JustMarkets won the “Best CFD Broker” award in the UF Awards MEA 2024. The broker offers a Cent account with a minimum deposit requirement of $10 and leverage options of up to 1:3000.

The broker supports trading in 5 major asset classes, 90+ financial instruments, and 10+ base currencies, including USD, EUR, GBP, and JPY. Traders can choose from 4 account types and open positions as small as 0.01 lots.

JustMarkets Company Information and Regulatory Status

Since its founding in 2012, the broker has attracted over 2 million traders from 160+ countries. Headquartered in Mahe, Seychelles, the global company has quickly gained a reputation for providing top-notch trading services with tight fees.

But what really sets JustMarkets apart is its strong regulatory standing. The Forex broker is regulated in multiple jurisdictions by some of the top-tier regulatory bodies.

Here are the regulatory details of all the branches:

Entity Parameters / Branches | Just Global Markets Ltd. | JustMarkets Ltd. | Just Global Markets (PTY) Ltd. | Just Global Markets (MU) Limited ) | Just Global Markets (VG) Limited |

Regulation | Seychelles Financial Services Authority (FSA) | Cyprus Securities and Exchange Commission (CySEC) | Financial Sector Conduct Authority (FSCA) | Financial Services Commission (FSC) | Financial Services Commission (FSC) |

Regulation Tier | Tier 4 | Tier 1 | Tier 2 | Tier 5 | Tier 5 |

Country | Seychelles | Cyprus | South Africa | Mauritius | British Virgin Islands |

Investor Protection Fund / Compensation Scheme | N/A | Investor Compensation Fund (ICF) – up to €20,000 per client | N/A | N/A | N/A |

Segregated Funds | Yes | Yes | Yes | Yes | Yes |

Negative Balance Protection | Yes | Yes | Yes | Yes | Yes |

Maximum Leverage | 1:3000 | 1:30 | 1:500 | 1:1000 | 1:3000 |

Client Eligibility | Global clients except restricted jurisdictions | EU/EEA residents | South African and eligible international clients | International clients (non-EU) | Global clients (non-EU regions) |

All entities enforce essential security protocols:

- Negative Balance Protection for all clients

- Segregation of client funds in reputable, Tier-1 banks

- Bank-grade SSL encryption and PCI DSS data security

JustMarkets Table of Specifications

The broker boasts about its instant withdrawal, tight spreads, swap-free trading, and fast execution. let’s take a closer look at the company’s features.

Broker | JustMarkets |

Account Types | Standard Cent, Standard, Pro, Raw Spread |

Regulating Authorities | CySEC, FSA, FSCA, FSC |

Based Currencies | USD, EUR, GBP, JPY, MYR, IDR, THB, VND, KWD, CNY, ZAR, AED, NGN |

Minimum Deposit | From $10 |

Deposit Methods | Bank transfer, E-payments, Credit/Debit cards, Crypto, Local banks |

Withdrawal Methods | Bank transfer, E-payments, Credit/Debit cards, Crypto, Local banks |

Minimum Order | 0.01 lot |

Maximum Leverage | 1:3000 |

Investment Options | Copy Trading |

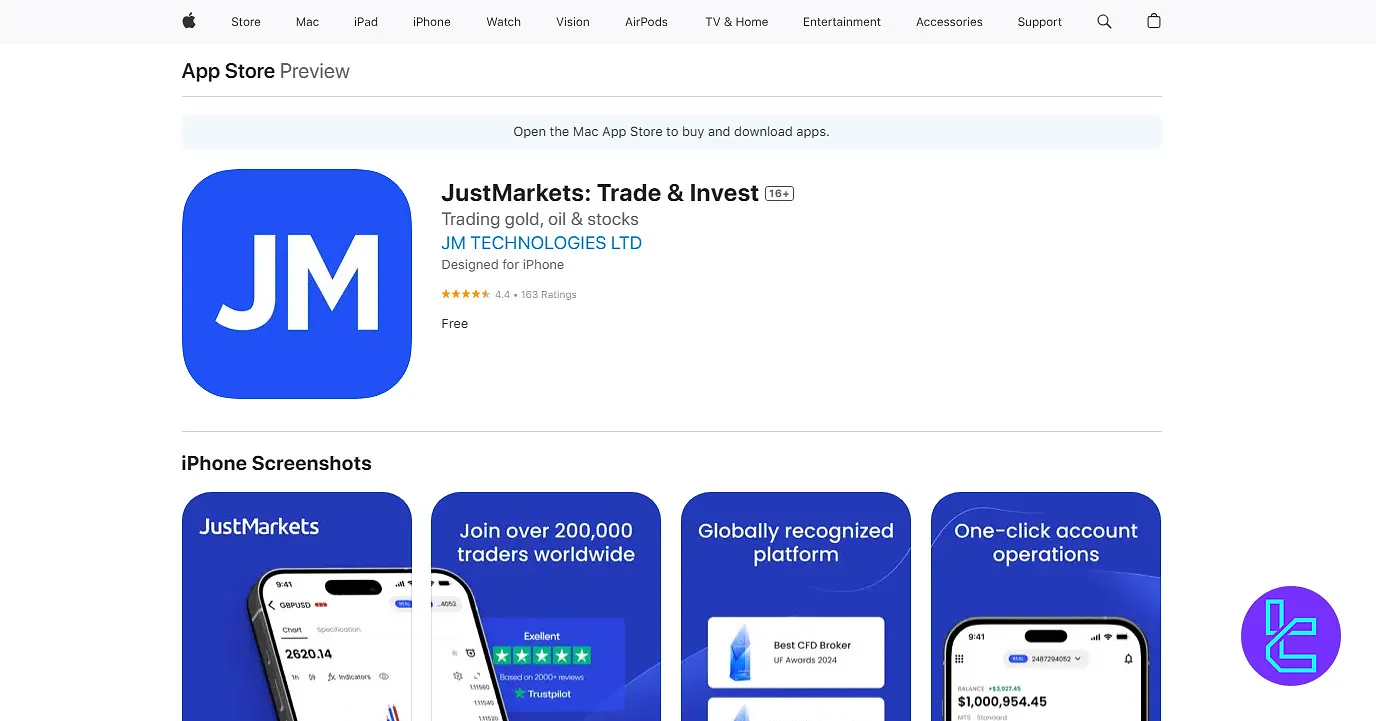

Trading Platforms & Apps | MT4, MT5, Mobile App |

Markets | Forex, Commodities, Indices, Crypto, Stocks |

Spread | Floating from 0.00 pips |

Commission | $3 each side per lot in Raw Spread accounts |

Orders Execution | Market |

Margin Call/Stop Out | Margin call 40% Stop out 20% |

Trading Features | Economic Calendar, VPS, Market Analysis, Educational Materials |

Affiliate Program | Yes |

Bonus & Promotions | Deposit, Referral |

Islamic Account | Yes |

PAMM Account | No |

Customer Support Ways | Email, Phone, Online chat, Callback request |

Customer Support Hours | 24/7 |

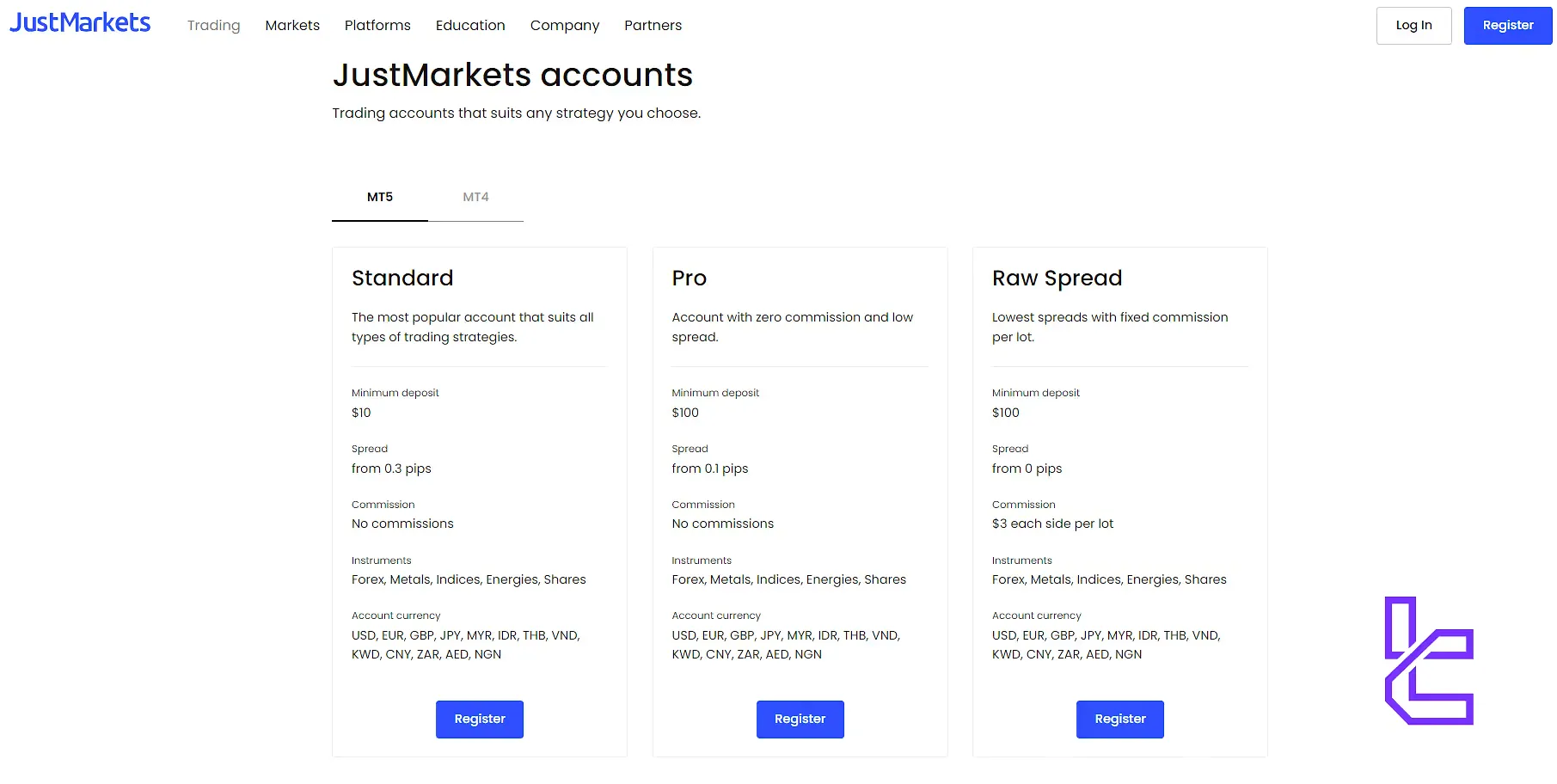

JustMarkets Account Types

The broker offers a wide range of account types to cater to traders of all experience levels and trading styles. Key features of JustMarkets account offerings:

Features | Standard Cent | Standard | Pro | Raw Spread |

Currency | USC | USD, EUR, GBP, JPY, MYR, IDR, THB, VND, KWD, CNY, ZAR, AED, NGN | USD, EUR, GBP, JPY, MYR, IDR, THB, VND, KWD, CNY, ZAR, AED, NGN | USD, EUR, GBP, JPY, MYR, IDR, THB, VND, KWD, CNY, ZAR, AED, NGN |

Min deposit | $10 | $10 | $100 | $100 |

Min order size (Lots) | 0.01 cent | 0.01 | 0.01 | 0.01 |

Leverage | 1:3000 | 1:3000 | 1:3000 | 1:3000 |

Instruments | Forex, Metals | Forex, Metals, Indices, Energies, Shares | Forex, Metals, Indices, Energies, Shares | Forex, Metals, Indices, Energies, Shares |

Swap free | Available | Available | Available | Available |

It's important to note that specific account types, features, and requirements may vary. Traders should carefully review the options available on the broker to choose the account that best aligns with their trading goals and risk tolerance.

Pros & Cons with JustMarkets Broker

While the company offers some of the best conditions available in the market, it sure has downsides too. Let's break down the advantages and disadvantages of trading with the broker in the JustMarkets review.

Pros | Cons |

Multi-regulated (CySEC, FSA, and FSCA) | Limited asset offerings |

Fast withdrawals | Service restrictions for some countries |

User-friendly platforms | Some reports of technical glitches |

Multi-lingual customer support | - |

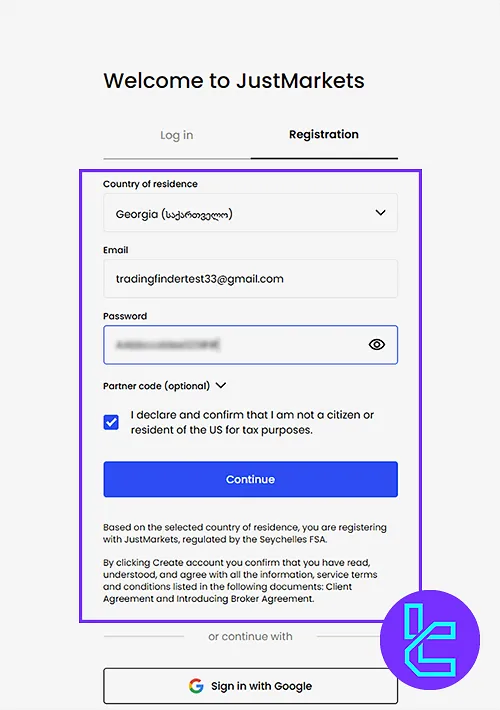

How to Register and Verify on JustMarkets

Getting started with the broker is a straightforward process designed to ensure both convenience for traders and compliance with regulatory requirements. Here's a step-by-step guide to JustMarkets Registration and verifying your JustMarkets account.

#1 Go to the JustMarkets Signup Portal

Visit the official JustMarkets website. Navigate to the broker’s page and click the “Go to Website” or “Register” button to begin the signup.

#2 Complete the Account Creation Form

Enter your country of residence, a valid email address, and create a strong password using a combination of uppercase, lowercase, numbers, and symbols.

If you have a promo code, enter it (optional). You must also confirm you are not a U.S. citizen for tax reasons. Click Continue to proceed.

#3 Confirm Your Email Address

Check your inbox for the verification email sent by JustMarkets. Click the Confirm Email button inside the message.

Once done, log in to your account with your credentials.

#4 KYC Verification

Once your initial registration is complete, you must verify your identity and address to comply with Know Your Customer (KYC) regulations.

Here are the JustMarkets Verification steps:

- Navigate through the JustMarkets client area;

- Click on “Complete Verification”;

- Fill out the personal information form;

- Provide the required information on the financial profile, including employment status, trading experience, and annual income.

After completing your profile, you must provide proof of identity and address. Required documents for JustMarkets verification:

- A government-issued ID (passport, driver's license, or national ID card)

- Proof of address (recent utility bill or bank statement)

What Trading Platforms Are Available on JustMarkets?

The broker offers its clients access to some of the industry's most popular and powerful trading platforms. The flagship platform is MetaTrader 4 (MT4), developed by MetaQuotes Software Corporation.

OS | JustMarkets app | MT4 | MT5 |

Windows | - | ||

Android | |||

iOS | |||

MacOS | - |

Offering various platforms, the broker ensures that traders have access to the tools they need for efficient market analysis, trade execution, and portfolio management.

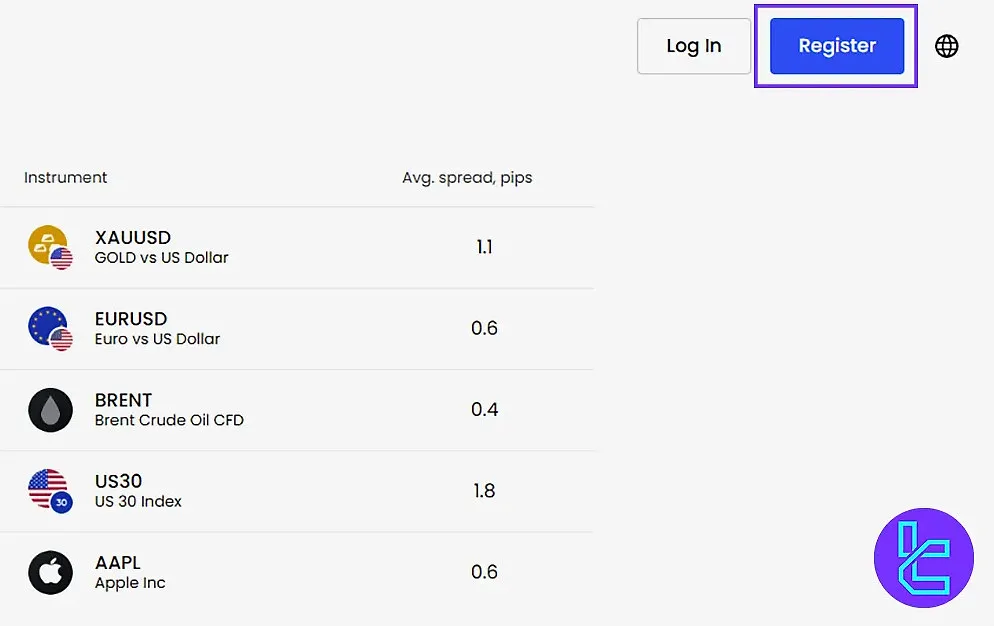

JustMarkets Broker Trading Costs (Fees and Spread)

The company strives to offer competitive and transparent trading costs to its clients. Now, it’s time to discuss the fee structure in this JustMarkets review.

Account Type | Spread | Commission |

Standard Cent | Floating from 0.3 pips | $0.00 |

Standard | Floating from 0.3 pips | $0.00 |

Pro | Floating from 0.1 pips | $0.00 |

Raw Spread | Floating from 0.0 pips | $3 each side per lot |

The broker's flexible fee structure caters to various trading styles, from high-volume traders who benefit from raw spreads to beginners who prefer all-inclusive pricing.

Always review the full fee schedule and compare it with your trading strategy to determine the most cost-effective option for your needs.

JustMarkets Swap Fees

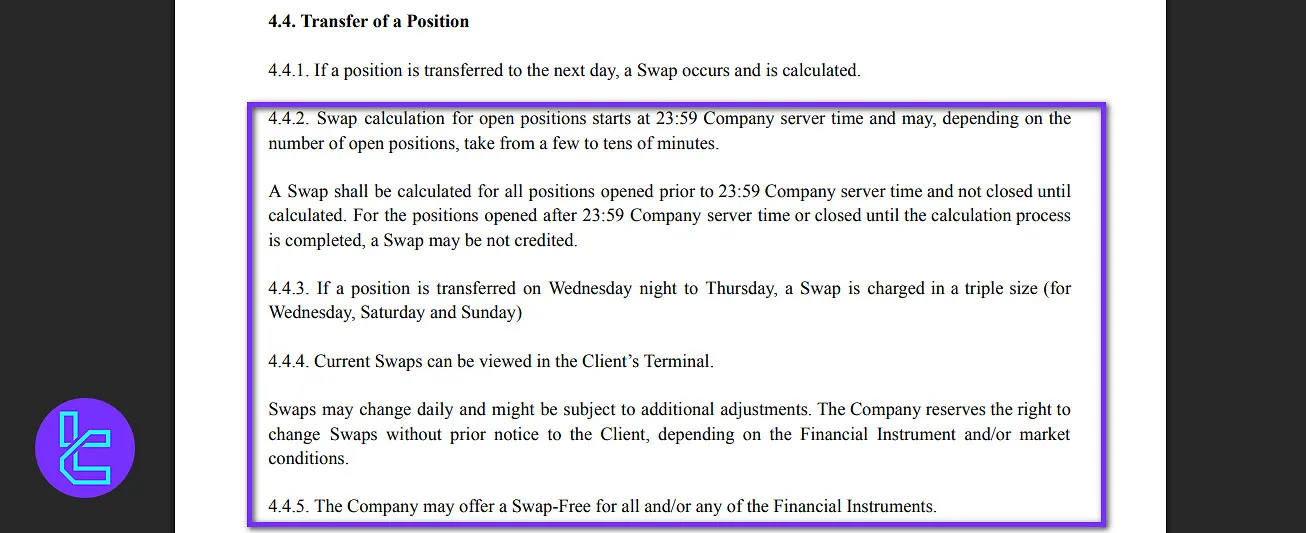

When a trading position remains open past the end of the trading day, it incurs a Swap, also known as an overnight financing charge.

This fee is calculated daily at 23:59 (server time) and may take several minutes depending on the number of active positions.

Only trades opened before this time and still active during the calculation are subject to swaps in JustMarkets broker; positions opened or closed afterward may not receive any adjustment.

On Wednesdays, the Swap is applied at three times the normal rate, covering the rollover for Wednesday, Saturday, and Sunday.

Traders can check current swap rates directly in their trading terminal, but these values fluctuate daily and can change without prior notice based on the instrument or market conditions.

JustMarkets also offers Swap-Free options, allowing certain financial instruments to be exempt from overnight charges. There are two Swap-Free tiers: Standard and Extended.

Clients can verify their assigned level in their Personal Area, where eligible instruments are clearly listed. The company may revise the available instruments or swap-free tiers at its discretion, with appropriate notice to affected clients.

For traders of the Islamic faith, JustMarkets provides Islamic Accounts, which permanently exclude swaps on all financial instruments to comply with Sharia law.

However, depending on trading behavior, some Islamic accounts may incur a fixed commission fee for overnight positions instead of interest-based swaps.

JustMarkets Non-Trading Fees

JustMarkets applies a maintenance charge to accounts that remain inactive for extended periods.

If a trading account shows no market activity, meaning no open positions or non-trading transactions, for 150 consecutive days, a $5 inactivity fee is applied every 30 days thereafter.

This charge only applies to accounts with a positive balance and continues until trading or transfer activity resumes.

JustMarkets does not charge deposit or withdrawal fees. However, traders should be aware that banks and electronic payment systems (EPS) may impose independent transaction costs.

JustMarkets Payment Methods

The company offers various deposit and withdrawal options to accommodate its global client base. Available payment methods on JustMarkets:

| Method | Min (Deposit) | Max (Deposit) | Min (Withdrawal) | Max (Withdrawal) | Deposit Time | Withdrawal Time |

Bank Transfer | $100 | $50,000 | $500 | $50,000 | 1 to 6 Business Days | 1 to 6 Business Days |

MasterCard | $10 | $10,000 | $5 | $5,000 | Within 30 minutes | 1-2 hours |

VISA | $10 | $10,000 | $5 | $5,000 | Within 30 minutes | 1-2 hours |

Crypto | $30 | - | Variable | - | Within 30 minutes | 1-3 hours |

Perfect Money | $10 | - | $5 | - | Within 5 minutes | 1-2 hours |

Skrill | $10 | - | $5 | - | Within 5 minutes | 1-2 hours |

FasaPay | $10 | - | $10 | $25,000 | Within 30 minutes | 1-3 hours |

Neteller | $10 | - | $5 | $10,000 | Within 5 minutes | 1-2 hours |

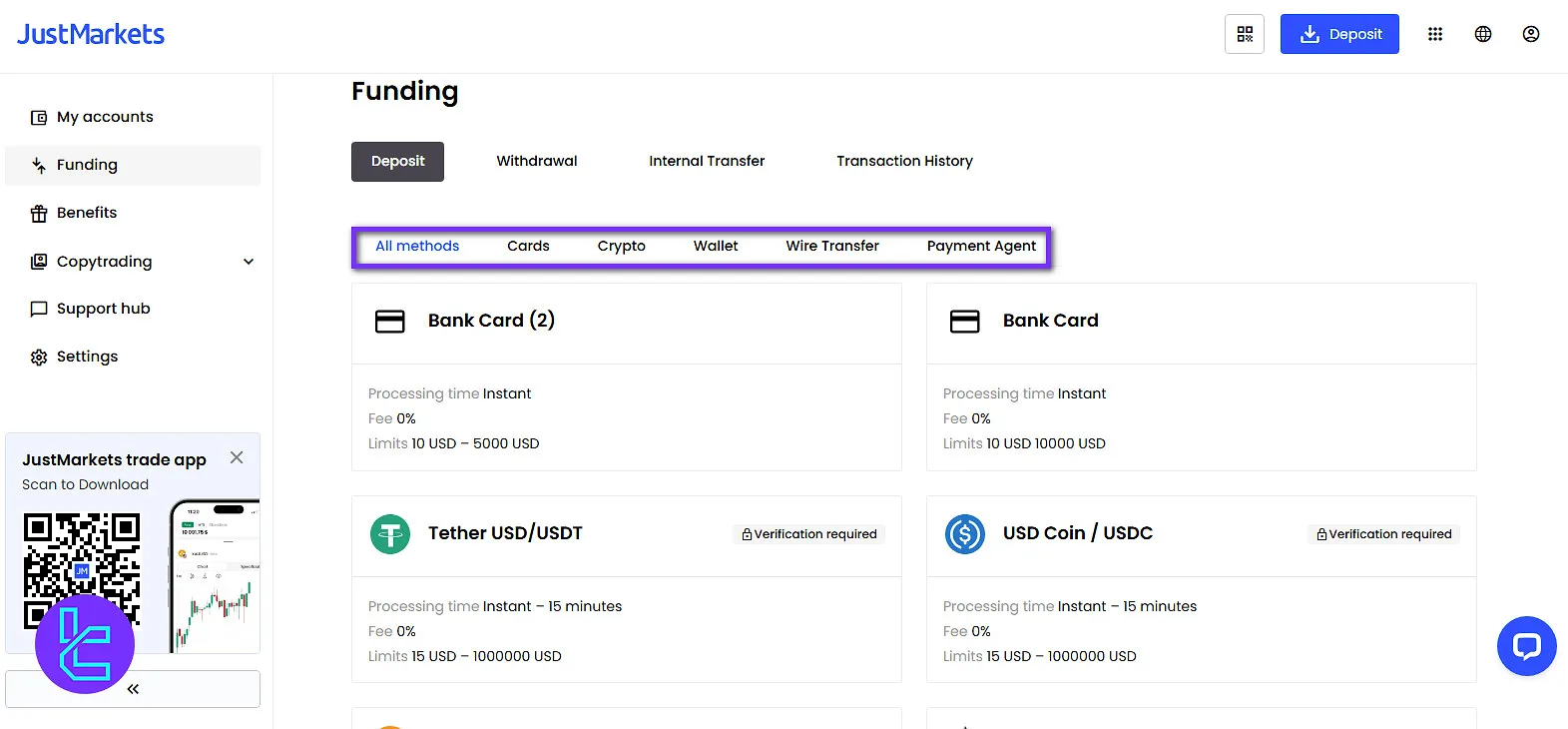

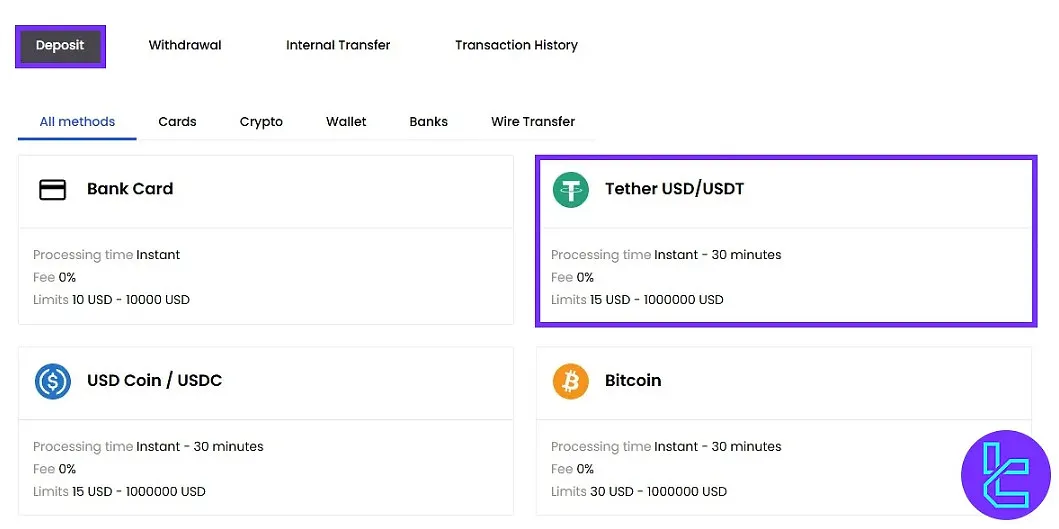

JustMarkets Deposit

JustMarkets provides a wide selection of funding options that support both fiat and cryptocurrency transactions.

Deposits are typically processed instantly and are free of charge, although some blockchain-based methods may take up to 30 minutes depending on network congestion.

Verification is required for crypto deposits, ensuring compliance with AML and KYC standards. The broker also partners with local payment agents in select regions for added convenience.

Below is an overview of all supported deposit methods, including limits, processing times, and applicable fees:

Deposit Method | Verification Required | Processing Time | Fee | Deposit Limits (USD) |

Bank Cards | No | Instant | 0% | Depends on the bank |

Tether (USDT) | Yes | Instant – 15 min | 0% | 15 – 1,000,000 |

USD Coin (USDC) | Yes | Instant – 15 min | 0% | 15 – 1,000,000 |

Bitcoin (BTC) | Yes | Instant – 30 min | 0% | 30 – 1,000,000 |

Ethereum (ETH) | Yes | Instant – 30 min | 0% | 30 – 1,000,000 |

Tron (TRX) | Yes | Instant – 30 min | 0% | 30 – 1,000,000 |

Litecoin (LTC) | Yes | Instant – 30 min | 0% | 30 – 10,000,000 |

Dogecoin (DOGE) | Yes | Instant – 30 min | 0% | 30 – 1,000,000 |

Ripple (XRP) | Yes | Instant – 30 min | 0% | 30 – 1,000,000 |

STICPAY | No | Instant | 0% | 10 – 100,000 |

Wire Transfer | No | Instant – 1 day | 0% | 100 – 50,000 |

Local Payment Agent | Depends on the region | Instant – 24 hrs | 0% | 10 – No limit |

All deposits are credited in the base currency of the trading account. While JustMarkets applies no internal deposit fees, users should note that external providers or networks may impose separate transaction costs depending on the chosen payment system or blockchain.

JustMarkets TRC20 Deposit

JustMarkets TRC20 deposit method is a quick and commission-free process designed for convenience and efficiency. Traders can fund their accounts with a minimum of just $15, making it accessible to both new and experienced users.

The process uses the Tether (USDT) stablecoin on the Tron network (TRC20), ensuring low fees and near-instant blockchain confirmations.

With only three steps required, clients can deposit securely while benefiting from the speed and transparency of crypto-based transfers.

To fund an account, users first log in and navigate to the “Deposit” section, selecting Tether USD (TRC20) as the preferred method.

Next, they fill in the transaction details, choosing the trading account, entering the amount, and confirming the network. Once submitted, the platform generates a unique wallet address and QR code for the transfer.

Traders simply send the funds from their crypto wallet to the provided address, after which the deposit is typically confirmed within 30 minutes.

The completion status can be easily verified in the “Transaction History” section of the JustMarkets account dashboard.

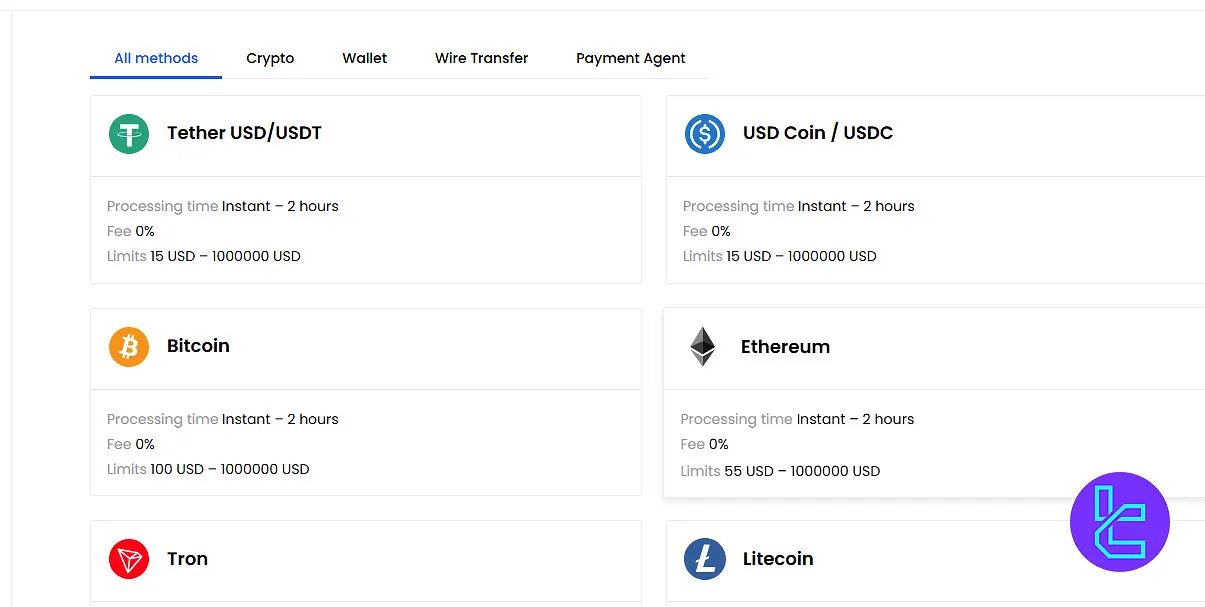

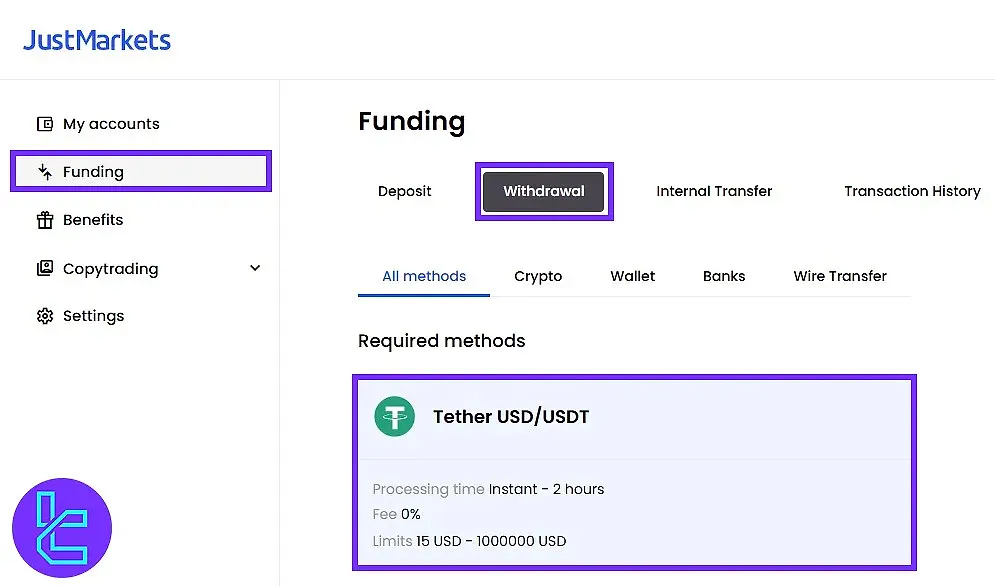

JustMarkets Withdrawal

JustMarkets supports a wide range of withdrawal options designed for flexibility, speed, and accessibility. The broker allows both crypto and fiat withdrawals, offering instant or near-instant processing across most channels.

Below is a detailed overview of each available withdrawal method, including supported currencies, transaction limits, and expected processing times:

Method | Processing Time | Fee | Limits (Min–Max) |

Tether (USDT) | Instant – 2 hours | 0% | 15 USD – 1,000,000 USD |

USD Coin (USDC) | Instant – 2 hours | 0% | 15 USD – 1,000,000 USD |

Bitcoin (BTC) | Instant – 2 hours | 0% | 100 USD – 1,000,000 USD |

Ethereum (ETH) | Instant – 2 hours | 0% | 55 USD – 1,000,000 USD |

Tron (TRX) | Instant – 2 hours | 0% | 80 USD – 1,000,000 USD |

Litecoin (LTC) | Instant – 2 hours | 0% | 35 USD – 10,000,000 USD |

Dogecoin (DOGE) | Instant – 2 hours | 0% | 190 USD – 1,000,000 USD |

Ripple (XRP) | Instant – 2 hours | 0% | 150 USD – 1,000,000 USD |

STICPAY | Instant – 2 hours | 0% | 10 USD – 100,000 USD |

Wire Transfer | Instant – 1 day | 0% | 500 USD – 50,000 USD |

Local Payment Agent | Instant – 24 hours | 0% | 10 USD – No Limit |

All JustMarkets withdrawal methods operate with no transaction fees, enabling traders to retain their full profit margins.

The processing speed depends on the selected payment channel, crypto withdrawals and e-wallets are usually completed within minutes, while bank wire transfers can take up to one business day.

JustMarkets TRC20 Withdrawal

JustMarkets TRC20 withdrawal is a quick, three-step procedure that typically takes only a few minutes to complete, although processing may range from instant approval to two hours.

The method allows traders to conveniently transfer Tether (USDT) on the Tron blockchain, providing fast, low-cost, and secure withdrawals.

This streamlined process ensures users can cash out their trading profits directly to an external wallet without unnecessary delays or complications.

To begin, users log in to their JustMarkets account, go to the “Funding” section, and select “Withdrawal” with the Tether USD (TRC20) method.

They then enter the required transaction details, including the trading account, payout amount, and the destination TRC20 wallet address, with limits typically set between $15 and $1,000,000.

After verifying the request via an email confirmation code, the withdrawal is submitted for processing. The transaction status can be monitored under “Transaction History”, where it first appears as “Pending” before updating to “Completed” once finalized.

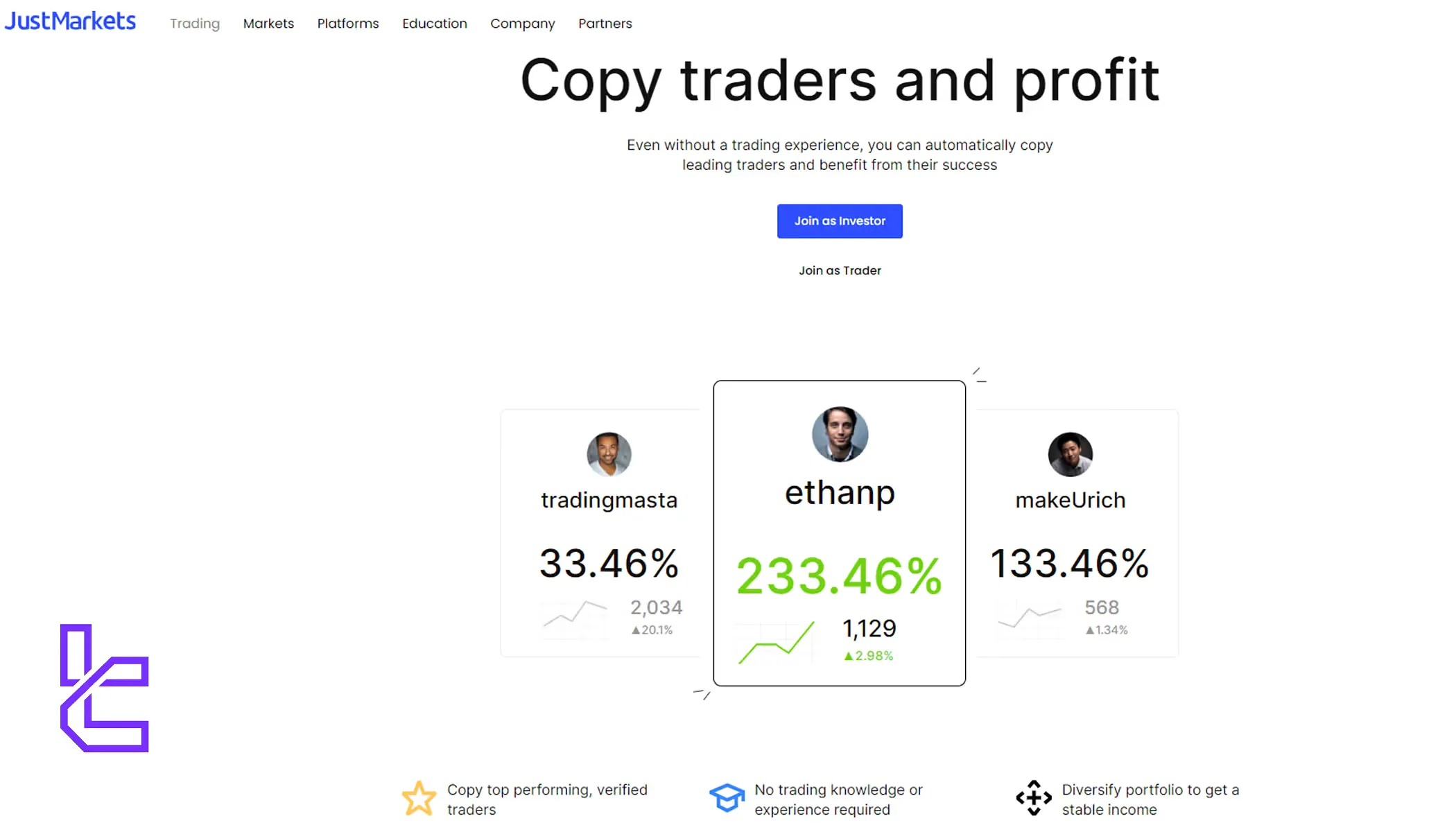

Copy Trading and Growth Plans on JustMarkets Broker

The broker offers an innovative copy trading feature that allows less experienced traders to benefit from the expertise of seasoned professionals. Key features of JustMarkets copy trade service:

- Copy successful traders: Browse a list of expert traders and their performance metrics;

- Customizable: Decide how much capital to allocate and set risk management rules;

- Automatic Copying: The system will automatically replicate the chosen trader's positions in your account;

- Monitor and Adjust: Keep track of your copied trades and make changes as needed.

You can also join the company’s affiliate program, earn revenue up to 65%, and CPA up to $1500.

JustMarkets Financial Instruments

The broker offers diverse financial instruments to cater to various trading preferences and strategies:

Category | Type of Instruments | Number of Symbols | Competitor Average | Maximum Leverage |

Forex | Standard, Micro, Ultra Low accounts (major, minor, exotic pairs) | 50+ currency pairs | 50–70 currency pairs | 1:3000 |

Stocks | CFDs on global company shares via MT5 | Over 1,000 stocks | 800–1,200 | 1:20 |

Commodities | CFDs on metals and energy (XAUUSD, XAGUSD, XPTUSD, XPDUSD, XAUAUD, XAGEUR) | Around 15 instruments | 10–20 instruments | 1:3000 |

Indices | CFDs on global indices (US500, UK100, JP225, DE40, FR40, SG20, HK50, EU50, ES35, CHA50) | 10+ indices | 10–20 indices | 1:500 |

Cryptocurrencies | CFDs on popular digital assets (UNIUSD, TRXUSD, AVXUSD, XRPUSD, XLMUSD, SOLUSD, LTCUSD, LNKUSD) | 10+ crypto pairs | 20–40 crypto pairs | N/A |

JustMarkets Broker Promotion and Bonus Offerings

The company, like many competitive forex brokers, offers various promotions and bonuses to attract new clients and reward existing ones. JustMarkets promotion plans:

- 50% Deposit Bonus: Get 50% more funds on deposits from $10;

- Just Invite Friends: Earn profits from your friends’ trading activities.

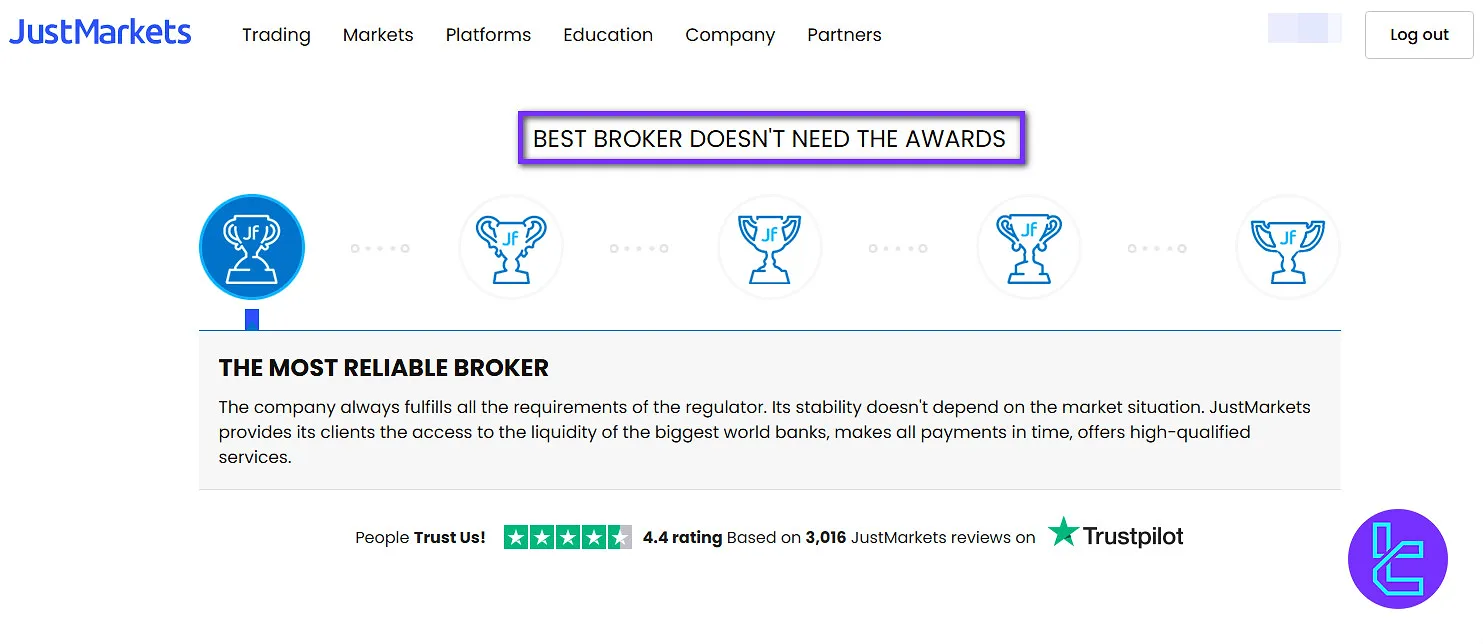

JustMarkets Awards

JustMarkets chooses not to pursue industry awards or certifications, emphasizing transparency and integrity over accolades.

The broker believes that purchasing trophies, diplomas, or certificates does not enhance reliability or improve service quality for clients. So there are no JustMarkets awards listed on the broker’s website.

With that said, even though JustMarkets doesn’t list any awards on its website, the broker has won multiple awards, including:

- Best Global Broker Award at JFEX 2025

- Best Broker in MENA at FED 2025

- Most Innovative Broker in Africa Award at FMAS:25

- Best Trading Conditions Award at MEAD 2025

How to Contact JustMarkets Customer Support

The broker offers multiple channels for customer support, ensuring that traders can get assistance whenever needed. Contact channels to the JustMarkets support team:

support@justmarkets.com | |

Live chat | Through the website |

Phone | +248 4632027, +230 52970330 |

Callback request | Submit a request through the contacts form |

JustMarkets Broker Geo-Restrictions

Like many financial service providers, the company implements geo-restrictions to comply with international regulations and manage risk. List of restricted countries on JustMarkets:

- Australia

- Canada

- EU (European Union)

- EEA (European Economic Area)

- Japan

- United Kingdom

- United States

- Sanctioned countries by the EU

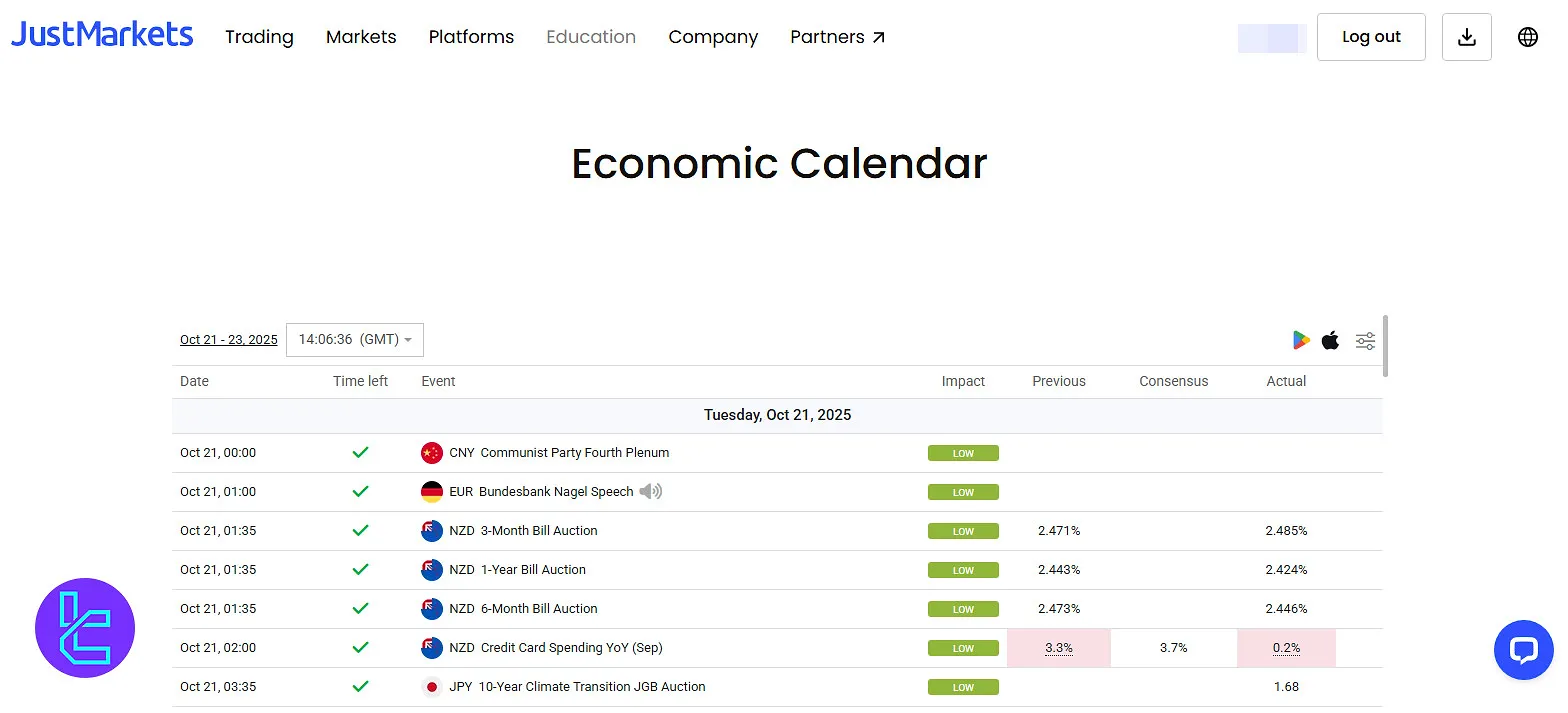

JustMarkets Additional Tools and Features

The broker focuses on answering any trading needs that clients may have. Therefore, it offers some special tools and features. We must discuss these interesting offerings in the JustMarkets review.

- Economic Calendar: Stay informed about major market events and data releases

- Trading Signals: Access expert analysis and ideas to make informed decisions

- VPS Hosting: Uninterrupted trading with virtual private server options

- Mobile Trading: Trade on the go with dedicated apps for iOS and Android devices

JustMarkets Broker Trust Scores

The broker has built a strong reputation in the online trading industry over its decade-long history. JustMarkets in reputable review sources:

Trustpilot | 4.3 out of 5 |

2.8 out of 5 |

7% of reviews on TrustPilot have graded the company as a 1-star broker (the lowest rating). Here’s a list of the common complaints.

- Time-consuming withdrawal process

- Bonus issues

- Poor support

- Deposits not reaching the account

Does JustMarkets Provide Educational Materials?

In addition to providing online trading services, the broker also excels in educating traders. From analytics material to the learning center, JustMarkets offers a wide range of educational content.

- Analytics: Market overview, daily forecast, news, and economic calendar

- Learning Center: Forex articles, glossary, webinars, and educational videos on subjects like how to create a trading bot

JustMarkets in Comparison to Its Peers

Here's how JM performs compared to top Forex brokers in the industry:

Parameter | JustMarkets Broker | IC Markets Broker | XM Broker | Exness Broker |

Regulation | CySEC, FSA, FSCA, FSC | FSA, CySEC, ASIC | ASIC, FSC, DFSA, CySEC | FSA, CySEC, FCA, FSCA, CBCS, FSC, CMA |

Minimum Spread | 0 Pips | From 0.0 Pips | From 0.6 Pips | From 0.0 Pips |

Commission | $3 Each Side per Lot in Raw Spread Accounts | From $3 | $0 (except on Shares account) | From $0.2 to USD 3.5 |

Minimum Deposit | $10 | $200 | $5 | $10 |

Maximum Leverage | 1:3000 | 1:500 | 1:1000 | Unlimited |

Trading Platforms | MT4, MT5, Mobile App | Metatrader 4, Metatrader 5, cTrader, cTrader Web, IC Markets Mobile | MT4, MT5, Mobile App | Exness Trade (mobile), Exness Terminal (web), MT4, MT5 |

Account Types | Standard Cent, Standard, Pro, Raw Spread | Standard, Raw Spread, Islamic | Micro, Standard, Ultra Low, Shares | Standard, Standard Cent, Pro, Raw Spread, Zero |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | 90+ | 2,250+ | 1400+ | 200+ |

| Trade Execution | Market | Market | Market, Instant | Market, Instant |

Conclusion and Final Words

JustMarkets provides access to 5 asset classes, including Forex and Crypto with floating spreads from 0.0 pips and a $3 commission through its Raw Spread account. JustMarkets broker has a score of 4.3 on TrustPilot, and doesn’t accept US clients.