LCM FX provides access to 30+ financial instruments across two asset classes, including Forex and Metals with a minimum deposit of $100. The broker supports Skrill and bank payments.

This broker operates under an SVG registration and lacks a tier-1 regulation with investor protection. On the other hand, LCMFX allows you to use leverage of up to 1:500 in your trades.

LCM FX (An Introduction to the Company and its Regulatory Status)

LCMFX is an STP brokerage firm operating as a brand name of Lucror Ltd, registered in the UK (Company No. 05975456). However, the broker is not regulated by any financial authority.

This lack of regulatory oversight raises significant concerns about the safety and security of client funds, as well as the overall compliance and transparency of the broker's operations.

The broker’s information is summarized in the table below:

Entity Parameters / Branches | Lucror Ltd (LCMFX) |

Regulation | Unregulated (SVG) |

Regulation Tier | N/A |

Country | Saint Vincent & the Grenadines |

Investor Protection Fund / Compensation Scheme | None |

Segregated Funds | No |

Negative Balance Protection | No |

Maximum Leverage | 1:500 |

Client Eligibility | Global — excl. Caribbean & OFAC-sanctioned |

LCM FX Table of Specifications

LCMFX was founded in 2017. Here are some other specific details about the Forex broker.

Broker | LCM FX |

Account Types | Standard Trade, Pro Trade |

Regulating Authorities | None |

Based Currencies | EUR |

Minimum Deposit | $100 |

Deposit Methods | Bank Transfers, Skrill |

Withdrawal Methods | Bank Transfers, Skrill |

Minimum Order | 0.01 lots |

Maximum Leverage | 1:500 |

Investment Options | None |

Trading Platforms & Apps | MT4 |

Markets | Forex, Metals |

Spread | From 0.9 pips |

Commission | None |

Orders Execution | Instant |

Margin Call / Stop Out | 75% / 50% |

Trading Features | Economic Calendar, Mobile Trading, Copy Trading |

Affiliate Program | Yes |

Bonus & Promotions | Partnership |

Islamic Account | N/A |

PAMM Account | No |

Customer Support Ways | Phone, Email, Skype (Deactivated), Feedback Form |

Customer Support Hours | 24/5 |

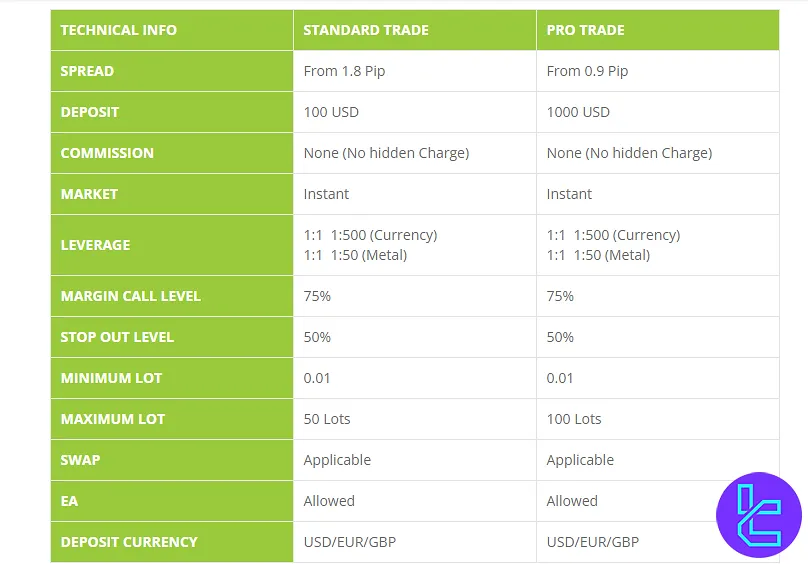

LCM FX Broker Account Types

The company offers two main account types with different entry barriers, spreads, and maximum order sizes.

Features | Standard Trade | Pro Trade |

Base Currency | EUR | EUR |

Min Deposit | $100 | $1,000 |

Execution | Instant | Instant |

Max Leverage | FX 1:500 Metals 1:50 | FX 1:500 Metals 1:50 |

Margin Call | 75% | 75% |

Stop Out | 50% | 50% |

Min Order Size | 0.01 lots | 0.01 lots |

Max Order Size | 50 lots | 100 lots |

Spreads | From 1.8 pips | From 0.9 pips |

Commission | None | None |

The broker provides two primary account types, each with distinct deposit requirements, trading conditions, and maximum order limits, catering to different trader profiles.

LCM FX Advantages and Disadvantages

The broker supports the use of EAs and copy trading. However, like any other trading platform, it has weaknesses, too. To have a balanced view, let’s weigh the LCMFX’s upsides against its downsides.

Pros | Cons |

Multilingual support | Limited trading instruments (30+) |

No Dealing Desk platform | High entry barrier |

Free demo account | Unregulated broker |

Multi Account Manager (MAM) accounts | No Forex education |

While LCM FX offers some attractive features like competitive spreads and high leverage, the lack of regulation and Forex tutorials are significant drawbacks that traders should carefully consider before opening an account.

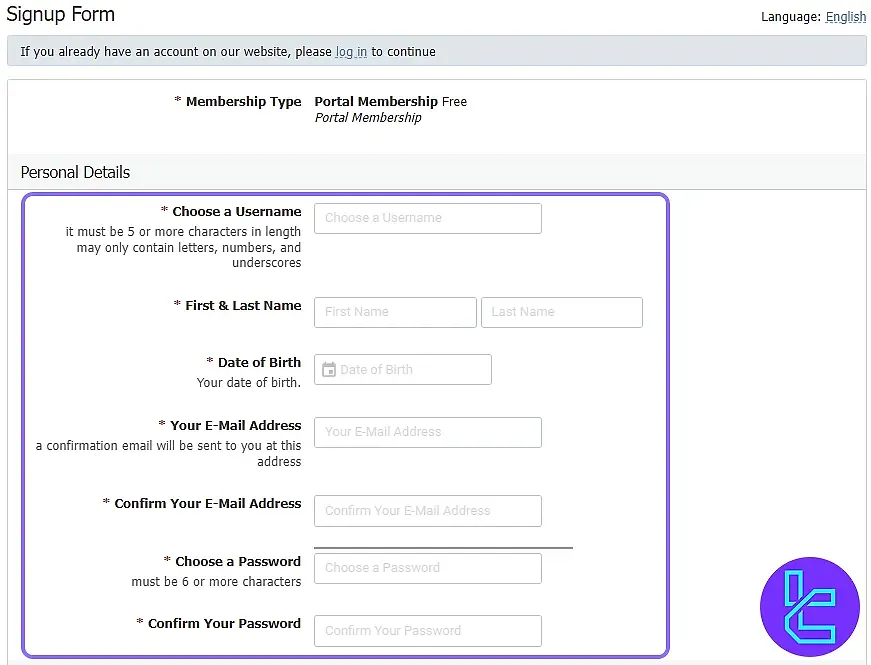

LCMFX Registration and KYC Verification

We must discuss the required documents for account opening in this LCM FX review. To complete the LCMFX registration process, follow the steps below, but get your ID and residence documents ready before starting.

#1 Access the LCM FX Registration Portal

Visit the official LCM FX website and click on "Open Live Account" to begin your registration.

#2 Create Your Login Credentials

Fill out the registration form with the following personal details:

- Username

- First name

- Last name

- Date of birth

Then, set a secure password consisting of a minimum of eight characters, incorporating uppercase and lowercase letters, numbers, and special symbols.

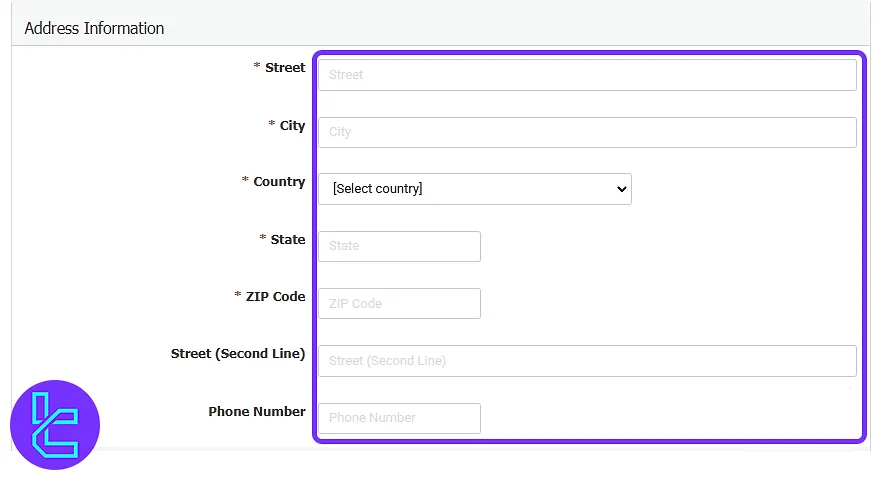

#3 Enter Contact & Residential Information

Input your full address, phone number, and country of residence. This information ensures the entry level of identity verification and legal compliance.

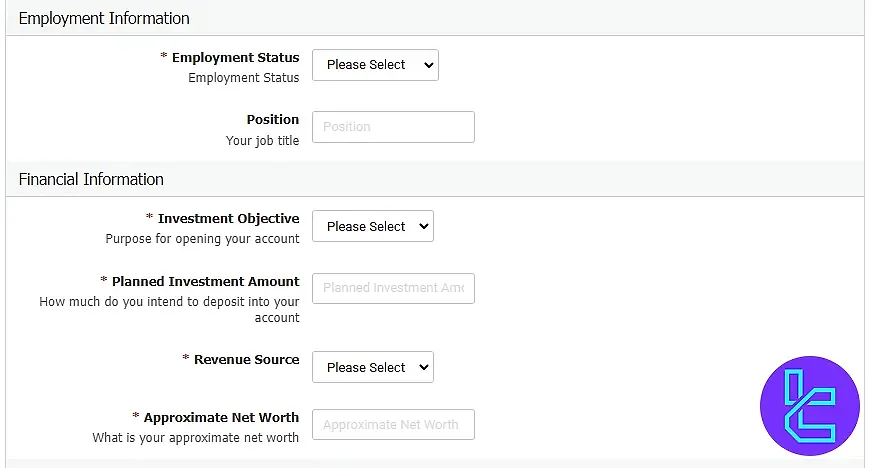

#4 Provide Employment and Financial Information

Complete the employment and financial sections by entering these details:

- Employment Status and Position: Outline your current professional situation and role;

- Purpose of Opening an Account: Explain your objectives for trading with this broker;

- Primary Source of Revenue: Specify your main income stream;

- Investment Amount: State the funds you intend to allocate for trading;

- Approximate Net Worth: Provide an estimate of your total financial assets.

#5 Verify Your Identity

To pass the KYC, provide proof of identity (driver’s license or passport) and proof of residence (recent utility bill or bank statement).

What Trading Platforms Are Available on LCM FX Broker?

LCMFX supports only one trading platform: the industry standard and popular MetaTrader 4. You can utilize various trading features, such as Expert Advisors (EAs) and 50+ MT4 indicators, via this platform. MT4 is available in various versions, including:

- Desktop

- MT4 Android

- MT4 iOS

The broker provides a Multi Account Manager (MAM) program through the MT4 platform for professional money managers to execute trades simultaneously on all of their followers’ accounts.

LCM FX Fees and Commissions

LCMFX provides free-commission trading conditions with no hidden fees. The broker’s fee structure mainly consists of spreads and swaps. There is no specific data available on swap rates, but here’s a list of spreads in the two account types.

Standard Trade | From 1.8 pips |

Pro Trade | From 0.9 pips |

Swap Fees at LCMFX

LCMFX applies overnight swap charges based on the interest rate differential between two currencies in a position. These rates vary by instrument and direction (long or short).

Also, the broker clearly states that swaps are tripled from Wednesday to Thursday to account for the weekend. For instance, EURUSD carries one of the highest negative swaps among majors.

Below are the most important highlights from the official swap specifications:

- EURUSD has a swap rate of -10.4832 for long positions and +4.73195 for short positions;

- EURAUD shows a strong differential, with -10.1959 (long) and +3.3435 (short);

- LCMFX does not mention the availability of swap-free or Islamic accounts anywhere on its official website.

Non-Trading Fees at LCMFX

According to verified review sources and the broker’s publicly available information, LCMFX does not impose any non-trading fees on its clients.

Deposits and withdrawals are free of charge, which makes the broker cost-efficient for traders who value flexibility in fund management. Also, LCMFX does not apply any inactivity or dormancy charges on unused accounts.

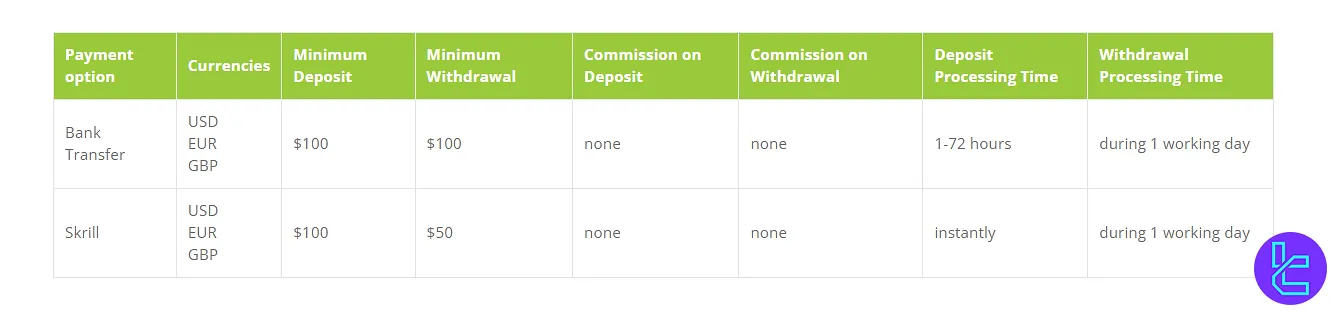

LCMFX Payment Methods

The company comes short in regard to deposit/withdrawal options since it doesn’t support Crypto transactions and Credit/Debit Cards.

LCM FX main payment options are included Bank Transfer and Skrill with currencies like USD and EUR.

Deposit Methods at LCMFX

LCMFX offers two deposit methods to facilitate seamless funding of trading accounts. The broker ensures that all deposit transactions are executed without any internal fees, providing clients with a cost-effective means to fund their accounts.

Deposits are processed promptly, with different methods offering varying processing times to suit the preferences of international clients.

Below is a detailed overview of the available deposit methods:

Deposit Method | Currency | Minimum Deposit | Deposit Fee | Processing Time |

Bank Transfer | USD, EUR, GBP | $100 | None | 1–72 hours |

Skrill | USD, EUR, GBP | $100 | None | Instant |

Withdrawal Methods at LCMFX

LCMFX provides clients with a variety of withdrawal options to ensure convenient and efficient access to their funds. The broker maintains a zero-withdrawal-fee policy, allowing clients to transfer funds without incurring additional costs.

Withdrawal requests are processed promptly, with specific processing times depending on the chosen method.

Below is a detailed overview of the available withdrawal methods:

Withdrawal Method | Currency | Minimum Withdrawal | Withdrawal Fee | Processing Time |

Bank Transfer | USD, EUR, GBP | $100 | None | during 1 working day |

Skrill | USD, EUR, GBP | $50 | None | during 1 working day |

Does LCM FX offer Investment Plans or Copy Trading?

The broker does not offer traditional copy trading or social trading features. It also doesn’t provide any exclusive investment plans. However, LCMFX does present the MT4 Multi-Account Manager (MAM) solution, which allows:

- Money managers to trade multiple client accounts simultaneously

- Allocation of trades across various accounts

- Customizable allocation methods (balance and equity)

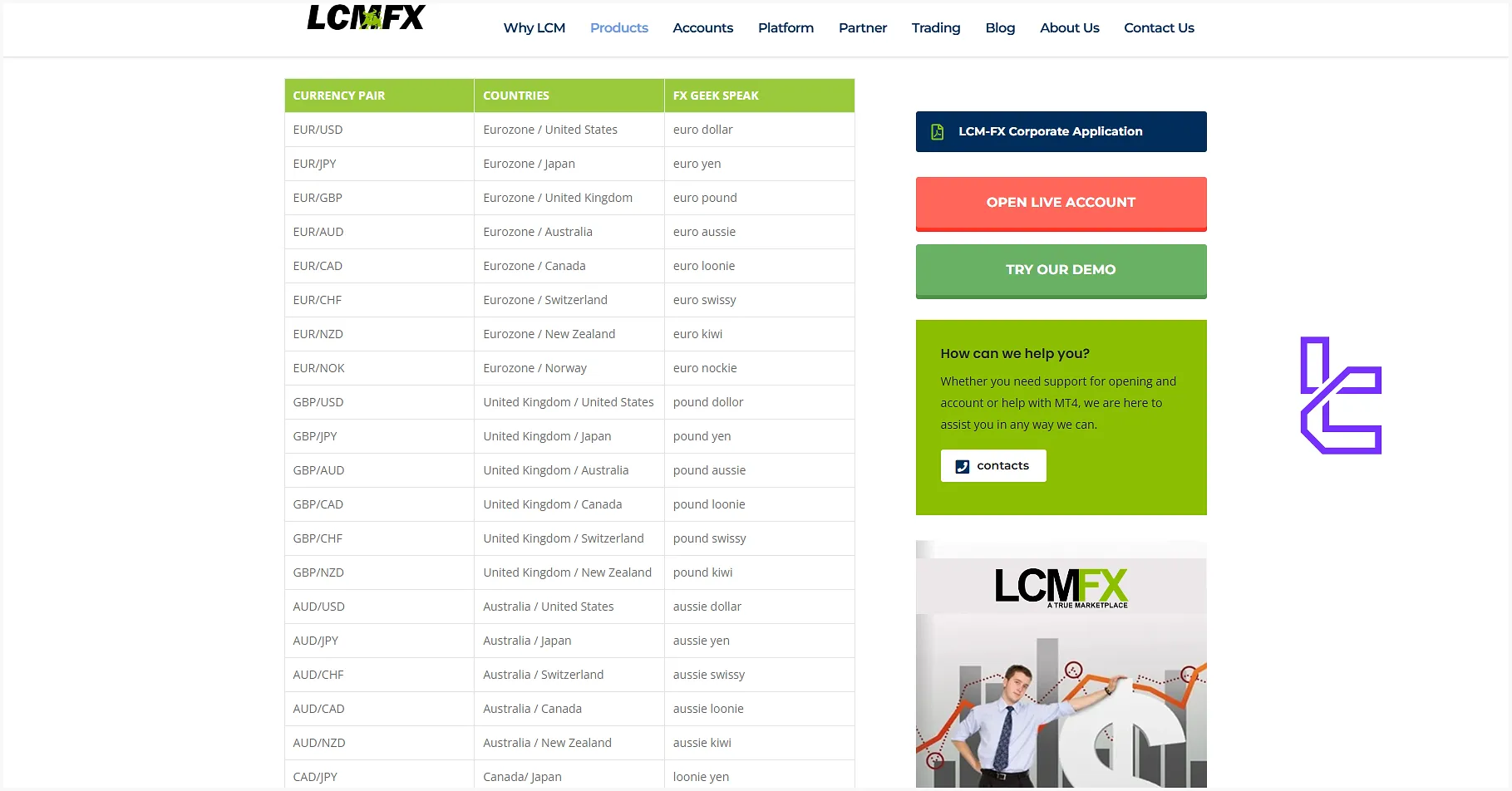

LCM FX Trading Assets

Offering limited trading instruments is one of the biggest weaknesses of LCMFX. The company offers only a limited range of 30+ tradable assets across the Metal and Forex markets.

Category | Type of Instruments | Number of Symbols | Competitor Average | Max. Leverage |

Forex | Currency Pairs | 30+ | 40 | 1:500 |

Precious Metals | Gold, Silver | 2 | 2 | 1:50 |

With this limited range of instruments and the absence of stocks, equities, cryptocurrencies, and other markets, traders must decide whether LCMFX is suitable for their trading needs.

LCMFX Broker Promotions

Promotion is one of the most attractive topics in all of LCM FX reviews. However, the broker disappoints in this aspect as well, since it doesn’t offer any traditional bonuses, such as no deposit or welcome gifts. But LCM FX offers a comprehensive partnership program for:

- Introducing Brokers (IBs)

- Strategy Providers

- Financial companies (White Label)

- Forex Educators/Trainers

LCMFX encourages collaboration through these partnership opportunities, allowing affiliates to earn commissions or expand their trading communities.

LCMFX Awards

According to official sources, LCMFX has not received any industry awards. There is no public record of recognitions or accolades granted to this broker.

How to Reach LCM FX Customer Support?

The company provides 24/5 support through various channels, including phone calls, email, and a dedicated feedback form.

- Phone: +64-9-9722150

- Email: support@lcm-fx.com

- Feedback Form: Available on the “Contact Us” page

- Skype: Deactivated

LCM FX Red Flag Countries

As a brand name of Lucror Ltd., registered in the UK, the broker is obliged to deny services to “Caribbean Islands” and “UN Sanctioned” countries, including:

- Afghanistan

- Central African Republic

- Democratic Republic of Congo

- North Korea

- Guinea-Bissau

- Iran

- Libya

- Mali

- Somalia

- South Sudan

- Sudan

- Yemen

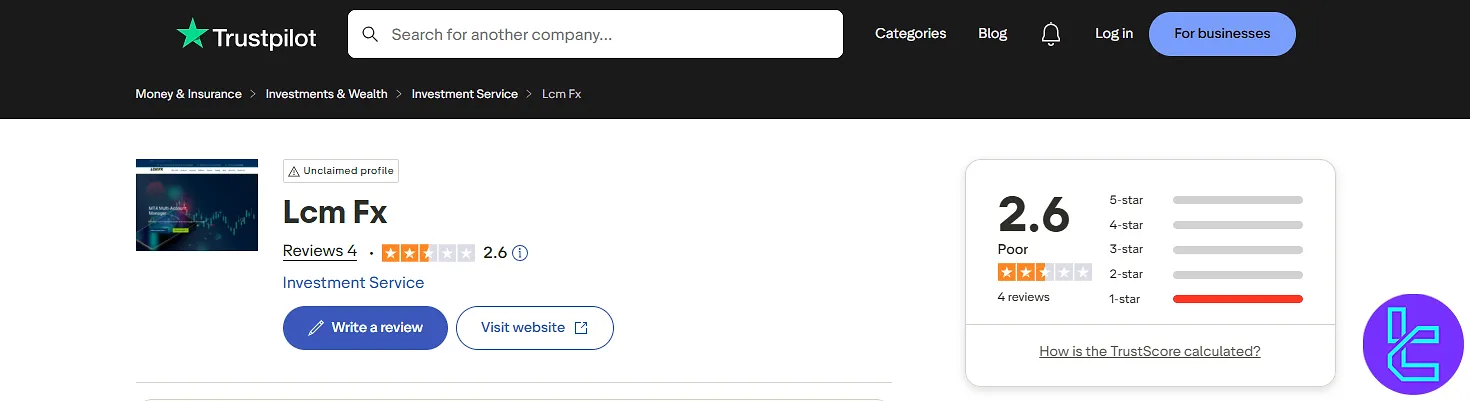

LCMFX User Ratings and Trust Scores

User Satisfaction may be the most important topic in all LCM FX reviews. You can get a good sense of the broker’s service quality and reliability by exploring its ratings on reputable websites.

The LCMFX Trustpilot profile has a score of 2.6 out of 5. Two TP users have rated LCM FX as a 1-star broker (the lowest rating).

Does LCMFX Provide Educational Resources?

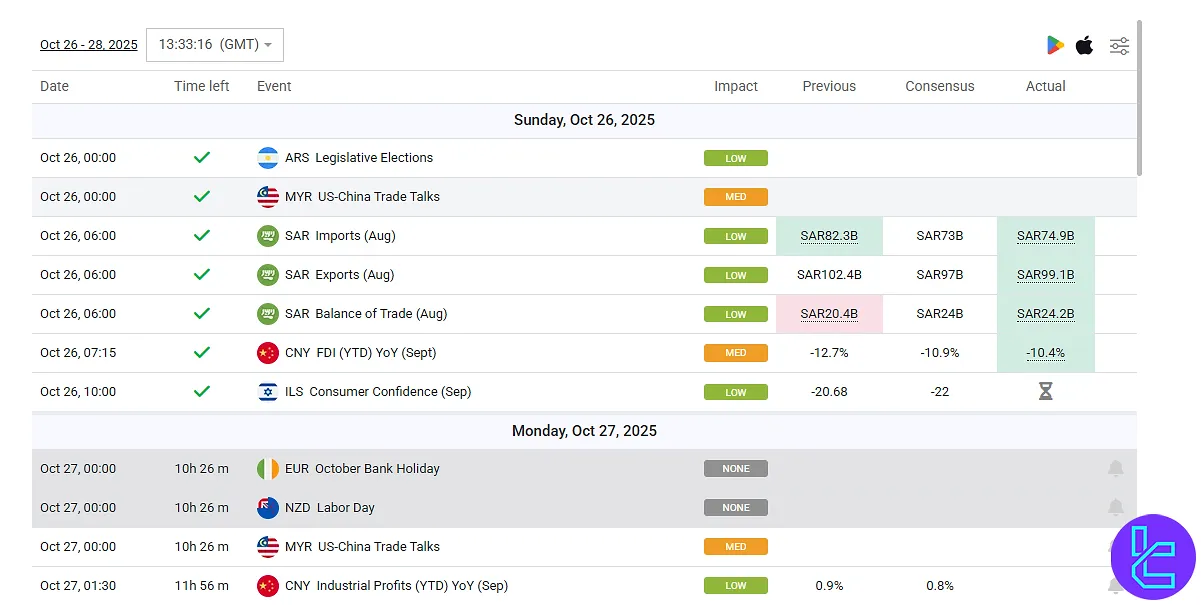

While the company doesn’t offer any educational resources, it provides an exclusive economic calendar and a dedicated blog covering various topics, including:

- Fundamental/Technical analysis

- Market news

- Tutorials

- Trading Strategies

- Forex Calendar

LCMFX in Comparison to Other Brokers

The brokerage is compared against other companies in the table below:

Parameter | LCMFX Broker | Tickmill Broker | Exness Broker | HFM Broker |

Regulation | None | FSA, FCA, CySEC, LFSA, FSCA | FSA, CySEC, FCA, FSCA, CBCS, FSC, CMA | CySEC, DFSA, FCA, FSCA, FSA |

Minimum Spread | 0.9 Pips | From 0.0 Pips | From 0.0 Pips | From 0.0 Pips |

Commission | None | From $0.0 | From $0.2 to USD 3.5 | From $0 |

Minimum Deposit | $100 | $100 | $10 | From $0 |

Maximum Leverage | 1:500 | 1:1000 | Unlimited | 1:2000 |

Trading Platforms | MT4 | Metatrader 4, Metatrader 5, Metatrader Web, Mobile App | Exness Trade (mobile), Exness Terminal (web), MT4, MT5 | MT4, MT5, Mobile App |

Account Types | Standard Trade, Pro Trade | Classic, Raw | Standard, Standard Cent, Pro, Raw Spread, Zero | Cent, Zero, Pro, Premium |

Islamic Account | N/A | Yes | Yes | Yes |

Number of Tradable Assets | 30 | 620+ | 200+ | 1,000+ |

| Trade Execution | Instant | Market | Market, Instant | Market, Buy Stop, Stop Loss, Limit, Take Profit |

Conclusion and Final Words

LCM FX offers spreads from 0.9 pips and MAM accounts through the robust MetaTrader 4 platform. The broker isn’t regulated by any respected authorities and has an average TrustPilot score of 2.9.