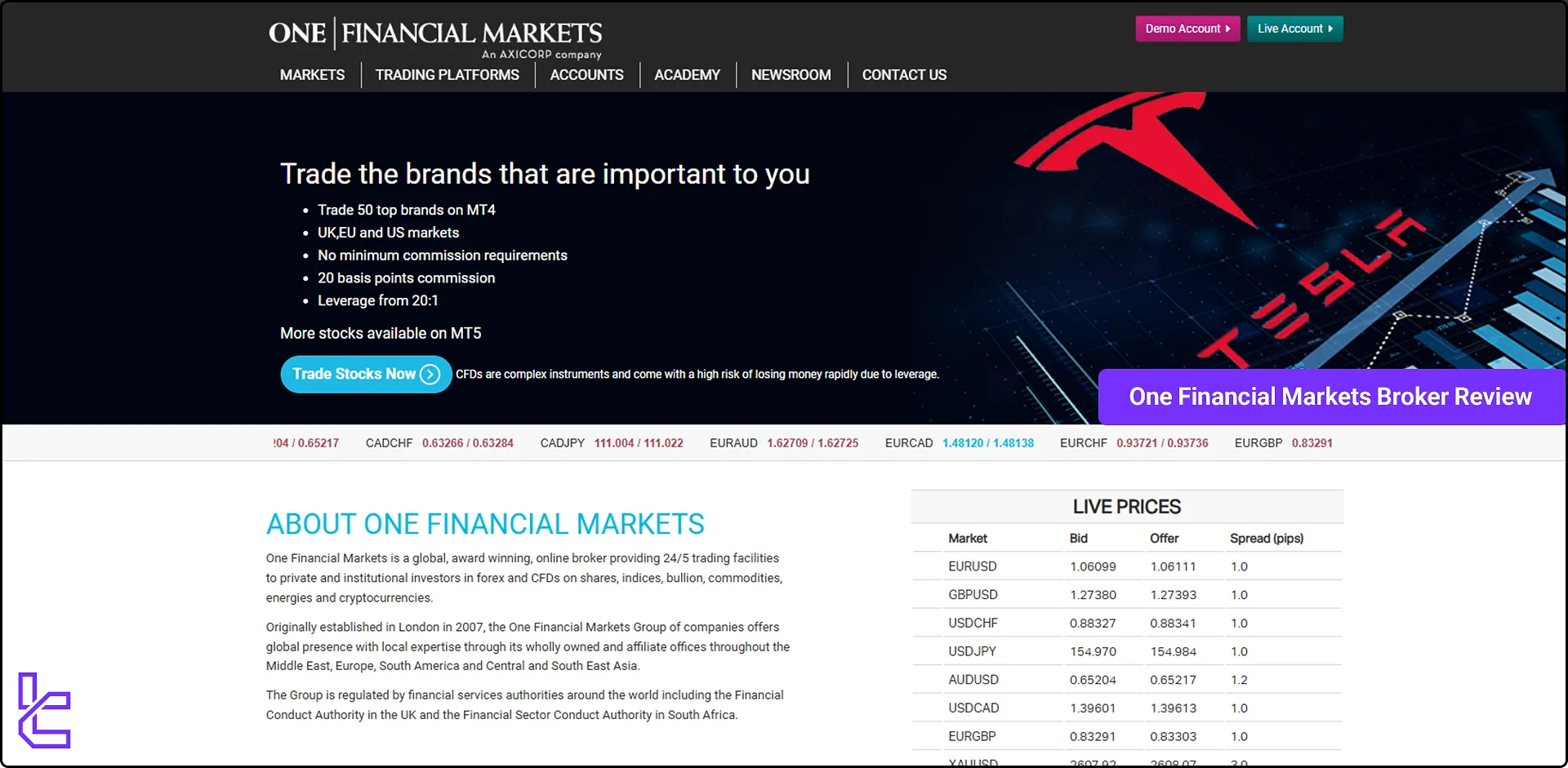

One Financial Markets is the trade name of Axi Financial Services Ltd, a registered company in London, United Kingdom. Founded in 2007, this award-winning broker (8 Prestigious awards) provides over 60 currency pairs and various instruments in 7 markets for individual and institutional traders.

One Financial Markets has multiple branches worldwide and operates under the supervision of reputable regulators such as the FCA, FSCA, and FSA.

Company Information & Regulations of One Financial Markets Broker

One Financial Markets, founded in 2007 in London, has become an award-winning online broker. This forex broker is now part of the Axi Group of companies, further solidifying its position in the financial markets. Key points about One Financial Markets:

- Established year: 2007

- Founding location: London

- Global presence: Offices throughout the Middle East, Europe, South America, and Central/Southeast Asia

- Regulated by the Financial Conduct Authority (FCA) in the UK [Reference number 466201]

- Operates based on the Financial Sector Conduct Authority (FSCA) in South Africa standards

The broker's strong regulatory oversight by respected financial authorities like the FCA and FSCA provides traders with an added layer of security and peace of mind.

The company offers segregated client funds and claimsnegative balance protection on standard accounts.

Entity Parameters / Branches | Axi Financial Services (UK) Ltd | One Financial Markets (FSP) | AxiTrader / OFM (SVG) | One Financial Markets (DIFC) |

Regulation | FCA (466201) | FSCA (FSP 45784) | FSA (SVG) | DFSA |

Regulation Tier | 1 | 2 | N/A | 2 |

Country | United Kingdom | South Africa | St Vincent & Grenadines | United Arab Emirates |

Investor Protection Fund / Compensation | FSCS up to £85,000 | None | None | None |

Segregated Funds | Yes | Yes | No | N/A |

Negative Balance Protection | Yes | Yes | No | N/A |

Maximum Leverage | 1:400 (Professional Accounts) | 1:500 | 1:500 | N/A |

Client eligibility (served regions) | UK clients | South Africa & many African countries | International excludes restricted jurisdictions (e.g., US) | UAE clients |

With over 580 tradable instruments, the broker has positioned itself as a versatile CFD and forex provider. Over the years, it has earned multiple awards such as “Best Customer Service” (2018) and “Top International Forex Broker” (2015), reflecting its reputation in client support and education.

One Financial Markets Broker Specifications Table

Here’s a general overview of the information you need to know about One Financial Markets:

Broker | One Financial Markets |

Account Types | Standard, Professional, Demo |

Regulating Authorities | FCA, FSCA, FSA, DFSA |

Based Currencies | $USD, £GBP, €EUR |

Minimum Deposit | $250 |

Deposit Methods | Bank transfer, Skrill, Neteller, Visa/MasterCard |

Withdrawal Methods | Bank transfer, Skrill, Neteller, Visa/MasterCard |

Minimum Order | 0.01 Lot |

Maximum Leverage | 1:500 |

Investment Options | Copy trading |

Trading Platforms & Apps | MT4, MT5, WebTrader |

Markets | Forex, indices, commodities, stocks, cryptocurrencies, energies, bullion |

Spread | Floating from 1.0 pips |

Commission | From $2.0 |

Orders Execution | Market |

Margin Call/Stop Out | 100%/50% |

Trading Features | Demo account, One indicator, economic calendar, copy trading app |

Affiliate Program | Yes |

Bonus & Promotions | No |

Islamic Account | Yes |

PAMM Account | No |

Customer Support Ways | Email, live chat, phone, WhatsApp, FAX |

Customer Support Hours | 24/5 |

Restricted Countries | Iran, USA, North Korea, Canada, and more |

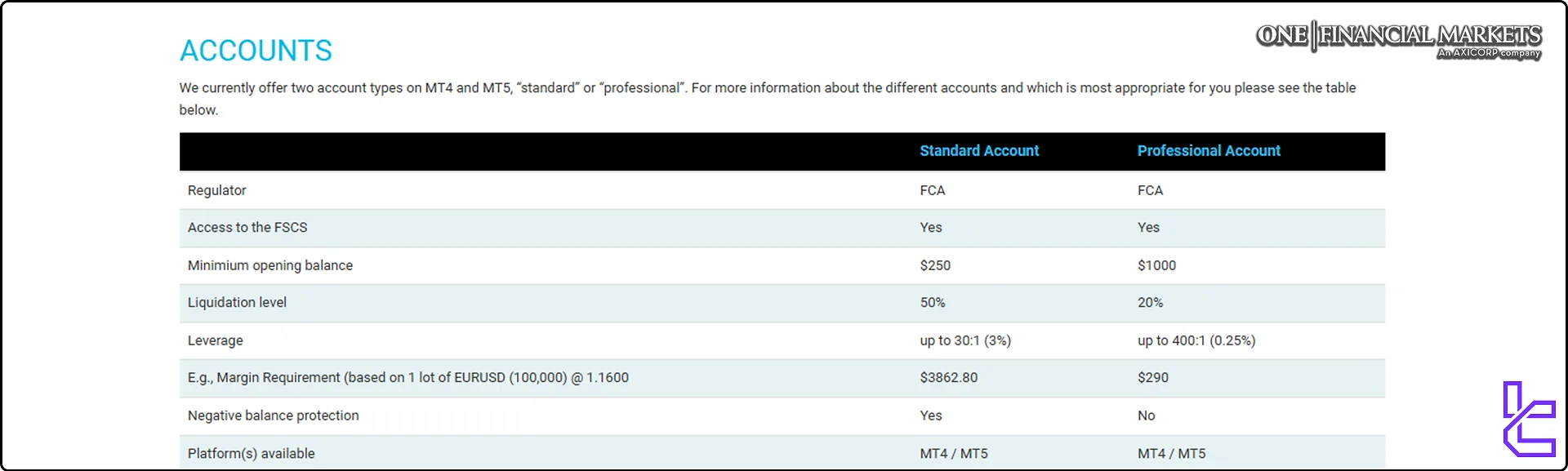

One Financial Markets Accounts Overview

One Financial Markets offers two main account types to cater to different trader needs:

Account types | Standard | Professional |

Minimum deposit | $250 | $1000 |

Minimum trading volume | 0.01 Lot | 0.01 Lot |

Maximum Leverage | 1:30 | 1:400 |

Average spreads | Floating from 1.0 pips | |

Commission | $0 | $2 |

Trading platform | MT4, MT5, WebTrader | MT4, MT5, WebTrader |

Stop Out | 50% | 20% |

One Financial Markets trading costs are relatively higher than the industry average, which is a drawback for many traders.

Note: The Professional account doesn't offer negative balance protection.

One Financial Markets also offers a demo account. Key features of this account type:

- Risk-free practice environment

- Real market conditions access

- Perfect for testing trading strategies and learning platforms

One Financial Markets Broker Advantages and Disadvantages

To decide whether One Financial Markets is a good option to consider, we have reviewed its pros and cons:

Advantages | Disadvantages |

Regulated by FCA and FSCA | Limited accounts |

Wide range of trading instruments | High minimum deposit accounts |

Supports MT4 and MT5 trading platforms | Negative user reviews on Trustpilot |

Various deposit and withdrawal methods | Higher than the industry average spreads |

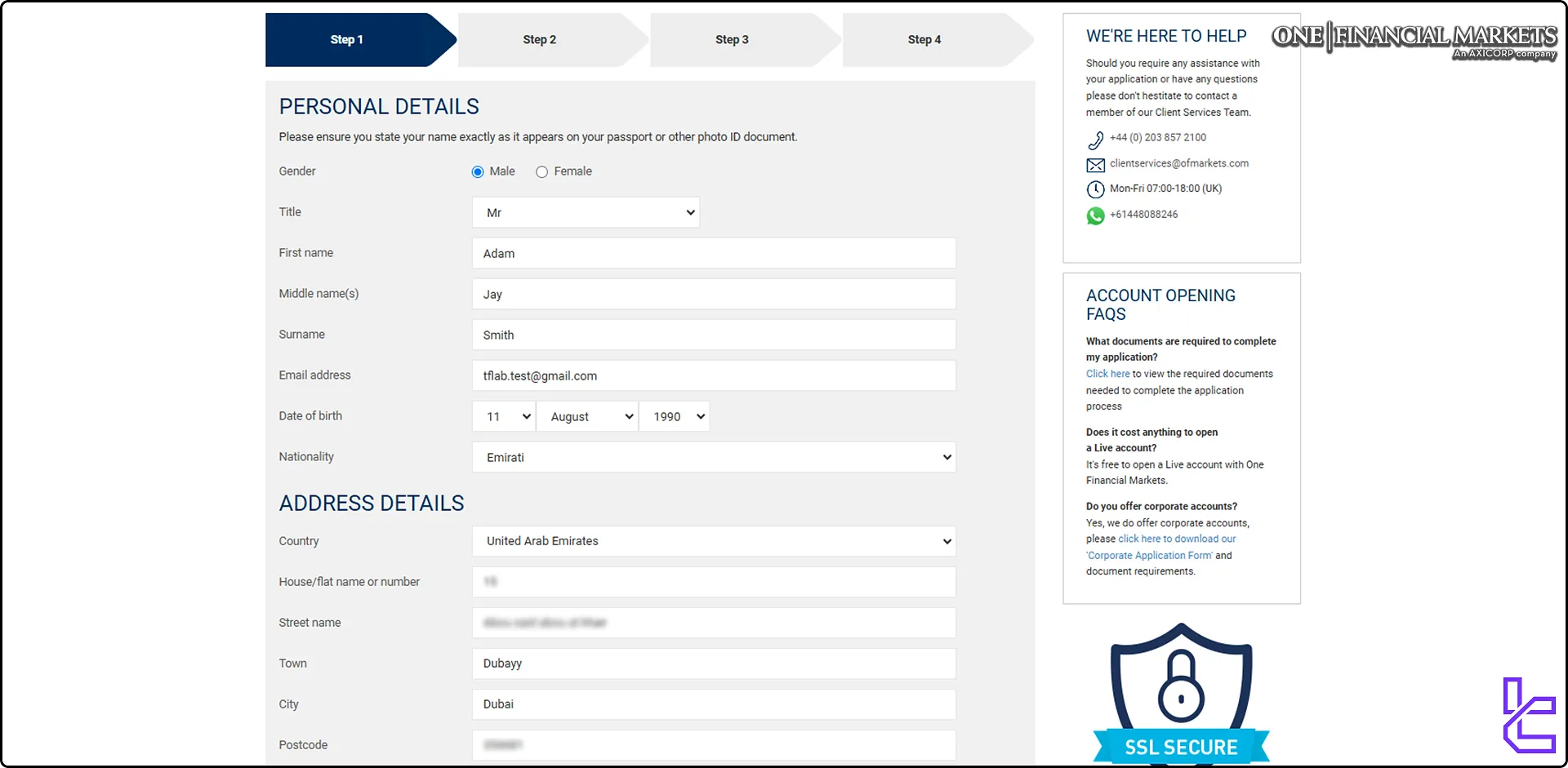

One Financial Markets Broker Registration and Verification

Creating a live trading account with One Financial Markets is designed for simplicity and regulatory compliance. The onboarding process ensures traders are verified under FCA and FSCA standards while gaining access to Forex, commodities, and CFDs.

#1 Start the Registration

Head to the official One Financial Markets website and click “Open Live Account”. Complete the online application form, including:

- Full name and contact information

- Employment status and financial background

- Account type and base currency

Enter your personal details to create your account in One Financial Markets broker

Enter your personal details to create your account in One Financial Markets broker

#2 Identity & Address Verification

To activate the account and unlock the full range of the broker's services, you must upload supporting documents, including:

- Proof of ID: Passport, Driver’s license, or National ID

- Proof of Address: Utility bill or Bank statement

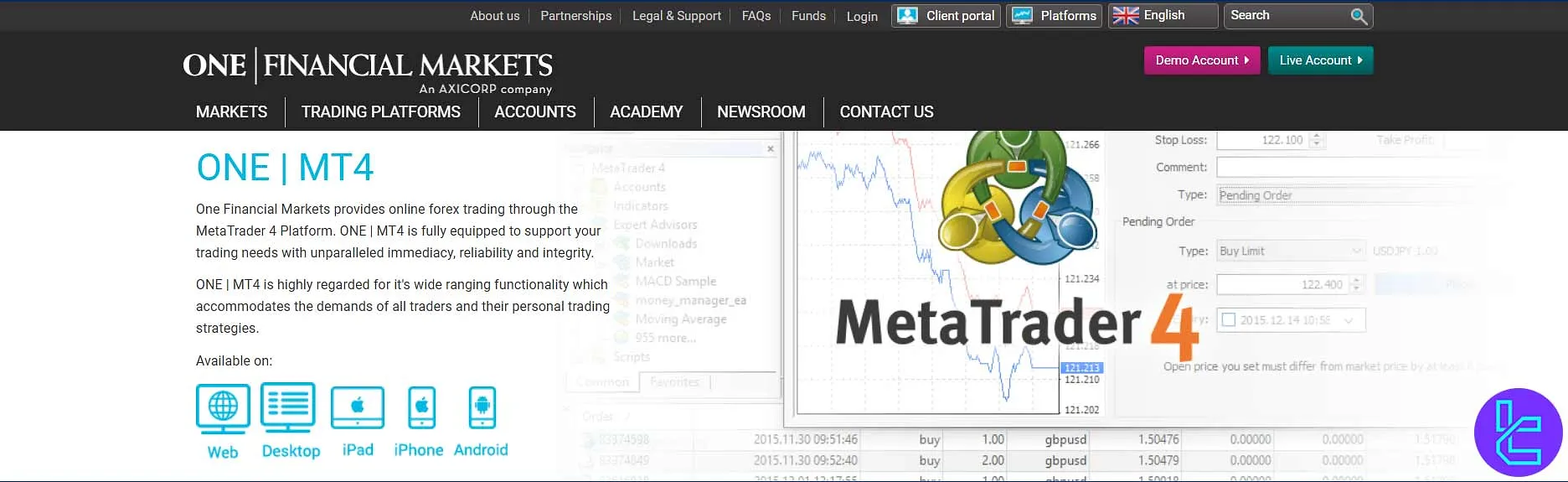

One Financial Markets Trading Platforms and Applications

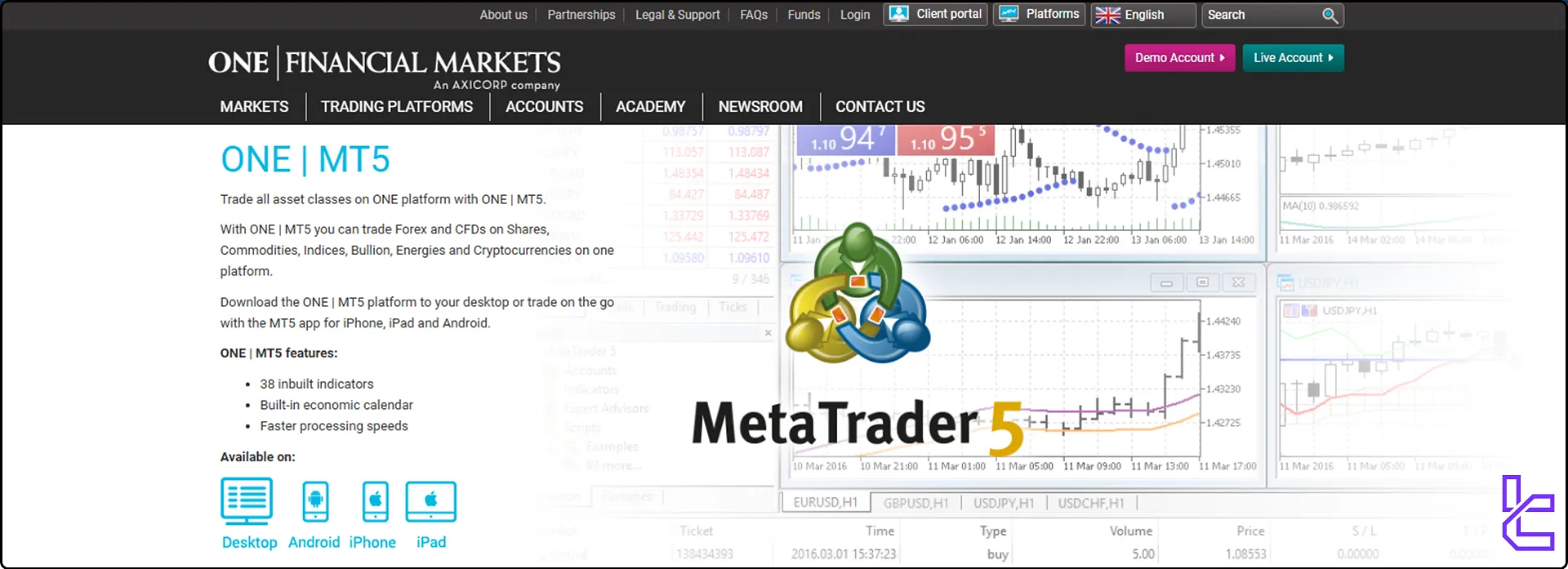

Traders at One Financial Markets can access both MetaTrader 4 and MetaTrader 5 platforms. MT5 features include 38 built-in indicators, 44 graphical tools, 21 timeframes, and real tick data.

Additional tools such as Trading Central, MT4 Expert Advisors, the proprietary “One Indicator”, and an integrated economic calendar support strategy development and technical analysis.

MetaTrader 4 (MT4)

MetaTrader 4 is a globally recognized trading platform, trusted by millions of traders for its reliability and versatility.

- The world's most popular trading platform

- User-friendly interface

- Advanced charting tools

- Expert Advisors (EAs) support

- Available for desktop, web, and mobile

Links:

With its robust features and extensive community support, MT4 remains a preferred choice for traders of all levels.

MetaTrader 5 (MT5)

MetaTrader 5 is the next-generation platform designed to provide enhanced analytical tools and a superior trading experience.

- Next-generation of MetaTrader 4

- Enhanced analytical tools

- More timeframes and chart types

- Improved backtesting capabilities

- Available for desktop, web, and mobile

Links:

MetaTrader 5 is the next-generation platform designed to provide enhanced analytical tools and a superior trading experience.

One Financial Markets MT5 trading platform features

One Financial Markets MT5 trading platform features

ONE Web Trader

This platform delivers a streamlined, browser-based trading experience with key features and capabilities outlined below:

- Browser-based trading platform

- No download required

- Access to MT4 accounts

- Real-time quotes and charts

- Trade on the go from any device

All platforms offer a seamless trading experience with real-time market data, multiple order types, and advanced risk management tools.

One Financial Markets Spreads and Commissions

One Financial Markets charges average-to-high trading costs. Spreads begin at 0.1 pips on major forex pairs, 10 pips on indices, and 13 pips on commodities. Cryptocurrency spreads start from 0.0034.

- Spreads: Floating from 0.1 pips

- Professional Commission: $2

- Standard Commission: $0

- Inactivity fee: $25 after 12 months of inactivity

- Deposit and Withdrawal fee: No fees

Spreads are variable and may widen during high market volatility. Professional accounts typically benefit from tighter spreads than Standard accounts.

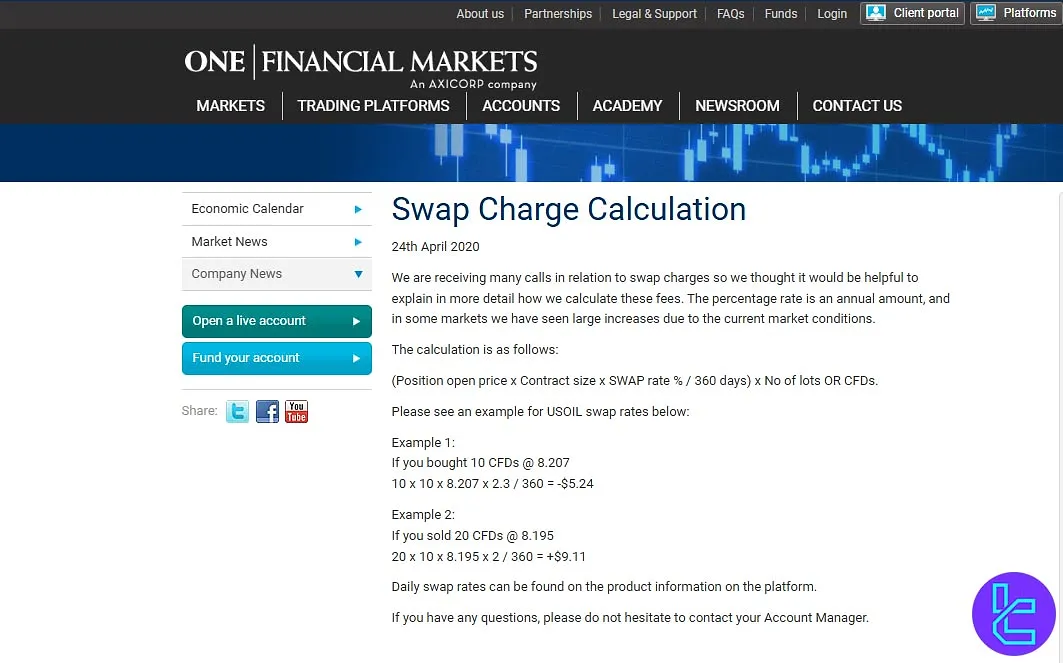

Swap Fee at One Financial Markets

In the overnight financing model of One Financial Markets, swap charges (also known as financing or holding fees) apply to positions held overnight. For instance, buying 10 CFDs of USOIL at 8.207 with a swap rate of 2.3% results in a −US$5.24 debit for that night.

These examples highlight how overnight positions can either incur a cost or generate a credit depending on the market direction and swap rate.

To give a clearer view, here are the most important operational points regarding swap fees:

The swap (financing) fee is calculated as:

- Swap rates differ by instrument and direction (long vs short) and may be positive or negative, meaning traders can either pay or receive overnight interest;

- Swap-free / Islamic accounts are available upon request, subject to eligibility and broker approval.

Non-Trading Fees at One Financial Markets

In One Financing Markets’ fee schedule, the key non-trading charge specified is a dormant account fee of US $25 (or £20/€20) applied if no open positions and no trading activity occur for 12 months or more.

These charges are separate from swap/financing costs and are purely account-maintenance related.

With that context in mind, here are the practical bullet-points for you:

- No commission charged on standard accounts for trades themselves (so commission-free trading is possible in that sense);

- There is no explicit fee for deposits listed by One Financing Markets, but external bank fees may apply (for withdrawals, third-party bank charges may be borne by the trader);

- The inactivity/dormant fee is removed once either the account is closed by you, you resume trading, or the account balance falls to zero.

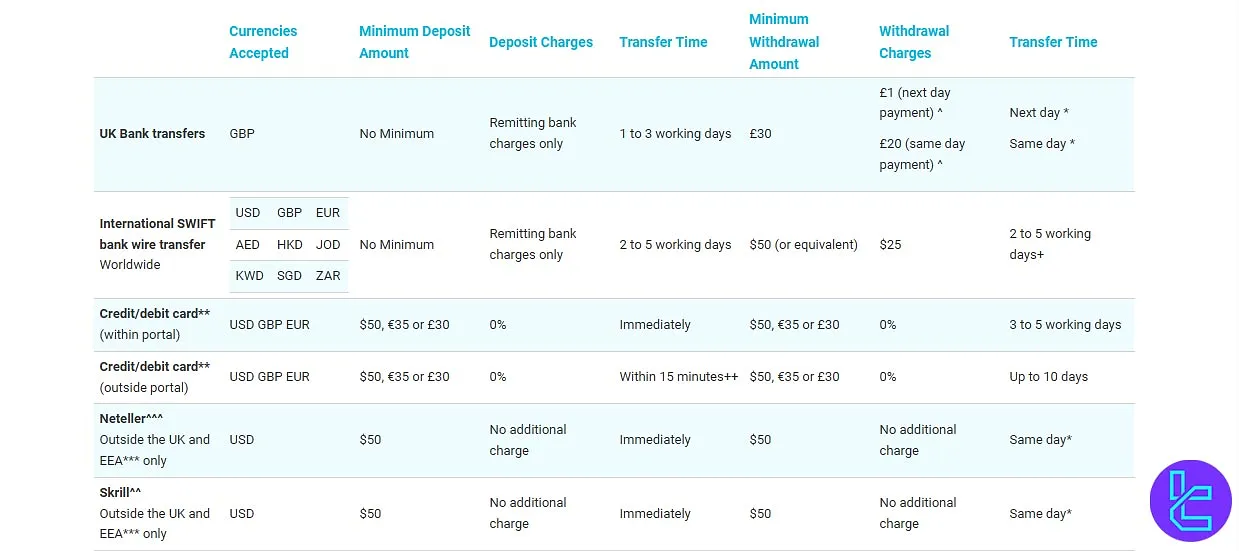

Deposit & Withdrawal Methods in One Financial Markets

One Financial Markets offers various payment methods for deposits and withdrawals:

Method | Minimum deposit | Minimum withdrawal | Withdrawal processing time |

UK bank transfer | No minimum | £30 | Same or next day |

Swift Wire transfer | No minimum | $50 | 2-5 days |

Credit/debit cards | $50 | $50 | 3-5 days |

Neteller | $50 | $50 | Same day |

Skrill | $50 | $50 | Same day |

There are no broker-side fees for most methods, though wire transfers may incur bank charges. Processing time varies from the same day to five business days.

This wide variety of payment options makes One Financial Markets suitable for traders with various preferences.

Deposit Methods at One Financial Markets

You can fund your account via the client portal, choosing from online card payments, international and UK bank transfers, and e-wallets; with each method clearly outlining currencies, minimums, fees and processing times.

Before depositing you must use an account in your own name (third-party and cash deposits are not accepted) and always include your client ID and any promotional code in the reference.

Below are the main deposit method details as published by One Financial Markets:

Deposit Method | Currency | Minimum Amount | Deposit Fee | Funding Time |

UK Bank Transfers | GBP | No minimum | Remitting bank charges only | 1 – 3 working days |

International SWIFT Bank Wire | USD / GBP / EUR / AED / HKD / JOD / KWD / SGD / ZAR | No minimum | Remitting bank charges only | 2 – 5 working days |

Credit/Debit Card (within portal) | USD / GBP / EUR | $50 / £30 / €35 | 0 % | Immediately |

Credit/Debit Card (outside portal) | USD / GBP / EUR | $50 / £30 / €35 | 0 % | Within 15 minutes (02:00–17:00 GMT) |

Neteller (outside UK & EEA) | USD | $50 | No additional charge | Immediately |

Skrill (outside UK & EEA) | USD | $50 | No additional charge | Immediately |

Withdrawal Methods at One Financial Markets

Here’s a focused look at how you can request a withdrawal with One Financial Markets, covering all the essential terms and rules that matter.

The process requires that you initiate your request via the client portal, that your landing-account holds the funds and the trading account is not in deficit, and that withdrawals are returned to the original deposit source.

Now, here are the key withdrawal methods and their respective details:

Withdrawal Method | Currency | Minimum Amount | Withdrawal Fee | Funding Time |

UK Bank Transfers | GBP | £30 | £30 (or higher if same-day) | Next day or Same day |

International SWIFT Bank Wire | USD / GBP / EUR / AED / HKD / JOD / KWD / SGD / ZAR | $50 (or equivalent) | $25 | 2 to 5 working days |

Credit/Debit Card (within portal) | USD / GBP / EUR | $50 / £30 / €35 | 0% | 3 to 5 working days |

Credit/Debit Card (outside portal) | USD / GBP / EUR | $50 / £30 / €35 | 0% | Up to 10 days |

Neteller (outside UK & EEA) | USD | $50 | No additional charge | Same day |

Skrill (outside UK & EEA) | USD | $50 | No additional charge | Same day |

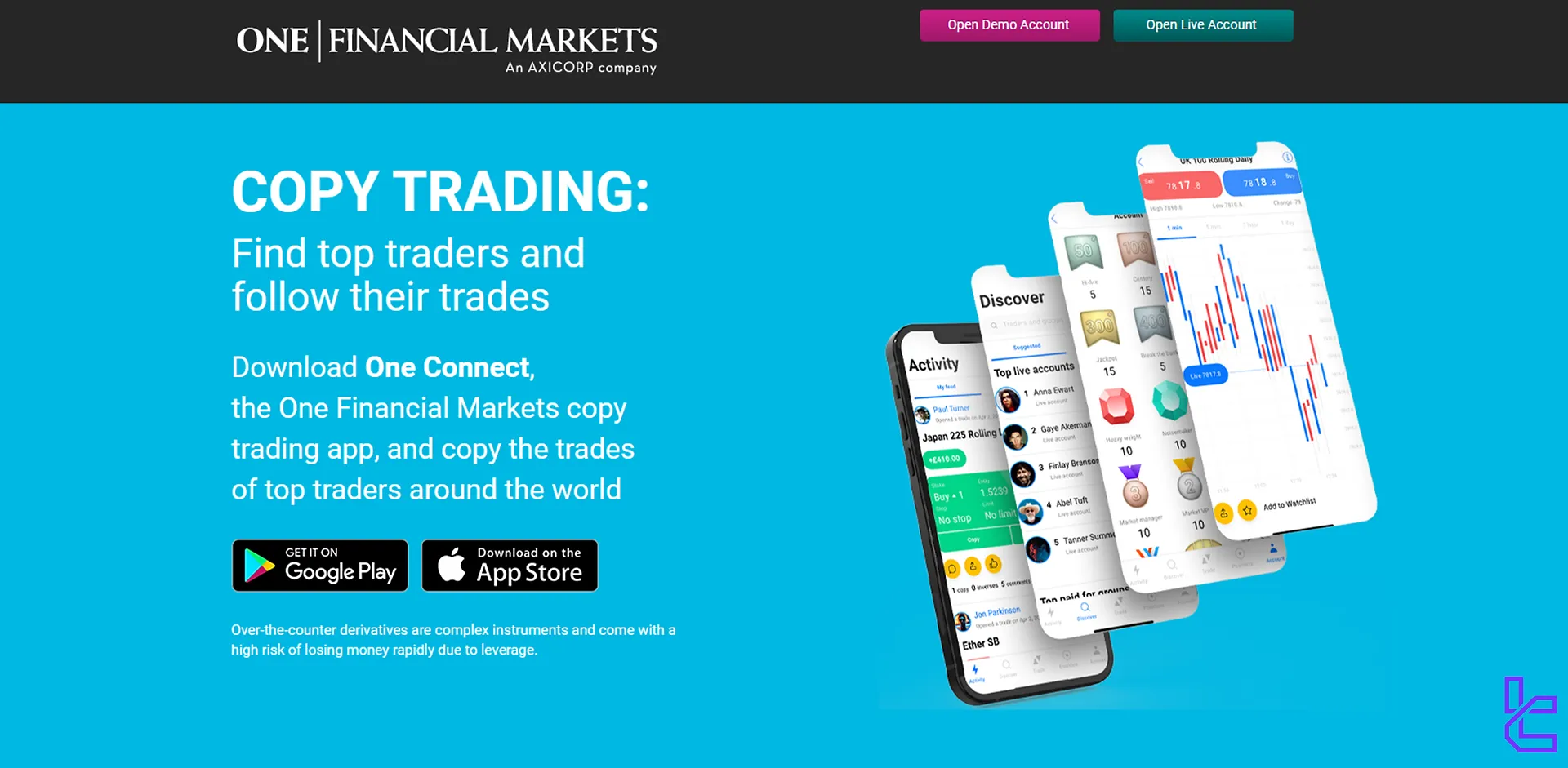

Investment Options Offered on One Financial Markets Broker

One Financial Markets offers a copy trading solution called "One Connect":

- Allows traders to automatically copy successful traders' strategies;

- Available on the One Connect app;

- Choose from a selection of verified Strategy Providers;

- Set your risk tolerance and investment amount;

- Access real-time copying of trades;

- Monitor performance and adjust settings as needed.

Copy trading can be an excellent option for beginners or those with limited time to analyze markets. However, it's crucial to understand that past performance doesn't guarantee future results, and there are risks involved in copy trading.

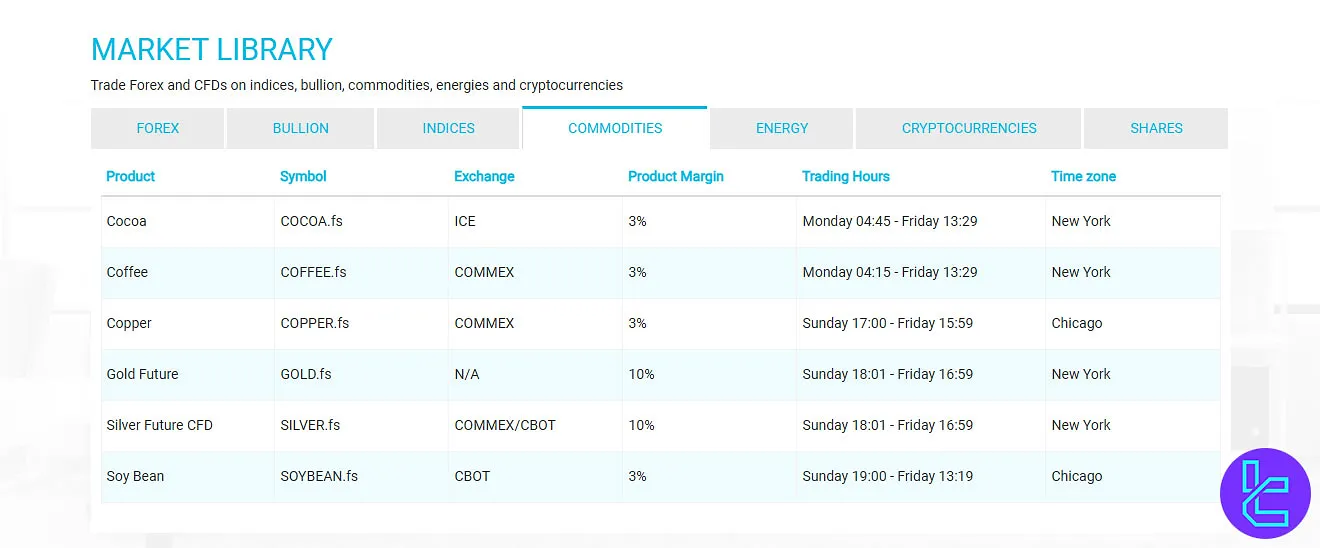

Tradable Markets & Symbols in One Financial Markets Broker

One Financial Markets offers a wide range of 580+ tradable instruments across seven asset classes, including the Forex market, Stocks, and Cryptocurrencies.

Category | Type of Instruments | Number of Symbols | Competitor Average | Max. Leverage |

Forex | Major, minor & exotic currency pairs | ~60 | ~40–50 | 1:500 |

Bullion | Silver, Platinum, Gold CFDs | 6+ | ~5–6 | 1:100 |

Indices | Major global indices CFDs | ~20–30 | ~30 | N/A |

Commodities | Metals, softs, agricultural CFDs | ~10 | ~20 | N/A |

Energy | Oil, gas CFDs | ~5–10 | ~5–10 | N/A |

Cryptocurrencies | BTC, ETH, LTC, XRP, major crypto CFDs | ~10 | ~8–12 | 1:100 |

Shares | Global stock CFDs (US, EU, UK, Asia) | 500+ | ~2000–3000 | N/A |

Bonds and mutual funds are not offered. All instruments are traded as CFDs with flexible leverage, capped at 1:30 for retail clients.

A diverse selection of instruments allows traders to diversify their portfolios and capitalize on opportunities across multiple markets.

One Financial Markets Broker Bonuses and Promotions

While One Financial Markets doesn't offer a traditional welcome bonus, they do have promotional offers such as trading competitions and the Introducing Partner program.

Note that bonuses and promotions may vary depending on your region and are subject to change. Always read the terms and conditions carefully before participating in any promotional offers.

One Financial Markets Awards

As a globally recognized brokerage, One Financial Markets has received multiple industry awards over the years for its excellence in online trading, education, and institutional services.

The One Financial Markets awards list reflects the company’s long-standing commitment to transparency, innovation, and client satisfaction marking it as a trusted name among global traders.

Below are some of the most notable awards received by the broker:

- Best Mobile Technology Provider (2016)

- Best FX Services Broker (2015)

- Best Institutional Broker (2014)

- Best Broker – Online Trading (2014)

- Best FSA Regulated Broker (2013)

- Best Education Product (2013)

One Financial Markets Customer Support

One Financial Markets offers 24/5 multilingual customer support via live chat, phone, WhatsApp, and email. Support staff are well-trained and responsive, with most inquiries addressed within the same day. Offices are based in London and Dubai.

- Live Chat: Available on the website for quick queries

- Phone: +44(0)2035449646 (London office open 24/5)

- Email: clientservices@ofmarkets.com

- WhatsApp: +61448088246

- FAX: +44(0)2038572001

The support team's response times are generally quick, with most queries being addressed within 24 hours.

One Financial Markets Restricted Countries and Regions

While One Financial Markets serves clients globally, there are some restrictions. The broker does not accept clients from:

- United States

- Canada

- Japan

- North Korea

- Iran

- Cuba

- Poland

- Belgium

Residents of the countries above should open an account with a broker that provides services in their jurisdiction.

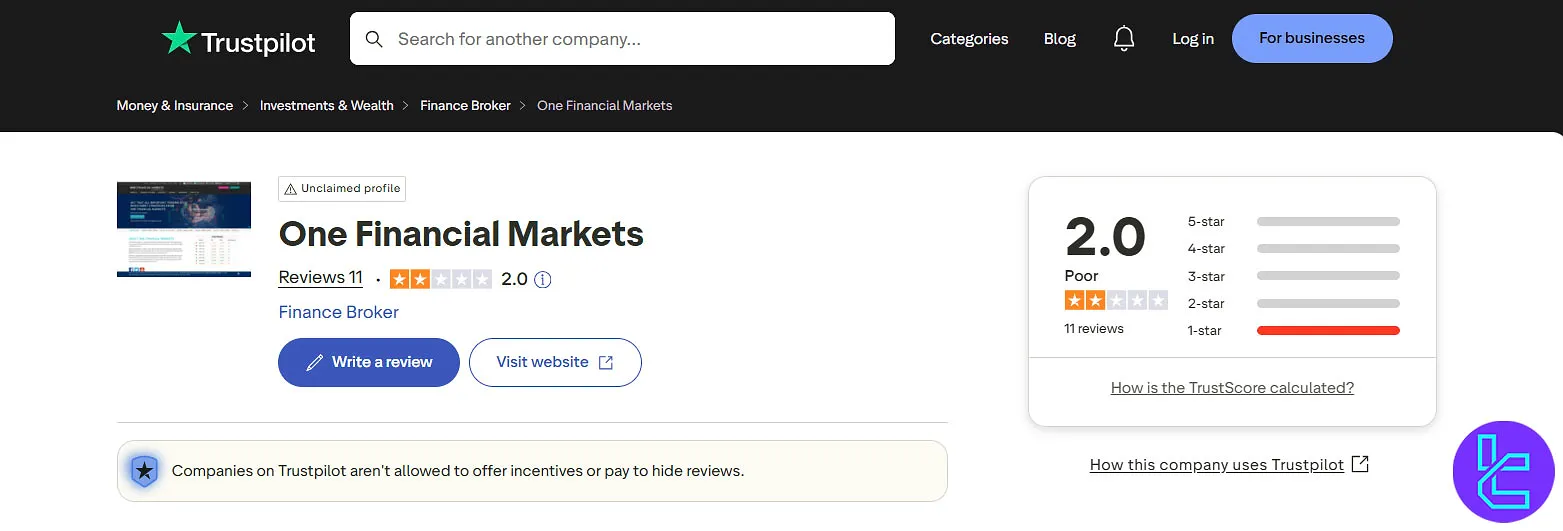

One Financial Markets Broker Trust Scores

The One Financial Markets Trustpilot profile holds an average rating based on a limited number of reviews. Users often cite the broker’s high trading fees and limited account customization as drawbacks, despite its solid regulatory background and platform offerings.

- Overall Trustpilot score: 2.0/5

- Total number of reviews: 11

Keep in mind that online reviews can be subjective and might not represent all experiences. Always conduct comprehensive research and review multiple sources before making a decision.

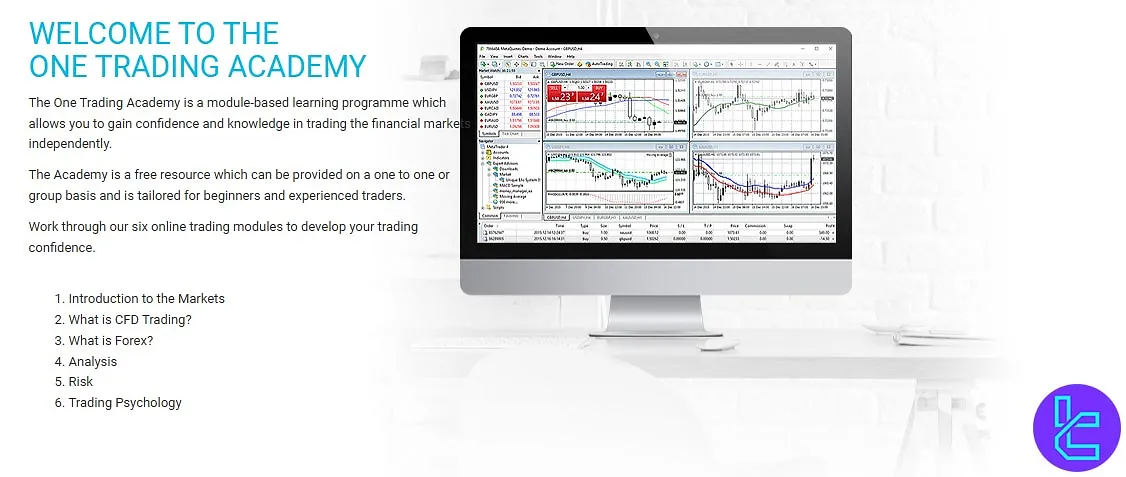

One Financial Markets Broker Educational Resources

The broker provides a wide educational suite via its online “Academy”, including a trading glossary, structured investment strategies, and an economic calendar.

The “Yasmeen Society” offers educational content tailored to women. Additional tools include Trading Central, the “One Indicator”, and MT4 Expert Advisors. Live seminars and multilingual webinars are hosted regularly.

- Trading Central: Technical analysis, trading signals, and market insights

- Webinars: Regular live sessions covering various trading topics

- Trading Glossary: Comprehensive list of trading terms and definitions

- Investment Strategies: Guides on different trading strategies

- Live Trading Seminars: In-person events in various locations

These educational resources cater to traders of all levels, from beginners to advanced, helping them enhance their trading knowledge and skills.

You can also check TradingFinder's Forex education section for additional learning materials.

One Financial Markets Comparison Table

Let's check OFM's standing in the Forex trading world in comparison with the top brokers.

Parameter | One Financial Markets Broker | IC Markets Broker | Exness Broker | HFM Broker |

Regulation | FCA, FSCA | FSA, CySEC, ASIC | FSA, CySEC, FCA, FSCA, CBCS, FSC, CMA | CySEC, DFSA, FCA, FSCA, FSA |

Minimum Spread | From 0.1 Pips | From 0.0 Pips | From 0.0 Pips | From 0.0 Pips |

Commission | From $2.0 | From $3 | From $0.2 to USD 3.5 | From $0 |

Minimum Deposit | $250 | $200 | $10 | From $0 |

Maximum Leverage | 1:400 | 1:500 | Unlimited | 1:2000 |

Trading Platforms | MT4, MT5, WebTrader | Metatrader 4, Metatrader 5, cTrader, cTrader Web, IC Markets Mobile | Exness Trade (mobile), Exness Terminal (web), MT4, MT5 | MT4, MT5, Mobile App |

Account Types | Standard, Professional, Demo | Standard, Raw Spread, Islamic | Standard, Standard Cent, Pro, Raw Spread, Zero | Cent, Zero, Pro, Premium |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | 580+ | 2,250+ | 200+ | 1,000+ |

Trade Execution | Market | Market | Market, Instant | Market, Buy Stop, Stop Loss, Limit, Take Profit |

TF Expert Suggestion

With over 15 years of experience, One Financial Markets is a reputable broker with solid FCA and FSCA regulations and a diverse range of trading instruments.

While the support for MT4 and MT5 is an excellent advantage for One Financial Markets, negative user reviews on the Trustpilot website (2.8/5 stars from 4 reviews) and high minimum deposit ($250) are important disadvantages traders must consider.