Optimus Futures does not charge separate swap fees on futures contracts, as carrying costs are built into contract pricing. In contrast, CFD trading often applies daily swap rates for overnight positions, adding a recurring financing cost to trades.

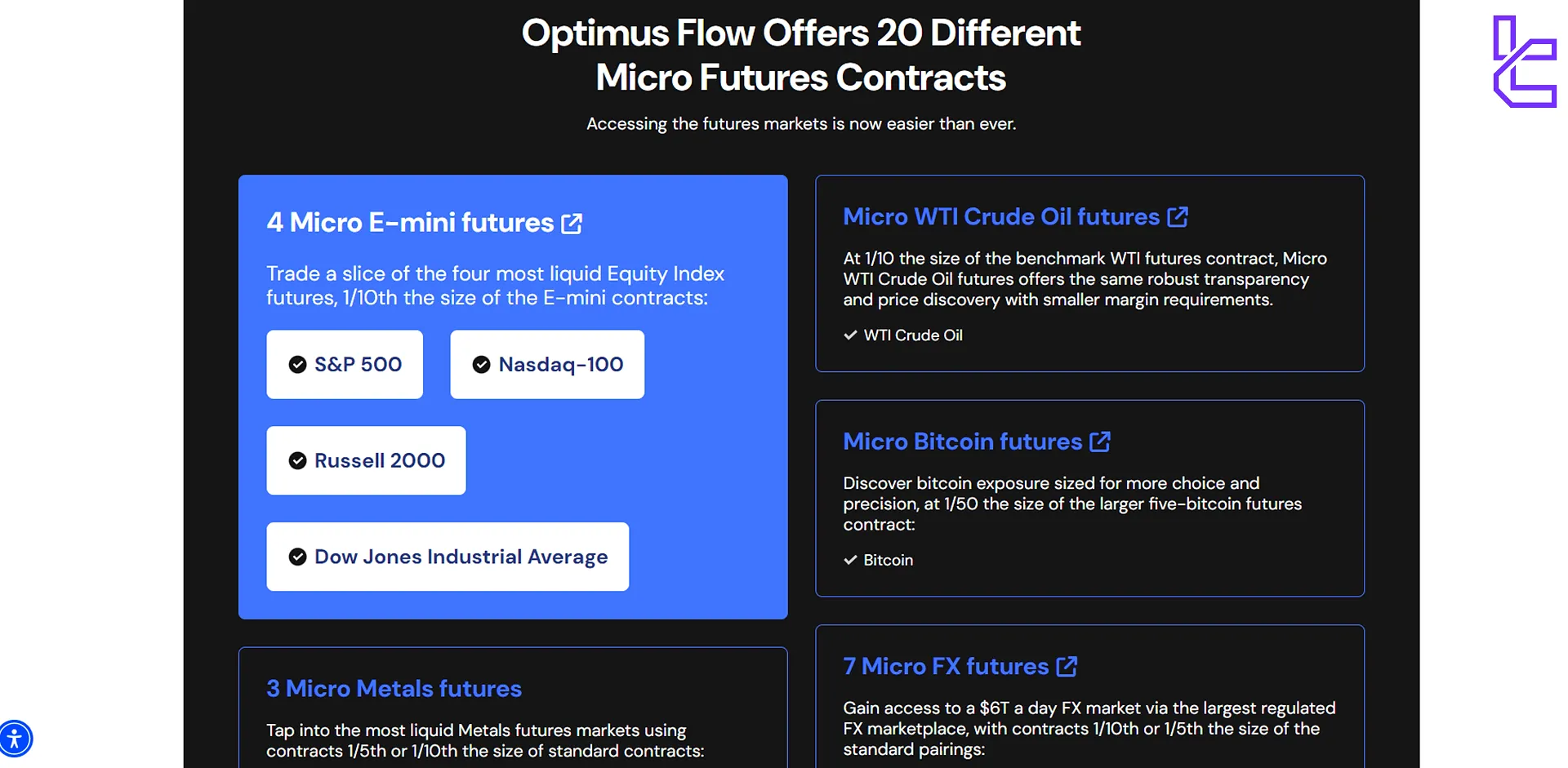

Optimus Futures is a famous broker that offers7 account types, including Individual, Joint, IRA, and Corporate accounts for futures traders. This broker provides 20 different micro futures contracts with no spreads and variable commissions starting from $0.05.

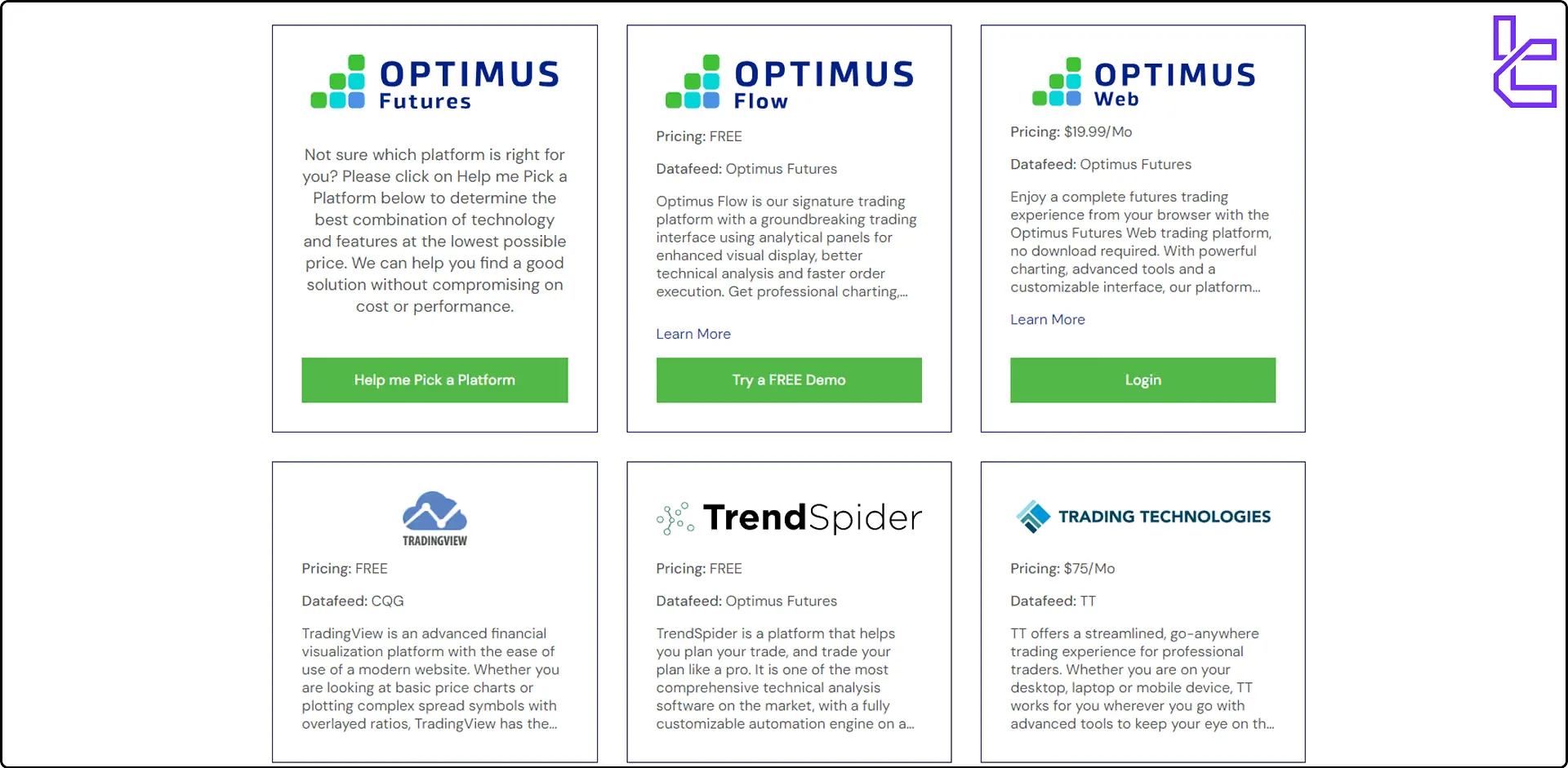

Optimus Futures supports numerous trading platforms, including Optimus Flow, Optimus Web, TradingView, Sierra Chart, TrendSpider, and more.

Optimus Futures General Information and Regulation

Optimus Futures, an independent introducing broker headquartered in Boca Raton, Florida, was established in 2004 with a clear mission to nurture traders by offering advanced technology and friendly, knowledgeable support.

This philosophy, championed by founder Matt Zimberg, has been the driving force behind the company's growth and reputation in the futures trading industry. Key aspects of Optimus Futures' company profile include:

- Regulatory Compliance: Optimus Futures is licensed and regulated by the National Futures Association (NFA) and the Commodity Futures Trading Commission (CFTC), ensuring a secure and compliant trading environment;

- Clearing Arrangements: The firm has partnerships with several of the world's largest Futures Clearing Merchants (FCMs), providing clients with robust financial backing;

- Transparency: The company prides itself on honest practices and encourages clients to conduct due diligence on its ethical standards, longevity, and technical proficiency;

- Full-Service at Discount Prices: Optimus Futures aims to provide comprehensive services while maintaining competitive pricing to support traders' long-term goals.

The firm connects clients with several top-tier futures clearing merchants and supports a wide array of trading platforms, including Optimus Flow, MetaTrader 5, and TradingView, along with more than 16 additional platforms.

Optimus Futures is specifically focused on US-based futures trading, offering a streamlined and transparent trading environment.

With segregated client funds, institutional platform access, and volume-based commission rebates, the broker positions itself as a reliable choice for active futures traders, particularly those seeking an execution-only model with minimal conflict of interest.

| Entity Parameters/Branches | Optimus Futures, LLC |

Regulation | NFA, CFTC |

Regulation Tier | 1 |

Country | United States |

Investor Protection Fund/Compensation Scheme | No |

Segregated Funds | Yes |

Negative Balance Protection | Yes |

Maximum Leverage | 1:400 |

Client Eligibility | United States |

Optimus Futures CEO

Matt Zimberg, CEO of Optimus Futures under Optimus Trading Group, is a veteran futures broker known for integrating low-latency technology, compliance rigor, and client-focused services since the early 2000s. He’s also an active educator in trading communities.

- Industry Experience: Over 20 years in futures trading, advising retail and institutional clients;

- Founder Role: Established Optimus Futures to deliver tech-driven, low-cost brokerage solutions;

- Education Outreach: Produces webinars, articles, and market insights for traders.

Optimus Futures Broker Specification Summary

Optimus Futures stands out in the crowded futures brokerage landscape with its comprehensive suite of services tailored to meet the diverse needs of futures traders. Here's a detailed summary of what sets the Forex broker apart:

Broker | Optimus Futures |

Account Types | Individual, joint, corporate, IRA, superannuation, LLC, Trust, Partnership |

Regulating Authorities | NFA, CFTC |

Based Currencies | USD |

Minimum Deposit | $50 |

Deposit Methods | Checks, bank wire, ACH |

Withdrawal Methods | Bank transfer |

Minimum Order | N/A |

Maximum Leverage | 1:400 |

Investment Options | Copy trading, Social trading |

Trading Platforms & Apps | Optimus Flow, Optimus Web, TradingView, MT5, etc. |

Markets | Forex, metals, crypto, indices, stocks, commodities |

Spread | No |

Commission | Starting from $0.05 |

Orders Execution | N/A |

Margin Call/Stop Out | N/A |

Trading Features | Demo account |

Affiliate Program | Yes |

Bonus & Promotions | No |

Islamic Account | No |

PAMM Account | No |

Customer Support Ways | Email, phone, ticket, social media |

Customer Support Hours | Monday to Friday 7 am to 6 pm |

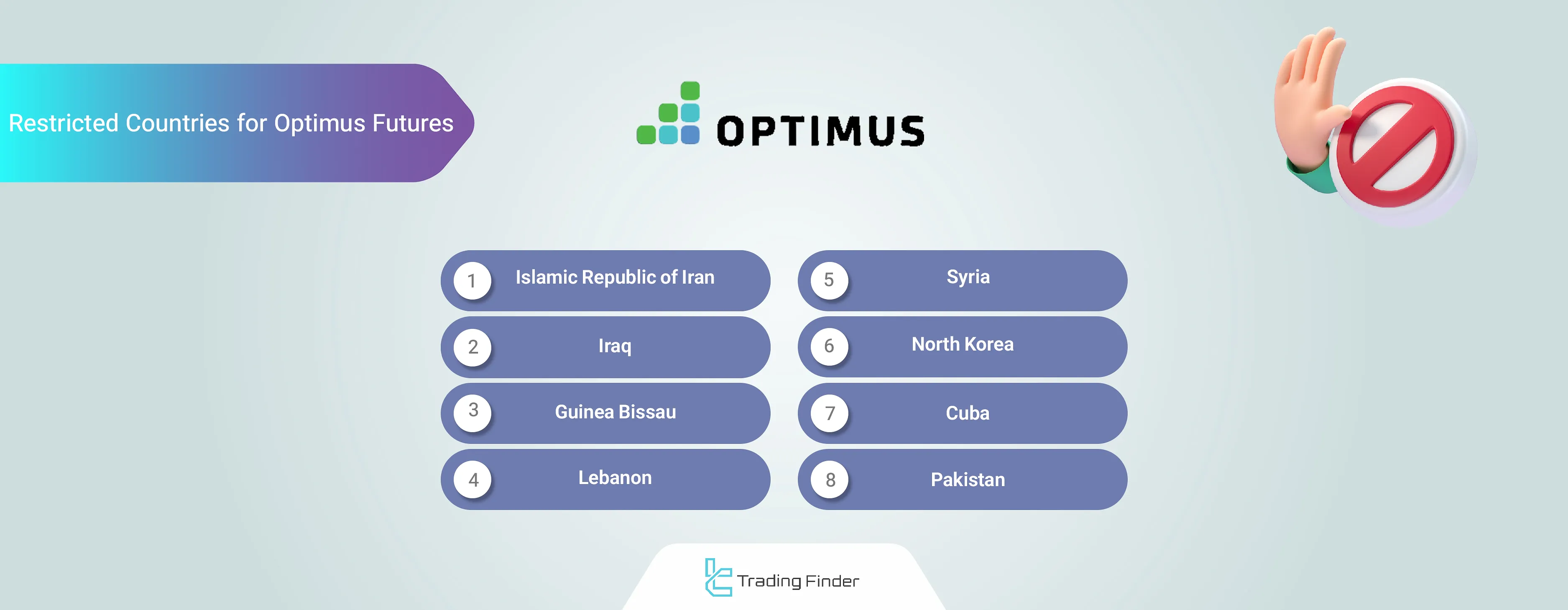

Restricted Countries | Iran, North Korea, Iraq, Cuba, Lebonan, and more |

Optimus Futures Different Types of Accounts

Optimus Futures caters to a wide range of traders by offering various account types to suit different needs and legal structures.

This flexibility ensures that whether you're an individual trader or representing a larger entity, you can find an account type that fits your requirements. The account types offered by Optimus Futures include:

- Individual Accounts

- Joint Accounts

- IRA Accounts

- Corporate Accounts

- LLC Accounts

- Partnership Accounts

- Trust Accounts

Key features of Optimus Futures accounts:

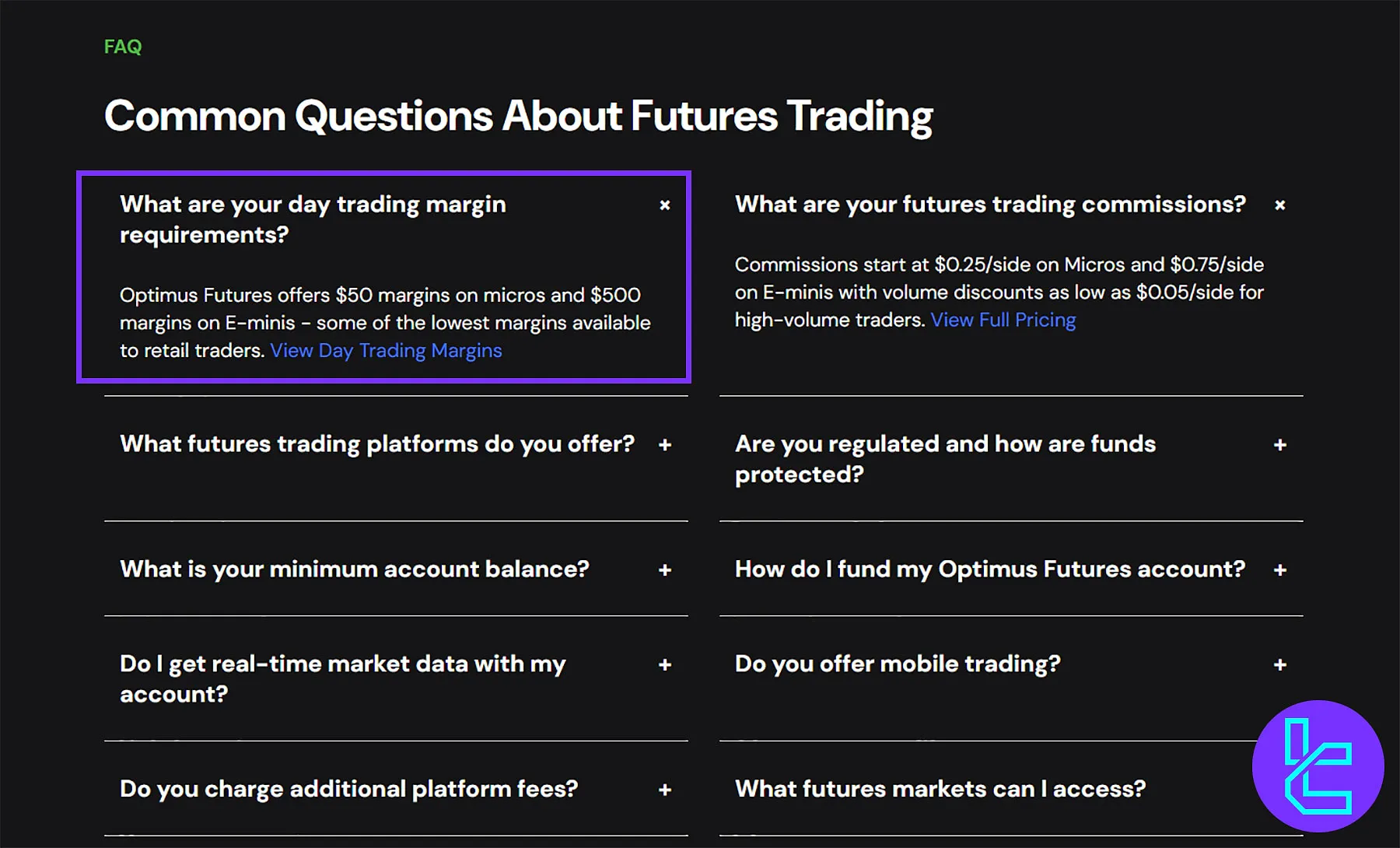

- Minimum Initial Deposit: $50 for Micros, $500 for E-Minis or standard contracts

- Fund Safety: Proper segregation of client funds

- Withdrawal Policy: Withdrawals at any time when there are no open positions

- Market Access: Access to micro and global futures markets

This tiered funding structure allows beginners to enter with modest capital while also supporting institutional participants.

Optimus Futures Strengths and Weaknesses

When considering Optimus Futures as your broker, it's crucial to weigh both the advantages and disadvantages. Here's a balanced overview:

Advantages | Disadvantages |

High liquidity in major markets | High risk of liquidation due to leverage |

Low fees starting from $0.25 per side | Complex for beginner traders |

Regulated by CFTC and NFA | - |

Various support channels | - |

Various trading platforms | - |

Optimus Futures Signing Up & Verification Guide

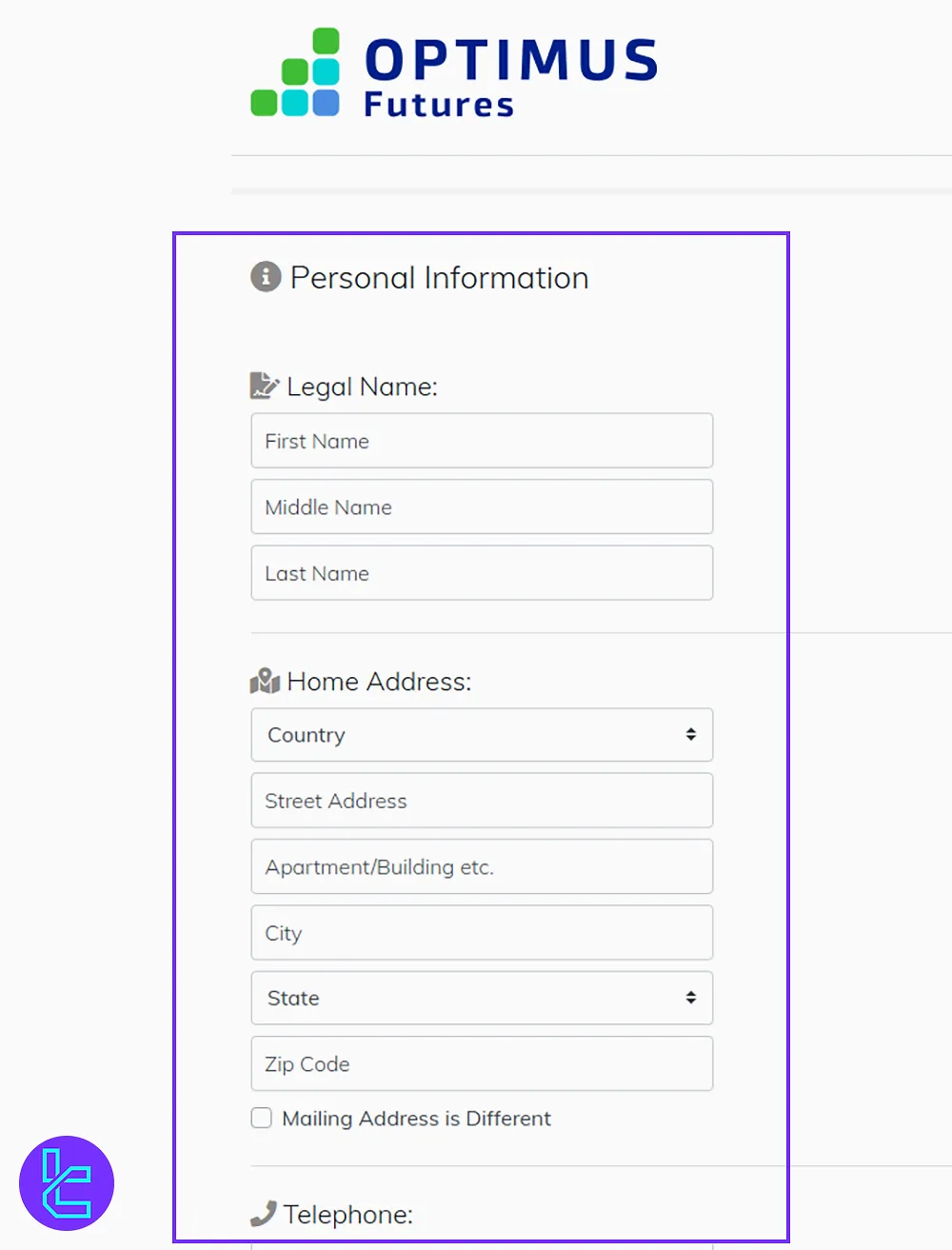

Opening an account with Optimus Futures requires detailed personal and financial information, ensuring regulatory compliance and eligibility for hedge trading. Steps to Optimus Futures registration:

#1 Start from the Official Website

Go to the Optimus Futures website, click “Get Started”, and proceed with “Open Account”.

#2 Create Login Credentials

Enter your email, set a secure password, and confirm it. Click "Create Account" to continue.

#3 Select Account Type & Objectives

Choose an Individual account, set Hedge as your trading objective, and click Next.

#4 Submit Personal Details

Provide your personal information, including:

- Full name

- Residential address

- Phone number

- Date of birth

- Nationality

- ID information

At the end, declare whether you're a US citizen and complete the W9 and employment status forms.

#5 Fill Financial & Investor Profiles

List your financial details, such as:

- Annual income

- Net worth

- Risk capital

- Dependents

- Trading experience

- Family affiliations

Review and accept all broker agreements and disclosures.

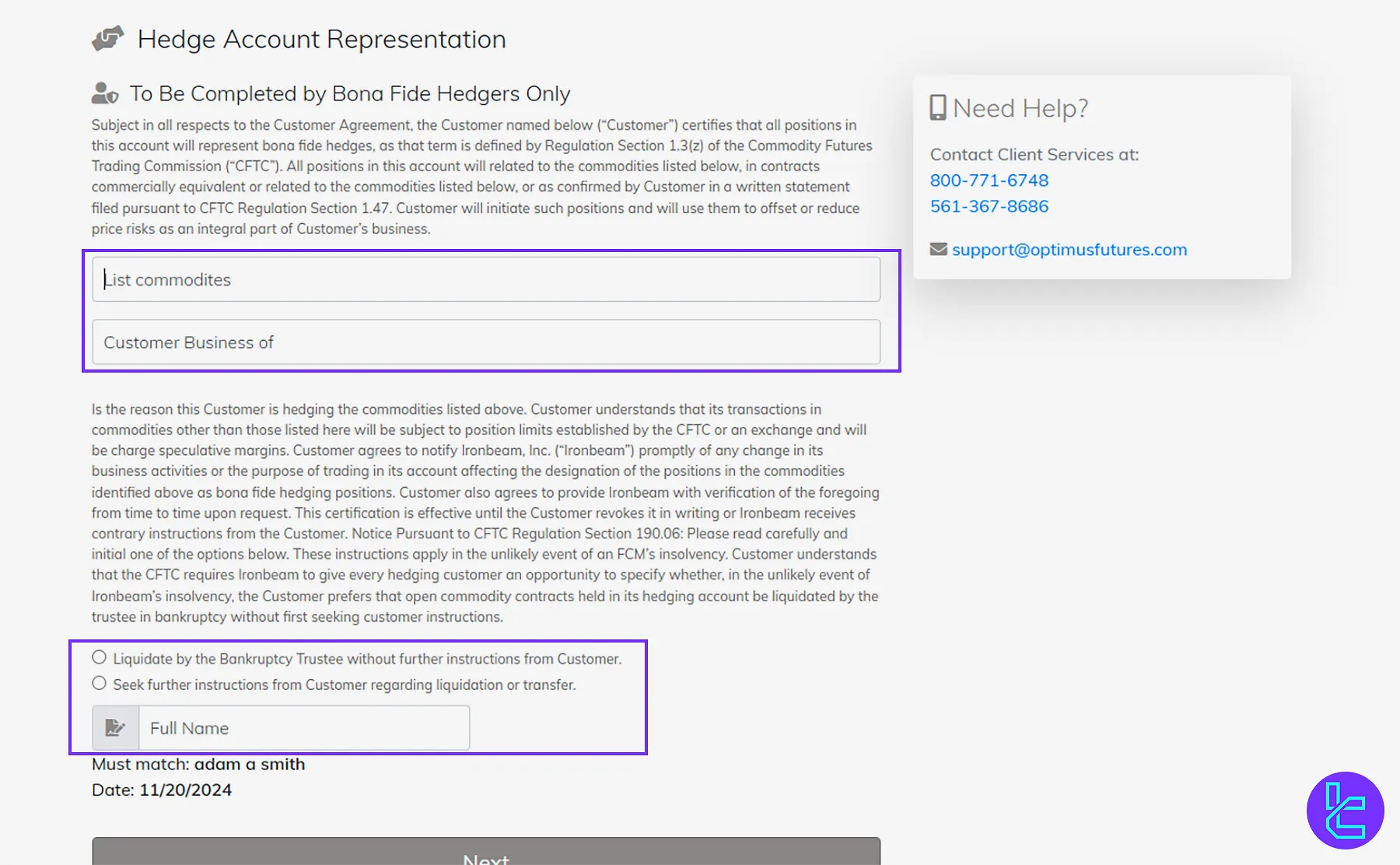

#6 Provide Hedge Representation

Specify the commodities traded, type of customer business, and confirm with your full name.

#7 Proceed with the Verification Process

After completing registration, proceed to document verification to activate your trading privileges.

- Proof of Identity: Passport or Driving license

- Proof of Address: Utility bill or Bank statement

Optimus Futures Platforms

Optimus Futures provides access to over 20 futures trading platforms, accommodating every trading strategy, from discretionary to algorithmic.

Optimus Flow

Optimus Flow is the main trading platform for the Optimus Futures broker. Here are some of its key features:

- Proprietary platform

- Advanced charting capabilities for technical analysis

- Order flow analysis tools

- Customizable workspaces

Optimus Web

Optimus Web is a browser-based trading platform with various benefits, but it comes with a cost. Optimus web key points:

- Browser-based platform

- User-friendly interface

- Accessible from any device with an internet connection

- $99 monthly subscription fee

TradingView

TradingView is one of the most well-known trading platforms for futures traders. Key features of this platform include:

- Popular third-party charting and social trading platform

- Extensive technical analysis tools

- Large community of traders for idea-sharing

TradingFinder has developed various TradingView indicators that you can access for free.

Other Supported Platforms on Optimus Futures

It’s worth mentioning that Optimus Futures also supports other trading platforms, including:

- Sierra Chart

- Bookmap

- ATAS (Advanced Trading Analysis Software)

- MetaTrader 5

- R Trader Pro

- TrendSpider

- And more

Some platforms are free, while others may carry monthly software fees, ranging up to $775, depending on the features included.

Optimus Futures' commitment to providing a range of powerful yet accessible trading tools, combined with competitive pricing, makes it an attractive choice for futures traders at all levels of experience.

Fees and Commissions on Optimus Futures

Optimus Futures has positioned itself as a competitive player in the futures brokerage market with its attractive commission structure and low-cost trading environment. Here's a detailed look at their volume-based commissions:

Daily Volume (Contracts) | Micros commission (per side) | Futures commission (per side) |

0-20 | $0.25 | $0.75 |

21-100 | $0.20 | $0.50 |

101-500 | $0.15 | $0.25 |

501-1000 | $0.10 | $0.20 |

Over 1000 | $0.05 | $0.10 |

It’s worth noting that some of Optimus Futures' platforms have associated costs, and traders should factor these into their decision before joining this broker.

- Optimus Flow: Free

- CQG/Rithmic: $0.10 per side

- TT: $0.50 per side

Exchange data fees are billed monthly and range from $3 to over $100, depending on asset class and depth of data (Level 1 vs. Level 2).

Optimus Futures Swap Fees

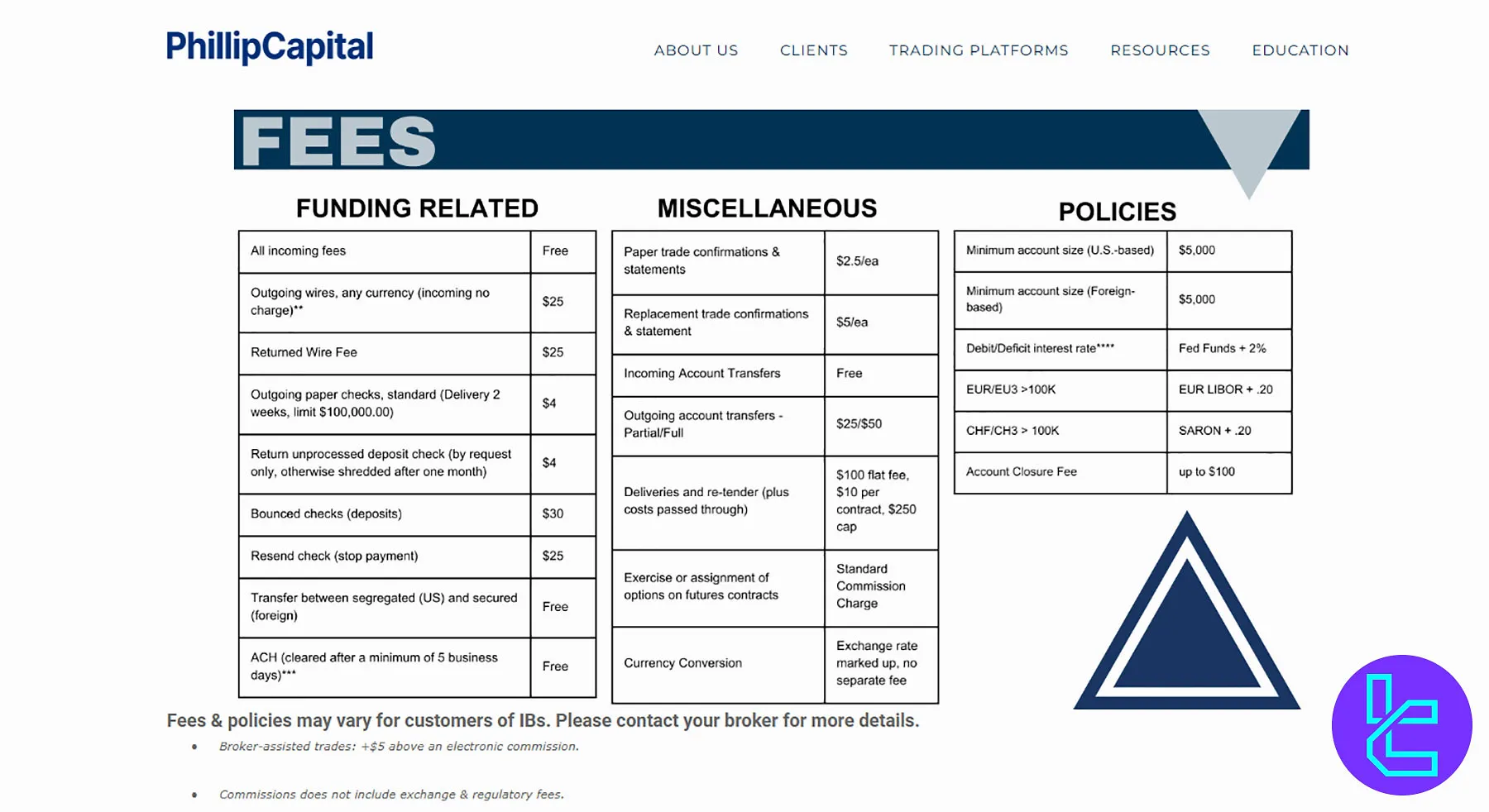

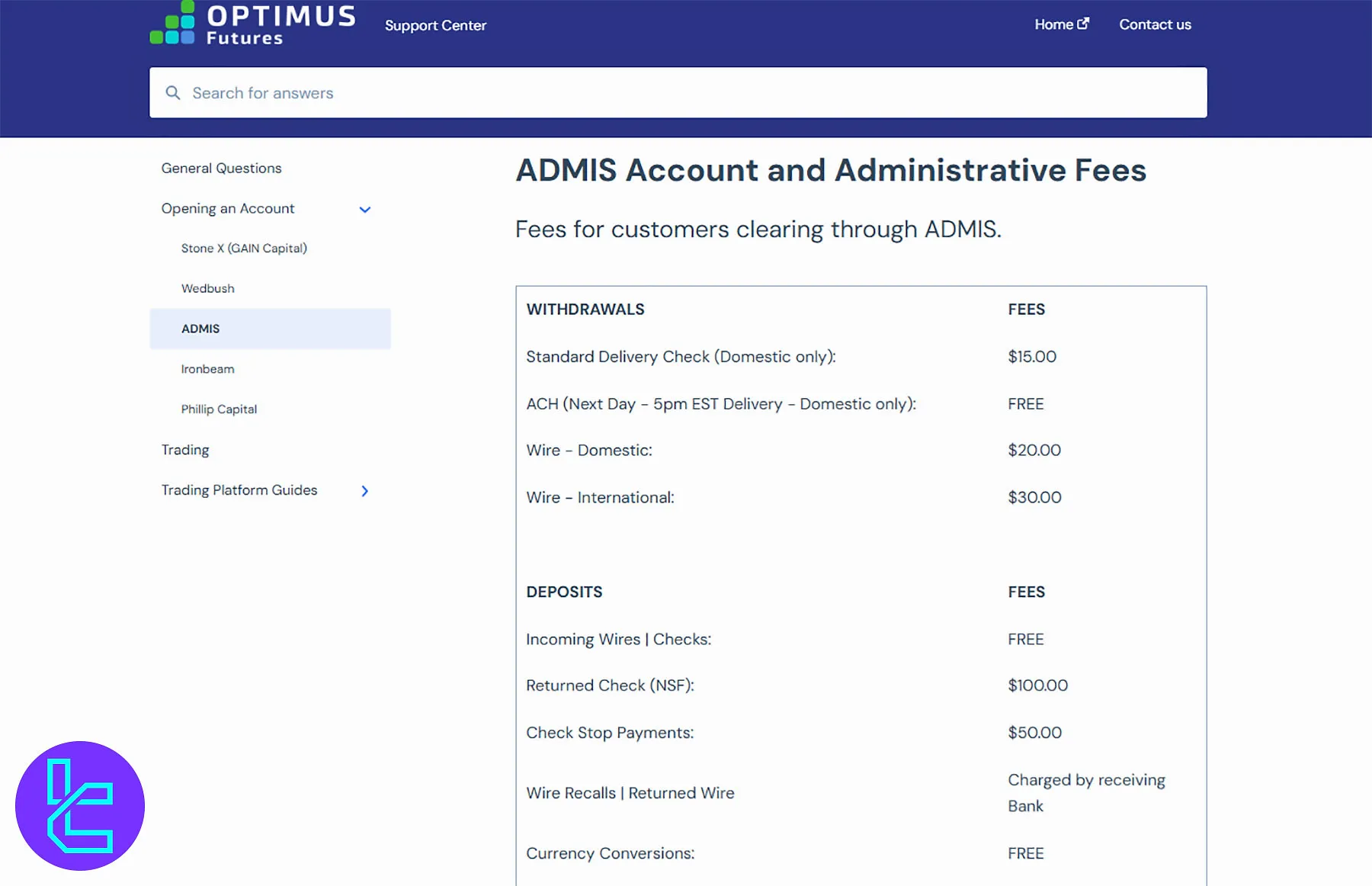

The platform utilizes various brokers to clear traders' orders. These brokers charge inactivity fees, including:

Clearing Broker | Inactivity Fee |

Stone X (Gain Capital) | N/A |

Wedbush | $40 monthly after 2 years of dormancy |

ADMIS | $25 per month (first and second months after account opening are exempt) |

Ironbeam | N/A |

PhillipCapital | N/A |

Note: While PhillipCapital doesn't specify inactivity costs, it charges an account closure fee of up to $100. You can check the full pricing on the PhillipCapital Fees page.

Optimus Futures partners with specialized clearing brokers, known as Futures Commission Merchants (FCMs), such as Ironbeam and StoneX, to process, settle, and guarantee trades.

This setup lets Optimus focus on execution and service, while FCMs manage clearing, margin requirements, and risk control.

Deposit & Withdrawal in Optimus Futures

It’s time to go through deposits and withdrawals in our Optimus Futures review. Optimus Futures only allows ACH and bank transfers for deposits and withdrawals.

Some of the FCMs that Optimus Futures works with also accept checks.

Optimus Futures Deposits

Let's examine the funding methods and associated fees for each FCM:

Futures Commission Merchants (FCMs) | Wire Deposit Fee | ACH Deposit Fee | Check Deposit Fee |

StoneX (GAIN Capital) | $0 | $0 | $5 |

Wedbush | $0 | $0 | N/A |

ADMIS | $0 | $0 | $50 Returned Check $100 |

Ironbeam | $0 | $0 | $0 |

Phillip Capital | $0 | $0 | $0 |

Note: StoneX allows ACH deposits of up to $10,000 per 3 days. The ACH transaction limit for PhillipCapital is $5,000 per 60 days.

Optimus Futures Withdrawals

While most of the incoming funds are charge-free, it's a different story for withdrawals.

Futures Commission Merchants (FCMs) | Wire Withdrawal Fee | ACH Withdrawal Fee | Check Withdrawal Fee |

StoneX (GAIN Capital) | Domestic $25 International $30 | N/A | $5 |

Wedbush | Domestic $20 International $75 | N/A | Check Delivery $30 |

ADMIS | Domestic $20 International $30 | $0 | $15 |

Ironbeam | Domestic $40 International $60 | N/A | $0 |

Phillip Capital | $25 | $0 | $4 |

This is a major downside, especially for traders who only use credit/debit cards and electronic wallets to transfer funds in and out of their brokers.

Investment Options Offered on Optimus Futures Broker

Optimus Futures provides a range of investment options, including the increasingly popular social trading feature. Here's an overview of the copy trading and investment options available:

- Allows investors to automatically replicate the trades of successful traders;

- Provides access to experienced traders' strategies without extensive knowledge.

Benefits of Copy Trading:

- Leverage the expertise of successful traders;

- Automate the trading process;

- Diversify investment across multiple traders;

- Potential cost savings compared to traditional fund management;

- Learning opportunity for novice traders.

Optimus Futures Markets & Symbols

Optimus Futures provides traders with access to a wide array of futures markets across various asset classes, including the Forex market, Meat commodities, and Cryptocurrencies.

Category | Type of Instruments | Number of Symbols | Competitor Average | Max Leverage |

Forex | Futures | 24 | 40 | N/A |

Stock Index | Futures | 27 | 35 | N/A |

Energies | Futures | 11 (e.g., WTI, BRENT, and NGAS) | 15 | N/A |

Metals | Futures | 13 (e.g., Gold, Silver, and Copper) | 16 | N/A |

Financials | Futures | 19 (e.g., Eurodollar, Ultra T-Bond, and US 10-Year Treasury Note) | 25 | N/A |

Soft Commodities | Futures | 18 instruments like Cotton, Wheat, Oats, and Ethanol | 20 | N/A |

Meats | Futures | 4 (e.g., Feeder Cattle, Pork Bellies, and Lean Hogs) | 6 | N/A |

Cryptocurrency | Futures | 1 (Bitcoin) | 8 | N/A |

Note: Optimus Futures offers leverage through exchange-set and reduced intraday margins, enabling traders to control large futures positions with minimal capital, though overnight positions require full margin compliance.

Optimus Futures' extensive range of tradable markets and symbols, coupled with their advanced trading tools and competitive pricing, provides traders with ample opportunities to diversify their portfolios and implement various trading strategies across global futures markets.

However, you must note that the broker doesn't provide regular Forex or CFDs trading.

Optimus Futures Bonuses

Unlike many brokers in the industry, Optimus Futures takes a different approach when it comes to attracting and retaining clients.

They don't rely on flashybonuses or promotional gimmicksto lure traders. This strategy aligns with their commitment to helping traders succeed based on skill and knowledge rather than short-term incentives.

Optimus Futures Broker Support Channels

One area where Optimus Futures truly shines is in its customer support. They offer multiple channels of assistance to ensure that traders can get help Monday to Friday, 7 am to 6 pm:

- Email Support: support@optimusfutures.com

- Phone Support: 800-771-6748 or 561-367-8686 to speak with a representative

- Live Chat: Get immediate assistance through their website

- Remote Desktop Support: Download an application for secure, hands-on technical support

Additionally, Optimus Futures maintains an active community forum where traders can discuss strategies and get advice from both the technical team and fellow traders.

Optimus Futures Restricted Regions and Countries

While Optimus Futures welcomes clients from around the globe, it's important to note that certain restrictions may apply depending on your location.

The company is licensed and regulated by the NFA and CFTC, which provides strong protection for clients' funds. However, specific country restrictions may exist due to regulatory requirements.

If you're interested in opening an account with Optimus Futures, it's best to contact their team directly and ask about eligibility.

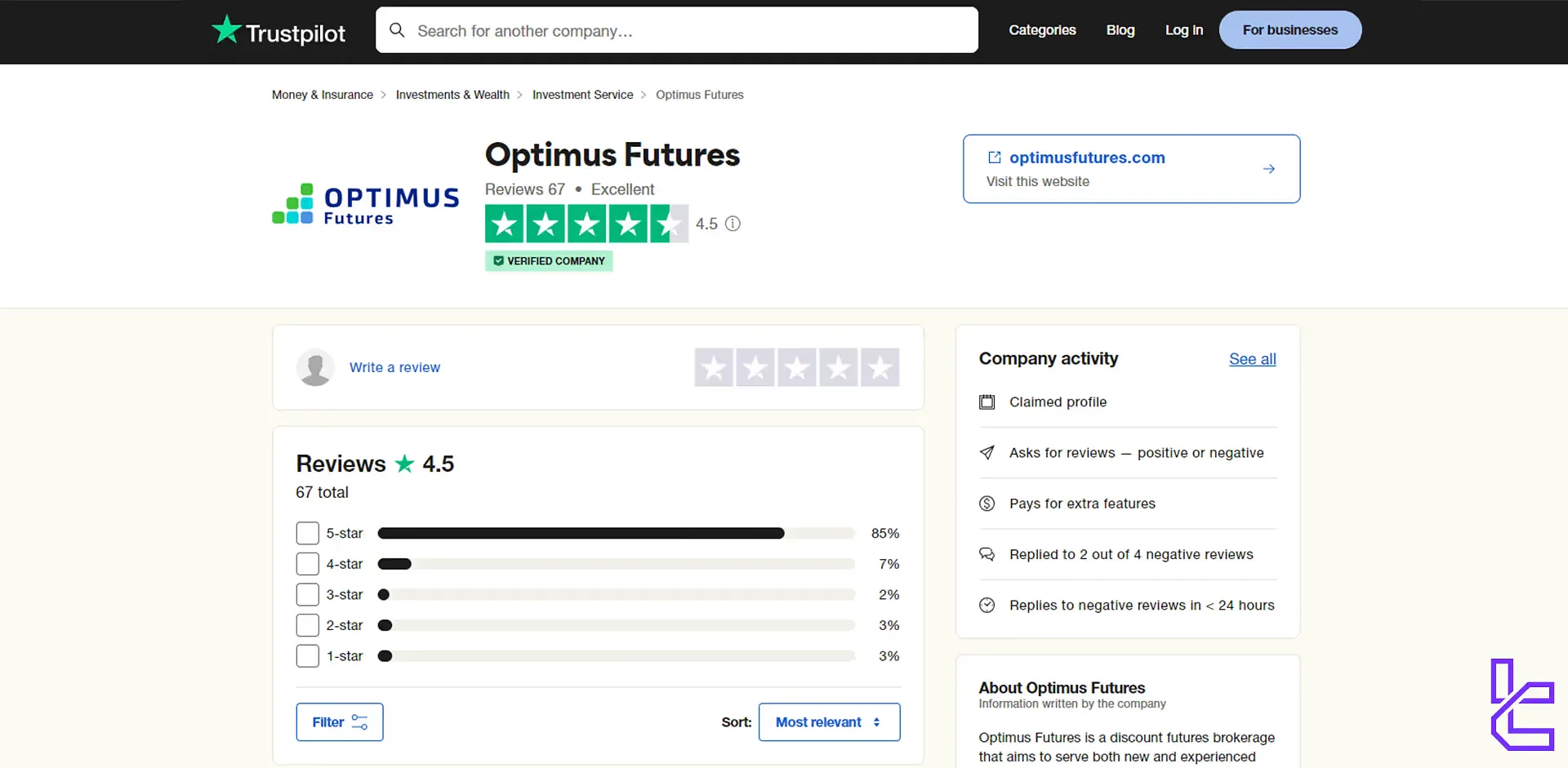

Optimus Futures Trust Scores

Trust is paramount in the world of financial services, and Optimus Futures has earned a strong reputation among its clients. According to the Optimus Futures Trustpilot profile, the broker has received an impressive average rating of 4.5 out of 5 stars from over 60 reviews.

This high trust score reflects Optimus Futures' commitment to providing a superior trading experience for novice and experienced traders.

Optimus Futures Education Resources

Optimus Futures stands out in the industry for its comprehensive educational resources. They understand that informed traders are successful traders, and they've invested heavily in creating a robust educational ecosystem:

- Blog: Regular articles on trading strategies, platform guides, and market analysis

- Trading Community: A forum where traders can interact, share insights, and learn from each other

- Video Tutorials: Covering both basic and advanced features of their trading platforms

- Podcast: Hosted by the company's president, discussing practicaltrading tips and strategies

- Guides: In-depth resources on various aspects of futures trading

By offering these diverse educational resources, Optimus Futures ensures that traders have access to the knowledge and tools they need in the fast-paced futures markets.

You can check TradingFinder's Forex education section for additional resources.

Optimus Futures Comparison Table

The table below compares Optimus Futures' services and features with top players in the market:

Parameter | Optimus Futures Broker | Fusion Markets Broker | TMGM Broker | AvaTrade Broker |

Regulation | NFA, CFTC | ASIC, VFSC | ASIC, VFSC, FSC, FMA | ASIC, CySEC, CBI, FSA, FSCA, MiFID, ADGM, PFSA, ISA |

Minimum Spread | 0.0 | From 0.0 pips | From 0.0 Pips | From 0.0 Pips |

Commission | From $0.05 | From $0.0 | From $0.0 | $0 |

Minimum Deposit | $50 | $0 | $100 | $100 |

Maximum Leverage | 1:400 | 1:500 | 1:1000 | 1:400 |

Trading Platforms | Optimus Flow, Optimus Web, TradingView, MT5, and more | MetaTrader 4, MetaTrader 5, TradingView, cTrader | MT4, MT5, IRESS, TMGM Mobile App | MetaTrader 4, MetaTrader 5, Mobile App, WebTrader |

Account Types | Individual, joint, corporate, IRA, superannuation, LLC, Trust, Partnership | Zero, Classic, Swap-Free | EDGE, CLASSIC | Standard, Demo, Professional |

Islamic Account | No | Yes | Yes | Yes |

Number of Tradable Assets | N/A | 250+ | 12000+ | 1250+ |

Trade Execution | N/A | Market, Instant | Market, Instant | Instant |

TF Expert Suggestion

Optimus Futures is one of the best futures brokers that operate under the supervision of NFA and CFTC financial authorities.

Even so, the broker has its own drawbacks, including a high minimum deposit of $50, a lack of variety in withdrawal methods (it only offers bank transfers), and a $20 commission for transferring funds from the broker to your bank.