OnFin Verification takes approximately 1 working day and involves verifying identity, address, and payment method. An ID card and a recent bank statement or utility bill are required for proof of residence.

OnFin User Authentication Process: Step-by-Step Guide

OnFin KYC is mandatory process that traders must complete to become eligible for deposits and withdrawals.

OnFin KYC overview:

- Accessing the verification section in the dashboard;

- Submitting identity and address authentication documents;

- Confirming the payment method.

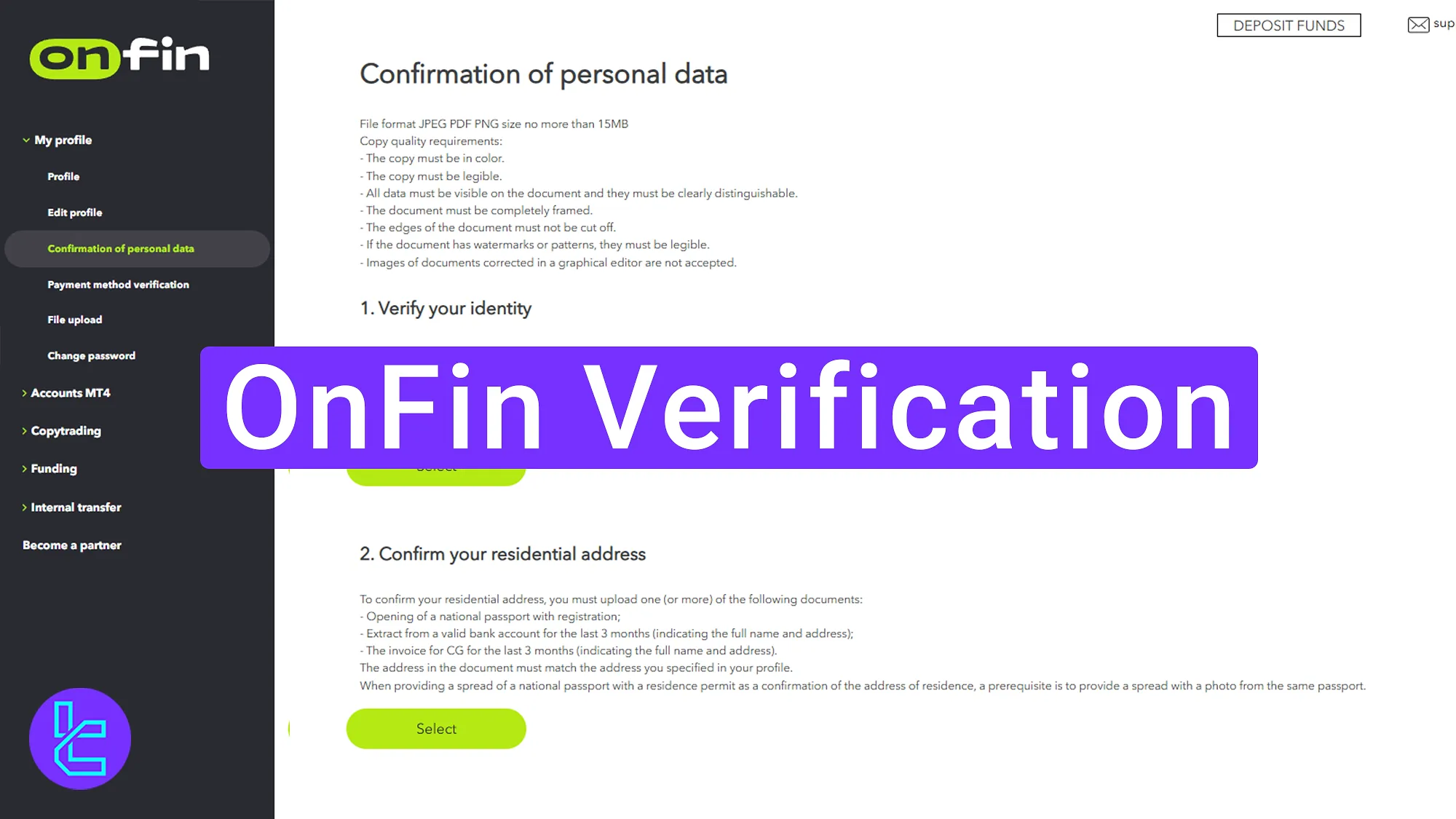

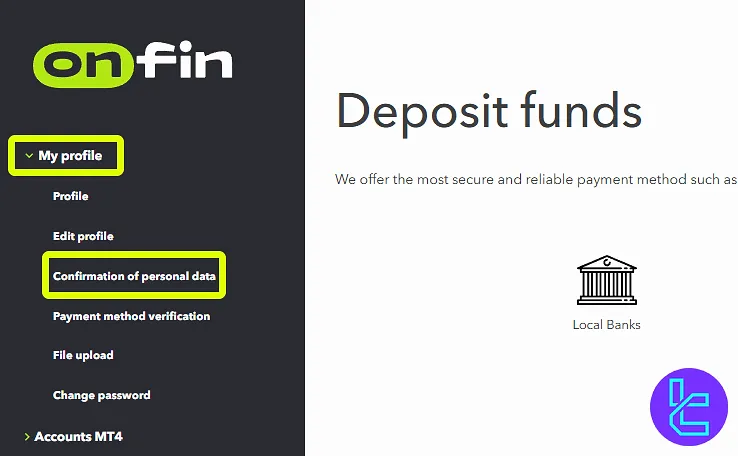

#1 Accessing the Verification Section

Navigate to the profile section in the OnFin dashboard and click on "Confirmation of Personal Data" to start the KYC process.

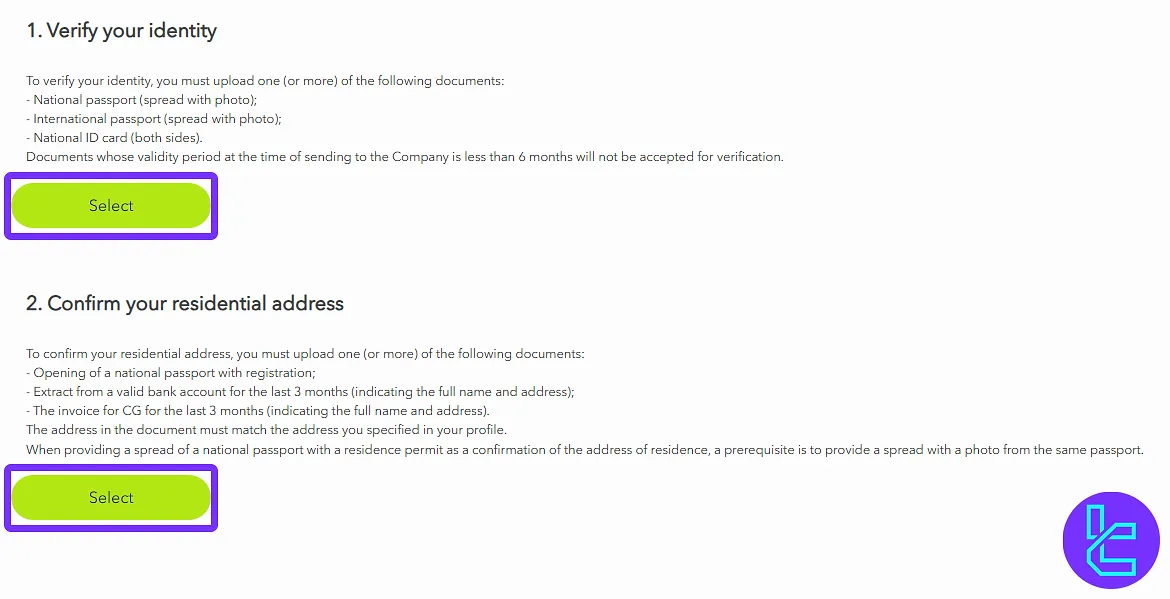

#2 Upload Identity and Address Documents

To complete identity verification, upload a clear front and back photo of the ID card.

For address confirmation, submit a bank statement or utility bill issued within the last 3 months and click "Submit for Review".

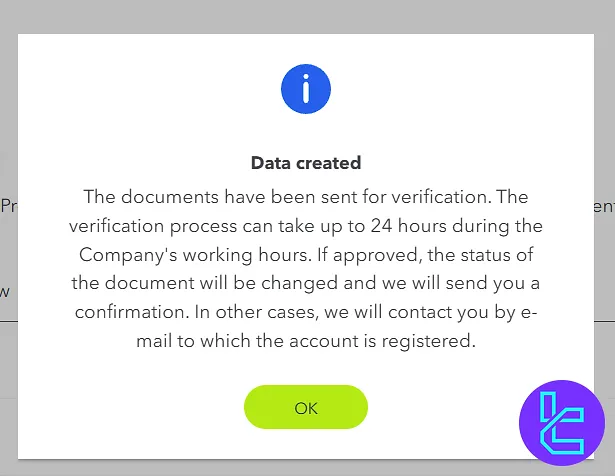

Once submitted, a notification will confirm that the documents are under review.

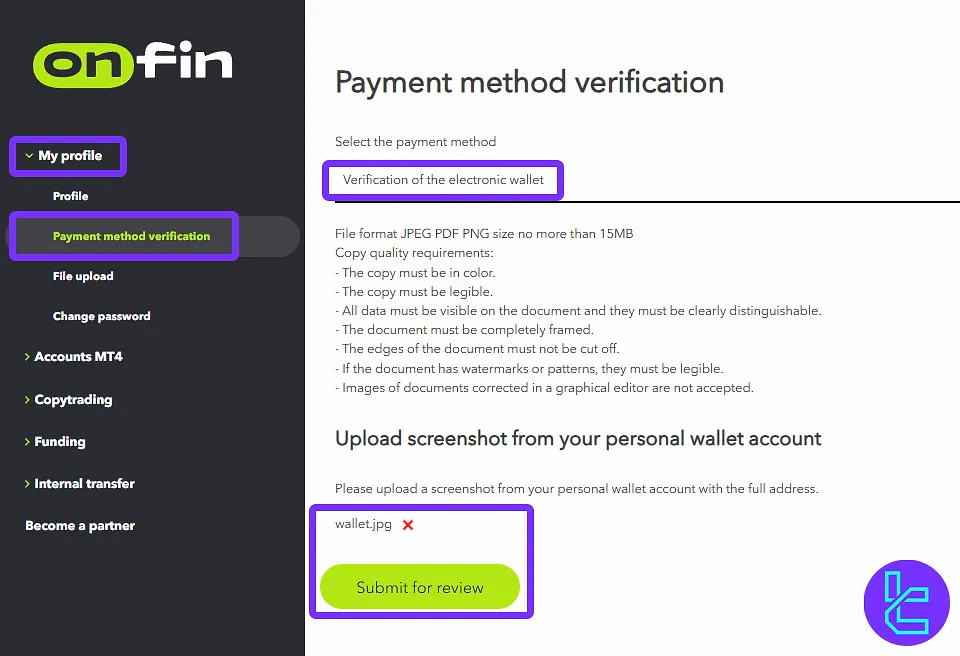

#3 Confirm Payment Method

Go to the payment method verification section and select "Electronic Wallet Verification". Upload a screenshot of the e-wallet and click "Submit for Review".

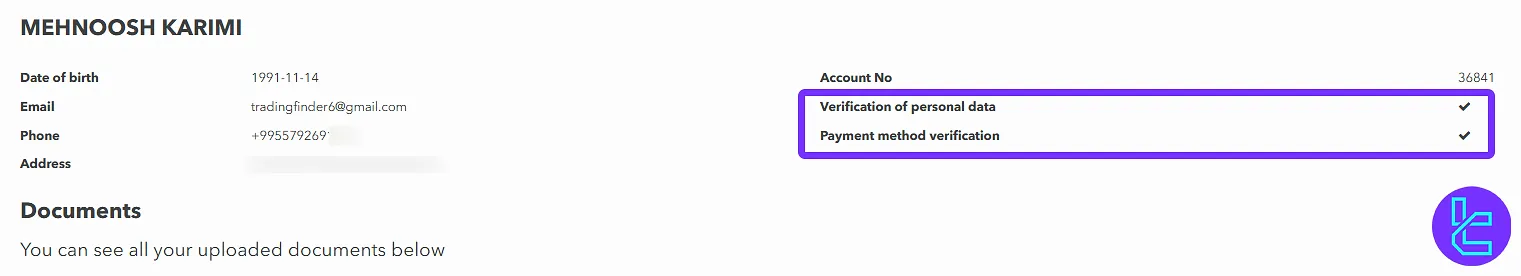

Once submitted, a notification will confirm that the payment authentication request is being reviewed. After successful verification, the OnFin dashboard will display "Verified Account Status".

TF Expert Suggestion

The OnFin verification process consists of 3 essential steps, including identity confirmation, address verification, and payment method confirmation.

Documents must be issued within the last 3 months to avoid rejection. The final step requires submitting electronic wallet details to complete the process.

Now that you have a verified account, you can use one of the OnFin deposit and withdrawal methods to fund your account. For more information, visit the OnFin tutorial page.