Just2Trade offers trading services through Forex and CFD Standard, Forex ECN, and MT5 Global accounts. These accounts have variable spreads from 0.0 pips and trading commissions from $2 per lot.

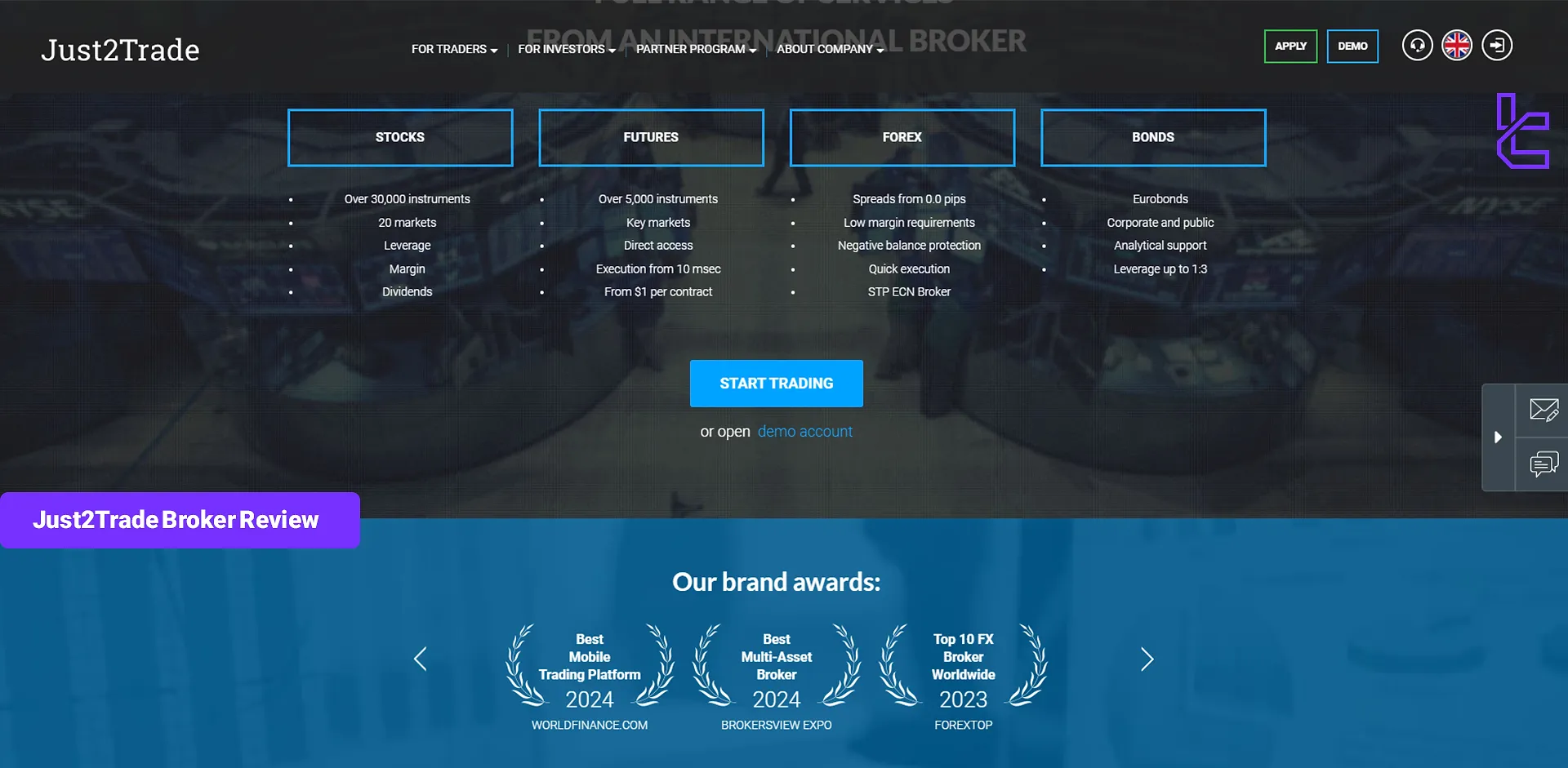

Just2Trade has won 6 prestigious awards, offering excellent services to over 155,000 users.

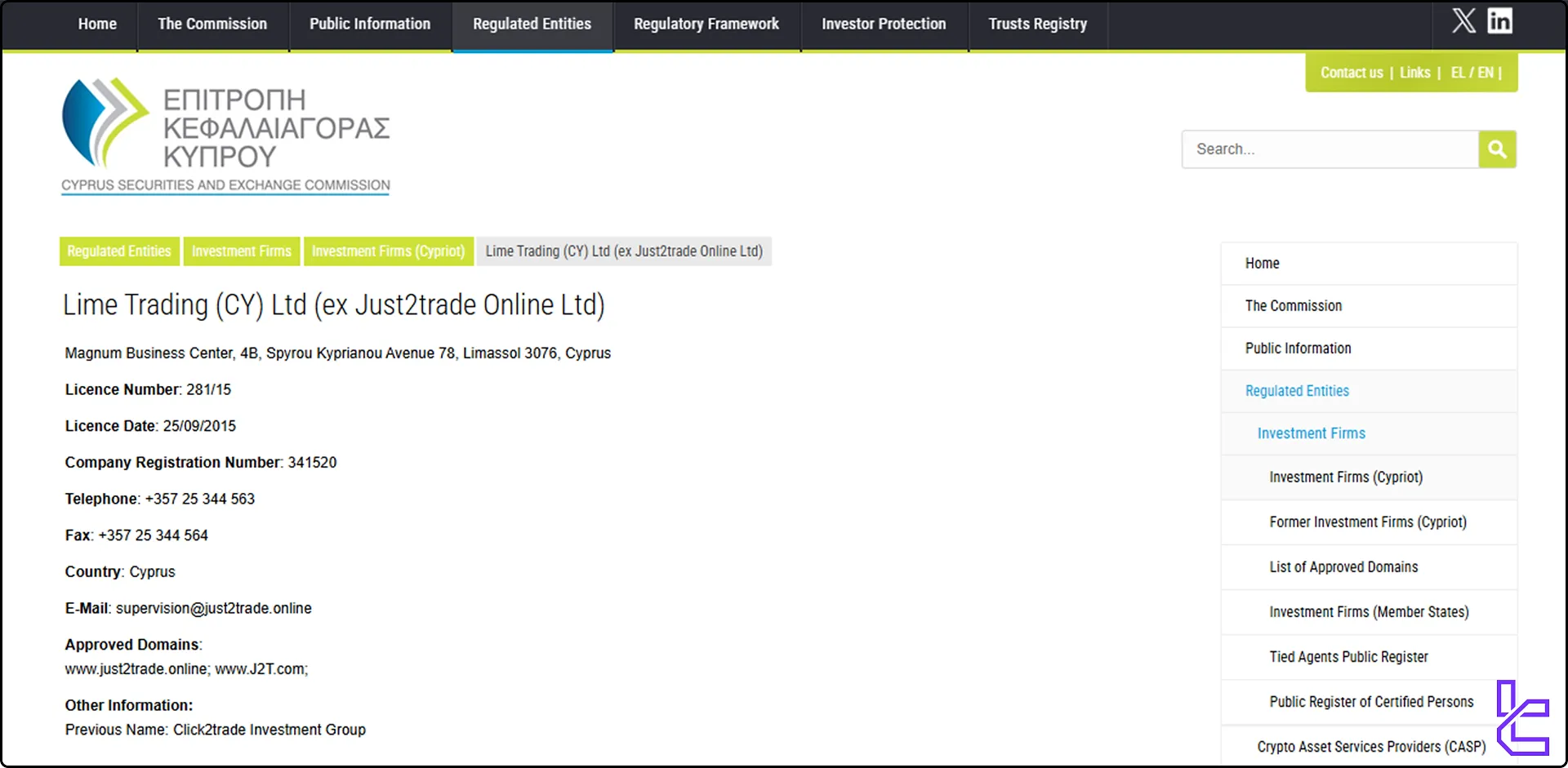

Just2Trade Broker Company Information & Regulation Overview

Just2Trade is a leading international investment company providing brokerage services since 2015.

The company is authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC), subject to the oversight of the European Securities and Markets Authority (ESMA). Key points about Just2Trade:

- Founded in 2015

- Regulated by CySEC (License number 281/15)

- Serves over 155,000 clients from 33 countries

In the table below you can check out the regulatory details of Just2Trade:

Entity Parameters / Branches | Lime Trading (CY) Ltd |

Regulation | Authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC) |

Regulation Tier | Tier 1 |

Country | Cyprus |

Investor Protection Fund / Compensation Scheme | Member of the Investor Compensation Fund (ICF), offering up to €20,000 per eligible client |

Segregated Funds | Yes |

Negative Balance Protection | Yes |

Maximum Leverage | 1:30 |

Client Eligibility | Available to both retail and professional clients within the European Economic Area (EEA) |

Just2Trade Broker Specifications Summary

Just2Trade offers a comprehensive suite of trading services catering to both novice and experienced traders. Here's a quick overview of what the Forex broker brings to the table:

Broker | Just2Trade |

Account Types | Forex and CFD standard, Forex ECN, MT5 Global |

Regulating Authorities | CySEC, ESMA |

Based Currencies | USD, EUR, RUB |

Minimum Deposit | $100 |

Deposit Methods | Visa/MasterCard, PayPal, Bank wired, Neteller, Skrill, OXXO, SPEI, 7-Eleven |

Withdrawal Methods | Visa/MasterCard, PayPal, Bank wired, Neteller, Skrill, Finam, UnionPay, AstroPay |

Minimum Order | 0.01 Lot |

Maximum Leverage | 1:500 |

Investment Options | Copy trading, Robo Adviser, Individual investment portfolio |

Trading Platforms & Apps | MT4, MT5, CQG, Sterling Trader Pro |

Markets | Forex, indices, commodities, bonds, stocks, CFDs, Futures, Options |

Spread | Floating from 0.0 pips |

Commission | From $2 |

Orders Execution | Market |

Margin Call/Stop Out | 100%/50% |

Trading Features | Demo account, economic calendar, invest in IPO |

Affiliate Program | Yes |

Bonus & Promotions | Deposit bonus |

Islamic Account | Yes |

PAMM Account | Yes |

Customer Support Ways | Email, live chat, phone |

Customer Support Hours | 24/7 |

Restricted Countries | Iran, Syria, Canada, USA, and more |

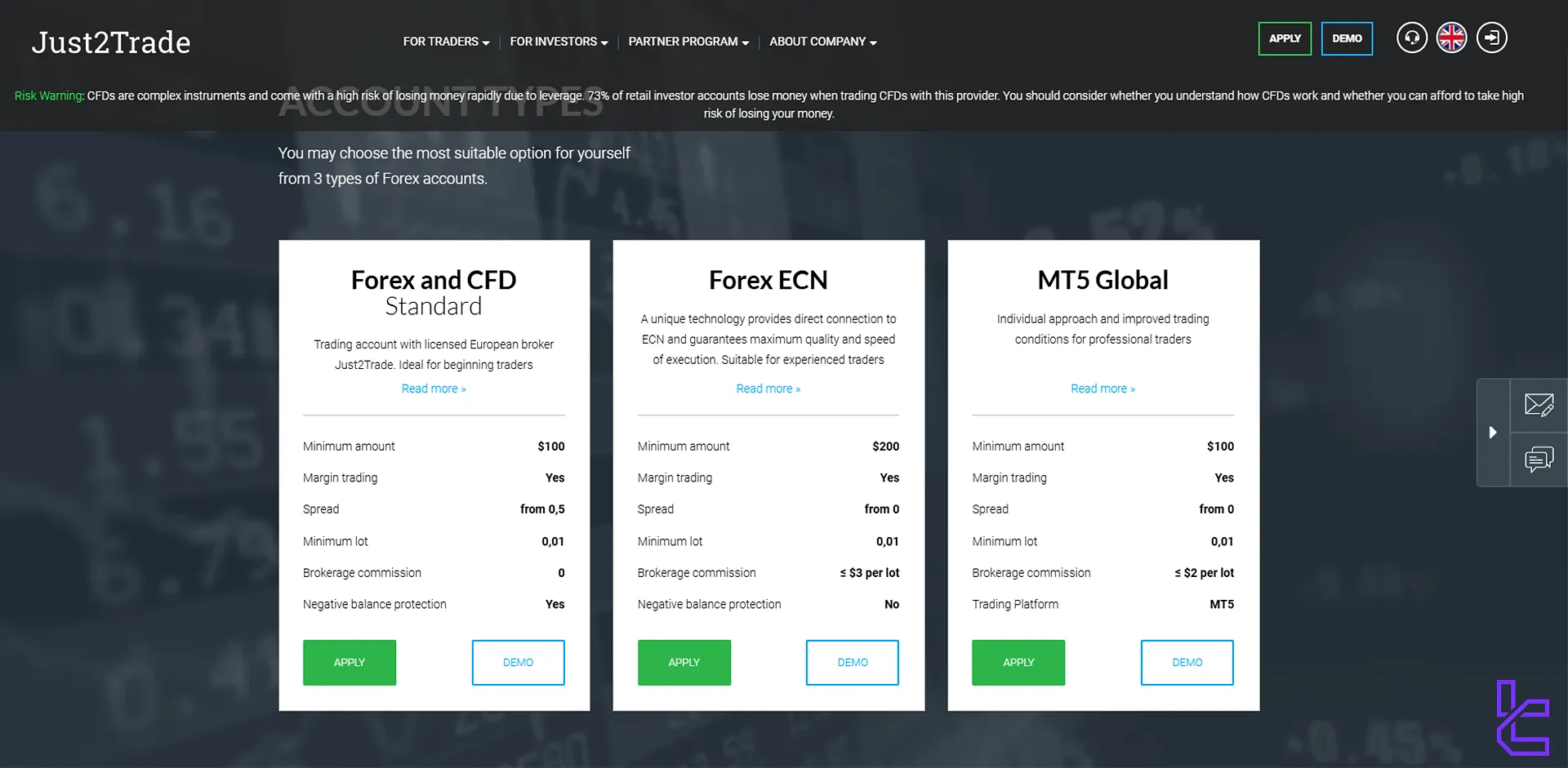

What Are Just2Trade Broker Account Types?

Just2Trade offers a variety of account types to cater to different trading styles and experience levels:

Account types | Forex and CFD Standard | Forex ECN | MT5 Global |

Minimum deposit | $100 | $200 | $100 |

Minimum trading volume | 0.01 Lot | 0.01 Lot | 0.01 Lot |

Spreads | Floating from 0.5 pips | Floating from 0.0 pips | Floating from 0.0 pips |

Commission | $0 | $3 per lot per side | $2 per lot per side |

Tradable instruments | Forex, metals, indices, commodities, CFDs | Forex, metals, indices, commodities, CFDs | Forex, metals, indices, commodities, CFDs, futures, bonds |

Each account type offers unique features tailored to different trading needs, ensuring that traders can find the most suitable conditions for their style and experience level.

Traders also have the option to open Islamic and demo accounts with Just2Trade broker to cater to diverse trading needs. The Islamic account complies with Sharia law by eliminating interest charges, making it suitable for Muslim traders.

Meanwhile, the demo account allows new and experienced traders to practice strategies in a risk-free environment using virtual funds.

Just2Trade Broker Advantages and Disadvantages

Let's break down the pros and cons of trading with Just2Trade:

Advantages | Disadvantages |

Wide range of tradable assets | Old and outdated website design |

Competitive pricing with low spreads and commissions | Not available to US citizens |

Robust regulation by CySEC | No cryptocurrency offerings |

Flexible account types | Negative user reviews |

Wide range of investment options | - |

Just2Trade Account Opening and Verification Guide

Just2Trade registration is a simple 3-step process that takes under 10 minutes. Each stage is explained separately in this part of the review.

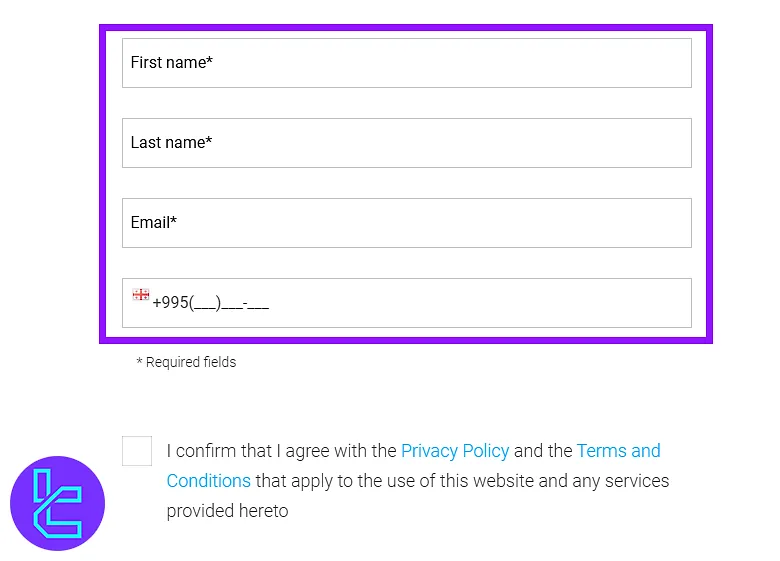

#1 Begin Your Application Online

Start by visiting the official Just2Trade website and selecting the "Apply" or "Open an Account" option. This will launch the onboarding form required to create your profile.

#2 Enter Your Personal Information

You’ll be asked to submit basic identity data such as:

- First and last name

- Email address

- Contact number

Agree to the platform's user terms and proceed to the next step.

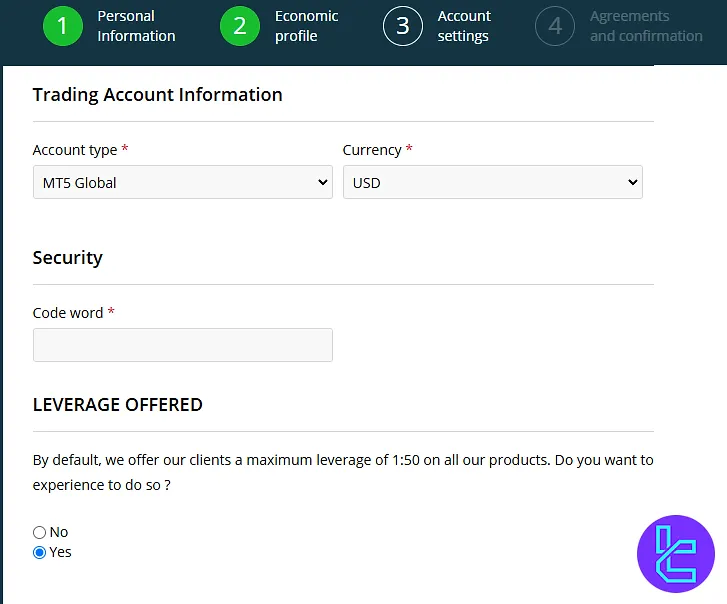

#3 Complete Identity & Financial Setup

To finalize registration, enter:

- Full legal details (including nationality, birth data, Tax ID)

- Residential address and contact confirmation

- Employment status, source of funds, and financial background

- Preferred account type, leverage level, and base currency

Accept the terms and submit the form to activate your trading dashboard.

#4 Go Through the KYC Process

Submit proof of identity (passport or ID) and proof of address (utility bill or bank statement).

The verification process typically takes 1-3 business days, depending on the accuracy and completeness of the submitted documents.

Just2Trade Broker Trading Platforms and Apps

Just2Trade broker offers a range of popular trading platforms to cater to different trader preferences:

- MetaTrader 4

- MetaTrader 5

- CQG

- Sterling Trader Pro

MetaTrader 4 (MT4)

- Industry-standard platform with advanced charting tools

- Supports Expert Advisors for automated trading

- Available on desktop, web, and mobile devices

Links:

- MT4 Android

- MT4 iOS

- Windows

- Mac

MetaTrader 5 (MT5)

- An enhanced version of MT4 with additional features

- Offers 21 timeframes for in-depth market analysis

- Supports more asset classes, including stocks and futures

Links:

- MT5 Android

- MT5 iOS

- Windows

- Mac

CQG

- A professional-grade platform for advanced traders

- Provides real-time market data and advanced order types

- Offers sophisticated charting and analytics tools

Links:

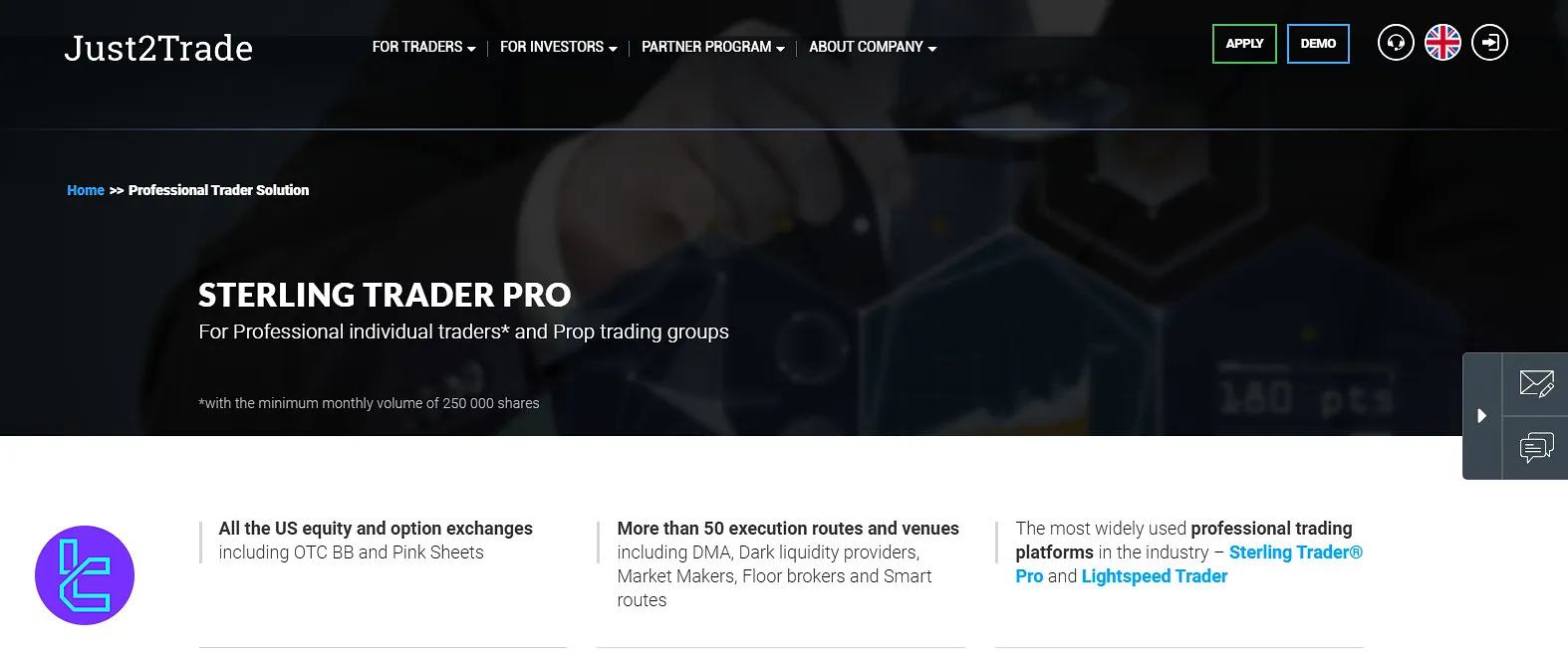

Sterling Trader Pro

- Designed for high-volume, professional traders

- Offers direct market access and advanced risk management tools

- Customizable interface for a personalized trading experience

These platforms provide traders with a range of trading tools and features to execute their trading strategies effectively across various markets.

Just2Trade Broker Spreads and Commissions

Just2Trade is known for its competitive pricing structure. Here's an overview of their spreads and commissions:

Account types | Spread | Commission |

Forex and CFD Standard | Variable from 0.5 Pips | No commission |

Forex ECN | Variable from 0.0 Pips | $3 per lot |

MT5 Global | Variable from 0.0 Pips | $2 per lot |

You could use profit calculator tools to predict a trade's profitability and outcome based on commissions.

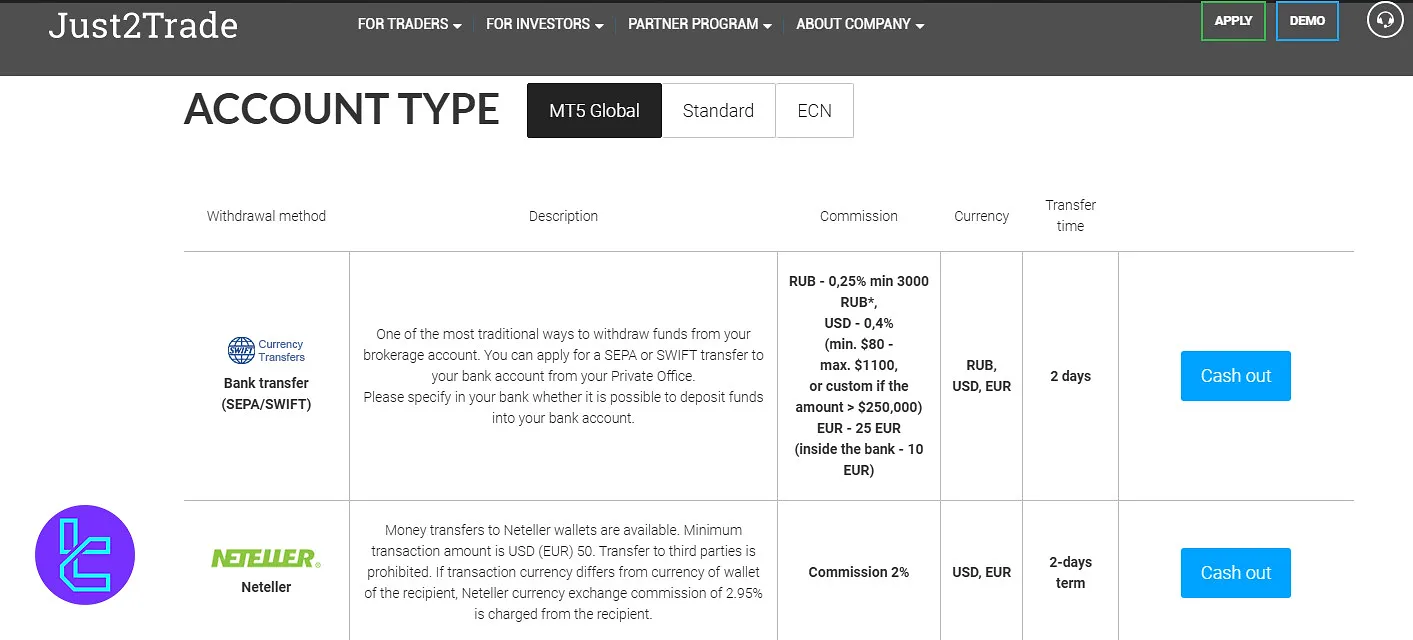

Just2Trade broker also charges 0% to 2% on various withdrawal methods. You can see withdrawal fees in the table below:

Withdrawal method | Commission |

Finam Bank | 0.5% On USD withdrawals |

Bank Transfer | 0.4% on USD withdrawals |

Neteller | 2% |

AstroPay | 2% |

UnionPay | 0% |

Skrill | 2% |

PayPal | 2% |

Visa/MasterCard | 2.5% |

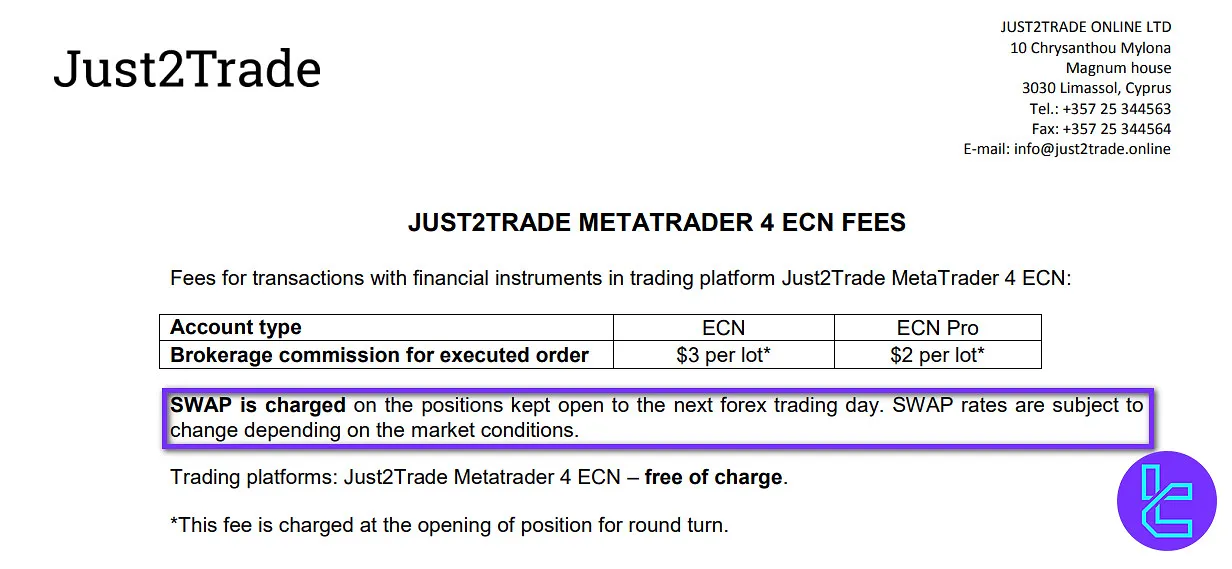

Just2Trade Swap Fees

When a trading position remains open overnight, a swap fee (also known as an overnight or rollover rate) is applied.

The exact swap rate of Just2Trade varies based on prevailing market conditions and may be adjusted periodically to reflect interest rate differentials or liquidity changes.

Just2Trade Non-Trading Fees

Just2Trade provides limited public details on its non-trading fees. Currently, the broker has not disclosed whether an inactivity fee applies.

Deposits are generally free of charge, except when made via bank transfer, where intermediary banks may apply their own service fees.

The withdrawal fee depends on the method:

- Bank Transfer (SEPA/SWIFT): 25% (min 3,000 RUB), 0.4% for USD ($80–$1,100), €25 for EUR;

- Neteller: 2% commission, min $/€50;

- AstroPay:8% fee for local currency withdrawals in Latin America;

- China UnionPay: 0% fee (CUP’s 2.5% only applies if less than 30% of initial deposit remains);

- Skrill: 2% fee, min 1 USD/EUR;

- PayPal: 2% fee for EUR, USD, RUB;

- Bank Card: 0–2.5% fee (min €1/$1/₽50).

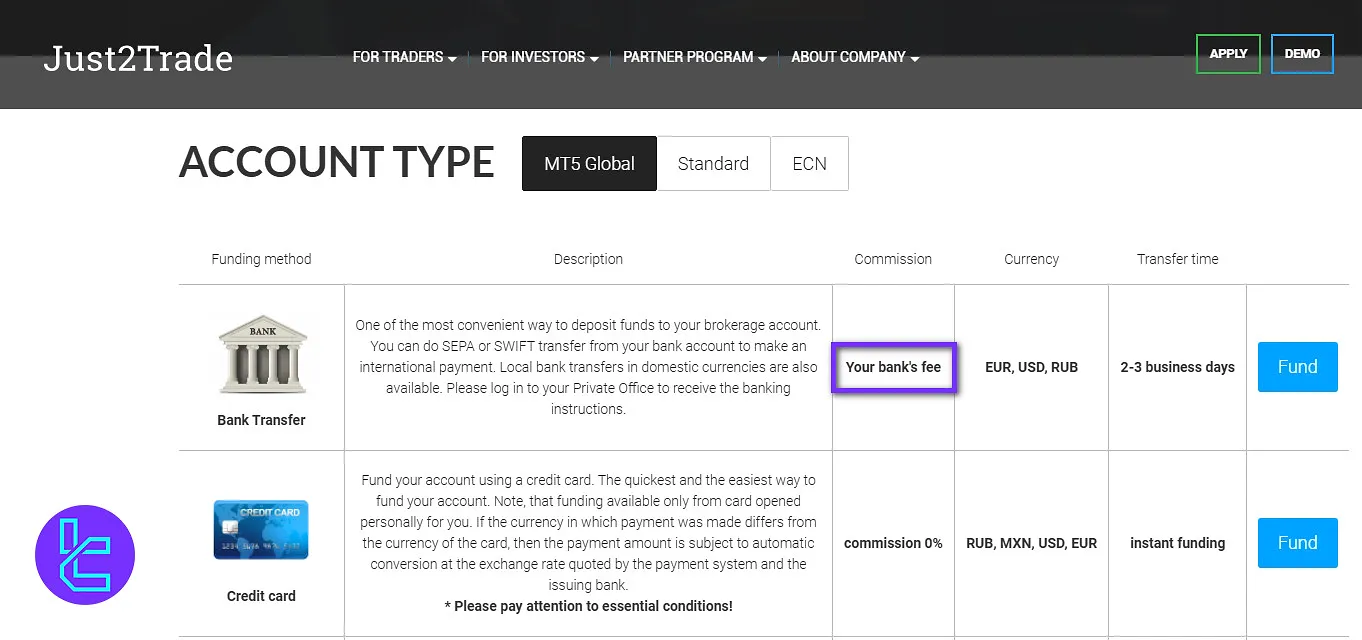

Just2Trade Deposit & Withdrawal Methods Overview

Just2Trade offers a variety of funding and payment options to accommodate traders from different regions:

Deposit methods

Just2Trade offers a wide range of convenient and secure deposit methods designed to meet the needs of traders worldwide.

Below you’ll find a detailed overview of all available funding methods, their processing times, supported currencies, and any applicable commissions:

Funding Method | Commission | Supported Currencies | Transfer Time |

Bank Transfer | Your bank’s fee | EUR, USD, RUB | 2–3 business days |

Credit Card | 0% | RUB, MXN, USD, EUR | Instant |

Skrill (Moneybookers) | 0% | USD, EUR | Instant |

Giropay (by Skrill) | 0% | USD, EUR | Instant |

iDeal (by Skrill) | 0% | USD, EUR | Instant |

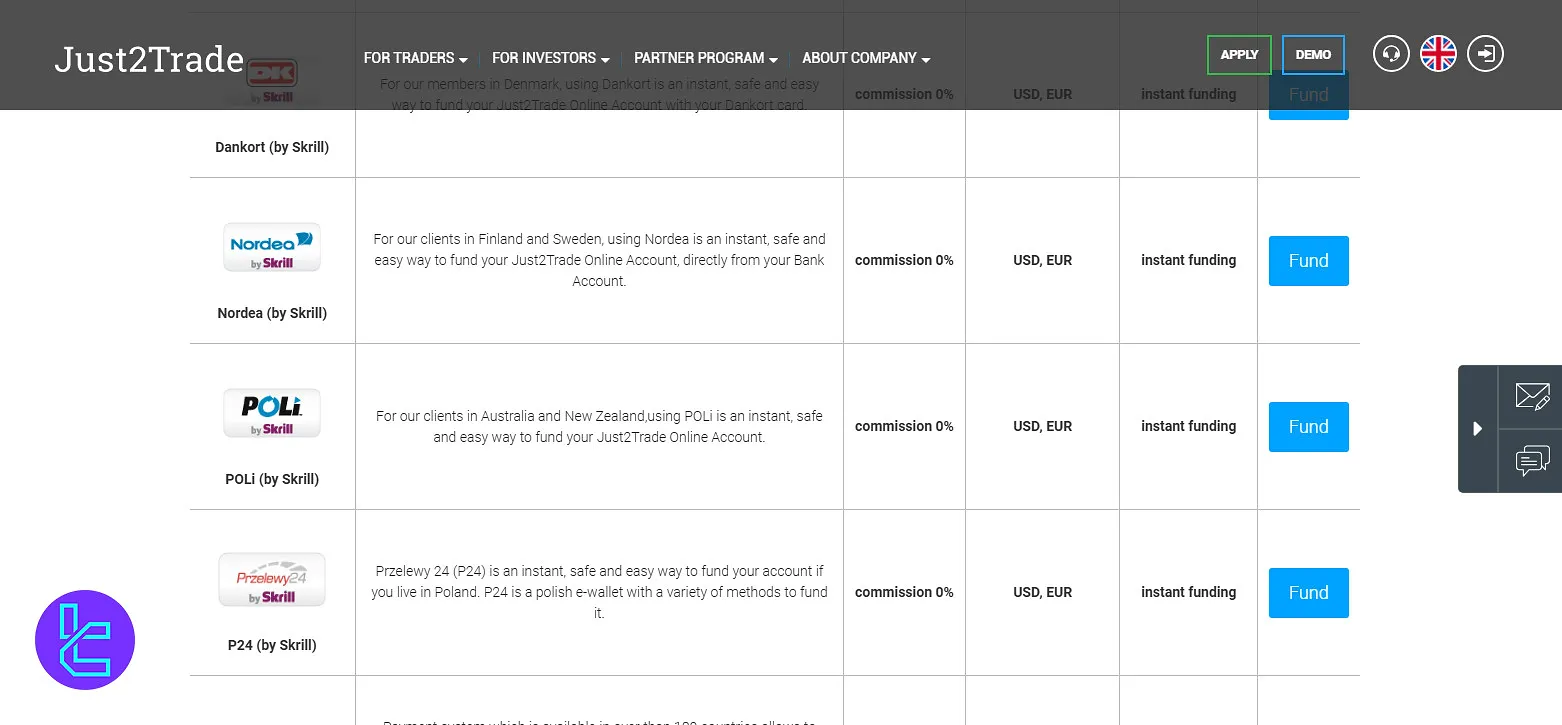

Dankort (by Skrill) | 0% | USD, EUR | Instant |

Nordea (by Skrill) | 0% | USD, EUR | Instant |

POLi (by Skrill) | 0% | USD, EUR | Instant |

P24 (by Skrill) | 0% | USD, EUR | Instant |

Neteller | 0% | USD, EUR | Instant |

Klarna (by Skrill) | 0% | USD, EUR | Instant |

Pay Pal | 0% | USD, EUR, RUB | Instant |

OXXO | 0% | MXN | Instant |

SPEI | 0% | MXN | Instant |

Davivienda | 0% | COP | Instant |

7-Eleven & Partner Stores | 0% | MXN | Instant |

Local Cards (Mexico) | 0% | MXN | Instant |

With its broad selection of payment systems, Just2Trade makes account funding effortless for traders around the globe. Most deposit methods are processed instantly with zero commission, allowing users to start trading without delays.

Withdrawal methods

Just2Trade provides traders with multiple secure and efficient ways to withdraw their funds, ensuring fast processing and transparent fees.

Below is a detailed overview of all available withdrawal methods, including fees, supported currencies, and estimated transfer times.

Withdrawal Method | Commission | Supported Currencies | Transfer Time |

Bank Transfer (SEPA/SWIFT) | RUB – 0.25% (min 3000 RUB) USD – 0.4% (min $80, max $1100, or custom for >$250,000) EUR – €25 (within bank – €10) | RUB, USD, EUR | 2 days |

Neteller | 2% | USD, EUR | 2 days |

Direct Payment (AstroPay) | 2.8% | BRL, COP, MXN, PEN, CLP, etc. | 2–3 days |

China UnionPay | 0% | CNY | Same day (if submitted before 2 p.m.) |

Skrill | 2% (min €1 / $1) | EUR | Same day |

Pay Pal | 2% | EUR, USD, RUB | Same day |

Bank Card | 0–2.5% (min €1 / $1 / ₽50) | EUR, USD, RUB | 5–10 minutes (usually) |

Just2Trade ensures that traders can access their funds easily, with flexible withdrawal options tailored to different regions and currencies.

Most withdrawal methods are processed within the same day or a few business days, depending on the payment channel.

Although some options include small commissions, all transactions are handled securely and efficiently, allowing traders to focus on what truly matters; their trading performance.

Just2Trade Broker Copy Trading & Investment Options

Just2Trade provides several options for passive investing and copy trading:

J2copy:

- Just2Trade Managed account where a trader manager trades with their own and the investor's funds.

- Customizable allocation

- The minimum investment amount is $100

Robo Adviser:

- Automated investment service based on modern portfolio theory

- Creates diversified portfolios tailored to individual risk profiles

- Regular rebalancing to maintain optimal asset allocation

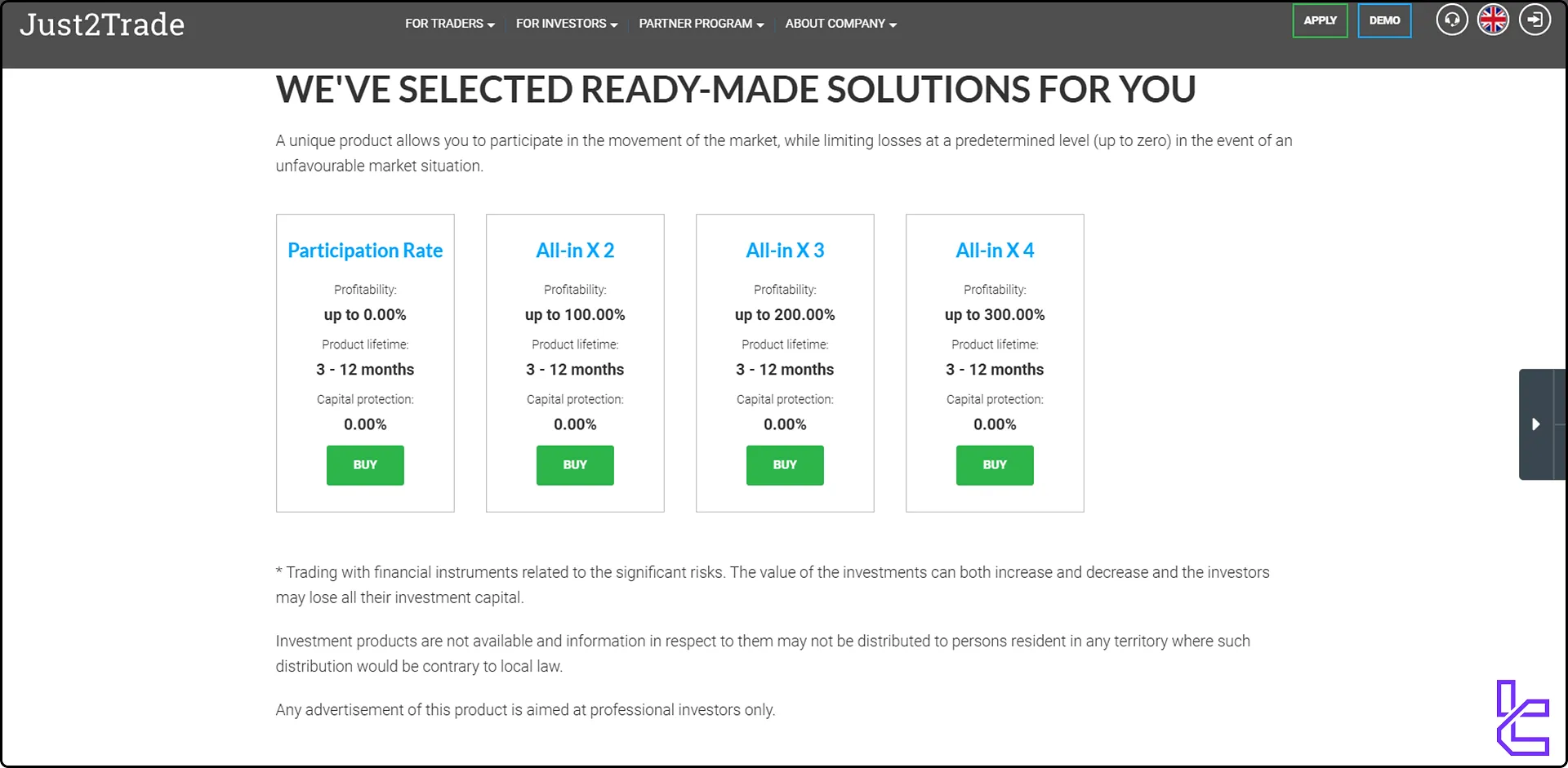

Individual Investment Portfolios:

- Professionally managed portfolios for different investment goals

- Options for various risk levels and investment horizons

- Some portfolios offer up to 100% capital protection

Just2Trade PAMM:

- Earn profits based on the performance of the managed account

- Flexibility to choose from professional account managers

- Monitor managers progress

- Risk management options

These options provide flexibility for traders who prefer a more hands-off approach or want to diversify their trading strategies.

Just2Trade Broker Tradable Markets & Symbols

Just2Trade offers access to a wide range of financial markets and instruments:

Category | Type of Instruments | Number of Symbols | Competitor Average | Maximum Leverage |

Forex | Majors, minors, and exotic currency pairs | 50+ currency pairs | 50–70 currency pairs | 1:30 |

Stocks | Direct access to global exchanges via DMA and CFDs | Over 30,000 stocks | 800–1,200 (CFDs) | N/A |

Futures | Contracts on commodities, indices, and financial assets | Around 50+ futures | 30–60 futures | N/A |

CFDs | Contracts for Difference on indices and commodities | Around 30+ CFDs | 20–40 CFDs | N/A |

Bonds | Government and corporate bonds from major global markets | Around 100+ bond instruments | 50–100 bonds | 1:3 |

Options | Stock options and derivative products | Around 1,000+ options | 500–1,000 options | N/A |

By offering a wide selection of instruments, traders can diversify their holdings and capitalize on potential gains across various sectors and asset categories.

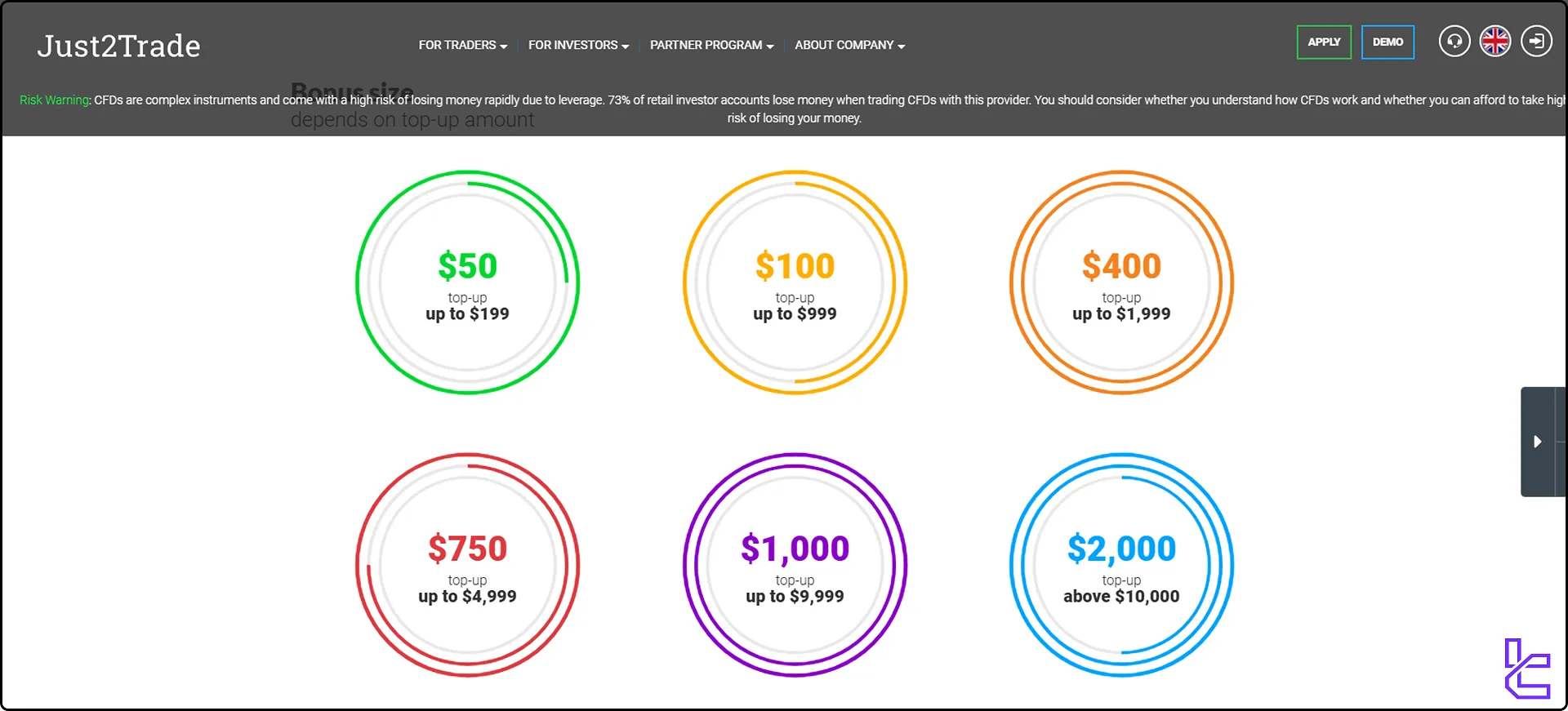

Just2Trade Broker Bonuses

Just2Trade offers several promotional programs to attract and retain clients:

Welcome Bonus:

- New clients can receive up to a $2,000 bonus based on their initial deposit;

- The bonus has a tiered structure and goes up with your deposit amount.

Partnership Program:

- Offers commission-based rewards for introducing new clients

- Three available models, including CPA, IB, and combined CPA+IB for private persons

- Partners can earn up to 50% of client trading commissions

It's important to note that bonuses and promotions often have specific time limits and conditions. Traders should carefully review these before participating in any promotional offers. We will make sure to update our articles with the latest offerings of the broker.

Just2Trade Awards

Over the years, Just2Trade has earned multiple international awards highlighting its strong position across different areas of online trading.

The broker has been recognized by leading financial publications and expos for its technology, multi-asset offering, and trading platforms.

- Best MT5 Broker 2025 WorldFinance.com

- Best Mobile Trading Platform 2024 WorldFinance.com

- Best Multi-Asset Broker 2024 BrokersView Expo

- Top 10 FX Broker Worldwide 2023 ForexTop

Just2Trade awards reflect the broker’s consistent focus on innovation, reliability, and broad market access, supporting both retail and institutional clients worldwide.

Just2Trade Broker Customer Support

Just2Trade provides customer support through multiple channels:

- Email: 24_support@j2t.com

- Phone: +357 25 055 966

- Live Chat: Available on the website (some users reported issues with this feature

While Just2Trade advertises 24/7 support, some users have reported occasional delays in response times.

Just2Trade Broker Restricted Countries List

Since Just2Trade broker only offers its services to traders in 33 countries, we can assume that the broker doesn’t provide services to traders outside of its regulatory jurisdictions, including:

- USA

- Canada

- Iran

- Iraq

- Syria

- Yemen

- Cuba

- North Korea

It's always best to check directly with Just2Trade or consult their terms of service for the most up-to-date information on country restrictions.

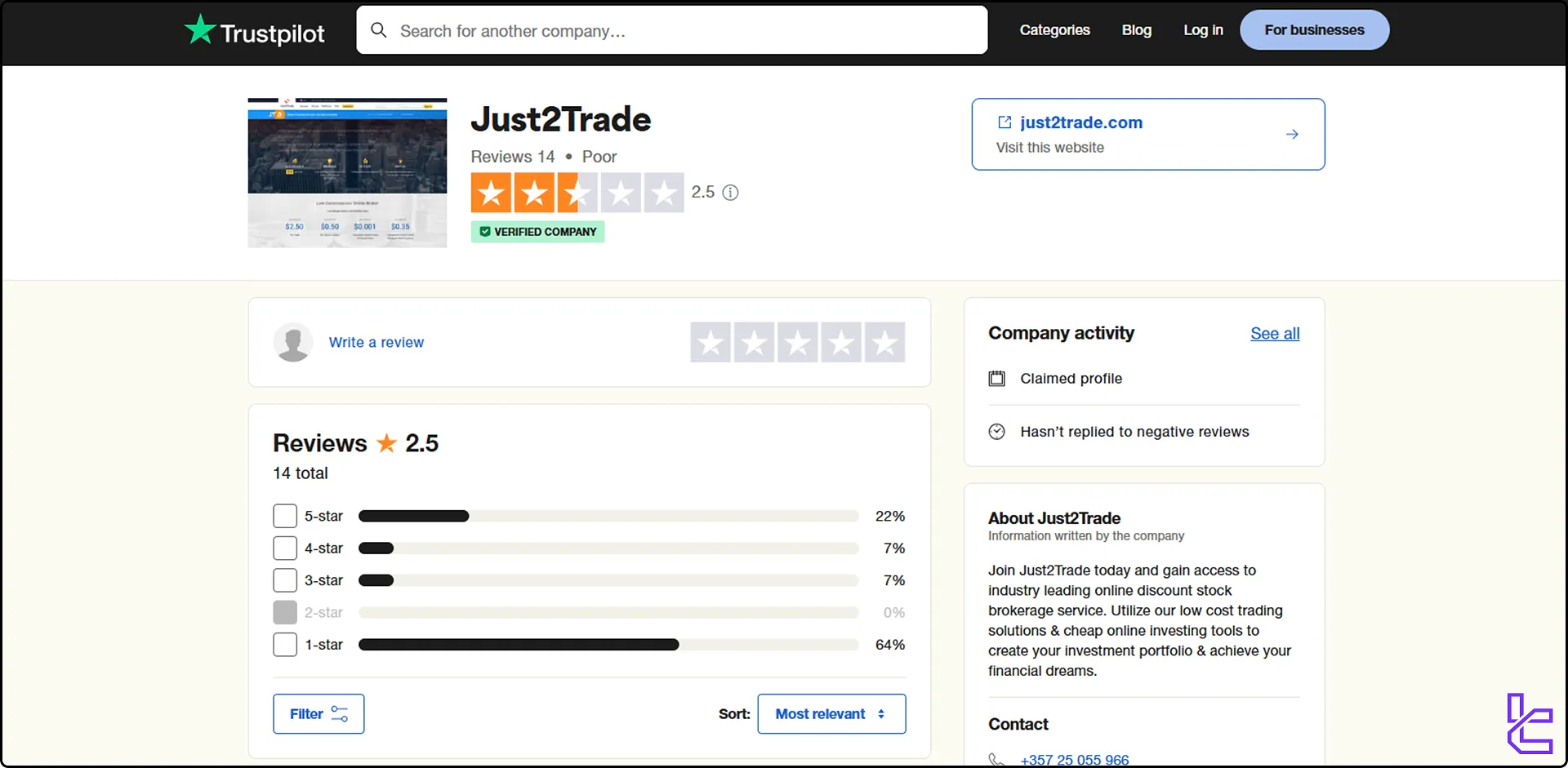

User Trust Scores and Reviews of Just2Trade Broker

Just2Trade's reputation among traders is mixed, as evidenced by reviews on platforms. Just2Trade's Trustpilot Page:

- Review Source: Trustpilot website

- Rating: 2.5/5

- Total number of reviews: 14

It's crucial to recognize that online reviews reflect personal opinions and may not capture the full spectrum of client experiences. Traders should view these reviews as one aspect of their comprehensive assessment of Just2Trade.

Just2Trade Broker Educational Resources

Just2Trade offers various educational resources to support traders in their learning journey:

- Blog: Regular articles covering market analysis, trading strategies, and financial news

- Research Notes: In-depth analysis of specific markets or trading topics

- Economic Calendar: Up-to-date information on important economic events and releases

- Financial Terms Glossary: Comprehensive explanations of trading and financial terminology

Subscribing to Just2Trade research notes can be beneficial for several reasons:

- Global Markets weekly review

- Forex daily mailout of analytical review

- Global Markets daily forecasts

- Daily technical analysis from market experts

Table of Comparison

Here's an exhaustive comparison between Just2Trade and some of the best other options out there:

Parameter | Just2Trade Broker | AMarkets Broker | AvaTrade Broker | FBS Broker |

Regulation | CySEC, ESMA | FSA, FSC, Misa, FinaCom | ASIC, CySEC, CBI, FSA, FSCA, MiFID, ADGM, PFSA, ISA | FSC, CySEC |

Minimum Spread | Floating from 0.0 Pips | From 0.0 pips | From 0.0 Pips | From 0.0 Pips |

Commission | From $2 | From $0.0 | $0 | From $0.0 |

Minimum Deposit | $100 | $100 | $100 | $5 |

Maximum Leverage | 1:500 | 1:3000 | 1:400 | 1:3000 |

Trading Platforms | MT4, MT5, CQG, Sterling Trader Pro | MetaTrade 4, MetaTrade 5, Mobile App | MetaTrader 4, MetaTrader 5, Mobile App, WebTrader | MT4, MT5, Mobile App |

Account Types | Forex and CFD standard, Forex ECN, MT5 Global | Standard, ECN, Fixed, Crypto, Demo | Standard, Demo, Professional | Standard |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | 30,000+ | 550+ | 1250+ | 550+ |

Trade Execution | Market | Instant, Market | Instant | Market |

TF Expert Suggestion

Just2Trade aims to provide high-quality services with 8 low commission (from 0% to 2.5%) deposit and withdrawal methods and 4 investment options, including J2copy, Robo Adviser, Individual Investment Portfolios, and PAMM accounts.

However, this broker's low Trustpilot rating (2.5/5) and limited worldwide availability (only 33 countries) make it not the best option for everyone.