The MultiBank verification process is a three-step procedure that requires the upload of proof of identity (POI) and proof of address (POA) documents, in addition to completing financial information and account preferences.

Traders who open an account with this broker can trade Forex, stocks, metals, indices, and cryptocurrencies using MetaTrader 4 and 5, as well as the MultiBank official app.

How to Complete the MultiBank Verification Process in Just Three Steps

Once MultiBank registration is completed, follow this streamlined process to verify your account. MultiBank broker verification process:

- Enter personal details and select account type;

- Upload proof of identity (POI);

- Submit proof of address (POA).

Before following the steps in detail, check to see if you have the following documents.

Verification Requirement | Yes/No |

Full Name | No |

Country of Residence | No |

Date of Birth Entry | No |

Phone Number Entry | No |

Residential Address Details | No |

Phone Number Verification | No |

Document Issuing Country | No |

ID Card (for POI) | Yes |

Driver’s License (for POI) | Yes |

Passport (for POI) | Yes |

Residence Permit (for POI or POA) | No |

Utility Bill (for POA) | Yes |

Bank Statement (for POA) | Yes |

2-Factor Authentication | No |

Biometric Face Scan | No |

Financial Status Questionnaire | Yes |

Trading Knowledge Questionnaire | No |

Restricted Countries | Yes |

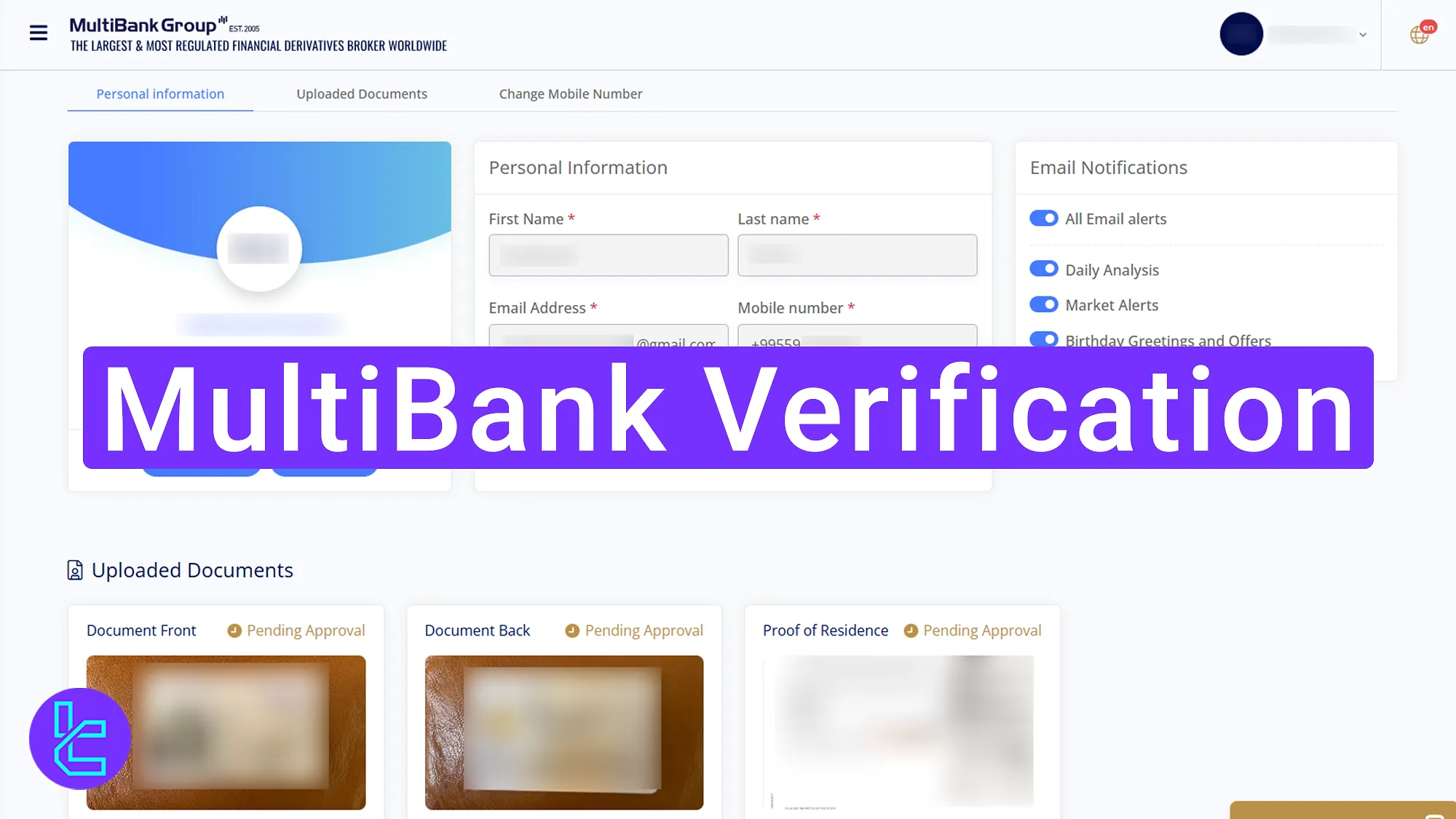

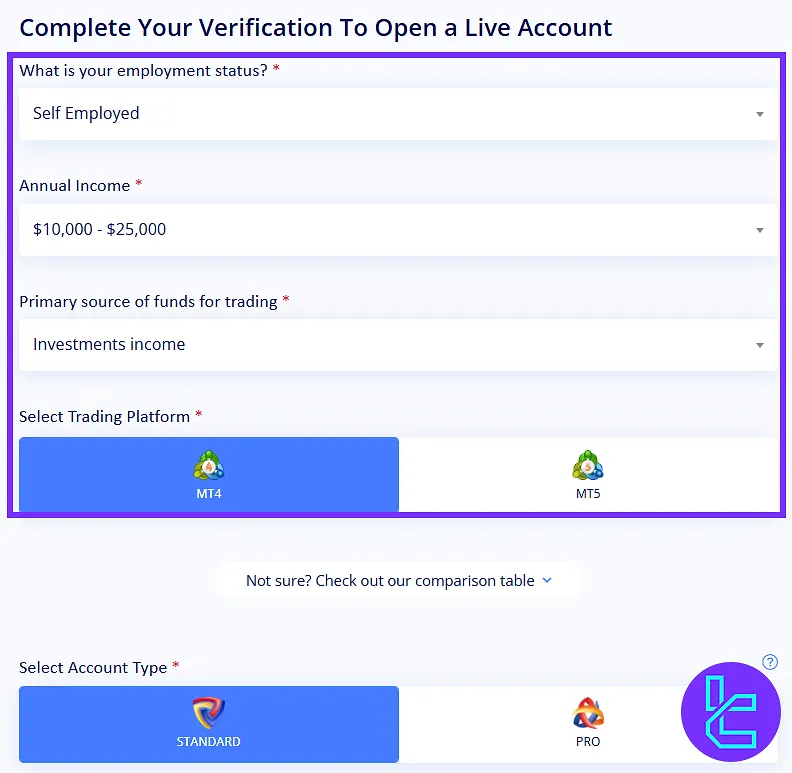

#1 Entering Personal Details and Selecting Account Type

After logging into the MultiBank trading cabin, select "Real Account" and proceed to complete financial profile and preferred account features.

You can choose between MT4 and MT5 and select an account type which suits you better.

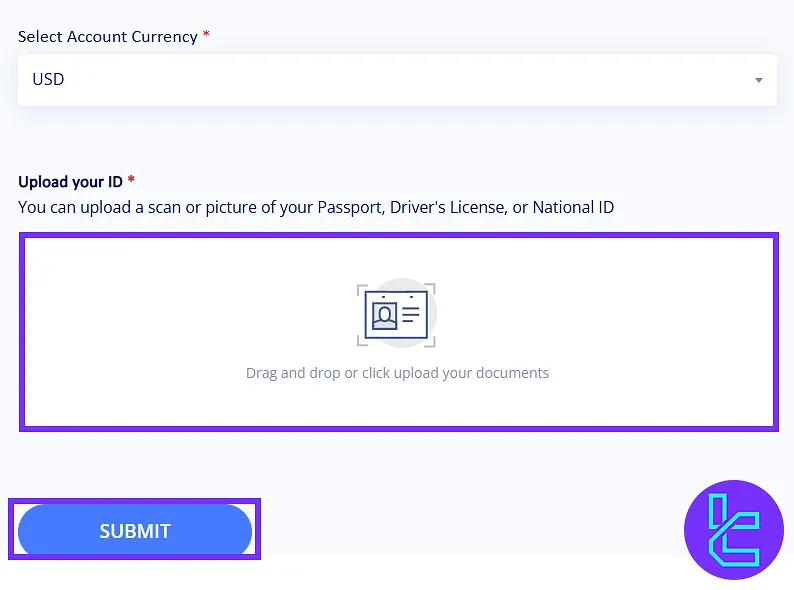

#2 Uploading Proof of Identity (POI)

Upload one of the accepted ID documents:

- Passport

- Driver’s license

- National ID card

Ensure that the document is clear, all four corners are visible, and the expiration date is readable.

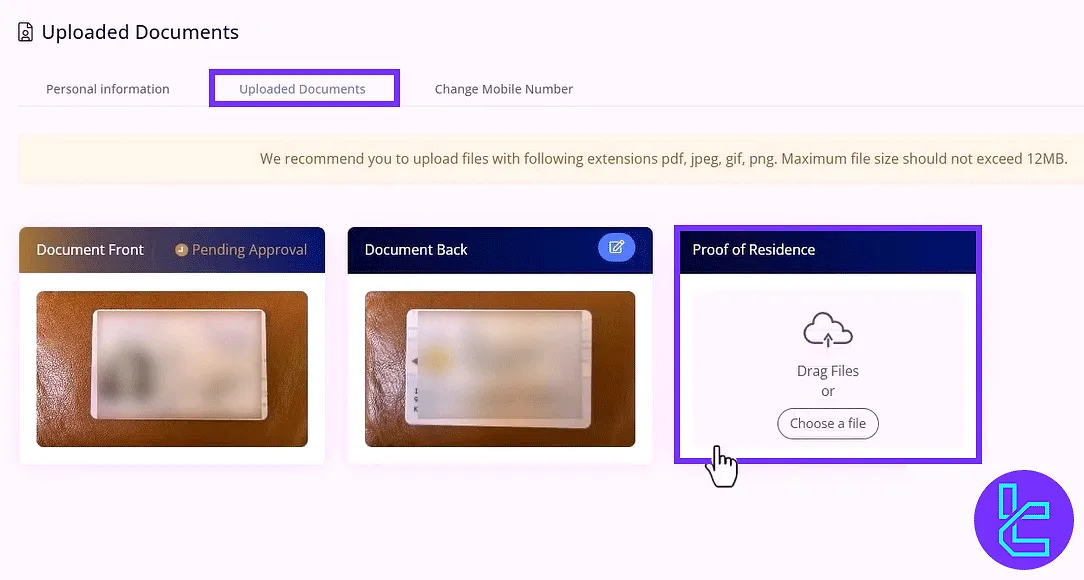

#3 Submitting Proof of Address (POA)

For address verification, upload a utility bill, credit card, or bank statement issued within the last 6 months.

The document must display your full name, address, and the issuing authority's logo.

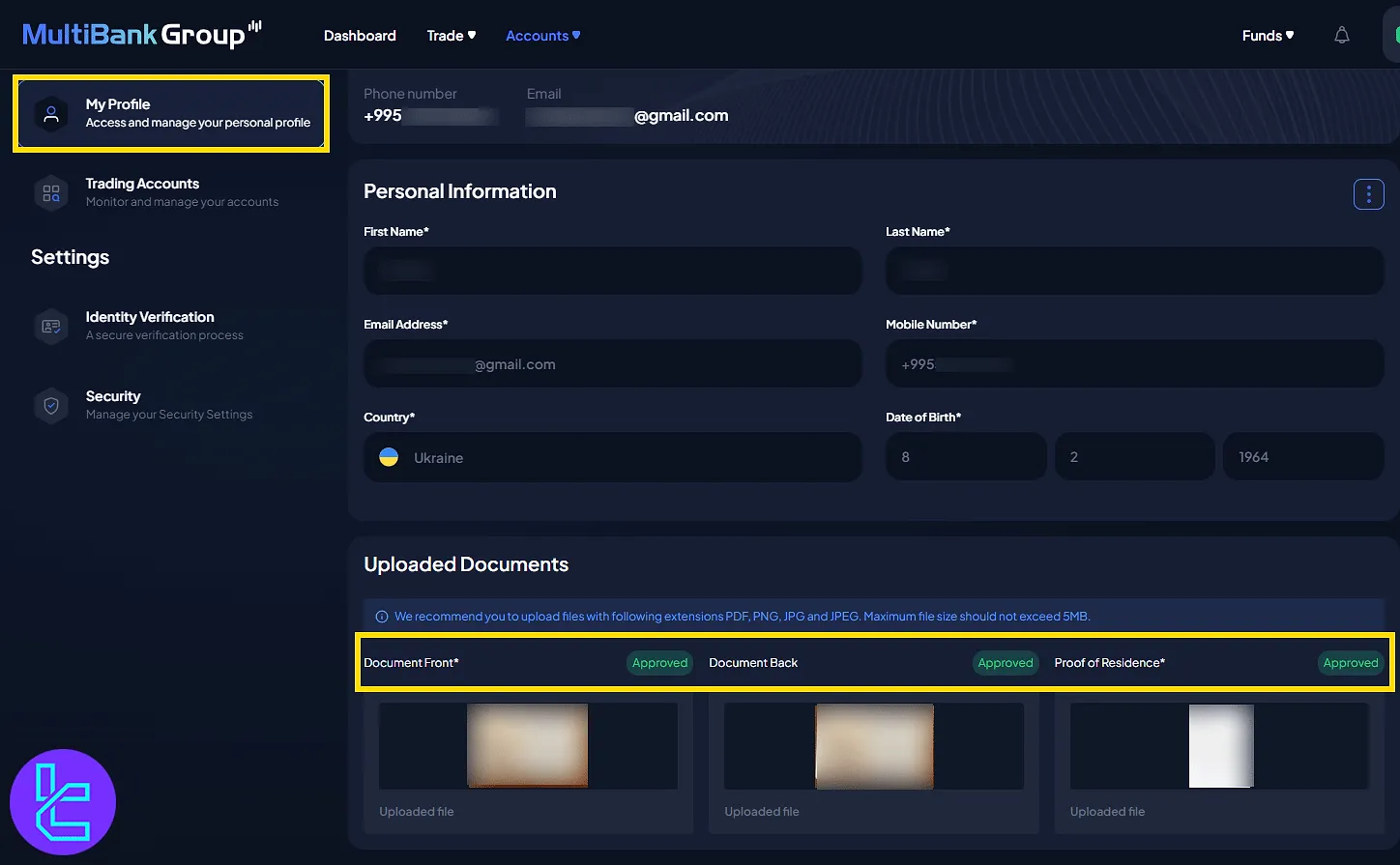

Once submitted, documents are reviewed, and you can track the status of this process from the "My Profile" section.

MultiBank Account Verification Requirements in Comparison to 3 Other Brokers

If you wonder how the required documents for KYC differ from MultiBank to other Brokers, check the table below.

Verification Requirement | MultiBank Broker | |||

Full Name | No | Yes | Yes | No |

Country of Residence | No | Yes | Yes | No |

Date of Birth Entry | No | Yes | Yes | No |

Phone Number Entry | No | No | No | No |

Residential Address Details | No | Yes | Yes | No |

Phone Number Verification | No | No | No | No |

Document Issuing Country | No | Yes | No | Yes |

ID Card (for POI) | Yes | Yes | Yes | Yes |

Driver’s License (for POI) | Yes | Yes | Yes | Yes |

Passport (for POI) | Yes | Yes | Yes | Yes |

Residence Permit (for POI or POA) | No | Yes | Yes | Yes |

Utility Bill (for POA) | Yes | Yes | Yes | Yes |

Bank Statement (for POA) | Yes | Yes | Yes | Yes |

2-Factor Authentication | No | No | No | No |

Biometric Face Scan | No | Yes | No | Yes |

Financial Status Questionnaire | Yes | No | Yes | No |

Trading Knowledge Questionnaire | No | Yes | Yes | No |

Restricted Countries | Yes | Yes | Yes | Yes |

TF Expert Suggestion

The MultiBank verification process is simple, typically taking 5 minutes to submit documents. Broker approval is generally completed within 1 business day.

After the KYC process, explore various MultiBank deposit and withdrawal options on the MultiBank tutorial page to deposit funds to your trading account.