MTrading provides trading services from 10 offices to over 260,000 customers worldwide. Traders can buy and sell 38 currency pairs, 4 spot metal CFDs, 3 spot energy CFDs, 10 indices, 67 company stocks, and 12 cryptocurrencies with this broker.

Company Information & Regulation of MTrading Broker

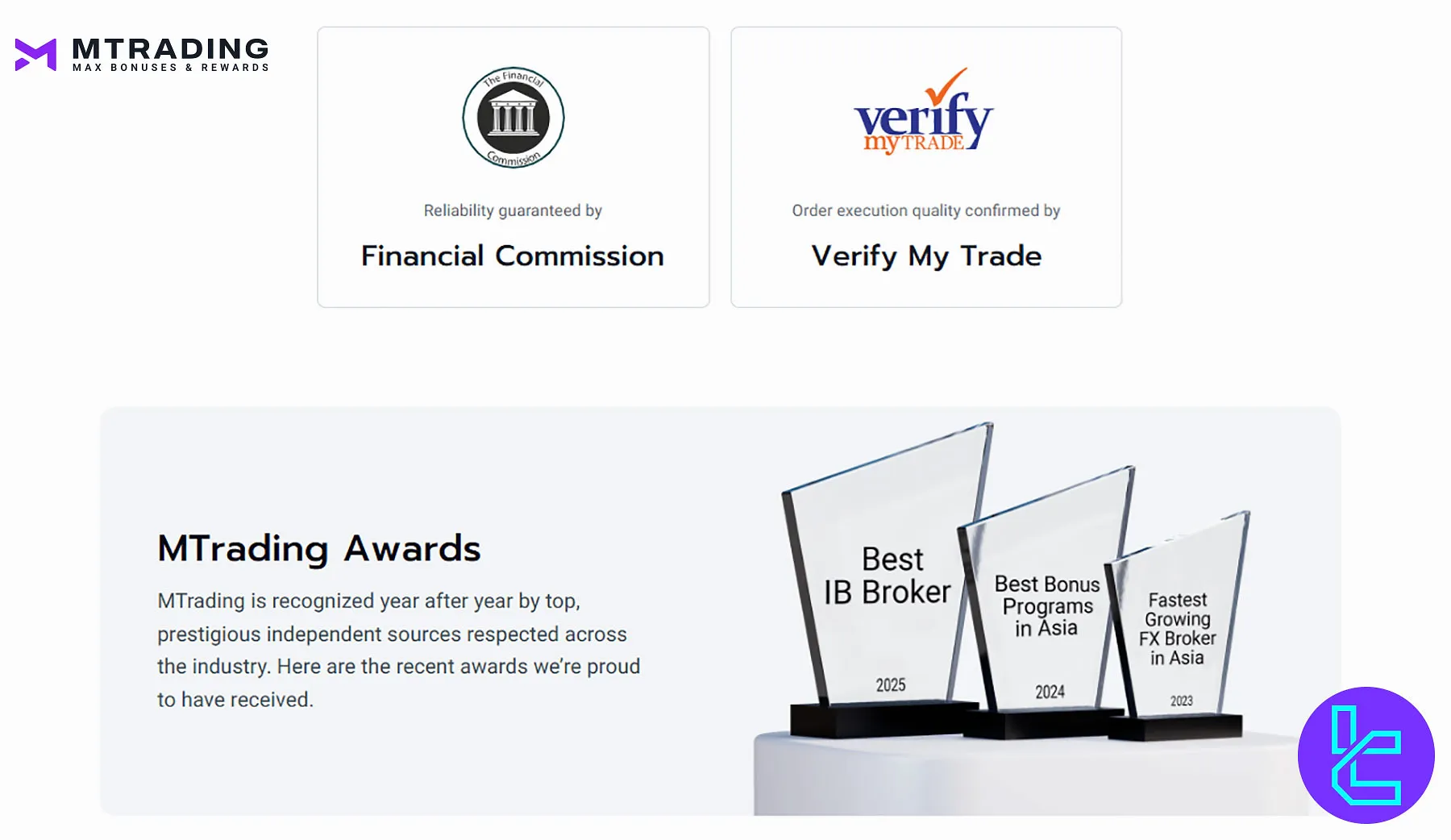

MTrading, established in 2012, has quickly made a name for itself in the online trading industry. The broker is regulated by The Financial Commission (FinaCom), an independent external dispute resolution (EDR) organization that provides a layer of protection for traders.

Client funds are held in segregated accounts, and traders are covered by a compensation fund of up to $20,000. The broker offers negative balance protection across all accounts.

While MTrading is not licensed by tier-1 regulators such as the FCA or CySEC, its membership in FinaCom provides an added layer of trust and client fund security.

MTrading aims to provide low-cost Forex trading services for traders worldwide, with a strong focus on the Asia-Pacific, Africa, and Latin America regions.

By blending competitive trading conditions with regional accessibility, MTrading appeals to traders looking for flexibility, safety, and global exposure.

| Entity Parameters/Branches | ServiceComsvg LLC |

Regulation | FinaCom |

Regulation Tier | 4 |

Country | N/A |

Investor Protection Fund/Compensation Scheme | Up to $20,000 |

Segregated Funds | Yes |

Negative Balance Protection | Yes |

Maximum Leverage | 1:1000 |

Client Eligibility | Global |

MTrading Broker Summary of Specifics

Let’s give you a quick overview of the Forex broker:

Broker | MTrading |

Account Types | M.Cent, M.Premium, M.Pro |

Regulating Authorities | The Financial Commission |

Based Currencies | EUR, USD, RUB |

Minimum Deposit | $10 |

Deposit Methods | Bank transfer, Neteller, Skrill, USDT |

Withdrawal Methods | Bank transfer, Neteller, Skrill, USDT |

Minimum Order | 0.01 Lot |

Maximum Leverage | 1:1000 |

Investment Options | Copy trading |

Trading Platforms & Apps | MT4 |

Markets | Forex, indices, commodities, cryptocurrencies, stock CFDs |

Spread | Floating from 0.0 pips |

Commission | From $4 |

Orders Execution | Market |

Margin Call/Stop Out | 100%/30% |

Trading Features | Demo account |

Affiliate Program | Yes |

Bonus & Promotions | Welcome bonus, deposit bonus |

Islamic Account | Yes |

PAMM Account | No |

Customer Support Ways | Email, live chat |

Customer Support Hours | 24/5 |

Restricted Countries | Iran, Syria, North Korea, USA, Canada, UK, France and more |

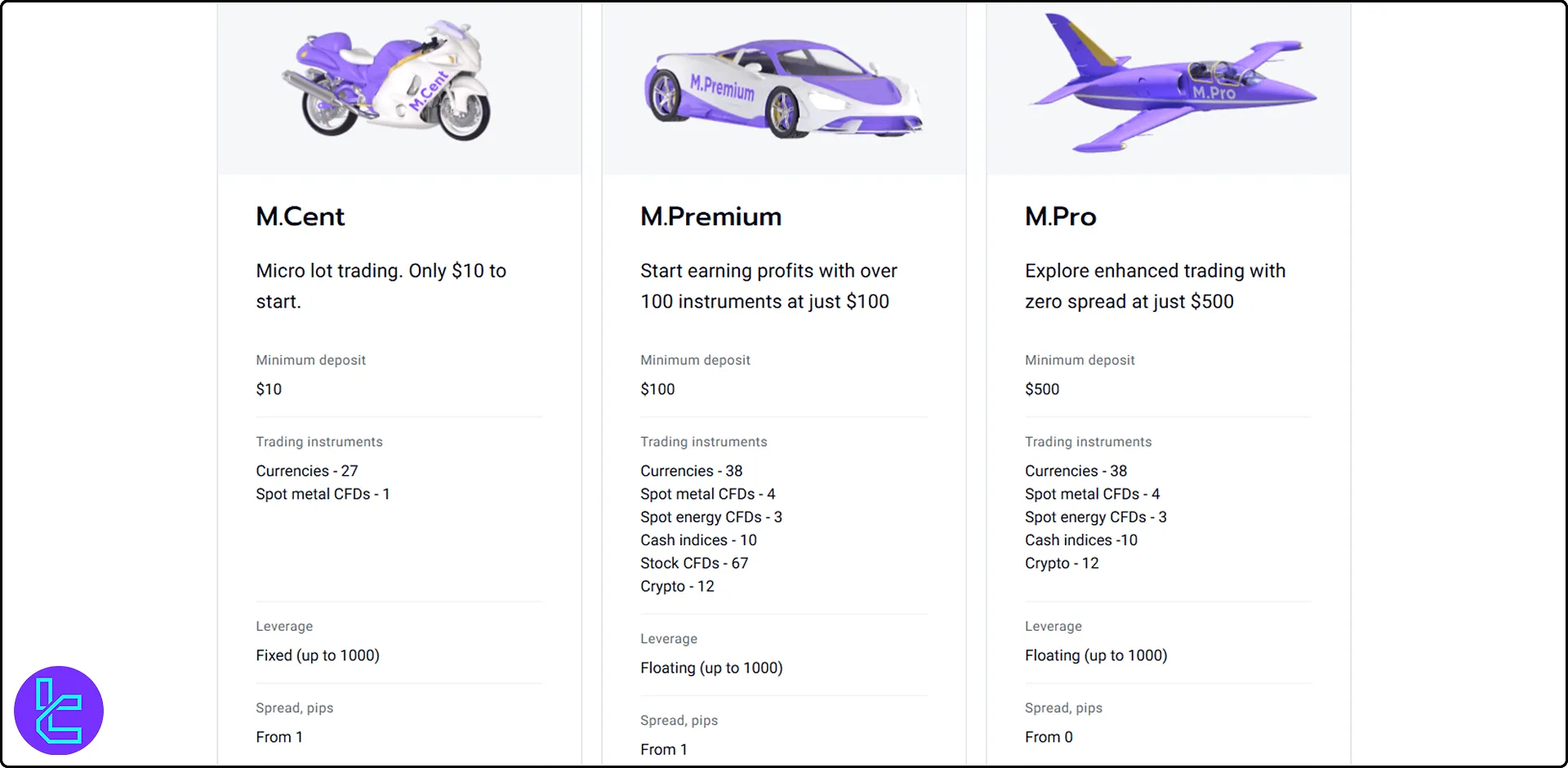

MTrading Broker Account Types

MTrading offers 3 distinct account types to suit different trading styles and investment capacities:

Account types | M.Cent | M.Premium | M.Pro |

Minimum deposit | $10 | $100 | $500 |

Minimum trading volume | 0.01 Lot | 0.01 Lot | 0.01 Lot |

Maximum Leverage | 1:1000 (Fixed) | 1:1000 (Floating) | 1:1000 (Floating) |

Spreads | Floating from 1.0 pips | Floating from 1.0 pips | Floating from 0.0 pips |

Commission | No | No | $4 per lot |

Trading platform | MT4 | MT4 | MT4 |

Execution type | Market Execution | Market Execution | Market Execution |

All account types provide access to the MT4 Supreme Edition add-on, one-click trading, and automated trading with Expert Advisors.

It’s worth mentioning that MTrading also provides demo and Islamic accounts for Forex traders.

Advantages and Disadvantages of MTrading Broker

Here’s a brief overview of the upsides and downsides of trading with MTrading broker:

Advantages | Disadvantages |

Low minimum deposit ($10) | Limited regulatory oversight |

High leverage (up to 1:1000) | Lack of advanced trading platforms (e.g., MT5) |

A diverse range of trading instruments | $50 monthly inactivity fee |

Copy trading functionality | - |

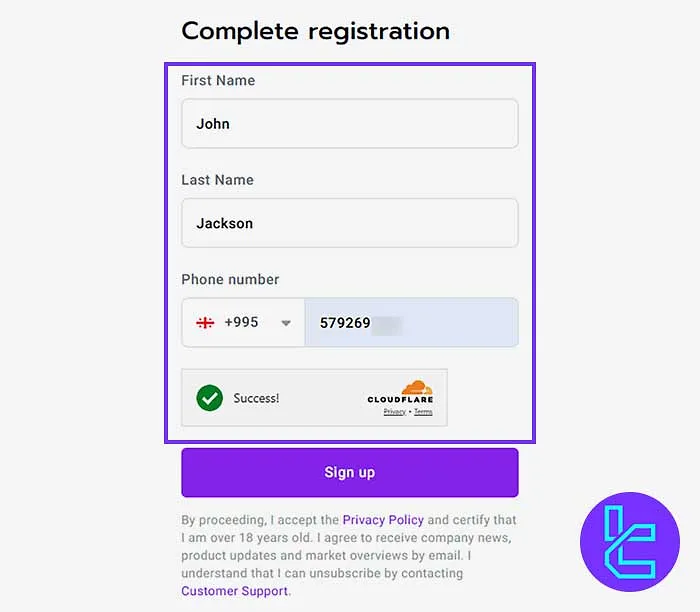

MTrading Broker Sign-Up & Verification

Opening an account on MTrading is a streamlined 4-step process that takes only a few minutes. You'll provide your email, mobile number, and personal identification to access MTrading's trading environment.

MTrading registration is free, with compliance ensured via identity verification.

#1 Go to the Signup Page

Click “Open an Account” or “Sign Up” on MTrading’s homepage to access the registration form.

#2 Enter Login Credentials

Submit your email address and create a secure password using uppercase, lowercase, numbers, and symbols. Pass the security check and proceed.

#3 Fill in Personal Information

Fill out the registration form with the following details:

- First name

- Last name

- Mobile phone number

Confirm the information and click “Sign Up”.

#4 Verify Your Email

Open the confirmation email sent by MTrading and click “Confirm Email” to activate your account.

You can start trading once your email is verified. No documents are required at this stage. However, to access the platform's full features and services, you must complete the MTrading verification procedure.

#5 Complete the KYC Process

Log in to your client portal, navigate through the "Verify Account" menu, provide additionalpersonal information, and upload supporting documents, including:

- Proof of Identity: Passport or Driving license

- Proof of Address: Utility bill or Bank statement

At the end, you must perform a liveness check to complete the Know Your Customer (KYC) process.

MTrading Broker Trading Platforms and Applications

MTrading primarily offers the MetaTrader 4 (MT4) platform, known for its powerful features and easy-to-use interface. The MT4 platform provides:

- Adaptive trading options, including algorithmic strategies

- Seamless access across devices: desktop, web, and mobile

- Sophisticated charting with customizable timeframes

- Extensive library of technical indicators and drawing utilities

- Compatibility with Expert Advisors (EAs) for hands-free trading

- Live market data and real-time news updates

You can download MT4 mobile applications from the links below:

In addition to the standard MT4 platform, MTrading offers MT4 Supreme Edition, an enhanced version of MT4 with additional plugins and customizable tools, suitable for a diverse range of trading strategies.

MT4 supreme edition provides enhanced features likeMini Terminal, real-time news, Tick Chart Trader, and expanded indicators.

You can also find a wide range of advanced MT4 indicators for free on TradingFinder.

MTrading Broker Trading Costs (Spreads and Commissions)

MTrading offers competitive spreads and low commissions across its account types:

- Cent Account: Spreads from 1.0 pip, no commissions

- Premium Account: Spreads from 1.0 pip, no commissions

- Pro Account: Spreads from 0.0 pips, $4 commission per 1.0 lots

MTrading Swap Rates

Holding positions overnight and over the weekend incurs a swap rate. The MTrading official website offers transparent rollover fees on the products page. Here are some examples:

| Trading Instrument | Swap Long | Swap Short |

EURUSD | -6.75 | -4.19 |

GBPUSD | -4.84 | -3.77 |

USDJPY | -2.4 | -14.16 |

WTI | -3.68 | -2.36 |

DAX40 | -2.45 | -3.56 |

AAPL | 0.056 | 0.035 |

Gold | -41.6 | 18.3 |

Silver | -1.88 | -0.84 |

Note: The swap rate differs based on the instrument and account type.

MTrading Non-Trading Costs

The tight spreads and low commissions make MTrading an attractive option for both novice and experienced traders.MTrading broker's other fees:

- $50 monthly inactivity fee

- No deposit and withdrawal fees

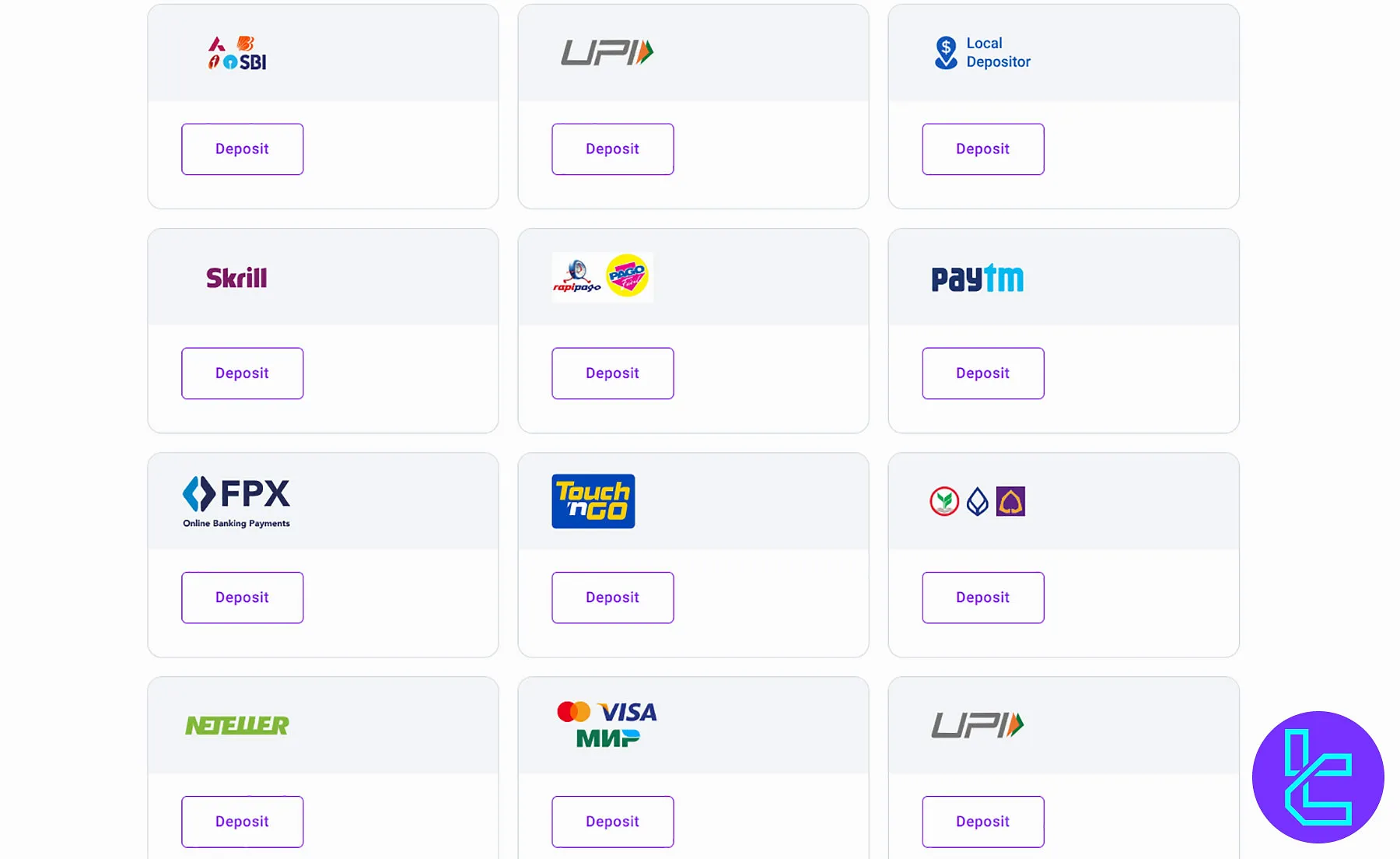

MTrading Deposit & Withdrawal Methods Overview

MTrading supports a wide range of payment options, including:

- Bank transfer

- Neteller

- Skrill

- USDT (Tether)

- and many more

MTrading Deposit Options

While the broker claims to support a wide range of payment systems, when we accessed the dashboard, there were only four deposit methods, including:

| Payment Method | Min Deposit | Processing Time |

Tether USDT | $1 | Instant |

Neteller | €50 | Within 1 hour |

Skrill | $50 | Within 1 hour |

Wire Transfer | N/A | N/A |

MTrading Withdrawal Methods

To be able to withdraw from your account, you must verify your identity and enable 2FA. The methods for MTrading withdrawals are the same as deposits, excluding Bank Wire.

| Withdrawal Method | Min Withdrawal | Processing Time |

Tether USDT | $10 | Instant |

Neteller | $10 | Instant |

Skrill | $10 | Instant |

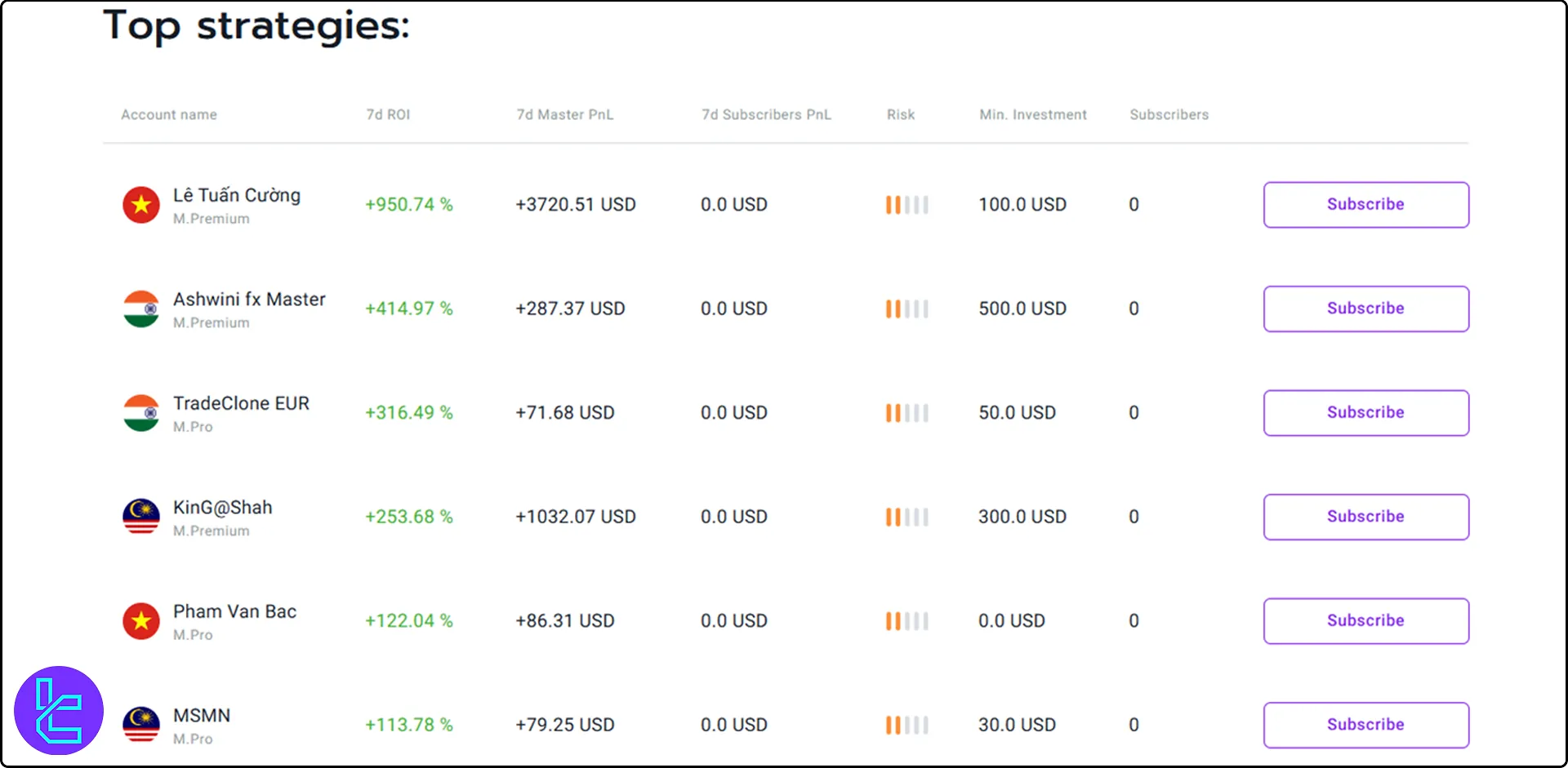

Copy Trading & Investment Options Offered on MTrading

MTrading offers a robust copy trading feature that allows traders to automatically replicate the trades of successful investors. This service is particularly beneficial for:

- Beginners eager to gain insights from seasoned traders

- Time-pressed individuals aiming to invest without day-to-day oversight

- Investors interested in expanding their portfolio through varied strategies

The Subscribers tab shows a wide range of helpful information regarding the Masters' performance, including:

- 7-day ROI

- 7-day profit and loss

- Minimum investment

- Number of subscribers

- Subscribers' profit and loss

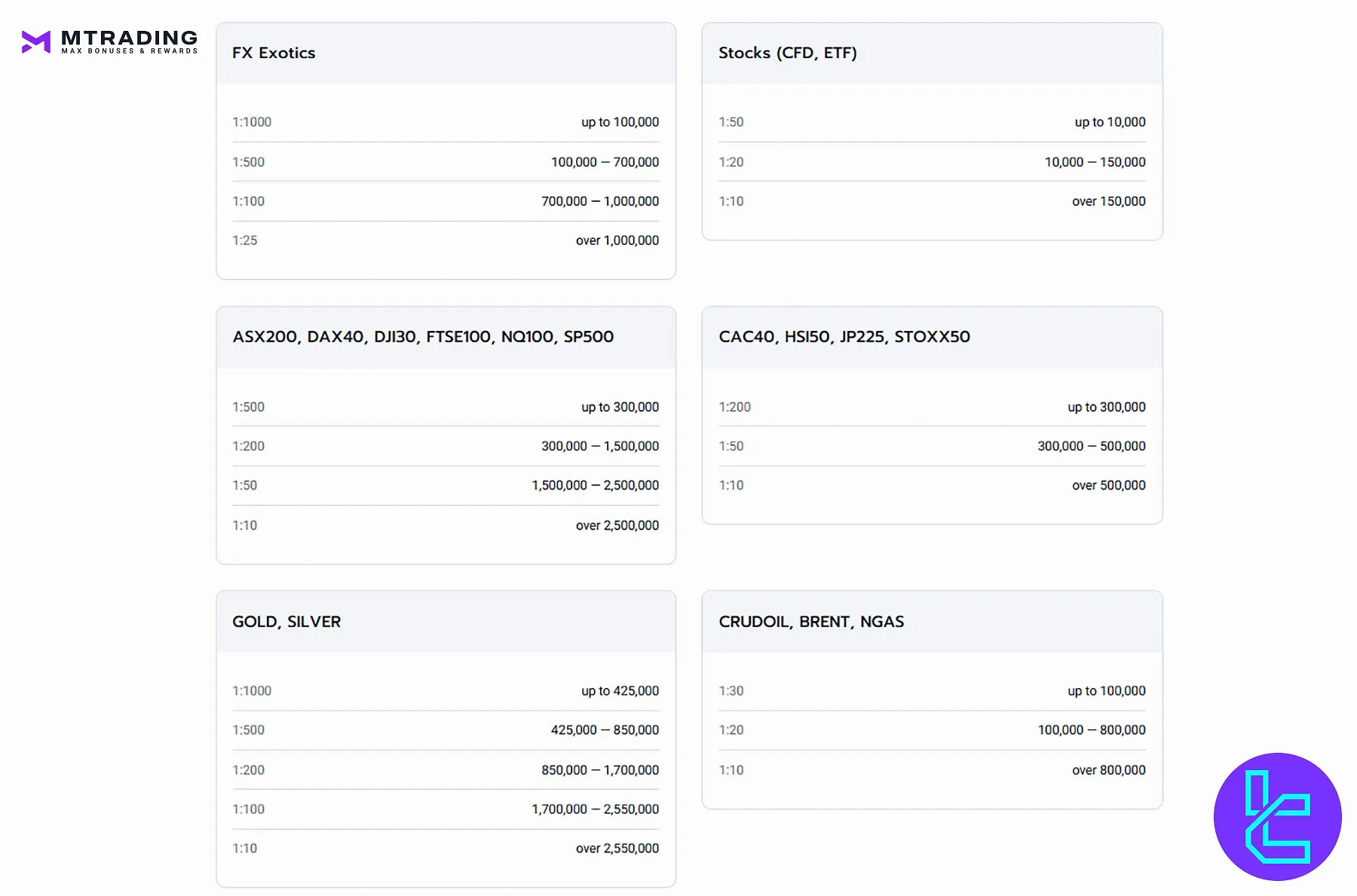

MTrading Broker Tradable Markets & Symbols Overview

MTrading offers a diverse range of 130+ tradable markets and instruments across five asset classes, from the Forex market to commodities and cryptocurrencies.

Category | Type of Instruments | Number of Symbols | Competitor Average | Max Leverage |

Forex | CFDs | 30 currency pairs | 50 - 70 currency pairs | 1:1000 |

Indices | CFDs | 10 | 10 - 20 instruments | 1:500 |

Stocks | CFDs, ETFs | 28 | 800 - 1200 | 1:50 |

Commodities | CFDs, Options, Futures | 5 instruments, including precious metals (gold and silver) and energies (WTI, NGAS, and BRENT) | 15 - 30 instruments | Metals 1:1000 Energies 1:30 |

Cryptocurrencies | CFDs, ETFs | 6 digital assets, including Bitcoin and Ethereum | 20 - 30 instruments | 1:100 |

Note: Leverage options are subject to order size conditions and bonus terms. Traders should review the rules before participating.

MTrading Broker Bonuses and Promotions

MTrading offers attractive bonuses and promotions to both new and existing clients:

- $30 Welcome Bonus: New clients can receive a $30 no-deposit bonus to start trading risk-free;

- 200% Deposit Bonus: Traders can boost their trading capital with a 200% bonus on their deposits;

- Dynamic IB Partnership Program: Earn up to 10% extra rewards on net deposits for IBs.

It's crucial to understand that all bonuses and promotions are subject to specific terms and conditions, such as minimum trading volume requirements. Traders must thoroughly review these conditions before engaging in promotional offers.

MTrading Awards

The broker has been recognized by financial industry authorities across the globe. The awards reflect the broker’s growth, bonus offerings, and excellence in affiliate partnerships.

- Best IB Broker 2025

- Best Bonus Programs in Asia 2024

- Fastest Growing FX Broker in Asia 2023

MTrading Broker Customer Support

MTrading provides customer support through the following channels:

- Live Chat: Available 24/5 for quick assistance

- Phone Number: +357 220 241 66

- Email: support@mtrading.com

- FAQ Section: Comprehensive answers to common questions

The support team is multilingual, catering to the broker's global client base. While the live chat feature is primarily bot-driven, it can escalate issues to human support agents when necessary.

MTrading Broker Restricted Countries List

MTrading does not provide services to residents of certain jurisdictions due to regulatory requirements. Restricted countries include:

- Asia: Afghanistan, Hong Kong, Bangladesh, Kiribati, North and South Korea, Myanmar, Syria, Taiwan, Pakistan, Australia, Iran, Iraq

- Europe: United Kingdom, Sweden, Norway, Portugal, Spain, Poland, Romania, Italy, Iceland, Germany, France, Denmark, Estonia, Belgium

- North America: USA and Canada

- South America: Brazil, Cuba, Venezuela

- Africa: Guinea-Bissau, Niger, South Sudan, Togo, Zimbabwe, Gabon

Traders from these countries are advised to seek alternative brokers that comply with their local regulations. It is also worth mentioning that MTrading has the right to add or remove countries from the list above.

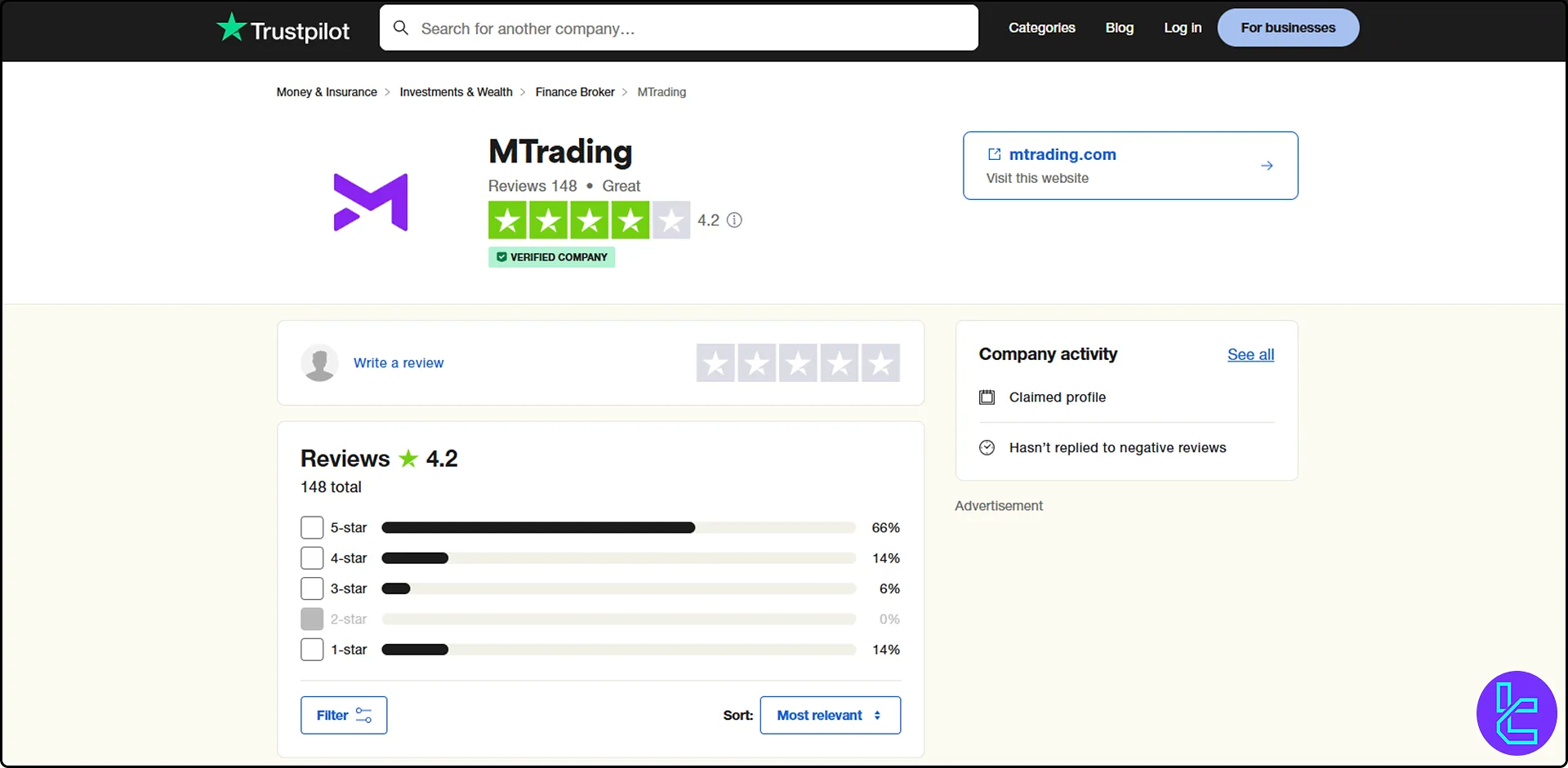

MTrading Broker Trust Scores and User Reviews

MTrading has received mixed reviews from clients and industry experts. The MTrading Trustpilot profile maintains a high rating, with some clients praising the trading conditions and others expressing concerns about withdrawal processes.

Key points from user reviews:

- Positive feedback on tight spreads and fast execution

- Appreciation for the copy trading feature

- Some complaints about account verification delays

It's important to note that online reviews should be considered alongside other factors when evaluating a broker.

MTrading Broker Education Resources Overview

MTrading offers various educational resources to help traders improve their skills:

- Educational Articles: Covering basic to advanced trading topics

- Market News: Regular updates on market events and economic indicators

- Technical Analysis: Daily market insights and trading ideas

- Video Tutorials: Step-by-step guides on platform usage and trading strategies

- Webinars: Live sessions with experienced traders and market analysts

These resources cater to traders of all experience levels, from beginners to advanced professionals.

You can also check TradingFinder's Forex education and crypto tutorial sections for additional resources.

MTrading vs Other Brokers

Let's check MTrading's standing in the forex trading world in comparison with other brokerage companies:

Parameter | MTrading Broker | LiteForex Broker | Exness Broker | HFM Broker |

Regulation | FinaCom | CySEC | FSA, CySEC, FCA, FSCA, CBCS, FSC, CMA | CySEC, DFSA, FCA, FSCA, FSA |

Minimum Spread | From 0.0 Pips | From 0.0 Pips | From 0.0 Pips | From 0.0 Pips |

Commission | From $4.0 | From $0.0 | From $0.2 to USD 3.5 | From $0 |

Minimum Deposit | $10 | $50 | $10 | From $0 |

Maximum Leverage | 1:1000 | 1:30 | Unlimited | 1:2000 |

Trading Platforms | MT4 | MetaTrader 4, MetaTrader 5, Mobile Proprietary App | Exness Trade (mobile), Exness Terminal (web), MT4, MT5 | MT4, MT5, Mobile App |

Account Types | M.Cent, M.Premium, M.Pro | Classic, ECN, Demo | Standard, Standard Cent, Pro, Raw Spread, Zero | Cent, Zero, Pro, Premium |

Islamic Account | Yes | No | Yes | Yes |

Number of Tradable Assets | 130+ | N/A | 200+ | 1,000+ |

Trade Execution | Market | Market | Market, Instant | Market, Buy Stop, Stop Loss, Limit, Take Profit |

TF Expert Suggestion

MTrading’s $10 minimum deposit and spreads starting at 0.1 pips make it accessible for new traders, but its lack of regulation by FCA, CySEC, and SEC could be a drawback.

The $30 welcome bonus, $4 commissions on Pro accounts, and a 4.2 Trustpilot score are additional aspects worth noting.