Maunto is a Forex broker regulated by MISA authority under license number T2023409. This broker provides 5 accounts, including Classic, Silver, Gold, Platinum, and VIP, for traders to buy and sell over 160 instruments.

This broker has 3 deposit and withdraw methods with a minimum deposit amount of $250.

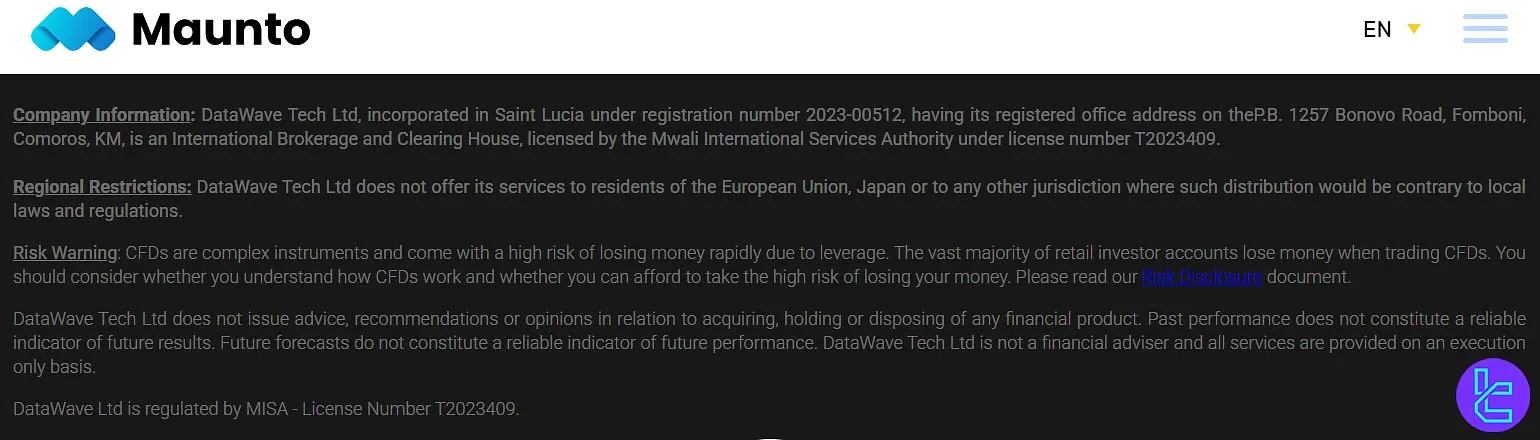

Maunto Company Information & Regulation Overview

Unlike most online forex brokers, Maunto is driven by a mission to simplify financial market access, catering to traders from beginners to experts. Here's what you need to know about the company behind the platform:

- Company Name: DataWave Tech Ltd

- Incorporation: Saint Lucia (Registration Number: 2023-00512)

- Founding Year: 2023

- Regulatory Body: Mwali International Services Authority (MISA)

- License Number: T2023409

Maunto operates under the regulation of the Mwali International Services Authority (MISA), Comoros, with license number T2023409.

While MISA is an offshore regulator with limited oversight compared to Tier-1 bodies, Maunto supports basic safety mechanisms such as negative balance protection and encrypted communications.

Here are basic Information you need to know about broker:

Entity Parameters | DataWave Tech Ltd (Registration No. 2023-00512) |

Regulation | MISA |

Regulation Tier | Tier 3 |

Country | Comoros (via St Lucia) |

Investor Protection Fund/Compensation Scheme | None |

Segregated Funds | N/A |

Negative Balance Protection | Yes |

Maximum Leverage | 1:400 |

Client Eligibility | Worldwide excl. EU, Japan |

Maunto Broker Summary of Specifications

To give you a quick overview of what Maunto offers, here's a snapshot of its key features based on the Forex brokers review methodology:

Broker | Maunto |

Account Types | Classic, Silver, Gold, Platinum, VIP |

Regulating Authorities | MISA |

Based Currencies | USD, JPY |

Minimum Deposit | $250 |

Deposit Methods | Visa/MasterCard, Bank wired, APMs |

Withdrawal Methods | Visa/Master Card, Bank Wired, e-wallets |

Minimum Order | 0.01 Lot |

Maximum Leverage | 1:400 |

Investment Options | No |

Trading Platforms & Apps | Webtrader, Trading APP |

Markets | Forex, indices, commodities, stocks, cryptocurrencies, metals |

Spread | Floating from 0.9 pips |

Commission | No commission |

Orders Execution | Market |

Margin Call/Stop Out | 100%/20% |

Trading Features | Demo account |

Affiliate Program | No |

Bonus & Promotions | No |

Islamic Account | No |

PAMM Account | No |

Customer Support Ways | Email, live chat, phone |

Customer Support Hours | Monday to Friday, 12:00 to 21:00 |

Restricted Countries | USA, Iran, Spain, North Korea and more |

What are Maunto Account Types?

Maunto offers five account types tailored to different experience levels and deposit sizes. All accounts feature similar leverage and margin conditions, while trading costs decrease in higher tiers.

The minimum trade size is 0.01 lots, and the maximum is 50 lots.

Account types | Classic | Silver | Gold | Platinum | VIP |

Minimum trading volume | 0.01 Lot | 0.01 Lot | 0.01 Lot | 0.01 Lot | 0.01 Lot |

Maximum Leverage | 1:400 | 1:400 | 1:400 | 1:400 | 1:400 |

Spreads | Floating from 2.5 pips | Floating from 2.5 pips | Floating from 1.8 pips | Floating from 1.4 pips | Floating from 0.9 pips |

Margin call | 100% | 100% | 100% | 100% | 100% |

Stop out | 20% | 20% | 20% | 20% | 20% |

Each account type provides access to Maunto's full range of markets and educational resources. The main differences lie in the spread offerings and additional perks at higher tiers.

Maunto broker also offers a Demo account, enabling traders to practice without financial risk. It’s an excellent way to explore strategies and get comfortable with the platform before committing to real funds.

Maunto Broker Advantages and Disadvantages

Like any trading platform, Maunto comes with its own set of pros and cons. Let's weigh them up:

Advantages | Disadvantages |

Over 160 tradable instruments | Limited Customer Support Hours |

User-Friendly Platform | Lack of top-tier regulation |

No commissions | Mixed user reviews on the Trustpilot website |

Vast educational resources | High than average spreads |

The absence of ECN or raw spread accounts may be a limitation for scalpers and advanced traders.

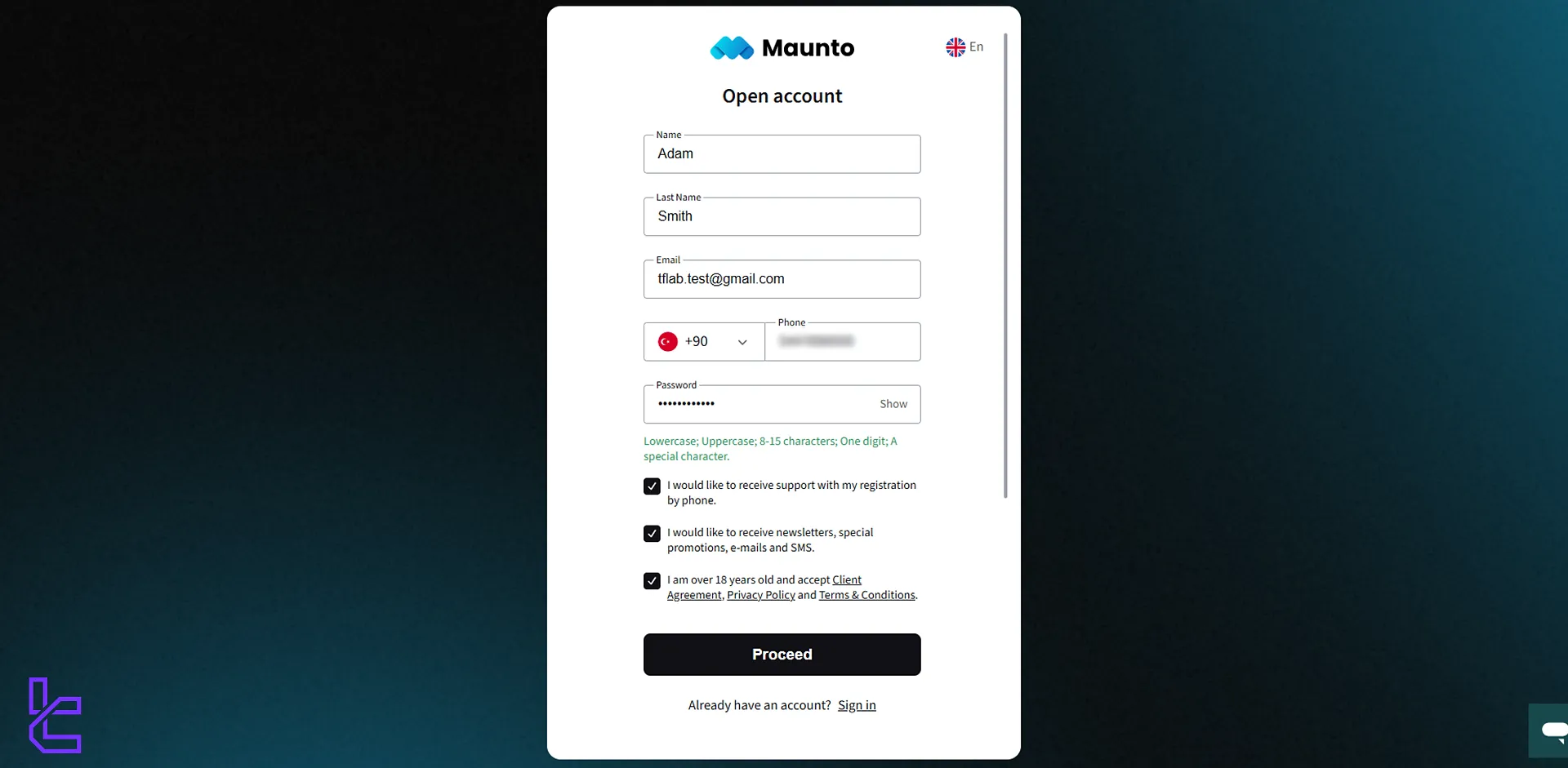

Maunto Broker Account Creation & Verification

Maunto registration is to easy and takes just 4 quick steps. All you need is to enter essential details, including your full name, email, and phone number.

Getting started with Maunto is a straightforward process. Here's a step-by-step guide:

#1 Visit the broker's official website

Navigate to the Maunto official website and click "Create Account" on the home page.

#2 Personal information form

Fill out the registration form with the following details:

- Name

- Last name

- Phone number

- Password (must contain lowercase, uppercase, 8-15 characters, one digit, and one special character)

Declare that you're above 18 and accept the company's T&C.

#3 Email verification

Use the verification link sent to your email to activate your account. Then, proceed to the Maunto client portal to adjust your trading account's settings.

#4 Maunto KYC verification

Navigate through the client dashboard and access the KYC area to upload supporting documents, including:

- Proof of ID: Passport or ID card

- Proof of Address: Utility bill or Bank statement

The Maunto verification process takes a few days, depending on the quality of the pictures you uploaded on Maunto website.

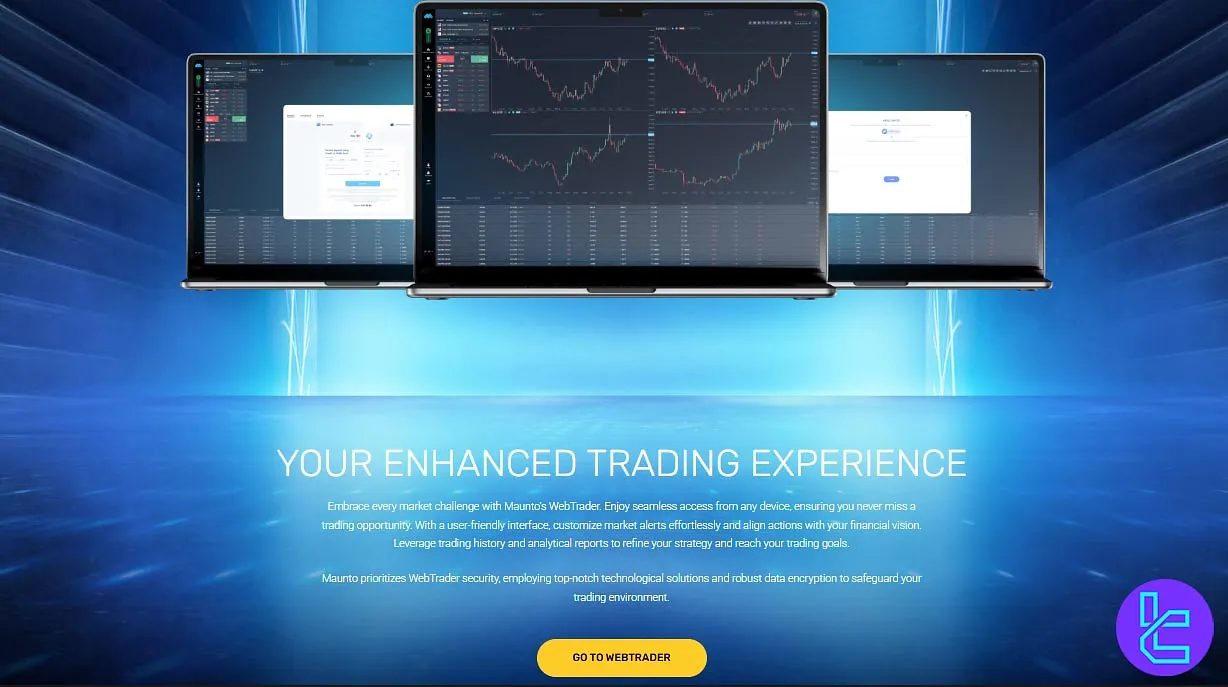

Maunto Trading Platforms

Maunto provides two primary trading platforms designed to meet the needs of traders at every experience level, from beginners to seasoned professionals.

These platforms combine user-friendly interfaces with advanced tools, fast execution, and real-time market data, ensuring a seamless and efficient trading experience across all devices.

Maunto offers services on:

WebTrader Platform

Maunto WebTrader allows traders to buy and sell various instruments regardless of their device software. Key features of this trading platform:

- Instant price alerts

- Various order type

- Real-time data streaming

- Over 160 CFDs

Mobile Trading App

The Maunto Trading App is still under development. You can visit the application page on Firebase, experience trading with this app, and test its features to provide feedback to the developing team.

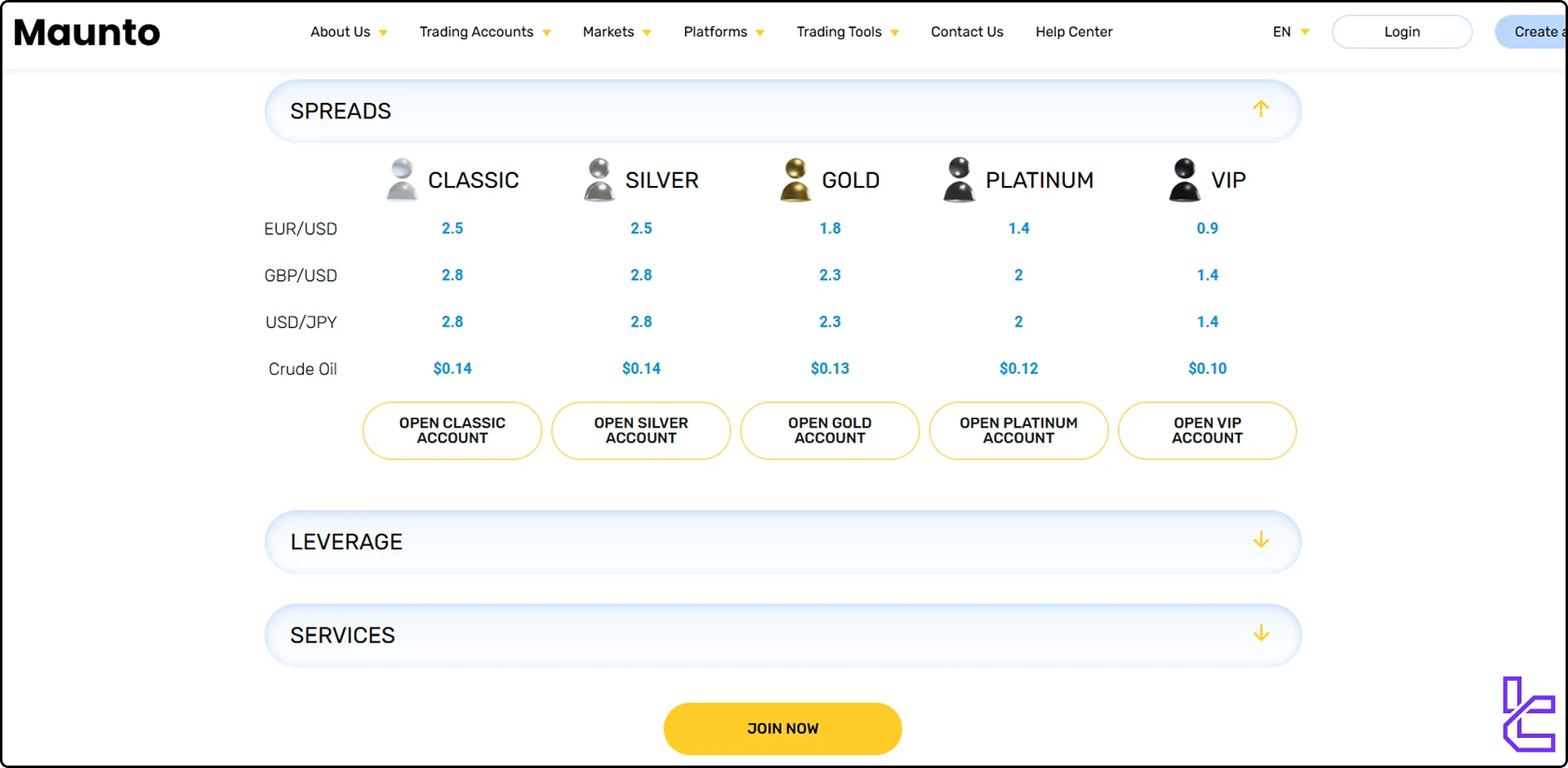

Maunto Broker Fees (Spreads and Commissions)

Maunto uses a spread-only pricing model with no commissions on forex trades. Spreads on the EUR/USD pair range from 2.5 pips in the Classic and Silver accounts to 0.9 pips in the VIP tier.

- Classic/Silver Accounts: Spreads from 2.5 pips on major pairs

- Gold Account: Spreads from 1.8 pips

- Platinum Account: Spreads from 1.4 pips

- VIP Account: Spreads as low as 0.9 pips

A $10 monthly maintenance fee applies, regardless of account activity. While the broker has no deposit or inactivity costs, Withdrawal fees include:

- 5% for cards and e-wallets

- $30 for bank wire

- $10 penalty for withdrawing without trading

It's important to note that while Maunto offers competitive spreads, especially at higher account levels, they're not the lowest in the market. Traders should weigh these costs against the platform's other features and benefits.

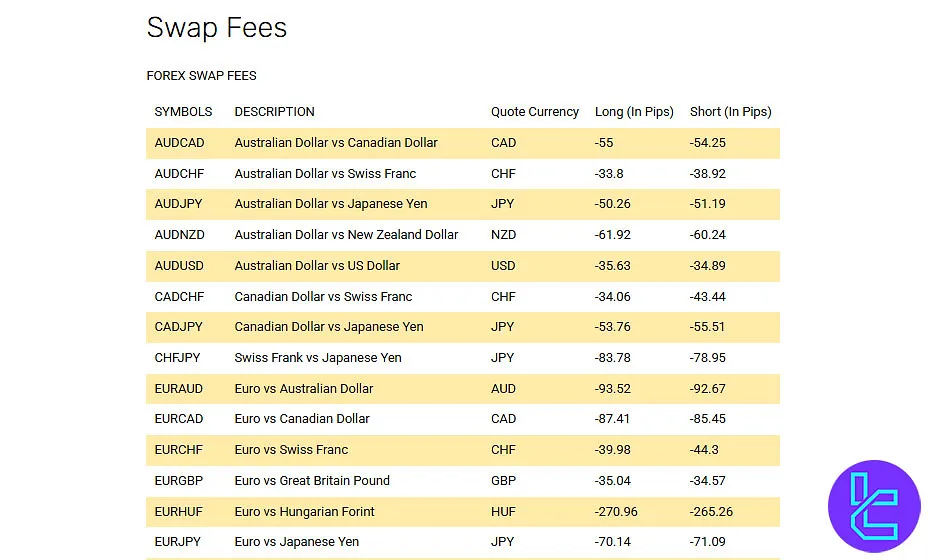

Swap Fee at Maunto Broker

Maunto applies overnight swaps for all positions held past the daily rollover time; for example, the swap for the pair GBP/USD is –72.01 pips (short) and –70.84 pips (long) per lot.

On Wednesday nights, a three-times swap rate is applied in a single charge to account for the weekend rollover.

Here are some important details you should know:

- The swap for EUR/USD long is –28 pips and for EUR/USD short –45.70 pips per lot, as listed in Maunto’s official fee schedule;

- For AUD/USD long, the swap is –63 pips and for AUD/USD short –34.89 pips;

- Swap is debited (or credited) daily at 00:00 (GMT+2 DST off) and is automatically converted into the account’s base currency;

- Maunto currently does not offer swap-free or Islamic accounts, meaning all overnight positions are subject to standard swap fees;

- Swap rates may change due to interest-rate fluctuations or liquidity conditions, and Maunto reserves the right to adjust them without prior notice.

Non-Trading Fees at Maunto Broker

The broker applies specific charges for withdrawals and inactive accounts, ensuring transparency in its cost structure.

Unlike many brokers that claim zero non-trading fees, Maunto clearly defines its pricing policies in detail.

Below are some of the most important fee items you should know:

- If an account is fully verified and at least one trade has been opened, the first withdrawal is free; otherwise, a USD 10 fee applies;

- Subsequent withdrawals are subject to charges such as USD 30 (or equivalent) for wire transfers;

- Inactivity fee schedule: if no activity for 1-2 months, fee is USD 100 (or equivalent); 2-6 months, fee is USD 250 and for 6-12 months, fee is USD 500;

- Deposit funding is free of commission from the broker’s side, although third-party payment provider fees may still apply;

- Internal transfers between accounts under the same client profile are free of charge and processed instantly.

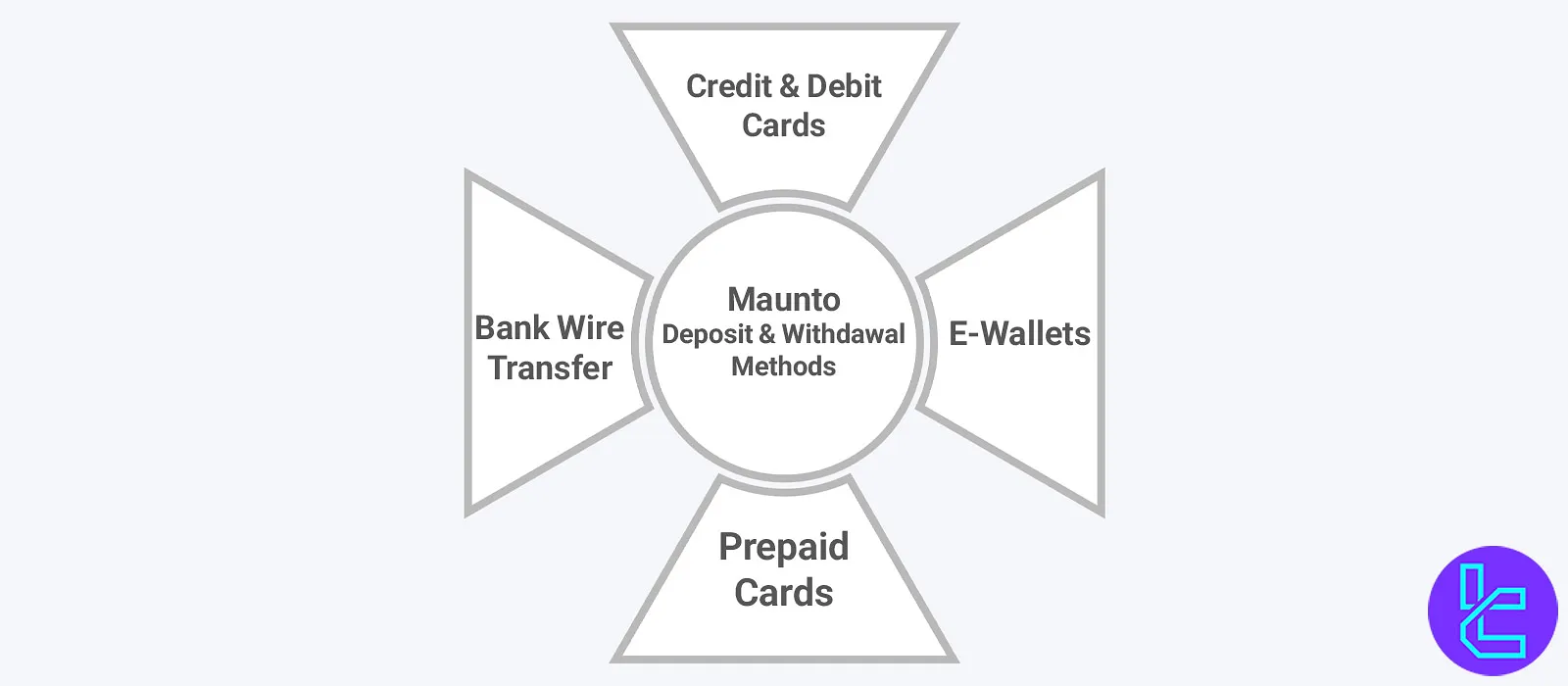

What Deposit & Withdrawal Methods Are Available in Maunto?

Although Maunto deposit and withdrawal methods are limited compared to other brokers, they are sufficient for many traders. Here’s Key Points to remember about Maunto deposits and withdrawals:

- Minimum deposit: $250 (or equivalent)

- Withdrawal processing time: 8-10 business days

- Advanced security measures protect client information

Maunto's deposit and withdrawal system aims to balance convenience with security. However, the longer withdrawal processing times might be a drawback for some traders.

Deposit Methods at Maunto

Funding your Maunto trading account is simple and secure, with multiple deposit options designed for both global and regional clients. The broker supports deposits in USD, EUR, JPY, INR, and KRW, ensuring flexibility for traders worldwide.

According to Maunto’s official funding policy, the minimum deposit requirement is USD 250 (or equivalent) across all methods.

Here’s a breakdown of Maunto’s available deposit methods and their key conditions:

Deposit Method | Currency | Minimum Amount | Deposit Fee | Funding Time |

Credit/Debit Card | USD, EUR, JPY, INR, KRW | USD 250 (or equivalent) | May apply by payment provider | N/A |

Bank Wire Transfer | USD, EUR, JPY, INR, KRW | USD 250 (or equivalent) | May apply by payment provider | N/A |

Alternative Payment Methods (APMs) | USD, EUR, JPY, INR, KRW | USD 250 (or equivalent) | May apply by payment provider | N/A |

Withdrawal Fees at Maunto

Maunto provides several secure and transparent withdrawal options tailored to different trader needs. Verified clients who have executed at least one trade enjoy their first withdrawal free of charge, while subsequent transactions incur standard processing fees based on the method used.

The platform’s supported withdrawal channels include card-based methods, e-wallets, and international bank transfers, each with distinct processing times and fee structures.

Below is the official summary of Maunto’s withdrawal methods and their respective conditions:

Withdrawal Method | Currency | Minimum Amount | Withdrawal Fee | Funding Time |

Credit / Debit Card | USD, EUR, JPY, INR, KRW | USD 10 (or equivalent) | 3.5% | 8–10 business days |

Prepaid Card | USD, EUR, JPY, INR, KRW | USD 10 (or equivalent) | 3.5% | 8–10 business days |

E-wallets | USD, EUR, JPY, INR, KRW | Any amount covering the fee | 3.5% | 8–10 business days |

Wire Transfer | USD, EUR, JPY, INR, KRW | USD 100 (or equivalent) | USD 30 (or equivalent) | 8–10 business days |

Copy Trading & Investment Options Offered on Maunto Broker

As of the latest information available, Maunto does not offer copy trading or social trading features. This absence might be a disadvantage for traders who prefer to follow or mimic the strategies of successful traders.

While Maunto focuses on providing a straightforward trading experience, those looking for copy trading functionality might need to explore other platforms like eToro, AvaTrade, or Pepperstone, which specialize in this area.

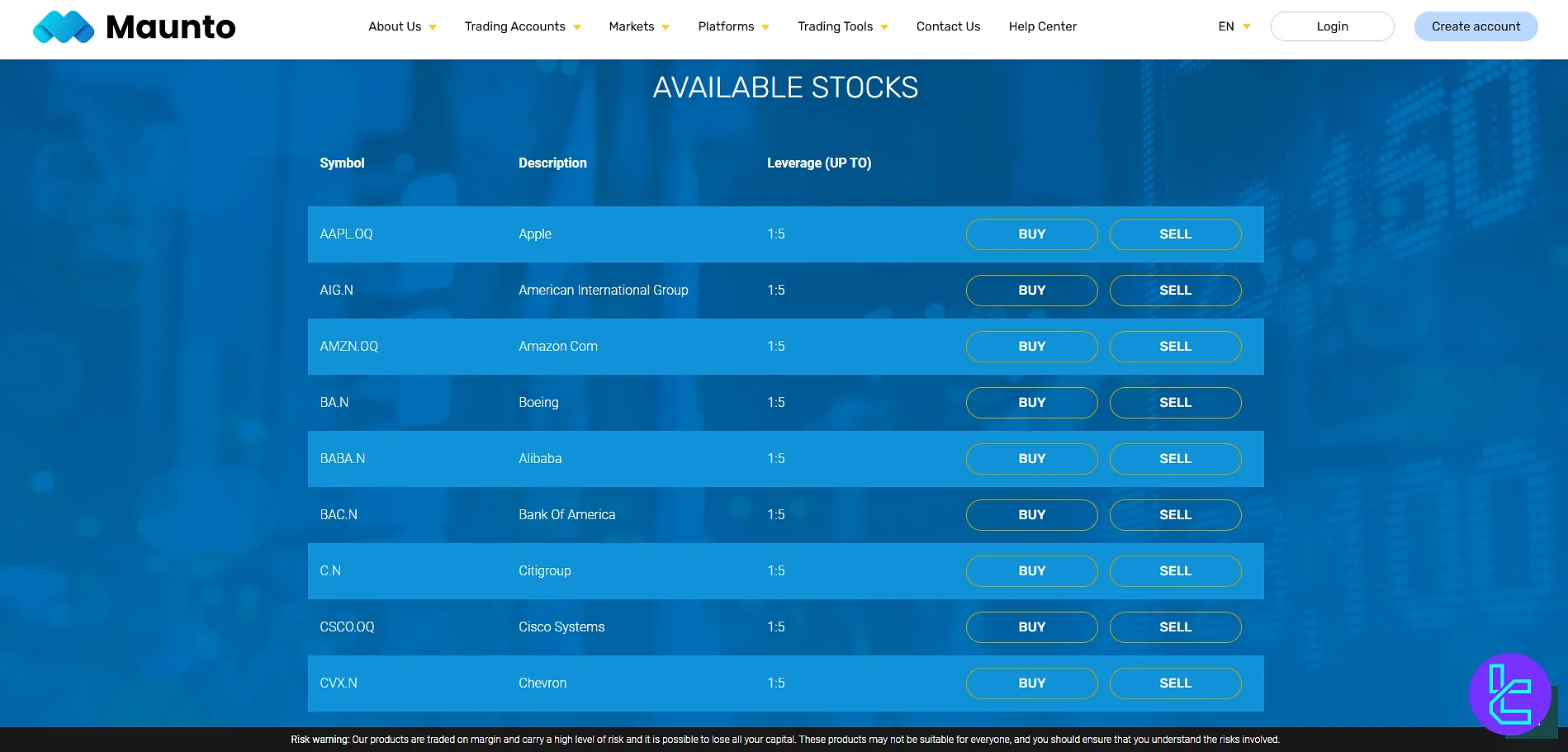

Maunto Available Markets and Tradable Instruments

Maunto offers an extensive range of trading instruments across global markets, designed to meet the needs of both retail and professional traders. From major forex pairs to commodities, indices, metals, stocks, and cryptocurrencies, each category provides diverse opportunities.

Competitive leverage, tight spreads, and robust liquidity define Maunto’s market access.

Here are what you need to know:

Category | Type of Instruments | Number of Symbols | Competitor Average | Max. Leverage |

Currency pairs (majors, minors, exotics) | ~45+ | 40–100 | 1:400 | |

Indices (CFDs) | Global stock indices (e.g. US500, DE40, JP225) | 13 | 20–30 | 1:200 |

Commodities | Energy, agricultural, and base/soft commodities | ~20+ | 30–50 | 1:20 |

Metals / Precious | Gold, Silver, Platinum, Palladium CFDs | 6 | 5–10 metals | 1:200 |

Stocks / Shares | Public company equity CFDs | ~150 | 100–500 stocks | 1:5 |

Crypto CFDs (BTC, ETH, LTC, XRP, etc.) | 10+ | 20–50 cryptos | 1:5 |

While the overall asset count is lower than industry leaders, Maunto focuses on providing high-liquidity instruments suited for beginner-level traders.

Maunto Broker Bonuses Overview

As of the latest information, Maunto does not offer any specific bonuses or promotions. This approach aligns with many regulated brokers who have moved away from offering trading bonuses due to regulatory constraints.

While the lack of promotions might seem like a drawback, it can also be seen as a positive. It allows traders to focus on the platform's core offerings and trading conditions without the distraction of temporary incentives.

Maunto Awards

Maunto does not appear to have received any publicly documented awards. There are no specific accolades or recognitions listed on its official website, and independent searches through financial news sources and broker review platforms confirm the absence of verified awards.

Maunto Customer Support

Maunto broker provides customer support through multiple channels:

- Live Chat: Available on the website

- Email: support@maunto.com

- Phone: +44 203 150 2 347

Support hours are Monday to Friday, 12:00 to 21:00 GMT. Maunto's support structure aims to provide comprehensive assistance to traders. However, the limited hours of operation might be inconvenient for some, especially those trading outside of standard European business hours.

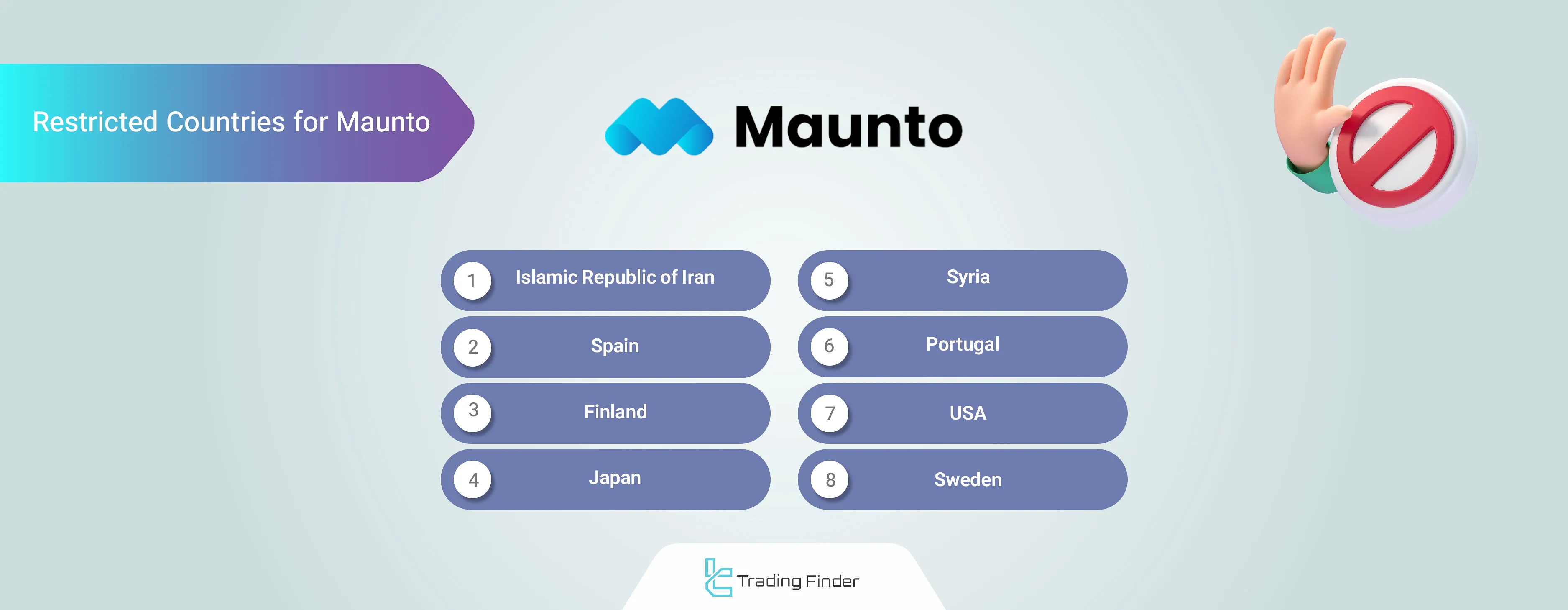

Maunto Broker Restricted Countries

Due to its regulatory status, Maunto broker doesn’t provide services to traders residing in the countries listed below:

- Japan

- USA

- Finland

- Portugal

- Spain

- Sweden

- North Korea

- Iran

Potential clients must confirm if Maunto’s services are legally accessible in their region. Each trader is responsible for ensuring they comply with local regulations.

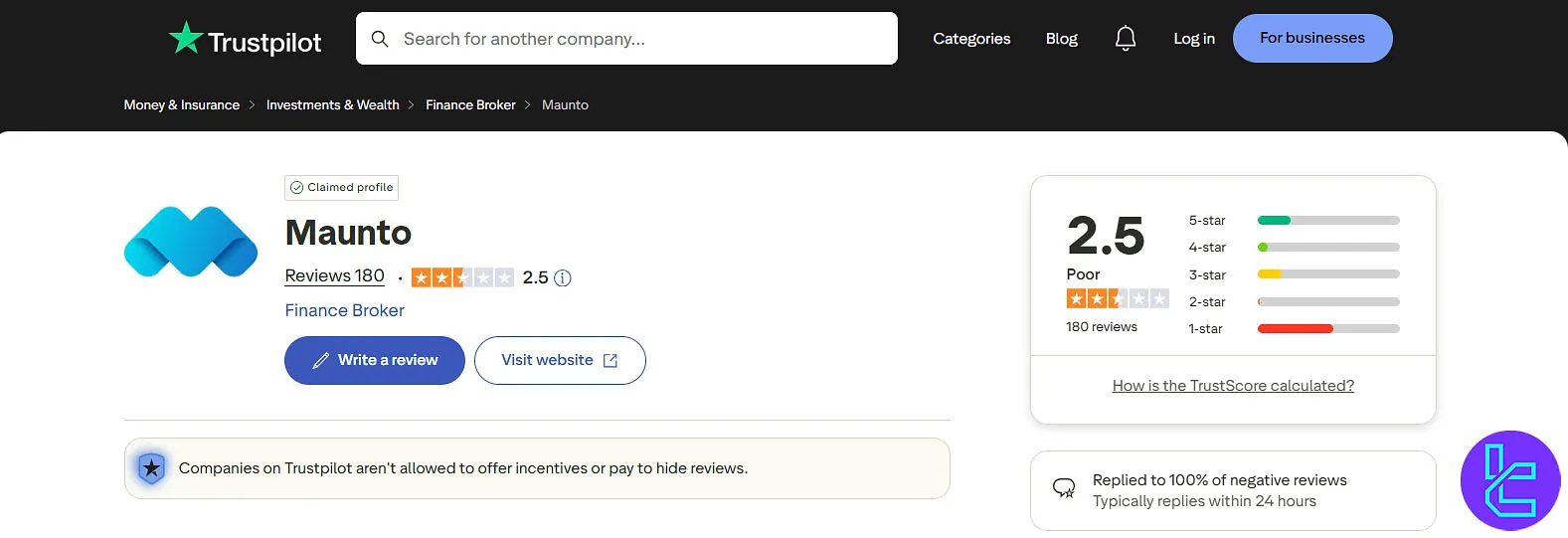

Maunto User Reviews and Trust Scores

As a relatively new broker, Maunto has mixed reviews on the Trustpilot website:

- Total number of reviews: 178

- Score: 3.3

- Percentage of 5-star reviews: 44%

The Maunto broker rating is based on over 180 reviews and scores on the Maunto website. Notably, nearly half of the users have given this broker a score of 1.

Traders must remember that these are the current scores and reviews of Maunto broker and can change in the future.

Maunto Broker Educational Resources

Maunto places a strong emphasis on trader education and Forex educational resources:

- Advanced lessons on trading strategies and technical analysis

- Interactive videos and eBooks

- Regular market insights

- Trading tips and tricks

This comprehensive educational offering is a significant strength, especially for new traders looking to build their knowledge and skills.

Maunto Comparison Table

The table below compares Maunto's features with popular Forex brokers:

Parameter | Maunto Broker | |||

Regulation | MISA | None | FSA, CySEC, ASIC | Cent, Zero, Pro, Premium |

Minimum Spread | From 0.9 Pips | 0.1 Pips | From 0.0 pips | 0.0 Pips |

Commission | $0 | None | Average $1.5 | From Zero |

Minimum Deposit | $250 | $10 | $200 | From $0 |

Maximum Leverage | 1:400 | 1:3000 | 1:500 | 1:2000 |

Trading Platforms | Mobile Application, WebTrader | MT4, MT5 | Metatrader 4, Metatrader 5, cTrader, IC Markets Mobile | MT4, MT5, Mobile App |

Account Types | Classic, Silver, Gold, Platinum, VIP | Standard, Premium, VIP, CIP | Standard, Raw Spread, Islamic | Cent, Zero, Pro, Premium |

Islamic Account | No | Yes | Yes | Yes |

Number of Tradable Assets | 160+ | 50+ | 2,100+ | 1,000+ |

| Trade Execution | Market | Market, Instant | Market | Market, Buy Stop, Stop Loss, Limit, Take Profit |

TF Expert Suggestion

With no inactivity fee, spreads from 0.9 pips, and $0 trading commissions, Maunto aims to attract Forex traders to its WebTrader and Maunto Trading app.

Even so, a low Trustpilot rating of 3.3, high minimum deposit ($250), and high withdrawal processing times (up to 10 days) are important facts traders need to consider when weighing the advantages and disadvantages of this broker.