JustMarkets EU provides 260+ trading instruments, including Gold, Oil, and BTC, through the MT5 platform. The broker offers professional clients leverage options of up to 1:300. US clients are not accepted.

The platform supports a minimum trade size of 0.01 lots, and account funding starts from $10 via cards or e-wallets and $100 via bank transfer. Since its European launch, JustMarkets has handled over 10,000 trades per day on average.

JustMarkets EU; Company Background and Its Regulatory Status

JustMarkets Ltd operates under the international brand JustMarkets, formerly JustForex, and provides services to EU residents (excluding France and Belgium).

The broker offers a regulated trading environment under the supervision of the Cyprus Securities and Exchange Commission (CySEC).

Key features of JustMarkets Europe:

- Spreads from 0.0 pips

- Leverage options of up to 1:30

- Allowing strategies such as expert advisors, intraday trading, hedging, and scalping

- Swap-free (Islamic) accounts

- Founded in 2012

- CySEC-regulated with license number 401/21

Here are the regulatory details of JustMarkets EU:

Entity Parameters / Branches | JustMarkets EU |

Regulation | Regulated by the Cyprus Securities and Exchange Commission (CySEC) |

Regulation Tier | Tier 1 |

Country | Cyprus |

Investor Protection Fund / Compensation Scheme | Member of the Investor Compensation Fund (ICF), covering eligible clients up to €20,000 |

Segregated Funds | Yes |

Negative Balance Protection | Yes |

Maximum Leverage | 1:30 (1:300 for professionals) |

Client Eligibility | Available to EU residents (excluding France and Belgium) |

JustMarkets EU Broker Specifications

The Forex broker provides fast execution from 0.01s across 6 financial markets, from the Forex Market to Crypto. Let's examine the offerings of JustMarkets' European branch.

Broker | JustMarkets EU |

Account Types | Pro, Raw Spread, Islamic |

Regulating Authorities | CySEC |

Based Currencies | USD, EUR, GBP, PLN |

Minimum Deposit | $100 |

Deposit Methods | Wire Transfer, Visa, MasterCard, Google Pay, Neteller, Skrill, PayPal |

Withdrawal Methods | Wire Transfer, Visa, MasterCard, Google Pay, Neteller, Skrill, PayPal |

Minimum Order | 0.01 lots |

Maximum Leverage | 1:30 (1:300 for professionals) |

Investment Options | None |

Trading Platforms & Apps | MT5, JustMarkets application |

Markets | Forex, Metals, Energies, Stocks, Indices, Crypto |

Spread | From 0.0 pips |

Commission | Variable based on the account type |

Orders Execution | Market |

Margin Call / Stop Out | N/A |

Trading Features | Swap-free accounts, Economic Calendar, 1:300 leverage for professionals, Mobile trading |

Affiliate Program | N/A |

Bonus & Promotions | N/A |

Islamic Account | Yes |

PAMM Account | No |

Customer Support Ways | Email, Tel, Live Chat, Chatbot |

Customer Support Hours | N/A |

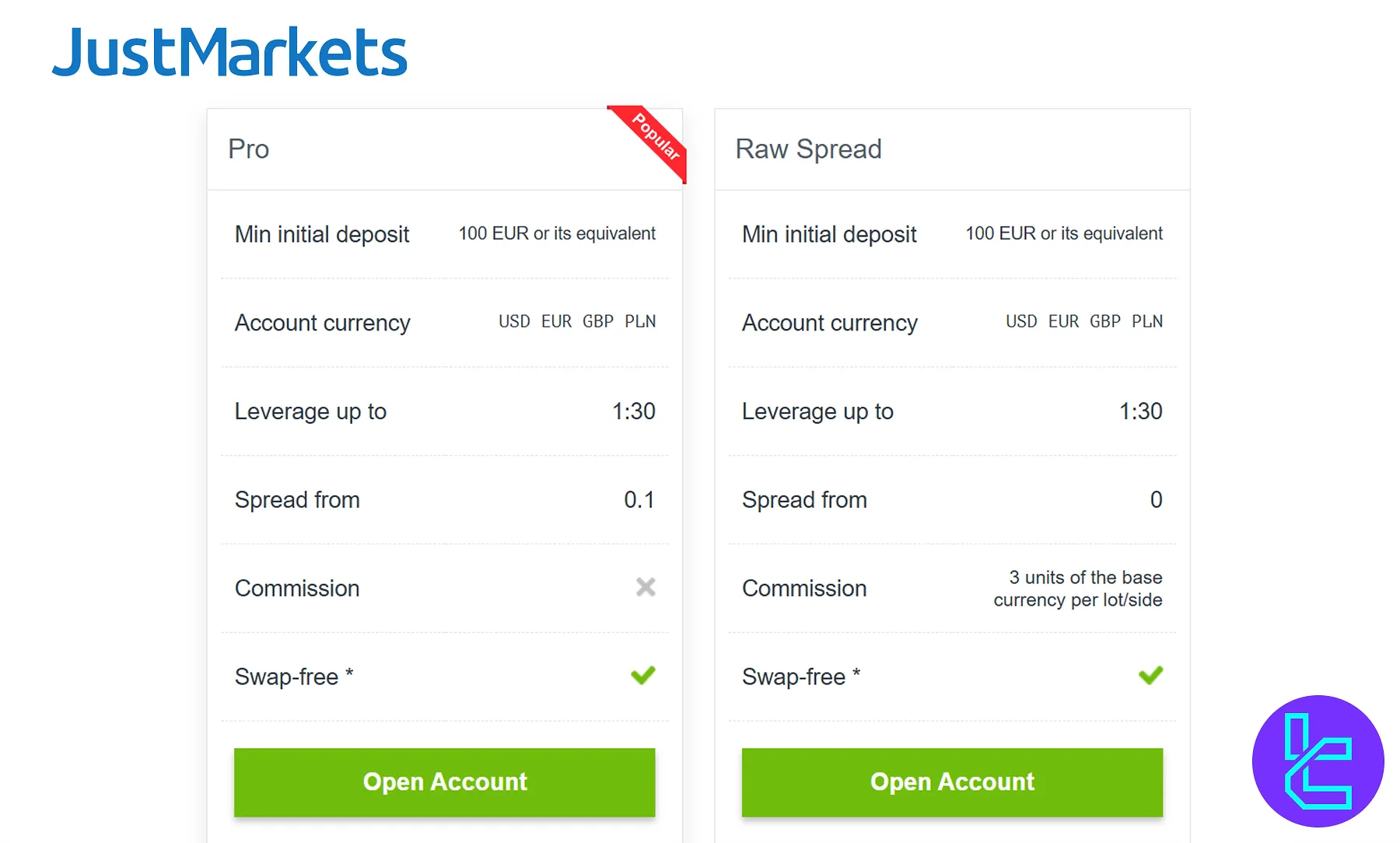

Account Types

JustMarkets strives to become one of the best Forex brokers across Europe. So, it offers multiple options to suit the different needs of traders, including:

Features | Pro | Raw Spread |

Min Deposit | $100 | $100 |

Base Currency | USD, EUR, GBP, PLN | USD, EUR, GBP, PLN |

Max Leverage | 1:30 | 1:30 |

Spreads from (Pips) | 0.1 | 0.0 |

Commission | $0.0 | 3 units of the base currency |

Swap-free Option | Yes | Yes |

JustMarkets EU Upsides and Downsides

While the company offers professional clients leverage options of up to 1:300, its limited 1:30 offering can be a letdown for non-professionals.

Let’s weigh some of the broker’s pros against its cons.

Pros | Cons |

User-friendly trading interface | Limited range of trading instruments (260+) |

Competitive spreads | No investment plans |

Fast execution speeds (10ms) | Geo-restrictions |

CySEC regulation | No support for TradingView |

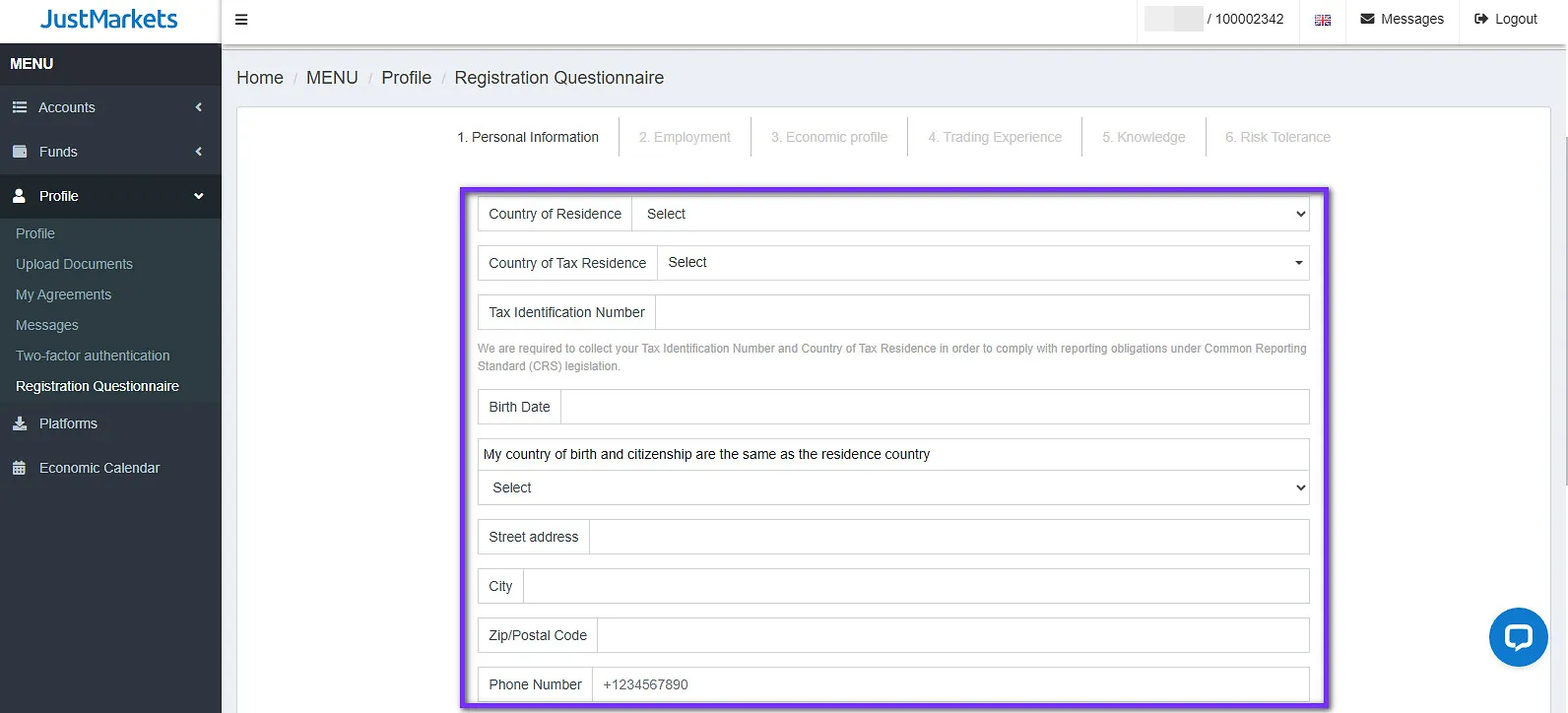

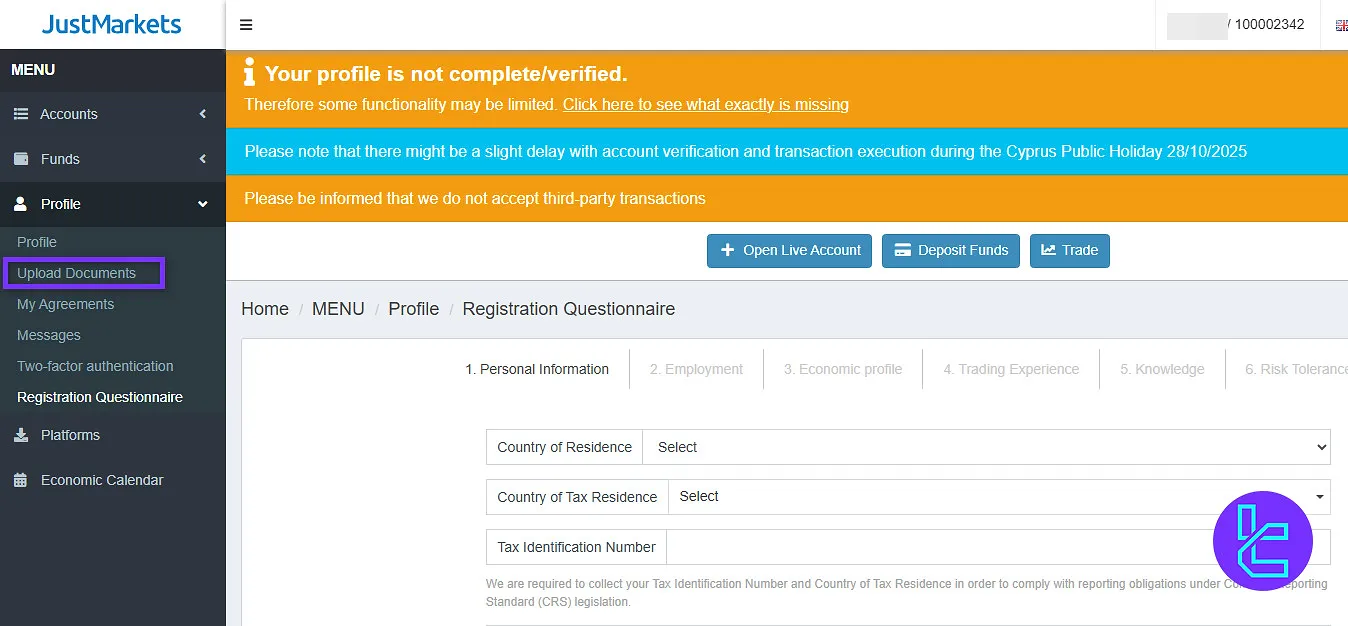

A Complete Registration and KYC Guide

Opening an account with JustMarkets EU involves a quick yet regulation-compliant process aligned with AML and KYC standards. Traders must provide accurate personal data, complete a risk assessment, and verify their identity.

#1 Create Your Account

Visit the officialJustMarkets EU website and click on the “Registration” button. Enter your basic account information, including email and a secure password.

#2 Complete the Profile

You’ll be asked to provide detailed personal and financial data, such as employment status, economic background, trading experience, and risk appetite.

This helps tailor your access under MiFID II compliance.

#3 Verify Your Identity

Upload a valid passport or EU national ID, along with proof of residence (e.g., utility bill or bank statement).

JustMarkets EU Broker Trading Platforms

The company offers access to MetaTrader 5 (MT5), one of the best trading solutions on the market, and a proprietary mobile application.

MetaTrader 5 (MT5)

- MT5 Android

- MT5 iOS

- Desktop

- WebTrader

JustMarkets Application

TradingFinder has developed various MT4 indicators and MT5 indicators that you can use for free.

Fees and Commissions

One of the brightest points in this JustMarkets EU review is the option to trade Forex with no commissions.

The broker’s fee structure is simple and varies based on your account type. We’ll explore the minimum spreads for some of the most popular Forex pairs:

Currency Pairs | Spreads from (Pips) | |

Pro | Raw Spread | |

EURUSD | 0.0 | 0.6 |

AUDCAD | 2.0 | 3.0 |

EURGBP | 1.0 | 2.2 |

GBPJPY | 1.0 | 2.4 |

USDCHF | 2.0 | 3.0 |

USDJPY | 0.0 | 1.0 |

While the broker claims that the Pro spreads start from 0.0 pips, its “Contract Specifications” page showcases the above figures.

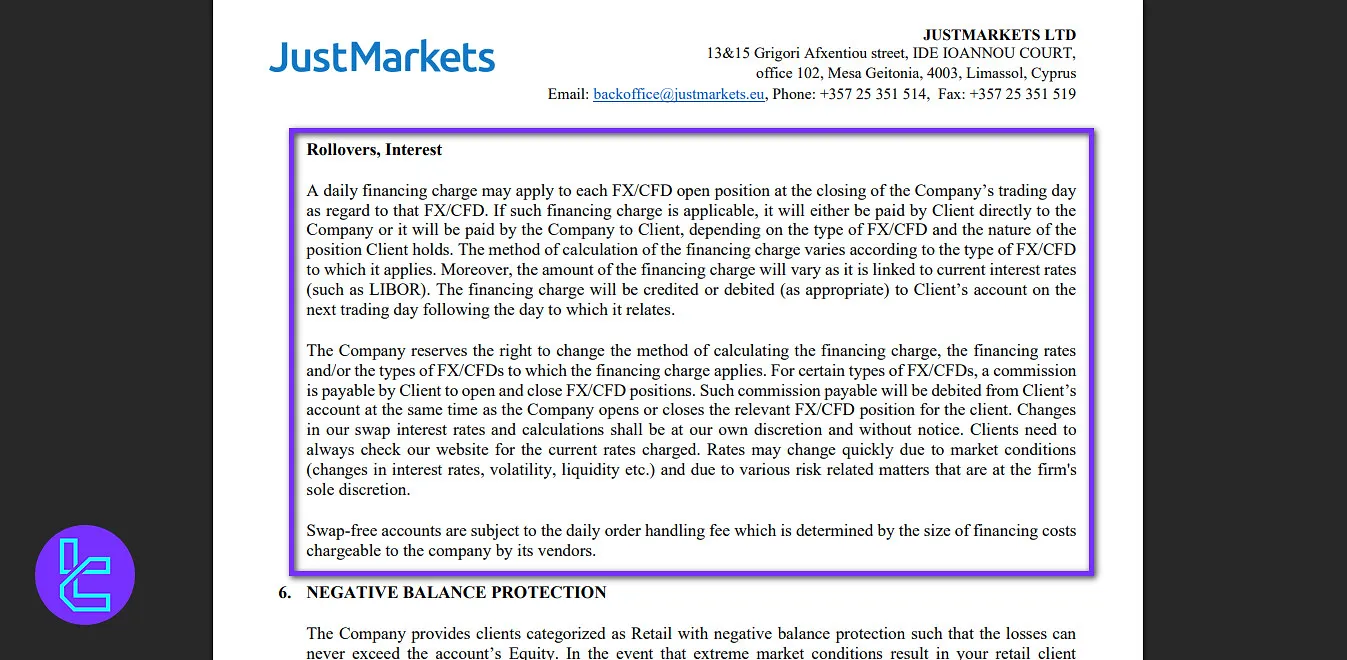

JustMarkets EU Swap Fees

At JustMarkets EU, financing costs, often referred to as swap or rollover fees, may apply to FX and CFD positions held open after the trading day closes.

Depending on the instrument and whether a trader’s position is long or short, this cost can either be charged to or credited to the client’s account.

The rate of this overnight adjustment is tied to prevailing benchmark interest rates such as LIBOR and can fluctuate based on broader market conditions, including liquidity and volatility levels.

Calculations differ among asset classes and are reviewed regularly by the company, which reserves the right to modify the methodology or rates without prior notice.

For certain FX/CFD instruments, traders may also incur a commission upon opening or closing positions. These fees are deducted automatically from the client’s account at the time of execution.

Additionally, swap-free (Islamic) accounts do not incur standard overnight interest charges; instead, they are subject to a daily handling fee that reflects the financing costs imposed on the company by its liquidity providers.

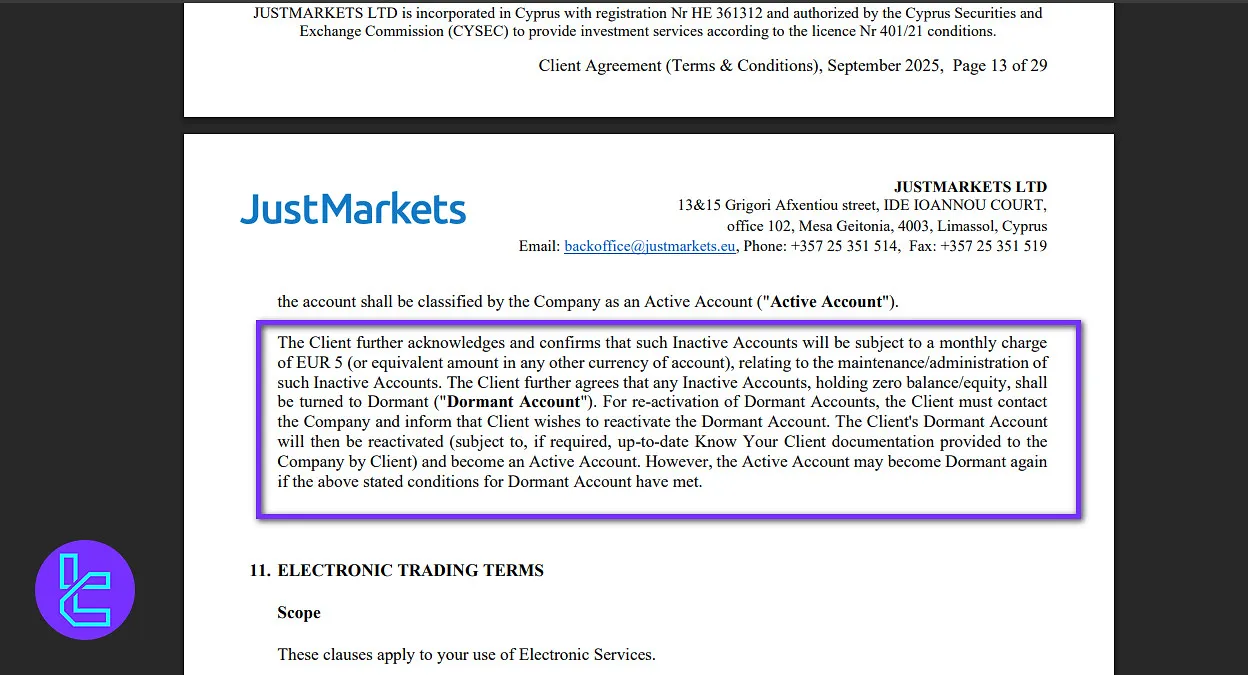

JustMarkets EU Non-Trading Fees

At JustMarkets EU, trading accounts are monitored for activity. Accounts with no trading activity, including no executed trades, no trading position openings or closings, and no deposits, for 90 days or more are designated as Inactive Accounts.

Inactive Accounts incur a monthly maintenance fee of €5 (or the currency equivalent) to cover administrative costs.

Accounts that remain active through trading, deposits, or position management are classified as Active Accounts. If an Inactive Account holds a zero balance, it is converted into a Dormant Account.

Reactivation of Dormant Accounts requires the client to contact the company and may necessitate up-to-date Know Your Client (KYC) documentation.

Once reactivated, the account returns to Active status, though it can become Dormant again if inactivity resumes.

For deposits and withdrawals, JustMarkets EU does not apply its own fees, although charges from banks may still occur.

Payment provider fees are generally covered by the company, but in cases where deposits or withdrawals are rejected due to Anti-Money Laundering (AML) compliance, the company reserves the right to reclaim these fees.

JustMarkets EU Withdrawal & Deposit

With the safety, reliability, and compliance factors in mind, the company has provided multiple payment options, from Credit/Debit Cards to E-Payments.

Method | Available Currency | Min Deposit | Min Withdrawal |

Bank Transfer | EUR, USD, PLN | €100 | €50 |

MasterCard | EUR, USD, GBP | €10 | €1 |

Visa | €10 | €1 | |

Google Pay | €10 | €1 | |

Skrill | EUR, USD, GBP, PLN | €10 | €1 |

Neteller | €10 | €1 | |

PayPal | €10 | €1 |

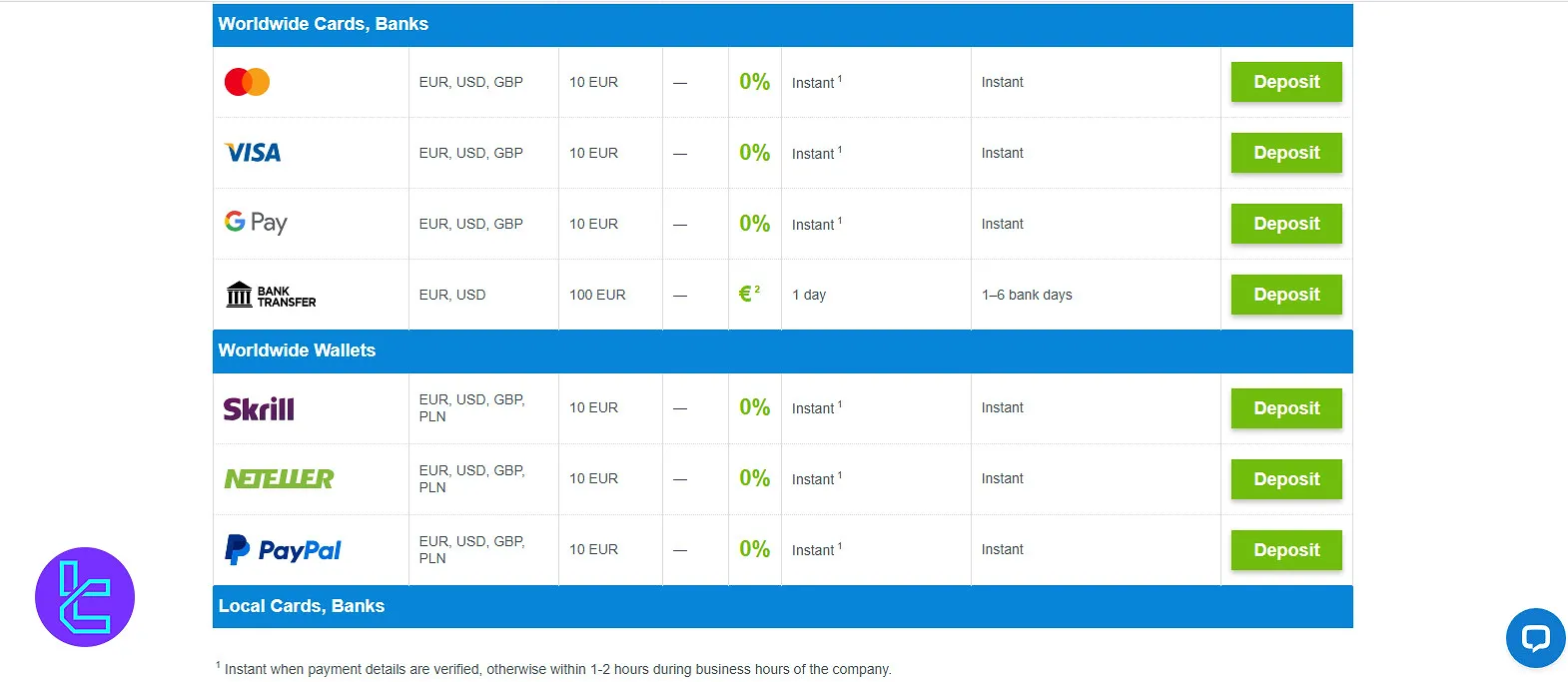

JustMarkets EU Deposit

JustMarkets EU provides multiple deposit channels to accommodate traders worldwide, ensuring flexibility in both currency selection and processing speed.

Below is a summary of the available methods, currencies, limits, fees, and processing times:

Deposit Method | Supported Currencies | Minimum Transaction | Fee | Processing Time (JustMarkets) | Processing Time (Payment Provider) |

Master Card | EUR, USD, GBP | 10 EUR | 0% | Instant | Instant |

VISA | EUR, USD, GBP | 10 EUR | 0% | Instant | Instant |

Google Pay | EUR, USD, GBP | 10 EUR | 0% | Instant | Instant |

Bank Transfer | EUR, USD | 100 EUR | 0% (Bank fees may apply) | 1 day | 1–6 bank days |

Skrill | EUR, USD, GBP, PLN | 10 EUR | 0% | Instant | Instant |

Neteller | EUR, USD, GBP, PLN | 10 EUR | 0% | Instant | Instant |

Paypal | EUR, USD, GBP, PLN | 10 EUR | 0% | Instant | Instant |

JustMarkets itself does not charge deposit fees; however, intermediary or banking charges may still apply.

All payment provider costs are initially covered by the company, but may be reclaimed if a transaction is reversed for Anti-Money Laundering (AML) compliance reasons.

JustMarkets EU Withdrawal

The same methods of deposit are available for JustMarkets EU withdrawals. Below you can see the details of each withdrawal method:

Withdrawal Method | Supported Currencies | Minimum Transaction | Fee | Processing Time (JustMarkets) | Processing Time (Payment Provider) |

Master Card | EUR, USD, GBP | 1 EUR | 0% | 1–2 hours | 4–10 bank days |

VISA | EUR, USD, GBP | 1 EUR | 0% | 1–2 hours | 4–10 bank days |

Google Pay | EUR, USD, GBP | 1 EUR | 0% | 1–2 hours | 4–10 bank days |

Bank Transfer | EUR, USD | 50 EUR | 0% (Bank fees may apply) | 1–2 hours | 1–6 bank days |

Skrill | EUR, USD, GBP, PLN | 1 EUR | 0% | 1–2 hours | Instant |

Neteller | EUR, USD, GBP, PLN | 1 EUR | 0% | 1–2 hours | Instant |

Paypal | EUR, USD, GBP, PLN | 1 EUR | 0% | 1–2 hours | Instant |

JustMarkets EU doesn’t charge any fees for withdrawals but for bank transfers there are fees charged by banks.

Copy Trading and Investment Plans

While the broker’s international branch provides a comprehensive copy trading service for investors and strategy providers with a dedicated Android/iOS application, the European branch hasn’t mentioned the service on its website.

When writing this JustMarkets EU review, we attempted to ask the support team about the matter. However, the Chatbot couldn’t find an answer, and live agents weren’t available on Tuesday at 12:33 GMT.

JustMarkets EU Broker Trading Instruments

The broker offers a diverse range of trading instruments (250+) across 6 asset classes to suit various trading styles and preferences.

Here are the various types of JustMarkets EU instruments:

Category | Type of Instruments | Number of Symbols | Competitor Average | Maximum Leverage |

Forex | Major, minor, and exotic currency pairs (Standard, Micro, Ultra Low accounts) | 40+ currency pairs | 50–70 currency pairs | 1:30 (1:300 for professionals) |

Stocks | CFDs on shares via MT5 platform (Airbus, Puma, Ubisoft, etc.) | Over 1000 global stocks | 800–1200 | N/A |

Crypto | CFDs on 11 cryptocurrencies (ADA, BTC, DOT, ETH, etc.) | 11 | 8–15 (typical broker range) | N/A |

Metals | CFDs on Gold and Silver | 5 trading pairs | 4–6 instruments | N/A |

Energies | CFDs on BRENT, WTI, and US Natural Gas | 3 | 3–5 instruments | N/A |

Indices | CFDs on 11 global indices (DE40, HK50, JP225, UK100, US100, etc.) | 11 indices | 10–20 indices | N/A |

Does JustMarkets EU Offer Promotions?

As of our latest review, the company does not prominently advertise any ongoing promotions or bonus offers on its website.

This approach aligns with strict regulatory guidelines in the EU, which often restrict or prohibit specific trading bonuses.

JustMarkets EU Awards

Currently, JustMarkets EU does not appear to have received any widely recognized industry awards. The company’s official website doesn’t provide information highlighting such achievements.

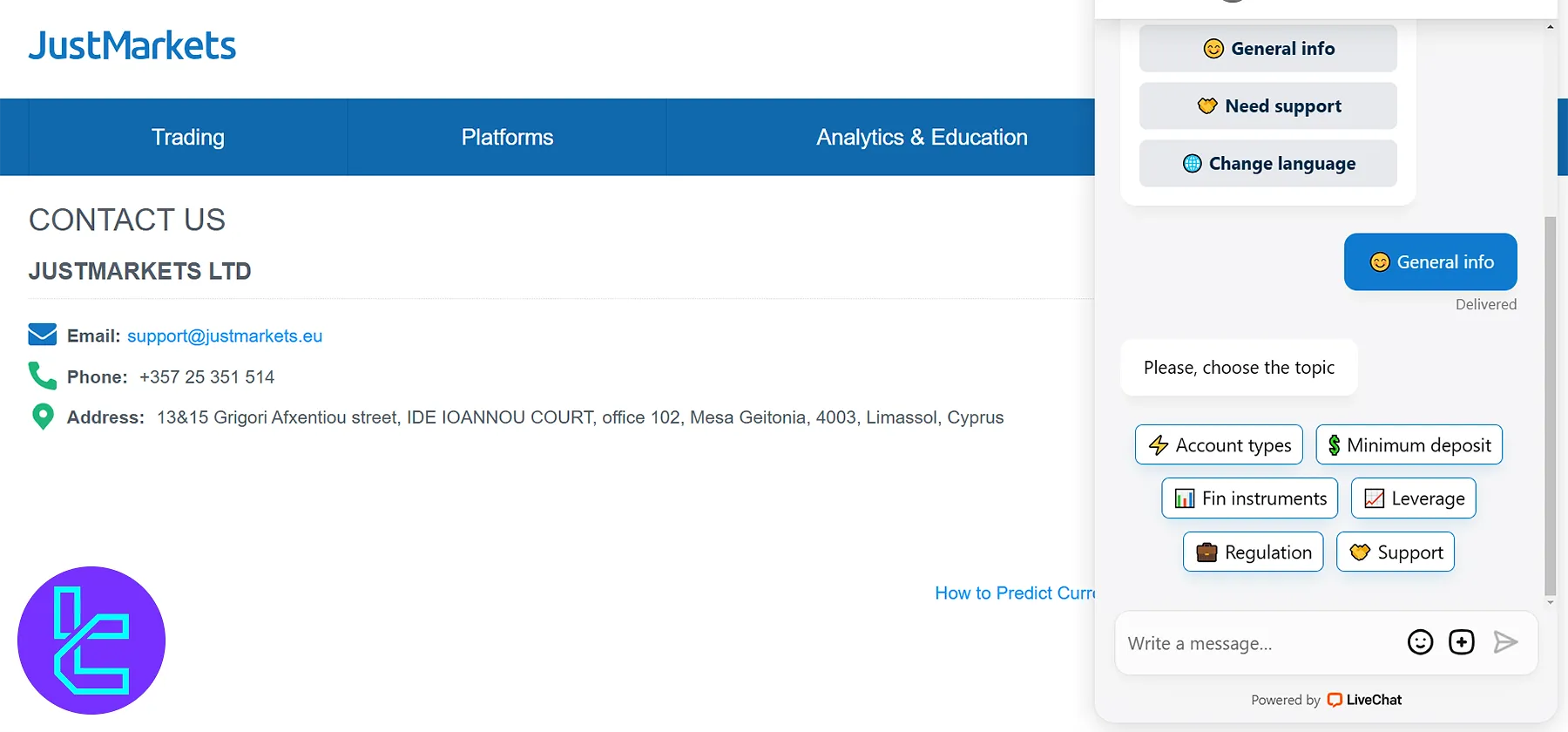

How to Reach Customer Support?

When it comes to customer support, the broker offers several channels, including online chat and email, to ensure you can get help when you need it.

However, as mentioned earlier, we couldn’t reach the support agents through the live chat feature.

support@justmarkets.eu | |

Live Chat | Ask the Chatbot to connect you to the agents |

Phone | +357 25 351 514 |

Chatbot | Available on the official website |

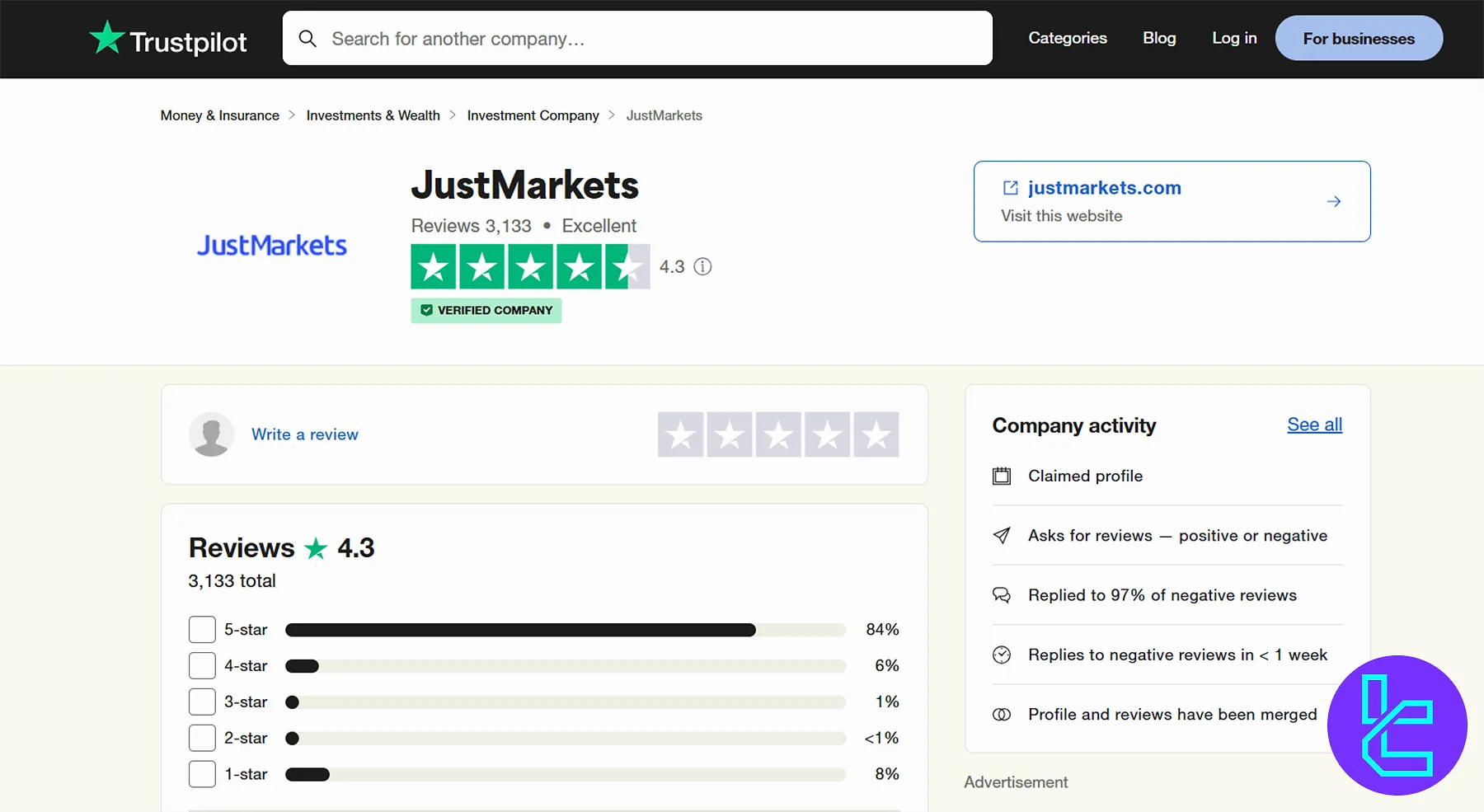

JustMarkets EU Trust Score

As the branch itself isn’t separately featured on reputable sources like TrustPilot and Forex Peace Army, we’ll explore the international brand’s scores in this JustMarkets EU review.

4.3 out of 5 based on 3,133 ratings | |

Forex Peace Army | 2.798 out of 5 based on 166 reviews |

While 90% of the reviews on the broker’s TrustPilot profile are 4-star and 5-star, less than 9% are negative (1-star and 2-star).

Educational Offerings

JustMarkets EU provides a comprehensive list of world currencies, an economic calendar with coverage of 50+ countries, and various educational resources, including:

- Forex Glossary

- Market analysis

- Articles on strategies, instruments, platforms, and accounts

- Video tutorials about MetaTrader

JustMarkets EU in Comparison to Other Brokerages

Here's how JustMarkets EU fares compared to the 3 top Forex brokers:

Parameter | JustMarkets EU Broker | LiteForex Broker | Exness Broker | HFM Broker |

Regulation | CySEC | CySEC | FSA, CySEC, FCA, FSCA, CBCS, FSC, CMA | CySEC, DFSA, FCA, FSCA, FSA |

Minimum Spread | 0.0 Pips | From 0.0 Pips | From 0.0 Pips | From 0.0 Pips |

Commission | Variable based on the account type | From $0.0 | From $0.2 to USD 3.5 | From $0 |

Minimum Deposit | $100 | $50 | $10 | From $0 |

Maximum Leverage | 1:30 (1:300 for professionals) | 1:30 | Unlimited | 1:2000 |

Trading Platforms | MT5, JustMarkets Application | MetaTrader 4, MetaTrader 5, Mobile Proprietary App | Exness Trade (mobile), Exness Terminal (web), MT4, MT5 | MT4, MT5, Mobile App |

Account Types | Pro, Raw Spread, Islamic | Classic, ECN, Demo | Standard, Standard Cent, Pro, Raw Spread, Zero | Cent, Zero, Pro, Premium |

Islamic Account | Yes | No | Yes | Yes |

Number of Tradable Assets | 250+ | N/A | 200+ | 1,000+ |

| Trade Execution | Market | Market | Market, Instant | Market, Buy Stop, Stop Loss, Limit, Take Profit |

Conclusion and Final Words

JustMarkets EU provides access to 6 asset classes through its 2 main account types, including Raw Spread and Pro, for a minimum deposit of $100.

The broker supports Neteller, Google Pay, and PayPal payments with no transaction fees.