LiteFinance Verification is a process that takes up to 5 minutes to do. Upload your identification documents, verify your address, and complete your profile.

Traders can use a passport, ID card, or driver's license to verify their identity in LiteFinance and utilize various features, including copy trading, with a minimum deposit of only $50.

Key Steps for LiteFinance Verification

Verifying your identity and address in the LiteFinance Broker has simple steps;LiteFinance KYC:

- Access the verification section;

- Upload the identity documents;

- Upload necessary documents for address verification.

Let's check the required document and information before continuing the KYC process in LiteFinance.

Verification Requirement | Yes/No |

Full Name | Yes |

Country of Residence | Yes |

Date of Birth Entry | Yes |

Phone Number Entry | No |

Residential Address Details | Yes |

Phone Number Verification | No |

Document Issuing Country | Yes |

ID Card (for POI) | Yes |

Driver’s License (for POI) | Yes |

Passport (for POI) | Yes |

Residence Permit (for POI or POA) | Yes |

Utility Bill (for POA) | Yes |

Bank Statement (for POA) | Yes |

2-Factor Authentication | No |

Biometric Face Scan | No |

Financial Status Questionnaire | No |

Trading Knowledge Questionnaire | No |

Restricted Countries | Yes |

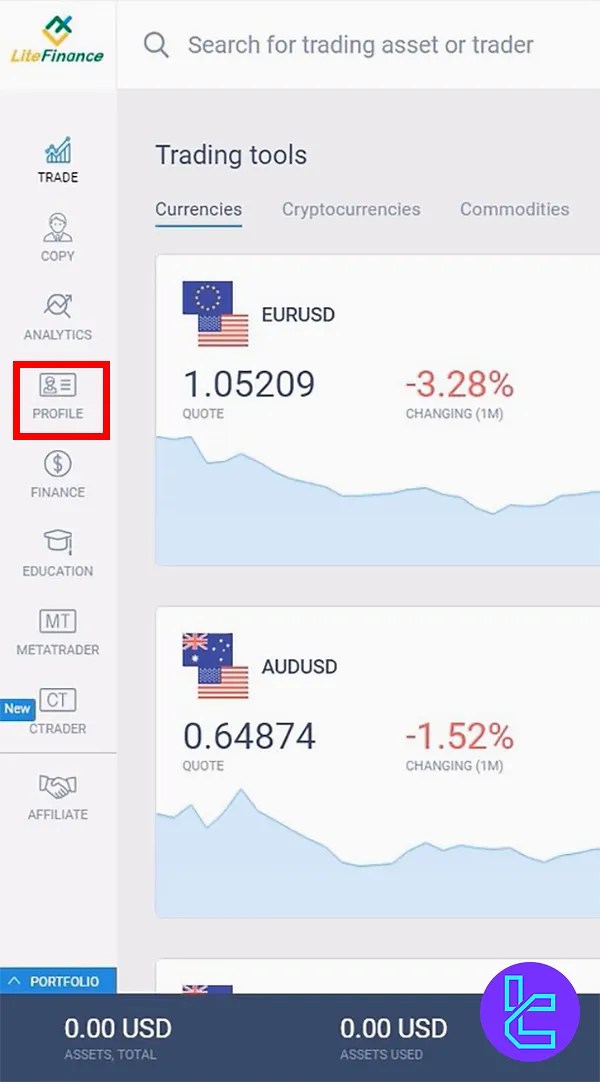

#1 Access Profile and Verification Section

- Log in to your real account and click on your profile;

- Navigate to the "Verification" section.

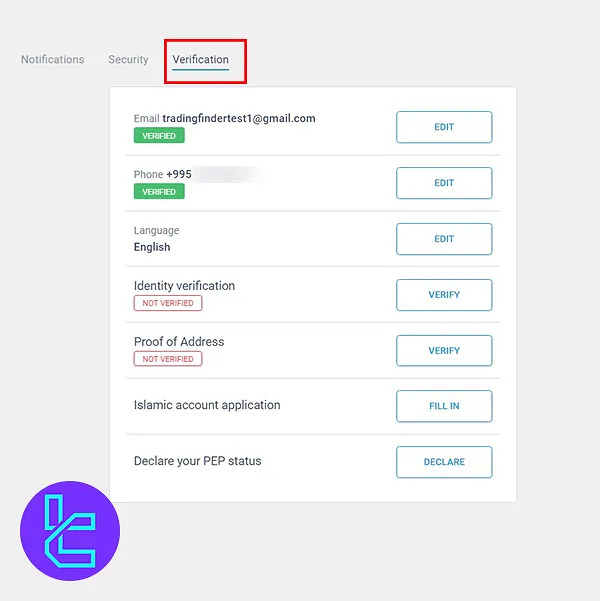

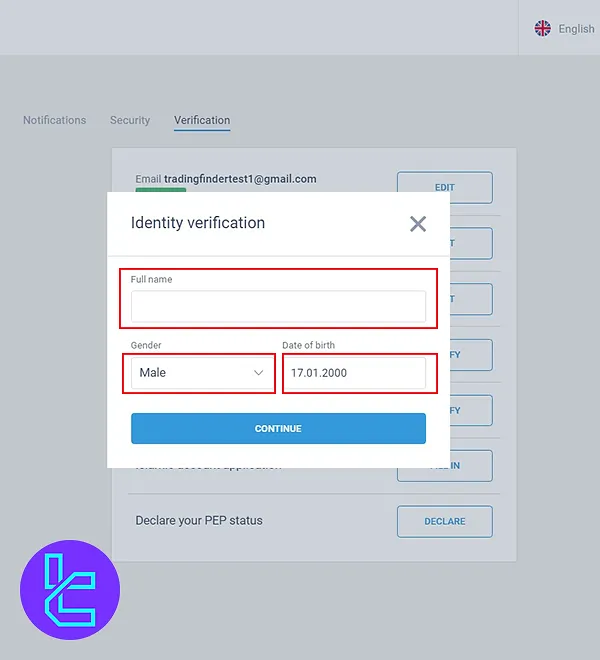

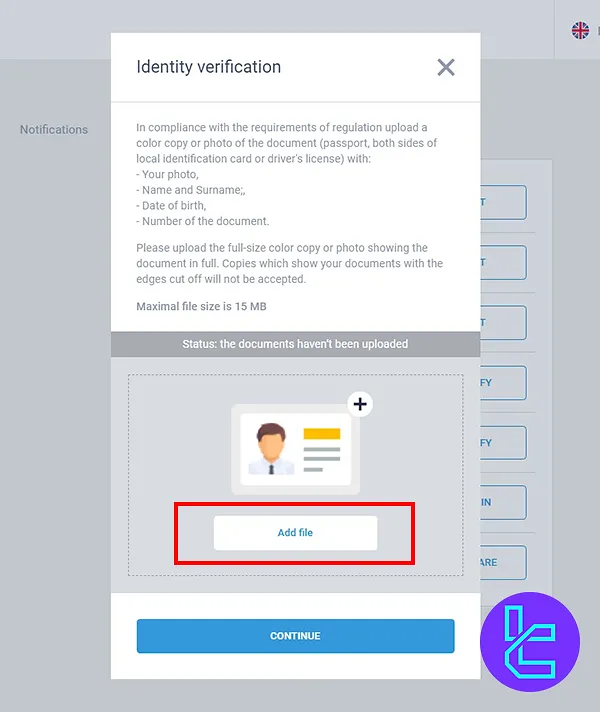

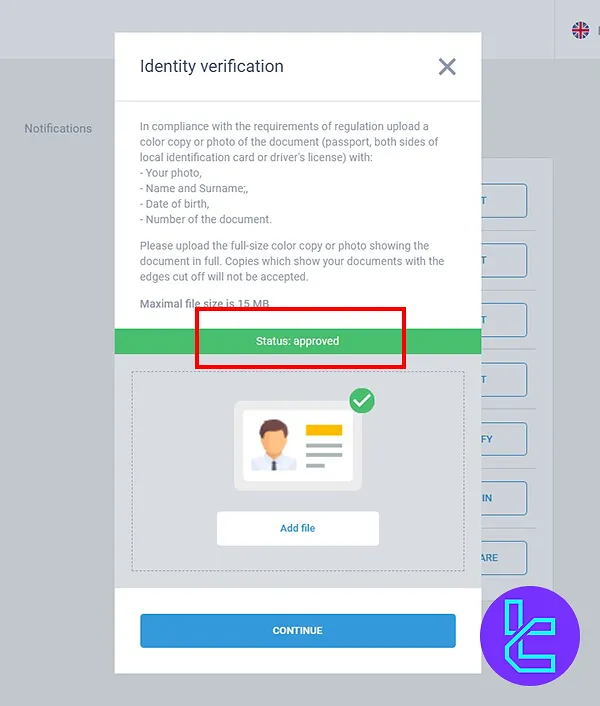

#2 Verify Identity on LiteFinance

- Click on "Verify" in the Identity Verification section;

- Enter your full name, gender, and date of birth;

- Click "Continue";

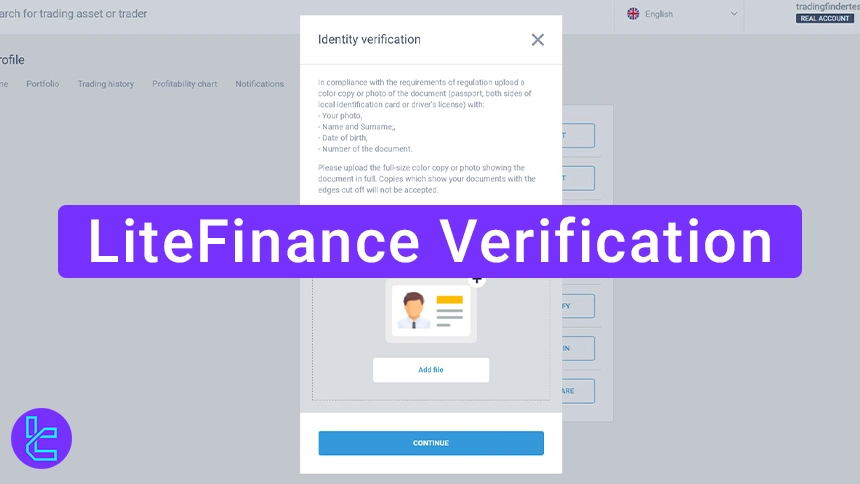

- Upload your ID document (passport, driver’s license, or ID card).

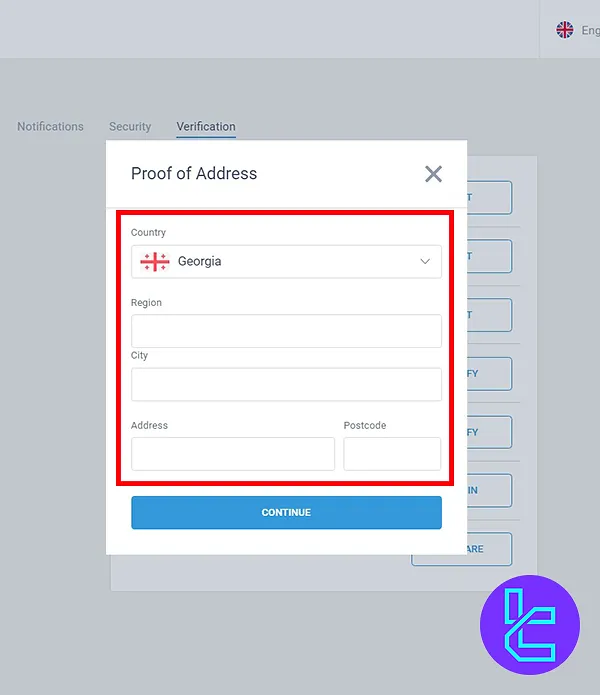

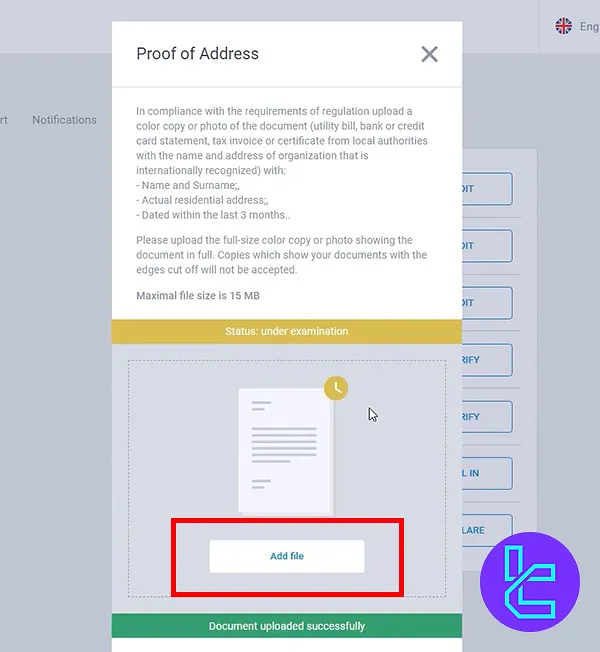

#3 Verify Address in the LiteFinance broker

- Click on "Verify" in the Address Verification section;

- Enter your complete address and upload proof (utility bill, bank statement, or tax document);

- Ensure the document is under 15MB;

- Upload one of the utility bills, bank statements, or tax payment certificates.

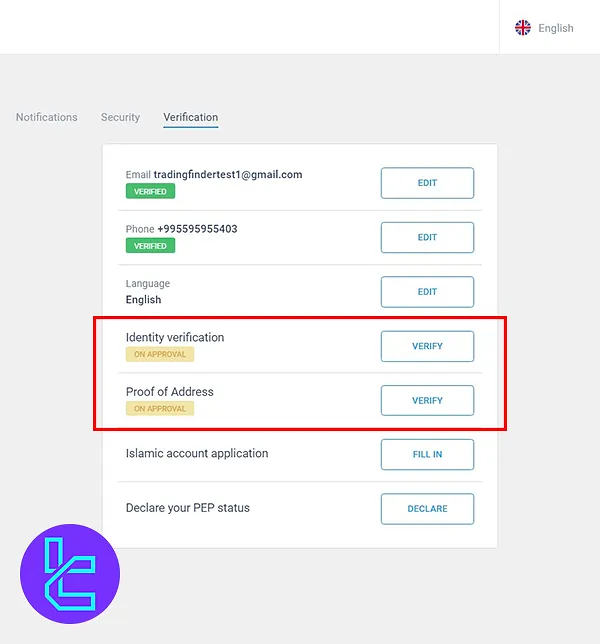

Both identity and address documents will be reviewed.

Approval usually is done within 24 hours.

LiteFinance KYC vs Other Brokers

Here is the required information and documents to verify your account in LiteFinance in comparison to those of other Forex brokers.

Verification Requirement | LiteFinance Broker | |||

Full Name | Yes | No | No | Yes |

Country of Residence | Yes | No | No | Yes |

Date of Birth Entry | Yes | No | No | Yes |

Phone Number Entry | No | No | No | Yes |

Residential Address Details | Yes | No | No | Yes |

Phone Number Verification | No | No | No | Yes |

Document Issuing Country | Yes | Yes | No | Yes |

ID Card (for POI) | Yes | Yes | Yes | Yes |

Driver’s License (for POI) | Yes | Yes | Yes | Yes |

Passport (for POI) | Yes | Yes | Yes | Yes |

Residence Permit (for POI or POA) | Yes | No | Yes | Yes |

Utility Bill (for POA) | Yes | Yes | Yes | No |

Bank Statement (for POA) | Yes | Yes | Yes | No |

2-Factor Authentication | No | No | No | No |

Biometric Face Scan | No | No | Yes | Yes |

Financial Status Questionnaire | No | No | No | No |

Trading Knowledge Questionnaire | No | No | No | No |

Restricted Countries | Yes | Yes | Yes | Yes |

Conclusion and Final Words

LiteFinance Verification is complete in 3 steps, with approval taking up to 24 hours. If you want to use your passport for KYC, make sure that its serial number is clearly visible.

Now that your account is verified, read Litefinance Deposit and Withdrawal from our articles listed on the Litefinance Tutorial page.