NordFX provides several account types, such as MT4 Pro, MT4 Zero, MT5 Pro, and MT5 Zero, with spreads starting from 0.0 pips and leverage up to 1:1000.

NordFX offers its industry-leading platforms, MT4 and MT5, which offer advanced charting tools, support for Expert Advisors (EAs), and automated trading capabilities.

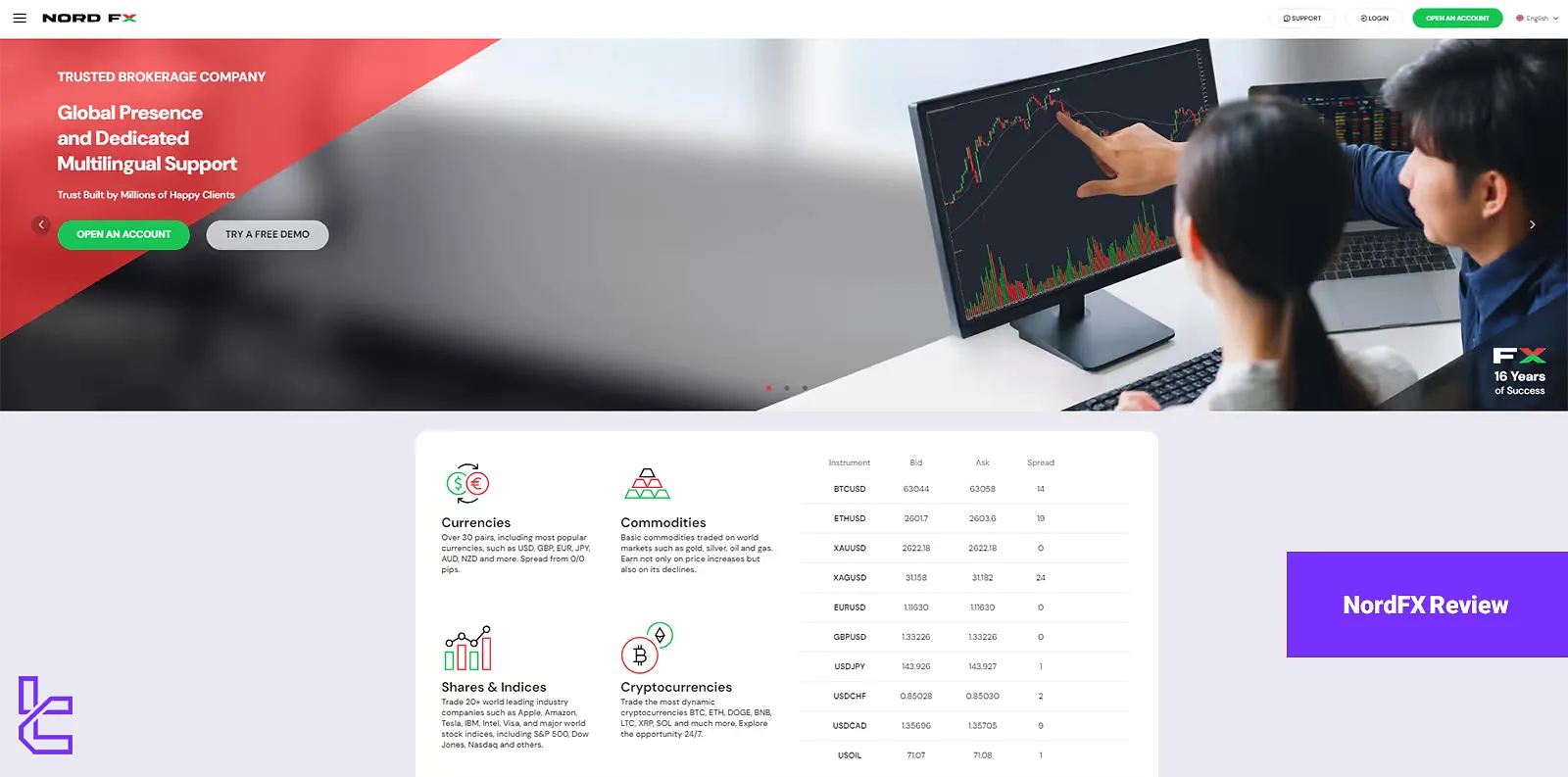

Trade Currencies, shares, Indices, Crypto, and commodities on NordFX

Trade Currencies, shares, Indices, Crypto, and commodities on NordFX

NordFX Information & Regulations

NordFX is a trusted global forex broker that has been serving traders for over 16 years. Founded in 2008, the company has become a major online trading player, boasting over 1.7 million client accounts across 190 countries.

NordFX's longevity and widespread adoption speak volumes about its reliability and the quality of its services.

Here are the regulatory details of the 3 branches of NordFX:

Parameter / Branch | NordFX LTD (Saint Lucia) | Maximus Global LTD (Seychelles) | Nord International MU LTD (Mauritius) |

Regulation | Registered company, Saint Lucia | Financial Services Authority (FSA), Seychelles | Financial Services Commission (FSC), Mauritius |

Regulation Tier | N/A | Tier 4 | N/A |

Country | Saint Lucia | Seychelles | Mauritius |

Investor Protection Fund / Compensation Scheme | Not specified | Not specified | Not specified |

Segregated Funds | N/A | Yes | Yes |

Negative Balance Protection | N/A | Yes | Yes |

Maximum Leverage | 1:1000 | N/A | N/A |

Client Eligibility | Excludes USA, Canada, EU, Russia, Cuba, Sudan, Syria, Malaysia, Panama, Indonesia, Japan, Brazil, Ukraine, North Korea | International clients (excluding restricted jurisdictions) | International clients (excluding restricted jurisdictions) |

NordFX operates without regulation from any recognized financial authority, which raises concerns about transparency and client protection.

The absence of oversight means that traders should be cautious, as there are no strict guidelines or industry best practices governing the broker's operations.

This lack of regulation can lead to increased risks for traders who may not have the same level of security and recourse as those dealing with regulated brokers.

NordFX Broker Summary of Specifics

Let's take a closer look at what makes NordFX stand out in the crowded forex broker landscape:

Broker | NordFX |

Account Types | MT4 Zero, MT4 Pro, MT5 Zero, MT5 Pro |

Regulating Authorities | Not regulated |

Based Currencies | USD |

Minimum Deposit | $10 |

Deposit Methods | Bank wire transfer, Credit/debit cards, E-wallets, Cryptocurrencies |

Withdrawal Methods | Bank wire transfer, Credit/debit cards, E-wallets, Cryptocurrencies, Internal Transfer |

Minimum Order | 0.01 |

Maximum Leverage | 1:1000 |

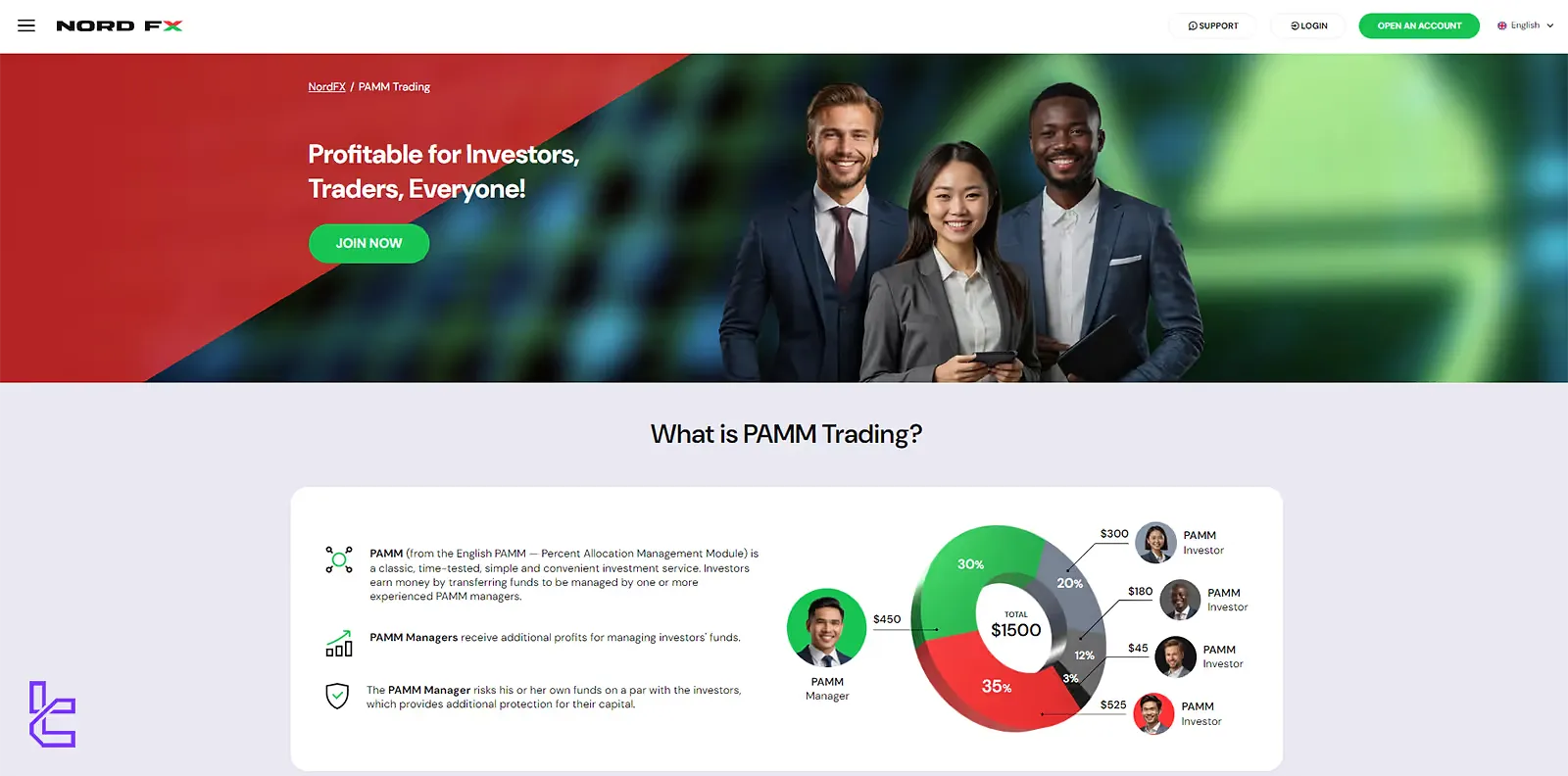

Investment Options | PAMM accounts |

Trading Platforms & Apps | MT4 / MT5 |

Markets | Crypto, Metals, FX Currencies, Energies, Indices & Stocks |

Spread | From 0.0 |

Commission | From 0 (0,0035% per trade for Zero accounts) |

Orders Execution | Market |

Margin Call/Stop Out | 40%/20% for Pro, 60%/40% for Zero |

Trading Features | CopyTrading, Demo account |

Affiliate Program | Yes |

Bonus & Promotions | No |

Islamic Account | Yes |

PAMM Account | Yes |

Customer Support Ways | Email, Phone Number |

Customer Support Hours | N/A |

NordFX offers comprehensive trading services catering to novice and experienced traders. The broker's competitive edge lies in its diverse account types, high-leverage options, and tight spreads.

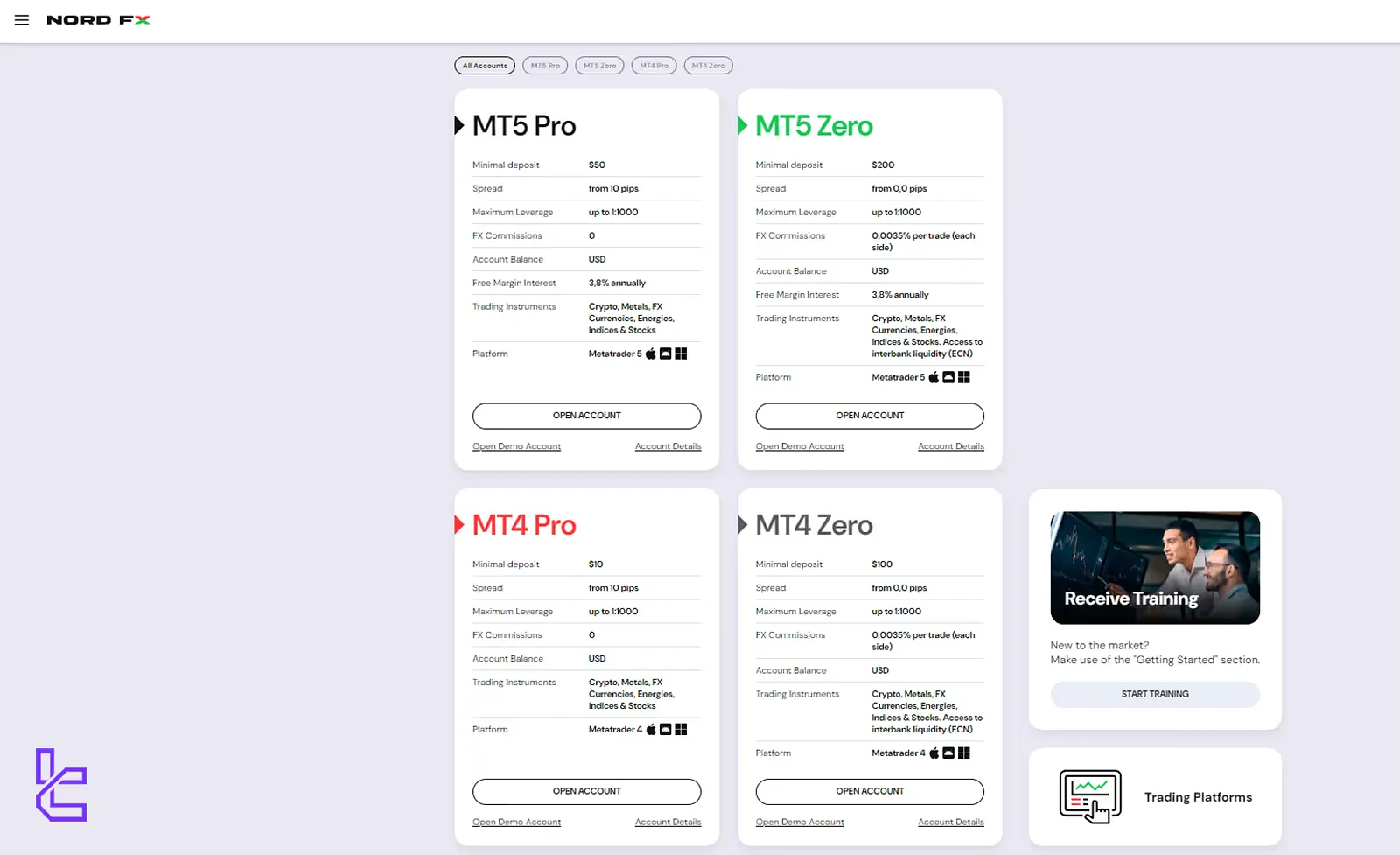

NordFX Account Types

NordFX offers a range of account types to suit different trading styles and experience levels. Here are the account options:

NordFX MT5 Pro Account

Ideal for traders seeking high leverage and zero commission on the MT5 platform, starting with a low $50 deposit:

- Minimum deposit: $50

- Spreads from: 0.0 pips

- Maximum leverage: 1:1000

- Commission: $0

NordFX MT5 Zero Account

Designed for serious MT5 traders who prefer tighter spreads and don’t mind paying a small commission per trade:

- Minimum deposit: $200

- Spreads from: 0.0 pips

- Maximum leverage: 1:1000

- Commission: 0.0035% per trade

NordFX MT4 Pro Account

A beginner-friendly MT4 account with minimal deposit requirements and commission-free trading:

- Minimum deposit: $10

- Spreads from: 0.0 pips

- Maximum leverage: 1:1000

- Commission: $0

NordFX MT4 Zero Account

Perfect for MT4 users who want ultra-low spreads with a small commission, suitable for active trading strategies:

- Minimum deposit: $100

- Spreads from: 0.0 pips

- Maximum leverage: 1:1000

- Commission: 0.0035% per trade

All account types provide access to various trading instruments, including forex pairs, cryptocurrencies, metals, indices, and stocks.

Traders can choose between MetaTrader 4 and MT5 platforms, allowing them to select the interface they're most comfortable with.

NordFX Advantages and Disadvantages

The broker claims to implement standard security measures for safeguarding client assets, including the use of segregated bank accounts and encryption technologies such as SSL and firewalls.

However, the broker does not offer investor compensation funds or insurance coverage in the event of insolvency.

Advantages | Disadvantages |

Competitive leverage up to 1:1000 | Limited research and educational resources compared to some competitors |

Negative balance protection | Only offers MT4 and MT5 platforms, no proprietary options |

Multiple account types to suit different needs | Restricted access for traders from certain countries (e.g., US, Canada, EU) |

Industry-leading MT4 and MT5 platforms | No regulations |

Tight spreads from 0.0 pips on Zero accounts | - |

Passive income opportunities through investment funds and PAMM accounts | - |

24/5 multilingual customer support | - |

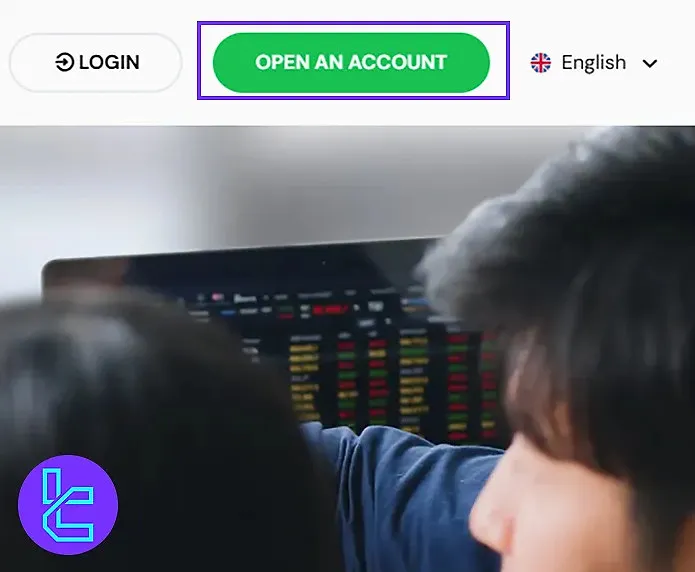

Signing Up & Verification: Complete Guide

Creating a trading account on NordFX takes just a few minutes and includes selecting your preferred platform, currency, and leverage level.

The process involves submitting essential details, such as your email address, mobile number, and country of residence, making it accessible to traders globally. NordFX registration steps:

#1 Navigate to NordFX’s Registration Portal

Start by navigating to the official NordFX website, look for the “Open an Account” button on the broker’s homepage, and proceed to the registration interface.

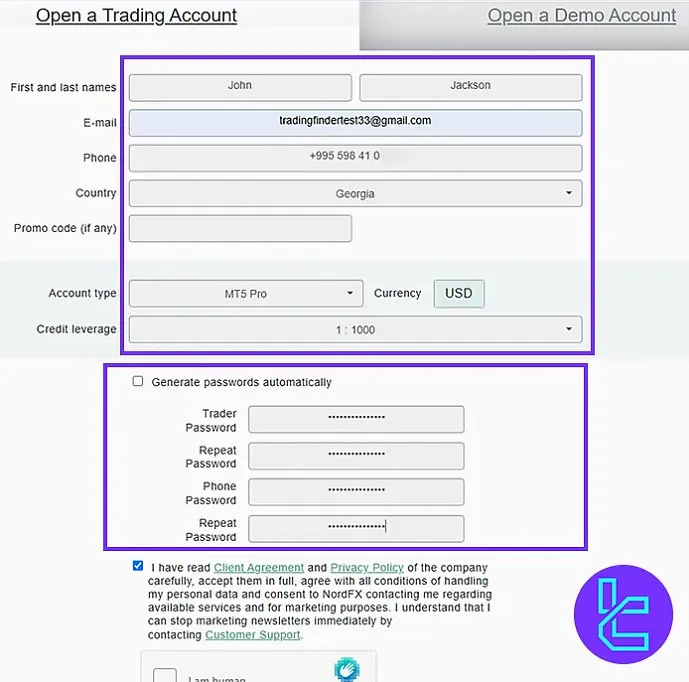

#2 Complete Your Account Details

Fill out the personal information and adjust account settings on the sign up application:

- Full name

- Phone number

- Residency country

- Trading platform

- Account currency

- Leverage

You’ll also be prompted to create strong passwords, both for the platform and mobile access. Agree to the terms, pass the CAPTCHA, and finalize your registration.

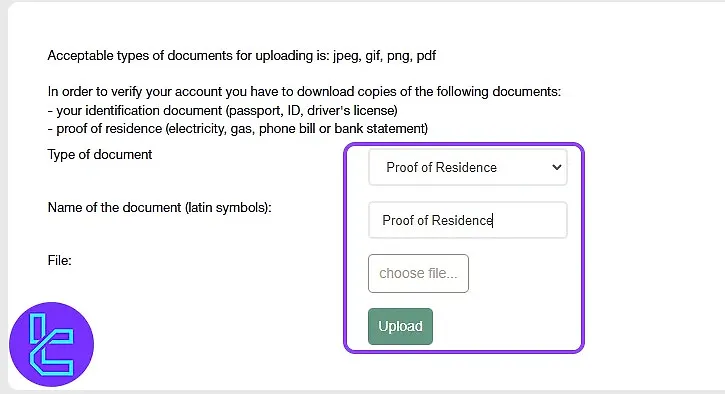

#3 NordFX KYC

For NordFX verification, log in to your client portal, then click on the “Upload Documents” button from your profile. Choose the type of documents and upload them, including:

- Proof of Identity: Passport or Driving license

- Proof of Address: Utility bill or Bank statement

The verification process typically takes 1-2 business days. Once your account is verified, you can access all NordFX trading features and start exploring the markets.

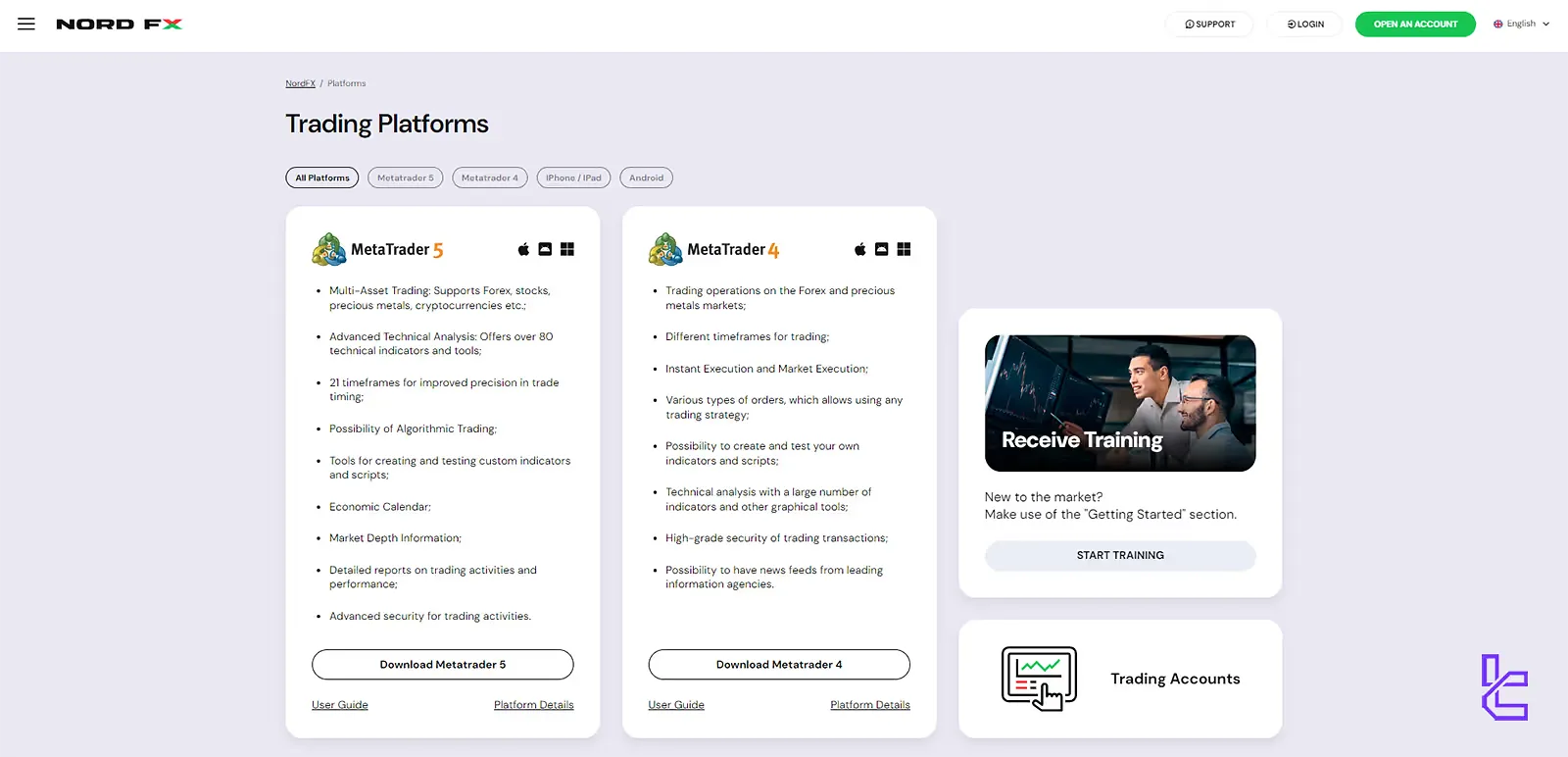

Trading Platforms

NordFX offers two of the most popular trading platforms in the forex industry:

NordFX MetaTrader 4 (MT4)

A widely trusted platform offering a user-friendly interface, advanced charting, and full support for Expert Advisors:

- Industry-standard platform

- User-friendly interface

- Advanced charting tools

- Expert Advisors (EAs) support

- Mobile trading app available

NordFX MetaTrader 5 (MT5)

The next-generation platform with enhanced analysis tools, more order types, and superior back-testing capabilities for serious traders:

- Next-generation platform

- Enhanced analytical trading tools

- More timeframes and pending order types

- Integrated economic calendar

- Improved back-testing capabilities

Both platforms provide:

- Real-time quotes

- One-click trading

- Multiple order types

- Customizable interface

- Extensive indicator library

- Automated trading capabilities

NordFX ensures that traders access robust, reliable platforms catering to various trading styles and strategies. To simplify your job, here are the MetaTrader4/5 links given below:

TradingFinder has developed a wide range of MT4 and MT5 indicators that you can use for free.

Additionally, NordFX offers VPS hosting to support uninterrupted automated trading and integrates with MQL5 for copy trading and trading signal subscriptions.

Spreads and Commissions explained

NordFX offers competitive pricing structures across its account types:

- Pro Accounts: Spreads startfrom 10.0 pips with no commissions;

- Zero Accounts: Spreadsfrom 0.0 pips with a small commission of 0.0035% per trade.

The Zero accounts provide direct access to liquidity providers, offering institutional-grade spreads. This makes NordFX particularly attractive for high-volume traders and scalpers.

It's noteworthy that spreads can widen during high market volatility or low liquidity. Additionally, overnight positions may incur swap fees, which vary depending on the instrument and direction of the trade.

NordFX charges no fees for deposits. Withdrawal fees are dependent on the chosen payment method. The broker does not publicly disclose any inactivity fees, indicating a relatively trader-friendly cost model for active users.

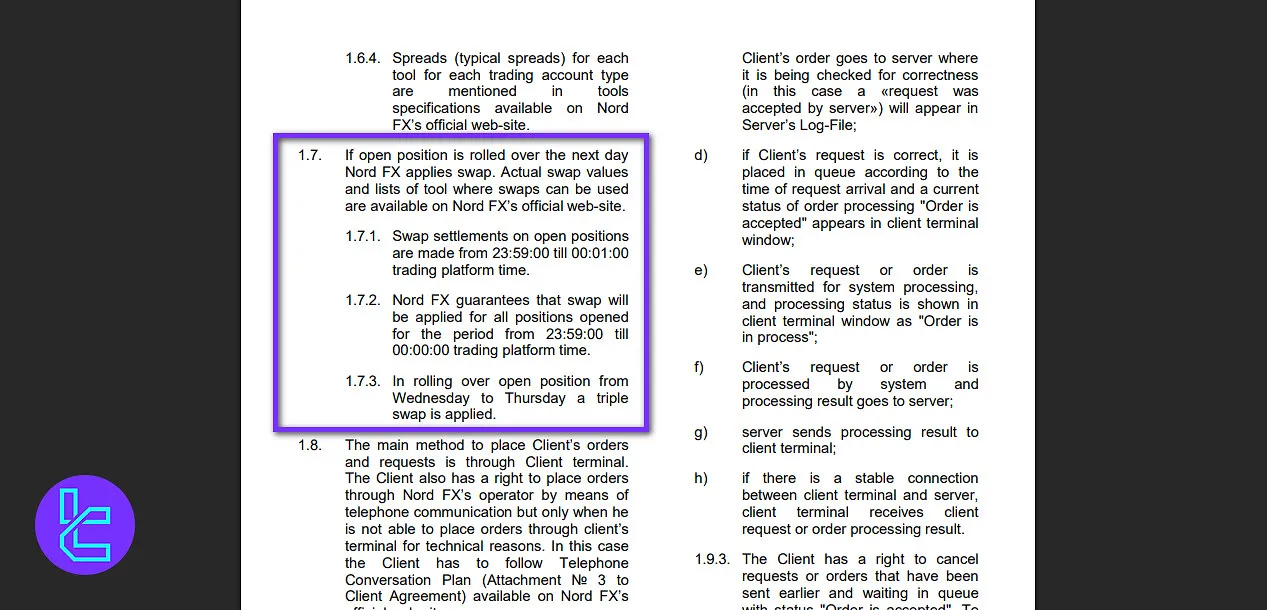

NordFX Swap Fees

When a trading position remains open overnight, NordFX applies a swap, a financing adjustment reflecting interest rate differentials between traded currencies or instruments.

The swap calculation occurs daily between 23:59 and 00:01 platform time, ensuring all open trades during that window are subject to the appropriate rollover adjustment.

Additionally, positions held from Wednesday to Thursday incur a triple swap, accounting for weekend days when trading is paused.

Traders can find the exact swap rates and the list of instruments they apply to on the official NordFX website, where rates are updated regularly to reflect market conditions.

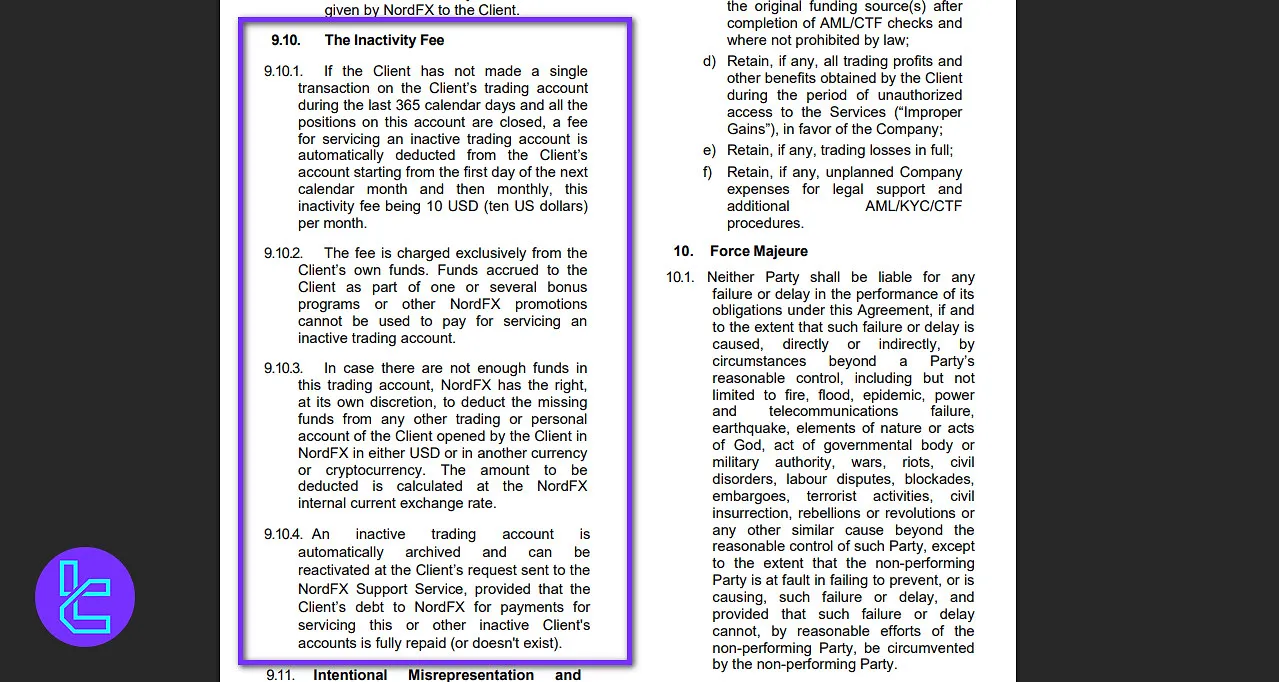

NordFX Non-Trading Fees

A non-trading fee is applied by NordFX to accounts that have been inactive for 365 consecutive days, provided all open positions have been closed.

Beginning on the first day of the following month, a $10 monthly maintenance charge is automatically deducted.

This fee is drawn only from the client’s own funds, meaning that bonus credits or promotional balances cannot be used to cover it.

If the account balance is insufficient, NordFX reserves the right to recover the outstanding amount from any other account held by the same client, whether denominated in USD, another fiat currency, or cryptocurrency, using the broker’s internal exchange rate for conversion.

NordFX does not charge fees for deposits and withdrawals, but some methods have third-party fees.

Deposit & Withdrawal System

NordFX offers a wide range of payment options to cater to its global client base. Key points about NordFX payment methods:

- Most deposits are processed instantly;

- Withdrawals are done within 24 hours;

- Minimum deposit varies by account type (from $10);

- No fees are charged by NordFX for deposits or withdrawals (third-party fees may apply).

NordFX Deposit Methods

NordFX supports a wide range of deposit methods covering bank transfers, cards, e-wallets, regional systems, and cryptocurrencies.

Most payment options are processed instantly and without commission, while a few may involve minimal fees or short processing delays, depending on the provider or region.

Deposits can be made in major global currencies, including USD, EUR, GBP, JPY, and BRL, as well as local and digital currencies such as BTC, ETH, and USDT across multiple blockchain networks (TRC20, ERC20, BEP20).

Here are the details of various NordFX deposit methods:

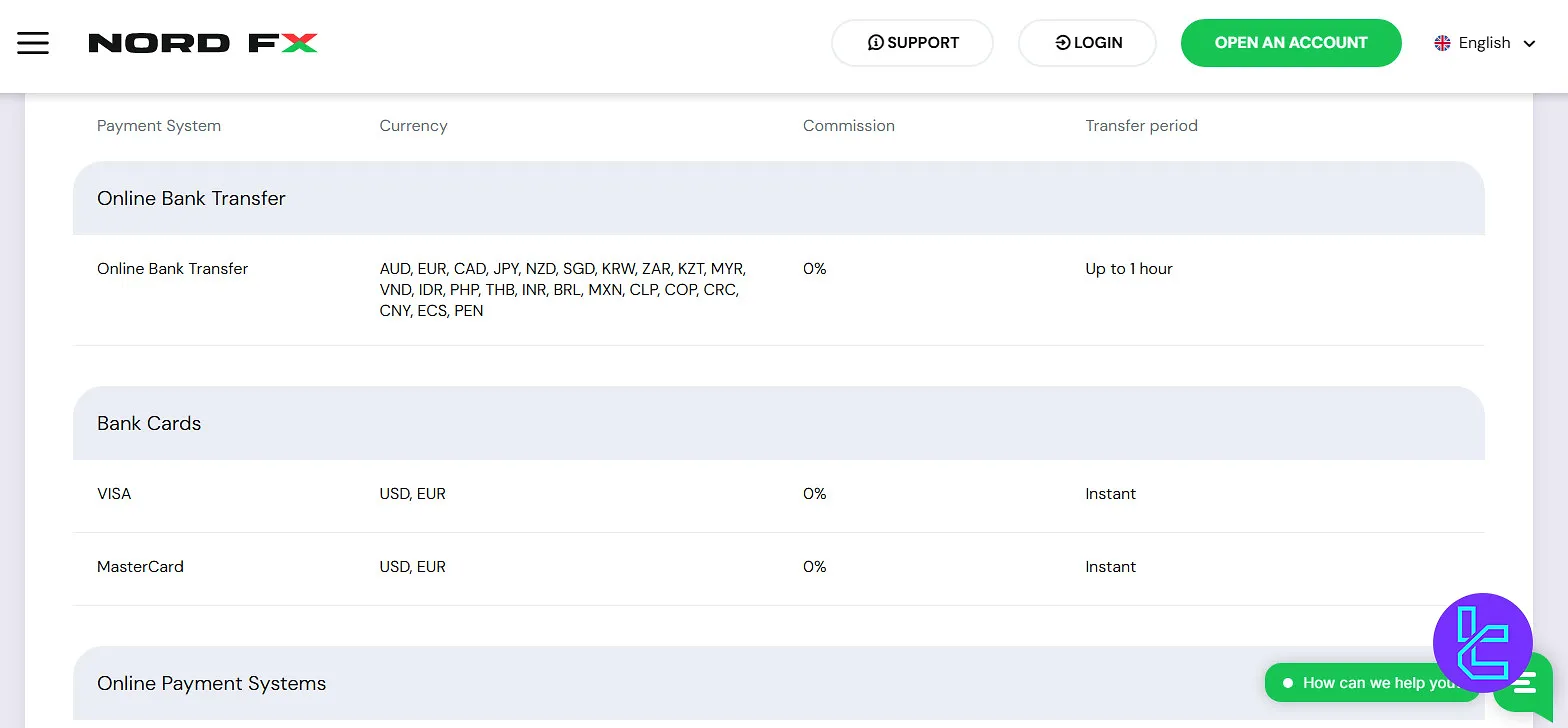

Category | Payment Systems | Supported Currencies | Commission | Processing Time |

Online Bank Transfer | Online Bank Transfer | AUD, EUR, CAD, JPY, NZD, SGD, KRW, ZAR, KZT, MYR, VND, IDR, PHP, THB, INR, BRL, MXN, CLP, COP, CRC, CNY, ECS, PEN | 0% | Up to 1 hour |

Bank Cards | VISA, MasterCard | USD, EUR | 0% | Instant |

Online Payment Systems | Skrill, NETELLER, Perfect Money, Help2Pay, PayToday, Thailand QR Code, Vietnam QR Code, Dragonpay, FasaPay, SticPay, PIX Brazil, BOLETO Brazil, OXXO Mexico, FairPay, Turkey QR Code, Bangladesh Nagad/Bkash, Pinikle Voucher | Multi-currency support (USD, EUR, local currencies) | Mostly 0% (Perfect Money: 0.5–1.99%, PayToday: 4%) | Instant or up to 1 hour |

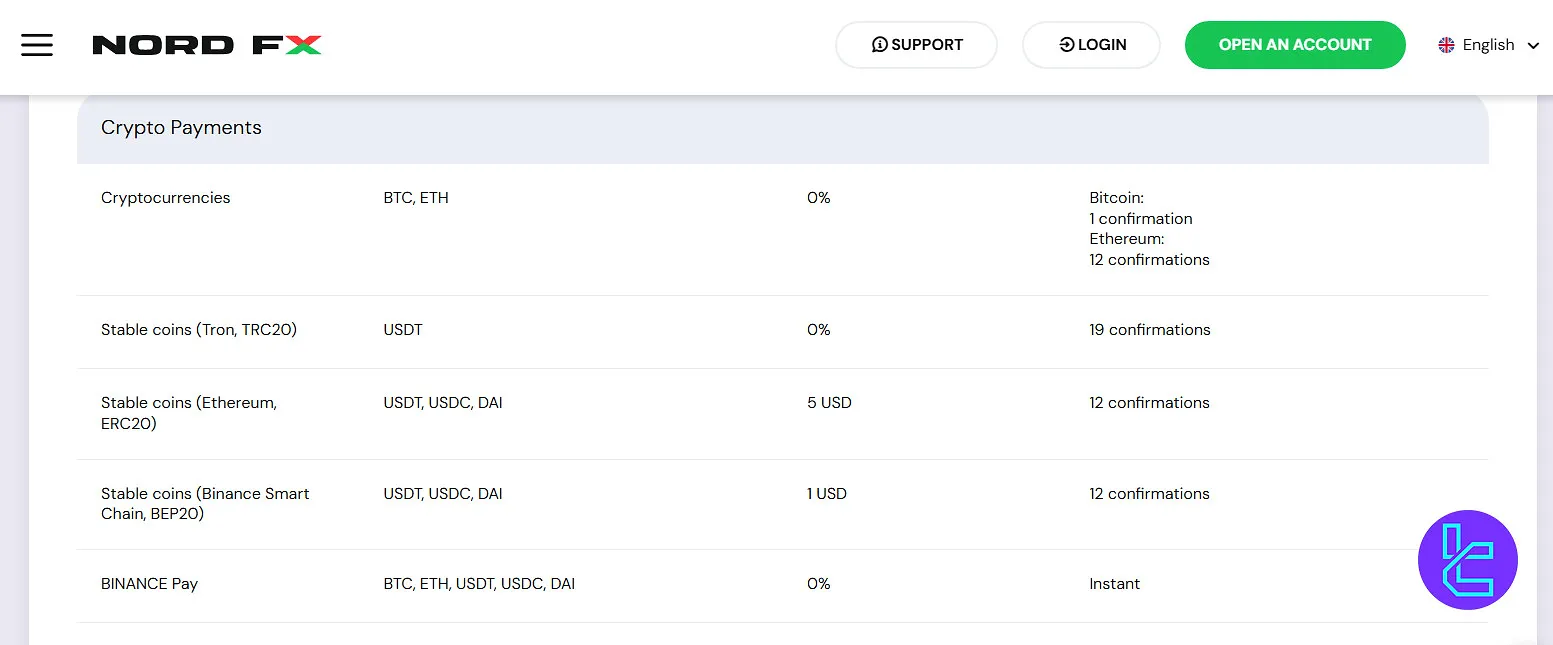

Crypto Payments | Bitcoin (BTC), Ethereum (ETH), Stablecoins (USDT, USDC, DAI via TRC20, ERC20, BEP20), Binance Pay | BTC, ETH, USDT, USDC, DAI | 0% | 1–19 blockchain confirmations or Instant (Binance Pay) |

Mobile Payments (Africa) | Cameroon, Ghana, Kenya, Rwanda, Tanzania, Uganda Mobile Payments | XAF, GHS, KES, RWF, TZS, UGX | 0% | Up to 1 hour |

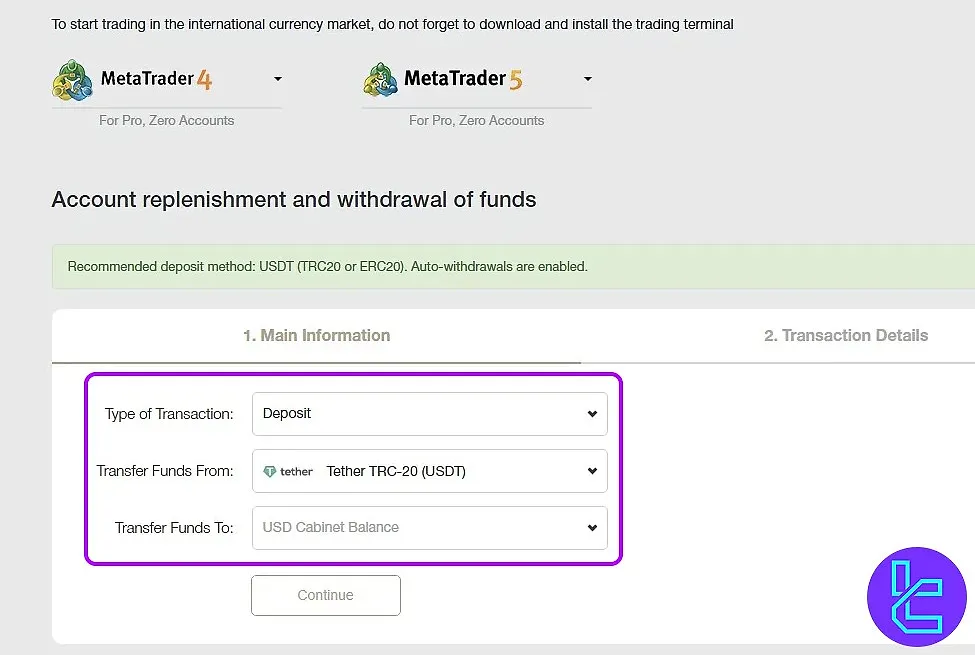

NordFX TRC20 Deposit

Funding a NordFX account with Tether (USDT) via the TRC20 (Tron) network is a quick, four-step process that typically takes around five minutes.

- Access the Deposit Section: Log in to your verified NordFX account and open the “Funds Deposit” page from the dashboard;

- Choose USDT (TRC20): Select Tether (USDT) on the TRC20 network as your deposit method and specify the target trading account;

- Copy the Wallet Address: A unique TRC20 wallet address will appear. Copy it and send your USDT from your crypto wallet to this address;

- Confirm the Transaction: Once completed, the deposit will appear in your Deposit History, reflecting the updated account balance.

The process of NordFX TRC20 deposit is designed to be simple and beginner-friendly, with full visibility through the Deposit History tab.

NordFX also supports deposits via ERC20 (Ethereum) for users who prefer that blockchain network.

NordFX Withdrawal Options

NordFX provides a broad selection of withdrawal options, including traditional bank transfers, e-wallets, regional payment systems, and cryptocurrency networks.

Processing times vary depending on the provider, with most requests completed instantly or within one business day.

Fees differ across methods, typically ranging from 0% to 5%, reflecting network or service provider charges rather than NordFX’s internal commission.

Here are all of the withdrawal methods offered by NordFX:

Category | Payment Systems | Supported Currencies | Commission | Processing Time |

Online Bank Transfer | Standard Bank Transfer | NGN, MXN, JPY, ARS | 3% | Up to 1 hour |

Bank Transfer (VND) | VND, INR, ZAR | 2% | Up to 1 hour | |

Online Payment Systems | Skrill, NETELLER, Perfect Money, PayToday, Dragonpay, Help2Pay, Bangladesh Nagad/Bkash, Philippines G-Cash, FasaPay | USD, EUR, IDR, PHP, THB, MYR, VND, BDT | 0%–5% (varies by provider) | Instant to 1 business day |

Internal Transfer | Between NordFX Accounts | USD, EUR | 0% | Instant (consolidated) or within 1 business day |

Crypto Payments | Bitcoin (BTC), Ethereum (ETH), Stablecoins (USDT, USDC, DAI) via TRC20, ERC20, BEP20, Binance Pay | BTC, ETH, USDT, USDC, DAI | 0%–$5 fixed fee | 1–19 confirmations or Instant (Binance Pay) |

The diverse payment options and quick processing times make funding and withdrawing from your NordFX account a hassle-free experience.

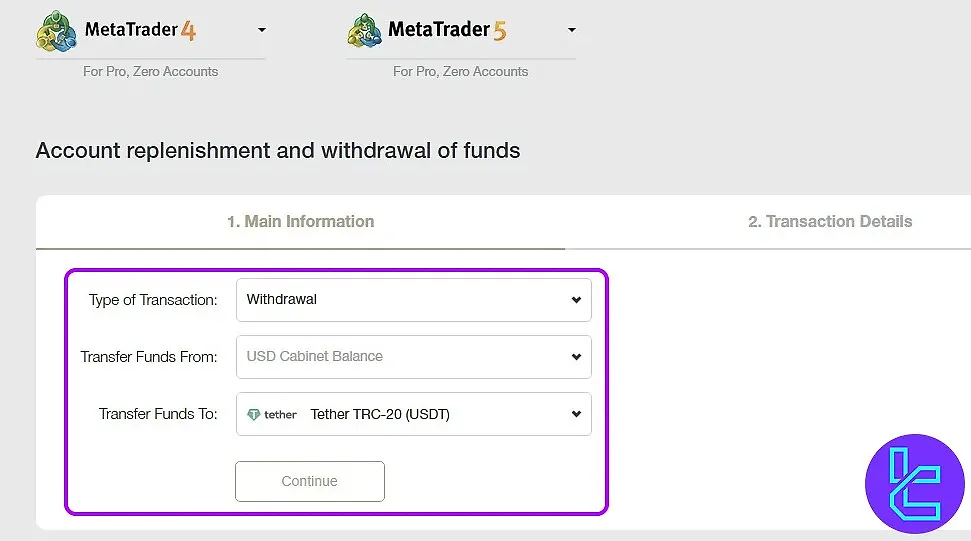

NordFX TRC20 Withdrawal

The NordFX TRC20 withdrawal process is simple and completed in seven steps.

Users log in to their NordFX dashboard, select the trading account, and specify the withdrawal amount.

Then, they choose Tether TRC20 as the payout method, enter their TRC20 wallet address, confirm the details, and submit the request.

Key details:

- Verification is mandatory before any withdrawal

- No transaction fee is charged for TRC20 withdrawals

- Processing usually takes a few minutes

- Users can monitor their transaction progress via the “Withdrawal History” section

Copy Trading & Investment Options

NordFX provides several options for traders looking to diversify their investment strategies:

NordFX Copy Trading

- Automatically copy trades of successful traders;

- Choose from a selection of signal providers;

- Set risk parameters and allocation amounts;

- Monitor performance in real-time.

NordFX PAMM Accounts

- Invest in professionally managed accounts;

- Transparent performance tracking;

- Flexible investment terms.

These services allow novice and experienced traders to benefit from the expertise of successful traders and fund managers.

Tradable Markets & Symbols Overview

NordFX offers a diverse range of tradable instruments:

Category | Type of Instruments | Number of Symbols | Competitor Average | Maximum Leverage |

Forex | Major, Minor & Exotic Currency Pairs | 33+ Currency Pairs | 50–70 Currency Pairs | 1:1000 |

Cryptocurrencies | CFDs on digital assets (BTC, ETH, LTC, etc.) | 11+ Cryptos | 10–20 Cryptos | N/A |

Metals | Gold & Silver CFDs | 2 Instruments | 2–5 Instruments | N/A |

Energies | CFDs on Crude Oil & Natural Gas | 2 Instruments | 2–5 Instruments | N/A |

Indices | Global Index CFDs (S&P 500, NASDAQ, DJIA, etc.) | Around 10 Indices | 10–20 Indices | N/A |

Stocks | CFDs on major global companies (via MT5) | 100+ Global Stocks | 800–1200 | N/A |

This diversified selection supports both short-term speculation and long-term trading strategies, particularly appealing to traders looking for high leverage opportunities.

NordFX Forex Broker Bonuses and Promotions

NordFX does not offer any bonuses or promotions, including deposit bonuses or sign-up bonuses. Traders looking for additional incentives, such as bonus capital or promotional offers, will not find these features with NordFX.

It's important for potential clients to be aware of this when considering their options, as other brokers may provide such benefits.

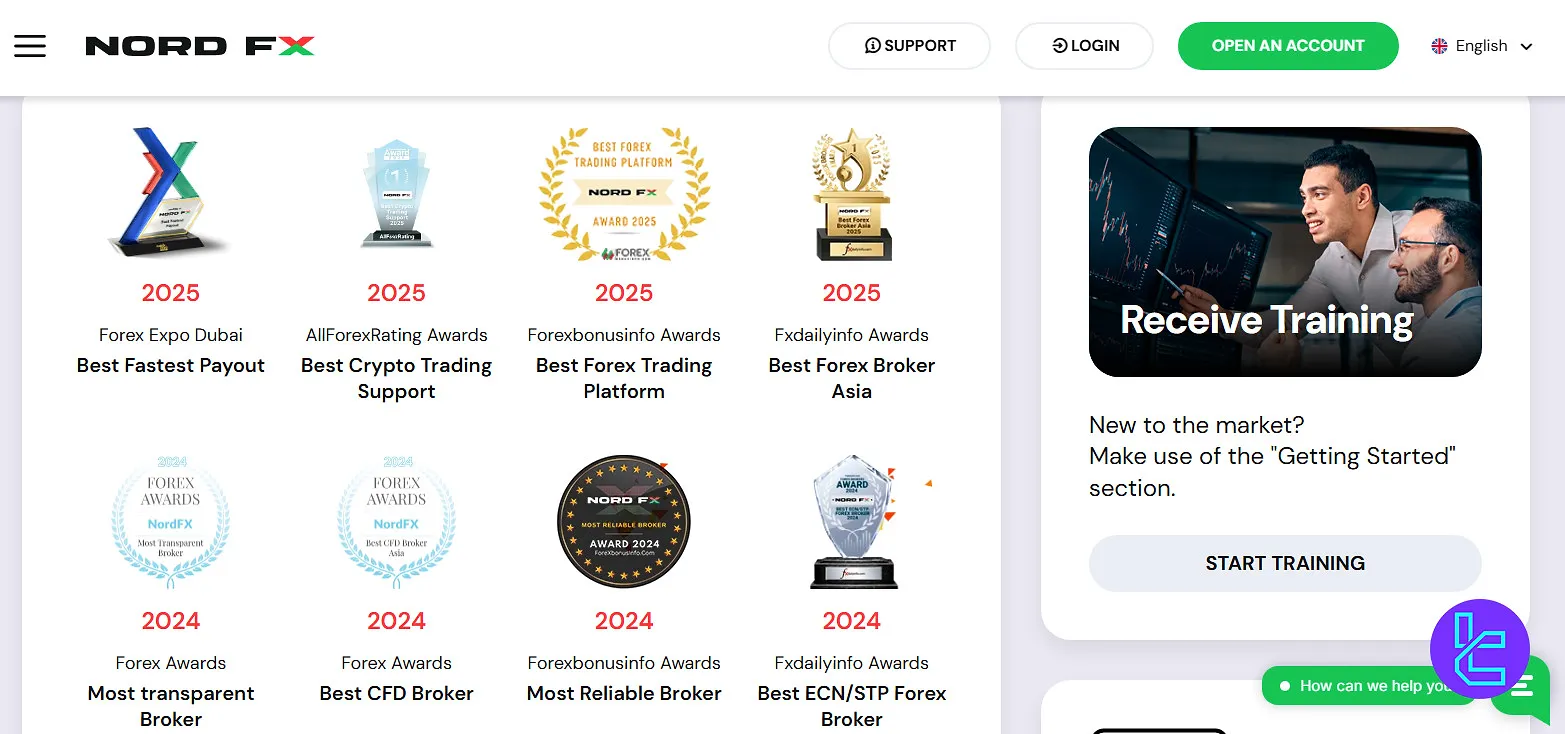

NordFX Awards

Over recent years, NordFX has earned consistent recognition across multiple global financial industry platforms for its excellence in trading technology, transparency, and client services.

In 2025, the broker received several distinctions, including Best Fastest Payout at the Forex Expo Dubai, Best Crypto Trading Support from AllForexRating Awards, Best Forex Trading Platform by Forexbonusinfo Awards, and Best Forex Broker Asia from Fxdailyinfo Awards.

The year 2024 also brought a strong lineup of achievements. Forex Awards named NordFX both Most Transparent Broker and Best CFD Broker, while Forexbonusinfo Awards highlighted it as the Most Reliable Broker.

Fxdailyinfo Awards recognized NordFX as the Best ECN/STP Forex Broker, and World Forex Award honored the company with The Most Trusted Broker and The Best IB Program titles.

Together, these NordFX awards reflect the broker’s consistent performance, innovation, and reliability across different market segments and global regions.

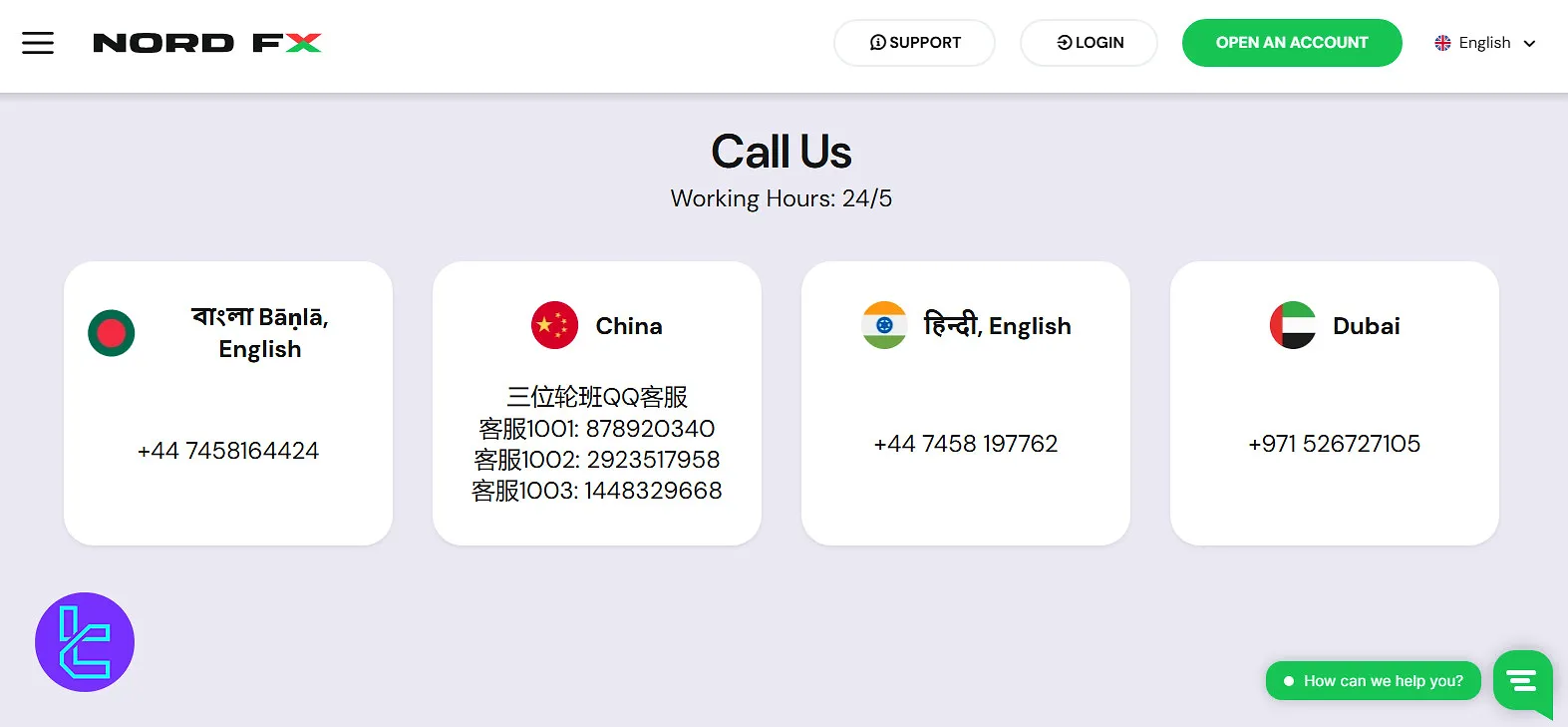

NordFX Broker Support

The broker provides comprehensive customer support:

- 24/5 multilingual support

- Support channels: Email & phone call

- Languages supported: English, Bangla, Hindi, and more

You can contact the support team through these phone numbers:

- China

- Customer Service 1001: QQ 878920340

- Customer Service 1002: QQ 2923517958

- Customer Service 1003: QQ 1448329668

- Europe: +357-25030262

- India (हिन्दी, English): +972559662836

- Philippines: +632 8538-1162

- Sri Lanka (සිංහල, English): +357-25030262

- Thailand: +66600035101

- Dubai: +971526727105

- Global Support: +44 2038688742

- Bangladesh (বাংলা, English): +447458197795

The broker's commitment to customer service ensures that traders can get assistance whenever needed, enhancing the overall trading experience.

NordFX Broker List of Restricted Countries

While NordFX serves clients from over 190 countries, it does have restrictions for some jurisdictions:

- United States

- Canada

- European Union countries

- Russian Federation

- Cuba

- Sudan

- Syria

Traders from these countries are unable to open accounts with NordFX due to regulatory restrictions.

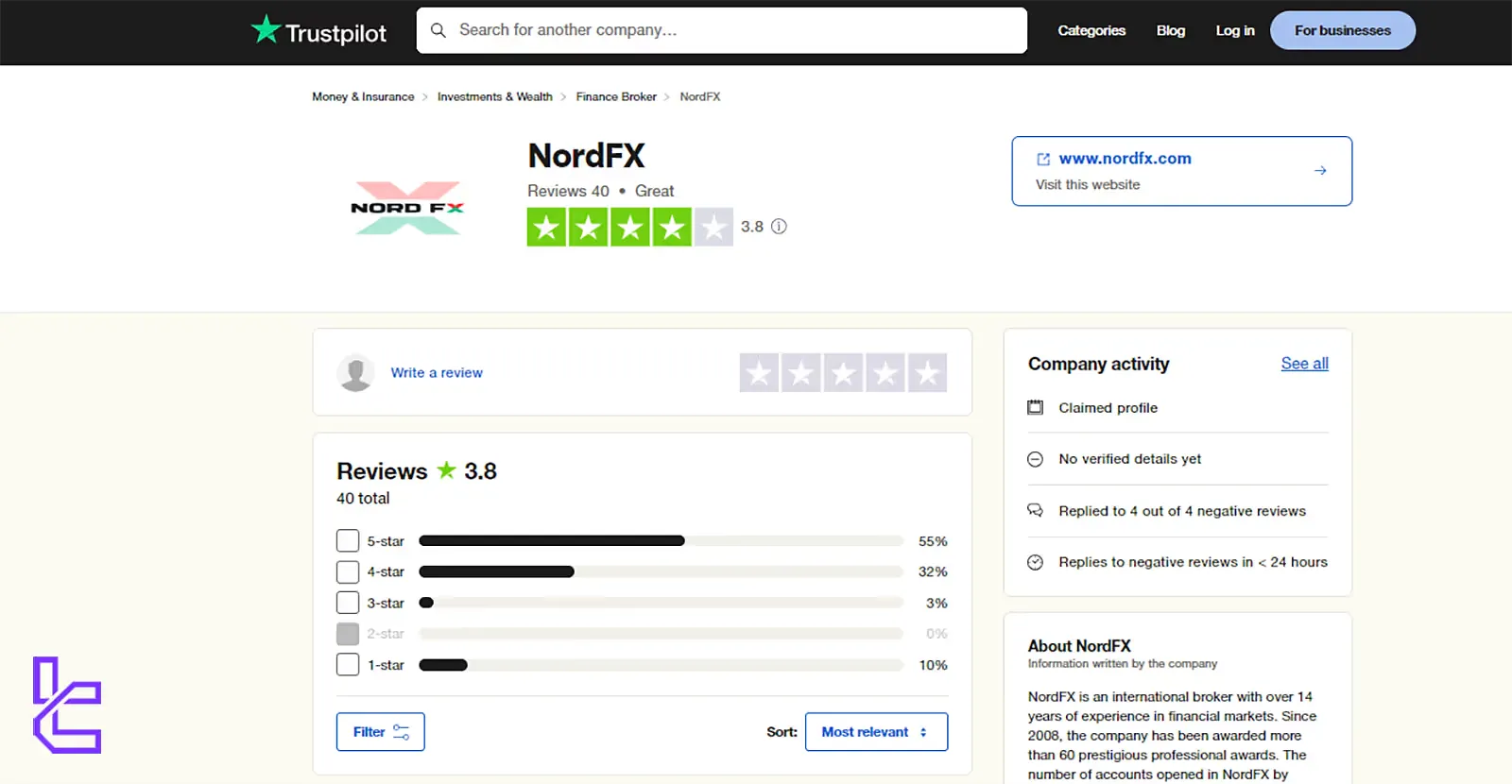

NordFX Broker Trust Scores & Reviews

The NordFX Trustpilot profile has received a TrustScore of 3.8 out of 5 from 40 reviews.

The majority of users (55%) rate the broker 5 stars, highlighting positive experiences with services such as affiliate programs, dedicated account managers, and efficient trading and withdrawal processes.

There are also several 1-star reviews (10%) that criticize the broker for issues related to account access, withdrawal difficulties, and customer service response times.

Although some customers report smooth and satisfactory transactions, others claim their withdrawals were blocked or delayed, raising concerns about the reliability of NordFX’s financial processes.

Positive Feedback:

- Good trading services, especially for BTC/USDT

- No issues with deposits and withdrawals, as reported by long-term users

- Affiliate program praised for its commission rates and daily withdrawals

- Dedicated Relationship Managers available for all account sizes

- Low spreads

Negative Feedback:

- Complaints about blocked withdrawals and frozen accounts

- Delayed response from customer service, especially in resolving financial issues

- Difficulty in using certain withdrawal methods like Binance Pay

Education on NordFX Broker

The NordFX Learning Center offers a range of educational resources, making it a practical and accessible hub for traders looking to enhance their trading strategies.

One key feature of the learning center is its comprehensive Glossary, which helps new traders understand the terminology and concepts used in the financial markets.

Additionally, NordFX broker provides useful articles that cover a wide array of topics, from basic trading principles to advanced strategies, allowing traders to expand their understanding of the market gradually.

The platform also emphasizes the importance of understanding Trading Platforms like MT4 and MT5, offering guidance on how to navigate and utilize these tools effectively.

Moreover, NordFX highlights the variety of Trading Accounts available, ensuring traders can match their learning and trading experience with the appropriate account type.

This education model promotes a structured learning approach, providing traders with the necessary theoretical knowledge and practical tools to succeed in Forex trading.

Check TradingFinder's Forex education section for additional resources.

NordFX vs Other Brokers

Let's check NordFX's standing in the financial world compared to top forex brokers:

Parameter | NordFX Broker | |||

Regulation | No | No | FSA, CySEC, ASIC | Standard, Standard Cent, pro, Raw Spread, Zero |

Minimum Spread | From 0.0 pips | 0.1 Pips | 0.0 Pips | 0.0 Pips |

Commission | From $0.0 | $0 | Average $1.5 | From $0.2 |

Minimum Deposit | $10 | $1 | $200 | $10 |

Maximum Leverage | 1:1000 | 1:3000 | 1:500 | Unlimited |

Trading Platforms | MT4, MT5 | MetaTrader 4, MetaTrader 5 | Metatrader 4, Metatrader 5, cTrader, cTrader Web, IC Markets Mobile | Exness Trade (mobile), Exness Terminal (web), MT4, MT5 |

Account Types | MT4 Zero, MT4 Pro, MT5 Zero, MT5 Pro | Standard, Premium, VIP, CIP | Standard, Raw Spread, Islamic | Standard, Standard Cent, pro, Raw Spread, Zero |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | 500+ | 45 | 2,250+ | 230+ |

| Trade Execution | Market | Market, Instant | Market | Market, Instant |

Conclusion and final words

With the availability of copy trading and PAMM accounts, NordFX offers unique features for new and experienced traders.

NordFX operates without regulation, which may be a concern for some traders. It restricts access in several countries, including the USA, Canada, and the countries from the EU.

While the broker does not offer bonuses or promotions and has limited educational resources, its customer support is available in multiple languages, 24/5, allowing traders to get help whenever needed.