NAGA offers various account types, including Iron, Bronze, Silver, Gold, Diamond, and Crystal. The broker's minimum deposit starts at $250, and the maximum leverage is 1:30.

Spreads are variable, and commissions start at $2.5 for stocks.

Unique features like social trading benefit traders. The broker also includes tools such as an economic calendar to support decision-making.

Company Information & Regulation Status

NAGA, a leading fintech powerhouse, has revolutionized the trading landscape with its comprehensive financial platform.

Headquartered in Germany, NAGA is a proud member of the NAGA Group AG, a publicly listed company on the Frankfurt Stock Exchange a testament to its transparency and financial stability.

NAGA operates under the supervision of the Cyprus Securities and Exchange Commission (CySEC), holding license number 204/13, and adheres to the Markets in Financial Instruments Directive (MiFID).

With over 1.5 million users and a stellar Trustpilot rating, NAGA has earned its stripes in the trading community. The broker's status as a regulated Market Maker (MM) underscores compliance with European financial standards.

Here are the regulatory details of NAGA broker:

Entity Parameters / Branches | NAGA Markets Europe Ltd | NAGA Capital Ltd |

Regulation | Cyprus Securities and Exchange Commission (CySEC), License No. 204/13 | Financial Services Authority (FSA) Seychelles, License No. SD026 |

Regulation Tier | Tier 1 | Tier 4 |

Country | Cyprus | Seychelles |

Investor Protection Fund / Compensation Scheme | Investor Compensation Fund (ICF) up to €20,000 per client | No formal investor compensation scheme |

Segregated Funds | Yes | Yes |

Negative Balance Protection | Yes | Yes |

Maximum Leverage | Up to 1:30 | Up to 1:30 |

Client Eligibility | EU / EEA Clients | International / Non-EU Clients |

NAGA Broker Summary of Specifics

Here is all you need to know about the Forex broker:

Broker | NAGA |

Account Types | Iron, Bronze, Silver, Gold, Diamond, Crystal |

Regulating Authorities | CySEC, MiFID |

Based Currencies | EUR |

Minimum Deposit | $250 |

Deposit/Withdrawal Methods | Neteller, Skrill, Bank Wire, NAGA Pay |

Minimum Order | 0.01 |

Maximum Leverage | 1:30 |

Investment Options | No |

Trading Platforms & Apps | MT4, MT5, NAGA App |

Markets | Forex, CFD Stocks, Indices, ETFs, Commodities, Cryptocurrencies, Futures, Real Stocks |

Spread | Variable |

Commission | From $2.5 (for Stock) |

Orders Execution | Market |

Margin Call/Stop Out | 100% / 50% |

Trading Features | Copy Trading, Economic Calendar |

Affiliate Program | YES |

Bonus & Promotions | No |

Islamic Account | YES |

PAMM Account | No |

Customer Support Ways | Email, Phone |

Customer Support Hours | 07:30 am to 02:00 am EEST |

Types of Accounts

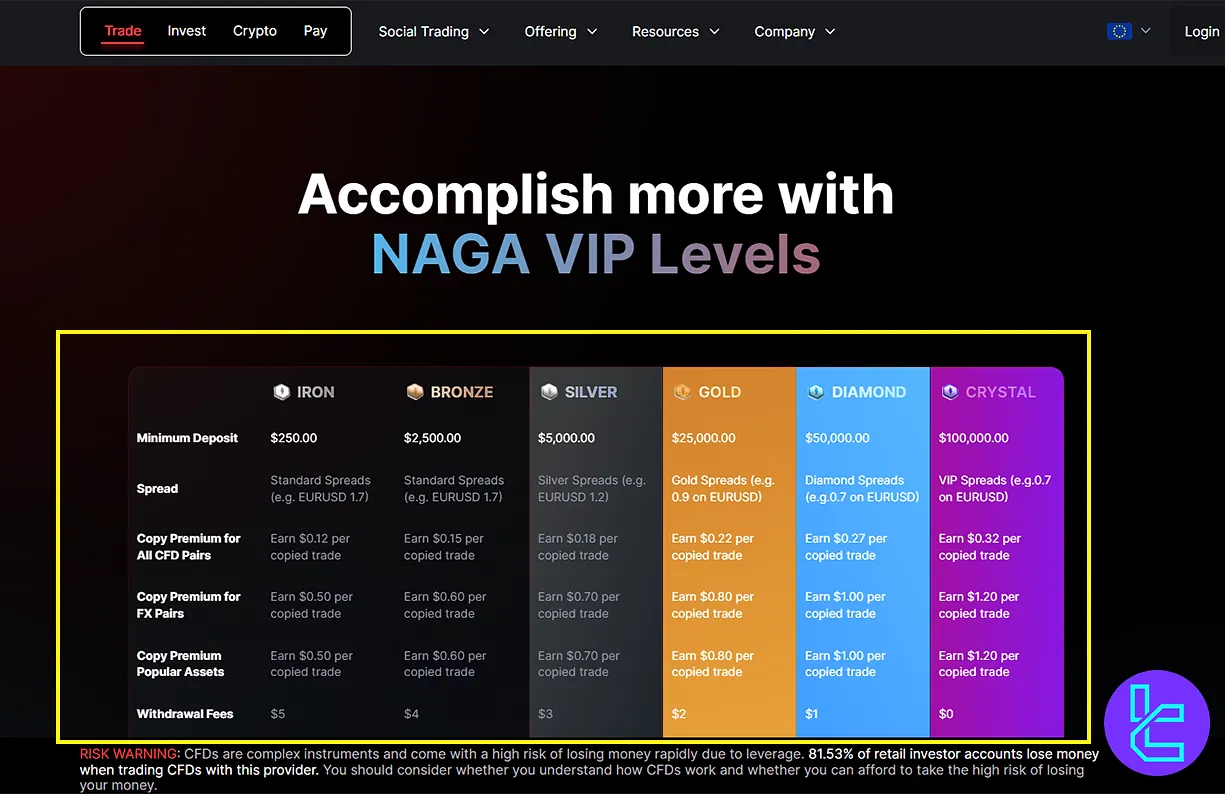

NAGA broker offers a tiered account structure to cater to traders of varying experience and capital levels. Here's a breakdown of the account types:

Account | Min. Deposit | Max. Leverage |

Iron | $250 | 1:30 |

Bronze | $2,500 | 1:30 |

Silver | $5,000 | 1:30 |

Gold | $25,000 | 1:30 |

Diamond | $50,000 | 1:30 |

Crystal | $100,000 | 1:30 |

Each account type offers progressively better trading conditions and perks as the deposit amount increases.

NAGA’s Advantages and Disadvantages

Besides all the benefits, NAGA can have some areas of concern:

Pros | Cons |

social trading platform | High minimum deposits for premium accounts |

Regulated by reputable authorities | Withdrawal fees for some payment methods |

Multiple account types | - |

The higher minimum deposits for premium accounts and the variable spread structure may only suit some traders, especially those with smaller capital or those seeking fixed spreads.

Signing Up & Verification Process

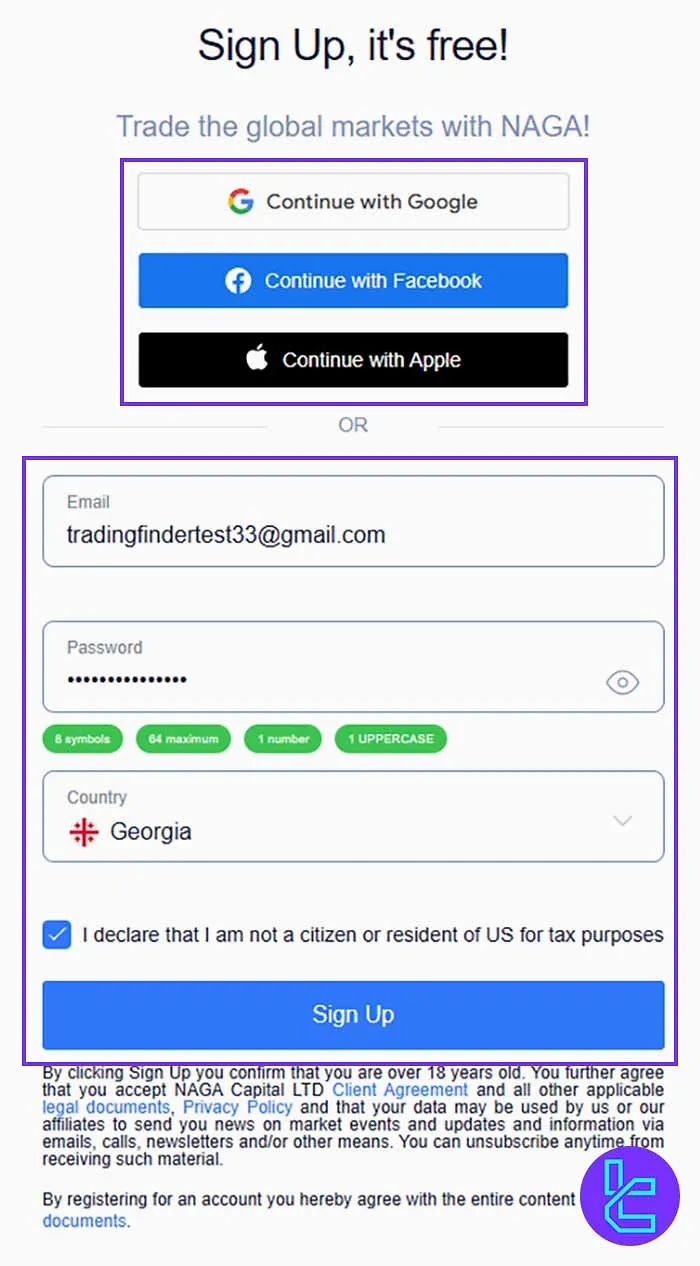

Creating a trading account with NAGA is effortless and takes just a few minutes. You can register using Google, Facebook, Apple, or by manually entering your email and personal info.

Once signed up, you’ll unlock access to NAGA’s social trading platform, portfolio management tools, and account dashboard. Here's a step-by-step guide to NAGA registration:

#1 Visit the NAGA Sign-Up Page

Go to the official website and either:

- Click “Open an Account” or;

- Hit the “Get Started” button to begin.

#2 Choose Your Registration Method

Options includeGoogle, Facebook, Apple, or manually sign up, requiring the following information:

- Password

- Country of residence

Accept the terms and solve the CAPTCHA to continue.

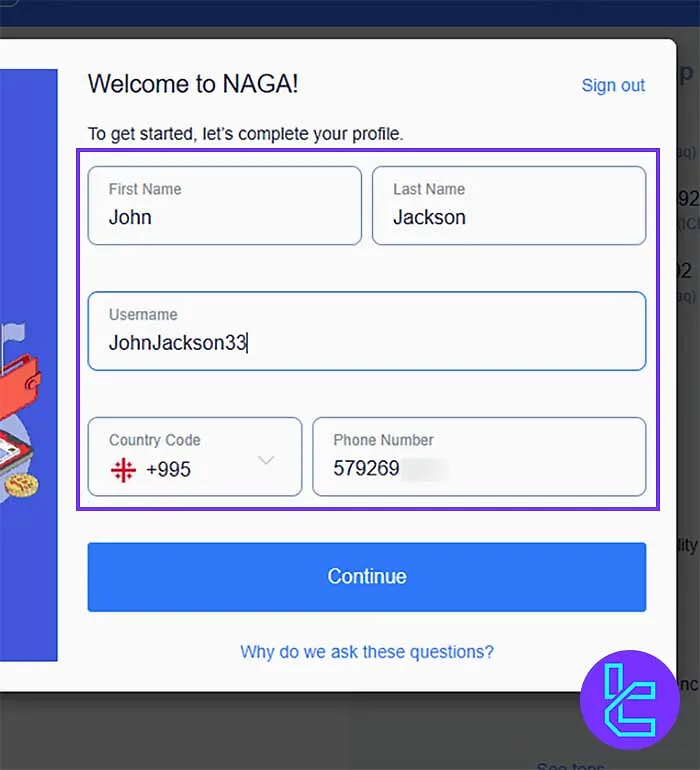

#3 Enter Personal Details

Complete your profile with the following details:

- First Name

- Last Name

- Username

- Phone Number (with country code)

Then click the "Continue"button to proceed with phone verification via SMS and WhatsApp. Select from the available account options based on your trading goals and capital.

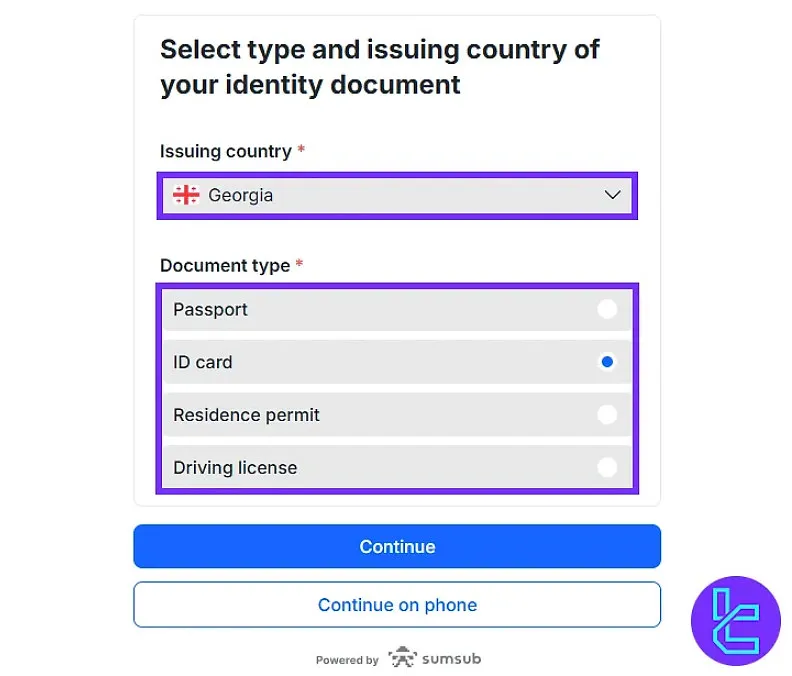

#4 Naga KYC Procedure

Navigate through the client dashboard, select the Naga verification menu, and upload supporting documents, including:

- Proof of Identity: Passport or National ID

- Proof of Residence: Utility bill or Bank statement

Remember, NAGA adheres to strict KYC (Know Your Customer) and AML (Anti-Money Laundering) policies, so verification is crucial for maintaining account security and complying with regulatory requirements.

NAGA’s Trading Platforms

NAGA offers a versatile suite of trading platforms to cater to different trader preferences:

- NAGA Webtrader: Custom-built platform offering social and copy trading

- NAGA Mobile App: Available oniOS and Android

- MetaTrader 4: Industry-standard platforms for advanced technical analysis

- MetaTrader 5: An advanced version of MT4 offering access to38 built-in indicators

All platforms provide access to over 4,000 instruments across various asset classes, including Forex, stocks, indices, ETFs, commodities, and cryptocurrencies.

NAGA's proprietary platforms stand out with their integrated social trading features, allowing users to interact with other traders and copy successful strategies.

TradingFinder has developed a wide range of MT4 and MT5 indicators that you can use for free.

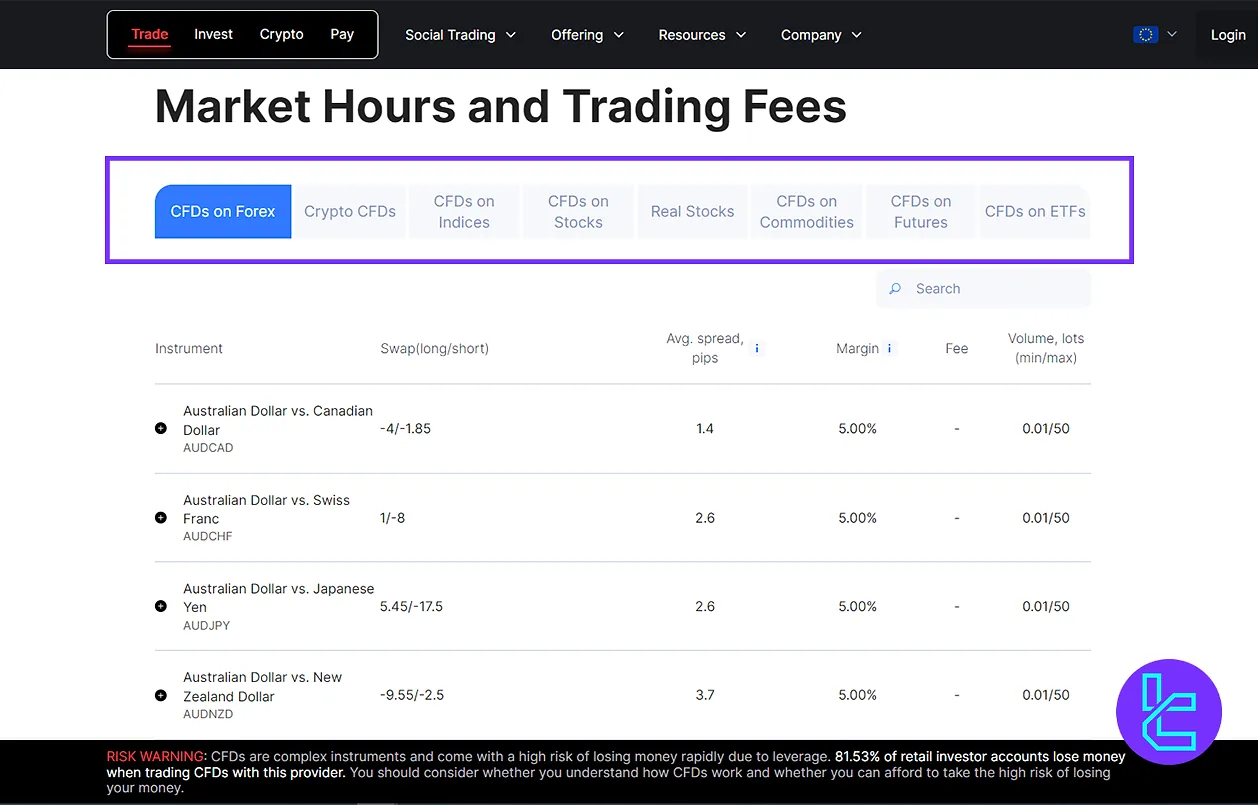

NAGA’s Spreads and Commission Structure

Trading costs on NAGA are spread-based, with the IRON account starting at 1.1 pips on EUR/USD. Spreads become more competitive on higher-tier accounts (e.g., 0.5 pips on Gold).

NAGA does not charge direct commissions on trades (except for stocks), but generates revenue through spreads and copy trading fees, which vary by asset and trader status.

Markets | Spreads | Commission From |

Forex | From 0.2 pips (EUR/USD) | - |

Stocks | Variable | 2.5 EUR |

Indices | Variable | - |

Commodities | Variable | - |

Cryptocurrencies | Variable | - |

NAGA's variable spreads adjust based on market conditions, potentially widening during high volatility.

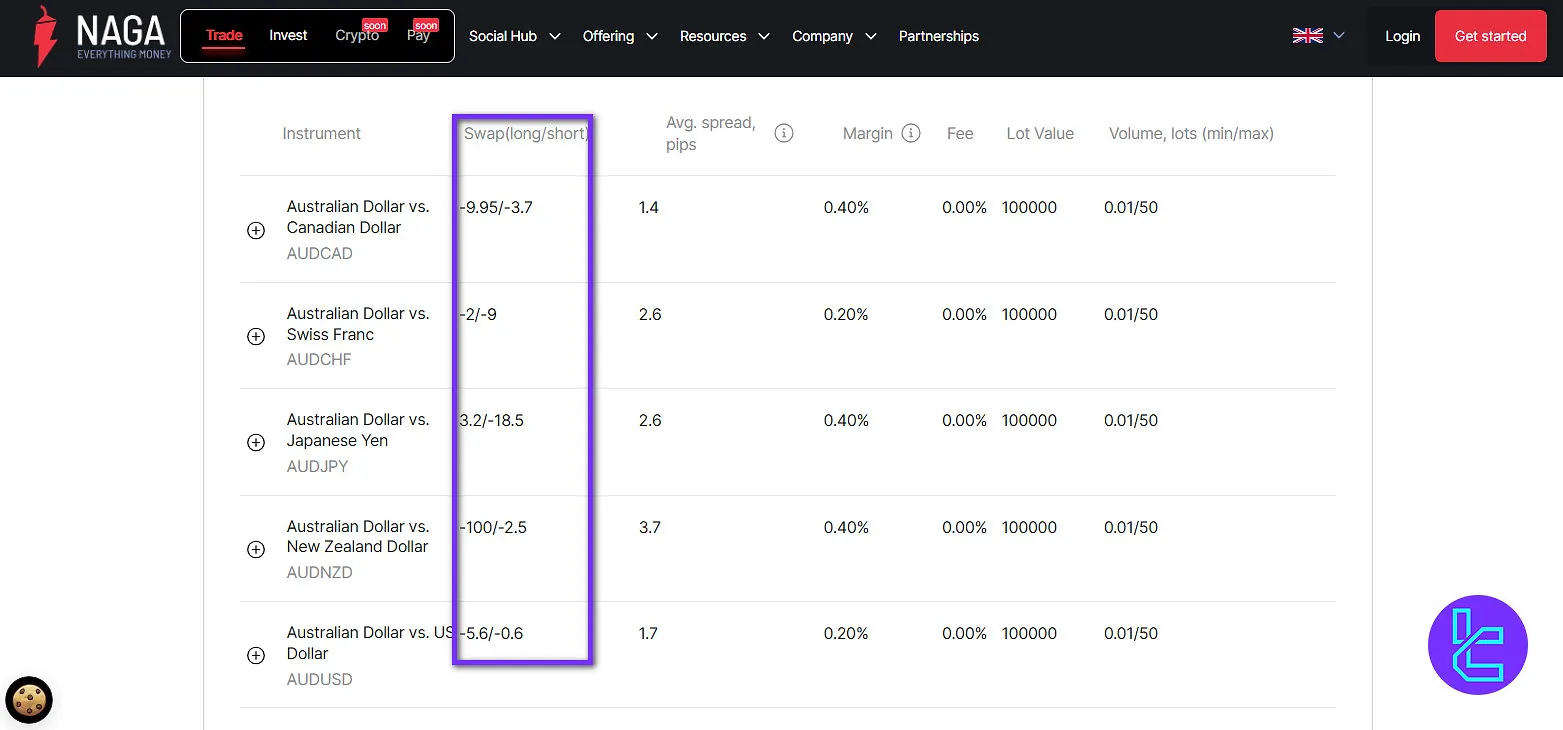

NAGA Broker Swap Fees

Swap fees on NAGA are applied once per trading day, calculated at midnight and based on the previous day’s exposure. The accumulated swap appears in the “Swaps” field of each trading position and is deducted from realized profit or loss upon closing the trade.

To account for non-trading days, a triple swap is charged either midweek or at the end of the week, depending on the asset class:

- Wednesdays: Forex pairs and Commodities

- Fridays: Indices, Stocks, ETFs, Cryptocurrencies, Futures, and Oils

Swap rates fluctuate daily, influenced by market interest rates and liquidity conditions. Traders can review all applied swap charges within their daily account statements or directly inside each trade’s details, ensuring full transparency.

Swap Fee Calculation Method in NAGA

The daily swap charge is determined using the following formula:

For instruments like Cryptocurrencies, Stock CFDs, Futures, and ETFs, the calculation is expressed as a percentage:

All swap fees are computed in the asset’s base currency and then converted into the client’s account currency.

NAGA Broker Non-Trading Fees

NAGA applies a transparent policy regarding non-trading charges, with no standard fees for deposits or withdrawals.

However, traders should be aware that intermediary or sender banks may impose additional costs on bank transfers, which can result in the credited amount being lower than the original transfer.

While NAGA generally processes withdrawal requests within 24 working hours, a USD 25 fee may be applied at the company’s discretion.

All transactions are handled in the currency of the original deposit, and if a conversion is required, it is performed at NAGA’s prevailing exchange rate.

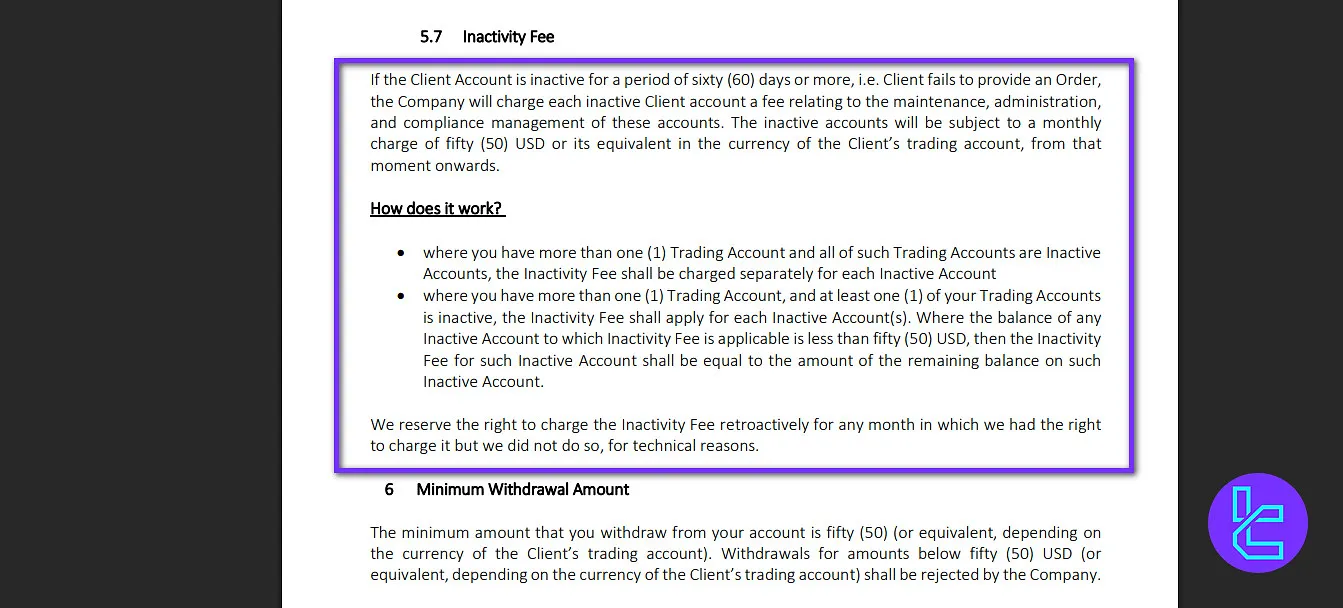

Accounts that remain inactive for 60 consecutive days or more, meaning no orders or trading activity, are subject to a USD 50 monthly fee (or its equivalent in the account’s base currency). This charge covers account maintenance, administrative, and compliance-related costs.

If a client holds multiple accounts:

- Each inactive trading account incurs its own separate fee;

- When the balance of an inactive account is below USD 50, the inactivity fee equals the remaining balance, effectively closing that account;

- NAGA also reserves the right to apply inactivity fees retroactively for any eligible months in which charges were not previously processed due to technical reasons.

This structure ensures that operational resources are efficiently allocated while maintaining transparency across all client accounts.

NAGA Broker Deposit & Withdrawal Methods

NAGA provides a variety of options for funding your account and withdrawing your profits:

- Neteller

- Skrill

- Bank Wire

- NAGA Pay

Key points to remember:

- Minimum deposit varies by account type (starting from $250);

- No deposit fees are charged by NAGA (third-party fees may apply);

- Withdrawals are processed within 1-3 business days.

NAGA employs state-of-the-art security measures to protect client funds and personal information, ensuring safe and efficient transactions.

NAGA Deposit

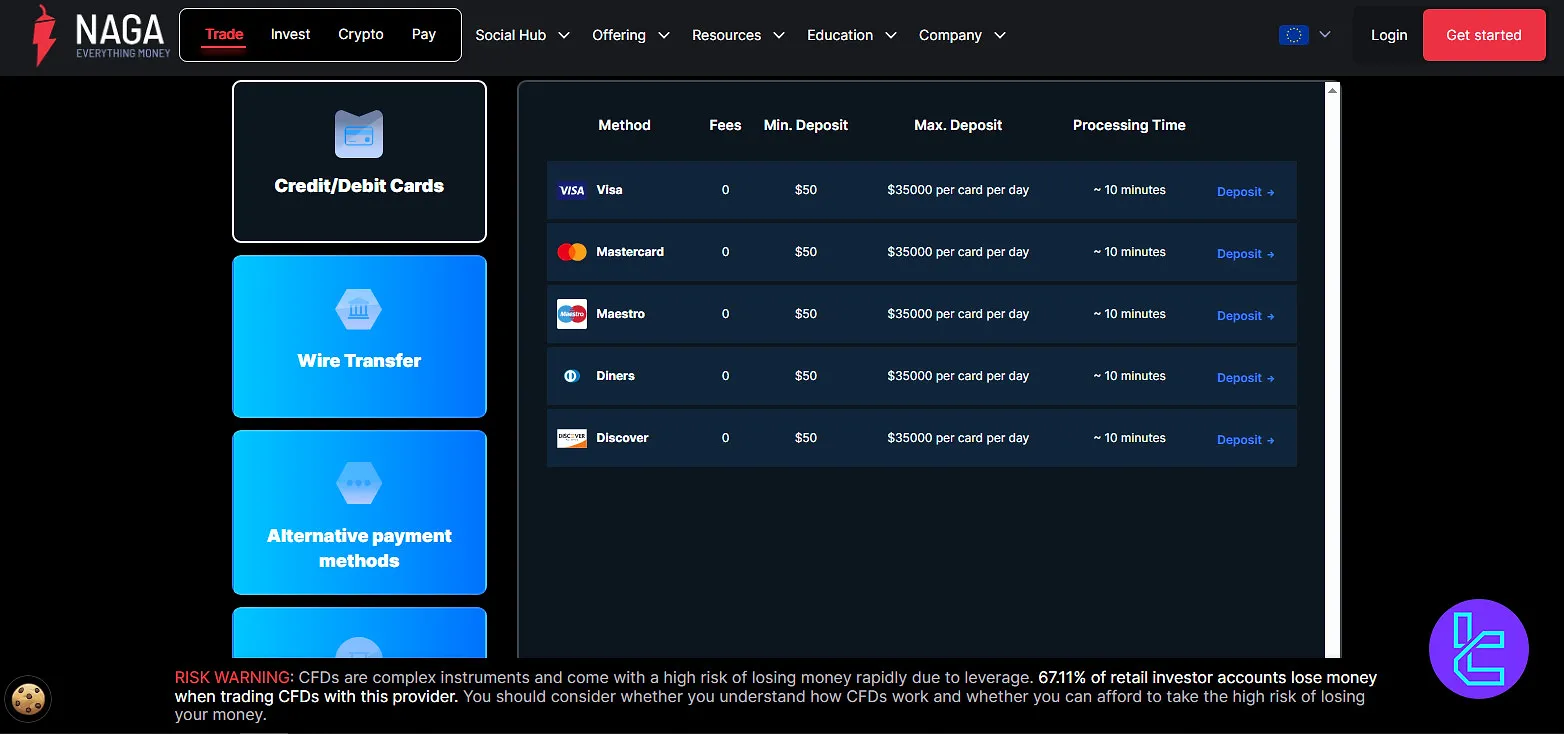

NAGA provides a wide range of deposit options designed to suit traders worldwide.

All funding methods come with zero deposit fees and a minimum deposit of $50, ensuring accessibility while maintaining compliance with financial regulations.

Processing times and deposit limits vary depending on the payment category and provider. Below is a detailed breakdown of NAGA’s accepted deposit methods.

Here is the detailed information on the different methods available:

Deposit Category | Available Methods | Fees | Minimum Deposit | Maximum Deposit | Processing Time |

Credit / Debit Cards | Visa, Mastercard, Maestro, Diners, Discover | $0 | $50 | $35,000 per card per day | ~10 minutes |

Wire Transfer | Equals Money, Eurobank, Astrobank, Alphabank | $0 | $50 | N/A | 2–5 business days |

Alternative Payment Methods | PayPal, iDEAL, Skrill, Neteller, Sofort, PaySafeCard | $0 | $50 | Varies by provider (€4,000 per hour for iDEAL, €15,000 per transaction for Sofort, or based on PaySafeCard voucher) | Instant to 1 business day |

Crypto | Bitcoin, Bitcoin Cash, Cardano, DOGE, and more | $0 | N/A | N/A | Instant |

Direct Bank Transfer (by country) | Example: ING Netherlands | Covered by NAGA | $50 | Up to €999,999,999.99 | 1–2 business days |

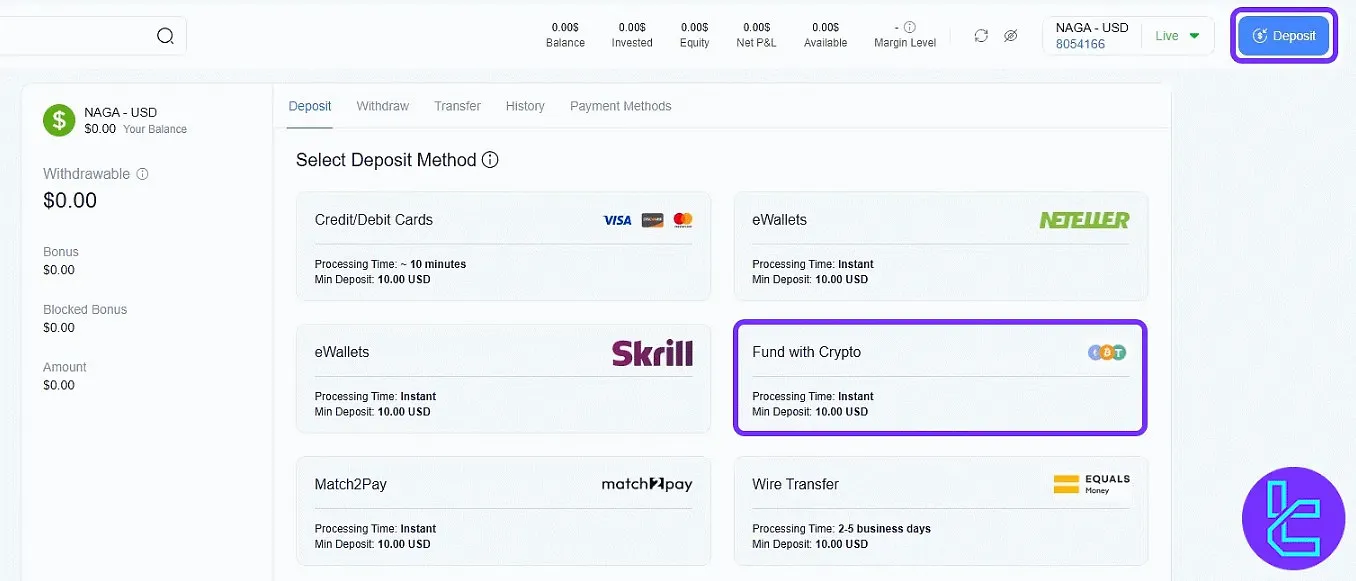

NAGA BTC Deposit

NAGA allows traders to fund their accounts using Bitcoin through a simple three-step process. The minimum deposit for NAGA BTC deposit is $10, and transactions are processed instantly once confirmed on the blockchain.

After completing account verification, users can access all crypto funding options via the NAGA dashboard:

- Open Deposit Panel: Click “Deposit” and choose “Fund with Crypto”;

- Enter Amount & Generate Address: Select your base currency, specify the deposit amount, and choose Bitcoin (BTC) to receive a unique one-time wallet address or QR code;

- Confirm Transaction: Send the exact BTC amount from your personal wallet and verify completion under “Manage Funds” and then “History”.

Each BTC address is single-use for security, ensuring transparent tracking and quick account funding. Profits can later be withdrawn using the NAGA BTC withdrawal option.

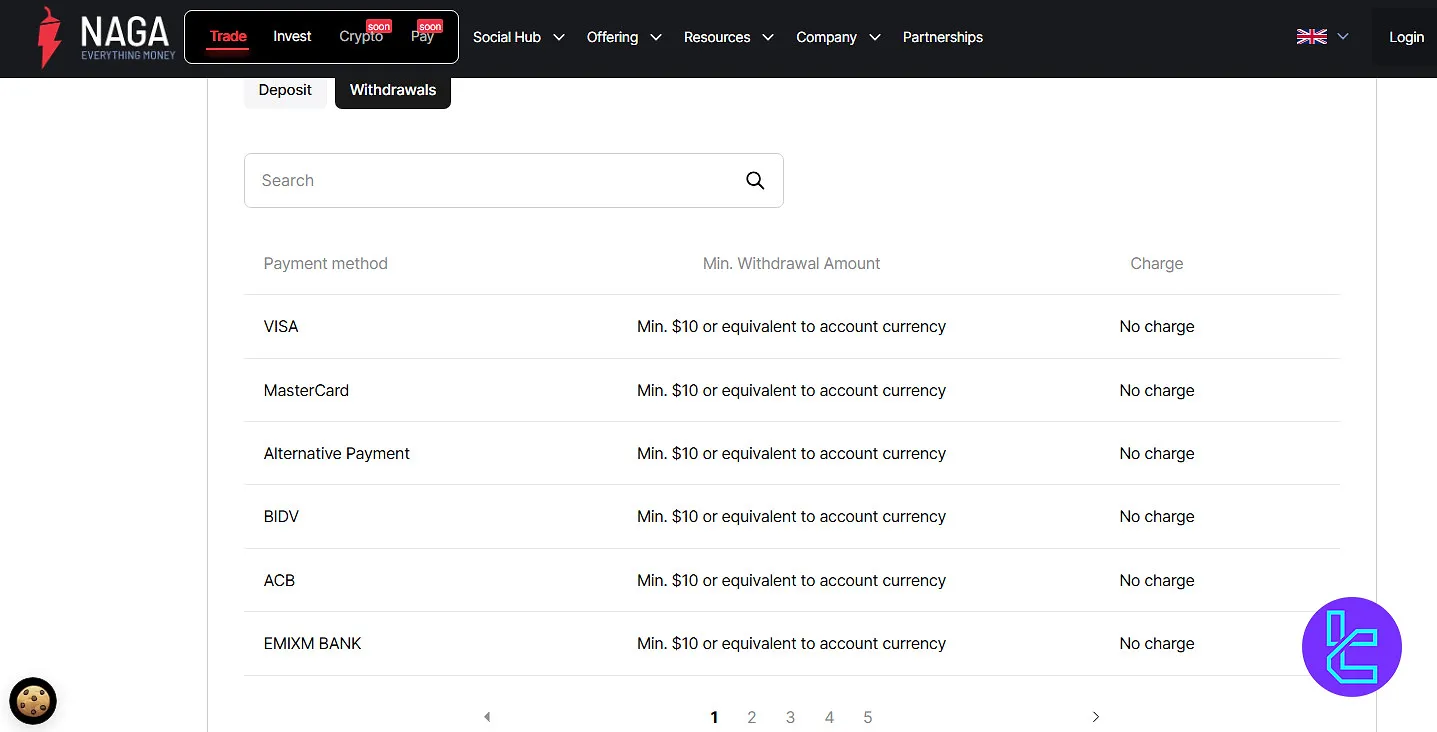

NAGA Withdrawal

NAGA provides multiple payout options, allowing traders to withdraw funds via Credit Cards, Bank Transfers, E-wallets, and Cryptocurrencies.

The broker generally does not charge withdrawal fees; however, transactions involving digital assets may include network fees based on blockchain activity.

All withdrawal requests are processed promptly, with most digital and card payments completed within 24 hours, while bank transfers typically take 2–5 business days, depending on intermediary banks and regional regulations.

The minimum withdrawal threshold for all supported methods is $10.

Let’s check out the details of each withdrawal method:

Withdrawal Method | Category | Fees | Minimum Withdrawal | Processing Time |

Visa | Credit Card | Free | $10 | Within 24 hours |

Mastercard | ||||

Bank Account | Bank Transfer | 2–5 business days | ||

Skrill | E-wallet | Within 24 hours | ||

Neteller | ||||

Bitcoin (BTC) | Cryptocurrency | Network fee applies | ||

Ethereum (ETH) | ||||

Litecoin (LTC) | ||||

Bitcoin Cash (BCH) | ||||

USD Coin (USDC) | ||||

Tether USD (USDT) | ||||

Tether TRC20 (USDT-TRC20) |

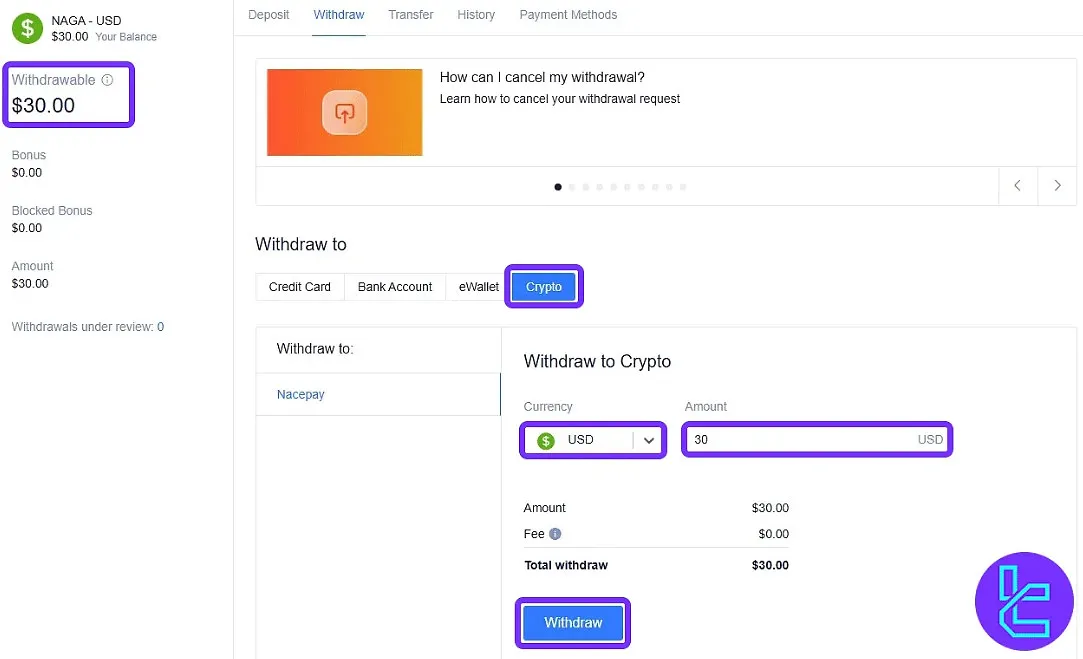

NAGA BTC Withdrawal

Withdrawing Bitcoin from NAGA is a simple 3-step process that is usually approved within 24 hours.

Here are the NAGA BTC Withdrawal steps:

- Access "Manage Funds" and then "Withdraw" to open the payout section;

- Select "Crypto", choose USD, enter the withdrawal amount, and pick Bitcoin as the crypto asset. Add your BTC wallet address and confirm;

- Track progress in the "Withdrawal History" tab under "Manage Funds".

Note: Verification must be completed before starting the withdrawal.

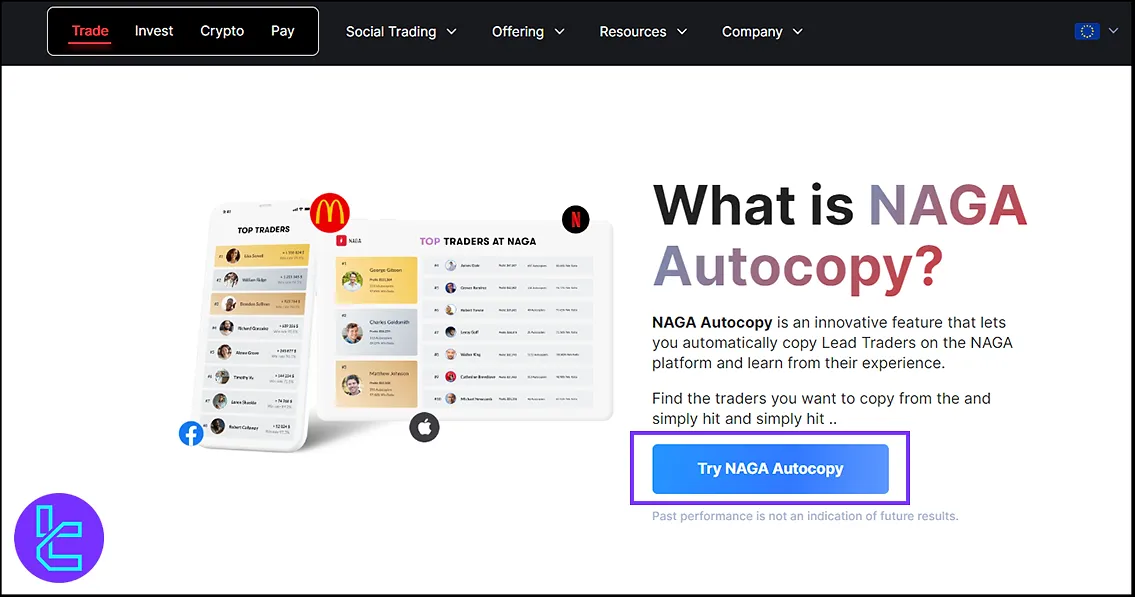

Copy Trading & Investment Options Offered by NAGA

NAGA copy trading feature, known as "NAGA Autocopy", is a standout offering that allows users to replicate the trades of successful investors:

- Trader Pool

- Real-Time Copying

- Performance Metrics

- Close autocopying whenever you want

NAGA's social trading environment encourages learning and collaboration, making it an attractive platform for beginners and professionals.

Tradable Markets & Symbols Overview

NAGA provides access to an extensive portfolio of over 4,000 tradable assets, spanning:

Category | Type of Instruments | Number of Symbols | Competitor Average | Maximum Leverage |

Forex | Major, Minor & Exotic Currency Pairs | 49 pairs | 50–70 currency pairs | 1:30 |

CFD Stocks | CFDs on global shares (via MT4/MT5 platforms) | Over 1,000 global stocks | 800–1200 | 1:5 |

Indices | CFDs on major global indices | 14 indices | 10–20 indices | 1:20 |

ETFs | CFDs on exchange-traded funds | 60+ ETFs | 40–60 ETFs | 1:5 |

Commodities | CFDs on metals, energy, and soft commodities | 7 instruments | 10–20 instruments | 1:10 |

Cryptocurrencies | CFDs on crypto assets like BTC, ETH, LTC | 60 crypto pairs | 30–50 crypto pairs | N/A |

Futures | CFDs on major global futures | 22 instruments | 5–15 instruments | N/A |

Real Stocks | Direct stock ownership via NAGA’s investing platform | 1,000+ listed stocks | 800–1200 | N/A |

This diverse offering allows traders to build a well-rounded portfolio and exploit opportunities across market conditions.

Bonus offerings and Promotions

Although NAGA broker doesn't explicitly promote traditional bonuses or promotions, they offer an attractive referral program for theirNAGA Pay app.

Users can earn up to €100 in Bitcoin by referring eligible friends to join NAGA Pay, providing a unique earnings opportunity beyond standard bonus offerings.

This referral initiative adds significant value to NAGA users, allowing them to benefit from their network while expanding the app's community.

NAGA Broker Awards

Although NAGA has not accumulated numerous awards, it earned notable recognition at the Middle East Financial Markets Awards 2023, held on September 24 at the Palazzo Versace Hotel in Dubai.

This event highlighted leading financial institutions for their innovation and reliability.

During the ceremony, NAGA was acknowledged among the Top 100 Most Trusted Brokers in the Middle East, reflecting the company’s community-focused and technology-driven approach to online trading.

This NAGA Award marks a significant milestone for the broker.

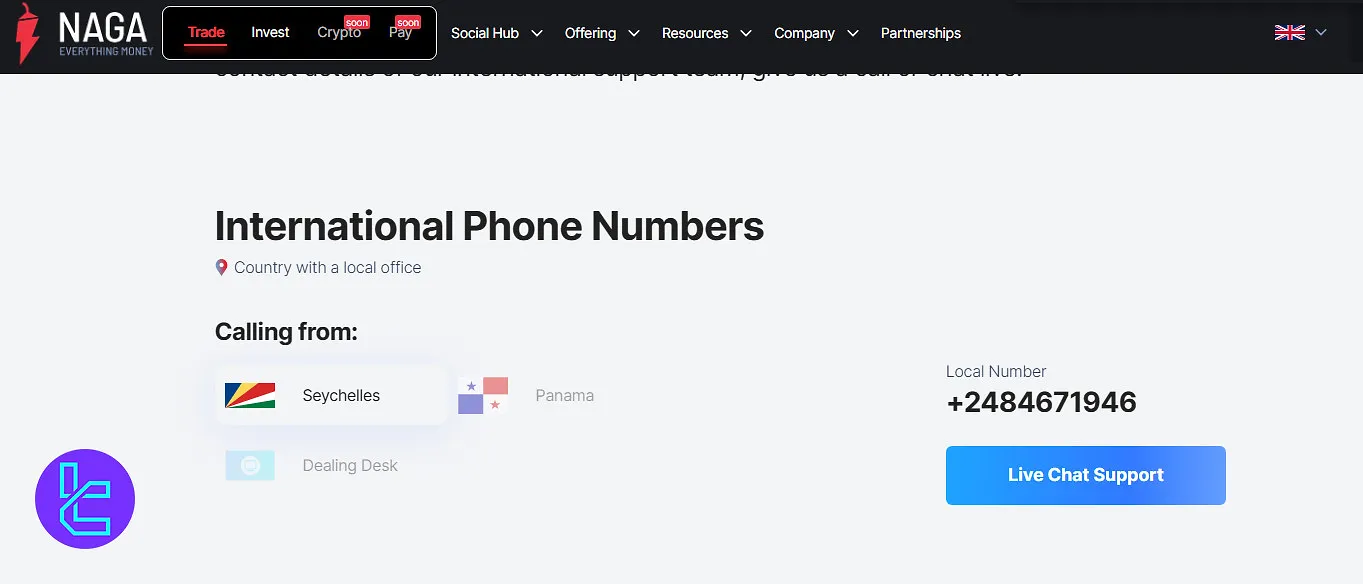

NAGA Broker Support Team and Hours

NAGA offers customer support channels to assist traders with any queries or issues:

- Email: support@naga.com

- Phone: +35725041410

Support is available Monday to Friday, from 07:30 am to 02:00 am EEST. NAGA's support team is multilingual and caters to a global clientele.

NAGA Broker List of Restricted Countries

NAGA Markets Europe LTD, regulated by the Cyprus Securities and Exchange Commission (CySEC), provides investment and ancillary services within the European Economic Area, excluding Belgium. However, the company does not offer these services in third-country territories:

- United States

- Japan

- Canada

- Australia

- New Zealand

- North Korea

- Iran

- Cuba and more

It's important to note that the list of restricted countries may change based on regulatory requirements and NAGA's business decisions.

NAGA Broker Trust Scores & Reviews

NAGA has garnered a strong reputation in the online trading community, reflected in its trust scores and user reviews on the Trustpilot website (4.5 out of 5):

Users frequently commend NAGA for | Areas for improvement |

Useful services | Higher minimum deposits for premium accounts |

Flexibility environment | Refund issues |

Tight spreads | - |

Responsive customer support | - |

Overall, NAGA's trust scores and reviews indicate a generally positive user experience, with particular appreciation for its social trading capabilities and diverse instrument offerings.

Education on NAGA Broker

NAGA has invested significantly in educational resources to empower traders with knowledge and skills:

- NAGA Academy (login required)

- Webinars

- E-books

NAGA's educational offerings cater to traders of all levels, providing a solid foundation for those new to trading and advanced insights for experienced traders looking to refine their skills.

Naga Comparison with Other Brokers

The table below compares Naga features and services with other popular brokers:

Parameter | Naga Broker | |||

Regulation | CySEC, MiFID | No | FSC | ASIC, FSC, DFSA, CySEC |

Minimum Spread | From 0.2 pips | 0.1 Pips | 0.0 Pips | From 0.6 Pips |

Commission | From $0.0 | $0 | $0 | From Zero |

Minimum Deposit | $250 | $1 | $200 | $5 |

Maximum Leverage | 1:30 | 1:3000 | 1:3000 | 1:1000 |

Trading Platforms | MT4, MT5, NAGA App | MetaTrader 4, MetaTrader 5 | MetaTrader 4, MetaTrader 5, FXTM Trader App | MT4, MT5, Mobile App |

Account Types | Iron, Bronze, Silver, Gold, Diamond, Crystal | Standard, Premium, VIP, CIP | ADVANTAGE, STOCKS, ADVANTAGE, ADVANTAGE PLUS | Micro, Standard, Ultra Low, Shares |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | 4,000+ | 45 | 1000+ | 1,400+ |

| Trade Execution | Market | Market, Instant | Market | Market, Instant |

Conclusion and final words

NAGA, with a Trustpilot rating of 4.5/5 and over 1.5 million users, is a trusted and transparent broker.

Though third-party fees may apply, there are no deposit fees, and withdrawals typically take 1-3 business days.

Despite challenges like high minimum deposits for premium accounts (up to $100,000), NAGA’s regulatory compliance, multilingual customer support, and educational resources make it a valuable option for traders.