IUX currently does not support Social or Copy trading features. Traders cannot mirror or automatically follow the strategies of other investors on the platform. Additionally, automated trading (EA or bot trading) is not available, meaning all trading activities must be performed manually by users.

IUX provides multiple account options, including Standard, Raw, and Pro, with minimum deposit of 10$.

It supports trading via the proprietary IUX Trade App, IUX Web Trading platform, and the widely used MetaTrader 5 (MT5).

IUX broker Company Information & Regulation Status

Since its founding in 2016, IUX has established itself as a prominent player in the online forex market. The company's primary goal has been to create a reliable and user-centric trading platform that caters to traders of all experience levels.

By focusing on innovation and striving for excellence, the broker has managed to carve out a niche in the competitive world of online trading. List of IUX regulations:

- Financial Services Authority in Saint Vincent and the Grenadines (FSA)

- Financial Sector Conduct Authority (FSCA) in South Africa

- Financial Services Commission (FSC) Mauritius

- Australian Securities and Investments Commission (ASIC)

Transactions are managed by UAB Woxa Corporation Limited (registered in Lithuania).

Here are the regulatory details of IUX:

Entity Parameters / Branches | IUX MARKETS (MU) LTD | IUX Markets ZA (PTY) Ltd | IUX Markets AU Pty Ltd |

Regulation | Financial Services Commission (FSC) Mauritius with License No GB22200605 | Financial Sector Conduct Authority (FSCA) in South Africa with License NO 53103 | Australian Securities and Investments Commission (ASIC) |

Regulation Tier | Tier 3 | Tier 2 | Tier 1 |

Country | Mauritius | South Africa | Australia |

Investor Protection Fund / Compensation Scheme | N/A | N/A | N/A |

Segregated Funds | Yes | Yes | Yes |

Negative Balance Protection | Yes | Yes | Yes |

Maximum Leverage | 1:3000 | Not specified | Not specified |

Client Eligibility | Not available to residents of Australia, Canada, Ukraine, any EU Member State, Iceland, Norway, Liechtenstein, the United Kingdom, the United States, or Malaysia | Only Clients from South America | Only Australian Residents |

As a Straight Through Processing (STP) broker, IUX ensures fast, transparent, and secure order execution for all clients.

IUX Summary of Specifics

IUX is a derivatives broker that offers a unique blend of features and services to cater to various traders' needs. Here's a quick overview of what the company brings to the table:

Broker | IUX |

Account Types | Standard, Raw, Pro |

Regulating Authorities | FSC, FSCA, ASIC |

Based Currencies | USD |

Minimum Deposit | $10 |

Deposit/Withdrawal Methods | Mobile Money, Bank Transfer, Cards (Visa, Master), QR, E-wallet, Crypto, Virtual Bank |

Minimum Order | 0,01 |

Maximum Leverage | 1:3000 |

Investment Options | NO |

Trading Platforms & Apps | MetaTrader5, Web Trader, Application |

Markets | Currencies, Crypto CFD, Indices, Stocks, Commodities, Asset Quotes |

Spread | Floating (From 0) |

Commission | From 0 |

Orders Execution | MM/STP |

Margin Call/Stop Out | 30/0% for Standard, Raw and Pro Accounts |

Trading Features | Economic calendar, Calculator, IUX Blog, IUX Education |

Affiliate Program | Yes |

Bonus & Promotions | No |

Islamic Account | Yes |

PAMM Account | No |

Customer Support Ways | Email, Live Chat |

Customer Support Hours | 24/7 |

IUX is particularly well-suited for experienced day and swing traders due to its low trading costs and high-speed execution.

However, beginner traders seeking comprehensive educational resources might find the broker's offerings lacking in this area.

IUX Forex Broker Account Types

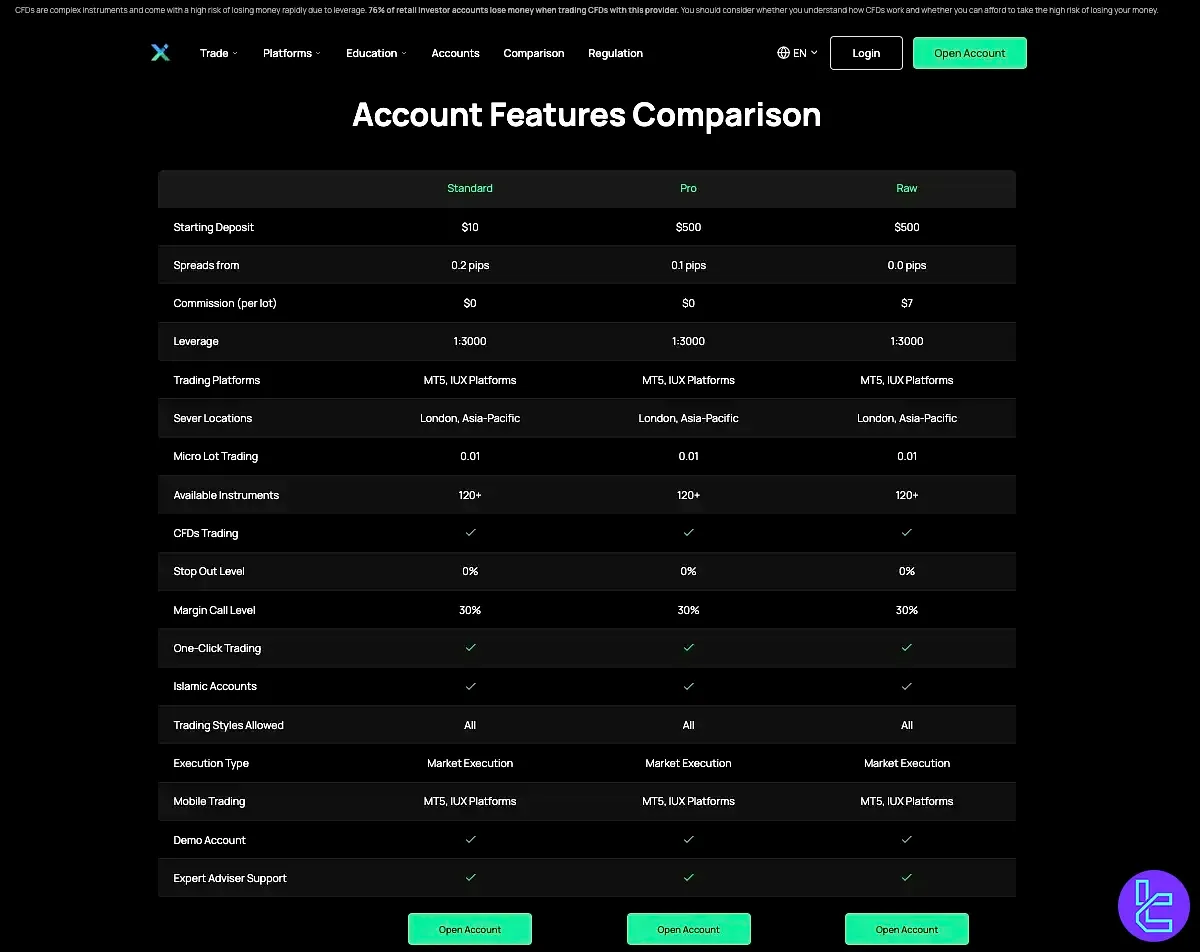

The broker offers a variety of account types to cater to different trading styles and experience levels.

Here's a breakdown of the main account types:

| Account Type | Standard | Pro | Raw |

| Minimum Deposit | $10 | $500 | $500 |

| Minimum Withdrawal | $5 | $5 | $5 |

| Spreads From | 0.2 Pips | 0.1 Pips | 0.0 Pips |

| Commission | $0 Per Lot | $0 Per Lot | $6 Per Lot |

| Maximum Leverage | 1:3000 | 1:3000 | 1:3000 |

All IUX accounts provide:

- Access to a wide range of trading instruments (currencies, cryptocurrencies, indices, stocks, and commodities)

- Choice of trading platforms (MetaTrader 4 and MetaTrader 5)

- Index CFDs Trading

IUX Advantages and Disadvantages

When considering IUX as your forex broker, weighing both the pros and cons is essential. Here's a balanced overview of the advantages and disadvantages:

Advantages | Disadvantages |

Low transaction costs | overnight fees |

Very high liquidity | Risks associated with high leverage |

A diverse range of tradable products | Lack of strict regulation |

Traders must carefully consider these factors and thoroughly research IUX's reputation, security measures, and financial stability before opening an account.

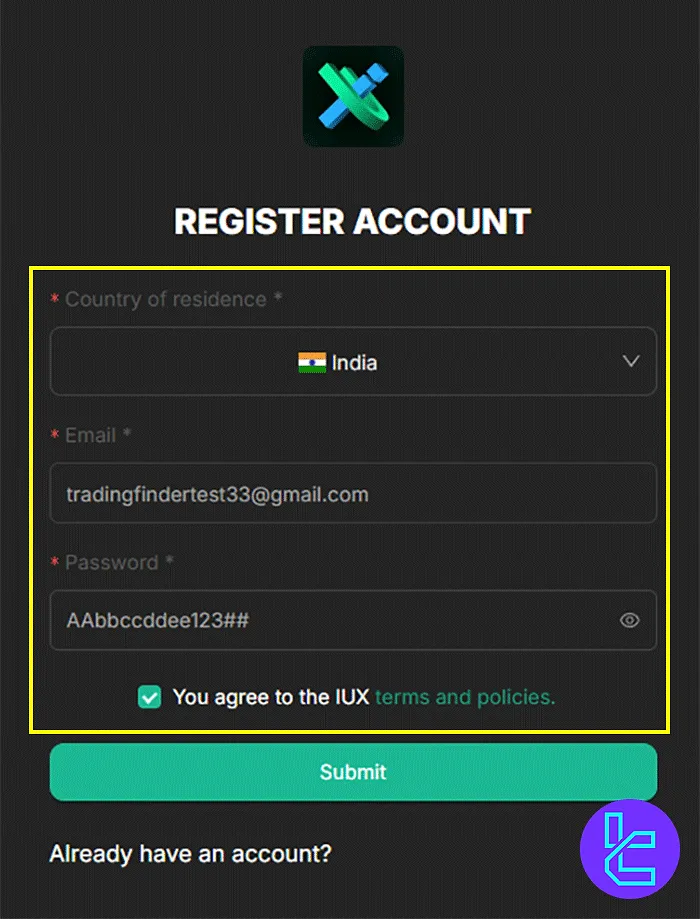

IUX Signing Up & Verification Process

IUX Broker registration takes just a couple of minutes, and all you need is a valid email, a strong password, and to select your country of residence.

#1 Initial Registration

New users begin by creating an account. This can be done by providing an email address and selecting a password, or by linking an existing Google or Apple account for instant sign-up.

#2 Provide Personal Details

The user must fill in basic personal information, including their country of residence.

#3 Account Verification

To comply with regulations, users must verify their identity. This typically involves submitting two types of documents:

- Proof of Identity (POI): A clear, color copy of a valid government-issued ID (such as a passport, national identity card, or driver's license);

- Proof of Address (POA): A document to confirm the user's residential address (such as a recent utility bill or bank statement).

#4 Fund and Trade

Once the verification documents are submitted and approved by the IUX team, the account is fully activated. The user can then fund their account using one of the available methods and begin trading.

IUX Broker Trading Platforms

IUX broker offers a range of trading platforms to suit different trader preferences and needs:

Platform | Features | Availability |

Trade App | - User-friendly interface - Real-time market data and news - Access to the global markets | iOS, Android |

Web Trade | - Browser-based trading platform - No download required - Seamless trading across devices - Integrated with TradingView charts | Web-based (any browser) |

MetaTrader 5 (MT5) | - Industry-standard platform - Advanced technical analysis tools - Extensive customization options | Desktop, Web, Mobile |

IUX's focus on providing a variety of platforms.

Combined with its emphasis on fast execution and deep liquidity, these features make the broker particularly attractive to high-frequency traders, scalpers, and algorithmic traders.

IUX Spreads and Commissions Structure

IUX offers competitive pricing across its account types:

Account type | Spreads From | Commission |

Standard | 0.2pips | $0 |

Raw | 0 | $3 |

Pro | 0.1 | $0 |

There are no inactivity fees. However, traders should be aware of the broker’s overnight swap charges. Depending on position and market direction, these fees can be significant.

For instance, holding a 1-lot EUR/USD buy trade for 7 nights could incur a swap fee of –$25.84, while the same sell position might gain +$8.21.

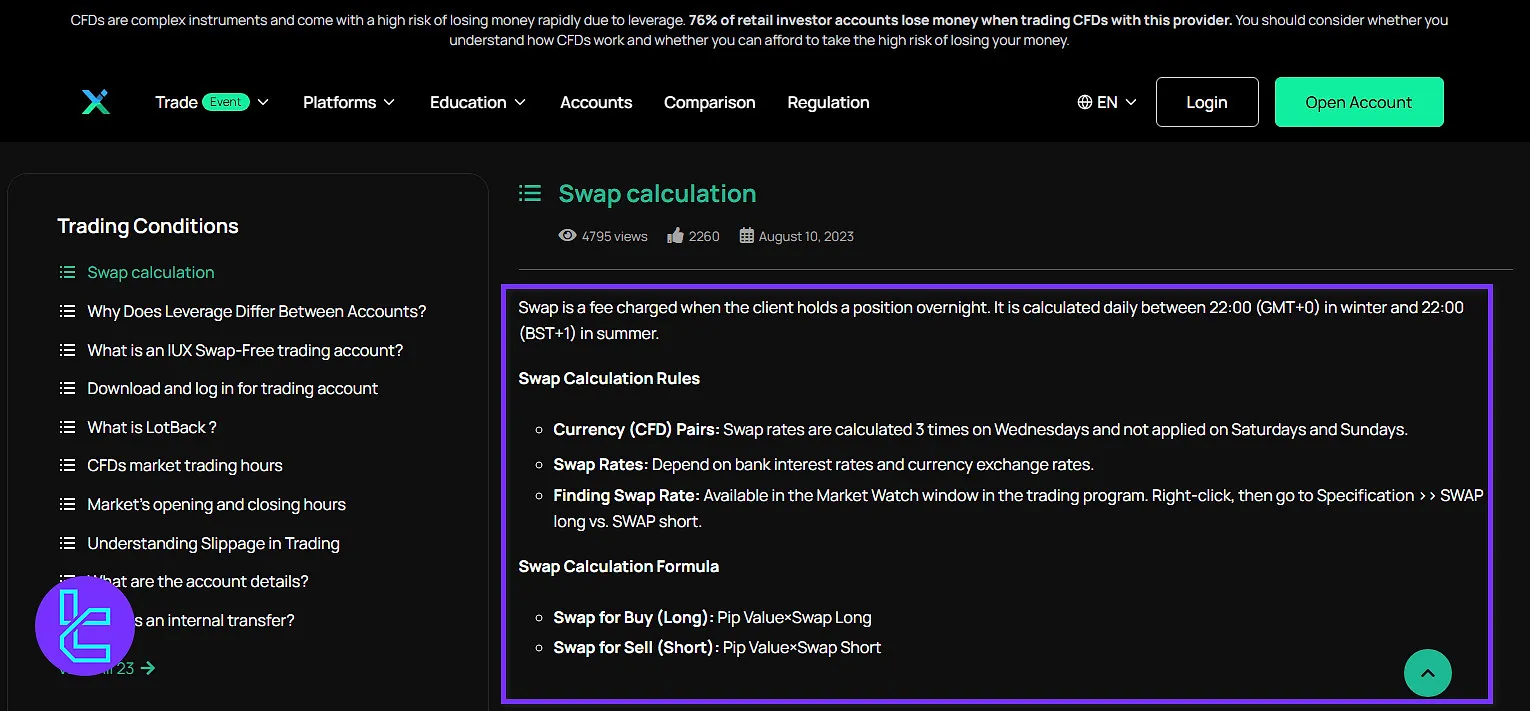

IUX Broker Swap Fees

At IUX Markets, swap fees apply when a trading position remains open overnight. These overnight financing costs are calculated once each trading day, typically at 22:00 (GMT+0) during winter and 22:00 (BST+1) in summer.

For currency and CFD pairs, swaps are charged three times on Wednesdays to account for weekend rollover, as no swaps are applied on Saturdays or Sundays.

The exact swap rate varies depending on interbank interest rate differentials and currency exchange rates.

Traders can view current swap rates directly in the Market Watch section of the trading platform. By right-clicking on a symbol and selecting Specification, both Swap Long and Swap Short values become visible.

Swap Calculation Formula:

These rates fluctuate based on market conditions, interest rate changes, and the instruments being traded, making it important for traders to verify swap values before holding positions overnight.

IUX Broker Non-Trading Fees

IUX Markets maintains a fee-free policy across all account types, ensuring that clients can open and manage their trading accounts without additional platform charges. The broker does not impose any internal fees for account creation, maintenance, or trading activity.

Costs related to deposits or withdrawals depend solely on third-party payment providers or banks, which may apply their own processing fees or exchange-rate adjustments.

These charges can vary depending on transaction time, method, and financial institution policies.

Although financial institutions typically apply service fees when transferring funds or trading CFDs and currencies, IUX Markets itself does not add any extra markup beyond those external costs.

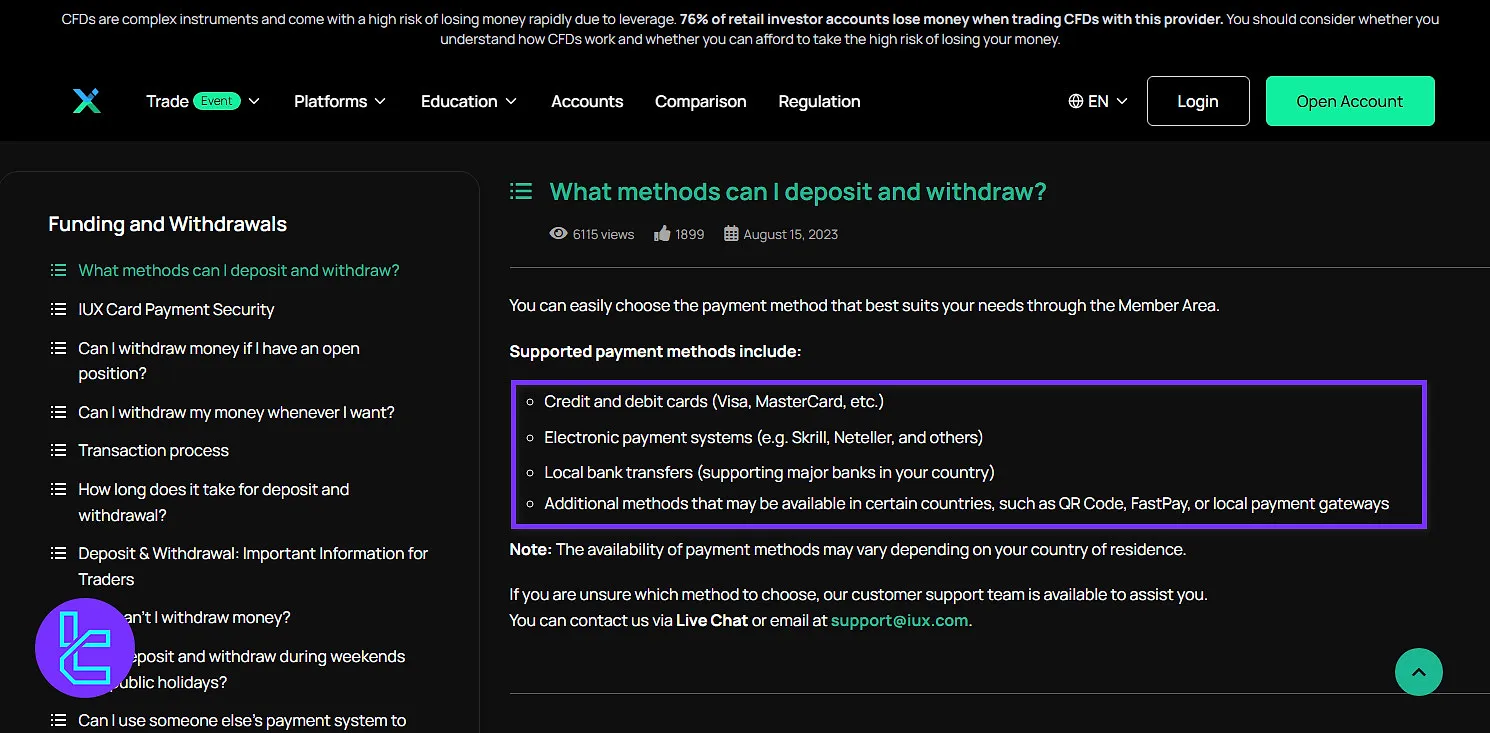

IUX Broker Deposit & Withdrawal Methods

The broker offers a streamlined deposit and withdrawal process to ensure smooth transactions for its clients:

- Mobile Money

- Bank Transfer

- Cards (Visa, MasterCard)

- QR

- E-wallet

- Cryptocurrency

- Virtual Bank

The processing time for deposits varies from instant transactions to periods of up to 20 minutes. IUX's efficient deposit and withdrawal system, along with its low minimum deposit requirement, makes it accessible to a wide range of traders.

IUX Broker Deposit

IUX Markets offers multiple funding options designed to meet the needs of traders across different regions. All deposits can be made directly through the Member Area, allowing clients to select their preferred payment method conveniently.

Available options include credit and debit cards (such as Visa and MasterCard), e-payment systems like Skrill and Neteller, and local bank transfers supporting major domestic banks.

In some countries, alternative channels, including QR Code payments, FastPay, or local gateways, may also be accessible. The range of payment methods depends on the client’s country of residence.

Deposit-related fees are not charged by IUX Markets Limited. Any applicable transaction costs are determined by the payment providers or banks involved, and may vary based on timing or institutional conditions.

Here are the details of every deposit method in IUX broker:

Deposit Method | Supported Currencies | Deposit Fees | Processing Time | Notes |

Credit / Debit Cards (Visa, MasterCard) | Major currencies (e.g. USD, EUR) | None (provider fees may apply) | Instant | Must be in the account holder’s name |

Electronic Payment Systems (Skrill, Neteller, etc.) | USD, EUR, and others | None (provider fees may apply) | Instant | Widely supported; varies by region |

Local Bank Transfer | Major local currencies | Bank fees may apply | 1–3 business days | Supports domestic banks in eligible countries |

Alternative Methods (QR Code e.g) | Depends on the region | None (provider fees may apply) | Instant or same day | Available only in certain countries |

According to the broker’s AML (Anti-Money Laundering) policy, deposits must originate from the account holder’s own name.

Transactions from third parties, unauthorized sources, or mismatched identities may lead to the invalidation of trading profits and could result in legal consequences under applicable laws.

IUX Markets applies no withholding tax on deposits or withdrawals. Clients remain responsible for their own tax obligations and may contact their local tax authority for clarification.

Complete transaction and trading histories are available through the broker’s website, client area, or the MetaTrader 5 platform.

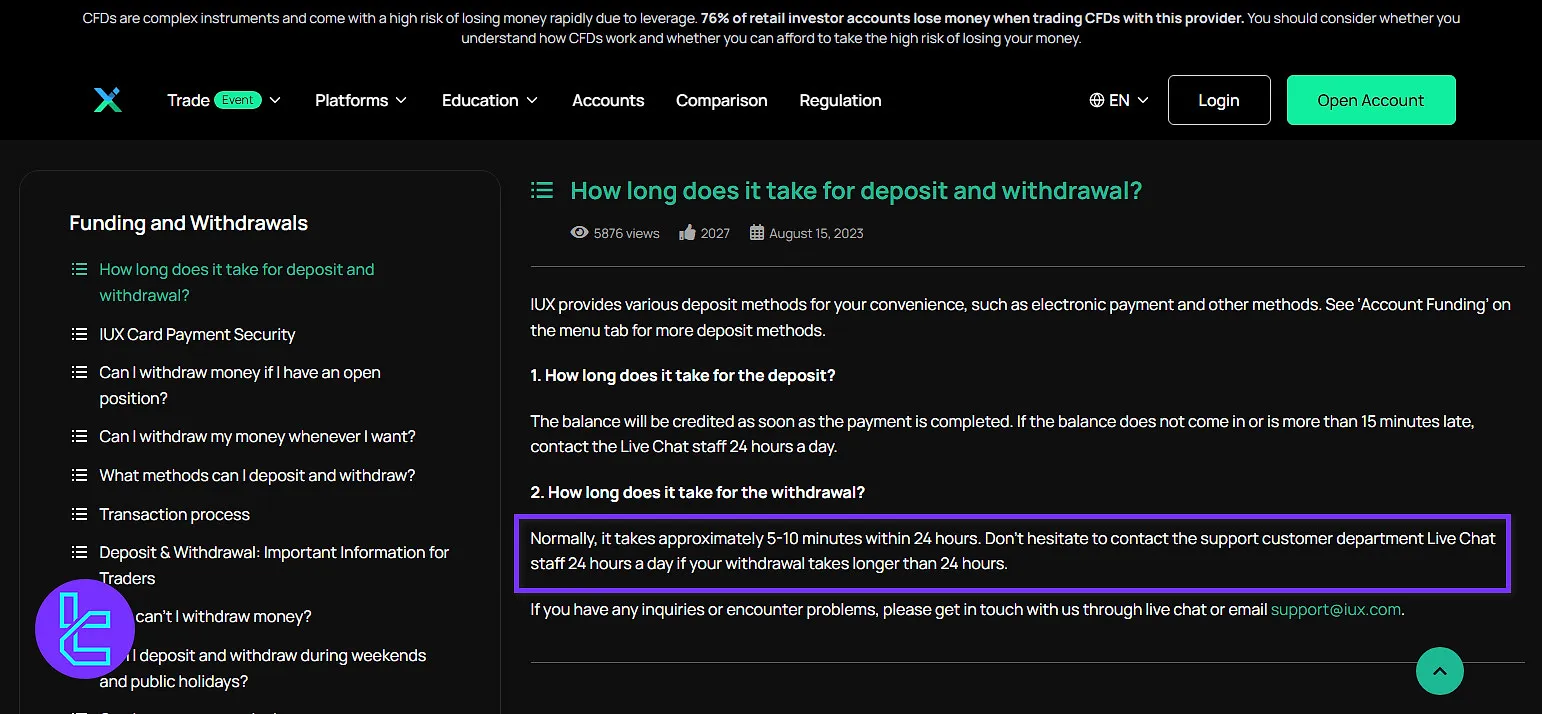

Once a payment is confirmed, the deposited amount is normally credited instantly. If funds are not reflected within 15 minutes, clients can reach 24/7 Live Chat support for immediate assistance.

IUX Broker Withdrawal

IUX Markets allows traders to withdraw funds even while maintaining open positions, provided certain margin requirements are met.

The maximum allowable amount is up to 90% of the available Free Margin, excluding any credit bonuses.

Formula:

Before requesting a withdrawal under open trades, traders are advised to verify that sufficient Free Margin remains to support their positions.

Withdrawals can only be processed once both the trading account and bank account have been fully verified. This procedure is mandatory to ensure compliance with security and anti-fraud regulations.

All requests are reviewed within 24 business hours, after which approved transactions are released to the verified account holder.

For safety reasons, funds must be withdrawn to an account registered under the same name as the trading profile. Third-party transfers are strictly prohibited.

Clients can manage their withdrawal preferences through the Member Area, where several payment options are available:

Payment Method | Type | Availability | Processing Time | Notes |

Credit / Debit Cards | Visa, MasterCard | Deposits & Withdrawals | 5–10 minutes (up to 24 hours) | Must use a verified card in the account holder’s name |

E-Wallets | Skrill, Neteller, etc. | Deposits & Withdrawals | 5–10 minutes (up to 24 hours) | Fastest option for electronic payments |

Local Bank Transfer | Domestic bank transfer | Deposits & Withdrawals | Within 24 business hours | Supports major banks in supported countries |

Regional Payment Methods | QR Code | Deposits & Withdrawals (where available) | Varies by provider | May depend on local service availability |

Processing times vary by method. Most digital withdrawals are completed within 5–10 minutes, while some transactions may take up to 24 hours, depending on the payment provider.

Copy Trading & Investment Options offerings

IUX Broker Tradable Markets & Symbols Overview

The broker provides access to 162 global markets and assets from various categories:

Category | Type of Instruments | Number of Symbols (IUX) | Competitor Average | Maximum Leverage |

Forex | Major, Minor, and Exotic Currency Pairs (available on Standard, Micro, and Ultra Low accounts) | 42 | 50–70 Currency Pairs | 1:3000 |

Stocks | Global shares, including AMZN, TSLA, META, and others via MT5 | 48 | 800–1,200 Stocks | 1:20 |

Commodities | Spot CFDs on Metals and Energy | 5 | 10–20 Instruments | 1:300 |

Indices | CFDs on Major Global Indices | 10 | 10–20 Indices | 1:400 |

Crypto CFDs | Leading cryptocurrencies in global markets | 15 | 30–50 Cryptos (average range) | 1:3000 |

Thematic | Covers the most popular and liquid global markets | 6 | N/A | 1:50 |

IUX’s Bonuses and Promotions

IUX currently does not offer any bonuses for new clients. However, traders can benefit from the active cashback program known as the “LotBack Program,” which rewards users based on their trading volume. Additionally, VPS service is available for clients seeking enhanced trading performance and stability.

IUX Broker Awards

IUX has earned multiple international awards acknowledging its performance in trading services, platform innovation, and client support.

These IUX awards reflect the broker’s consistent development of trading infrastructure and technology-driven solutions for retail and institutional clients.

- Best Trading Broker by TrustFinance Award 2024

- Best Low Spread Broker by Money Exhibition Asia

- Best Low Spread Broker 2024 by Forex Brokers Award 2024 (Fxdailyinfo)

- Best Innovative Platform by Brokersview

Each award highlights IUX’s strong presence in the global brokerage industry, particularly its focus on competitive spreads, efficient execution, and platform advancement.

IUX Broker Support Team

IUX broker places a strong emphasis on customer support to ensure a smooth trading experience. IUX support at a glance

- Support Availability: 24/7

- Contact Options:

- Email support: support@iux.com

- Live chat: 24/7 via official website and IUX application

- Supported Languages: English, Español, Bahasa Indonesia, Português, Vietnamese, Chinese

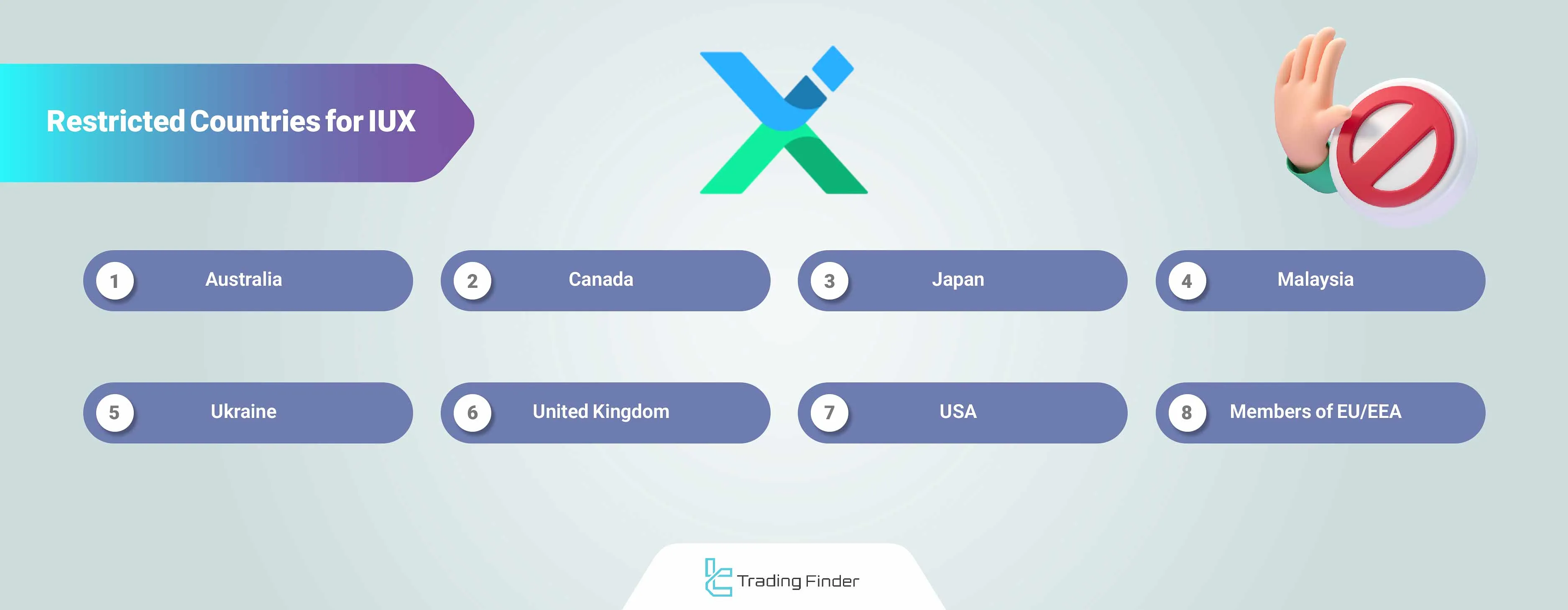

IUX Broker List of Restricted Countries

IUX, while operating globally, does not accept clients from certain countries due to regulatory and compliance requirements. Here’s the complete list:

- Australia

- Canada

- Japan

- Malaysia

- Ukraine

- United Kingdom

- United States of America

- Members of EU/EEA

This list is subject to change at the broker's discretion. IUX cites compliance with Anti-Terrorism Financing and Reduction of International Money Laundering Laws as the primary reason for these restrictions.

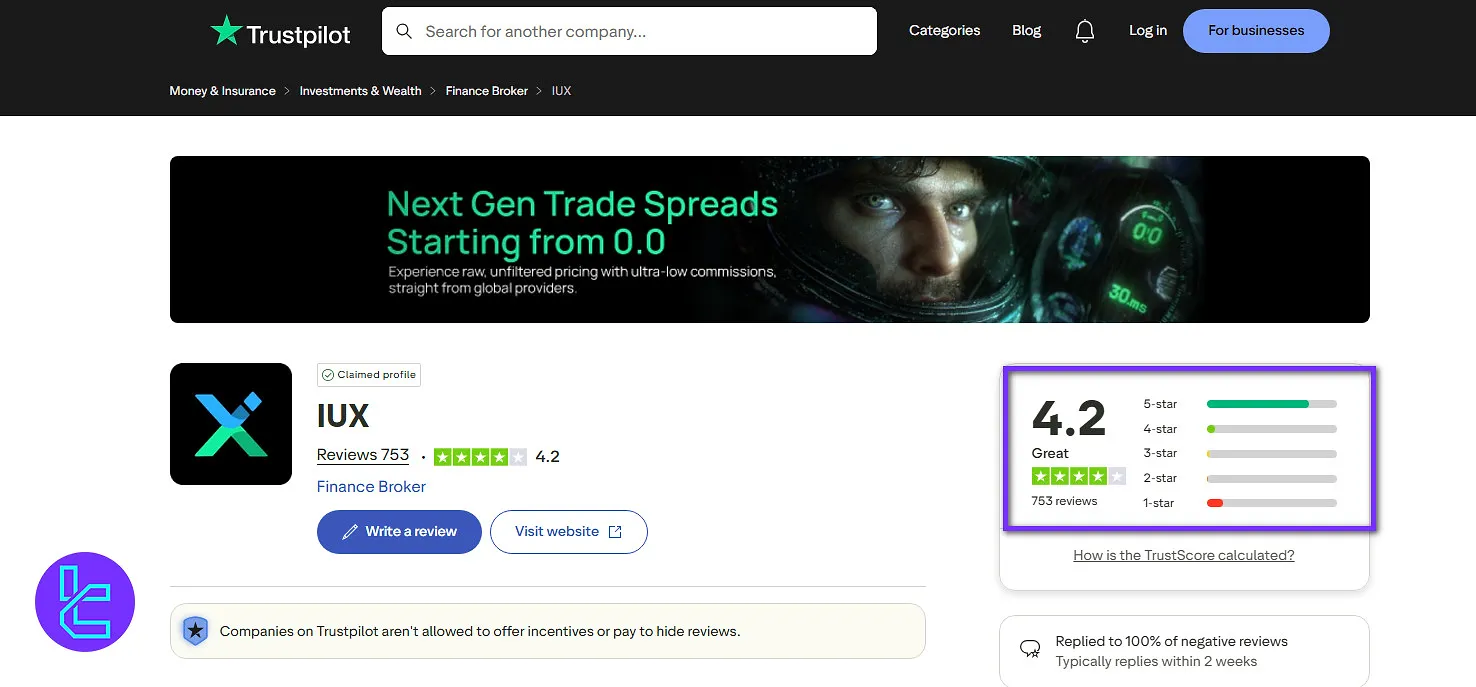

IUX Broker Trust Scores & Reviews

IUX's Trustpilot profile shows a score of 4.2 out of 5. IUX has received a mix of reviews from users, with a total of 750+ ratings.

Many users appreciate the low spreads, fast deposit and withdrawal processes, and the availability of a $30 welcome bonus without a deposit requirement.

However, there are also negative reviews, notably from users expressing frustration over withdrawal issues and a perceived lack of support from customer service.

One reviewer highlighted that despite following withdrawal conditions, they faced difficulties accessing their earnings, leading to disappointment.

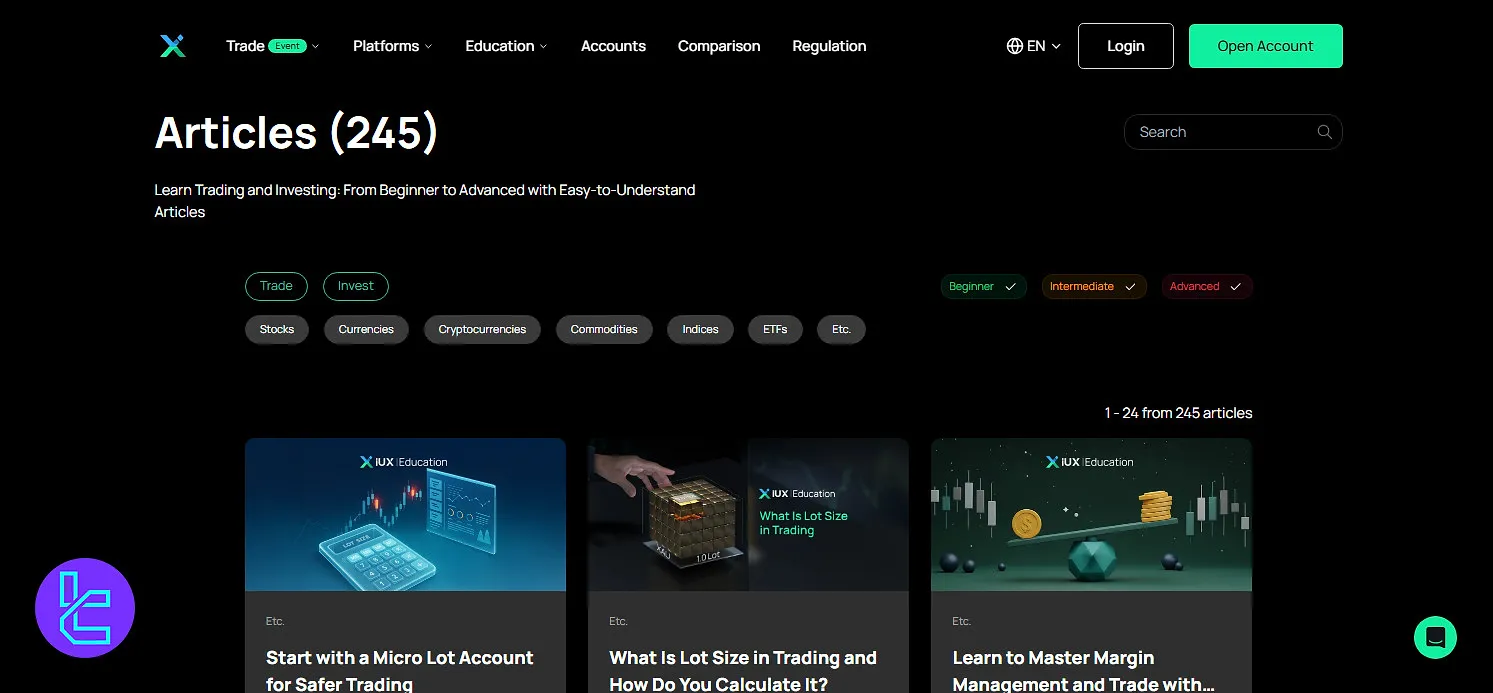

Educational Resources on IUX Broker

IUX Broker offers a robust educational platform designed to enhance trading and investing skills for all levels of traders, from beginners to advanced.

Their comprehensive courses cover essential topics to help users effectively manage their investments and improve financial stability.

With a user-friendly interface, learners can easily navigate through the available resources and gain valuable knowledge. IUX Educational Resources:

- Courses available for beginners, intermediates, and advanced traders

- Focus on practical skills for managing positions

- Structured learning paths with clearly defined lesson plans

- Interactive lessons and resources to enhance understanding

- Opportunities to learn at your own pace with flexible course durations

IUX in Comparison to Other Brokerages

The table below compares the brokerage against some of its peers:

Parameter | IUX Broker | IC Markets Broker | LiteForex Broker | FXGlory Broker |

Regulation | FSA, FSCA | FSA, CySEC, ASIC | CySEC | No |

Minimum Spread | From 0 | From 0.0 Pips | From 0.0 Pips | From 0.1 Pips |

Commission | From 0 | From $3 | From $0.0 | $0 |

Minimum Deposit | $3 | $200 | $50 | $1 |

Maximum Leverage | 1:3000 | 1:500 | 1:30 | 1:3000 |

Trading Platforms | MetaTrader5, Web Trader, Mobile App | Metatrader 4, Metatrader 5, cTrader, cTrader Web, IC Markets Mobile | MetaTrader 4, MetaTrader 5, Mobile Proprietary App | MetaTrader 4, MetaTrader 5 |

Account Types | Standard, , Raw, Pro, Demo | Standard, Raw Spread, Islamic | Classic, ECN, Demo | Standard, Premium, VIP, CIP |

Islamic Account | Yes | Yes | No | Yes |

Number of Tradable Assets | N/A | 2,250+ | N/A | 45 |

| Trade Execution | Market | Market | Market | Market, Instant |

Conclusion and Final Words

Offering maximum leverage of 1:3000 spreads starting at zero pips and commissions as low as $0 for some accounts, IUX appeals to experienced traders.

Bonuses like the $30 welcome bonus and promotions such as a 35% deposit bonus enhance its appeal.

Despite these strengths, drawbacks like overnight fees, risks associated with high leverage, and the lack of strict regulation must be carefully weighed.