation, Interactive Brokers is overseen by top-tier financial authorities worldwide, ensuring a high level of security and trustworthiness for its clients. Key Regulators:

- The U.S. Securities and Exchange Commission (SEC)

- The Financial Industry Regulatory Authority (FINRA)

- New York Stock Exchange (NYSE)

- Financial Conduct Authority (FCA)

- Various international regulatory bodies in the countries where it operates

In the UK, IBKR is regulated by the Financial Conduct Authority (FCA), offering protection up to £85,000 through the FSCS for CFDs and non-U.S. derivative instruments. U.S.-based accounts are backed by SIPC, providing up to $500,000 in coverage (including $250,000 in cash).

EU accounts under the Central Bank of Ireland are protected up to €20,000, while Canadian clients receive CAD 1 million in protection via CIRO. Some regions, like Australia, Singapore, and India, offer limited or no formal coverage for retail clients.

Across most regions, Interactive Brokers provides negative balance protection to retail traders using leverage, ensuring clients cannot lose more than their deposits.

Additionally, IBKR’s status as a NASDAQ-listed company adds a layer of financial transparency and credibility, as it is required to publish audited financials and meet strict governance standards.

Here's a summary of the brokerage's various entities in the form of a table:

Entity Parameters/Branches | Interactive Brokers LLC | Interactive Brokers Canada Inc. | Interactive Brokers (UK) Limited | Interactive Brokers Ireland Limited | Interactive Brokers Central Europe Zrt. | Interactive Brokers India Pvt. Ltd. | Interactive Brokers Securities Japan Inc. | Interactive Brokers Hong Kong Limited | Interactive Brokers Singapore Pte. Ltd. | Interactive Brokers Australia Pty. Ltd. |

Regulation | SEC | IIROC | FCA | CBI | MNB | SEBI | JSDA | SFC | MAS | ASIC |

Regulation Tier | 1 | 1 | 1 | 1 | 1 | 2 | 1 | 1 | 1 | 1 |

Country | United States | Canada | United Kingdom | Western Europe | Eastern Europe | India | Japan | Hong Kong | Singapore | Australia |

Investor Protection Fund / Compensation Scheme | SIPC up to $500,000 | CIPF up to $1,000,000 | FSCS up to £85,000 | DGS up to €100,000 | No | No | No | No | No | No |

Segregated Funds | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

Negative Balance Protection | No | Yes | Yes | Yes | No | No | No | No | No | No |

Maximum Leverage | 1:50 | 1:50 | 1:30 | 1:30 | 1:30 | 1:25 | 1:25 | 1:20 | 1:20 | 1:30 |

Client Eligibility | Only US | Only Canada | Only the UK | Ireland | Eastern European Clients | Indian Clients | Clients from Japan | Hong Kong Users | Singaporean Clients | Australian Clients |

An Introduction to the Interactive Brokers CEO

Milan Galik has been the Chief Executive Officer of Interactive Brokers since 2019, leading the company’s global expansion in electronic brokerage services. He first joined the firm in 1990 as a software developer, recruited by founder Thomas Peterffy.

With a strong engineering background, Galik played a key role in building automated market-making systems and launching the firm’s German derivatives trading desk in Frankfurt in 1991. Returning to the U.S. in 1992, he shifted focus to Interactive Brokers’ electronic brokerage segment, which later became one of the company’s core strengths.

Recognized for his contributions, he was promoted to President in 2014 and later advanced to CEO in 2019. Galik holds an M.S. in Electrical Engineering from the Technical University of Budapest, a foundation that underpins his technical and strategic leadership style.

Summary of Key Specifics

Brokerages operate based on a set of common specifics with different parameters in the industry. In the table below, we will look at the specifications of Interactive Brokers:

Broker | Interactive Brokers |

Account Types | Individual, Joint, Trust, Retirement, Institutional, Non-Professional Advisor |

Regulating Authorities | SEC, FINRA, NYSE, FCA, etc. |

Based Currencies | USD, EUR, GBP, AUD, CZK, CHF, CNH, CAD, etc. |

Minimum Deposit | $1 |

Deposit Methods | Bank Transfer, Check |

Withdrawal Methods | Bank Transfer, Check |

Minimum Order | 0.01 lot |

Maximum Leverage | 1:1000 |

Investment Options | None |

Trading Platforms & Apps | Proprietary |

Markets | Forex, Stocks, ETFs, Options, Futures, US Spot Gold, Bonds, Mutual Funds, Hedge Funds |

Spread | Variable from 0 |

Commission | Variable from 0 |

Orders Execution | Instant |

Margin Call/Stop Out | Varies |

Trading Features | Options Trading |

Affiliate Program | Yes |

Bonus & Promotions | No |

Islamic Account | No |

PAMM Account | No |

Customer Support Ways | Ticket, Live Chat, Phone Support |

Customer Support Hours | 24/6 |

Note: The data presented in this article are based on the US entity of Interactive Brokers.

Trading Account Types + Comparison

Interactive Brokers offers a range of account types to suit different trader profiles with various purposes. Let's have a look at each account type below:

- Individual: Ideal for personal trading and investing

- Joint: Suitable for couples or partners who want to invest together

- Retirement: For retirement savings with tax advantages

- Trust: Designed for estate planning and wealth management

- Institutional: For businesses and institutions

- Non-Professional Advisor: For trading as a master for copy traders

In addition to these real-money accounts, Interactive Brokers provides a robust demo account option, which is invaluable for both beginners and experienced traders.

Advantages and Disadvantages

Interactive Brokers offers a compelling package for traders, but like any broker, it comes with its own set of pros and cons:

Advantages | Disadvantages |

Low Commissions And Tight Spreads | Customer Service Can Be Hit Or Miss |

Wide Range of Tradable Assets Beyond Forex | Limitations in Payment Methods |

Strong Regulatory Oversight | - |

Access To Global Markets | - |

Advanced Trading Platforms With Powerful Tools | - |

Signing Up & Verification Guide

The Interactive Brokers sign-up requires creating login credentials, verifying your email, and proceeding with identity verification to enable full trading features.

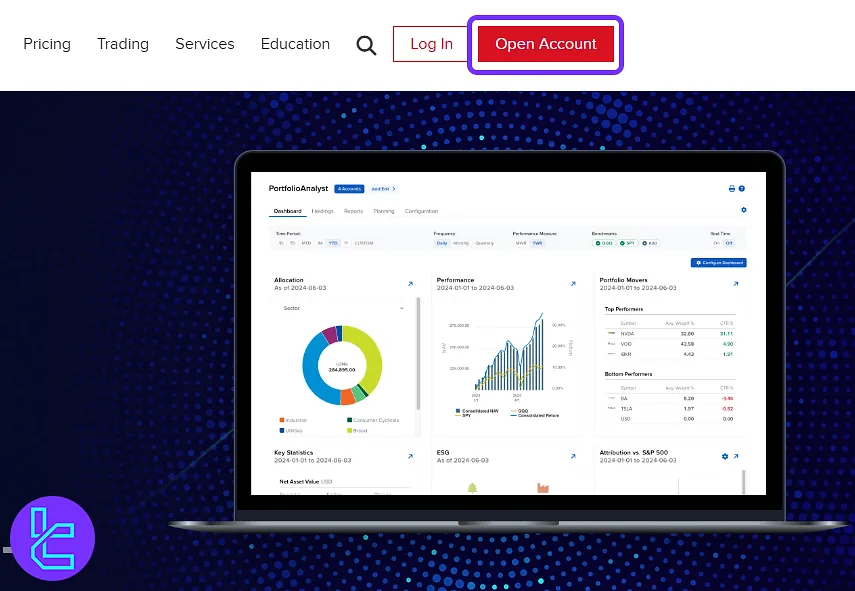

#1 Start from the Official Website

Go to the genuine website and click on the “Open Account” button.

This initiates the account creation process.

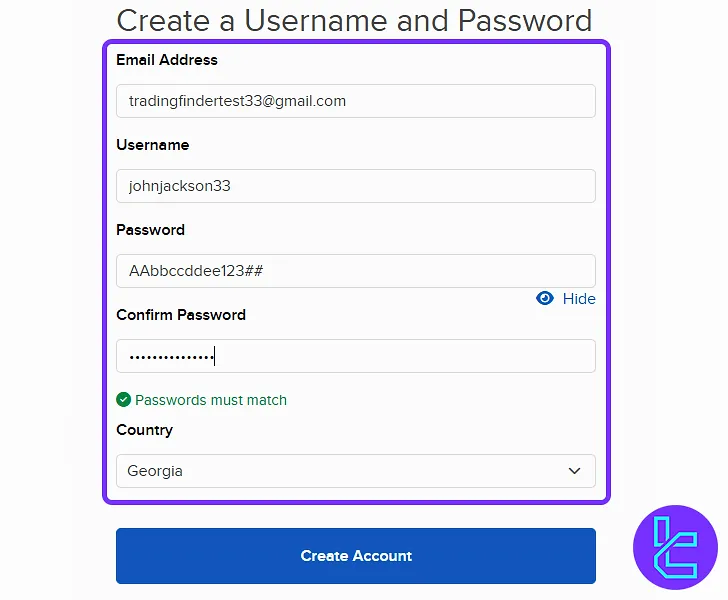

#2 Create Login Credentials

Enter your email address, choose a username and a secure password, and confirm your country of residence. Use strong character combinations for enhanced security.

#3 Verify Your Email

After submitting the form, check your inbox for a verification message. Click “Confirm Email” to activate your account and proceed to full identity verification.

#4 Verify Your Identity

Provide additional information and submit the required documents related to KYC to complete your account opening process.

Trading Platforms Overview

Interactive Brokers offers a suite of powerful trading platforms designed to provide traders with comprehensive services. Here's an overview of their main platforms

- Trader Workstation (TWS): Flagship desktop platform with advanced charting and analytical tools and a Customizable workspace

- IBKR Mobile: Real-time quotes and charts for trading on the go

- Client Portal: Web-based platform with basic trading and account management features

- IBKR APIs: For developers and algorithmic traders

This broker provides much more variety in trading platforms than most other brokers. You can download IBKR Mobile for your device from the links below:

Spreads and Commissions: Does Interactive Brokers Charge Fair Fees?

In this section, we will take a look at the broker's fees for trading and other operations done by the clients. Spreads and Commissions in Interactive Brokers:

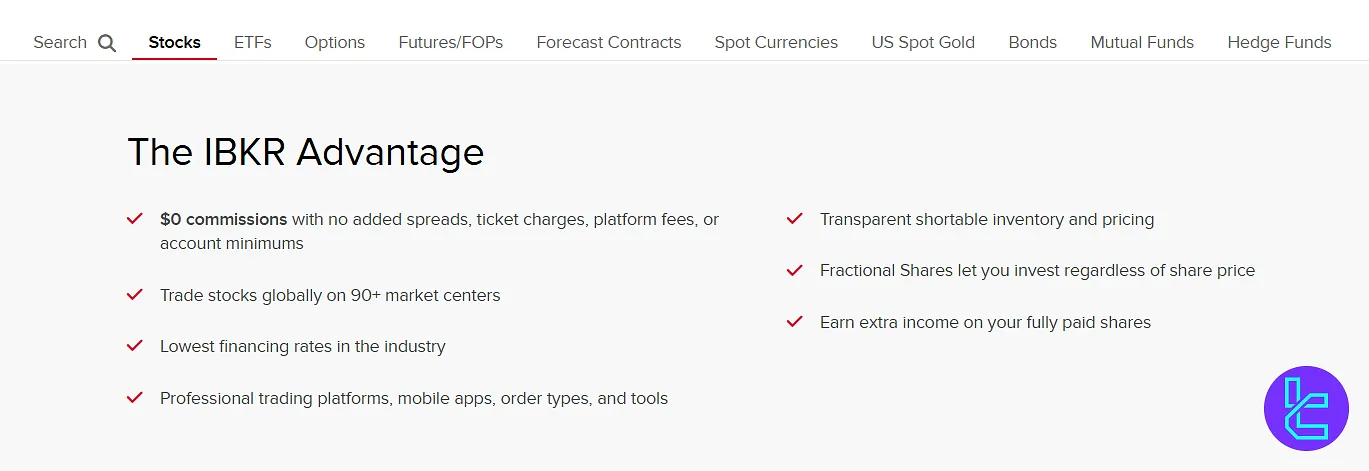

- Spreads: As low as 0.1 pips, with no hidden markups

- Commissions: Starting from $0, depending on the asset or symbol

Non-Trading Fees

Regarding withdrawal fees, you can only withdraw your funds for free once per month. For more frequent withdrawals, a commission will be paid. There are no additional exchange or regulatory fees. Also, no hidden costs were seen.

Deposit & Withdrawal Methods

Interactive Brokers offers several methods for funding your account and withdrawing funds. However, it does not support some popular options. The following sections will dig into more details.

Deposit Options

The table below is a summary of the available funding options at IBKR with brief related information:

Payment Method | Estimated Fee | Processing Time |

ACH, SEPA, BACS, and Other Bank Transfers | Free | 1–4 Business Days |

Bill Payment | Free (no IBKR fee; your bank may charge) | 1–2 Business Days (depends on bank) |

Check | Free | 5–10 Business Days (mailing time dependent) |

Wire Transfer | Free | Same Day (domestic); 1–4 Business Days (international) |

As mentioned, the brokerage does not support payments via e-wallets or credit/debit cards, which can be disappointing for some traders.

WIthdrawal Methods

The brokerage offers the same payment solutions for making withdrawals from the account. However, note that there might be fees involved in withdrawal transactions.

Copy Trading & Investment Options Offered on Interactive Brokers

As of the last update, the company does not offer a dedicated copy trading feature. In fact, Interactive Brokers focuses mainly on providing trading services in various markets. Therefore, you cannot find any investment options in this broker.

Which Markets & Symbols Are Available?

A vast range of tradable symbols is one of the most notable benefits of Interactive Brokers. Let's take a brief look at the offered trading products in the table below:

Category | Type of Instruments | Number of Symbols | Competitor Average |

Forex | Standard, Micro, Ultra Low Accounts | Over 100 Currency Pairs | 50–70 Currency Pairs |

Stocks | Direct Access to Shares Across Global Exchanges | 90+ Global Exchanges | 800–1200 Stocks (Typical CFD Brokers) |

ETFs | ETFs From Multiple International Markets | Thousands Of ETFs | 5-10 ETFs |

Options | Options on Stocks, Indexes, and Futures | Extensive Range (US & Global Markets) | Limited Coverage Among Competitors |

Commodities, Indexes, and Currency Futures | Broad Selection Across Asset Classes | Limited to Commodities/Indices | |

US Spot Gold | Trade Gold Like a Currency with Tight Spreads | Spot Trading (XAU/USD) | Often Offered As CFD Only |

Bonds | Government, Corporate, And Municipal Bonds | Wide Variety Across Regions | Very Limited (Few Brokers Offer Bonds) |

Mutual Funds | Thousands of Actively Managed And Index Funds | Thousands of Funds | Rare Among Competitors |

Hedge Funds | Alternative Investment Vehicles (For Accredited Investors) | Select Range of Hedge Funds | Not Typically Offered |

This diverse offering allows traders to build well-rounded portfolios and take advantage of opportunities across multiple asset classes.

Does Interactive Brokers Offer Any Bonuses and Promotions?

As per our latest investigations on the website, this brokerage does not currently provide any bonuses or promotional offerings to its clients. However, keep in mind that this might change in the future.

Therefore, check the official resources and channels for any changes in this regard.

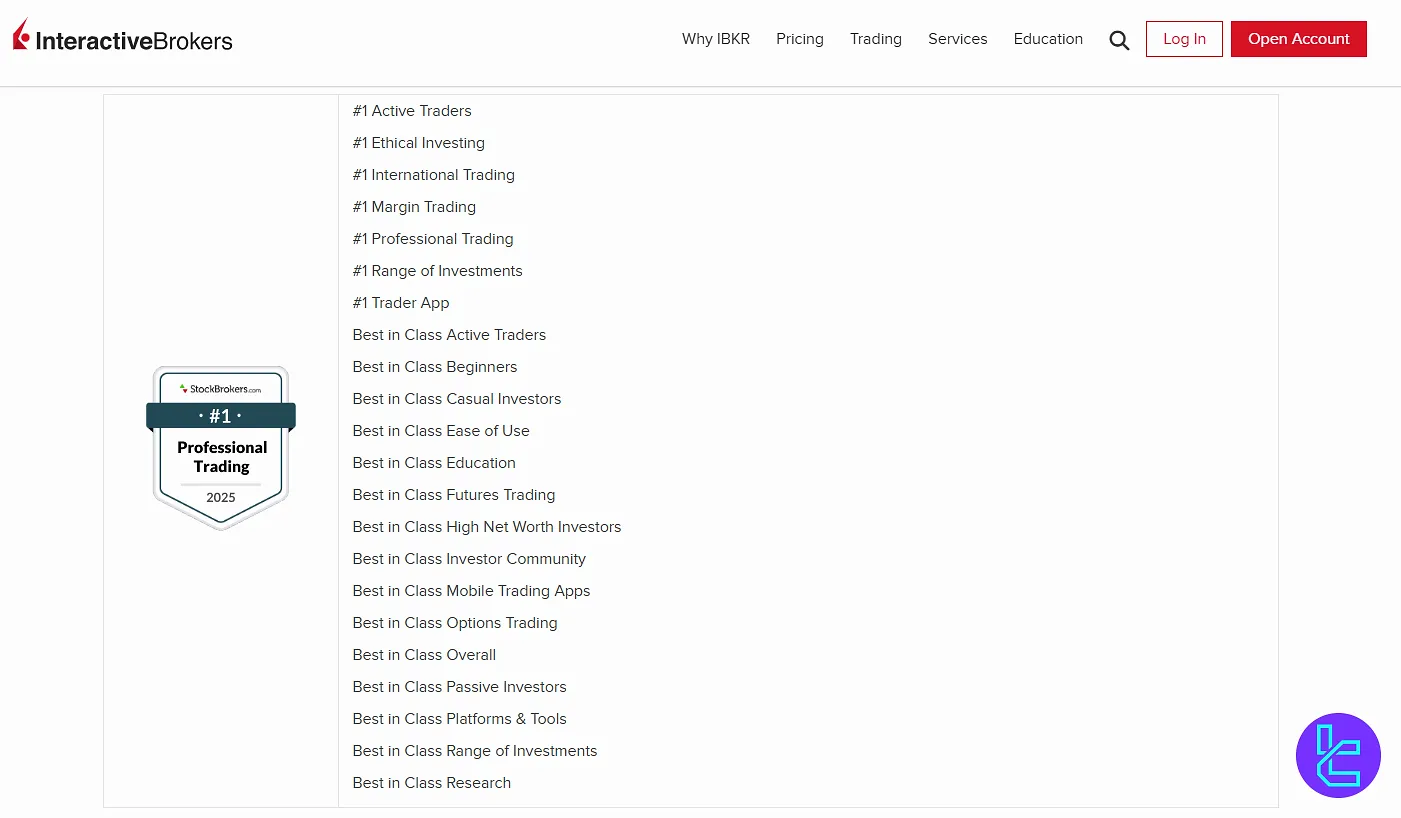

Interactive Brokers Awards & Industry Recognition

Interactive Brokers has earned widespread industry recognition for its competitive fee structure, advanced trading technology, and broad international market access. The firm’s performance has been consistently acknowledged by reputable financial publications and research platforms.

The Interactive Brokers awards will be reviewed in the following sections.

Barron’s Rankings

Barron’s has regularly positioned Interactive Brokers among the top-tier online brokerages. In its 2018 rankings (as reported by Yahoo Finance), the platform was awarded the #1 spot for Best Online Broker, emphasizing its robust offering for both retail and professional traders.

StockBrokers.com Accolades

According to data shared by Interactive Brokers U.K. Limited, the firm secured top positions in several key categories in 2018, including:

- Lowest Commissions and Fees

- Range of Investment Offerings

- Best for Active Traders

- Best for International Trading

Platform & App Recognition

Interactive Brokers' technological edge has also been acknowledged. As reported by HFM Week, the broker received the Best Mobile Application award in 2018, further reinforcing its reputation among active and professional users.

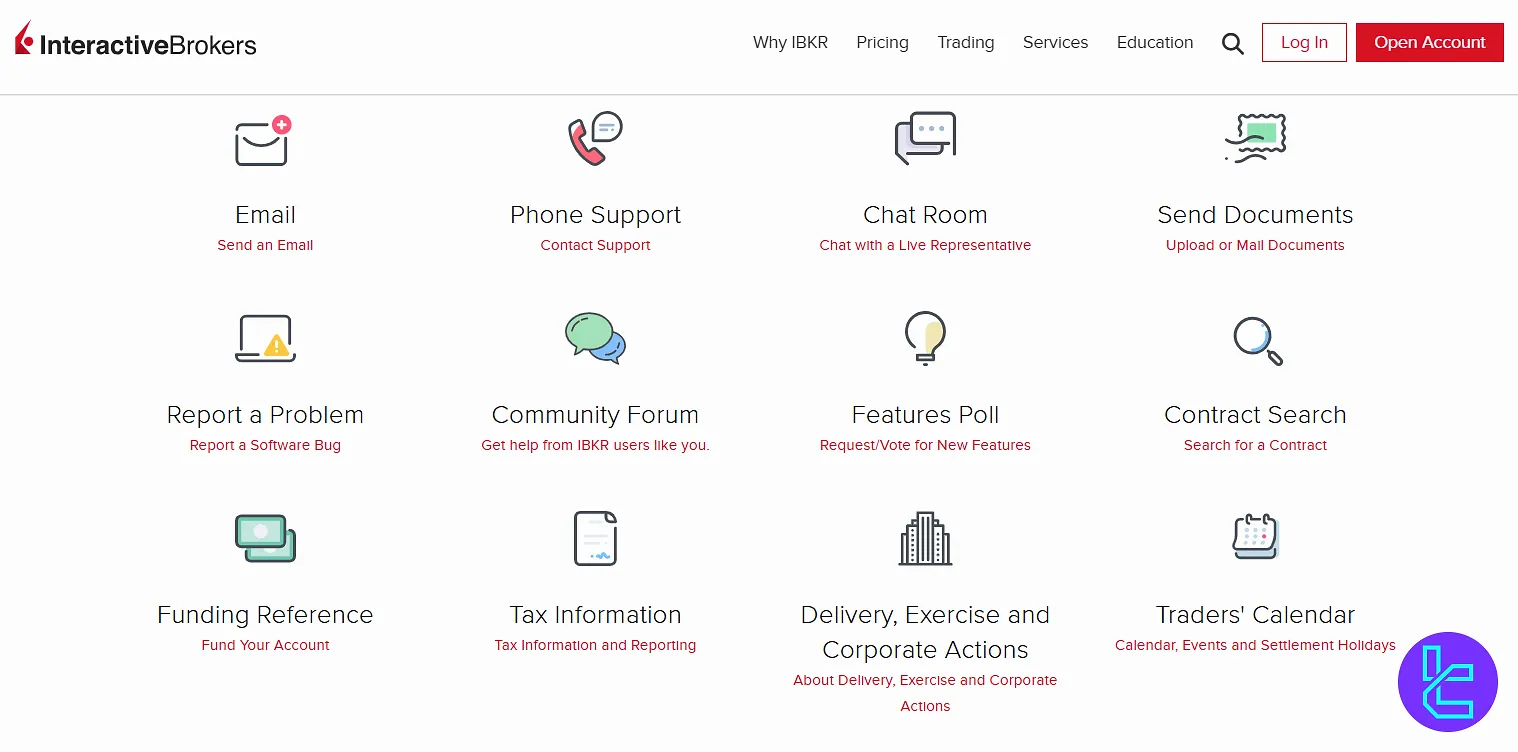

Support Contact Methods and Working Hours

Customer support service is one of the most critical parts of every broker. Interactive Brokers provides comprehensive support services with various contact methods:

- Phone Call: Different call centers for different regions, numbers available on the website

- Ticket: Via the official website

- Live Chat: Available on the website

Based on our investigations, the company provides 24/6 support services. However, hours might vary based on the region of the call center.

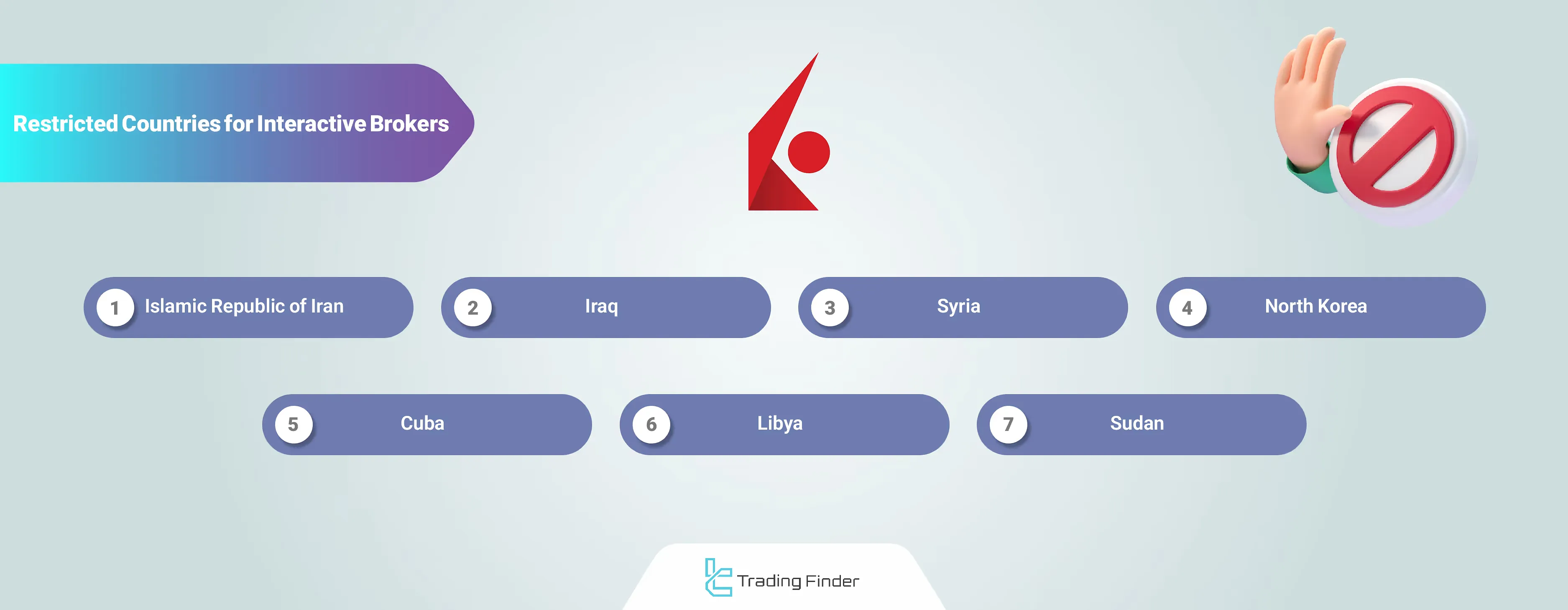

IB List of Restricted Countries

Interactive Broker operates globally, but service availability may vary by region. While they don't publicly list restricted countries, certain limitations may apply based on:

- Local regulations

- International sanctions

- IBKR's internal policies

As per our investigations, this brokerage does not offer its services to these countries:

- Iran

- Iraq

- Syria

- North Korea

- Cuba

- Libya

- Sudan

It's best to consult IBKR's website or contact their support for the most up-to-date information regarding service availability in your area.

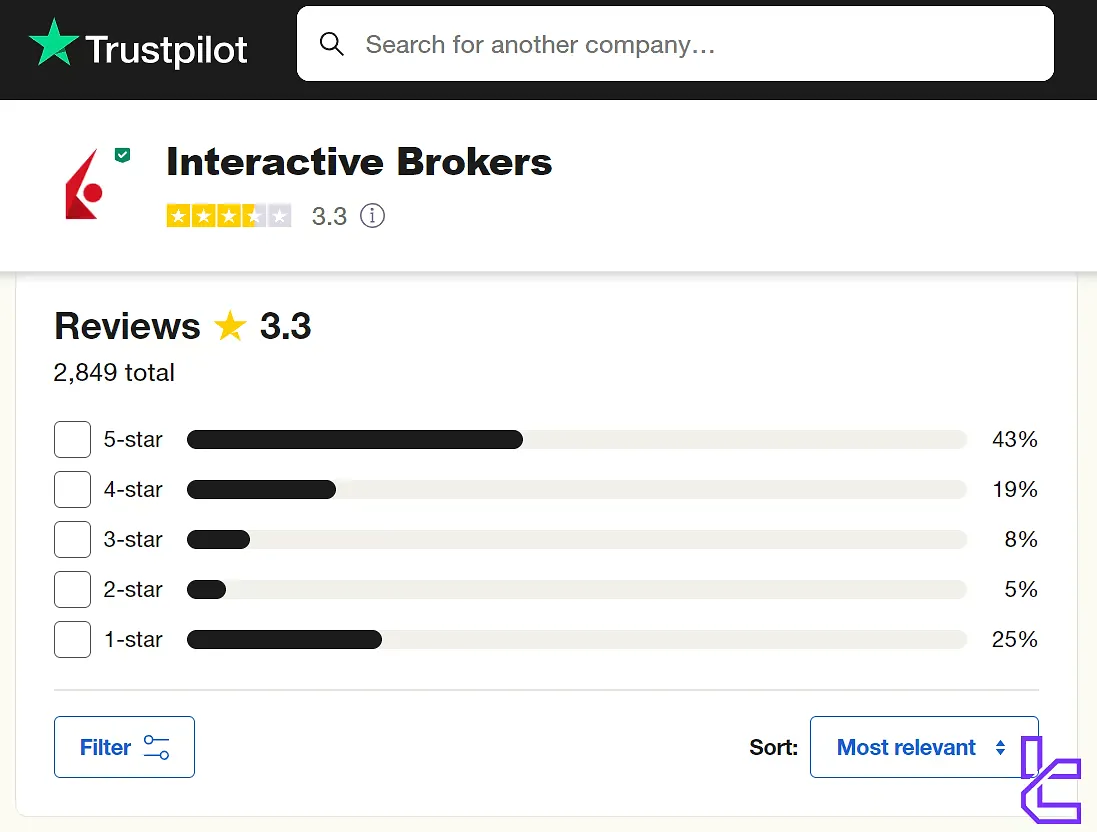

Trust Scores & Reviews

Interactive Brokers generally receives mediocre trust scores from industry evaluators and users alike on review websites such as Trustpilot. In this section, we will investigate scores on two resources in detail:

- Trustpilot Interactive Review: 3.3/5, more than 2,800 ratings

- ForexPeaceArmy: 2.4 out of 5, over 150 reviews

Based on these scores, IB might not be the most reliable broker in the industry, and traders should proceed with caution.

Education Content

Interactive Brokers offers a decent educational platform called IBKR Campus. This section covers various resources and content, including:

- Traders' Academy: Online courses on various trading topics

- Traders' Insight: Market commentary and financial news

- IBKR Quant: Resources for quantitative finance and programming

- Webinars: Live and recorded presentations by financial professionals

- IBKR Podcasts: Discussions on market trends and trading strategies

- Traders' Glossary: A dictionary for terms and phrases related to the financial world

- Traders' Calendar: An international trading calendar containing data about important events

Interactive Compared to Other Brokers

The table below compares Interactive Brokers with some of the popular brokerages in the industry:

Parameter | Interactive Broker | AvaTrade Broker | Tickmill Broker | FxGrow Broker |

Regulation | SEC, FINRA, NYSE, FCA, etc. | ASIC, CySEC, CBI, FSA, FSCA, MiFID, ADGM, PFSA, ISA | FSA, FCA, CySEC, LFSA, FSCA | CySEC, MiFID, CNMV, MNB, FINANSTILSYNET, ACPR, KNF, BaFin, FI, HCMC |

Minimum Spread | 0 Pips | From 0.0 Pips | From 0.0 Pips | From 0.00001 pips |

Commission | Variable from 0 | $0 | From $0.0 | $8 |

Minimum Deposit | $1 | $100 | $100 | $100 |

Maximum Leverage | 1:1000 | 1:400 | 1:1000 | 1:300 |

Trading Platforms | Proprietary | MetaTrader 4, MetaTrader 5, Mobile App, WebTrader | Metatrader 4, Metatrader 5, Metatrader Web, Mobile App | MetaTrader 5 |

Account Types | Individual, Joint, Trust, Retirement, Institutional, Non-Professional Advisor | Standard, Demo, Professional | Classic, Raw | ECN, ECN Plus, ECN VIP, Demo |

Islamic Account | No | Yes | Yes | Yes |

Number of Tradable Assets | 4,900+ | 1250+ | 620+ | 120+ |

Trade Execution | Instant | Instant | Market | Market |

Conclusion and Final Words

Interactive Brokers has received a trust score of 3.3/5 on "Trustpilot" with more than 2,800 reviews. The rating is 2.4/5 on "ForexPeaceArmy" and the number of reviewers is +150.

The company has a "Traders' Academy" program with online courses on trading topics. Also, a "Traders' Glossary" is provided.